As Filed with the Securities and Exchange Commission on July 25, 2006

Securities Act File No. 333-135111

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-14

| | | | |

| | REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933 | | x |

| | Pre-Effective Amendment No. 1 | | x |

| | Post-Effective Amendment No. | | ¨ |

DWS VARIABLE SERIES II

(Exact Name of Registrant as Specified in Charter)

222 South Riverside Plaza

Chicago, IL 60606

(Address of Principal Executive Offices) (Zip Code)

617-295-2572

(Registrant’s Area Code and Telephone Number)

John Millette, Secretary

Two International Place

Boston, Massachusetts 02110

(Name and Address of Agent for Service)

With copies to:

David A. Sturms, Esq.

Vedder, Price, Kaufman & Kammholz, P.C.

222 North LaSalle Street

Chicago, Illinois 60601

Approximate date of proposed public offering: As soon as practicable after the effective date of this Registration Statement.

No filing fee is required because an indefinite number of shares have previously been registered pursuant to Rule 24f-2 under the Investment Company Act of 1940.

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment that specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the Registration Statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

Questions & Answers

DWS Dreman Financial Services VIP

DWS MFS Strategic Value VIP

DWS Income Allocation VIP

DWS Variable Series II

Q&A

Q What is happening?

A Deutsche Asset Management (or “DeAM” as defined on page 36 in the enclosed Prospectus/Proxy Statement) has initiated a program to reorganize and merge selected funds within the DWS fund family.

Q What issue am I being asked to vote on?

A You are being asked to vote on one (or more) of three proposals, as applicable to you, to merge an Acquired Fund into the corresponding Acquiring Fund, as listed below:

| | | | |

Acquired Fund

| | | | Acquiring Fund

|

DWS Dreman Financial Services VIP | | into | | DWS Dreman High Return Equity VIP |

DWS MFS Strategic Value VIP | | into | | DWS Dreman High Return Equity VIP |

DWS Income Allocation VIP | | into | | DWS Conservative Allocation VIP |

After carefully reviewing the proposals, the Board of DWS Variable Series II, of which each Acquired Fund is a series, has determined that each merger is in the best interests of the applicable Acquired Fund. The Board unanimously recommends that you vote for the proposal that applies to you.

Q Why has this proposal been made for my fund?

A DeAM has advised the Board of DWS Variable Series II that, as part of its ongoing program to restructure its product line, it is exiting the proprietary variable insurance

Q&A continued

products business (DeAM’s proprietary variable insurance products business involved relationships DeAM developed with select insurance companies to provide “Scudder” branded variable insurance products using certain DWS funds, including DWS Variable Series II, and certain non-DWS funds as underlying investments). Accordingly, DeAM would like to eliminate a significant number of the subadvised portfolios of DWS Variable Series II. In addition, DeAM would like to eliminate those portfolios that have little opportunity for growth. Because DeAM no longer wishes to manage or support the Acquired Funds in their current form, DeAM has proposed the merger of each Acquired Fund with an Acquiring Fund that DeAM believes is similar from an investment objective standpoint.

While DeAM believes that each Acquiring Fund should provide a comparable investment opportunity for shareholders of each Acquired Fund, there are a number of significant differences in the portfolios of each Fund. DeAM has estimated that approximately 62%, 89% and 19% of the portfolios of DWS Dreman Financial Services VIP, DWS MFS Strategic Value VIP and DWS Income Allocation VIP, respectively, will be liquidated and the proceeds will be reinvested in other securities so that upon the merger, the Acquired Fund’s portfolio will conform to the corresponding Acquiring Fund’s investment objective, policies, restrictions and strategies. As noted below, DeAM will pay all costs associated with each merger, including but not limited to transaction costs associated with the repositioning of each Fund’s portfolio.

Q Will any fund pay for the solicitation of voting instructions and legal costs associated with this solicitation?

A No. DeAM will bear these costs.

Q Will I have to pay taxes as a result of the merger of my Fund?

A Each merger is expected to be a tax-free transaction for federal income tax purposes and will not take place unless special tax counsel provides an opinion to that effect. However, if you choose to redeem or exchange your investment by surrendering your Contract or initiating a partial withdrawal, you may be subject to taxes and tax penalties.

Q&A continued

Q Upon merger, how will the value of my investment change?

A The aggregate value of your investment will not change as a result of the merger. It is likely, however, that the number of shares owned by your insurance company on your behalf will change as a result of the merger because your insurance company’s shares will be exchanged at the net asset value per share of the corresponding Acquiring Fund, which will probably be different from the net asset value per share of your Acquired Fund.

Q When would the merger take place?

A If approved, each merger would occur on or about September 17, 2006 or as soon as reasonably practicable after shareholder approval is obtained. Shortly after completion of each merger, shareholders whose accounts are affected by a merger (i.e., your insurance company) will receive a confirmation statement reflecting their new account number and the number of shares of the corresponding Acquiring Fund they are receiving. Subsequently, you will be notified of changes to your account information by your insurance company.

Q Are the mergers related?

A No. Each Acquired Fund’s shareholders will vote separately on the merger of their Fund into the corresponding Acquiring Fund. The merger of one Acquired Fund into an Acquiring Fund is not contingent upon the approval of the other Acquired Funds’ shareholders. Each merger is separate and distinct from the other and each will be governed by a separate Agreement and Plan of Reorganization.

Q I am the owner of a variable life insurance policy or a variable annuity contract offered by my insurance company. I am not a shareholder of an Acquired Fund. Why am I being asked to vote on a proposal for Acquired Fund shareholders?

A You have previously directed your insurance company to invest certain proceeds relating to your variable life insurance policy and/or variable annuity contract (each a “Contract”) in one or more of the Acquired Funds. Although you receive the gains,

Q&A continued

losses and income from this investment, your insurance company holds on your behalf any shares corresponding to your investment in an Acquired Fund. Thus, you are not the “shareholder”; rather, your insurance company is the shareholder. However, you have the right to instruct your insurance company on how to vote the Acquired Fund shares corresponding to your investment through your Contract. It is your insurance company, as the shareholder, that will actually vote the shares corresponding to your investment (likely by executing a proxy card) once it receives instructions from its Contract owners.

The attached Prospectus/Proxy Statement is used to solicit voting instructions from you and other owners of Contracts. All persons entitled to direct the voting of shares of an Acquired Fund, whether or not they are shareholders, are described as voting for purposes of the Prospectus/Proxy Statement. Please see page 1 of the attached Prospectus/Proxy Statement for more details.

Q How can I vote?

A You can vote in any one of three ways:

| n | | Through the Internet, by going to the website listed on your voting instruction form; |

| n | | By telephone, with a toll-free call to the number listed on your voting instruction form; or |

| n | | By mail, by sending the enclosed voting instruction form, signed and dated, in the enclosed envelope. |

We encourage you to vote over the Internet or by telephone, following the instructions that appear on your voting instruction form. Whichever method you choose, please take the time to read the full text of the Prospectus/Proxy Statement before you vote.

Q&A continued

Q If I send in my voting instructions now as requested, can I change my vote later?

A Shareholders may revoke proxies, including proxies given by telephone or over the Internet, at any time before they are voted at the special meeting either (i) by sending a written revocation to the Secretary of DWS Variable Series II as explained in the Prospectus/Proxy Statement; (ii) by properly executing a later-dated proxy that is received by the Fund at or prior to the special meeting; or (iii) by attending the special meeting and voting in person. Only a shareholder may execute or revoke a proxy. You should consult your insurance company regarding your ability to revoke voting instructions after you have provided them to your insurance company.

Q Whom should I call for additional information about this Prospectus/Proxy Statement?

A Please call Computershare Fund Services, Inc., your Fund’s information agent, at 1-866-390-5113.

DWS DREMAN FINANCIAL SERVICES VIP

DWS MFS STRATEGIC VALUE VIP

DWS INCOME ALLOCATION VIP

A Message from the President of DWS Variable Series II

[mailing date], 2006

Dear Investor:

I am writing to ask you to instruct your insurance company as to how to vote on an important matter that affects your investment in one or more of the DWS Funds listed above. You may vote by filling out and signing the enclosed voting instruction form, or by voting by telephone or through the Internet.

