UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-5003

Blue Chip Value Fund, Inc.

(Exact name of registrant as specified in charter)

1225 17th Street, 26th Floor, Denver, Colorado 80202 |

(Address of principal executive offices) (Zip code) |

Michael P. Malloy

Drinker Biddle & Reath LLP

One Logan Square

18th & Cherry Streets

Philadelphia, Pennsylvania 19103-6996

(Name and address of agent for service)

Registrant’s Telephone Number, including Area Code: (800) 624-4190

Date of fiscal year end: December 31

Date of reporting period: June 30, 2009

Item 1. Reports to Stockholders.

The following is a copy of the report to shareholders pursuant to Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1).

Semi-Annual Report to Stockholders June 30, 2009 |

SUSPENSION OF MANAGED DISTRIBUTION POLICY

The Fund issued a press release on May 4, 2009, followed by a letter to stockholders. Both the press release and letter stated that on May 1, 2009, your Board of Directors concluded that it was in the best interest of stockholders to suspend the Fund’s managed distribution policy effective immediately. The managed distribution policy, which is at the discretion of the Board of Directors, has been in place since 1989. The policy of making quarterly distributions to stockholders of an amount equal to 2.5% of the Fund’s net asset value was first implemented in 1997.

The Board took this action after considering a number of factors including, but not limited to, the outlook for the overall economy, an assessment of investment opportunities, the asset size and expense ratio of the Fund and the negative impact that the policy may have on the asset level and expense ratio. The Fund will continue to pay out any net investment income and net realized capital gains on an annual basis. As always, the Board will continue to evaluate its distribution policy.

In addition, in an effort to reduce Fund expenses the Board decided to prepare only two stockholder reports annually: the Fund’s Annual and Semi-Annual Reports. Stockholders may continue to review the investment adviser commentary and the Fund’s monthly holdings on its website at www.blu.com.

The Board appreciates your understanding of these difficult decisions and the confidence you have placed in the Fund.

| 1-800-624-4190 ▪ www.blu.com | 1 |

INVESTMENT ADVISER’S COMMENTARY

| Dear Fellow Stockholders: | August 4, 2009 |

The stock market began a sustained rebound in March after a dismal start to 2009. For the six months ended June 30, 2009 Blue Chip Value Fund, Inc.’s net asset value was up 9.70%, outperforming the S&P 500 Index, the Fund’s benchmark index, which was up 3.16%. The Fund also outperformed the Lipper Large Cap Core index which was up 5.35% for the same period.

The Fund’s relative outperformance during the period came from strong stock selection combined with maintaining approximately 10% leverage despite the uncertain markets.

Turning to the portfolio, the stock with the highest contribution to the Fund’s return during the period was Transocean, an offshore drilling contractor. Transocean provided strong returns within the energy sector. In our 2008 Annual Report, we wrote that we believed Transocean had underperformed due to expectations that long-term contracts for its offshore drilling rigs would be cancelled. Now, six months later, drilling contracts continue to produce meaningful cash flow. This along with recovering commodity prices appears to have given the market reason to be more positive about the stock.

Expedia, an online travel service company was another top performer in the consumer cyclical sector. We believe that economic stabilization in the first half of the year gave investors increased confidence that the company’s business would continue to be profitable.

Quanta Services, a commercial services contractor for electric utility services, benefited from infrastructure spending and the ongoing demand for power distribution. This offset economic weaknesses in other areas of its business. Infrastructure spending allowed Quanta to hold earnings and cash flow relatively constant.

The precipitous economic slowing contributed to the poor performance of Fund holding Norfolk Southern. We believe that increased shipping activity will again allow Norfolk to improve earnings and capitalize on operational improvements that it has achieved over the last several years.

Another disappointment was Abbott Laboratories. Its stock price was down after it reported weaker than expected first quarter earnings. Sales of Humira were weaker than expected due to the high cost of the drug into the foreseeable future. We believe prescriptions for Humira will rebound and the company’s new products coming to market should lead to greater free cash flow generation.

Defense contractor Raytheon’s performance lagged that of other names in the capital goods sector. It appears to us that investors are anticipating a slowdown in defense spending over the coming years and have found other areas in which to invest. We believe that Raytheon’s stock price reflects overly pessimistic views of defense funding and expect the stock price to recover.

| 2 | Semi-Annual Report June 30, 2009 |

We continue to prefer the consumer cyclicals, commercial services and technology sectors where we focus on companies we believe have good balance sheets and the ability to generate attractive levels of free cash flow. This has resulted in the portfolio being overweight in these sectors as compared to the S&P 500. We view typically defensive sectors like consumer staples with caution because we believe prices are still high. Until the direction of healthcare reform becomes clearer, we remain cautious in this sector as well.

At the end of the first quarter we began seeing signs that the rate of decline in the economy was beginning to stabilize. The trends that we saw have generally continued, and we believe the likelihood is now that the economy will start to show positive growth over the next several months. While we are cautiously optimistic, we continue to watch for risks that could change the economic outlook. As always, our focus remains on constructing a diversified portfolio of attractively priced, high-quality stocks based on our rigorous research.

We appreciate the confidence you have placed in us.

Sincerely,

Todger Anderson, CFA

President, Blue Chip Value Fund, Inc.

Chairman, Denver Investment Advisors LLC

The Investment Adviser’s Commentary included in this report contains certain forward-looking statements about the factors that may affect the performance of the Fund in the future. These statements are based on Fund management’s predictions and expectations concerning certain future events and their expected impact on the Fund, such as performance of the economy as a whole and of specific industry sectors, changes in the levels of interest rates, the impact of developing world events, and other factors that may influence the future performance of the Fund. Management believes these forward-looking statements to be reasonable, although they are inherently uncertain and difficult to predict. Actual events may cause adjustments in portfolio management strategies from those currently expected to be employed..

| 1-800-624-4190 ▪ www.blu.com | 3 |

| Sector Diversification in Comparison to |

| S&P 500 as of June 30, 2009* |

| | | |

| | Fund | | S&P 500 | |

| Basic Materials | 3.6% | | 2.7% | |

| Capital Goods | 5.1% | | 7.2% | |

| Commercial Services | 6.1% | | 2.3% | |

| Communications | 8.8% | | 8.3% | |

| Consumer Cyclical | 13.2% | | 11.7% | |

| Consumer Staples | 7.5% | | 11.2% | |

| Energy | 13.3% | | 12.0% | |

| Interest Rate Sensitive | 9.9% | | 11.6% | |

| Medical/Healthcare | 13.0% | | 13.4% | |

| REITs | 0.0% | | 0.9% | |

| Technology | 14.0% | | 12.7% | |

| Transportation | 2.3% | | 2.0% | |

| Utilities | 2.4% | | 4.0% | |

| Short-Term Investments | 0.8% | | 0.0% | |

| *Sector diversification percentages are based on the Fund’s total investments at market value. Sector diversification is subject to change and may not be representative of future investments. |

| Return | 3 Mos. | Year-To-

Date | 1-Year | 3-Year | 5-Year | 10-Year |

| Blue Chip Value Fund – NAV | 17.86% | 9.70% | (17.81%) | (8.31%) | (1.73%) | (0.93%) |

| Blue Chip Value Fund – | | | | | | |

| Market Price | 15.86% | 9.94% | (37.67%) | (15.17%) | (8.75%) | (2.61%) |

| S&P 500 Index | 15.93% | 3.16% | (26.21%) | (8.22%) | (2.24%) | (2.22%) |

Past performance is no guarantee of future results. Share prices will fluctuate, so that a share may be worth more or less than its original cost when sold. Total investment return is calculated assuming a purchase of common stock on the opening of the first day and a sale on the closing of the last day of each period reported. Dividends and distributions, if any, are assumed for purposes of this calculation to be reinvested at prices obtained under the Fund’s dividend reinvestment plan. Rights offerings, if any, are assumed for purposes of this calculation to be fully subscribed under the terms of the rights offering. Please note that the Fund’s total return shown above does not reflect the deduction of taxes that a stockholder would pay on Fund distributions or the cost of sale of Fund shares. Current performance may be higher or lower than the total return shown above. Please visit our website at www.blu.com to obtain the most recent month end returns. Generally, total investment return based on net asset value will be higher than total investment return based on market value in periods where there is an increase in the discount or a decrease in the premium of the market value to the net asset value from the beginning to the end of such periods. Conversely, total investment return based on the net asset value will be lower than total investment return based on market value in periods where there is a decrease in the discount or an increase in the premium of the market value to the net asset value from the beginning to the end of such periods. The Fund’s annualized gross expense ratio for the six months ended June 30, 2009 was 1.46%.

|

| 4 | Semi-Annual Report June 30, 2009 |

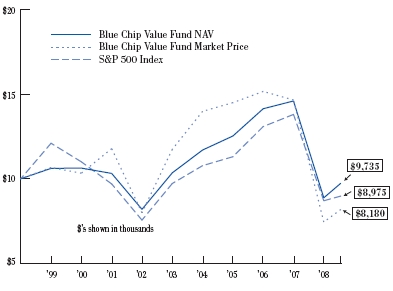

Comparison of Change in Value of $10,000 Investment in

Blue Chip Value Fund versus the S&P 500 Index |

|

This chart compares the change in market price and net asset value of an investment of $10,000 in the Fund since January 1, 1999, compared to the S&P 500 Index. The comparison assumes the reinvestment of all distributions and full participation in any "rights offerings" during the period.

