Exhibit 99.1

2018 Annual Highlights MOMENTUM:

2018 EXECUTIVE TEAM Deborah E Scott EVP and Director Trust Division Harold F Hoose, III EVP and Director of Lending J Bradley Scovill President & CEO John M Reber EVP and Director of Risk Management Mark A Hughes EVP and Director Financial Division Shelley L D'Haene EVP and Senior Operations Officer Stan R Dunsmore EVP and Chief Credit Officer Thomas L Rudy, Jr EVP and Director of Branch Delivery Tracy E Watkins EVP and Director of Human Resources 2018 CORPORATE OFFICERS J Bradley Scovill President & CEO Mark A Hughes Treasurer Kimberly N Battin Corporate Secretary Citizens & Northern Corporation is a bank holding company with assets of approximately $1.3 billion and is headquartered in Wellsboro, PA Banking services are provided by its subsidiary, Citizens & Northern Bank, from 25 banking offices in Bradford, Cameron, Lycoming, McKean, Potter, Sullivan and Tioga Counties in Pennsylvania and Steuben County in New York Commercial, residential and consumer lending services are now being offered in Elmira, NY and York, PA through our loan production office Investment products are offered through C&N Investment Services and insurance products are offered by C&N Financial Services Corp Trust services are offered by Citizens & Northern Bank through the C&N Trust and Financial Management Group Citizens & Northern stock trades on the NASDAQ Capital Market Securities under the symbol CZNC

Contents Executive Team/Corporate Officers Inside Front Cover Our Vision, Mission & Values 1 Momentum 2 New for 2018 4 Letter from the President & CEO 5 Financial Profile 8 Quarterly Share Data 8 Operations Comparisons 9 End of Period Balances 9-10 Consolidated Financial Data 12 Trust & Financial Management Group 13 Employee Highlights 12 Giving Back, Giving Together 14-15 Employee Achievements 16-17 Service Awards 18 Mitchell Scholarship 19 Board of Directors .Inside Back Cover Vision, Mission & Values VISION Every customer says "C&N is the ONLY bank I need." MISSION Creating value through lifelong relationships with our customers, our teammates, our shareholders and our communities as their resource for customized financial solutions, expertise and partnership VALUES Teamwork Together we are stronger Respect Value one another Responsibility & Accountability Work like you own it Excellence Do your best Every day Every time Integrity Do the right thing when no one is looking Client-Focus Consider your customer in everything you do Have Fun Work hard! Play hard! WIN! Committed to our Communities, Local Families and Businesses, Employees and Shareholders MOMENTUM: The Pursuit of Excellence 1

Physical Presence Technology Employees Redirecting Resources At C&N, we are taking a proactive approach to these changes by adjusting our delivery model in a three-tiered approach; our physical presence, technology and employees Over the last few years, there has been a drastic decrease in the number of in-branch transactions due to the increase in technology and online banking services Many customers are managing their daily banking activities remotely from their smartphones, tablets and computers As a result, the decision was made to close our Ralston branch and redirect these resources We are also in the midst of relocating our Towanda branch to a new state-of-the-art facility that positions us to better serve our customers Our mergers and acquisitions team has been hard at work evaluating potential markets and partnerships throughout the region In October, we announced a pending acquisition of Monument Bank in Bucks County, PA with two branches and a loan production office We plan to finalize this acquisition in the second quarter of 2019 At the end of January, we also announced an expansion into York, PA with a loan production office and long-term plans to add two new branches in that area 2 MOMENTUM: The Pursuit of Excellence

PeoplePay vs Venmo Users 3,000 2,800 2,600 2,400 2,200 2,000 PeoplePay1 Over the last few years, evaluating and investing in technology has been a primary focus We are investing in technology that creates convenience and is relevant to the consumers in our footprint One of the products rolled out in 2018 was a feature through online banking that allows you to send money to friends and family through email and text messages, named PeoplePay One of the main competitors of this product is Venmo From February - November 2018, C&N had 2,892 transactions (credits/debits) through PeoplePay and 2,321 through Venmo Ebeginnings2 We also unveiled our 'eBeginnings' applications in 2018, which include 27 Mortgages processed online 20 Accounts opened online Percentage of employees failed before and after cybersecurity training EMPLOYEES FAILED BEFORE cybersecurity training 34% online account opening and online mortgages We've had over 27 mortgages processed online since it went live in September and over 20 accounts opened online from mid-December through the end of the year These high adoption rates prove that we are making the right investments in technology for our customers Cybersecurity Training As we continue to grow our online resources, we've invested in enhanced cybersecurity training for our employees Pete Boergermann, our Information Security Director, sends weekly updates to employees on how to identify and avoid new threats, provides online classes followed by simulation testing by setting up fake email scams and providing further education for employees who fail Prior to implementing these trainings, 34% of C&N employees failed the cybersecurity testing After completing these trainings, only 4% of employees failed Developing our current teams and recruiting quality new employees continues to be a key priority 1You may be charged access rates depending on your mobile phone carrier Check with your service provider for details Citizens & Northern Bank will not be held responsible or make refunds for payments made for the exchange of goods or services that are unlawful or not delivered as expected Only use PeoplePay with people you know and trust 2Loans subject to credit approval The banking industry is facing numerous changes and disruptions To stay competitive, we're taking a proactive approach and adjusting our delivery model to meet new expectations, while remaining committed to creating positive experiences and building relationships that create value for our clients Everything we do comes back to the people we serve and ensuring that we are achieving our desired financial targets so we are able to keep that promise in the future MOMENTUM: The Pursuit of Excellence 3

NEW for 2018 In early 2018, we introduced the technology to print debit cards at 10 branch locations throughout our footprint Now, customers don't have to wait for their cards to come through the mail As Citizens & Northern Bank's peer-to-peer payment feature, customers can send money to their family and friends straight from their C&N online banking or mobile app There is no need to download a separate app and it's free to use! Now customers can experience the convenience of completing a transaction with a live person without needing to wait in the teller line Our ITMs look like an ATM with the comfort of working with a live person Customers can manage the entire home loan process online, 24 hours a day, with the confidence that comes from their local, trusted C&N lender Within minutes, customers can open a checking, savings or certificate of deposit online from their PC or mobile device At C&N, it's important to us that our customers are prepared for the next stage in life, especially when it comes to retiring Our Retirement Planning team reworked their online planning tool to be easier and more insightful than ever before We are in the process of relocating our Towanda branch to a new, state- of-the-art facility that positions us to serve our customers even better To continue to execute on our mission of creating value for our customers, as well as continuing to offer state-of-the-art banking products, we closed our Ralston branch We've worked hard to deliver a first-class, convenient banking experience for every customer Over the years, we have adopted some of the latest electronic and remote banking services and we are excited to share these services with our customers in the southern part of the state As we continue to grow our online resources, we've invested in enhanced cybersecurity training for our employees After completing these trainings, we saw a 30% increase in employee test scores 1You may be charged access rates depending on your mobile phone carrier Check with your service provider for details Citizens & Northern Bank will not be held responsible or make refunds for payments made for the exchange of goods or services that are unlawful or not delivered as expected Only use PeoplePay with people you know and trust 2Loans subject to credit approval 3Some products are not FDIC insured or guaranteed, not a deposit or other obligation of the bank, not guaranteed by the bank and are subject to investment risk, including the possible loss of the principal amount invested and are not insured by any other federal government agency 4 MOMENTUM: The Pursuit of Excellence

2018 was an outstanding year at C&N and the theme of this year's Annual Highlights - Momentum - is most appropriate Our efforts over the past several years to strengthen our values-based culture and business model grounded on relationships are producing current performance while we also build future capacity Our efforts have been disciplined and persistent and progress has been steady In 2018, C&N announced its expansion into Bucks County, PA through the pending acquisition of Monument Bank, delivered strong earnings, continued the extraordinary community engagement of the C&N Team, and provided a solid return to shareholders through price appreciation and an increased dividend Importantly, we continued the discipline of investing in our people, technology, and data management to support strategic growth and expansion and to continue our momentum into the future The September announcement of the acquisition of Monument Bank is a significant event for C&N as we step out of our historic market area We have built an exceptionally strong community banking franchise with capacity for growth 2017 Earnings for both J BRADLEY SCOVILL Establishing a presence in Bucks County is an initial step to leverage our strengths in a larger market with a partner that is a strong cultural fit and shares our focus on local communities Monument's market leadership and lending teams will remain in place and begin to utilize the products, services and years were affected by the change in tax rates enacted in late 2017 and by net securities gains/losses, so it is useful to discuss our results on a pre-tax basis after adjusting for both items With these adjustments, 2018 pre-tax income was $24.2 million, a 19.2% increase from other resources provided by C&N to create additional value for customers upon closing of the transaction which is expected to occur in the second quarter We We have built an exceptionally strong community banking franchise with capacity for growth $20.3 million in 2017 Sustained revenue growth was the primary driver as both net interest income and noninterest income grew at a substantially faster pace than are confident this strategic move will create long term value for our shareholders as we drive growth in Bucks County and seek additional opportunities to expand into attractive markets over time While we have been actively pursuing expansion, our focus on deepening relationships to grow the historic franchise has not wavered Our regional market Teams are steadily improving their effectiveness at identifying customer needs and delivering solutions from all business lines And while these markets are not growing rapidly, there is significant opportunity to improve market share, particularly in Lycoming County in Pennsylvania and Steuben and Chemung counties in New York This core franchise has produced excellent results and will continue to provide the foundation for growth in the years ahead Net income totaled $22 million during 2018 or $1.79 per share as compared to $13.4 million or $1.10 per share in noninterest expenses during the year This operating leverage in our core business gained momentum in 2018 Growth in net interest income and expansion of the net interest margin resulted from modest overall loan growth, the strength of C&N's core deposits, and continued improvement in the mix of the balance sheet Loan growth was muted due to lower production levels and several larger commercial loan payoffs, however the mix of new loan business and repricing in the portfolio produced higher yields and revenue Total deposit growth was solid for the year Demand deposits were the primary source of growth which further improved our funding mix and controlled the related costs Credit quality remains stable and solid as measured by our past due and non-performing loans metrics at year- end when compared to December 31, 2017 The provision was $584,000 in 2018 compared to $801,000 in 2017 This decrease was primarily due to a lower level of specific MOMENTUM: The Pursuit of Excellence 5