We are asking for your vote on the following matter:

| | |

| Proposal: | | Approval of a proposed merger of an Acquired Fund into the corresponding Acquiring Fund, as listed below. In each merger, your investment in the Acquired Fund would, in effect, be exchanged, on a tax-free basis for federal income tax purposes, for an investment in the same class of shares of the corresponding Acquiring Fund with an equal aggregate net asset value. |

| | | | |

Acquired Fund

| | | | Acquiring Fund

|

DWS Dreman Financial Services VIP | | into | | DWS Dreman High Return Equity VIP |

DWS MFS Strategic Value VIP | | into | | DWS Dreman High Return Equity VIP |

DWS Income Allocation VIP | | into | | DWS Conservative Allocation VIP |

Each proposed merger is part of an ongoing program initiated by Deutsche Asset Management (or “DeAM” as defined on page in the enclosed Prospectus/Proxy Statement). This program is intended to restructure DeAM’s product line to match its distribution focus in the future and to eliminate funds that have little opportunity for growth and that add unnecessary complexity and inefficiency to its business. As a part of this program, DeAM is exiting the proprietary variable insurance products business (DeAM’s proprietary variable insurance products business involved relationships DeAM developed with select insurance companies to provide “Scudder” branded variable insurance products using certain DWS funds, including DWS Variable Series II, and certain non-DWS funds as underlying investments). Accordingly, DeAM would like to eliminate a significant number of the subadvised portfolios of DWS Variable Series II. In addition, DeAM would like to eliminate those portfolios with little opportunity for growth. In order to provide you with a continuity of investment within the DWS fund family, DeAM proposed to the Board merging your fund with another DWS fund that DeAM believes is similar, from an investment objective standpoint, to your fund. Please note, however, that the investment strategies of your fund and its corresponding Acquired Fund are different. See “Investment Strategies and Risk Factors” in the enclosed Prospectus/Proxy Statement for more details.

In determining to recommend approval of each merger, the Trustees of DWS Variable Series II conducted a thorough review of the potential implications of each merger, and concluded that each Acquired Fund’s participation in its proposed merger would be in the best interests of such Acquired Fund and would not dilute the interests of such Acquired Fund’s existing shareholders. If the proposed mergers are approved, the Board expects that the proposed changes will take effect during the fourth calendar quarter of 2006.

Included in this booklet is information about the upcoming shareholders’ meeting:

| | • | | A Notice of a Joint Special Meeting of Shareholders, which summarizes the proposal(s) for which you are being asked to provide voting instructions; and |

| | • | | A Prospectus/Proxy Statement, which provides detailed information on each Acquiring Fund, the specific proposals being considered at the shareholders’ meeting, and why each proposal is being made. |

We need your voting instructions and urge you to review the enclosed materials thoroughly. Once you’ve determined how you would like your interests to be represented, please promptly complete, sign, date and return the enclosed voting instruction form or vote by telephone or through the Internet. A postage-paid envelope is enclosed for mailing, and telephone and Internet voting instructions are listed at the top of your voting instruction form. You may receive more than one voting instruction form. If so, please vote each one.

I’m sure that you, like most people, lead a busy life and are tempted to put this Prospectus/Proxy Statement aside for another day. Please don’t. Your prompt return of the enclosed voting instruction form (or voting by telephone or through the Internet) may save the necessity and expense of further solicitations.

Your vote is important to us. We appreciate the time and consideration I am sure you will give to this important matter. If you have questions about any proposal, please call Computershare Fund Services, Inc., the information agent, at 1-866-390-5113, or contact your insurance company. Thank you for your continued support of DWS Scudder.

Sincerely yours,

[Signature]

Michael Clark

President

DWS Variable Series II

DWS DREMAN FINANCIAL SERVICES VIP

DWS MFS STRATEGIC VALUE VIP

DWS INCOME ALLOCATION VIP

NOTICE OF A JOINT SPECIAL MEETING OF SHAREHOLDERS

This is the formal agenda for your Fund’s shareholder special meeting. It tells you what matters will be voted on and the time and place of the special meeting.

To the Shareholders of the Acquired Funds:

A Special Meeting of Shareholders of the Acquired Funds will be held August 24, 2006 at 4:00 p.m. Eastern time, at the offices of Deutsche Investment Management Americas Inc., 345 Park Avenue, 27th Floor, New York, New York 10154 (the “Meeting”), to consider the following:

| | |

| Proposal: | | Approving an Agreement and Plan of Reorganization and the transactions it contemplates, including the transfer of all of the assets of the Acquired Fund to the corresponding Acquiring Fund, as listed below: |

| | | | |

Acquired Fund

| | | | Acquiring Fund

|

DWS Dreman Financial Services VIP | | into | | DWS Dreman High Return Equity VIP |

DWS MFS Strategic Value VIP | | into | | DWS Dreman High Return Equity VIP |

DWS Income Allocation VIP | | into | | DWS Conservative Allocation VIP |

|

| in exchange for shares of the Acquiring Fund and the assumption by the Acquiring Fund of all liabilities of the corresponding Acquired Fund, and the distribution of such shares, on a tax-free basis for federal income tax purposes, to the shareholders of the Acquired Fund in complete liquidation of the Acquired Fund. |

The persons named as proxies will vote in their discretion on any other business that may properly come before the Meeting or any adjournments or postponements thereof.

Holders of record of shares of each Acquired Fund at the close of business on June 13, 2006 are entitled to vote with respect to their Acquired Fund at the Meeting and at any adjournments or postponements thereof.

In the event that the necessary quorum to transact business or the vote required to approve a merger is not obtained at the Meeting, the persons named as proxies may propose one or more adjournments of the Meeting in accordance with applicable law to permit such further solicitation of proxies as may be deemed necessary or advisable.

By order of the Trustees

John Millette

Secretary

[mailing date], 2006

WE URGE YOU TO MARK, SIGN, DATE AND MAIL THE ENCLOSED PROXY CARD OR VOTING INSTRUCTION FORM IN THE POSTAGE-PAID ENVELOPE PROVIDED OR RECORD YOUR VOTING INSTRUCTIONS BY TELEPHONE OR THROUGH THE INTERNET SO THAT YOU WILL BE REPRESENTED AT THE MEETING.

INSTRUCTIONS FOR SIGNING PROXY CARDS

AND VOTING INSTRUCTION FORMS

The following general rules for signing proxy cards and voting instruction forms may be of assistance to you and avoid the time and expense involved in validating your vote if you fail to sign your proxy card or voting instruction form properly.

1. Individual Accounts: Sign your name exactly as it appears in the registration on the proxy card or voting instruction form.

2. Joint Accounts: Either party may sign, but the name of the party signing should conform exactly to the name shown in the registration on the proxy card or voting instruction form.

3. All Other Accounts: The capacity of the individual signing the proxy card or voting instruction form should be indicated unless it is reflected in the form of registration. For example:

| | |

Registration

| | Valid Signature

|

Corporate Accounts | | |

(1) ABC Corp. | | ABC Corp., John Doe, Treasurer |

(2) ABC Corp. | | John Doe, Treasurer |

(3) ABC Corp. c/o John Doe, Treasurer | | John Doe |

(4) ABC Corp. Profit Sharing Plan | | John Doe, Trustee |

| |

Partnership Accounts | | |

(1) The XYZ Partnership | | Jane B. Smith, Partner |

(2) Smith and Jones, Limited Partnership | | Jane B. Smith, General Partner |

| |

Trust Accounts | | |

(1) ABC Trust Account | | Jane B. Doe, Trustee |

(2) Jane B. Doe, Trustee u/t/d 12/28/78 | | Jane B. Doe |

| |

Custodial or Estate Accounts | | |

(1) John B. Smith, Cust. f/b/o John B. Smith Jr. UGMA/UTMA | | John B. Smith |

(2) Estate of John B. Smith | | John B. Smith, Jr., Executor |

IMPORTANT INFORMATION

FOR OWNERS OF VARIABLE ANNUITY

OR LIFE INSURANCE CONTRACTS INVESTED IN

DWS DREMAN FINANCIAL SERVICES VIP

DWS MFS STRATEGIC VALUE VIP

DWS INCOME ALLOCATION VIP

This document contains a Prospectus/Proxy Statement and a voting instruction form. You can use your voting instruction form to tell your insurance company how to vote on your behalf on an important issue relating to your investment in one or more of the funds listed above. If you complete and sign the voting instruction form (or tell your insurance company by telephone or through the Internet how you want it to vote), your insurance company will vote the shares corresponding to your insurance contract exactly as you indicate. If you simply sign the voting instruction form, your insurance company will vote the shares corresponding to your insurance contract in accordance with the Trustees’ recommendation on page 42. If you do not return your voting instruction form or record your voting instructions by telephone or through the Internet, your insurance company will vote your shares in the same proportion as shares for which instructions have been received.

We urge you to review the Prospectus/Proxy Statement carefully and either fill out your voting instruction form and return it by mail or record your voting instructions by telephone or through the Internet. You may receive more than one voting instruction form since several shareholder special meetings are being held as part of the broader restructuring program of the DWS fund family. If so, please return each one. Your prompt return of the enclosed voting instruction form (or your providing voting instructions by telephone or through the Internet) may save the necessity and expense of further solicitations.

