Exhibit 99.10

Communications

9th Floor, Edmonton Federal Building

9820 – 107 Street NW

Edmonton, Alberta, T5K 1E7

Telephone: (780) 427-5364

Toll-free within Alberta: 310-0000 then (780) 427-5364

E-mail: TBF.Communications@gov.ab.ca

For electronic copies of Budget 2018: Fiscal Plan

visit our website at:

www.alberta.ca/budget-documents.aspx

ISBN 978-1-4601-3833-5 (Print)

ISBN 978-1-4601-3834-2 (Electronic PDF)

ISSN 2369-0119 (Print)

ISSN 2369-0127 (Online)

Copyright © 2018 President of Treasury Board and Minister of Finance and its licensors. All rights reserved.

2018–21

Fiscal Plan

| | |

| | PRESENTED BY JOE CECI PRESIDENT OF TREASURY BOARD AND MINISTER OF FINANCE in the Legislative Assembly of Alberta March 22, 2018 |

Accountability Statement

The government’s Fiscal Plan for the three years commencing April 1, 2018 was prepared under my direction in accordance with the Fiscal Planning and Transparency Act and the government’s accounting policies. All of the government’s policy decisions as of March 7, 2018 with material economic or fiscal implications have been considered in preparing the three-year Fiscal Plan.

Original signed by

Joe Ceci

President of Treasury Board and Minister of Finance

March 15, 2018

2 FISCAL PLAN 2018 – 21

Fiscal Plan 2018 – 21

| | | | |

Overview | | | 4 | |

| |

Expense | | | 16 | |

| |

Revenue | | | 41 | |

| |

Capital Plan | | | 55 | |

| |

Path to Balance | | | 68 | |

| |

Economic Outlook | | | 85 | |

| |

Tax Plan | | | 116 | |

| |

Fiscal Plan Tables | | | 131 | |

| |

Response to the Auditor General | | | 151 | |

NOTE: Amounts presented in tables and charts may not add to totals due to rounding.

Fiscal Plan

Overview

Table of Contents

OVERVIEW

| | | | |

A Recovery Built to Last | | | 6 | |

| |

Diversifying the Economy | | | 6 | |

| |

Protecting Vital Public Services | | | 8 | |

| |

Returning to Balance | | | 9 | |

| |

Revenue | | | 11 | |

| |

Expense | | | 11 | |

| |

Energy and Economic Assumptions | | | 13 | |

| |

Capital Plan | | | 14 | |

| |

Gender Budgeting | | | 15 | |

| | |

| FISCAL PLAN 2018 – 20 • OVERVIEW | | 5 |

Overview

A Recovery Built to Last

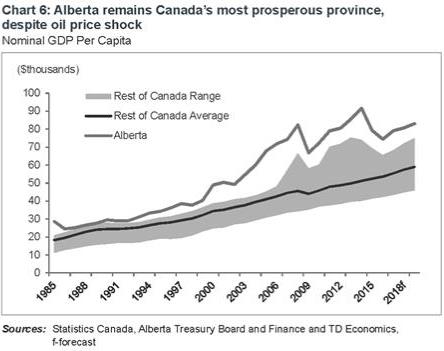

After the worst recession in a generation, things are looking up. Jobs are up, the deficit is down, and Alberta’s economy is growing faster than anywhere in Canada.

Budget 2018 is focused squarely on extending the recovery to all Albertans and continuing to build a more resilient, diversified and stable economy that is less vulnerable to oil price shocks - a recovery that is built to last for working people.

The plan is built on three pillars:

| ∎ | | Diversifying the Economy – fighting for market access, adding value to our energy products and supporting new and developing industries. |

| ∎ | | Protecting Vital Public Services – making sure loved ones get the care they need, young people get the best education possible, and no one is left behind. |

| ∎ | | Returning to Balance – investing tax dollars where they are needed most, eliminating waste, and controlling spending to return to balance by 2023-24. |

Diversifying the Economy

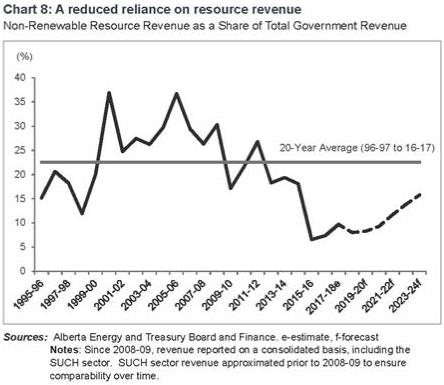

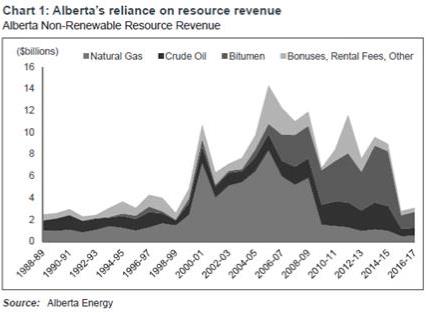

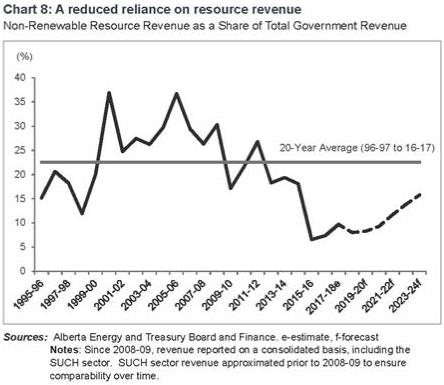

A growing and diverse economy benefits all Albertans. It supports job creation and helps move Alberta off the resource revenue rollercoaster. While government continues to fight for market access, Budget 2018 includes a range of initiatives to add value to our energy products and support developing industries. These programs stimulate growth across sectors, support job creation and open doors for entrepreneurs to start and expand a business.

DIVERSIFICATION WITHIN THE ENERGY SECTOR

As we work to get needed pipelines built to access new markets and get better value for our resources, we will also do more to add value to our resources right here at home.

