SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

| | | | |

| ☒ | | | | Preliminary Proxy Statement |

| ☐ | | | | Confidential, for Use of the Commission Only (as permitted by Rule14a-6(e)(2)) |

| ☐ | | | | Definitive Proxy Statement |

| ☐ | | | | Definitive Additional Materials |

| ☐ | | | | Soliciting Material Pursuant toSection 240.14a-12 |

PIMCO FUNDS

(Name of Registrant as Specified In Its Charter)

|

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

Payment of Filing Fee (Check the appropriate box):

| | | | | | | | |

| ☒ | | | | No fee required. |

| ☐ | | | | Fee computed on table below per Exchange Act Rules14a-6(i)(1) and0-11. |

| | | | (1) | | | | Title of each class of securities to which transaction applies: |

| | | | (2) | | | | Aggregate number of securities to which transaction applies: |

| | | | (3) | | | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | | | (4) | | | | Proposed maximum aggregate value of transaction: |

| | | | (5) | | | | Total fee paid: |

| ☐ | | | | Fee paid previously with preliminary materials. |

| ☐ | | | | Check box if any part of the fee is offset as provided by Exchange Act Rule0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | | | (1) | | | | Amount Previously Paid |

| | | | (2) | | | | Form, Schedule or Registration Statement No.: |

| | | | (3) | | | | Filing Party: |

| | | | (4) | | | | Date Filed: |

PIMCO FUNDS

650 Newport Center Drive

Newport Beach, California 92660

[ ], 2018

Dear Shareholder:

On behalf of the Board of Trustees of PIMCO Funds (the “Trust”), I am pleased to invite you to a special meeting of shareholders (the “Meeting”) of the Private Account Portfolio Series: PIMCO Asset-Backed Securities Portfolio and the Private Account Portfolio Series: PIMCO Short-Term Portfolio, each a series of the Trust (each, a “Portfolio” and collectively, the “Portfolios”), to be held at 650 Newport Center Drive, [ ] Floor, Newport Beach, California 92660 on July 20, 2018 at [ ] A.M., Pacific time.

At the Meeting, shareholders of the Portfolios will be asked to vote on modifications to the Portfolios’ fundamental industry concentration policy.

Your vote is important. The proposal has been carefully reviewed by the Board of Trustees. They unanimously recommend that you votefor the proposal. On behalf of the Board of Trustees, I ask you to review the proposal and vote. For more information about the proposal requiring your vote, please refer to the accompanying proxy statement.

No matter how many shares you own, your timely vote is important. If you are not able to attend the Meeting, then please complete, sign, date and mail the enclosed proxy card(s) promptly in order to avoid the expense of additional mailings. If you have any questions regarding the proxy statement, please call (866) 416-0577.

Thank you in advance for your participation in this important event.

|

| Sincerely, |

|

|

Brent R. Harris Chairman of the Board |

PIMCO FUNDS

650 Newport Center Drive

Newport Beach, California 92660

NOTICE OF SPECIAL MEETING OF SHAREHOLDERS

To be held July 20, 2018

Dear Shareholder:

Notice is hereby given that a special meeting of shareholders of the Private Account Portfolio Series: PIMCO Asset-Backed Securities Portfolio and the Private Account Portfolio Series: PIMCO Short-Term Portfolio, each a series of the Trust (each a “Portfolio” and collectively, the “Portfolios”), will be held in the offices of Pacific Investment Management Company LLC, each Portfolio’s investment adviser and administrator, 650 Newport Center Drive, [ ] Floor, Newport Beach, California 92660 on July 20, 2018 at [ ] A.M., Pacific time, or as adjourned from time to time (the “Meeting”).

The purpose of the Meeting is to consider and act upon the following proposal for the Trust, and to transact such other business as may properly come before the Meeting or any adjournments thereof.

| | 1. | To modify the Portfolios’ fundamental industry concentration policy. |

The Board of Trustees has fixed the close of business on June 11, 2018 as the record date for determining shareholders entitled to notice of and to vote at the Meeting.

