Exhibit 99

Forward-Looking Statements

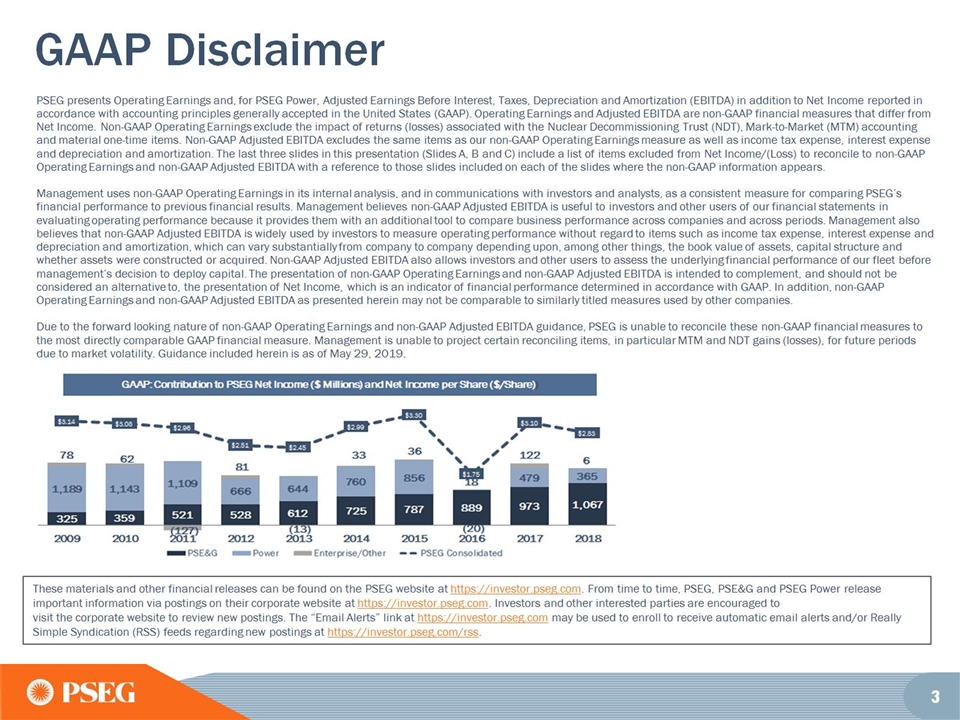

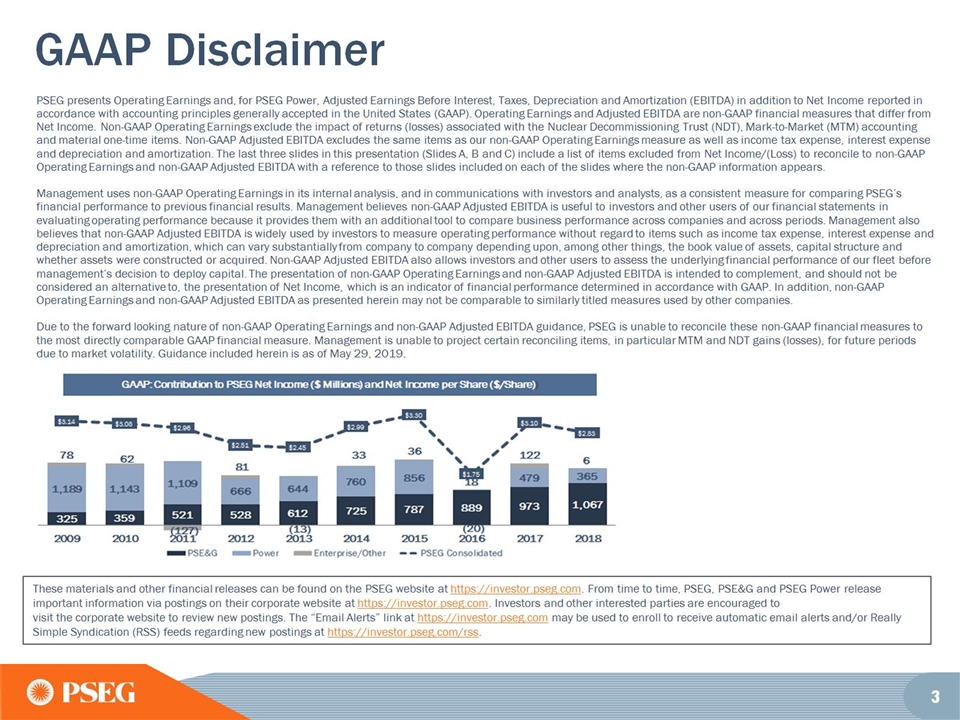

GAAP Disclaimer

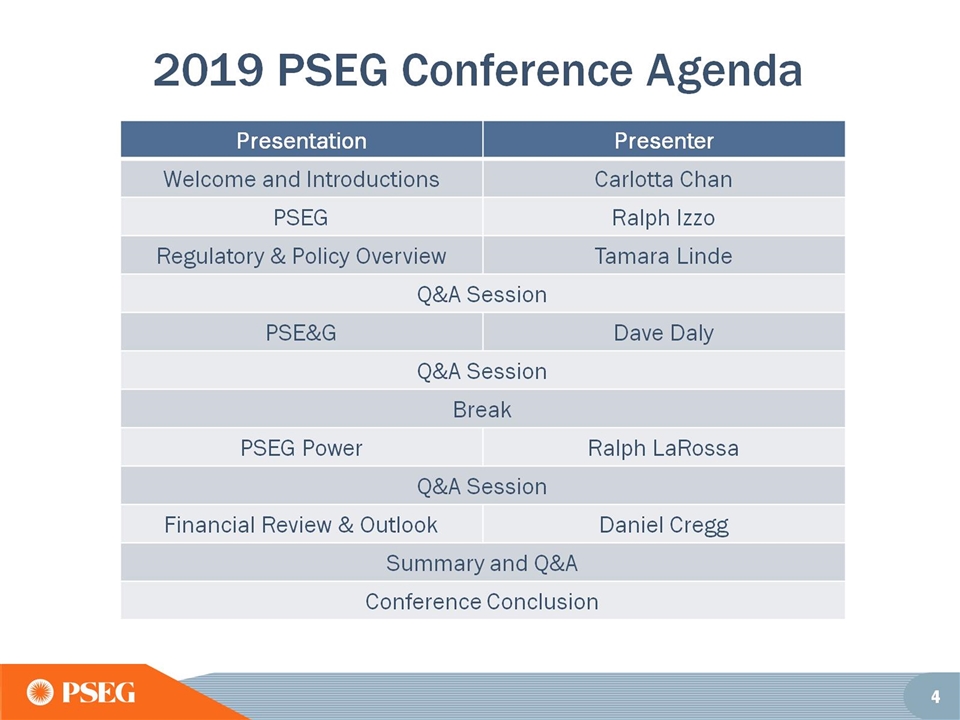

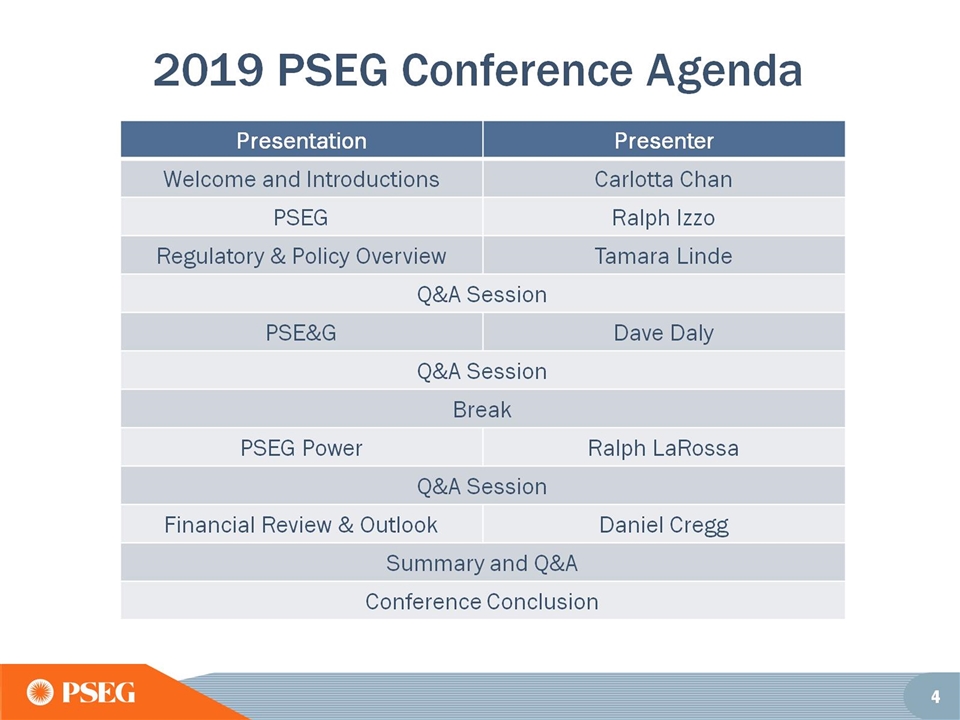

2019 PSEG Conference Agenda

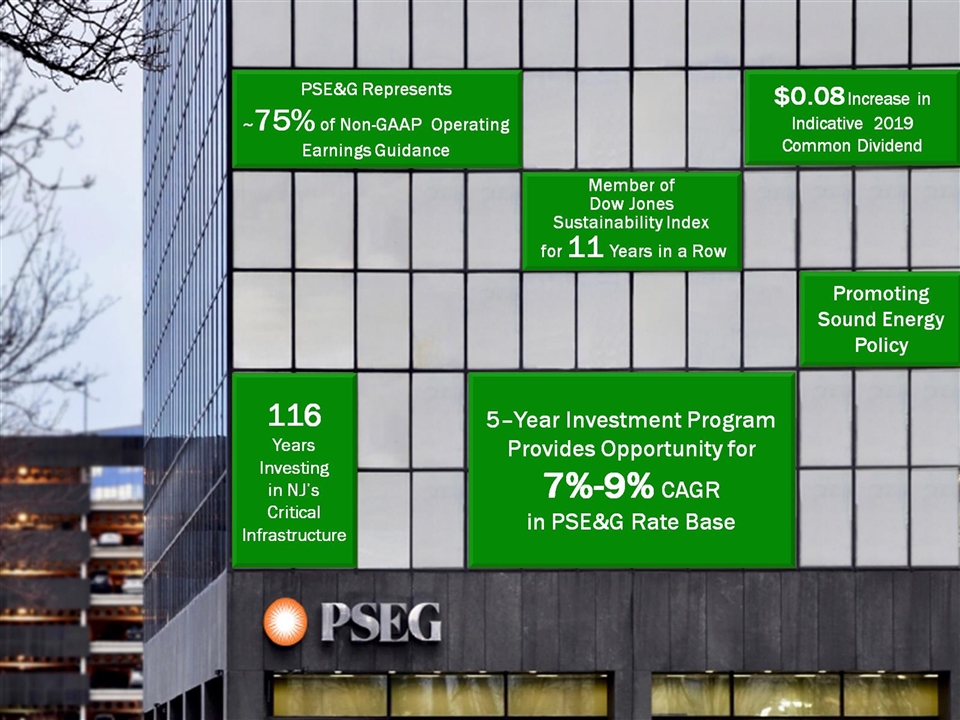

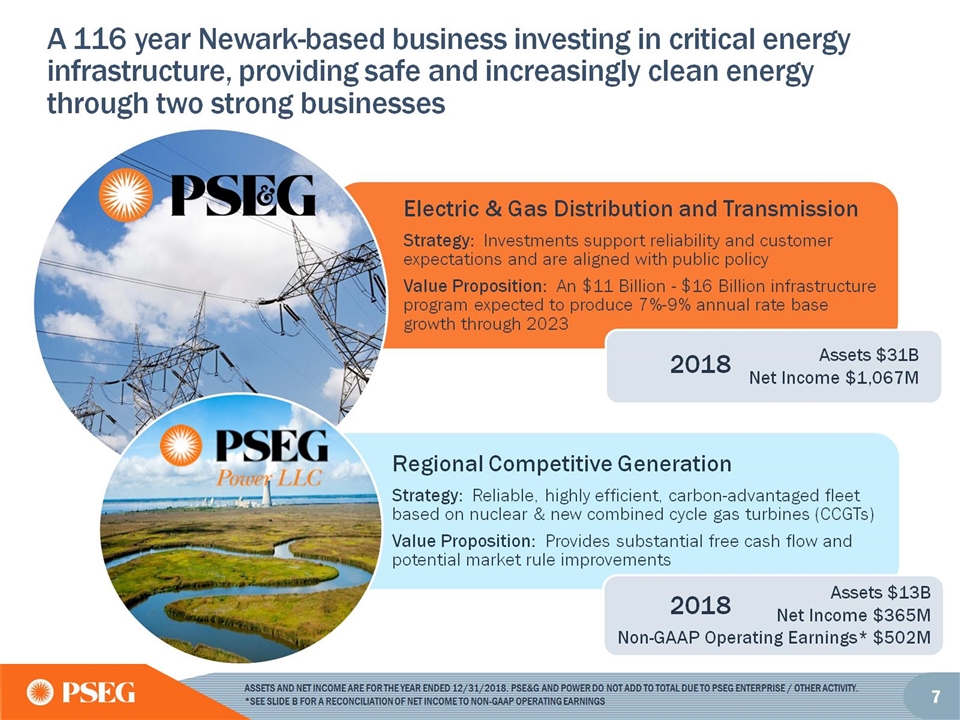

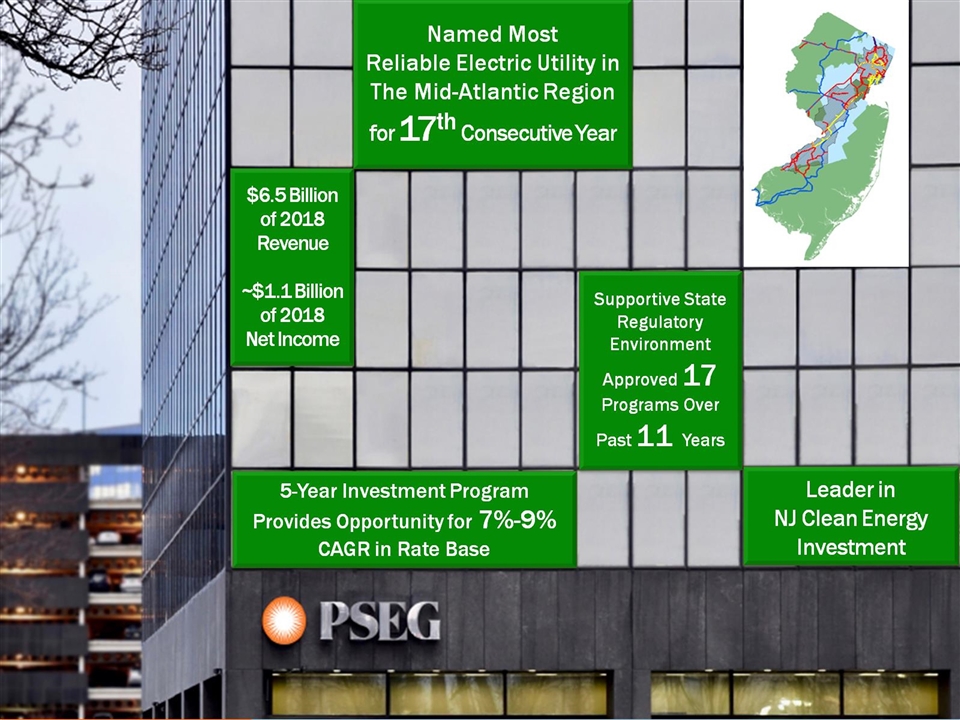

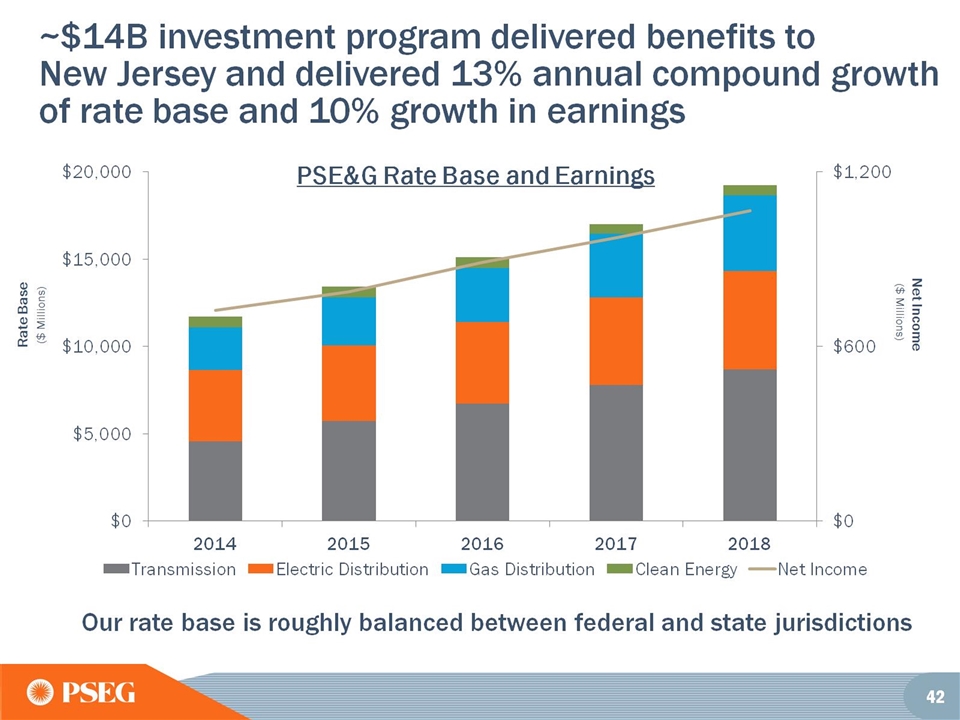

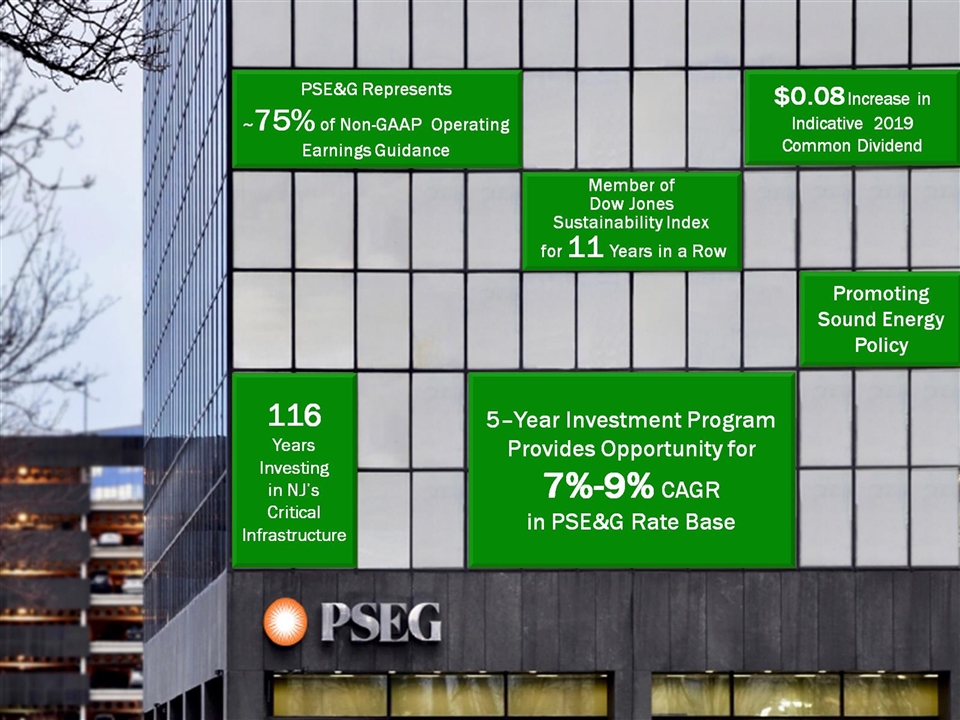

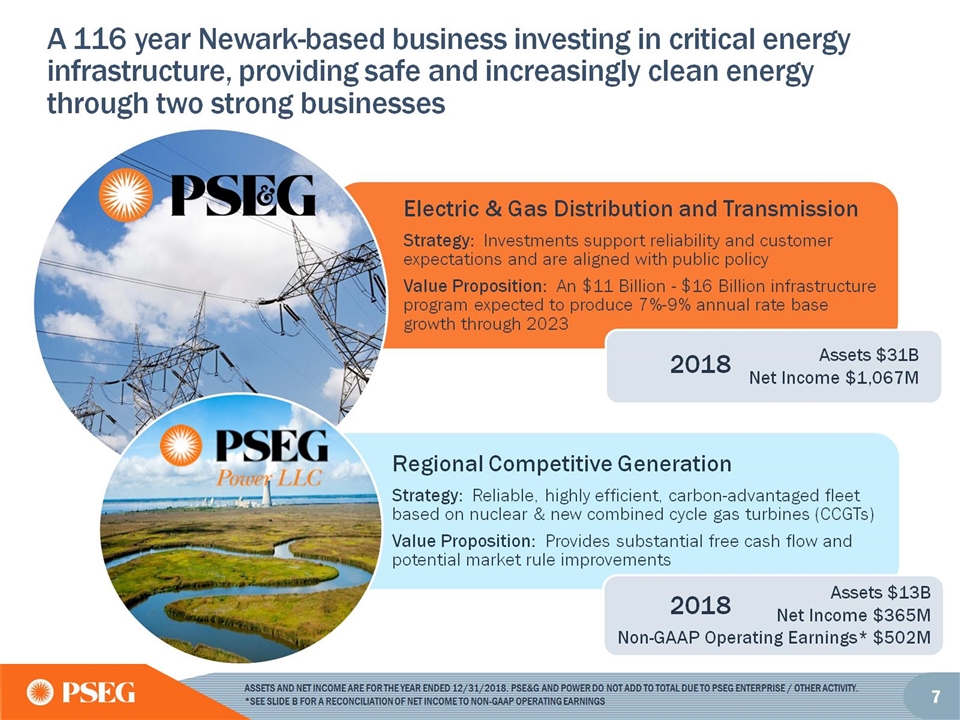

A 116 year Newark-based business investing in critical energy infrastructure, providing safe and increasingly clean energy through two strong businesses

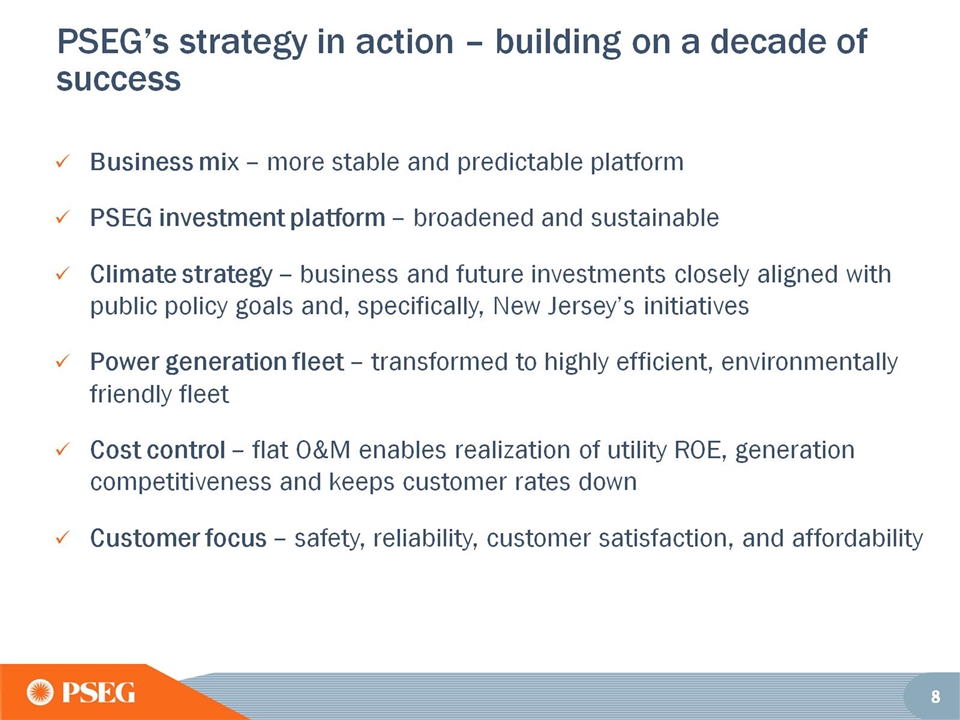

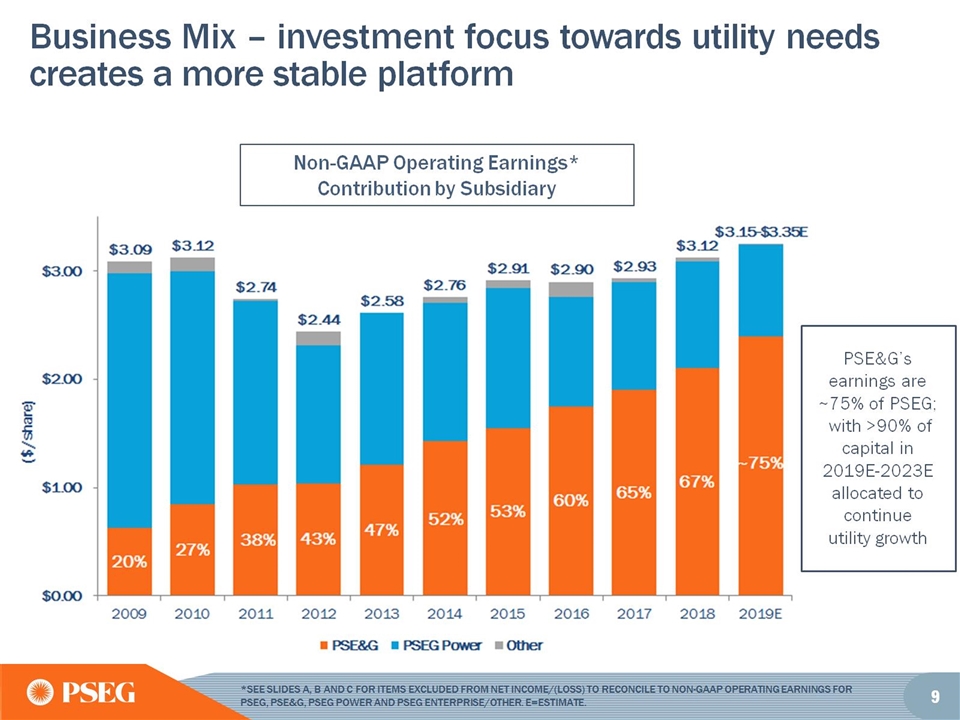

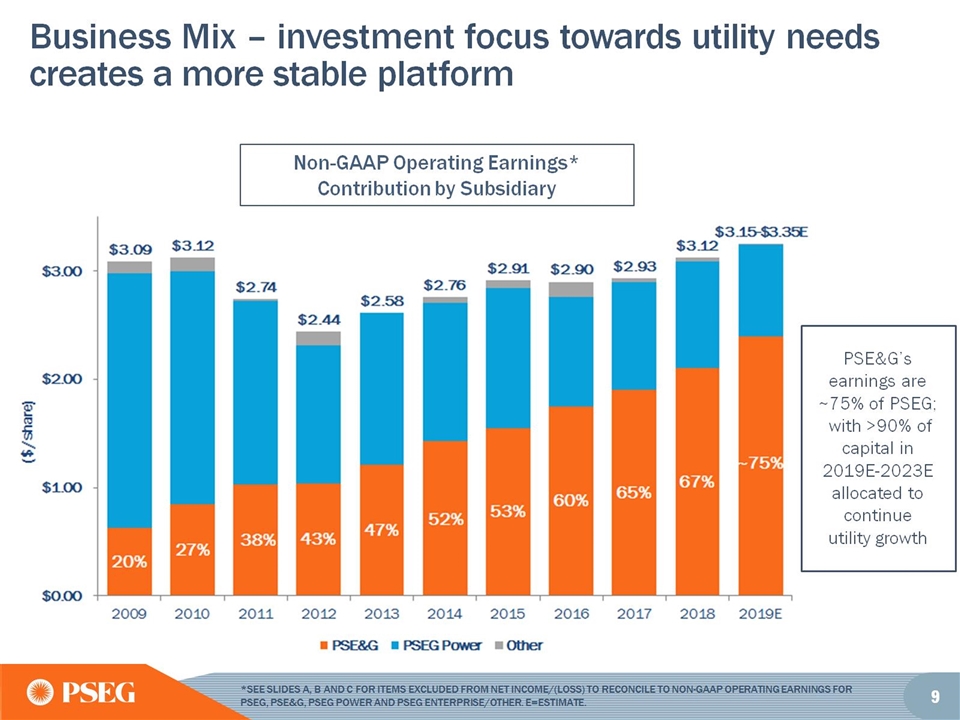

Business Mix – investment focus towards utility needs creates a more stable platform

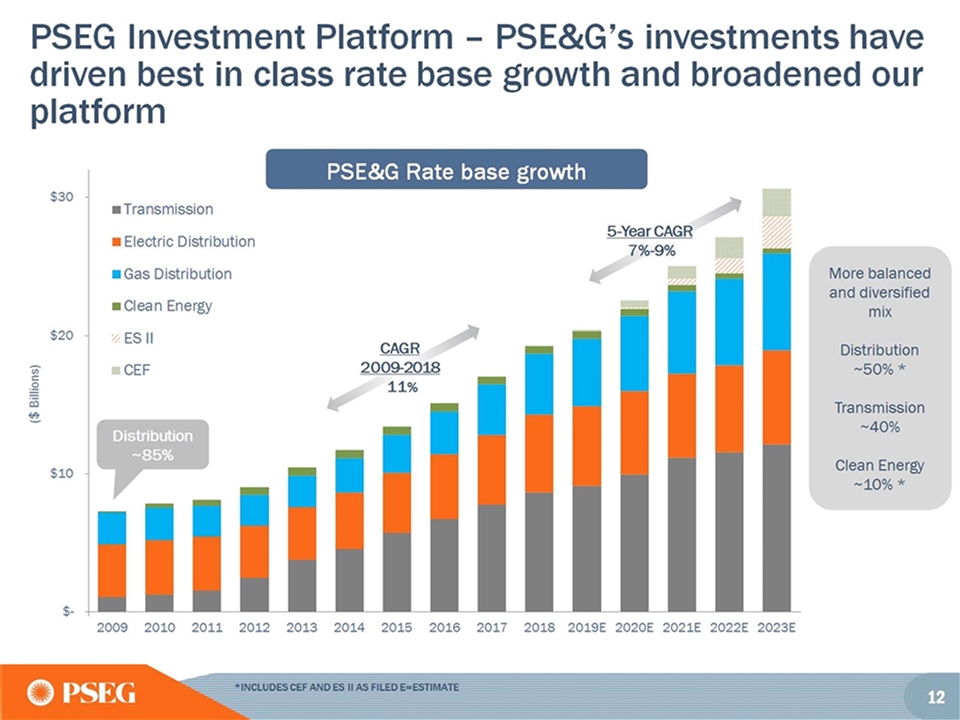

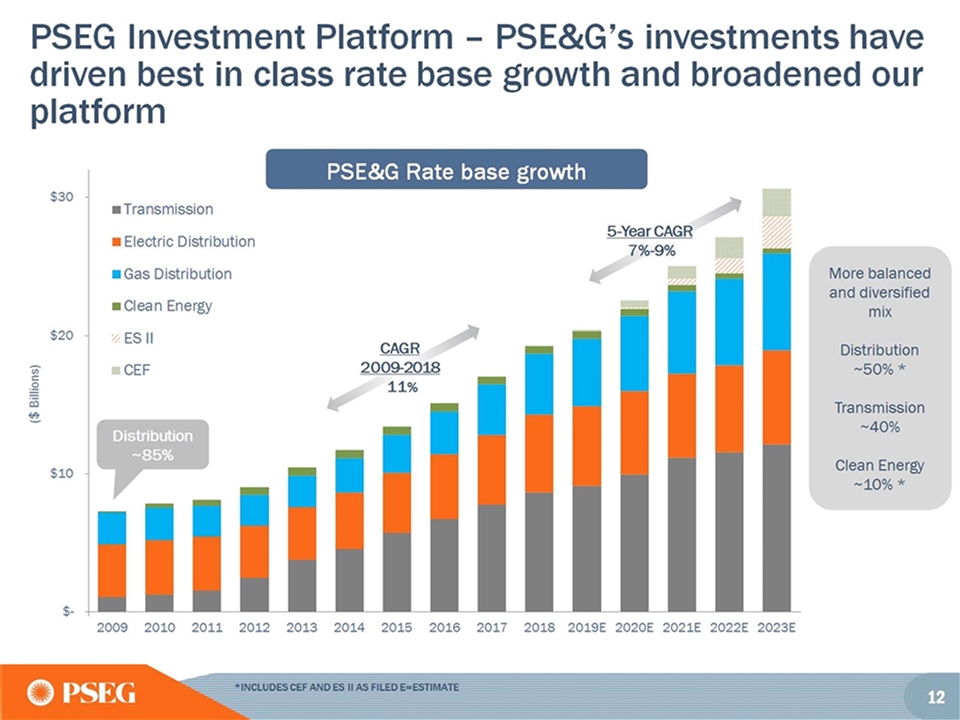

PSEG Investment Platform – outlook increases capital allocation to the utility, addressing infrastructure needs, customer expectations and public policy

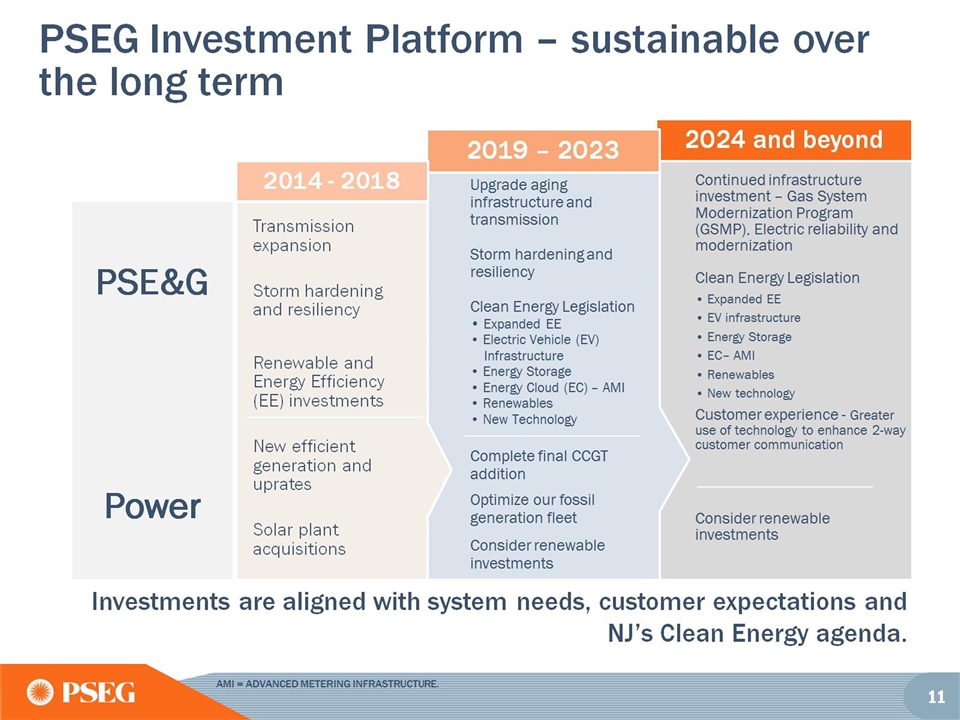

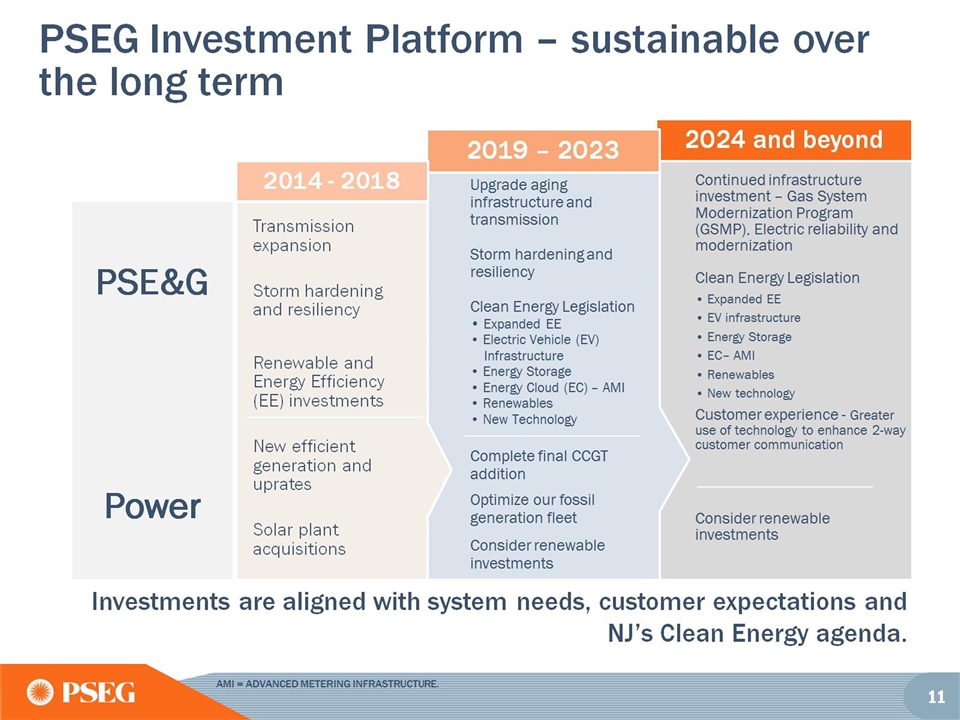

PSEG Investment Platform – sustainable over the long term

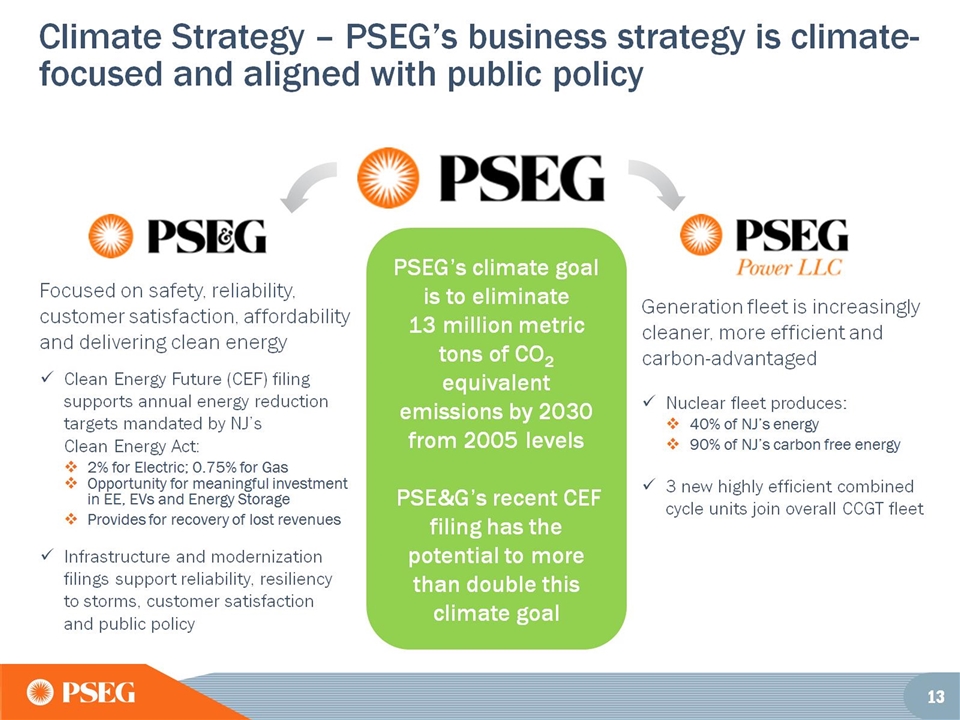

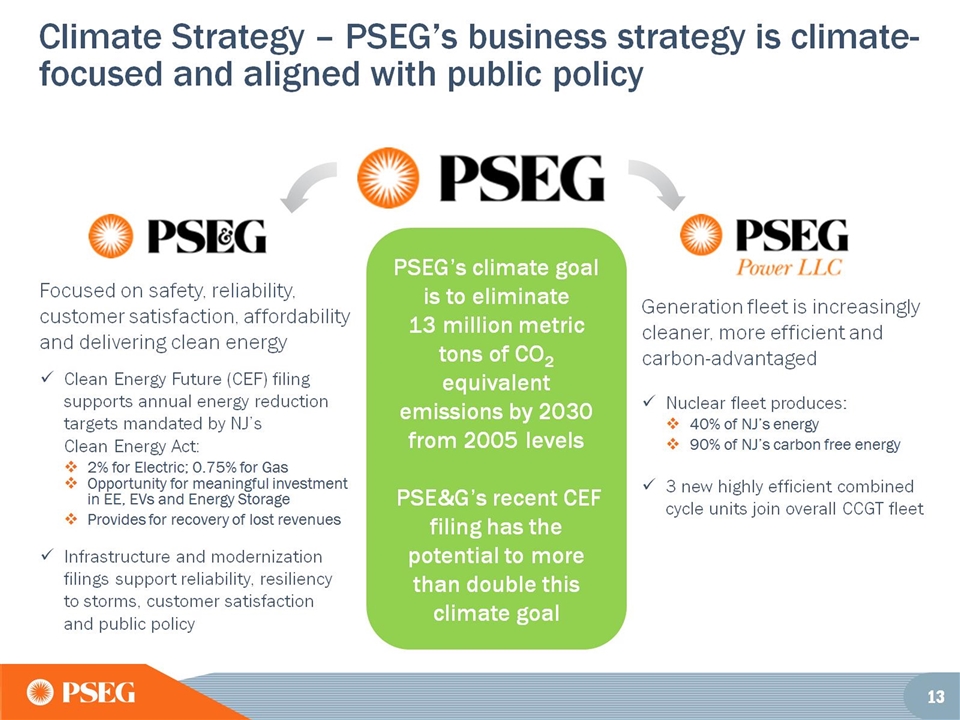

Climate Strategy – PSEG’s business strategy is climate-focused and aligned with public policy