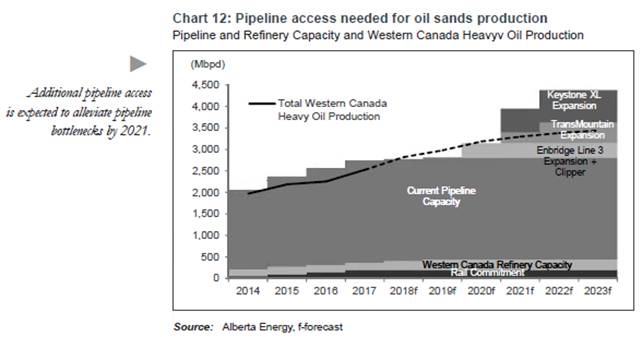

| ∎ | | $1 billion for partial upgrading over eight years beginning in 2019-20, which includes a variety of tools such as loan guarantees and grants. Partial upgrading allows oil sands bitumen to flow through pipelines more easily, enhancing oil sands industry competitiveness by reducing costs, increasing pipeline capacity and enabling more refineries to process Alberta bitumen product. This will support construction of two to five partial upgrading facilities, representing up to $5 billion in private investment, 4,000 jobs during construction and 200 full-time jobs during operation. |

Budget 2018 supports developing

industries and job creation.

| | |

| FISCAL PLAN 2018 – 20 • OVERVIEW | | 6 |

Budget 2018 launches the

Interactive Digital Media

Tax Credit.

| ∎ | | $500 million in royalty credits to initiate a second phase of the successful Petrochemicals Diversification Program (PDP) that ensures companies have access to the natural gas liquids they need to grow private investment in Alberta-based natural gas processing. The intended outcome of the program is one to three world scale petrochemical facilities in Alberta, resulting in approximately $6 billion worth of new investment, creating roughly 4,000 new jobs during construction and over 200 full-time jobs once operations begin. |

| ∎ | | $500 million for a Petrochemical Feedstock Infrastructure Program that encourages the construction of new extraction facilities on major pipelines to recover natural gas liquids feedstock. It is intended to encourage the development of one or two natural gas mid-stream projects to support liquids extraction with a focus on ethane extraction. The program will be a combination of loan guarantees and grants. |

DIVERSIFICATION ACROSS OUR ECONOMY

While we work to diversify our traditional strengths in the energy sector, we will also diversify by helping other sectors of the economy grow.

| ∎ | | $60 million a year for two successful tax credit programs that are being extended to 2021-22 – the Alberta Investor and the Capital Investment Tax Credits. They will continue to foster new investment, encourage innovation, and accelerate growth in new industries. These two programs have already supported more than $1 billion in private sector capital projects. |

| ∎ | | $20 million a year by 2020-21 for a new Interactive Digital Media Tax Credit that will attract more tech entrepreneurs to Alberta, and retain Alberta’s homegrown talent to inspire the next generation of tech innovators. |

| ∎ | | 3,000 new post-secondary technology spaces over the next five years and new scholarships to support technology and other emerging sectors like life sciences, clean technology and health innovation. |

These investments will help create a recovery that is built to last for working people, ensuring that Albertans get the full value for our energy resources. At the same time, promoting economic diversification and the creation of good paying jobs.

| | |

| FISCAL PLAN 2018 – 20 • OVERVIEW | | 7 |

Protecting Vital Public Services

During the downturn, government supported Albertans by investing in healthcare, education and social services and taking steps to make life more affordable for families. While the economy is now recovering, government continues to focus on these vital services and ensuring that no Albertan gets left behind.

MAKING SURE OUR LOVED ONES GET THE CARE THEY NEED

Making continued investments to support the delivery of publicly funded health programs and services. This includes capital investments in health care such as building high-quality health facilities such as the Calgary Cancer Centre and the new hospital in Edmonton and bringing on-line hundreds of continuing care beds in 2018-19 to support the shift to better community-based care.

YOUNG PEOPLE GET THE BEST EDUCATION POSSIBLE

Alberta’s young population continued to grow through the recession, so the province is fully funding enrolment growth in the K–12 education system and reducing school fees. For post-secondary students, government is extending the tuition freeze for the fourth year to keep education more affordable, and investing in 3,000 new technology spaces and providing new scholarships for technology and other emerging sectors so Alberta’s talent can thrive and prepare for the jobs of the future.

ENSURING NO ONE IS LEFT BEHIND

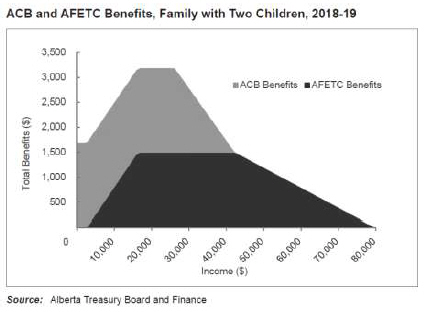

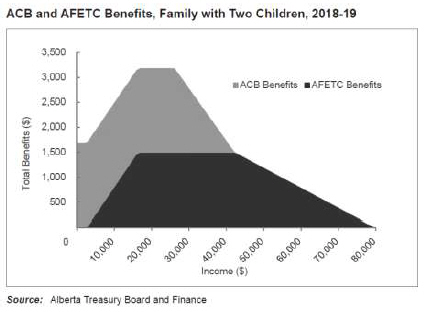

The Early Learning and Child Care Centre program will create an additional 4,500 affordable child care spaces that help working parents. The Alberta Child Benefit (ACB) makes life more affordable for Albertans by providing direct financial assistance to lower-income families and the Alberta Family Employment Tax Credit (AFETC) helps lower-and middle-income working families support their children. Approximately $328 million in ACB and AFETC benefits are provided in 2018-19.

A minimum wage of $15 per hour will help make sure that no Albertan has to stop at the food bank on their way home from work.

Government continues to make significant investments so Albertans with disabilities have timely and accessible services so that they are supported in leading meaningful lives in inclusive, welcoming communities. A review of the Persons with Developmental Disabilities program will ensure that Albertans living with disabilities get the right supports.

The Alberta Child Benefit

makes life more affordable.

| | |

| FISCAL PLAN 2018 – 20 • OVERVIEW | | 8 |

Budget 2018 focuses tax dollars

where they are needed most to return

to balance by 2023-24.

