EXHIBIT 99

| | | | |

| | Investor News | | NYSE: PEG |

For further information, contact:

| | |

• Kathleen A. Lally, Vice President – Investor Relations | | Phone:973-430-6565 |

• Carlotta Chan, Manager - Investor Relations | | Phone:973-430-6596 |

PSEG ANNOUNCES 2017 THIRD QUARTER RESULTS

Net Income of $0.78 Per Share

Non-GAAP Operating Earnings of $0.82 Per Share

Re-Affirms 2017Non-GAAP Operating Earnings Guidance of $2.80 - $3.00 Per Share

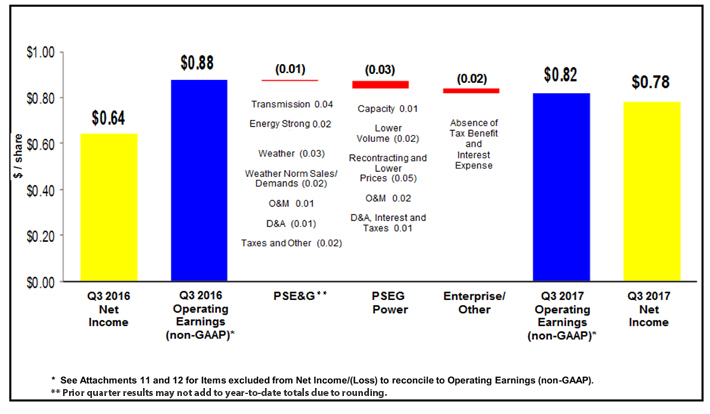

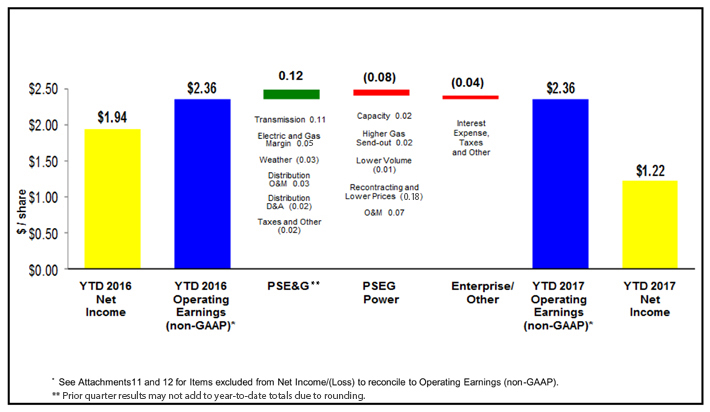

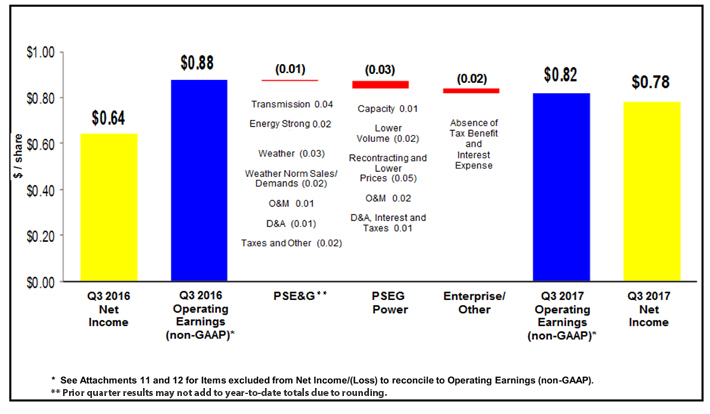

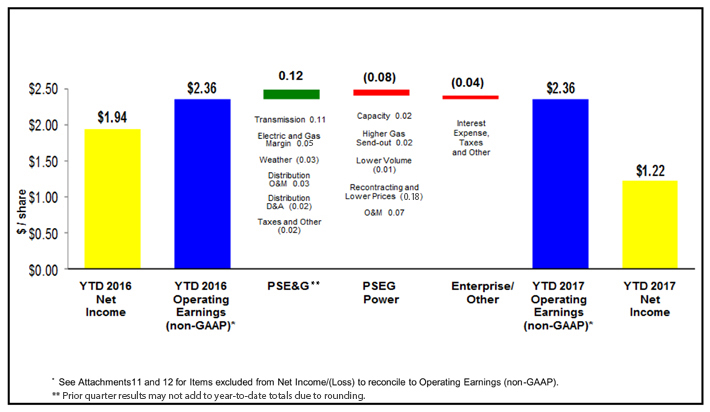

October 31, 2017 (Newark, NJ) (NYSE – PEG) Public Service Enterprise Group (PSEG) reported third quarter 2017 Net Income of $395 million or $0.78 per share as compared to Net Income of $327 million or $0.64 per share reported for the third quarter of 2016.Non-GAAP Operating Earnings for the third quarter of 2017 were $417 million or $0.82 per share as compared tonon-GAAP Operating Earnings for the third quarter of 2016 of $444 million or $0.88 per share.

“We experienced solid results for the quarter, executing well on major initiatives,” said Ralph Izzo, Chairman, President and Chief Executive Officer, “delivering reliable, efficient service, as we continue to upgrade our transmission system, replace cast-iron pipe and construct three new cleangas-fired combined cycle generating stations.”

Management usesnon-GAAP Operating Earnings in its internal analysis, and in communications with investors and analysts, as a consistent measure for comparing PSEG’s financial performance to previous financial results.Non-GAAP Operating Earnings exclude the impact of returns(losses) associated with Nuclear Decommissioning Trust (NDT),Mark-to-Market (MTM) accounting and materialone-time items.

The table below provides a reconciliation of PSEG’s Net Income tonon-GAAP Operating Earnings for the third quarter. See Attachment 11 for a complete list of items excluded from Net Income in the determination ofnon-GAAP Operating Earnings. The presentation ofnon-GAAP Operating Earnings is intended to complement, and should not be considered an alternative to, the presentation of Net Income, which is an indicator of financial performance determined in accordance with GAAP. In addition,non-GAAP Operating Earnings as presented in this release may not be comparable to similarly titled measures used by other companies.

PSEG CONSOLIDATED RESULTS (unaudited)

Third Quarter Comparative Results

2017 and 2016

| | | | | | | | | | | | | | | | | | | | |

| | | Income | | | | | | Diluted Earnings | |

| | | ($ millions) | | | | | | Per Share | |

| | | 2017 | | | 2016 | | | | | | 2017 | | | 2016 | |

Net Income | | $ | 395 | | | $ | 327 | | | | | | | $ | 0.78 | | | $ | 0.64 | |

Reconciling Items* | | | 22 | | | | 117 | | | | | | | | 0.04 | | | | 0.24 | |

| | | | | | | | | | | | | | | | | | | | |

Non-GAAP Operating Earnings | | $ | 417 | | | $ | 444 | | | | | | | $ | 0.82 | | | $ | 0.88 | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | | | Avg. Shares | | | | 507M | | | | 508M | |

Ralph Izzo went on to say, “Despite the impact of abnormally cool weather on third quarter sales and earnings, we remain within ournon-GAAP Operating Earnings guidance for the full year of $2.80 - $3.00 per share.”

