UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

| | |

| Investment Company Act file number: | | 811-05029 |

| |

| Name of Registrant: | | Legg Mason Income Trust, Inc. |

| |

| Address of Principal Executive Offices: | | 100 Light Street, Baltimore, MD 21202 |

| |

| Name and address of agent for service: | | Richard M. Wachterman, Esq. |

| | Legg Mason & Co., LLC |

| | 100 Light Street |

| | Baltimore, MD 21202 |

| |

| Registrant’s telephone number, including area code: | | (410) 539-0000 |

| |

| Date of fiscal year-end: | | December 31, 2007 |

| |

| Date of reporting period: | | June 30, 2007 |

Item 1. Report to Shareholders.

Semi-Annual Report to Shareholders

To Our Shareholders,

We are pleased to provide you with Legg Mason Income Trust’s semi-annual report for the six months ended June 30, 2007, combining reports for the Legg Mason Core Bond Fund, Investment Grade Income Portfolio and Limited Duration Bond Portfolio.

The following table summarizes key statistics for the Primary Class of each portfolio, as of June 30, 2007:

| | | | | | | | |

| | | SEC YieldA | | | Average Life | | Net Asset Value

Per Share |

Core Bond | | 5.04 | % | | 9.67 years | | $ | 9.58 |

Investment Grade | | 5.41 | % | | 10.85 years | | $ | 10.27 |

Limited Duration | | 5.16 | % | | 3.55 years | | $ | 10.18 |

For the six-month period ended June 30, 2007, total returns for the Primary Class of shares of the Core Bond, Investment Grade and Limited Duration Portfolios were +0.47%, +0.90% and +1.84%, respectively. Total returns for the Institutional Class of shares of the Investment Grade and Limited Duration Portfolios were +1.15% and +2.19%, respectively.

The performance data quoted represents past performance and does not guarantee future results. The performance stated may have been due to extraordinary market conditions, which may not be duplicated in the future. Current performance may be lower or higher than the performance data quoted. To obtain the most recent month-end performance information for the Primary Class please visit www.leggmasonfunds.com; for the Institutional Class please call 1-888-425-6432. The investment return and principal value of the Funds will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. Calculations assume reinvestment of dividends and capital gain distributions. Performance would have been lower if fees had not been waived in various periods.

Information about the Fund’s performance over longer periods of time is shown in the Performance Information section within this report. For more information about the Fund share classes included in this report, please contact your financial advisor.

Since June 30, the U.S. fixed-income markets have experienced a period of extreme volatility which has negatively impacted market liquidity conditions. Initially, the concern on the part of market participants was limited to the subprime segment of the mortgage-backed market. However, these concerns have since broadened to include a wide range of financial institutions and markets. As a result, other fixed income instruments have experienced increased price volatility.

A | SEC yields are for the 30 days ended June 30, 2007. Yields are subject to change at any time. |

1

Semi-Annual Report to Shareholders

Many of our shareholders regularly add to their Primary Class Fund holdings by authorizing automatic, monthly transfers from their bank of $50 or more checking or brokerage accounts. Dollar cost averaging is a convenient and sensible way to invest, as it encourages continued purchases over time regardless of fluctuating price levels. Of course, it does not ensure a profit nor protect against declines in the value of your investment. Your financial advisor will be happy to help you establish a dollar cost averaging plan should you wish to do so.

Sincerely,

| | | | | | |

| | /s/ John F. Curley, Jr. | | | | /s/ Mark R. Fetting |

| | John F. Curley, Jr. | | | | Mark R. Fetting |

| | Chairman | | | | President |

July 26, 2007

2

Semi-Annual Report to Shareholders

Expense Example

Core Bond Fund

As a shareholder of the Fund, you incur ongoing costs, including management fees, distribution and service (12b-1) fees, and other Fund expenses. These examples are intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds. Each example is based on an investment of $1,000 invested on January 1, 2007, and held through June 30, 2007.

Actual Expenses

The first line in the table below provides information about actual account values and actual expenses for the Fund. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During the Period” to estimate the expenses you paid on your account if your shares were held for the entire period.

Hypothetical Example for Comparison Purposes

The second line in the table below provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare these 5% hypothetical examples with the 5% hypothetical examples that appear in the shareholder reports of other funds.

| | | | | | | | | |

| | | Beginning Account Value 1/1/07 | | Ending Account Value 6/30/07 | | Expenses PaidA

During the Period 1/1/07 to 6/30/07 |

Primary Class: | | | | | | | | | |

Actual | | $ | 1,000.00 | | $ | 1,004.70 | | $ | 4.97 |

Hypothetical (5% return before expenses) | | | 1,000.00 | | | 1,019.84 | | | 5.01 |

A | These calculations are based on expenses incurred in the most recent fiscal half-year. The dollar amounts shown as “Expenses Paid” are equal to the annualized expense ratio of 1.00% multiplied by the average value over the period, multiplied by the number of days in the most recent fiscal half-year (181), and divided by 365. |

3

Semi-Annual Report to Shareholders

Performance Information

Core Bond Fund

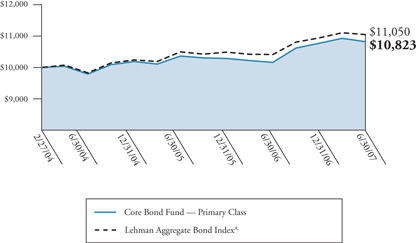

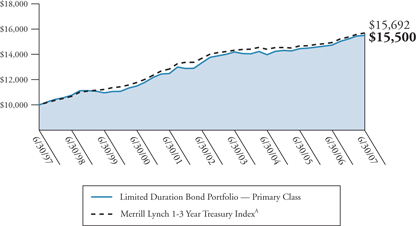

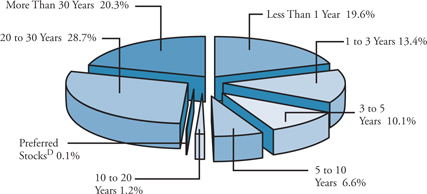

The graph on the following page compares the Fund’s total returns to that of a closely matched broad-based securities market index. The graph illustrates the cumulative total return of an initial $10,000 investment in the Fund’s Primary Class shares, for the periods indicated. The line for the Fund represents the total return after deducting all Fund investment management and other administrative expenses and the transaction costs of buying and selling securities. The line representing the securities market index does not take into account any transaction costs associated with buying and selling securities in the index or other administrative expenses. Both the Fund’s and the index’s results assume reinvestment of all dividends and distributions.

Total return measures investment performance in terms of appreciation or depreciation in a fund’s net asset value per share, plus dividends and any capital gain distributions. It assumes that dividends and distributions were reinvested at the time they were paid. Average annual returns tend to smooth out variations in a fund’s return, so that they differ from actual year-to-year results.

4

Semi-Annual Report to Shareholders

Growth of a $10,000 Investment—Primary Class

Periods Ended June 30, 2007

| | | | | | |

| | | Cumulative Total Return | | | Average Annual Total Return | |

One Year | | +6.50 | % | | +6.50 | % |

Life of Class* | | +8.23 | % | | +2.40 | % |

| * | Inception date: February 27, 2004 |

The performance data quoted represents past performance and does not guarantee future results. The performance stated may have been due to extraordinary market conditions, which may not be duplicated in the future. Current performance may be lower or higher than the performance data quoted. To obtain the most recent month-end performance information please visit www.leggmasonfunds.com. The investment return and principal value of the Fund will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. Calculations assume reinvestment of dividends and capital gain distributions. Performance would have been lower if fees had not been waived in various periods.

The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

A | A market value-weighted index that tracks the daily price, coupon, pay-downs, and total return performance of fixed rate, publicly placed, dollar-denominated, and nonconvertible investment grade debt issues with at least $100 million par amount outstanding and with at least one year to final maturity. Index returns are for the periods beginning February 29, 2004. |

5

Semi-Annual Report to Shareholders

Performance Information—Continued

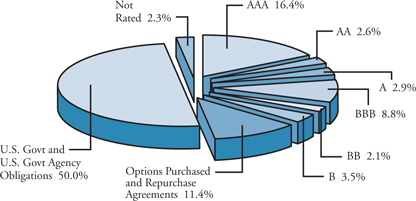

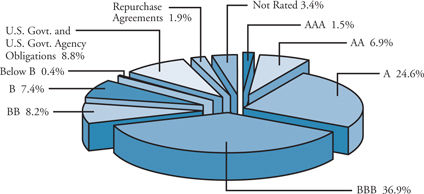

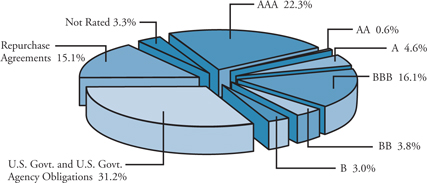

Portfolio Composition (as of June 30, 2007)B

Standard & Poor’s Debt RatingsC (as a percentage of the portfolio)

Maturity Schedule (as a percentage of the portfolio)

B | The Fund is actively managed. As a result, the composition of its portfolio holdings and sectors is subject to change at any time. |

C | Standard & Poor’s Ratings Services provide capital markets with credit ratings for the evaluation and assessment of credit risk. |

D | Preferred Stocks do not have a defined maturity date. |

6

Semi-Annual Report to Shareholders

Portfolio of Investments

Core Bond Fund

June 30, 2007 (Unaudited)

(Amounts in Thousands)

| | | | | | | | | | | | |

| | | Rate | | | Maturity Date | | Par/Shares | | Value | |

Long-Term Securities — 115.9% | | | | | | | | | | | | |

Corporate Bonds and Notes — 21.7% | | | | | | | | | | | | |

Aerospace and Defense—N.M. | | | | | | | | | | | | |

United Technologies Corp. | | 5.400 | % | | 5/1/35 | | $ | 20 | | $ | 18 | |

| | | | | | | | | | | | |

| | | | |

Airlines — 0.9% | | | | | | | | | | | | |

Delta Air Lines Inc. | | 6.619 | % | | 3/18/11 | | | 130 | | | 131 | |

JetBlue Airways Corp. | | 5.124 | % | | 8/15/16 | | | 274 | | | 274 | A |

JetBlue Airways Corp. | | 5.810 | % | | 11/15/16 | | | 300 | | | 302 | A |

| | | | | | | | | | | | |

| | | | | | | | | | | 707 | |

| | | | | | | | | | | | |

| | | | |

Automobiles — 1.4% | | | | | | | | | | | | |

DaimlerChrysler NA Holding Corp. | | 4.050 | % | | 6/4/08 | | | 95 | | | 94 | |

DaimlerChrysler NA Holding Corp. | | 7.200 | % | | 9/1/09 | | | 50 | | | 52 | |

General Motors Corp. | | 8.250 | % | | 7/15/23 | | | 1,000 | | | 911 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 1,057 | |

| | | | | | | | | | | | |

| | | | |

Capital Markets — 0.7% | | | | | | | | | | | | |

Goldman Sachs Group LP | | 4.500 | % | | 6/15/10 | | | 70 | | | 68 | |

Lehman Brothers Holdings Inc. | | 5.250 | % | | 2/6/12 | | | 115 | | | 113 | |

Morgan Stanley | | 3.625 | % | | 4/1/08 | | | 30 | | | 30 | |

Morgan Stanley | | 5.625 | % | | 1/9/12 | | | 110 | | | 110 | |

Morgan Stanley | | 5.809 | % | | 10/18/16 | | | 40 | | | 40 | A |

The Bear Stearns Cos. Inc. | | 5.550 | % | | 1/22/17 | | | 150 | | | 142 | |

The Goldman Sachs Group Inc. | | 5.000 | % | | 1/15/11 | | | 40 | | | 39 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 542 | |

| | | | | | | | | | | | |

| | | | |

Commercial Banks — 1.2% | | | | | | | | | | | | |

Bank One Corp. | | 2.625 | % | | 6/30/08 | | | 335 | | | 326 | |

Rabobank Capital Funding Trust II | | 5.260 | % | | 12/31/49 | | | 10 | | | 10 | B,C |