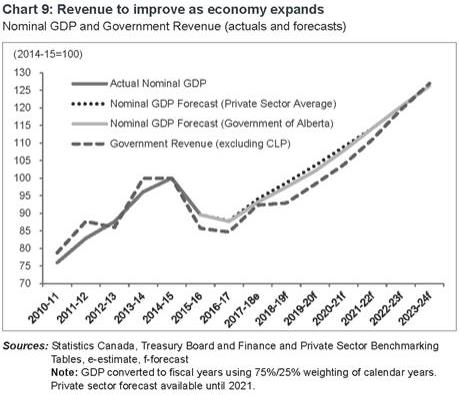

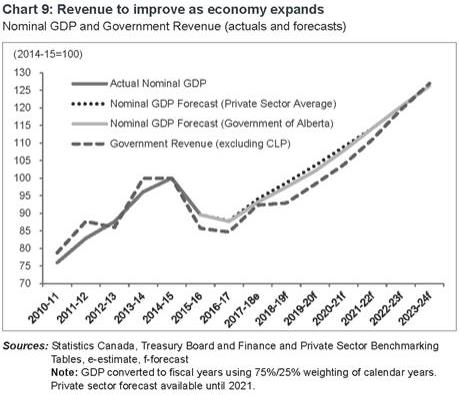

Returning to Balance

When the price of oil collapsed, the recession hit Alberta hard. The recovery in Alberta’s economy and a growing population will increase government revenues over the path to balance. However, this is not enough. It is not until 2019-20 that government revenues of $50.6 billion are forecast to surpass the $49.4 billion in revenue reached in 2013-14. The government will focus the investment of tax dollars where they are needed most, eliminate waste, control spending and find efficiencies to balance the budget by 2023-24:

| ∎ | | Managing public sector compensation which is over half of government’s annual operating expense by: |

| | ● | | Reaching practical agreements with labour unions; |

| | ● | | Continuing with a salary freeze on non-union employees in the public sector; |

| | ● | | Cutting the salaries and eliminating perks and bonuses for some of the highest paid executives of Alberta’s agencies, boards and commissions; and |

| | ● | | Keeping the size of the Alberta Public Service flat. |

| ∎ | | Keeping health spending growth below growth in population and inflation. Health spending is more than 40% of government’s annual operating expense. |

| ∎ | | Developing a new fiscal relationship with municipalities where grants under the Municipal Sustainability Initiative (MSI) are adjusted while the province returns to balance and a new infrastructure grant program to replace the MSI is developed, with a funding formula based on revenue sharing. |

| ∎ | | Returning capital spending to normal levels as the economic recovery becomes broad-based. |

| ∎ | | Dissolving or amalgamating government agencies, boards and commissions. |

| ∎ | | Transforming corporate services across government including communications, finance, human resources and information technologies to deliver better services at a lower cost. |

| ∎ | | Continuing to tightly manage discretionary spending across government. |

| | |

| FISCAL PLAN 2018 – 20 • OVERVIEW | | 9 |

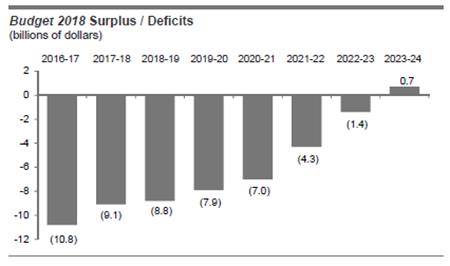

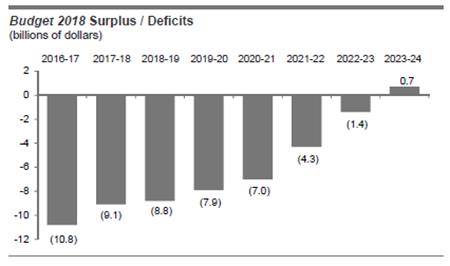

Through the implementation of the cost constraints identified above, the deficit along the path to balance improves annually to arrive at a projected surplus of $0.7 billion in 2023-24. More detail is included in the Path to Balance chapter.

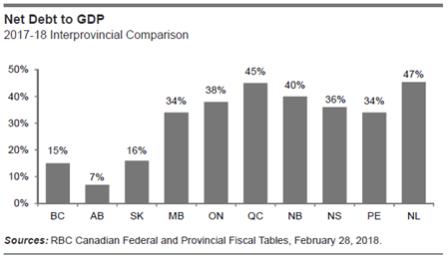

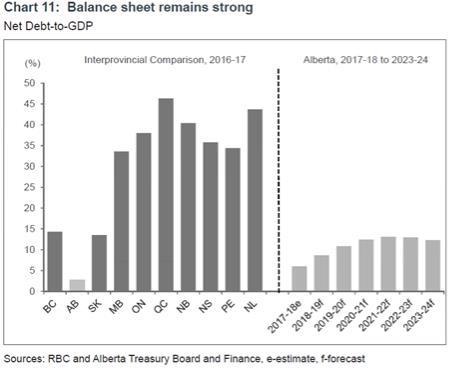

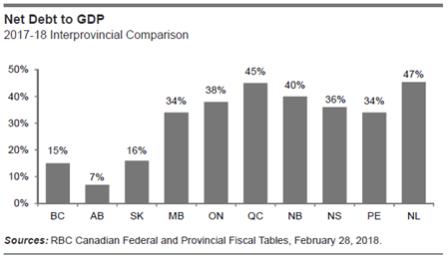

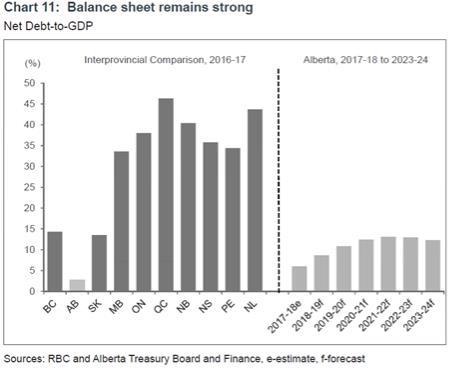

Net Debt to GDP ratio. The government is committed to maintaining one of the lowest net debt to nominal GDP ratios among the provinces.

Risk Adjustment. Alberta’s revenue is extremely volatile and difficult to predict given the volatility of the price of oil. Budget 2018 continues to include a risk adjustment factor, ensuring a level of prudence in Alberta’s budget and fiscal planning. The risk adjustment is $500 million in 2018-19 and increases to $700 million in 2019-20 and then to $1 billion in 2020-21.