Non-GAAP Operating Earnings guidance by company for the full year remains unchanged:

2017Non-GAAP Operating Earnings Guidance

($ millions, except EPS)

| | |

| | | 2017 Estimate |

PSE&G | | $945 - $985 |

PSEG Power | | $435 - $510 |

PSEG Enterprise/Other | | $35 - $35 |

Non-GAAP Operating Earnings | | $1,415 - $1,530 |

| | |

Non-GAAP EPS | | $2.80 - $3.00 |

| | |

Due to the forward looking nature ofnon-GAAP Operating Earnings guidance, PSEG is unable to reconcile thisnon-GAAP financial measure to the most directly comparable GAAP financial measure. Management is unable to project certain reconciling items, in particular MTM and NDT gains (losses), for future periods due to market volatility.

Non-GAAP Operating Earnings Review and Outlook by Operating Subsidiary

See Attachment 5 for detail regarding the quarter-over-quarter reconciliations for each of PSEG’s businesses.

PSE&G

PSE&G reported Net Income of $246 million ($0.49 per share) for the third quarter of 2017 compared with Net Income of $255 million ($0.50 per share) for the third quarter of 2016.

Net Income growth in the third quarter associated with PSE&G’s expanded investment in electric and gas transmission and distribution facilities was offset by the impact on sales of weather conditions which were substantially cooler than experienced in theyear-ago quarter and cooler than normal.

Returns on PSE&G’s expanded investment in transmission added $0.04 per share to Net Income in the quarter. Incremental revenue associated with recovery of PSE&G’s Energy Strong investment infrastructure program of $0.02 per share was offset by a decline in electric demand-related revenues and weather-normalized electric sales. Net Income comparisons were also impacted by a decline in electric sales associated with weather conditions which were approximately 27% cooler than conditions experienced during the 2016 third quarter and 5% cooler than normal. The decline in electric sales reduced third quarter Net Income comparisons by $0.03 per share. An increase in depreciation expense of $0.01 per share associated with PSE&G’s expanded capital base was offset by a decline in operating and maintenance expense. An absence of tax credits available in theyear-ago third quarter and other items reduced Net Income comparisons by $0.02 per share.

Electric sales, as a result of cooler summer weather, declined 8.3% in the quarter. The decline was led by an approximate 13.9% decline in sales to residential customers and accompanied a decline in sales to commercial and industrial customers of 4.8% and 4.2%, respectively. On a trailing twelve-month basis, weather-normalized electric sales decreased by 0.1% year-over-year. Gas sales, on the same basis, increased 1.5% led by the commercial sector.

Electric sales comparisons for the quarter reflect warmer than normal weather experienced in the second half of September. The warm weather in the second half of September had a more modest impact on margins, as those sales are accrued at the lowernon-summer billing rates.

PSE&G filed an update of its Formula Rate for transmission at the Federal Energy Regulatory Commission (FERC) in October 2017. The update, which reflects an increase in the level of PSE&G’s investment in transmission and atrue-up of prior year results, provides for a $212 million increase in annual transmission revenues effective January 1, 2018. The increase is due to planned capital improvements with a focus on improvements to system reliability.

PSE&G, following discussions with the staff of the NJ Board of Public Utilities (BPU) and Rate Counsel, and as approved by the BPU at its October 20, 2017 meeting, agreed to delay the filing of its base distribution rate case by one month to no later than December 1, 2017. The filing will be based upon three months of actual data and nine months of forecasted data with the test year ending June 2018 remaining unchanged.

PSE&G invested approximately $2.1 billion for the nine months ended September 30 in electric and gas transmission and distribution capital projects designed to provide more reliable, safe and resilient service to its 2.2 million customers. For the year, PSE&G currently expects to invest $3.1 billion of capital in its infrastructure. This is lower than the plan of $3.4 billion due to a delay in timing on certain projects and better than anticipated efficiencies.

The forecast of PSE&G’s Net Income for 2017 remains unchanged at $945 - $985 million.

PSEG Power

PSEG Power reported Net Income of $136 million ($0.27 per share) for the third quarter of 2017 andnon-GAAP Adjusted EBITDA of $356 million compared with Net Income of $139 million ($0.27 per share) andnon-GAAP Adjusted EBITDA of $387 million for the third quarter of 2016.Non-GAAP Operating Earnings for the third quarter of 2017 were $158 million ($0.31 per share) compared withnon-GAAP Operating Earnings for the third quarter of 2016 of $170 million ($0.34 per share).

Power’s Net Income in the third quarter was impacted by a decline in energy prices and the effect of cooler than normal weather on demand and output, which offset a decline in operating and maintenance expense.

Non-GAAP Operating Earnings in the quarter increased $0.01 per share as the result of higher capacity prices in New England and PJM. Lower average prices on energy hedges and a decline in market prices combined to reducenon-GAAP Operating Earnings comparisons by $0.05 per share. A 6% decline in output associated with the impact of cooler than normal weather conditions on demand reducednon-GAAP Operating Earnings comparisons by $0.02 per share. A reduction in O&M expense associated with the June 1, 2017 retirement of the Hudson and Mercer coal stations and a decline in nuclear plant related costs improvednon-GAAP Operating Earnings comparisons by $0.02 per share. A decline in depreciation expense associated with the retirement of Hudson and Mercer combined with a decline in interest expense and taxes to improvenon-GAAP Operating Earnings comparisons by $0.01 per share.

Cooler than normal weather limited peak demand requirements and utilization of thegas-fired combined cycle and peaking fleets. The nuclear fleet’s output increased 20% quarter-over-quarter to 8.2 TWh as the fleet’s capacity factor improved to 96% from 80%. The improvement in performance reflects the absence of lengthy repair-related work at the Salem Station (including repair and replacement of baffle bolts) in theyear-ago quarter and strong performance at Hope Creek in the current quarter. Power’sgas-fired combined cycle fleet experienced a 29% decline in output to 3.7 TWh. An increase in the price of gas improved the competitive position of the base-load coal fleet as a decline in market demand sharply reduced utilization of the peaking fleet.

Power continues to forecast output for 2017 of 49 – 50 TWh. Approximately 86% of production for the remainder of the year of 11 TWh is hedged at an average price of $45 per MWh. Power has hedged approximately 70% - 75% of 2018’s forecast output of 52 – 54 TWh

at an average price of $41 per MWh. For 2019, Power has hedged 30% - 35% of forecast output of 58 – 60 TWh at an average price of $39 per MWh. The forecast of output for 2018 and 2019 remains unchanged from prior estimates.

