UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-K

(Mark One)

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2010

Or

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission file number 001-33405

Dreams, Inc.

(Exact name of registrant as specified in its charter)

| | |

| Utah | | 87-0368170 |

(State or other jurisdiction of incorporation or organization) | | (I.R.S. Employer Identification No.) |

| |

| 2 South University Drive, suite 325 Plantation, Florida | | 33324 |

| (Address of principal executive offices) | | (Zip Code) |

Registrant’s telephone number (954) 377-0002

Securities registered pursuant to Section 12(b) of the Act:

| | |

Title of each class | | Name of each exchange on which registered |

| Common stock, no par value | | NYSE Amex Equities Exchange |

Securities registered pursuant to Section 12(g) of the Act:

None

(Title of class)

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. ¨ Yes x No

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. ¨ Yes x No

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for a shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. x Yes ¨ No

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). ¨ Yes ¨ No

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer”, “accelerated filer”, “non-accelerated filer”, and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

| | | | | | |

| Large accelerated filer | | ¨ | | Accelerated filer | | ¨ |

| | | |

| Non-accelerated filer | | ¨ | | Smaller reporting company | | x |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act.) ¨ Yes x No

The aggregate market value of the voting and non-voting common equity held by non-affiliates as of the closing price of such shares on the last business day of the registrant’s most recently completed second fiscal quarter was approximately $23,971,843.

The number of shares outstanding of the registrant’s common stock as of March 1, 2011 is 44,609,563.

DOCUMENTS INCORPORATED BY REFERENCE—NONE

TABLE OF CONTENTS

FORM 10-K

i

Part I

Introduction.

As used in this Form 10-K “we”, “our”, “us”, “the Company” and “Dreams” refer to Dreams, Inc. and its subsidiaries unless the context requires otherwise.

Overview

Dreams, Inc., headquartered in Plantation, Florida is a Utah Corporation which was formed on April 9, 1980, has evolved into a technology driven, vertically integrated, multi-channel retailer focused on the sports licensed products industry. This has previously been accomplished, in part, via organic growth and strategic acquisitions. We believe our senior management and corporate infrastructure is well suited to acquire both large and small industry competitors, especially online.

Specifically, we are engaged in multiple aspects of the licensed sports products and autographed memorabilia industry through a variety of distribution channels.

We generate revenues principally from:

| | • | | Our e-commerce component featuringwww.FansEdge.com and others; (reported in retail segment) |

| | • | | Our web syndication sites; (reported in retail segment) |

| | • | | Our nine (9) company-owned FansEdge stores; (reported in retail segment) |

| | • | | Our seven (7) company-owned Field of Dreams stores; (reported in retail segment) |

| | • | | Our catalogues; (reported in retail segment) |

| | • | | Our manufacturing/distribution of sports memorabilia products, custom acrylic display cases and framing; (reported in mfg/wholesale segment) |

| | • | | Our running of sports memorabilia /collectible trade shows; (reported in mfg/wholesale segment) |

| | • | | Our franchise program through the four (4) Field of Dreams franchise stores presently operating*; (reported in other income) and |

| | • | | Our representation and corporate marketing of individual athletes* (reported in other income). |

| * | revenues not material to the overall consolidated results. |

Organic Growth (dollar amounts in thousands)

Key components of our organic growth strategy include building brand recognition; improving sales conversion rates both on our web sites and in our stores; continuing our execution of multi-channel retailing under our flagship brand, FansEdge; aggressively marketing our web syndication services, exploring additional distribution channels for our products; and cross pollinating corporate assets among our various operating divisions. Management believes that there remain significant benefits to cross pollinating the various corporate assets and leveraging the vertically integrated model that has been constructed over the years.

In particular, we have had success with the marketing of our products on-line via FansEdge.com and the complement of each of our web properties. The Company’s sales associated with these e-commerce initiatives have grown from $4,000 in 2004 to $84,728 in 2010, placing us at number 198 in 2009 of the largest Internet retailers in the nation (2010 ranking is forthcoming). This remains the fastest growing area of the Company and will remain its primary focus. This Internet growth has re-defined our Company as we have completed a transformation to a technology company, operating in the sports licensed products industry, generating a majority of our revenues via the eCommerce channel. In fact, 2010 brought 41% growth for the Internet division.

1

The Company has drawn on a complete spectrum of competencies it has developed over the years to support its flagship online brand, FansEdge. This has allowed the Company to leverage the investments made during the past several years by marketing a proven range of services to third parties that include: managed hosting, custom site design and development, customer service, order fulfillment, purchasing, inventory management, marketing, merchandising, and analytics and reporting. The Company calls the compilation of e-commerce services described above,Web Syndicationand believes there are significant growth opportunities that exist in the marketplace. Our current web syndication portfolio consists of some of the best known brands and properties in the country, including JC Penney, AOL Sports, Majestic Athletic, NBC Sports and the Philadelphia Eagles, to name a few.

With the continued growth of ourWeb Syndicationbusiness model, we are leveraging the Company’s investment in its broad inventory by adding additional distribution channels for our products through our partner’s sites. This concurrent marketing effort is improving our inventory turns, increasing our absorption rates, and reducing overall inventory carrying costs.

2

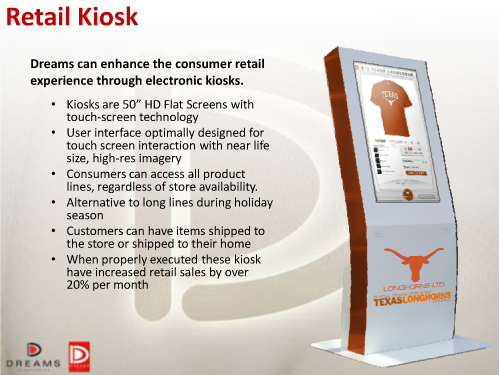

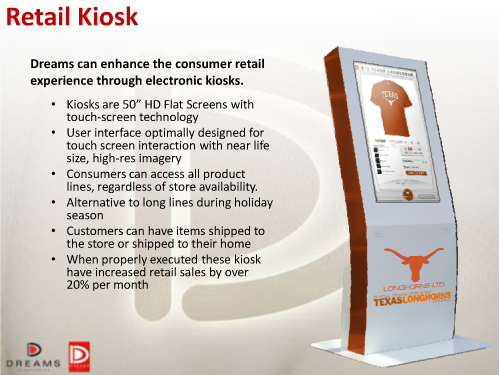

Commencing in June 2008, we opened (6) six FansEdge stores in the greater Chicago, IL area. (Our FansEdge store count is currently nine (9).) This was in support of ourMulti-channel Retailing strategy; whereby we market a single brand via multiple channels. We are pleased with the results to date of our FansEdge brick & mortar stores. They have performed well during the slow economy as we believe they offer approachable price points for the consumer. They cross market with the on-line Fansedge.com site and benefit by a high-tech inter-active kiosk used in each of the FansEdge stores. Furthermore, we have begun to offer this suite ofMulti-channel Retailing services to third parties who are seeking to add one or more distribution channels to their retail model.

3

Our proprietary eCommerce platform has also enabled us to fuel a state-of-the-art interactiveKiosk for ordering products. TheseKiosks are in each of our FansEdge stores and are providing a unique shopping experience for our customers by allowing them to access the entire Company portfolio of more than 200,000 product offerings. In 2010, we experienced a range of 10% to 20% lift in store sales attributed to theKiosk. The Company is exploring joint venture deals with other retailers who could benefit by adding a broader range of merchandising options to their patrons by placing ourKiosks within their store footprint or integrating our technology feed into their own hardware. In fact, on February 7, 2011, JC Penney announced that they rolled out its Findmore® smart fixture (kiosk) to over 120 select stores across the country, featuring our Sports Fan Shop.