Please Note: Performance calculations are as of the end of December each year and the current period end. Past performance is not indicative of future results. This chart assumes an investment of $10,000 on 1/1/99. This chart does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

S&P 500 Index is a broad-based measurement of changes in stock market conditions based on the average performance of 500 widely held common stocks. It is an unmanaged index.

Please see Average Annual Total Return information and disclosures on page 4. |

| 1-800-624-4190 ▪ www.blu.com | 5 |

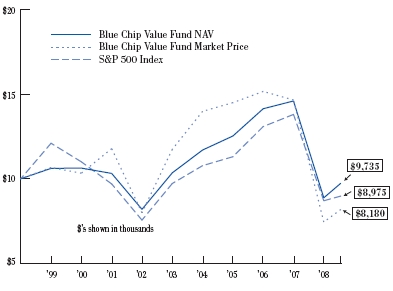

History of Market Price and Net Asset Value

January 1, 1999 through June 30, 2009 |

|

This chart shows the change in the Fund’s market price and net asset value on a per share basis since January 1, 1999, along with the annual distribution totals. Fund management believes this information is useful for those stockholders who have elected to receive their distributions in cash in evaluating their investment in the Fund.

Please Note: line graph points are as of the end of each calendar quarter.

Past performance is no guarantee of future results. Share prices will fluctuate, so that a share may be worth more or less than its original cost when sold.

1Reflects the actual market price of one share as it has traded on the NYSE.

2Reflects the actual NAV of one share.

3The graph above includes the distribution totals since January 1, 1999, which equal $7.16 per share. In May 2009 the Fund suspended its Managed Distribution Policy. Only one distribution has been paid for the six months ended June 30, 2009. The NAV per share is reduced by the amount of the distribution on the ex-dividend date. The sources of these distributions are depicted in the chart on the next page. |

| 6 | Semi-Annual Report June 30, 2009 |

| HISTORICAL SOURCES OF DISTRIBUTIONS |

Year | Net

Investment

Income | Capital

Gains | Return of

Capital | Total Total

Amount of Amount of

Distribution Distribution

(Tax Basis) | Total Total

Amount of Amount of

Distribution Distribution

(Book Basis) |

1999 | $0.0335 | $1.6465 | $0.0000 | $1.68 | $1.68 |

2000 | $0.0530 | $0.8370 | $0.0000 | $0.89 | $0.89 |

2001 | $0.0412 | $0.3625 | $0.3363 | $0.74 | $0.74 |

2002 | $0.0351 | $0.0000 | $0.5249 | $0.56 | $0.56 |

2003 | $0.0136 | $0.0000 | $0.4964 | $0.51 | $0.51 |

2004 | $0.0283 | $0.5317 | $0.0000 | $0.56 | $0.56 |

2005 | $0.0150 | $0.1128 | $0.4422 | $0.57 | $0.57 |

2006 | $0.0182 | $0.1260 | $0.4358 | $0.58 | $0.58 |

2007 | $0.0146 | $0.2118 | $0.2136 | $0.44 | $0.58 |

2008 | $0.0180 | $0.0073 | $0.4647 | $0.49 | $0.42 |

2009 (estimated) | $0.0093 | $0.0000 | $0.1307 | $0.14 | $0.07 |

Totals | $0.2798 | $3.8356 | $3.0446 | $7.16 | $7.16 |

% of Total | | | | | |

Distribution. | 3.91% | 53.57% | 42.52% | 100% | |

Pursuant to Section 852 of the Internal Revenue Code, the taxability of the $0.07 per share distribution in the 4th quarter of 2008 has been deferred until 2009.

| 1-800-624-4190 ▪ www.blu.com | 7 |

DIVIDEND REINVESTMENT AND CASH PURCHASE PLAN

The Blue Chip Value Fund Inc.’s (the “Fund”) Dividend Reinvestment and Cash Purchase Plan (the “Plan”) offers stockholders the opportunity to reinvest the Fund’s dividends and distributions in additional shares of the Fund. A stockholder may also make additional cash investments under the Plan.

Participating stockholders will receive additional shares issued at a price equal to the net asset value per share as of the close of the New York Stock Exchange on the record date (“Net Asset Value”), unless at such time the Net Asset Value is higher than the market price of the Fund’s common stock plus brokerage commission. In this case the Fund, through BNY Mellon Shareowner Services, (the “Plan Administrator”) will attempt, generally over the next 10 business days (the “Trading Period”), to acquire shares of the Fund’s common stock in the open market at a price plus brokerage commission which is less than the Net Asset Value. In the event that prior to the time such acquisition is completed, the market price of such common stock plus commission equals or exceeds the Net Asset Value, or in the event that such market purchases are unable to be completed by the end of the Trading Period, then the balance of the distribution shall be completed by issuing additional shares at Net Asset Value. The reinvestment price is then determined by the weighted average price per share, including trading fees, of the shares issued by the Fund and/or acquired by the Plan Administrator in connection with that transaction.

Participating stockholders may also make additional cash investments (minimum $50 and maximum $10,000 per month) to acquire additional shares of the Fund. Please note, however, that these additional shares will be purchased at market value plus brokerage commission (without regard to net asset value) per share. The transaction price of shares and fractional shares acquired on the open market for each participant’s account in connection with the Plan shall be determined by the weighted average price per share, including trading fees, of the shares acquired by the Plan Administrator in connection with that transaction.

A registered stockholder may join the Plan by completing an Enrollment Form from the Plan Administrator. The Plan Administrator will hold the shares acquired through the Plan in book-entry form, unless you request share certificates. If your shares are registered with a broker, you may still be able to participate in the Fund’s Dividend Reinvestment and Cash Purchase Plan. Please contact your broker about how to reregister your shares through the Direct Registration System (“DRS”) and to inquire if there are any fees which may be charged by the broker to your account.

The automatic reinvestment of dividends and distributions will not relieve participants of any income taxes that may be payable (or required to be withheld) on dividends or distributions, even though the stockholder does not receive the cash.

| 8 | Semi-Annual Report June 30, 2009 |

A stockholder may elect to withdraw from the Plan at any time on prior written notice, and receive future dividends and distributions in cash. There is no penalty for withdrawal from the Plan and stockholders who have withdrawn from the Plan may rejoin in the future. In addition, you may request the Plan Administrator to sell all or a portion of your shares. When your shares are sold, you will receive the proceeds less a service charge of $15.00 and trading fees of $0.02 per share. The Plan Administrator will generally sell your shares on the day your request is received in good order, however the Plan Administrator reserves the right to take up to 5 business days to sell your shares. Shares will be aggregated by the Plan Administrator with the shares of other participants selling their shares that day and sold on the open market. A participant will receive the weighted average price minus trading fees and service charges of all liquidated shares sold by the Plan Administrator on the transaction date.

The Fund may amend the Plan at any time upon 30-days prior notice to participants.

Additional information about the Plan may be obtained from the Plan Administrator by writing to BNY Mellon Shareowner Services, 480 Washington Blvd., Jersey City, NJ 07310, by telephone at (800) 624-4190 (option #1) or by visiting the Plan Administrator at www.bnymellon.com/shareowner.

BLUE CHIP VALUE FUND BOARD CONSIDERATIONS RELATING TO THE ADVISORY CONTRACT RENEWAL

The Board of Directors of the Fund decided on February 12, 2009 whether to renew the Advisory Agreement with Denver Investments (the “Agreement”). Prior to making its determination, the Board received detailed information from Denver Investments, including, among other things, information provided by an independent rating and ranking organization and Denver Investments comparing the performance, advisory fee and other expenses of the Fund to that of relevant peer groups identified by the organization and the Fund’s benchmark and information responsive to requests by the Fund’s independent counsel for certain information to assist the Board in its considerations, including Denver Investments’ Form ADV. In addition, the Board reviewed a memorandum from its independent counsel detailing the Board’s duties and responsibilities in considering renewal of the Agreement.