We want to know how you would like your interests to be represented. Please take a few minutes to read these materials and return your voting instruction form.

If you have any questions, please call Computershare Fund Services, Inc., the information agent, at the special toll-free number we have set up for you (1-866-390-5113) or contact your insurance company.

PROSPECTUS/PROXY STATEMENT

[effective date], 2006

| | |

Acquisition of the assets of:

| | By and in exchange for shares of:

|

| |

DWS Dreman Financial Services VIP DWS MFS Strategic Value VIP DWS Income Allocation VIP each a series of DWS Variable Series II | | DWS High Return Equity VIP DWS High Return Equity VIP DWS Conservative Allocation VIP each a series of DWS Variable Series II |

| |

222 South Riverside Plaza Chicago, IL 60606 800-621-1048 | | 222 South Riverside Plaza Chicago, IL 60606 800-621-1048 |

This Prospectus/Proxy Statement is being furnished in connection with the proposed merger of each Acquired Fund listed above (each an “Acquired Fund” and collectively, the “Acquired Funds”) into the corresponding Acquiring Fund listed above (each an “Acquiring Fund” and collectively, the “Acquiring Funds”). The Acquired Funds and the Acquiring Funds are referred to herein collectively as the “Funds,” and each is referred to herein individually as a “Fund.” As a result of each proposed merger, each shareholder of an Acquired Fund will receive a number of full and fractional shares of the corresponding class of the corresponding Acquiring Fund equal in value as of the Valuation Time (as defined below on page 42 to the total value of such shareholder’s Acquired Fund shares.

Shares of an Acquired Fund are available exclusively as a pooled funding vehicle for variable life insurance policies and variable annuity contracts (each a “Contract”) offered by the separate accounts, or sub-accounts thereof, of certain life insurance companies (“Participating Insurance Companies”). The Participating Insurance Companies own shares of an Acquired Fund as depositors for the owners of their respective Contracts (each a “Contract Owner”). Thus, individual Contract Owners are not the “shareholders” of an Acquired Fund. Rather, the Participating Insurance Companies and their separate accounts are the shareholders. To the extent required to be consistent with the interpretations of voting requirements by the staff of the Securities and Exchange Commission (“SEC”), each Participating Insurance Company will offer to Contract Owners the opportunity to instruct it as to how it should vote shares held by it and the separate accounts on the proposed merger. This Prospectus/Proxy Statement is, therefore, furnished to Contract Owners entitled to give voting instructions with regard to the Acquired Funds. All persons entitled to direct the voting of shares of an Acquired Fund, whether or not they are shareholders, are described as voting for purposes of this Prospectus/Proxy Statement. This Prospectus/Proxy Statement, along with the Notice of a Joint Special Meeting of Shareholders and the proxy card or voting instruction form, is being mailed to shareholders and Contract Owners on or about [mailing date], 2006. It explains concisely what you should know before voting on the proposals described in this Prospectus/Proxy Statement or investing in an Acquiring Fund, each of which is a diversified series of DWS Variable Series II, an open-end, registered management investment company. Please read it carefully and keep it for future reference.

The securities offered by this Prospectus/Proxy Statement have not been approved or disapproved by the SEC, nor has the SEC passed upon the accuracy or adequacy of this Prospectus/Proxy Statement. Any representation to the contrary is a criminal offense.

1

The following documents have been filed with the SEC and are incorporated into this Prospectus/Proxy Statement by reference:

| | (i) | | the prospectus of DWS Variable Series II, dated May 1, 2006, as supplemented from time to time, relating to Class A shares of each Acquired Fund (File No. 333-11802); |

| | (ii) | | the prospectus of DWS Variable Series II, dated May 1, 2006, as supplemented from time to time, relating to Class B shares of each Acquired Fund (File No. 333-11802); |

| | (iii) | | the prospectus of DWS Variable Series II, dated May 1, 2006, as supplemented from time to time, relating to Class A shares of each Acquiring Fund (File No. 333-11802), a copy of which, if applicable, is included with this Prospectus/Proxy Statement; |

| | (iv) | | the prospectus of DWS Variable Series II, dated May 1, 2006, as supplemented from time to time, relating to Class B shares of each Acquiring Fund (File No. 333-11802), a copy of which, if applicable, is included with this Prospectus/Proxy Statement; |

| | (v) | | the statement of additional information of DWS Variable Series II, dated May 1, 2006, as supplemented from time to time, relating to Class A and Class B shares of each Acquired Fund (File No. 333-11802); |

| | (vi) | | the statement of additional information of DWS Variable Series II, dated May 1, 2006, as supplemented from time to time, relating to Class B shares of DWS Income Allocation VIP (File No. 333-11802); |

| | (vii) | | the statement of additional information relating to the proposed merger, dated [effective date], 2006 (the “Merger SAI”) (File No. 333-135111); and |

| | (viii) | | the financial statements and related report of the independent registered public accounting firm relating to the Acquired Funds included in DWS Variable Series II’s Annual Report to Shareholders for the fiscal year ended December 31, 2005. |

No other parts of the prospectuses, statements of additional information or Annual Report is incorporated by reference.

You may receive free copies of the Funds’ annual reports, semiannual reports, prospectuses, statements of additional information or the Merger SAI, request other information about a Fund or make inquiries by contacting your insurance company or by calling the corresponding Fund at 1-800-621-1048.

Like shares of the Acquired Funds, shares of the Acquiring Funds are not deposits or obligations of, or guaranteed or endorsed by, any financial institution, are not insured by the Federal Deposit Insurance Corporation, the Federal Reserve Board or any other agency, and involve risk, including the possible loss of the principal amount invested.

This document is designed to give you the information you need to vote on the proposal. Much of the information is required disclosure under rules of the SEC; some of it is technical. If there is anything you don’t understand, please contact Computershare Fund Services, Inc., the information agent, at 1-866-390-5113, or contact your insurance company.

2

DWS Variable Series II is subject to the informational requirements of the Securities Exchange Act of 1934, as amended, and in accordance therewith files reports and other information with the SEC. You may review and copy information about the Funds, including the prospectuses and the statement of additional information, at the SEC’s public reference room at 100 F Street, N.E., Washington, D.C. You may call the SEC at 1-202-551-5850 for information about the operation of the public reference room. You may obtain copies of this information, with payment of a duplication fee, by electronic request at the following e-mail address: publicinfo@sec.gov, or by writing the SEC’s Public Reference Branch, Office of Consumer Affairs and Information Services, Securities and Exchange Commission, Washington, D.C. 20549. You may also access reports and other information about the Funds on the EDGAR database on the SEC’s Internet site at http://www.sec.gov.

3

I. SYNOPSIS

The responses to the questions that follow provide an overview of key points typically of concern to shareholders considering a proposed merger between mutual funds. These responses are qualified in their entirety by the remainder of this Prospectus/Proxy Statement, which you should read carefully because it contains additional information and further details regarding the proposed mergers.

| 1. | | What is being proposed? |

The Trustees of DWS Variable Series II (the “Trust”), of which each Acquired Fund (and each Acquiring Fund) is a series, are recommending that shareholders approve the transactions contemplated by an Agreement and Plan of Reorganization (as described below in Part IV and a form of which is attached hereto as Exhibit A), each of which we refer to as a “merger” of an Acquired Fund into the corresponding Acquiring Fund. If approved by shareholders, all of the assets of an Acquired Fund will be transferred to the corresponding Acquiring Fund solely in exchange for the issuance and delivery to the Acquired Fund of Class A shares, as applicable, and Class B shares of the corresponding Acquiring Fund (“Merger Shares”) with a value equal to the value of the Acquired Fund’s assets net of liabilities, and for the assumption by the corresponding Acquiring Fund of all liabilities of the Acquired Fund. Immediately following the transfer, the appropriate class of Merger Shares received by each Acquired Fund will be distributed pro-rata, on a tax-free basis for federal income tax purposes, to each of its shareholders of record.

| 2. | | What will happen to my investment in the Acquired Fund as a result of the merger? |

Your investment in the Acquired Fund will, in effect, be exchanged for an investment in the same share class of the corresponding Acquiring Fund with an equal aggregate net asset value as of the Valuation Time (as defined below on page 42).

| 3. | | Why have the Trustees of the Trust recommended that shareholders approve the mergers? |

In determining to recommend that shareholders approve the merger of each Acquired Fund, the Trustees considered, among others, the following factors:

| | • | | That, as a part of its ongoing program to restructure its product line, Deutsche Asset Management (or “DeAM” as defined below on p. 36) is exiting the proprietary variable insurance product business and/or would like to eliminate portfolios with little opportunity for growth, and in any event no longer wishes to manage or support the Acquired Fund; |

| | • | | Various alternatives to each proposed merger (e.g., liquidation of the Acquired Fund); |

| | • | | That DeAM recommended the merger of the Acquired Fund into the Acquiring Fund based on its belief that such Acquiring Fund has a similar investment objective and strategy to the Acquired Fund, relative to other DWS funds; |

| | • | | That the merger would provide a continuity of investment within the DWS fund family for shareholders of the Acquired Fund; and |

4

| | • | | With respect to Financial Services VIP, the proposed merger would address the Fund’s long-term relative underperformance. |

In addition, the Trustees noted that for each merger, DeAM has agreed to cap the total operating expense ratios of the combined fund at levels that are the same or lower than the current total expense ratios of the corresponding Acquired Fund for at least three years following each merger. The Trustees also noted that DeAM agreed to pay all costs associated with each merger, including but not limited to, transaction costs associated with the repositioning of each Fund’s portfolio.