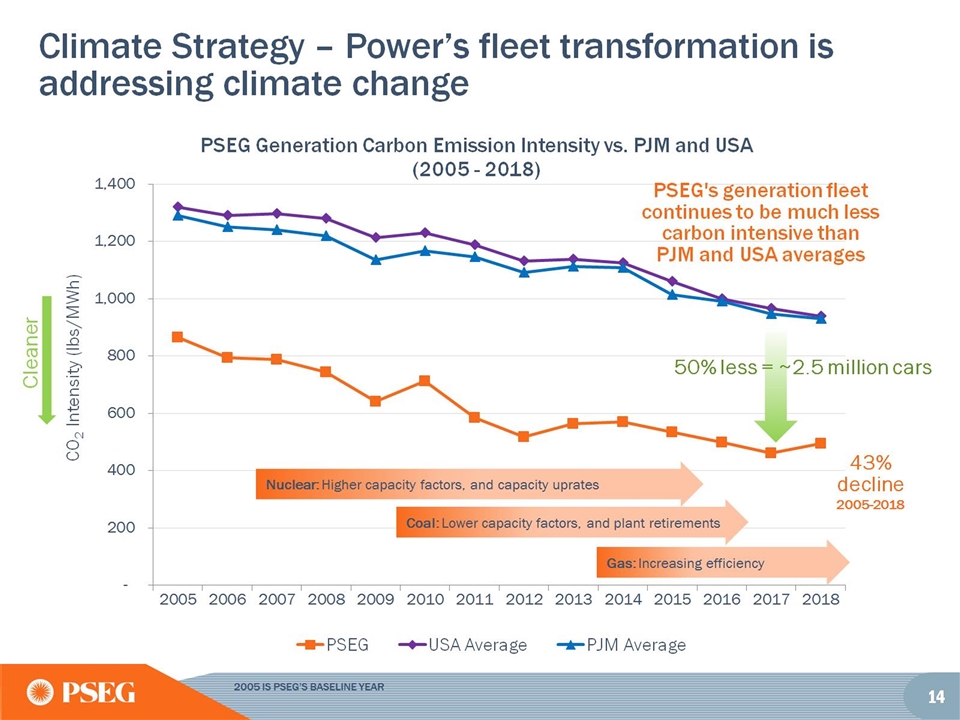

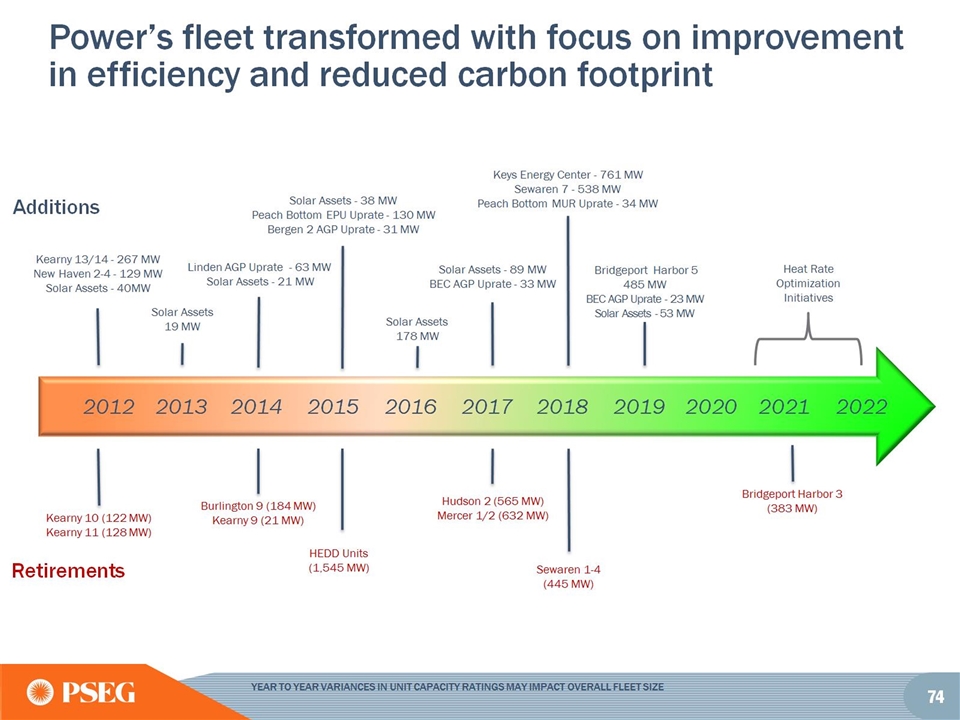

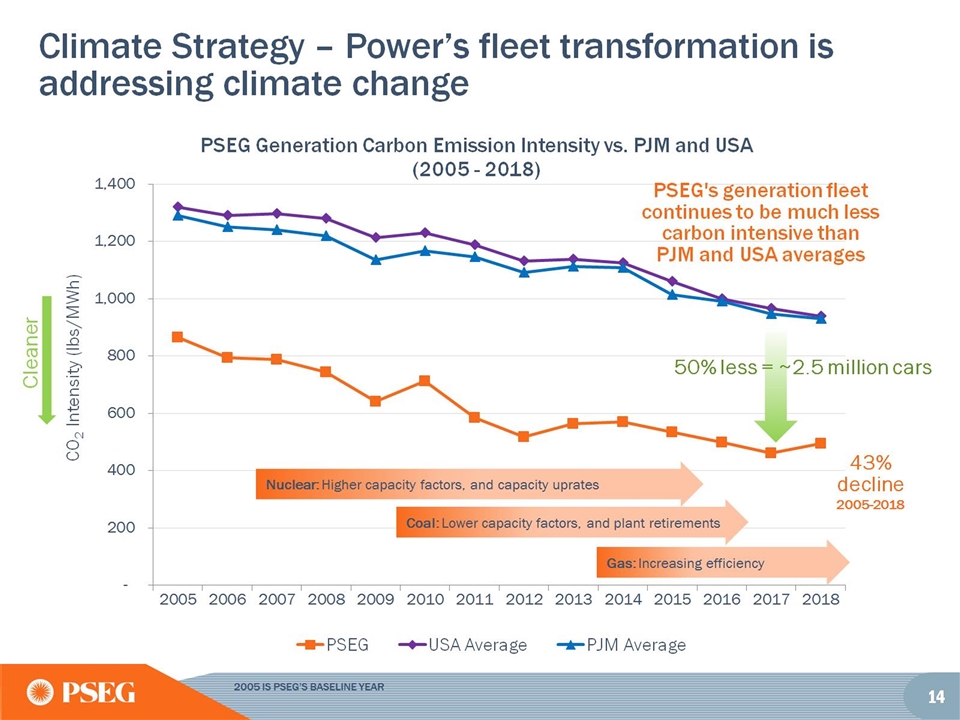

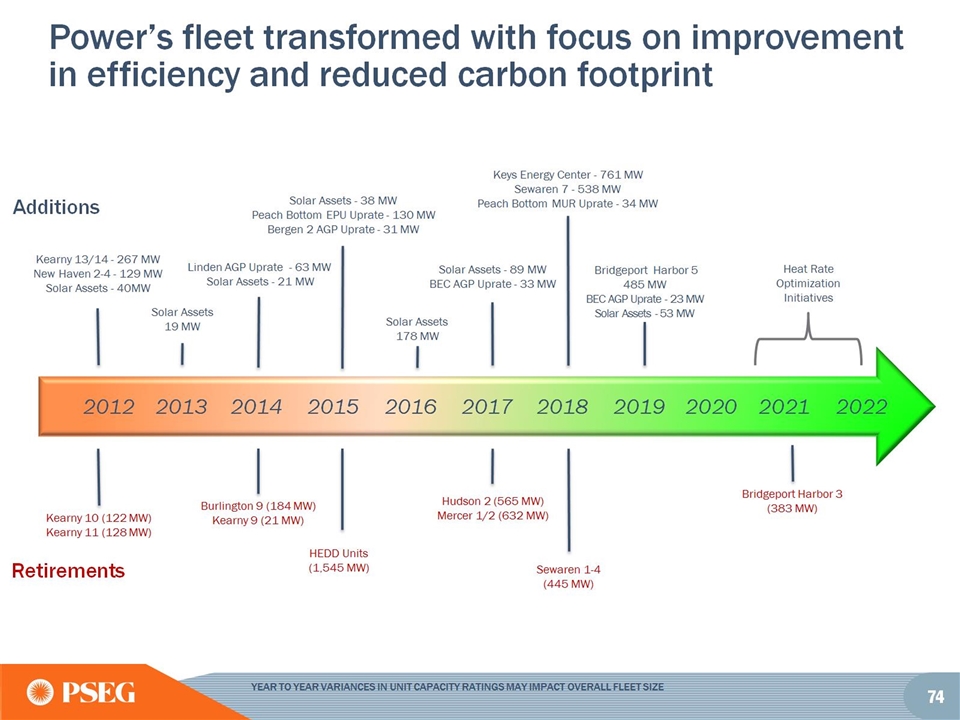

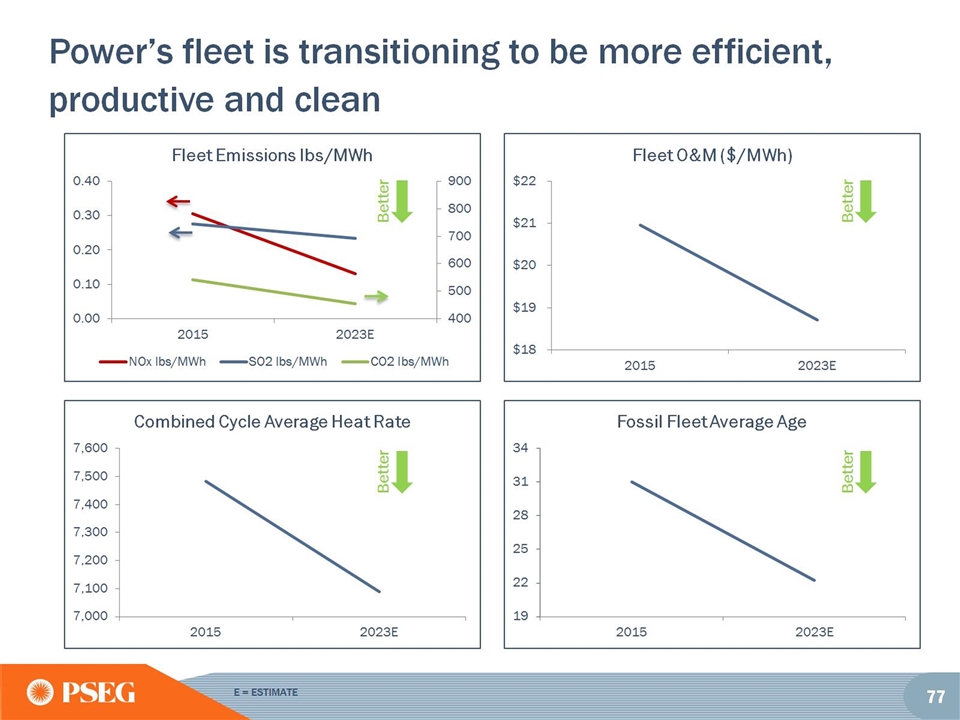

Climate Strategy – Power’s fleet transformation is addressing climate change

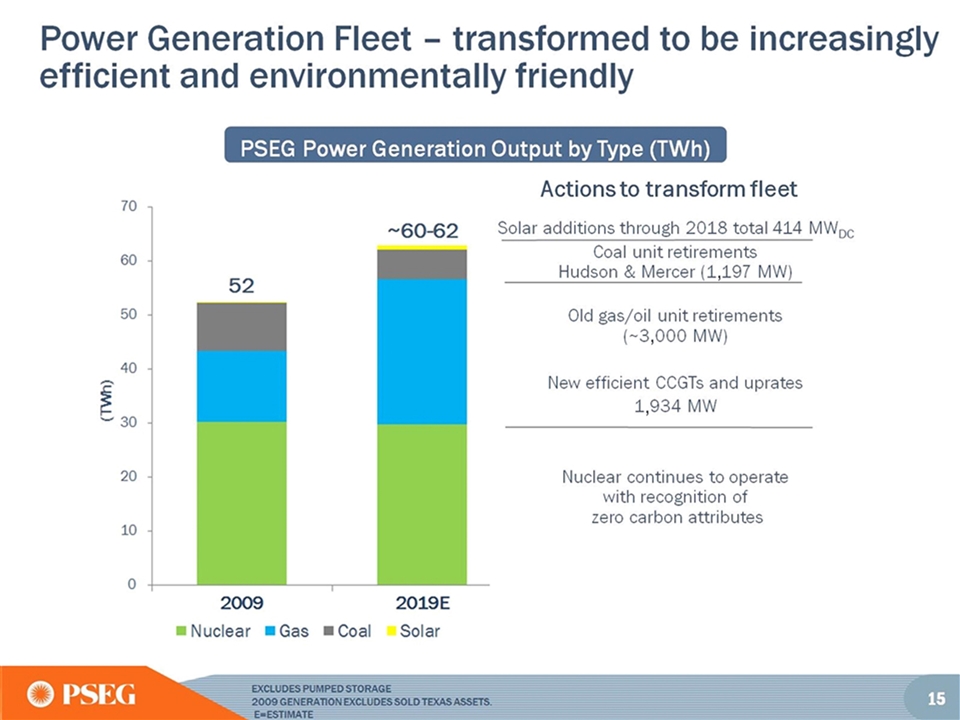

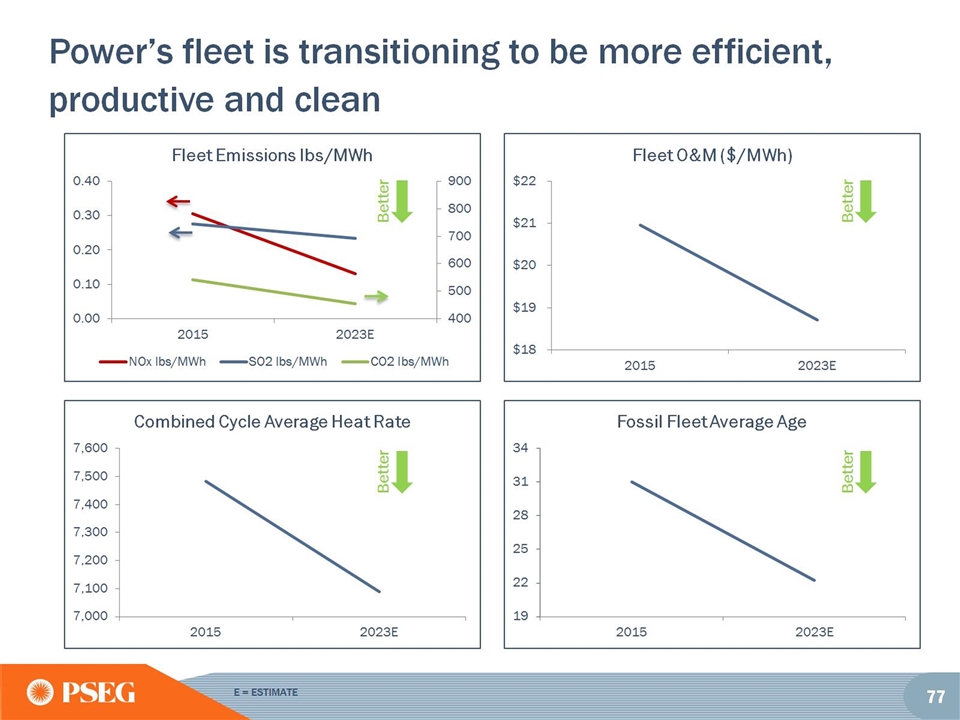

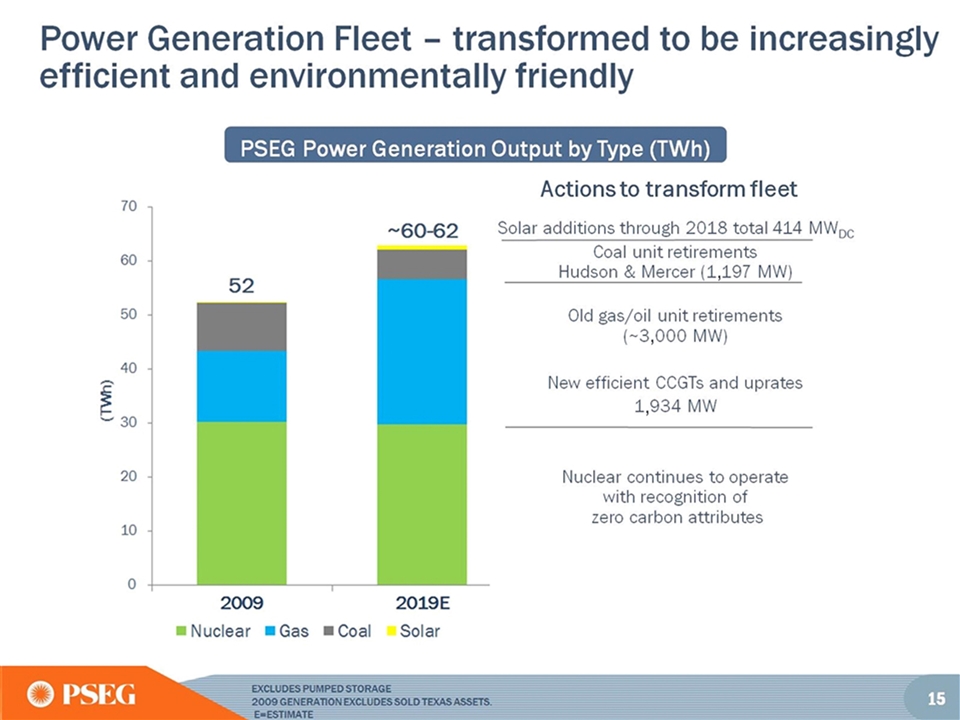

Power Generation Fleet – transformed to be increasingly efficient and environmentally friendly

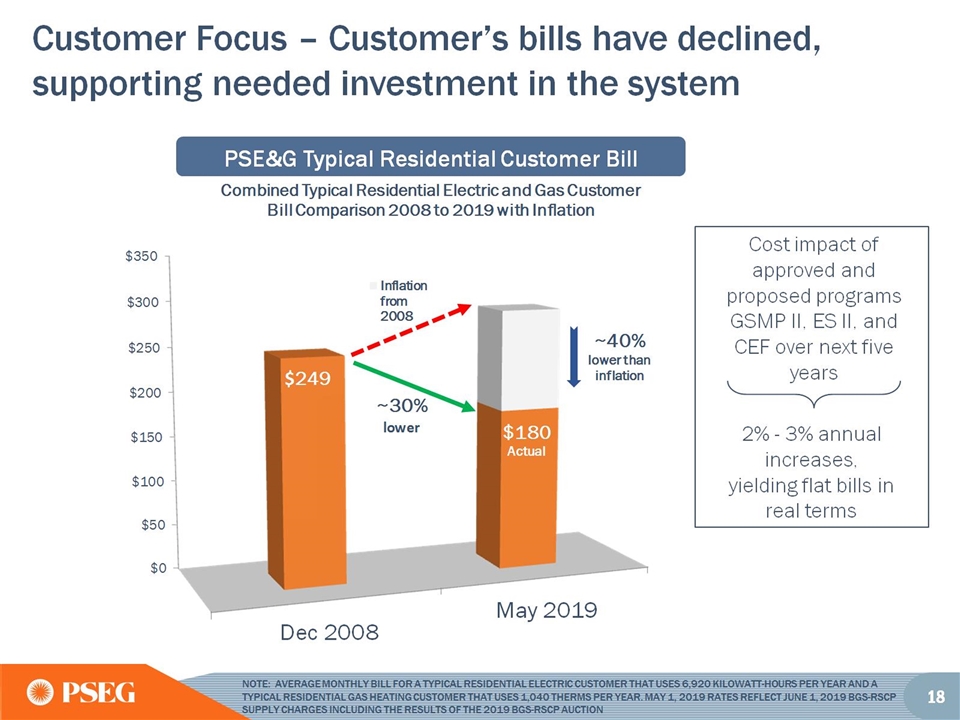

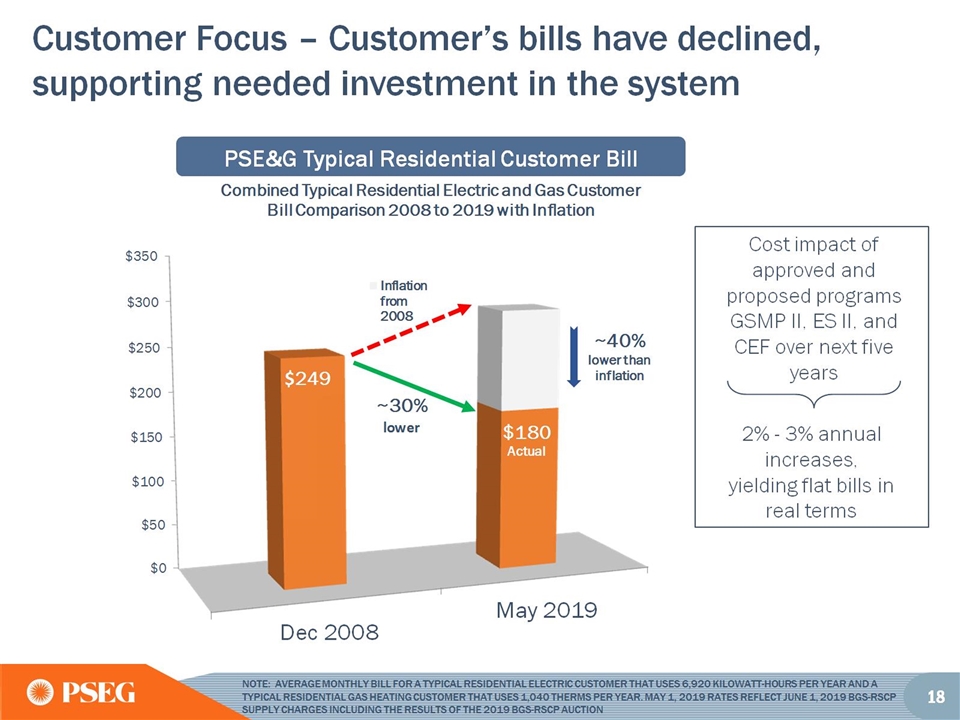

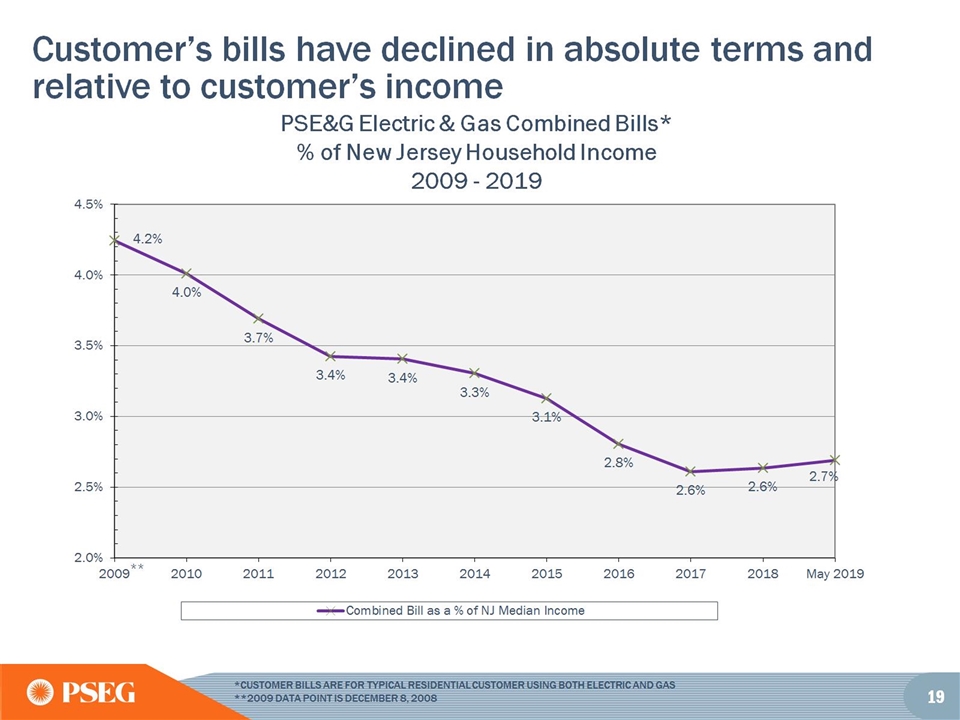

Customer Focus – Customer’s bills have declined, supporting needed investment in the system

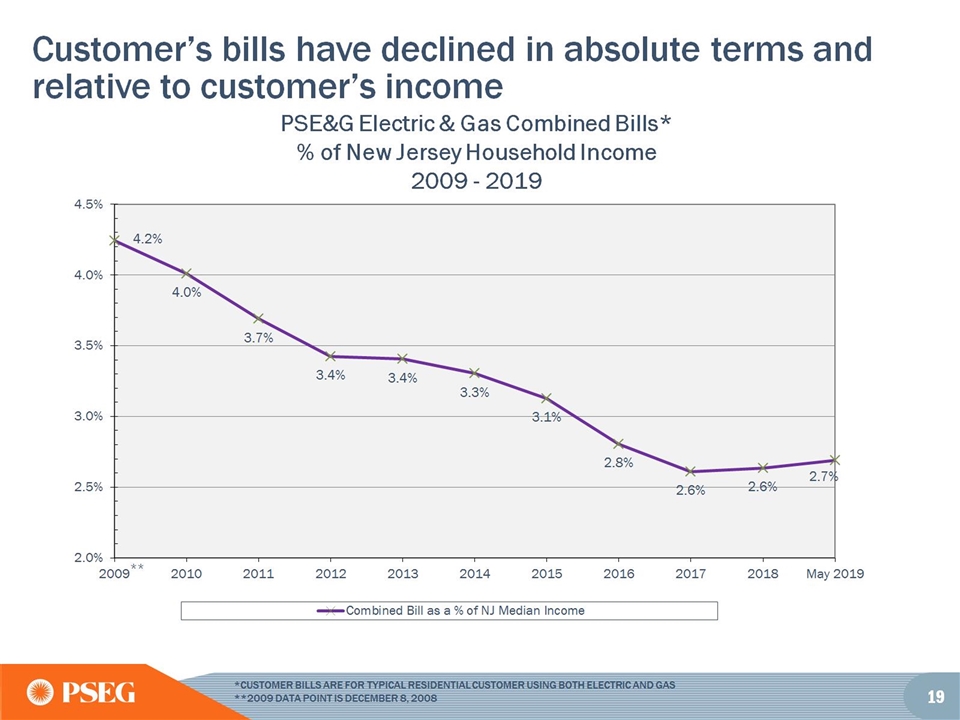

Customer’s bills have declined in absolute terms and relative to customer’s income

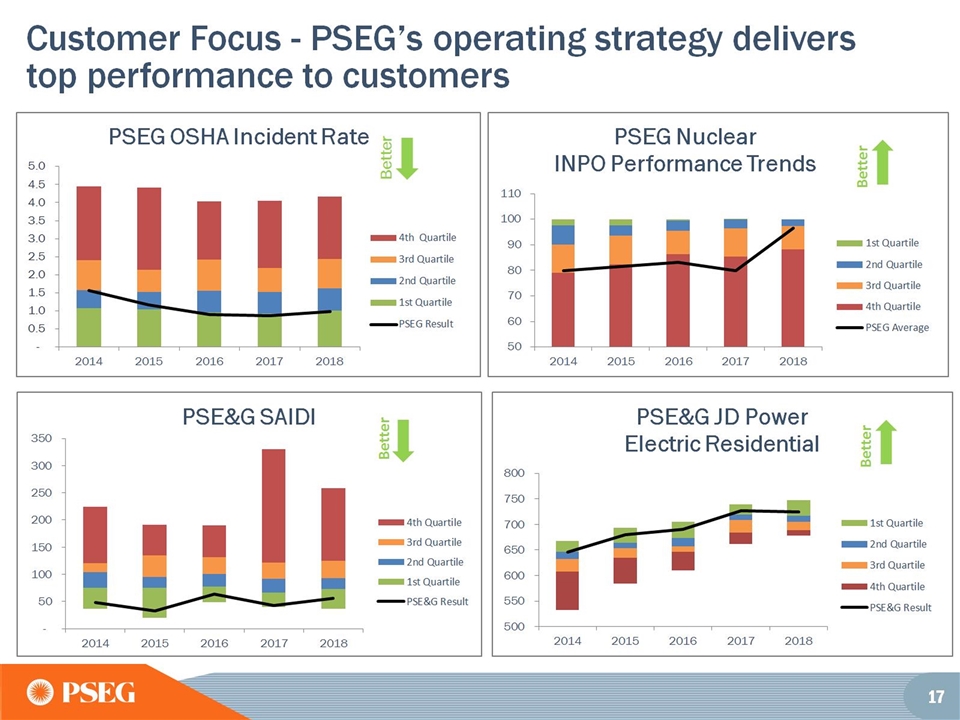

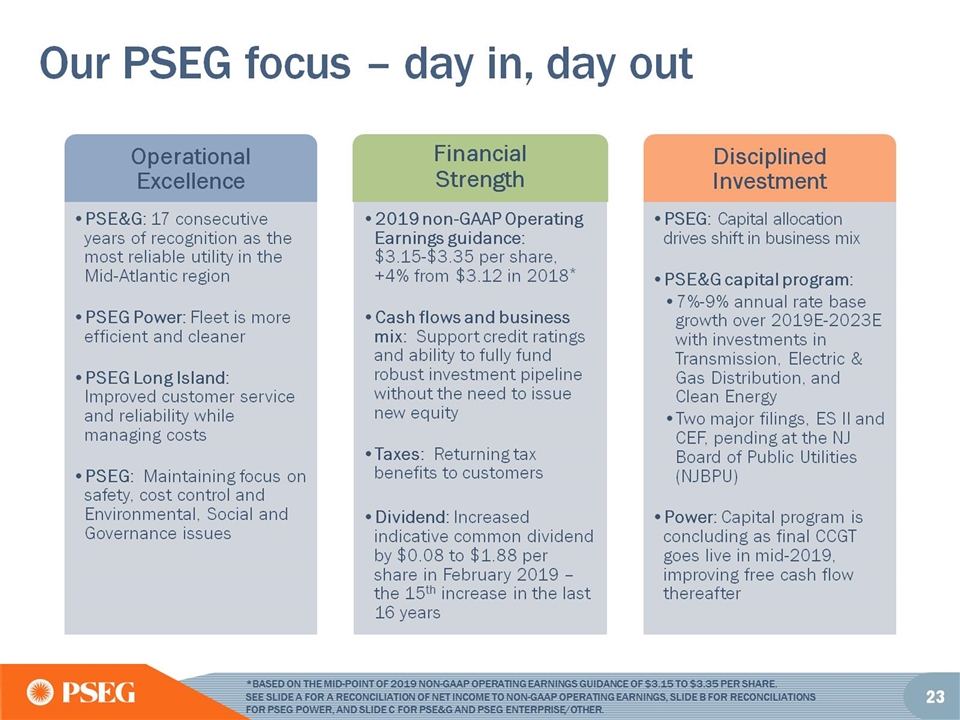

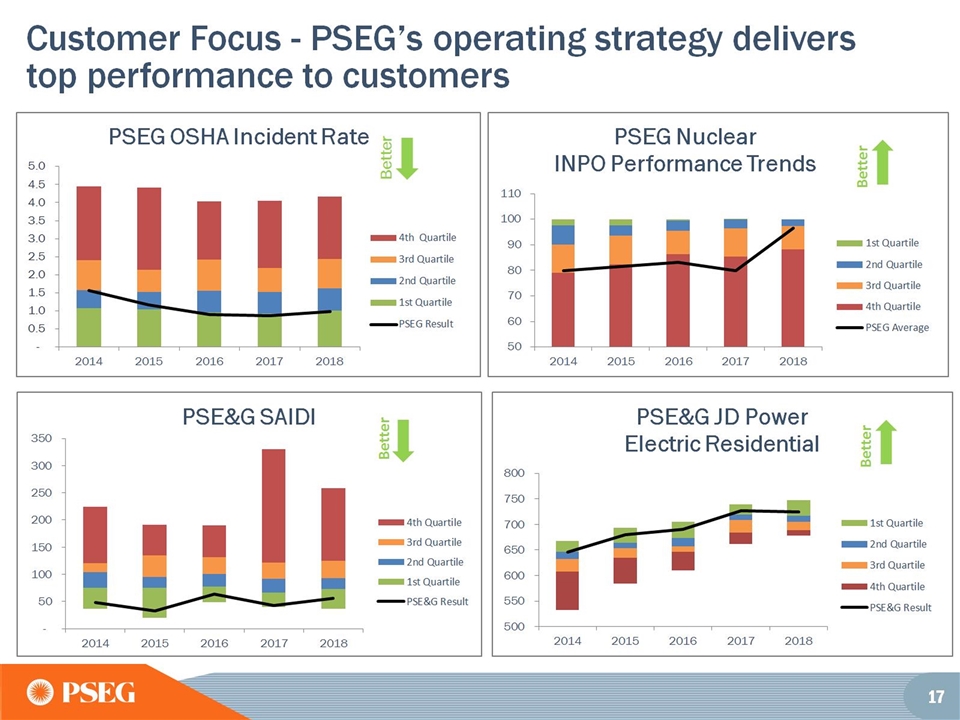

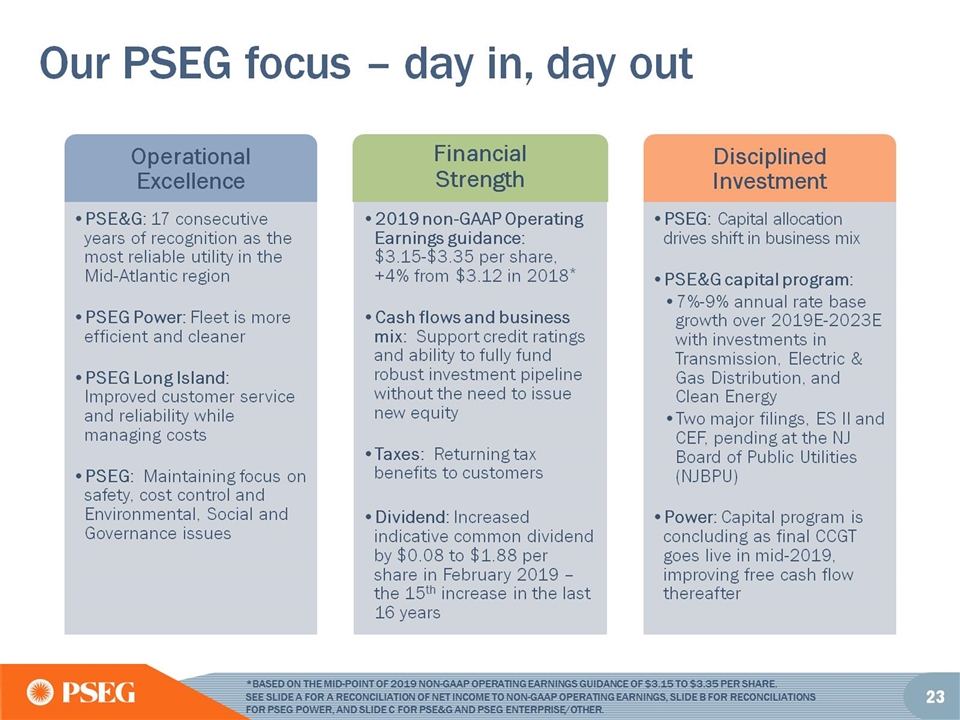

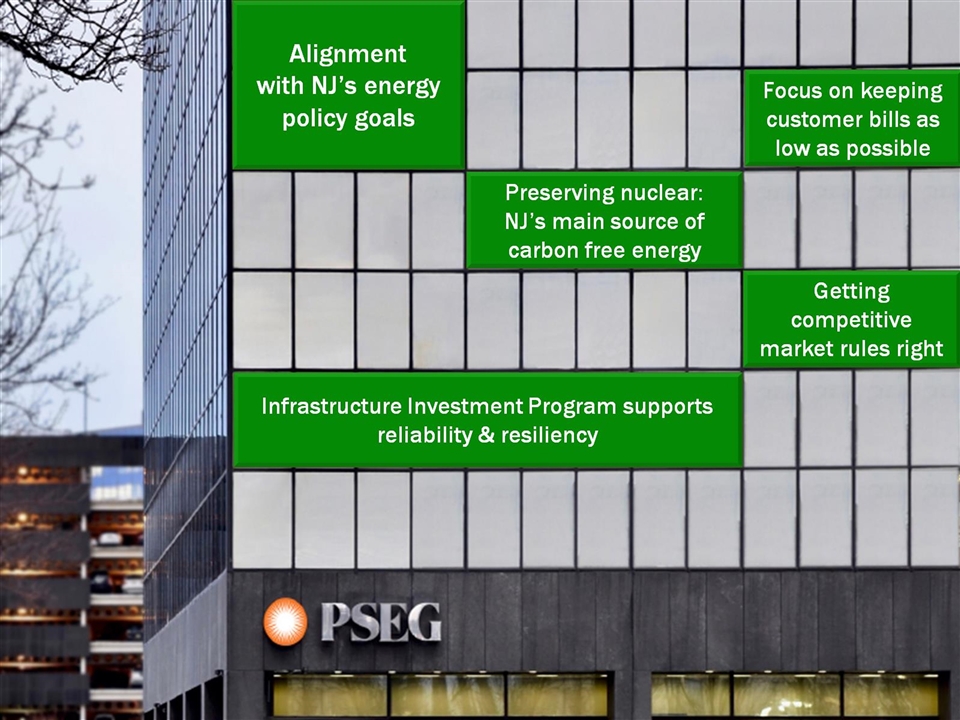

Our PSEG focus – day in, day out

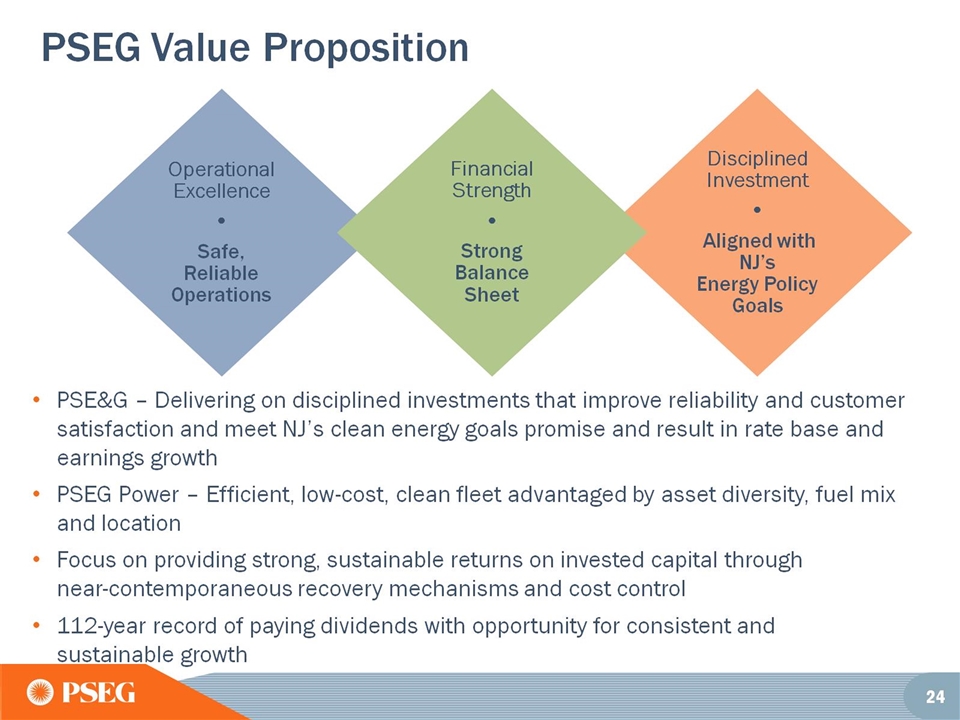

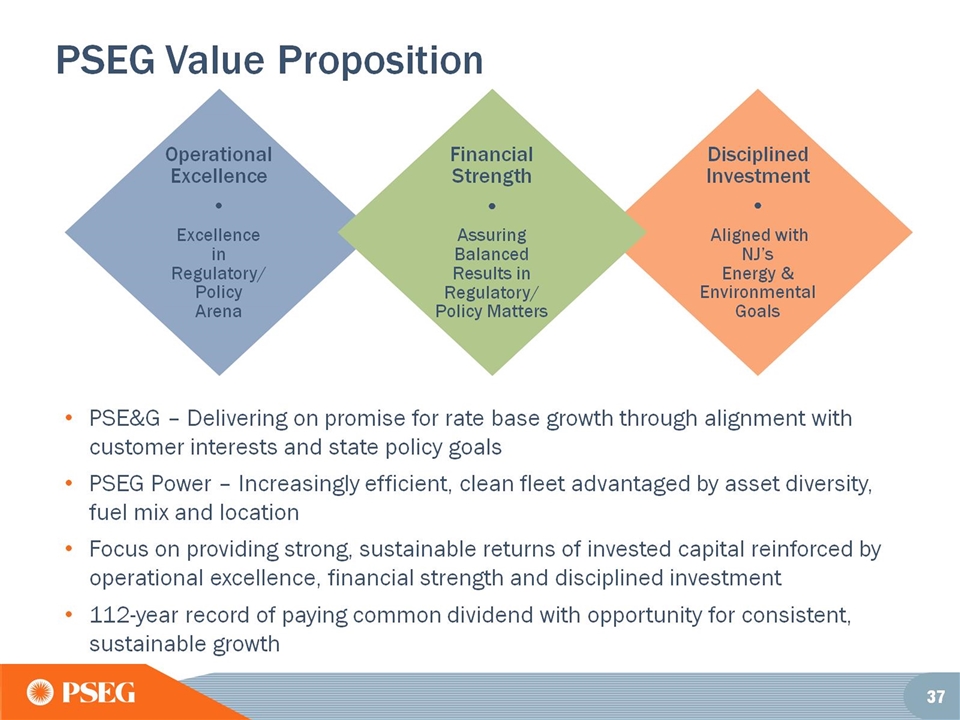

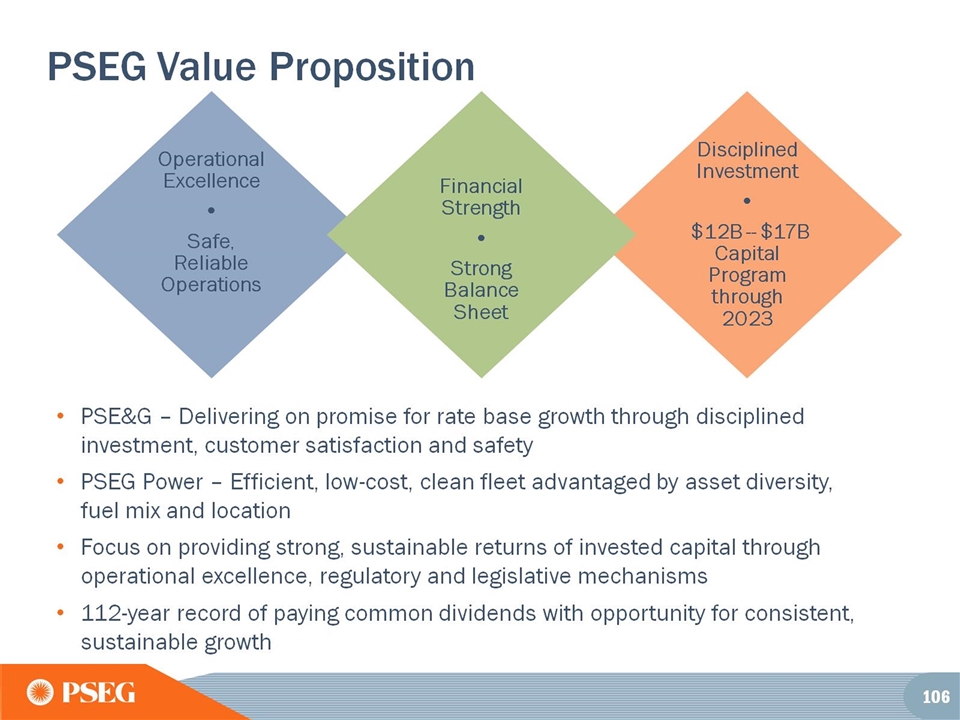

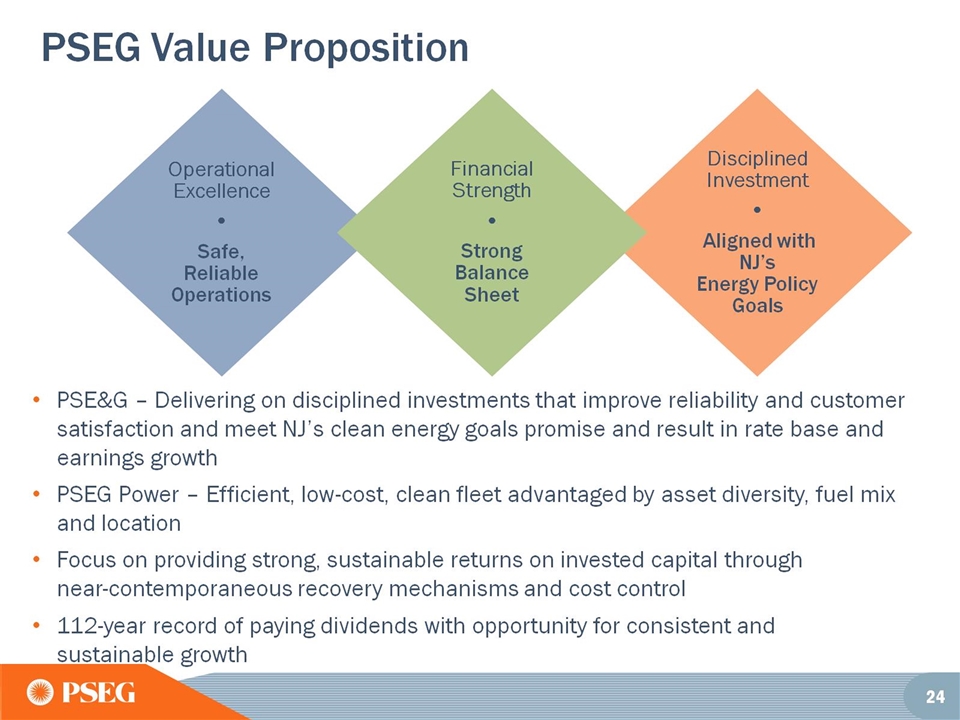

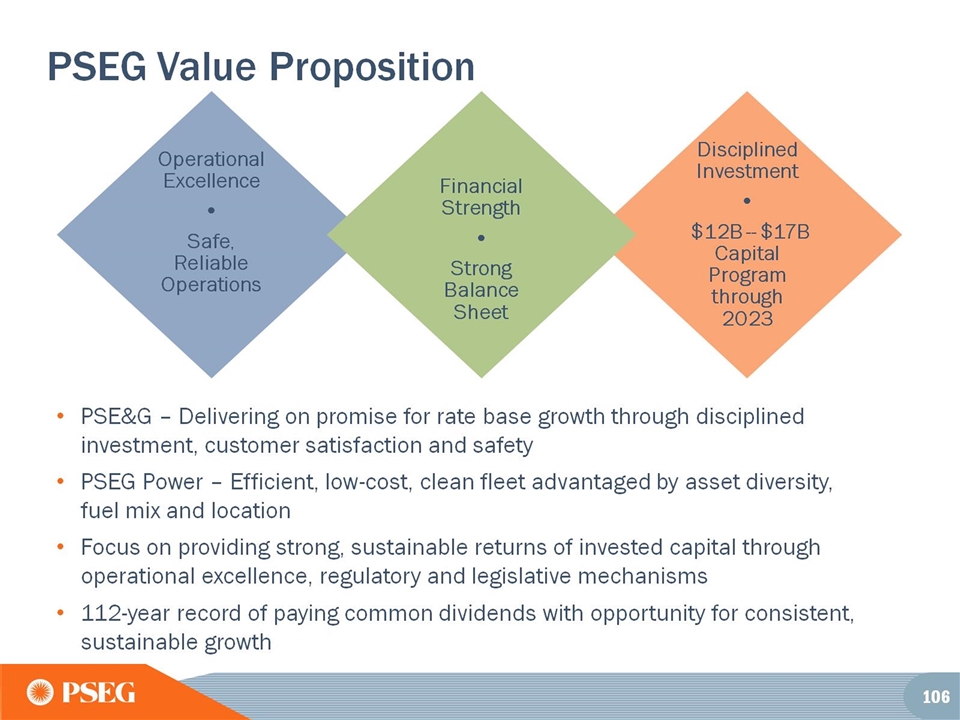

PSEG Value Proposition

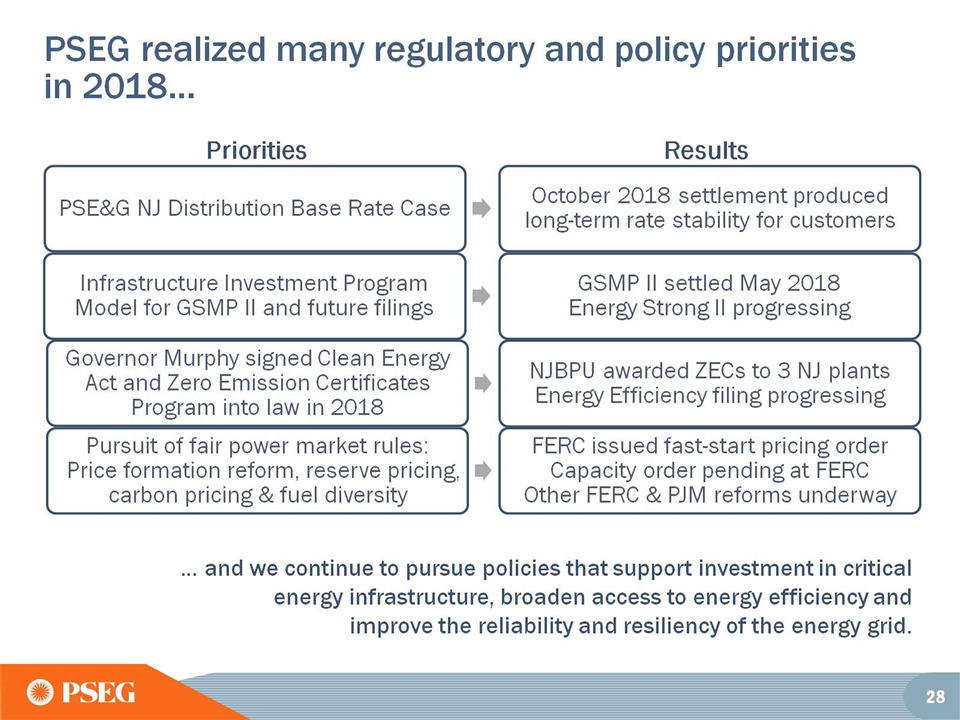

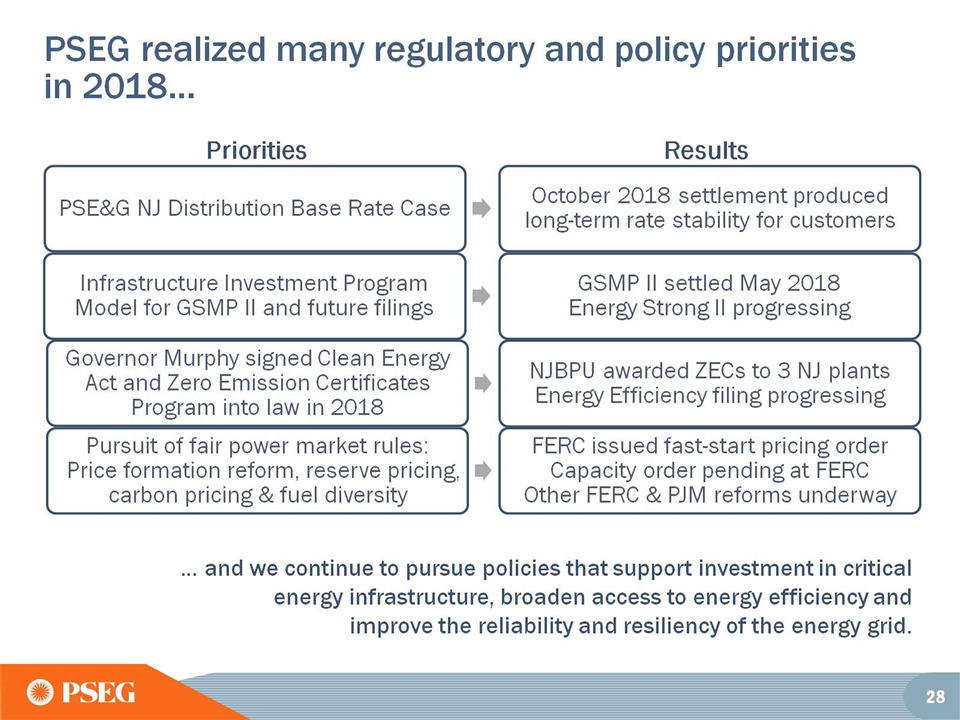

PSEG realized many regulatory and policy priorities in 2018…

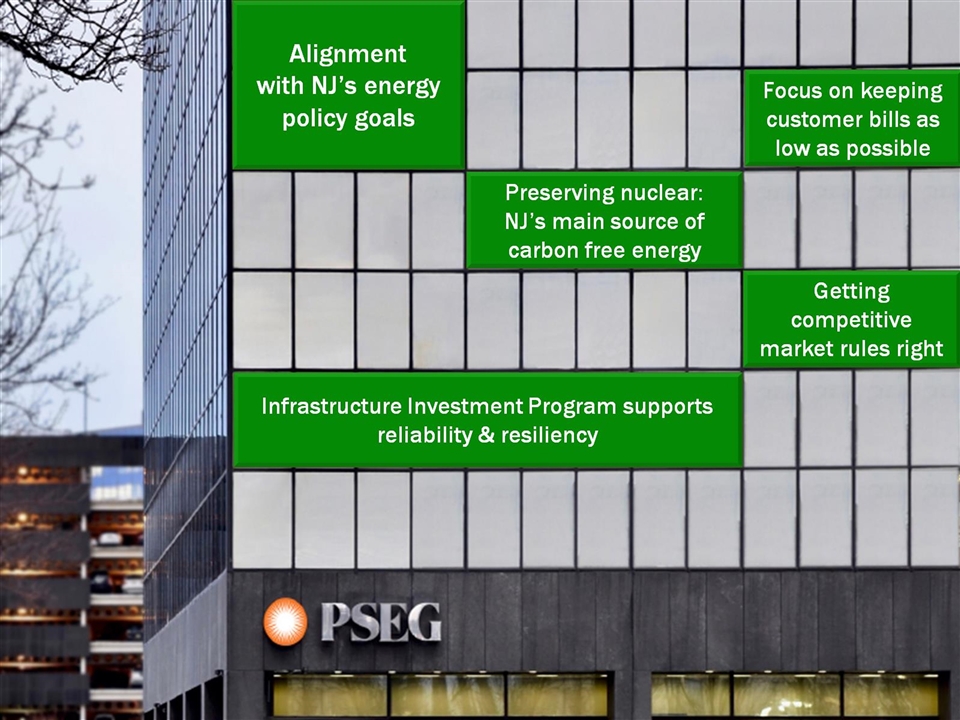

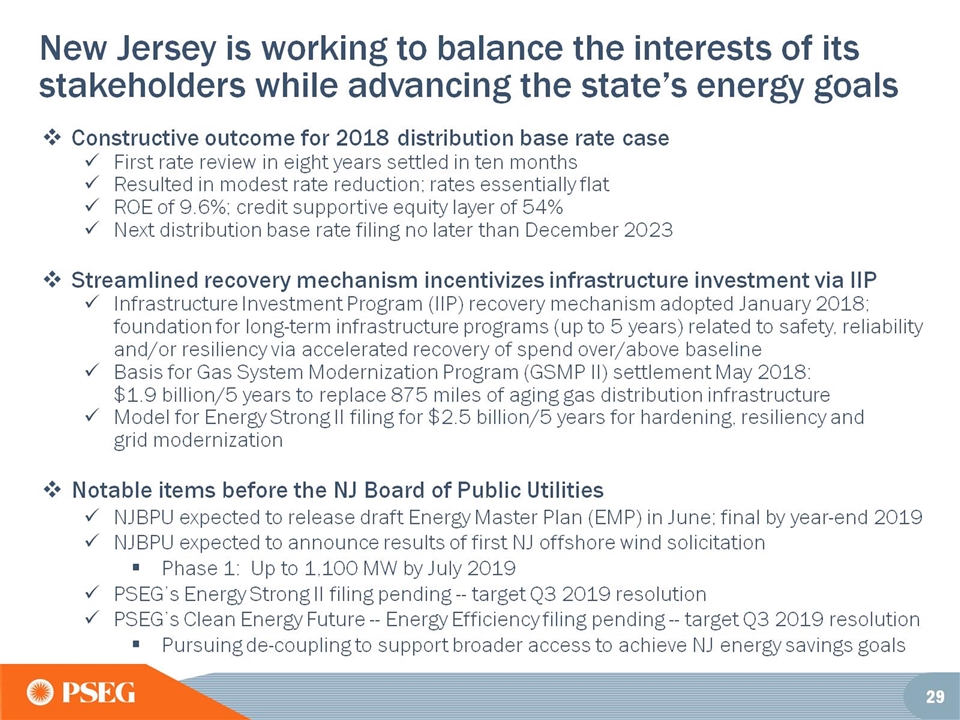

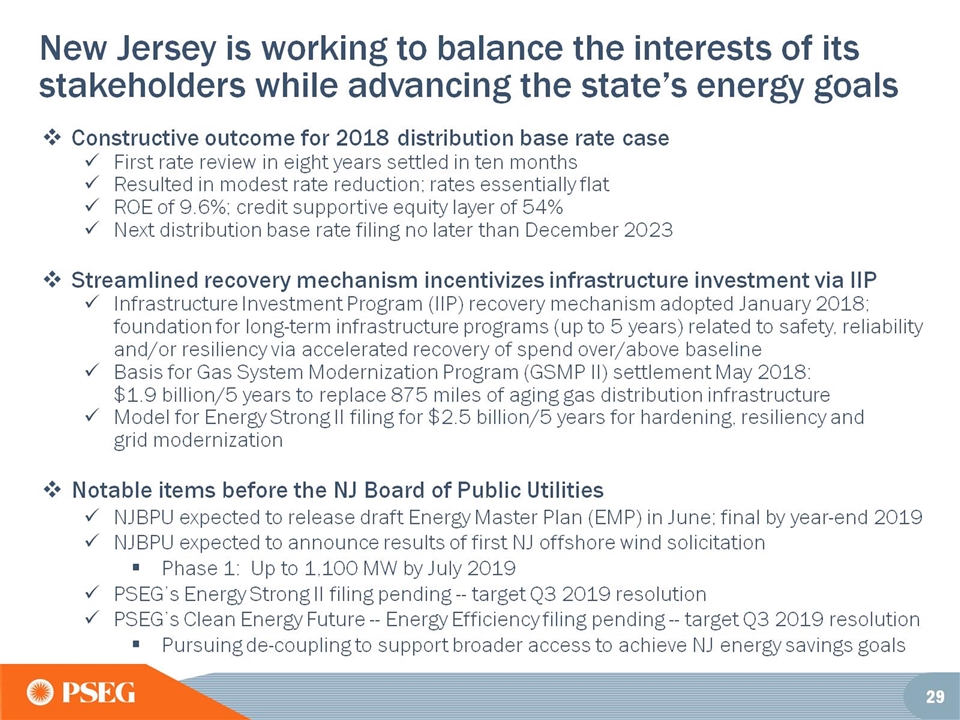

New Jersey is working to balance the interests of its stakeholders while advancing the state’s energy goals