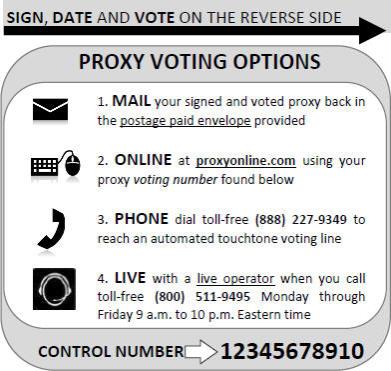

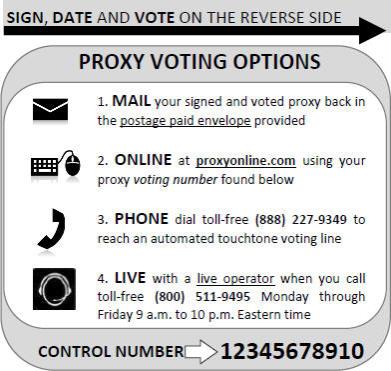

Shareholders may attend the Meeting in person. Any shareholder who does not expect to attend the Meeting is requested to complete, date and sign the enclosed proxy card, and return it in the envelope provided. You also have the opportunity to provide voting instructions via telephone or the Internet. In order to avoid unnecessary expense, we ask your cooperation in responding promptly, no matter how large or small your holdings may be. If you wish to wait until the meeting to vote your shares, you will need to request a paper ballot at the meeting in order to do so.

If you have any questions regarding the enclosed proxy material or need assistance in voting your shares, please contact AST Fund Solutions, LLC at(866) 416-0577 [Monday through Friday from 8 a.m. to 10 p.m. ET and Saturday 11 a.m. to 5 p.m. ET.]

Important Notice Regarding the Availability of Proxy Materials for the Special Meeting of Shareholders to Be Held on July 20, 2018.This Notice of

Special Meeting of Shareholders, the Proxy Statement and the form of proxy cards are available on the Internet at [ ]. On this website, you will be able to access the Notice of Special Meeting of Shareholders, the Proxy Statement, the form of proxy cards and any amendments or supplements to the foregoing material that are required to be furnished to shareholders.

|

| By Order of the Board of Trustees |

|

Joshua D. Ratner, Secretary [ ], 2018 |

PORTFOLIOS PARTICIPATING IN THE MEETING

ON JULY 20, 2018

PIMCO Asset-Backed Securities Portfolio

PIMCO Short-Term Portfolio

PIMCO FUNDS

PIMCO Asset-Backed Securities Portfolio

PIMCO Short-Term Portfolio

650 Newport Center Drive

Newport Beach, California 92660

For proxy information call:

(866) 416-0577

For account information call:

(888)877-4626

If a broker or other nominee holds your shares, you may contact the broker or nominee directly.

PROXY STATEMENT

Special Meeting of Shareholders

To be Held on July 20, 2018

This proxy statement is being furnished in connection with the solicitation of proxies on behalf of the Board of Trustees (the “Board of Trustees” or the “Board”) of PIMCO Funds (the “Trust”), a Massachusetts business trust andopen-end management investment company registered under the Investment Company Act of 1940, as amended (the “1940 Act”) for use at a special meeting of shareholders of the Private Account Portfolio Series: PIMCO Asset-Backed Securities Portfolio and the Private Account Portfolio Series: PIMCO Short-Term Portfolio, each a series of the Trust (each, a “Portfolio” and collectively, the “Portfolios”) (the “Meeting”). The Meeting is scheduled to be held at the offices of Pacific Investment Management Company LLC (“PIMCO”), each Portfolio’s investment adviser and administrator, 650 Newport Center Drive, [ ] Floor, Newport Beach, California 92660 on July 20, 2018 at [ ] A.M., Pacific time, or as adjourned from time to time. This Proxy Statement, Notice of Meeting and proxy card are first being mailed to shareholders on or about June 15, 2018.

The purpose of the Meeting is to consider and act upon a proposal to modify the Portfolios’ fundamental concentration policy (the “Proposal”) and to transact such other business as may properly come before the Meeting or any adjournments thereof.

