... which experience higher prices during periods of high demand.

Power’s assets are located in attractive markets near load

centers …

Current plant locations,

site expansion capability

Bethlehem Energy Center

(Albany)

New Haven

Bergen

Kearny

Essex

Sewaren

Edison

Linden

Mercer

Burlington

National Park

Hudson

Conemaugh

Keystone

Bridgeport

Peach Bottom

Hope Creek

Salem

System Interface

6

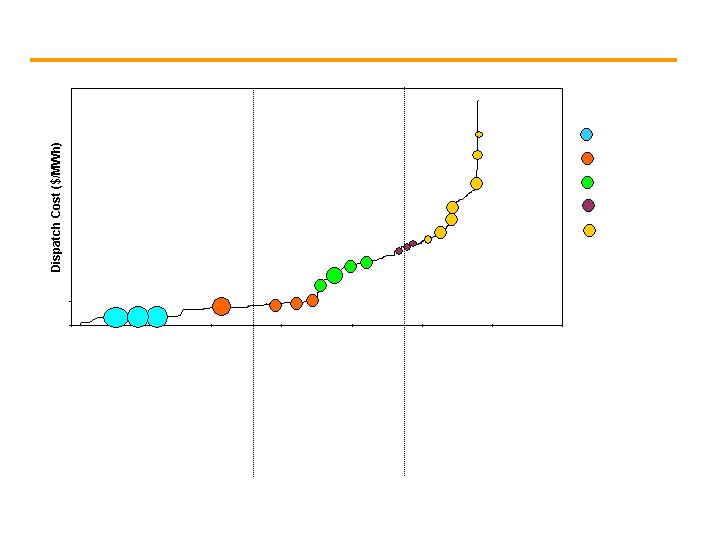

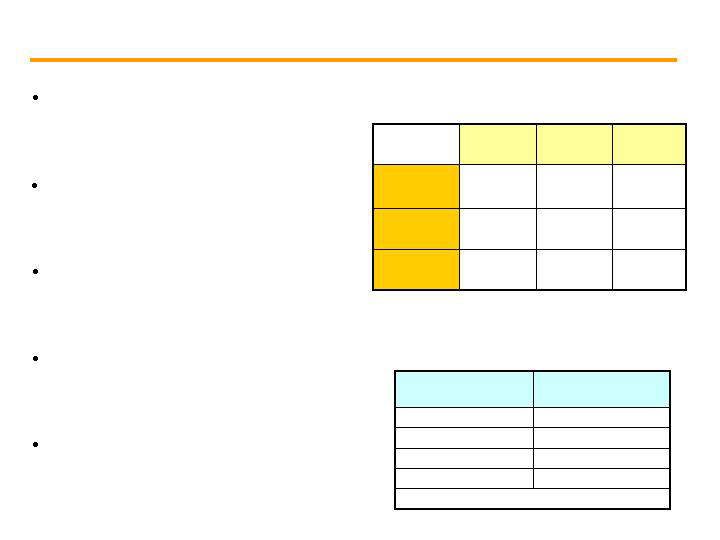

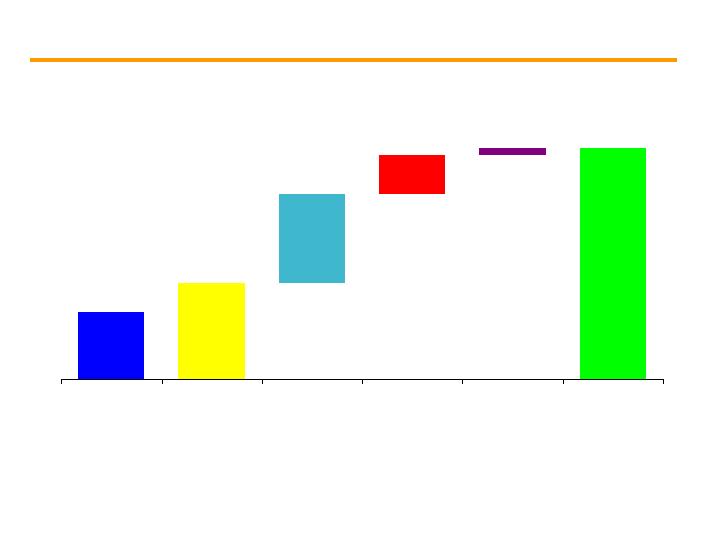

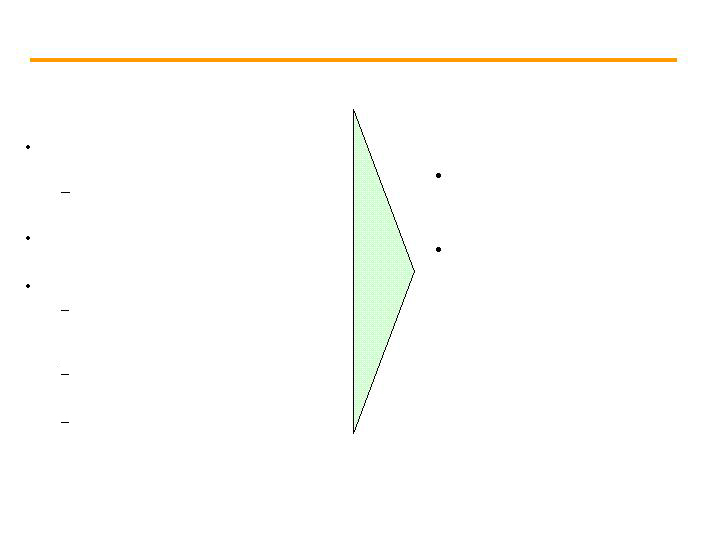

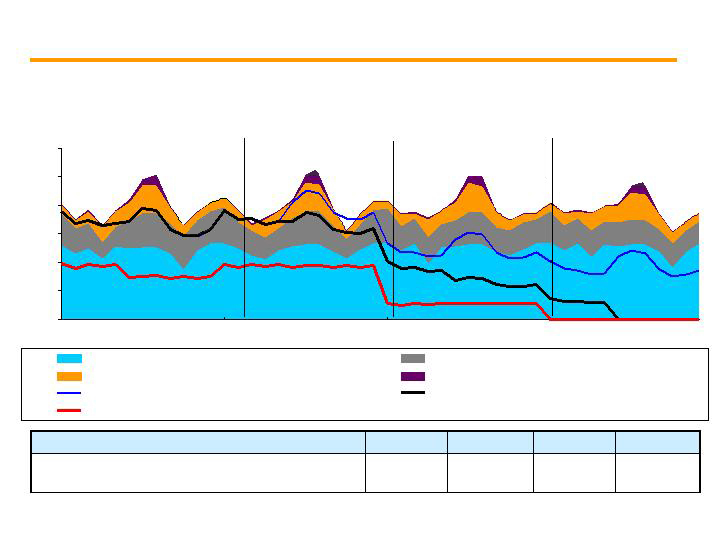

Baseload units:

- Very low variable cost, low

bid price into the energy

market

- Always, or almost always

called upon to provide

power to serve load

Load following units:

- Primarily gas-fired,

higher variable cost

- Intermittently called

upon to provide power

to serve load

Peaking units:

- Gas- and oil-fired, high variable cost,

leading to high bid price into the

energy market

- Called upon to provide power only

during periods of peak demand to

serve load

Salem

Hope

Creek

Keystone

Conemaugh

Hudson 2

Linden 1,2

Burlington

Edison

Essex

Bergen 1

Sewaren

Hudson 1

Megawatts (MW)

Mercer1, 2

Bergen 2

… position the company well to serve full requirement load contracts.

Sewaren

Kearny

Linden / Essex

Burlington 12 / Kearny 12

Peach

Bottom

Bridgeport

New

Haven

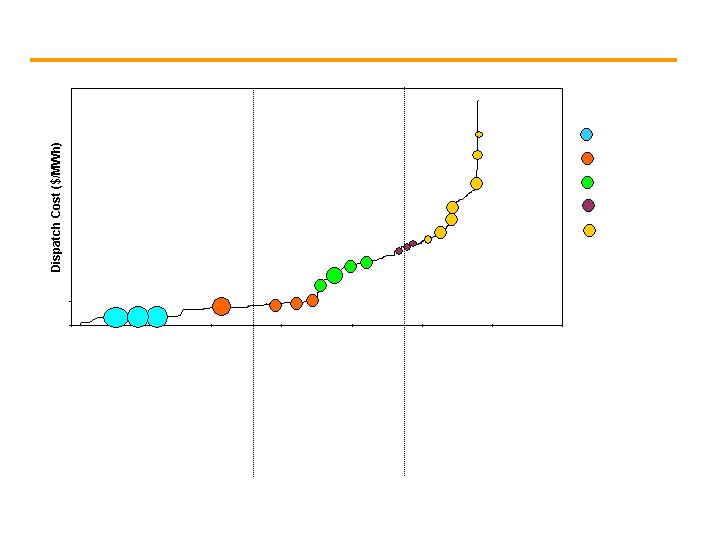

Nuclear

Coal

Combined Cycle

Steam

GT Peaking

Power’s assets along the dispatch curve …

BEC

Illustrative

7

Operated by PSEG Nuclear

PSEG Ownership: 100%

Technology:

Boiling Water Reactor

Total Capacity: 1,061MW*

Owned Capacity: 1,061MW

License Expiration: 2026

Operated by PSEG Nuclear

Ownership: PSEG - 57%,

Exelon – 43%

Technology:

Pressurized Water Reactor

Total Capacity: 2,304MW

Owned Capacity: 1,323MW

License Expiration: 2016 and

2020

Operated by Exelon

Ownership: PSEG 50%,

Exelon – 50%

Technology:

Boiling Water Reactor

Total Capacity: 2,224MW

Owned Capacity: 1,112MW

License Expiration: 2033

and 2034

Hope Creek

Salem Units 1 and 2

Peach Bottom Units 2 and 3

Our five-unit nuclear fleet …

… is a critical element of Power’s success.