7

Semi-Annual Report to Shareholders

Portfolio of Investments—Continued

Core Bond Fund—Continued

| | | | | | | | | | | | |

| | | Rate | | | Maturity Date | | Par/Shares | | Value | |

Corporate Bonds and Notes—Continued | | | | | | | | | | | | |

Commercial Banks—Continued | | | | | | | | | | | | |

Rabobank Capital Funding Trust III | | 5.254 | % | | 10/21/49 | | $ | 20 | | $ | 19 | B,C |

SunTrust Capital VIII | | 6.100 | % | | 12/15/36 | | | 190 | | | 174 | C |

Wachovia Capital Trust III | | 5.800 | % | | 3/15/42 | | | 100 | | | 99 | C |

Wachovia Corp. | | 5.750 | % | | 6/15/17 | | | 170 | | | 168 | |

Wells Fargo Capital X | | 5.950 | % | | 12/15/36 | | | 100 | | | 93 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 889 | |

| | | | | | | | | | | | |

| | | | |

Commercial Services and Supplies — 0.1% | | | | | | | | | | | | |

Waste Management Inc. | | 6.375 | % | | 11/15/12 | | | 85 | | | 87 | |

| | | | | | | | | | | | |

| | | | |

Consumer Finance — 3.6% | | | | | | | | | | | | |

American Express Co. | | 6.800 | % | | 9/1/66 | | | 40 | | | 41 | C |

Ford Motor Credit Co. | | 4.950 | % | | 1/15/08 | | | 40 | | | 40 | |

Ford Motor Credit Co. | | 6.625 | % | | 6/16/08 | | | 190 | | | 190 | |

Ford Motor Credit Co. | | 7.375 | % | | 10/28/09 | | | 590 | | | 586 | |

Ford Motor Credit Co. | | 7.375 | % | | 2/1/11 | | | 230 | | | 225 | |

Ford Motor Credit Co. | | 7.250 | % | | 10/25/11 | | | 210 | | | 202 | |

GMAC LLC | | 6.125 | % | | 8/28/07 | | | 230 | | | 230 | |

GMAC LLC | | 5.625 | % | | 5/15/09 | | | 685 | | | 670 | |

GMAC LLC | | 7.750 | % | | 1/19/10 | | | 110 | | | 111 | |

SLM Corp. | | 5.625 | % | | 8/1/33 | | | 490 | | | 382 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 2,677 | |

| | | | | | | | | | | | |

| | | | |

Diversified Financial Services — 2.7% | | | | | | | | | | | | |

Air 2 US | | 8.027 | % | | 10/1/19 | | | 152 | | | 157 | B |

Bank of America Corp. | | 5.375 | % | | 8/15/11 | | | 160 | | | 159 | |

Citigroup Inc. | | 5.100 | % | | 9/29/11 | | | 230 | | | 226 | |

General Electric Capital Corp. | | 4.250 | % | | 1/15/08 | | | 70 | | | 70 | |

General Electric Capital Corp. | | 4.125 | % | | 9/1/09 | | | 90 | | | 88 | |

HSBC Finance Corp. | | 4.125 | % | | 11/16/09 | | | 225 | | | 218 | |

ILFC E-Capital Trust II | | 6.250 | % | | 12/21/65 | | | 20 | | | 19 | B,C |

Lilacs Repackaging 05-I | | 5.138 | % | | 1/15/64 | | | 490 | | | 470 | B |

Residential Capital Corp. | | 6.125 | % | | 11/21/08 | | | 50 | | | 50 | |

8

Semi-Annual Report to Shareholders

| | | | | | | | | | | | |

| | | Rate | | | Maturity Date | | Par/Shares | | Value | |

Corporate Bonds and Notes—Continued | | | | | | | | | | | | |

Diversified Financial Services—Continued | | | | | | | | | | | | |

Residential Capital Corp. | | 6.000 | % | | 2/22/11 | | $ | 290 | | $ | 281 | |

Residential Capital Corp. | | 6.500 | % | | 6/1/12 | | | 90 | | | 88 | |

Sigma Finance Inc. | | 8.000 | % | | 6/22/17 | | | 220 | | | 220 | B,D |

| | | | | | | | | | | | |

| | | | | | | | | | | 2,046 | |

| | | | | | | | | | | | |

| | | | |

Diversified Telecommunication Services — 0.2% | | | | | | | | | | | | |

AT&T Inc. | | 5.100 | % | | 9/15/14 | | | 90 | | | 86 | |

BellSouth Corp. | | 4.750 | % | | 11/15/12 | | | 10 | | | 9 | |

Verizon Global Funding Corp. | | 7.375 | % | | 9/1/12 | | | 35 | | | 38 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 133 | |

| | | | | | | | | | | | |

| | | | |

Electric Utilities — 1.0% | | | | | | | | | | | | |

Duke Energy Corp. | | 6.250 | % | | 1/15/12 | | | 50 | | | 51 | |

Duke Energy Corp. | | 5.625 | % | | 11/30/12 | | | 90 | | | 90 | |

FirstEnergy Corp. | | 7.375 | % | | 11/15/31 | | | 105 | | | 114 | |

Pacific Gas and Electric Co. | | 6.050 | % | | 3/1/34 | | | 115 | | | 111 | |

Pacific Gas and Electric Co. | | 5.800 | % | | 3/1/37 | | | 20 | | | 19 | |

The Cleveland Electric Illuminating Co. | | 5.700 | % | | 4/1/17 | | | 5 | | | 5 | |

TXU Energy Co. | | 7.000 | % | | 3/15/13 | | | 320 | | | 330 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 720 | |

| | | | | | | | | | | | |

| | | | |

Food and Staples Retailing — 0.9% | | | | | | | | | | | | |

CVS Lease Pass-Through Trust | | 6.036 | % | | 12/10/28 | | | 465 | | | 451 | B |

Wal-Mart Stores Inc. | | 3.375 | % | | 10/1/08 | | | 190 | | | 186 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 637 | |

| | | | | | | | | | | | |

| | | | |

Gas Utilities—N.M. | | | | | | | | | | | | |

Southern Natural Gas Co. | | 5.900 | % | | 4/1/17 | | | 30 | | | 29 | B |

| | | | | | | | | | | | |

| | | | |

Health Care Providers and Services — 0.9% | | | | | | | | | | | | |

Cardinal Health Inc. | | 5.850 | % | | 12/15/17 | | | 160 | | | 155 | |

HCA Inc. | | 5.750 | % | | 3/15/14 | | | 615 | | | 521 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 676 | |

| | | | | | | | | | | | |

9

Semi-Annual Report to Shareholders

Portfolio of Investments—Continued

Core Bond Fund—Continued

| | | | | | | | | | | | |

| | | Rate | | | Maturity Date | | Par/Shares | | Value | |

Corporate Bonds and Notes—Continued | | | | | | | | | | | | |

Independent Power Producers and Energy Traders — 0.4% | | | | | | | | | | | | |

TXU Corp. | | 5.550 | % | | 11/15/14 | | $ | 30 | | $ | 25 | |

TXU Corp. | | 6.500 | % | | 11/15/24 | | | 20 | | | 17 | |

TXU Corp. | | 6.550 | % | | 11/15/34 | | | 280 | | | 226 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 268 | |

| | | | | | | | | | | | |

| | | | |

Insurance — 1.4% | | | | | | | | | | | | |

American International Group Inc. | | 6.250 | % | | 3/15/37 | | | 200 | | | 189 | |

ASIF Global Financing XIX | | 4.900 | % | | 1/17/13 | | | 20 | | | 19 | B |

MetLife Inc. | | 6.400 | % | | 12/15/36 | | | 470 | | | 435 | C |

The Travelers Cos. Inc. | | 6.250 | % | | 3/15/37 | | | 420 | | | 404 | C |

| | | | | | | | | | | | |

| | | | | | | | | | | 1,047 | |

| | | | | | | | | | | | |

| | | | |

IT Services—N.M. | | | | | | | | | | | | |

Electronic Data Systems Corp. | | 7.125 | % | | 10/15/09 | | | 10 | | | 10 | |

| | | | | | | | | | | | |

| | | | |

Leisure Equipment and Products — 0.7% | | | | | | | | | | | | |

Eastman Kodak Co. | | 7.250 | % | | 11/15/13 | | | 540 | | | 540 | |

| | | | | | | | | | | | |

| | | | |

Media — 0.8% | | | | | | | | | | | | |

Clear Channel Communications Inc. | | 4.625 | % | | 1/15/08 | | | 30 | | | 30 | |

Clear Channel Communications Inc. | | 4.250 | % | | 5/15/09 | | | 50 | | | 48 | |

Clear Channel Communications Inc. | | 6.250 | % | | 3/15/11 | | | 40 | | | 39 | |

Clear Channel Communications Inc. | | 5.500 | % | | 9/15/14 | | | 15 | | | 13 | |

Comcast Corp. | | 6.500 | % | | 1/15/15 | | | 170 | | | 174 | |

Comcast Corp. | | 6.500 | % | | 1/15/17 | | | 70 | | | 71 | |

Cox Communications Inc. | | 3.875 | % | | 10/1/08 | | | 70 | | | 69 | |

10

Semi-Annual Report to Shareholders

| | | | | | | | | | | | |

| | | Rate | | | Maturity Date | | Par/Shares | | Value | |

| | |

Corporate Bonds and Notes—Continued | | | | | | | | | | | | |

Media—Continued | | | | | | | | | | | | |

Time Warner Inc. | | 6.875 | % | | 5/1/12 | | $ | 75 | | $ | 78 | |

Time Warner Inc. | | 7.700 | % | | 5/1/32 | | | 75 | | | 81 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 603 | |

| | | | | | | | | | | | |

| | | | |

Multi-Utilities — 0.2% | | | | | | | | | | | | |

Dominion Resources Inc. | | 4.750 | % | | 12/15/10 | | | 30 | | | 29 | |

Dominion Resources Inc. | | 5.700 | % | | 9/17/12 | | | 95 | | | 95 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 124 | |

| | | | | | | | | | | | |

| | | | |

Multiline Retail — 0.2% | | | | | | | | | | | | |

Target Corp. | | 5.400 | % | | 10/1/08 | | | 155 | | | 155 | |

| | | | | | | | | | | | |

| | | | |

Oil, Gas and Consumable Fuels — 1.9% | | | | | | | | | | | | |

Anadarko Petroleum Corp. | | 5.760 | % | | 9/15/09 | | | 160 | | | 160 | A |

Anadarko Petroleum Corp. | | 6.450 | % | | 9/15/36 | | | 55 | | | 53 | |

Conoco Inc. | | 6.950 | % | | 4/15/29 | | | 90 | | | 98 | |

ConocoPhillips | | 4.750 | % | | 10/15/12 | | | 60 | | | 58 | |

Hess Corp. | | 7.875 | % | | 10/1/29 | | | 30 | | | 34 | |

Hess Corp. | | 7.300 | % | | 8/15/31 | | | 215 | | | 231 | |

Kerr-McGee Corp. | | 6.875 | % | | 9/15/11 | | | 300 | | | 312 | |

Kerr-McGee Corp. | | 6.950 | % | | 7/1/24 | | | 10 | | | 10 | |

Kinder Morgan Energy Partners LP | | 7.125 | % | | 3/15/12 | | | 65 | | | 68 | |

Kinder Morgan Energy Partners LP | | 5.000 | % | | 12/15/13 | | | 35 | | | 33 | |