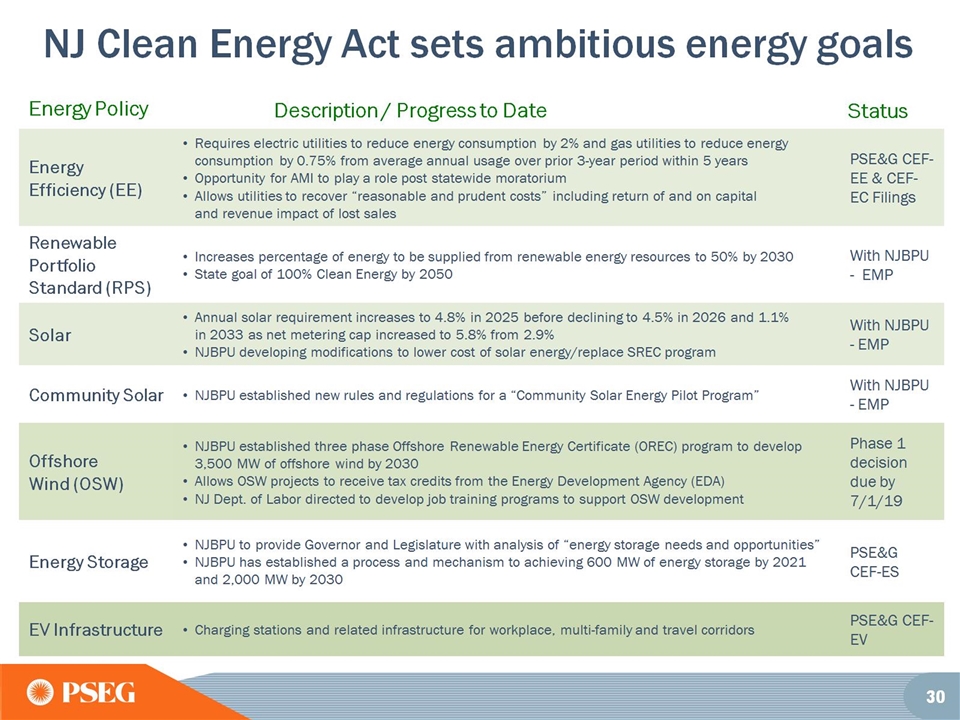

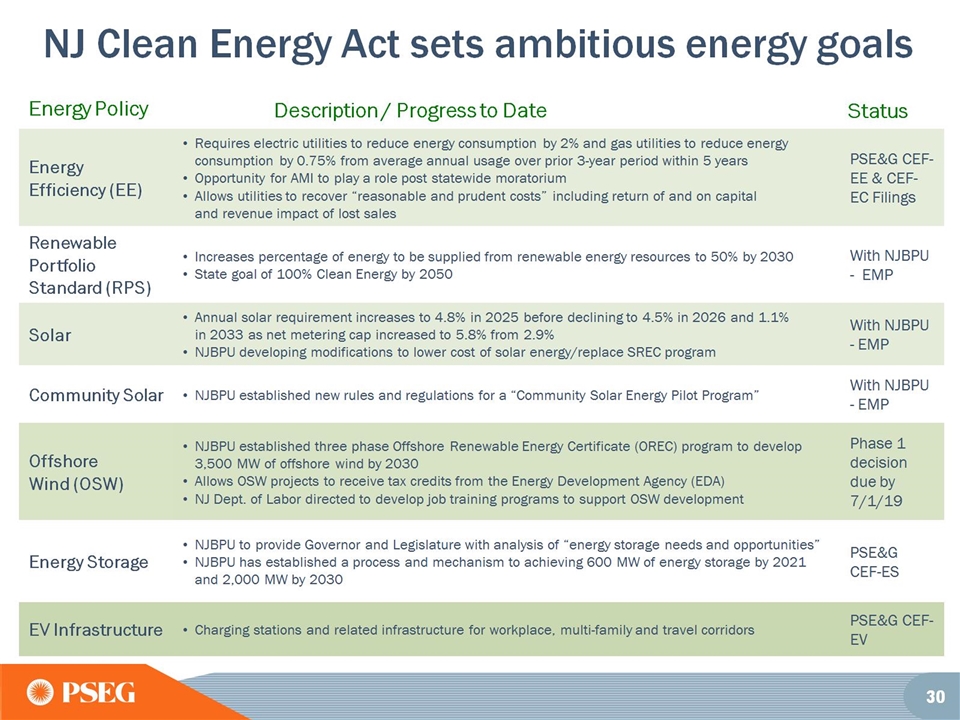

NJ Clean Energy Act sets ambitious energy goals

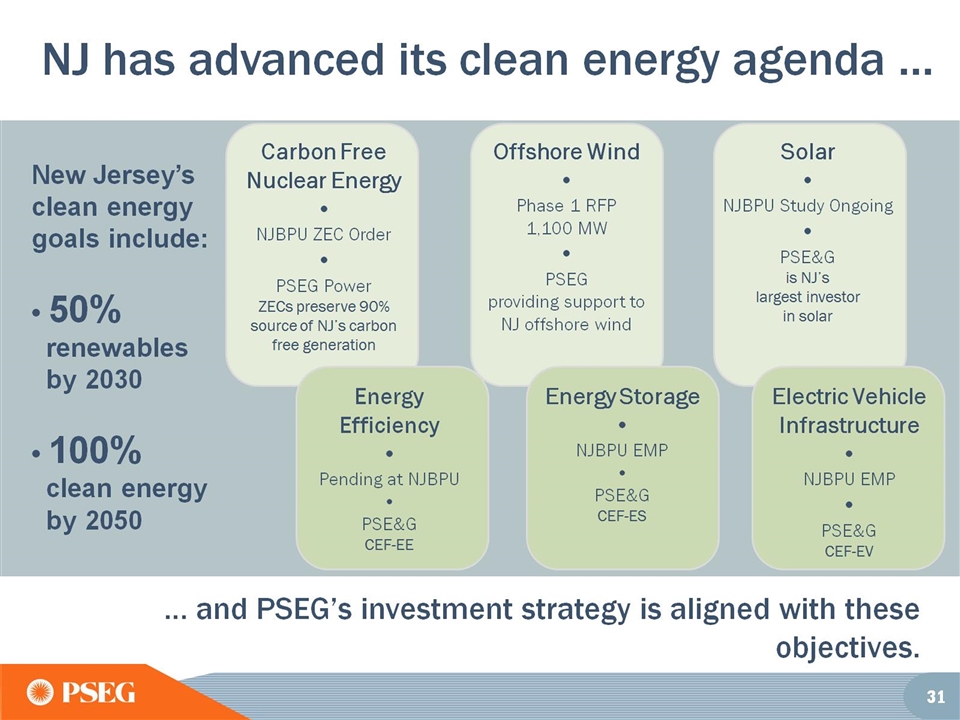

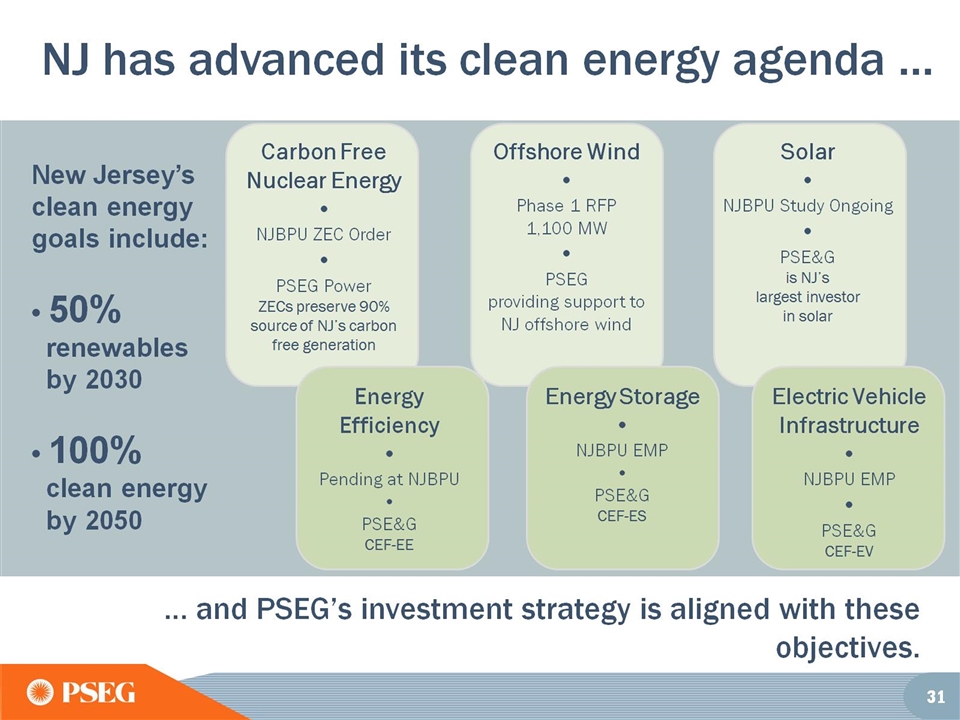

NJ has advanced its clean energy agenda …

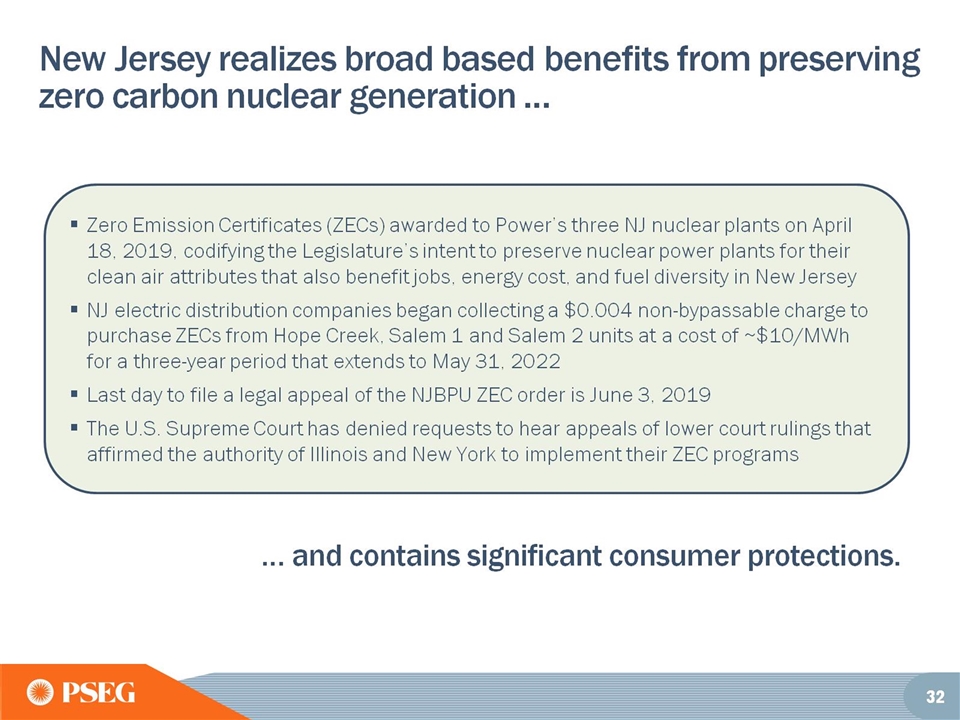

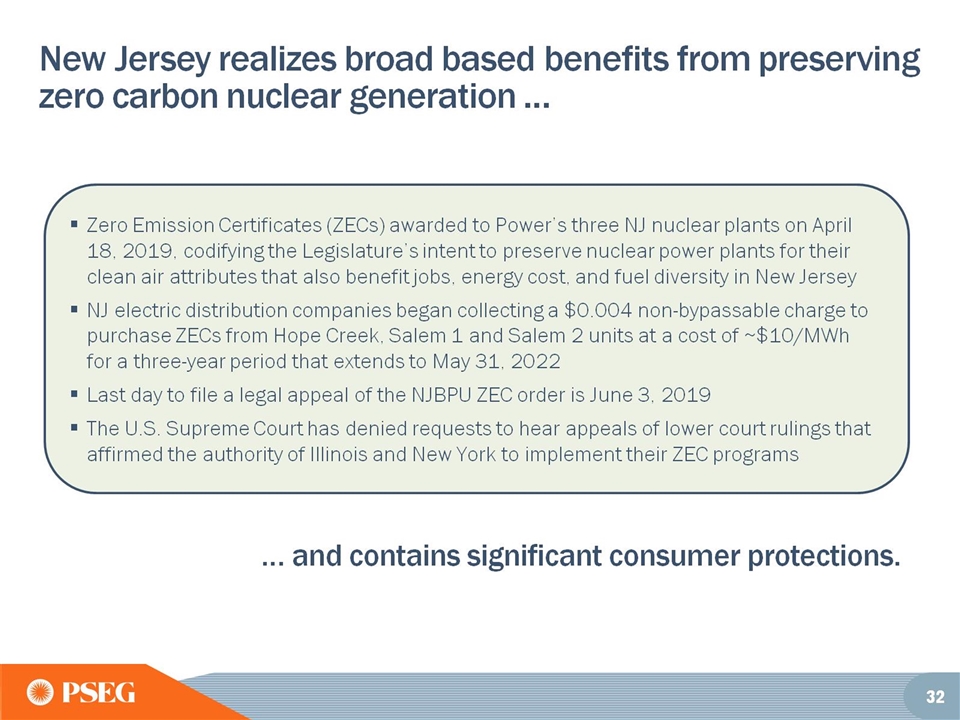

New Jersey realizes broad based benefits from preserving zero carbon nuclear generation …

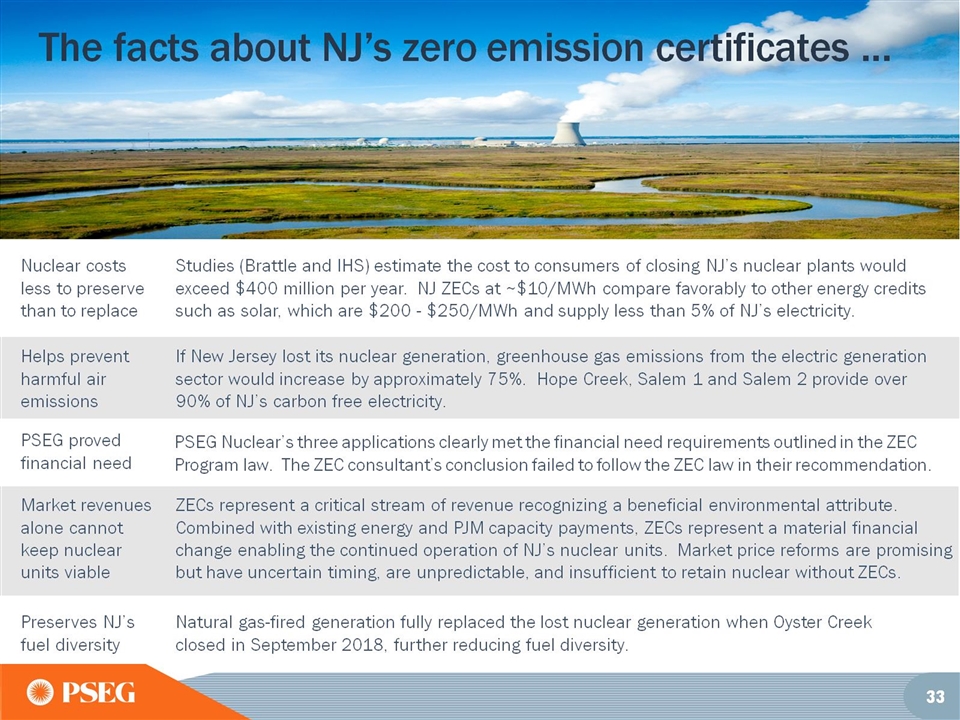

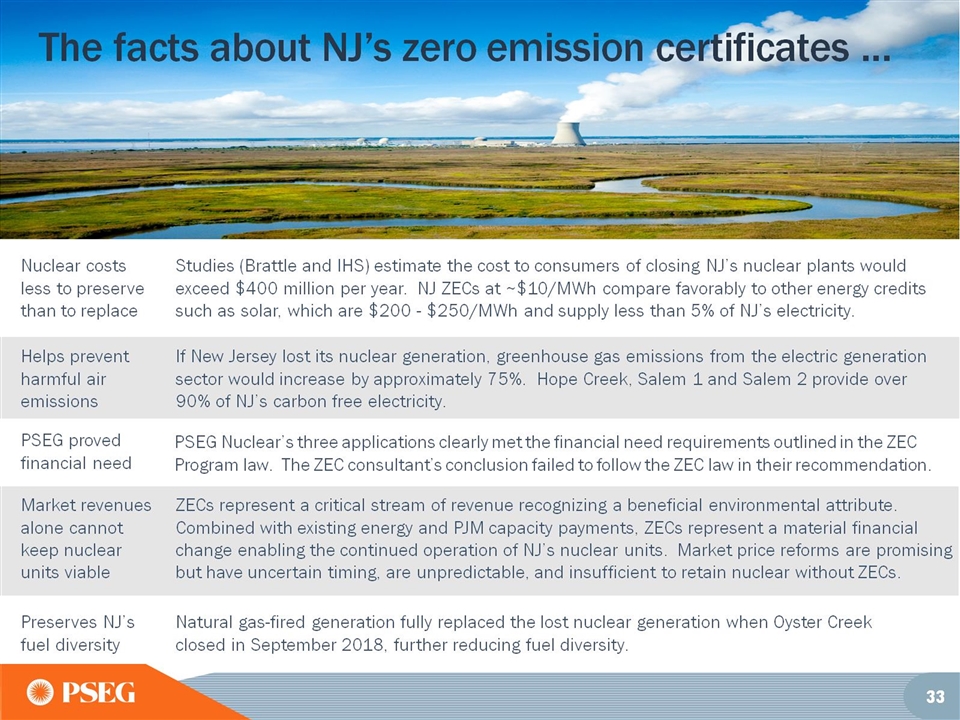

The facts about NJ’s zero emission certificates …

PSEG advocating for competitive market reforms … process still moving slowly

PSEG is committed to excellence in corporate governance

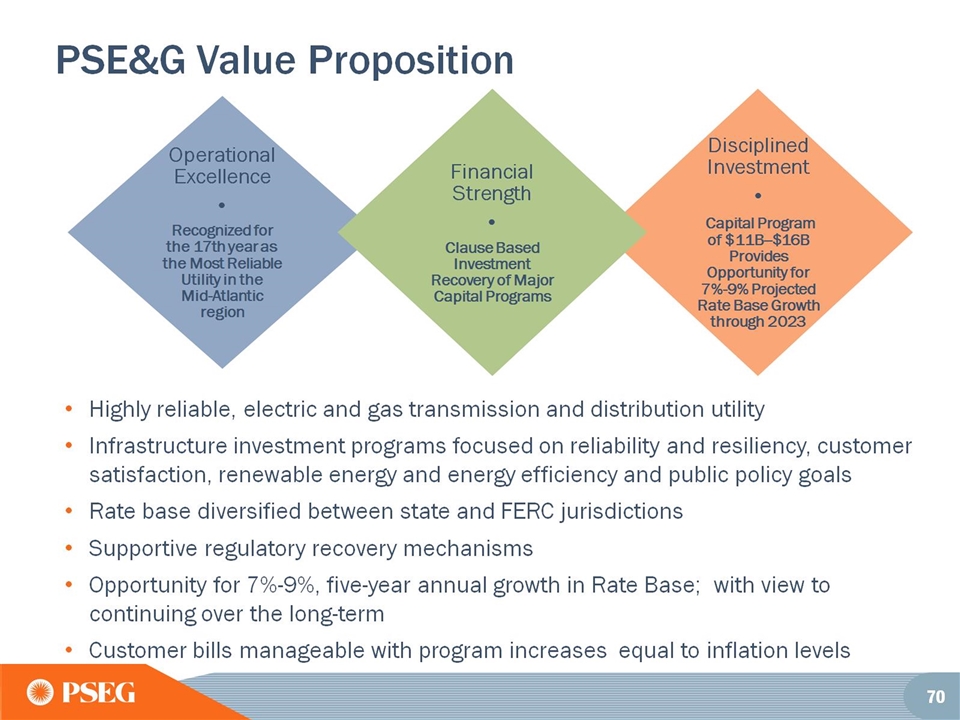

PSEG Value Proposition

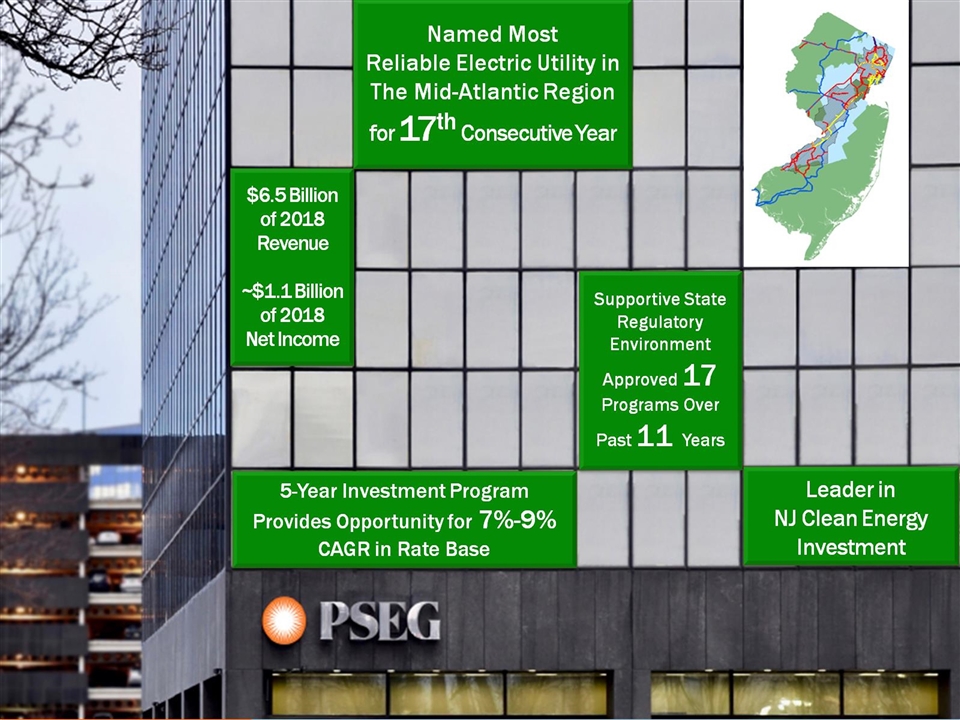

PSE&G

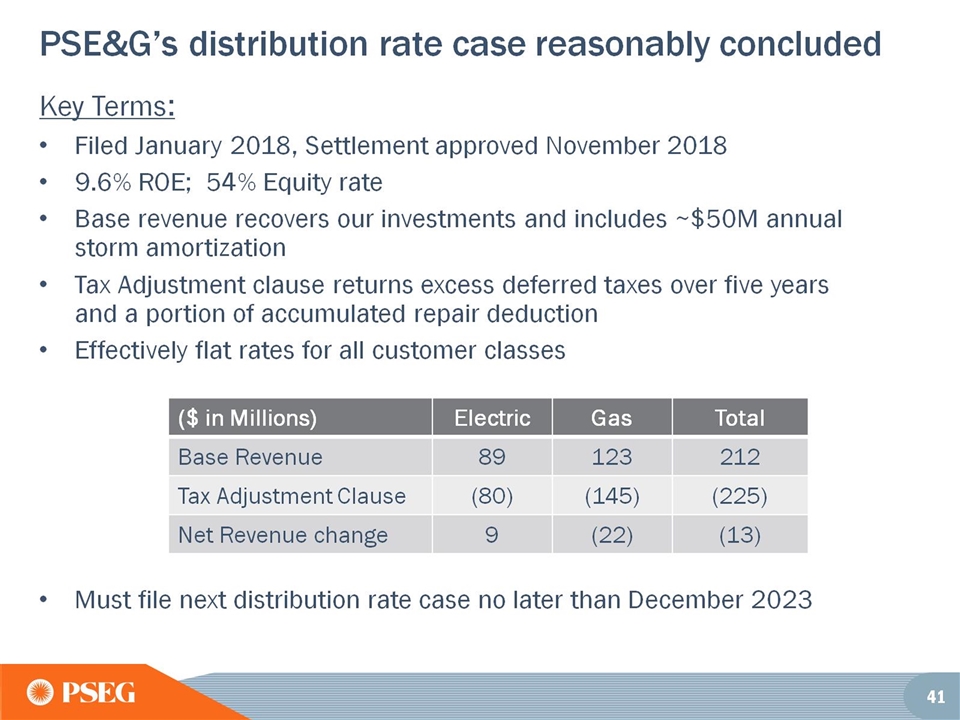

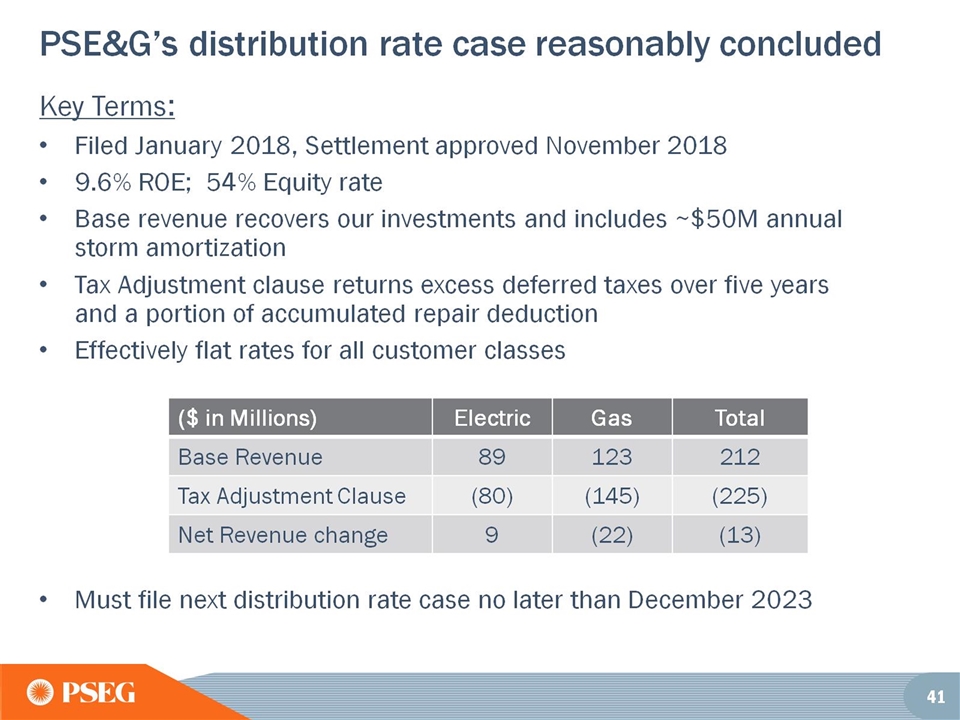

PSE&G’s distribution rate case reasonably concluded

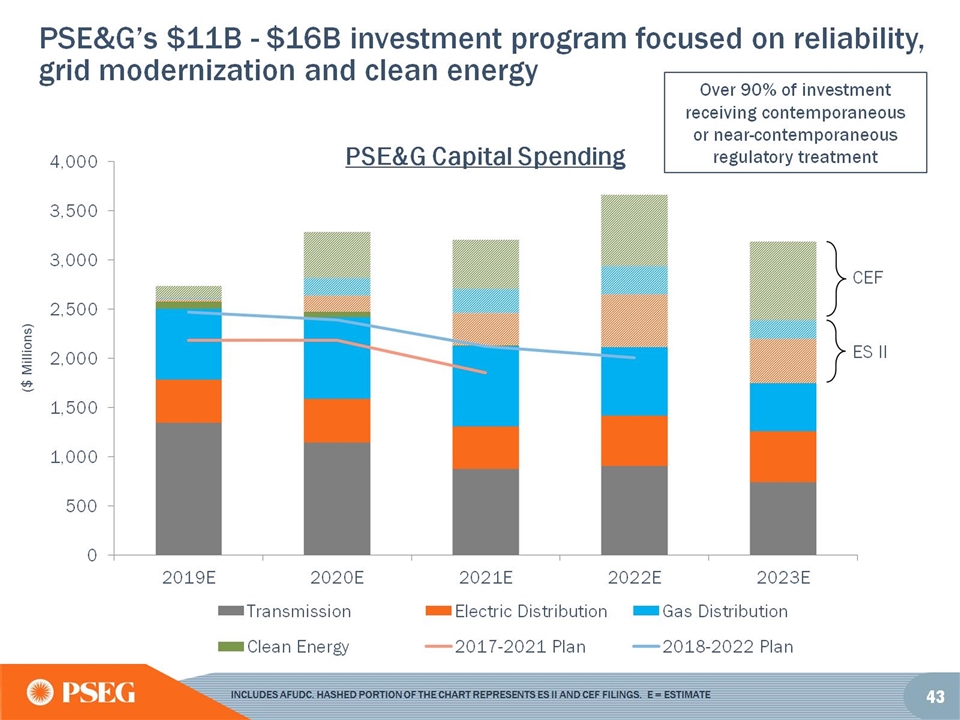

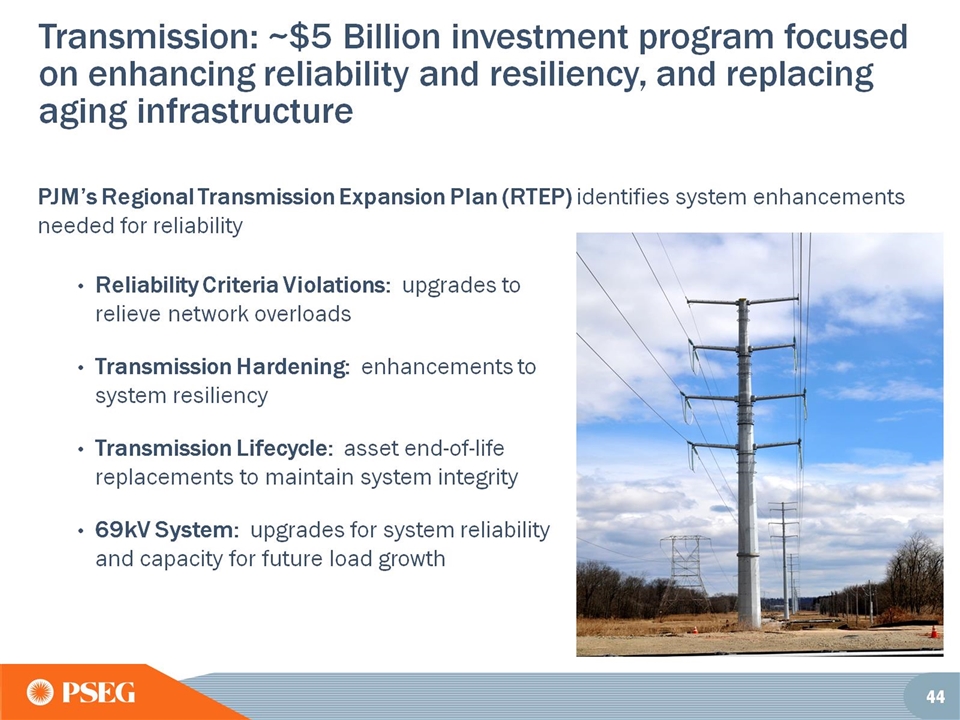

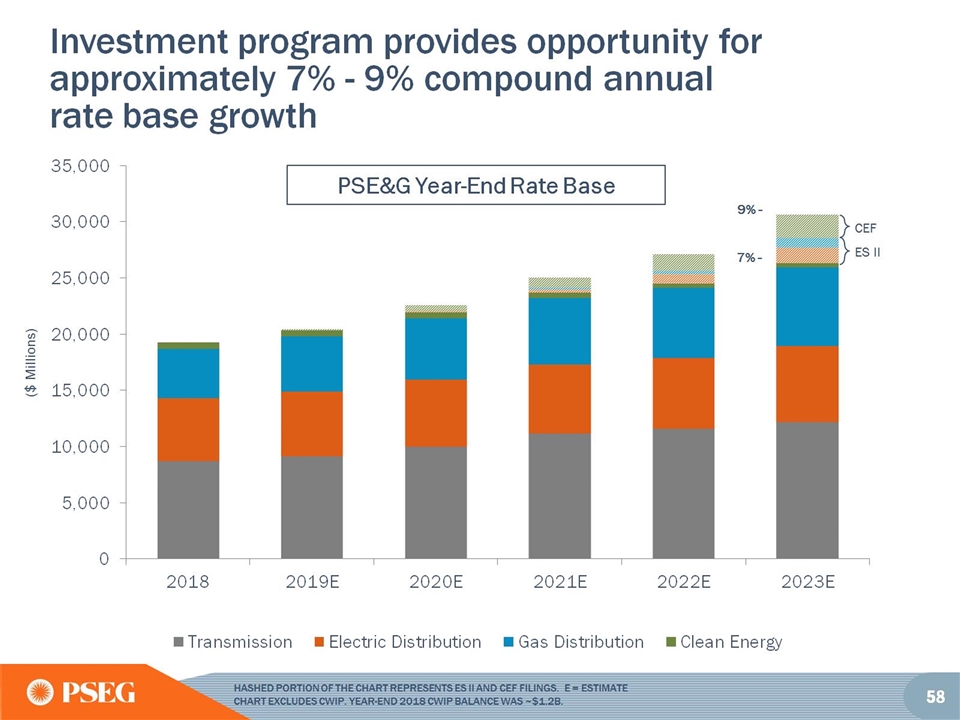

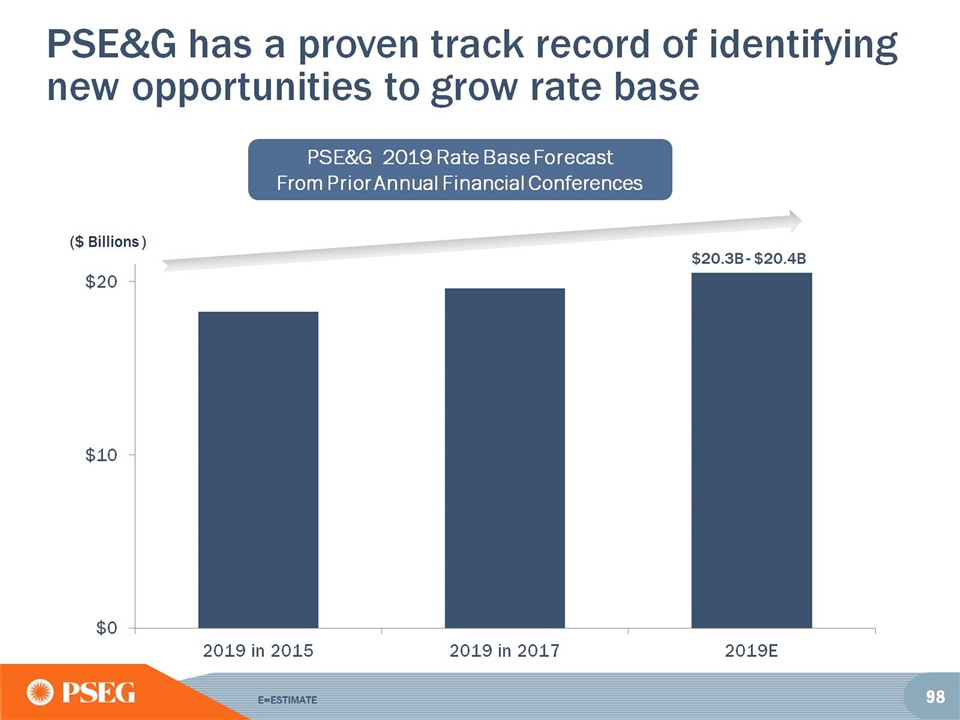

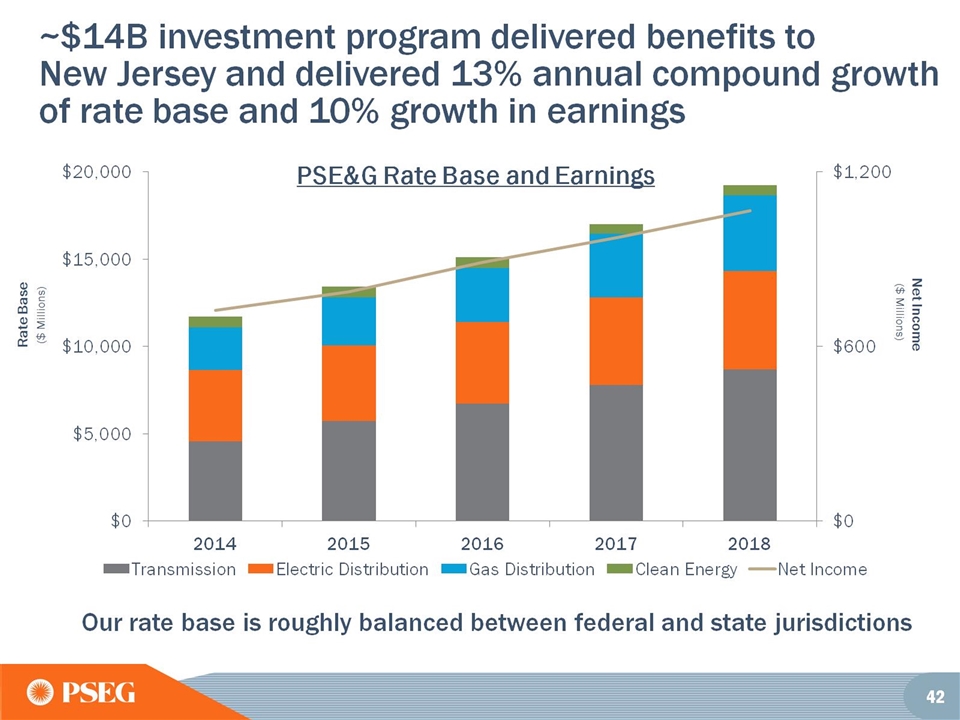

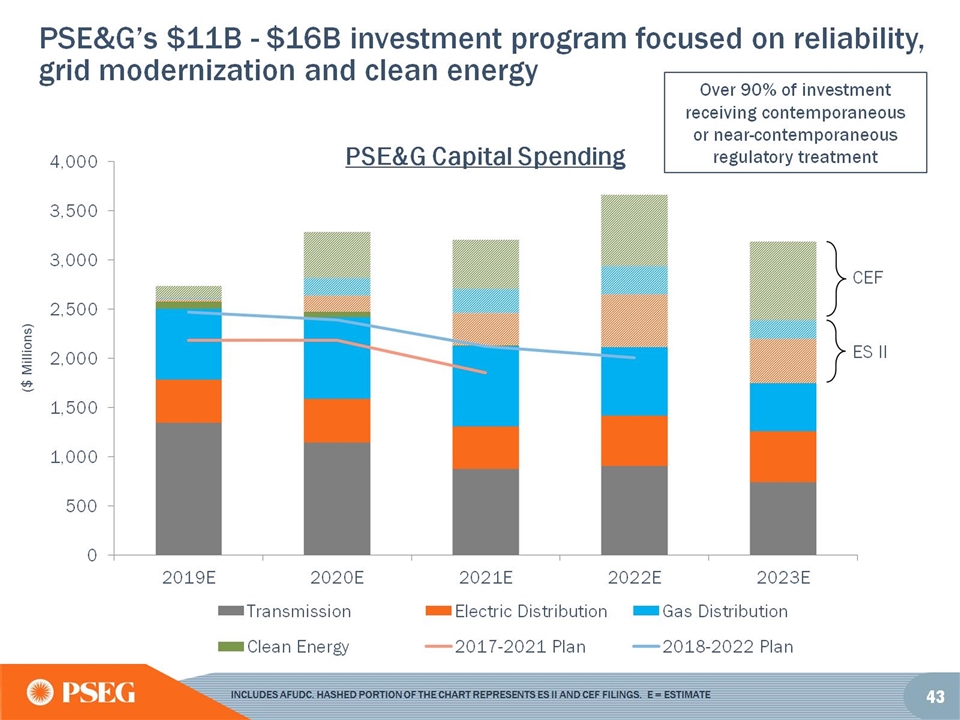

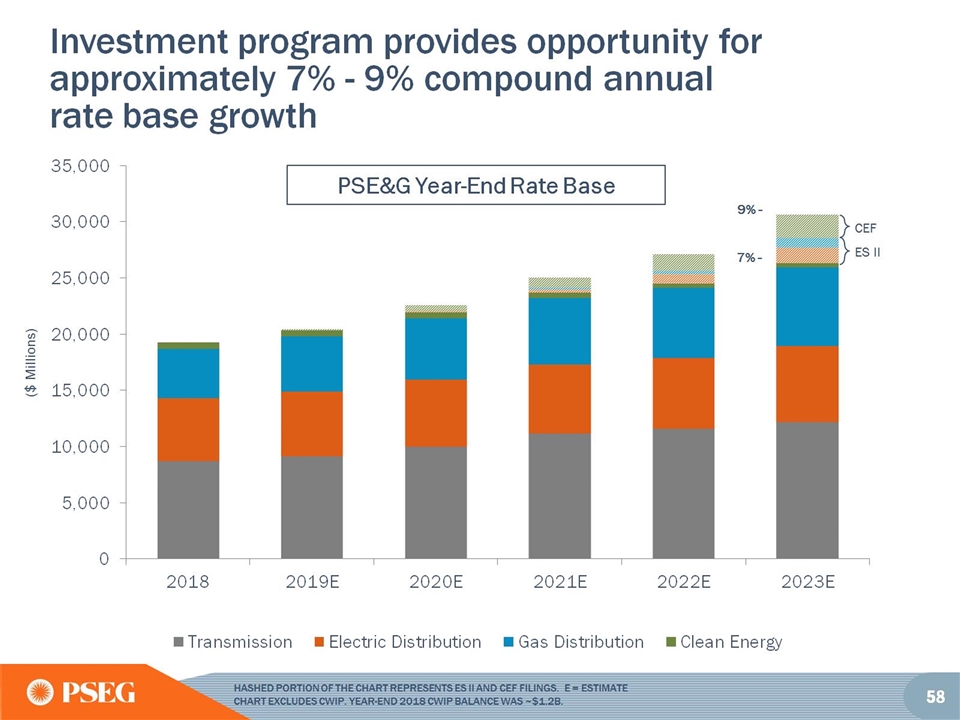

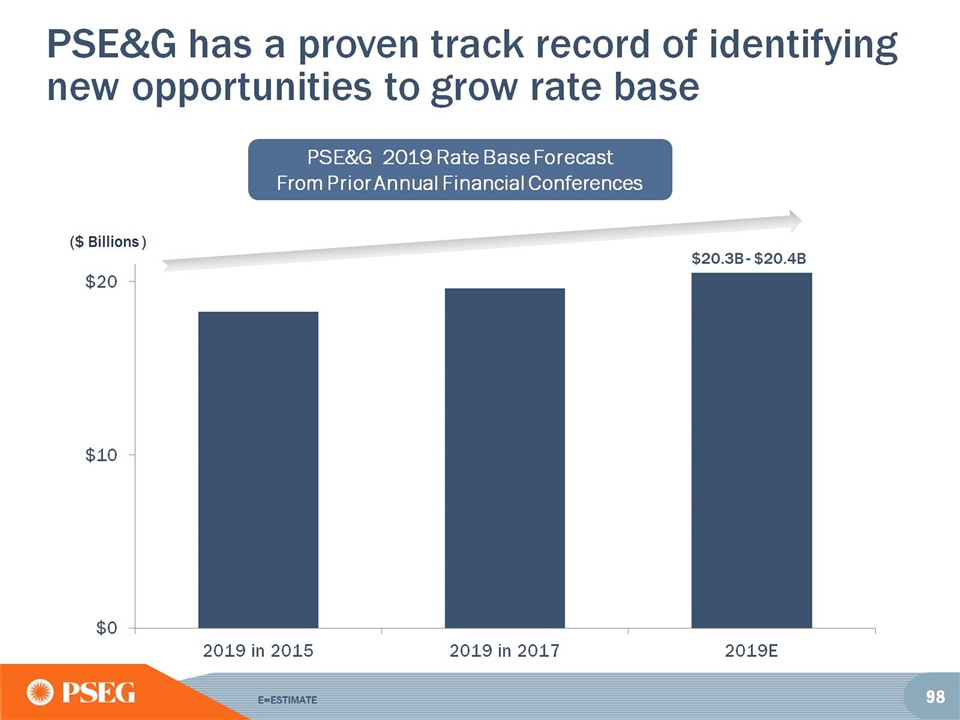

PSE&G’s $11B - $16B investment program focused on reliability, grid modernization and clean energy

