Exhibit 2.1

AGREEMENT AND PLAN OF MERGER

BY AND BETWEEN

Monument Bancorp, Inc. AND

Citizens & Northern Corporation

September 27, 2018

| | TABLE OF CONTENTS | |

| | | |

| Article I. THE MERGER | 2 |

| 1.1 | Merger | 2 |

| 1.2 | Name | 2 |

| 1.3 | Articles of Incorporation and Bylaws | 2 |

| 1.4 | Directors and Officers | 2 |

| Article II. CONVERSION AND EXCHANGE OF SHARES | 2 |

| 2.1 | Conversion of Shares | 2 |

| 2.2 | Election Procedure | 4 |

| 2.3 | Undisbursed Consideration | 11 |

| 2.4 | Treatment of Outstanding Monument Options | 12 |

| 2.5 | Reservation and Registration of Shares | 13 |

| 2.6 | Withholding Rights | 13 |

| 2.7 | Expenses | 13 |

| 2.8 | Dissenters’ Rights | 13 |

| Article III. REPRESENTATIONS AND WARRANTIES OF Monument | 13 |

| 3.1 | Organization | 13 |

| 3.2 | Authority | 14 |

| 3.3 | Subsidiaries | 14 |

| 3.4 | Capitalization | 15 |

| 3.5 | Consents and Approvals | 16 |

| 3.6 | Charter, Bylaws and Minute Books | 16 |

| 3.7 | Reports | 17 |

| 3.8 | Financial Statements | 17 |

| 3.9 | Absence of Undisclosed Liabilities | 19 |

| 3.10 | Absence of Changes | 19 |

| 3.11 | Dividends, Distributions and Stock Purchases | 19 |

| 3.12 | Taxes | 20 |

| 3.13 | Title to and Condition of Assets | 21 |

| 3.14 | Contracts | 21 |

| 3.15 | Litigation and Governmental Directives | 22 |

| 3.16 | Risk Management Instruments | 22 |

| 3.17 | Environmental Matters | 22 |

| 3.18 | Intellectual Property | 23 |

| 3.19 | Privacy | 23 |

| 3.20 | Compliance with Laws; Governmental Authorizations | 24 |

| 3.21 | Insurance | 24 |

| 3.22 | Financial Institutions Bonds | 24 |

| 3.23 | Labor Relations and Employment Agreements | 25 |

| 3.24 | Employee Benefit Plans | 25 |

| 3.25 | Loan Portfolio | 26 |

| 3.26 | Investment Portfolio | 27 |

| 3.27 | Related Party Transactions | 27 |

| 3.28 | Certain Activities | 27 |

| 3.29 | No Finder | 28 |

| 3.30 | Complete and Accurate Disclosure | 28 |

| 3.31 | Proxy Statement/Prospectus | 28 |

| 3.32 | Beneficial Ownership of C&N Common Stock | 28 |

| 3.33 | Fairness Opinion | 29 |

| 3.34 | State Takeover Laws | 29 |

| 3.35 | Reorganization | 29 |

| Article IV. REPRESENTATIONS AND WARRANTIES OF C&N | 29 |

| 4.1 | Organization | 29 |

| 4.2 | Authority | 29 |

| 4.3 | Subsidiaries | 30 |

| 4.4 | Capitalization | 30 |

| 4.5 | Consents and Approvals | 31 |

| 4.6 | Charter, Bylaws and Minute Books | 31 |

| 4.7 | Reports | 32 |

| 4.8 | Financial Statements | 33 |

| 4.9 | Absence of Undisclosed Liabilities | 34 |

| 4.10 | Absence of Changes | 34 |

| 4.11 | Dividends, Distributions and Stock Purchases | 35 |

| 4.12 | Taxes | 35 |

| 4.13 | Litigation and Governmental Directives | 36 |

| 4.14 | Risk Management Instruments | 36 |

| 4.15 | Privacy | 37 |

| 4.16 | Compliance with Laws; Governmental Authorizations | 37 |

| 4.17 | Insurance | 37 |

| 4.18 | Employee Benefit Plans | 38 |

| 4.19 | Loan Portfolio. | 38 |

| 4.20 | Investment Portfolio. | 39 |

| 4.21 | Certain Activities | 39 |

| 4.22 | No Finder | 39 |

| 4.23 | Complete and Accurate Disclosure | 39 |

| 4.24 | Proxy Statement/Prospectus | 40 |

| 4.25 | Reorganization | 40 |

| Article V. COVENANTS OF Monument | 40 |

| 5.1 | Conduct of Business | 40 |

| 5.2 | Best Efforts | 42 |

| 5.3 | Access to Properties and Records | 43 |

| 5.4 | Subsequent Financial Statements | 43 |

| 5.5 | Update Schedules | 43 |

| 5.6 | Notice | 43 |

| 5.7 | No Solicitation | 44 |

| 5.8 | No Purchases or Sales of C&N Common Stock During Price Determination Period | 47 |

| 5.9 | Dividends | 47 |

| 5.10 | Internal Controls | 47 |

| 5.11 | Transaction Expenses of Monument | 47 |

| Article VI. COVENANTS OF C&N | 47 |

| 6.1 | Best Efforts | 48 |

| 6.2 | Access to Properties and Records | 49 |

| 6.3 | Subsequent Financial Statements | 49 |

| 6.4 | Update Schedules | 49 |

| 6.5 | Notice | 49 |

| 6.6 | No Purchase or Sales of C&N Common Stock During Price Determination Period | 49 |

| 6.7 | Employment Arrangements | 50 |

| 6.8 | Insurance; Indemnification | 51 |

| 6.9 | Appointment of C&N Director | 53 |

| Article VII. CONDITIONS PRECEDENT | 53 |

| 7.1 | Common Conditions | 53 |

| 7.2 | Conditions Precedent to Obligations of C&N | 54 |

| 7.3 | Conditions Precedent to the Obligations of Monument | 55 |

| Article VIII. TERMINATION, AMENDMENT AND WAIVER | 56 |

| 8.1 | Termination | 56 |

| 8.2 | Effect of Termination. | 59 |

| 8.3 | Amendment | 60 |

| 8.4 | Waiver | 60 |

| Article IX. CLOSING AND EFFECTIVE TIME | 60 |

| 9.1 | Closing | 60 |

| 9.2 | Effective Time | 60 |

| Article X. NO SURVIVAL OF REPRESENTATIONS AND WARRANTIES | 61 |

| 10.1 | No Survival | 61 |

| Article XI. GENERAL PROVISIONS | 61 |

| 11.1 | Expenses | 61 |

| 11.2 | Press Releases, Etc. | 61 |

| 11.3 | Notices | 61 |

| 11.4 | Counterparts | 62 |

| 11.5 | Governing Law | 62 |

| 11.6 | Parties in Interest | 62 |

| 11.7 | Disclosure Schedules | 62 |

| 11.8 | Entire Agreement | 62 |

APPENDIX

INDEX OF EXHIBITS

| Exhibit A | Bank Merger Agreement |

| Exhibit B | Form of Voting Agreement |

| Exhibit C | Form of Non-Competition Agreement |

INDEX OF SCHEDULES

Schedule 2.4 – Treatment of Outstanding Monument Options

Schedule 3.3(i) – Monument Subsidiaries

Schedule 3.3(ii) – Monument Bank Subsidiaries

Schedule 3.4(a) – Capitalization

Schedule 3.4(c) – Monument Options Outstanding

Schedule 3.9 – Absence of Undisclosed Liabilities

Schedule 3.10 – Absence of Changes

Schedule 3.11 - Dividends, Distributions and Stock Purchases

Schedule 3.12 - Taxes

Schedule 3.13 - Title to and Condition of Assets

Schedule 3.14 - Contracts

Schedule 3.15 – Litigation and Governmental Directives

Schedule 3.17– Environmental Matters

Schedule 3.21 - Insurance

Schedule 3.22 – Financial Institution Bonds

Schedule 3.23 – Labor Relations and Employment Agreements

Schedule 3.24 – Employee Benefit Plans

Schedule 3.25(a) – Loan Portfolio

Schedule 3.29– No Finder

Schedule 4.3(i) – C&N Subsidiaries

Schedule 4.3(ii) – C&N Bank Subsidiaries

Schedule 4.4(a) – Capitalization

Schedule 4.4(c) – C&N Stock Plans

Schedule 4.9 – Absence of Undisclosed Liabilities

Schedule 4.10 – Absence of Changes

Schedule 4.11 – Dividends, Distributions and Stock Purchases

Schedule 4.12 - Taxes

Schedule 4.13- Litigation and Governmental Directives

Schedule 4.18 – Employee Benefit Plans

Schedule 4.22 – No Finder

Schedule 5.1 – Conduct of Business

Schedule 6.7(a) – Designated Employees

Schedule 6.7(b) – Contract Employees

AGREEMENT AND PLAN OF MERGER

This Agreement and Plan of Merger (the “Agreement”), entered into as of September 27, 2018, by and between Citizens & Northern Corporation, a Pennsylvania corporation having its administrative headquarters at 90-92 Main Street, Wellsboro, Pennsylvania 16901 (“C&N”), and Monument Bancorp, Inc., a Pennsylvania corporation having its administrative headquarters at 465 N Main Street, Doylestown, Pennsylvania 18901 (“Monument”).