reserves on commercial loans and more modest loan growth Management maintains a robust process to determine the adequacy of the allowance that incorporates a broad range of factors Generation of core noninterest income is a strength for C&N and is one of the positive outcomes of our focus on developing value-based relationships with Noninterest expenses increased approximately 7% when compared to 2017 Salaries and wages were the primary component of this growth, driven by performance-based salary adjustments, incentive compensation, and additional staff Pensions and employee benefits declined primarily due to lower health care expenses Data processing and telecommunications increases customers Trust and brokerage revenues from our wealth management business continued to grow as we added new business and received the full year benefits of a modest fee increase implemented in mid- 2017 Service charges and fees related to our core deposits, Importantly, we continued the discipline of investing in our people, technology, and data management to support strategic growth and expansion and to continue our momentum into the future resulted from investment in systems and technology and their ongoing costs Professional fees were higher due to acquisition expenses and various other projects, and the mid- year donation of the Towanda Office to a non-profit pushed contributions expense higher for including interchange revenue from debit cards, also increased substantially Net gains from the sale of loans declined as conforming mortgage loan originations as a percentage of total mortgage originations declined, resulting in fewer sales the year Leveraging C&N's capital position and paying off our investments in C&N's capacity for growth have been important elements of our strategic plan for the past several years 6 MOMENTUM: The Pursuit of Excellence

The Monument acquisition is consistent with this strategy and provides some initial leverage along with the potential for substantial future growth Our focus has also been on producing earnings that support a strong dividend and positive stock valuation, positioning our "currency" to support our capacity for growth 2018 earnings were exceptional and dividends per share increased from $1.04 to $1.08, producing a dividend yield of 4.09% based on the December 31, 2018 closing price of $26.43 per share This closing price was a 10.1% increase from the $24.00 closing price a year earlier At its January 2019 meeting, the Board of Directors declared a regular quarterly dividend of $.27 per share, or an annualized rate of $1.08 per share At the same time, the Board declared a special dividend of $.10 per share in recognition of C&N's overall performance in 2018 and the Company's ongoing strength As we look to continue our momentum going forward, the external environment remains positive, on balance National and regional economic growth remain solid while politics and the Federal Reserve continue to influence the broad economy and the banking industry We foreshadowed the possibility of regulatory relief and further Fed rate hikes in the 2017 Annual Review and in 2018, both occurred The Economic Growth, Regulatory Relief, and Consumer Protection Act (the "Act") was signed into law in May 2018, with the goal of easing the burden imposed by the Dodd-Frank legislation passed in 2010 There are provisions in the new Act that may simplify and streamline the activities of smaller banks relating to reporting requirements, regulatory capital standards, certain lending functions, and brokered deposits We expect to benefit from some elements of the Act immediately while others will take time to assess A more substantial and immediate impact was felt as the Fed raised its fed funds target rate four times in 2018 to 2.25% - 2.50% This continued tightening of monetary policy reflected the Fed's ongoing concern regarding inflation as the economy remained strong throughout the year At year-end, however, Chairman Powell stated that the Fed would be patient about further increases and would be driven by economic data moving forward While short term rates increased, longer rates decreased during the year and the yield curve flattened substantially, extending the challenging environment faced by banks to expand the net interest margin While the rate environment has not had a significant impact on business and lending activity, management will devote significant attention to our efforts to generate deposit growth while managing the cost of funds in 2019 During 2018, two of our Directors, R Bruce Haner and Edward H Owlett, III, retired from the Board Having served for 20 years and 24 years respectively, Bruce and Ed have provided C&N with leadership, advice, and counsel throughout their tenures We thank them for their commitment and many contributions to C&N We also welcomed Bobbi Kilmer to the Board Bobbi has been the President & CEO of Claverack Rural Electric Cooperative since 2006 and comes to C&N with extensive business experience and knowledge of our regional markets She is also serving as the Chair of the Mansfield University Council of Trustees, one of her numerous community and professional volunteer activities We look forward to her insight and perspective as she contributes to C&N's future success To continue momentum into 2019, C&N will remain committed to developing our Team and our values-based culture and sustaining performance in our core franchise We are also excited to work through the integration activities with our partners at Monument Bank and pursue the opportunities presented by expanding into new markets We have an engaged and motivated Team that is focused on our mission of Creating Value Through Lifelong Relationships for our customers, communities, and shareholders I remain confident in their ability to be successful and grateful for their commitment to C&N Thank you to all of our shareholders for your confidence and continued support MOMENTUM: The Pursuit of Excellence 7