The Trustees of the Trust have concluded that: (1) each merger is in the best interests of the Acquired Fund, and (2) the interests of the existing shareholders of the Acquired Fund will not be diluted as a result of the merger. Accordingly, the Trustees of the Trust unanimously recommend approval of each Agreement and Plan of Reorganization (as defined below) effecting the mergers.

| 4. | | How do the investment goals, policies and restrictions of the Funds compare? |

DWS Dreman Financial Services VIP—DWS Dreman High Return Equity VIP

DWS Dreman Financial Services VIP (“Financial Services VIP”) seeks to provide long-term capital appreciation. DWS Dreman High Return Equity VIP (“High Return VIP”) seeks to achieve a high rate of total return. Both Funds are managed by the same portfolio managers and use the same value investment style and investment process. Financial Services VIP normally invests at least 80% of its net assets, plus the amount of any borrowings for investment purposes, in equity securities (mainly common stocks) of financial services companies. High Return VIP normally invests 80% of its net assets, plus the amount of any borrowings for investment purposes, in common stocks and other equity securities, focusing on stocks of large US companies that are similar in size to the companies in the S&P 500 Index and that the portfolio managers believe are undervalued. Financial Services VIP may invest up to 30% of total assets in foreign securities and up to 20% of net assets in investment-grade debt securities. High Return VIP may also invest up to 30% of its net assets in US dollar-denominated American Depositary Receipts and in securities of foreign companies traded principally in securities markets outside the US. Both Funds may invest in derivatives (contracts whose value is based on, for example, indices, currencies or securities) and may lend their portfolio securities in an amount up to 33- 1/3% of their respective total assets to approved institutional borrowers. Please also see Part II—Investment Strategies and Risk Factors—below for a more detailed comparison of each Fund’s investment policies and restrictions.

While DeAM believes that High Return VIP should provide a comparable investment opportunity for shareholders of Financial Services VIP, there are a number of significant differences in the portfolios of each Fund. DeAM has estimated that approximately 62% of the portfolio of Financial Services VIP will be liquidated and the proceeds will be reinvested in other securities so that upon the merger, its portfolio will conform to the investment objective, policies, restrictions and strategies of High Return VIP.

5

The following table sets forth a summary of the composition of the investment portfolio of each Fund as of December 31, 2005, and DeAM’s estimation of the portfolio composition of High Return VIP assuming consummation of the proposed merger(s).

Portfolio Composition (as a % of Fund)

(excludes cash equivalents)

| | | | | | | | | | | | |

Common Stocks

| | Financial

Services

VIP

| | | High

Return VIP

| | | High Return

VIP—Estimated(1)

(assuming

consummation of

Financial Services

VIP—High Return

VIP merger only)

| | | High Return VIP— Estimated(2)

(assuming

consummation of

Financial Services

VIP—High Return

VIP merger and of

Strategic Value

VIP—High Return

VIP merger)

| |

Energy | | 9 | % | | 21 | % | | 21 | % | | 21 | % |

Consumer Staples | | 3 | % | | 19 | % | | 19 | % | | 19 | % |

Financials: | | | | | | | | | | | | |

Banks | | 38 | % | | 8 | % | | 8 | % | | 8 | % |

Diversified Financial Services | | 22 | % | | 17 | % | | 17 | % | | 17 | % |

Capital Markets | | 13 | % | | 0 | % | | 0 | % | | 0 | % |

Insurance | | 12 | % | | 4 | % | | 4 | % | | 4 | % |

Consumer Finance | | 2 | % | | 0 | % | | 0 | % | | 0 | % |

Real Estate | | 1 | % | | 0 | % | | 0 | % | | 0 | % |

| | |

|

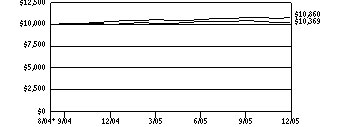

| |

|

| |

|

| |

|

|

Total Financials | | 88 | % | | 29 | % | | 29 | % | | 29 | % |

Health Care | | 0 | % | | 17 | % | | 17 | % | | 17 | % |

Consumer Discretionary | | 0 | % | | 6 | % | | 6 | % | | 6 | % |

Industrials | | 0 | % | | 5 | % | | 5 | % | | 5 | % |

Information Technology | | 0 | % | | 3 | % | | 3 | % | | 3 | % |

| | |

|

| |

|

| |

|

| |

|

|

| | | 100% | | | 100 | % | | 100 | % | | 100 | % |

| | |

|

| |

|

| |

|

| |

|

|

| (1) | | Reflects DeAM’s estimation of the portfolio composition of High Return VIP subsequent to the merger, taking into account that prior to the merger, pursuant to the Agreement and Plan of Reorganization, a significant portion of the portfolio of Financial Services VIP will be liquidated and the proceeds will be used to acquire other securities consistent with the investment objective, policies, restrictions and strategies of High Return VIP. No assurance can be given as to the actual portfolio composition of High Return VIP subsequent to the merger. |

| (2) | | Reflects DeAM’s estimation of the portfolio composition of High Return VIP subsequent to the merger, taking into account that prior to the merger, pursuant to the Agreement and Plan of Reorganization, a significant portion of the portfolios of Strategic Value VIP and Financial Services VIP will be liquidated and the proceeds will be used to acquire other securities consistent with the investment objective, policies, restrictions and strategies of High Return VIP. No assurance can be given as to the actual portfolio composition of High Return VIP subsequent to the merger. |

6

DWS MFS Strategic Value VIP—DWS Dreman High Return Equity VIP

DWS MFS Strategic Value VIP’s (“Strategic Value VIP”) investment objective is to provide capital appreciation. DWS Dreman High Return Equity VIP (“High Return VIP”) seeks to obtain a high rate of total return. Both Funds use a value investment style and may invest in companies with market capitalizations of any size. Strategic Value VIP normally invests at least 65% of its net assets in common stocks and related securities, such as preferred stocks, convertible securities and depository receipts, of companies which the manager believes are undervalued in the market relative to their long-term potential. High Return VIP normally invests at least 80% of its net assets, plus the amount of any borrowings for investment purposes, in common stocks and other equity securities, focusing on stocks of large US companies that are similar in size to the companies in the S&P 500 Index and that the portfolio managers believe are undervalued. Strategic Value VIP may also invest in other types of securities, such as fixed income securities, including lower rated securities (“junk bonds”) and warrants. Strategic Value VIP may also invest in foreign securities (including emerging markets securities) and engage in frequent trading. High Return VIP may invest up to 20% of its net assets in US dollar-denominated American Depository Receipts and in securities of foreign companies traded principally in securities markets outside the US. Both Funds may invest in derivatives (contracts whose value is based on, for example, indices, currencies or securities) and may lend their portfolio securities in an amount up to 33- 1/3% of their respective total assets to approved institutional borrowers. Please also see Part II—Investment Strategies and Risk Factors—below for a more detailed comparison of each Fund’s investment policies and restrictions.

While DeAM believes that High Return VIP should provide a comparable investment opportunity for shareholders of Strategic Value VIP, there are a number of significant differences in the portfolios of each Fund. DeAM has estimated that approximately 89% of the portfolio of Strategic Value VIP will be liquidated and the proceeds will be reinvested in other securities so that upon the merger, its portfolio will conform to the investment objective, policies, restrictions and strategies of High Return VIP.