BACKGROUND:

C&N is a bank holding company registered under the Bank Holding Company Act of 1956, as amended (the “BHC Act”), and is the parent holding company of Citizens & Northern Bank, a Pennsylvania chartered financial institution (“C&N Bank”).

Monument is a bank holding company registered under the BHC Act and is the parent holding company of Monument Bank, a Pennsylvania chartered financial institution (“Monument Bank”).

The Boards of Directors of C&N and Monument have determined that it is in the best interests of C&N and Monument, respectively, for Monument to merge with and into C&N with C&N surviving (the “Merger”), and for Monument Bank to merge with and into C&N Bank, with C&N Bank surviving (the “Bank Merger”). In connection with the Bank Merger, C&N Bank and Monument Bank have entered into that certain Bank Merger Agreement, of even date herewith, attached hereto asExhibit A (the “Bank Merger Agreement”).

In connection with the Merger, all of the outstanding shares of the common stock of Monument, $1.00 par value per share (the “Monument Common Stock”), will be converted into cash and shares of the common stock of C&N, par value $1.00 per share (the “C&N Common Stock”), on the terms described in this Agreement.

In connection with the execution of this Agreement, Monument has obtained voting agreements in the form ofExhibit B, attached hereto, from the directors and executive officers listed onExhibit B, pursuant to which each such person has agreed to vote certain shares of Monument Common Stock beneficially owned by him or her in favor of this Agreement, the Merger and, to the extent required, all transactions incident thereto (collectively, the “Voting Agreements”).

WITNESSETH:

NOW, THEREFORE, in consideration of the mutual covenants contained herein and intending to be legally bound, the Parties hereby agree as follows:

ARTICLE I.A.

DEFINITIONS

Appendix I sets forth (i) definitions of capitalized terms used in this Agreement which are not otherwise defined within the text of this Agreement, and (ii) cross references to capitalized terms defined within the text of the Agreement.

Article I.

THE MERGER

1.1 Merger. Subject to the terms and conditions of this Agreement, at the Effective Time: (i) Monument shall merge with and into C&N pursuant to the provisions of the Applicable Corporate Law, whereupon the separate existence of Monument shall cease, and C&N shall be the surviving corporation (hereinafter sometimes referred to as the “Surviving Corporation”), and (ii) all of the outstanding shares of Monument Common Stock will be converted into C&N Common Stock and cash in accordance with the provisions of Article II.

1.2 Name. The name of the Surviving Corporation shall be “Citizens & Northern Corporation”. The address of the principal office of the Surviving Corporation will be the address of C&N at the Effective Time.

1.3 Articles of Incorporation and Bylaws. The Articles of Incorporation and Bylaws of the Surviving Corporation shall be the Articles of Incorporation and Bylaws of C&N as in effect at the Effective Time.

1.4 Directors and Officers. Subject to the provisions of Section 6.9, the directors and officers of the Surviving Corporation shall be the directors and officers of C&N in office at the Effective Time. Each of such directors and officers shall serve until such time as his or her successor is duly elected and has qualified.

Article II.

CONVERSION AND EXCHANGE OF SHARES

2.1 Conversion of Shares. At the Effective Time, the shares of Monument Common Stock then outstanding shall be converted into shares of C&N Common Stock and cash, as follows:

(a) Conversion of Shares.

(i) Except for the Canceled Shares and Dissenting Shares, each share of Monument Common Stock issued and outstanding immediately prior to the Effective Time (a “Monument Share” and, collectively, the “Monument Shares”) shall, by virtue of the Merger and without any action on the part of the holder thereof, cease to be outstanding and shall be canceled and extinguished and converted into the right to receive, upon the surrender of the share certificates evidencing the Monument Shares (it being understood that any reference herein to a “certificate” of Monument Shares shall be deemed to include reference to book-entry account statements relating to the ownership of shares of Monument Common Stock), the C&N Stock Consideration or the Cash Consideration, or a combination of C&N Stock Consideration and the Cash Consideration, without any interest thereon (collectively, the “Merger Consideration”), as specified in this Article.

(ii) Shares of Monument Common Stock owned as of the Effective Time by C&N, C&N Bank, Monument or any Monument Subsidiary (except for trust account shares or shares acquired in connection with debts previously contracted) (collectively, the “Canceled Shares”) shall not be converted into the Merger Consideration and shall be canceled at the Effective Time.

(iii) Each share of C&N Common Stock that is issued and outstanding immediately before the Effective Time shall, on and after the Effective Time, remain issued and outstanding as one (1) share of C&N Common Stock, and each holder thereof shall retain his or her rights therein. The holders of the shares of C&N Common Stock outstanding immediately prior to the Effective Time shall, immediately after the Effective Time, continue to hold a majority of the outstanding shares of C&N Common Stock.

(b) Definitions. For purposes hereof, the following terms have the following meanings:

“C&N Share Value” means the closing price of C&N Common Stock on the Market on the Effective Date.

“C&N Stock Consideration” means a number of shares of C&N Common Stock equal to the number of Monument Shares to be converted into C&N Common Stock multiplied by the Conversion Ratio.

“Cash Consideration” means $28.10 per share, which is the amount of cash payable in the Merger per Monument Share exchanged therefor.

“Conversion Ratio” means 1.0144, which is the number of shares of C&N Common Stock payable in the merger per Monument share exchanged therefor; provided, however, that if C&N or Monument shall, at any time after the date of this Agreement and before the Effective Time, change its issued and outstanding shares into a different number of shares or a different class of shares as a result of a stock split, reverse stock split, stock dividend, spin-off, extraordinary dividend, recapitalization, reclassification, subdivision, combination of shares or other similar transaction, or there shall have been a record date declared for any such matter, then the Conversion Ratio shall be proportionately adjusted (calculated to four (4) decimal places), so that each Monument shareholder shall receive at the Effective Time, in exchange for his or her shares of Monument Common Stock, the number of shares of C&N Common Stock as would then have been owned by such Monument shareholder if the Effective Time had occurred before the record date of such event. For example, if C&N were to declare a five percent (5%) stock dividend after the date of this Agreement, and if the record date for that stock dividend were to occur before the Effective Time, the Conversion Ratio would be adjusted from 1.0144 to 1.06512 shares.

“Outstanding Shares” means the aggregate number of Monument Shares outstanding immediately prior to the Effective Time, but excluding the Canceled Shares, which number shall not be greater than the number of shares outstanding on the date of this Agreement (except as permitted by Section 5.1 herein).

(c) No Fractional Shares. No fractional shares of C&N Common Stock shall be issued in connection with the Merger. In lieu of the issuance of any fractional share to which a Monument shareholder would otherwise be entitled, such shareholder shall instead receive, in cash, an amount equal to the product of (i) the fraction of a share to which such holder would otherwise have been entitled and (ii) the Cash Consideration.

(d) Closing Market Price. For purposes of this Agreement, the “Closing Market Price” shall be the average of the closing prices for C&N Common Stock, calculated to two (2) decimal places, for the ten (10) consecutive trading days immediately preceding the date which is five (5) business days before the Effective Date (the “Price Determination Period”), as reported by the Market. For example, if April 1, 2019 were to be the Effective Date, then the Price Determination Period would be March 11-15 and18-22, 2019. In the event that there is no trading activity for C&N Common Stock on the Market on a day during the Price Determination Period, the Closing Market Price shall be based on the days during the Price Determination Period during which there is trading activity.

