August 23, 2017

VIA EDGAR

Elisabeth Bentzinger

Office of Disclosure and Review

Division of Investment Management

U.S. Securities and Exchange Commission

100 F Street, N.E.

Washington, D.C. 20549

Re: Mutual Fund & Variable Insurance Trust, Rational Total Return Income Fund - File Nos. 033-11905 and 811-05010

Dear Ms. Bentzinger:

On April 13, 2017, Mutual Fund and Variable Insurance Trust (the “Trust” or the “Registrant”) filed a registration statement under the Securities Act of 1933 on Form N-1A (the “Registration Statement”) with respect to the Rational Total Return Income Fund. On June 5, 2017, you provided oral comments. On July 3, 2017, the Registrant filed an amendment to the Registration Statement and a response letter to address your June 5, 2017 comments. On July 10, 2017, you provided follow up comments. Please find below a summary of those comments and the Registrant's responses, which the Registrant has authorized Thompson Hine LLP to make on behalf of the Registrant.

Comment 1. Please confirm that the Fund will limit its investments in below investment grade, non-agency CMBS to 15% of the Fund’s portfolio (because they are illiquid securities) or explain in detail how the Registrant determined that the below investment grade, non-agency CMBS in which the Fund expects to invest are liquid (meaning they can be sold in the ordinary course of business within 7 days at approximately the value at which the Fund has valued the investments). The response should reference the specific below investment grade, non-agency CMBS in the Fund’s portfolio over a recent period and include:

| a. | general market data on the securities; |

| b. | information regarding whether the Fund will impose any limits as a percentage of net assets with respect to the position sizes in these securities; |

| c. | specific measures the Fund would take if received a large redemption request; |

| d. | confirmation of the existence of an active market for the securities including the number, diversity, and quality of the market participants; |

Page2

| e. | the frequency of the trades or quotes for the securities including the daily trading volume; |

| f. | the volatility of the trading prices for the securities; |

| g. | the bid and ask spread for the securities; |

| h. | the existence of any restrictions on trading or transfers of the securities; |

| i. | the availability of and adviser access to information on the underlying assets; and |

| j. | how the Fund will be able to appropriately value the securities on a daily basis. |

Response. The sub-adviser does not believe that all investments in below investment grade, non-agency CMBS are illiquid. The sub-adviser agrees thatnew issue(issued in December 2016 or later), below investment grade, non-agency CMBS are illiquid due to the limitations imposed on a holder’s ability to transfer the securities; therefore, the Fund has not previously invested, and does not intend to invest in the future, in new issue, below investment grade, non-agency CMBS at all (see the attached appendix for more information on these securities under “Illiquid”). However, the sub-adviser believes that other below investment grade, non-agency CMBS are, in fact, liquid. In particular, conduit CMBS originated prior to 2008 of any rating and conduit CMBS originated after 2008 rated BB+, BB or BB-, or their equivalents, are liquid as supported by a robust secondary market for such securities.

Due to the low level of disclosure of specific trade data among dealers and investors in the CMBS market for both investment grade and below investment grade CMBS, FINRA has adopted the TRACE system, which requires that dealers report all CMBS trades by the end of the trading day. Therefore, although there is no visual bid/ask spread on specific securities by broker dealers, the sub-adviser (and most others inthe market) rely on TRACE data and data from ICE Data Services (formerly Interactive Data Corporation or IDC) (“ICE”) for determining the activity in the market for, and liquidity of, CMBS. ICE is the leading third party pricing service and market data provider for fixed income securities.

The Fund’s current portfolio, which is representative of the Fund’s strategy both historically and going forward, is 100% liquid based on both the Sub-Adviser’s determination and that of ICE. ICE has developed a new product that provides liquidity assessments of securities/portfolios in advance of the implementation of the new Rule 22e-4 governing Liquidity Risk Management for mutual funds. The liquidity module within their Vantage product incorporates their evaluated price and spread, price and spread history, market depth assessments, and daily trading activity. It is the Sub-Adviser’s understanding that ICE has been working closely with the SEC in development of the product.

The 2009 recession and corresponding rapid increase in underlying defaults caused the ratings agencies who had rated CMBS 1.0deals (which are dealsoriginated prior to 2008) to drastically cut, or pull their ratings altogether. As this underlying collateral is maturing and winding down due to payoffs and liquidated losses, the agencies have not focused on updating their ratings of these securities and many, if not all, of their ratings are stale and do not reflect the proper risk associated with the respective security. In general, the market gages principal

Page3

risk through valuation. The higher the price the more likely the market believes there will be a full principal recovery. This is accepted by the market and the ratings on CMBS 1.0 below investment grade bonds are largely ignored.