Kinder Morgan Energy Partners LP | | 6.000 | % | | 2/1/17 | | | 100 | | | 98 | |

Pemex Project Funding Master Trust | | 6.625 | % | | 6/15/35 | | | 140 | | | 142 | |

XTO Energy Inc. | | 7.500 | % | | 4/15/12 | | | 145 | | | 156 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 1,453 | |

| | | | | | | | | | | | |

| | | | |

Paper and Forest Products — 0.1% | | | | | | | | | | | | |

Weyerhaeuser Co. | | 6.750 | % | | 3/15/12 | | | 45 | | | 47 | |

| | | | | | | | | | | | |

11

Semi-Annual Report to Shareholders

Portfolio of Investments—Continued

Core Bond Fund—Continued

| | | | | | | | | | | |

| | | Rate | | | Maturity Date | | Par/Shares | | Value |

| |

Corporate Bonds and Notes—Continued | | | | | | | | | | | |

Pharmaceuticals — 0.1% | | | | | | | | | | | |

Wyeth | | 5.950 | % | | 4/1/37 | | $ | 110 | | $ | 105 |

| | | | | | | | | | | |

| | | | |

Thrifts and Mortgage Finance — 1.3% | | | | | | | | | | | |

Countrywide Financial Corp. | | 6.250 | % | | 5/15/16 | | | 600 | | | 590 |

Washington Mutual Bank | | 5.500 | % | | 1/15/13 | | | 220 | | | 215 |

Washington Mutual Inc. | | 5.250 | % | | 9/15/17 | | | 150 | | | 139 |

| | | | | | | | | | | |

| | | | | | | | | | | 944 |

| | | | | | | | | | | |

| | | | |

Tobacco — 0.2% | | | | | | | | | | | |

Altria Group Inc. | | 7.000 | % | | 11/4/13 | | | 155 | | | 164 |

| | | | | | | | | | | |

| | | | |

Wireless Telecommunication Services — 0.8% | | | | | | | | | | | |

Sprint Capital Corp. | | 8.375 | % | | 3/15/12 | | | 540 | | | 588 |

Sprint Capital Corp. | | 8.750 | % | | 3/15/32 | | | 30 | | | 34 |

Sprint Nextel Corp. | | 6.000 | % | | 12/1/16 | | | 10 | | | 9 |

| | | | | | | | | | | |

| | | | | | | | | | | 631 |

| | | | | | | | | | | |

| | | | |

Total Corporate Bonds and Notes | | | | | | | | | | | |

(Cost — $16,742) | | | | | | | | | | | 16,309 |

| | | | | | | | | | | |

| | | | |

Asset-Backed Securities — 2.6% | | | | | | | | | | | |

Fixed Rate Securities — 0.3% | | | | | | | | | | | |

Bank One Issuance Trust 2003-C1 | | 4.540 | % | | 9/15/10 | | | 200 | | | 199 |

| | | | | | | | | | | |

| | | | |

Indexed SecuritiesA — 1.7% | | | | | | | | | | | |

Ace Securities Corp. Home Equity Loan Trust, Series 2006-SL3 | | 5.420 | % | | 6/25/36 | | | 330 | | | 330 |

Bayview Financial Acquisition Trust 2004-C | | 5.740 | % | | 5/28/44 | | | 260 | | | 260 |

Brazos Higher Education Authority Inc. 2005-1 | | 5.376 | % | | 6/15/42 | | | 269 | | | 266 |

12

Semi-Annual Report to Shareholders

| | | | | | | | | | | | | |

| | | Rate | | | Maturity Date | | Par/Shares | | | Value | |

| | |

Asset-Backed Securities—Continued | | | | | | | | | | | | | |

Indexed Securities—Continued | | | | | | | | | | | | | |

Credit-Based Asset Servicing and Securitization 2005-RP1 | | 5.500 | % | | 1/25/35 | | $ | 22 | | | $ | 22 | B |

Lehman XS Trust 2007-8H A1 | | 5.450 | % | | 6/25/37 | | | 293 | | | | 298 | |

MSDWCC Heloc Trust 2005-1 | | 5.510 | % | | 7/25/17 | | | 31 | | | | 31 | |

Wachovia Asset Securitization Inc. 2002-HE1 | | 5.690 | % | | 9/27/32 | | | 61 | | | | 62 | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | 1,269 | |

| | | | | | | | | | | | | |

| | | | |

Variable Rate SecuritiesD — 0.6% | | | | | | | | | | | | | |

Renaissance Home Equity Loan Trust 2007-2 AF5 | | 6.203 | % | | 6/25/37 | | | 460 | | | | 448 | |

| | | | | | | | | | | | | |

Total Asset-Backed Securities | | | | | | | | | | | | | |

(Cost — $1,928) | | | | | | | | | | | | 1,916 | |

| | | | | | | | | | | | | |

| | | | |

Mortgage-Backed Securities — 19.6% | | | | | | | | | | | | | |

Fixed Rate Securities — 5.9% | | | | | | | | | | | | | |

Asset Securitization Corp. 1996-D2 A1 | | 6.920 | % | | 2/14/29 | | | — | E | | | — | F |

Banc of America Commercial Mortgage Inc. 2005-3 A4 | | 4.668 | % | | 7/10/43 | | | 500 | | | | 465 | |

Banc of America Commercial Mortgage Inc. 2006-3 A4 | | 5.889 | % | | 7/10/44 | | | 370 | | | | 371 | |

Banc of America Commercial Mortgage Inc. 2007-1 A4 | | 5.451 | % | | 1/15/49 | | | 600 | | | | 580 | |

Countrywide Alternative Loan Trust 2004-2 CB | | 4.250 | % | | 3/25/34 | | | 177 | | | | 173 | |

GS Mortgage Securities Corp. II 2005-GG4 | | 4.680 | % | | 7/10/39 | | | 200 | | | | 191 | |

LB-UBS Commercial Mortgage Trust 2005-C3 A5 | | 4.739 | % | | 7/15/30 | | | 140 | | | | 131 | |

13

Semi-Annual Report to Shareholders

Portfolio of Investments—Continued

Core Bond Fund—Continued

| | | | | | | | | | | | |

| | | Rate | | | Maturity Date | | Par/Shares | | Value | |

| | |

Mortgage-Backed Securities—Continued | | | | | | | | | | | | |

Fixed Rate Securities—Continued | | | | | | | | | | | | |

LB-UBS Commercial Mortgage Trust 2005-C3 AAB | | 4.664 | % | | 7/15/30 | | $ | 200 | | $ | 191 | |

LB-UBS Commercial Mortgage Trust 2006-C7 A3 | | 5.347 | % | | 11/15/38 | | | 370 | | | 356 | |

MASTR Reperforming Loan Trust 2005-1 | | 7.000 | % | | 8/25/34 | | | 221 | | | 226 | B |

Morgan Stanley Capital I Series 2005-HQ6 | | 4.989 | % | | 8/13/42 | | | 240 | | | 228 | |

Prime Mortgage Trust 2006-DR1 2A1 | | 5.500 | % | | 5/25/35 | | | 936 | | | 916 | B |

Prime Mortgage Trust 2006-DR1 2A2 | | 6.000 | % | | 5/25/36 | | | 564 | | | 554 | B |

Washington Mutual MSC Mortgage Pass-Through Certificates Series 2004-RA1 | | 7.000 | % | | 3/25/34 | | | 65 | | | 66 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 4,448 | |

| | | | | | | | | | | | |

| | | | |

Indexed SecuritiesA — 12.1% | | | | | | | | | | | | |

ABFS Mortgage Loan Trust 2003-2 | | 5.820 | % | | 4/25/34 | | | 56 | | | 56 | B |

Banc of America Funding Corp. 2005-E | | 5.729 | % | | 6/20/35 | | | 275 | | | 276 | |

Countrywide Alternative Loan Trust 2005-17 1A1 | | 5.580 | % | | 7/25/35 | | | 260 | | | 260 | |

Countrywide Alternative Loan Trust 2005-38 A3 | | 5.670 | % | | 9/25/35 | | | 259 | | | 260 | |

Countrywide Home Loans 2005-03 1A2 | | 5.610 | % | | 4/25/35 | | | 225 | | | 226 | |

Countrywide Home Loans 2005-09 1A1 | | 5.620 | % | | 5/25/35 | | | 221 | | | 221 | |

Countrywide Home Loans 2005-11 3A3 | | 6.271 | % | | 4/25/35 | | | 218 | | | 220 | |

14

Semi-Annual Report to Shareholders

| | | | | | | | | | | | |

| | | Rate | | | Maturity Date | | Par/Shares | | Value | |

| | |

Mortgage-Backed Securities—Continued | | | | | | | | | | | | |

Indexed Securities—Continued | | | | | | | | | | | | |

Countrywide Home Loans 2005-11 6A1 | | 5.620 | % | | 3/25/35 | | $ | 182 | | $ | 183 | |

DSLA Mortgage Loan Trust 2006-AR1 1A1A | | 5.947 | % | | 4/19/36 | | | 430 | | | 430 | |

Greenpoint Mortgage Funding Trust 2005-AR1 | | 5.540 | % | | 6/25/45 | | | 210 | | | 210 | |

Greenpoint Mortgage Funding Trust 2005-AR4 | | 5.580 | % | | 10/25/45 | | | 92 | | | 92 | |

GSMPS Mortgage Loan Trust 2005-RP2 | | 5.670 | % | | 3/25/35 | | | 247 | | | 246 | B |

Harborview Mortgage Loan Trust 2005-7 | | 6.226 | % | | 6/19/45 | | | 334 | | | 336 | |

Harborview Mortgage Loan Trust 2005-9 | | 5.660 | % | | 6/20/35 | | | 230 | | | 230 | |

IXIS Real Estate Capital Trust 2006-HE2 | | 5.380 | % | | 8/25/36 | | | 219 | | | 219 | |

Lehman XS Trust 2005-7N 1A1B | | 5.620 | % | | 12/25/35 | | | 225 | | | 226 | |

Lehman XS Trust 2006-GP2 1A1A | | 5.390 | % | | 6/25/46 | | | 454 | | | 454 | |

Structured Asset Mortgage Investments Inc. 2006-AR7 A1A | | 5.530 | % | | 8/25/36 | | | 539 | | | 539 | |

Thornburg Mortgage Securities Trust 2005-2 A1 | | 5.540 | % | | 7/25/45 | | | 133 | | | 134 | |

Thornburg Mortgage Securities Trust 2005-2 A2 | | 5.550 | % | | 7/25/45 | | | 322 | | | 322 | |

Thornburg Mortgage Securities Trust 2005-4 A4 | | 5.520 | % | | 12/25/35 | | | 537 | | | 537 | |

