EXHIBIT 99

Group

Enterprise

Service

Public

Lynch

Merrill

Conference

Leaders

Gas

&

Power

Global

2006

26,

September

1

Forward-Looking Statements

This presentation includes forward-looking statements within the meaning of the Private Securities

Litigation Reform Act of 1995, that are subject to risks and uncertainties. The factors that could

cause actual results of Public Service Enterprise Group Incorporated (PSEG), Public Service

Electric and Gas Company, PSEG Power LLC, and PSEG Energy Holdings L.L.C. (collectively,

the PSEG Companies) to differ materially from these forward-looking statements include those

discussed herein as well as those discussed in (1) the PSEG Companies' 2005 Annual Report on

Form 10-K, and 2006 Quarterly Reports on Form 10-Q in (a) Forward Looking Statements (b) Risk

Factors, and (c) Management's Discussion and Analysis of Financial Condition and Results of

Operations and (2) other factors discussed in filings with the SEC by the PSEG Companies.

Readers are cautioned not to place undue reliance on these forward-looking statements, which

apply only as of the date of this presentation. None of the PSEG Companies undertakes any

obligation to publicly release any revision to its forward-looking statements to reflect events or

circumstances after the date of this presentation.

,

2

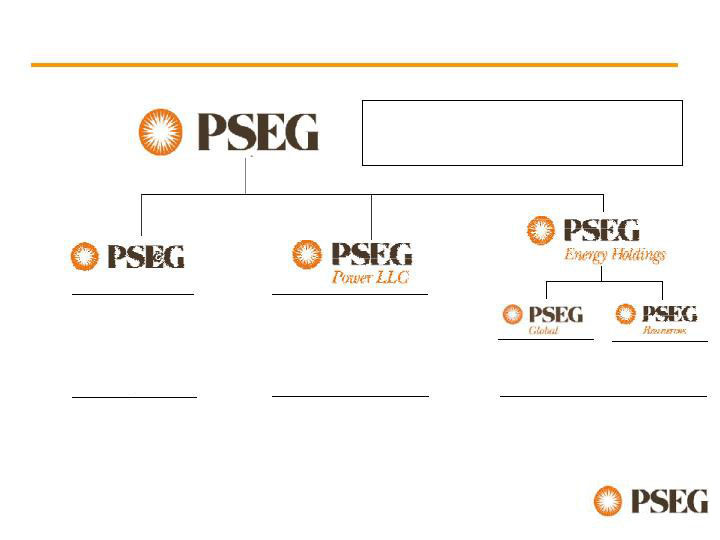

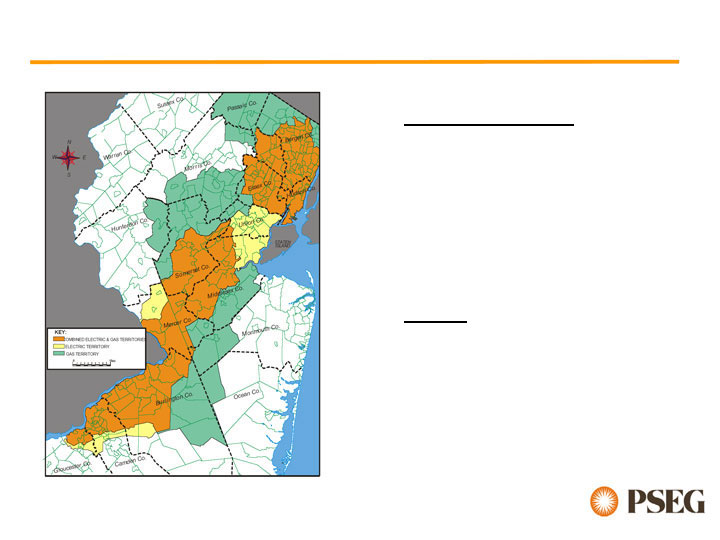

Gas Customers: 1.7M

Nuclear Capacity: 3,494 MW

Total Capacity: 14,636 MW

Traditional T&D

Leveraged

Leases

2006E Operating Earnings(1)(2): $875M - $950M

2006 EPS Guidance(1)(2): $3.45 - $3.75

Assets (as of 12/31/05): $ 29.8B

Regional

Wholesale Energy

Domestic/Int’l

Energy

2005 Results: $347M(3)

$418M(3)