*Uprate of 125MW scheduled for fall 2007

8

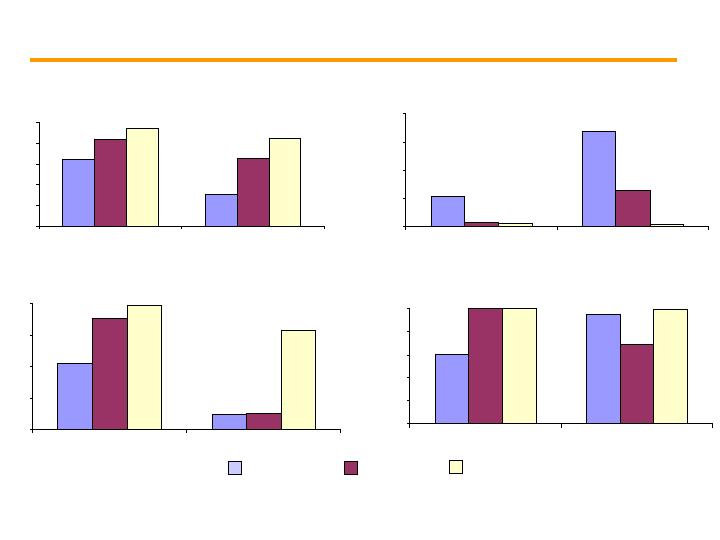

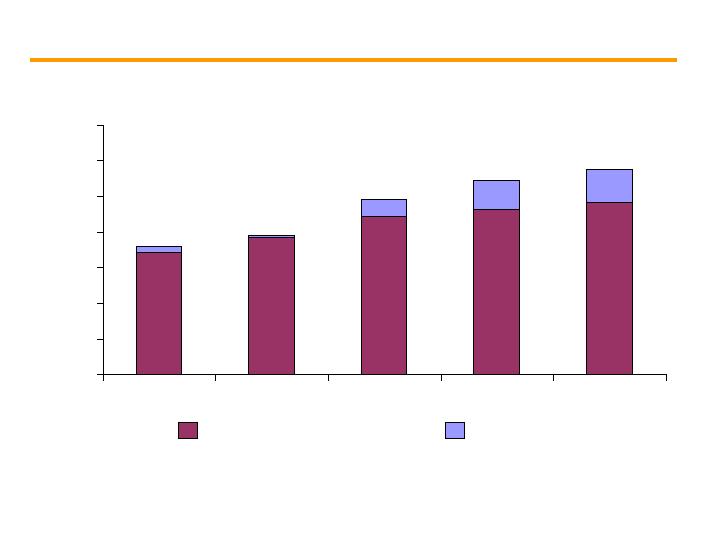

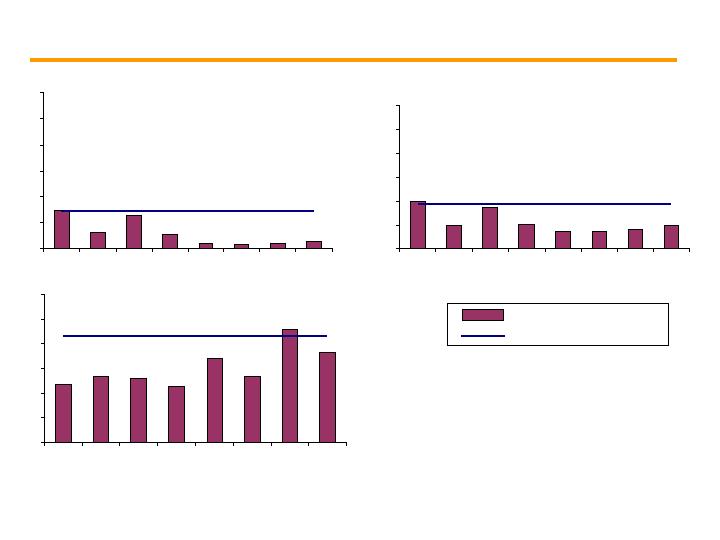

82.3%

65.6%

92.0%

82.8%

92.6%

97.2%

50%

60%

70%

80%

90%

100%

Salem

Hope Creek

Capacity Factor

6.5%

20.2%

0.9%

7.6%

0.7%

0.4%

0%

6%

12%

18%

24%

Salem

Hope Creek

Forced Loss Rate

81.0

64.8

95.2

65.0

99.2

91.4

60

70

80

90

100

Salem

Hope Creek

INPO Index

80.2%

97.4%

84.7%

99.9%

99.8%

100.0%

50%

60%

70%

80%

90%

100%

Salem

Hope Creek

Summer Capacity Factor

… and corresponds directly with improved regulatory relations and

financial outcomes.

Improvement in nuclear performance can be seen in

numerous measures of operations ...

2004

2005

2006

9

Complete Management Model

implementation

Maintain operational focus

Resume independent operation

Succession plan

Bill Levis appointed as President &

COO, PSEG Power; retains CNO

positon

Richard Lopriore appointed as

President, PSEG Fossil

Tom Joyce appointed as Senior VP –

Operations for Salem – Hope Creek

… which will strengthen Power’s results going forward.

Continuing efforts are focused on sustaining the

improving trend …

Maintain stakeholder

confidence

Preserve nuclear options

for Power

Ongoing Initiatives

Expected Results

10

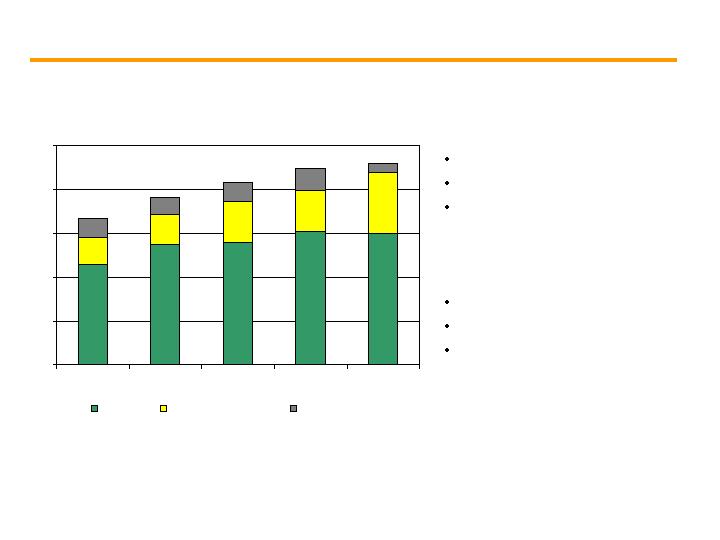

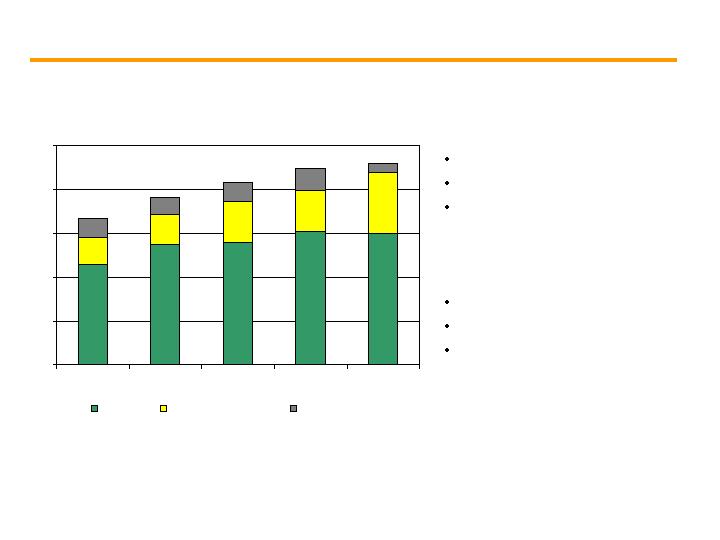

0

5,000

10,000

15,000

20,000

25,000

2002

2003

2004

2005

2006

Coal

Combined Cycle

Peaking & Other

Total Fossil Output (GWh)

A Diverse 10,000 MW Fleet

2,400 MW coal

3,200 MW combined cycle

4,400 MW peaking and other

Strong Performance

Continued growth in output

Improved fleet performance

Achieved resolution regarding

Hudson / Mercer

… contribute to a low-cost fossil portfolio in which two-thirds of

fleet output is from coal facilities.

Strong Fossil operations …

11

$490

$600 - $750

2007 – 2010 Total

($ million)

2010

Mercer**

2010

Hudson

Unit 2

Completion

Date

Environmental Capital Requirements

Emissions Control Technology Projects

- NOx control – SCR

- SO2 control – Scrubber

- Hg and particulate matter control -

Baghouse

Hudson Unit 2* (608 MW)

NOx control – SCR installation complete

SO2 control – Scrubbers

Hg and particulate matter control –

Baghouse

Mercer (648 MW) – Units 1&2

Our environmental strategy…

… will help preserve the availability of our fossil fleet.