WaMu Mortgage Pass Through Certificates, Series 2007-0A5 1A | | 5.779 | % | | 6/25/47 | | | 689 | | | 689 | |

15

Semi-Annual Report to Shareholders

Portfolio of Investments—Continued

Core Bond Fund—Continued

| | | | | | | | | | | | |

| | | Rate | | | Maturity Date | | Par/Shares | | Value | |

| | |

Mortgage-Backed Securities—Continued | | | | | | | | | | | | |

Indexed Securities—Continued | | | | | | | | | | | | |

WaMu Mortgage Pass-Through Certificates, Series 2005-AR06 2A1A | | 5.550 | % | | 4/25/45 | | $ | 213 | | $ | 213 | |

WaMu Mortgage Pass-Through Certificates, Series 2005-AR08 1A1A | | 5.590 | % | | 7/25/45 | | | 179 | | | 179 | |

WaMu Mortgage Pass-Through Certificates, Series 2005-AR11 | | 5.640 | % | | 8/25/45 | | | 582 | | | 583 | |

WaMu Mortgage Pass-Through Certificates, Series 2005-AR13 A1A1 | | 5.610 | % | | 10/25/45 | | | 275 | | | 276 | |

WaMu Mortgage Pass-Through Certificates, Series 2005-AR19 A1A2 | | 5.610 | % | | 12/25/45 | | | 353 | | | 354 | |

WaMu Mortgage Pass-Through Certificates, Series, 2007-0A5 A1B | | 5.869 | % | | 5/25/47 | | | 700 | | | 699 | |

Zuni Mortgage Loan Trust 2006-OA1 | | 5.450 | % | | 8/25/36 | | | 372 | | | 372 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 9,042 | |

| | | | | | | | | | | | |

| | | | |

Stripped Securities — 0.5% | | | | | | | | | | | | |

GE Capital Commercial Mortgage Corp. 2005-C4 | | 5.333 | % | | 11/10/45 | | | 360 | | | 350 | G1 |

Mach One Trust, Commercial Mortgage-Backed Securities 2004-1A | | 1.589 | % | | 5/28/40 | | | 1,172 | | | 39 | B,G1,I |

| | | | | | | | | | | | |

| | | | | | | | | | | 389 | |

| | | | | | | | | | | | |

16

Semi-Annual Report to Shareholders

| | | | | | | | | | | | |

| | | Rate | | | Maturity Date | | Par/Shares | | Value | |

| | |

Mortgage-Backed Securities—Continued | | | | | | | | | | | | |

Variable Rate SecuritiesD — 1.1% | | | | | | | | | | | | |

Bear Stearns ARM Trust, Mortgage Pass-Through Certificates, Series 2004-4 | | 3.517 | % | | 6/25/34 | | $ | 200 | | $ | 196 | |

Credit-Based Asset Servicing and Securitization 1999-3 | | 6.630 | % | | 1/3/29 | | | 51 | | | 49 | B |

IndyMac INDX Mortgage Loan Trust 2005-AR15 | | 5.099 | % | | 9/25/35 | | | 123 | | | 119 | |

JPMorgan Chase Commercial Mortgage Securities Corp., Series 2005-CB13 | | 5.472 | % | | 1/12/43 | | | 100 | | | 97 | |

JPMorgan Chase Commercial Mortgage Securities Corp., Series 2005-LDP4 | | 4.918 | % | | 10/15/42 | | | 200 | | | 188 | |

Merrill Lynch/Countrywide Commercial Mortgage 2007-6 A4 | | 5.485 | % | | 3/12/51 | | | 200 | | | 194 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 843 | |

| | | | | | | | | | | | |

Total Mortgage-Backed Securities | | | | | | | | | | | | |

(Cost — $14,895) | | | | | | | | | | | 14,722 | |

| | | | | | | | | | | | |

| | | | |

U.S. Government and Agency Obligations — 16.7% | | | | | | | | | | | | |

Fixed Rate Securities — 11.1% | | | | | | | | | | | | |

Fannie Mae | | 6.625 | % | | 9/15/09 | | | 160 | | | 165 | |

Fannie Mae | | 5.200 | % | | 11/8/10 | | | 170 | | | 169 | |

Fannie Mae | | 5.625 | % | | 5/19/11 | | | 290 | | | 291 | |

Fannie Mae | | 4.610 | % | | 10/10/13 | | | 560 | | | 534 | |

Federal Home Loan Bank | | 3.875 | % | | 8/22/08 | | | 120 | | | 118 | |

Federal Home Loan Bank | | 5.400 | % | | 1/2/09 | | | 130 | | | 130 | |

Freddie Mac | | 4.750 | % | | 1/18/11 | | | 110 | | | 108 | |

Freddie Mac | | 5.250 | % | | 2/24/11 | | | 160 | | | 159 | |

Freddie Mac | | 5.625 | % | | 3/15/11 | | | 40 | | | 40 | |

Freddie Mac | | 4.650 | % | | 10/10/13 | | | 600 | | | 573 | |

Freddie Mac | | 5.450 | % | | 11/21/13 | | | 180 | | | 178 | |

17

Semi-Annual Report to Shareholders

Portfolio of Investments—Continued

Core Bond Fund—Continued

| | | | | | | | | | | | |

| | | Rate | | | Maturity Date | | Par/Shares | | Value | |

| | |

U.S. Government and Agency Obligations—Continued | | | | | | | | | | | | |

Fixed Rate Securities—Continued | | | | | | | | | | | | |

Freddie Mac | | 5.300 | % | | 5/12/20 | | $ | 690 | | $ | 659 | |

Freddie Mac | | 5.625 | % | | 11/23/35 | | | 210 | | | 196 | |

United States Treasury Bonds | | 4.500 | % | | 2/15/36 | | | 455 | | | 412 | |

United States Treasury Bonds | | 4.750 | % | | 2/15/37 | | | 1,830 | | | 1,725 | |

United States Treasury Notes | | 3.750 | % | | 5/15/08 | | | 40 | | | 40 | |

United States Treasury Notes | | 4.500 | % | | 3/31/09 | | | 60 | | | 60 | |

United States Treasury Notes | | 4.750 | % | | 2/15/10 | | | 310 | | | 309 | |

United States Treasury Notes | | 4.125 | % | | 8/15/10 | | | 100 | | | 98 | |

United States Treasury Notes | | 4.625 | % | | 10/31/11 | | | 1,200 | | | 1,186 | |

United States Treasury Notes | | 4.625 | % | | 12/31/11 | | | 150 | | | 148 | |

United States Treasury Notes | | 4.500 | % | | 3/31/12 | | | 240 | | | 236 | |

United States Treasury Notes | | 4.500 | % | | 4/30/12 | | | 290 | | | 285 | |

United States Treasury Notes | | 4.250 | % | | 8/15/14 | | | 560 | | | 536 | |

United States Treasury Notes | | 5.125 | % | | 5/15/16 | | | 13 | | | 13 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 8,368 | |

| | | | | | | | | | | | |

| | | | |

Stripped Securities — 0.3% | | | | | | | | | | | | |

United States Treasury Bonds | | 0.000 | % | | 11/15/21 | | | 420 | | | 198 | G2 |

United States Treasury Strip Principal | | 0.000 | % | | 5/15/30 | | | 100 | | | 31 | G2 |

| | | | | | | | | | | | |

| | | | | | | | | | | 229 | |

| | | | | | | | | | | | |

| | | | |

Treasury Inflation-Protected SecuritiesJ — 5.3% | | | | | | | | | | | | |

United States Treasury Inflation-Protected Security | | 3.875 | % | | 1/15/09 | | | 25 | | | 26 | |

United States Treasury Inflation-Protected Security | | 2.000 | % | | 1/15/14 | | | 73 | | | 70 | |

United States Treasury Inflation-Protected Security | | 1.875 | % | | 7/15/15 | | | 159 | | | 150 | |

United States Treasury Inflation-Protected Security | | 2.000 | % | | 1/15/16 | | | 396 | | | 376 | |

United States Treasury Inflation-Protected Security | | 2.375 | % | | 1/15/17 | | | 871 | | | 850 | |

United States Treasury Inflation-Protected Security | | 2.375 | % | | 1/15/25 | | | 565 | | | 543 | |

18

Semi-Annual Report to Shareholders

| | | | | | | | | | | | |

| | | Rate | | | Maturity Date | | Par/Shares | | Value | |

| | |

U.S. Government and Agency Obligations—Continued | | | | | | | | | | | | |

Treasury Inflation-Protected Securities—Continued | | | | | | | | | | | | |

United States Treasury Inflation-Protected Security | | 2.000 | % | | 1/15/26 | | $ | 604 | | $ | 547 | |

United States Treasury Inflation-Protected Security | | 2.375 | % | | 1/15/27 | | | 1,066 | | | 1,023 | |

United States Treasury Inflation-Protected Security | | 3.875 | % | | 4/15/29 | | | 277 | | | 334 | |

United States Treasury Inflation-Protected Security | | 3.375 | % | | 4/15/32 | | | 58 | | | 67 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 3,986 | |

| | | | | | | | | | | | |

Total U.S. Government and Agency Obligations | | | | | | | | | | | | |

(Cost — $12,865) | | | | | | | | | | | 12,583 | |

| | | | | | | | | | | | |

| | | | |

U.S. Government Agency Mortgage-Backed Securities — 48.5% | | | | | | | | | | | | |

Fixed Rate Securities — 47.5% | | | | | | | | | | | | |

Fannie Mae | | 5.500 | % | | 12/1/17 to 4/1/36 | | | 1,390 | | | 1,346 | |

Fannie Mae | | 5.000 | % | | 10/1/20 to 3/1/36 | | | 1,934 | | | 1,853 | |

Fannie Mae | | 6.000 | % | | 8/1/21 to 9/1/36 | | | 3,896 | | | 3,868 | |

Fannie Mae | | 5.500 | % | | 12/1/22 to 12/1/37 | | | 3,380 | | | 3,266 | K |

Fannie Mae | | 6.000 | % | | 12/1/22 to 12/1/37 | | | 3,100 | | | 3,063 | K |

Fannie Mae | | 4.500 | % | | 9/1/35 | | | 89 | | | 81 | |

Fannie Mae | | 5.000 | % | | 12/1/37 | | | 12,050 | | | 11,280 | K |

Fannie Mae | | 6.500 | % | | 12/1/37 | | | 4,790 | | | 4,833 | K |

Freddie Mac | | 4.500 | % | | 4/1/19 | | | 256 | | | 243 | |

Freddie Mac | | 5.000 | % | | 7/1/20 to 9/1/35 | | | 1,244 | | | 1,196 | |

Government National Mortgage Association | | 6.000 | % | | 11/15/28 to 12/15/33 | | | 635 | | | 633 | |

Government National Mortgage Association | | 6.500 | % | | 2/15/32 | | | 226 | | | 230 | |

Government National Mortgage Association | | 5.000 | % | | 8/15/33 to 5/15/34 | | | 834 | | | 790 | |

19

Semi-Annual Report to Shareholders

Portfolio of Investments—Continued

Core Bond Fund—Continued

| | | | | | | | | | | | |

| | | Rate | | | Maturity Date | | Par/Shares | | Value | |

| | |

U.S. Government Agency Mortgage-Backed Securities—Continued | | | | | | | | | | | | |