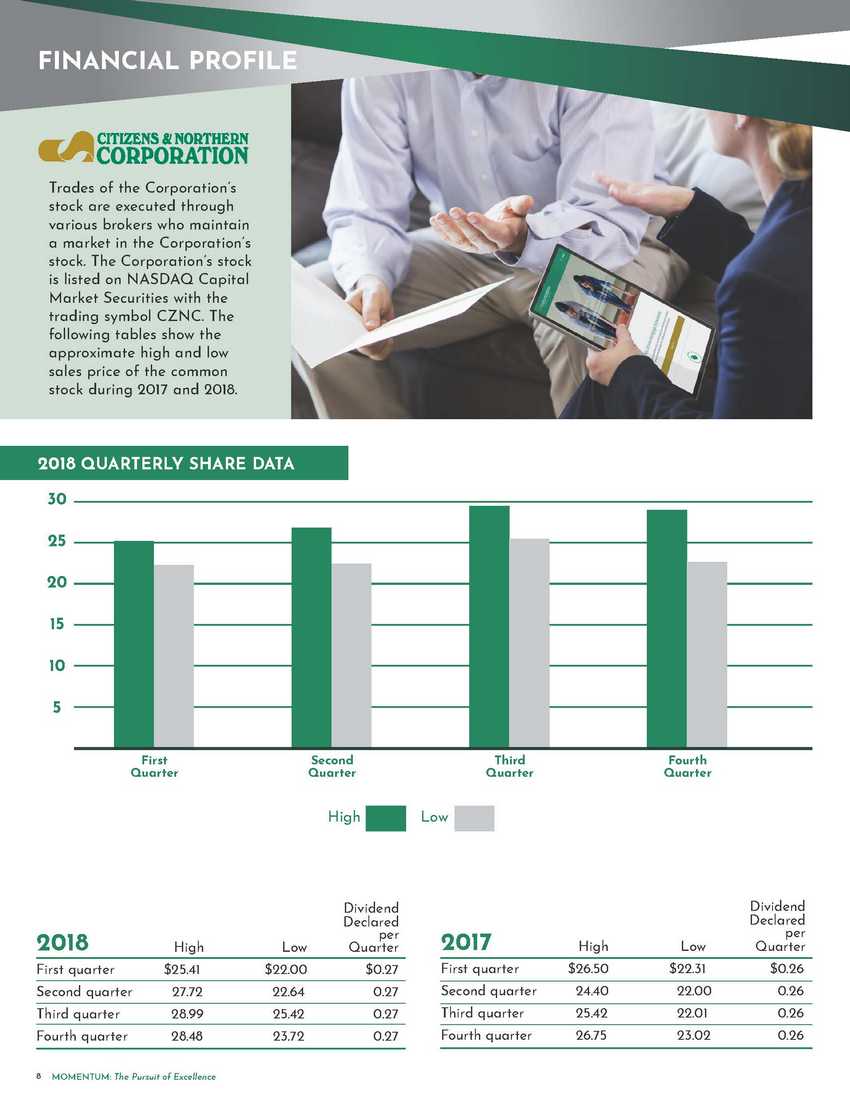

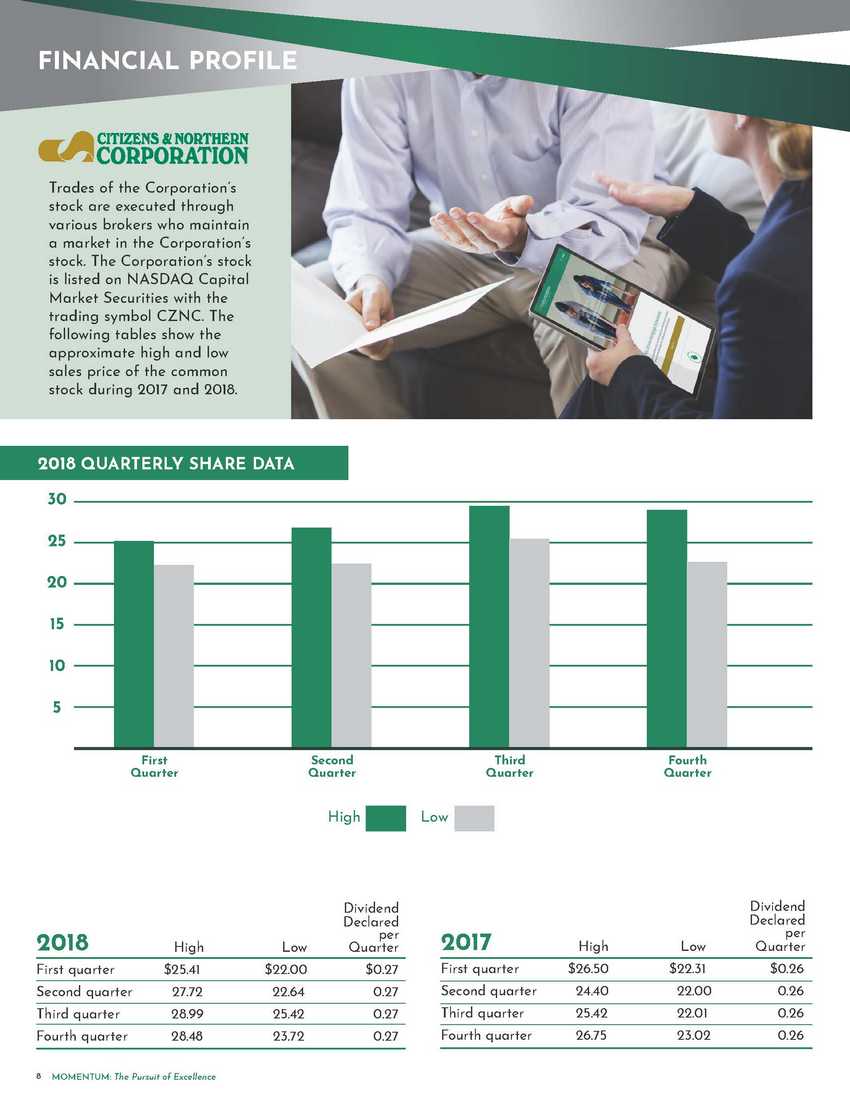

2018 QUARTERLY SHARE DATA 30 25 20 15 10 5 First Quarter Second Quarter High Low Third Quarter Fourth Quarter Dividend Declared Dividend Declared 2018 High Low per Quarter 2017 High Low per Quarter First quarter $25.41 $22.00 $0.27 First quarter $26.50 $22.31 $0.26 Second quarter 27.72 22.64 0.27 Second quarter 24.40 22.00 0.26 Third quarter 28.99 25.42 0.27 Third quarter 25.42 22.01 0.26 Fourth quarter 28.48 23.72 0.27 Fourth quarter 26.75 23.02 0.26 8 MOMENTUM: The Pursuit of Excellence

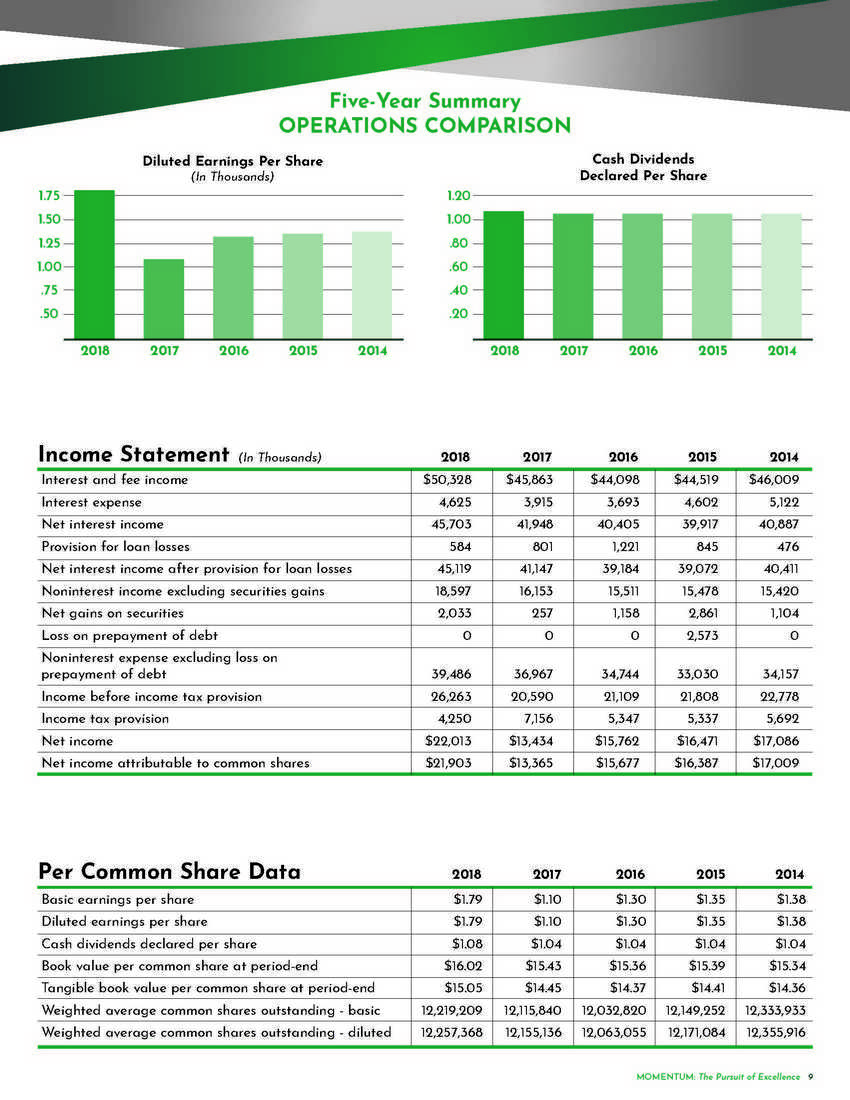

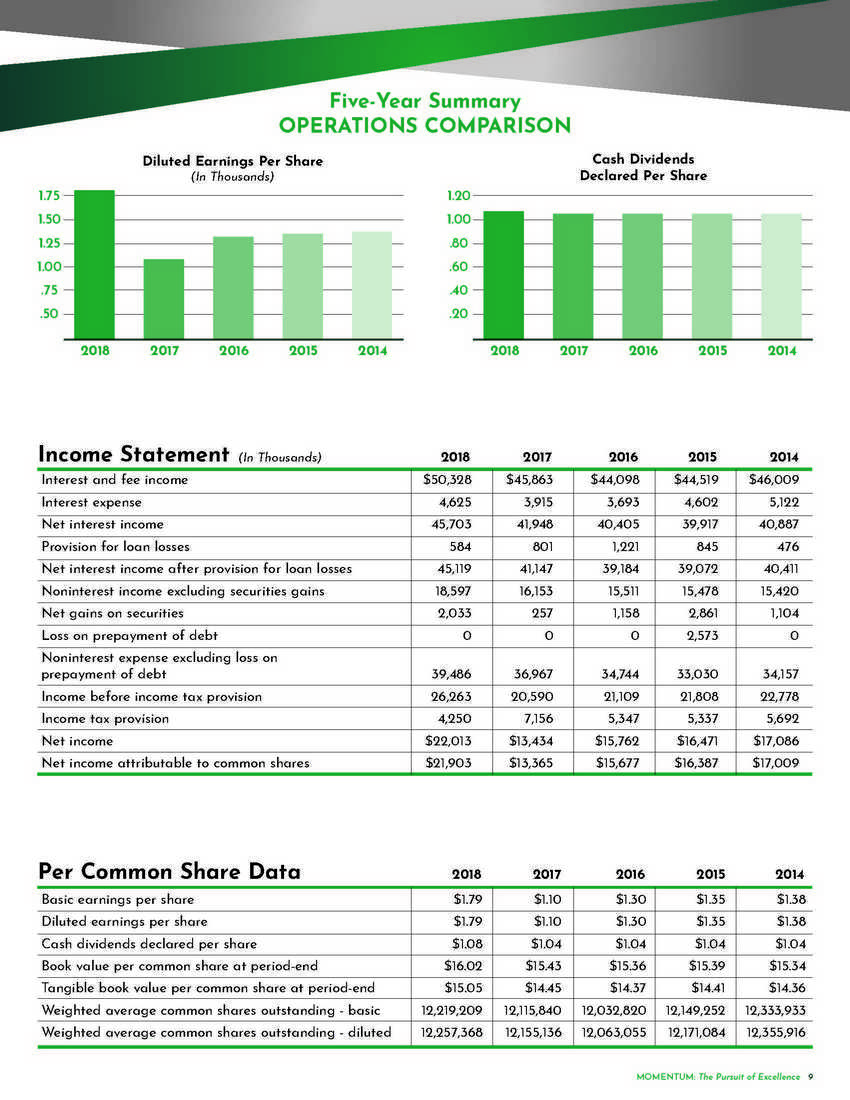

1.75 1.50 1.25 1.00 .75 .50 Diluted Earnings Per Share (In Thousands) 2018 2017 2016 2015 2014 1.20 1.00 .80 .60 .40 .20 Cash Dividends Declared Per Share 2018 2017 2016 2015 2014 Income Statement (In Thousands) 2018 2017 2016 2015 2014 Interest and fee income $50,328 $45,863 $44,098 $44,519 $46,009 Interest expense 4,625 3,915 3,693 4,602 5,122 Net interest income 45,703 41,948 40,405 39,917 40,887 Provision for loan losses 584 801 1,221 845 476 Net interest income after provision for loan losses 45,119 41,147 39,184 39,072 40,411 Noninterest income excluding securities gains 18,597 16,153 15,511 15,478 15,420 Net gains on securities 2,033 257 1,158 2,861 1,104 Loss on prepayment of debt 0 0 0 2,573 0 Noninterest expense excluding loss on prepayment of debt 39,486 36,967 34,744 33,030 34,157 Income before income tax provision 26,263 20,590 21,109 21,808 22,778 Income tax provision 4,250 7,156 5,347 5,337 5,692 Net income $22,013 $13,434 $15,762 $16,471 $17,086 Net income attributable to common shares $21,903 $13,365 $15,677 $16,387 $17,009 Per Common Share Data 2018 2017 2016 2015 2014 Basic earnings per share $1.79 $1.10 $1.30 $1.35 $1.38 Diluted earnings per share $1.79 $1.10 $1.30 $1.35 $1.38 Cash dividends declared per share $1.08 $1.04 $1.04 $1.04 $1.04 Book value per common share at period-end $16.02 $15.43 $15.36 $15.39 $15.34 Tangible book value per common share at period-end $15.05 $14.45 $14.37 $14.41 $14.36 Weighted average common shares outstanding - basic 12,219,209 12,115,840 12,032,820 12,149,252 12,333,933 Weighted average common shares outstanding - diluted 12,257,368 12,155,136 12,063,055 12,171,084 12,355,916 MOMENTUM: The Pursuit of Excellence 9