We believe this expansion of our revenue producing footprint will serve us well as we navigate our business models and look to distinguish ourselves from our competitors.

Objective

Our overall objective is twofold; to become the premier multi-channel retailer in the team licensed products industry under our FansEdge brand; and become the leading online syndicator for sports related properties.

Analysis

We review our operations based on both our financial results and various non-financial measures. Management’s focus in reviewing performance begins with growth in sales, margin integrity and operating income. On the expense side, with a majority of our sales being achieved as an on-line retailer of licensed sports products, we spend a disproportionate amount of our operating expenses in internet marketing. Therefore, we continuously monitor the return on investment of these particular expenses. Non-financial measures which management reviews include: unique visitors to our web sites, foot traffic in our stores, sales conversion rates and average sold unit prices.

During 2010, we closed three (3) under-performing Field of Dreams stores as their lease terms came due and we chose not to renew. We are targeting additional Field of Dreams store closings in the first quarter of 2011. We will continue to monitor the results of the remaining stores to ensure that they are providing the Company with the desired results.

We believe the implementation of ourMulti-channel Retailing strategy will strengthen our FansEdge brand in the marketplace, and that we are well positioned to capture increased activity of on-line retail purchases. Industry experts and analysts state that currently, only 7-8% of all retail sales are being conducted on-line and are anticipated to increase.

With the continued growth of ourWeb Syndication business model, which grew from 31 clients in 2008 to 50 clients in 2009, and 65 clients in 2010, and revenues from syndication growing from $3,000 in 2008 to over $17,000 in 2009, and $34,000 in 2010 (this figure of $34,000 is included in our Internet revenues of $84,728), we are leveraging the Company’s investment in its broad

4

inventory by offering the items to multiple sites simultaneously. This improves our inventory turnover, increases our absorption rates and reduces inventory carrying costs. We believe there is significant opportunity in the marketplace to continue to aggressively grow this model. However, with the success we are experiencing with this web syndication model, we will be seeking a more quality client and have and may continue to not-renew smaller accounts.

Historically, the fourth quarter of the fiscal year (October to December) has accounted for a greater proportion of our operating income than have each of the other three quarters of our fiscal year. This is primarily due to increased activities as a result of the holiday season. We expect that we will continue to experience quarterly variations and operating results principally as a result of the seasonal nature of our industry. Management continues to seek ways to shift expenses from the non-holiday quarters to the busier holiday quarter in order to improve cash flow. Other factors also cause a significant fluctuation of our quarterly results, including the timing of special events, the general popularity of a specific team that plays in a championship or an individual athlete who enters their respective sports’ Hall of Fame, the amount and timing of new sales contributed by new web syndication accounts, new stores, the timing of personal appearances by particular athletes and general economic conditions. Additional factors may cause fluctuations in expenses, including the costs associated with the opening of new stores, the integration of acquired businesses and stores into our operations , the general health of the economy, and corporate expenses needed to support our expansion and growth strategy.

Conclusion

We set ourselves apart from other companies with our diversified product and services line, our proprietary e-commerce platform, our plethora of sports leagues and celebrity licenses, as well as our relationships with sports leagues, agents and athletes. Management believes we can continue to capture market share, especially on-line.

5

Current Landscape

Dreams presently operates in two business segments:

| | • | | Retail. Our retail segment is made up of manylocationsfor our inventory. Revenues are achieved by moving inventory through our sales channels to reach and expand our customer base. These channels include the internet, stores, kiosks and our catalogues. The retail segment is comprised of Company owned and operated Field of Dreams® retail stores, Company owned and operated FansEdge retail stores, catalogues and e-Commerce sites featuring FansEdge.com and ProSportsMemorabilia.com. The e-commerce component of the segment consists primarily of two e-commerce retailers along with a growing portfolio of syndicated web sites selling a diversified selection of sports licensed products and memorabilia on the Internet and has represented the fastest growing area of the Company. |

| | • | | Manufacturing/Distribution. The manufacturing/distribution segment represents the manufacturing and wholesaling of sports and celebrity memorabilia products, custom framing and acrylic display cases. These operations are conducted through Mounted Memories™. New additional capabilities include apparel sourcing, decorating and screen printing through The Comet Clothing Company, LLC and Dreams Apparel Manufacturing, Inc. |

Retail Segment.

Brick & Mortar Channel

As of March 1, 2011 we owned and operated seven (7) Field of Dreams® retail stores and nine (9) FansEdge stores. We closed two (2) of our Field of Dreams stores on January 28, 2011. The Company will continue to evaluate the opening of new retail stores under the FansEdge brand. Stores typically are located in high traffic areas in regional shopping malls. The stores average approximately 1,000-2,500 square feet. We pay a 1% royalty fee to MCA Universal Licensing for the use of the “Field of Dreams” trademark relating to sales generated in our Field of Dreams stores. Effective December 31, 2010, the parties extended the exclusive licensing agreement for an additional two-year term. During the years ended December 31, 2010 and 2009, we incurred royalty fees of $102 and $125, respectively.

This segment prides itself on being the ultimate, corporate-owned licensed sports products and celebrity gift stores in the country. This goal has been achieved by:

| | • | | Incorporating technology into the retail shopping experience (Inter-active kiosks); |

| | • | | Staying ahead of the competition by offering innovative and fresh products; |

| | • | | Offering unrivaled service and product knowledge communicated through the best personnel in the industry; |

| | • | | Implementing management, product and financial controls to ensure maximum profitability. |

A store typically has a full-time manager and a full time assistant manager in addition to hourly personnel, most of who work part-time. The number of hourly sales personnel in each store fluctuates depending upon our seasonal needs. Our stores are generally open seven days per week and ten hours per day.

6

Set forth below is a listing of our stores as of March 1, 2011, their location and the date opened or acquired.

| | | | |

STORE NAME | | LOCATION | | DATE OPENED OR ACQUIRED |

Field of Dreams: | | | | |

| | |

| Park Meadows Mall | | Denver, CO | | March 2002 |

| Woodfield Mall | | Schaumberg, IL | | October 2002 |

| The Rio Hotel | | Las Vegas, NV | | December 2006 |

| Smith & Wollensky Plaza | | Las Vegas, NV | | December 2006 |

| Caesars Palace Forum Shops | | Las Vegas, NV | | December 2006 |

| Boca Town Center | | Boca Raton, FL | | June 2007 |

| Florida Mall | | Orlando, FL | | July 2007 |

| | |

Fans Edge: | | | | |

| | |

| Fox Valley Mall | | Aurora, IL | | June 2008 |

| Northbridge Mall | | Chicago, IL | | August 2008 |

| Orland Square | | Orland Pk, IL | | September 2008 |

| Lincolnwood Mall | | Lincolnwood, IL | | September 2008 |

| Woodfield Mall | | Schaumberg, IL | | October 2008 |

| River Oaks Mall | | Calumet City, IL | | October 2008 |

| Oklahoma University | | Norman, OK | | September 2010 |

| Oakbrook Shopping Centre | | Oakbrook, IL | | September 2010 |

| Gurnee Mills Mall | | Gurnee, IL | | November 2010 |

E-Commerce Channel

The Company sells officially licensed products and authentic autographed memorabilia of the NFL, MLB, NHL, NBA, NCAA and NASCAR via our e-commerce channel with our feature sites Fansedge.com and ProSportsMemorabilia.com leading the way.

Our focus is on providing the best customer experience in the online sports-licensed products and memorabilia vertical.

These e-commerce channels have provided for the fastest growing area of the Company with revenues climbing from approximately $4,000 in 2004 to over $84,000 in 2010.