7

The following table sets forth a summary of the composition of the investment portfolio of each Fund as of December 31, 2005, and DeAM’s estimation of the portfolio composition of High Return VIP assuming consummation of the proposed merger(s) as of that date:

Portfolio Composition (as a % of Fund)

(excludes cash equivalents)

| | | | | | | | | | | | |

Common Stocks

| | Strategic

Value

VIP

| | | High

Return VIP

| | | High Return

VIP—Estimated(1)

(assuming

consummation

of Strategic

Value VIP—High

Return

VIP merger only)

| | | High Return VIP—

Estimated(2)

(assuming

consummation of

Financial Services

VIP—High Return

VIP merger and of

Strategic Value

VIP—High Return

VIP merger)

| |

Financials | | 23 | % | | 29 | % | | 29 | % | | 29 | % |

Information Technology | | 17 | % | | 3 | % | | 3 | % | | 3 | % |

Consumer Discretionary | | 17 | % | | 6 | % | | 6 | % | | 6 | % |

Health Care | | 10 | % | | 17 | % | | 17 | % | | 17 | % |

Energy | | 9 | % | | 21 | % | | 21 | % | | 21 | % |

Telecommunication Services | | 9 | % | | 0 | % | | 0 | % | | 0 | % |

Industrials | | 7 | % | | 5 | % | | 5 | % | | 5 | % |

Materials | | 5 | % | | 0 | % | | 0 | % | | 0 | % |

Consumer Staples | | 3 | % | | 19 | % | | 19 | % | | 19 | % |

| | |

|

| |

|

| |

|

| |

|

|

| | | 100% | | | 100 | % | | 100 | % | | 100 | % |

| | |

|

| |

|

| |

|

| |

|

|

| (1) | | Reflects DeAM’s estimation of the portfolio composition of High Return VIP subsequent to the merger, taking into account that prior to the merger, pursuant to the Agreement and Plan of Reorganization, a significant portion of the portfolio of Strategic Value VIP will be liquidated and the proceeds will be used to acquire other securities consistent with the investment objective, policies, restrictions and strategies of High Return VIP. No assurance can be given as to the actual portfolio composition of High Return VIP subsequent to the merger. |

| (2) | | Reflects DeAM’s estimation of the portfolio composition of High Return VIP subsequent to the merger, taking into account that prior to the merger, pursuant to the Agreement and Plan of Reorganization, a significant portion of the portfolios of Strategic Value VIP and Financial Services VIP will be liquidated and the proceeds will be used to acquire other securities consistent with the investment objective, policies, restrictions and strategies of High Return VIP. No assurance can be given as to the actual portfolio composition of High Return VIP subsequent to the merger. |

8

DWS Income Allocation VIP—DWS Conservative Allocation VIP

DWS Income Allocation VIP (“Income Allocation VIP”) and DWS Conservative Allocation VIP (“Conservative Allocation VIP”) have similar investment objectives and policies, and both invest in Class A shares of other DWS funds (“underlying portfolios”). The same management team manages both Funds.

Income Allocation VIP seeks current income and, as a secondary objective, long-term growth of capital. Conservative Allocation VIP seeks a balance of current income and long-term growth of capital with an emphasis on current income. Income Allocation VIP generally allocates 60-90% of its assets in underlying portfolios which invest primarily in fixed income securities of all credit qualities and maturities (“fixed income portfolios”) and allocates 10-40% of its assets in underlying portfolios which invest primarily in equity securities of all capitalization levels (“equity portfolios”). Conservative Allocation VIP generally invests 45-75% in fixed income portfolios and 25-55% in equity portfolios. Both Funds expect in the future to use derivatives to attempt to manage risk and enhance returns. Please also see “Part II—Investment Strategies and Risk Factors” below for a more detailed comparison of each Fund’s investment policies and restrictions.

While DeAM believes that Conservative Allocation VIP should provide a comparable investment opportunity for shareholders of Income Allocation VIP, there are a number of significant differences in the portfolios of each Fund. DeAM has estimated that approximately 19% of the portfolio of Income Allocation VIP will be liquidated and the proceeds will be reinvested in other securities so that upon the merger, its portfolio will conform to the investment objective, policies, restrictions and strategies of Conservative Allocation VIP.

The following table sets forth a summary of the composition of the investment portfolio of each Fund as of December 31, 2005, and DeAM’s estimation of the portfolio composition of Conservative Allocation VIP assuming consummation of the proposed merger.

Portfolio Composition (as a % of Fund)

| | | | | | | | | |

Asset Allocation

| | Income

Allocation

VIP

| | | Conservative

Allocation VIP

| | | Conservative

Allocation VIP—

Estimated(1)

| |

Equity Funds | | 25 | % | | 43 | % | | 43 | % |

Fixed Income Funds | | 56 | % | | 38 | % | | 38 | % |

Cash Equivalents | | 19 | % | | 19 | % | | 19 | % |

| | |

|

| |

|

| |

|

|

| | | 100% | | | 100 | % | | 100 | % |

| | |

|

| |

|

| |

|

|

| (1) | | Reflects DeAM’s estimation of the portfolio composition of Conservative Allocation VIP subsequent to the merger, taking into account that prior to the merger, pursuant to the Agreement and Plan of Reorganization, a significant portion of the portfolio of Income Allocation VIP will be liquidated and the proceeds will be used to acquire other securities consistent with the investment objective, policies, restrictions and strategies of Conservative Allocation VIP. No assurance can be given as to the actual portfolio composition of Conservative Allocation VIP subsequent to the merger. |

9

| 5. | | How do the expense ratios and management fee rates of the Funds compare, and what are they estimated to be following each merger? |

DWS Dreman Financial Services VIP—DWS Dreman High Return Equity VIP

The following tables summarize the fees and expenses you may bear directly or indirectly as an investor in the Funds, the expenses that each of the Funds incurred for the year ended December 31, 2005, and the pro forma estimated expense ratios of High Return VIP assuming consummation of the merger of Financial Services VIP into High Return VIP only, and assuming consummation of the merger of Financial Services VIP and Strategic Value VIP into High Return VIP as of December 31, 2005. The information shown below does not reflect charges and fees associated with the separate accounts that invest in the Funds or any Contract for which the Funds are investment options. These charges and fees will increase expenses.

As shown below, the merger is expected to result in a lower total expense ratio for shareholders of Financial Services VIP. However, there can be no assurance that the merger will result in expense savings.

Annual Fund Operating Expenses

(expenses that are deducted from fund assets)

(as a % of average net assets)

| | | | | | | | | | | | | | | | | |

| | | Management

Fee

| | | Distribution/

Service

(12b-1)

Fee

| | | Other

Expenses

| | | Total

Annual

Fund

Operating

Expenses

| | | Less Expense

Waiver/

Reimbursements

| | Net

Annual

Fund

Operating

Expenses

(after

waiver)

| |

Financial Services VIP | | | | | | | | | | | | | | | |

Class A | | 0.75 | % | | None | | | 0.14 | % | | 0.89 | % | | — | | 0.89 | % |

Class B | | 0.75 | % | | 0.25 | % | | 0.29 | % | | 1.29 | % | | — | | 1.29 | % |

High Return VIP | | | | | | | | | | | | | | | |

Class A | | 0.73 | % | | None | | | 0.05 | % | | 0.78 | % | | — | | 0.78 | % |

Class B | | 0.73 | % | | 0.25 | % | | 0.19 | % | | 1.17 | % | | — | | 1.17 | % |

High Return VIP

(Pro forma combined, assuming consummation of Financial Services VIP merger only) | | | | | | | | | | | | | | | | | |

Class A | | 0.73 | % | | None | | | 0.05 | %(1) | | 0.78 | % | | — | | 0.78 | %(2) |

Class B | | 0.73 | % | | 0.25 | % | | 0.17 | %(1) | | 1.15 | % | | — | | 1.15 | %(2)(3) |

High Return VIP

(Pro forma combined, assuming consummation of Financial Services VIP merger and Strategic Value VIP merger into High Return VIP) | | | | | | | | | | | | | | | | | |

Class A | | 0.73 | % | | None | | | 0.05 | %(1) | | 0.78 | % | | — | | 0.78 | %(2) |

Class B | | 0.73 | % | | 0.25 | % | | 0.17 | %(1) | | 1.15 | % | | — | | 1.15 | %(2)(3) |

10

| (1) | | Other expenses are estimated, accounting for the effect of the merger. |

| (2) | | Contingent upon effectuation of the merger, through April 30, 2010, DeIM has contractually agreed to waive all or a portion of its management fee and/or reimburse or pay operating expenses of the combined fund to the extent necessary to maintain the combined fund’s total operating expenses at 0.78% and 1.15% for Class A and Class B shares, respectively, excluding certain expenses such as extraordinary expenses, taxes, brokerage and interest. |

| (3) | | DeIM has been notified by a participating insurance company that it intends to seek a substitution order from the SEC, which would permit the insurance company to substitute shares of the Funds with shares of certain other non-DWS variable insurance product funds. There is no assurance that the substitution order will be granted by the SEC or if granted, there is no assurance as to the impact, if any, on the Funds or their respective operating expense ratios. If the substitution order is effected, and contingent upon effectuation of the merger, DeIM has contractually agreed to waive all or a portion of its management fee and/or reimburse or pay operating expenses of the combined fund to the extent necessary to maintain the combined fund’s total operating expenses at 1.11% through April 30, 2010 for Class B shares, excluding certain expenses such as extraordinary expenses, taxes, brokerage and interest. |

The tables are provided to help you understand the expenses of investing in the Funds and your share of the operating expenses that each Fund incurs and that DeAM expects the combined fund to incur in the first year following the merger.