Fixed Rate Securities—Continued | | | | | | | | | | | | |

Government National Mortgage Association | | 5.500 | % | | 2/15/35 | | $ | 2,418 | | $ | 2,349 | |

Government National Mortgage Association | | 6.500 | % | | 12/1/37 | | | 700 | | | 711 | K |

| | | | | | | | | | | | |

| | | | | | | | | | | 35,742 | |

| | | | | | | | | | | | |

| | | | |

Indexed SecuritiesA — 1.0% | | | | | | | | | | | | |

Freddie Mac | | 5.920 | % | | 4/1/37 | | | 745 | | | 748 | |

| | | | | | | | | | | | |

Total U.S. Government Agency Mortgage-Backed Securities | | | | | | | | | | | | |

(Cost — $37,007) | | | | | | | | | | | 36,490 | |

| | | | | | | | | | | | |

| | | | |

Yankee BondsL — 6.5% | | | | | | | | | | | | |

Commercial Banks — 2.6% | | | | | | | | | | | | |

BNP Paribas NY | | 6.875 | % | | 3/1/09 | | | 110 | | | 112 | |

Eksportfinans ASA | | 5.500 | % | | 5/25/16 | | | 160 | | | 161 | |

Glitnir Banki Hf | | 6.330 | % | | 7/28/11 | | | 130 | | | 132 | B |

Glitnir Banki Hf | | 6.693 | % | | 6/15/16 | | | 120 | | | 124 | B,C |

Kaupthing Bank Hf | | 6.045 | % | | 4/12/11 | | | 270 | | | 272 | A,B |

Kaupthing Bank Hf | | 7.125 | % | | 5/19/16 | | | 440 | | | 465 | B |

Landsbanki Islands Hf | | 6.100 | % | | 8/25/11 | | | 230 | | | 233 | B |

Resona Preferred Global Securities | | 7.191 | % | | 7/30/49 | | | 140 | | | 143 | B,C |

RSHB Capital SA | | 6.299 | % | | 5/15/17 | | | 190 | | | 186 | B |

Shinsei Finance Cayman Ltd. | | 6.418 | % | | 7/20/49 | | | 100 | | | 97 | B,C |

| | | | | | | | | | | | |

| | | | | | | | | | | 1,925 | |

| | | | | | | | | | | | |

| | | | |

Diversified Financial Services — 0.8% | | | | | | | | | | | | |

Banagricola DPR Funding Ltd. | | 5.800 | % | | 3/15/10 | | | 139 | | | 139 | A,B |

MUFG Capital Finance 1 Ltd. | | 6.346 | % | | 7/29/49 | | | 100 | | | 98 | C |

SMFG Preferred Capital | | 6.078 | % | | 1/29/49 | | | 250 | | | 241 | B,C |

TNK-BP Finance SA | | 7.500 | % | | 7/18/16 | | | 140 | | | 144 | B |

| | | | | | | | | | | | |

| | | | | | | | | | | 622 | |

| | | | | | | | | | | | |

20

Semi-Annual Report to Shareholders

| | | | | | | | | | | | |

| | | Rate | | | Maturity Date | | Par/Shares | | Value | |

| | |

Yankee Bonds—Continued | | | | | | | | | | | | |

Diversified Telecommunication Services — 0.5% | | | | | | | | | | | | |

British Telecommunications PLC | | 8.625 | % | | 12/15/10 | | $ | 100 | | $ | 109 | |

Deutsche Telekom International Finance BV | | 5.750 | % | | 3/23/16 | | | 75 | | | 73 | |

Koninklijke (Royal) KPN NV | | 8.000 | % | | 10/1/10 | | | 80 | | | 86 | |

Telecom Italia Capital SpA | | 4.950 | % | | 9/30/14 | | | 70 | | �� | 65 | |

Telecom Italia Capital SpA | | 5.250 | % | | 10/1/15 | | | 20 | | | 18 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 351 | |

| | | | | | | | | | | | |

| | | | |

Foreign Government — 0.6% | | | | | | | | | | | | |

Russian Federation | | 7.500 | % | | 3/31/30 | | | 51 | | | 56 | B |

United Mexican States | | 5.625 | % | | 1/15/17 | | | 4 | | | 4 | |

United Mexican States | | 6.750 | % | | 9/27/34 | | | 346 | | | 369 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 429 | |

| | | | | | | | | | | | |

| | | | |

Gas Utilities — 0.2% | | | | | | | | | | | | |

Intergas Finance BV | | 6.375 | % | | 5/14/17 | | | 187 | | | 179 | B |

| | | | | | | | | | | | |

| | | | |

Industrial Conglomerates — 0.8% | | | | | | | | | | | | |

Tyco International Group SA | | 6.125 | % | | 11/1/08 | | | 10 | | | 10 | |

Tyco International Group SA | | 6.750 | % | | 2/15/11 | | | 40 | | | 42 | |

Tyco International Group SA | | 6.375 | % | | 10/15/11 | | | 75 | | | 77 | |

Tyco International Group SA | | 6.000 | % | | 11/15/13 | | | 100 | | | 103 | |

Tyco International Group SA | | 6.875 | % | | 1/15/29 | | | 310 | | | 358 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 590 | |

| | | | | | | | | | | | |

| | | | |

Metals and Mining — 0.2% | | | | | | | | | | | | |

Vale Overseas Ltd. | | 6.875 | % | | 11/21/36 | | | 180 | | | 181 | |

| | | | | | | | | | | | |

| | | | |

Oil, Gas and Consumable Fuels — 0.8% | | | | | | | | | | | | |

Anadarko Finance Co. | | 7.500 | % | | 5/1/31 | | | 5 | | | 5 | |

ChevronTexaco Capital Co. | | 3.500 | % | | 9/17/07 | | | 140 | | | 140 | |

Conoco Funding Co. | | 6.350 | % | | 10/15/11 | | | 10 | | | 10 | |

Gazprom | | 6.212 | % | | 11/22/16 | | | 170 | | | 166 | B |

21

Semi-Annual Report to Shareholders

Portfolio of Investments—Continued

Core Bond Fund—Continued

| | | | | | | | | | | | | |

| | | Rate | | | Maturity Date | | Par/Shares | | | Value | |

| | |

Yankee Bonds—Continued | | | | | | | | | | | | | |

Oil, Gas and Consumable Fuels—Continued | | | | | | | | | | | | | |

Gazprom | | 6.510 | % | | 3/7/22 | | $ | 190 | | | $ | 188 | B |

Petrobras International Finance Co. | | 6.125 | % | | 10/6/16 | | | 130 | | | | 127 | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | 636 | |

| | | | | | | | | | | | | |

Total Yankee Bonds | | | | | | | | | | | | | |

(Cost — $4,899) | | | | | | | | | | | | 4,913 | |

| | | | | | | | | | | | | |

| | | | |

Preferred Stocks — 0.3% | | | | | | | | | | | | | |

Fannie Mae | | 5.375 | % | | | | | — | E | | | 99 | M |

General Motors Corp. | | 5.250 | % | | | | | 7 | | | | 146 | M |

| | | | | | | | | | | | | |

Total Preferred Stocks | | | | | | | | | | | | | |

(Cost — $213) | | | | | | | | | | | | 245 | |

| | | | | | | | | | | | | |

Total Long-Term Securities (Cost — $88,549) | | | | | | | | | | | | 87,178 | |

| | |

Short-Term Securities — 15.3% | | | | | | | | | | | | | |

U.S. Government and Agency Obligations — 0.3% | | | | | | | | | | | | | |

Fannie Mae | | 0.000 | % | | 3/17/08 | | $ | 255 | | | | 246 | N,O |

| | | | | | | | | | | | | |

Options PurchasedP — 0.2% | | | | | | | | | | | | | |

Eurodollar Futures Call, December 2007, Strike Price $94.00 | | | | | | | | 16 | Q | | | 28 | |

Eurodollar Futures Call, September 2007, Strike Price $94.00 | | | | | | | | 57 | Q | | | 95 | |

Eurodollar Futures Call, September 2007, Strike Price $94.50 | | | | | | | | 19 | Q | | | 8 | |

Eurodollar Futures Call, September 2007, Strike Price $94.75 | | | | | | | | 10 | Q | | | 1 | |

22

Semi-Annual Report to Shareholders

| | | | | | | | | | | | |

| | | Rate | | Maturity Date | | Par/Shares | | | Value | |

| | |

Options Purchased—Continued | | | | | | | | | | | | |

Eurodollar Futures Put, September 2007, Strike Price $94.00 | | | | | | | 2 | Q | | $ | — | F |

U.S. Treasury Note Futures Call, August 2007, Strike Price $103.00 | | | | | | | 18 | Q | | | 22 | |

U.S. Treasury Note Futures Call, August 2007, Strike Price $104.50 | | | | | | | 4 | Q | | | 1 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 155 | |

| | | | | | | | | | | | |

Repurchase Agreements — 14.8% | | | | | | | | | | | | |

Deutsche Bank AG | | | | | | | | | | | | |

5.2%, dated 6/29/07, to be repurchased at $5,558 on 7/2/07 (Collateral: $6,043 Freddie Mac notes, 5.0%, due 12/14/18 value $5,667) | | | | | | $ | 5,556 | | | | 5,556 | |

Merrill Lynch Government Securities Inc. | | | | | | | | | | | | |

5.15%, dated 6/29/07, to be repurchased at $5,557 on 7/2/07 (Collateral: $21,182 Fannie Mae zero-coupon bonds, due 11/15/30, value $5,666) | | | | | | | 5,555 | | | | 5,555 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 11,111 | |

| | | | | | | | | | | | |

Total Short-Term Securities (Cost — $11,574) | | | | | | | | | | | 11,512 | |

| | |

Total Investments — 131.2% (Cost — $100,123)R | | | | | | | | | | | 98,690 | |

Other Assets Less Liabilities — (31.2)% | | | | | | | | | | | (23,485 | ) |

| | | | | | | | | | | | |

Net Assets — 100.0% | | | | | | | | | | $ | 75,205 | |

| | | | | | | | | | | | |

23

Semi-Annual Report to Shareholders

Portfolio of Investments—Continued

Core Bond Fund—Continued

| | | | | | | | |

| | | Expiration | | Actual

Contracts | | Appreciation/

(Depreciation) | |

| | |

Futures Contracts PurchasedP | | | | | | | | |

Eurodollar Futures | | September 2007 | | 8 | | $ | (3 | ) |

Eurodollar Futures | | December 2007 | | 37 | | | (11 | ) |

Eurodollar Futures | | March 2008 | | 34 | | | (2 | ) |

U.S. Treasury Bond Futures | | September 2007 | | 15 | | | 15 | |

U.S. Treasury Note Futures | | September 2007 | | 117 | | | (51 | ) |

| | | | | | | | |

| | | | | | $ | (52 | ) |

| | | | | | | | |

| | | |

Futures Contracts WrittenP | | | | | | | | |

U.S. Treasury Note Futures | | September 2007 | | 98 | | | (5 | ) |

U.S. Treasury Note Futures | | December 2007 | | 1 | | | (1 | ) |

| | | | | | | | |

| | | | | | $ | (6 | ) |

| | | | | | | | |

| | | |

Options WrittenP | | | | | | | | |

Eurodollar Futures Call, Strike Price $95.00 | | September 2007 | | 3 | | | — | F |

Eurodollar Futures Call, Strike Price $95.00 | | March 2008 | | 11 | | | (1 | ) |