E-commerce products are marketed through a series of company-owned and syndicated websites that offer customers a daily selection of items from more than 200 teams and over 1,300 different athletes. This division sells over 200,000 products across categories such as apparel, auto accessories, autographed memorabilia, collectibles, headwear, home and office items, jewelry and watches, tailgate and stadium gear, and DVD’s. These online properties represent several of the leading brand names in this market including, but not limited to:

Big Box Retailer Sites – (JC Penney, WalMart)

Professional Sports Team Sites – (Philadelphia Eagles, San Diego Chargers)

Colleges – (University of Texas, University of Miami)

Content/Media Sites – (NBCSports, Football.com)

Newspaper Sites – (Baltimore Sun, SF Gate, USA Today, Boston Globe)

Player Sites – (Dan Marino, Dick Butkus, Mike Schmidt , Andre Dawson)

Miscellaneous Sites – (Majestic Athletic, Orange Bowl Stadium, Zubaz)

Beginning in January 2008, the Company began marketing its web syndication services to third parties.Web Syndication is when website material is made available to multiple other sites. This arrangement benefits both the Company providing content/products and the websites displaying it. The Company’s list of syndication clients has grown from 31 in 2008, to 50 in 2009, and 65 in 2010, with associated revenues of $3,000 in 2008 and over $17,000 in 2009 and $34,000 in 2010 (this figure of $34,000 is included in our Internet revenues of $84,728). The Company has drawn on the complete spectrum of competencies it developed to support its flagship online brand, FansEdge. These services include: managed hosting, custom site design and development, customer service, order fulfillment, purchasing, inventory management, marketing, merchandising, analytics and reporting. The Company calls the compilation of e-commerce services described above,Web Syndicationand believes there are significant growth opportunities that exist in the marketplace. However, with the success we are experiencing with our web syndication model, we will be seeking a more quality client and have and may continue to not-renew smaller accounts.

7

In addition, FansEdge maintains strategic alliances with Amazon.com and WalMart.com in which our FansEdge and ProTeam brands and their products are sold in the apparel and sporting section of these websites. Amazon, with an audience of more than 60 million active customer accounts, affords us national brand prominence for our FansEdge.com brand. On August 31, 2009, WalMart announced the launch of the “WalMart Marketplace” whereby they selected a few retailers based on their strong customer service track records and large assortments of quality brands and products to enhance the WalMart on-line experience. Pro Team, a Dreams, Inc. brand, was chosen to provide their vast array of sports licensed products. Also, beginning in March of 2011, Dreams went live with Sears.com as a key vendor in their innovative on-line community to exclusively manage the team licensed products category experience.

E-commerce orders are fulfilled by shipping products from its own warehouse facilities in Sunrise, Florida, Chicago, Illinois, Las Vegas, Nevada and Denver, Colorado, and from suppliers via drop-ship agreements. Our distribution network enables us to provide prompt delivery service to our online customers. It is our goal to be the market leader by shipping orders the same day they are received.

This channel’s strategy is to be the best at what they do within the sports-licensed products and memorabilia vertical. Tactics employed to execute this strategy include:

| | • | | Applying critical expertise to improve logistics and provide the best possible customer experience; |

| | • | | Strengthening brands by continually expanding catalogs and reinforcing market positioning in response to market demand; |

| | • | | Efficiently transforming shoppers into customers and effectively turning customers into repeat customers; and |

| | • | | Operating with optimal efficiencies realized through superior market expertise and technology, total commitment to quality, accuracy, and timely fulfillment. |

Manufacturing/Distribution Segment.

Mounted Memories.

Mounted Memories (“MMI”) celebrating its 22ndanniversary this year, is one of the largest wholesalers of authentic sports and celebrity memorabilia products, custom framing and acrylic display cases in the country. The Company maintains exclusive and non-exclusive agreements with numerous athletes who frequently provide autographs and/ or game used memorabilia at agreed upon terms. In addition to its relationships with various athletes and their representatives, MMI holds licenses with different sports leagues which allow for the manufacture and distribution of a wide array of products. Licenses are currently held with MLB, MLBPA, NFL, NBA, NHL, Golden Bear (Jack Nicklaus), NASCAR and a variety of NASCAR teams and drivers and many more. MMI has diversified into obtaining several celebrity licenses to compliment their sports licenses during the past year, including Signature Product (Elvis Presley), and CBS (I Love Lucy).

Specifically, MMI strives to enhance its market leading position by executing against the following objectives:

| | • | | Expand and diversify product lines by adding new licenses and bringing new products to market. |

| | • | | Continue to pursue exclusive licensing and memorabilia opportunities. |

| | • | | Enhance manufacturing efficiencies. |

| | • | | Provide strategic advantages to company owned retail properties by offering exclusively manufactured items. |

8

MMI has been in business since 1989 and has achieved its industry leading status fundamentally due to a combination of its licenses and its strict authenticity policies. The only sports memorabilia products sold by MMI are those produced by MMI through private or public signings organized by MMI or purchased from an authorized agent of MMI and witnessed by an MMI and /or league representative. In addition to sports and celebrity memorabilia products, MMI manufactures a large selection and supply of custom acrylic display cases, with over 50 combinations of materials, colors and styles. The primary raw material used in the production process is acrylic. There are many vendors who sell plastic throughout South Florida. The Company seeks to obtain the best pricing through competitive vendor bidding. The Company does not produce the helmets, footballs, baseballs or other objects which are autographed. Those products are available through numerous suppliers. No individual supplier represented more than ten percent of the Company’s total year ended December 31, 2010 or 2009 purchases.

MMI has one of the most advanced and effective fulfillment processes in the industry and utilizes the most current shipping software to assist in the process. MMI operates out of a 50,000 square foot facility in Sunrise, Florida and has satellite operations in Denver, CO and Chicago, IL and will continue to invest in technologies that enhance its competitive manufacturing and distribution advantages.

The Comet Clothing Company, LLC

Comet Clothing sources and manufacturers cut and sew and import apparel goods for retail distribution. Its major brand holdings include Zubaz, one of the original licensed products brands in the industry.

The Greene Organization.

The Greene Organization since 1991 has been engaged in athlete representation and corporate sports marketing of individual athletes. This boutique division provides athletes with all “off-field” activities including but not limited to; personal appearances, product endorsements, book publishing deals, public/private autograph signings, licensing and marketing opportunities. As a result, over the years, The Greene Organization has become a portal for numerous corporate clients who regularly contract this division to identify a professional athlete to enhance their company’s profile, products and or services. Recently, The Greene Organization added Andre Dawson, the sole inductee into the 2010 National Baseball Hall of Fame as a client. In addition, the auction arm of this division, SCAC (Sports Collectibles and Auction Company) provides complete auction services to charities and organizations throughout the country. Warren H. Greene, president of The Greene Organization, is the brother-in-law of the Company’s president.

Competition.

The Company’s retail stores compete with other retail establishments, including the Company’s franchise stores and other stores that sell sports related merchandise, memorabilia and similar products. The success of our stores depends, in part, on the quality, availability and the varied selection of authentic products as well as providing strong customer service.

Our e-commerce business competes with a variety of online and multi-channel competitors including mass merchants, fan shops, major sporting goods chains and online retailers. We believe the principal competitive factors are product selection, price, customer service and support, web site features and functionality, and delivery performance.

MMI competes with several major companies and numerous individuals in the sports and celebrity memorabilia industry such as Steiner Sports and Upper Deck Authenticated. MMI believes it competes well within the industry because of the reputation it has established in its 22-year existence. MMI focuses on ensuring authenticity and providing the best possible customer service. MMI has concentrated on maintaining and selling memorabilia items of athletes and celebrities that have a broad national appeal. MMI believes it maintains its competitive edge because of its long established relationships with numerous high profile athletes, each of the major sports leagues and several of the largest sports agencies. Several of its competitors tend to focus on specific regional markets due to their relationships with sports franchises in their immediate markets. The success of those competitors typically depends on the athletic performance of those specific franchises. Additionally, MMI typically focuses on the three core sports that provide the greatest source of industry revenue, baseball, football and NASCAR.