The forecast increase in output in both 2018 and 2019 reflects the commercialstart-up inmid-2018 of 1,300 MWs of newgas-fired combined cycle capacity at the Keys Energy Center in Maryland and Sewaren in New Jersey, and themid-2019 commercialstart-up of the 485 MWgas-fired combined cycle generating unit in Bridgeport Harbor, Connecticut.

Management believesnon-GAAP Adjusted EBITDA is useful to investors and other users of our financial statements in evaluating operating performance because it provides them with an additional tool to compare business performance across companies and across periods. Management also believes thatnon-GAAP Adjusted EBITDA is widely used by investors to measure operating performance without regard to items such as income tax expense, interest expense and depreciation and amortization, which can vary substantially from company to company depending upon, among other things, the book value of assets, capital structure, whether assets were constructed or acquired and accounting methods.Non-GAAP Adjusted EBITDA also allows investors and other users to assess the underlying financial performance of our fleet before management’s decision to deploy capital.Non-GAAP Adjusted EBITDA excludes the same items as ournon-GAAP Operating Earnings measure as well as income tax expense, interest expense and depreciation and amortization. See Attachment 12 for a complete list of items excluded from Net Income in the determination ofnon-GAAP Adjusted EBITDA. The presentation ofnon-GAAP Adjusted EBITDA is intended to complement, and should not be considered an alternative to, the presentation of Net Income, which is an indicator of financial performance determined in accordance with GAAP. In addition,non-GAAP Adjusted EBITDA as presented in this release may not be comparable to similarly titled measures used by other companies.

Due to the forward looking nature ofnon-GAAP Adjusted EBITDA guidance, PSEG is unable to reconcile thisnon-GAAP financial measure to the most directly comparable GAAP financial measure. Management is unable to project certain reconciling items, in particular MTM and NDT gains (losses), for future periods due to market volatility.

The forecast range of Power’s 2017non-GAAP Operating Earnings andnon-GAAP Adjusted EBITDA remain unchanged at $435 – $510 million and $1,080 – $1,210 million, respectively.

PSEG Enterprise/Other

PSEG Enterprise/Other reported Net Income of $13 million ($0.02 per share) for the third quarter of 2017 compared to a Net Loss of $67 million ($0.13 per share) for the third quarter of 2016.

Non-GAAP Operating Earnings for the third quarter of 2017 were $13 million ($0.02 per share) compared withnon-GAAP Operating Earnings of $19 million ($0.04 per share) during the third quarter of 2016.

The decrease innon-GAAP Operating Earnings year-over-year reflects the absence of certain tax items at PSEG Energy Holdings and Parent recognized in the third quarter of 2016 as well as higher interest expense at the Parent.

The forecast of PSEG Enterprise/Other full yearnon-GAAP Operating Earnings remains at $35 million.

Financing

PSEG closed the quarter ended September 30, 2017 with $278 million of cash on its balance sheet with debt at the end of the quarter representing approximately 49% of consolidated capital. PSEG Power had debt at the end of the quarter representing 31% of capital.

###

About PSEG:

Public Service Enterprise Group (NYSE: PEG) is a publicly traded diversified energy company with annual revenues of $9.1 billion. Its operating subsidiaries are: Public Service Electric and Gas Company (PSE&G), PSEG Power LLC, and PSEG Long Island.

PSE&G is New Jersey’s oldest and largest regulated gas and electric delivery utility, serving nearly three-quarters of the state’s population. PSE&G is the winner of the ReliabilityOne Award for superior electric system reliability.

PSEG Power LLC is an independent power producer that generates and sells electricity in the PJM, New York and New England wholesale power markets.

Forward-Looking Statement

Certain of the matters discussed in this presentation about our and our subsidiaries’ future performance, including, without limitation, future revenues, earnings, strategies, prospects, consequences and all other statements that are not purely historical constitute “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Such forward-looking statements are subject to risks and uncertainties, which could cause actual results to differ materially from those anticipated. Such statements are based on management’s beliefs as well as assumptions made by and information currently available to management. When used herein, the words “anticipate,” “intend,” “estimate,” “believe,” “expect,” “plan,” “should,” “hypothetical,” “potential,” “forecast,” “project,” variations of such words and similar expressions are intended to identify forward-looking statements. Factors that may cause actual results to differ are often presented with the forward-looking statements themselves. Other factors that could cause actual results to differ materially from those contemplated in any forward-looking statements made by us herein are discussed in filings we make with the United States Securities and Exchange Commission (SEC) including our Annual Report on Form10-K and subsequent reports on Form10-Q and Form8-K. These factors include, but are not limited to:

| | • | | fluctuations in wholesale power and natural gas markets, including the potential impacts on the economic viability of our generation units; |

| | • | | our ability to obtain adequate fuel supply; |

| | • | | any inability to manage our energy obligations with available supply; |

| | • | | increases in competition in wholesale energy and capacity markets; |

| | • | | changes in technology related to energy generation, distribution and consumption and customer usage patterns; |

| | • | | third party credit risk relating to our sale of generation output and purchase of fuel; |

| | • | | adverse performance of our decommissioning and defined benefit plan trust fund investments and changes in funding requirements; |

| | • | | changes in state and federal legislation and regulations; |

| | • | | the impact of pending rate case proceedings; |

| | • | | regulatory, financial, environmental, health and safety risks associated with our ownership and operation of nuclear facilities; |

| | • | | adverse changes in energy industry laws, policies and regulations, including market structures and transmission planning; |

| | • | | changes in federal and state environmental regulations and enforcement; |

| | • | | delays in receipt of, or an inability to receive, necessary licenses and permits; |

| | • | | adverse outcomes of any legal, regulatory or other proceeding, settlement, investigation or claim applicable to us and/or the energy industry; |

| | • | | changes in tax laws and regulations; |

| | • | | the impact of our holding company structure on our ability to meet our corporate funding needs, service debt and pay dividends; |

| | • | | lack of growth or slower growth in the number of customers or changes in customer demand; |

| | • | | any inability of Power to meet its commitments under forward sale obligations; |

| | • | | reliance on transmission facilities that we do not own or control and the impact on our ability to maintain adequate transmission capacity; |

| | • | | any inability to successfully develop or construct generation, transmission and distribution projects; |

| | • | | any equipment failures, accidents, severe weather events or other incidents that impact our ability to provide safe and reliable service to our customers; |

| | • | | our inability to exercise control over the operations of generation facilities in which we do not maintain a controlling interest; |

| | • | | any inability to maintain sufficient liquidity; |

| | • | | any inability to realize anticipated tax benefits or retain tax credits; |

| | • | | challenges associated with recruitment and/or retention of key executives and a qualified workforce; |

| | • | | the impact of our covenants in our debt instruments on our operations; and |

| | • | | the impact of acts of terrorism, cybersecurity attacks or intrusions. |

All of the forward-looking statements made in this presentation are qualified by these cautionary statements and we cannot assure you that the results or developments anticipated by management will be realized or even if realized, will have the expected consequences to, or effects on, us or our business, prospects, financial condition, results of operations or cash flows. Readers are cautioned not to place undue reliance on these forward-looking statements in making any investment decision. Forward-looking statements made in this presentation apply only as of the date of this presentation. While we may elect to update forward-looking statements from time to time, we specifically disclaim any obligation to do so, even in light of new information or future events, unless otherwise required by applicable securities laws.