Eurodollar Futures Call, Strike Price $95.25 | | September 2007 | | 21 | | | 5 | |

Eurodollar Futures Call, Strike Price $95.50 | | December 2007 | | 8 | | | 1 | |

Eurodollar Futures Put, Strike Price $94.75 | | September 2007 | | 15 | | | (2 | ) |

U.S. Treasury Bond Futures Call, Strike Price $108.00 | | July 2007 | | 5 | | | (2 | ) |

U.S. Treasury Bond Futures Call, Strike Price $109.00 | | August 2007 | | 37 | | | (9 | ) |

U.S. Treasury Bond Futures Call, Strike Price $110.00 | | August 2007 | | 2 | | | — | F |

U.S. Treasury Bond Futures Call, Strike Price $108.00 | | November 2007 | | 5 | | | (1 | ) |

U.S. Treasury Bond Futures Call, Strike Price $112.00 | | August 2007 | | 5 | | | 1 | |

U.S. Treasury Bond Futures Call, Strike Price $114.00 | | August 2007 | | 1 | | | — | F |

24

Semi-Annual Report to Shareholders

| | | | | | | | |

| | | Expiration | | Actual

Contracts | | Appreciation/

(Depreciation) | |

| | |

Options Written—Continued | | | | | | | | |

U.S. Treasury Bond Futures Call, Strike Price $115.00 | | August 2007 | | 2 | | $ | 1 | |

U.S. Treasury Bond Futures Put, Strike Price $104.00 | | August 2007 | | 5 | | | 1 | |

U.S. Treasury Bond Futures Put, Strike Price $105.00 | | August 2007 | | 20 | | | 6 | |

U.S. Treasury Note Futures Call, Strike Price $104.00 | | August 2007 | | 3 | | | — | F |

U.S. Treasury Note Futures Call, Strike Price $105.00 | | August 2007 | | 2 | | | — | F |

U.S. Treasury Note Futures Call, Strike Price $106.00 | | July 2007 | | 12 | | | (1 | ) |

U.S. Treasury Note Futures Call, Strike Price $106.00 | | August 2007 | | 34 | | | (8 | ) |

U.S. Treasury Note Futures Call, Strike Price $106.00 | | November 2007 | | 6 | | | (2 | ) |

U.S. Treasury Note Futures Call, Strike Price $107.00 | | August 2007 | | 8 | | | — | F |

U.S. Treasury Note Futures Call, Strike Price $107.00 | | November 2007 | | 28 | | | (6 | ) |

U.S. Treasury Note Futures Call, Strike Price $108.00 | | August 2007 | | 4 | | | — | F |

U.S. Treasury Note Futures Call, Strike Price $108.00 | | November 2007 | | 18 | | | — | F |

U.S. Treasury Bond Futures Call, Strike Price $108.00 | | August 2007 | | 3 | | | (1 | ) |

U.S. Treasury Note Futures Call, Strike Price $109.00 | | August 2007 | | 17 | | | 9 | |

U.S. Treasury Note Futures Call, Strike Price $110.00 | | August 2007 | | 16 | | | 5 | |

U.S. Treasury Note Futures Put, Strike Price $102.00 | | August 2007 | | 3 | | | — | F |

U.S. Treasury Note Futures Put, Strike Price $102.00 | | November 2007 | | 5 | | | 1 | |

25

Semi-Annual Report to Shareholders

Portfolio of Investments—Continued

Core Bond Fund—Continued

| | | | | | | | |

| | | Expiration | | Actual

Contracts | | Appreciation/

(Depreciation) | |

| | |

Options Written—Continued | | | | | | | | |

U.S. Treasury Note Futures Put, Strike Price $103.00 | | August 2007 | | 6 | | $ | 3 | |

U.S. Treasury Note Futures Put, Strike Price $103.00 | | November 2007 | | 3 | | | — | F |

U.S. Treasury Note Futures Put, Strike Price $104.00 | | July 2007 | | 8 | | | 2 | |

U.S. Treasury Note Futures Put, Strike Price $104.00 | | August 2007 | | 14 | | | 4 | |

U.S. Treasury Notes Futures Put, Strike Price $104.00 | | November 2007 | | 2 | | | — | F |

| | | | | | | | |

| | | | | | $ | 6 | |

| | | | | | | | |

N.M. — Not Meaningful.

A | Indexed Security—The rates of interest earned on these securities are tied to the London Interbank Offered Rate (“LIBOR”), the Consumer Price Index (“CPI”), or the one-year Treasury Bill Rate. The coupon rates are the rates as of June 30, 2007. |

B | Rule 144a Security—A security purchased pursuant to Rule 144a under the Securities Act of 1933 which may not be resold subject to that rule except to qualified institutional buyers. These securities, which the Fund’s investment adviser has determined to be liquid, represent 8.33% of net assets. |

C | Stepped Coupon Security—A security with a predetermined schedule of interest or dividend rate changes at which time it begins to accrue interest or pay dividends according to the predetermined schedule. |

D | The coupon rates shown on variable rate securities are the rates at June 30, 2007. These rates vary with the weighted average coupon of the underlying loans. |

E | Amount represents less than 0.50 Par/Shares. |

F | Amount represents less than $1. |

G | Stripped Security—Security with interest-only or principal-only payment streams, denoted by a 1 or 2, respectively. For interest-only securities, the amount shown as principal is the notional balance used to calculate the amount of interest due. |

I | Illiquid security valued at fair value under the procedures approved by the Board of Directors. |

J | Treasury Inflation-Protected Security—Treasury security whose principal value is adjusted daily in accordance with changes to the Consumer Price Index for All Urban Consumers. Interest is calculated on the basis of the current adjusted principal value. |

K | When-issued Security—Security purchased on a delayed delivery basis. Final settlement amount and maturity date have not yet been announced. |

L | Yankee Bond—A dollar-denominated bond issued in the U.S. by foreign entities. |

M | Convertible Security—Security may be converted into the issuer’s common stock. |

N | Zero coupon bond—A bond with no periodic interest payments which is sold at such a discount as to produce a current yield to maturity. |

26

Semi-Annual Report to Shareholders

O | All or a portion of this security is collateral to cover futures and options contracts written. |

P | Options and futures are described in more detail in the notes to financial statements. |

Q | Par represents actual number of contracts. |

R | Aggregate cost for the federal income tax purposes is substantially the same as book cost. At June 30, 2007, the aggregate gross unrealized appreciation and depreciation of investments for federal income tax purposes was substantially as follows: |

| | | | |

Gross unrealized appreciation | | $ | 223 | |

Gross unrealized depreciation | | $ | (1,656 | ) |

| | | | |

Net unrealized appreciation/(depreciation) | | $ | (1,433 | ) |

| | | | |

See notes to financial statements.

27

Semi-Annual Report to Shareholders

Statement of Assets and Liabilities

Core Bond Fund

June 30, 2007 (Unaudited)

(Amounts in Thousands)

| | | | | | | |

| | | | | | | | |

Assets: | | | | | | | |

Investment securities at market value (cost – $ 88,549) | | | | | $ | 87,178 | |

Short-term securities at value (cost – $ 11,574) | | | | | | 11,512 | |

Cash | | | | | | 2 | |

Receivable for securities sold | | | | | | 10,381 | |

Interest and dividends receivable | | | | | | 622 | |

Receivable for fund shares sold | | | | | | 295 | |

Futures variation margin receivable | | | | | | 12 | |

| | | | | | | |

Total assets | | | | | | 110,002 | |

| | |

Liabilities: | | | | | | | |

Payable for securities purchased | | $ | 34,277 | | | | |

Income distribution payable | | | 134 | | | | |

Payable for fund shares repurchased | | | 125 | | | | |

Options written (Proceeds – $ 125) | | | 119 | | | | |

Accrued expenses | | | 94 | | | | |

Accrued distribution and service fees | | | 31 | | | | |

Accrued management fee | | | 10 | | | | |

Swap contracts at value | | | 7 | | | | |

| | | | | | | |

Total liabilities | | | | | | 34,797 | |

| | | | | | | |

Net Assets | | | | | $ | 75,205 | |

| | | | | | | |

Net assets consist of: | | | | | | | |

Accumulated paid-in-capital | | | | | $ | 77,847 | |

Undistributed net investment income | | | | | | 34 | |

Accumulated net realized loss on investments, options and futures | | | | | | (1,189 | ) |

Net unrealized depreciation on investments, options, futures and swaps | | | | | | (1,487 | ) |

| | | | | | | |

Net Assets | | | | | $ | 75,205 | |

| | | | | | | |

| | |

Net Asset Value Per Share: | | | | | | | |

Primary Class (7,852 shares outstanding) | | | | | $ | 9.58 | |

| | | | | | | |

| | | | | | | | |

See notes to financial statements.

28

Semi-Annual Report to Shareholders

Statement of Operations

Core Bond Fund

For the Six Months Ended June 30, 2007 (Unaudited)

(Amounts in Thousands)

| | | | | | | | |

| | | | | | | | | |

Investment Income: | | | | | | | | |

Interest | | $ | 2,019 | | | | | |

Dividends | | | 7 | | | | | |

| | | | | | | | |

Total income | | | | | | $ | 2,026 | |

| | |

Expenses: | | | | | | | | |

Management fees | | | 166 | | | | | |

Distribution and service fees: | | | | | | | | |

Primary Class | | | 185 | | | | | |

Audit and legal fees | | | 31 | | | | | |

Custodian fees | | | 21 | | | | | |

Directors’ fees and expenses | | | 17 | | | | | |

Registration fees | | | 13 | | | | | |

Reports to shareholders | | | 19 | | | | | |

Transfer agent and shareholder servicing expense: | | | | | | | | |

Primary Class | | | 29 | | | | | |

Other expenses | | | 30 | | | | | |

| | | | | | | | |

| | | 511 | | | | | |

Less: Fees waived | | | (140 | ) | | | | |

Compensating balance credits | | | (2 | )A | | | | |

| | | | | | | | |

Net expenses | | | | | | | 369 | |

| | | | | | | | |

Net Investment Income | | | | | | | 1,657 | |

| | |

Net Realized and Unrealized Gain/(Loss) on Investments: | | | | | | | | |

Net realized gain/(loss) on: | | | | | | | | |

Investments | | | (448 | ) | | | | |

Options | | | 81 | | | | | |

Swaps | | | — | B | | | | |

Futures | | | 88 | | | | | |

| | | | | | | | |

| | | | | | | (279 | ) |

Change in unrealized appreciation/(depreciation) of investments, options, futures and swaps | | | | | | | (1,077 | ) |

| | | | | | | | |

Net Realized and Unrealized Loss on Investments | | | | | | | (1,356 | ) |

Change in Net Assets Resulting From Operations | | | | | | $ | 301 | |

A | See Note 1, Compensating Balance Credits, in the notes to financial statements. |

See notes to financial statements.