In reaching its decision to renew the Agreement, the Board, including a majority of the Directors who are not interested persons under the Investment Company Act of 1940 (the “Independent Directors”), considered, among other things: (i) the nature, extent and quality of Denver Investments’ services provided to the Fund, Denver Investments’ compliance culture and resources committed to its compliance program; (ii) the experience and qualifications of the portfolio management team; (iii) Denver Investments’ investment philosophy and process; (iv) Denver Investments’ assets under management and client descriptions; (v) Denver Investments’ brokerage and soft dollar commission reports; (vi) current advisory fee arrangement with the Fund

| 1-800-624-4190 ▪ www.blu.com | 9 |

and Denver Investments’ other similarly managed mutual fund client, noting that Denver Investments did not provide advisory fee information on its other separate account clients, because those clients are not managed similarly to the Fund’s large cap value style; (vii) independent rating and ranking organization information comparing the Fund’s performance, advisory fee and other expenses to those of comparable funds; (viii) information provided by Denver Investments on the Fund’s performance in relation to its benchmark index and Denver Investments’ composite large-cap core performance; (ix) Denver Investments’ financial statements, Form ADV, profitability analysis related to providing advisory and administrative services to the Fund; (x) the level of Denver Investments’ insurance coverage; (xi) compensation and possible benefits to Denver Investments and its affiliates arising from their advisory, administrative and other relationships with the Fund; and (xii) the extent to which economies of scale are relevant to the Fund.

During the course of its deliberations, the Board, including a majority of Independent Directors, reached the following conclusions, among others, regarding Denver Investments and the Agreement: that Denver Investments had the capabilities, resources and personnel necessary to manage the Fund; that the performance of the Fund over the last 1, 3, 5 and 9 year periods was generally competitive with that of its peer groups, benchmark index and Denver Investments’ composite large-cap core performance; the advisory fee is competitive with that of its peer groups, consistent with Denver Investments’ other similarly managed mutual fund client and is fair and reasonable; that the combined advisory and co-administration fee payable to Denver Investments is also competitive with that of its peer group; the Fund’s expense ratio, without interest expense from the line of credit, is favorable compared to the peer group averages. The Board determined that it was reasonable to factor out the interest expense on the Fund’s expenses and performance to those of the peer group because none of these funds incur interest expense. The Board also concluded that the expected profit to Denver Investments for advisory and administrative services seemed reasonable based on the data Denver Investments provided; that the benefits derived by Denver Investments from managing the Fund, including how Denver Investments uses soft-dollars, and the ways in which it conducts portfolio transactions for the Fund and selects brokers are reasonable; and that the breakpoints in the advisory and administrative fees payable to Denver Investments allow shareholders to benefit from economies of scale as the Fund’s asset level increases.

Based on the factors considered, the Board, including a majority of the Independent Directors, concluded that it was appropriate to renew the Agreement.

| 10 | Semi-Annual Report June 30, 2009 |

OTHER IMPORTANT INFORMATION

Notice is hereby given in accordance with Section 23(c) of the Investment Company Act of 1940 that the Fund may purchase, from time to time, shares of its common stock on the open market.

How to Obtain a Copy of the Fund’s Proxy Voting Policies and Records

A description of the policies and procedures that are used by the Fund’s investment adviser to vote proxies relating to the Fund’s portfolio securities is available (1) without charge, upon request, by calling (800) 624-4190; (2) on the Fund’s website at www.blu.com and (3) on the Fund’s Form N-CSR which is available on the U.S. Securities and Exchange Commission (“SEC”) website at www.sec.gov.

Information regarding how the Fund’s investment adviser voted proxies relating to the Fund’s portfolio securities during the most recent 12-month period ended June 30 is available, (1) without charge, upon request by calling (800) 624-4190; (2) on the Fund’s website at www.blu.com and (3) on the SEC website at www.sec.gov.

Quarterly Portfolio Holdings

The Fund files its complete schedule of portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-Q. The Fund’s Forms N-Q are available on the SEC’s website at www.sec.gov and may be reviewed and copied at the SEC’s Public Reference Room in Washington, D.C. Information on the operation of the SEC’s Public Reference Room may be obtained by calling 1-800-SEC-0330. In addition, the Fund’s complete schedule of portfolio holdings for the first and third quarters of each fiscal year is available on the Fund’s website at www.blu.com.

Send Us Your E-mail Address

If you would like to receive monthly portfolio composition and characteristic updates, press releases and financial reports electronically as soon as they are available, please send an e-mail to blu@denvest.com and include your name and e-mail address. You will still receive paper copies of any required communications and reports in the mail. This service is completely voluntary and you can cancel at any time by contacting us via e-mail at blu@denvest.com or toll-free at 1-800-624-4190.

| 1-800-624-4190 ▪ www.blu.com | 11 |

| BLUE CHIP VALUE FUND, INC. | | | | | |

| | | | | | |

| STATEMENT OF INVESTMENTS | | | | |

| June 30, 2009 (Unaudited) | | | | | | | |

| | | | | | | | Market |

| | Shares | | | Cost | | | Value |

| COMMON STOCKS – 111.34% | | | | | | | |

| BASIC MATERIALS – 6.19% | | | | | | | |

| Forestry & Paper – 4.55% | | | | | | | |

| Ball Corp. | 41,940 | | | $ | 2,200,539 | | | $ | 1,894,010 |

| International Paper Co. | 138,600 | | | 2,411,801 | | | 2,097,018 |

| | | | | 4,612,340 | | | 3,991,028 |

| Specialty Chemicals – 1.64% | | | | | | | |

| The Mosaic Co. | 32,500 | | | 1,409,579 | | | 1,439,750 |

| TOTAL BASIC MATERIALS | | | | 6,021,919 | | | 5,430,778 |

| CAPITAL GOODS – 5.28% | | | | | | | |

| Aerospace & Defense – 2.97% | | | | | | | |

| General Dynamics Corp. | 22,100 | | | 1,145,929 | | | 1,224,119 |

| Raytheon Co. | 31,000 | | | 1,376,871 | | | 1,377,330 |

| | | | | 2,522,800 | | | 2,601,449 |

| Industrial Products – 2.31% | | | | | | | |

| ITT Corp. | 45,500 | | | 2,466,884 | | | 2,024,750 |

| TOTAL CAPITAL GOODS | | | | 4,989,684 | | | 4,626,199 |

| COMMERCIAL SERVICES – 6.06% | | | | | | | |

| Business Products & Services – 2.98% | | | | | | | |

| Quanta Services Inc.** | 113,000 | | | 3,475,189 | | | 2,613,690 |

| IT Services – 1.57% | | | | | | | |

| Computer Sciences Corp.** | 31,050 | | | 1,460,059 | | | 1,375,515 |

| Transaction Processing – 1.51% | | | | | | | |

| The Western Union Co. | 81,000 | | | 1,341,107 | | | 1,328,400 |

| TOTAL COMMERCIAL SERVICES | | | | 6,276,355 | | | 5,317,605 |

| COMMUNICATIONS – 9.90% | | | | | | | |

| Networking – 4.52% | | | | | | | |

| Cisco Systems Inc.** | 212,500 | | | 5,209,726 | | | 3,961,000 |

| Telecomm Equipment & Solutions – 5.38% | | | | | | |

| Nokia Corp. – ADR (Finland) | 72,230 | | | 1,081,638 | | | 1,053,113 |

| QUALCOMM Inc. | 81,200 | | | 3,437,813 | | | 3,670,240 |

| | | | | 4,519,451 | | | 4,723,353 |

| TOTAL COMMUNICATIONS | | | | 9,729,177 | | | 8,684,353 |

| CONSUMER CYCLICAL – 12.45% | | | | | | | |

| Apparel & Footwear Manufacturers – 1.84% | | | | | | |

| Nike Inc. | 31,150 | | | 1,956,597 | | | 1,612,947 |

| Clothing & Accessories – 1.61% | | | | | | | |

| TJX Companies Inc. | 44,900 | | | 1,208,551 | | | 1,412,554 |

| | | | | | | | |

| | | | | | | | |

| 12 | Semi-Annual Report June 30, 2009 |

| STATEMENT OF INVESTMENTS (cont’d.) | | | | |

| | | | | | Market |

| | Shares | | Cost | | Value |

| Hotels & Gaming – 0.55% | | | | | | | |

| Starwood Hotels & Resorts Worldwide Inc. | 21,700 | | $ | 829,353 | | $ | 481,740 |