The forward-looking statements contained in this presentation are intended to qualify for the safe harbor provisions of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended.

From time to time, PSEG, PSE&G and PSEG Power release important information via postings on their corporate website athttp://investor.pseg.com. Investors and other interested parties are encouraged to visit the corporate website to review new postings. The “Email Alerts” link athttp://investor.pseg.com may be used to enroll to receive automatic email alerts and/or Really Simple Syndication (RSS) feeds regarding new postings.

Visit PSEG at: www.pseg.com;PSEG blog, Energize!;PSEG My Alerts!

Visit PSEG at: www.pseg.com;PSEG blog, Energize!;PSEG My Alerts!

TO FOLLOW AND CONNECT WITH PSEG VIA SOCIAL MEDIA, CLICK ON THE LINKS BELOW:

PSEG Social Media Channels: PSEG on Facebook;PSEG on Twitter;PSEG on LinkedIn;PSEG on YouTube

Attachment 1

PUBLIC SERVICE ENTERPRISE GROUP INCORPORATED

Consolidating Statements of Operations

(Unaudited, $ millions, except per share data)

| | | | | | | | | | | | | | | | |

| | | Three Months Ended September 30, 2017 | |

| | | PSEG | | | PSEG Enterprise/

Other (a) | | | PSE&G | | | PSEG

Power | |

| | | | |

OPERATING REVENUES | | $ | 2,263 | | | $ | (119 | ) | | $ | 1,509 | | | $ | 873 | |

| | | | |

OPERATING EXPENSES | | | | | | | | | | | | | | | | |

Energy Costs | | | 638 | | | | (254 | ) | | | 535 | | | | 357 | |

Operation and Maintenance | | | 680 | | | | 107 | | | | 346 | | | | 227 | |

Depreciation and Amortization | | | 252 | | | | 7 | | | | 169 | | | | 76 | |

| | | | | | | | | | | | | | | | |

Total Operating Expenses | | | 1,570 | | | | (140 | ) | | | 1,050 | | | | 660 | |

| | | | | | | | | | | | | | | | |

| | | | |

OPERATING INCOME | | | 693 | | | | 21 | | | | 459 | | | | 213 | |

| | | | |

Income from Equity Method Investments | | | 3 | | | | — | | | | — | | | | 3 | |

Other Income and (Deductions) | | | 56 | | | | (1 | ) | | | 22 | | | | 35 | |

Other-Than-Temporary Impairments | | | (5 | ) | | | — | | | | — | | | | (5 | ) |

Interest Expense | | | (100 | ) | | | (9 | ) | | | (79 | ) | | | (12 | ) |

| | | | | | | | | | | | | | | | |

| | | | |

INCOME BEFORE INCOME TAXES | | | 647 | | | | 11 | | | | 402 | | | | 234 | |

| | | | |

Income Tax Benefit (Expense) | | | (252 | ) | | | 2 | | | | (156 | ) | | | (98 | ) |

| | | | | | | | | | | | | | | | |

| | | | |

NET INCOME | | $ | 395 | | | $ | 13 | | | $ | 246 | | | $ | 136 | |

| | | | | | | | | | | | | | | | |

Reconciling Items Excluded from Net Income(b) | | | 22 | | | | — | | | | — | | | | 22 | |

| | | | | | | | | | | | | | | | |

OPERATING EARNINGS(non-GAAP) | | $ | 417 | | | $ | 13 | | | $ | 246 | | | $ | 158 | |

| | | | | | | | | | | | | | | | |

| | | | |

Earnings Per Share | | | | | | | | | | | | | | | | |

| | | | |

NET INCOME | | $ | 0.78 | | | $ | 0.02 | | | $ | 0.49 | | | $ | 0.27 | |

| | | | | | | | | | | | | | | | |

Reconciling Items Excluded from Net Income (b) | | | 0.04 | | | | — | | | | — | | | | 0.04 | |

| | | | | | | | | | | | | | | | |

OPERATING EARNINGS(non-GAAP) | | $ | 0.82 | | | $ | 0.02 | | | $ | 0.49 | | | $ | 0.31 | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| |

| | | Three Months Ended September 30, 2016 | |

| | | PSEG | | | PSEG Enterprise/

Other (a) | | | PSE&G | | | PSEG

Power | |

| | | | |

OPERATING REVENUES | | $ | 2,450 | | | $ | (309 | ) | | $ | 1,684 | | | $ | 1,075 | |

| | | | |

OPERATING EXPENSES | | | | | | | | | | | | | | | | |

Energy Costs | | | 866 | | | | (317 | ) | | | 721 | | | | 462 | |

Operation and Maintenance | | | 776 | | | | 111 | | | | 376 | | | | 289 | |

Depreciation and Amortization | | | 231 | | | | 8 | | | | 137 | | | | 86 | |

| | | | | | | | | | | | | | | | |

Total Operating Expenses | | | 1,873 | | | | (198 | ) | | | 1,234 | | | | 837 | |

| | | | | | | | | | | | | | | | |

| | | | |

OPERATING INCOME (LOSS) | | | 577 | | | | (111 | ) | | | 450 | | | | 238 | |

| | | | |

Income from Equity Method Investments | | | 3 | | | | — | | | | — | | | | 3 | |

Other Income and (Deductions) | | | 39 | | | | 1 | | | | 21 | | | | 17 | |

Other-Than-Temporary Impairments | | | (5 | ) | | | — | | | | — | | | | (5 | ) |

Interest Expense | | | (99 | ) | | | (3 | ) | | | (72 | ) | | | (24 | ) |

| | | | | | | | | | | | | | | | |

| | | | |

INCOME (LOSS) BEFORE INCOME TAXES | | | 515 | | | | (113 | ) | | | 399 | | | | 229 | |

| | | | |

Income Tax Benefit (Expense) | | | (188 | ) | | | 46 | | | | (144 | ) | | | (90 | ) |

| | | | | | | | | | | | | | | | |

| | | | |

NET INCOME (LOSS) | | $ | 327 | | | $ | (67 | ) | | $ | 255 | | | $ | 139 | |

| | | | | | | | | | | | | | | | |

Reconciling Items Excluded from Net Income (Loss)(b) | | | 117 | | | | 86 | | | | — | | | | 31 | |