*PSEG Fossil to notify USEPA and NJDEP by end of 2007 on decision to install emissions controls at Hudson Unit 2

**Capital investment $40M above 2006 10-K disclosure -- EPC Contract signed

Power’s New Jersey coal units are

mid-merit, with capacity factors

averaging 50% to 60%

As markets tighten, increased

production is anticipated

12

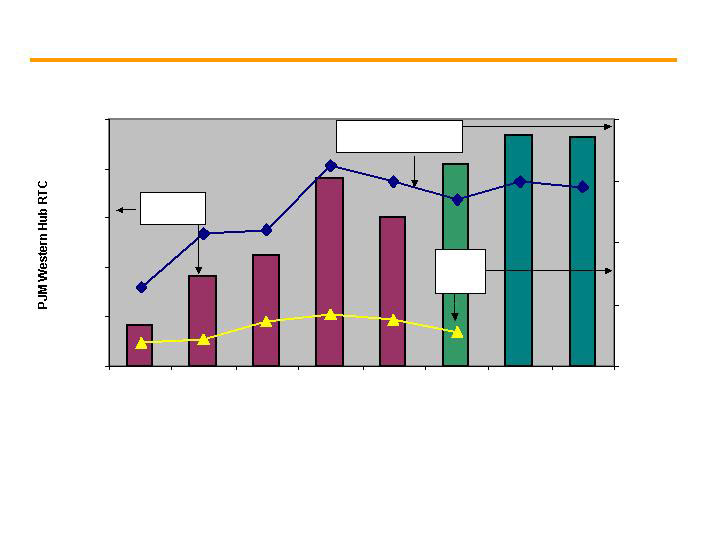

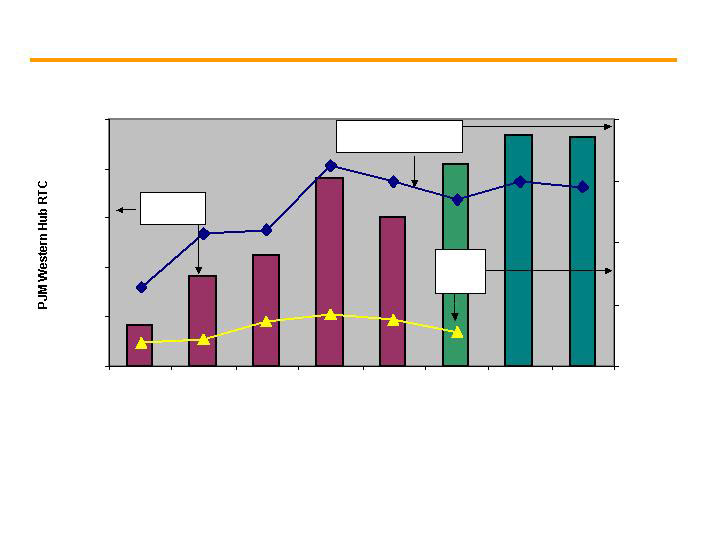

$20

$30

$40

$50

$60

$70

2002

2003

2004

2005

2006

2007

Est

2008

Fwd

2009

Fwd

$0

$3

$6

$9

$12

$/mmbtu

$/MWh

… benefiting Power’s coal and nuclear fleet.

(1)

Central Appalachian coal

(2)

Forward prices as of May 18, 2007

Increases in fossil fuels have driven up energy prices …

Electricity

(left scale)

Coal(1)

(right

scale)

Natural Gas Henry Hub

(right scale)

(2)

(2)

(2)

13

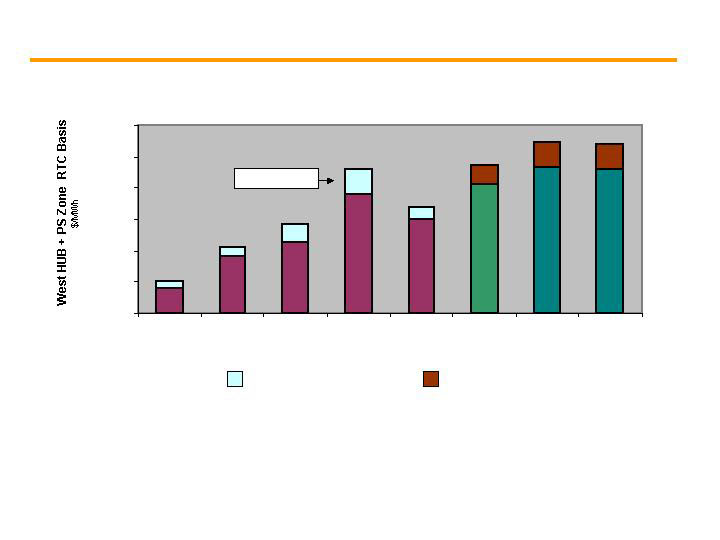

$20

$30

$40

$50

$60

$70

$80

2002

2003

2004

2005

2006

2007 Est

2008

Fwd

2009

Fwd

PS Zone Basis

Historical spot basis

Forward basis

Large portion of sales are into forward market where forward basis has remained high.

Zonal prices in the eastern portions of PJM have

historically been higher than the Western Hub…

… allowing Power to realize higher prices due to its favorable

location.