Budget 2018 – Key Fiscal Metrics

(billions of dollars)

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | 2016-17 | | 2017-18 | | 2017-18 | | 2018-19 | | 2019-20 | | 2020-21 |

| | | | | | |

| | | Actual | | Budget | | Forecast | | Estimate | | Target | | Target |

| | | | | | |

Total Revenue | | | 42.3 | | | | 44.9 | | | | 46.9 | | | | 47.9 | | | | 50.6 | | | | 53.8 | |

Total Expense | | | 53.1 | | | | 54.9 | | | | 55.9 | | | | 56.2 | | | | 57.8 | | | | 59.8 | |

Risk Adjustment | | | - | | | | (0.5 | ) | | | - | | | | (0.5 | ) | | | (0.7 | ) | | | (1.0 | ) |

Surplus / (Deficit) | | | (10.8 | ) | | | (10.5 | ) | | | (9.1 | ) | | | (8.8 | ) | | | (7.9 | ) | | | (7.0 | ) |

| | | | | | |

Other Key Metrics: | | | | | | | | | | | | | | | | | | | | | | | | |

Capital / Other Non-financial Assets | | | 49.4 | | | | 52.7 | | | | 52.0 | | | | 53.8 | | | | 55.3 | | | | 56.8 | |

Heritage Fund Year-end Balances | | | 15.4 | | | | 15.7 | | | | 15.6 | | | | 16.0 | | | | 16.3 | | | | 16.6 | |

Net Financial Assets / Net Debt | | | (8.9 | ) | | | (22.6 | ) | | | (20.3 | ) | | | (30.5 | ) | | | (39.8 | ) | | | (48.2 | ) |

Net Debt to Nominal GDP Ratio | | | 2.8% | | | | 7.0% | | | | 6.0% | | | | 8.7% | | | | 10.8% | | | | 12.4% | |

| | |

| FISCAL PLAN 2018 – 20 • OVERVIEW | | 10 |

Albertans pay the lowest

overall taxes in Canada.

Revenue

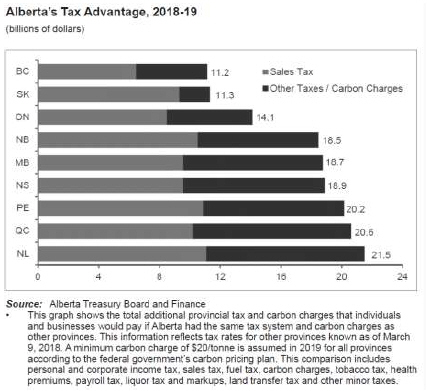

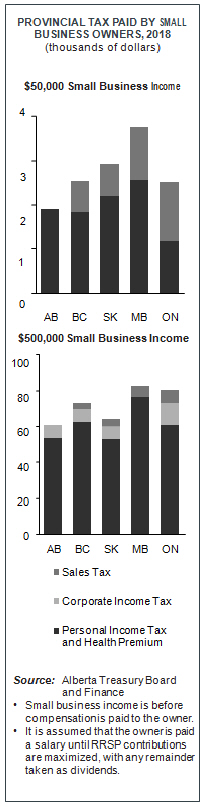

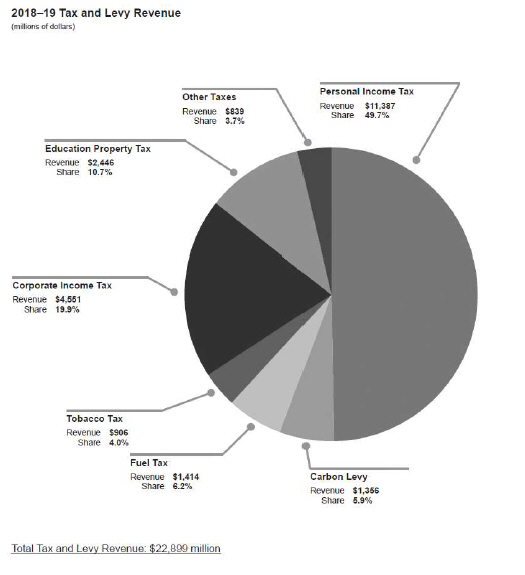

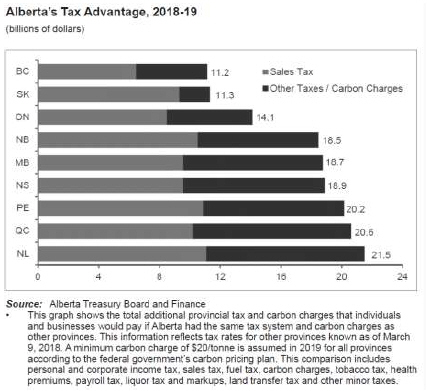

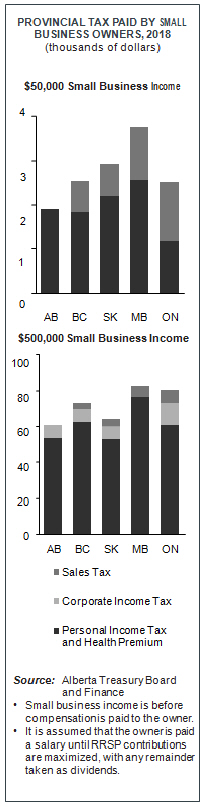

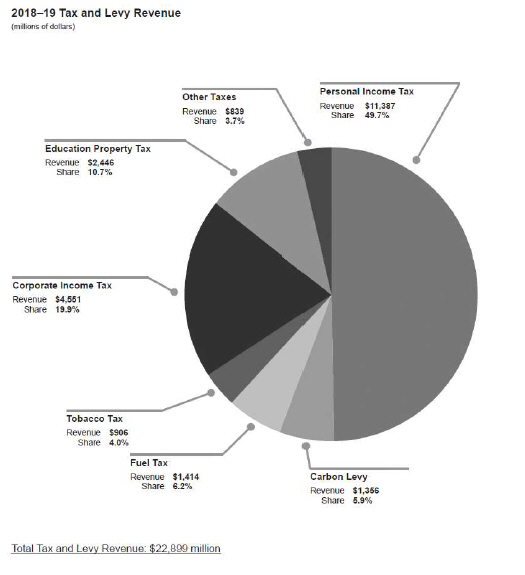

Alberta maintains the lowest overall tax regime in Canada, with no provincial sales tax, health premium or payroll tax. Albertans across all income ranges will continue to pay the lowest overall taxes when compared to other provinces. Alberta’s tax advantage is $11.2 billion in 2018-19. In addition, in 2018-19, the government will maintain the Education Property Tax requisition at 2017-18 levels and Alberta’s post-secondary students will benefit from a tuition freeze, for the fourth year.

Total revenue is forecast to be $47.9 billion in 2018-19, up 2.1% from 2017-18. Despite strong growth, revenue is not expected to exceed pre-recession levels until 2019-20.

Revenue growth will be led by income taxes, as stronger employment growth and higher household income will increase personal income taxes, while a robust manufacturing sector and an increase in bitumen production will boost corporate income taxes.