| | | | | | | | | | | | | | | | |

OPERATING EARNINGS(non-GAAP) | | $ | 444 | | | $ | 19 | | | $ | 255 | | | $ | 170 | |

| | | | | | | | | | | | | | | | |

| | | | |

Earnings Per Share | | | | | | | | | | | | | | | | |

| | | | |

NET INCOME (LOSS) | | $ | 0.64 | | | $ | (0.13 | ) | | $ | 0.50 | | | $ | 0.27 | |

| | | | | | | | | | | | | | | | |

Reconciling Items Excluded from Net Income (Loss)(b) | | | 0.24 | | | | 0.17 | | | | — | | | | 0.07 | |

| | | | | | | | | | | | | | | | |

OPERATING EARNINGS(non-GAAP) | | $ | 0.88 | | | $ | 0.04 | | | $ | 0.50 | | | $ | 0.34 | |

| | | | | | | | | | | | | | | | |

| (a) | Includes activities at Energy Holdings, PSEG Long Island and the Parent as well as intercompany eliminations. |

| (b) | See Attachments 11 and 12 for details of items excluded from Net Income/(Loss) to compute Operating Earnings(non-GAAP). |

Attachment 2

PUBLIC SERVICE ENTERPRISE GROUP INCORPORATED

Consolidating Statements of Operations

(Unaudited, $ millions, except per share data)

| | | | | | | | | | | | | | | | |

| | | Nine Months Ended September 30, 2017 | |

| | | PSEG | | | PSEG Enterprise/

Other (a) | | | PSE&G | | | PSEG

Power | |

| | | | |

OPERATING REVENUES | | $ | 6,988 | | | $ | (787 | ) | | $ | 4,689 | | | $ | 3,086 | |

| | | | |

OPERATING EXPENSES | | | | | | | | | | | | | | | | |

Energy Costs | | | 2,100 | | | | (1,121 | ) | | | 1,760 | | | | 1,461 | |

Operation and Maintenance | | | 2,100 | | | | 325 | | | | 1,064 | | | | 711 | |

Depreciation and Amortization | | | 1,721 | | | | 24 | | | | 506 | | | | 1,191 | |

| | | | | | | | | | | | | | | | |

Total Operating Expenses | | | 5,921 | | | | (772 | ) | | | 3,330 | | | | 3,363 | |

| | | | | | | | | | | | | | | | |

| | | | |

OPERATING INCOME (LOSS) | | | 1,067 | | | | (15 | ) | | | 1,359 | | | | (277 | ) |

| | | | |

Income from Equity Method Investments | | | 11 | | | | — | | | | — | | | | 11 | |

Other Income and (Deductions) | | | 178 | | | | 6 | | | | 67 | | | | 105 | |

Other-Than-Temporary Impairments | | | (9 | ) | | | — | | | | — | | | | (9 | ) |

Interest Expense | | | (289 | ) | | | (25 | ) | | | (223 | ) | | | (41 | ) |

| | | | | | | | | | | | | | | | |

| | | | |

INCOME (LOSS) BEFORE INCOME TAXES | | | 958 | | | | (34 | ) | | | 1,203 | | | | (211 | ) |

| | | | |

Income Tax Benefit (Expense) | | | (340 | ) | | | 30 | | | | (450 | ) | | | 80 | |

| | | | | | | | | | | | | | | | |

NET INCOME (LOSS) | | $ | 618 | | | $ | (4 | ) | | $ | 753 | | | $ | (131 | ) |

| | | | | | | | | | | | | | | | |

Reconciling Items Excluded from Net Income (Loss) (b) | | | 581 | | | | 45 | | | | — | | | | 536 | |

| | | | | | | | | | | | | | | | |

OPERATING EARNINGS(non-GAAP) | | $ | 1,199 | | | $ | 41 | | | $ | 753 | | | $ | 405 | |

| | | | | | | | | | | | | | | | |

| | | | |

Earnings Per Share | | | | | | | | | | | | | | | | |

| | | | |

NET INCOME (LOSS) | | $ | 1.22 | | | $ | (0.01 | ) | | $ | 1.49 | | | $ | (0.26 | ) |

| | | | | | | | | | | | | | | | |

Reconciling Items Excluded from Net Income (Loss) (b) | | | 1.14 | | | | 0.08 | | | | — | | | | 1.06 | |

| | | | | | | | | | | | | | | | |

OPERATING EARNINGS(non-GAAP) | | $ | 2.36 | | | $ | 0.07 | | | $ | 1.49 | | | $ | 0.80 | |

| | | | | | | | | | | | | | | | |

| |

| | | Nine Months Ended September 30, 2016 | |

| | | PSEG | | | PSEG Enterprise/

Other (a) | | | PSE&G | | | PSEG

Power | |

| | | | |

OPERATING REVENUES | | $ | 6,971 | | | $ | (877 | ) | | $ | 4,746 | | | $ | 3,102 | |

| | | | |

OPERATING EXPENSES | | | | | | | | | | | | | | | | |

Energy Costs | | | 2,326 | | | | (1,134 | ) | | | 1,979 | | | | 1,481 | |

Operation and Maintenance | | | 2,215 | | | | 298 | | | | 1,110 | | | | 807 | |

Depreciation and Amortization | | | 679 | | | | 22 | | | | 412 | | | | 245 | |

| | | | | | | | | | | | | | | | |

Total Operating Expenses | | | 5,220 | | | | (814 | ) | | | 3,501 | | | | 2,533 | |

| | | | | | | | | | | | | | | | |

| | | | |

OPERATING INCOME (LOSS) | | | 1,751 | | | | (63 | ) | | | 1,245 | | | | 569 | |

| | | | |

Income from Equity Method Investments | | | 9 | | | | — | | | | — | | | | 9 | |

Other Income and (Deductions) | | | 100 | | | | 1 | | | | 58 | | | | 41 | |

Other-Than-Temporary Impairments | | | (25 | ) | | | — | | | | — | | | | (25 | ) |