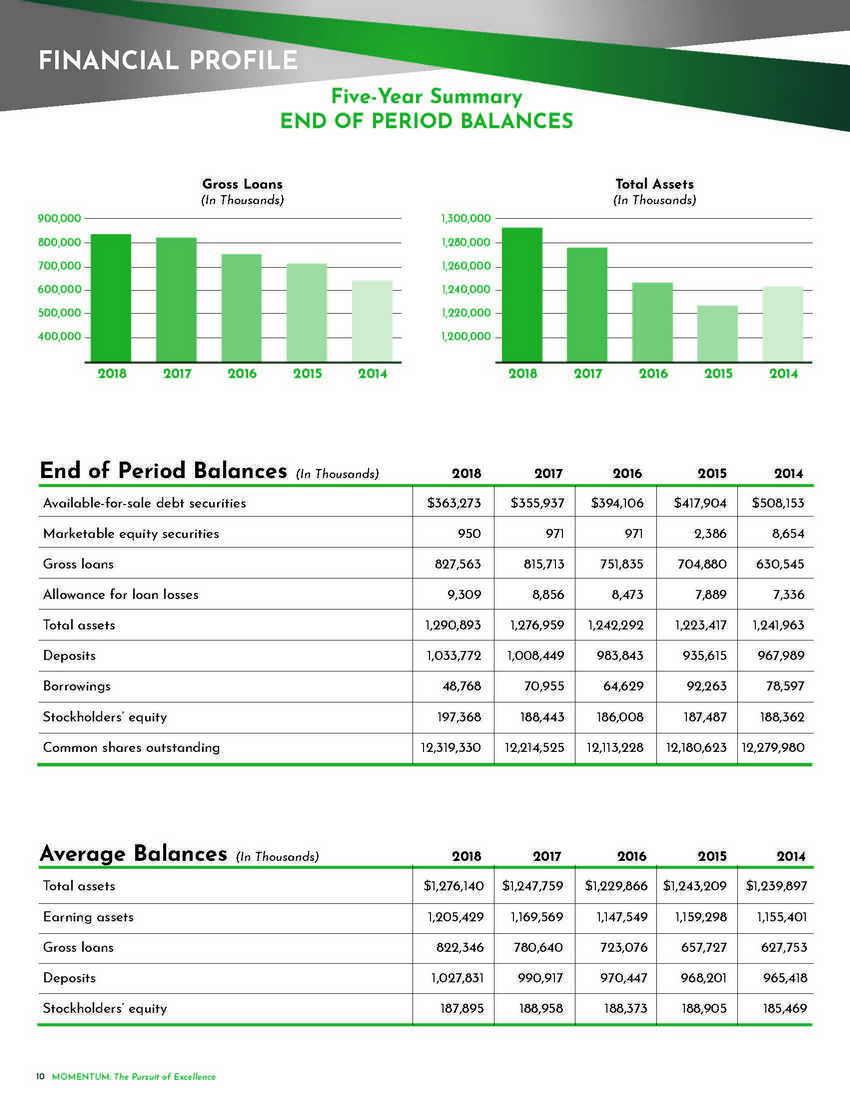

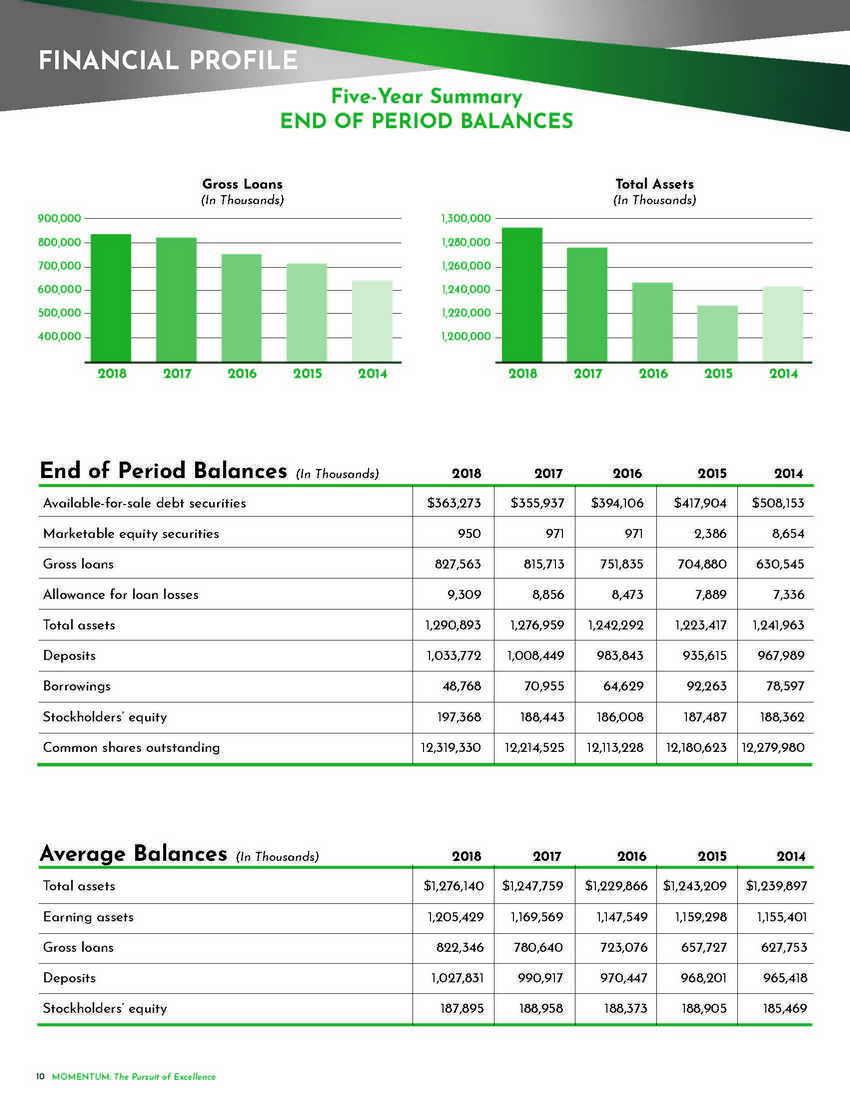

900,000 800,000 700,000 600,000 500,000 400,000 Gross Loans (In Thousands) 2018 2017 2016 2015 2014 1,300,000 1,280,000 1,260,000 1,240,000 1,220,000 1,200,000 Total Assets (In Thousands) 2018 2017 2016 2015 2014 End of Period Balances (In Thousands) 2018 2017 2016 2015 2014 Available-for-sale debt securities $363,273 $355,937 $394,106 $417,904 $508,153 Marketable equity securities 950 971 971 2,386 8,654 Gross loans 827,563 815,713 751,835 704,880 630,545 Allowance for loan losses 9,309 8,856 8,473 7,889 7,336 Total assets 1,290,893 1,276,959 1,242,292 1,223,417 1,241,963 Deposits 1,033,772 1,008,449 983,843 935,615 967,989 Borrowings 48,768 70,955 64,629 92,263 78,597 Stockholders' equity 197,368 188,443 186,008 187,487 188,362 Common shares outstanding 12,319,330 12,214,525 12,113,228 12,180,623 12,279,980 Average Balances (In Thousands) 2018 2017 2016 2015 2014 Total assets $1,276,140 $1,247,759 $1,229,866 $1,243,209 $1,239,897 Earning assets 1,205,429 1,169,569 1,147,549 1,159,298 1,155,401 Gross loans 822,346 780,640 723,076 657,727 627,753 Deposits 1,027,831 990,917 970,447 968,201 965,418 Stockholders' equity 187,895 188,958 188,373 188,905 185,469 10 MOMENTUM: The Pursuit of Excellence