| Other Consumer Services – 1.94% | | | | | | | |

| Expedia Inc.** | 112,400 | | | 2,749,931 | | | 1,698,364 |

| Publishing & Media – 2.49% | | | | | | | |

| Walt Disney Co. | 93,500 | | | 2,319,585 | | | 2,181,355 |

| Restaurants – 2.25% | | | | | | | |

| Darden Restaurants Inc. | 59,940 | | | 1,485,485 | | | 1,976,821 |

| Specialty Retail – 1.77% | | | | | | | |

| Best Buy Co. Inc | 46,300 | | | 1,992,323 | | | 1,550,587 |

| TOTAL CONSUMER CYCLICAL | | | | 12,541,825 | | | 10,914,368 |

| | | | | | | | |

| CONSUMER STAPLES – 7.77% | | | | | | | |

| Consumer Products – 2.94% | | | | | | | |

| Colgate Palmolive Co. | 36,400 | | | 2,367,041 | | | 2,574,936 |

| Food & Agricultural Products – 4.83% | | | | | | | |

| Campbell Soup Co. | 67,900 | | | 2,476,554 | | | 1,997,618 |

| Unilever N.V. (Netherlands) | 92,700 | | | 3,284,852 | | | 2,241,486 |

| | | | | 5,761,406 | | | 4,239,104 |

| TOTAL CONSUMER STAPLES | | | | 8,128,447 | | | 6,814,040 |

| | | | | | | | |

| ENERGY – 15.48% | | | | | | | |

| Exploration & Production – 7.48% | | | | | | | |

| Occidental Petroleum Corp. | 59,180 | | | 3,163,301 | | | 3,894,637 |

| XTO Energy Inc. | 69,837 | | | 2,100,865 | | | 2,663,583 |

| | | | | 5,264,166 | | | 6,558,220 |

| Integrated Oils – 4.64% | | | | | | | |

| ConocoPhillips | 9,600 | | | 463,583 | | | 403,776 |

| Exxon Mobil Corp. | 18,000 | | | 1,365,034 | | | 1,258,380 |

| Marathon Oil Corp. | 79,800 | | | 2,494,045 | | | 2,404,374 |

| | | | | 4,322,662 | | | 4,066,530 |

| Oil Services – 3.36% | | | | | | | |

| Transocean Inc. (Switzerland)** | 39,649 | | | 3,471,042 | | | 2,945,524 |

| TOTAL ENERGY | | | | 13,057,870 | | | 13,570,274 |

| | | | | | | | |

| INTEREST RATE SENSITIVE – 13.52% | | | | | | | |

| Integrated Financial Services – 3.39% | | | | | | | |

| JPMorgan Chase & Co. | 87,100 | | | 3,201,943 | | | 2,970,981 |

| Money Center Banks – 1.83% | | | | | | | |

| Bank of America Corp. | 121,200 | | | 1,389,691 | | | 1,599,840 |

| Property Casualty Insurance – 2.96% | | | | | | | |

| ACE Ltd. (Switzerland) | 38,700 | | | 2,087,882 | | | 1,711,701 |

| The Travelers Cos. Inc. | 21,500 | | | 904,597 | | | 882,360 |

| | | | | 2,992,479 | | | 2,594,061 |

| 1-800-624-4190 ▪ www.blu.com | 13 |

| STATEMENT OF INVESTMENTS (cont’d.) | | | | | |

| | | | | | Market | |

| | Shares | | Cost | | Value | |

| Regional Banks – 2.36% | | | | | | | | |

| The Bank of New York Mellon | 38,400 | | $ | 1,257,450 | | $ | 1,125,504 | |

| SunTrust Banks Inc. | 57,400 | | | 908,207 | | | 944,230 | |

| | | | | 2,165,657 | | | 2,069,734 | |

| Securities & Asset Management – 2.98% | | | | | | | | |

| Invesco Ltd. | 56,200 | | | 1,370,566 | | | 1,001,484 | |

| State Street Corp. | 34,200 | | | 2,116,114 | | | 1,614,240 | |

| | | | | 3,486,680 | | | 2,615,724 | |

| TOTAL INTEREST RATE SENSITIVE | | | | 13,236,450 | | | 11,850,340 | |

| | | | | | | | | |

| MEDICAL & HEALTHCARE – 12.99% | | | | | | | | |

| Medical Technology – 2.38% | | | | | | | | |

| Zimmer Holdings Inc.** | 49,000 | | | 3,345,140 | | | 2,087,400 | |

| Pharmaceuticals – 10.61% | | | | | | | | |

| Abbott Laboratories | 53,000 | | | 2,802,905 | | | 2,493,120 | |

| Amgen Inc.** | 54,500 | | | 3,131,118 | | | 2,885,230 | |

| Forest Laboratories Inc.** | 80,000 | | | 1,909,272 | | | 2,008,800 | |

| Wyeth | 42,100 | | | 1,612,871 | | | 1,910,919 | |

| | | | | 9,456,166 | | | 9,298,069 | |

| TOTAL MEDICAL & HEALTHCARE | | | | 12,801,306 | | | 11,385,469 | |

| | | | | | | | | |

| TECHNOLOGY – 15.21% | | | | | | | | |

| Computer Software – 4.53% | | | | | | | | |

| Microsoft Corp. | 88,300 | | | 2,318,118 | | | 2,098,891 | |

| Symantec Corp.** | 120,300 | | | 2,195,749 | | | 1,871,868 | |

| | | | | 4,513,867 | | | 3,970,759 | |

| PC’s & Servers – 5.38% | | | | | | | | |

| Dell Inc.** | 115,500 | | | 1,813,417 | | | 1,585,815 | |

| International Business Machines Corp. | 30,000 | | | 2,749,830 | | | 3,132,600 | |

| | | | | 4,563,247 | | | 4,718,415 | |

| Semiconductors – 5.30% | | | | | | | | |

| Altera Corp. | 153,900 | | | 2,972,728 | | | 2,505,492 | |

| Intel Corp. | 129,100 | | | 2,486,977 | | | 2,136,605 | |

| | | | | 5,459,705 | | | 4,642,097 | |

| TOTAL TECHNOLOGY | | | | 14,536,819 | | | 13,331,271 | |

| | | | | | | | | |

| TRANSPORTATION – 2.55% | | | | | | | | |

| Railroads – 2.55% | | | | | | | | |

| Norfolk Southern Corp. | 59,300 | | | 3,122,554 | | | 2,233,831 | |

| TOTAL TRANSPORTATION | | | | 3,122,554 | | | 2,233,831 | |

| | | | | | | | | |

| UTILITIES – 3.94% | | | | | | | | |

| Independent Power – 1.63% | | | | | | | | |

| PPL Corp. | 43,450 | | | 1,999,930 | | | 1,432,112 | |

| 14 | Semi-Annual Report June 30, 2009 |

| STATEMENT OF INVESTMENTS (cont’d.) | | | | | |

| | | | | | Market | |

| | Shares | | Cost | | Value | |

| Regulated Electric – 2.31% | | | | | | | | |

| Edison International | 64,200 | | $ | 1,824,166 | | $ | 2,019,732 | |

| TOTAL UTILITIES | | | | 3,824,096 | | | 3,451,844 | |

| TOTAL COMMON STOCKS | | | | 108,266,502 | | | 97,610,372 | |

| | | | | | | | | |

| SHORT TERM INVESTMENTS – 0.42% | | | | | | | |

| Fidelity Institutional Money Market | | | | | | | | |

| Government Portfolio – Class I | | | | | | | | |

| (7 Day Yield 0.26%)(1) | 370,648 | | | 370,648 | | | 370,648 | |

| TOTAL SHORT TERM INVESTMENTS | | | | 370,648 | | | 370,648 | |

| | | | | | | | | |

| TOTAL INVESTMENTS | 111.76% | | $ | 108,637,150 | | $ | 97,981,020 | |

| Liabilities in Excess of Other Assets | (11.76)% | | | | | | (10,312,713) | |

| NET ASSETS | 100.00% | | | | | $ | 87,668,307 | |

| | | | | | | | | |

| **Non-dividend paying stock | |

| (1)Investments in other funds are calculated at their respective net asset values as determined by those funds, in accordance with the Investment Company Act of 1940. | |

| ADR – American Depositary Receipt | |

| Sector and industry classifications presented herein are based on the sector and industry categorization methodology of the Investment Adviser to the Fund. | |