29

Semi-Annual Report to Shareholders

Statement of Changes in Net Assets

Core Bond Fund

(Amounts in Thousands)

| | | | | | | | |

| | | For the Six Months Ended June 30, 2007 | | | For The Year Ended December 31, 2006 | |

| | | (Unaudited) | | | | |

Change in Net Assets: | | | | | | | | |

Net investment income | | $ | 1,657 | | | $ | 2,992 | |

Net realized loss | | | (279 | ) | | | (141 | ) |

Change in unrealized appreciation/depreciation | | | (1,077 | ) | | | 402 | |

Change in net assets resulting from operations | | | 301 | | | | 3,253 | |

Distributions to shareholders from: | | | | | | | | |

Net investment income: | | | | | | | | |

Primary Class | | | (1,657 | ) | | | (2,992 | ) |

Change in net assets from fund share transactions: | | | | | | | | |

Primary Class | | | 4,211 | | | | 264 | |

Change in net assets | | | 2,855 | | | | 525 | |

| | |

Net Assets: | | | | | | | | |

Beginning of period | | | 72,350 | | | | 71,825 | |

End of period | | $ | 75,205 | | | $ | 72,350 | |

Undistributed net investment income | | $ | 34 | | | $ | 34 | |

See notes to financial statements.

30

Semi-Annual Report to Shareholders

Financial Highlights

Core Bond Fund

Contained below is per share operating performance data for a share of common stock outstanding, total investment return, ratios to average net assets and other supplemental data. This information has been derived from information provided in the financial statements.

Primary Class:

| | | | | | | | | | | | | | | | |

| | | Six Months Ended June 30, 2007 | | | Years Ended December 31, | |

| | | | 2006 | | | 2005 | | | 2004A | |

| | |

| | | (Unaudited) | | | | | | | | | | |

Net asset value, beginning of period | | $ | 9.75 | | | $ | 9.71 | | | $ | 9.95 | | | $ | 10.00 | |

| | | | | | | | | | | | | | | | |

Investment operations: | | | | | | | | | | | | | | | | |

Net investment income | | | .22 | B | | | .40 | B | | | .32 | | | | .18 | |

Net realized and unrealized gain/(loss) | | | (.17 | ) | | | .04 | | | | (.23 | ) | | | .00 | C |

| | | | | | | | | | | | | | | | |

Total from investment operations | | | .05 | | | | .44 | | | | .09 | | | | .18 | |

| | | | | | | | | | | | | | | | |

Distributions from: | | | | | | | | | | | | | | | | |

Net investment income | | | (.22 | ) | | | (.40 | ) | | | (.33 | ) | | | (.21 | ) |

Net realized gain on investments | | | — | | | | — | | | | (.00 | )C | | | (.02 | ) |

| | | | | | | | | | | | | | | | |

Total distributions | | | (.22 | ) | | | (.40 | ) | | | (.33 | ) | | | (.23 | ) |

| | | | | | | | | | | | | | | | |

Net asset value, end of period | | $ | 9.58 | | | $ | 9.75 | | | $ | 9.71 | | | $ | 9.95 | |

| | | | | | | | | | | | | | | | |

Total return | | | 0.47 | %D | | | 4.71 | % | | | .94 | % | | | 1.90 | %D |

| | | | |

Ratios to Average Net Assets:E | | | | | | | | | | | | | | | | |

Total expenses | | | 1.39 | %F | | | 1.44 | % | | | 1.38 | % | | | 1.56 | %F |

Expenses net of waivers, if any | | | 1.01 | %F | | | 1.02 | % | | | 1.00 | % | | | 1.00 | %F |

Expenses net of all reductions | | | 1.00 | %F | | | 1.00 | % | | | 1.00 | % | | | 1.00 | %F |

Net investment income | | | 4.49 | %F | | | 4.19 | % | | | 3.29 | % | | | 2.50 | %F |

| | | | |

Supplemental Data: | | | | | | | | | | | | | | | | |

Portfolio turnover rate | | | 201.5 | %D | | | 428.1 | % | | | 435.7 | % | | | 233.8 | %D |

Net assets, end of period (in thousands) | | $ | 75,205 | | | $ | 72,350 | | | $ | 71,825 | | | $ | 63,773 | |

| | | | | | | | | | | | | | | | | |

A | For the period February 27, 2004 (commencement of operations) to December 31, 2004. |

B | Computed using average daily shares outstanding. |

C | Amount represents less than $.01 per share. |

E | Total expenses reflects operating expenses prior to any voluntary expense waivers and/or compensating balance credits. Expenses net of waivers reflects total expenses before compensating balance credits but net of any voluntary expense waivers. Expenses net of all reductions reflects expenses less any compensating balance credits and/or voluntary expense waivers. |

See notes to financial statements.

31

Semi-Annual Report to Shareholders

Expense Example

Investment Grade Income Portfolio

As a shareholder of the Fund, you incur ongoing costs, including management fees, distribution and service (12b-1) fees on Primary Class shares; and other Fund expenses. These examples are intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds. Each example is based on an investment of $1,000 invested on January 1, 2007, and held through June 30, 2007.

Actual Expenses

The first line for each class in the table below provides information about actual account values and actual expenses for each class. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During the Period” to estimate the expenses you paid on your account if your shares were held through the entire period.

Hypothetical Example for Comparison Purposes

The second line for each class in the table below provides information about hypothetical account values and hypothetical expenses based on the relevant class’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the class’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare these 5% hypothetical examples with the 5% hypothetical examples for the relevant class that appear in the shareholder reports of other funds.

| | | | | | | | | |

| | | Beginning Account Value

1/1/07 | | Ending Account Value

6/30/07 | | Expenses PaidA During the Period 1/1/07 to 6/30/07 |

Primary Class: | | | | | | | | | |

Actual | | $ | 1,000.00 | | $ | 1,009.00 | | $ | 4.98 |

Hypothetical (5% return before expenses) | | | 1,000.00 | | | 1,019.84 | | | 5.01 |

Institutional Class: | | | | | | | | | |

Actual | | $ | 1,000.00 | | $ | 1,011.50 | | $ | 2.49 |

Hypothetical (5% return before expenses) | | | 1,000.00 | | | 1,022.32 | | | 2.51 |

A | These calculations are based on expenses incurred in the most recent fiscal half-year. The dollar amounts shown as “Expenses Paid” are equal to the annualized expense ratios of 1.00% and 0.50% for the Primary Class and Institutional Class, respectively, multiplied by the average values over the period, multiplied by the number of days in the most recent fiscal half-year (181), and divided by 365. |

32

Semi-Annual Report to Shareholders

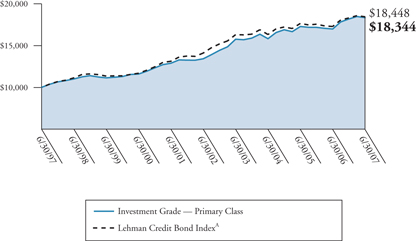

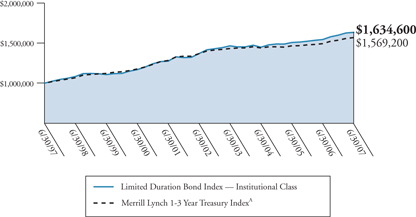

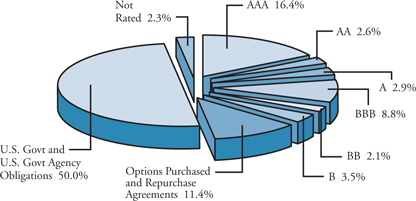

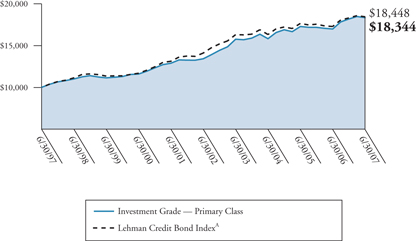

Performance Information

Investment Grade Income Portfolio

The graphs on the following pages compare the Fund’s total returns to that of a closely matched broad-based securities market index. The graphs illustrate the cumulative total return of an initial $10,000 investment in Primary Class shares and an initial $1,000,000 investment in Institutional Class shares of the Fund, for the periods indicated. The lines for the Fund represent the total return after deducting all Fund investment management and other administrative expenses and the transaction costs of buying and selling securities. The line representing the securities market index does not include any transaction costs associated with buying and selling securities in the index or other administrative expenses. Both the Fund’s and the index’s results assume reinvestment of all dividends and distributions.

Total return measures investment performance in terms of appreciation or depreciation in a fund’s net asset value per share, plus dividends and any capital gain distributions. It assumes that dividends and distributions were reinvested at the time they were paid. Average annual returns tend to smooth out variations in a fund’s return, so that they differ from actual year-to-year results.

33

Semi-Annual Report to Shareholders

Performance Information—Continued

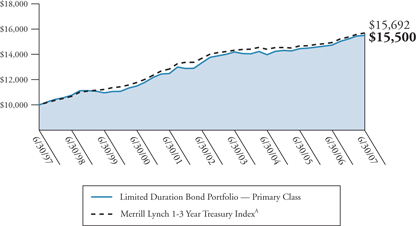

Growth of a $10,000 Investment—Primary Class

Periods Ended June 30, 2007

| | | | | | |

| | | Cumulative Total

Return | | | Average

Annual Total

Return | |

One Year | | +8.01 | % | | +8.01 | % |

Five Years | | +36.65 | % | | +6.44 | % |

Ten Years | | +83.44 | % | | +6.26 | % |

The performance data quoted represents past performance and does not guarantee future results. The performance stated may have been due to extraordinary market conditions, which may not be duplicated in the future. Current performance may be lower or higher than the performance data quoted. To obtain the most recent month-end performance information please visit www.leggmasonfunds.com. The investment return and principal value of the Fund will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. Calculations assume reinvestment of dividends and capital gain distributions. Performance would have been lower if fees had not been waived in various periods.

The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

A | This index consists of publicly issued U.S. corporate and specified foreign debentures and secured notes that meet the specified maturity, liquidity, and quality requirements. To qualify, bonds must be SEC-registered. The index includes both corporate (industrial, utility and finance) and non-corporate (sovereign, supranational, foreign agency, and foreign local government) sectors. |

34

Semi-Annual Report to Shareholders

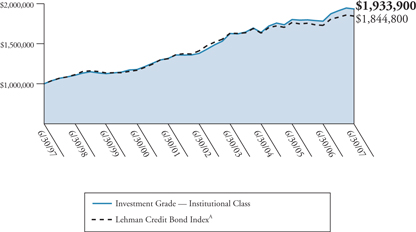

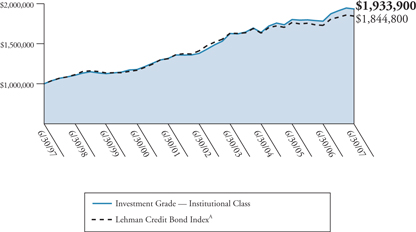

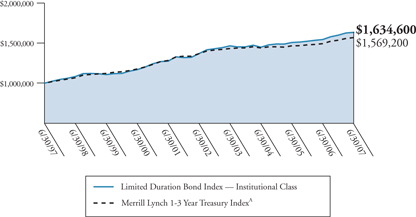

Growth of a $1,000,000 Investment—Institutional Class

Periods Ended June 30, 2007

| | | | | | |

| | | Cumulative Total

Return | | | Average

Annual Total

Return | |

One Year | | +8.55 | % | | +8.55 | % |

Five Years | | +40.26 | % | | +7.00 | % |

Ten Years | | +93.39 | % | | +6.82 | % |

The performance data quoted represents past performance and does not guarantee future results. The performance stated may have been due to extraordinary market conditions, which may not be duplicated in the future. Current performance may be lower or higher than the performance data quoted. To obtain the most recent month-end performance information please call 1-888-425-6432. The investment return and principal value of the Fund will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. Calculations assume reinvestment of dividends and capital gain distributions. Performance would have been lower if fees had not been waived in various periods.