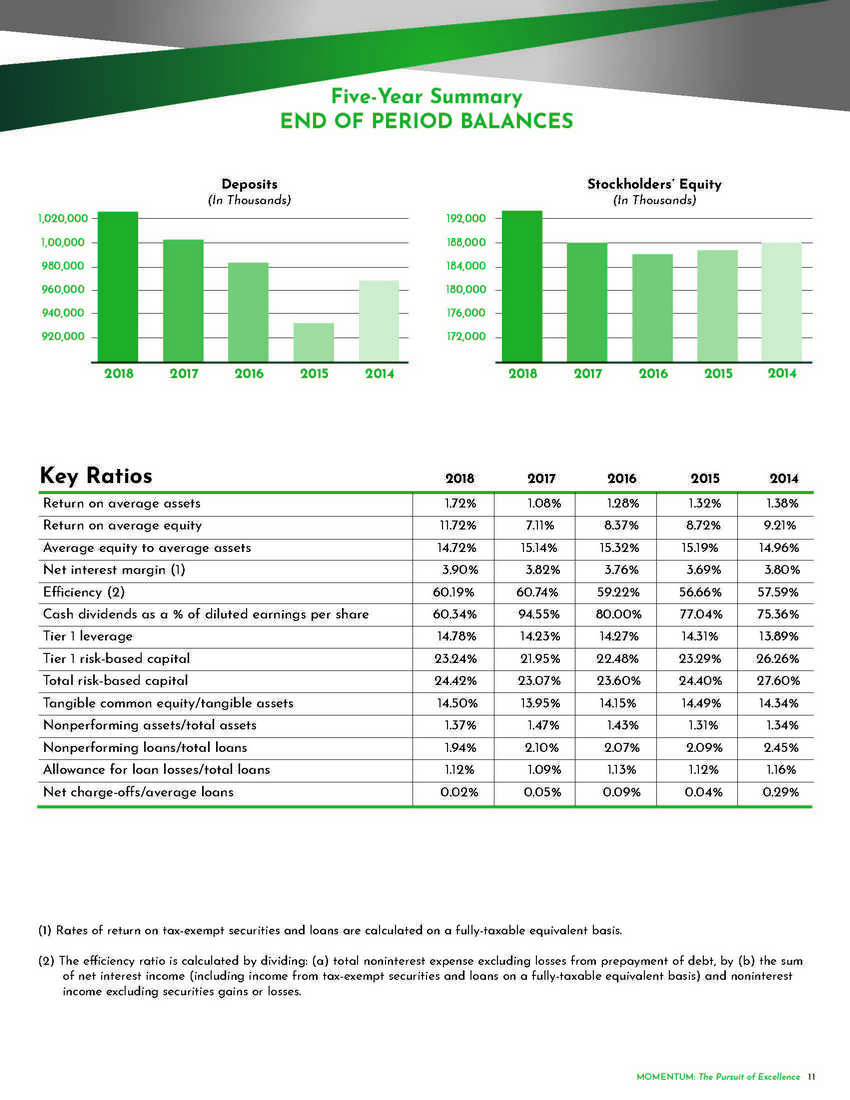

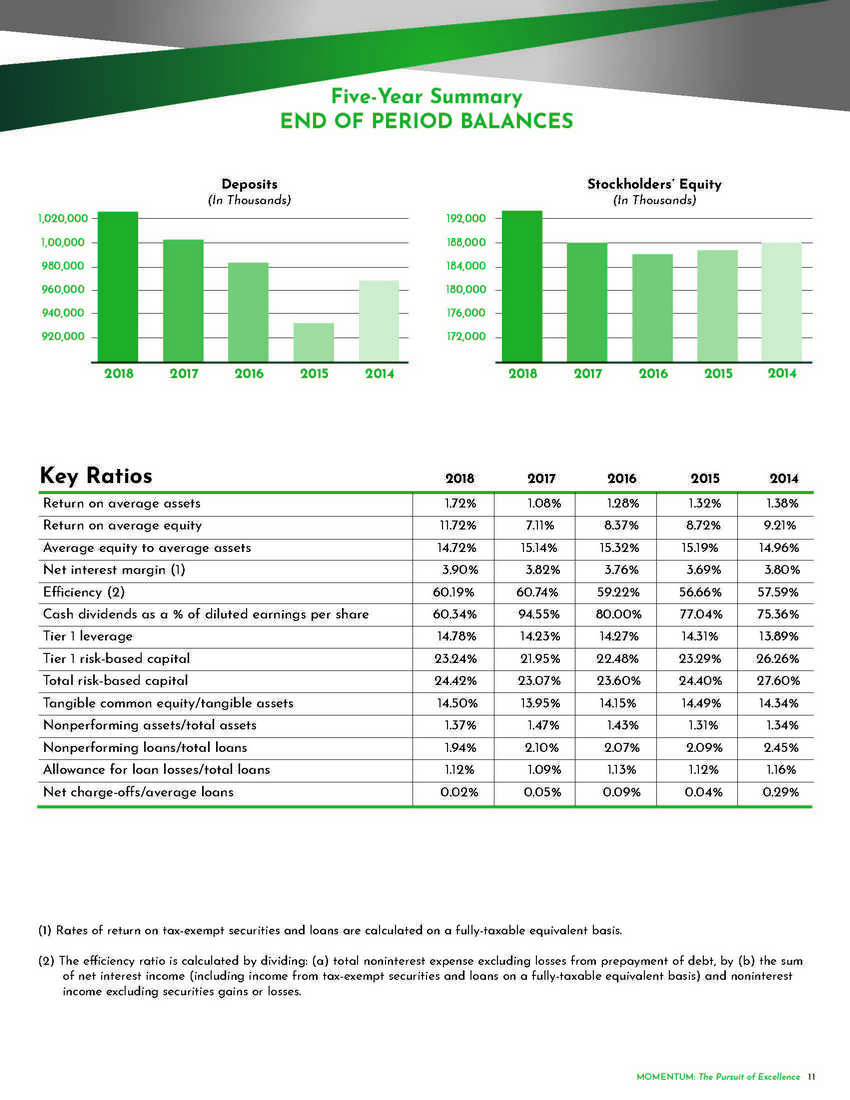

1,020,000 1,00,000 980,000 960,000 940,000 920,000 Deposits (In Thousands) 2018 2017 2016 2015 2014 192,000 188,000 184,000 180,000 176,000 172,000 Stockholders' Equity (In Thousands) 2018 2017 2016 2015 2014 Key Ratios 2018 2017 2016 2015 2014 Return on average assets 1.72% 1.08% 1.28% 1.32% 1.38% Return on average equity 11.72% 7.11% 8.37% 8.72% 9.21% Average equity to average assets 14.72% 15.14% 15.32% 15.19% 14.96% Net interest margin (1) 3.90% 3.82% 3.76% 3.69% 3.80% Efficiency (2) 60.19% 60.74% 59.22% 56.66% 57.59% Cash dividends as a % of diluted earnings per share 60.34% 94.55% 80.00% 77.04% 75.36% Tier 1 leverage 14.78% 14.23% 14.27% 14.31% 13.89% Tier 1 risk-based capital 23.24% 21.95% 22.48% 23.29% 26.26% Total risk-based capital 24.42% 23.07% 23.60% 24.40% 27.60% Tangible common equity/tangible assets 14.50% 13.95% 14.15% 14.49% 14.34% Nonperforming assets/total assets 1.37% 1.47% 1.43% 1.31% 1.34% Nonperforming loans/total loans 1.94% 2.10% 2.07% 2.09% 2.45% Allowance for loan losses/total loans 1.12% 1.09% 1.13% 1.12% 1.16% Net charge-offs/average loans 0.02% 0.05% 0.09% 0.04% 0.29% (1) Rates of return on tax-exempt securities and loans are calculated on a fully-taxable equivalent basis (2) The efficiency ratio is calculated by dividing: (a) total noninterest expense excluding losses from prepayment of debt, by (b) the sum of net interest income (including income from tax-exempt securities and loans on a fully-taxable equivalent basis) and noninterest income excluding securities gains or losses MOMENTUM: The Pursuit of Excellence 11