$196M(3)

2006 Range: $250M - $270M(2)

$500M - $550M(2)

$185M - $205M(2)

1) Includes the parent impact of $(60-70)M

(

2) Income from Continuing Operations, excluding merger-related costs and

gains/losses from asset sales and related costs

(

3) Income from Continuing Operations, excluding merger-related costs of $3M for

PSE&G and $12M for PSEG Power

(

PSEG Overview

Electric Customers: 2.1M

3

P

PSEG 2007 Earnings Outlook & Drivers

2006 Guidance

Power

PSE&G

Holdings

2008

$3.45 - $3.75

Excess

Growth

•

Forward

•

•

•

•

•

Weather

•

Texas

•

2006 RGE

Sale

•

New

Accounting

Standard

Hedging

Re-contracting

- PJM/NE

Capacity

Market Design

Gas Rate

Case

Electric

Proceeding

2007 Guidance

$4.60 - $5.00

of 10%

PSEG Power

5

PSEG Power Overview

Nuclear

•

Nuclear Operating Services Agreement provides stability

•

2005 – record output

V•

2006 – year to date output exceeds 2005 at each unit

Fossil

•

Increased output over 2005

•

Improved performance

Energy & Capacity Margin Growth

•

2006 – energy recontracting improvements

•

2007 and beyond – energy recontracting and capacity market improvements

•

Year over year growth

-

2006: $5-6/MWh improvement

-

2007: additional $7-9/MWh improvement

-

2008: further margin increase at a declining rate

6

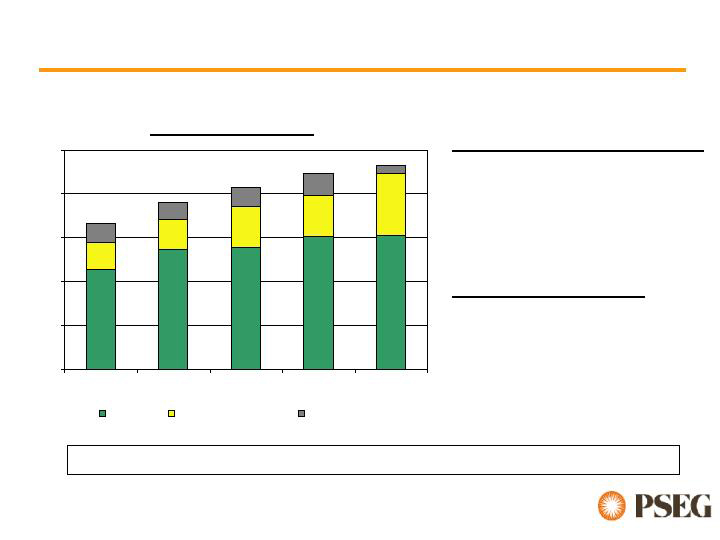

Improvements in Nuclear Operations

0

500

1,000

1,500

,

2,000

2,500

,Peach Bottom

Salem 1 & 2

Hope Creek

2 & 3

MW

Exelon Share

PSEG

Share

• Strong operational performance

- Capacity factors: YTD ~96%

Summer ~100%

• Outage management

- Record for reactor head replacement

- Site records achieved

• Station culture improvements

- SCWE issue closed

- “Substantial, sustainable progress”

• Nuclear Operating Services

Agreement (NOSA) remains

effective

Total:

3,494MW

• PSEG Owned

• PSEG Operated

(NOSA)

• Jointly Owned

• PSEG Operated

(NOSA)