Within the acrylic display case line of business, MMI competes with other companies which mass produce cases. MMI does not compete with companies which custom design one-of-a-kind cases. MMI believes that because it is one of the country’s largest acrylic case manufacturers, it is price competitive due to its ability to purchase large quantities of material and pass the savings on to customers.

The Greene Organization competes with other companies which provide “off-field” services to athletes, some of which are much larger and better capitalized, including traditional sports agencies such as International Management Group.

9

Employees.

The Company employs 405 full-time employees and 40 part-time employees. None of our employees are represented by a labor union and we believe that our employee relations are good.

Seasonality.

Our business is highly seasonal with operating results varying from quarter to quarter. We have historically experienced higher revenues in the October – December quarter, primarily due to holiday sales. Approximately 53% and 50% of our annual revenues were generated during this quarter for 2010 and 2009. Management believes that the percentage of revenues in the holiday quarter will increase in future years as we focus on and grow the retail segment. As a result, we may incur additional expenses and cash needs during our holiday quarter, including higher inventory of product and additional staffing in anticipation of increased sales activity.

Not required for smaller reporting companies.

| Item 1B. | Unresolved Staff Comments. |

None.

We do not own any real property. The Company leases its corporate office and primary manufacturing/warehouse facility in Plantation, Florida and Sunrise, Florida, respectively. The corporate office lease is for approximately 7,500 square feet of office space and expires in June 2013, and has total occupancy costs of approximately, $18 per month. The Company’s principal executive, human resources and accounting offices are located at the Plantation, Florida facility.

Our primary manufacturing/warehouse facility is located in Sunrise, Florida and has approximately 50,000 square feet of office, manufacturing and warehousing space. The lease is for a 10 year term expiring in 2012 with total occupancy costs of approximately $40 per month with 3% annual increases. We also lease a warehouse facility in Denver, Colorado which has approximately 1,500 square feet and a warehouse facility in Las Vegas, NV which has approximately 12,000 square feet that have occupancy costs of $1 and $15 per month, respectively.

Our sixteen (16) company-owned stores currently lease their facilities, with lease terms (including renewal options) expiring in various years through September 2018 with initial terms of 5 to 10 years.

Our Internet division leases a 207,000 square foot facility in Northbrook, IL with a termination date of May 31, 2014 and a monthly occupancy cost of approximately, $120. We are analyzing whether we will require a larger distribution facility or another satellite facility in late 2011 or early 2012 to support our continued eCommerce growth.

| Item 3. | Legal Proceedings. |

None.

| Item 4. | Removed and Reserved |

10

Part II

| Item 5. | Market for the registrant’s common equity, related stockholder matters and Issuer purchases of equity securities. |

The Company’s common stock is listed on the NYSE Amex Equities Exchange as a result of an acquisition by the NYSE of the American Stock Exchange under the symbol “DRJ”. The high and low bids of the Company’s common stock for each quarter during the year ended December 31, 2010, and the year ended December 31, 2009, are as follows:

Year Ended December 31, 2010

| | | | | | | | |

| | | High Bid Price | | | Low Bid Price | |

First Quarter | | $ | 1.64 | | | $ | 1.47 | |

Second Quarter | | | 1.54 | | | | 1.28 | |

Third Quarter | | | 1.90 | | | | 1.88 | |

Fourth Quarter | | | 2.67 | | | | 2.55 | |

Year Ended December 31, 2009

| | | | | | | | |

| | | High Bid Price | | | Low Bid Price | |

First Quarter | | $ | .51 | | | $ | .30 | |

Second Quarter | | | .47 | | | | .21 | |

Third Quarter | | | 1.74 | | | | .34 | |

Fourth Quarter | | | 1.68 | | | | .81 | |

The records of Fidelity Transfer, the Company’s transfer agent, indicate that there are 375 record owners of the Company’s common stock as of March 1, 2011. Because many of our shares of common stock are held by brokers, and other institutions on behalf of stockholders, we are unable to determine the total number of stockholders represented by these record holders. However, we believe there are more than 1,900 beneficial holders of our common stock. On March 1, 2011, the high bid price was $2.98 and the low bid price was $2.90 for the Company’s common stock.

Dividend Policy

The Company has never paid dividends and we intend to retain future earnings to finance the expansion of our operations and for general corporate purposes. In addition, our current loan and security agreement with Regions Bank prohibits the Company from paying cash dividends.

Issuance of Unregistered Securities

The Company issued 337,835 unregistered common shares as a result of options that were exercised during the reporting period.

The Company issued 87,573 unregistered common shares as a result of options that were exercised during the year ended December 31, 2009.

All of the common stock issued for the above transactions were not registered under the Securities Act of 1933 (the “Act”) and were issued pursuant to an exemption from registration under Section 4 (2) of the Act.

11

EQUITY COMPENSATION PLAN INFORMATION

| | | | | | | | | | | | |

| | | Number of securities

to be issued upon

exercise of outstanding

options, warrants and

rights | | | Weighted – average

exercise price of

outstanding options,

warrants and rights | | | Number of securities

remaining available

for future issuances

under equity

compensation plans

(excluding securities

reflected in column (a)) | |

| | | (a) | | | (b) | | | (c) | |

Equity Compensation Plans Approved by Security Holders | | | 1,203,557 | | | $ | .54 | | | | 1,244,441 | |

Equity Compensation Plans Not Approved by Security Holders | | | *319,995 | | | $ | .60 | | | | 0 | |

| * | Represents options granted during the previous four-years to employees and consultants prior to the adoption of the Company’s 2006 Equity Incentive Plan which was approved by the shareholders in January 2007. |

| Item 6. | Selected Financial Data. |

Not required for smaller reporting companies.

| Item 7. | Management’s Discussion and Analysis of Financial Condition and Results of Operations. |

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

Certain statements in this Form 10-K under “Management’s Discussion and Analysis of Financial Condition and Results of Operations” constitute “forward-looking” statements within the meaning of the Private Securities Litigation Reform Act of 1995. Such forward-looking statements involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of the Company to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements. Such statements are indicated by words or phrases such as “anticipates,” “projects,” “management believes,” “Dreams believes,” “intends,” “expects,” and similar words or phrases. Such factors include, among others, the following: competition; seasonality; success of operating initiatives; new product development and introduction schedules; acceptance of new product offerings; franchise sales; advertising and promotional efforts; adverse publicity; expansion of the franchise chain; availability, locations and terms of sites for franchise development; changes in business strategy or development plans; availability and terms of capital including the continuing availability of our credit facility with Comerica Bank or a similar facility with another financial institution; labor and employee benefit costs; changes in government regulations; and other factors particular to the Company.

Should one or more of these risks, uncertainties or other factors materialize, or should underlying assumptions prove incorrect, actual results, performance, or achievements of Dreams may vary materially from any future results, performance or achievements expressed or implied by such forward-looking statements. All subsequent written and oral forward-looking statements attributable to Dreams or persons acting on our behalf are expressly qualified in their entirety by the cautionary statements in this paragraph. Dreams disclaims any obligation to publicly announce the results of any revisions to any of the forward-looking statements contained herein to reflect future events or developments.

Management’s Overview

Dreams, Inc., headquartered in Plantation, Florida is a Utah Corporation which was formed on April 9, 1980, has evolved into a technology driven, vertically integrated, multi-channel retailer focused on the sports licensed products industry. This has previously been accomplished, in part, via organic growth and strategic acquisitions. We believe our senior management and corporate infrastructure is well suited to acquire both large and small industry competitors, especially online.

Specifically, we are engaged in multiple aspects of the licensed sports products and autographed memorabilia industry through a variety of distribution channels.