The Sub-Adviser determines liquidity using the requirements of the new Rule 22e-4 (although the compliance date has not yet passed).

The information below shows the Fund’s current holdings, as of 7/26/17, along with the corresponding liquidity determination for each of the holdings as determined by the Sub-Adviser. Additionally, there is a chart showing ICE’s liquidity determination for the majority of the Fund’s CMBS holdings as of 7/25/17. The three bonds not shown on ICE’s chart were purchased after the portfolio holdings information of the Fund were given to ICE. Both the Sub-Adviser and ICE consider the current portfolio is 100% liquid. How the Sub-Adviser categorizes securities using the new Rule 22e-4 categories is set forth in the appendix to this letter.

Page4

In addition, below is the data requested by the Staff with respect to below investment grade, non-agency CMBS specifically, rather than just all CMBS as was previously provided by the Registrant.

| a. | general market data on the securities; |

See attached spreadsheet showing market data for below investment grade, non-agency CMBS.

| b. | information regarding whether the Fund will impose any limits as a percentage of net assets with respect to the position sizes in these securities; |

Page5

The sub-adviser has confirmed to the Registrant that the Fund intends to limit below investment grade, non-agency CMBS to 60% of the Fund’s net assets and that these securities will be moderately to highly liquid as determined by ICE standards. In addition, the Fund has not previously invested, and will not invest in the future, in new issue, below investment grade, non-agency CMBS that are subject to Dodd Frank risk retention rules.

| c. | specific measures the Fund would take if received a large redemption request; |

Like with investment grade non-agency CMBS, the sub-adviser expects to be able to meet redemption requests because the Fund’s portfolio will be liquid. As part of the pre-investment selection process, the sub-advisor targets below investment grade, non-agency CMBS investments that have daily liquidity. The sub-advisor has also established trading accounts and relationships with over 30 broker dealers who are actively trading and making markets in below investment grade, non-agency CMBS. In addition, the Registrant has a redemption overdraft program in place with its custodian for short term liquidity needs. If necessary, the Fund may also establish a line of credit to assist when any temporary liquidity concerns as a result of large redemptions.

In general, below investment grade, non-agency CMBS exhibits significant daily liquidity. See attached spreadsheet for information regarding the liquidity of the securities in the Fund’s portfolio, which shows a 3 day liquidity window.

| d. | confirmation of the existence of an active market for the securities including the number, diversity, and quality of the market participants; |