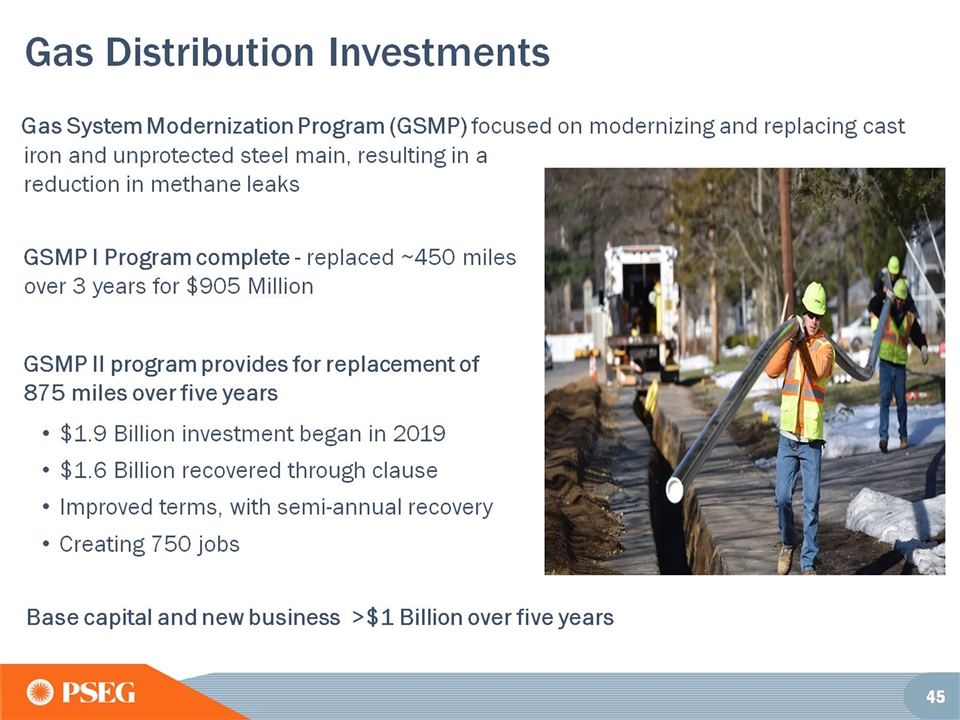

Gas Distribution Investments

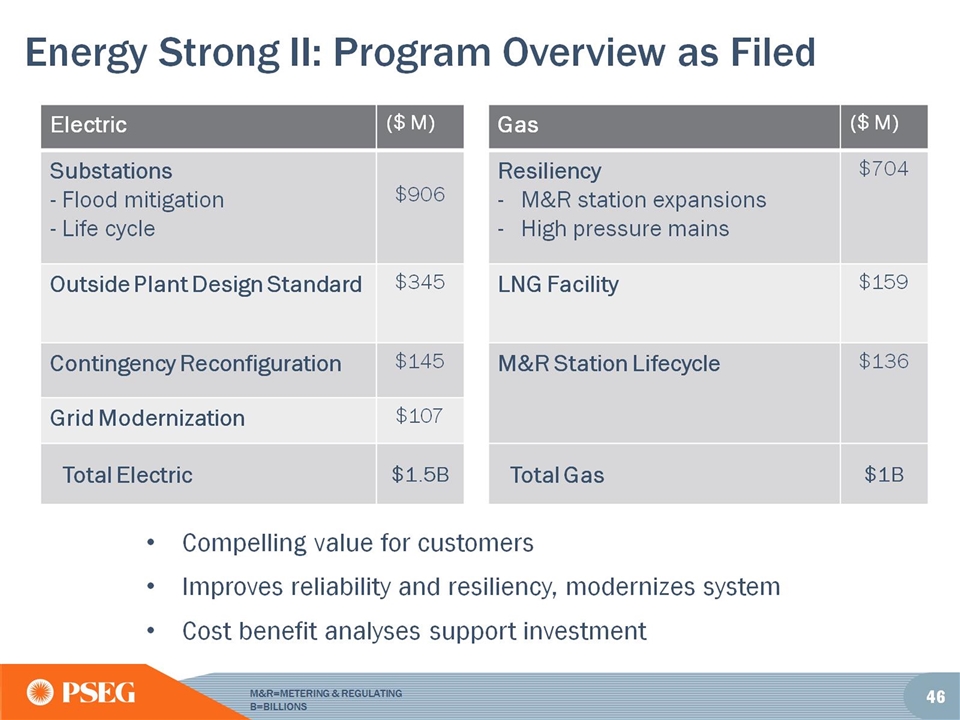

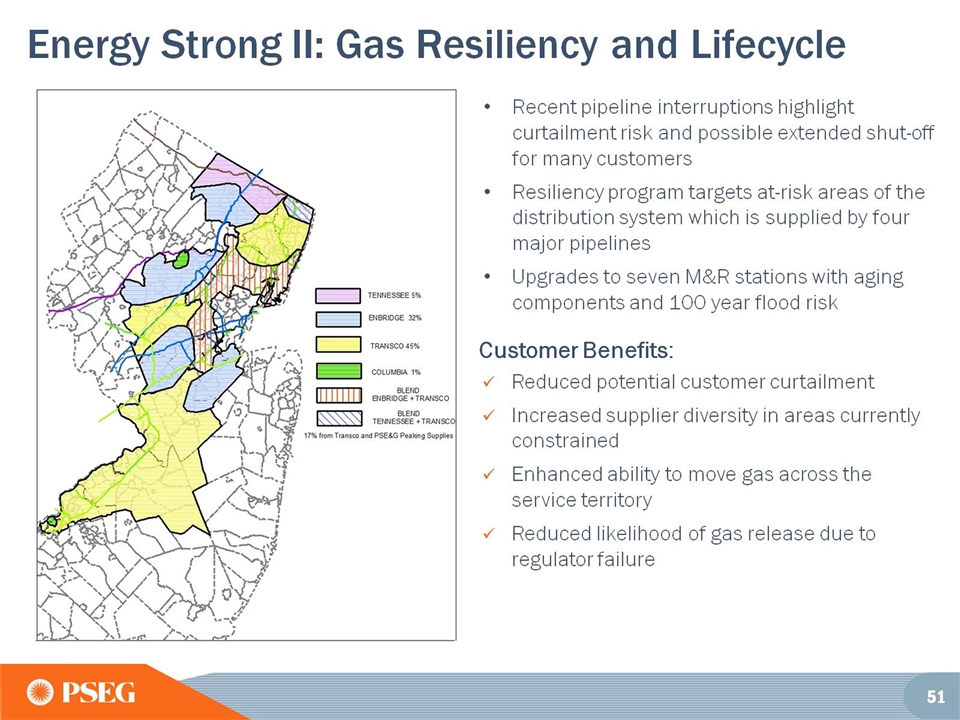

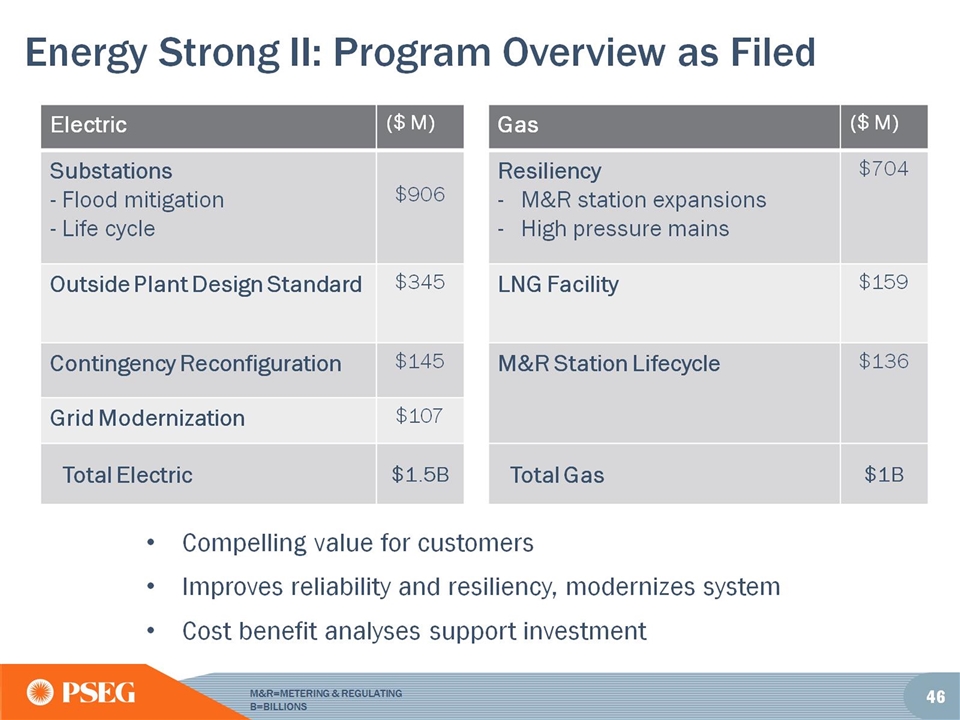

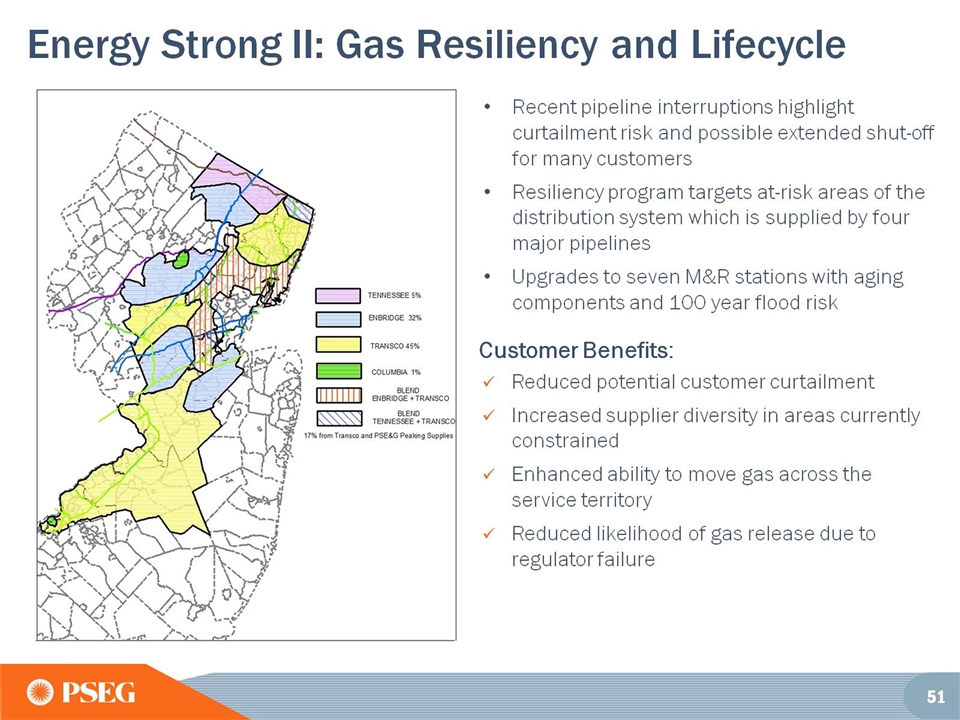

Energy Strong II: Program Overview as Filed

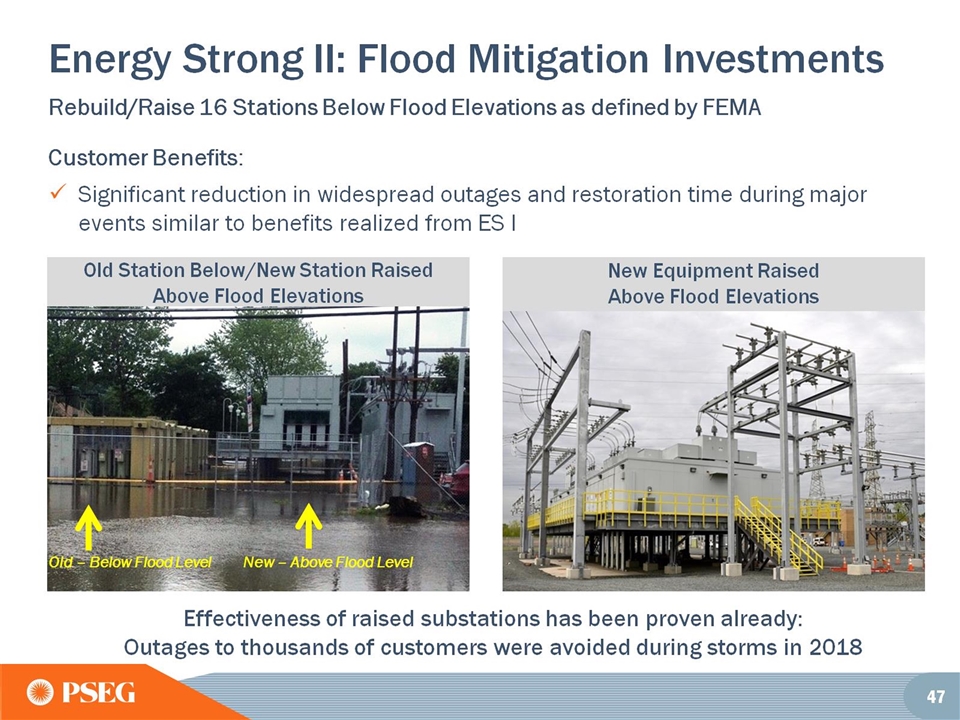

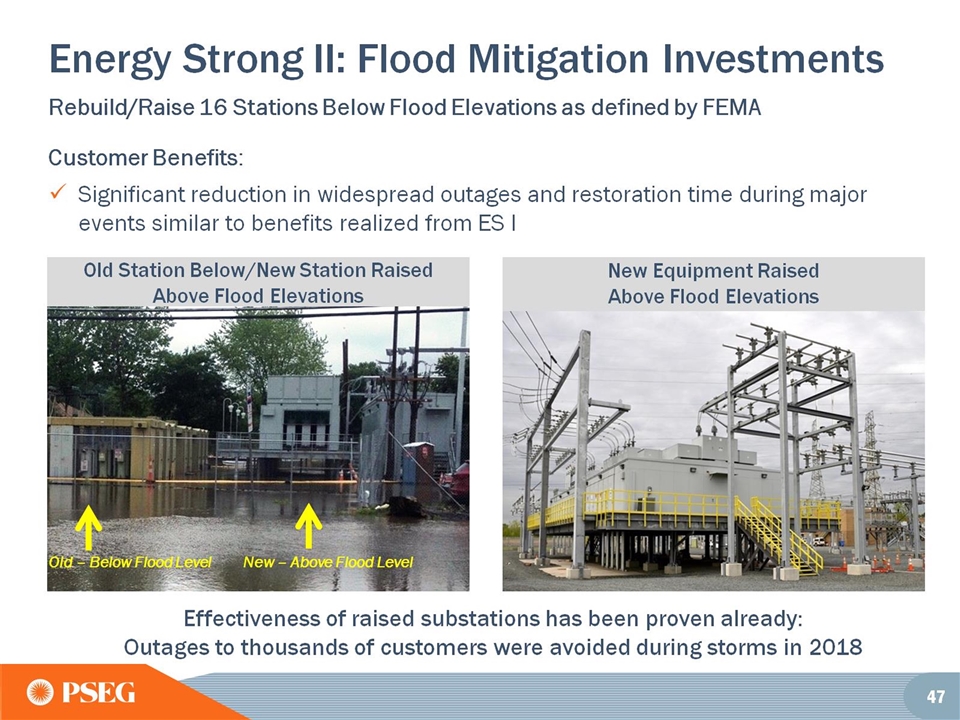

Energy Strong II: Flood Mitigation Investments

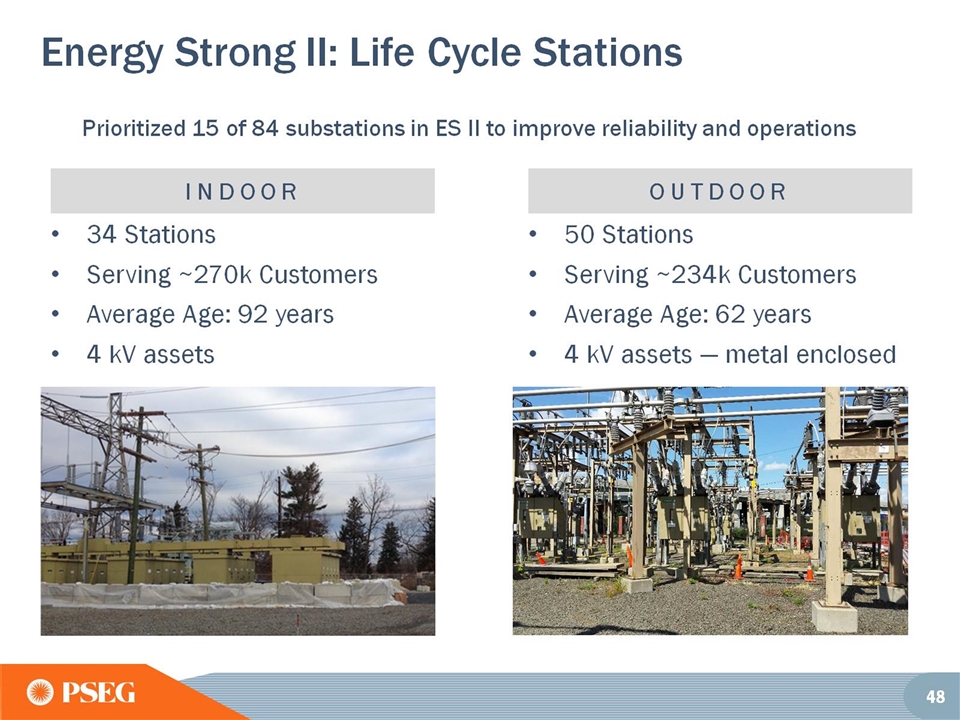

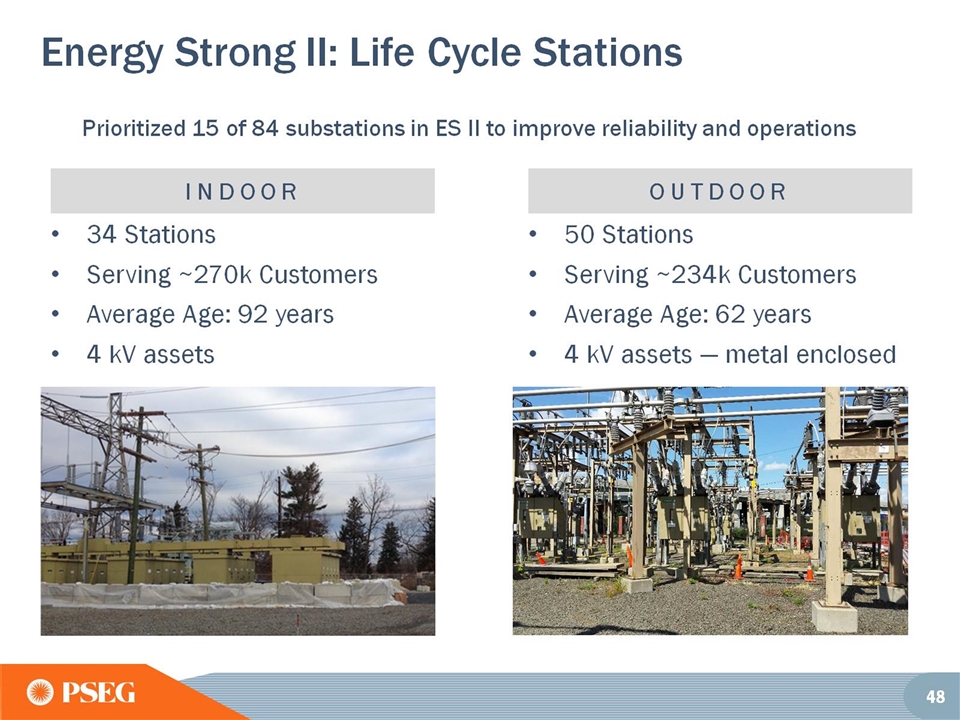

Energy Strong II: Life Cycle Stations

Energy Strong II: Outside Plant Design Standards and Contingency Reconfiguration

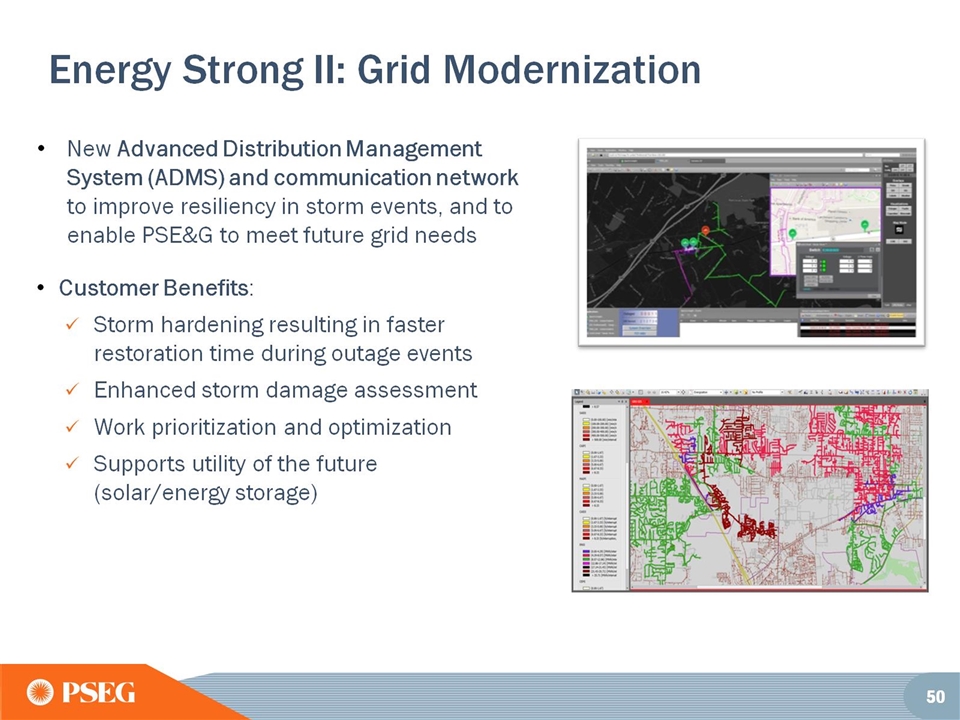

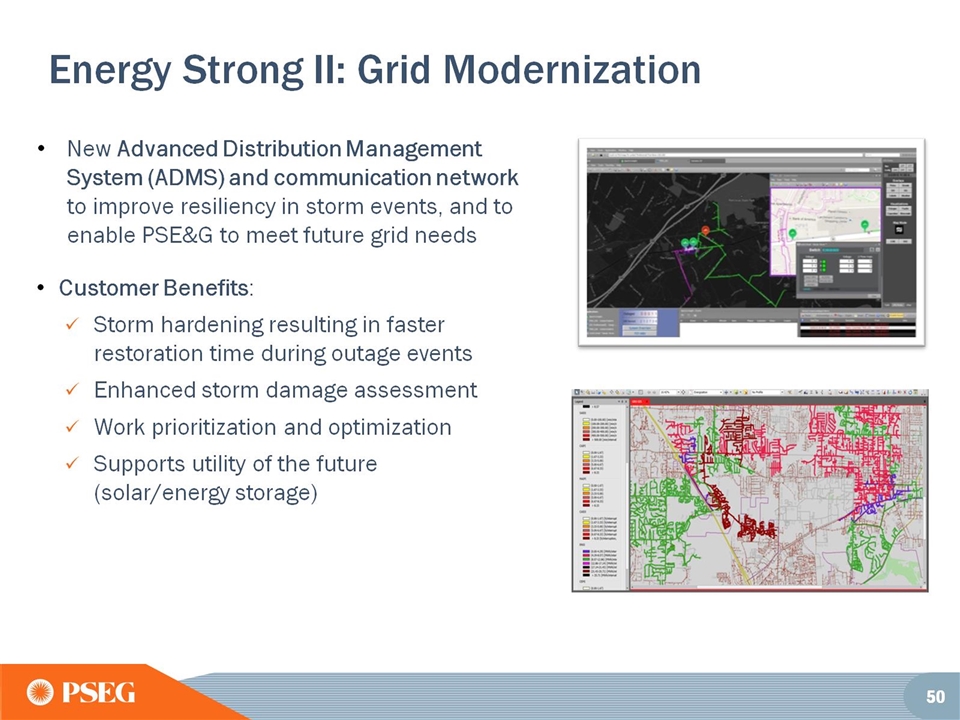

Energy Strong II: Grid Modernization

Partnership for a Clean Energy Future (CEF)