| | | | | |

| COUNTRY BREAKDOWN | | | | | |

| As of June 30, 2009 (Unaudited) | | | | | |

| | Market | | | |

| Country | Value | | % | |

| United States | $ | 90,029,196 | | 102.69% | |

| Switzerland | | 4,657,225 | | 5.31% | |

| Netherlands | | 2,241,486 | | 2.56% | |

| Finland | | 1,053,113 | | 1.20% | |

| Total Investments | $ | 97,981,020 | | 111.76% | |

| Liabilities in Excess of Other Assets | (10,312,713) | | (11.76%) | |

| Net Assets | $ | 87,668,307 | | 100.00% | |

| | | | | | |

| Please note the country classification is based on the company headquarters. All of the Fund’s investments are traded on U.S. exchanges. | |

| | | | | | |

| See accompanying notes to financial statements. | | | | | |

| 1-800-624-4190 ▪ www.blu.com | 15 |

| BLUE CHIP VALUE FUND, INC. | | |

| | | |

STATEMENT OF ASSETS AND LIABILITIES

| | |

| June 30, 2009 (Unaudited) | | |

| | | |

| ASSETS | | |

| Investments at market value (cost $108,637,150) | $ | 97,981,020 |

| Dividends and interest receivable | | 94,261 |

| Other assets | | 21,381 |

TOTAL ASSETS | | 98,096,662 |

| | | |

| LIABILITIES | | |

| Loan payable to bank (Note 5) | | 10,325,000 |

| Interest due on loan payable to bank | | 11,147 |

| Advisory fee payable | | 47,411 |

| Administration fee payable | | 7,125 |

| Accrued Compliance Officer fees compensation | | 3,017 |

| Accrued expenses and other liabilities | | 34,655 |

TOTAL LIABILITIES | | 10,428,355 |

| NET ASSETS | $ | 87,668,307 |

| | | |

| COMPOSITION OF NET ASSETS | | |

| Capital stock, at par | $ | 284,639 |

| Paid-in-capital | | 110,022,585 |

| Undistributed net investment income | | 264,886 |

| Accumulated net realized loss | | (10,254,442) |

| Net unrealized depreciation on investments | | (10,656,130) |

| Undesignated distributions (Note 1) | | (1,993,231) |

| NET ASSETS | $ | 87,668,307 |

| | | |

| SHARES OF COMMON STOCK OUTSTANDING | | |

(100,000,000 shares authorized at $0.01 par value) | | 28,463,912 |

| | | |

| Net asset value per share | $ | 3.08 |

| | | |

| See accompanying notes to financial statements. | | |

| 16 | Semi-Annual Report June 30, 2009 |

BLUE CHIP VALUE FUND, INC.

STATEMENT OF OPERATIONS

For the Six Months Ended June 30, 2009 (Unaudited) | | | |

| | | | |

INCOME | | | |

Dividends (net of foreign withholding taxes of $15,487) | $ | 843,374 | | |

Interest | 727 | | |

TOTAL INCOME | | | $ | 844,101 |

EXPENSES | | | |

Investment advisory fee (Note 4) | 257,980 | | |

Administrative services fee (Note 4) | 40,376 | | |

Interest on outstanding loan payable to bank | 65,772 | | |

Legal fees | 44,749 | | |

Directors’ fees | 43,687 | | |

Stockholder reporting | 37,192 | | |

Transfer agent fees | 32,233 | | |

Audit and tax preparation fees | 14,663 | | |

NYSE listing fees | 13,725 | | |

Chief Compliance Officer compensation | 10,674 | | |

Insurance and fidelity bond | 10,602 | | |

Custodian fees | 4,760 | | |

Other | 2,802 | | |

| TOTAL EXPENSES | | | 579,215 |

| NET INVESTMENT INCOME | | | 264,886 |

| REALIZED AND UNREALIZED GAIN/(LOSS) | | | |

| ON INVESTMENTS | | | (8,699,166) |

| Net realized loss on investments | | | |

| Change in net unrealized appreciation or | | | |

| depreciation of investments | | | 15,816,806 |

NET REALIZED AND UNREALIZED GAIN | | | |

| ON INVESTMENTS | | | 7,117,640 |

| NET INCREASE IN NET ASSETS | | | |

| RESULTING FROM OPERATIONS | | | $ | 7,382,526 |

| | | | |

See accompanying notes to financial statements.

| 1-800-624-4190 ▪ www.blu.com | 17 |

| BLUE CHIP VALUE FUND, INC. | | | | |

| | | | | |

| STATEMENTS OF CHANGES IN NET ASSETS | | |

| | | For the | | For the |

| | | Six Months Ended | | Year Ended |

| | | June 30, 2009 | | December 31, |

| | | (Unaudited) | | 2008 |

| Increase/(decrease) in net assets | | | | | |

| from operations: | | | | | |

| Net investment income | $ | 264,886 | | $ | 510,959 |

| Net realized gain/(loss) on investments | | (8,699,166) | | | 248,725 |

| Change in net unrealized appreciation | | | | | |

| or depreciation of investments | | 15,816,806 | | | (58,762,315) |

| | | | 7,382,526 | | | (58,002,631) |

| | | | | | | |

| Decrease in net assets from distributions | | | | | |

| to stockholders from: | | | | | |

| Net investment income | | 0 | | | (510,959) |

| Net realized gain on investments | | 0 | | | (208,973) |

| Tax return of capital | | 0 | | | (11,232,334) |

| Undesignated (Note 1) | | (1,993,231) | | | 0 |

| | | | (1,993,231) | | | (11,952,266) |

| | | | | | | |

| Increase in net assets from common | | | | | |

| stock transactions: | | | | | |

| Net asset value of common stock issued to | | | | | |

| stockholders from reinvestment of dividends | | | | | |

| (0 and 29,014 shares issued, respectively) | | 0 | | | 142,459 |

| | | | 0 | | | 142,459 |

| | | | | | | |

| NET INCREASE/(DECREASE) IN NET ASSETS | | 5,389,295 | | | (69,812,438) |

| | | | | | | |

| NET ASSETS | | | | | | |

| Beginning of year | | 82,279,012 | | | 152,091,450 |

| End of year (including undistributed net investment | | | | | |

| income of $264,886 and $0, respectively) | $ | 87,668,307 | | $ | 82,279,012 |

| | | | | | | |

| See accompanying notes to financial statements. | | | | | |

| 18 | Semi-Annual Report June 30, 2009 |

| BLUE CHIP VALUE F UND, INC. | | |

| | | |

| STATEMENT OF CASH FLOWS | | |

| | | |

| For the Six Months Ended June 30, 2009 (Unaudited) | | |

| | | |

| Cash Flows from Operating Activities | | |

| Net increase in net assets from operations | $ | 7,382,526 |

| Adjustments to reconcile net increase in net | | |

| assets from operations to net cash provided | | |

| by operating activities: | | |

| Purchase of investment securities | | (11,051,156) |

| Proceeds from disposition of investment securities | | 16,665,184 |

| Net purchase of short-term investment securities | | (78,756) |

| Proceeds from class-action litigation settlements | | 50,821 |

| Net realized loss from securities investments | | 8,699,166 |

| Net change in unrealized depreciation | | |

| on investments | | (15,816,806) |

| Decrease in dividends and interest receivable | | 131,866 |

| Increase in other assets | | (2,697) |

| Increase in advisory fee payable | | 3,737 |

| Increase in interest due on loan payable to bank | | 255 |

| Increase in administrative fee payable | | 227 |

| Decrease in accrued Compliance Officer compensation | | (1,664) |

| Decrease in other accrued expenses and payables | | (46,998) |

| Net cash provided by operating activities | | 5,935,705 |

| | | |

| Cash Flows from Financing Activities | | |

| Proceeds from bank borrowing | | 3,700,000 |

| Repayment of bank borrowing | | (5,650,000) |

| Cash distributions paid | | (3,985,705) |

| Net cash used in financing activities | | (5,935,705) |

| | | |

| Net increase in cash | | 0 |

| Cash, beginning balance | | 0 |

| Cash, ending balance | | 0 |

| | | |

| Supplemental disclosure of cash flow information: | | |

| Cash paid during the period for interest from bank borrowing $65,517. | | |

| | | |

| See accompanying notes to financial statements. | | |

| 1-800-624-4190 ▪ www.blu.com | 19 |

| BLUE CHIP VALUE FUND. INC. | | |

| | | |

| FINANCIAL HIGHLIGHTS | | |

| | Six Months |

| | Ended |

| Per Share Data | June 30, |

| (for a share outstanding throughout each period) | 2009 (Unaudited) |

| Net asset value – beginning of year | $ | 2.89 |

| Investment operations(1) | | |

| Net investment income | | 0.01 |

| Net gain/(loss) on investments | | 0.25 |

| Total from investment operations | | 0.26 |

| Distributions | | |

| From net investment income | | — |

| From net realized gains on investments | | — |

| Tax return of capital | | — |

| Undesignated | | (0.07) |

| Total distributions | | (0.07) |

| Net asset value, end of period | $ | 3.08 |

| | | |

| Per share market value, end of period | $ | 2.51 |

| | | |

| Total investment return(2) based on: | | |

| Market Value | | 9.94% |

| Net Asset Value | | 9.70% |

| Ratios/Supplemental data: | | |

| Ratio of total expenses to average net assets(3) | | 1.46%(4) |

| Ratio of net investment income to average net assets | | 0.67%(4) |

| Ratio of total distributions to average net assets | | 2.49% |

| Portfolio turnover rate(5) | | 12% |

| Net assets – end of period (in thousands) | | 87,668 |

| | | |

| | See accompanying notes to financial statements. |

| | (1) | Per share amounts calculated based on average shares outstanding during the period. |