1

The record date for determining shareholders entitled to notice of, and to vote at, the Meeting and at any adjournment or postponement thereof has been fixed at the close of business on June 11, 2018 (the “Record Date”), and each shareholder of record at that time is entitled to cast one vote for each share registered in his or her name. The total number of shares outstanding as of [ ], 2018 for each Portfolio is set forth in the table below.

| | | | |

PORTFOLIO NAME | | TOTAL SHARES

OUTSTANDING FOR THE

PORTFOLIO | |

PIMCO Asset-Backed Securities Portfolio | | | [ | ] |

PIMCO Short-Term Portfolio | | | [ | ] |

Persons who, to the knowledge of the Trust, beneficially own more than five percent of a Portfolio’s outstanding shares as of [ ], 2018 are listed inExhibit A.

Certain funds and accounts for which PIMCO serves as investment adviser (collectively, the “PIMCO Funds of Funds and Separate Accounts”) invest a significant portion of their assets in other funds advised by PIMCO, including the Portfolios. [As of [ ], 2018, the PIMCO Funds of Funds and Separate Accounts together owned 25% or more of the outstanding shares of beneficial interest of each Portfolio, and therefore may be presumed to “control” the Portfolios, as that term is defined in the 1940 Act. Please seeExhibit A for more information regarding the PIMCO Funds of Funds and Separate Accounts ownership of Portfolio shares. PIMCO, with respect to the PIMCO Funds of Funds and Separate Accounts for which PIMCO has discretionary power to vote, will vote any shares of a Portfolio held by the PIMCO Funds of Funds and Separate Accounts in proportion to the votes of all other shareholders in the applicable Portfolio, or will vote in accordance with the recommendation of a designated third-party service provider, Institutional Shareholder Services Inc. (ISS).]

The principal business address of PIMCO, each Portfolio’s investment adviser and administrator, is 650 Newport Center Drive, Newport Beach, California 92660. The principal business address of PIMCO Investments LLC (“PIMCO Investments”), each Portfolio’s principal underwriter and distributor, is 1633 Broadway, New York, New York 10019.

All properly executed proxies received prior to the Meeting will be voted at the Meeting in accordance with the instructions marked on the proxy card. Unless instructions to the contrary are marked on the proxy card, proxies submitted by holders of each Portfolio’s shares (“Shares”) will be voted “FOR” the Proposal. The persons named as proxy holders on the proxy card will vote in their discretion on any other matters that may properly come before the Meeting

2

or any adjournments or postponements thereof. Any shareholder executing a proxy has the power to revoke it prior to its exercise by submission of a properly executed, subsequently dated proxy, by voting in person, or by written notice to the Secretary of the Trust (addressed to the Secretary at the principal executive office of the Trust, 650 Newport Center Drive, Newport Beach, California 92660). However, attendance at the Meeting, by itself, will not revoke a previously submitted proxy. Unless the proxy is revoked, the Shares represented thereby will be voted in accordance with specifications therein.

Only shareholders or their duly appointed proxy holders can attend the Meeting and any adjournment or postponement thereof. To gain admittance, if you are a shareholder of record, you must bring a form of personal identification to the Meeting, where your name will be verified against the Trust’s shareholder list. If a broker or other nominee holds your Shares and you plan to attend the Meeting, you should bring a recent brokerage statement showing your ownership of the Shares as of the record date, as well as a form of personal identification.

Shareholders can find important information about the Portfolios in the annual and semi-annual reports to shareholders, dated March 31, 2018 and September 30, 2017, respectively, each of which previously has been furnished to shareholders. Shareholders may request another copy of these reports by writing to the Trust at the above address, or by calling the appropriate telephone number above.

PROPOSAL

MODIFICATION OF THE PORTFOLIOS’ FUNDAMENTAL INDUSTRY CONCENTRATION POLICY

The purpose of this proposal is to modify the Portfolios’ fundamental industry concentration policy to normally require the Portfolios to concentrate their investments in mortgage-related assets, as set forth below. The 1940 Act requires an investment company (a “fund”) to recite in its registration statement, among other things, its policy in respect of concentrating investments in a particular industry or group of industries, including whether it reserves the freedom to concentrate investments in a particular industry or group of industries. If a fund reserves this freedom, it must include a statement that indicates the extent to which it intends to concentrate its investments. The Securities and Exchange Commission (the “SEC”) has taken the position that a fund that invests more than 25% of its assets in a particular industry is concentrating its investments. The 1940 Act further requires a fund to obtain shareholder approval to change its concentration policy.