Interest Expense | | | (288 | ) | | | (8 | ) | | | (214 | ) | | | (66 | ) |

| | | | | | | | | | | | | | | | |

| | | | |

INCOME (LOSS) BEFORE INCOME TAXES | | | 1,547 | | | | (70 | ) | | | 1,089 | | | | 528 | |

| | | | |

Income Tax Benefit (Expense) | | | (562 | ) | | | 39 | | | | (393 | ) | | | (208 | ) |

| | | | | | | | | | | | | | | | |

| | | | |

NET INCOME (LOSS) | | $ | 985 | | | $ | (31 | ) | | $ | 696 | | | $ | 320 | |

| | | | | | | | | | | | | | | | |

Reconciling Items Excluded from Net Income (Loss)(b) | | | 211 | | | | 86 | | | | — | | | | 125 | |

| | | | | | | | | | | | | | | | |

OPERATING EARNINGS(non-GAAP) | | $ | 1,196 | | | $ | 55 | | | $ | 696 | | | $ | 445 | |

| | | | | | | | | | | | | | | | |

| | | | |

Earnings Per Share | | | | | | | | | | | | | | | | |

| | | | |

NET INCOME (LOSS) | | $ | 1.94 | | | $ | (0.06 | ) | | $ | 1.37 | | | $ | 0.63 | |

| | | | | | | | | | | | | | | | |

Reconciling Items Excluded from Net Income (Loss) (b) | | | 0.42 | | | | 0.17 | | | | — | | | | 0.25 | |

| | | | | | | | | | | | | | | | |

OPERATING EARNINGS(non-GAAP) | | $ | 2.36 | | | $ | 0.11 | | | $ | 1.37 | | | $ | 0.88 | |

| | | | | | | | | | | | | | | | |

| (a) | Includes activities at Energy Holdings, PSEG Long Island and the Parent as well as intercompany eliminations. |

| (b) | See Attachments 11 and 12 for details of items excluded from Net Income/(Loss) to compute Operating Earnings(non-GAAP). |

Attachment 3

PUBLIC SERVICE ENTERPRISE GROUP INCORPORATED

Capitalization Schedule

(Unaudited, $ millions)

| | | | | | | | |

| | | September 30,

2017 | | | December 31,

2016 | |

DEBT | | | | | | | | |

Commercial Paper and Loans | | $ | 202 | | | $ | 388 | |

Long-Term Debt* | | | 12,524 | | | | 11,395 | |

| | | | | | | | |

Total Debt | | | 12,726 | | | | 11,783 | |

| | |

STOCKHOLDERS’ EQUITY | | | | | | | | |

Common Stock | | | 4,938 | | | | 4,936 | |

Treasury Stock | | | (750 | ) | | | (717 | ) |

Retained Earnings | | | 9,140 | | | | 9,174 | |

Accumulated Other Comprehensive Loss | | | (204 | ) | | | (263 | ) |

| | | | | | | | |

Total Stockholders’ Equity | | | 13,124 | | | | 13,130 | |

| | | | | | | | |

Total Capitalization | | $ | 25,850 | | | $ | 24,913 | |

| | | | | | | | |

| * | Includes current portion of Long-Term Debt |

Attachment 4

PUBLIC SERVICE ENTERPRISE GROUP INCORPORATED

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(Unaudited, $ millions)

| | | | | | | | |

| | | Nine Months Ended September 30, | |

| | | 2017 | | | 2016 | |

CASH FLOWS FROM OPERATING ACTIVITIES | | | | | | | | |

Net Income | | $ | 618 | | | $ | 985 | |

Adjustments to Reconcile Net Income to Net Cash Flows From Operating Activities | | | 2,116 | | | | 1,776 | |

| | | | | | | | |

NET CASH PROVIDED BY OPERATING ACTIVITIES | | | 2,734 | | | | 2,761 | |

| | | | | | | | |

| | |

NET CASH USED IN INVESTING ACTIVITIES | | | (3,104 | ) | | | (3,054 | ) |

| | | | | | | | |

| | |

NET CASH PROVIDED BY FINANCING ACTIVITIES | | | 225 | | | | 349 | |

| | | | | | | | |

| | |

Net Change in Cash and Cash Equivalents | | | (145 | ) | | | 56 | |

| | |

Cash and Cash Equivalents at Beginning of Period | | | 423 | | | | 394 | |

| | | | | | | | |

Cash and Cash Equivalents at End of Period | | $ | 278 | | | $ | 450 | |

| | | | | | | | |

Attachment 5

PUBLIC SERVICE ENTERPRISE GROUP INCORPORATED

Quarter-over-Quarter EPS Reconciliation

September 30, 2017 vs. September 30, 2016

(Unaudited)

Attachment 6

PUBLIC SERVICE ENTERPRISE GROUP INCORPORATED

Year-over-Year EPS Reconciliation

September 30, 2017 vs. September 30, 2016

(Unaudited)

Attachment 7

PUBLIC SERVICE ELECTRIC & GAS COMPANY

Retail Sales and Revenues

(Unaudited)

September 30, 2017

Electric Sales and Revenues

| | | | | | | | | | | | | | | | |

Sales (millions kWh) | | Three Months

Ended | | | Change vs.

2016 | | | Nine Months

Ended | | | Change vs.

2016 | |

Residential | | | 4,239 | | | | -13.9 | % | | | 10,213 | | | | -6.5 | % |

Commercial & Industrial | | | 7,428 | | | | -4.7 | % | | | 20,756 | | | | -1.3 | % |

Street Lighting | | | 66 | | | | -4.8 | % | | | 231 | | | | -2.5 | % |

Interdepartmental | | | 2 | | | | -9.5 | % | | | 7 | | | | -4.4 | % |

| | | | | | | | | | | | | | | | |

Total | | | 11,735 | | | | -8.3 | % | | | 31,207 | | | | -3.0 | % |

| | | | | | | | | | | | | | | | |

| | | | |

Revenue ($ millions) | | | | | | | | | | | | |

Residential | | $ | 628 | | | | -18.6 | % | | $ | 1,512 | | | | -10.1 | % |

Commercial & Industrial | | | 507 | | | | -6.7 | % | | | 1,293 | | | | -2.0 | % |

Street Lighting | | | 16 | | | | -3.5 | % | | | 49 | | | | -1.8 | % |

Other Operating Revenues* | | | 183 | | | | 10.8 | % | | | 562 | | | | 11.8 | % |

| | | | | | | | | | | | | | | | |

Total | | $ | 1,334 | | | | -10.8 | % | | $ | 3,416 | | | | -3.9 | % |

| | | | | | | | | | | | | | | | |

| | | | |

Weather Data | | Three Months

Ended | | | Change vs.

2016 | | | Nine Months

Ended | | | Change vs.

2016 | |

THI Hours - Actual | | | 11,100 | | | | -26.7 | % | | | 15,484 | | | | -18.5 | % |

THI Hours - Normal | | | 11,720 | | | | | | | | 15,811 | | | | | |

| * | Primarily sales ofNon-Utility Generator energy to PJM and Transmission related revenues. |

Attachment 8

PUBLIC SERVICE ELECTRIC & GAS COMPANY

Retail Sales and Revenues

(Unaudited)

September 30, 2017

Gas Sold and Transported

| | | | | | | | | | | | | | | | |

Sales (millions therms)* | | Three Months

Ended | | | Change vs.

2016 | | | Nine Months

Ended | | | Change vs.