| | (2) | Total investment return is calculated assuming a purchase of common stock on the opening of the first day and a sale on the closing of the last day of each period reported. Dividends and distributions, if any, are assumed for purposes of this calculation to be reinvested at prices obtained under the Fund’s dividend reinvestment plan. Rights offerings, if any, are assumed for purposes of this calculation to be fully subscribed under the terms of the rights offering. Please note that the Fund’s total investment return does not reflect the deduction of taxes that a stockholder would pay on Fund distributions or the sale of Fund shares. Generally, total investment return based on net asset value will be higher than total investment return based on market value in periods where there is an increase in the discount or a decrease in the premium of the market value to the net asset value from the beginning to the end of such periods. Conversely, total investment return based on the net asset value will be lower than total investment return based on market value in periods where there is a decrease in the discount or an increase in the premium of the market value to the net asset value from the beginning to the end of such periods. |

| 20 | Semi-Annual Report June 30, 2009 |

For the year ended December 31, |

| | 2008 | | | 2007 | | | 2006 | | | 2005 | | | 2004 | |

| | $ | 5.35 | | | $ | 5.73 | | | $ | 5.62 | | | $ | 5.76 | | | $ | 5.58 | |

| | | | | | | | | | | | | | | |

| | 0.02 | | | 0.01 | | | 0.02 | | | 0.01 | | | 0.03 | |

| | (2.06) | | | 0.19 | | | 0.67 | | | 0.42 | | | 0.71 | |

| | (2.04) | | | 0.20 | | | 0.69 | | | 0.43 | | | 0.74 | |

| | | | | | | | | | | | | | | |

| | (0.02) | | | (0.02) | | | (0.02) | | | (0.02) | | | (0.03) | |

| | (0.01) | | | (0.21) | | | (0.13) | | | (0.11) | | | (0.53) | |

| | (0.39) | | | (0.35) | | | (0.43) | | | (0.44) | | | — | |

| | — | | | — | | | — | | | — | | | — | |

| | (0.42) | | | (0.58) | | | (0.58) | | | (0.57) | | | (0.56) | |

| | $ | 2.89 | | | $ | 5.35 | | | $ | 5.73 | | | $ | 5.62 | | | $ | 5.76 | |

| | $ | 2.35 | | | $ | 5.21 | | | $ | 5.96 | | | $ | 6.31 | | | $ | 6.68 | |

| | | | | | | | | | | | | | | |

| | (49.27%) | | | (3.3%) | | | 4.6% | | | 3.7% | | | 19.2% | |

| | (39.25%) | | | 3.3% | | | 12.9% | | | 7.1% | | | 13.1% | |

| | | | | | | | | | | | | | | |

| | 1.38% | | | 1.34% | | | 1.36% | | | 1.33% | | | 1.12% | |

| | 0.41% | | | 0.25% | | | 0.32% | | | 0.21% | | | 0.57% | |

| | 9.51% | | | 10.04% | | | 10.25% | | | 10.13% | | | 10.16% | |

| | 51% | | | 40% | | | 37% | | | 41% | | | 115% | |

| | $ | 82,279 | | | $ | 152,091 | | | $ | 160,663 | | | $ | 155,208 | | | $ | 156,903 | |

| | | | | | | | | | | | | | | |

| (3) | For the six months ended June 30, 2009 and the years ended December 31, 2008, 2007, 2006, 2005 and 2004, the ratio of total expenses to average net assets excluding interest expense was 1.29%, 1.09%, 0.93%, 0.92%, 0.97% and 0.99%, respectively. |

| (4) | Annualized. | | | | | | | | | | | | | |

| (5) | A portfolio turnover rate is the percentage computed by taking the lesser of purchases or sales of portfolio securities (excluding short-term investments) for the year and dividing it by the monthly average of the market value of the portfolio securities during the year. Purchases and sales of investment securities (excluding short-term securities) for the six months ended June 30, 2009 were $11,051,156 and $16,665,184, respectively. |

| 1-800-624-4190 ▪ www.blu.com | 21 |

BLUE CHIP VALUE FUND , INC.

NOTES TO FINANCIAL STATEMENTS

June 30, 2009 (Unaudited)

1. ORGANIZATION AND SIGNIFICANT ACCOUNTING POLICIES

Blue Chip Value Fund, Inc. (the “Fund”) is registered under the Investment Company Act of 1940, as amended, as a diversified, closed-end management investment company.

The following is a summary of significant accounting policies followed by the Fund in the preparation of its financial statements.

Security Valuation – All securities of the Fund are valued as of the close of regular trading on the New York Stock Exchange (“NYSE”), generally 4:00 p.m. (Eastern Time), on each day that the NYSE is open. Listed securities are generally valued at the last sales price as of the close of regular trading on the NYSE. Securities traded on the National Association of Securities Dealers Automated Quotation (“NASDAQ”) are generally valued at the NASDAQ Official Closing Price (“NOCP”). In the absence of sales and NOCP, such securities are valued at the mean of the bid and asked prices.

Securities having a remaining maturity of 60 days or less are valued at amortized cost which approximates market value.

When market quotations are not readily available or when events occur that make established valuation methods unreliable, securities of the Fund may be valued at fair value determined in good faith by or under the direction of the Board of Directors. Factors which may be considered when determining the fair value of a security include (a) the fundamental data relating to the investment; (b) an evaluation of the forces which influence the market in which the security is sold, including the liquidity and depth of the market; (c) the market value at date of purchase; (d) information as to any transactions or offers with respect to the security or comparable securities; and (e) any other relevant matters.

Investment Transactions – Investment transactions are accounted for on the date the investments are purchased or sold (trade date). Realized gains and losses from investment transactions and unrealized appreciation and depreciation of investments are determined on the “specific identification” basis for both financial statement and federal income tax purposes. Dividend income is recorded on the ex-dividend date. Interest income, which includes interest earned on money market funds, is accrued and recorded daily.

Federal Income Taxes – For federal income tax purposes, the Fund currently qualifies, and intends to remain qualified, as a regulated investment company under the provisions of the Internal Revenue Code by distributing substantially all of its investment company taxable net income including realized gain, not offset by capital loss carryforwards, if any, to its shareholders. Accordingly, no provision for federal income or excise taxes has been made.

| 22 | Semi-Annual Report June 30, 2009 |

The Fund intends to elect to defer to its fiscal year ending December 31, 2009 approximately $918,881 of losses recognized during the period from November 1, 2008 to December 31, 2008.

In accordance with FASB Interpretation No. 48 (“FIN 48”) “Accounting for Uncertainty in Income Taxes,” the financial statement effects of a tax position taken or expected to be taken in a tax return are to be recognized in the financial statements when it is more likely than not, based on the technical merits, that the position will be sustained upon examination. Management has concluded that the Fund has taken no uncertain tax positions that require adjustment to the financial statements to comply with the provisions of FIN 48. The Fund files income tax returns in the U.S. federal jurisdiction and Colorado. For the years ended December 31, 2005 through December 31, 2008 for the federal jurisdiction and for the years ended December 31, 2004 through December 31, 2008 for Colorado, the Fund’s returns are still open to examination by the appropriate taxing authority.

Classification of Distributions to Shareholders – Net investment income (loss) and net realized gain (loss) may differ for financial statement and tax purposes. The character of distributions made during the year from net investment income or net realized gains may differ from its ultimate characterization for federal income tax purposes. Also, due to the timing of dividend distributions, the fiscal year in which amounts are distributed may differ from the fiscal year in which the income or realized gain was recorded by the Fund.