The Portfolios, like most other series of the Trust, have adopted a policy tonotconcentrate their investments in any particular industry (the “Concentration

3

Policy”). The Trust has historically taken the position, as disclosed in its registration statement, that privately issued mortgage-related securities (“Private MBS”) do not represent interests in any particular industry for purposes of the Portfolios’ Concentration Policy, which means the Portfolios are free to invest in Private MBS without limit, consistent with the Portfolios’ other investment guidelines and policies. Each Portfolio holds, as of the date of this proxy statement, more than 25% of its total assets in Private MBS including privately-issued residential mortgage-related securities (“Private RMBS”) and privately issued commercial mortgage-related securities (“Private CMBS”). Any mortgage-related securities issued or guaranteed by the U.S. government or its agencies or instrumentalities (“Government MBS”) are typically excluded from any industry in reliance on long-standing SEC guidance permitting the exclusion of any securities issued by U.S. or state governments or political subdivisions of such governments from any industry. However, notwithstanding that guidance, the Staff has more recently providedno-action assurances to permit funds to count both Private MBS and Government MBS for a policy to concentrate in mortgage-related securities, which provides such funds greater flexibility in maintaining the 25% minimum required by a policy to concentrate in an industry or group of related industries.

PIMCO has recently determined that it is in the best interests of the series of the Trust, including the Portfolios, to treat each of Private RMBS and Private CMBS as a separate industry for purposes of a fund’s policy to not concentrate in any particular industry. This change in industry classification affects how Private RMBS and Private CMBS are counted for purposes of the Portfolios’ Concentration Policy, and, absent modifications to the Portfolios’ Concentration Policy, the Portfolios may be forced to reduce their investments in such securities. However, with respect to the Portfolios, PIMCO believes that it is in the Portfolios’ and shareholders’ best interests to provide the Portfolios with the continued flexibility to invest more than 25% of each Portfolio’s assets in Private RMBS and/or Private CMBS from time to time.

Accordingly, PIMCO has determined that it is in the Portfolios’ shareholders’ best interests to modify the Portfolios’ Concentration Policy to normally require the Portfolios to invest more than 25% of a Portfolio’s assets in mortgage-related assets, inclusive of Private MBS and Government MBS. The Board of Trustees, including the Independent Trustees, has approved, and recommends that shareholders approve, proposed changes to the Concentration Policy to permit the Portfolios’ to concentrate in mortgage-related assets. PIMCO believes that amending the Portfolios’ Concentration Policy to concentrate in mortgage-related assets would provide the Portfolios with continued flexibility to invest in such assets without limitation, notwithstanding the Trust’s change in industry classifications described above. PIMCO believes

4

that the proposed changes to the Concentration Policy are consistent with shareholder expectations that each Portfolio be an efficient means to gain exposure to the mortgage credit markets.

The table below sets forth the proposed changes to the Concentration Policy (new language is bold underlined).

| | |

Current Concentration Policy | | Proposed Concentration Policy |

| |

| A Portfolio may not concentrate its investments in a particular industry, as that term is used in the 1940 Act, as amended, and as interpreted, modified, or otherwise permitted by regulatory authority having jurisdiction, from time to time. | | A Portfolio(except the PIMCO Asset-Backed Securities Portfolio and PIMCO Short-Term Portfolio) may not concentrate its investments in a particular industry, as that term is used in the 1940 Act, as amended, and as interpreted, modified, or otherwise permitted by regulatory authority having jurisdiction, from time to time.Each of the PIMCO Asset-Backed Securities Portfolio and PIMCO Short-Term Portfolio will normally concentrate its investments in mortgage-related assets issued or guaranteed by government agencies or other governmental entities or by private originators or issuers, which for purposes of this investment restriction, each of the PIMCO Asset-Backed Securities Portfolio and PIMCO Short-Term Portfolio treats collectively as an industry or group of related industries. |

Required Vote

Approval of the Proposal requires the affirmative vote of a majority of the applicable Portfolio’s outstanding voting securities. Under the 1940 Act, the vote of a “majority of the outstanding voting securities” means the affirmative vote of the lesser of (a) 67% or more of the voting securities present at the Meeting or represented by proxy if the holders of more than 50% of the outstanding voting securities are present or represented by proxy or (b) more than 50% of the outstanding voting securities. With respect to the Proposal, votes to ABSTAIN and brokernon-votes will have the same effect as votes cast AGAINST the Proposal.