2.2 Election Procedure.

(a) Elections. Each holder of Monument Shares shall have the right to submit a request (an “Election”) to convert the Monument Shares owned by such holder (excluding any Canceled Shares) into: (1) the right to receive the Cash Consideration in the Merger (a “Cash Election”); (2) the right to receive the C&N Stock Consideration in the Merger (a “Stock Election”); or (3) the right to receive the Cash Consideration in the Merger for a portion of the Monument Shares owned, and the right to receive the C&N Stock Consideration in the Merger for the remainder of the Monument Shares owned (a “Cash/Stock Election”), in accordance with the following procedures:

(i) All Cash/Stock Elections shall be made solely in ten percent increments (i.e., 10% cash/90% stock; 20% cash/80% stock, etc.).

(ii) C&N shall prepare a form (the “Form of Election”) pursuant to which each holder of Monument Shares may make an Election, which shall be, in form and substance, acceptable to Monument. C&N and Monument shall mutually determine the timing of the mailing of the Form of Election to all Monument shareholders so as to permit Monument’s shareholders to exercise their right to make an Election on or prior to the Election Deadline. C&N and Monument shall each use its best efforts to mail or otherwise make available the Form of Election to all persons who become holders of Monument Shares during the period between the date of original mailing of the Form of Election and the Election Deadline. “Election Deadline” means the date announced by C&N (which date shall be mutually agreeable to Monument), as the last day on which Forms of Election will be accepted. In the event this Agreement shall have been terminated prior to the Effective Time, the Exchange Agent shall immediately return all Forms of Election and certificates for Monument Shares that have been submitted to the appropriate Monument shareholders.

(iii) Holders of record of Monument Shares who hold such shares as nominees, trustees, or in other representative capacities may submit multiple Forms of Election, provided that such representative certifies that each Form of Election covers all Monument Shares held by such representative for a particular beneficial owner.

(iv) Not later than the effective date of the Proxy Statement/Prospectus filed with the SEC, as contemplated in Section 6.1(b) hereof, C&N shall appoint Exchange Agent as the person to receive Forms of Election and to act as exchange agent under this Agreement. Any Monument shareholder’s Election shall have been made properly only if the Exchange Agent shall have received, by 5:00 p.m. local time in the city in which the principal office of such Exchange Agent is located, on the date of the Election Deadline, a Form of Election properly completed and signed and accompanied by certificates for the Monument Shares representing all certificated shares to which such Form of Election relates (or by an appropriate guarantee of delivery of such certificates, as set forth in such Form of Election, from a member of any registered national securities exchange or of the National Association of Securities Dealers, Inc. or a commercial bank or trust company in the United States, provided such certificates are in fact delivered to the Exchange Agent by the time required in such guarantee of delivery). Failure to deliver Monument Shares covered by such a guarantee of delivery within the time set forth on such guarantee shall be deemed to invalidate any otherwise properly made Election.

(v) Any Monument shareholder may at any time prior to the Election Deadline change his or her Election by written notice received by the Exchange Agent prior to the Election Deadline accompanied by a revised Form of Election properly completed and signed.

(vi) Any Monument shareholder may, at any time prior to the Election Deadline, revoke his or her Election by written notice received by the Exchange Agent prior to the Election Deadline or by withdrawal, prior to the Election Deadline, of such shareholder’s previously submitted certificates for Monument Shares, or of the guarantee of delivery of such certificates. All Elections shall be automatically deemed revoked upon receipt by the Exchange Agent of written notification from the Parties that this Agreement has been terminated in accordance with the terms hereof.

(vii) C&N and Monument shall have the right to make rules, not inconsistent with the terms of this Agreement, governing the validity of the Forms of Election, the manner and extent to which Elections are to be taken into account in making the determinations prescribed by Section 2.2, the issuance and delivery of certificates for C&N Common Stock into which Monument Shares are converted in the Merger and the payment of cash for Monument Shares converted into the right to receive the Cash Consideration in the Merger.

(viii) Outstanding Shares as to which a valid Election has not been made are referred to as “Non-Electing Shares”. If C&N shall determine that any Election is not properly made, such Election shall be deemed to be not in effect, and the Monument Shares covered by such Election shall, for purposes hereof, be deemed to be Non-Electing Shares. Monument, C&N and the Exchange Agent shall have no obligation to notify any person of any defect in any Election submitted.

(b) Conversion and Proration. The manner in which each Monument Share (except Canceled Shares) shall be converted into the C&N Stock Consideration, the Cash Consideration or the right to receive a combination of C&N Stock Consideration and Cash Consideration at the Effective Time shall be as set forth in this Section 2.2(b).

(i) The number of Outstanding Shares to be converted into the right to receive the Cash Consideration in the Merger pursuant to this Agreement shall be twenty percent (20%) (the “Cash Percentage”) of the Outstanding Shares, determined without consideration of any shares for which holders have validly exercised dissenters rights (“Dissenting Shares”) and cash received by holders of Dissenting Shares (“Dissenting Shareholders”); provided, however, that the Parties desire that the Merger should qualify as a reorganization under the provisions of Section 368(a) of the Internal Revenue Code of 1986, as amended (the “Code”) for federal income tax purposes. Therefore, notwithstanding anything to the contrary contained in this Agreement, in order that the Merger will not fail to satisfy continuity of interest requirements under applicable federal income tax principles relating to reorganizations under Section 368(a) of the Code, as reasonably determined by Barley Snyder LLP, C&N shall increase the number of Outstanding Shares that will be converted into the C&N Stock Consideration and reduce the number of Outstanding Shares that will be converted into the right to receive the Cash Consideration to the extent, if any, necessary to cause the Stock Test Amount to exceed the Cash Test Amount by at least $100.00; provided, however, that, solely for purposes of determining whether the Stock Test Amount exceeds the Cash Test Amount, cash paid for Monument Options pursuant to Section 2.4 shall be disregarded. For purposes of the foregoing: “Stock Test Amount” means the product of (i) the number of Outstanding Shares to be converted into C&N Stock Consideration (determined after taking into account adjustments under this Section), multiplied by (ii) the Conversion Ratio, multiplied by (iii) the C&N Share Value; and “Cash Test Amount” means the product of (i) the number of Outstanding Shares to be converted into the right to receive the Cash Consideration (determined after taking into account adjustments under Section 2.2(b)(i)), multiplied by (ii) the Cash Consideration.

(ii) If the total number of Outstanding Shares for which a Cash Election is requested (including the cash portion of any Cash/Stock Election, but excluding any fractional share for which cash is paid in lieu of receipt of such fractional share) is equal to the Cash Percentage, all such Cash Elections shall be honored as submitted, all Stock Elections shall be honored as submitted and all Non-Electing Shares shall be converted into C&N Stock Consideration.

(iii) If the total number of Outstanding Shares for which a Cash Election is requested (including the cash portion of any Cash/Stock Elections, but excluding any fractional share for which cash is paid in lieu of receipt of such fractional share) is greater than the Cash Percentage: all Non-Electing Shares shall be converted into the C&N Stock consideration and all remaining Monument shares shall be converted as follows:

(A) each Outstanding Share for which the holder made a Stock Election and the portion of each Cash/Stock Election electing C&N Stock Consideration (collectively, the “Aggregate Stock Elections”) shall be converted in the Merger into the C&N Stock Consideration; and

(B) each Outstanding Share for which the holder made a Cash Election and the portion of each Cash/Stock Election electing Cash Consideration (collectively, the “Aggregate Cash Elections”) shall be converted into the right to receive Cash Consideration or C&N Stock Consideration in the following manner:

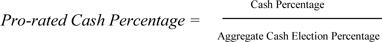

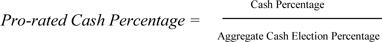

1) Each Monument shareholder shall receive Cash Consideration for the Pro-rated Cash Percentage of the number of Outstanding Shares for which he or she elected to receive Cash Consideration (including the cash portion of any Cash/Stock Election), where “Pro-rated Cash Percentage” means the percentage determined by dividing the Cash Percentage by the Aggregate Cash Election Percentage:

For purposes of the foregoing calculation, “Aggregate Cash Election Percentage” shall mean the percentage of Outstanding Shares represented by the Aggregate Cash Elections.