Examples

The following examples translate the expenses shown in the preceding table into dollar amounts. By doing this, you can more easily compare the costs of investing in the Funds. The examples make certain assumptions. They assume that you invest $10,000 in a Fund for the time periods shown and reinvest all dividends and distributions. They also assume a 5% return on your investment each year and that a Fund’s operating expenses remain the same. The examples are hypothetical; your actual costs may be higher or lower.

| | | | | | | | | | | | |

| | | 1 Year

| | 3 Years

| | 5 Years

| | 10 Years

|

Financial Services VIP | | | | | | | | | |

Class A | | $ | 91 | | $ | 284 | | $ | 493 | | $ | 1,096 |

Class B | | $ | 131 | | $ | 409 | | $ | 708 | | $ | 1,556 |

High Return VIP | | | | | | | | | |

Class A | | $ | 80 | | $ | 249 | | $ | 433 | | $ | 966 |

Class B | | $ | 119 | | $ | 372 | | $ | 644 | | $ | 1,420 |

High Return VIP

(Pro forma combined, assuming consummation of Financial Services VIP merger only) | | | | | | | | | | | | |

Class A | | $ | 80 | | $ | 249 | | $ | 433 | | $ | 966 |

Class B | | $ | 117 | | $ | 365 | | $ | 633 | | $ | 1,398 |

High Return VIP

(Pro forma combined, assuming consummation of Financial Services VIP merger and Strategic Value VIP merger into High Return VIP) | | | | | | | | | | | | |

Class A | | $ | 80 | | $ | 249 | | $ | 433 | | $ | 966 |

Class B | | $ | 117 | | $ | 365 | | $ | 633 | | $ | 1,398 |

11

The table below compares the annual management fee schedules of the Funds, which are identical, expressed as a percentage of net assets. As of December 31, 2005, High Return VIP and Financial Services VIP had net assets of $920,617,494 and $137,817,528, respectively.

| | | | | | |

Financial Services VIP

| | High Return VIP

(pre- and post-merger)

|

Average Daily

Net Assets

| | Management

Fee

| | Average Daily

Net Assets

| | Management

Fee

|

| $0 to $250 million | | 0.750% | | $0 to $250 million | | 0.750% |

| $250 million to $1 billion | | 0.720% | | $250 million to $1 billion | | 0.720% |

| $1 billion to $2.5 billion | | 0.700% | | $1 billion to $2.5 billion | | 0.700% |

| $2.5 billion to $5 billion | | 0.680% | | $2.5 billion to $5 billion | | 0.680% |

| $5 billion to $7.5 billion | | 0.650% | | $5 billion to $7.5 billion | | 0.650% |

| $7.5 billion to $10 billion | | 0.640% | | $7.5 billion to $10 billion | | 0.640% |

| $10 billion to $12.5 billion | | 0.630% | | $10 billion to $12.5 billion | | 0.630% |

| Over $12.5 billion | | 0.620% | | Over $12.5 billion | | 0.620% |

DWS MFS Strategic Value VIP—DWS Dreman High Return Equity VIP

The following tables summarize the fees and expenses you may bear directly or indirectly as an investor in the Funds, the expenses that each of the Funds incurred for the year ended December 31, 2005, and the pro forma estimated expense ratios of High Return VIP assuming consummation of the merger of Strategic Value VIP into High Return VIP only, and assuming consummation of the merger of Strategic Value VIP and Financial Services VIP into High Return VIP as of December 31, 2005. The information shown below does not reflect charges and fees associated with the separate accounts that invest in the Funds or any Contract for which the Funds are investment options. These charges and fees will increase expenses.

As shown below, the merger is expected to result in a lower management fee ratio and total expense ratio for shareholders of Strategic Value VIP. However, there can be no assurance that the merger will result in expense savings.

Annual Fund Operating Expenses

(expenses that are deducted from fund assets)

(as a % of average net assets)

| | | | | | | | | | | | | | | | | |

| | | Management

Fee

| | | Distribution/

Service

(12b-1)

Fee

| | | Other

Expenses

| | | Total

Annual

Fund

Operating

Expenses

| | | Less Expense

Waiver/

Reimbursements

| | Net

Annual

Fund

Operating

Expenses

(after

waiver)

| |

Strategic Value VIP | | | | | | | | | | | | | | | |

Class A | | 0.95 | % | | None | | | 0.30 | % | | 1.25 | % | | — | | 1.25 | %(1) |

Class B | | 0.95 | % | | 0.25 | % | | 0.45 | % | | 1.65 | % | | — | | 1.65 | %(1) |

High Return VIP | | | | | | | | | | | | | | | |

Class A | | 0.73 | % | | None | | | 0.05 | % | | 0.78 | % | | — | | 0.78 | % |

Class B | | 0.73 | % | | 0.25 | % | | 0.19 | % | | 1.17 | % | | — | | 1.17 | % |

12

| | | | | | | | | | | | | | | | | |

| | | Management

Fee

| | | Distribution/

Service

(12b-1)

Fee

| | | Other

Expenses

| | | Total

Annual

Fund

Operating

Expenses

| | | Less Expense

Waiver/

Reimbursements

| | Net

Annual

Fund

Operating

Expenses

(after

waiver)

| |

High Return VIP

(Pro forma combined, assuming consummation of Strategic Value VIP merger only) | | | | | | | | | | | | | | | | | |

Class A | | 0.73 | % | | None | | | 0.05 | %(2) | | 0.78 | % | | — | | 0.78 | %(3) |

Class B | | 0.73 | % | | 0.25 | % | | 0.17 | %(2) | | 1.15 | % | | — | | 1.15 | %(3)(4) |

High Return VIP

(Pro forma combined, assuming consummation of Strategic Value VIP merger and Financial Services VIP merger into High Return VIP) | | | | | | | | | | | | | | | | | |

Class A | | 0.73 | % | | None | | | 0.05 | %(2) | | 0.78 | % | | — | | 0.78 | %(3) |

Class B | | 0.73 | % | | 0.25 | % | | 0.17 | %(2) | | 1.15 | % | | — | | 1.15 | %(3)(4) |

| (1) | | Pursuant to their respective agreements with DWS Variable Series II, DeIM, DWS-Scudder Distributors, Inc. and DWS-Scudder Fund Accounting Corporation have agreed, through September 30, 2006, to limit their respective fees and to reimburse other expenses to the extent necessary to limit total operating expenses of Class A and Class B shares of Strategic Value VIP to 0.86% and 1.26%, excluding certain expenses such as extraordinary expenses, taxes, brokerage and interest. |

| (2) | | Other expenses are estimated, accounting for the effect of the merger. |

| (3) | | Contingent upon effectuation of the merger, through April 30, 2010, DeIM has contractually agreed to waive all or a portion of its management fee and/or reimburse or pay operating expenses of the combined fund to the extent necessary to maintain the combined fund’s total operating expenses at 0.78% and 1.15% for Class A and Class B shares, respectively, excluding certain expenses such as extraordinary expenses, taxes, brokerage and interest. |

| (4) | | DeIM has been notified by a participating insurance company that it intends to seek a substitution order from the SEC, which would permit the insurance company to substitute shares of the Funds with shares of certain other non-DWS variable insurance |

13

| | product funds. There is no assurance that the substitution order will be granted by the SEC or if granted, there is no assurance as to the impact, if any, on the Funds or their respective operating expense ratios. If the substitution order is effected, and contingent upon effectuation of the merger, DeIM has contractually agreed to waive all or a portion of its management fee and/or reimburse or pay operating expenses of the combined fund to the extent necessary to maintain the combined fund’s total operating expenses at 1.11% through April 30, 2010 for Class B shares, excluding certain expenses such as extraordinary expenses, taxes, brokerage and interest. |

The tables are provided to help you understand the expenses of investing in the Funds and your share of the operating expenses that each Fund incurs and that DeAM expects the combined fund to incur in the first year following the merger.