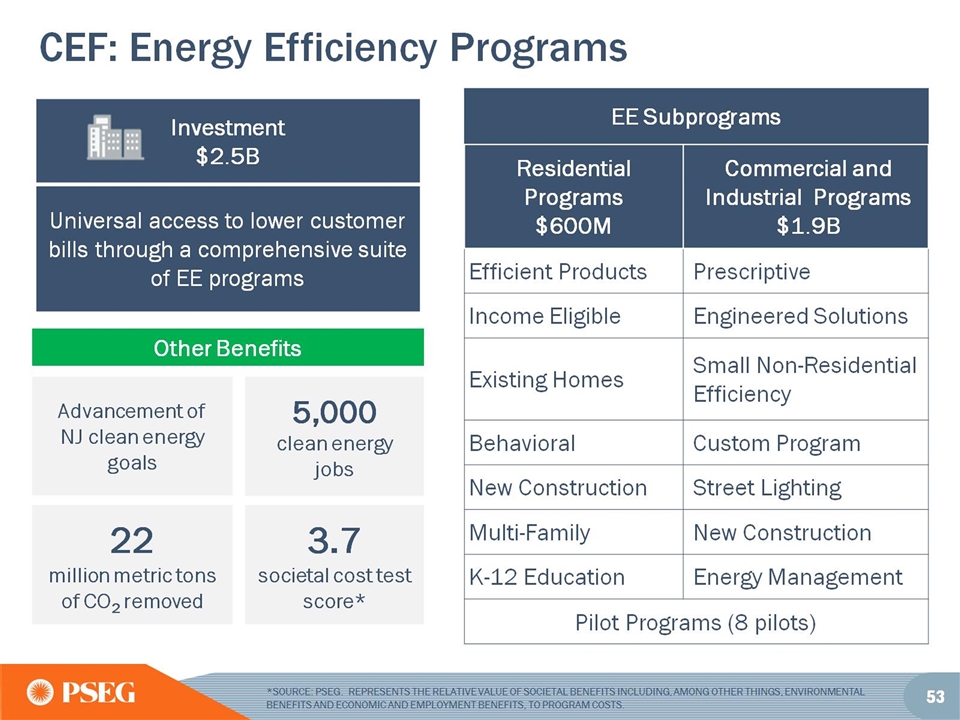

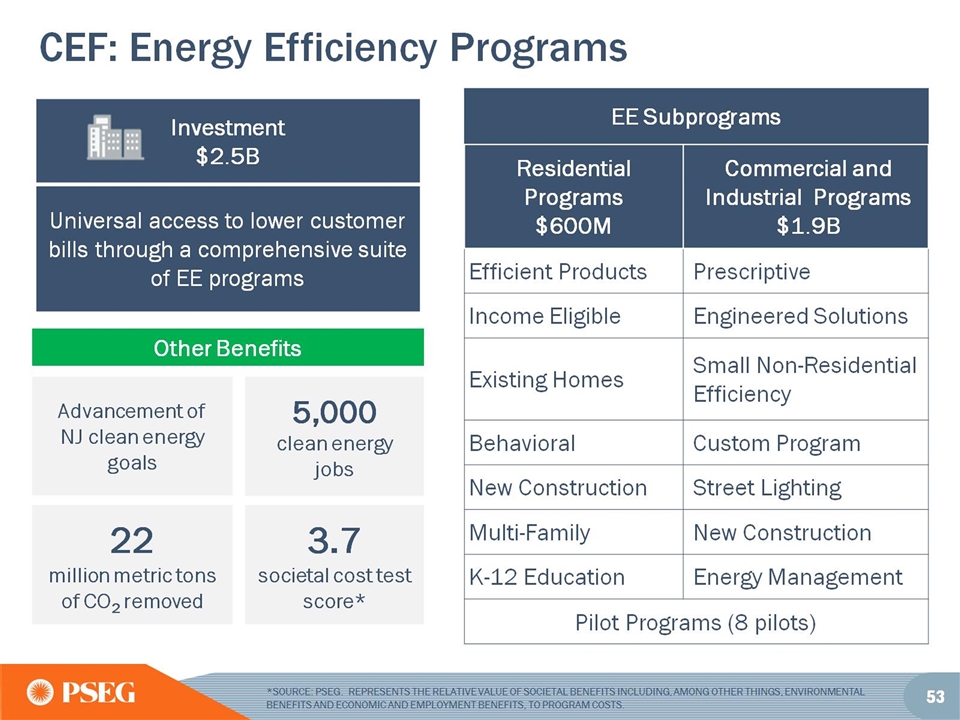

CEF: Energy Efficiency Programs

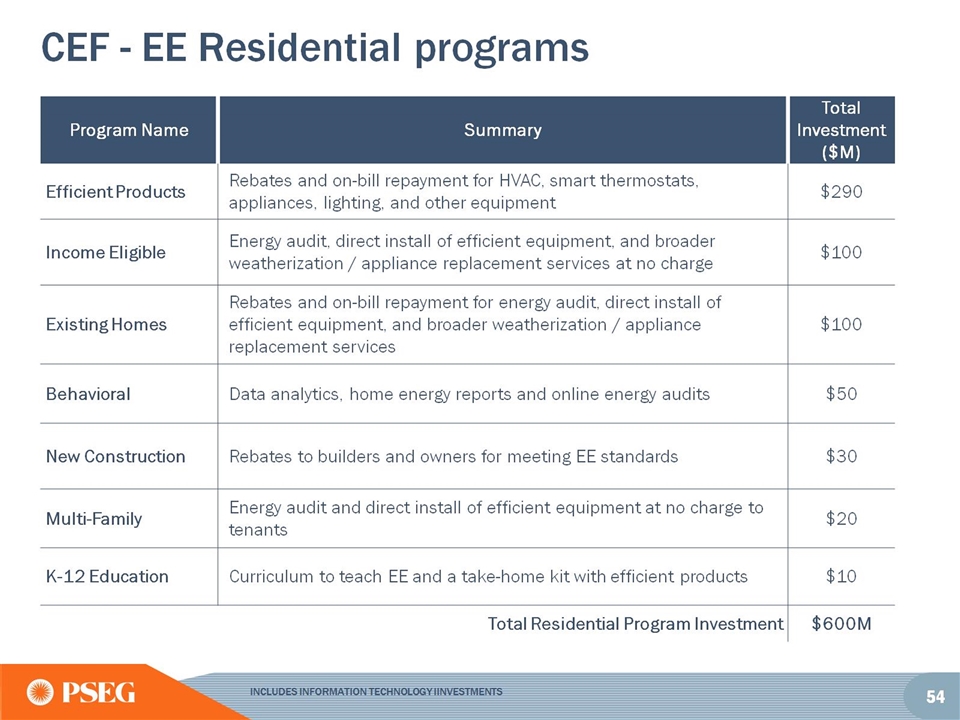

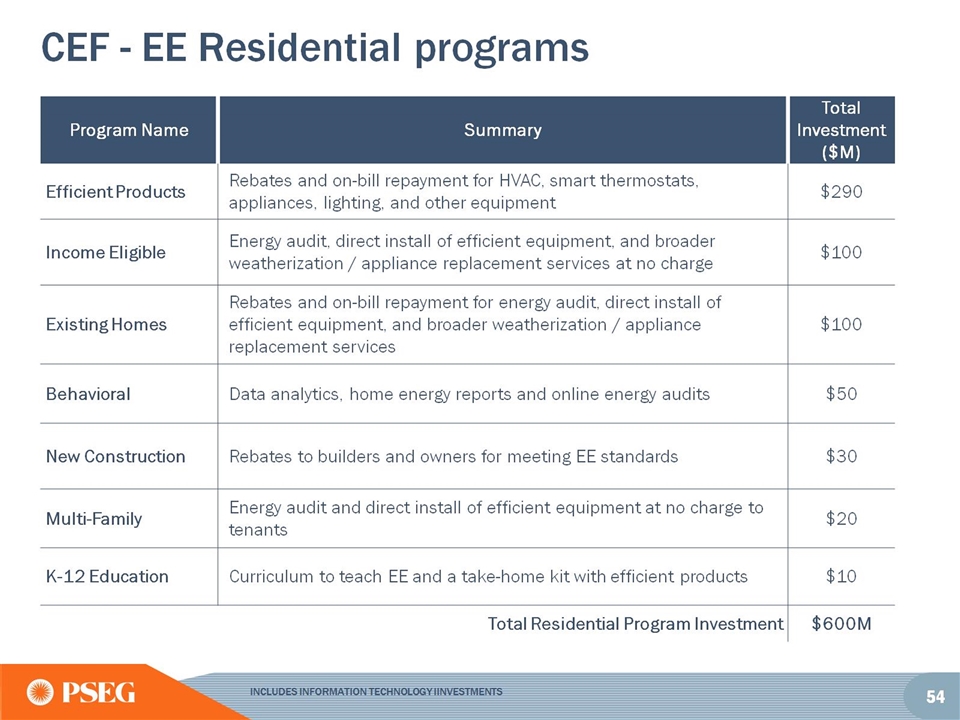

CEF - EE Residential programs

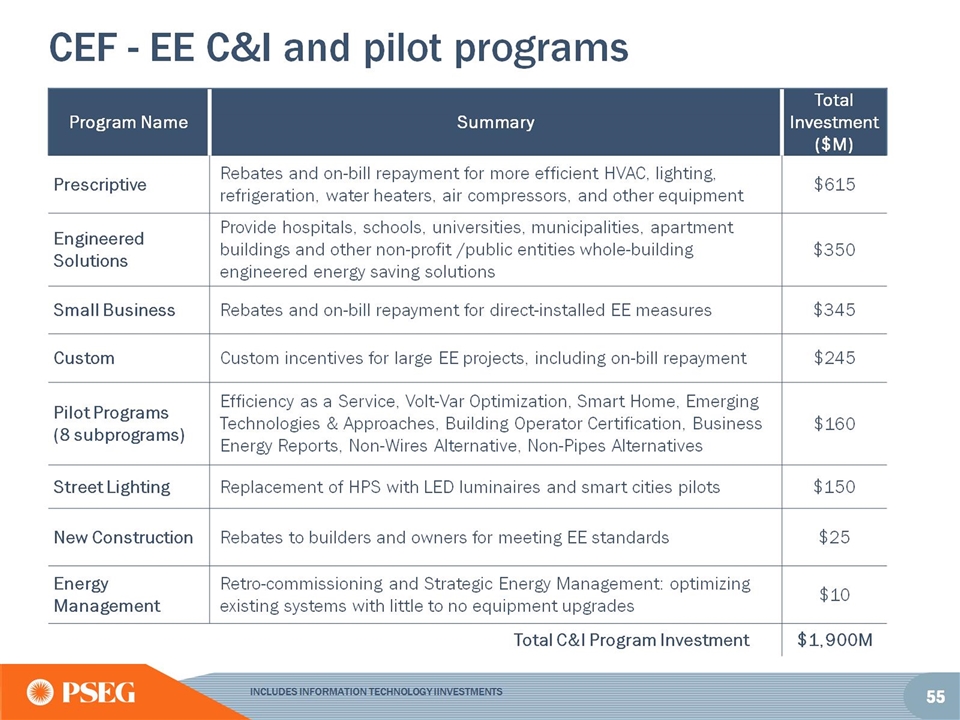

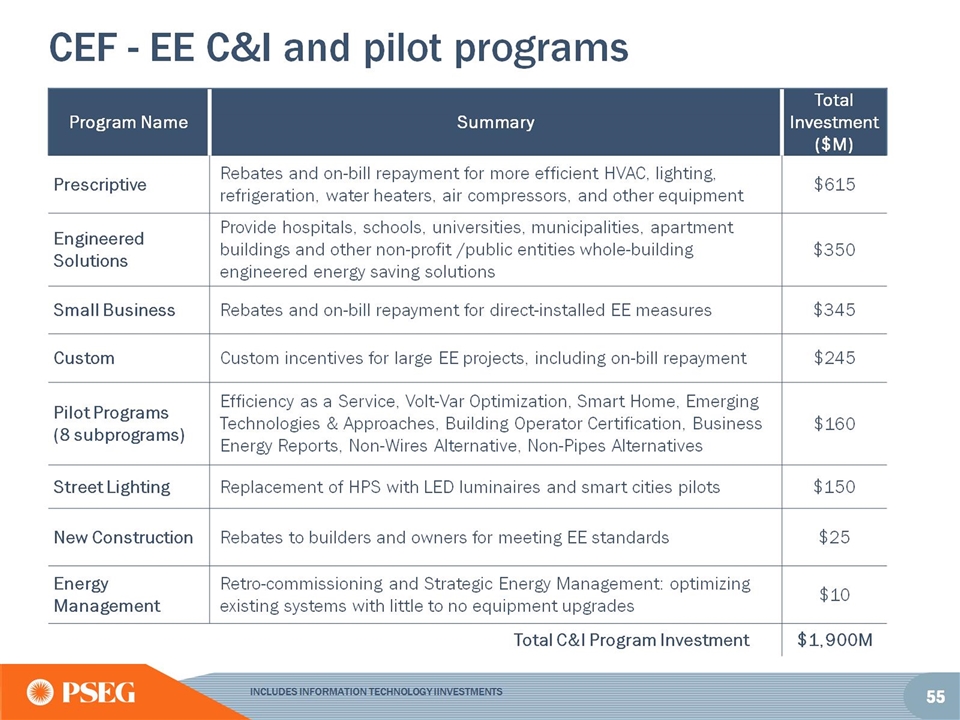

CEF - EE C&I and pilot programs

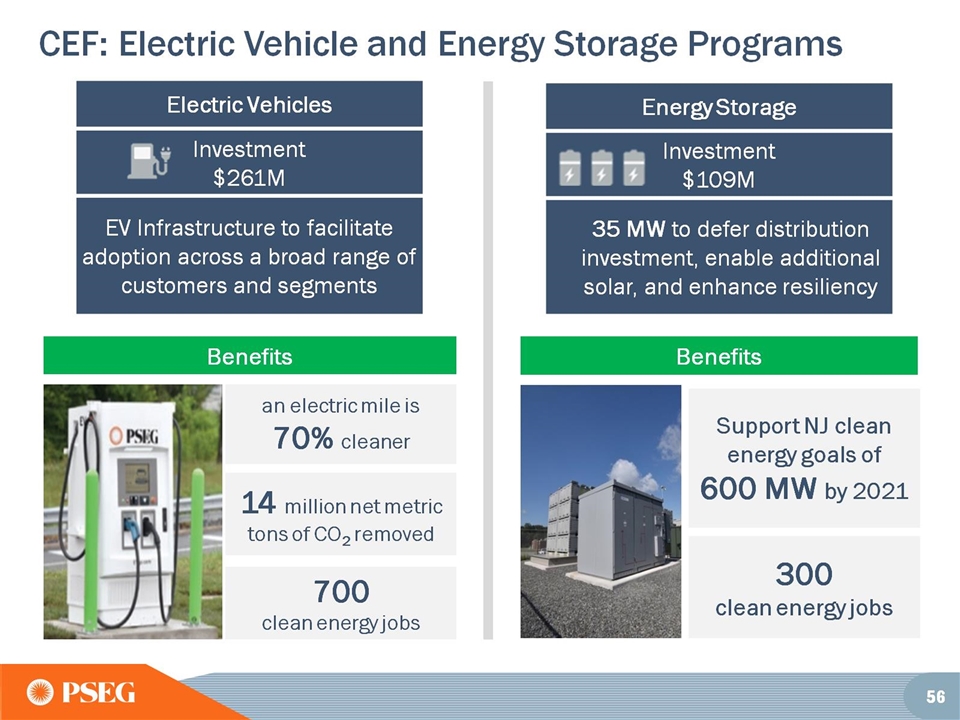

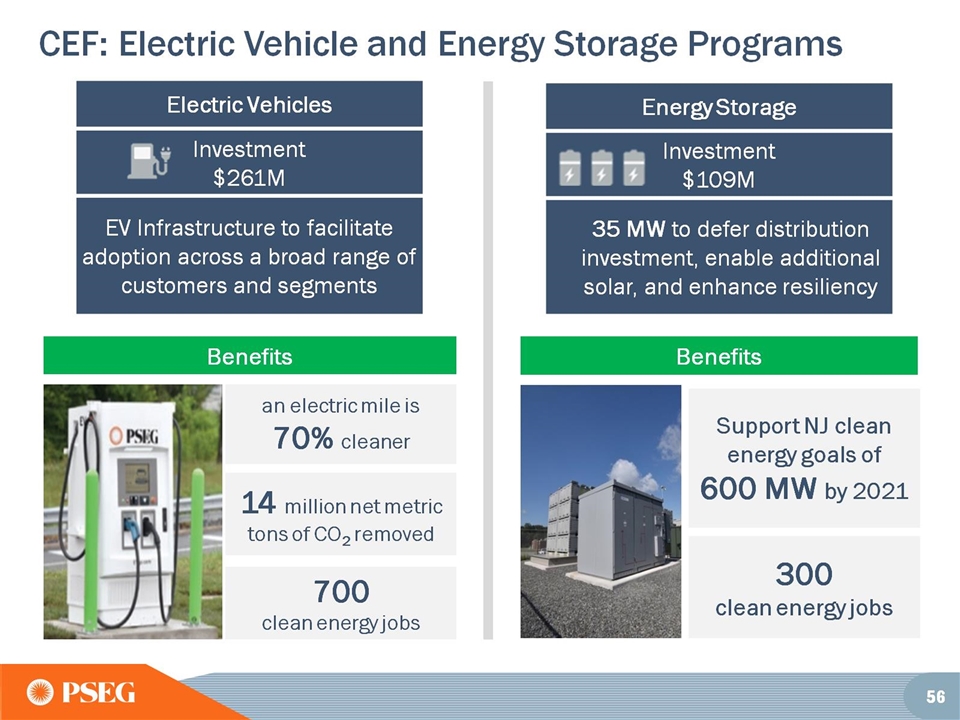

CEF: Electric Vehicle and Energy Storage Programs

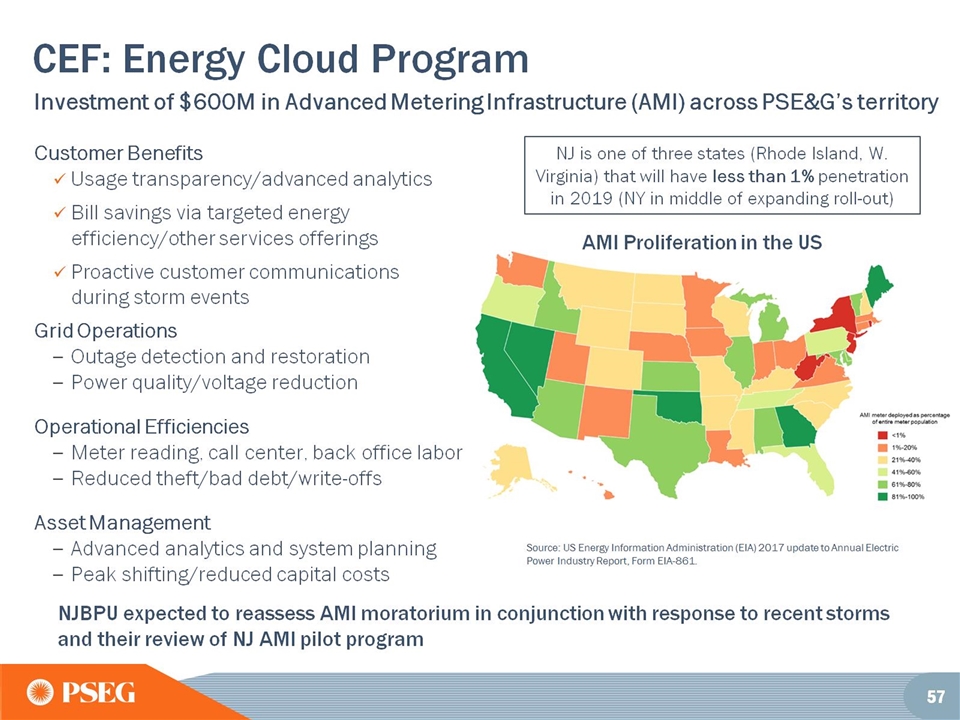

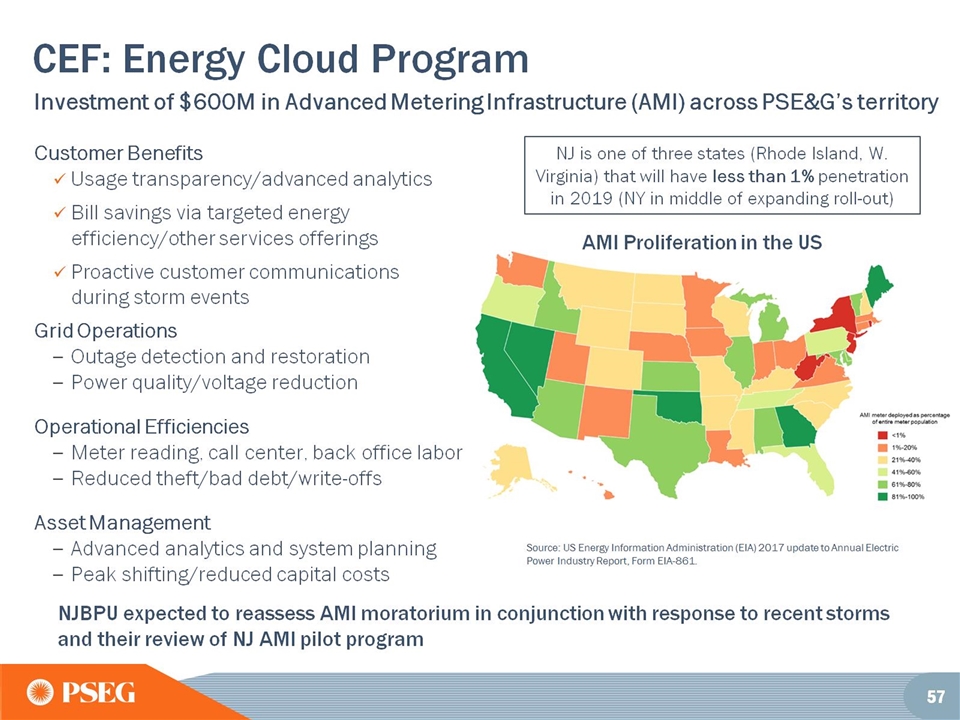

CEF: Energy Cloud Program

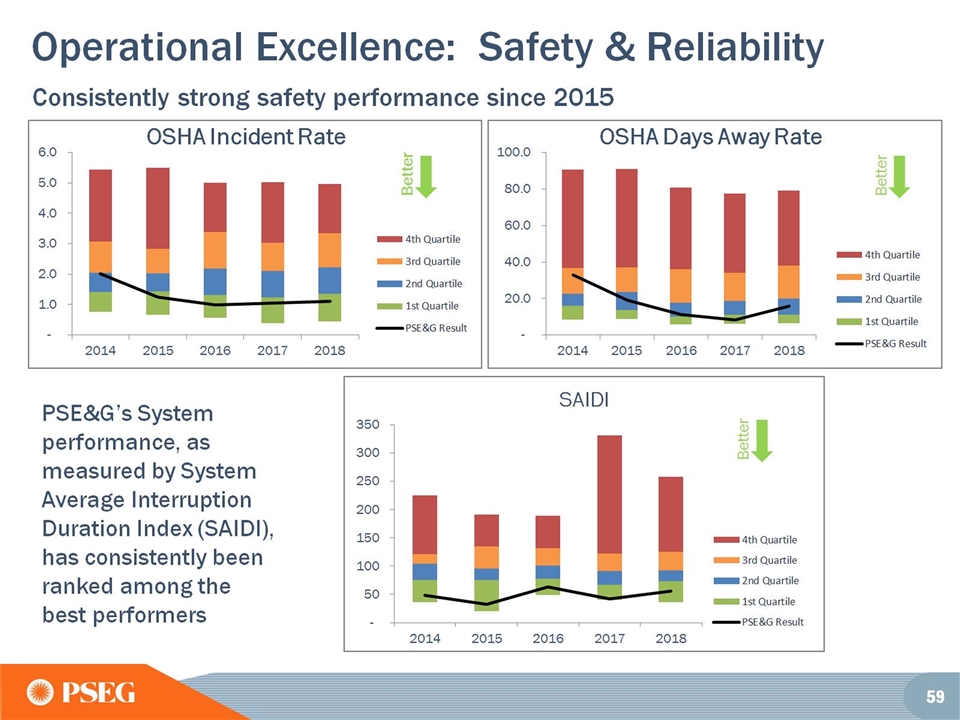

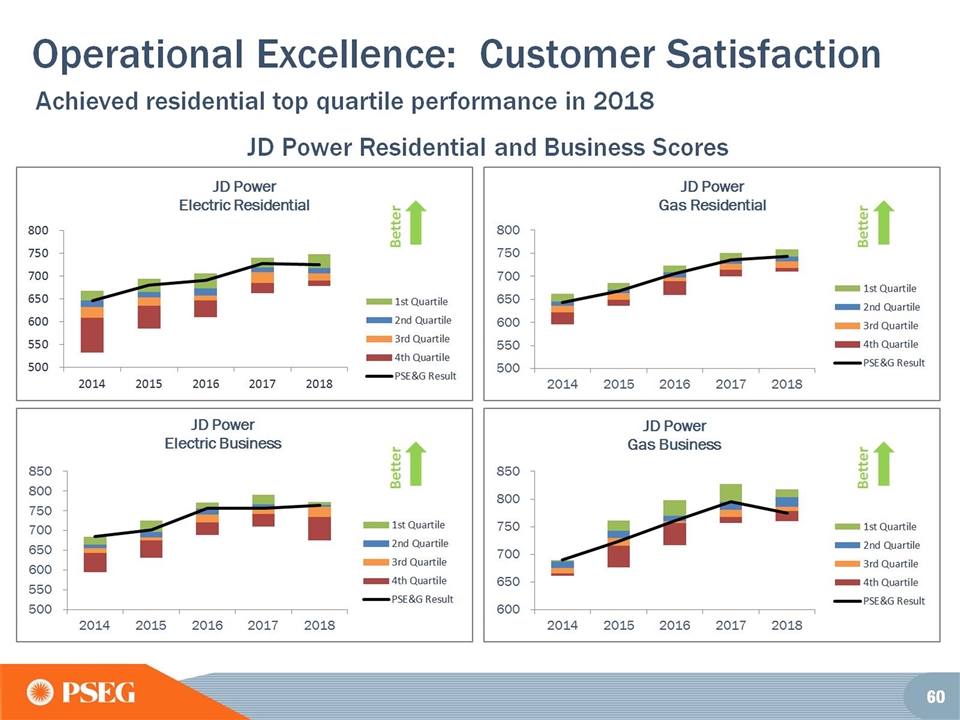

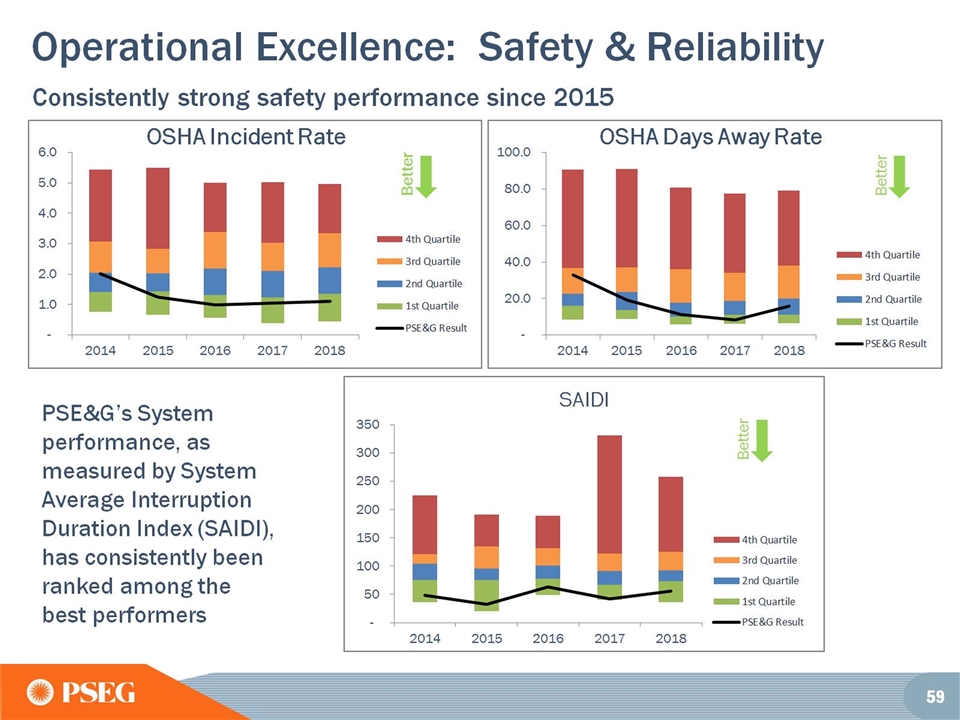

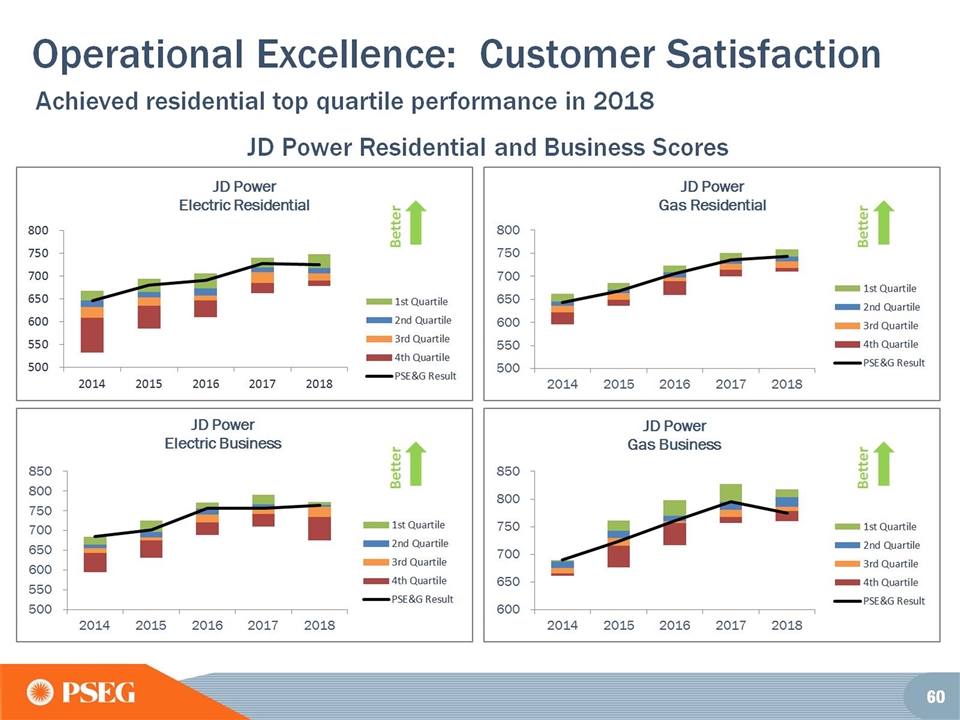

Operational Excellence: Safety & Reliability

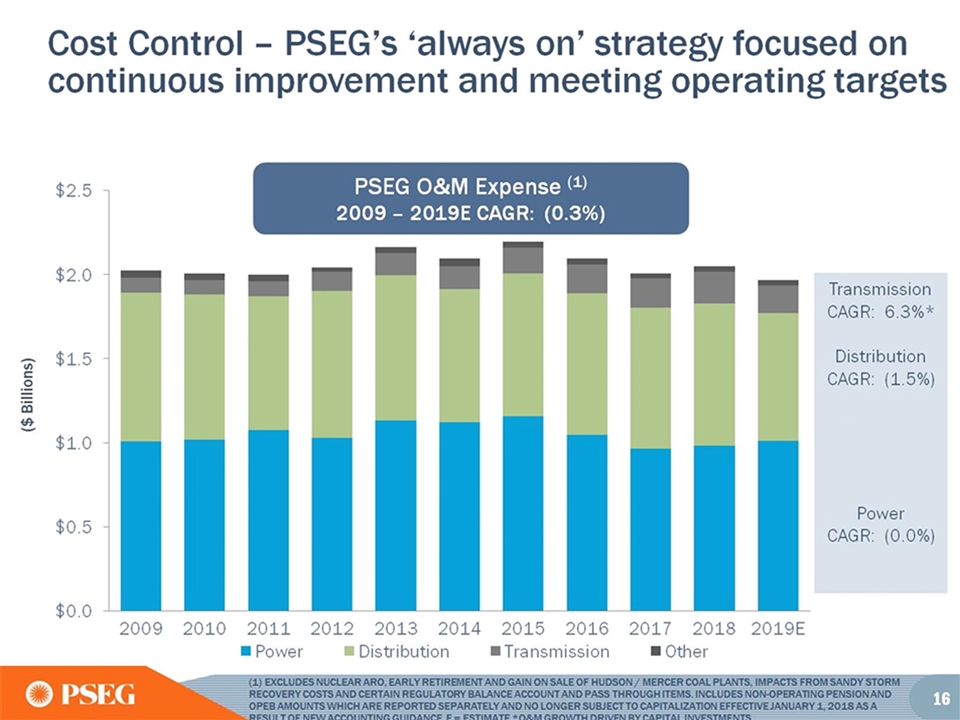

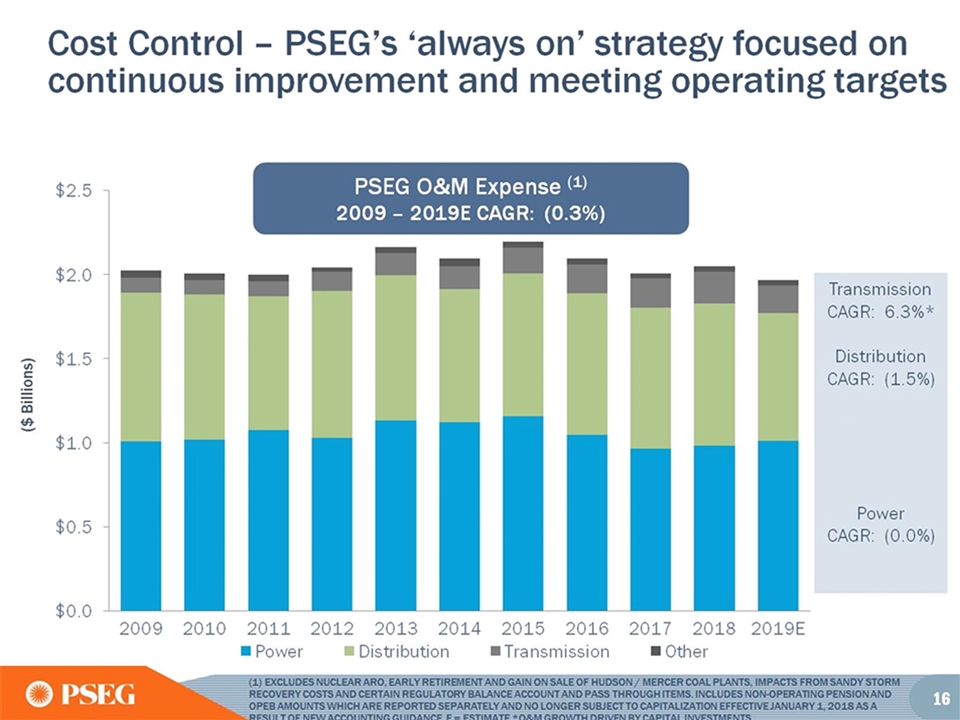

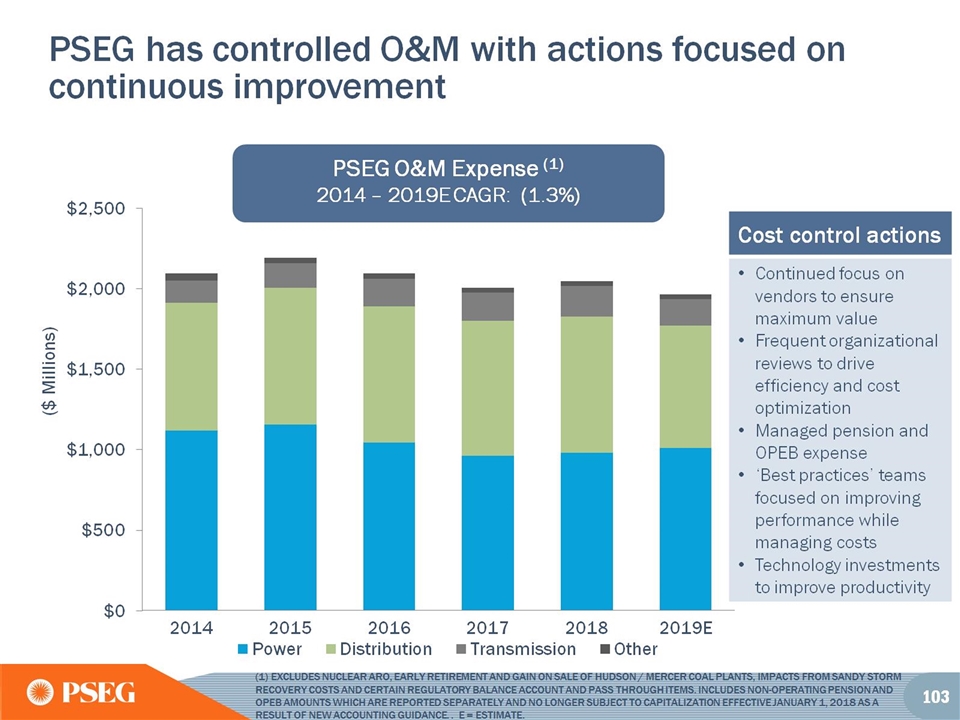

Operational Excellence: Successfully managing O&M costs

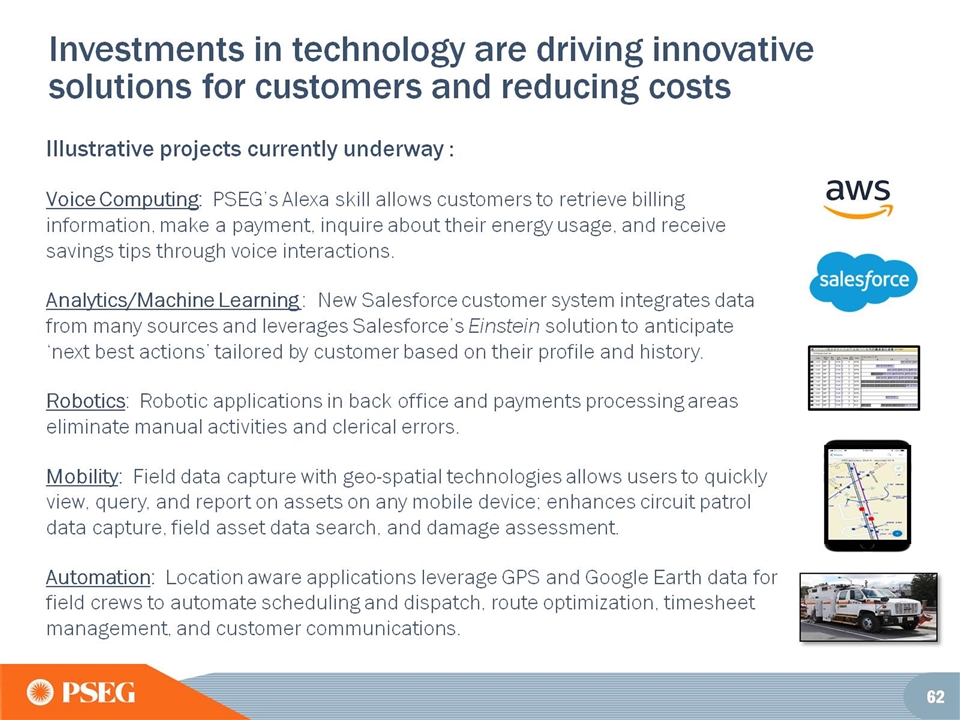

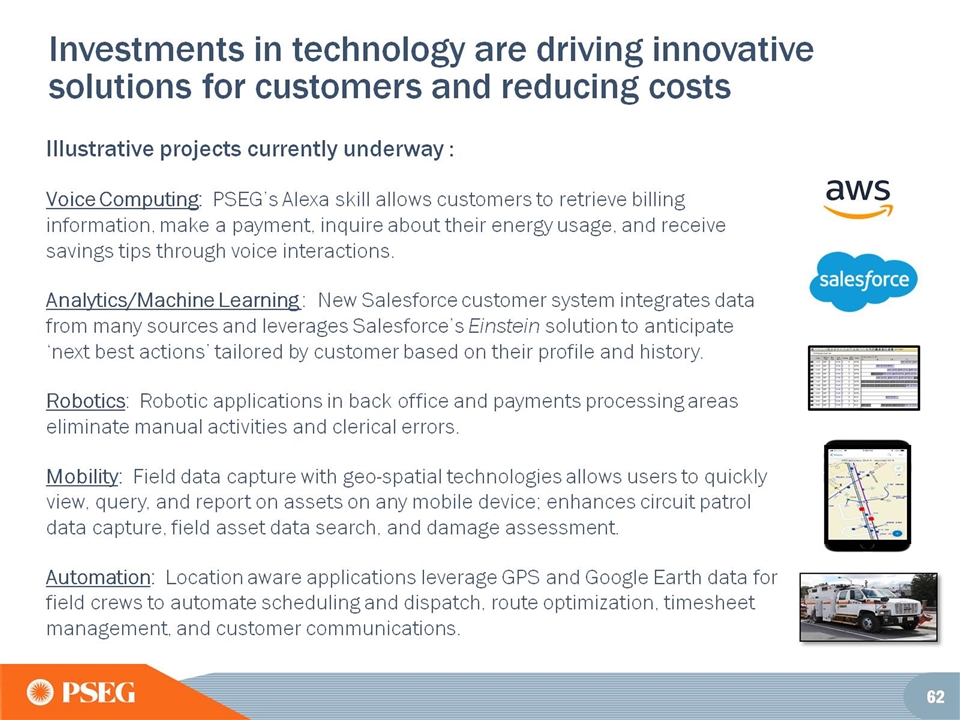

Investments in technology are driving innovative solutions for customers and reducing costs

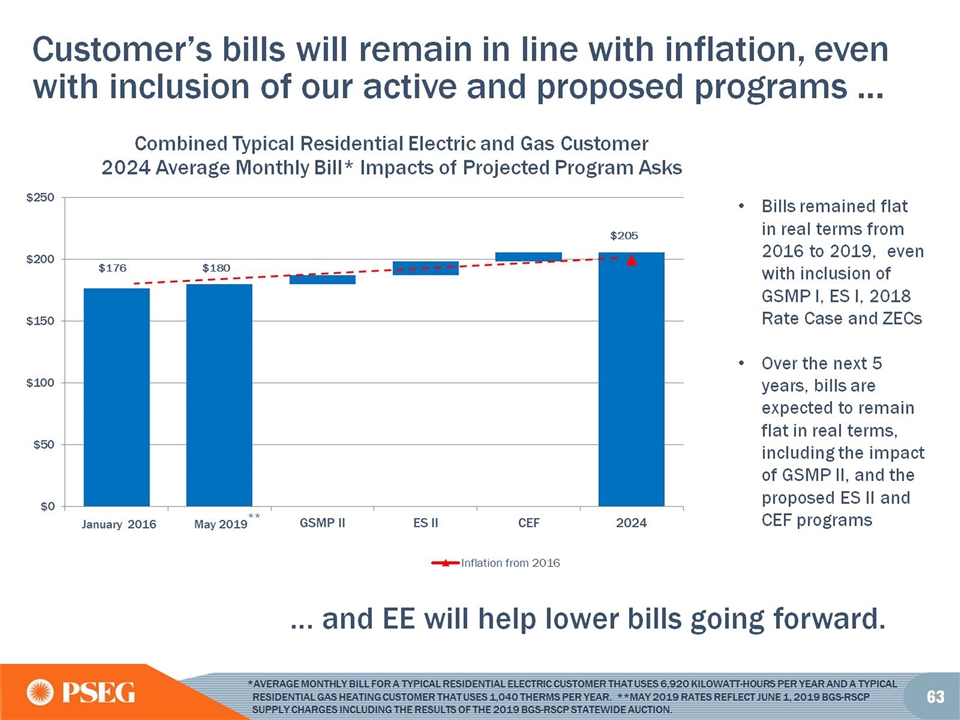

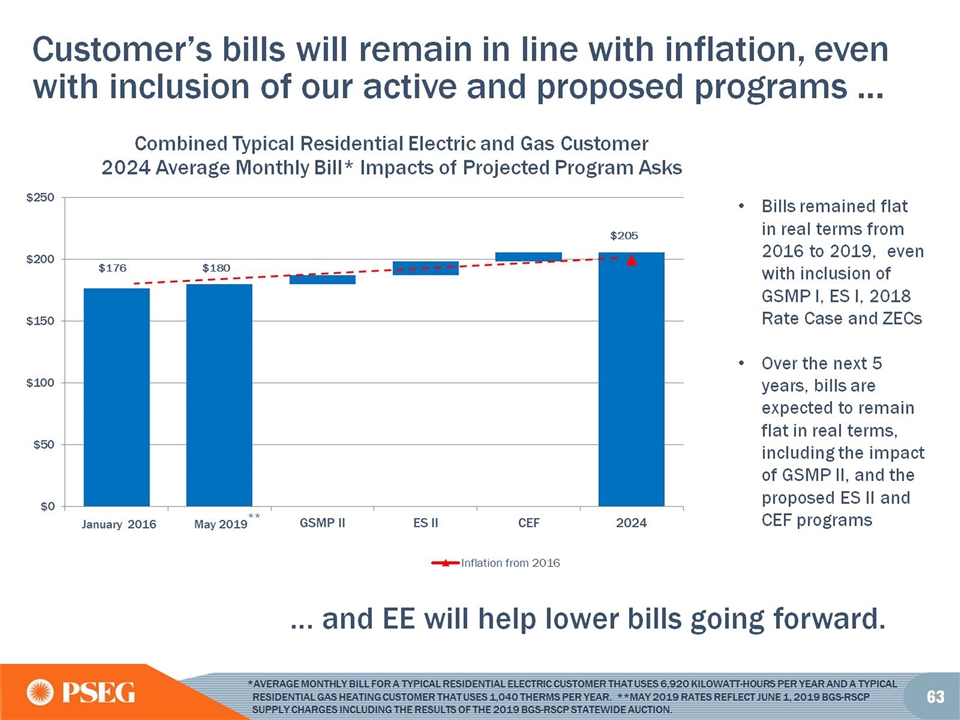

Customer’s bills will remain in line with inflation, even with inclusion of our active and proposed programs …

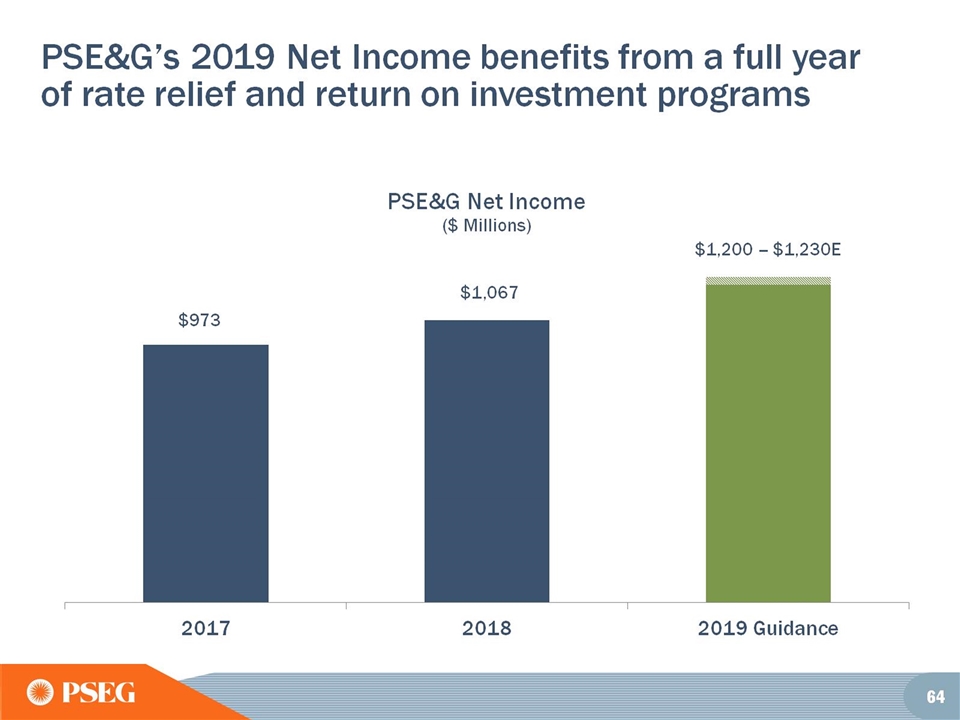

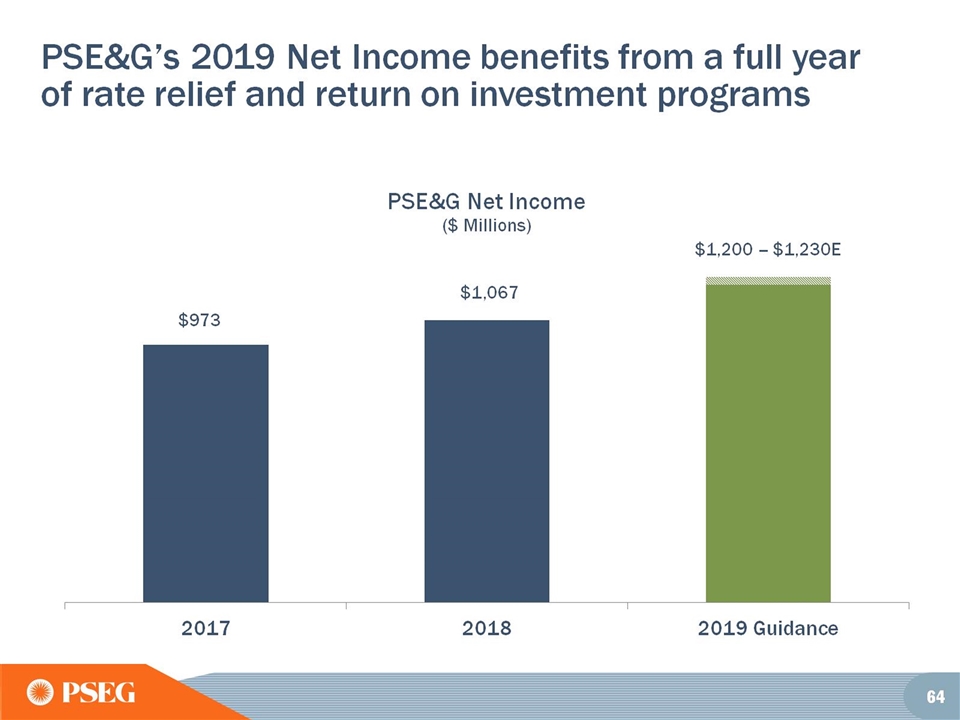

PSE&G’s 2019 Net Income benefits from a full year of rate relief and return on investment programs

PSEG LONG ISLAND

PSEG Long Island: Focused on improving customer service and reliability while managing costs

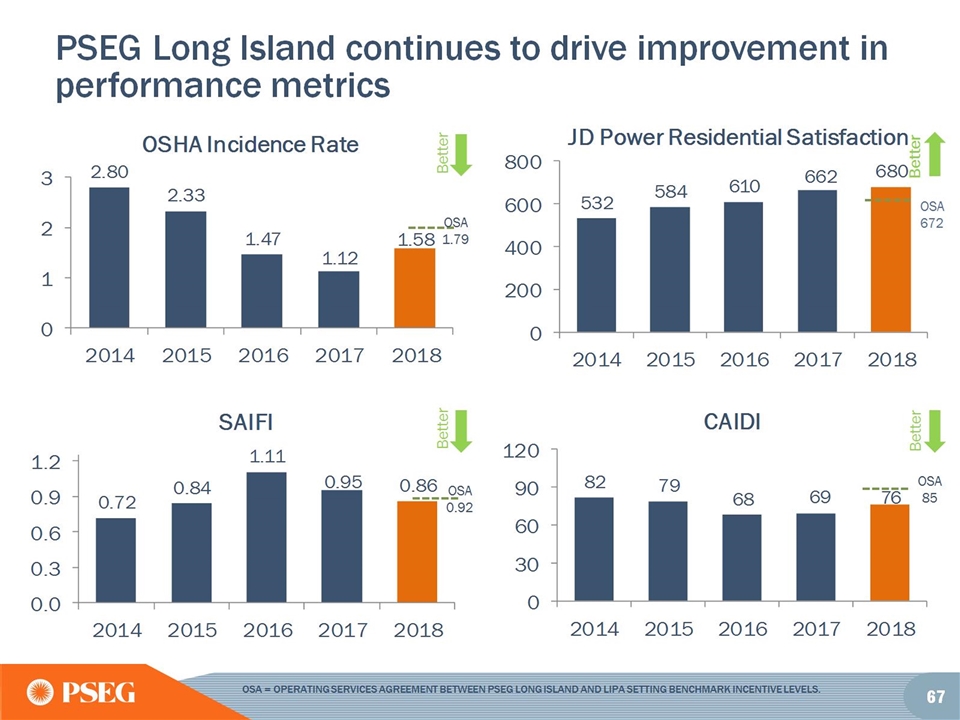

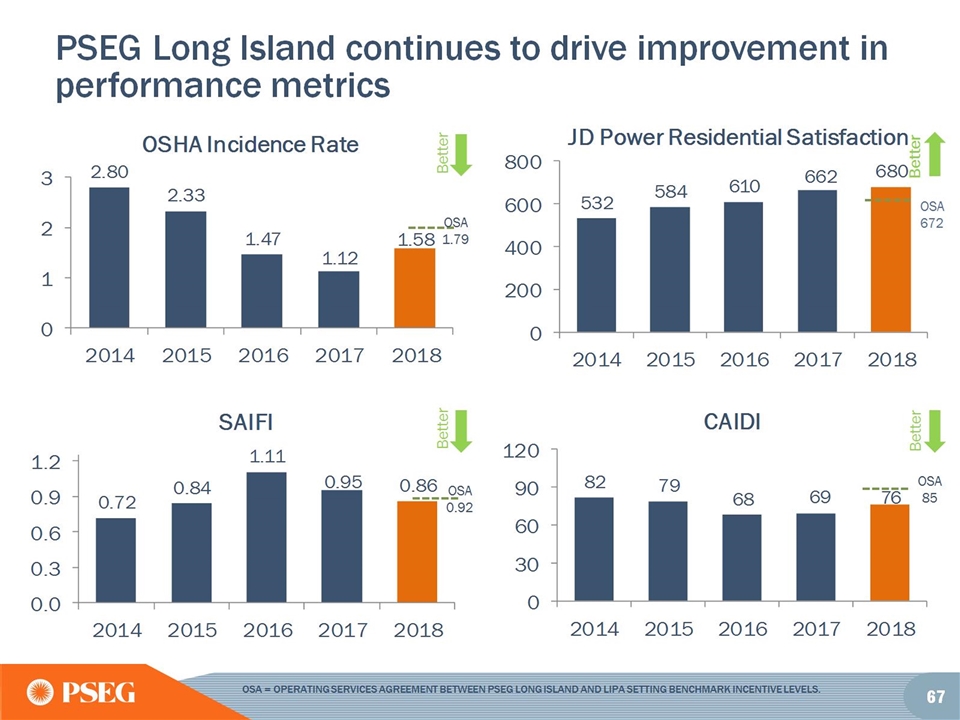

PSEG Long Island continues to drive improvement in performance metrics

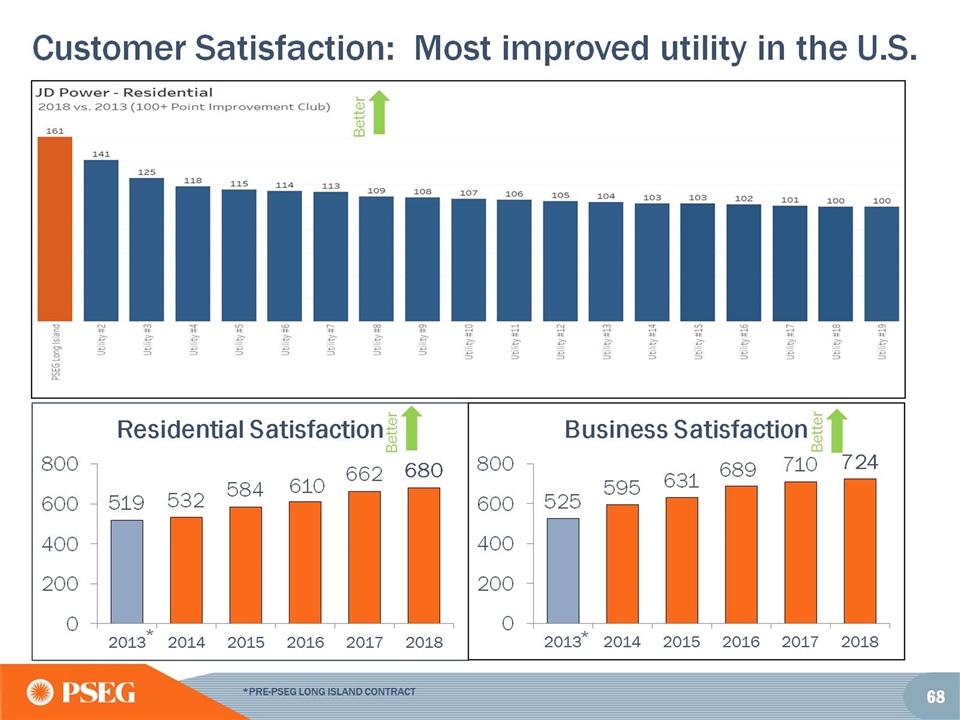

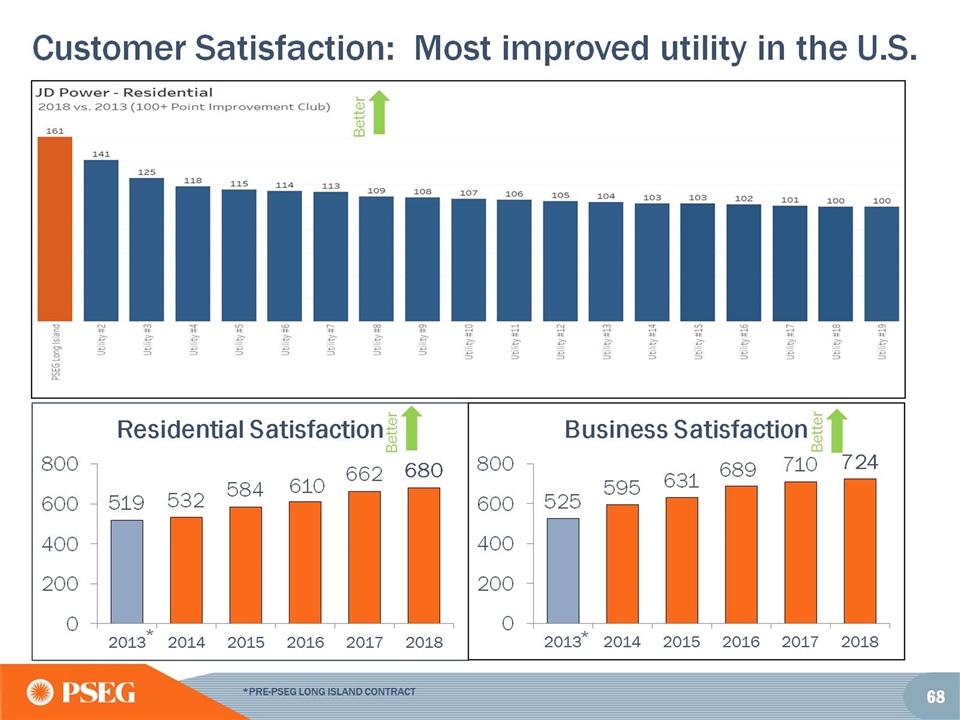

Customer Satisfaction: Most improved utility in the U.S.