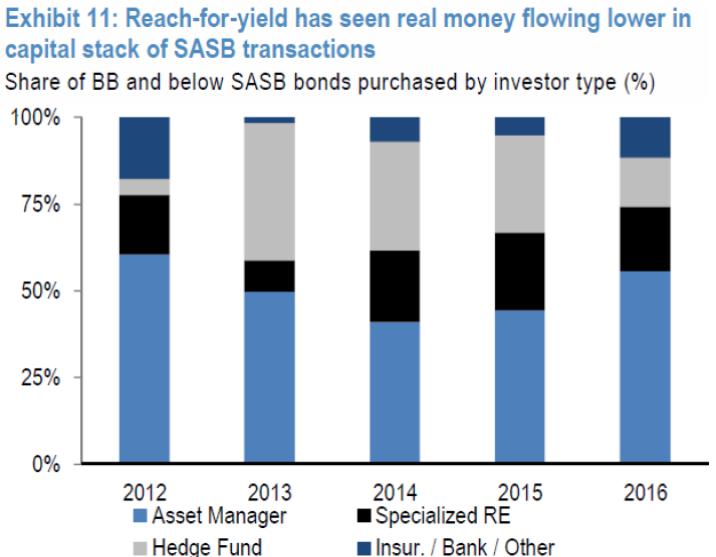

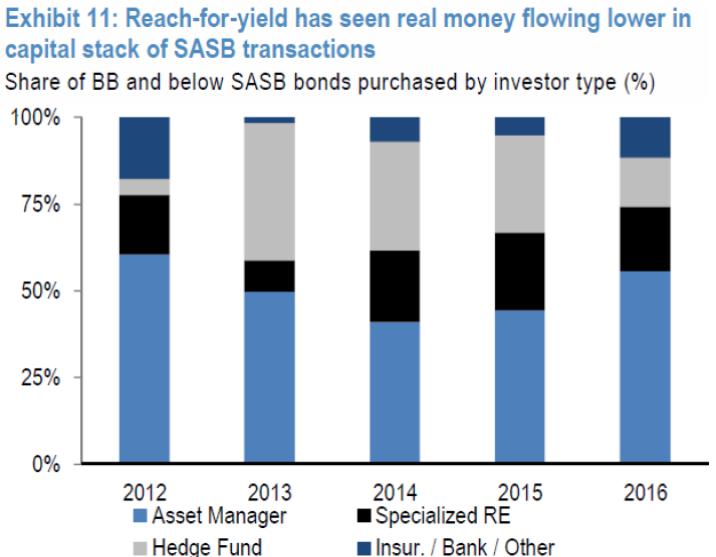

The non-agency CMBS market is a robust and active market in the fixed income sector. New regulations have created costlier capital rules and have lessened the appetite of dealers to hold inventory in below investment grade CMBS for prolonged periods of time. In place of reduced dealer inventories of securities, there has been an increase in real money accounts participating in below investment grade, as dealers become conduits for investors to buy securities as opposed to competitors for securities. While not widely reported in CMBS research, we would estimate that, depending on credit quality, there could be anywhere from 25 to 100+ different buyers for our securities. These buyers consist primarily of institutional money managers, pension funds, asset managers/mutual funds, hedge funds, REITs, specialized real estate investors, as well as broker dealers. The two charts below show these investors are active buyers of BB rated and below SASB (Single Asset Single Borrower) CMBS as well as BBB rated new issue CMBS.

|

Page6

Source: JPMorgan

At new issue, the sale of all below investment grade (BB, B and NR) classes (the “B-piece”) is negotiated between the issuer and a single investor, (the “B-piece Buyer”) prior to the issuance date. The B-piece Buyer typically re-underwrites every single loan in the collateral pool as their NR bond is the first bond to absorb any losses on the collateral. The B-piece is generally held long-term and valued at a model-driven fair value by the B-piece Buyer, rather than at a mark-to-market valuation. While the sub-adviser views B-pieces as illiquid and the Fund will not invest in these securities, it is worth showing how the amount of B-piece Buyers is growing in CMBS, as these investors would also be buyers of below investment grade, non-agency CMBS.

Page7

| e. | the frequency of the trades or quotes for the securities including the daily trading volume; |