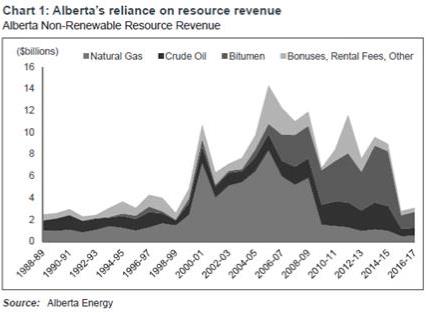

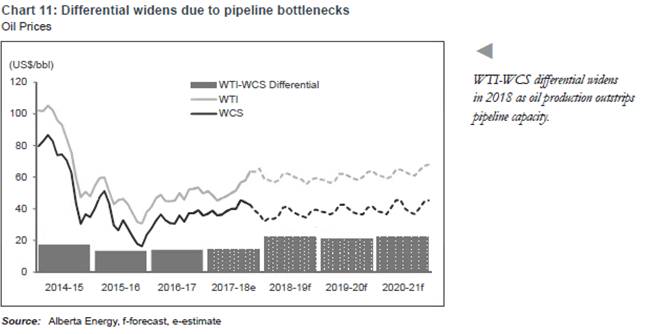

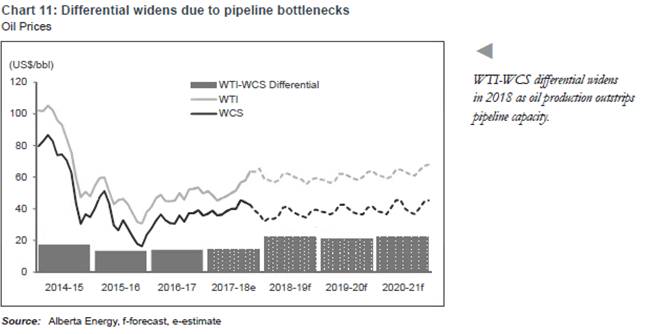

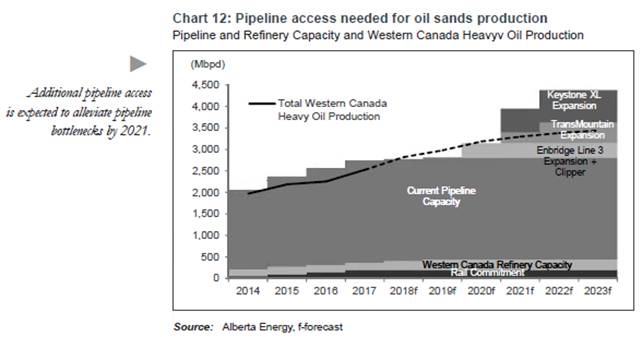

This increase in bitumen production will also increase non-renewable resource revenue (NRR). However, NRR in 2018-19 will still lag 2017-18 levels due to the US$7.90 per barrel estimated increase in the light-heavy oil price differential due to pipelines reaching capacity towards the end of 2017 and rail transport not being able to fill the gap.

Alberta’s share of the cannabis tax revenue is reported in other taxes. The province, through this budget, has signalled that it will have the federal government collect Alberta’s share of tax revenue from cannabis on our behalf. The Alberta Gaming and Liquor Commission (AGLC) is responsible for administering the distribution of cannabis, including online sales, which will be reported in net income from government business enterprises.

Budget 2018 – Revenue

(millions of dollars)

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | 2016-17 | | 2017-18 | | 2017-18 | | 2018-19 | | 2019-20 | | 2020-21 |

| | | | | | |

| | | Actual | | Budget | | Forecast | | Estimate | | Target | | Target |

| | | | | | |

Income and Other Taxes | | | 20,181 | | | | 21,762 | | | | 21,211 | | | | 22,899 | | | | 24,548 | | | | 25,995 | |

Non-Renewable Resource Revenue | | | 3,097 | | | | 3,754 | | | | 4,534 | | | | 3,829 | | | | 4,183 | | | | 5,001 | |

Transfers from Government of Canada | | | 7,979 | | | | 7,988 | | | | 7,918 | | | | 8,218 | | | | 8,470 | | | | 8,645 | |

Investment Income | | | 3,698 | | | | 2,193 | | | | 3,061 | | | | 2,884 | | | | 3,161 | | | | 3,357 | |

Net Income from Government Business Enterprises | | | 543 | | | | 2,506 | | | | 3,294 | | | | 2,777 | | | | 2,707 | | | | 2,844 | |

Premiums, Fees and Licences | | | 3,701 | | | | 3,683 | | | | 3,742 | | | | 3,854 | | | | 3,929 | | | | 3,996 | |

Other | | | 3,094 | | | | 3,032 | | | | 3,121 | | | | 3,419 | | | | 3,617 | | | | 4,010 | |

Total Revenue | | | 42,293 | | | | 44,918 | | | | 46,881 | | | | 47,879 | | | | 50,615 | | | | 53,848 | |

| | |

| | Expense As part of its plan to balance, government is committed to providing stable funding for core public services, including health care, education and social services. Government will target operating spending growth below population plus inflation, and avoid the province’s history of volatile year-to-year swings in spending. |