• Jointly Owned

• Exelon Operated

PSEG

MW

Owned

1,112MW

1,323MW

1,059MW*

* Uprate of 127MW scheduled for Fall 2007

7

s

n

o

i

t

a

r

e

p

O

l

i

s

s

o

F

n

i

t

n

e

m

e

v

o

r

p

m

I

s

n

o

i

t

a

r

e

p

O

l

i

s

s

o

F

n

i

t

n

e

m

e

v

o

r

p

m

I

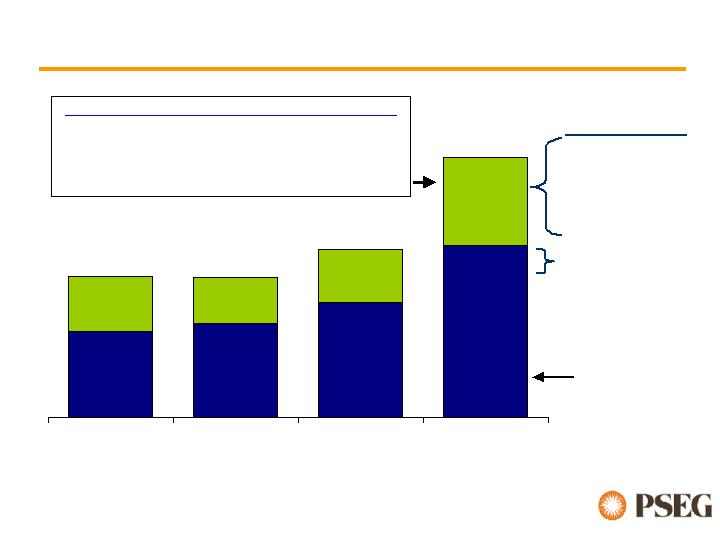

0

5

,

0

0

0

0

1

,

0

0

0

5

1

,

0

0

0

0

2

,

0

0

0

5

2

,

0

0

0

2

0

0

2

3

0

0

2

4

0

0

2

0

2

5

0

E

6

0

0

2

s

t.

o

C

a

l

Combined

Cycle

P

e

a

k

i

&

g

n

O

t

e

h

r

t

u

p

t

u

O

l

i

s

s

o

F

l

a

t

o

T

h

w

G

(

)

0

0

0

,

1

1

e

s

r

e

v

i

D

A

t

e

e

l

F

W

M

•

2

l

a

o

c

W

M

0

0

4

,

•

4

e

l

c

y

c

d

e

n

i

b

m

o

c

W

M

0

0

3

,

•

4

r

e

h

t

o

d

n

a

g

n

i

k

a

e

p

W

M

0

0

5

,

e

c

n

a

m

r

o

f

r

e

P

g

n

o

r

t

S

•

C

t

u

p

t

u

o

n

i

h

t

w

o

r

g

d

e

u

n

i

t

n

o

•

I

e

c

n

a

m

r

o

f

r

e

p

t

e

e

l

f

d

e

v

o

r

p

m

•

M

e

r

u

t

i

t

s

e

v

i

d

d

e

t

a

l

e

r

r

e

g

r

e

r

e

g

n

o

l

o

n

s

t

n

e

m

t

i

m

m

o

c

e

l

b

a

c

i

l

p

p

a

Low cost nuclear and coal generate more than 80% of Power’s total output

8

BGS Auction Results

•

Capacity

•

Load shape

•

Transmission

•

Congestion

•

Ancillary services

•

Risk premium

RTC Forward

Energy Cost

Full Requirements

$33 - $34

$36 - $37

$55.59

(34 Month NJ Avg.)

$55.05

(36 Month NJ Avg.)

$65.91

(36 Month NJ Avg.)

$44 - $46

~ $21

~ $18

~ $21

$102.21

(36 Month NJ Avg.)