The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

35

Semi-Annual Report to Shareholders

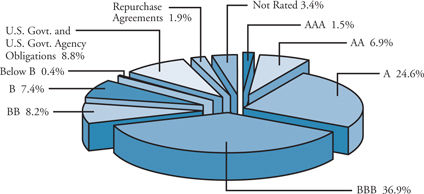

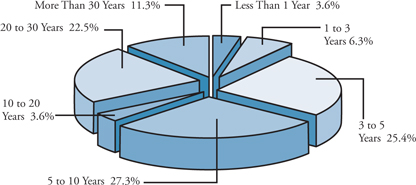

Performance Information—Continued

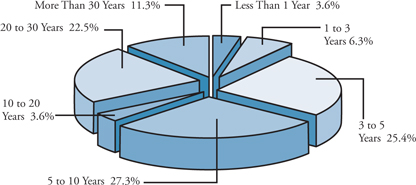

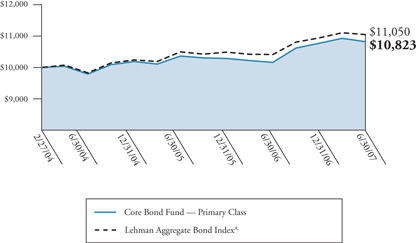

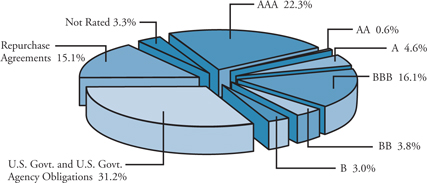

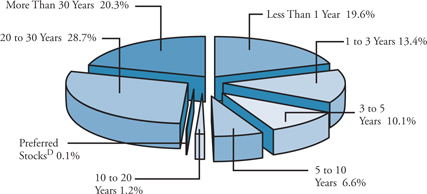

Portfolio Composition (as of June 30, 2007)B

Standard & Poor’s Debt RatingsC (as a percentage of the portfolio)

Maturity Schedule (as a percentage of the portfolio)

B | The Fund is actively managed. As a result, the composition of its portfolio holdings and sectors is subject to change at any time |

C | Standard & Poor’s Ratings Services provide capital markets with credit ratings for the evaluation and assessment of credit risk. |

36

Semi-Annual Report to Shareholders

Portfolio of Investments

Investment Grade Income Portfolio

June 30, 2007 (Unaudited)

(Amounts in Thousands)

| | | | | | | | | | | | |

| | | Rate | | | Maturity Date | | Par | | Value | |

Long-Term Securities — 97.6% | | | | | | | | | | | | |

Corporate Bonds and Notes — 66.1% | | | | | | | | | | | | |

Aerospace and Defense — 0.2% | | | | | | | | | | | | |

L-3 Communications Corp. | | 7.625 | % | | 6/15/12 | | $ | 1,000 | | $ | 1,024 | |

| | | | | | | | | | | | |

| | | | |

Airlines — 0.2% | | | | | | | | | | | | |

Continental Airlines Inc. | | 7.256 | % | | 3/15/20 | | | 482 | | | 501 | |

Continental Airlines Inc. | | 6.545 | % | | 8/2/20 | | | 156 | | | 159 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 660 | |

| | | | | | | | | | | | |

| | | | |

Automobiles — 1.7% | | | | | | | | | | | | |

DaimlerChrysler NA Holding Corp. | | 4.050 | % | | 6/4/08 | | | 160 | | | 158 | |

DaimlerChrysler NA Holding Corp. | | 7.200 | % | | 9/1/09 | | | 260 | | | 268 | |

DaimlerChrysler NA Holding Corp. | | 5.875 | % | | 3/15/11 | | | 300 | | | 301 | |

DaimlerChrysler NA Holding Corp. | | 7.300 | % | | 1/15/12 | | | 735 | | | 780 | |

DaimlerChrysler NA Holding Corp. | | 6.500 | % | | 11/15/13 | | | 290 | | | 299 | |

DaimlerChrysler NA Holding Corp. | | 8.500 | % | | 1/18/31 | | | 850 | | | 1,074 | |

Ford Motor Co. | | 7.450 | % | | 7/16/31 | | | 1,975 | | | 1,578 | |

Ford Motor Co. | | 8.900 | % | | 1/15/32 | | | 370 | | | 322 | |

General Motors Corp. | | 8.250 | % | | 7/15/23 | | | 650 | | | 592 | |

General Motors Corp. | | 8.375 | % | | 7/15/33 | | | 1,990 | | | 1,816 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 7,188 | |

| | | | | | | | | | | | |

| | | | |

Beverages — 0.2% | | | | | | | | | | | | |

Foster’s Finance Corp. | | 4.875 | % | | 10/1/14 | | | 840 | | | 781 | A |

| | | | | | | | | | | | |

| | | | |

Building Products — N.M. | | | | | | | | | | | | |

American Standard Inc. | | 8.250 | % | | 6/1/09 | | | 37 | | | 39 | |

American Standard Inc. | | 7.625 | % | | 2/15/10 | | | 5 | | | 5 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 44 | |

| | | | | | | | | | | | |

37

Semi-Annual Report to Shareholders

Portfolio of Investments—Continued

Investment Grade Income Portfolio—Continued

| | | | | | | | | | | | |

| | | Rate | | | Maturity Date | | Par | | Value | |

Corporate Bonds and Notes—Continued | | | | | | | | | | | | |

Capital Markets — 3.0% | | | | | | | | | | | | |

BankAmerica Capital III | | 5.926 | % | | 1/15/27 | | $ | 585 | | $ | 569 | B |

Lehman Brothers Holdings Inc. | | 5.750 | % | | 1/3/17 | | | 3,980 | | | 3,867 | |

Merrill Lynch and Co. Inc. | | 6.000 | % | | 2/17/09 | | | 800 | | | 807 | |

Merrill Lynch and Co. Inc. | | 5.700 | % | | 5/2/17 | | | 1,940 | | | 1,868 | |

Merrill Lynch and Co. Inc. | | 6.110 | % | | 1/29/37 | | | 910 | | | 854 | |

Morgan Stanley | | 5.050 | % | | 1/21/11 | | | 900 | | | 881 | |

Morgan Stanley | | 4.750 | % | | 4/1/14 | | | 65 | | | 61 | |

The Bear Stearns Cos. Inc. | | 5.500 | % | | 8/15/11 | | | 1,650 | | | 1,634 | |

The Bear Stearns Cos. Inc. | | 5.550 | % | | 1/22/17 | | | 320 | | | 302 | |

The Goldman Sachs Group Inc. | | 6.345 | % | | 2/15/34 | | | 2,025 | | | 1,931 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 12,774 | |

| | | | | | | | | | | | |

| | | | |

Chemicals — 0.6% | | | | | | | | | | | | |

E.I. du Pont de Nemours and Co. | | 4.875 | % | | 4/30/14 | | | 1,100 | | | 1,048 | |

The Dow Chemical Co. | | 6.000 | % | | 10/1/12 | | | 750 | | | 758 | |

The Dow Chemical Co. | | 7.375 | % | | 11/1/29 | | | 800 | | | 866 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 2,672 | |

| | | | | | | | | | | | |

| | | | |

Commercial Banks — 4.4% | | | | | | | | | | | | |

CBA Capital Trust I | | 5.805 | % | | 6/30/49 | | | 3,510 | | | 3,452 | A |

Comerica Capital Trust II | | 6.576 | % | | 2/20/37 | | | 990 | | | 926 | C |

KeyBank NA | | 5.800 | % | | 7/1/14 | | | 5 | | | 5 | |

Rabobank Capital Funding Trust II | | 5.260 | % | | 12/31/49 | | | 320 | | | 307 | A,C |

Rabobank Capital Funding Trust III | | 5.254 | % | | 10/21/49 | | | 3,120 | | | 2,921 | A,C |

RBS Capital Trust III | | 5.512 | % | | 9/30/49 | | | 4,020 | | | 3,864 | C |

SunTrust Bank | | 5.000 | % | | 9/1/15 | | | 770 | | | 727 | |

SunTrust Capital VIII | | 6.100 | % | | 12/15/36 | | | 1,550 | | | 1,419 | C |

UnionBanCal Corp. | | 5.250 | % | | 12/16/13 | | | 785 | | | 764 | |

Wachovia Capital Trust III | | 5.800 | % | | 3/15/42 | | | 520 | | | 518 | C |

Wachovia Corp. | | 5.625 | % | | 10/15/16 | | | 2,300 | | | 2,240 | |

Wachovia Corp. | | 5.750 | % | | 6/15/17 | | | 580 | | | 572 | |

Wells Fargo Capital X | | 5.950 | % | | 12/15/36 | | | 1,260 | | | 1,175 | C |

| | | | | | | | | | | | |

| | | | | | | | | | | 18,890 | |

| | | | | | | | | | | | |

38

Semi-Annual Report to Shareholders

| | | | | | | | | | | | |

| | | Rate | | | Maturity Date | | Par | | Value | |

Corporate Bonds and Notes—Continued | | | | | | | | | | | | |

Commercial Services and Supplies — 0.2% | | | | | | | | | | | | |

Waste Management Inc. | | 6.375 | % | | 11/15/12 | | $ | 310 | | $ | 317 | |

Waste Management Inc. | | 7.375 | % | | 5/15/29 | | | 690 | | | 727 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 1,044 | |

| | | | | | | | | | | | |

| | | | |

Communications Equipment—N.M. | | | | | | | | | | | | |

Motorola Inc. | | 7.625 | % | | 11/15/10 | | | 135 | | | 142 | |

| | | | | | | | | | | | |

| | | | |

Computers and Peripherals — 0.4% | | | | | | | | | | | | |

International Business Machines Corp. | | 4.750 | % | | 11/29/12 | | | 1,750 | | | 1,692 | |

| | | | | | | | | | | | |

| | | | |

Consumer Finance — 5.9% | | | | | | | | | | | | |

American Express Co. | | 6.800 | % | | 9/1/66 | | | 3,100 | | | 3,197 | C |

Capital One Financial Corp. | | 7.125 | % | | 8/1/08 | | | 340 | | | 345 | |

Caterpillar Financial Services Corp. | | 4.500 | % | | 6/15/09 | | | 1,040 | | | 1,024 | |

Ford Motor Credit Co. | | 7.375 | % | | 10/28/09 | | | 2,970 | | | 2,948 | |

Ford Motor Credit Co. | | 7.375 | % | | 2/1/11 | | | 2,390 | | | 2,335 | |

Ford Motor Credit Co. | | 10.610 | % | | 6/15/11 | | | 6,828 | | | 7,376 | B |

Ford Motor Credit Co. | | 7.250 | % | | 10/25/11 | | | 2,410 | | | 2,320 | |

GMAC LLC | | 6.125 | % | | 8/28/07 | | | 2,680 | | | 2,682 | |

GMAC LLC | | 6.311 | % | | 11/30/07 | | | 320 | | | 319 | |

GMAC LLC | | 6.875 | % | | 9/15/11 | | | 750 | | | 738 | |

GMAC LLC | | 0.000 | % | | 6/15/15 | | | 40 | | | 22 | D |

GMAC LLC | | 8.000 | % | | 11/1/31 | | | 590 | | | 603 | |