2016 | |

Firm Sales | | | | | | | | | | | | | | | | |

Residential Sales | | | 90 | | | | 2.6 | % | | | 944 | | | | -1.0 | % |

Commercial & Industrial | | | 99 | | | | 5.7 | % | | | 694 | | | | 1.8 | % |

| | | | | | | | | | | | | | | | |

Total Firm Sales | | | 189 | | | | 4.2 | % | | | 1,638 | | | | 0.2 | % |

| | | | | | | | | | | | | | | | |

| | | | |

Non-Firm Sales | | | | | | | | | | | | | | | | |

Commercial & Industrial | | | 292 | | | | -57.1 | % | | | 979 | | | | -37.5 | % |

| | | | | | | | | | | | | | | | |

TotalNon-Firm Sales | | | 292 | | | | | | | | 979 | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

Total Sales | | | 481 | | | | -44.2 | % | | | 2,617 | | | | -18.2 | % |

| | | | | | | | | | | | | | | | |

| | | | |

Revenue ($ millions) | | | | | | | | | | | | |

Residential Sales - Firm | | $ | 26 | | | | -13.0 | % | | $ | 237 | | | | 4.1 | % |

Commercial & Industrial - Firm Sales | | | 18 | | | | 16.4 | % | | | 180 | | | | 40.5 | % |

Non-Firm Sales | | | 5 | | | | -21.9 | % | | | 20 | | | | 6.0 | % |

Other Operating Revenues** | | | 42 | | | | -1.7 | % | | | 129 | | | | -0.5 | % |

| | | | | | | | | | | | | | | | |

Total | | $ | 91 | | | | -3.7 | % | | $ | 566 | | | | 12.2 | % |

| | | | | | | | | | | | | | | | |

| | | | |

Gas Transported | | $ | 84 | | | | -10.8 | % | | $ | 707 | | | | 2.7 | % |

| | | | |

Weather Data | | Three Months

Ended | | | Change vs.

2016 | | | Nine Months

Ended | | | Change vs.

2016 | |

Degree Days - Actual | | | 17 | | | | 1.5 | % | | | 2,788 | | | | -1.8 | % |

Degree Days - Normal | | | 28 | | | | | | | | 3,076 | | | | | |

| * | CSG rate included innon-firm sales |

| ** | Primarily Appliance Service. |

Attachment 9

PSEG POWER LLC

Generation Measures*

(Unaudited)

| | | | | | | | | | | | | | | | |

| | | GWhr Breakdown

Three Months Ended

September 30, | | | GWhr Breakdown

Nine Months Ended

September 30, | |

| | | 2017 | | | 2016 | | | 2017 | | | 2016 | |

Nuclear - NJ | | | 5,500 | | | | 4,151 | | | | 15,814 | | | | 13,878 | |

Nuclear - PA | | | 2,709 | | | | 2,712 | | | | 8,316 | | | | 8,387 | |

| | | | | | | | | | | | | | | | |

Total Nuclear | | | 8,209 | | | | 6,863 | | | | 24,130 | | | | 22,265 | |

| | | | |

Fossil - Coal** | | | 1,242 | | | | 1,493 | | | | 4,036 | | | | 3,432 | |

Fossil - Oil & Natural Gas - NJ | | | 2,262 | | | | 4,234 | | | | 6,889 | | | | 10,089 | |

Fossil - Oil & Natural Gas - NY | | | 1,582 | | | | 1,482 | | | | 4,027 | | | | 3,940 | |

Fossil - Oil & Natural Gas - CT | | | 9 | | | | 38 | | | | 8 | | | | 30 | |

| | | | | | | | | | | | | | | | |

Total Oil & Natural Gas | | | 3,853 | | | | 5,754 | | | | 10,924 | | | | 14,059 | |

| | | | | | | | | | | | | | | | |

| | | 13,304 | | | | 14,110 | | | | 39,090 | | | | 39,756 | |

| | |

| | | % Generation by Fuel Type

Three Months Ended

September 30, | | | % Generation by Fuel Type

Nine Months Ended

September 30, | |

| | | 2017 | | | 2016 | | | 2017 | | | 2016 | |

Nuclear - NJ | | | 41 | % | | | 29 | % | | | 41 | % | | | 35 | % |

Nuclear - PA | | | 21 | % | | | 19 | % | | | 21 | % | | | 21 | % |

| | | | | | | | | | | | | | | | |

Total Nuclear | | | 62 | % | | | 48 | % | | | 62 | % | | | 56 | % |

| | | | |

Fossil - Coal** | | | 9 | % | | | 11 | % | | | 10 | % | | | 9 | % |

Fossil - Oil & Natural Gas - NJ | | | 17 | % | | | 30 | % | | | 18 | % | | | 25 | % |

Fossil - Oil & Natural Gas - NY | | | 12 | % | | | 11 | % | | | 10 | % | | | 10 | % |

Fossil - Oil & Natural Gas - CT | | | 0 | % | | | 0 | % | | | 0 | % | | | 0 | % |

| | | | | | | | | | | | | | | | |

Total Oil & Natural Gas | | | 29 | % | | | 41 | % | | | 28 | % | | | 35 | % |

| | | | | | | | | | | | | | | | |

| | | 100 | % | | | 100 | % | | | 100 | % | | | 100 | % |

| * | Excludes Solar and Kalaeloa |

| ** | Includes Pumped Storage. Pumped Storage accounted for <1% of total generation for the three and nine months ended September 30, 2017 and 2016, respectively. |

Attachment 10

PUBLIC SERVICE ENTERPRISE GROUP INCORPORATED

Statistical Measures

(Unaudited)

| | | | | | | | | | | | | | | | |

| | | Three Months Ended September 30, | | | Nine Months Ended September 30, | |

| | | 2017 | | | 2016 | | | 2017 | | | 2016 | |

Weighted Average Common Shares Outstanding (millions) | | | | | | | | | | | | | | | | |

Basic | | | 505 | | | | 505 | | | | 505 | | | | 505 | |

Diluted | | | 507 | | | | 508 | | | | 507 | | | | 508 | |

| | | | |

Stock Price at End of Period | | | | | | | | | | $ | 46.25 | | | $ | 41.87 | |

| | | | |

Dividends Paid per Share of Common Stock | | $ | 0.43 | | | $ | 0.41 | | | $ | 1.29 | | | $ | 1.23 | |

| | | | |

Dividend Yield | | | | | | | | | | | 3.7 | % | | | 3.9 | % |

| | | | |

Book Value per Common Share | | | | | | | | | | $ | 26.01 | | | $ | 26.69 | |

| | | | |

Market Price as a Percent of Book Value | | | | | | | | | | | 178 | % | | | 157 | % |

| | | | |

Total Shareholder Return | | | 8.5 | % | | | -9.3 | % | | | 8.5 | % | | | 11.3 | % |

Attachment 11

PUBLIC SERVICE ENTERPRISE GROUP INCORPORATED

Consolidated Operating Earnings(non-GAAP) Reconciliation

| | | | | | | | | | | | | | | | |

| Reconciling Items | | Three Months Ended

September 30, | | | Nine Months Ended

September 30, | |

| | | 2017 | | | 2016 | | | 2017 | | | 2016 | |

| | | ($ millions, Unaudited) | |

| | | | |

Net Income | | $ | 395 | | | $ | 327 | | | $ | 618 | | | $ | 985 | |

(Gain) Loss on Nuclear Decommissioning Trust (NDT) Fund Related Activity,pre-tax (PSEG Power) | | | (22 | ) | | | (4 | ) | | | (69 | ) | | | 4 | |