We generate revenues principally from:

| | • | | Our e-commerce component featuringwww.FansEdge.com and others; (reported in retail segment) |

| | • | | Our web syndication sites; (reported in retail segment) |

| | • | | Our nine (9) company-owned FansEdge stores; (reported in retail segment) |

| | • | | Our seven (7) company-owned Field of Dreams stores; (reported in retail segment) |

12

| | • | | Our catalogues; (reported in retail segment) |

| | • | | Our manufacturing/distribution of sports memorabilia products, custom acrylic display cases and framing; (reported in mfg/wholesale segment) |

| | • | | Our running of sports memorabilia /collectible trade shows; (reported in mfg/wholesale segment) |

| | • | | Our franchise program through the four (4) Field of Dreams franchise stores presently operating*; (reported in other income) and |

| | • | | Our representation and corporate marketing of individual athletes* (reported in other income). |

| * | revenues not material to the overall consolidated results. |

Organic Growth (dollar amounts in thousands)

Key components of our organic growth strategy include building brand recognition; improving sales conversion rates both on our web sites and in our stores; continuing our execution of multi-channel retailing under our flagship brand, FansEdge; aggressively marketing our web syndication services, exploring additional distribution channels for our products; and cross pollinating corporate assets among our various operating divisions. Management believes that there remain significant benefits to cross pollinating the various corporate assets and leveraging the vertically integrated model that has been constructed over the years.

In particular, we have had success with the marketing of our products on-line via FansEdge.com and the complement of each of our web properties. The Company’s sales associated with these e-commerce initiatives have grown from $4,000 in 2004 to $84,728 in 2010, placing us at number 198 in 2009 of the largest Internet retailers in the nation (2010 ranking is forthcoming). This remains the fastest growing area of the Company and will remain its primary focus. This Internet growth has re-defined our Company as we have completed a transformation to a technology company, operating in the sports licensed products industry, generating a majority of our revenues via the eCommerce channel. In fact, 2010 brought 41% growth for the Internet division.

The Company has drawn on a complete spectrum of competencies it has developed over the years to support its flagship online brand, FansEdge. This has allowed the Company to leverage the investments made during the past several years by marketing a proven range of services to third parties that include; managed hosting, custom site design and development, customer service, order fulfillment, purchasing, inventory management, marketing, merchandising, and analytics and reporting. The Company calls the compilation of e-commerce services described above,Web Syndicationand believes there are significant growth opportunities that exist in the marketplace. Our current web syndication portfolio consists of some of the best known brands and properties in the country, including JC Penney, AOL Sports, Majestic Athletic, NBC Sports and the Philadelphia Eagles, to name a few.

With the continued growth of ourWeb Syndicationbusiness model, we are leveraging the Company’s investment in its broad inventory by adding additional distribution channels for our products through our partner’s sites. This concurrent marketing effort is improving our inventory turns, increasing our absorption rates, and reducing overall inventory carrying costs.

Commencing in June 2008, we opened (6) six FansEdge stores in the greater Chicago, IL area. (Our FansEdge store count is currently nine (9).) This was in support of ourMulti-channel Retailing strategy; whereby we market a single brand via multiple channels. We are pleased with the results to date of our FansEdge brick & mortar stores. They have performed well during the slow economy as we believe they offer approachable price points for the consumer. They cross market with the on-line Fansedge.com site and benefit by a high-tech inter-active kiosk used in each of the FansEdge stores. Furthermore, we have begun to offer this suite ofMulti-channel Retailing services to third parties who are seeking to add one or more distribution channels to their retail model.

13

Our proprietary eCommerce platform has also enabled us to fuel a state-of-the-art interactiveKiosk for ordering products. TheseKiosks are in each of our FansEdge stores and are providing a unique shopping experience for our customers by allowing them to access the entire Company portfolio of more than 200,000 product offerings. In 2010, we experienced a range of 10% to 20% lift in our store sales attributed to theKiosk. The Company is exploring joint venture deals with other retailers who could benefit by adding a broader range of merchandising options to their patrons by placing ourKiosks within their store footprint or integrating our technology feed into their own hardware. In fact, on February 7, 2011, JC Penney announced that they rolled out its Findmore® smart fixture (kiosk) to over 120 select stores across the country, featuring our Sports Fan Shop.

We believe this expansion of our revenue producing footprint will serve us well as we navigate our business models and look to distinguish ourselves from our competitors.

Objective

Our overall objective is twofold; to become the premier multi-channel retailer in the team licensed products industry under our FansEdge brand; and become the leading online syndicator for sports related properties.

Analysis

We review our operations based on both our financial results and various non-financial measures. Management’s focus in reviewing performance begins with growth in sales, margin integrity and operating income. On the expense side, with a majority of our sales being achieved as an on-line retailer of licensed sports products, we spend a disproportionate amount of our operating expenses in internet marketing. Therefore, we continuously monitor the return on investment of these particular expenses. Non-financial measures which management reviews include: unique visitors to our web sites, foot traffic in our stores, sales conversion rates and average sold unit prices.

During 2010, we closed three (3) under-performing Field of Dreams stores as their lease terms came due and we chose not to renew. We are targeting additional Field of Dreams store closings in the first quarter of 2011. We will continue to monitor the results of the remaining stores to ensure that they are providing the Company with the desired results.

We believe the implementation of ourMulti-channel Retailing strategy will strengthen our FansEdge brand in the marketplace, and that we are well positioned to capture increased activity of on-line retail purchases. Industry experts and analysts state that currently, only 7-8% of all retail sales are being conducted on-line and are anticipated to increase.

On themChannel front, we plan to continue to invest in various initiatives to leverage mobile opportunities to acquire customers online and offline, conduct mobile commerce, enhance the in-store experience and connect with our customers even when they are not shopping. Currently, our e-commerce platform is mobile capable and with revenues transacted from mobile devices growing exponentially, this will become a more material part of our overall revenue stream. In the near future, we plan on releasing an enhanced mobile e-commerce experience that is fully optimized for intuitive shopping via a mobile device. After this release we expect mobile revenue to grow even faster. Additionally, we plan to continue to expand our various mobile oriented marketing programs that we use to acquire new customers and stimulate repeat purchasing from existing programs. Currently, we use programs such as local search, text alerts and other mobile oriented promotions. We also plan to use mobile to enhance our in-store experience such as using QR codes to allow in-store shoppers to access customer reviews, quickly see what other teams we have available in a particular style and to quickly see what sizes we might have online that we may not have in the store.

With the continued growth of ourWeb Syndication business model, which grew from 31 clients in 2008 to 50 clients in 2009, and 65 clients in 2010, and revenues from syndication growing from $3,000 in 2008 to over $17,000 in 2009, and $34,000 in 2010 (this figure of $34,000 is included in our Internet revenues of $84,728), we are leveraging the Company’s investment in its broad inventory by offering the items to multiple sites simultaneously. This should improve our inventory turnover, increase our absorption rates and reduce inventory carrying costs. We believe there is significant opportunity in the marketplace to grow this model. However, with the success we are experiencing with our web syndication model, we will be seeking a more quality client and have and may continue to not-renew smaller accounts.

Towards the end of 2010, we acquired a 51% ownership stake in The Comet Clothing Company, LLC. This entity owns the rights to the Zubaz® brand, a line of casual sportswear with unique designs. Also, we consummated a purchase agreement for certain assets previously owned by Collegiate Marketing Services (CMS). The principal asset is the retail contract with the University of Texas for the management of both the official online store and all campus event sales. Both of these initiatives were strategic in nature for the Company. We have now added the ability to manufacture soft goods (apparel) within the organization and will seek to produce some of the items that will be featured on many of our online shops and our partners’ eCommerce sites. This should improve our overall gross margins. In addition, with our team providing game-day/stadium sales for the University of Texas, we are able to deliver a comprehensive retail solution to current and prospective clients that are looking for a provider who excels at eCommerce and in-stadium operations and merchandising.