2) Each Monument shareholder shall have the Remaining Stock Percentage of the number of Outstanding Shares for which he or she elected to receive Cash Consideration (including the portion of any Cash/Stock Election electing Cash Consideration) converted into the C&N Stock Consideration, where “Remaining Stock Percentage” means 100% minus the Pro-rated Cash Percentage.

(iv) If the total number of Outstanding Shares for which a Cash Election is requested (including the cash portion of any Cash/Stock Elections but excluding any fractional share for which cash is paid in lieu of receipt of a fractional share) is less than the Cash Percentage, all Non-Electing Shares shall be converted, pro-rata among all holders of Non-Electing Shares based on the number of Non-Electing Shares owned, into the Cash Consideration until the Cash Percentage is reached and thereafter into C&N Stock Consideration. If all Non-Electing Shares are converted into the Cash Consideration pursuant to the foregoing sentence, and total Cash Elections, including all such Non-Electing Shares, are still less than the Cash Percentage, all remaining Monument Shares shall be converted as follows:

(A) the Aggregate Cash Elections shall be converted in the Merger into the Cash Consideration; and

(B) the Aggregate Stock Elections shall be converted into the right to receive Cash Consideration or C&N Stock Consideration in the following manner:

1) Each Monument shareholder shall receive C&N Stock Consideration for the Pro-rated Stock Percentage of the number of Outstanding Shares for which he or she elected to receive C&N Stock Consideration (including the stock portion of any Cash/Stock Election), where “Pro-rated Stock Percentage” means the percentage determined by dividing the Stock Percentage by the Aggregate Stock Election Percentage:

For purposes of the foregoing formula, “Stock Percentage” shall mean 80%. “Aggregate Stock Election Percentage” shall mean the percentage of Outstanding Shares represented by the Aggregate Stock Elections.

2) Each Monument shareholder shall have the Remaining Cash Percentage of the number of Outstanding Shares for which he or she elected C&N Stock Consideration (including the portion of any Cash/Stock Election electing C&N Stock Consideration) converted into the Cash Consideration, where “Remaining Cash Percentage” means 100% minus the Pro-rated Stock Percentage.

(v) If Non-Electing Shares are not converted under Sections (iii)-(iv) above, the Exchange Agent shall convert each Non-Electing Share into the Cash Consideration.

(vi) The Exchange Agent shall make all computations contemplated by this Section, and all such computations shall be conclusive and binding on the holders of Monument Shares, absent manifest error.

(c) Issuance of C&N Stock Consideration.

(i) Immediately prior to the Effective Time, C&N shall deliver to the Exchange Agent, in trust for the benefit of the holders of Monument Shares, certificates representing an aggregate number of whole shares of C&N Common Stock equal to the number of whole shares of C&N Common Stock into which such Monument Shares are to be converted as determined in Section 2.2(b). Notwithstanding the foregoing, C&N may, at its election, deliver the required shares of C&N Common Stock in book entry form via direct registration in lieu of the delivery of physical certificates of C&N Common Stock.

(ii) As soon as practicable following the Effective Time, each holder of Monument Shares that are to be converted into C&N Stock Consideration, upon proper surrender to the Exchange Agent of one or more certificates for such Monument Shares for cancellation accompanied by a properly completed Letter of Transmittal (to the extent not previously surrendered with a Form of Election), shall be entitled to receive (and the Exchange Agent shall deliver) certificates or electronic book entry to their account representing the number of whole shares of C&N Common Stock into which such Monument Shares shall have been converted in the Merger and a check for any fractional interests in accordance with Section 2.2(d).

(iii) No dividends or distributions that have been declared, if any, will be paid to persons entitled to receive certificates for shares of C&N Common Stock until such persons surrender their certificates for Monument Shares, at which time all such dividends and distributions shall be paid. In no event shall the persons entitled to receive such dividends be entitled to receive interest on such dividends. If any C&N Common Stock is to be issued in a name other than that in which the Monument certificate surrendered in exchange therefor is registered, it shall be a condition of such exchange that the person requesting such exchange shall pay to the Exchange Agent any transfer taxes or other taxes required by reason of issuance in a name other than the registered holder of the certificate surrendered, or shall establish to the satisfaction of the Exchange Agent that such tax has been paid or is not applicable. Notwithstanding the foregoing, neither the Exchange Agent nor any party hereto shall be liable to a holder of Monument Shares for any C&N Common Stock or dividends thereon delivered to a public official pursuant to any applicable abandoned property, escheat or similar law.

(d) Payment of Cash Consideration. Immediately prior to the Effective Time, C&N shall deposit with the Exchange Agent, in trust for the benefit of the holders of Monument Shares, an amount in cash equal to (i) the Cash Consideration to be paid to holders of Monument Shares to be converted into the right to receive the Cash Consideration as determined in Section 2.2(b); and (ii) the cash in lieu of fractional shares to be paid in accordance with Section 2.1(c). As soon as practicable following the Effective Time, each holder of Monument Shares that are to be converted into Cash Consideration, upon proper surrender to the Exchange Agent of one or more certificates for such Monument Shares for cancellation (to the extent not previously surrendered with a Form of Election), shall be entitled to receive (and the Exchange Agent shall deliver) a bank check for an amount equal to the Cash Consideration multiplied by the number of Monument Shares (including fractional shares) to be converted into Cash Consideration. In no event shall the holder of any such surrendered certificates be entitled to receive interest on any of the Cash Consideration to be received in the Merger. If such check is to be issued in the name of a person other than the person in whose name the certificates surrendered for exchange therefor are registered, it shall be a condition of the exchange that the person requesting such exchange shall pay to the Exchange Agent any transfer or other taxes required by reason of issuance of such check to a person other than the registered holder of the certificates surrendered, or shall establish to the satisfaction of the Exchange Agent that such tax has been paid or is not applicable. Notwithstanding the foregoing, neither the Exchange Agent nor any party hereto shall be liable to a holder of Monument Shares for any amount paid to a public official pursuant to any applicable abandoned property, escheat or similar law.

(e) Letter of Transmittal. C&N will instruct the Exchange Agent to mail to each holder of record of Monument Shares who has not previously surrendered such holder’s certificates with a validly executed Form of Election, as soon as reasonably practical after the Effective Time: (i) a Letter of Transmittal (which shall specify that delivery shall be effected, and risk of loss and title to such holder’s certificates shall pass, only upon proper delivery of the certificates to the Exchange Agent and shall be in such form and have such other provisions as shall be agreed upon by Monument and C&N prior to the Effective Time) and (ii) instructions for use in effecting the surrender of certificates in exchange for the Merger Consideration (the “Letter of Transmittal”).

(f) Missing Certificates.

(i) If any holder of Monument Shares convertible into the right to receive the Merger Consideration is unable to deliver the certificates which represent such shares, the Exchange Agent shall deliver to such holder the Merger Consideration to which the holder is entitled for such shares upon presentation of the following:

(A) evidence to the reasonable satisfaction of C&N that any such certificate has been lost, wrongfully taken or destroyed;

(B) such security or indemnity as may be reasonably requested by C&N in accordance with industry standards, to indemnify and hold harmless C&N and the Exchange Agent; and

(C) evidence satisfactory to C&N that such person is the owner of the shares theretofore represented by each certificate claimed to be lost, wrongfully taken or destroyed and that the holder is the person who would be entitled to present such certificate for payment pursuant to this Agreement.

2.3 Undisbursed Consideration. The Exchange Agent shall return to C&N any remaining Cash Consideration and C&N Stock Consideration on deposit with the Exchange Agent on the date which is one (1) year after the Effective Date. Any shareholder of Monument who has not surrendered his or her certificate(s) to the Exchange Agent (an “Unexchanged Shareholder”) prior to such time shall be entitled to receive the Merger Consideration, without interest, upon the surrender of such certificate(s) to C&N, subject to applicable escheat or abandoned property laws. No dividends or distributions that have been declared, if any, on C&N Stock Consideration will be paid to Unexchanged Shareholders entitled to receive C&N Stock Consideration until such persons surrender their certificates (or electronic equivalents) for Monument Common Stock, at which time all such dividends and distributions shall be paid, without interest.