PSEG Long Island experience brings multiple opportunities

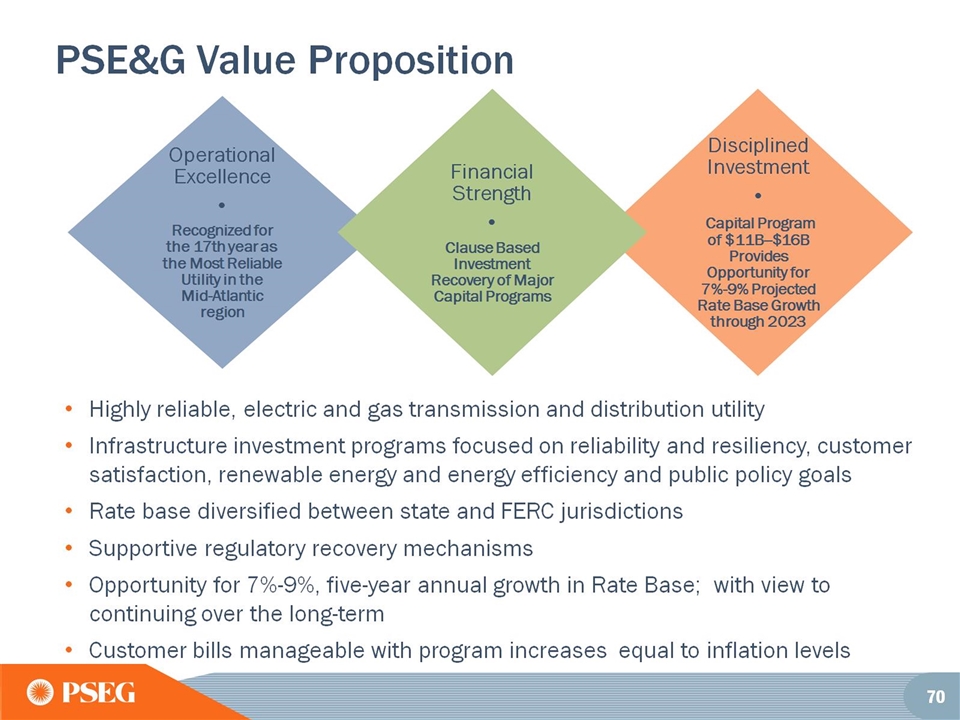

PSE&G Value Proposition

PSEG POWER

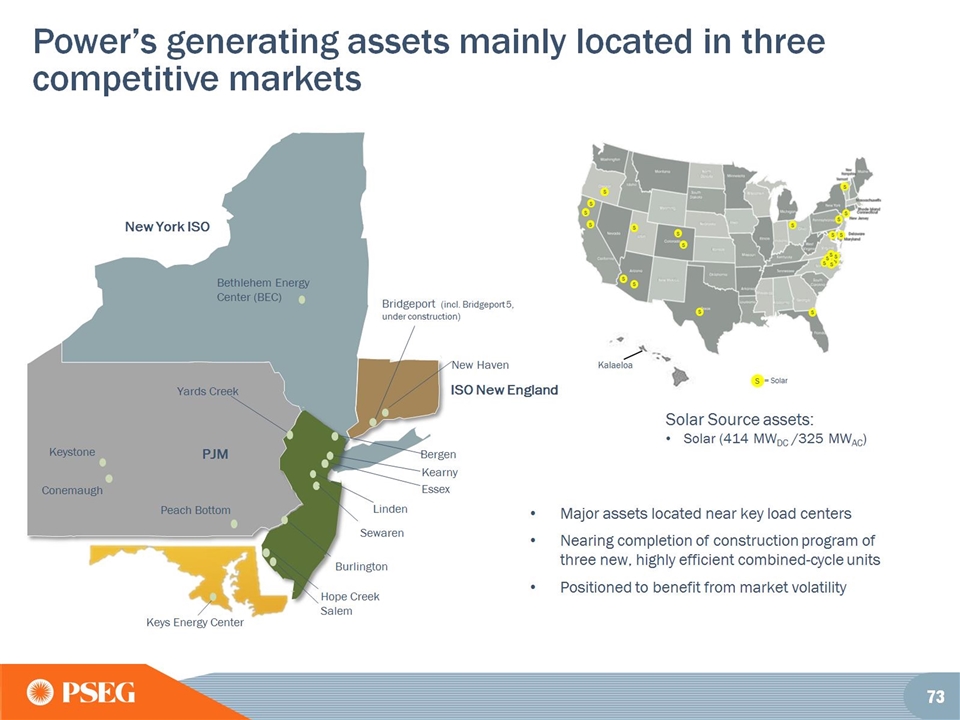

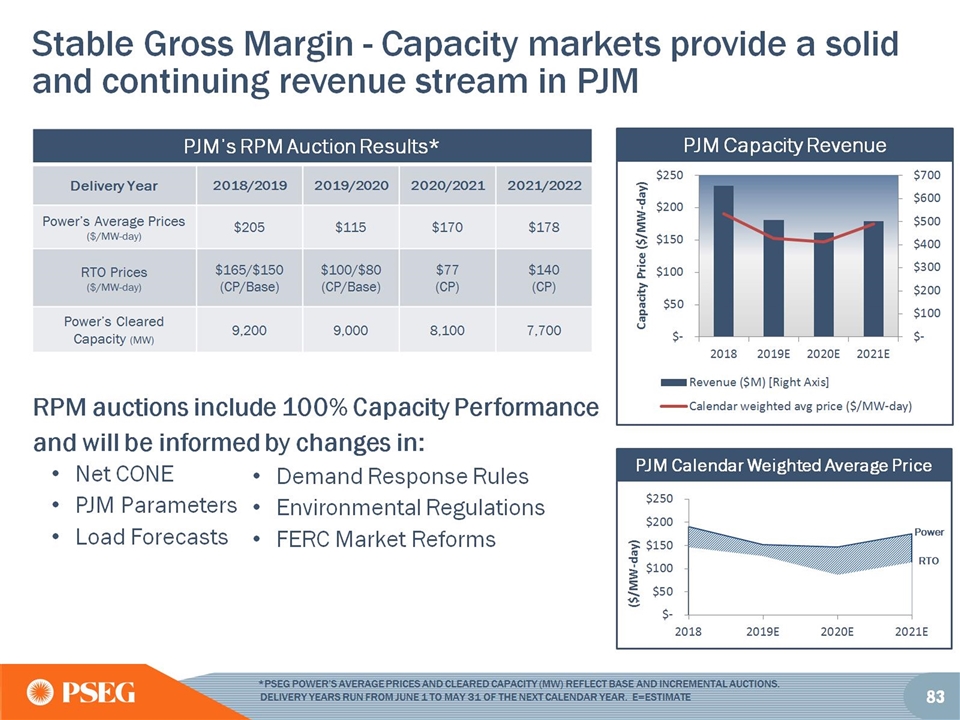

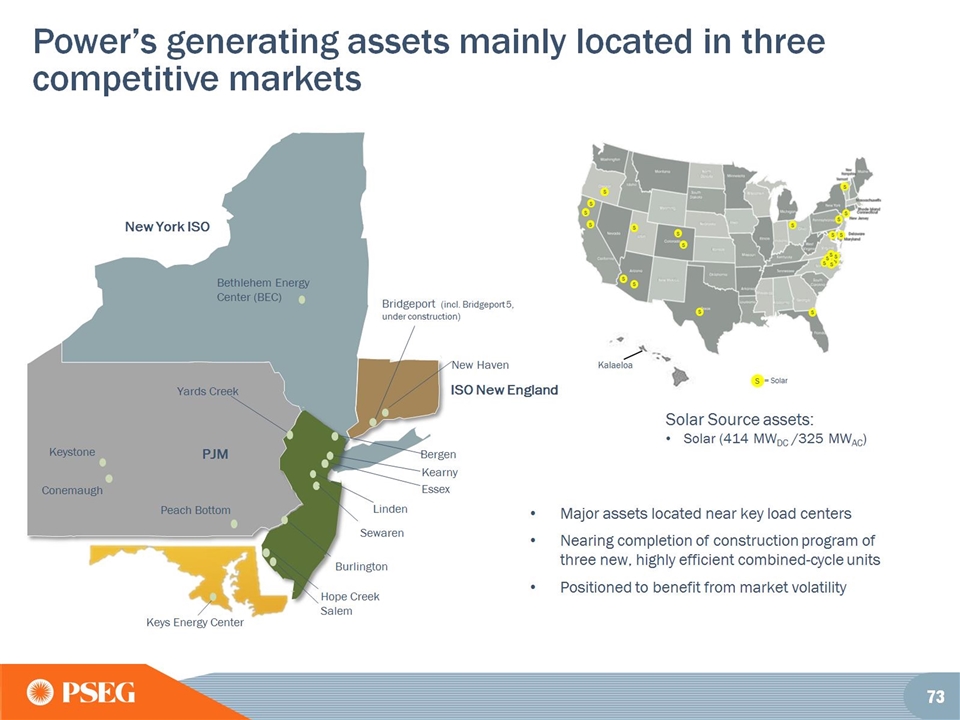

Power’s generating assets mainly located in three competitive markets

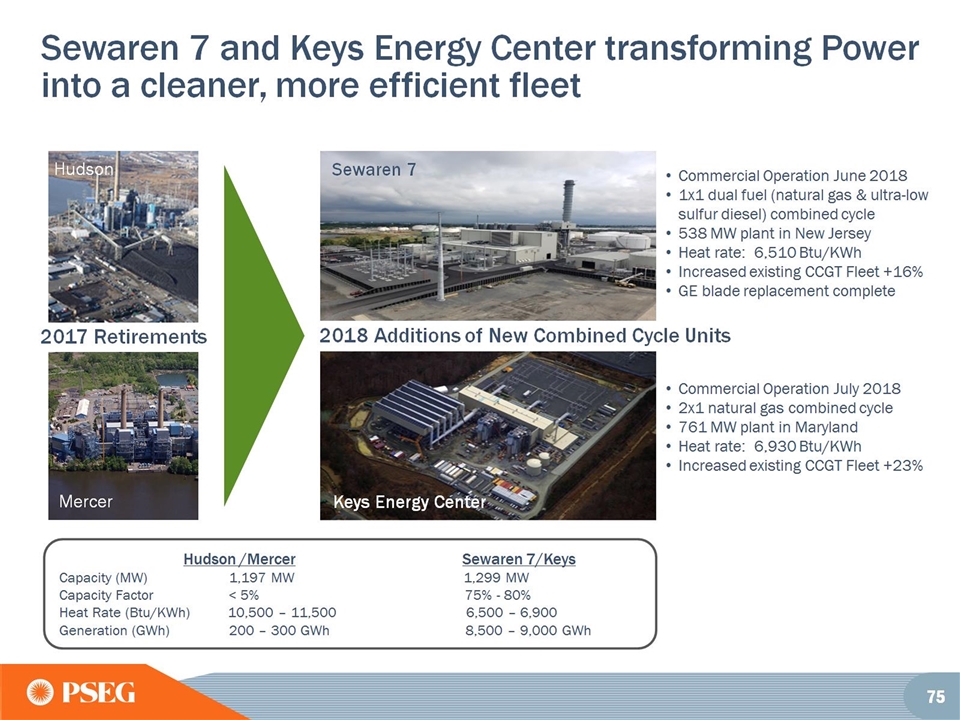

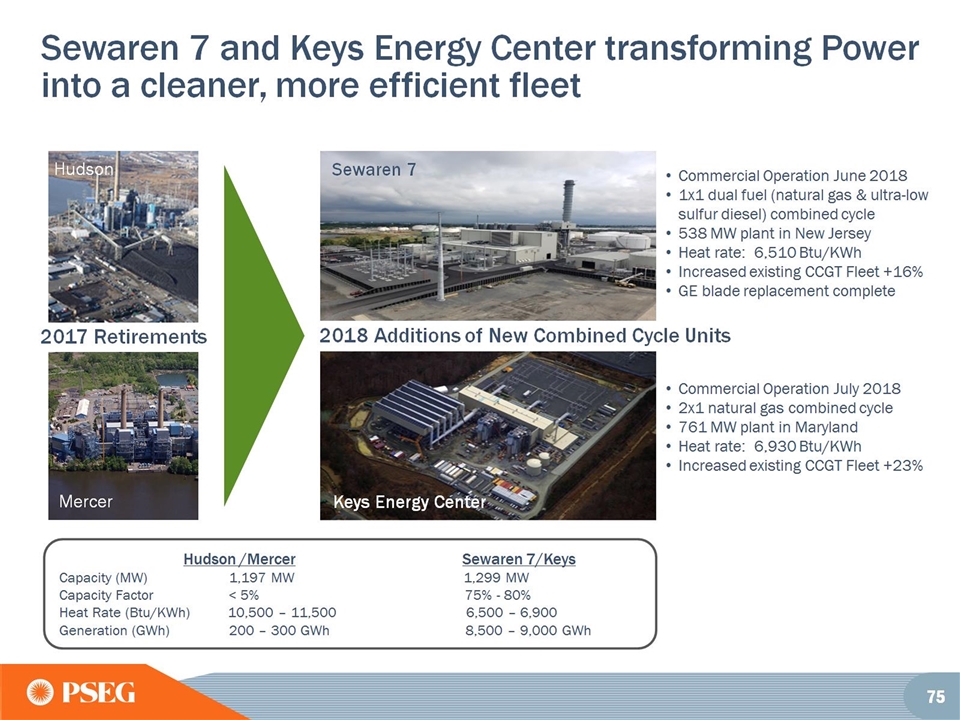

Sewaren 7 and Keys Energy Center transforming Power into a cleaner, more efficient fleet

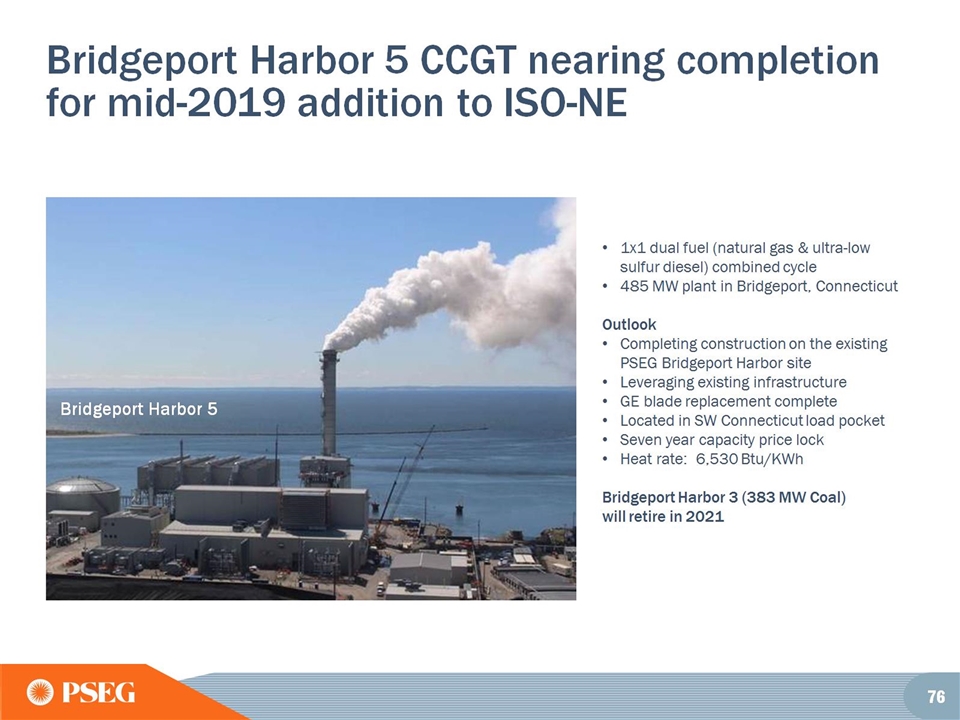

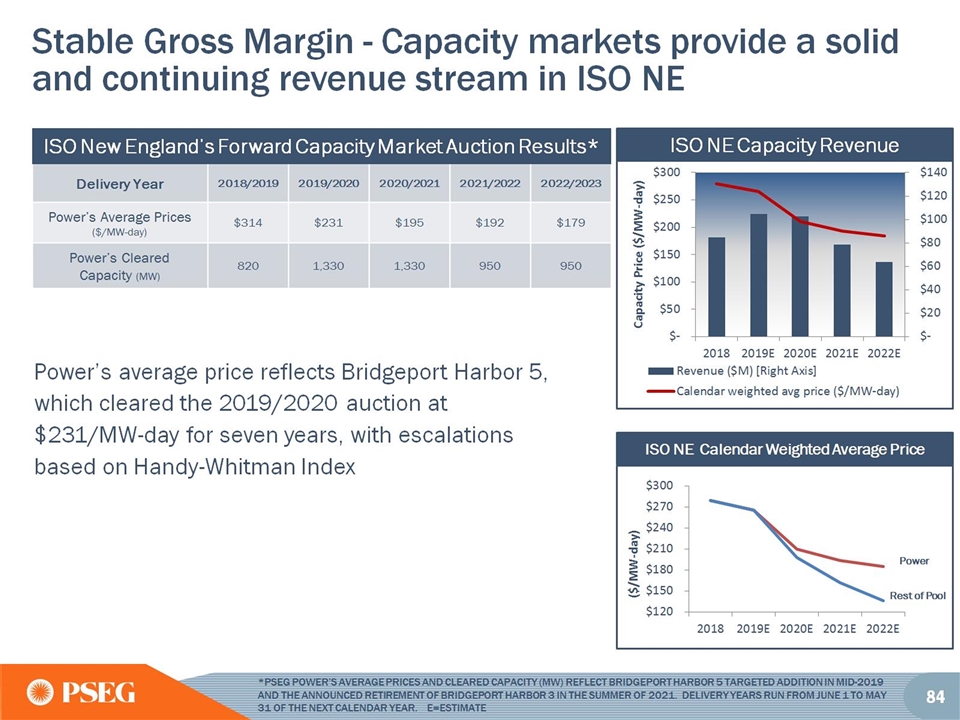

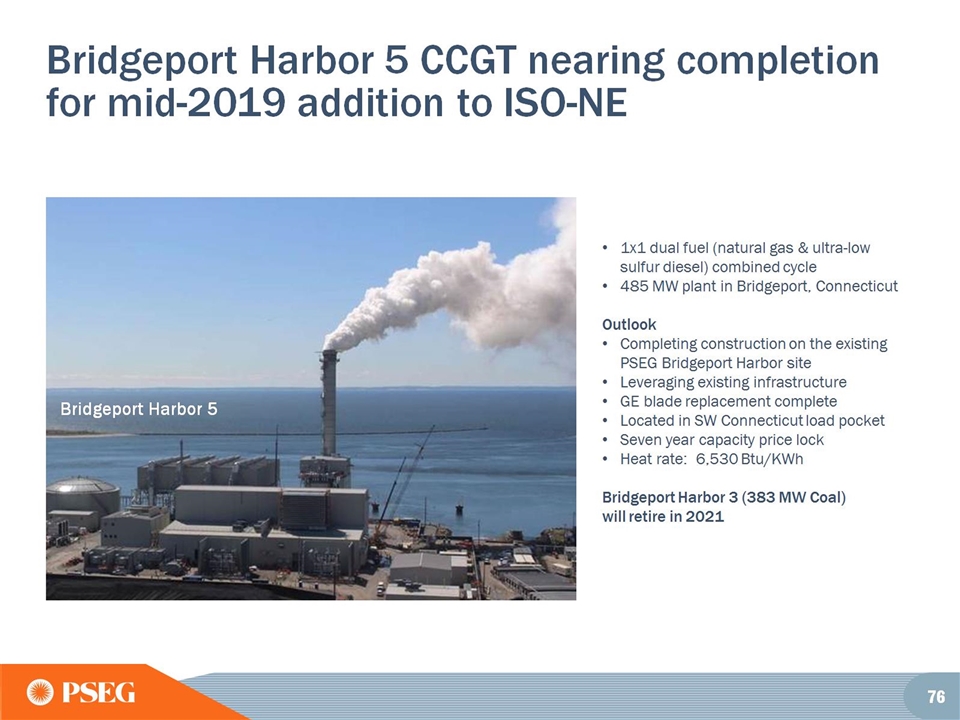

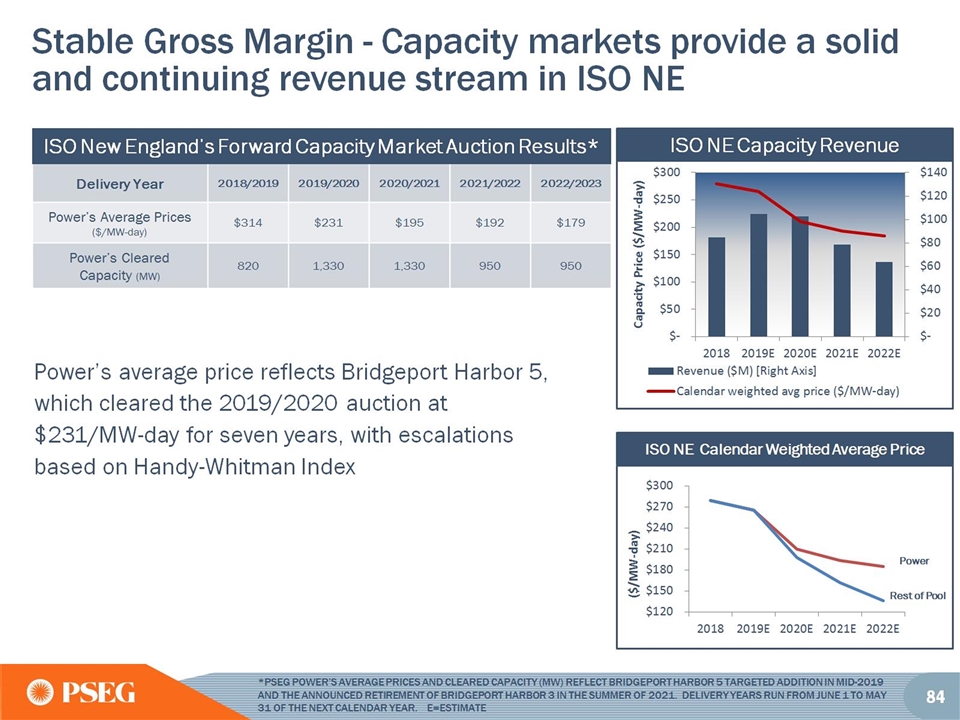

Bridgeport Harbor 5 CCGT nearing completion for mid-2019 addition to ISO-NE

Power’s three NJ nuclear plants recently awarded Zero Emission Certificates to help support NJ’s primary supply of zero-carbon electricity

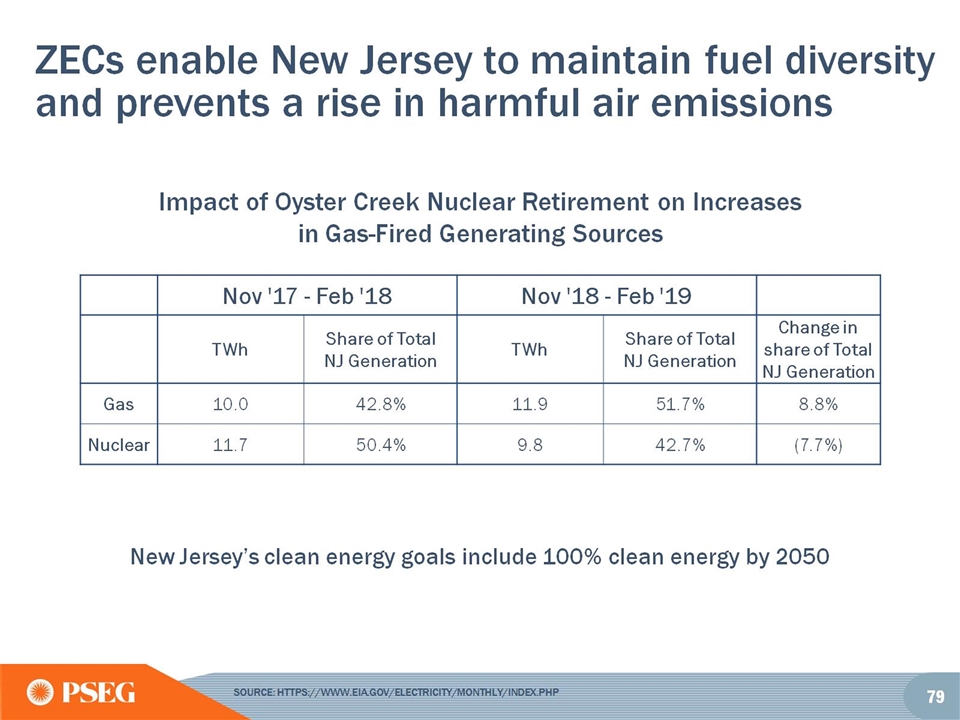

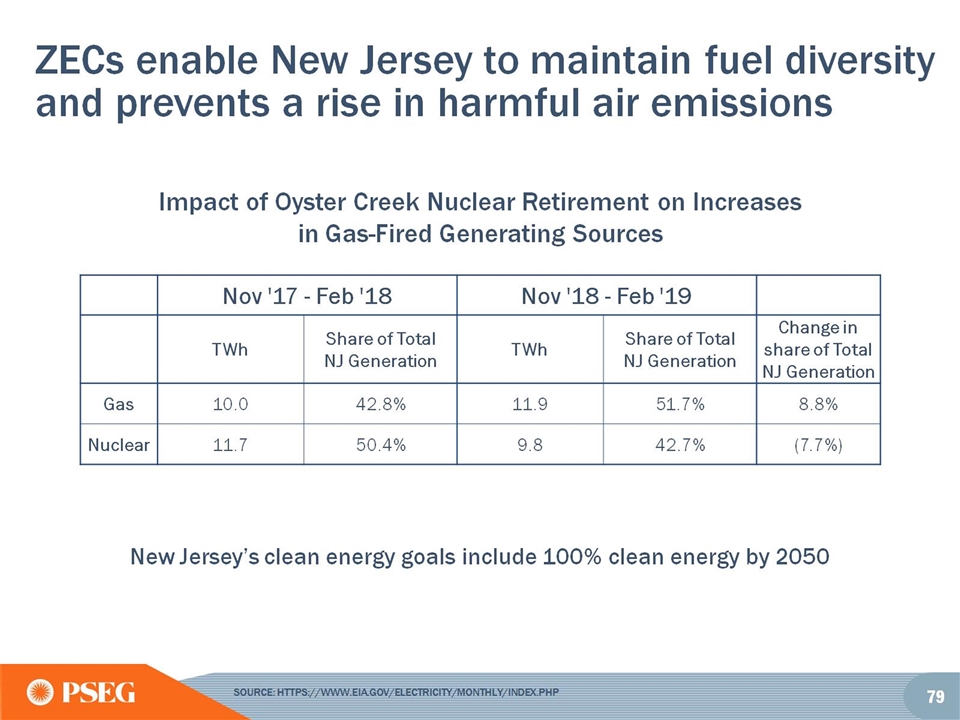

ZECs enable New Jersey to maintain fuel diversity and prevents a rise in harmful air emissions

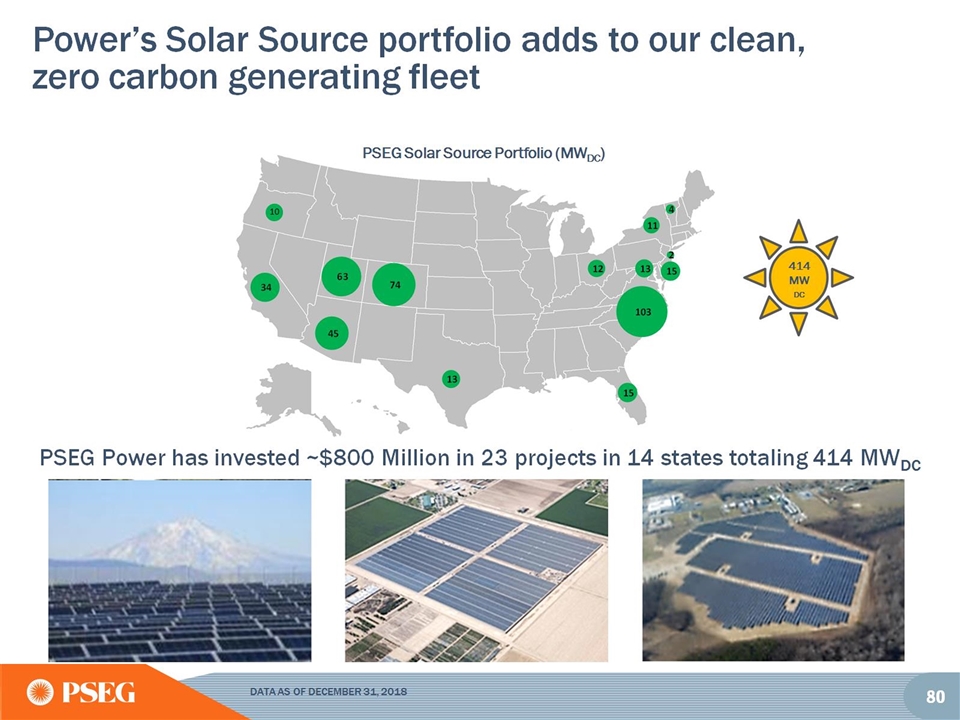

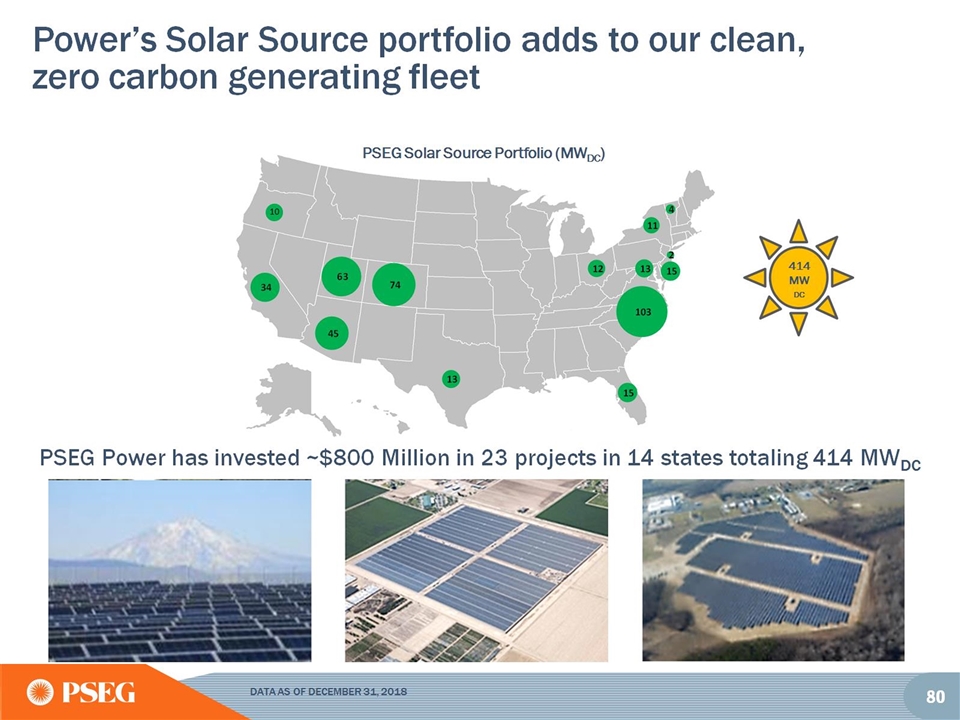

Power’s Solar Source portfolio adds to our clean, zero carbon generating fleet

NJ Offshore Wind Opportunity – Power has an option to invest in Ørsted’s Ocean Wind Project

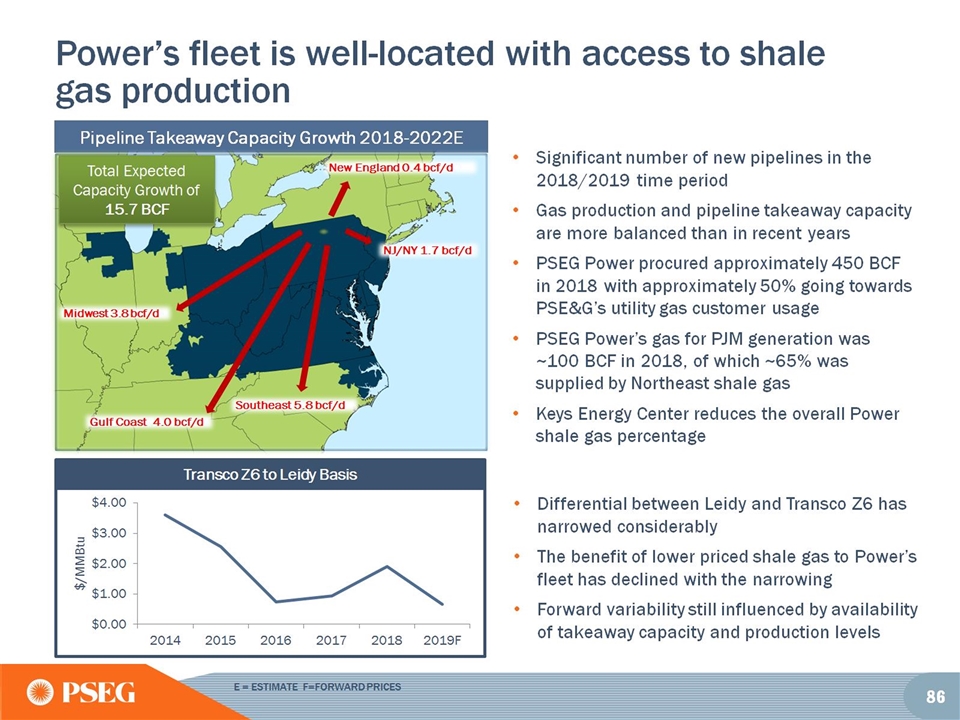

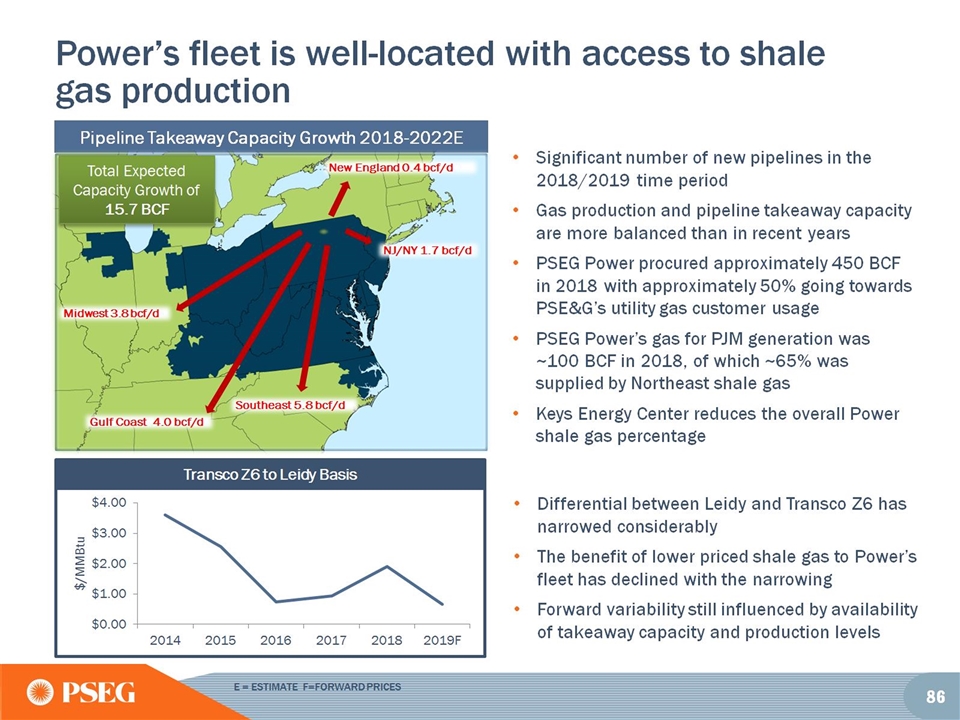

Power’s fleet is well-located with access to shale gas production

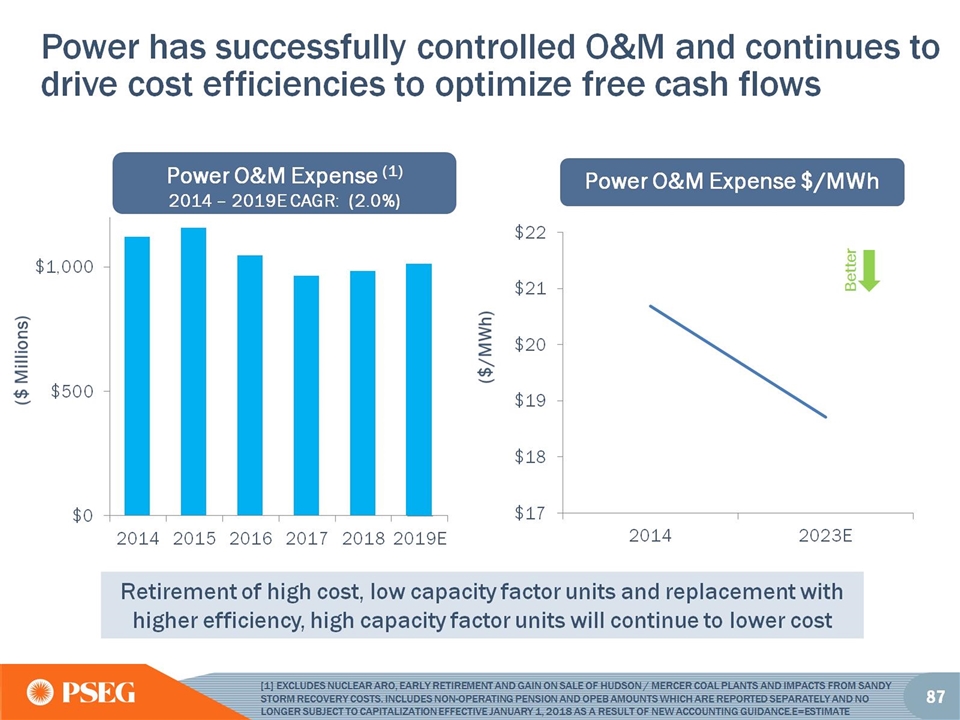

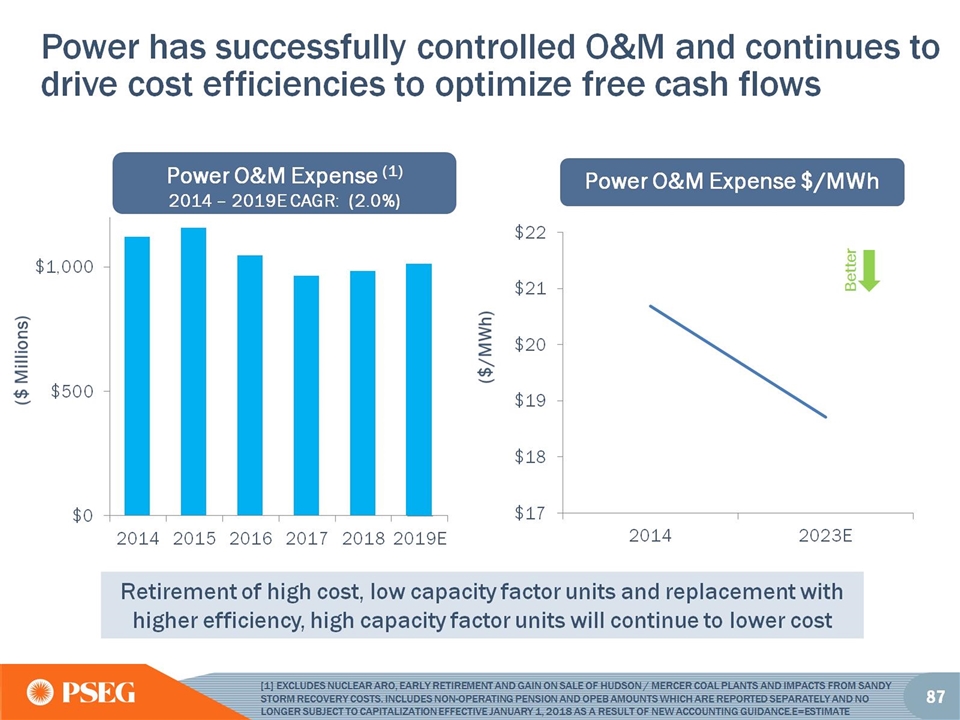

Power has successfully controlled O&M and continues to drive cost efficiencies to optimize free cash flows

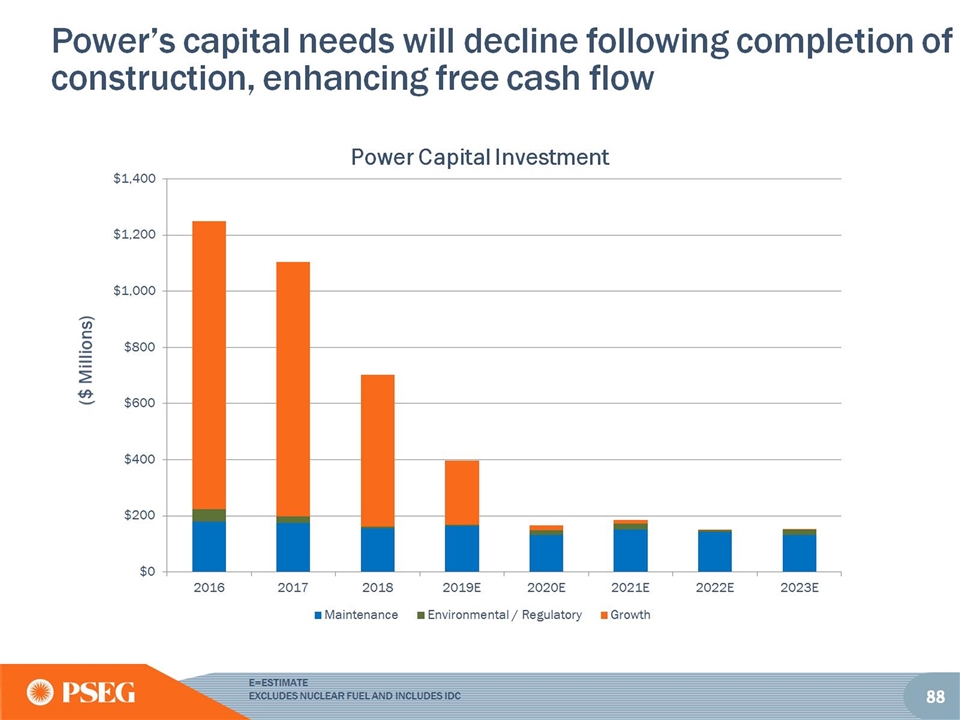

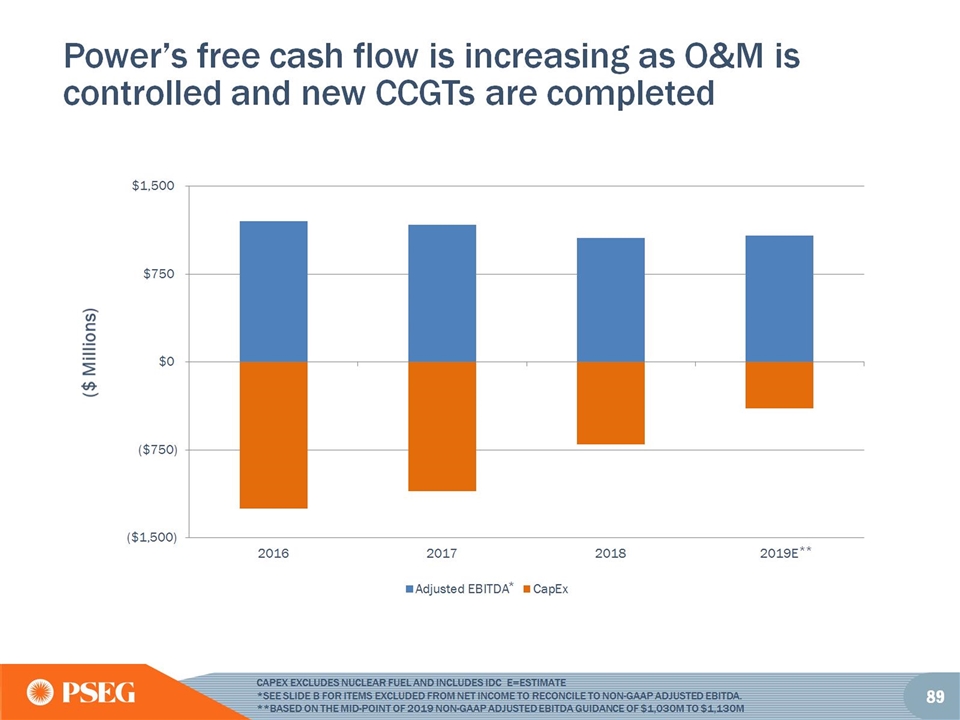

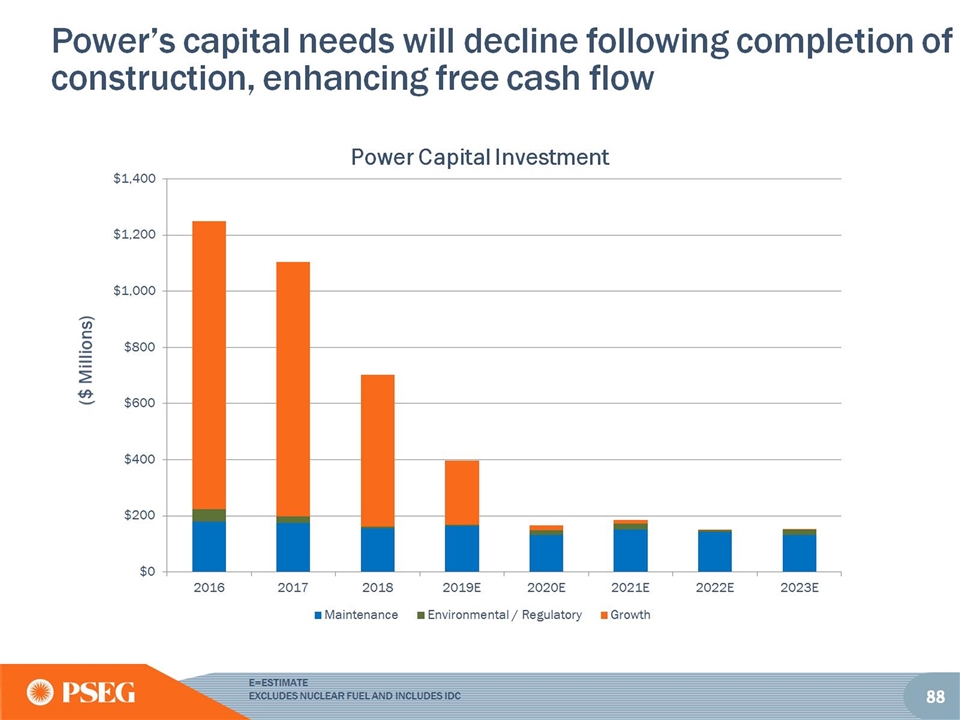

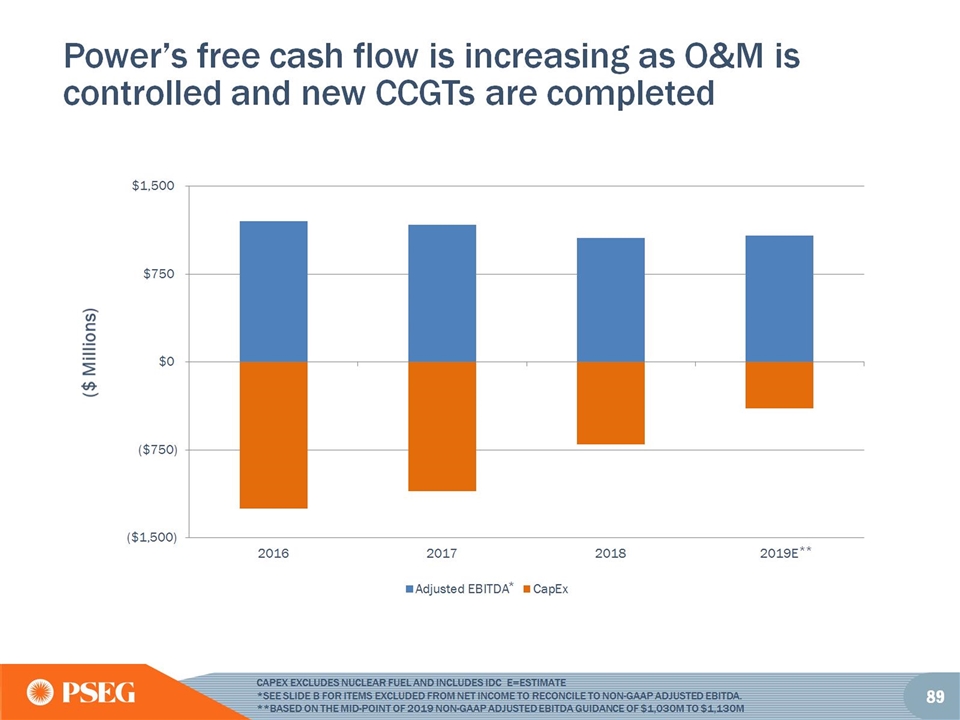

Power’s free cash flow is increasing as O&M is controlled and new CCGTs are completed