$67 - $70

2

3

$

~

Increase in Full Requirements Component Due to:

Increased Congestion (East/West Basis)

Anticipated Increase in Capacity Markets/RPM

Higher Volatility in Market Increases Risk Premium

Recent Forward

Price Range

RTC = round the clock

2003 Auction

2004 Auction

2005 Auction

2006 Auction

9

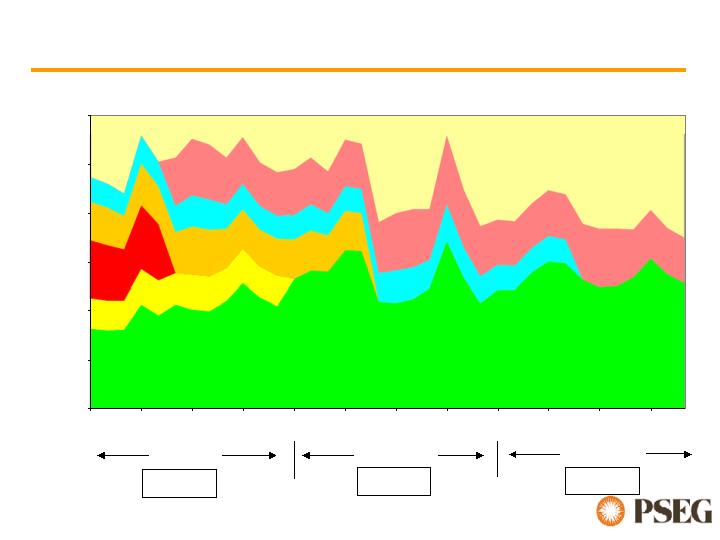

9

>

5

%

-

5

8

9

%

5

-

5

6

8

%

0

6

0

0

2

7

0

0

2

8

0

0

2

H

%

e

d

g

e

d

Generation output not under contract

2006 BGS

2005 BGS

2004 BGS

120%

100%

80%

60%

40%

20%

0%

2003 BGS

United Illuminating

Other term energy contracts

Jan-06

Apr-06

Jul-06

Oct-06

Jan-07

Apr-07

Jul-07

Oct-07

Jan-08

Apr-08

Jul-08

Oct-08

Significant Forward Hedging of Nuclear and Coal

% of

Nuclear

and

Coal

Generation

0

1

n

g

i

s

e

D

t

e

k

r

a

M

y

t

i

c

a

p

a

C

n

g

i

s

e

D

t

e

k

r

a

M

y

t

i

c

a

p

a

C

M

J

P

•

F

r

e

d

r

O

C

R

E

6

0

/

0

2

/

4

•

l

a

n

o

i

t

a

c

o

L

p

c

i

r

i

g

n

•

S

g

n

i

o

g

n

o

s

n

o

i

s

s

u

c

s

i

d

t

n

e

m

e

l

t

t

e

•

A

c

i

t

n

7

0

/

1

/

6

n

o

i

t

a

t

n

e

m

e

l

p

m

i

d

e

t

a

p

i

•

P

g

n

i

c

i

r

p

w

o

h

s

s

n

o

i

t

a

l

u

m

i

s

M

J

r

y

-

w

k

/

s

’

0

3

$

d

i

m

o

t

r

y

-

w

k

/

0

2

$

m

o

r

f

d

n

a

l

g

n

E

w

e

N

•

F

t

e

k

r

a

M

y

t

i

c

a

p

a

C

d

r

a

w

r

o

6

0

/

1

/

2

1

n

i

g

e

b

o

t

d

e

l

u

d

e

h

c

s

)

M

C

F

(

•

T

s

n

a

r

s

i

l

b

a

t

s

e

n

e

e

b

e

v

a

h

s

e

c

i

r

p

d

o

i

r

e

p

n

o

i

t

i

d

e

h

–

6

0

/

1

/

2

1

5

8

0

/

1

3

/

r

y

-

w

k

/

0

6

.

6

3

$

–

8

0

/

1

/

6

5

9

0

/

1

3

/

r

y

-

w

k

/

0

0

.

5

4

$

–

9

0

/

1

/

6

5

0

1

/

1

3

/

r

y

-

w

k

/

0

2

.