(a) None of C&N, Monument, the Exchange Agent or any other person shall be liable to any former holder of Monument Shares for any amount properly delivered to a public official pursuant to applicable abandoned property, escheat or similar laws

(b) No Unexchanged Shareholder shall be considered a “shareholder of record” of C&N for purposes of voting at any special or annual meeting of C&N’s shareholders. The voting rights of Unexchanged Shareholders entitled to receive C&N Stock Consideration shall commence only upon the surrender of their Monument certificate(s) and the issuance to them of certificates for the C&N Stock Consideration in exchange therefor.

(c) In the event that any certificates for Monument Shares have not been surrendered for exchange in accordance with this Section on or before the first anniversary of the Effective Time, C&N may at any time thereafter, with or without notice to the holders of record of such certificates, sell for the accounts of any or all of such holders any or all of the shares of C&N Common Stock which such holders are entitled to receive under this Agreement (the “Unclaimed Shares”). Any such sale may be made by public or private sale or sale at any broker’s board or on any securities exchange in such manner and at such times as C&N shall determine. If, in the opinion of counsel for C&N, it is necessary or desirable, any Unclaimed Shares may be registered for sale under the Securities Act of 1933, as amended (the “Securities Act”), and applicable state laws. C&N shall not be obligated to make any sale of Unclaimed Shares if it shall determine not to do so, even if notice of the sale of the Unclaimed Shares has been given. The net proceeds of any such sale of Unclaimed Shares shall be held for holders of the unsurrendered certificates for Monument Shares whose Unclaimed Shares have been sold, to be paid to them upon surrender of the certificates for shares of C&N Common Stock. From and after any such sale, the sole right of the holders of the unsurrendered certificates for Monument Shares whose Unclaimed Shares have been sold shall be the right to collect the net sale proceeds held by C&N for their respective accounts, and such holders shall not be entitled to receive any interest on such net sale proceeds held by C&N. If outstanding certificates are not surrendered or the payment for them is not claimed prior to the date on which such payments would otherwise escheat to or become the property of any governmental unit or agency, the unclaimed items shall, to the extent permitted by abandoned property laws, escheat laws and any other applicable law, become the property of C&N (and to the extent not in its possession shall be paid over to it), free and clear of all claims or interest of any person previously entitled to such claims. Notwithstanding the foregoing, none of C&N, Monument, the Exchange Agent or any other person shall be liable to any former holder of Monument Shares for any amount properly delivered to a public official pursuant to applicable abandoned property, escheat or similar laws.

2.4 Treatment of Outstanding Monument Options.

(a) At the Effective Time, each option (collectively, “Monument Options”) to purchase shares of Monument Common Stock that (i) is outstanding at the Effective Time, (ii) has been granted pursuant to the 2018 Employee and Non-Employee Director Stock Option Plan or the 2008 Employee and Non-Employee Director Stock Option Plan, as amended and restated May 14, 2010 (collectively, the “Monument Stock Option Plans”); and (iii) would otherwise survive the Effective Time in the absence of the transactions contemplated by this Agreement, shall be redeemed for cash in an amount equal to the number of shares of Monument Common Stock covered by such Monument Option multiplied by the excess, if any, of the Cash Consideration over the exercise price per share of such Monument Option.

(b) To the extent required, as determined by C&N or Monument in light of applicable law, the terms of the Monument Stock Option Plans or otherwise, C&N may require all holders of Monument Options to execute an agreement documenting such holder’s agreement to accept cash in substitution for the Monument Option as of the Effective Time. Such agreement shall be executed in such form as C&N may reasonably require, and delivery of such agreement shall be required before C&N shall be required to deliver any cash to such individual pursuant to this Section.

(c) Schedule 2.4 sets forth a listing of each Monument Option grant still outstanding as of the date of this Agreement (copies of which have been provided to C&N), including the name of each holder of such Monument Option, the date of grant, the number of shares of Monument Common Stock subject to such Monument Option, the exercise price per share of such Monument Option, the expiration date, and the classification of whether such Monument Option is an incentive stock option or a nonqualified stock option.

2.5 Reservation and Registration of Shares. (i) Prior to the Effective Time, C&N shall take appropriate action to reserve a sufficient number of authorized but unissued shares of C&N Common Stock to be issued in accordance with this Agreement as C&N Stock Consideration, and (ii) at the Effective Time, C&N will issue shares of C&N Common Stock to the extent set forth in, and in accordance with, this Agreement.

2.6 Withholding Rights. C&N shall be entitled to deduct and withhold, or cause the Exchange Agent to deduct and withhold, from funds provided by the holder or from the consideration otherwise payable pursuant to this Agreement to any holder of Monument Shares or Monument Options, the minimum amounts (if any) that C&N is required to deduct and withhold with respect to the making of such payment under the Code, or any provision of tax law. To the extent that amounts are so withheld by C&N, such withheld amounts shall be treated for all purposes of this Agreement as having been paid to the holder of such Monument Shares or Monument Options in respect of which such deduction and withholding was made by C&N.

2.7 Expenses. All costs and expenses associated with the surrender and exchange of Monument Shares for the Merger Consideration shall be borne by C&N.

2.8 Dissenters’ Rights. Pursuant to Applicable Corporate Law, the shareholders of Monument shall be entitled to exercise dissenters’ rights.

Article III.

REPRESENTATIONS AND WARRANTIES OFMonument

Monument represents and warrants to C&N, as of the date of this Agreement, as follows:

3.1 Organization.

(a) Monument is a corporation that is duly organized, validly existing and in good standing under the laws of the state of its incorporation. Monument is a bank holding company under the BHC Act, and has full corporate power and lawful authority to own and hold its properties and to carry on its business as presently conducted.

(b) Monument Bank is a Pennsylvania chartered financial institution that is duly organized, validly existing and in good standing under the laws of the jurisdiction of its formation. Monument Bank is an insured bank under the provisions of the Federal Deposit Insurance Act, as amended (the “FDI Act”), and is a member of the Federal Reserve System. Monument Bank has full corporate power and lawful authority to own and hold its properties and to carry on its business as presently conducted.

(c) Each of the Monument Subsidiaries currently conducting operations, other than Monument Bank, is an entity that is duly organized, validly existing and in good standing under the laws of its state of incorporation or formation. Each of the Monument Subsidiaries currently conducting operations has full corporate power and lawful authority to own and hold its properties and to carry on its business as presently conducted.

3.2 Authority.

(a) The execution and delivery of this Agreement and the Bank Merger Agreement, and the performance of the transactions contemplated herein and therein, have been authorized by the Board of Directors of Monument and of Monument Bank, as required by law. The Board of Directors of Monument has determined that the Merger, on the terms and conditions set forth in this Agreement, is in the best interests of Monument and has directed that this Agreement and the transactions contemplated hereby be submitted to Monument’s shareholders for adoption at a meeting of such shareholders and has adopted a resolution to the foregoing effect. Except for the approval of this Agreement by Monument’s shareholders, Monument and Monument Bank have taken all corporate action necessary to authorize this Agreement and the Bank Merger Agreement and the performance of the transactions contemplated herein and therein, including the Merger and the Bank Merger.

(b) This Agreement has been duly executed and delivered by Monument and, assuming due authorization, execution and delivery by C&N, constitutes the valid and binding obligation of Monument, enforceable against Monument in accordance with its terms, subject to applicable bankruptcy, insolvency, fraudulent conveyance, reorganization, moratorium and similar laws affecting creditors’ rights and remedies generally, regulations and rules affecting financial institutions and subject as to enforceability, to general principles of equity, regardless of whether enforcement is sought in a proceeding at law or in equity (the “Bankruptcy and Equity Exceptions”). The Bank Merger Agreement has been duly executed and delivered by Monument Bank and, assuming due authorization, execution and delivery by C&N Bank, constitutes the valid and binding obligation of Monument Bank, enforceable against Monument Bank in accordance with its terms, subject to the Bankruptcy and Equity Exceptions.

(c) The execution, delivery and performance of this Agreement and the Bank Merger Agreement will not constitute a violation or breach of or default under (i) the Articles of Incorporation or Bylaws of Monument or Monument Bank, (ii) any statute, rule, regulation, order, decree or directive of any governmental authority or court applicable to Monument or any Monument Subsidiary, subject to the receipt of all required governmental approvals, or (iii) any agreement, contract, memorandum of understanding, indenture or other instrument to which Monument or any Monument Subsidiary is a party or by which Monument or any Monument Subsidiary or any of their properties are bound.