Examples

The following examples translate the expenses shown in the preceding table into dollar amounts. By doing this, you can more easily compare the costs of investing in the Funds. The examples make certain assumptions. They assume that you invest $10,000 in a Fund for the time periods shown and reinvest all dividends and distributions. They also assume a 5% return on your investment each year and that a Fund’s operating expenses remain the same. The examples are hypothetical; your actual costs may be higher or lower.

| | | | | | | | | | | | |

| | | 1 Year

| | 3 Years

| | 5 Years

| | 10 Years

|

Strategic Value VIP | | | | | | | | | |

Class A | | $ | 127 | | $ | 397 | | $ | 686 | | $ | 1,511 |

Class B | | $ | 168 | | $ | 520 | | $ | 897 | | $ | 1,955 |

High Return VIP | | | | | | | | | |

Class A | | $ | 80 | | $ | 249 | | $ | 433 | | $ | 966 |

Class B | | $ | 119 | | $ | 372 | | $ | 644 | | $ | 1,420 |

High Return VIP

(Pro forma combined, assuming consummation of Strategic Value VIP merger only) | | | | | | | | | | | | |

Class A | | $ | 80 | | $ | 249 | | $ | 433 | | $ | 966 |

Class B | | $ | 117 | | $ | 365 | | $ | 633 | | $ | 1,398 |

High Return VIP

(Pro forma combined, assuming consummation of Strategic Value VIP merger and Financial Services VIP merger into High Return VIP) | | | | | | | | | | | | |

Class A | | $ | 80 | | $ | 249 | | $ | 433 | | $ | 966 |

Class B | | $ | 117 | | $ | 365 | | $ | 633 | | $ | 1,398 |

The table below compares the annual management fee schedules of the Funds, expressed as a percentage of net assets. As of December 31, 2005, High Return VIP and Strategic Value VIP had net assets of $920,617,494 and $61,073,237, respectively.

| | | | | | |

Strategic Value VIP

| | High Return VIP

(pre- and post-merger)

|

Average Daily

Net Assets

| | Management

Fee

| | Average Daily

Net Assets

| | Management

Fee

|

| $0 to $250 million | | 0.950% | | $0 to $250 million | | 0.750% |

| $250 million to $500 million | | 0.925% | | $250 million to $1 billion | | 0.720% |

| $500 million to $1 billion | | 0.900% | | $1 billion to $2.5 billion | | 0.700% |

| $1 billion to $1.5 billion | | 0.825% | | $2.5 billion to $5 billion | | 0.680% |

| $1.5 billion to $2.5 billion | | 0.800% | | $5 billion to $7.5 billion | | 0.650% |

| Over $2.5 billion | | 0.775% | | $7.5 billion to $10 billion | | 0.640% |

| | | | | $10 billion to $12.5 billion | | 0.630% |

| | | | | Over $12.5 billion | | 0.620% |

14

DWS Income Allocation VIP—DWS Conservative Allocation VIP

The following tables summarize the fees and expenses you may bear directly or indirectly as an investor in the Funds, the expenses that each of the Funds incurred for the year ended December 31, 2005, and the pro forma estimated expense ratios of Conservative Allocation VIP assuming consummation of the merger as of that date. The information shown below does not reflect charges and fees associated with the separate accounts that invest in the Funds or any Contract for which the Funds are investment options. These charges and fees will increase expenses.

As shown below, the merger is expected to result in the same total expense ratio for shareholders of Income Allocation VIP. However, there can be no assurance that the merger will actually result in the same total expense ratio.

Annual Fund Operating Expenses

(expenses that are deducted from fund assets)

(as a % of average net assets)

| | | | | | | | | | | | | | | | | | | | | | | |

| | | Manage-

ment

Fee

| | | Distribution/

Service

(12b-1) Fee

| | | Other

Expenses

| | | Total

Annual

Fund

Operating

Expenses

| | | Less

Expense

Waiver/

Reimburse-

ments

| | | Net

Annual

Fund

Operating

Expenses

(after

waiver)

| | | Range of

Average

Weighted

Net

Expense

Ratios for

Underlying

Portfolios

| | Estimated

Total

Annual

Direct and

Indirect

Operating

Expenses(4)

| |

Income Allocation VIP | | | | | | | | | | | | | | | | | | |

Class B | | 0.15 | % | | 0.25 | % | | 1.13 | % | | 1.53 | % | | — | | | 1.53 | %(1) | | 0.48%

to

0.79% | | 2.10 | % |

Conservative Allocation VIP | | | | | | | | | | | | | | | |

Class B | | 0.15 | % | | 0.25 | % | | 0.54 | % | | 0.94 | % | | — | | | 0.94 | %(1) | | 0.45%

to

0.84% | | 1.60 | % |

Conservative Allocation VIP

(Pro forma combined) | | | | | | | | | | | | | | | |

Class B | | 0.15 | % | | 0.25 | % | | 0.42 | %(2) | | 0.82 | % | | 0.07 | %(3) | | 0.75 | %(3) | | 0.45%

to

0.84% | | 1.41 | % |

| (1) | | Through November 30, 2006, DeIM, DWS-Scudder Distributors, Inc. and DWS-Scudder Fund Accounting Corporation have each contractually agreed to waive their respective fees to the extent necessary to maintain each Fund’s direct operating expenses at 0.75% of average daily net assets, excluding certain expenses such as extraordinary expenses, taxes, brokerage and interest. |

| (2) | | Other expenses are estimated, accounting for the effect of the merger. |

| (3) | | Contingent upon effectuation of the merger, through April 30, 2010, DeIM has contractually agreed to waive all or a portion of its management fee and/or reimburse or pay operating expenses of the combined fund to the extent necessary to maintain the combined fund’s total operating expenses at 0.75%, excluding certain expenses such as extraordinary expenses, taxes, brokerage, interest, organizational and offering costs. |

15

| (4) | | The Estimated Total Annual Direct and Indirect Operating Expenses shown in the table is the sum of each Fund’s Total Annual Operating Expenses and the weighted average expense ratio of the underlying portfolios held by the Fund. |

The tables are provided to help you understand the expenses of investing in the Funds and your share of the operating expenses that each Fund incurs and that DeAM expects the combined fund to incur in the first year following the merger.

Examples

The following examples translate the expenses shown in the preceding table into dollar amounts. By doing this, you can more easily compare the costs of investing in the Funds. The examples make certain assumptions. They assume that you invest $10,000 in a Fund for the time periods shown and reinvest all dividends and distributions. They also assume a 5% return on your investment each year and that a Fund’s operating expenses remain the same. The examples are hypothetical; your actual costs may be higher or lower.

| | | | | | | | | | | | |

| | | 1 Year

| | 3 Years

| | 5 Years

| | 10 Years

|

Income Allocation VIP | | | | | | | | | | | | |

Class B | | $ | 213 | | $ | 658 | | $ | 1,129 | | $ | 2,431 |

Conservative Allocation VIP | | | | | | | | | | | | |

Class B | | $ | 163 | | $ | 505 | | $ | 871 | | $ | 1,900 |

Conservative Allocation VIP

(Pro forma combined) | | | | | | | | | | | | |

Class B | | $ | 144 | | $ | 446 | | $ | 786 | | $ | 1,747 |

The table below compares the annual management fee schedules of the Funds, which are identical, expressed as a percentage of net assets. As of December 31, 2005, Conservative Allocation VIP and Income Allocation VIP had net assets of $46,071,582 and $12,293,419, respectively.

| | | | | | |

Income Allocation VIP

| | Conservative Allocation VIP

(pre- and post-merger)

|

Average Daily

Net Assets

| | Management

Fee

| | Average Daily

Net Assets

| | Management

Fee

|

| $0 to $500 million | | 0.150% | | $0 to $500 million | | 0.150% |

| $500 million to $1 billion | | 0.140% | | $500 million to $1 billion | | 0.140% |

| $1 billion to $1.5 billion | | 0.130% | | $1 billion to $1.5 billion | | 0.130% |

| $1.5 billion to $2.5 billion | | 0.120% | | $1.5 billion to $2.5 billion | | 0.120% |

| Over $2.5 billion | | 0.110% | | Over $2.5 billion | | 0.110% |

| 6. | | What are the federal income tax consequences of the proposed mergers? |

For federal income tax purposes, no gain or loss is expected to be recognized by an Acquired Fund or its shareholders as a direct result of its merger. As described above, shares of the Acquired Funds are available to investors purchasing Contracts funded through the separate accounts (or sub-accounts thereof) of Participating Insurance Companies. As long as these Contracts qualify as annuity contracts under Section 72 of the Internal Revenue Code of 1986, as amended (the “Code”), and Treasury Regulations thereunder, the mergers, whether treated as tax-free reorganizations or not, will not create any federal income tax liability for Contract Owners. For more information, please see “Information about the Proposed Mergers—Certain Federal Income Tax Consequences,” below.