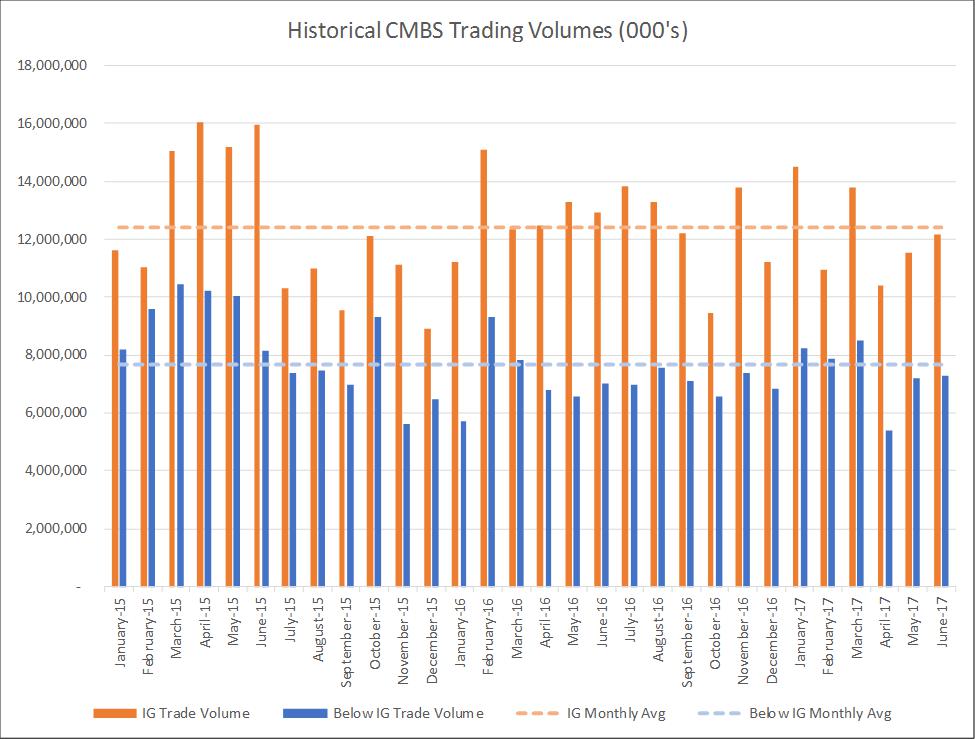

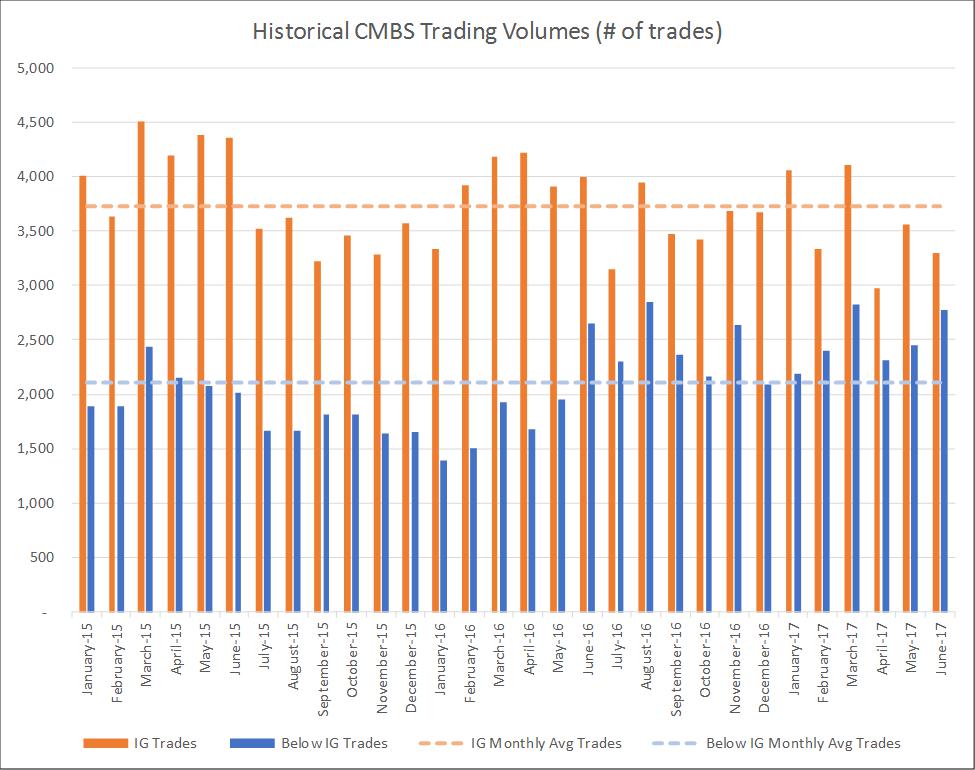

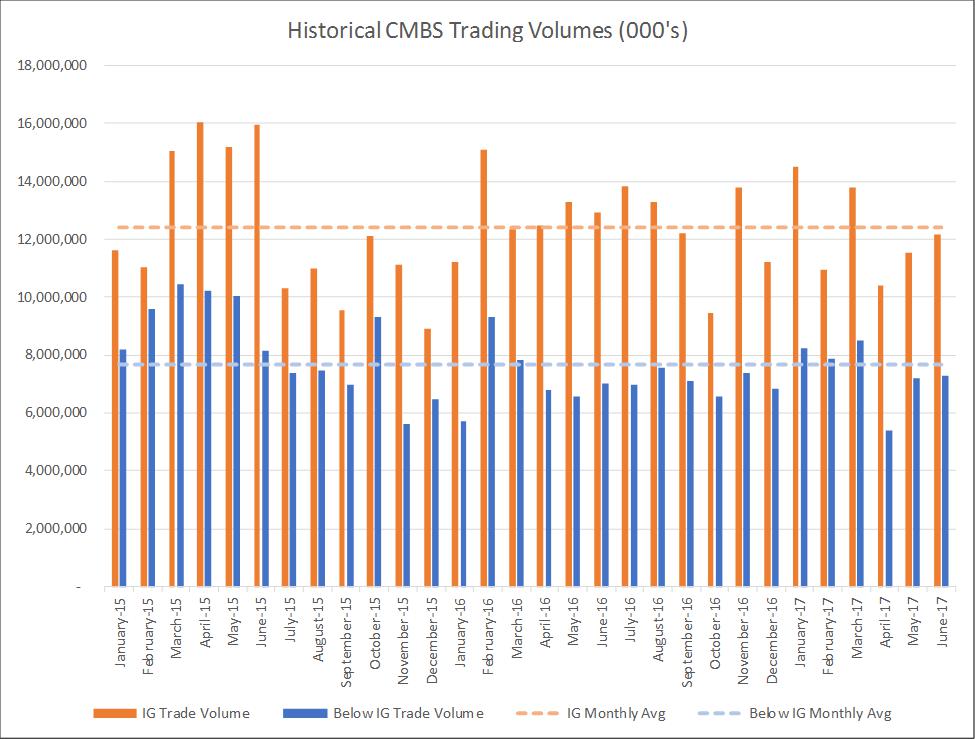

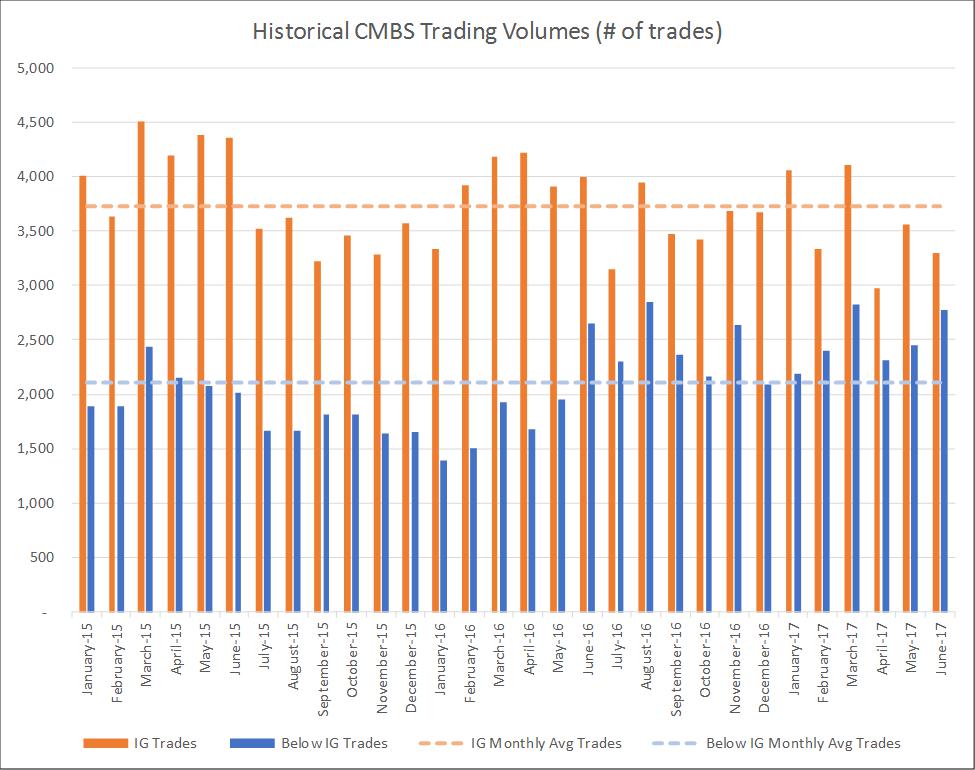

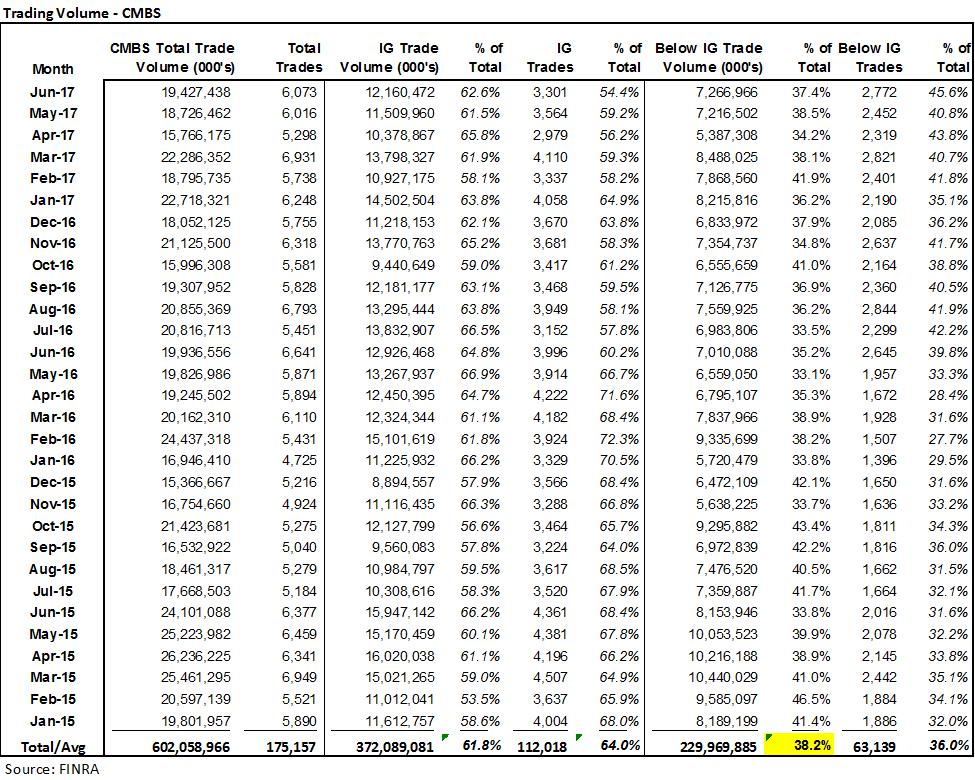

In the charts in this section, the