(1) Forward prices as of May 18, 2007

(1)

(1)

(1)

14

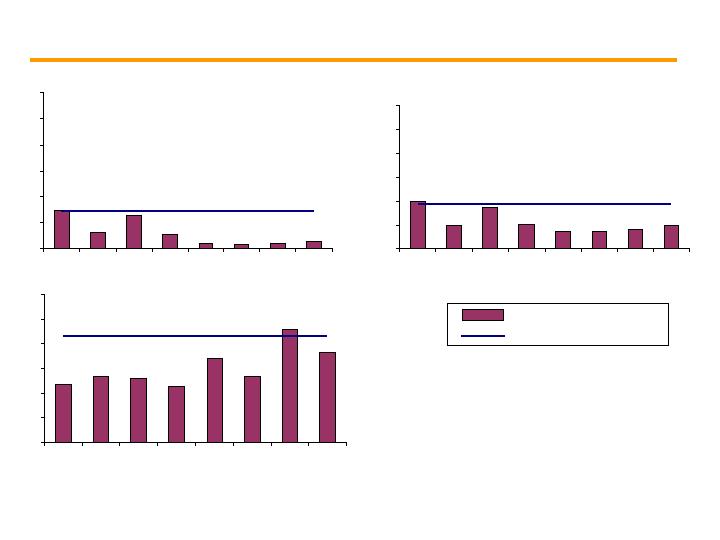

-

50

100

150

200

250

300

1999

2000

2001

2002

2003

2004

2005

2006

-

50

100

150

200

250

300

1999

2000

2001

2002

2003

2004

2005

2006

Source: Data per PJM’s State of the Market report March 2007

*Annualized payment required to make an investment

-

50

100

150

200

250

300

1999

2000

2001

2002

2003

2004

2005

2006

… which may serve to tighten reserve margins.

Despite the recent run up, prices have not

consistently supported new capacity construction …

Economic Dispatch Net Revenue

20-year Levelized Fixed Cost*

Combustion Turbine ($/KW-yr)

Combined Cycle ($/KW-yr)

Pulverized Coal ($/KW-yr)

15

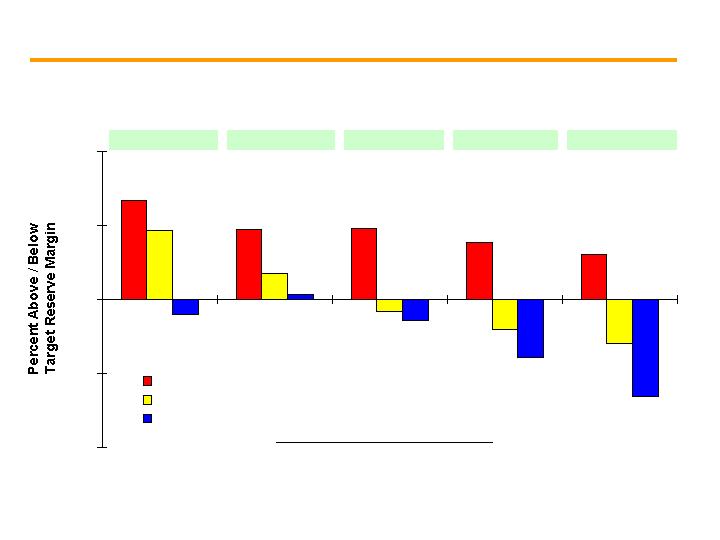

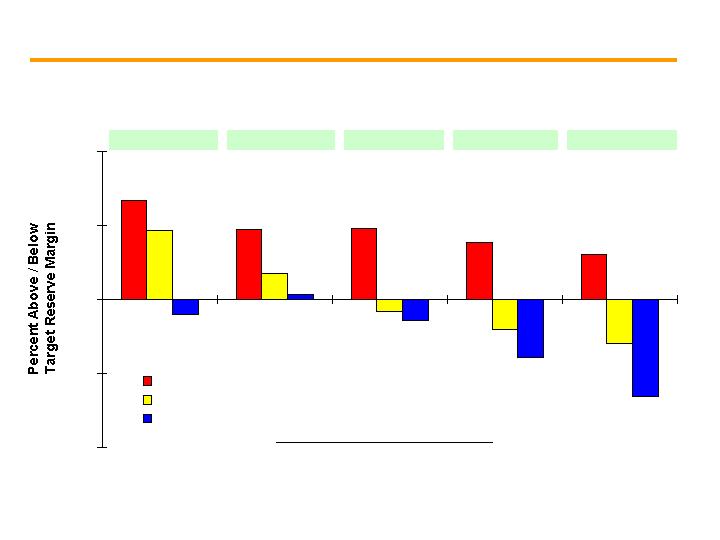

Regional Generation Balance 2007 - 2011

(Percent above or below target Reserve Margin)

7%

5%

5%

4%

3%

5%

2%

-1%

-2%

-3%

-1%

-1%

-4%

-7%

0%

-10%

-5%

0%

5%

10%

PJM (RM Target = 115%)

NY ISO (116.5%)

NE ISO (114.5% implied)

2011

2010

2009

2008

2007

Data Source: PJM, NY ISO and NE ISO

Reserve margins in the key Power markets are expected

to continue to decline …

… which should sustain higher energy prices as heat rates expand.

16

More structured, forward-

looking, transparent pricing

model

Gives prospective

investors in new

generating facilities more

clarity on future value of

capacity

Sends locational pricing

signal to encourage

expansion of capacity

where needed for future

market demands

… in which longer-term price signals are provided.

PJM’s Reliability Pricing Model (RPM) reflects a change

in market design …

$0

$20

$40

$60

2001

2002

2003

2004

2005

2006

2007

$80

2008

2009

Settled @ $72/kw-yr

’08 – ’09 Market

Trading

@ $40 -$45/kw-yr

’07 – ’08 Auction

Capacity Prices

$45/KW-yr = $123/MW-day

@ 50% load factor » $10/MWh

17

RPM Capacity Auction – April Results and Schedule

2007- 2008 Capacity Auction Results

($/ MW-day)

N/A

N/A

$40.80

Rest of

Pool

$48.38

$140.16

$188.54

Southwest

MAAC

$20.16

$177.51

$197.67

Eastern

MAAC

CTR

Value*

Load

Price

Unit

Price

PJM released results on April 13 from its

first capacity auction under the Reliability

Pricing Model (RPM) for the 2007-2008

delivery year.

Pricing in initial auction for Eastern MAAC

reflected “Cost of New Entry”: standard

simple cycle gas turbine adjusted for

location.

Future auction pricing could be influenced

by changes in demand and capacity

availability including transmission capability

between zones.

Market prices support our forecast year-

over-year improvement in capacity margin

of $125M - $175M in 2007 with further

improvement in 2008.

Auctions are scheduled throughout the

year to provide transition through the 2010-

2011 delivery year.

*CTR Value: Capacity Transfer Rights

Allocated to Load Serving Entities (LSE) in constrained zones to provide them with

access to supply from outside the zone.