14

Historically, the fourth quarter of the fiscal year (October to December) has accounted for a greater proportion of our operating income than have each of the other three quarters of our fiscal year. This is primarily due to increased activities as a result of the holiday season. We expect that we will continue to experience quarterly variations and operating results principally as a result of the seasonal nature of our industry. Management continues to seek ways to shift expenses from the non-holiday quarters to the busier holiday quarter in order to improve cash flow. Other factors also cause a significant fluctuation of our quarterly results, including the timing of special events, the general popularity of a specific team that plays in a championship or an individual athlete who enters their respective sports’ Hall of Fame, the amount and timing of new sales contributed by new web syndication accounts, new stores, the timing of personal appearances by particular athletes and general economic conditions. Additional factors may cause fluctuations in expenses, including the costs associated with the opening of new stores, the integration of acquired businesses and stores into our operations , the general health of the economy, and corporate expenses needed to support our expansion and growth strategy.

Conclusion

We set ourselves apart from other companies with our diversified product and services line, our proprietary e-commerce platform, our plethora of sports leagues and celebrity licenses, as well as our relationships with sports leagues, agents and athletes. Management believes we can continue to capture market share, especially on-line.

15

GENERAL

As used in this Form 10-K “we”, “our”, “us”, “the Company” and “Dreams” refer to Dreams, Inc. and its subsidiaries unless the context requires otherwise.

Use of Estimates and Critical Accounting Policies

The preparation of financial statements in conformity with accounting principles generally accepted in the United States of America requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the consolidated financial statements and the reported amounts of revenues and expenses during the reporting periods. Actual results could differ from those estimates.

Significant estimates underlying the accompanying consolidated financial statements include: the determination of the lower of cost or market adjustment for inventory; sales returns; the allowance for doubtful accounts; the recoverability of long-lived and intangible assets; the determination of deferred income taxes, including related valuation allowances; the accrual for actual, pending or threatened litigation, claims and assessments; and assumptions related to the determination of stock-based compensation

In an on-going basis, the Company reviews its outstanding customer receivables for collectability. Adjustments to the allowance account are made according to current knowledge. Additionally, management reviews the composition of its inventory no less than annually. Reserves are adjusted accordingly. On a quarterly basis, the Company also evaluates its ability to realize its deferred tax assets and whether or not a valuation allowance is necessary.

The Company has both Goodwill and other long-lived intangible assets which are not amortized. As prescribed by the FASB, the Company evaluates the carrying value of these assets for impairment. Significant economic changes may require the Company to recognize impairment. As of December 31, 2010, no impairment has been necessary. As of December 31, 2009, no impairment had been necessary, yet the Company had taken a write down to Goodwill in the amount of $64 due to the closing of stores previously acquired that had Goodwill associated with the original purchase during the second quarter of 2009.

Management believes that the following may involve a higher degree of judgment or complexity:

Collectibility of Accounts Receivable

The Company’s allowance for doubtful accounts is based on management’s estimates of the creditworthiness of its customers, current economic conditions and historical information, and, in the opinion of management, is believed to be an amount sufficient to respond to normal business conditions.Should business conditions deteriorate or any major customer default on its obligations to the Company, this allowance may need to be significantly increased, which would have a negative impact upon the Company’s operations. The Company’s current allowance for doubtful accounts is $26.

| | | | | | | | |

| | | December 31,

2010 | | | December 31,

2009 | |

Accounts receivable | | $ | 9,924 | | | $ | 5,377 | |

Allowance for doubtful accounts | | | 26 | | | | 35 | |

| | | | | | | | |

Accounts receivable, net | | $ | 9,898 | | | $ | 5,342 | |

Reserves on Inventories

The Company establishes a reserve based on historical experience and specific reserves when it is apparent that the expected realizable value of an inventory item falls below its original cost. A charge to operations results when the estimated net realizable value of inventory items declines below cost. Management regularly reviews the Company’s investment in inventories for declines in value. Adjustments are made to the reserve based on a number of factors, such as, players changing teams, falling out of favor with the public, incurring an injury, etc. These negative situations may impact valuation. However, dynamics that could increase inventory value, like the death of an athlete, do not result in writing up of inventory values. The Company’s current reserve for inventory obsolescence is $530.

| | | | | | | | |

| | | December 31,

2010 | | | December 31,

2009 | |

Inventory | | $ | 33,139 | | | $ | 27,063 | |

Reserves for inventory obsolescence | | | 530 | | | | 470 | |

| | | | | | | | |

Inventory, net | | $ | 32,609 | | | $ | 26,593 | |

16

Income Taxes

Significant management judgment is required in developing the Company’s provision for income taxes, including the determination of deferred tax assets and liabilities and any valuation allowances that might be required against the deferred tax assets. The Company evaluates quarterly its ability to realize its deferred tax assets and adjusts the amount of its valuation allowance, if necessary. The Company provides a valuation allowance against its deferred tax assets when it believes that it is more likely than not that the asset will not be realized. The Company has prepared an analysis based upon historical data and forecasted earnings projections to determine its ability to realize its net deferred tax asset. After consideration of all the evidence, both positive and negative, management has determined that a valuation allowance of $187 as of December 31, 2009, was necessary. The change in the valuation allowance for the current year is $187.

Goodwill and Unamortized Intangible Assets

In accordance with FASB Accounting Standards Codification Topic 350-20-35 Intangibles-Goodwill and Other > Goodwill > Subsequent Measure, the Company evaluates the carrying value of goodwill as of December 31 of each year and between annual evaluations if events occur or circumstances change that would more likely than not reduce the fair value of the reporting unit below its carrying amount. Such circumstances could include, but are not limited to, (1) a significant adverse change in legal factors or in business climate, (2) unanticipated competition, or (3) an adverse action or assessment by a regulator. When evaluating whether goodwill is impaired, the Company compares the fair value of the reporting unit to which the goodwill is assigned to its carrying amount, including goodwill. If the carrying amount of a reporting unit exceeds its fair value, then the amount of the impairment loss must be measured. The impairment loss would be calculated by comparing the implied fair value of the reporting unit’s goodwill to its carrying amount. In calculating the implied fair value of goodwill, the fair value of the reporting unit is allocated to all of the other assets and liabilities of that unit based on their fair value. The excess of the fair value of a reporting unit over the amount assigned to its other assets and liabilities is the implied fair value of goodwill. An impairment loss would be recognized when the carrying amount of goodwill exceeds it implied fair value.

The Company’s evaluations of the carrying amount of goodwill were completed as of December 31, 2010 in accordance with Topic 350-20-35, resulted in no impairment losses. During the quarter ended June 30, 2009, the Company closed one of its retail stores. As a result of the store closing, the Company wrote off approximately $64 of goodwill recorded in the original acquisition of this store in November of 2006.

Revenue Recognition

The Company recognizes retail (including e-commerce sales and web syndication sales) and wholesale/distribution revenues at the later of (a) the time of shipment or (b) when title passes to the customers, all significant contractual obligations have been satisfied and collection of the resulting receivable is reasonably assured. Retail revenues and wholesale/distribution are recognized at the time of sale. Return allowances, which reduce gross sales, are estimated using historical experience.

Revenues from the sale of franchises are deferred until the Company fulfills its obligations under the franchise agreement and the franchised unit opens. The franchise agreements provide for continuing royalty fees based on a percentage of gross receipts.

Management fee revenue related to the representation and marketing of professional athletes is recognized when earned and is reflected net of its related costs of sales. The majority of the revenue generated from the representation and marketing of professional athletes relates to services as an agent. In these arrangements, the Company is not the primary obligor in these transactions but rather only receives a net agent fee.

Revenues from industry trade shows are recognized at the time of the show when tickets are submitted for autographs or actual product purchases take place. In instances when the Company receives pre-payments for show autographs, the Company records these amounts as deferred revenue.