3.3 Subsidiaries. Each of Monument Bank and the entities listed onSchedule 3.3(i) is a wholly-owned subsidiary of Monument, and each of the entities listed onSchedule 3.3(ii)is a wholly-owned subsidiary of Monument Bank (collectively, the“Monument Subsidiaries”). Except for the Monument Subsidiaries, Monument has no Subsidiaries.

3.4 Capitalization.

(a) The authorized capital of Monument consists exclusively of 10,000,000 shares of preferred stock, $1,000 liquidation value per share, and 10,000,000 shares of common stock, $1.00 par value per share. As of the date of this Agreement, no shares of capital stock or other voting securities of Monument are issued, reserved for issuance or outstanding, other than as set forth onSchedule 3.4(a). All of the issued and outstanding shares of Monument Common Stock have been duly authorized and validly issued and are fully paid, nonassessable and free of preemptive rights, with no personal liability attaching to the ownership thereof. No bonds, debentures, notes or other indebtedness that have the right to vote on any matters on which shareholders of Monument may vote are issued or outstanding. Except as set forth inSchedule 3.4(a), as of the date of this Agreement, no trust preferred or subordinated debt securities of Monument are issued or outstanding. Other than the Monument Options, in each case, issued prior to the date of this Agreement, there are no outstanding subscriptions, options, warrants, puts, calls, rights, exchangeable or convertible securities or other commitments or agreements obligating Monument to issue, transfer, sell, purchase, redeem or otherwise acquire any such securities.

(b) Monument owns, directly or indirectly, all of the issued and outstanding shares of capital stock or other equity ownership interests of each of the Monument Subsidiaries, free and clear of any liens, pledges, charges, encumbrances and security interests whatsoever (“Liens”), and all of such shares or equity ownership interests are duly authorized and validly issued and are fully paid, nonassessable (except, with respect to Monument Subsidiaries that are insured depository institutions, as provided under 12 U.S.C. § 55 or any comparable provision of applicable state law) and free of preemptive rights, with no personal liability attaching to the ownership thereof. No Monument Subsidiary has or is bound by any outstanding subscriptions, options, warrants, calls, rights, commitments or agreements of any character calling for the purchase or issuance of any shares of capital stock or any other equity security of such Monument Subsidiary or any securities representing the right to purchase or otherwise receive any shares of capital stock or any other equity security of such Subsidiary.

(c) There are no voting trusts, shareholder agreements, proxies or other agreements in effect pursuant to which Monument or any of the Monument Subsidiaries has a contractual or other obligation with respect to the voting or transfer of the Monument Common Stock or other equity interests of Monument.Schedule 3.4(c) sets forth a true, correct and complete list of all Monument plans pursuant to which Monument equity interests may be issued (each a “Monument Stock Plan”) and all Monument Options outstanding as of the date hereof specifying, on a holder-by-holder basis: (i) the name of each holder, (ii) the number of shares subject to each such Monument Option, (iii) the grant date of each such Monument Option, (iv) the Monument Stock Option Plan under which such Monument Option was granted, (v) the exercise price for each such Monument Option, and (vi) the expiration date of each such Monument Option. Other than the Monument Options, no equity-based awards (including any cash awards where the amount of payment is determined in whole or in part based on the price of any capital stock of Monument or any of its Subsidiaries) are outstanding.

(d) The equity ownership interests of the Monument Subsidiaries are sometimes collectively referred to herein as the “Monument Subsidiaries Common Equity”.

3.5 Consents and Approvals. Except for (i) the filing of applications, filings and notices, as applicable, with the Bank Regulators as required by applicable law in connection with the Merger and the Bank Merger and approval of such applications, filings and notices, (ii) the filing of any required applications, filings or notices, as applicable, with the Financial Industry Regulatory Authority (“FINRA”) and the approval of such applications, filings and notices, (iii) the filing with the SEC of a proxy statement and prospectus in definitive form relating to the meeting of Monument’s shareholders to be held in connection with this Agreement, the offering of C&N’s common stock in the Merger and the other transactions contemplated hereby (including any amendments or supplements thereto, the “Proxy Statement/Prospectus”), and of the Registration Statement on Form S-4 in which the Proxy Statement/Prospectus will be included, to be filed with the SEC by C&N in connection with the transactions contemplated by this Agreement (the “Registration Statement”) and declaration of effectiveness of the Registration Statement, (iv) the filing of Articles of Merger with the Filing Offices and (v) such filings and approvals as are required to be made or obtained under the securities or “Blue Sky” laws of various states in connection with the issuance of the shares of C&N Common Stock pursuant to this Agreement and the approval of the listing of such C&N Common Stock on the Market, no consents or approvals of or filings or registrations with any court or administrative agency or commission or other governmental authority or instrumentality or SRO (each a “Governmental Entity”) are necessary in connection with (A) the execution and delivery by Monument of this Agreement or (B) the consummation by Monument of the Merger and the other transactions contemplated hereby (including the Bank Merger). As of the date hereof, Monument is not aware of any reason why the necessary regulatory approvals and consents will not be received in order to permit consummation of the Merger and Bank Merger on a timely basis.

3.6 Charter, Bylaws and Minute Books. Copies of the Articles of Incorporation and Bylaws or Articles of Organization and Operating Agreements or other operative charter or entity documents of Monument and each of the Monument Subsidiaries have been previously made available to C&N for inspection and are true, correct and complete. Except as previously disclosed to C&N in writing, the minute books of Monument and the Monument Subsidiaries that have been made available to C&N for inspection are true, correct and complete in all material respects and accurately record the actions taken by the Boards of Directors and shareholders or members of Monument and the Monument Subsidiaries at the meetings documented in such minutes.

3.7 Reports.

(a) Monument and each of its Subsidiaries have timely filed (or furnished, as applicable) all reports, registrations and statements, together with any amendments required to be made with respect thereto, that they were required to file (or furnish, as applicable) since January 1 of the Current Year with (i) any state regulatory authority, (ii) the Bank Regulators, (iii) any foreign regulatory authority and (iv) any SRO ((i) – (iv), each, a “Regulatory Agency” and, collectively the “Regulatory Agencies”), including any report, registration or statement required to be filed (or furnished, as applicable) pursuant to the laws, rules or regulations of the United States, any state, any foreign entity, or any Regulatory Agency, and have paid all fees and assessments due and payable in connection therewith, except where the failure to file such report, registration or statement or to pay such fees and assessments, either individually or in the aggregate, would not reasonably be likely to have a Material Adverse Effect on Monument. As of their respective dates, all such reports, registrations and statements filed with a Regulatory Agency complied as to form, in all material respects, with the published rules and regulations of such Regulatory Agencies. Except for examinations of Monument and its Subsidiaries conducted by a Regulatory Agency in the Ordinary Course of Business, no Regulatory Agency has initiated or has pending any proceeding or, to the knowledge of Monument, investigation into the business or operations of Monument or any of its Subsidiaries since January 1 of the Current Year, except where such proceedings or investigation would not reasonably be likely to have, either individually or in the aggregate, a Material Adverse Effect on Monument. There is no unresolved violation, criticism, or exception by any Regulatory Agency with respect to any report or statement relating to any examinations or inspections of Monument or any of its Subsidiaries, which would reasonably be likely to have, either individually or in the aggregate, a Material Adverse Effect on Monument.

(b) An accurate and complete copy of each final securities registration statement, securities offering prospectus, annual, quarterly or other financial statement or report or letter to shareholders, and any proxy statement produced by Monument, including any such materials filed with a Regulatory Agency, since January 1 of the Current Year (the “Monument Reports”) has previously been made available by Monument to C&N. No such Monument Report, at the time filed, mailed, furnished or communicated (and, in the case of registration statements and proxy statements, on the dates of effectiveness and the dates of the relevant meetings, respectively), contained any untrue statement of a material fact or omitted to state any material fact required to be stated therein or necessary in order to make the statements therein, in light of the circumstances in which they were made, not misleading, except that information provided as of a later date (but before the date of this Agreement) shall be deemed to modify information as of an earlier date.