| | |

| FISCAL PLAN 2018 – 20 • OVERVIEW | | 11 |

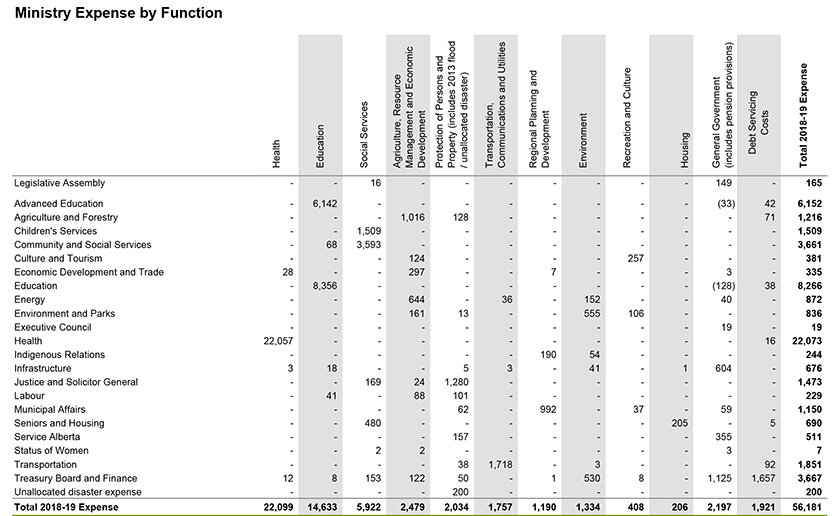

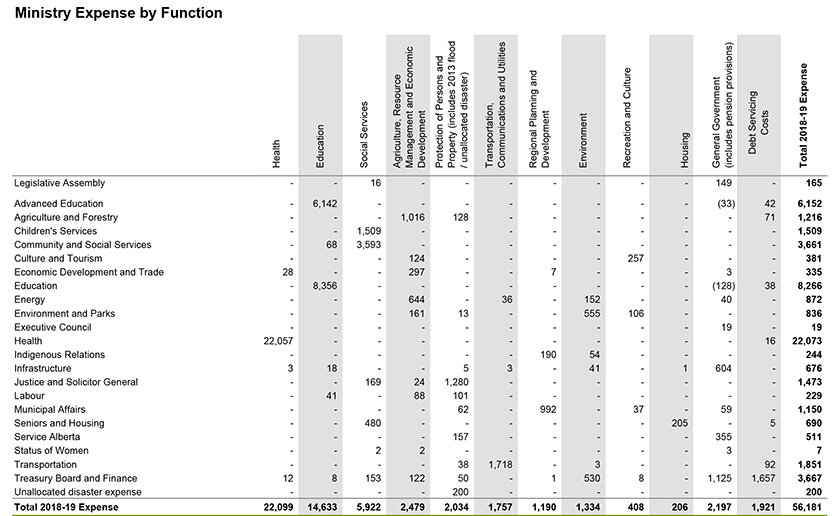

| ∎ | | Health. Budget 2018 provides $22.1 billion for Health in 2018-19, keeping government’s commitment to provide stable funding for health care. Health’s 2018-19 budget reflects growth of 3%. This includes $87 million for addictions and mental health in 2018-19. Mental health issues affect 20 per cent of Albertans and it is estimated that over 10 per cent of the population will require addiction treatment at some point in their lives. |

| ∎ | | Education. Budget 2018 provides $8.4 billion for Education in 2018-19, keeping government’s commitment to fund enrolment growth, projected at 2.2% in 2018-19. With $16 million in 2018-19, 30,000 students will receive a daily nutritious meal, up from 5,000 when the program was piloted in 2016-17. |

| ∎ | | Advanced Education. Budget 2018 provides $6.1 billion for Advanced Education in 2018-19, keeping government’s commitment to provide stable, predictable funding for post-secondary education. Base operating grants for institutions will increase 2% per year, while accessibility and affordability for students improves with the fourth year of tuition freeze. |

| ∎ | | Community and Social Services. Budget 2018 provides $3.7 billion for Community and Social Services in 2018-19, keeping government’s commitment to strong families and strong communities. Budget 2018 includes additional investment in the Association of Alberta Sexual Assault Services to ensure survivors of sexual assault have the supports they need. |

| ∎ | | Children’s Services. Budget 2018 provides $1.5 billion for Children’s Services in 2018-19, which includes keeping government’s commitment to continue investing in improved outcomes for Alberta’s children, including 78 new Early Learning and Child Care Centres, so that 4,500 additional children and their families will have access to affordable $25-per-day child care. |

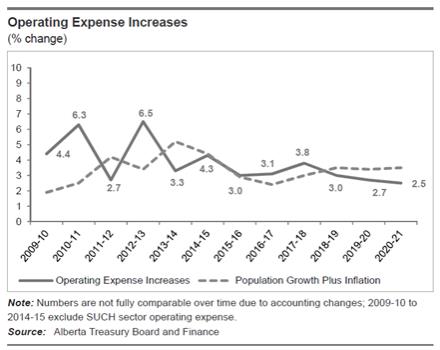

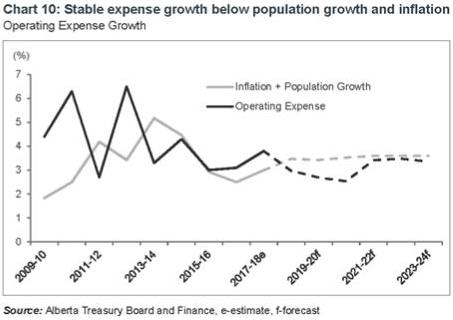

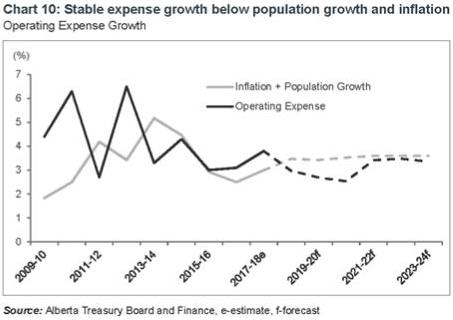

After funding to maintain core public services, operating expense increases are below forecast growth in population and inflation at 3.0% in 2018-19, 2.7% in 2019-20 and 2.5% in 2020-21. Population growth plus inflation is expected to be 3.5% in 2018-19, 3.4% in 2019-20 and 3.5% in 2020-21.

Budget 2018 – Expense1

(millions of dollars)

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | 2016-17 | | 2017-18 | | 2017-18 | | 2018-19 | | 2019-20 | | 2020-21 |

| | | | | | |

| | | Actual | | Budget | | Forecast | | Estimate | | Target | | Target |

| | | | | | |

Operating expense (net of in-year savings) | | | 44,661 | | | | 45,906 | | | | 46,370 | | | | 47,765 | | | | 49,053 | | | | 50,291 | |

Climate Leadership Plan operating expense | | | 1,379 | | | | 868 | | | | 577 | | | | 1,035 | | | | 1,132 | | | | 1,198 | |

Disaster assistance (with operating 2013 flood support) | | | 1,191 | | | | 235 | | | | 495 | | | | 206 | | | | 200 | | | | 200 | |

Capital grants | | | 2,159 | | | | 3,302 | | | | 3,729 | | | | 1,706 | | | | 1,352 | | | | 1,596 | |

Climate Leadership Plan capital grants | | | 2 | | | | 68 | | | | 391 | | | | 423 | | | | 446 | | | | 286 | |

Amortization / inventory consumption / disposal loss | | | 3,210 | | | | 3,375 | | | | 3,362 | | | | 3,434 | | | | 3,577 | | | | 3,677 | |

Debt servicing costs | | | 1,018 | | | | 1,398 | | | | 1,355 | | | | 1,921 | | | | 2,434 | | | | 2,937 | |

Pension provisions | | | (543 | ) | | | (237 | ) | | | (332) | | | | (310 | ) | | | (366 | ) | | | (365 | ) |