investment grade data includes agency CMBS, but the below investment grade trade volume shown is (99.9%) composed of non-agency CMBS.

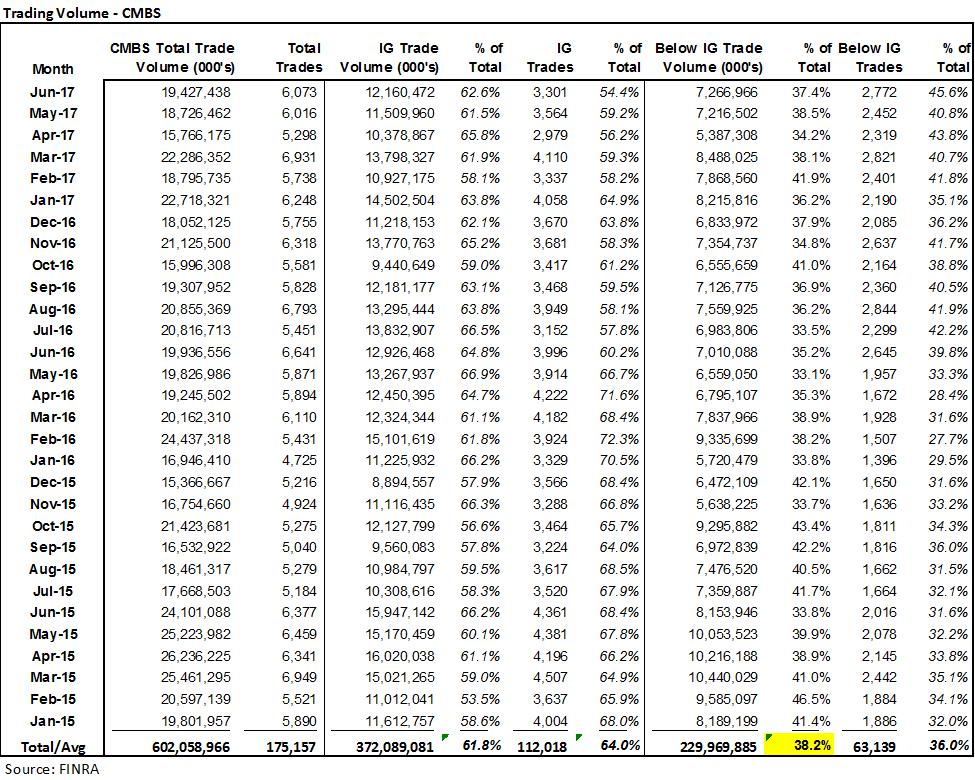

Below are three charts showing the monthly trading volumes in both above and below investment grade CMBS from January 2015 through June 2017.

Page8

Page9

Page10

Trading in Below Investment Grade CMBS represents 38.2% of the cumulative CMBS trading volume since January 2015, with $86.9B trading over the trailing 12 months.