The tax character of the distributions paid was as follows:

| | Six Months Ended

June 30,

2009 | | Year Ended

December 31,

2008 |

| Distributions paid from: | | | | | |

| Ordinary income | $ | — | | $ | 510,959 |

| Long-term capital gain | | — | | | 208,973 |

| Tax return of capital | | — | | | 13,220,746 |

| Undesignated | | 3,985,705 | | | — |

| Total | $ | 3,985,705 | | $ | 13,940,678 |

| | | | | | |

As of June 30, 2009, the components of distributable earnings on a tax basis were as follows:

| | | | | | |

| Undistributed net investment income | | | | $ | 264,886 |

| Accumulated net realized loss | | | | | (10,254,442) |

| Net unrealized depreciation | | | | | (10,656,130) |

| Total | | | | $ | (20,645,686) |

| 1-800-624-4190 ▪ www.blu.com | 23 |

The difference between book basis and tax basis is typically attributable to the tax deferral of losses on wash sales, corporate actions and post October losses.

Distributions to Stockholders – Distributions to stockholders are recorded on the ex-dividend date.

Prior to May 1, 2009, the Fund maintained a “managed distribution policy” (the “Policy”) which distributed at least 2.5% of its net asset value quarterly to its stockholders. The Fund declared and paid the first quarter distribution in April 2009. This distribution was not related to the amount of the Fund’s net investment income or net realized capital gains or losses and will be classified to conform to the tax reporting requirements of the Internal Revenue Code. If the Fund’s total distributions for the year exceed the Fund’s “current and accumulated earnings and profits,” the excess will be treated as non-taxable return of capital, reducing the stockholder’s adjusted basis in their shares.

The Fund’s Policy was suspended, as approved by the Board of Directors, at the regular meeting held May 1, 2009. The Board took this action after considering a number of factors including, but not limited to, the outlook for the overall economy, an assessment of investment opportunities, the asset size and expense ratio of the Fund and the negative impact that the policy may have on the asset level and expense ratio. The Fund will continue to pay out any net investment income and net realized capital gains on an annual basis.

The Board will continue to evaluate the Fund’s Policy and may reinstate the Policy at its discretion.

Use of Estimates – The preparation of financial statements in conformity with accounting principles generally accepted in the United States of America requires management to make estimates and assumptions that affect the amounts reported in the financial statements and disclosures made in the accompanying notes to the financial statements. Actual results could differ from those estimates. Management has also evaluated subsequent events through August 18, 2009, the issuance date of the financial statements.

2. FAS 157 MEASUREMENTS

The Fund adopted Financial Accounting Standards Board Statement of Financial Accounting Standards No. 157, Fair Value Measurements (“FAS 157”), effective January 1, 2008. FAS 157 defines fair value, establishes a three-tier hierarchy to measure fair value based on the extent of use of “observable inputs” as compared to “unobservable inputs” for disclosure purposes and requires additional disclosures about these valuations measurements. Inputs refer broadly to the assumptions that market participants would use in pricing a security. Observable inputs are inputs that reflect the assumptions market participants would use in pricing the security developed based on market data obtained from sources independent of the reporting entity. Unobservable inputs are inputs that reflect the reporting entity’s own assumptions about the assumptions market participants would use in pricing the security developed based on the best information available in the circumstances.

| 24 | Semi-Annual Report June 30, 2009 |

The three-tier hierarchy is summarized as follows:

Level 1 – quoted prices in active markets for identical investments.

Level 2 – other significant observable inputs (including quoted prices for similar investments, interest rates, prepayment speeds, credit risk, etc.).

Level 3 – significant unobservable inputs (including the Fund’s own assumptions in determining the fair value of investments).

The following is a summary of the inputs used as of June 30, 2009 in valuing the Fund’s assets:

| | Investments in |

| | Securities at |

| Valuation Inputs | Value |

| Level 1 – Quoted Prices | |

| Common Stocks | $ | 97,610,372 |

| Short Term Investments | | 370,648 |

| Level 2 – Other Significant Observable Inputs | | — |

| Level 3 – Significant Unobservable Inputs | | — |

| Total | $ | 97,981,020 |

| | | |

| All securities of the Fund were valued using Level 1 inputs during the six months ended June 30, 2009. |

| | | |

| The inputs or methodology used for valuing securities are not necessarily an indication of the risk associated with investing in those securities. |

| | | |

| | | |

3. UNREALIZED APPRECIATION AND DEPRECIATION OF INVESTMENTS (TAX BASIS)

| |

| As of June 30, 2009: | | |

| Gross appreciation (excess of value over tax cost) | $ | 4,487,851 |

| Gross depreciation (excess of tax cost over value) | | (15,497,725) |

| Net unrealized depreciation | $ | (11,009,874) |

| Cost of investments for income tax purposes | $ | 108,990,894 |

| 1-800-624-4190 ▪ www.blu.com | 25 |

4. INVESTMENT ADVISORY AND ADMINISTRATION SERVICES

The Fund has an Investment Advisory Agreement with Denver Investment Advisors LLC, also doing business as Denver Investments (“Denver Investments”), whereby an investment advisory fee is paid to Denver Investments based on an annual rate of 0.65% of the Fund’s average weekly net assets up to $100,000,000 and 0.50% of the Fund’s average weekly net assets in excess of $100,000,000. The management fee is paid monthly based on the average of the net assets of the Fund computed as of the last business day the New York Stock Exchange is open each week. Certain officers and a director of the Fund are also officers of Denver Investments.

ALPS Fund Services, Inc. (“ALPS”) and Denver Investments serve as the Fund’s co-administrators. The Administrative Agreement includes the Fund’s administrative and fund accounting services. The administrative services fee is based on the current annual rate for ALPS and Denver Investments, respectively, of 0.0955% and 0.01% of the Fund’s average daily net assets up to $75,000,000, 0.05%, and 0.005% of the Fund’s average daily net assets between $75,000,000 and $125,000,000, and 0.03% and 0.005% of the Fund’s average daily net assets in excess of $125,000,000 plus certain out-of-pocket expenses. The administrative service fee is paid monthly.

The Directors have appointed a Chief Compliance Officer who is also Treasurer of the Fund and an employee of Denver Investments. The Directors agreed that the Fund would reimburse Denver Investments a portion of his compensation for his services as the Fund’s Chief Compliance Officer.

5. LOAN OUTSTANDING

The Fund has a line of credit with The Bank of New York Mellon (“BONY”) in which the Fund may borrow up to the lesser of 15% of the Fund’s total assets, $15,000,000 or the maximum amount the Fund is permitted to borrow under the Investment Company Act of 1940. The interest rate resets daily at overnight Federal Funds Rate plus 0.825%. Effective March 1, 2009, the interest rate changed to the overnight Federal Funds Rate plus 1.00% and the Fund pays an annual loan facility fee of 0.03%. The borrowings under the BONY loan are secured by a perfected security interest on all of the Fund’s assets.

Details of the loan outstanding are as follows:

| | | | Average for the |

| | As of | | Six Months Ended |

| | June 30, | | June 30, |

| | 2009 | | 2009 |

| Loan outstanding | $ | 10,325,000 | | $ | 10,185,138 |

| Interest rate | | 1.17%* | | | 1.12% |

| % of Fund’s total assets | | 10.53% | | | 10.38% |

| Amount of debt per share outstanding | $ | 0.36 | | $ | 0.36 |

| Number of shares outstanding (in thousands) | | 28,464 | | | 28,464** |

| *Annualized | | | | | |

| **Weighted average | | | | | |

| 26 | Semi-Annual Report June 30, 2009 |

6. RESULTS OF ANNUAL MEETING OF STOCKHOLDERS

The Annual Meeting of Stockholders of the Fund (the “Annual Meeting”) was held May 1, 2009 pursuant to notice given to all stockholders of record at the close of business on March 6, 2009. At the Annual Meeting, stockholders were asked to approve the following:

Proposal 1.

To elect Kenneth V. Penland and Roberta M. Wilson, as Class III directors to serve until the Annual Meeting in the year 2012. The number of shares voting for the election of Mr. Penland was 21,446,541 and that 975,438 votes were withheld. The number of shares voting for the election of Ms. Wilson was 21,539,180 and that 882,799 votes were withheld

Proposal 2.