9

4

$

•

F

v

i

l

e

d

0

1

0

2

r

o

f

8

0

0

2

n

i

d

e

l

u

d

e

h

c

s

n

o

i

t

c

u

a

t

s

r

i

y

r

e

G

&

E

S

P

12

Recognized as a Top Performing Utility

0

0

1

l

m

Accomplishments

•

Top quartile performance

continues

•

Strong safety and reliability

results

•

Dedication to capital

investment program

Issues

•

Disappointing returns from

gas business

ROE: <4%

•

•

Re-establish constructive

regulatory relations regarding

traditional utility matters

3

1

PSE&G Regulatory Filings

P

Excess Depreciation Credit

•

$64M annual credit expired December 31, 2005

•

PSE&G filed 1Q 2006 actual results in June

•

Decision was put on hold, pending merger review

•

Expect discussions to resume with BPU shortly

Gas Base Rate Case

•

$133M revenue increase requested

•

Hearings held in July & August of this year

•

Currently conducting settlement discussions

•

Schedule calls for BPU decision late this year or early next year

PSEG Energy Holdings

5

1

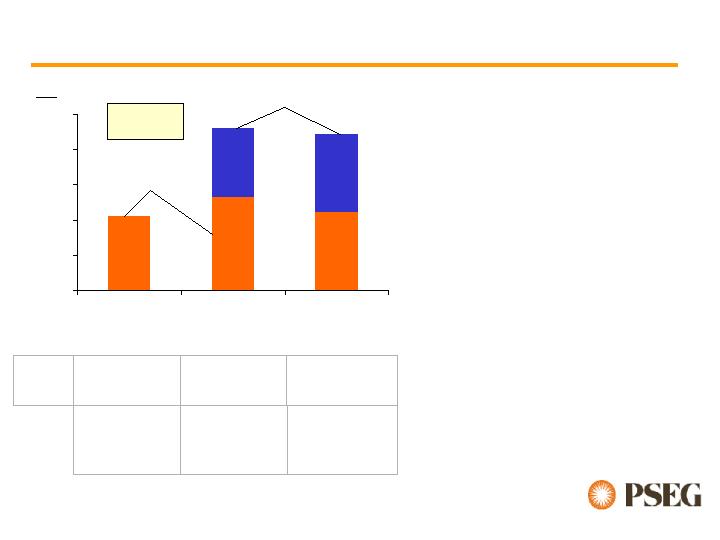

P

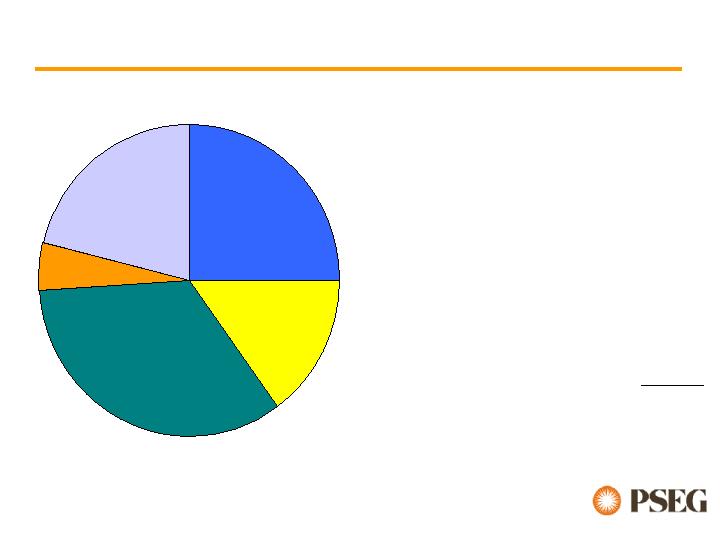

PSEG Holdings: Providing Meaningful Earnings

PSEG

Resources

Latin American

Texas Merchant

Generation

(2,000 MW)

International

Generation

Other fully contracted

US Generation

Projected Earnings Contribution

•

Significant decapitalization:

2004-2006

•

Recourse debt reduction:

$ 917M

•

Return of capital & dividends:

$1,309M

$2,226M

•

Approximately 95% of Global’s Earnings

come from US Generation and Latin

American Distribution assets

•

Continue strategic asset monetization

Distribution

6

1

P

PSEG’s Business Outlook

•

Improved performance and reliability of Nuclear Operations

•

Enhanced electric marketplace

•

Business risk improvements

17

Public Service Enterprise Group