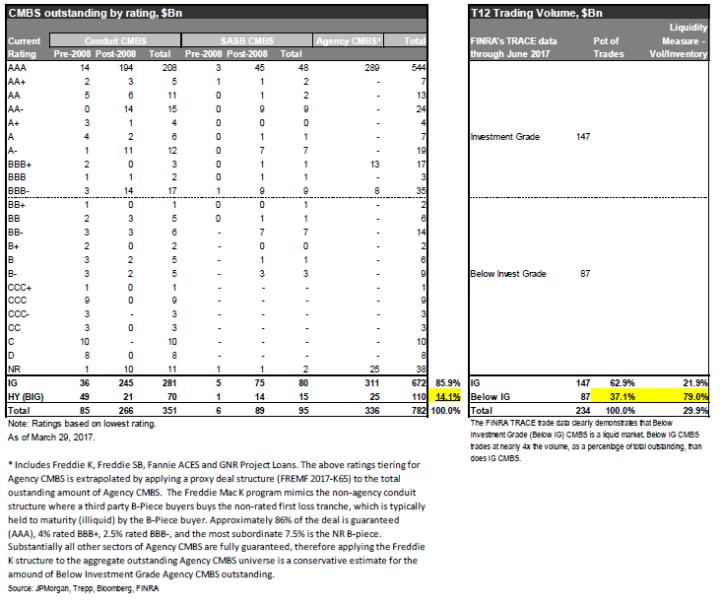

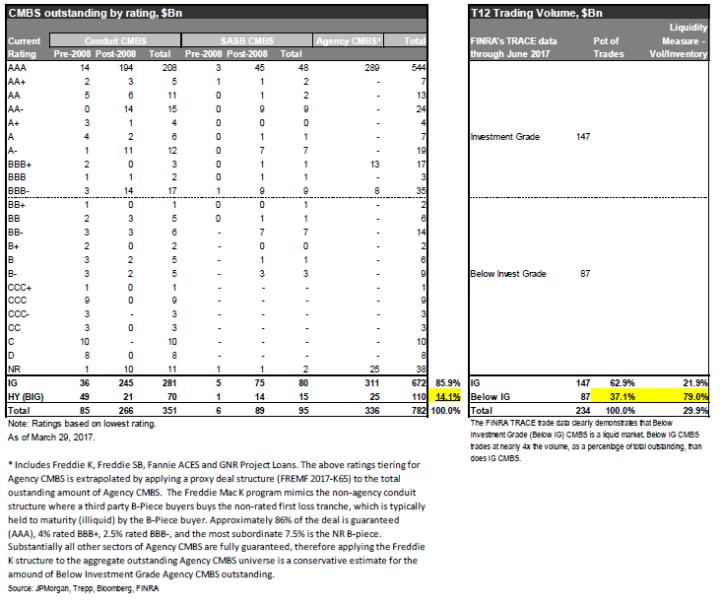

The chart below shows the distribution of CMBS by subcategory and rating. This chart was sourced from information in a JPMorgan CMBS research piece with information from Trepp and Bloomberg. The trailing 12 months trading volumes from FINRA for investment grade and below investment grade are also included. Below investment grade CMBS comprises 9.4% of the outstanding CMBS universe, yet it represents 37.1% of the CMBS trading activity over the trailing 12 months. The $87B of below investment grade trading activity over the past 12 months represents approximately 79.0% of the total amount of below investment grade CMBS outstanding, thus illustrating it is a highly liquid asset class.

Page11

| f. | the volatility of the trading prices for the securities; |

In the attached spreadsheet, entitled, Portfolio Bid Ask Spreads, YTD, we have listed the bid ask price per ICE for every security from 1/3/17 through 7/27/17.

| g. | the bid and ask spread for the securities; |

Each of the current portfolio holdings has bid/ask spreads in ICE. See attached spreadsheet for bid/ask spread history from 1/3/17 through 7/27/17. A summary for the current portfolio is below.

Page12

| h. | the existence of any restrictions on trading or transfers of the securities; |

Some CMBS are Rule 144A securities, which have restrictions on resale. However, the Fund deems many of these to be liquid because the Fund reasonably expects that they can be sold or disposed of in current market conditions in seven calendar days or less without the sale or disposition significantly changing the market value of the security. The Fund will invest no more than 15% of the Fund’s assets in illiquid securities, which may include illiquid Rule 144A securities.

| i. | the availability of and adviser access to information on the underlying assets; and |

Like investment grade, non-agency CMBS, the sub-adviser’s access to information on the underlying assets is robust. The sub-adviser has access to and examines various aspects of the underlying assets, including mortgage loan specifics (loan amount, rate, maturity, prepayment penalties, borrowing entity and carve out guarantors, loan reserves and escrows), property specifics (location, total square footage and acreage, parking, zoning, rent roll, lease rates, expirations and reimbursements, property age & condition, year built, year renovated), property financials, historical occupancy, historical financial revenue

Page13

and expenses, and periodic updates from the property owner of the financials and leasing activity regarding the properties. This information is tracked and complied by the master servicer, which subsequently allows multiple third party software providers including, Bloomberg, Trepp, and Real Capital Analytics as well as by the two rating agencies on every CMBS deal, who also provide updates and analysis

| j. | how the Fund will be able to appropriately value the securities on a daily basis. |

The Fund will use data from ICE in valuing CMBS. It should be noted that ICE is the “market standard” for CMBS pricing. Their pricing methodology includes daily trading activity in individual CUSIPs and comparable bonds, daily surveys of dealer markets, bid-wanted-in-competition activity (“BWIC”), bid-offer spreads, and discounted cash flow analysis. As they have a comprehensive view of the market, the Fund will use their services for daily pricing for each fixed income security in the Fund, along with dealer bid side markets as applicable.