To ratify the appointment by the Board of Directors of Deloitte & Touche LLP as the Fund’s independent registered public accounting firm for its fiscal year ending December 31, 2009. The number of shares voting for Proposal 2 was 21,888,634, the number voting against was 357,329 and the number abstaining was 176,016.

| 1-800-624-4190 ▪ www.blu.com | 27 |

| 28 | Semi-Annual Report June 30, 2009 |

| 1-800-624-4190 ▪ www.blu.com | 29 |

| 30 | Semi-Annual Report June 30, 2009 |

| 1-800-624-4190 ▪ www.blu.com | 31 |

| 32 | Semi-Annual Report June 30, 2009 |

BOARD OF DIRECTORS |

Kenneth V. Penland, Chairman

Todger Anderson, Director

Lee W. Mather, Jr, Director

Richard C. Schulte, Director

Roberta M. Wilson, Director |

OFFICERS |

Kenneth V. Penland, Chairman

Todger Anderson, President

Mark M. Adelmann, Vice President

Nancy P. O’Hara, Secretary

Jasper R. Frontz, Treasurer, Chief Compliance Officer Investment Adviser/Co-Administrator

Denver Investments

1225 17th Street, 26th Floor

Denver, CO 80202 Stockholder Relations

(800) 624-4190 (option #2)

e-mail: blu@denvest.com

Custodian

The Bank of New York Mellon

One Wall Street

New York, NY 10286 Co-Administrator

ALPS Fund Services, Inc.

1290 Broadway, Suite 1100

Denver, CO 80203 Transfer Agent Dividend Reinvestment Plan Agent

(Questions regarding your Account)

BNY Mellon Shareowner Services

480 Washington Blvd.

Jersey City, NJ 07310

(800) 624-4190 (option #1)

www.melloninvestor.com |

|

Item 2. Code of Ethics. |

| |

| Not Applicable to Semi-Annual Report. |

| |

Item 3. Audit Committee Financial Expert. |

| |

| Not Applicable to Semi-Annual Report. |

| |

Item 4. Principal Accountant Fees and Services. |

| |

| Not applicable to Semi-Annual Report. |

| |

Item 5. Audit Committee of Listed Registrants. |

| |

| Not applicable to Semi-Annual Report. |

| |

Item 6. Investments. |

| |

| (a) | Schedule of Investments in securities of unaffiliated issuers as of the close of the reporting period is included as part of the Report to Stockholders filed under Item 1 of this Form N-CSR. |

| | (b) | Not applicable |

| |

Item 7. Disclosure of Proxy Voting Policies and Procedures for Closed-End Management Investment Companies. |

| |

| Not Applicable to Semi-Annual Report. |

| |

Item 8. Portfolio Managers of Closed-End Management Investment Companies |

| |

| (a)(1) Not Applicable to Semi-Annual Report. |

2

| | |

| | (b) Effective April 30, 2009, Lisa Z. Ramirez, CFA joined the existing portfolio managers of the Blue Chip Value Fund as a Co-Portfolio Manager. The Blue Chip Value Fund is managed by the Value Equity Research Team at Denver Investments (the “Team”). She has been assigned specific sectors to focus her research efforts. The Team is further supported by dedicated research analysts who all may recommend purchase and sell decisions for the Fund. Every new investment is presented to the Team, which reviews investment ideas to determine whether that potential investment is attractive and compatible with the Fund’s investment objective. The Team typically seeks to reach consensus on all investment decisions. |

| | |

| | Lisa Z. Ramirez, CFA, is a Vice President and Portfolio Manager at Denver Investments and an Analyst on the Value Equity Research Team. Prior to joining the Value Equity Research Team in 2005, Ms. Ramirez was with Denver Investments’ Mid-Cap Growth Equity Research Team for eight years. Prior to joining the Mid-Cap Growth Equity Research Team, Ms. Ramirez started her career at Denver Investments as a Portfolio Administrator. She received a BS from the University of Colorado at Denver and an MBA from Regis University. Ms. Ramirez is a CFA charterholder and a member of the CFA Institute and the CFA Society of Colorado. |

| | |

| | Other Accounts Managed: As of the most recent practicable date (June 30, 2009), the following table summarizes the other investment activities of Ms. Ramirez. |

| | |

| | |

Portfolio Manager: | Ramirez |

| |

Registered Inv Companies | |

Assets | $496,772,982 |

# of Accounts | 6 |

| |

Performance Based | |

Assets | $15,737,943 |

# of Accounts | 1 |

| |

| |

Other Pooled Accts | |

Assets | $0 |

# of Accounts | 0 |

| |

Performance Based | |

Assets | $0 |

# of Accounts | 0 |

| |

| |

Other Accts | |

Assets | $338,474,024 |

# of Accounts | 524 |

| |

Performance Based | |

Assets | $0 |

# of Accounts | 0 |

| |

| |

| |

Grand Totals | |

Assets | $835,247,006 |

# of Accounts | 530 |

* Totals include 452 accounts within separately managed account (SMA) wrap programs which Denver Investments serves as a portfolio manager.

| | Potential material conflicts of interest that may arise when a portfolio manager has day-to-day management responsibilities with respect to other accounts in addition to the Fund, include conflicts relating to the allocation of limited investment opportunities, the order of executing transactions when the aggregation of the order is not possible, personal investing activities, differences in advisory fee arrangements, structure of portfolio manager compensation and proxy voting of portfolio securities. While there can be no guarantee, Denver Investments believes that the controls and oversight relating to these potential material conflicts of interest involving the Fund and its other managed funds and accounts is effective. |

| | |

3

| | Manager Compensation: As of the most recent practicable date (June 30, 2009), Ms. Ramirez’s compensation consists of a base salary, discretionary firm profit sharing and a predetermined potential bonus. A portion of the bonus is determined by the overall long-term pre-tax performance (3-5 years when available) of the investment accounts managed by Ms. Ramirez (including the Fund) in comparison to the applicable benchmark index and peer group data. The remaining portion of the bonus is subjective, based primarily on Ms. Ramirez’s contributions to the investment process, stock selection and teamwork. |

| | | |

| | Equity Securities in the Registrant: As of the most recent practicable date (June 30, 2009), Ms. Ramirez has no ownership in the Blue Chip Value Fund. |

Item 9. Purchases of Equity Securities by Closed-End Management Investment Company and Affiliated Purchasers. |

| |

| Not applicable. |

| |

Item 10. Submission of Matters to Vote of Security Holders. |

| |

| There have been no material changes to the procedures by which shareholders may recommend nominees to the registrant’s Board of Directors, where those changes were implemented after the registrant last provided disclosure in response to the requirements of Item 407(c)(2)(iv) of Regulation S-K or this Item. |

| |

Item 11. Controls and Procedures. |

| | | |

| | (a) | The registrant’s principal executive officer and principal financial officer have concluded that the registrant’s disclosure controls and procedures (as defined in Rule 30a-3(c) under the Investment Company Act of 1940, as amended) are effective based on their evaluation of these controls and procedures as of a date within 90 days of the filing date of this document. |

| | | |

| | (b) | There was no change in the registrant’s internal control over financial reporting (as defined in Rule 30a-3(d) under the Investment Company Act of 1940, as amended) during the second fiscal quarter of the period covered by this report that has materially affected, or is reasonably likely to materially affect, the registrant’s internal control over financial reporting. |

| | | |

Item 12. Exhibits. |

| | | |

| | (a)(1) | Not applicable. |

| | | |

| | (a)(2) | Separate certifications for the registrant's Principal Executive Officer and Principal Financial Officer, as required by Section 302 of the Sarbanes-Oxley Act of 2002 and Rule 30a-2(a) under the Investment Company Act of 1940, are attached hereto as Ex99.CERT. |

| | | |

| | (a)(3) | Not applicable. |

| | | |

| | (b) | A certification for the registrant's Principal Executive Officer and Principal Financial Officer, as required by Rule 30a-2(b) under the Investment Company Act of 1940, is attached hereto as Ex99.906CERT. The certification furnished pursuant to this paragraph is not deemed to be "filed" for purposes of Section 18 of the Securities Exchange Act of 1934, or otherwise subject to the liability of that section. Such certification is not deemed to be incorporated by reference into any filing under the Securities Act of 1933 or the Securities Exchange Act of 1934, except to the extent that the Registrant specifically incorporates it by reference. |

4

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

Blue Chip Value Fund, Inc. |

|

|

By: /s/ Todger Anderson |

Todger Anderson |

President and Chief Executive Officer |

|

Date: September 4, 2009 |

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, this report has been signed below by the following persons on behalf of the registrant and in the capacities and on the dates indicated.

By: /s/ Todger Anderson |

Todger Anderson |

President and Chief Executive Officer |

|

Date: September 4, 2009 |

|

By: /s/ Jasper R. Frontz |

Jasper R. Frontz |

Treasurer and Chief Financial Officer |

|

Date: September 4, 2009 |

5