The Company partnered in a corporate rebate program with a national consumer goods retailer. The Company issued rebate coupons for which it was pre-paid 50% of the coupon value. Certificates redeemed through March 31, 2009, were recognized as revenue in the period. Additionally, a breakage model was projected for the program’s eight month term, based upon redemption totals redeemed through April 27, 2009, the program’s termination date. Thus, the Company recognized breakage revenue over the seven months (September 2008 – March 09), of the program. The balance of certificates redeemed during the program’s last month (April 09), were relieved from deferred revenue and recognized in our manufacturing/wholesale revenues for the quarter ended June 30, 2009.

The Company had approximately $1,028 in orders not yet shipped as of December 31, 2010.

17

RESULTS OF OPERATIONS

The following table presents our historical operating results for the periods indicated as a percentage of net sales:

| | | | | | | | |

| | | Year Ended

December 31,

2010 | | | Year Ended

December 31,

2009 | |

Net Sales | | | 1.00 | | | | 1.00 | |

COGS | | | .54 | | | | .53 | |

Gross Profit | | | .46 | | | | .47 | |

*Operating Expenses | | | .41 | | | | .42 | |

Operating Income | | | .05 | | | | .05 | |

Income Before Taxes | | | .02 | | | | .01 | |

Net Income | | | .01 | | | | .00 | |

| * | Does not include depreciation. |

| ** | The above table may not foot due to rounding. |

18

RESULTS OF OPERATIONS—TWELVE MONTHS ENDED DECEMBER 31, 2010 AS COMPARED TO THE TWELVE MONTHS ENDED DECEMBER 31, 2009.

Revenues. Total revenues increased 30.2% to $111,363 during the twelve months ended December 31, 2010, from $85,535 during the same period ended December 31, 2009. This increase was attributed to an increase in retail revenues generated through on-line sales. Online sales continue to represent the fastest growing area of the Company and will remain its primary focus.

Manufacturing and distribution revenues decreased 2.6% to $15,321 during the twelve months ended December 31, 2010, from $15,730 during the same period ended December 31, 2009. Net revenues reported, after elimination of intercompany sales, decreased 3.2% to $11,107 during the twelve months ended December 31, 2010, from $11,470 during the same period ended December 31, 2009. During the first quarter of 2009, the Company recorded revenue of $762 associated with a national consumer goods retailer project. Nevertheless, the Company has modified its manufacturing segment to primarily support its retail efforts instead of maintaining and growing its own wholesale account customer base. This has resulted initially in a reduction of this segment’s revenues but is providing the Company’s retail assets with a competitive advantage.

Retail operation revenues increased 35.4% to $99,798 during the twelve months ended December 31, 2010, from $73,711 during the same period ended December 31, 2009. This increase was attributed to the continuing growth the Company is experiencing with its on-line properties.

| | • | | E-Commerce – Our Internet retail division revenues increased 41.9% to $84,728 for the year ended December 31, 2010, from $59,700 generated for the year ended December 31, 2009. We are experiencing nearly 20.0% organic online growth from our flagship brand, FansEdge.com and continue to grow the web syndication portfolio. |

| | • | | FansEdge stores– Retail revenues generated through our nine (9) FansEdge stores increased 53.7% to $5,725 for the year ended December 31, 2010, from $3,724 generated for the year ended December 31, 2009 when we had six (6) FansEdge stores operating. It is important to note that same store sales were up 36.0% as we continue to make operational improvements and were able to leverage the NHL Blackhawks Championship in June 2010. |

| | • | | Field of Dreams® stores-. Retail revenues generated through our nine (9) company-owned Field of Dreams stores decreased 17.8% to $8,453 for the year ended December 31, 2010, from $10,287 generated for the year ended December 31, 2009 when we had (12) company-owned Field of Dreams stores operating. |

| | • | | Stadium Sales– Retail revenues generated in stadium was $892 for the year ended December 31, 2010. This is a new channel for the Company. |

Costs and expenses.Total costs of sales for the twelve months ended December 31, 2010 increased 32.3%, to $59,715, versus $45,123 for the same period in 2009. As a percentage of total sales, costs were 53.6% and 52.7% for the twelve months ended December 31, 2010 and December 31, 2009, respectively.

Costs of sales of manufacturing/distribution products were $6,543 for the twelve month period ended December 31, 2010, versus $5,497 for the same twelve month period in 2009, or a 19.0% increase. As a percentage of total manufacturing/distribution sales, costs were 70.0% and 62.0% for the twelve months ended December 31, 2010 and December 31, 2009, respectively. After elimination of intercompany sales, as a percentage of total manufacturing/distribution sales, costs were 58.9% and 47.9%, respectively. During the first quarter of 2009, the Company recorded revenue of $762 associated with a national consumer goods retailer project with higher than historical gross profits.

Cost of sales of retail products were $53,172 for the twelve month period ended December 31, 2010, versus $39,626 for the same twelve month period in 2009, or a 34.1% increase. This increase is attributable to an overall increase in retail sales. While we maintained historical gross margins slightly north of 47.0% at Internet, we worked on greatly reduced margins at our Field of Dreams stores in anticipation of specific store closings. As a percentage of total sales, costs were 53.2% and 53.8% for the twelve months ended December 31, 2010 and December 31, 2009, respectively.

Operating expenses increased 26.8% to $45,939 for the twelve month period ended December 31, 2010, versus $36,226 for the same period in 2009. The current period expenses were elevated by some one-time, non-cash and cash charges totaling over $1,200 that included, charges associated with financings and M & A activity, certain legal fees, write-offs and expenses associated with the closing of several Field of Dreams stores, impairment charges associated with some pre-paid royalties, non cash, compensation expense related to the issuance of warrants as a part of an equity private placement, and severance expenses to released employees from the closed Field of Dreams stores. One-time charges for 2009 were approximately $600. As a percentage of sales, operating expenses were 41.2% and 42.2% for the twelve month periods ended December 31, 2010 and December 31, 2009, respectively. Without these one-time charges to operations, as a percentage of sales, operating expenses would have been 40.2% for the year ended December 31, 2010.

19

Interest expense, net.Net interest expense was $1,185 for the twelve months ended December 31, 2010, versus $1,268 for the same period last year. This slight decrease is a result of the Company refinancing its senior revolving credit facility in July 2010 at vastly reduced interest rates.

Provision for income taxes. The Company recognized an income tax expense of $1,363 for the year ended December 31, 2010, versus an income tax expense of $711 for the same period in 2009. Each quarter, the Company evaluates whether the realizability of its net deferred tax assets is more likely than not. Should the Company determine that a valuation reserve is necessary, it would have a material impact on the Company’s operations. The Company has prepared an analysis based upon historical data and forecasted earnings projections to determine its ability to realize its net deferred tax asset. The Company believes it is more likely than not that the net deferred tax asset will be realized. Therefore, the Company has determined that a valuation allowance was not necessary as of December 31, 2010. The effective tax rates for 2010 was 49.0% and for 2009 was 81.0% due to the cumulative timing of differences in the deferred tax benefits associated with federal and state net operating loss carry-forwards and a return to profitability of the operations in 2009.

LIQUIDITY AND CAPITAL RESOURCES

Our primary sources of liquidity during the twelve months ended December 31, 2010, are the cash flows generated daily from our operating subsidiaries; availability under our $20,000 senior revolving credit facility and available cash.

The balance sheet as of December 31, 2010, reflects working capital of $19,645 versus working capital of $9,903 at December 31, 2009. At December 31, 2010, the Company’s cash was $440 compared to $582 at December 31, 2009. Please note that the Company is not negatively impacted by the cash balance of $440 as it has sufficient access to capital under its revolving credit facility with its senior lender. As a lead-in to the holiday season, the Company draws down on its line of credit to make inventory purchases so it is properly positioned to support the increased sales activity experienced during the quarter ended December 31. The increased throughput results in significant pay-downs to the line balances; and the yearly cycle starts anew. For example, as of September 30, 2010, the Company’s outstanding line balance was $16,521. This figure peaked in October of 2010 near $19,000 and ended the year with a nominal outstanding line balance of $1,128. Net accounts receivable at December 31, 2010 were $9,898 compared to $5,342 at December 31, 2009.