May 2008

2011 – 2012

January 2008

2010 – 2011

Annual base auction in May of each subsequent year

October 2007

2009 – 2010

July 2007

2008 – 2009

Auction Date

Planning Year

(6/1 to 5/31)

Auction Schedule

18

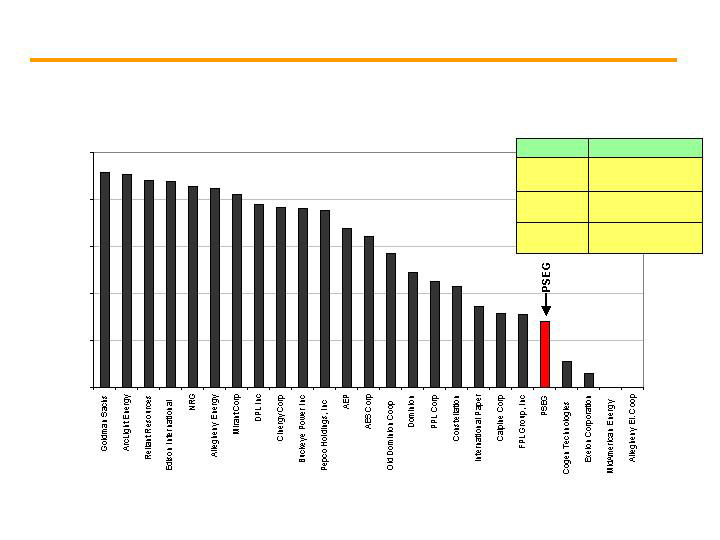

Policymakers are looking to cap and trade for the power

industry to reduce CO2 emissions.

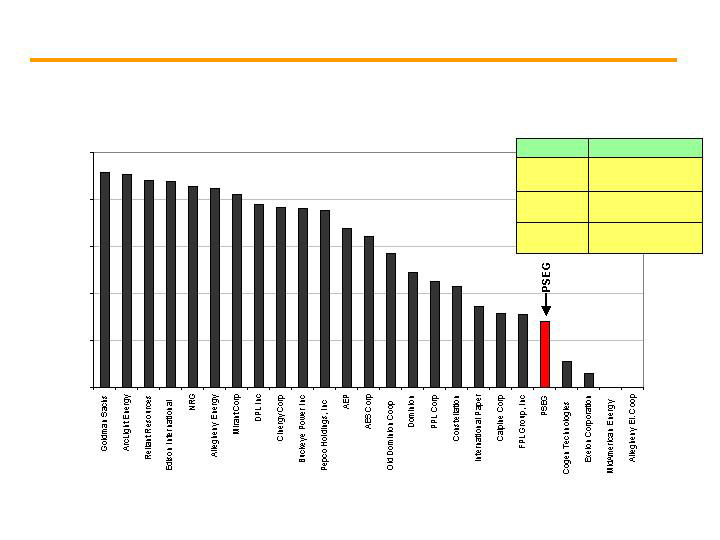

PSEG’s generation carbon intensity is lower than many competitors and benefits from a

cap and trade program comparably applied to all competitors.

2004 CO2 Emission Rate Ranking

(25 Largest Generating Companies in PJM)

0

500

1,000

1,500

2,000

2,500

(lbs/MWh

all sources)

$8-$12/MWh gas

$20/MWh coal

$20/ton

$4-$6/MWh gas

$10/MWh coal

$10/ton

$0.40-$0.60/MWh gas

$1/MWh coal

$1/ton

Generator Impact

CO2 Cost

Potential Impact of CO2 on

Power Plant Costs

Note: Ranking data compiled by NRDC, CERES and PSEG Power

19

… as market fundamentals and regulatory policy impact market

conditions.

Looking ahead, Power is well positioned to benefit from

generation value improvement …

Tightening reserve margins should:

Put upward pressure on capacity prices, and

Drive heat rate expansion if baseload additions are insufficient

The implementation of carbon rules is becoming more likely

Anticipated to put upward pressure on prices

Nuclear generation stands to benefit from carbon constraints

20

-

1,000

2,000

3,000

4,000

5,000

6,000

2007

2008

2009

2010

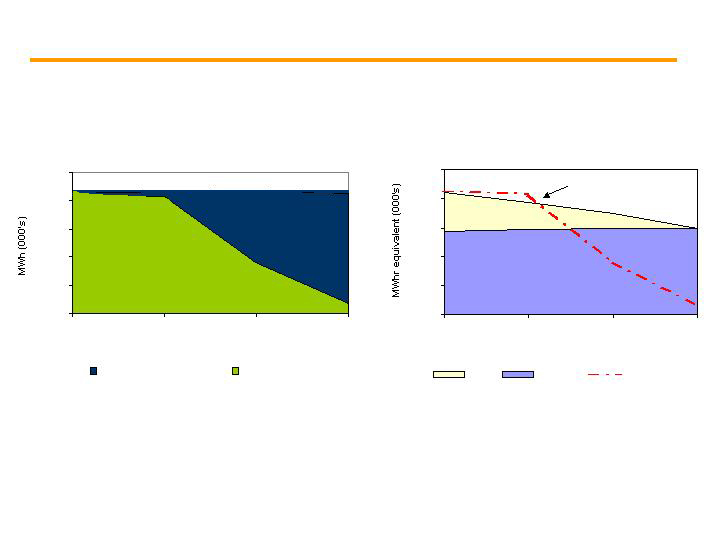

Nuclear / Pumped Storage

Coal

CC

Steam / CT

Existing Load + Hedges + Future BGS

Existing Load + Hedges

Existing Hedges

2007

2008

2009

2010

… while preserving market growth opportunities.