3.8 Financial Statements.

(a) The financial statements of Monument and its Subsidiaries included (or incorporated by reference) in the Monument Reports (including the related notes, where applicable) (i) have been prepared from, and are in accordance with, the books and records of Monument and its Subsidiaries, (ii) fairly present in all material respects the consolidated results of operations, cash flows, changes in shareholders’ equity and consolidated financial position of Monument and its Subsidiaries for the respective fiscal periods or as of the respective dates therein set forth (subject in the case of unaudited statements to year-end audit adjustments normal in nature and amount), (iii) complied, as of their respective dates of filing, issuance and use, in all material respects with applicable accounting requirements and applicable law, and (iv) have been prepared in accordance with GAAP consistently applied during the periods involved, except, in each case, as indicated in such statements or in the notes thereto. The books and records of Monument and its Subsidiaries have been, since January 1 of the Current Year, and are being, maintained in all material respects in accordance with GAAP and any other applicable legal and accounting requirements. No auditor of Monument has resigned (or informed Monument that it intends to resign) or been dismissed as independent public accountants of Monument as a result of or in connection with any disagreements with Monument on a matter of accounting principles or practices, financial statement disclosure or auditing scope or procedure in the past two completed fiscal years.

(b) Except as would not reasonably be likely to have, either individually or in the aggregate, a Material Adverse Effect on Monument, neither Monument nor any of its Subsidiaries has any liability of any nature whatsoever (whether absolute, accrued, contingent or otherwise and whether due or to become due), except for those liabilities that are reflected or reserved against on the consolidated balance sheet of Monument included in its audited financial statements as of and for the period ended December 31 of the Prior Year (including any notes thereto) and for liabilities incurred in the Ordinary Course of Business consistent with past practice since such date, or in connection with this Agreement and the transactions contemplated hereby.

(c) The records, systems, controls, data and information of Monument and its Subsidiaries are recorded, stored, maintained and operated under means (including any electronic, mechanical or photographic process, whether computerized or not) that are under the exclusive ownership and direct control of Monument or its Subsidiaries or accountants (including all means of access thereto and therefrom), except for any non-exclusive ownership and non-direct control that would not reasonably be likely to have, either individually or in the aggregate, a Material Adverse Effect on Monument. Monument (i) has implemented and maintains disclosure controls and procedures (as defined in Rule 13a-15(e) of the Exchange Act) to ensure that material information relating to Monument, including its Subsidiaries, is made known to the chief executive officer and the chief financial officer of Monument by others within those entities on a timely basis, and (ii) has not identified (x) any significant deficiencies and material weaknesses in the design or operation of internal control over financial reporting (as defined in Rule 13a-15(f) of the Exchange Act) which are reasonably likely to adversely affect Monument’s ability to record, process, summarize and report financial information, and (y) to the knowledge of Monument, any fraud, whether or not material, that involves management or other employees who have a significant role in Monument’s internal controls over financial reporting. These disclosures were made in writing by management to Monument’s auditors and audit committee and a copy has been previously made available to C&N. To the knowledge of Monument, there is no reason to believe that Monument’s outside auditors and its chief executive officer and chief financial officer would not be able to give the certifications and attestations required pursuant to the rules and regulations adopted pursuant to Section 404 of the Sarbanes Oxley Act of 2002 (the “SOX Act”), without qualification, if Monument were subject to such requirement.

(d) Since January 1 of the Current Year, (i) neither Monument nor any of its Subsidiaries, nor, to the knowledge of Monument, any director, officer, auditor, accountant or representative of Monument or any of its Subsidiaries, has received or otherwise had or obtained knowledge of any material complaint, allegation, assertion or claim, whether written or, to the knowledge of Monument, oral, regarding the accounting or auditing practices, procedures, methodologies or methods (including with respect to loan loss reserves, write-downs, charge-offs and accruals) of Monument or any of its Subsidiaries or their respective internal accounting controls, including any material complaint, allegation, assertion or written claim that Monument or any of its Subsidiaries has engaged in questionable accounting or auditing practices, and (ii) no attorney representing Monument or any of its Subsidiaries, whether or not employed by Monument or any of its Subsidiaries, has reported evidence of a material violation of securities laws, breach of fiduciary duty or similar violation by Monument or any of its officers, directors or employees to the Board of Directors of Monument or any committee thereof or to the knowledge of Monument, to any director or officer of Monument.

3.9 Absence of Undisclosed Liabilities. Except as disclosed inSchedule 3.9, or as reflected, noted or adequately reserved against in the most recent balance sheet provided by Monument to C&N prior to the date of this Agreement (the “Monument Balance Sheet”), as of the date of the Monument Balance Sheet, Monument had no material liabilities (whether accrued, absolute, contingent or otherwise) which were required to be reflected, noted or reserved against in the Monument Balance Sheet under GAAP. Except as disclosed inSchedule 3.9, Monument and the Monument Subsidiaries have not incurred, since the date of the Monument Balance Sheet, any such liability, other than liabilities of the same nature as those set forth in the Monument Balance Sheet, all of which have been incurred in the Ordinary Course of Business.

3.10 Absence of Changes. Since the date of the Monument Balance Sheet, Monument and the Monument Subsidiaries have each conducted their businesses in the Ordinary Course of Business and, except as disclosed inSchedule 3.10, neither Monument nor the Monument Subsidiaries have undergone any changes in their condition (financial or otherwise), assets, liabilities, business, results of operations or future prospects, other than changes in the Ordinary Course of Business, which, in the aggregate, had a Material Adverse Effect as to Monument and the Monument Subsidiaries on a consolidated basis.

3.11 Dividends, Distributions and Stock Purchases. Except as set forth inSchedule 3.11, since the date of the Monument Balance Sheet, Monument has not declared, set aside, made or paid any dividend or other distribution in respect of the Monument Common Stock, or purchased, issued or sold any shares of Monument Common Stock or the Monument Subsidiaries Common Equity, other than as described in the Monument Reports.

3.12 Taxes. Each of Monument and its Subsidiaries has duly and timely filed (taking into account all applicable extensions) all material Tax Returns in all jurisdictions in which Tax Returns are required to be filed by it, and all such Tax Returns are true, correct, and complete in all material respects. All material Taxes of Monument and its Subsidiaries (whether or not shown on any Tax Returns) that are due have been fully and timely paid or adequate provision has been made for any such Taxes on the Monument Balance Sheet in accordance with GAAP. Each of Monument and its Subsidiaries has withheld and paid all material Taxes required to have been withheld and paid in connection with amounts paid or owing to any employee, creditor, shareholder, independent contractor or other third party. Neither Monument nor any of its Subsidiaries has granted any extension or waiver of the limitation period applicable to any material Tax that remains in effect. Except as set forth onSchedule 3.12, the federal income Tax Returns of Monument and its Subsidiaries for all years in the five (5) year period ending December 31 of the Prior Year have been examined by the Internal Revenue Service (the “IRS”) or are Tax Returns with respect to which the applicable period for assessment under applicable law, after giving effect to extensions or waivers, has expired. No deficiency with respect to a material amount of Taxes has been proposed, asserted or assessed against Monument or any of its Subsidiaries. There are no pending or, to Monument’s knowledge, threatened, disputes, claims, audits, examinations or other proceedings regarding any material Taxes of Monument and its Subsidiaries or the assets of Monument and its Subsidiaries. In the last six (6) years, neither Monument nor any of its Subsidiaries has been informed in writing by any jurisdiction that the jurisdiction believes that Monument or any of its Subsidiaries was required to file any Tax Return that was not filed. Monument has made available to C&N true, correct, and complete copies of any private letter ruling requests, closing agreements or gain recognition agreements with respect to Taxes requested or executed in the last six (6) years. There are no Liens for material Taxes (except Taxes not yet due and payable) on any of the assets of Monument or any of its Subsidiaries. Neither Monument nor any of its Subsidiaries is a party to or is bound by any Tax sharing, allocation or indemnification agreement or arrangement (other than such an agreement or arrangement exclusively between or among Monument and its Subsidiaries). Neither Monument nor any of its Subsidiaries (A) has been a member of an affiliated group filing a consolidated federal income Tax Return (other than a group the common parent of which was Monument) or (B) has any liability for the Taxes of any person (other than Monument or any of its Subsidiaries) under Treasury Regulation Section 1.1502-6 (or any similar provision of state, local or foreign law), as a transferee or successor, by contract or otherwise. Neither Monument nor any of its Subsidiaries has been, within the past two (2) years or otherwise as part of a “plan (or series of related transactions)” within the meaning of Section 355(e) of the Code of which the Merger is also a part, a “distributing corporation” or a “controlled corporation” (within the meaning of Section 355(a)(1)(A) of the Code) in a distribution of stock intended to qualify for tax-free treatment under Section 355 of the Code. Neither Monument nor any of its Subsidiaries has participated in a “listed transaction” within the meaning of Treasury Regulations Section 1.6011-4(b)(2). At no time during the past five (5) years has Monument been a United States real property holding corporation within the meaning of Section 897(c)(2) of the Code. Neither Monument nor any of its Subsidiaries will be required to include any material item of income in, or to exclude any material item of deduction from, taxable income in any taxable period (or portion thereof) ending after the Effective Date as a result of any (i) change in method of accounting, (ii) closing agreement, (iii) intercompany transaction or excess loss account described in Treasury Regulations under Section 1502 of the Code (or any similar provision of state, local or foreign law), (iv) installment sale or open transaction disposition made on or prior to the Effective Date, or (v) prepaid amount received on or prior to the Effective Date, in the case of (i), (iii), (iv) and (v), outside of the Ordinary Course of Business.