Total Expense | | | 53,077 | | | | 54,915 | | | | 55,947 | | | | 56,181 | | | | 57,827 | | | | 59,818 | |

| 1 | Adjusted for government reorganization. |

| | |

| FISCAL PLAN 2018 – 20 • OVERVIEW | | 12 |

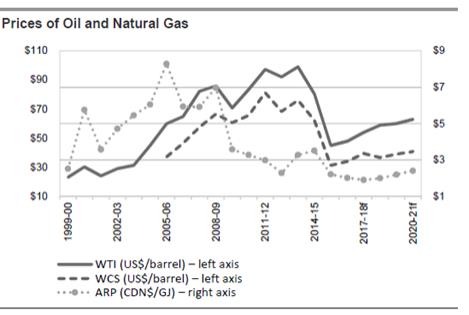

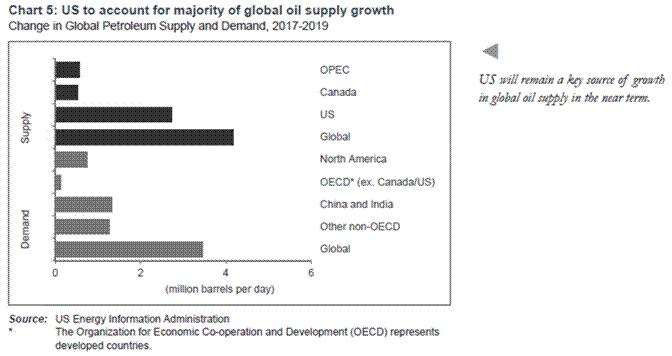

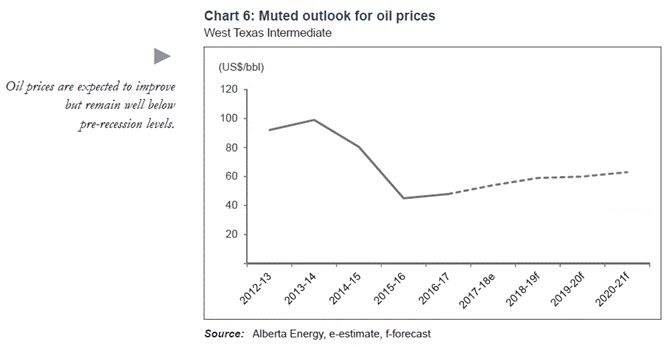

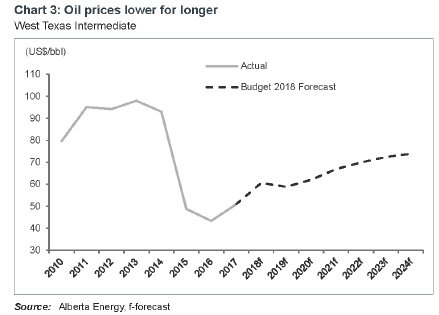

Energy and Economic Assumptions

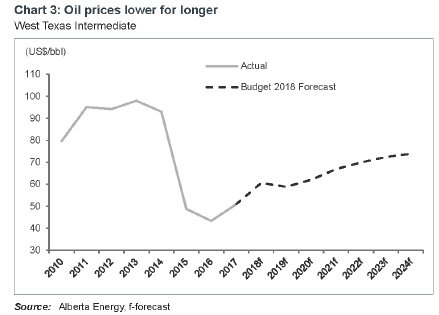

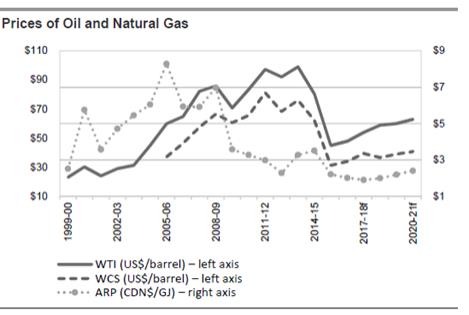

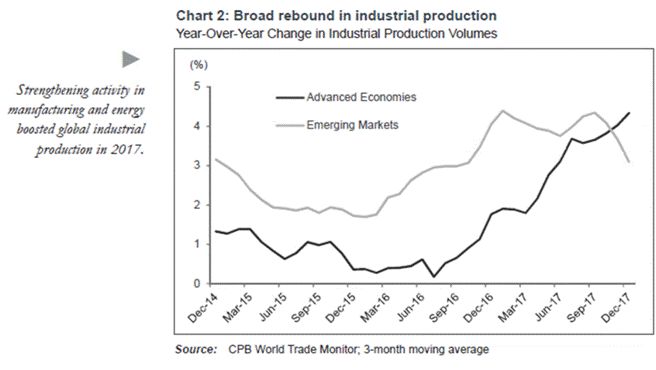

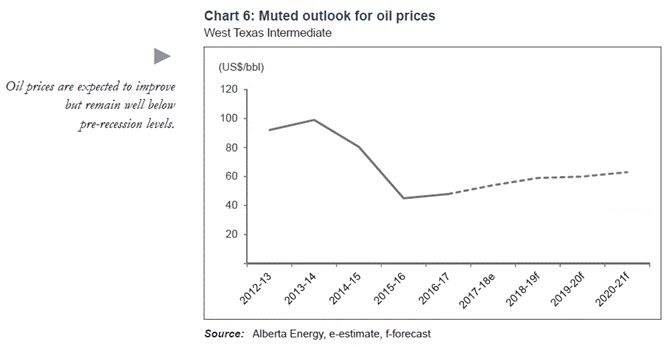

The Budget 2018 outlook is prudent and in line with other forecasts for energy prices and other economic and financial variables. A more balanced oil market is expected to support prices. WTI is expected to average US$59/bbl in 2018-19, $60 in 2019-20 and $63 in 2020-21.