Use of Funds

Cashprovided by operations amounted to $4,123 for the twelve months ended December 31, 2010, compared to $5,249 cashprovided byoperations during the same period of 2009. The Company had an increase in its inventory levels to support its continued online growth.

Cashused in investing activities was $3,091 for the twelve months ended December 31, 2010 and $919 cashused in investing activities for the same period ended December 31, 2009. The Company acquired specific assets previously owned by CMS during the period and purchased additional racking for its main distribution center.

Cashused in financing activities was $1,174 for the twelve months ended December 31, 2010, versus $4,246 cashused infinancing activities for the same period in 2009. The Company brought in $8,000 in equity capital to support its growth.

Other Activity

On May 18, 2010, the Company entered into a Securities Purchase Agreement with three accredited investors, pursuant to which the Company raised $2,000 through the issuance of 1,428,570 shares of the Company’s common stock and warrants to purchase 285,714 shares of the Company’s common stock at an exercise price of $1.80 per share. The offering was exempt from registration pursuant to exemption under section 4(2) of the Securities Act of 1933.

On July 16, 2010, the Company entered into a Subscription Agreement with a group led by William Blair & Company, LLC whereby the Company agreed to sell and issue to the investors a total of 4,615,384 shares of the Company’s common stock for $6,000. The shares had been registered on a Form S-3 filed by the Company with the Securities and Exchange Commission.

On July 23, 2010, the Company entered into a 3-year loan and security agreement with Regions Bank who provided the Company with a $20,000 Senior Secured Credit Facility, of which $11,200 was used at closing to pay-off its previous loan balances with Comerica Bank. The interest rate on the loan balance is the 30-day libor rate plus a 3.00% margin. The interest rates on outstanding loan balances were reduced from 6.5% from the previous lender, to libor plus a 3.00 margin, or 3.34% for the new line of credit. The new 3-year loan and security agreement is secured by all of the assets of the Company and its divisions. The Regions credit facility requires that certain performance financial covenants be met on a monthly and or quarterly and or yearly basis. These financial covenants consist of aFixed Charge Coverage Ratio and a Funded Debt to EBITDA Ratio.

The F.C.C. Ratio is defined as EBITDA, plus Rent Expense, minus all unfinanced Capital Expenditures, plus taxes paid, and any restricted payments made (over a rolling 12 month period ending in the current quarter). This amount is then divided by Interest Expense, Rent expense, and the current maturities of funded debt (over a rolling 12 month period ending in the current quarter). For the quarter ended December 31, 2010, the minimum required ratio is 1.2 to 1.0. The actual ratio was 1.39.

20

The Funded Debt to EBITDA ratio includes: debt for borrowed funds, subordinated debts, the principal component of all capital leases, any deferred payment by one year or more , and all other debt instruments (other than checks drawn in the ordinary course of business), divided by EBITDA. For the quarter ended December 31, 2010, the required ratio needs to be less than 2.5 to 1.00. The actual ratio was .52 to 1.00.

Analysis

In order to properly fund our growth and leverage each of the opportunities that the Company is delivering to its environment, it was determined that a strengthening of the balance sheet through a $2,000 private placement and subsequently, a $6,000 sale of newly issued common shares was prudent. The Company was also successful in re-financing its senior debt in July that has significantly reduced its cost of capital, thus, providing the Company with meaningful interest expense savings.

Summary

Management believes that future funds generated from our operations and available borrowing capacity will be sufficient to fund our debt service requirements, working capital requirements and our budgeted capital expenditure requirements for the foreseeable future.

Off-balance sheet arrangements

We have not created and are not a party to any special purpose or off-balance sheet entities for the purpose of raising capital, incurring debt or operating our business. Except as described herein, our management is not aware of any known trends or demands, commitments, events or uncertainties, as they relate to liquidity which could negatively affect our ability to operate and grow as planned, other than those previously disclosed.

NEW ACCOUNTING PRONOUNCEMENTS

In January 2010, the FASB amended guidance now codified as FASB ASC Topic 810, “Consolidation.” FASB ASC Topic 810 changes the accounting and reporting for minority interests, which will be re-characterized as non-controlling interests and classified as a component of equity. The amendment of FASB ASC Topic 810-10 establishes the accounting and reporting guidance for non-controlling interests and changes in ownership interests of a subsidiary. FASB ASC Topic 810 is effective for us on a prospective basis for business combinations with an acquisition date beginning in the first quarter of fiscal year 2010. The adoption of FASB ASC Topic 810 as amended did not have an impact on our consolidated financial statements.

In January 2010, the FASB amended its guidance now codified as FASB ASC Topic 505-20, “Equity – Stock Dividends and Stock Splits,” to clarify that the stock portion of a distribution to shareholders that allows them to elect to receive cash or stock with a limit on the amount of cash that will be distributed is not a stock dividend for purposes of applying Topics 505 and 260. These provisions of FASB ASC Topic 505 are effective for interim and annual periods ending after December 15, 2009 and, accordingly, are effective for us for the current fiscal reporting period. The adoption of this pronouncement did not have an impact on our financial condition or results of operations as we do not currently have distributions that allow shareholders such an election.

In January 2010, the FASB issued authoritative guidance which requires new disclosures and clarifies existing disclosure requirements for fair value measurements. Specifically, the changes require disclosure of transfers into and out of “Level 1” and “Level 2” (as defined in the accounting guidance) fair value measurements, and also require more detailed disclosure about the activity within “Level 3” (as defined) fair value measurements. This guidance is effective for interim and annual reporting periods beginning after December 15, 2009, with the exception of the disclosures about purchases, sales, issuances and settlements of Level 3 assets and liabilities, which is effective for fiscal years beginning after December 15, 2010. As this guidance only requires expanded disclosures, the adoption did not impact the Company’s consolidated financial position, results of operations or cash flows.

In December 2010, the FASB issued amendments that modify Step 1 of the goodwill impairment test for reporting units with zero or negative carrying amounts. For those reporting units, an entity is required to perform Step 2 of the goodwill impairment test if it is more likely than not that a goodwill impairment exists. In determining whether it is more likely than not that goodwill impairment exists, an entity should consider whether there are any adverse qualitative factors indicating that impairment may exist. The qualitative factors are consistent with the existing guidance, which requires that goodwill of a reporting unit be tested for impairment between annual tests if an event occurs or circumstances change that would more likely than not reduce the fair value of a reporting unit below its carrying amount. These amendments are effective for fiscal years, and interim periods within those years, beginning after December 15, 2010. Early adoption is not permitted. The adoption of this guidance is not expected to have a significant impact on the Company’s consolidated financial position, results of operations or cash flows.

21

A variety of proposed or otherwise potential accounting standards are currently under study by standard-setting organizations and various regulatory agencies. Because of the tentative and preliminary nature of these proposed standards, management has not determined whether implementation of such proposed standards would be material to our consolidated financial statements.

| Item 7A. | Quantitative and Qualitative Disclosures About Market Risk. |

Not required for smaller reporting companies.

| Item 8. | Financial Statements and Supplementary Data. |

The financial statements required by this Item 8 are included at the end of this Report beginning on page F-1 as follows:

| | | | |

| | | Page | |

AUDITED FINANCIAL STATEMENTS: | | | | |

Report of Independent Registered Public Accounting Firms | | | F-1 | |

| |

Consolidated Balance Sheets as of December 31, 2010 and December 31, 2009 | | | F-2 | |

| |