(Gain) Loss onMark-to-Market (MTM),pre-tax(a) (PSEG Power) | | | 46 | | | | (58 | ) | | | — | | | | 91 | |

Hudson/Mercer Early Retirement,pre-tax (PSEG Power) | | | 9 | | | | 114 | | | | 960 | | | | 114 | |

Lease Related Activity,pre-tax (PSEG Enterprise/Other) | | | — | | | | 137 | | | | 77 | | | | 137 | |

Income Taxes related to Operating Earnings(non-GAAP) reconciling items(b) | | | (11 | ) | | | (72 | ) | | | (387 | ) | | | (135 | ) |

| | | | | | | | | | | | | | | | |

Operating Earnings(non-GAAP) | | $ | 417 | | | $ | 444 | | | $ | 1,199 | | | $ | 1,196 | |

| | | | | | | | | | | | | | | | |

| | | | |

PSEG Fully Diluted Average Shares Outstanding (in millions) | | | 507 | | | | 508 | | | | 507 | | | | 508 | |

| | | ($ Per Share Impact - Diluted, Unaudited) | |

| | | | |

Net Income | | $ | 0.78 | | | $ | 0.64 | | | $ | 1.22 | | | $ | 1.94 | |

(Gain) Loss on NDT Fund Related Activity,pre-tax (PSEG Power) | | | (0.05 | ) | | | — | | | | (0.14 | ) | | | 0.01 | |

(Gain) Loss on MTM,pre-tax(a) (PSEG Power) | | | 0.09 | | | | (0.11 | ) | | | — | | | | 0.18 | |

Hudson/Mercer Early Retirement,pre-tax (PSEG Power) | | | 0.02 | | | | 0.22 | | | | 1.89 | | | | 0.22 | |

Lease Related Activity,pre-tax (PSEG Enterprise/Other) | | | — | | | | 0.27 | | | | 0.15 | | | | 0.27 | |

Income Taxes related to Operating Earnings(non-GAAP) reconciling items(b) | | | (0.02 | ) | | | (0.14 | ) | | | (0.76 | ) | | | (0.26 | ) |

| | | | | | | | | | | | | | | | |

Operating Earnings(non-GAAP) | | $ | 0.82 | | | $ | 0.88 | | | $ | 2.36 | | | $ | 2.36 | |

| | | | | | | | | | | | | | | | |

| (a) | Includes the financial impact from positions with forward delivery months. |

| (b) | Income tax effect calculated at 40.85% statutory rate, except for lease related activity which is calculated at a combined leveraged lease effective tax rate and NDT related activity which is calculated at the 40.85% statutory rate plus a 20% tax on income (losses) from qualified NDT funds. |

Attachment 12

PSEG Power Operating Earnings(non-GAAP) and Adjusted EBITDA(non-GAAP) Reconciliation

| | | | | | | | | | | | | | | | |

| Reconciling Items | | Three Months Ended

September 30, | | | Nine Months Ended

September 30, | |

| | | 2017 | | | 2016 | | | 2017 | | | 2016 | |

| | | ($ millions, Unaudited) | |

| | | | |

Net Income (Loss) | | $ | 136 | | | $ | 139 | | | $ | (131 | ) | | $ | 320 | |

(Gain) Loss on NDT Fund Related Activity,pre-tax | | | (22 | ) | | | (4 | ) | | | (69 | ) | | | 4 | |

(Gain) Loss on MTM,pre-tax(a) | | | 46 | | | | (58 | ) | | | — | | | | 91 | |

Hudson/Mercer Early Retirement,pre-tax | | | 9 | | | | 114 | | | | 960 | | | | 114 | |

Income Taxes related to Operating Earnings(non-GAAP) reconciling items(b) | | | (11 | ) | | | (21 | ) | | | (355 | ) | | | (84 | ) |

| | | | | | | | | | | | | | | | |

Operating Earnings(non-GAAP) | | $ | 158 | | | $ | 170 | | | $ | 405 | | | $ | 445 | |

Depreciation and Amortization,pre-tax(c) | | | 77 | | | | 83 | | | | 256 | | | | 244 | |

Interest Expense,pre-tax(c) (d) | | | 12 | | | | 23 | | | | 40 | | | | 65 | |

Income Taxes(c) | | | 109 | | | | 111 | | | | 275 | | | | 292 | |

| | | | | | | | | | | | | | | | |

Adjusted EBITDA(non-GAAP) | | $ | 356 | | | $ | 387 | | | $ | 976 | | | $ | 1,046 | |

| | | | | | | | | | | | | | | | |

| | | | |

PSEG Fully Diluted Average Shares Outstanding (in millions) | | | 507 | | | | 508 | | | | 507 | | | | 508 | |

| (a) | Includes the financial impact from positions with forward delivery months. |

| (b) | Income tax effect calculated at 40.85% statutory rate, except for NDT related activity which is calculated at the 40.85% statutory rate plus a 20% tax on income (losses) from qualified NDT funds. |

| (c) | Excludes amounts related to Operating Earnings(non-GAAP) reconciling items. |

| (d) | Net of capitalized interest. |

PSEG Enterprise/Other

Operating Earnings(non-GAAP) Reconciliation

| | | | | | | | | | | | | | | | |

| Reconciling Items | | Three Months Ended

September 30, | | | Nine Months Ended

September 30, | |

| | | 2017 | | | 2016 | | | 2017 | | | 2016 | |

| | | ($ millions, Unaudited) | |

| | | | |

Net Income (Loss) | | $ | 13 | | | $ | (67 | ) | | $ | (4 | ) | | $ | (31 | ) |

Lease Related Activity,pre-tax | | | — | | | | 137 | | | | 77 | | | | 137 | |

Income Taxes related to Operating Earnings(non-GAAP) reconciling items(a) | | | — | | | | (51 | ) | | | (32 | ) | | | (51 | ) |

| | | | | | | | | | | | | | | | |

Operating Earnings(non-GAAP) | | $ | 13 | | | $ | 19 | | | $ | 41 | | | $ | 55 | |

| | | | | | | | | | | | | | | | |

| | | | |

PSEG Fully Diluted Average Shares Outstanding (in millions) | | | 507 | | | | 508 | | | | 507 | | | | 508 | |

| (a) | Income tax effect calculated at a combined leveraged lease effective tax rate. |

Visit PSEG at: www.pseg.com;PSEG blog, Energize!;PSEG My Alerts!

Visit PSEG at: www.pseg.com;PSEG blog, Energize!;PSEG My Alerts!