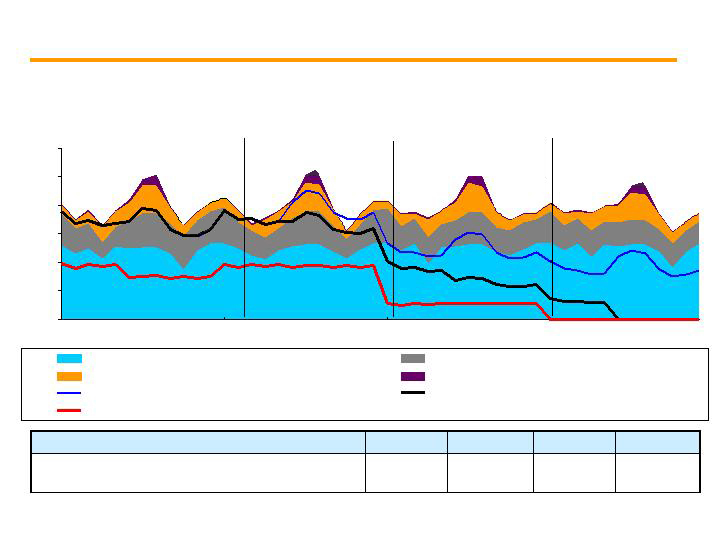

Power’s hedging strategy aims to balance stable

earnings …

0 – 20%

35 – 50%

90 – 100%

~100%

Percent of Power’s coal and nuclear energy output

hedged (total portfolio)*

2010

2009

2008

2007

PJM RTC (GWh)

*As of 1Q07

21

-

10,000

20,000

30,000

40,000

50,000

2007

2008

2009

2010

Year

Coal

Uranium

Contracted sales

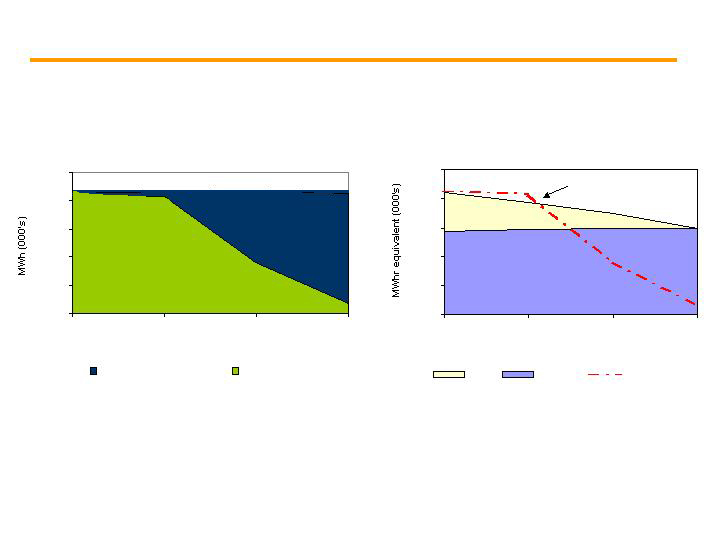

… is aligned with its low-cost generating output and our hedging

strategies.

Power has contracted for 100% of its nuclear uranium fuel through 2011 and

approximately 70% of its coal needs through 2009.

Coal and Nuclear Fuel

Power’s hedging of coal and nuclear fuel …

Gas supply secured

based on sales of output

Coal and Nuclear Output

-

10,000

20,000

30,000

40,000

50,000

2007

2008

2009

2010

Year

Nuclear and Coal output

Contracted sales

22

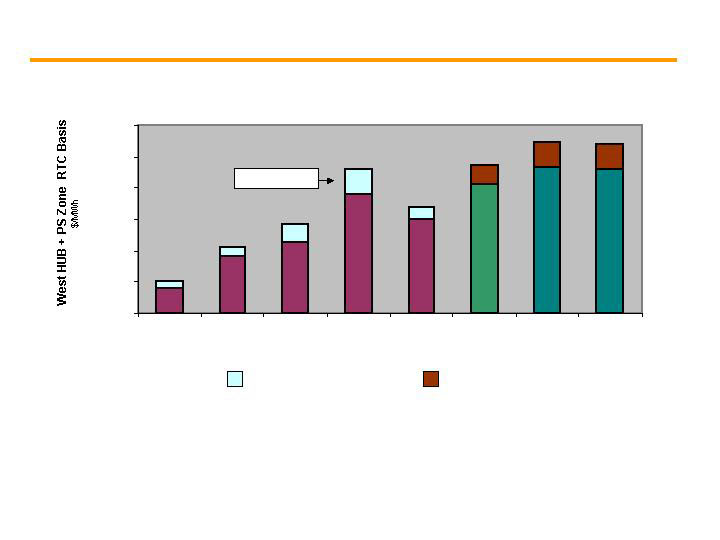

2003 Auction

2004 Auction

2005 Auction

2006 Auction

2007 Auction

Capacity

Load shape

Transmission

Congestion

Ancillary services

Risk premium

Full Requirements

Round the Clock

PJM West

Forward Energy

Price

$33 - $34

$36 - $37

$55

$55

$66

$44 - $46

~ $21

~ $18

~ $21

$102

$67 - $70

~ $32

Increase in Full Requirements Component Due to:

Increased Congestion (East/West Basis)

Increase in Capacity Markets/RPM

Volatility in Market Increases Risk Premium

$99

~ $41

$58-$60

Market Perspective – BGS Auction Results

… has enabled successful participation in each BGS auction.

Power’s fleet diversity and location ...

23

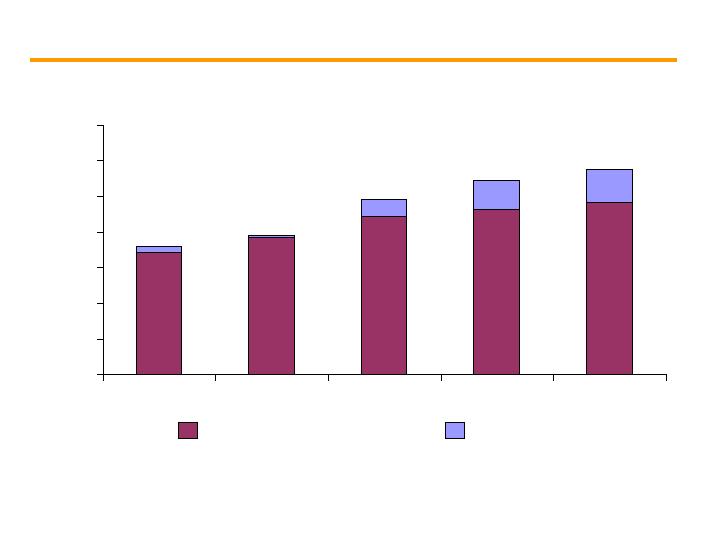

$0

$10

$20

$30

$40

$50

$60

$70

2005

2006

2007 Est

2008 Est

2009 Est

… are expected to drive significant increases in Power’s gross

margin.