5

The Board of Trustees, including the Independent Trustees, recommends that shareholders vote FOR the Proposal. Unmarked proxies will be so voted.

ADDITIONAL INFORMATION

Expenses and Methods of Proxy Solicitation

The expense of preparation, printing and mailing of the enclosed proxy card and accompanying Notice of Meeting and Proxy Statement will be borne by PIMCO under the terms of the Trust’s Supervision and Administration Agreement, including the costs of retaining AST Fund Solutions, LLC, which are estimated to be approximately $16,000. PIMCO will reimburse banks, brokers and others for their reasonable expenses in forwarding proxy solicitation material to the beneficial owners of Shares.

Shareholders may sign and mail the proxy card received with the proxy statement or attend the Meeting in person. Any proxy given by a shareholder is revocable. A shareholder may revoke the accompanying proxy at any time prior to its use by submitting a properly executed, subsequently dated proxy, giving written notice to the Secretary of the Trust at 650 Newport Center Drive, Newport Beach, California 92660, or by attending the Meeting and voting in person. However, attendance in person at the Meeting, by itself, will not revoke a previously tendered proxy.

The solicitation is being made primarily by the mailing of this Proxy Statement and the accompanying proxy on or about June 15, 2018. In order to obtain the necessary quorum at the Meeting, supplementary solicitation may be made by mail, telephone or personal interview. Such solicitation may be conducted by, among others, officers and regular employees of PIMCO.

With respect to votes recorded by telephone or through the internet, the Trust will use procedures designed to authenticate shareholders’ identities, to allow shareholders to authorize the voting of their shares in accordance with their instructions, and to confirm that their instructions have been properly recorded. Proxies voted by telephone or through the internet may be revoked at any time before they are voted in the same manner that proxies voted by mail may be revoked.

Quorum and Voting Requirements

The holders of a majority of outstanding shares of a Portfolio present in person or by proxy shall constitute a quorum with respect to such Portfolio at the

6

Meeting. For purposes of determining the presence of a quorum at the Meeting, abstentions and brokernon-votes will be treated as Shares that are present. Brokernon-votes are proxies from brokers or nominees indicating that such persons have not received instructions from the beneficial owner or other persons entitled to vote Shares on the proposal with respect to which the brokers or nominees do not have discretionary power.

Approval of the Proposal with respect to a Portfolio requires the affirmative vote of a majority of the applicable Portfolio’s outstanding voting securities. Under the 1940 Act, the vote of a “majority of the outstanding voting securities” means the affirmative vote of the lesser of (a) 67% or more of the voting securities present at the Meeting or represented by proxy if the holders of more than 50% of the outstanding voting securities are present or represented by proxy or (b) more than 50% of the outstanding voting securities. With respect to the Proposal, votes to ABSTAIN and brokernon-votes will have the same effect as votes cast AGAINST the Proposal.

Adjournment

If a quorum is not present in person or by proxy at the time the Meeting is called to order, the chairman of the Meeting or the shareholders may adjourn the Meeting. In the event that a quorum is present at the Meeting but sufficient votes to approve any proposal are not received, the chairman of the Meeting may propose one or more adjournments of the Meeting to permit further solicitation of proxies or to obtain the vote required for approval of one or more proposals. Any such adjournment will require the affirmative vote of a majority of those shares represented at the Meeting in person or by proxy. In the event of such a proposed adjournment, the persons named as proxies will vote those proxies which they are entitled to vote FOR the proposal in favor of such an adjournment and will vote those proxies required to be voted AGAINST the proposal against any such adjournment. A shareholder vote may be taken prior to any adjournment of the Meeting on any proposal for which there is sufficient votes for approval, even though the Meeting is adjourned as to other proposals.