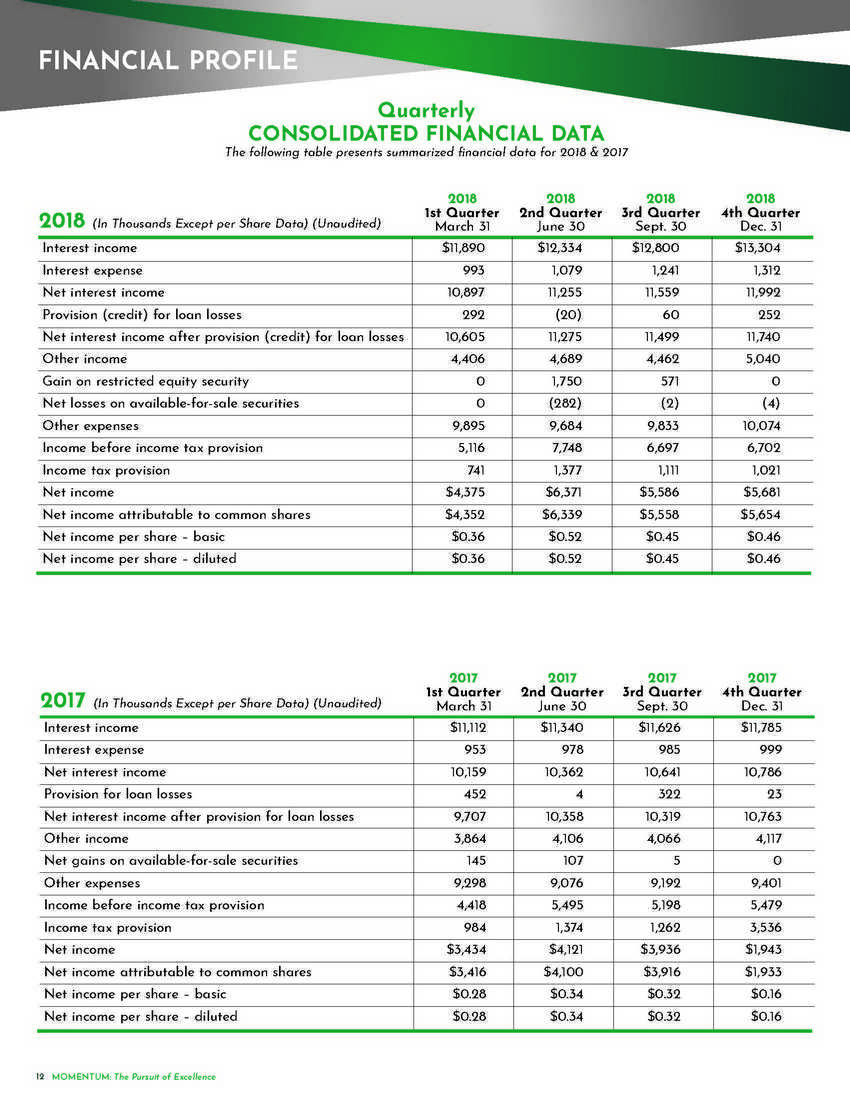

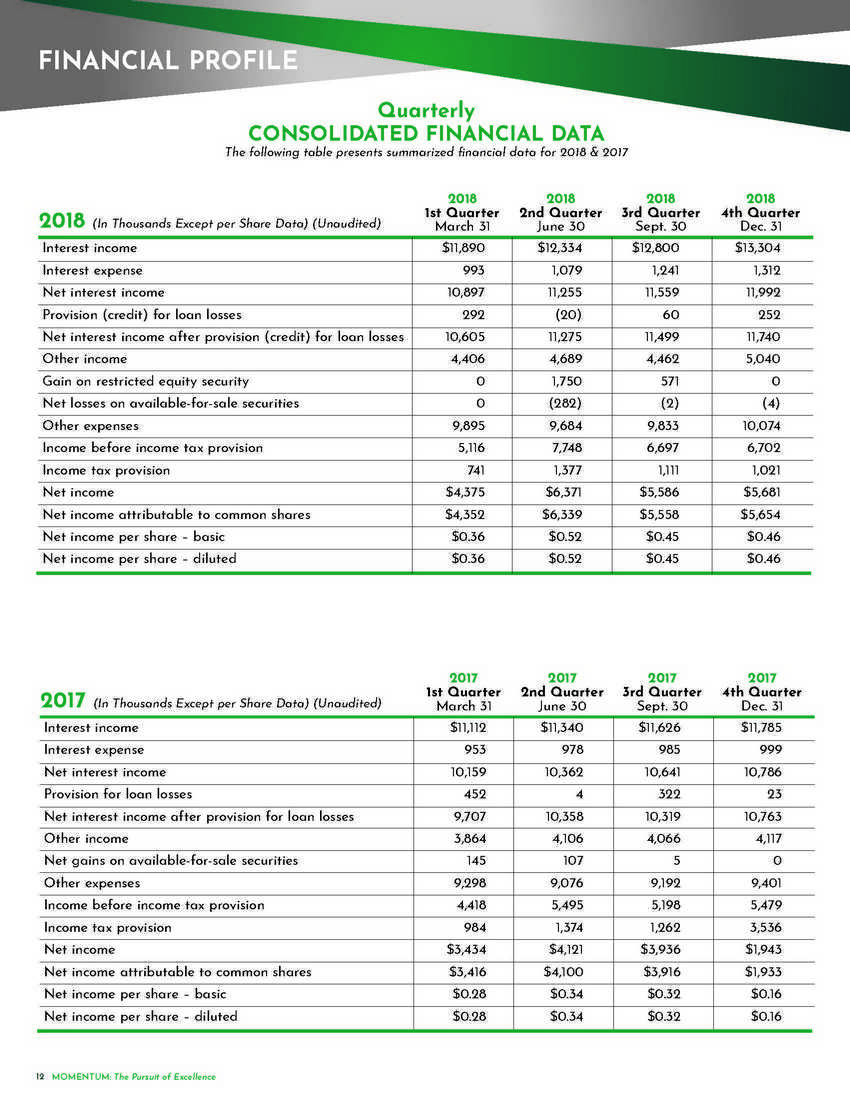

Quarterly CONSOLIDATED FINANCIAL DATA The following table presents summarized financial data for 2018 & 2017 2018 (In Thousands Except per Share Data) (Unaudited) 2018 2018 2018 2018 1st Quarter 2nd Quarter 3rd Quarter 4th Quarter March 31 June 30 Sept 30 Dec 31 Interest income $11,890 $12,334 $12,800 $13,304 Interest expense 993 1,079 1,241 1,312 Net interest income 10,897 11,255 11,559 11,992 Provision (credit) for loan losses 292 (20) 60 252 Net interest income after provision (credit) for loan losses 10,605 11,275 11,499 11,740 Other income 4,406 4,689 4,462 5,040 Gain on restricted equity security 0 1,750 571 0 Net losses on available-for-sale securities 0 (282) (2) (4) Other expenses 9,895 9,684 9,833 10,074 Income before income tax provision 5,116 7,748 6,697 6,702 Income tax provision 741 1,377 1,111 1,021 Net income $4,375 $6,371 $5,586 $5,681 Net income attributable to common shares $4,352 $6,339 $5,558 $5,654 Net income per share - basic $0.36 $0.52 $0.45 $0.46 Net income per share - diluted $0.36 $0.52 $0.45 $0.46 2017 (In Thousands Except per Share Data) (Unaudited) 2017 2017 2017 2017 1st Quarter 2nd Quarter 3rd Quarter 4th Quarter March 31 June 30 Sept 30 Dec 31 Interest income $11,112 $11,340 $11,626 $11,785 Interest expense 953 978 985 999 Net interest income 10,159 10,362 10,641 10,786 Provision for loan losses 452 4 322 23 Net interest income after provision for loan losses 9,707 10,358 10,319 10,763 Other income 3,864 4,106 4,066 4,117 Net gains on available-for-sale securities 145 107 5 0 Other expenses 9,298 9,076 9,192 9,401 Income before income tax provision 4,418 5,495 5,198 5,479 Income tax provision 984 1,374 1,262 3,536 Net income $3,434 $4,121 $3,936 $1,943 Net income attributable to common shares $3,416 $4,100 $3,916 $1,933 Net income per share - basic $0.28 $0.34 $0.32 $0.16 Net income per share - diluted $0.28 $0.34 $0.32 $0.16 12 MOMENTUM: The Pursuit of Excellence

2018 2017 2016 2015 2014 2018 2017 2016 2015 2014 Trust & Financial Management (In Thousands) 2018 2017 2016 2015 2014 Assets $862,517 $916,580 $879,844 $814,788 $825,918 Revenue $5,838 $5,399 $4,760 $4,626 $4,490 Investments (In Thousands) 2018 2017 2016 Mutual Funds $506,201 $536,731 $507,473 Stocks 172,695 194,099 179,345 Bonds 103,037 104,184 100,249 Savings and money market funds 68,129 69,659 80,860 Miscellaneous 6,798 6,069 6,864 Real Estate 5,517 5,681 4,876 Mortgages 140 157 177 Total $862,517 $916,580 $879,844 Accounts (In Thousands) 2018 2017 2016 Pension/profit sharing $342,501 $374,499 $369,916 Investment management 256,430 256,348 223,737 Trusts 176,428 185,300 177,860 Custody 79,786 93,598 98,844 Estates 4,941 4,397 7,367 Guardianships 2,431 2,438 2,120 Total $862,517 $916,580 $879,844 Some products are not FDIC insured or guaranteed, not a deposit or other obligation of the bank, not guaranteed by the bank and are subject to investment risk, including possible loss of the principal amount invested and are not insured by any other federal government agency MOMENTUM: The Pursuit of Excellence 13

Hannah J Jackson, Robert Baker, Leslie Fassett - Monroeton Branch Giving Back, Giving Together 2018 Giving Back, Giving Together (GBGT) began in March of 2015 as an employee-driven effort to create a positive and lasting impact on our local communities While we were optimistic about the new program, we never expected it to gain this much momentum so quickly or to have such a substantial impact In the first four years, our team members raised $248,938 in monetary donations, collected 17,701 item donations and volunteered their time on 434 occasions For 2018, our employees voted to support education and literacy in our communities through partnerships with 23 local public libraries Public libraries strengthen our communities by providing unique opportunities for children and adults to learn, network, connect with one another and access resources that may not be available to them otherwise Throughout the year, our teams have organized fundraisers and volunteer outings and collected donations for our libraries Fundraisers were primarily done during designated event weeks occurring the last week of each quarter On June 25, we held our largest fundraising event of the year, our 3rd annual C&N Charity Classic golf tournament, which raised over $15,000 We finished the year with over $65,417 in monetary donations, 3,339 items donated and volunteered on 35 occasions We sincerely appreciate the time and effort our teammates put into this program The success of GBGT is a direct reflection of the character of our employees and their commitment to their communities We also thank our customers, community members, business partners and our local public libraries for sharing in our passion to give back to the communities we serve For 2019, C&N employees voted to take on another worthy cause that will make a positive and lasting impact in the community: Honoring our Military Veterans This year, C&N will raise funds and awareness for local organizations that provide services for our nation's heroes 14 MOMENTUM: The Pursuit of Excellence

C&N President and CEO, Brad Scovill with representatives from the Wimodaughsian Free Library (Canisteo, NY), Howard Public Library, Knoxville Public Library, Blossburg Memorial Library, Monroeton Public Library, Towanda Public Library, Green Free Library (Wellsboro, PA), Bradford County Library (Troy, PA), Coudersport Library, Roulette Library, SW Smith Memorial Public Library (Port Allegany, PA), Allen F Pierce Free Library (Troy, PA) and the Mansfield Free Public Library with their C&N GBGT Team Captains Julie Wilson and Janelle Tombs volunteered at The Green Free Library in Wellsboro for their Libraries Rock Summer Program for kids Will Holmes and Ellen Conboy volunteered to help at the Allen F Pierce Library for their Holiday Book Sale If you would like to join us in support of this year's cause " Share & Like C&N's #GivingBackGivingTogether Facebook posts We donate $1 for every like & share to our libraries " Volunteer with us! Our teams coordinate with their local libraries to be directly involved " Visit us during our event weeks, when our offices coordinate on-site events, including fundraisers, book drives and other activities: o March 25 - 29 o September 23 - 28 o June 24 - 29 o December 9 - 14 o Spread the word! MOMENTUM: The Pursuit of Excellence 15

IMPACT PLAYER AWARDS The IMPACT Award recognizes six employees based not only performance but commitment The recipients of this award not only made measurable progress, but uphold our C&N values in their interactions at every opportunity FALL AWARD WINNERS (from left): Lori Brown, Trust Officer, Towanda; Katie Ackley, Admin Support, Wellsboro; Caitlin Hilliard, Marketing, Wellsboro; Karen Blackwell, Lending Quality Control, Wellsboro; Lisa Cook, Community Office Manager, Tioga; Denise Manley, Treasury Management, Wellsboro SPRING AWARD WINNERS (from left): Holly Young, Trust Administrative Asst., Wellsboro; Cindy Raub, Customer Service Rep, Sayre; Bob Miller, Facilities Management, Wellsboro; Cindy Carll, Commercial Lending Support Spec., Coudersport; Sara Heatley, Internal Auditor, Wellsboro; Amanda Reed, Video Client Contact Specialist Team Leader, Wellsboro 16 MOMENTUM: The Pursuit of Excellence