Operational improvements and recontracting in

current markets …

Realized Gross Margin ($/MWh)

Energy

Capacity

(Energy prices based on recent forward markets;

Illustrative capacity prices based on recent market for 2007/2008 in all years)

24

Gas Asset Optimization

Large wholesale provider to PSE&G and others

Storage capacity of 80 Bcf (in the Gulf and market regions)

Firm transportation of 1.1 Bcf/Day (on ten pipelines)

Off-system sales margins shared with residential customers

Commercial & Industrial customers (C&I) sales priced monthly at market

Storage spreads capture Summer/Winter price differential on C&I sales

Weather and price volatility drive results

Colder than normal weather increases unitized fixed cost recovery

Ancillary Services

Emissions

… to round out a robust portfolio.

In addition to energy and capacity, Power has other

attractive sources of revenues …

25

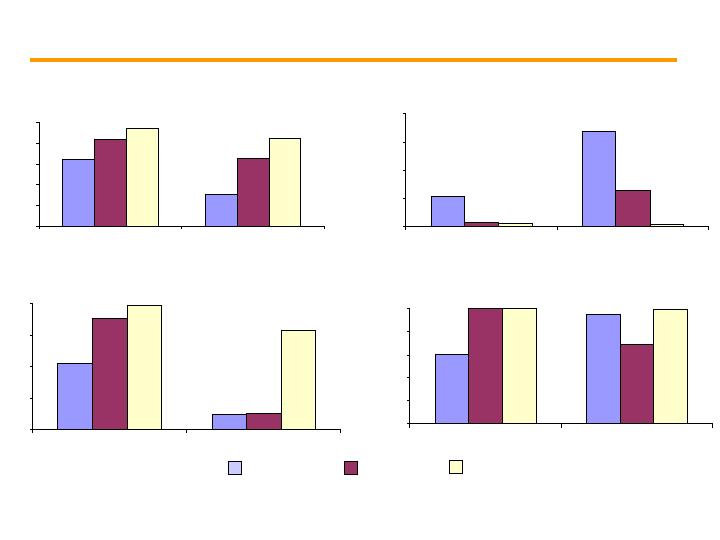

… drive the increase in PSEG’s 2007 earnings guidance.

*Excludes Merger costs of $12M in 2005, Cumulative Effect of a Change in Accounting Principle of $16M in 2005 and

Loss from Discontinued Operations of $226M and $239M in 2005 and 2006, respectively

2005 Operating

Earnings

2006 Operating

Earnings

Energy

Capacity

Other

2007 Guidance

$515M*

$446M*

$825M to

$905M

$15M - $25M

$220M - $260M

$75M - $105M

Improvements across the portfolio …

26

2007 Guidance

Energy

Capacity

Other

2008

Expectations

2009

Expectations

… drive PSEG’s earnings expectations for 2008 and beyond.

Drivers of 2009 Earnings

Recontracting

Operational excellence

Free cash flow

Growth opportunities

Further improvements at Power…

$825M to

$905M

27

Highest output ever from Nuclear

Highest output ever from Fossil

Balanced hedging strategy at ER&T

Strong, liquid markets

Sustainable BGS auction structure

Consent decree resolution

Rising energy prices

Favorable capacity market design

Diverse assets in constrained zones

Strong

Operations

Constructive

Regulatory and

Business

Environment

Positive Market

Fundamentals

Growth

Opportunities…

with Manageable

Risk

Near term – Hope Creek Uprate, RPM auctions

Longer term –

Tightening reserve margins

CO2 benefit to low carbon portfolio

Site expansion opportunities

Surrounding market opportunities

New nuclear investment potential

Manageable risk –

Enhanced operations

Balanced hedging strategy

Existing sites

Increasingly stable earnings base through

capacity market design

Positioned for growth in 2007 and beyond

28

Favorably Located Diverse Portfolio

Operational Improvements

Energy Market Improvements

Capacity Market Design Changes

Generation Value Improvement

Growth Opportunities

V

A

L

U

E

… fuel Power as the growth engine for PSEG.

Fundamental strengths and growth drivers …

29

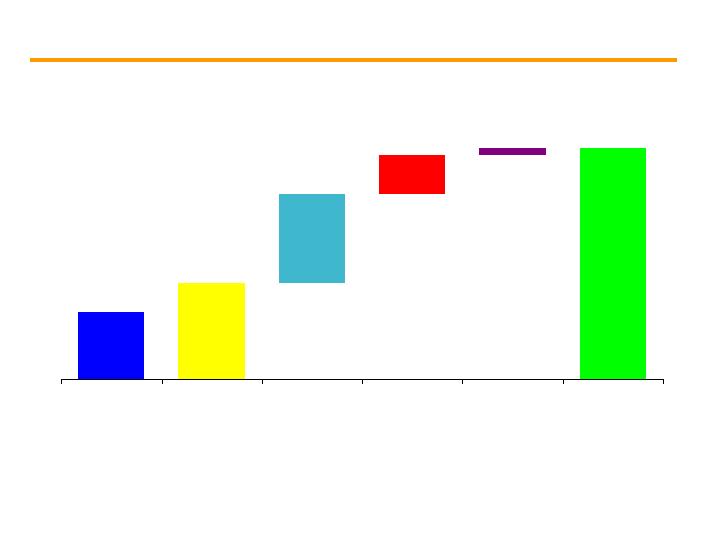

196

227

347

262

446

515

130-145

130-145

340-360

330-350

825-905

770-850

(71)

(66)

(50)-(40)

(60)-(50)

2005

2006

2007 (Initial)

2007 (Revised)

2008

Strong earnings growth in 2007 for PSEG …

… a 37% increase over 2006 and expectations of 15% growth in 2008.

Holdings

Parent***

$5.60 - $6.10

$3.77*

$3.71**

$4.60 - $5.00

$4.90 - $5.30

PSE&G

Power

Operating Earnings by Subsidiary

37%

15%

68%

» 0

*Excludes ($.14) Merger Costs, ($.07) Cumulative Effect of an Accounting Change and ($.85) Discontinued Operations

**Excludes ($.03) Merger Costs, ($.70) Loss on Sale of RGE and ($.05) Discontinued Operations

***Primarily including financing activities at the parent and intercompany elimination

30