Beneficial Ownership

As of [ ], 2018 the persons owning of record or beneficially 5% or more of the Portfolios’ Shares are set forth inExhibit A. As of [ ], 2018, the Trustees and officers of the Trust, as a group, beneficially owned less than 1% of the outstanding shares of each Portfolio.

7

Shareholder Proposals

The Trust does not hold regular shareholders’ meetings. Shareholders wishing to submit proposals for inclusion in a proxy statement for a subsequent shareholders’ meeting should send their written proposals to the Secretary of the Trust at the address set forth on the cover of this proxy statement.

Proposals must be received a reasonable time prior to the date of a meeting of shareholders to be considered for inclusion in the proxy materials for a meeting. Timely submission of a proposal does not, however, necessarily mean that the proposal will be included. Persons named as proxies for any subsequent shareholders’ meeting will vote in their discretion with respect to proposals submitted on an untimely basis.

OTHER MATTERS

The proxy holders have no present intention of bringing before the Meeting for action any matters other than the Proposal referred to above, nor has the management of the Trust any such intention. Neither the proxy holders nor the management of the Trust is aware of any matters which may be presented by others. If any other business properly comes before the Meeting, the proxy holders intend to vote thereon in accordance with their best judgment.

Notice to Banks, Broker-Dealers and Voting Trustees and Their Nominees

Please advise the Trust, in care of PIMCO Investments LLC, 1633 Broadway, New York, NY 10019, whether other persons are beneficial owners of shares for which proxies are being solicited and, if so, the number of copies of the proxy statement you wish to receive in order to supply copies to the beneficial owners of the respective shares.

|

| By Order of the Board of Trustees |

|

Joshua D. Ratner, Secretary |

[ ], 2018

Please complete, date and sign the enclosed proxy and return it promptly in the enclosed reply envelope. NO POSTAGE IS REQUIRED if mailed in the United States.

8

Copies of the PIMCO Funds Annual Report for the fiscal year ended March 31, 2018 and the PIMCO Funds Semi-Annual Report for the period ended September 30, 2017 are available without charge upon request by writing the Trust at 650 Newport Center Drive, Newport Beach, California 92660 or telephoning it at (888)877-4626.

9

EXHIBIT A

As of [ ], 2018, the following persons owned of record or beneficially 5% or more of the shares of the Portfolios:

| | | | | | |

PORTFOLIO NAME | | REGISTRATION | | SHARES

BENEFICIALLY

OWNED | | PERCENTAGE OF

OUTSTANDING

SHARES OF CLASS

OWNED |

PIMCO Asset-Backed Securities Portfolio | | [ ] | | [ ] | | [ ] |

PIMCO Short-Term Portfolio | | [ ] | | [ ] | | [ ] |

| * | Entity owned 25% or more of the outstanding shares of beneficial interest of the Portfolio, and therefore may be presumed to “control” the Portfolio, as that term is defined in the 1940 Act. |

| ** | Shares are believed to be held only as nominee. |

PROXY_PAPS_[ ]

10

| | |

| |  |

| | [Portfolio Name] |

YOUR VOTE IS IMPORTANT NO MATTER HOW MANY SHARES YOU OWN. THE MATTERS WE ARE SUBMITTING FOR YOUR CONSIDERATION ARE SIGNIFICANT TO THE PORTFOLIO AND TO YOU AS A PORTFOLIO SHAREHOLDER. PLEASE TAKE THE TIME TO READ THE PROXY STATEMENT AND CAST YOUR PROXY VOTE TODAY! | |  |