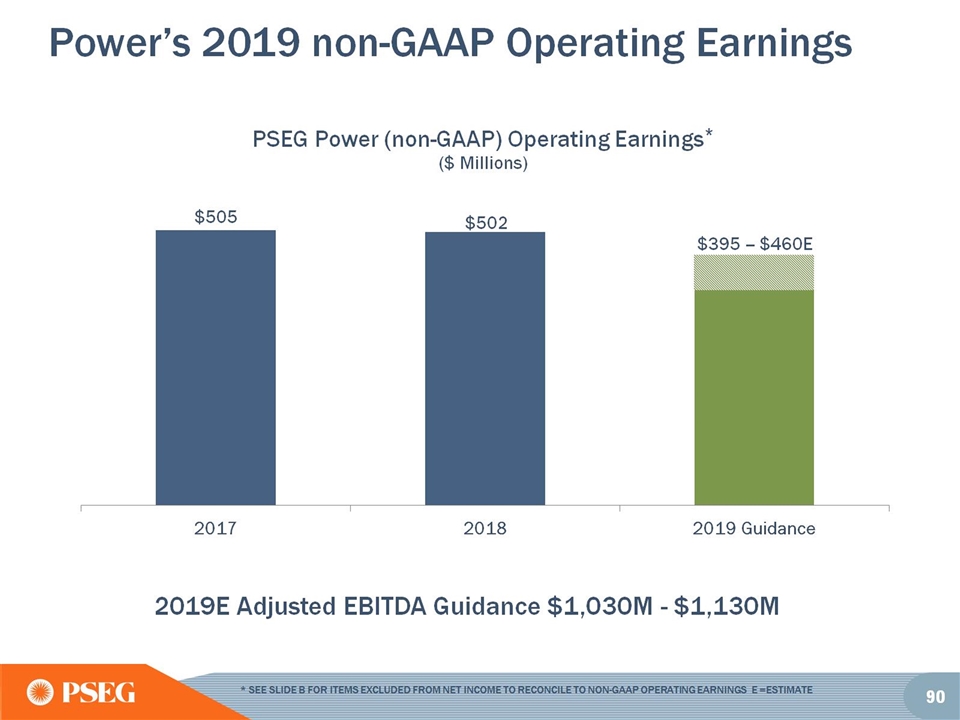

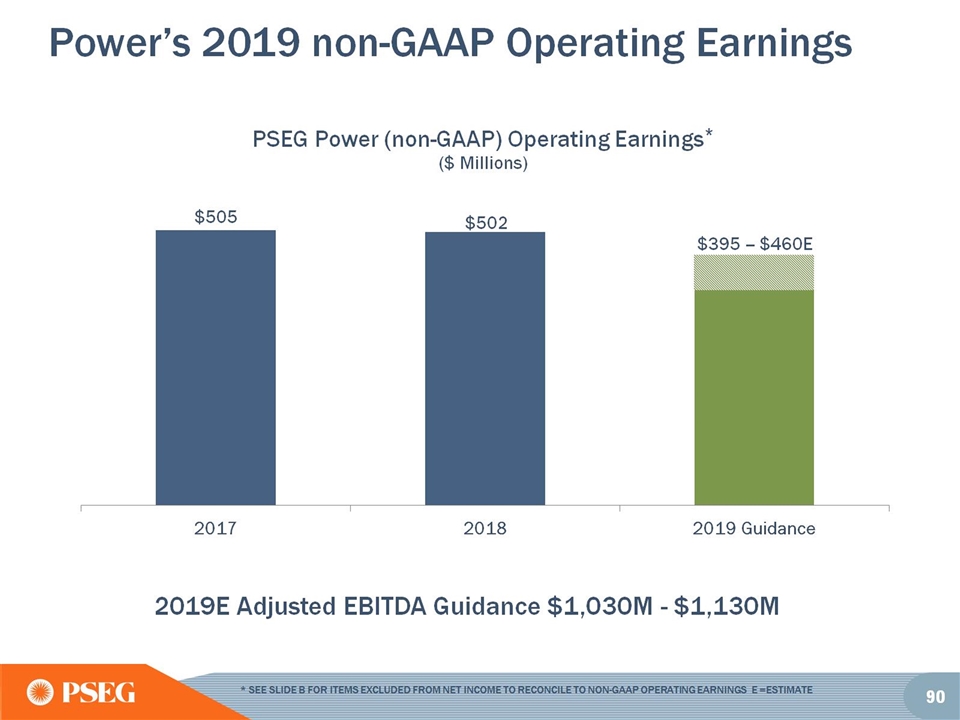

Power’s 2019 non-GAAP Operating Earnings

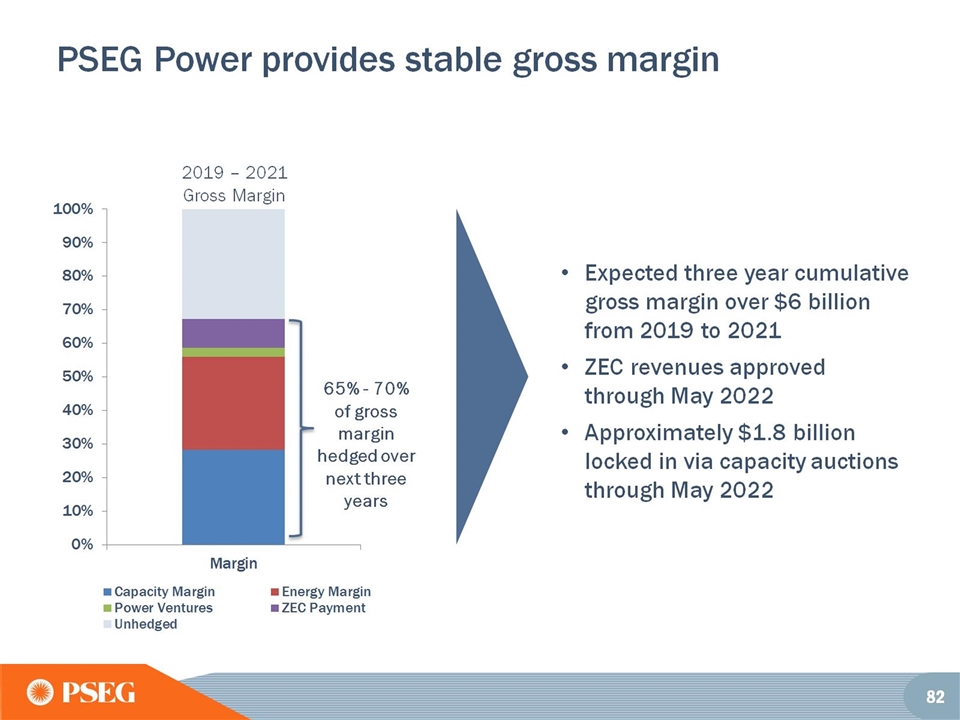

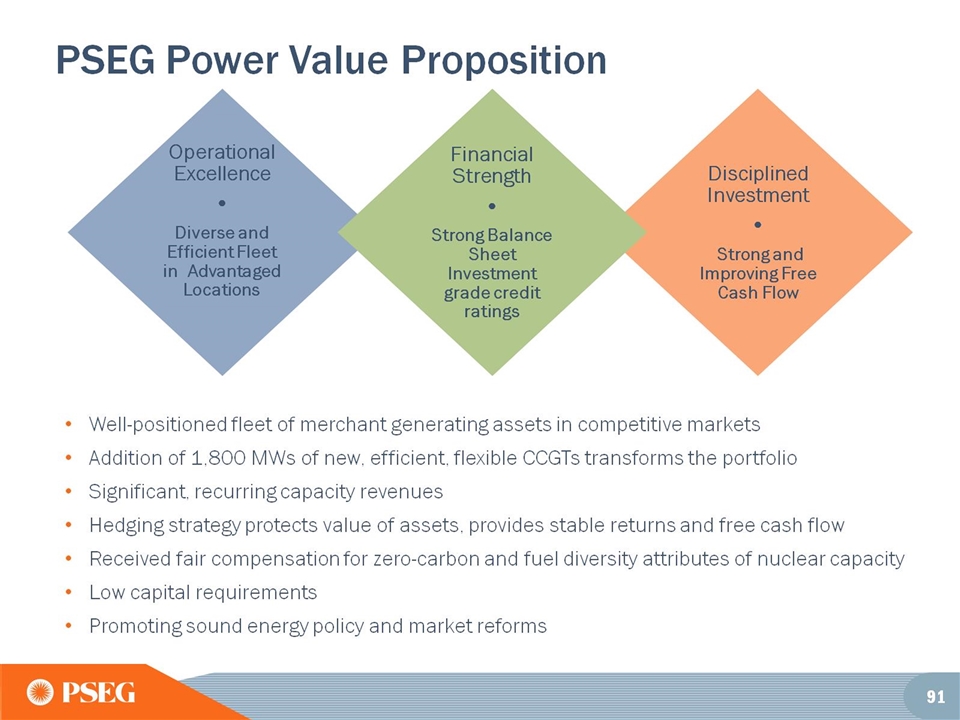

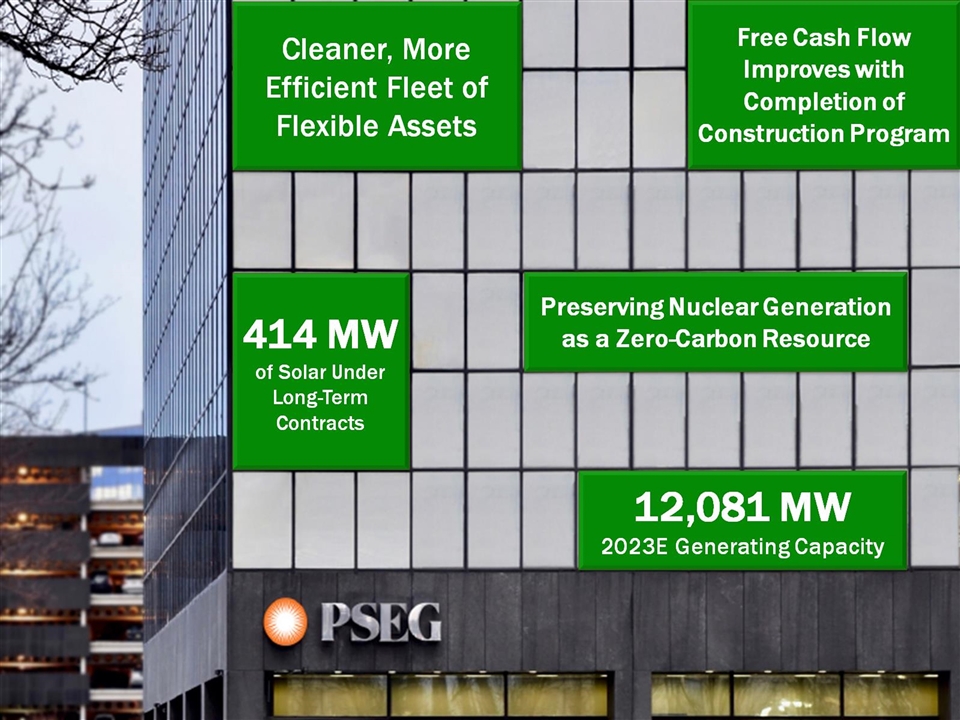

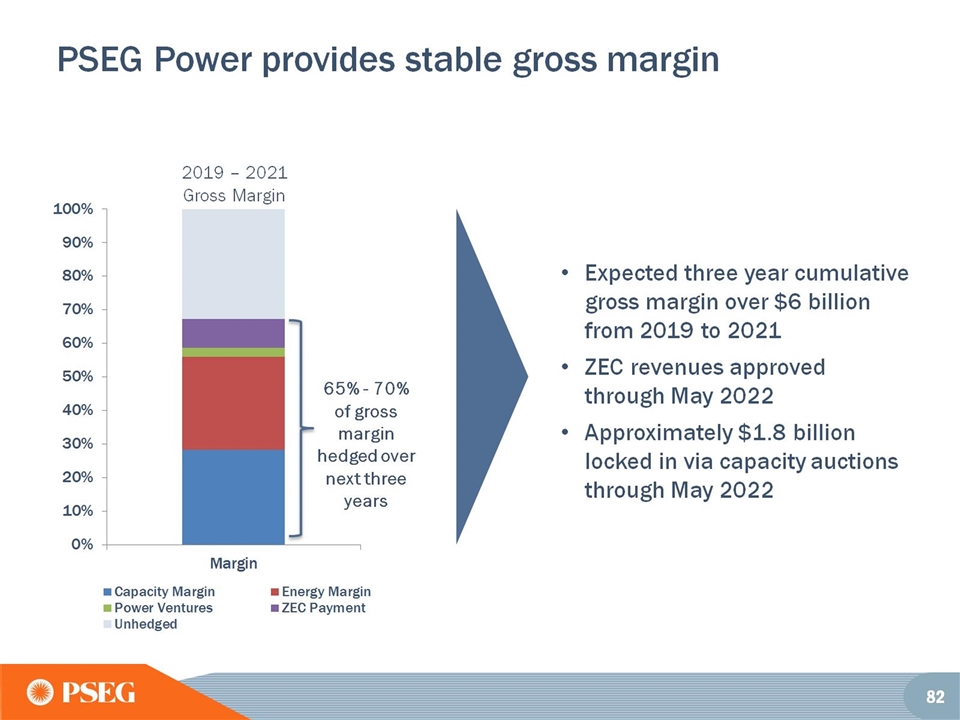

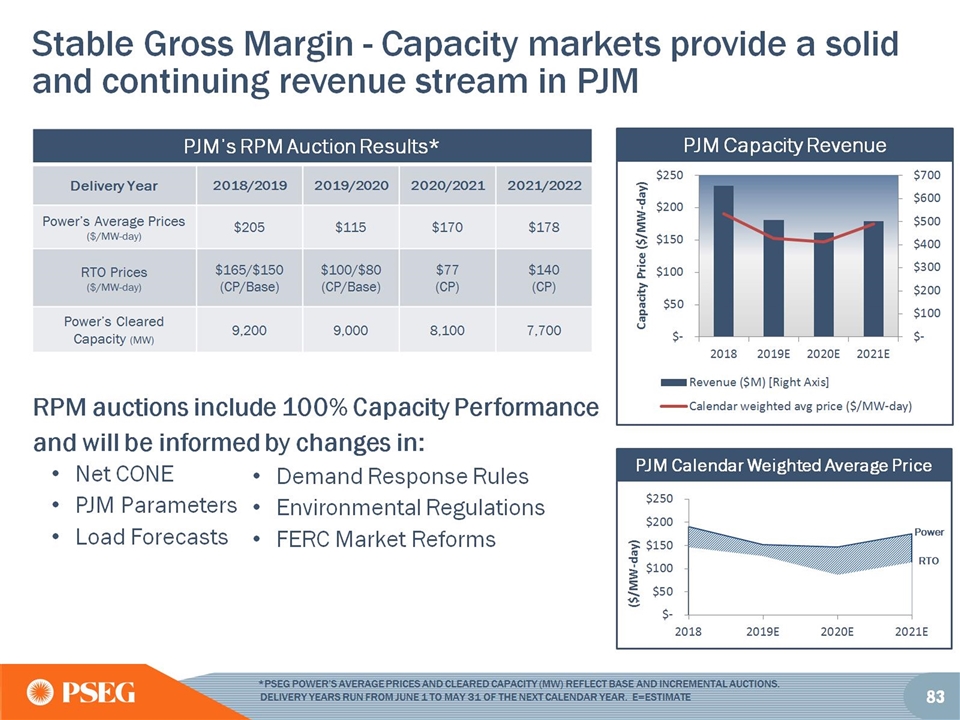

PSEG Power Value Proposition

PSEG FINANCIAL REVIEW & OUTLOOK

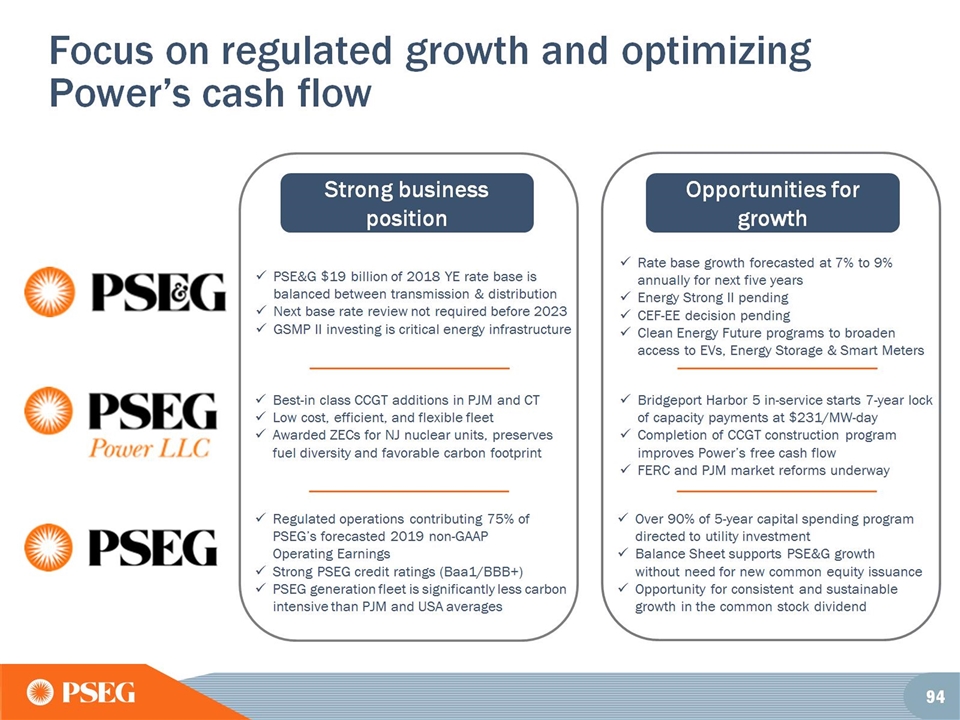

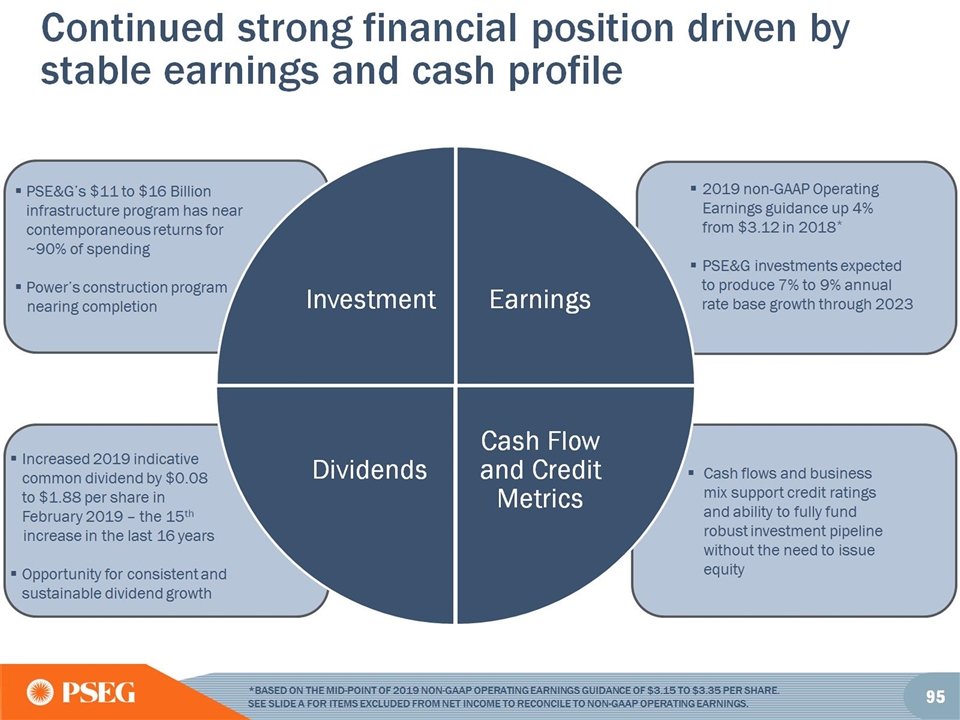

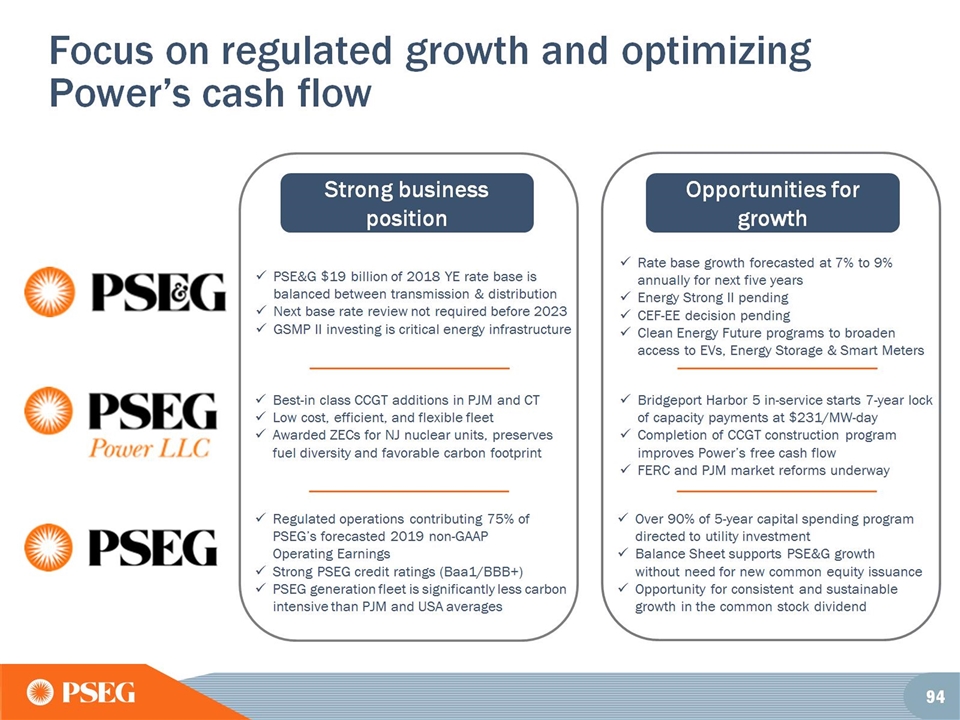

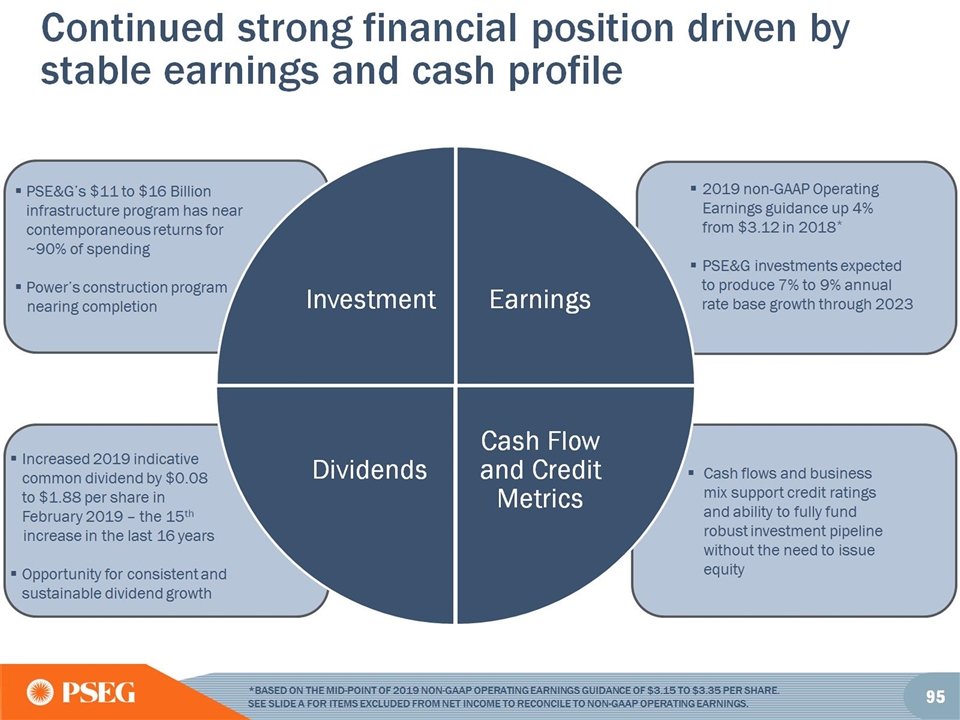

Continued strong financial position driven by stable earnings and cash profile

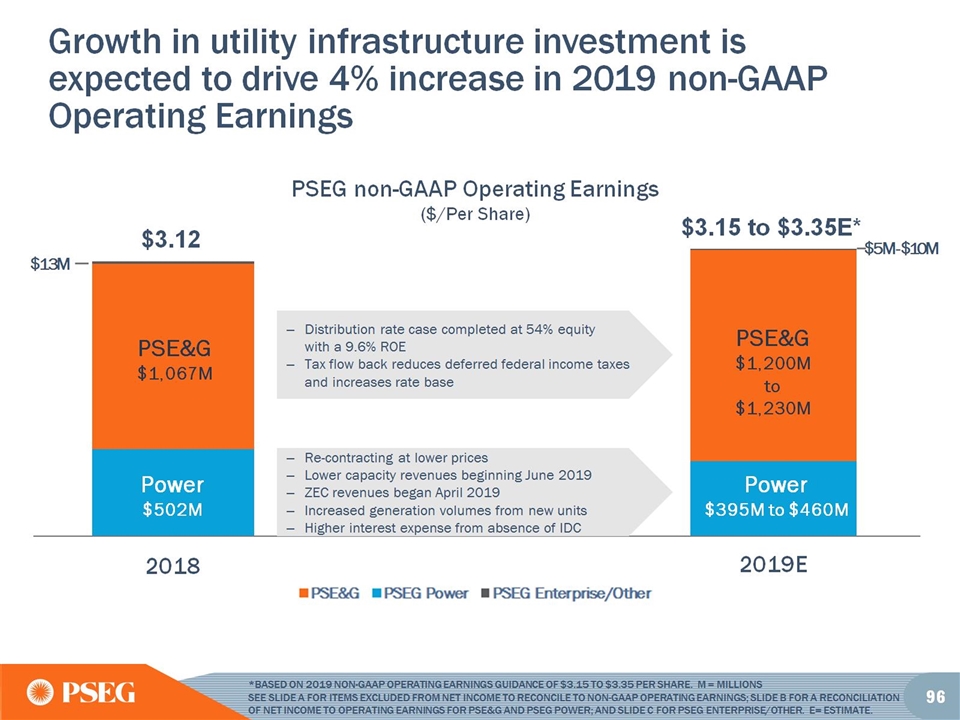

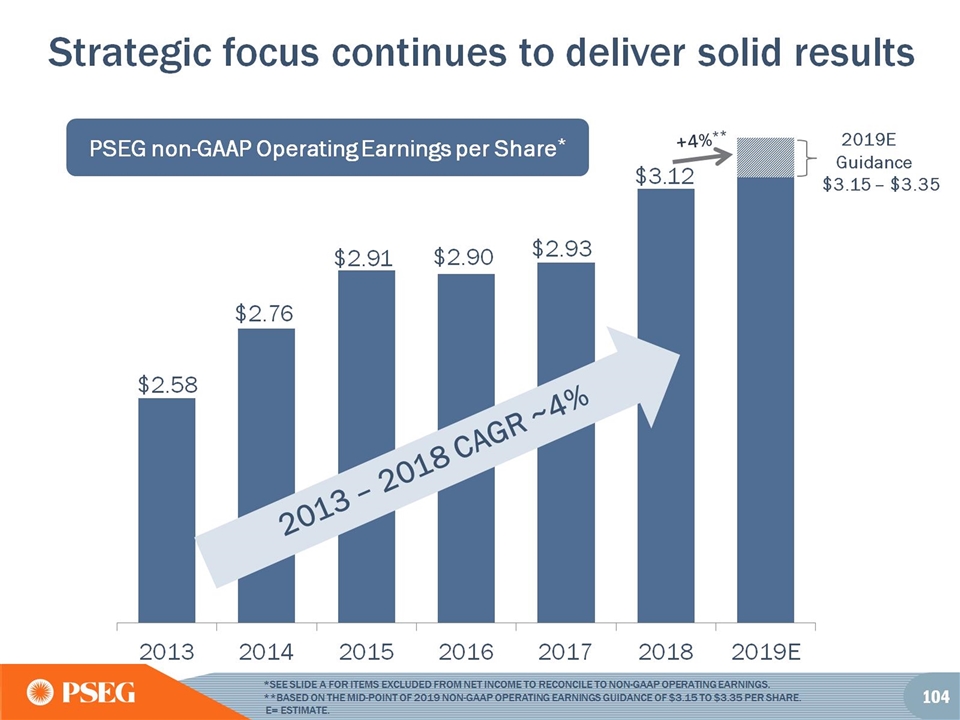

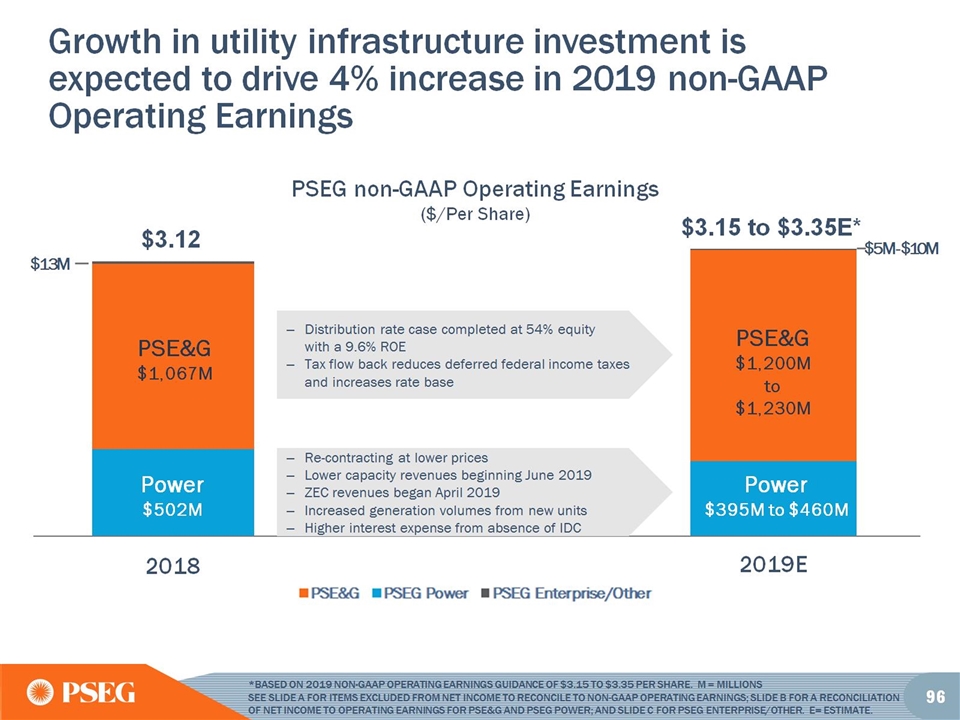

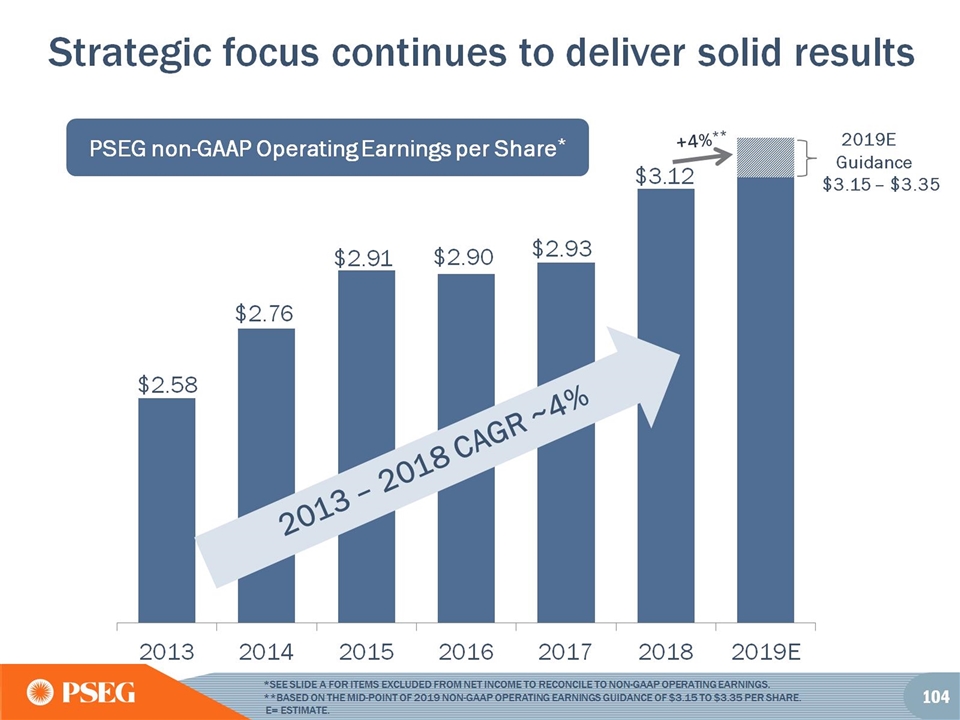

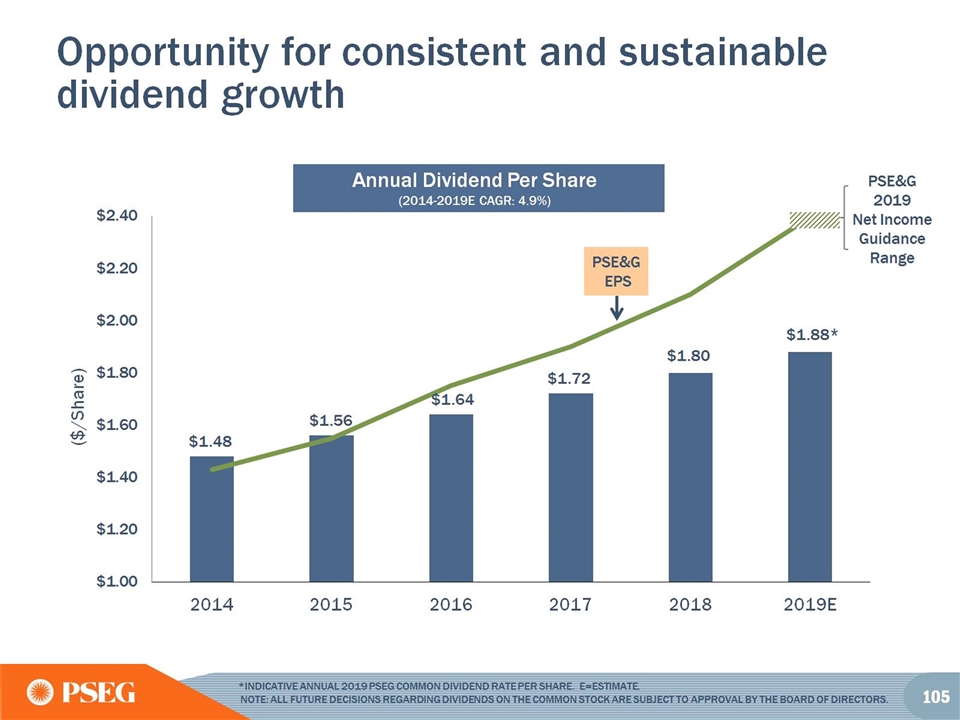

Growth in utility infrastructure investment is expected to drive 4% increase in 2019 non-GAAP Operating Earnings

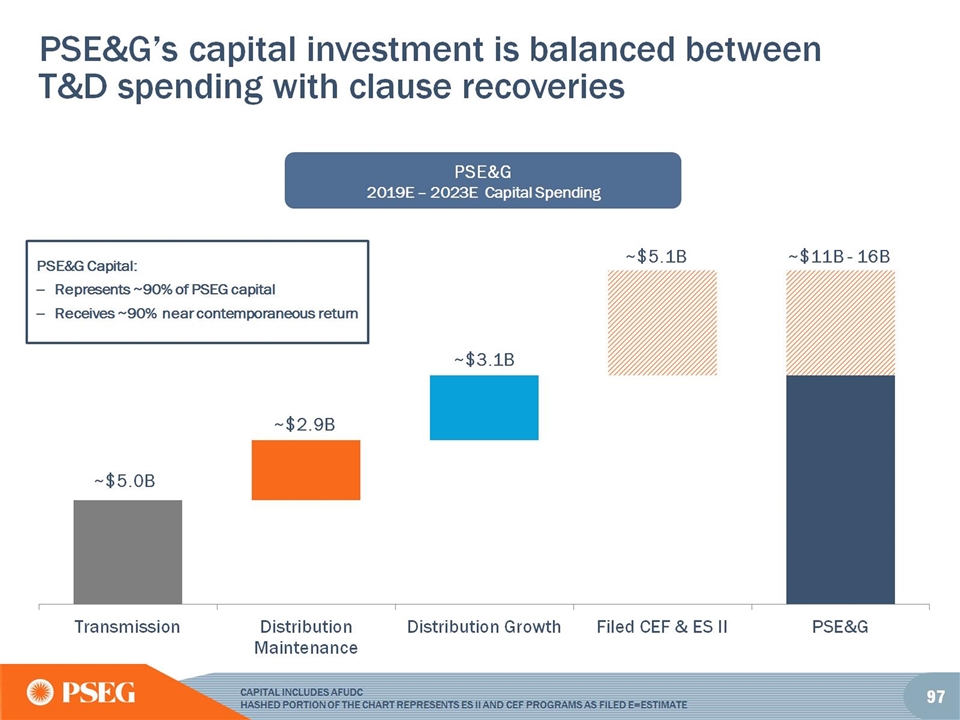

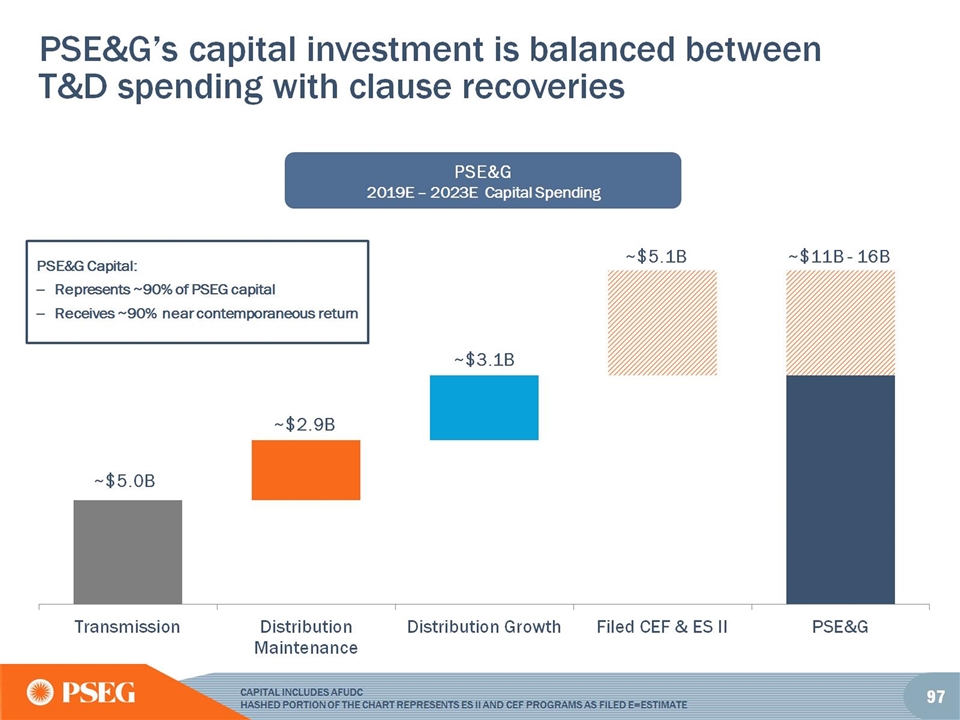

PSE&G’s capital investment is balanced between T&D spending with clause recoveries

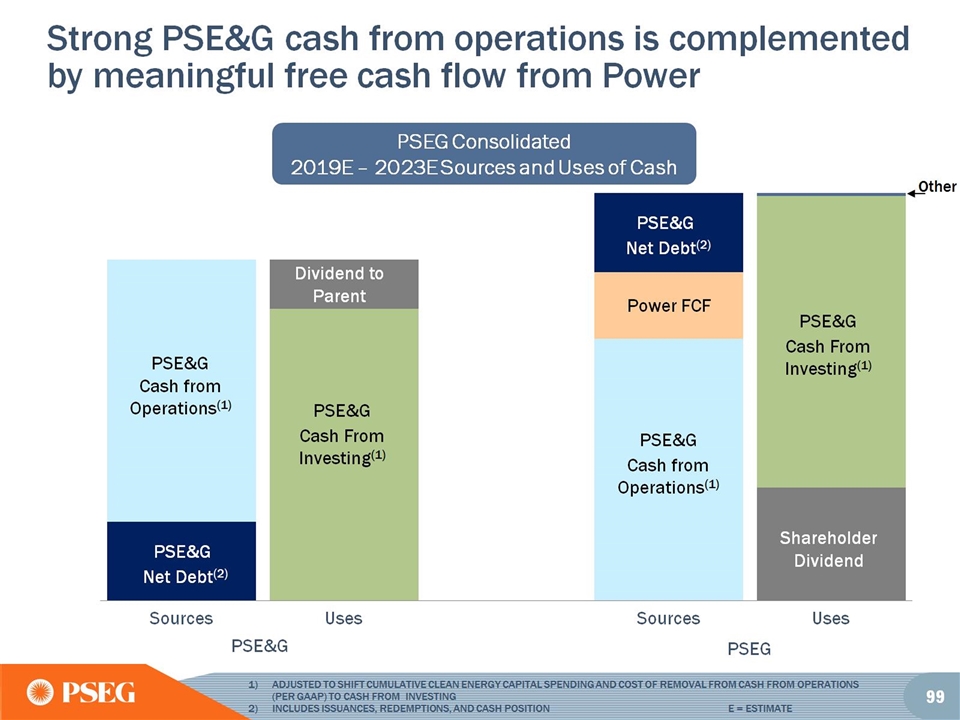

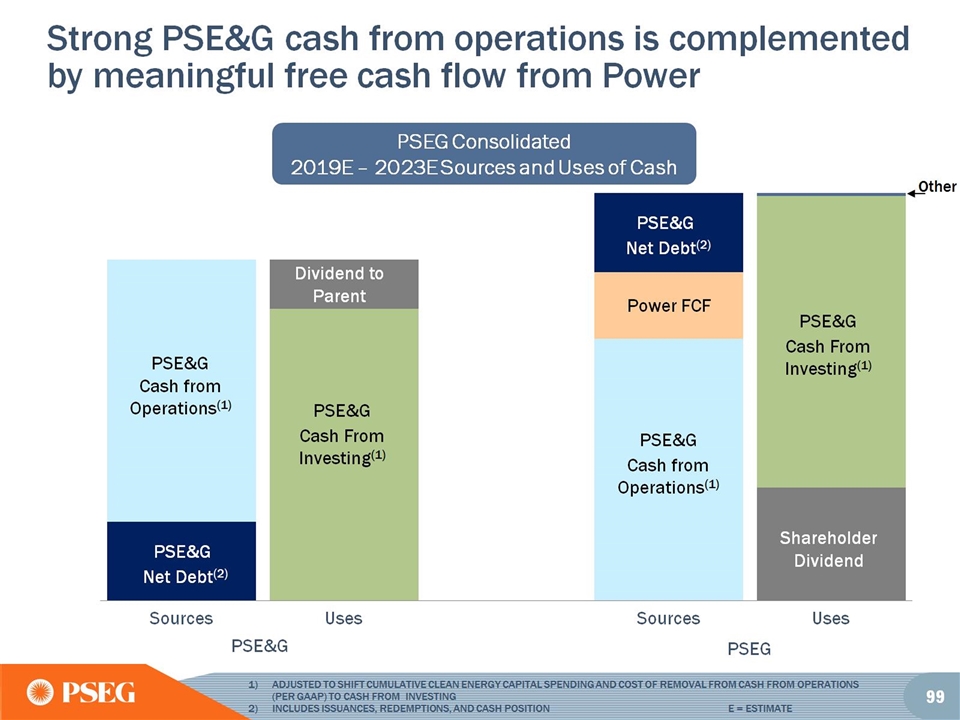

Strong PSE&G cash from operations is complemented by meaningful free cash flow from Power

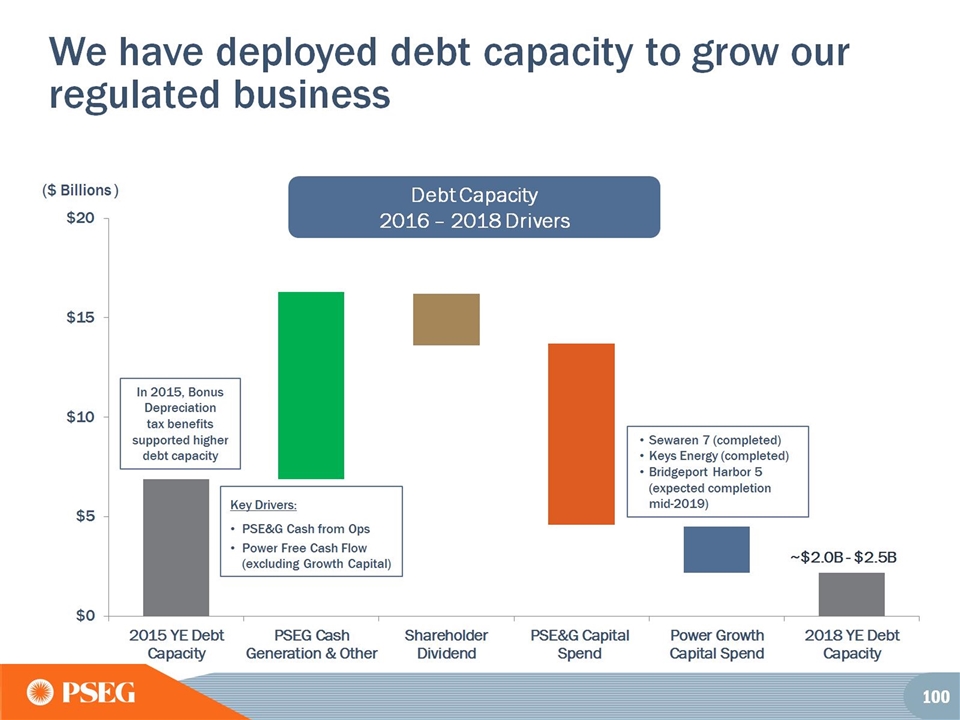

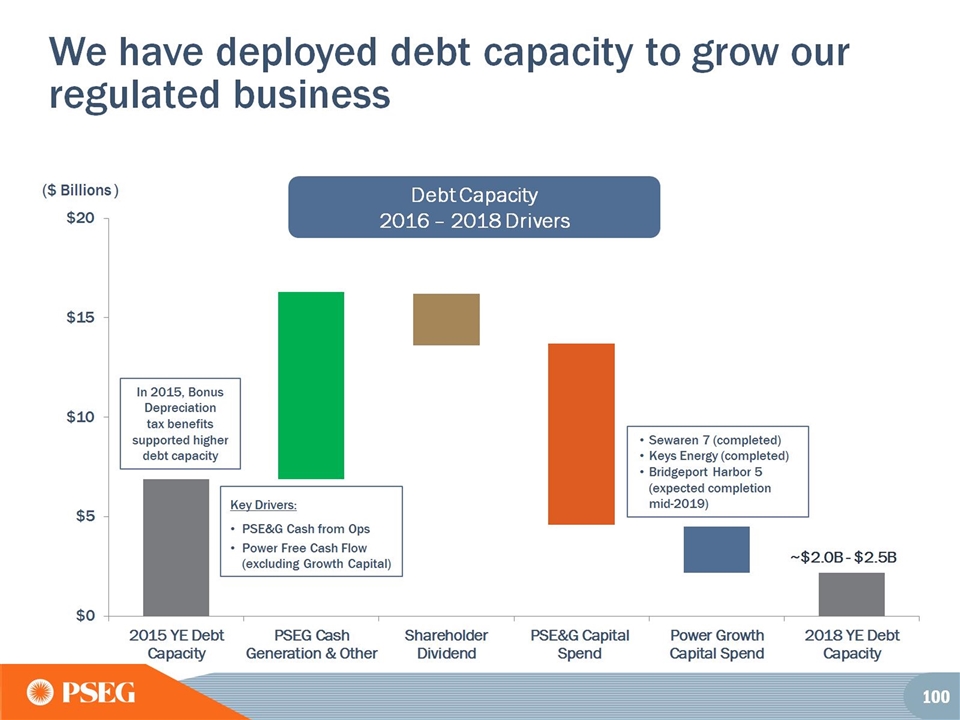

We have deployed debt capacity to grow our regulated business

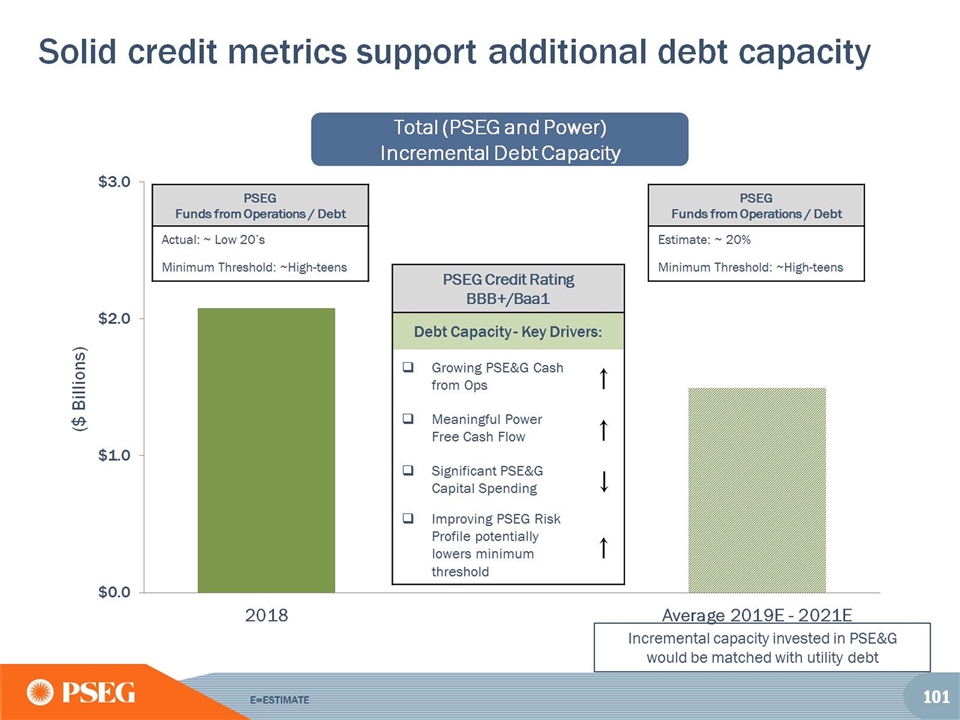

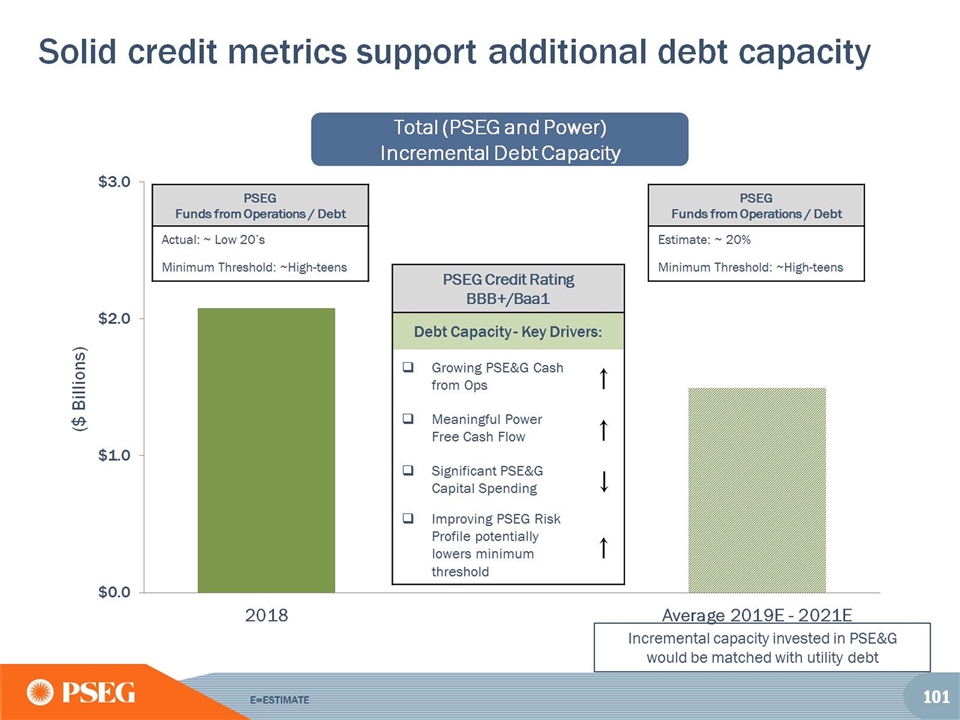

Solid credit metrics support additional debt capacity

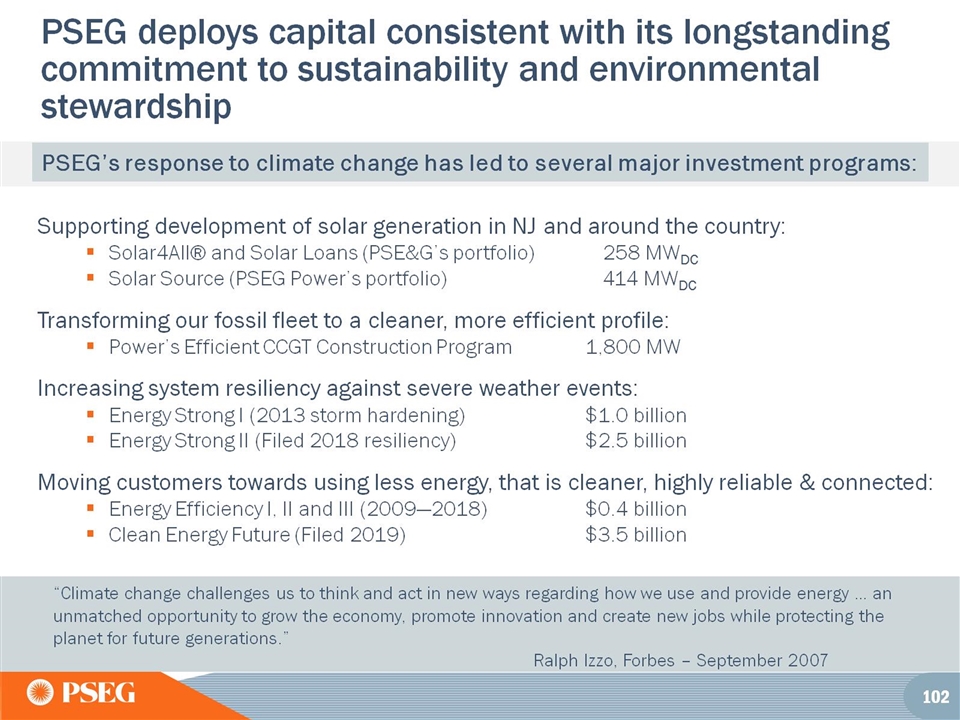

PSEG deploys capital consistent with its longstanding commitment to sustainability and environmental stewardship