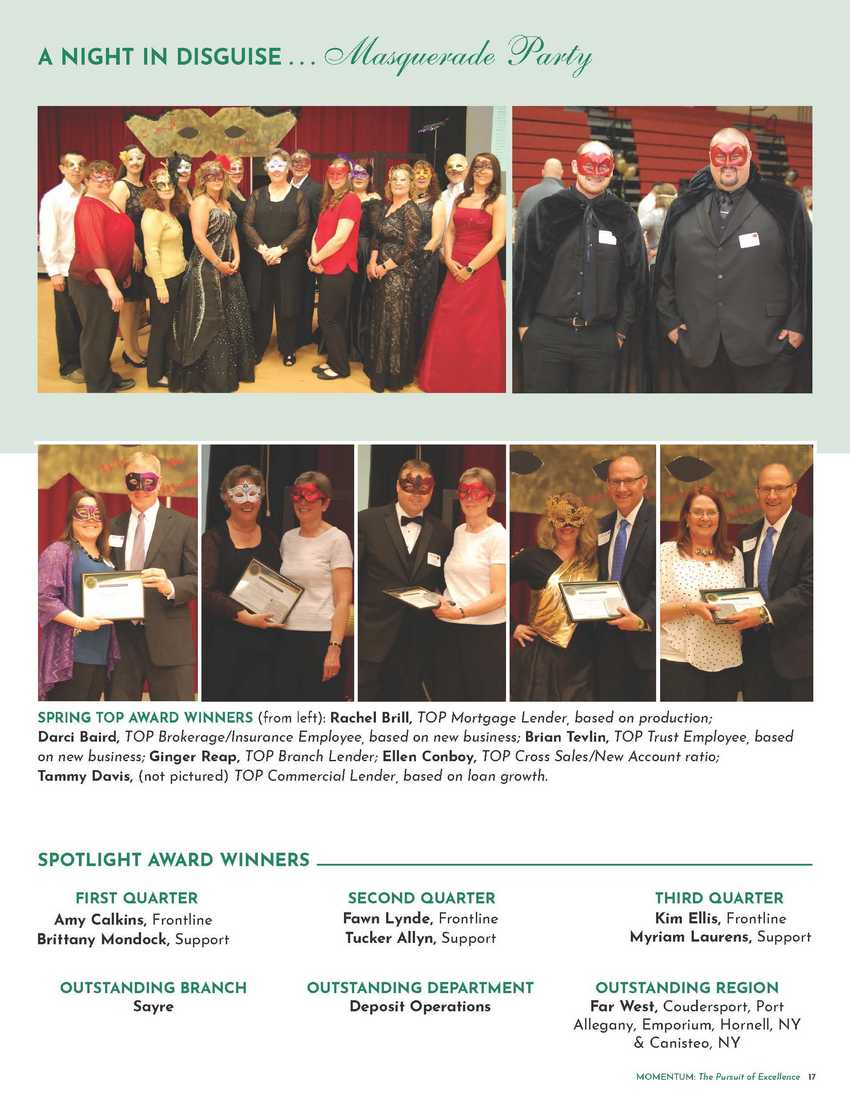

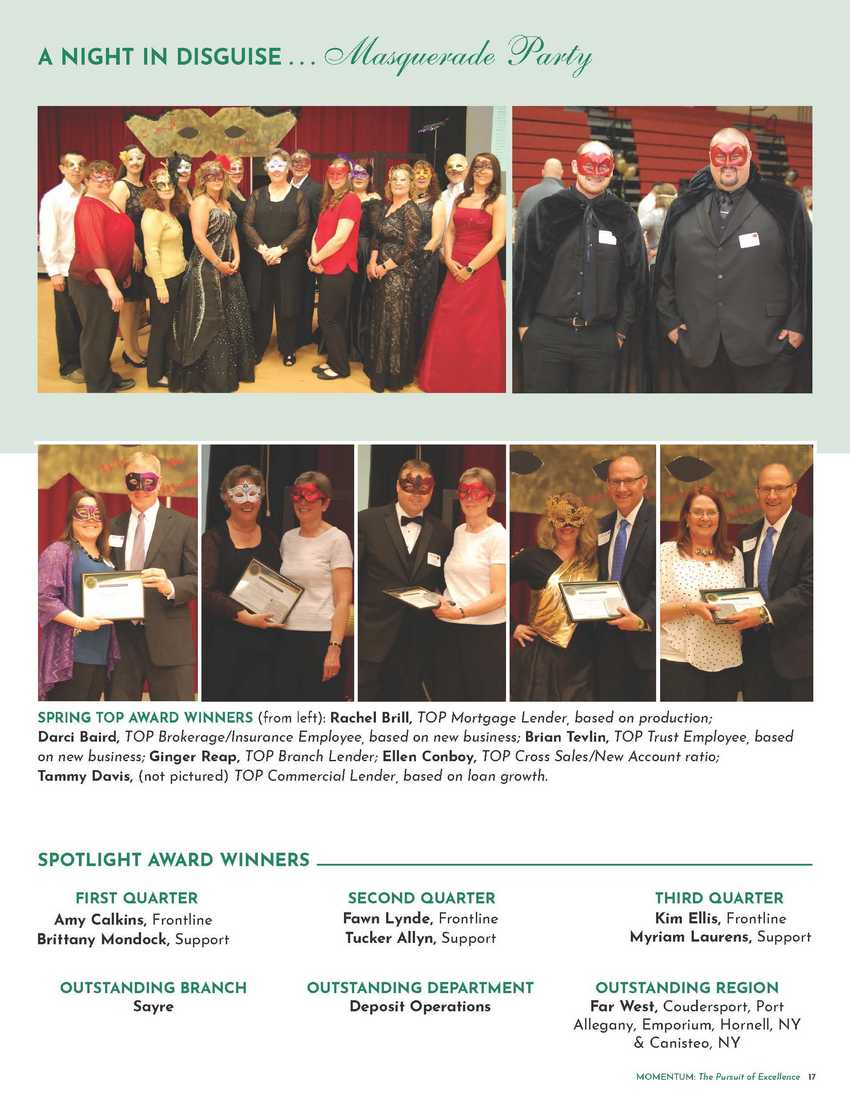

A NIGHT IN DISGUISE Masquerade Party SPRING TOP AWARD WINNERS (from left): Rachel Brill, TOP Mortgage Lender, based on production; Darci Baird, TOP Brokerage/Insurance Employee, based on new business; Brian Tevlin, TOP Trust Employee, based on new business; Ginger Reap, TOP Branch Lender; Ellen Conboy, TOP Cross Sales/New Account ratio; Tammy Davis, (not pictured) TOP Commercial Lender, based on loan growth SPOTLIGHT AWARD WINNERS FIRST QUARTER SECOND QUARTER THIRD QUARTER Amy Calkins, Frontline Brittany Mondock, Support Fawn Lynde, Frontline Tucker Allyn, Support Kim Ellis, Frontline Myriam Laurens, Support OUTSTANDING BRANCH Sayre OUTSTANDING DEPARTMENT Deposit Operations OUTSTANDING REGION Far West, Coudersport, Port Allegany, Emporium, Hornell, NY & Canisteo, NY MOMENTUM: The Pursuit of Excellence 17

30 YEARS OF SERVICE Dianne Zimmerman, Loan Servicing Boarder, Wellsboro 25 YEARS OF SERVICE Leslie Raymond, Customer Service Representative, Towanda Wendy Smith, Deposit Operations Team Leader, Wellsboro 20 YEARS OF SERVICE Peter Boergermann, VP/ IT Support Manager & Information Security Officer Victoria Harrison, Community Office Manager, Canisteo Deborah Scott, EVP / Trust Division Director, Wellsboro 15 YEARS OF SERVICE Donna Bowers, Customer Transaction Specialist, Tioga Marla McIlvain, AVP / Trust Officer, Wellsboro Christopher Rell, AVP / Senior Appraiser, Jersey Shore Sharlene Wagner, Loan Servicing Escrow & Flood, Wellsboro Tracy Watkins, EVP / Director of Human Resources, Wellsboro Amy Wherley, Treasury & Reconciliation Accountant, Wellsboro Nadine Wingrove, Commercial Document Preparation Specialist, Williamsport 10 YEARS OF SERVICE Candace Bower, Trust Administrative Assistant, Williamsport Cassie Brelo, AVP / Branch Operations Coordinator, Wellsboro Laeken Cook, Staff Auditor, Wellsboro Chrissi Hume, VP / Treasury Management Coordinator, Wellsboro, Sara Heatley, Internal Auditor, Wellsboro Rebecca Rodriguez, Deposit Operations Representative, Wellsboro Michael Strahota, Mortgage Loan Post Closer, Wellsboro 5 YEARS OF SERVICE Linda Bowen, Loan Specialist Assistant, Sayre Rachel Brill, Mortgage Loan Sales Officer, Sayre Julianne Burlison, Compensation & Performance Manager, Wellsboro Kori Casselberry, Mortgage Loan Underwriter Team Leader, Wellsboro Felicia Crumb, Deposit Operations Representative, Wellsboro Kim Ellis, Customer Transaction Specialist, Athens Patricia Ibach, Credit Analyst, Wellsboro Amy Long, Trust Support Manager, Wellsboro Wesley O'Neil, Community Office Manager, Elkland Amanda Reed, Video Client Contact Specialist Team Leader, Wellsboro Lynne Smith, AVP / Tax Officer, Wellsboro Faith Sonnema, Customer Transaction Specialist, Sayre Lorri Stocum, Customer Service Representative, Wellsboro Amy VanBlarcom-Lackey, VP / Senior Commercial Loan Sales Officer/Manager), Towanda Joshua Wooten, Cash Desk Specialist, Wellsboro May Recipients: (from left)- Wesley O'Neil, Linda Bowen, Leslie Raymond, Julianne Burlison, Brad Scovill, and Sharlene Wagner June Recipients: (from left) Nadine Wingrove, Brad Scovill, Candace Bower, Patricia Ibach, Laeken Cook, Kim Ellis and Rachel Brill August Recipients: (from left) Michael Strahota, Chrissi Copp, Brad Scovill, Janet Watters, Joshua Wooten, Donna Bowers and Peter Boergermann December Recipients: Left to Right - Diane Zimmerman, Christopher Rell, Lorri Stocum, Felicia Crumb and Victoria Harrison 18 MOMENTUM: The Pursuit of Excellence