PROXY IN CONNECTION WITH THE SPECIAL MEETING OF SHAREHOLDERS

TO BE HELD ON JULY 20, 2018

The undersigned holder(s) of [Portfolio Name] (the “Portfolio”), a series of PIMCO Funds (the “Trust”), hereby appoint(s) Peter G. Strelow, Eric Johnson and Joshua D. Ratner, or any of them, each with full power of substitution, as the proxy or proxies for the undersigned to: (i) attend the Special Meeting of Shareholders of the Portfolio (the “Special Meeting”) to be held at the offices of Pacific Investment Management Company LLC, 650 Newport Center Drive, [ ] Floor, Newport Beach, California 92660, on July 20, 2018 beginning at [ ] A.M. Pacific Time, and any adjournment(s) or postponement(s) thereof; and (ii) cast on behalf of the undersigned all votes that the undersigned is entitled to cast at the Special Meeting and otherwise to represent the undersigned with all powers possessed by the undersigned as if personally present at such Special Meeting. The undersigned acknowledges receipt of the Notice of the Special Meeting and the accompanying Proxy Statement dated [ ]. The undersigned hereby revokes any prior proxy given with respect to the Special Meeting, and ratifies and confirms all that the proxies, or any one of them, may lawfully do.

THIS PROXY IS SOLICITED ON BEHALF OF THE BOARD OF TRUSTEES OF THE TRUST, WHICH UNANIMOUSLY RECOMMENDS THAT YOU VOTE “FOR” THE PROPOSAL.

IF THIS PROXY IS PROPERLY EXECUTED, THE VOTES ENTITLED TO BE CAST BY THE UNDERSIGNED WILL BE CAST IN THE MANNER DIRECTED ON THE REVERSE SIDE HEREOF, AND WILL BE VOTED IN THE DISCRETION OF THE PROXY HOLDER(S) ON ANY OTHER MATTERS THAT MAY PROPERLY COME BEFORE THE SPECIAL MEETING OR ANY ADJOURNMENT(S) OR POSTPONEMENT(S) THEREOF. IF THIS PROXY IS PROPERLY EXECUTED BUT NO DIRECTION IS

MADE AS REGARDS TO THE PROPOSAL INCLUDED IN THE PROXY STATEMENT, SUCH VOTES ENTITLED TO BE CAST BY THE UNDERSIGNED WILL BE CAST “FOR” SUCH PROPOSAL.

Please refer to the Proxy Statement for a discussion of the Proposal.

PLEASE VOTE, DATE AND SIGN ON THE REVERSE SIDE HEREOF AND RETURN THE SIGNED PROXY PROMPTLY IN THE ENCLOSED ENVELOPE.

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE SPECIAL MEETING OF SHAREHOLDERS TO BE HELD ON JULY 20, 2018. The Proxy Statement is also available at [ ].

| | | | |

| | |

[PROXY ID NUMBER HERE] | | [BAR CODE HERE] | | [CUSIP HERE] |

| | |

| [Portfolio Name] | |  |

| | |

YOUR SIGNATURE IS REQUIRED FOR YOUR VOTE TO BE COUNTED. | | |

Please sign exactly as your name(s) appear(s) on the proxy card. Joint owners should each sign personally. Trustees and other fiduciaries should indicate the capacity in which they sign, and where more than one name appears, a majority must sign. If a corporation, the signature should be that of an authorized officer who should state his or her title.

| | |

SIGNATURE (AND TITLE IF APPLICABLE) | | DATE |

| | |

SIGNATURE (IF HELD JOINTLY) | | DATE |

TO VOTE, MARK ONE CIRCLE IN BLUE OR BLACK INK. Example:🌑

THE BOARD OF TRUSTEES RECOMMENDS A VOTE FOR THE FOLLOWING:

| | | | | | | | |

|

| |

| A. PROPOSAL |

| | FOR | | AGAINST | | ABSTAIN |

1. To modify the Portfolio’s fundamental industry concentration policy | | ○ | | ○ | | ○ |

You can vote on the internet, by telephone or by mail. Please see the reverse side for instructions.

PLEASE VOTE ALL YOUR BALLOTS IF YOU RECEIVED MORE THAN ONE BALLOT DUE TO MULTIPLE INVESTMENTS IN THE TRUST. REMEMBER TO SIGN AND DATE ABOVE BEFORE MAILING IN YOUR VOTE. THIS PROXY CARD IS VALID ONLY WHEN SIGNED AND DATED.

THANK YOU FOR VOTING

| | | | |

| | |

[PROXY ID NUMBER HERE] | | [BAR CODE HERE] | | [CUSIP HERE] |