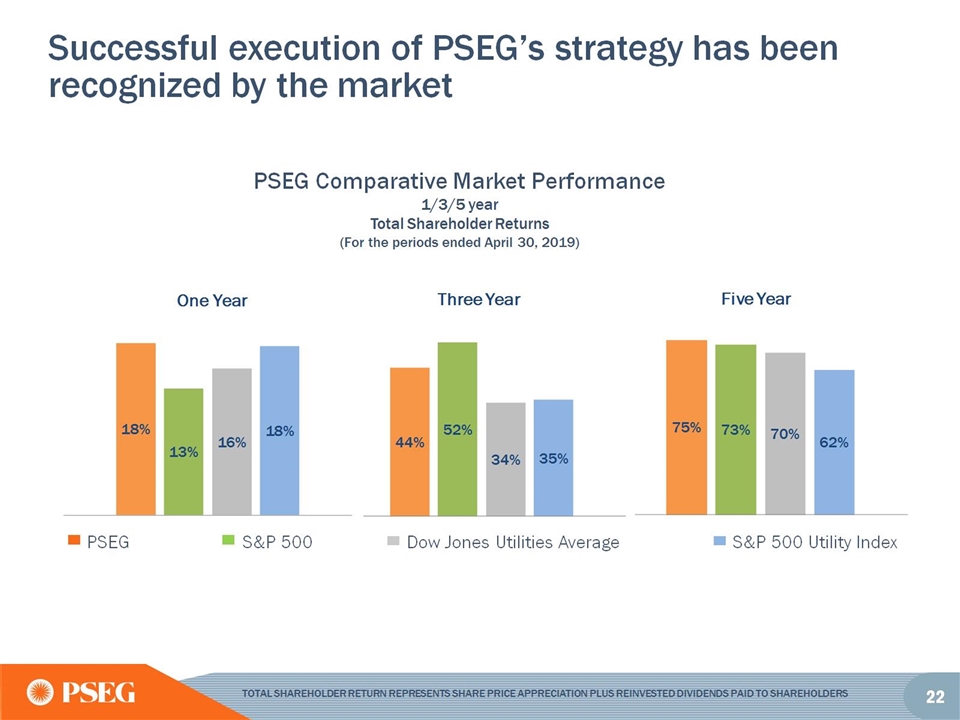

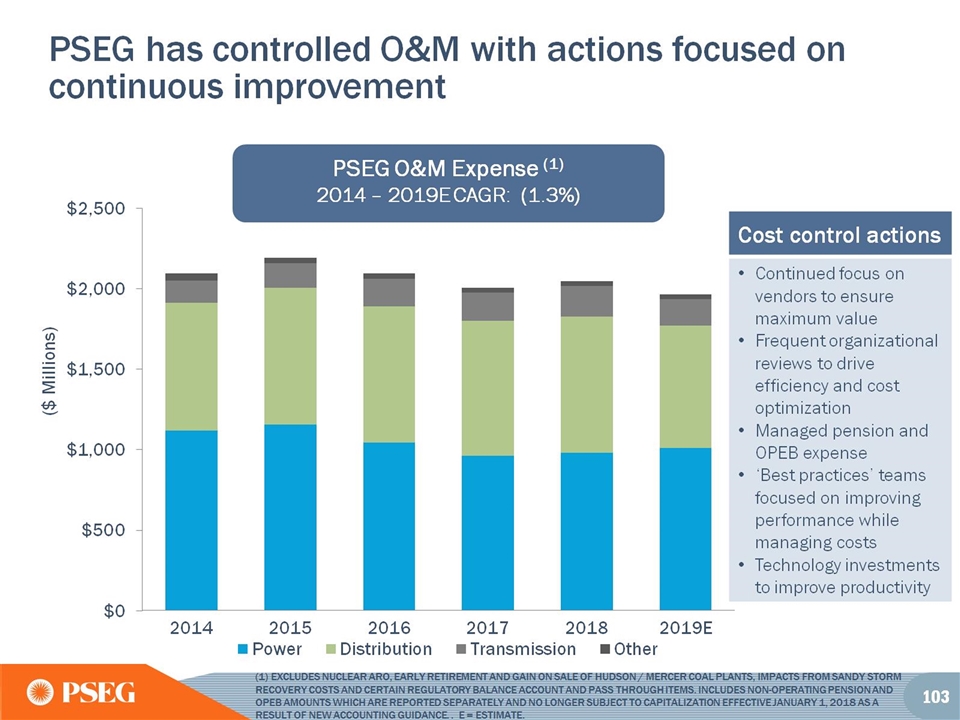

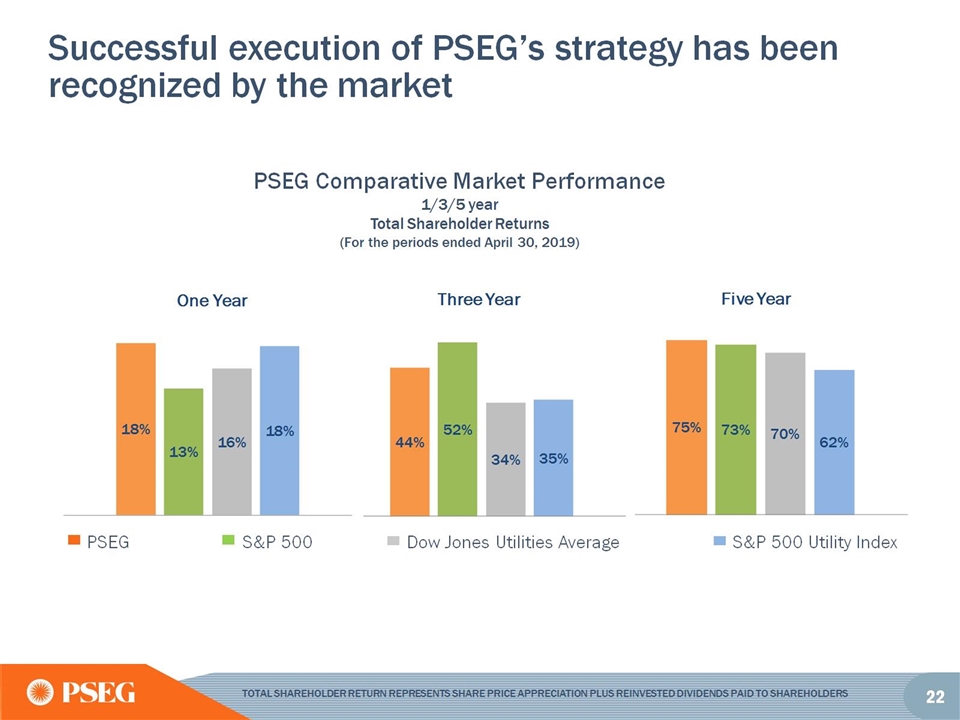

Strategic focus continues to deliver solid results

PSEG Value Proposition

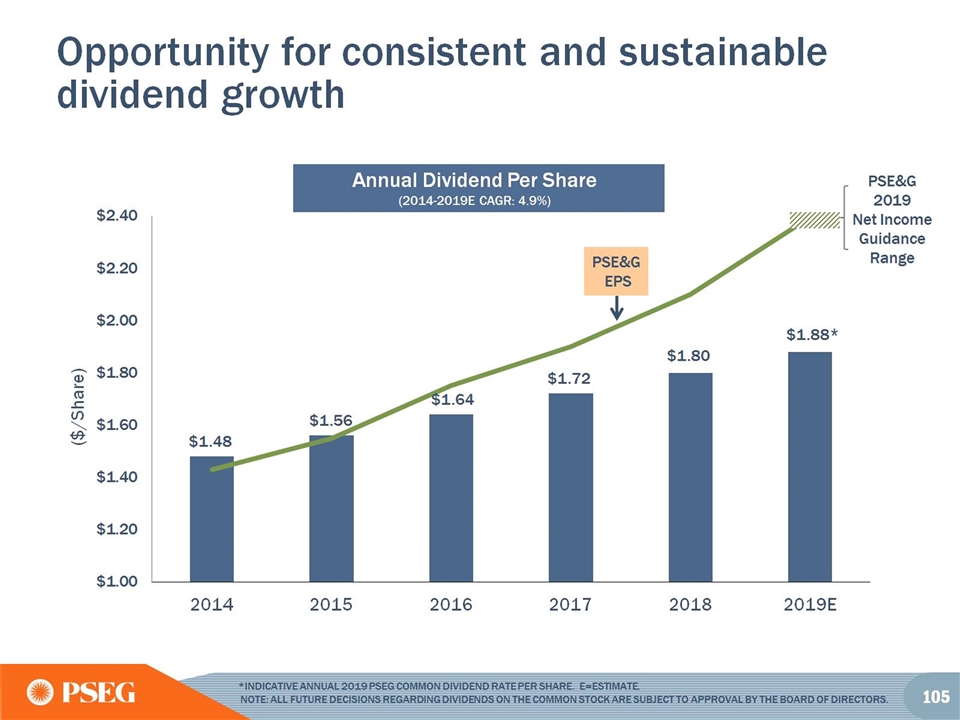

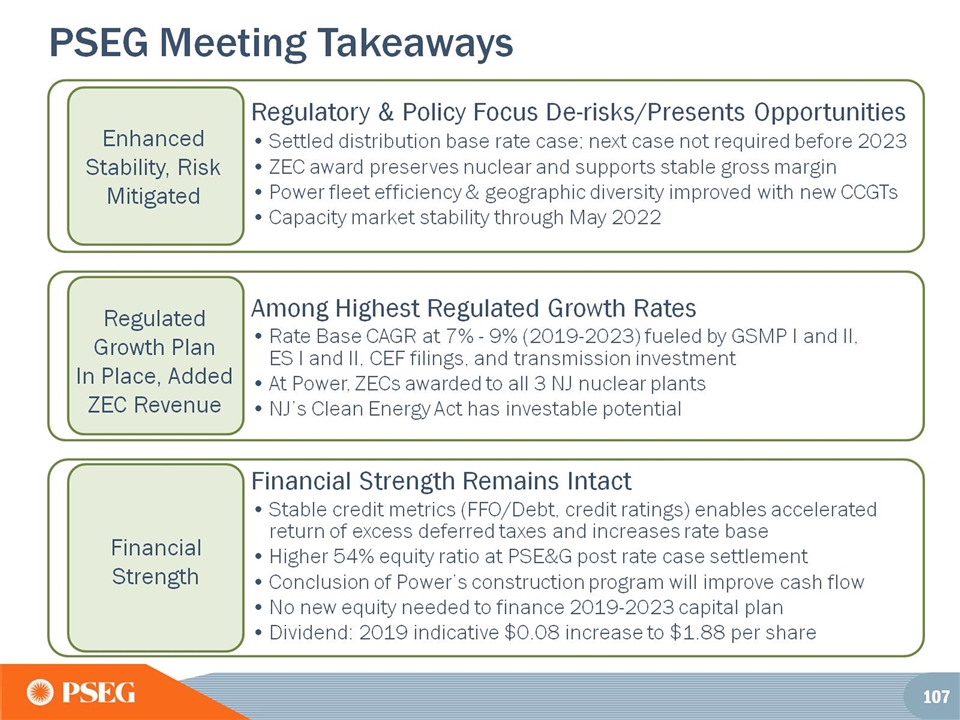

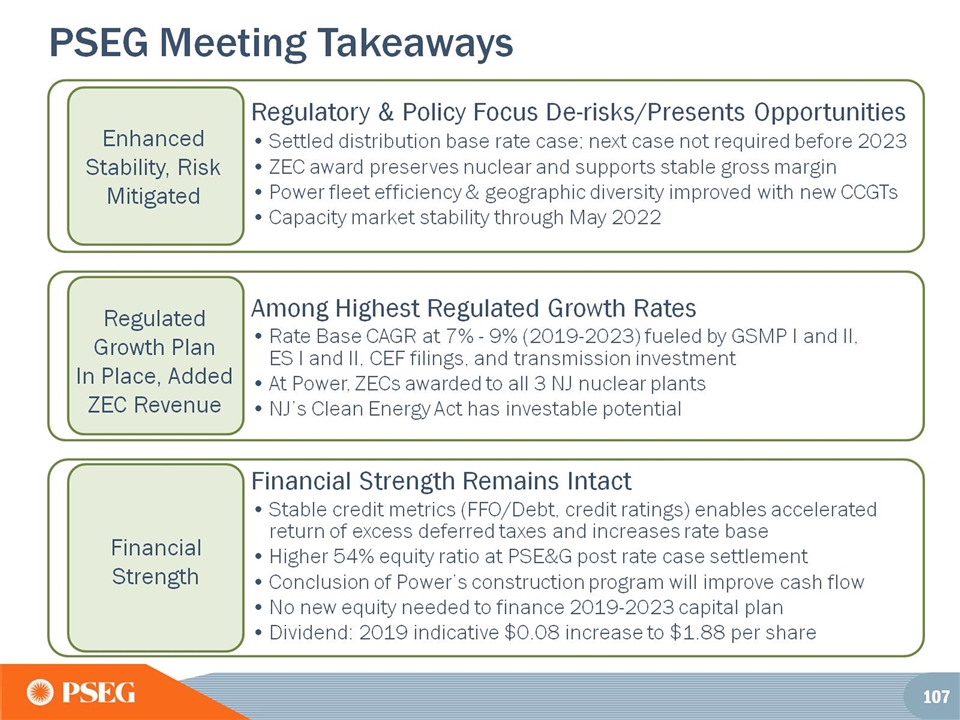

PSEG Meeting Takeaways

PSEG APPENDIX

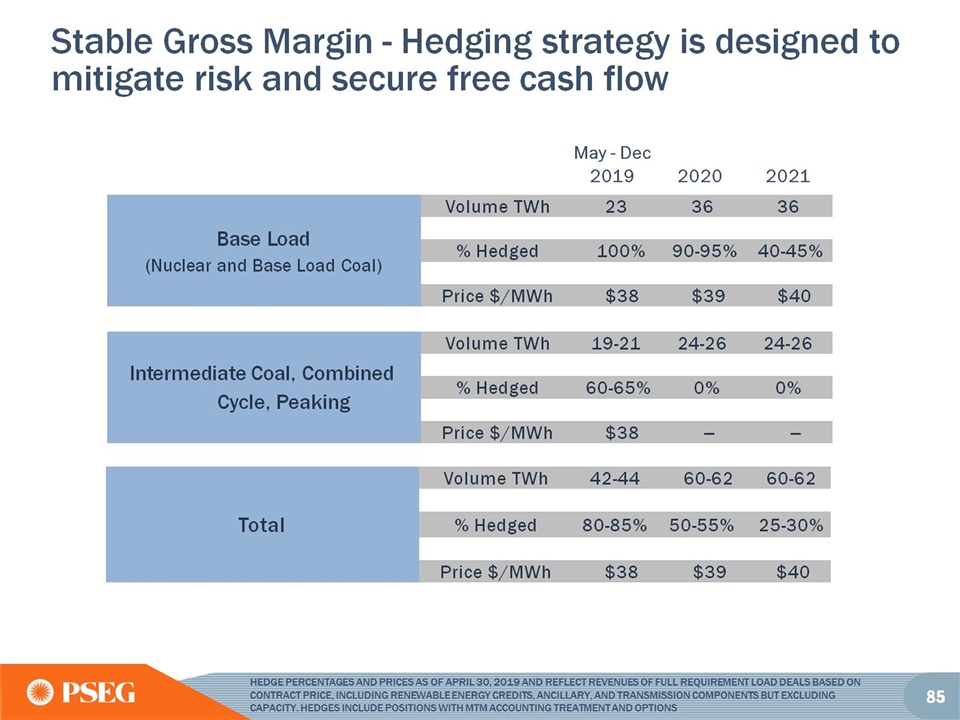

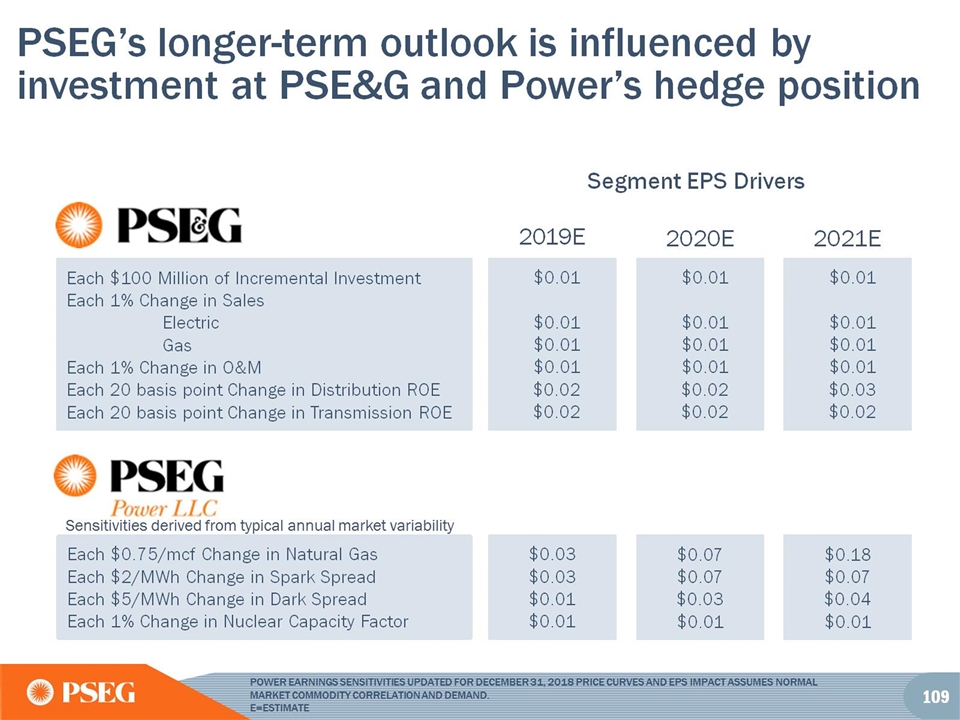

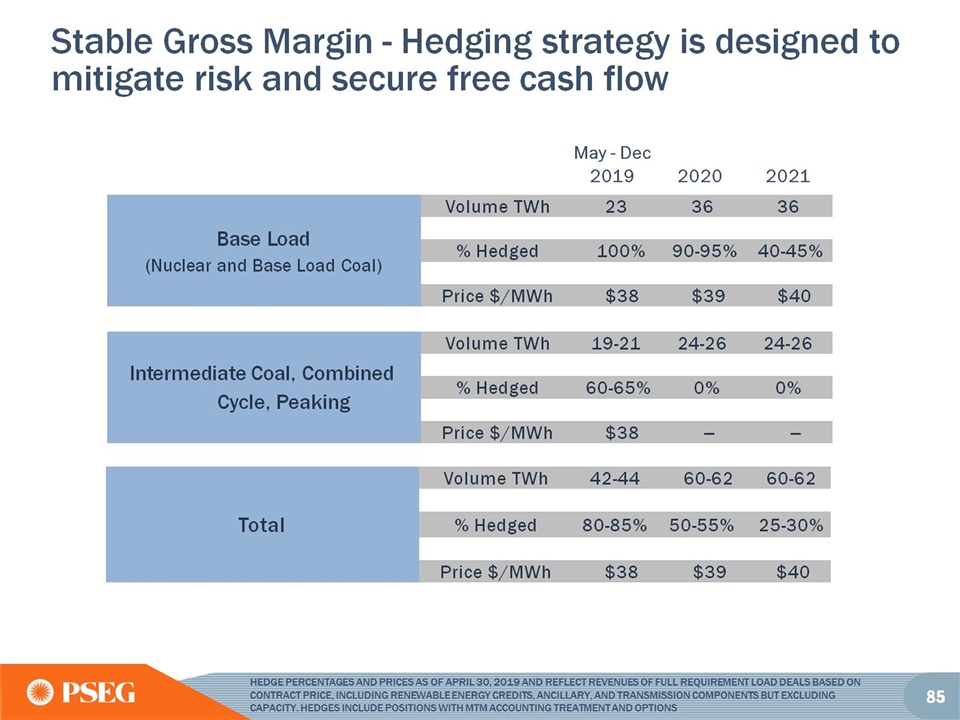

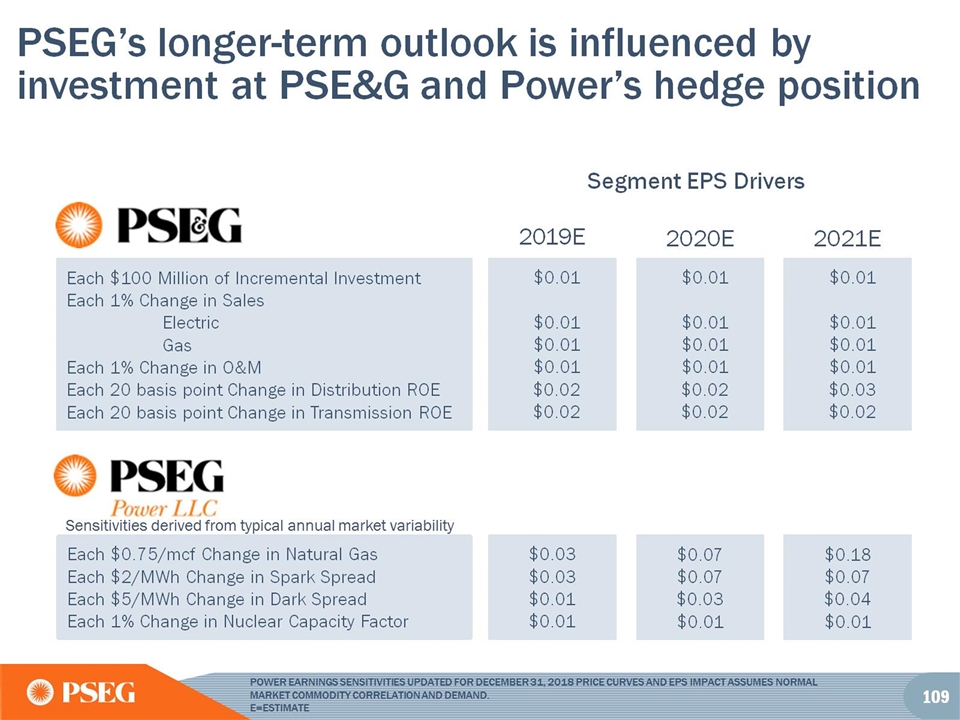

PSEG’s longer-term outlook is influenced by investment at PSE&G and Power’s hedge position

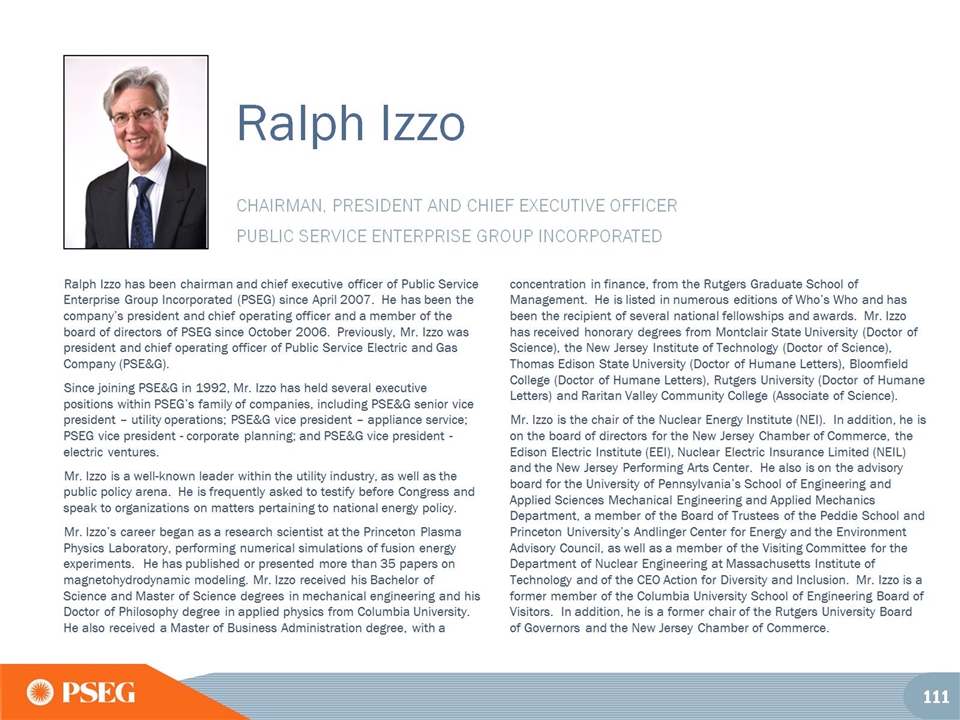

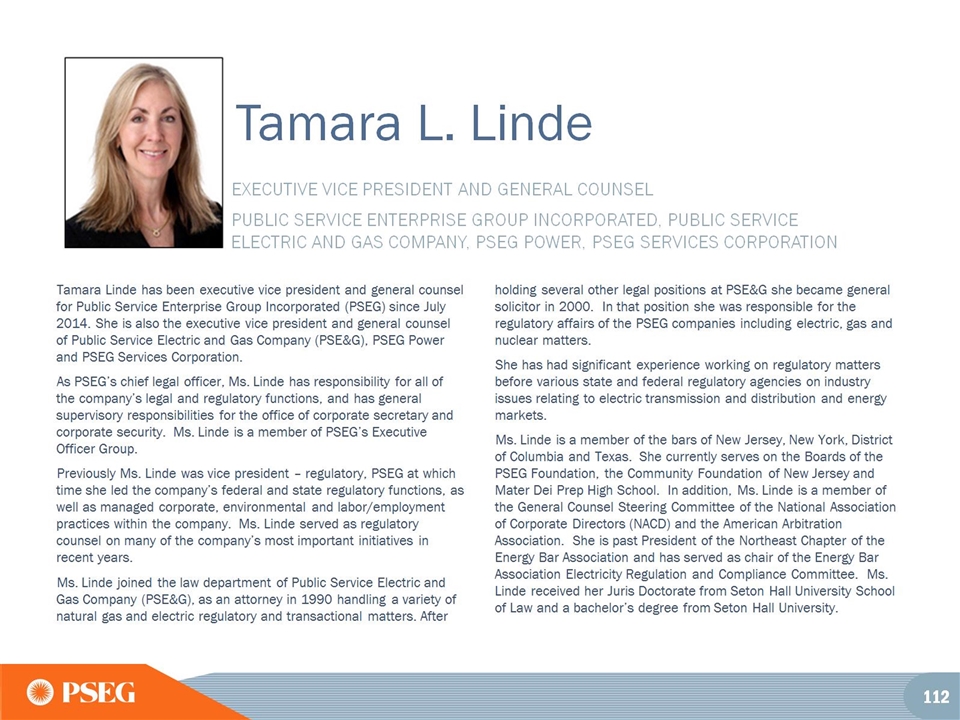

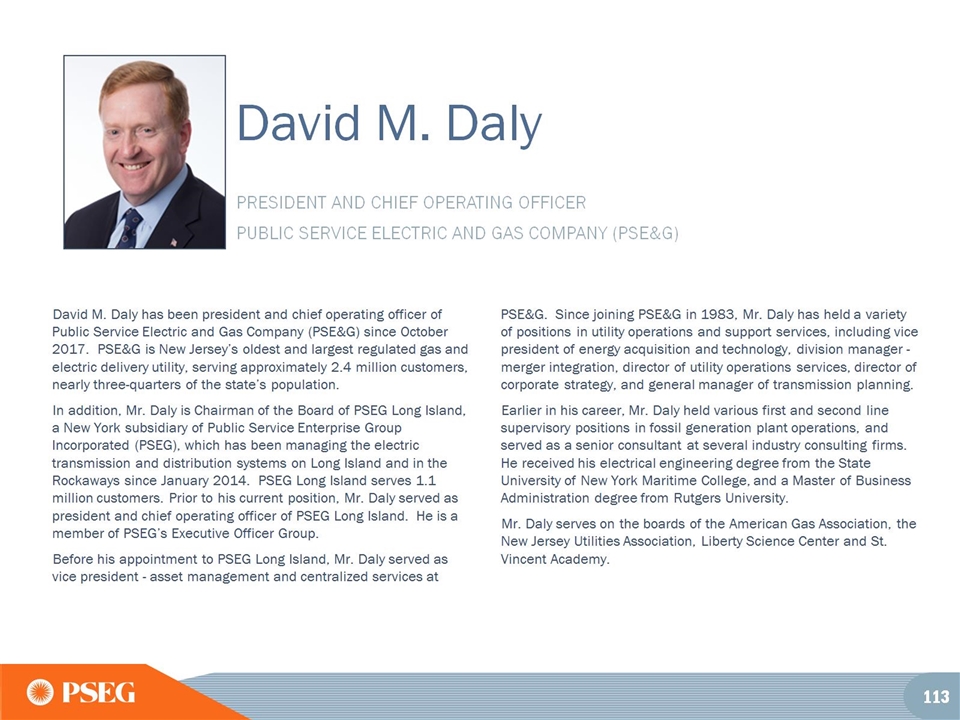

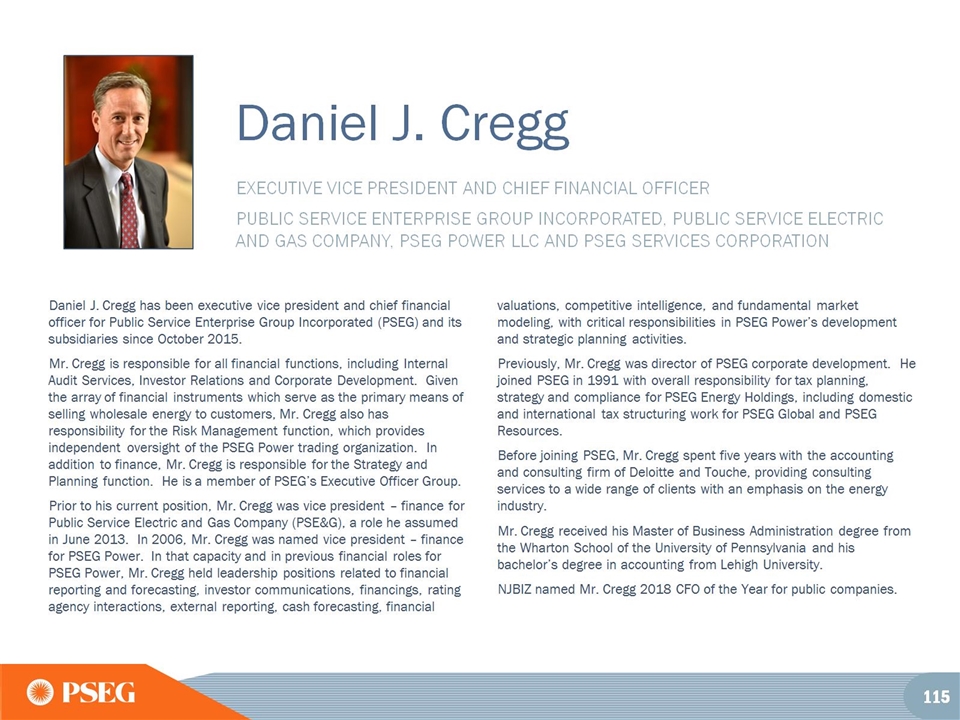

2019 PSEG EXECUTIVE PROFILES

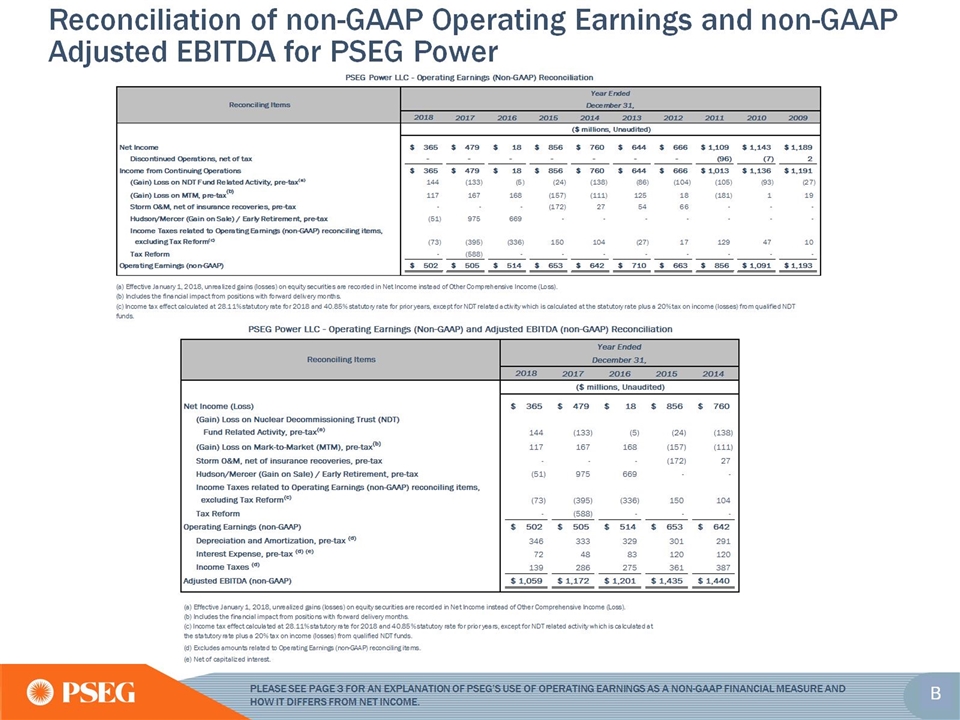

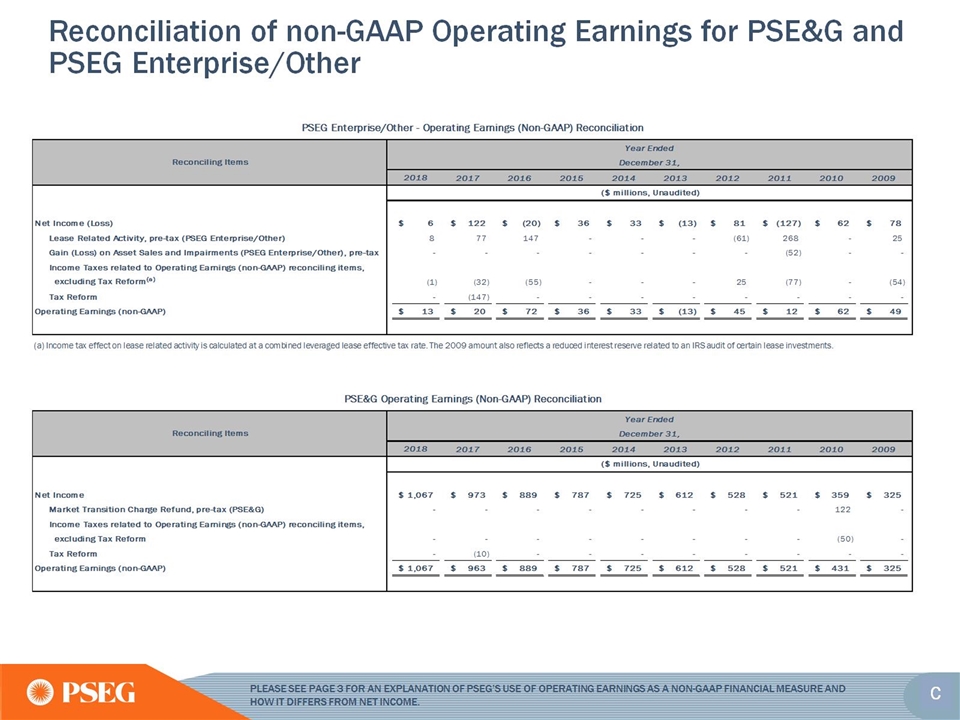

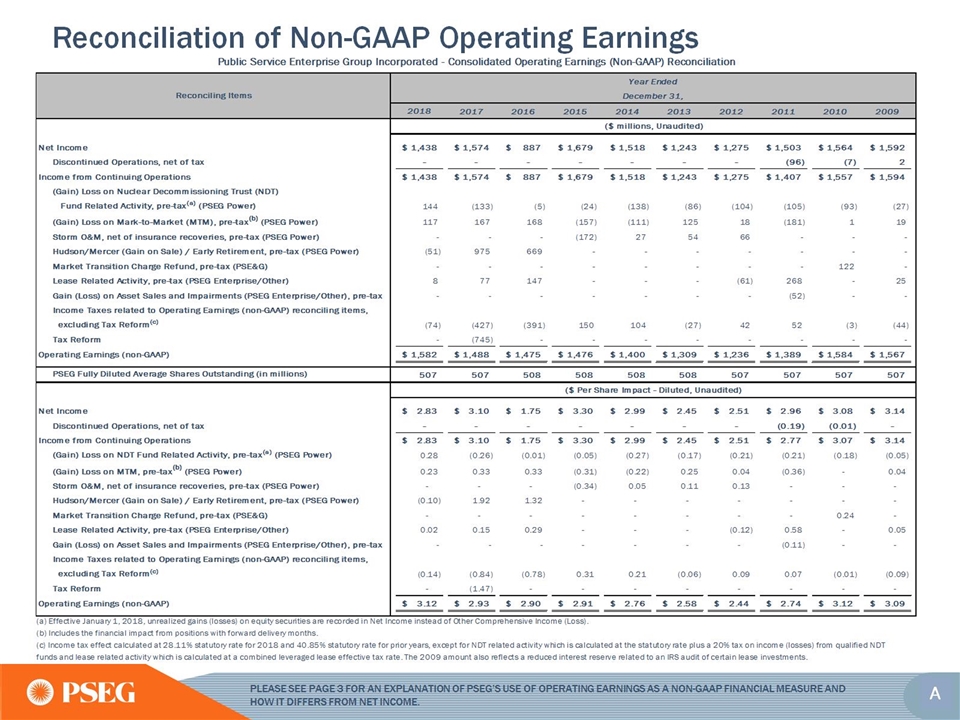

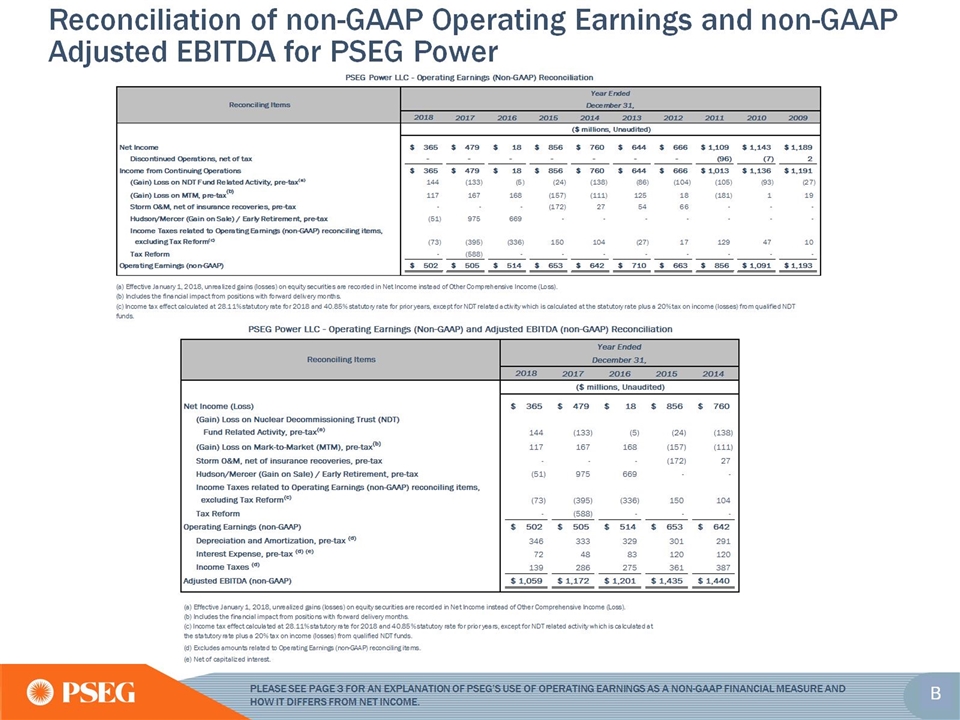

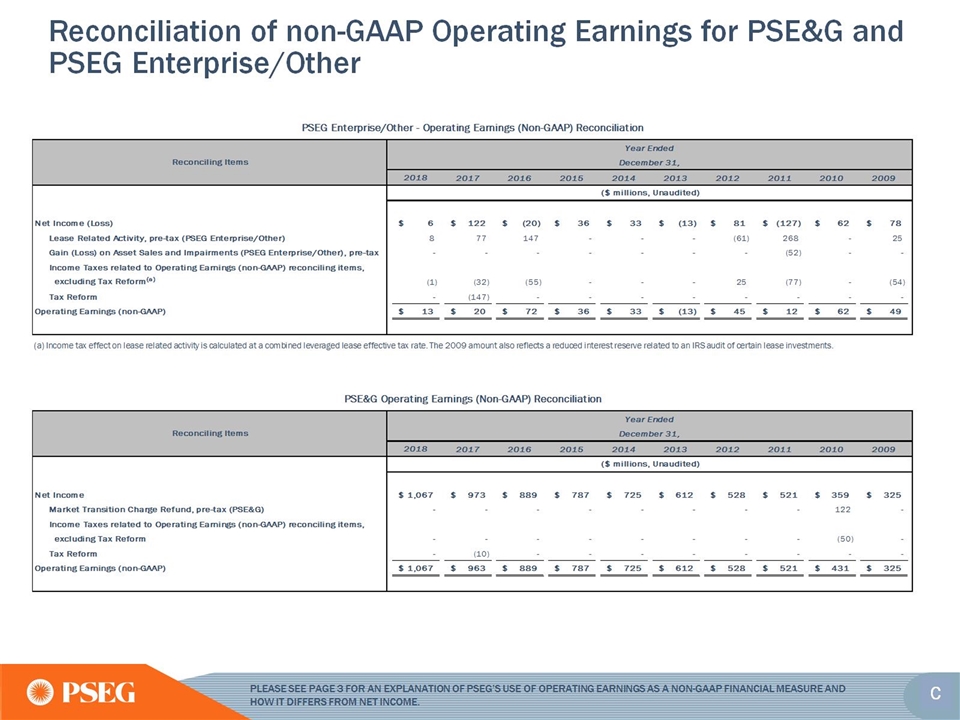

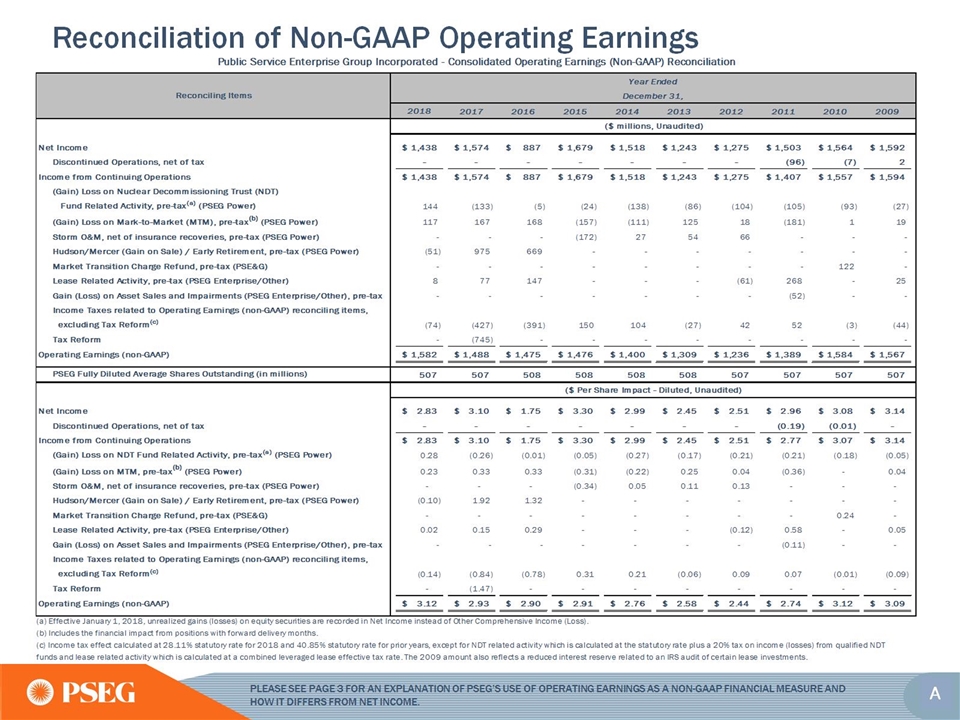

Reconciliation of Non-GAAP Operating Earnings