16

| 7. | | Will my dividends be affected by the mergers? |

The mergers will not result in a change in dividend policy. All Funds intend to declare and distribute dividends from their net investment income and capital gains, if any, annually.

| 8. | | Do the procedures for purchasing, redeeming and exchanging shares of the Funds differ? |

No. The procedures for purchasing and redeeming shares of each Fund, and for exchanging shares of each Fund for shares of other DWS funds, are identical. The separate accounts of the Participating Insurance Companies place orders to purchase and redeem shares of the Funds based on, among other things, the amount of premium payments to be invested and surrender and transfer requests to be effected on that day pursuant to its Contracts. The shares of each Fund are purchased and redeemed at the net asset value of the Fund’s shares next determined after an order in proper form is received. No fee is charged to shareholders when they purchase or redeem shares of the Funds, nor will a fee be charged to shareholders when they purchase or redeem shares of the combined funds. Please see the Funds’ prospectuses for additional information.

| 9. | | How will I be notified of the outcome of the merger of my Acquired Fund? |

If the proposed merger of your Acquired Fund is approved by shareholders, shareholders whose accounts are affected by the merger will receive a confirmation statement reflecting their new account number and the number of shares of the corresponding Acquiring Fund they are receiving after the merger is completed. Subsequently, affected Contract Owners will be notified of changes to their account information by their respective Participating Insurance Companies. If the proposed merger is not approved, this result will be noted in the next shareholder report of your Acquired Fund.

| 10. | | Will the value of my investment change? |

The number of shares owned by each Participating Insurance Company will most likely change. However, the total value of your investment in the Acquiring Fund will equal the total value of your investment in your Acquired Fund at the time of the merger. Even though the net asset value per share of each Fund is likely to be different, the total value of your holdings will not change as a result of the merger.

| 11. | | What percentage of shareholders’ votes is required to approve the merger of my Fund? |

Approval of each merger will require the affirmative vote of the shareholders of the applicable Acquired Fund entitled to vote more than 50% of the votes entitled to be cast on the matter at the special meeting.

The Trustees of the Trust believe that the proposed mergers are in the best interests of each Acquired Fund. Accordingly, the Trustees unanimously recommend that shareholders vote FOR approval of the proposed mergers.

17

II. INVESTMENT STRATEGIES AND RISK FACTORS

What are the main investment strategies and related risks of each Acquiring Fund and how do they compare with those of the corresponding Acquired Fund?

DWS Dreman Financial Services VIP—DWS Dreman High Return Equity VIP

Investment Objectives and Strategies. High Return VIP seeks to achieve a high rate of total return, whereas Financial Services VIP seeks to provide long-term capital appreciation.

Under normal circumstances, High Return VIP invests at least 80% of net assets, plus the amount of any borrowings for investment purposes, in common stocks and other equity securities. High Return VIP focuses on stocks of large US companies that are similar in size to the companies in the S&P 500 Index (as of March 31, 2006, the S&P 500 Index had a median market capitalization of $11.74 billion) and that the portfolio managers believe are undervalued. High Return VIP intends to invest primarily in companies whose market capitalizations fall within the normal range of the Index. In contrast, under normal circumstances, Financial Services VIP invests at least 80% of net assets, plus the amount of any borrowings for investment purposes, in equity securities (mainly common stocks) of financial services companies. These may include companies of any size that commit at least half of their assets to the financial services sector, or derive at least half of their revenues or net income from that sector. The major types of financial services companies are banks, insurance companies, savings and loans, securities brokerage firms and diversified financial companies.

Although High Return VIP can invest in stocks of any economic sector, at times it may emphasize the financial services sector or other sectors (in fact, it may invest more than 25% of total assets in a single sector). High Return VIP may invest up to 20% of net assets in US dollar-denominated American Depository Receipts and in securities of foreign companies traded principally in securities markets outside the US. While Financial Services VIP invests mainly in US stocks, it could invest up to 30% of total assets in foreign securities, and up to 20% of net assets in investment-grade debt securities.

Both Funds use the same value investment style and investment process and are managed by the same portfolio managers. The portfolio managers begin by screening for stocks whose price-to-earnings ratios are below the average for their respective Index. The managers then compare a company’s stock price to its book value, cash flow and yield, and analyze individual companies to identify those that are financially sound and appear to have strong potential for long-term growth and income.

The managers assemble each Fund from among the most attractive stocks, drawing on analysis of economic outlooks for various sectors and industries. The managers may favor securities from different sectors and industries at different times, while still maintaining variety in terms of industries and companies represented.

The managers normally will sell a stock when it reaches a target price, its fundamental factors have changed or when other investments offer better opportunities, or for Financial Services VIP, in the course of adjusting the emphasis on a given industry.

18

Each Fund may lend its investment securities in an amount up to 33 1/3% of its total assets to approved institutional borrowers who need to borrow securities in order to complete certain transactions.

Although major changes tend to be infrequent, the Board of Trustees could change either Fund’s investment objective without seeking shareholder approval. However, the Board will provide shareholders with at least 60 days notice prior to making any changes to a Fund’s 80% investment policy.

Although not a principal investment strategy, each Fund is permitted, but not required, to use various types of derivatives. In particular, High Return VIP may use futures, currency options and forward currency transactions and Financial Services VIP may use futures and options. Each Fund may also use derivatives in circumstances where the portfolio managers believe they offer an economical means of gaining exposure to a particular asset class or to keep cash on hand to meet shareholder redemptions or other needs while maintaining exposure to the market.

As a temporary defensive measure, each Fund could shift up to 100% of assets into investments such as money market securities. This measure could prevent losses but, while engaged in a temporary defensive position, a Fund will not be pursuing its investment objective. However, the portfolio managers may choose not to use these strategies for various reasons, even in very volatile market conditions.

The portfolio turnover rate for High Return VIP, i.e., the ratio of the lesser of annual sales or purchases to the monthly average value of the Fund (excluding from both the numerator and the denominator securities with maturities at the time of acquisition of one year or less), for the fiscal year ended December 31, 2005 was 10%. The portfolio turnover rate for Financial Services VIP for the fiscal year ended December 31, 2005 was 27%. A higher portfolio turnover rate involves greater brokerage and transaction expenses to a Fund.

Although DeAM believes that High Return VIP should provide a comparable investment opportunity for shareholders of Financial Services VIP, there are a number of significant differences in the portfolios of each Fund. Pursuant to the Agreement, DeAM has estimated that approximately 62% of the portfolio of Financial Services VIP will be liquidated prior to the merger. Proceeds from the liquidation will be used to acquire securities consistent with High Return VIP’s investment objective, policies, restrictions and strategies.

For a more detailed description of the investment techniques used by High Return VIP and Financial Services VIP, please see the applicable Fund’s prospectus and statement of additional information.

Primary Risks. As with any mutual fund, you may lose money by investing in High Return VIP. Certain risks associated with an investment in High Return VIP are summarized below. The risks of an investment in High Return VIP are similar to the risks of an investment in Financial Services VIP. More detailed descriptions of the risks associated with an investment in High Return VIP can be found in the current prospectus and statement of additional information for High Return VIP.

19

The value of your investment in High Return VIP will change with changes in the values of the investments held by the Fund. A wide array of factors can affect those values. In this summary, we describe the principal risks that may affect High Return VIP’s investments as a whole. The Fund could be subject to additional principal risks because the types of investments it makes can change over time.

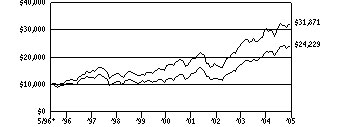

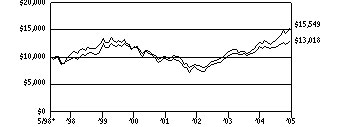

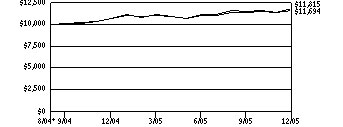

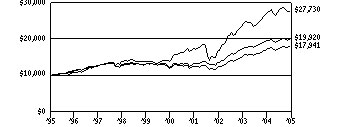

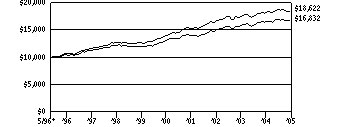

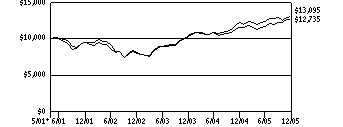

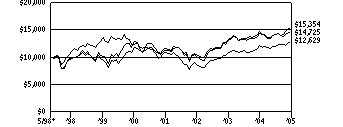

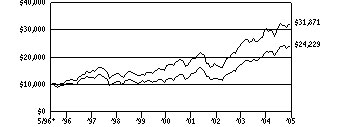

There are several risk factors that could hurt the performance of High Return VIP, cause you to lose money or cause the performance of High Return VIP to trail that of other investments.