TERESA (TERI ) L MITCHELL SCHOLARSHIP Award Winners From Left: Tracy Rooke, Angela Harlow, Sonya Route, Caitlin Hilliard, Ashley White, Michelle Rae, Patty Groover, Shelley D'Haene and Tracy Watkins Citizens & Northern Bank recently awarded seven employees with the Teresa (Teri) L Mitchell Scholarship This scholarship is a legacy scholarship that keeps the spirit of Teri and her dedication to C&N alive by providing employees with paid attendance to the PA Bankers Association's Women in Banking Conference The recipients of this award were: o Angela Harlow, Community Office Manager in Knoxville o Ashley White, Customer Transaction Specialist in Wysox o Caitlin Hilliard, Marketing & Communication Specialist in Wellsboro o Michelle Rae, Mortgage Loan Sales Officer in Towanda o Patty Groover, Client Contact Center Manager in Wellsboro o Sonya Route, Compliance & BSA Coordinator in Wellsboro o Tracy Rooke, Trust Administrative Assistant in Coudersport Also in attendance were Shelley D'Haene, Senior Operations Officer, and Tracy Watkins, Director of Human Resources The scholarship was started in memoriam of Teresa L Mitchell, a dedicated C&N employee for 37 years, to award educational opportunities to those employees who display commitment to their ongoing professional development and a strong work ethic RETIREES 47 Years of Service | Joan Blackwell Community Office Manager, Liberty 25 Years of Service | Cindy Black Customer Service Representative, Ralston 20 Years of Service | Janet Watters Customer Service Representative, Mansfield 17 Years of Service | Laura Losinger Customer Service Representative, Knoxville 13 Years of Service | Carol Ellenberger Customer Service Representative, Canisteo MOMENTUM: The Pursuit of Excellence 19

BRANCH LOCATIONS Athens .428 S Main Street Canisteo 3 Main Street Coudersport 10 N Main Street Dushore 111 W Main Street East Smithfield 563 Main Street Elkland 104 Main Street Emporium 135 East Fourth Street Hornell 6250 County Route 64 Jersey Shore 230 Railroad Street Knoxville 102 East Main Street Laporte 514 Main Street Liberty 4534 Williamson Trail Mansfield 1085 Main Street Monroeton 612 James Monroe Avenue Muncy 3461 Route 405 Highway Old Lycoming 1510 Dewey Avenue Port Allegany .100 Maple Street Sayre 1827 Elmira Street South Williamsport 2 East Mountain Avenue Tioga .41 N Main Street Towanda 428 Main Street Troy .64 Elmira Street Wellsboro 90-92 Main Street Williamsport 130 Court Street Wysox 1467 Golden Mile Road Loan Production Office Elmira 250 E Water Street York 2951 Whiteford Road CONTACT INFORMATION Client Contact Center 877-838-2517 Online Banking 877-838-2517 Telephone Banking .877-622-5526 C&N FINANCIAL SERVICES Wellsboro .866-ASK-CNFS Coudersport 814-274-1929 TRUST AND FINANCIAL MANAGEMENT GROUP Wellsboro 800-487-8784 Sayre 888-760-8192 Towanda 888-987-8784 Williamsport 866-732-7213 Canisteo 607-698-4295 Coudersport 814-274-1929 DIGITAL CONNECTIONS Email ContactCN@cnbankpa.com On the Web www.cnbankpa.com Facebook Facebook.com/citizensandnorthernbank Linkedin Linkedin.com/company/ citizens-&-northern-bank Twitter .@cnbankpa STOCKHOLDER INQUIRIES A copy of the Corporation's Annual Report on Form 10-K for the year ended December 31, 2018, as required to be filed with the Securities and Exchange Commission, will be furnished to any stockholder without charge upon written request to the Corporation's treasurer at our principal office at P.O Box 58, Wellsboro, PA 16901 The information is also available through the Citizens & Northern Bank website at www.cnbankpa.com and the website of the Securities and Exchange Commission at www.sec.gov This statement has not been reviewed or confirmed for accuracy or relevance by the Federal Deposit Insurance Corporation INVESTOR INFORMATION The annual meeting of shareholders will be held at the Deane Center, 104 Main Street in Wellsboro, PA at 2:00 p.m Thursday, April 18, 2019 General shareholder inquiries should be sent to Citizens & Northern Corporation, 90- 92 Main Street, P.O Box 58, Wellsboro, PA 16901 Our Stock Transfer Agent is American Stock Transfer & Trust Company, 6201 15th Avenue, Brooklyn, NY 11219 Telephone: 800-278-4353 Our independent auditors are Baker Tilly Virchow Krause, LLP, 400 Market Street, Williamsport, PA 17701 20 MOMENTUM: The Pursuit of Excellence

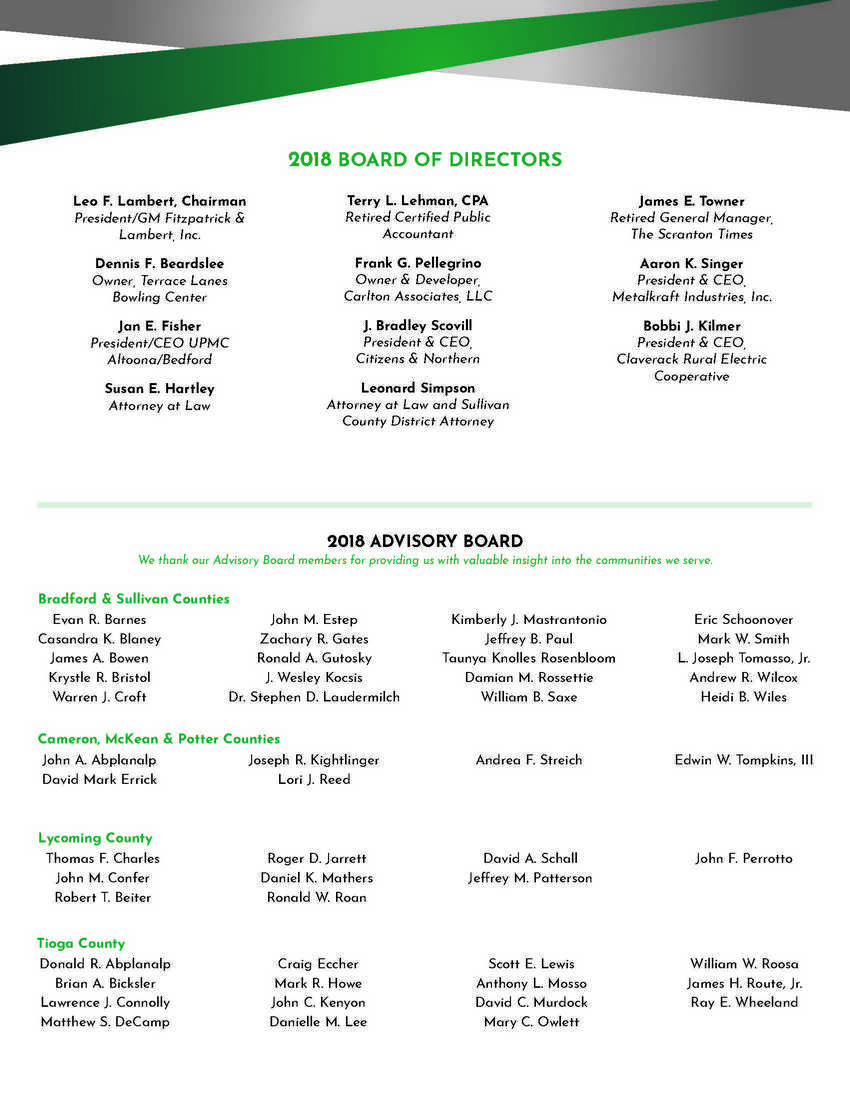

2018 BOARD OF DIRECTORS Leo F Lambert, Chairman President/GM Fitzpatrick & Lambert, Inc Dennis F Beardslee Owner, Terrace Lanes Bowling Center Jan E Fisher President/CEO UPMC Altoona/Bedford Susan E Hartley Attorney at Law Terry L Lehman, CPA Retired Certified Public Accountant Frank G Pellegrino Owner & Developer, Carlton Associates, LLC J Bradley Scovill President & CEO, Citizens & Northern Leonard Simpson Attorney at Law and Sullivan County District Attorney James E Towner Retired General Manager, The Scranton Times Aaron K Singer President & CEO, Metalkraft Industries, Inc Bobbi J Kilmer President & CEO, Claverack Rural Electric Cooperative 2018 ADVISORY BOARD We thank our Advisory Board members for providing us with valuable insight into the communities we serve Bradford & Sullivan Counties Evan R Barnes Casandra K Blaney James A Bowen Krystle R Bristol John M Estep Zachary R Gates Ronald A Gutosky J Wesley Kocsis Kimberly J Mastrantonio Jeffrey B Paul Taunya Knolles Rosenbloom Damian M Rossettie Eric Schoonover Mark W Smith L Joseph Tomasso, Jr Andrew R Wilcox Warren J Croft Dr Stephen D Laudermilch William B Saxe Heidi B Wiles Cameron, McKean & Potter Counties John A Abplanalp David Mark Errick Joseph R Kightlinger Lori J Reed Andrea F Streich Edwin W Tompkins, III Lycoming County Thomas F Charles John M Confer Robert T Beiter Roger D Jarrett Daniel K Mathers Ronald W Roan David A Schall Jeffrey M Patterson John F Perrotto Tioga County Donald R Abplanalp Brian A Bicksler Lawrence J Connolly Matthew S DeCamp Craig Eccher Mark R Howe John C Kenyon Danielle M Lee Scott E Lewis Anthony L Mosso David C Murdock Mary C Owlett William W Roosa James H Route, Jr Ray E Wheeland

Vision Every customer says "C&N is the ONLY bank I need." Mission Creating value through lifelong relationships with our customers, our teammates, our shareholders and our communities as their resource for customized financial solutions, expertise and partnership Values Teamwork Respect Responsibility & Accountability Excellence Integrity Client-Focus Have Fun c/o American Stock Transfer & Trust Company, LLC 6201 15th Avenue o Brooklyn, NY 11219 www.cnbankpa.com ContactCN@cnbankpa.com Trust@cnbankpa.com Contact Center/ Internet Banking: 1-877-838-2517 Trust & Financial Management Group: 1-800-487-8784 C&N Financial Services: 1-866-ASK-CNFS Telephone Banking: 1-877-622-5526