SAI:

Comment 2. The Fund’s concentration policy says that it does not concentrate in any industry or group of industries. Please revise the concentration policy to say that the Fund concentrates in CMBS or explain why it is not concentrated.

Response. The Registrant has made the revision requested.

If you have any further questions or additional comments, please contact Tanya Goins at (404) 541-2954 or JoAnn Strasser at (614) 469-3265.

Sincerely,

/s/Tanya. L. Goins

Tanya L. Goins

Page14

Appendix

Liquidity Definitions

Highly Liquid - Cash and any investment reasonably expected to be convertible to cash in current market conditions in 3 business days or less without conversion to cash significantly changing market value of the investment.

Fund considers cash or cash equivalent money market holdings, equity securities traded on an exchange, and certain CMBS holdings as highly liquid investments. Factors included in determining whether a CMBS is highly liquid include current valuation, expected cash flow and maturity, recent trading activity of same or comparable bonds, position size (relative to entire class), and credit risk profile. These are generally investment grade bonds, or if unrated/ratings out-of-date, of comparable credit quality as determined by the Sub-Adviser. These bonds would be traded after being marketed on a 1-day notice BWIC and would settle T+2. The Fund will maintain a minimum of 40% of its assets in the Highly Liquid bucket.

Moderately Liquid - Any investment reasonably expected to be convertible to cash in current market conditions in more than 3 calendar days but in 7 calendar days or less without conversion to cash significantly changing market value of investment.

Fund considers certain CMBS holdings as moderately liquid investments. Factors included in determining whether CMBS is moderately liquid include current valuation, expected cash flow and maturity, recent trading activity of same or comparable bonds, position size (relative to entire class), and credit risk profile. These may include bonds that are below investment grade and above CCC, where the market would expect additional time for cursory credit evaluation. These bonds would be traded after being marketed on a 1 to 3-day notice BWIC and would settle T+2.

Less Liquid -Any investment reasonably expected to be sold or disposed of in current market conditions in 7 calendar days or less without sale or disposition significantly changing market value of investment, but where sale or disposition is reasonably expected to settle in more than 7 calendar days.

Fund considers certain CMBS holdings as less liquid investments. Factors included in determining whether CMBS is less liquid include current valuation, expected cash flow and maturity, recent trading activity of same or comparable bonds, position size (relative to entire class), and credit risk profile. These may include bonds that are below investment grade, and may be CCC or below, and are expected to realize some level of credit loss. These are generally seasoned bonds with fewer underlying collateral loans, where market participants would expect additional time for diligence and credit work on the underlying collateral loans and properties. These bonds would be traded after being marketed on 3 to 7-day notice BWIC and would settle T+2.

Page15

Illiquid - Any investment that may not reasonably be expected to be sold or disposed of in current market conditions in 7 calendar days or less without sale or disposition significantly changing market value of the investment.

Fund considers certain CMBS investments to be illiquid. Factors included in determining whether CMBS is illiquid include current valuation, expected cash flow and maturity, recent trading activity of same or comparable bonds, position size (relative to entire class), and credit risk profile. These may include bonds with atypical structures or bonds that subject to restrictions on transfer, such as new issue (post December 2016 originated) bonds subject to Dodd-Frank risk retention rules.

The risk-retention rules require that the sponsor of a securitization retain a 5 percent interest in the credit risk of the securitized assets. There was a carve-out for CMBS (versus other asset backed securitizations), which allows an eligible 3rd party investor to retain the 5 percent risk piece instead of the sponsor. The securitization sponsor or eligible 3rd party investor, also known as the B-piece Buyer, must retain the 5% position for a minimum of 5 years and cannot sell or finance their investment. These restrictions ensure that the issuer, or B-Piece buyer, retains a risk position in the securitization per the spirit of the Dodd-Frank law. The 5 percent requirement can be satisfied by holding (i) a 5 percent interest in each class of the securitization (a “Vertical Strip”), (ii) 5 percent of the fair value of the securitization in a first loss position, (a “Horizontal Strip”), or (iii) any combination of a Vertical and Horizontal Strip that are equal to at least 5 percent, aka an “L-shaped” retention piece. The Sub-Adviser considers any CMBS subject to Dodd-Frank risk retention rules to be illiquid and will not invest in any bonds subject to the proscribed disposition restrictions.