3.13 Title to and Condition of Assets. Except as disclosed inSchedule 3.13, Monument and the Monument Subsidiaries have good and marketable title to all material consolidated real and personal properties and assets reflected in the Monument Balance Sheet or acquired subsequent to the date of the Monument Balance Sheet, (other than OREO or property and assets disposed of in the Ordinary Course of Business), free and clear of all liens or encumbrances of any kind whatsoever; provided, however, that the representations and warranties contained in this sentence do not cover liens or encumbrances that: (i) are reflected in the Monument Balance Sheet or inSchedule 3.13; (ii) represent liens of current taxes not yet due or which, if due, may be paid without penalty, or which are being contested in good faith by appropriate proceedings; and (iii) represent such imperfections of title, liens, encumbrances, zoning requirements and easements, if any, as are not substantial in character, amount or extent and do not materially detract from the value, or interfere with the present use, of the properties and assets subject thereto. The material structures and other improvements to real estate, furniture, fixtures and equipment reflected in the Monument Balance Sheet or acquired subsequent to the date of the Monument Balance Sheet: (A) are in good operating condition and repair (ordinary wear and tear excepted), and (B) comply in all material respects with all applicable laws, ordinances and regulations, including without limitation all building codes, zoning ordinances and other similar laws, except where any noncompliance would not materially detract from the value, or interfere with the present use, of such structures, improvements, furniture, fixtures and equipment. Monument and the Monument Subsidiaries own or have the right to use all real and personal properties and assets that are material to the conduct of their respective businesses as presently conducted.

3.14 Contracts.

(a) Except as set forth inSchedule 3.14, as of the date hereof, neither Monument nor any of its Subsidiaries is a party to or bound by any Material Contract, other than any Monument Benefit Plan. Neither Monument nor any of its Subsidiaries knows of, or has received written, or to Monument’s knowledge, oral notice of, any violation of a Material Contract by any of the other parties thereto which would reasonably be likely to be, either individually or in the aggregate, material to Monument and its Subsidiaries, taken as a whole.

(b) In each case, except as would not reasonably be likely to have, either individually or in the aggregate, a Material Adverse Effect on Monument: (i) Each Material Contract is valid and binding on Monument or one of its Subsidiaries, as applicable, and in full force and effect, (ii) Monument and each of its Subsidiaries has performed all obligations required to be performed by it prior to the date hereof under each Material Contract, (iii) to Monument’s knowledge, each third-party counterparty to each Material Contract has performed all obligations required to be performed by it to date under such Material Contract and (iv) no event or condition exists which constitutes or, after notice or lapse of time or both, will constitute, a default on the part of Monument or any of its Subsidiaries under any such Material Contract.

3.15 Litigation and Governmental Directives. Except as disclosed inSchedule 3.15, (i) there is no litigation, investigation or proceeding pending, or to the Knowledge of Monument or the Monument Subsidiaries, threatened, that involves Monument or the Monument Subsidiaries or any of their properties and that, if determined adversely, would have a Material Adverse Effect on Monument; (ii) there are no outstanding orders, writs, injunctions, judgments, decrees, regulations, directives, consent agreements or memoranda of understanding issued by any Governmental Entity against, or with the consent of, Monument or the Monument Subsidiaries that would have a Material Adverse Effect on, or that materially restricts the right of, Monument or the Monument Subsidiaries to carry on their businesses as presently conducted; and (iii) neither Monument nor the Monument Subsidiaries have Knowledge of any fact or condition presently existing that might give rise to any litigation, investigation or proceeding which, if determined adversely to either Monument or the Monument Subsidiaries, would have a Material Adverse Effect on, or would materially restrict the right of, Monument or the Monument Subsidiaries to carry on their businesses as presently conducted. All litigation (except for bankruptcy proceedings in which Monument or the Monument Subsidiaries have filed proofs of claim) in which Monument or the Monument Subsidiaries are involved as a plaintiff (other than routine collection and foreclosure suits initiated in the Ordinary Course of Business) in which the amount sought to be recovered is greater than $50,000 is identified inSchedule 3.15. Neither Monument nor any of its Subsidiaries is, or has been since January 1 of the Current Year, subject to any cease-and-desist or other order or enforcement action issued by, or is a party to any written agreement, consent agreement or memorandum of understanding with, or is a party to any commitment letter or similar undertaking to, or is subject to any order or directive by, or has been ordered to pay any civil money penalty by, or a recipient of any supervisory letter from, or, has adopted any policies, procedures or board resolutions at the request or suggestion of any Regulatory Agency or other Governmental Entity that currently restricts in any material respect the conduct of its business or that in any material manner relates to its capital adequacy, its ability to pay dividends, its credit or risk management policies, its management or its business (each, whether or not set forth in a Schedule, a “Regulatory Agreement”), nor been advised in writing or, to Monument’s knowledge, orally, by any Regulatory Agency or other Governmental Entity that it is considering issuing, initiating, ordering, or requesting any such Regulatory Agreement.

3.16 Risk Management Instruments. All interest rate swaps, caps, floors, option agreements, futures and forward contracts and other similar derivative transactions and risk management arrangements, whether entered into for the account of Monument, any of its Subsidiaries or for the account of a customer of Monument or one of its Subsidiaries, were entered into in the Ordinary Course of Business and in accordance with applicable rules, regulations and policies of any Regulatory Agency and with counterparties believed to be financially responsible at the time and are legal, valid and binding obligations of Monument or one of its Subsidiaries enforceable in accordance with their terms (except as may be limited by the Bankruptcy and Equity Exceptions). Monument and each of its Subsidiaries have duly performed in all material respects all of their material obligations thereunder to the extent that such obligations to perform have accrued, and, to Monument’s knowledge, there are no material breaches, violations or defaults or bona fide allegations or assertions of such by any party thereunder.

3.17 Environmental Matters. Except as disclosed inSchedule 3.17, neither Monument nor any of the Monument Subsidiaries has any material liability relating to any environmental contaminant, pollutant, toxic or hazardous waste or other similar substance that has been generated, used, stored, processed, disposed of or discharged onto any of the real estate now or previously owned or acquired (including without limitation any real estate acquired by means of foreclosure or exercise of any other creditor’s right) or leased by Monument or any of the Monument Subsidiaries and which is required to be reflected, noted or adequately reserved against in Monument’s consolidated financial statements under GAAP. In particular, without limiting the generality of the foregoing sentence, but subject to the materiality and financial statement disclosure standards therein, except as disclosed inSchedule 3.17, neither Monument nor any of the Monument Subsidiaries have environmental liabilities based on their use or incorporation of: (i) any materials containing asbestos in any building or other structure or improvement located on any of the real estate now or previously owned or acquired (including without limitation any real estate acquired by means of foreclosure or exercise of any other creditor’s right) or leased by Monument or any of the Monument Subsidiaries; (ii) any electrical transformers, fluorescent light fixtures with ballasts or other equipment containing PCBs on any of the real estate now or previously owned or acquired (including without limitation any real estate acquired by means of foreclosure or exercise of any other creditor’s right) or leased by Monument or any of the Monument Subsidiaries; or (iii) any underground storage tanks for the storage of gasoline, petroleum products or other toxic or hazardous wastes or similar substances located on any of the real estate now or previously owned or acquired (including without limitation any real estate acquired by means of foreclosure or exercise of any other creditor’s right) or leased by Monument or any of the Monument Subsidiaries.