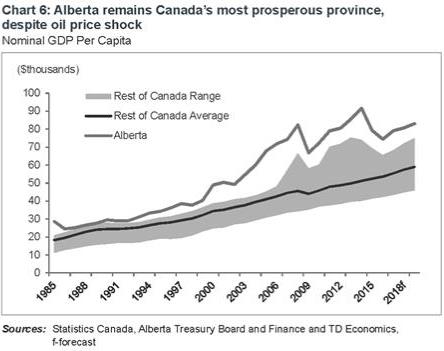

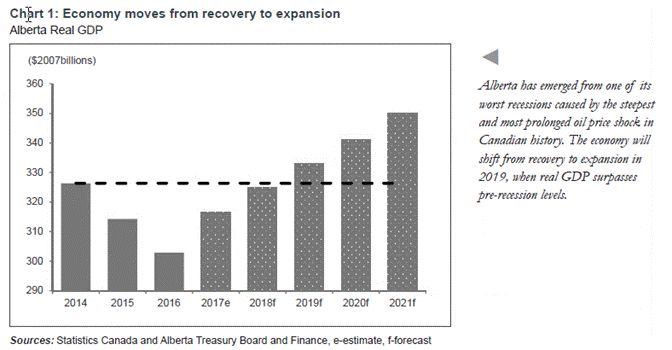

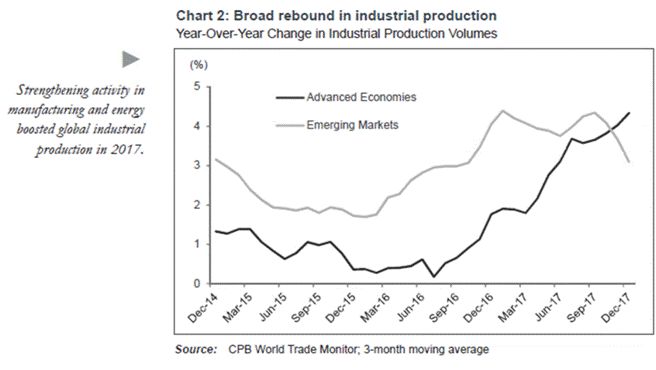

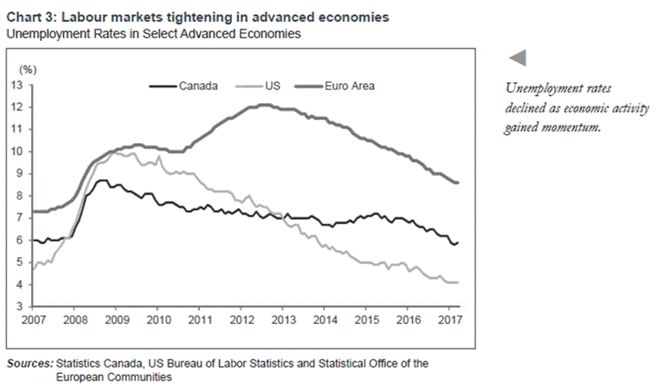

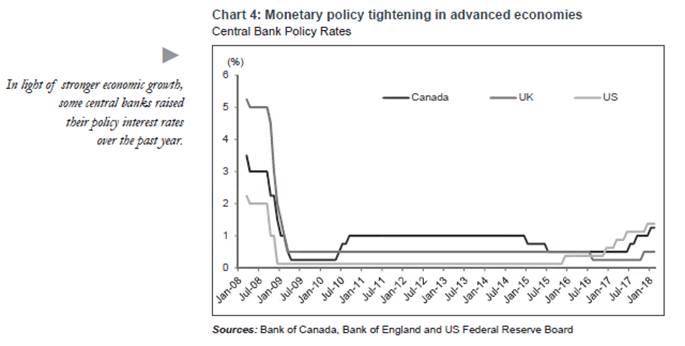

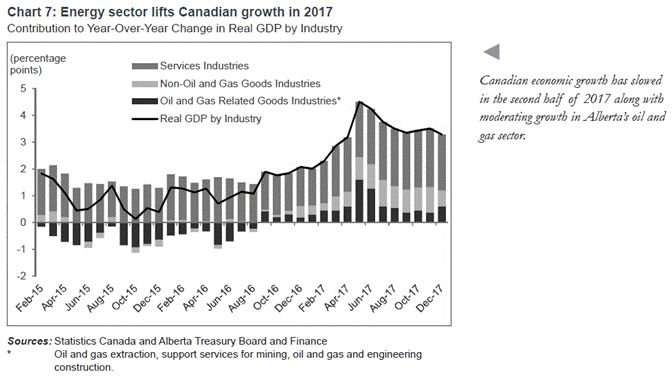

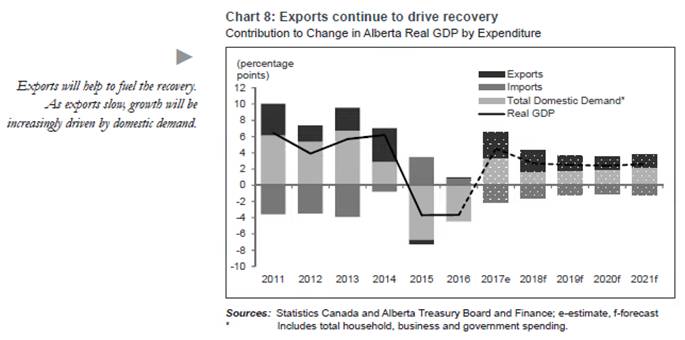

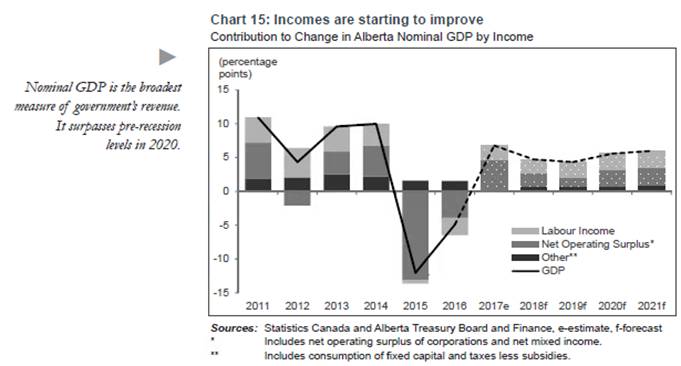

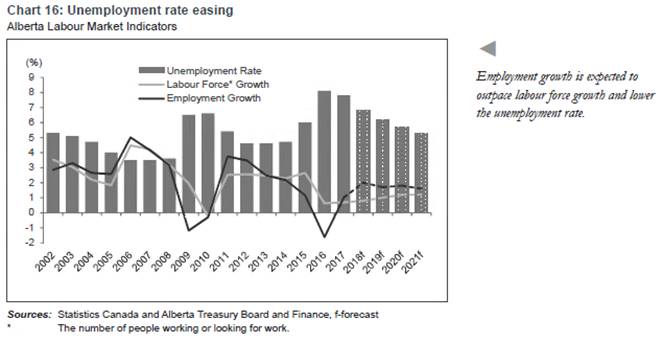

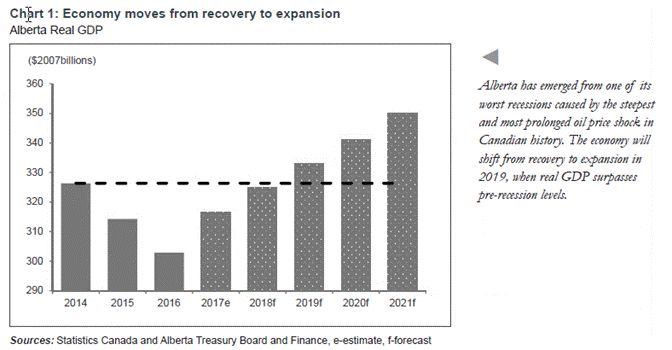

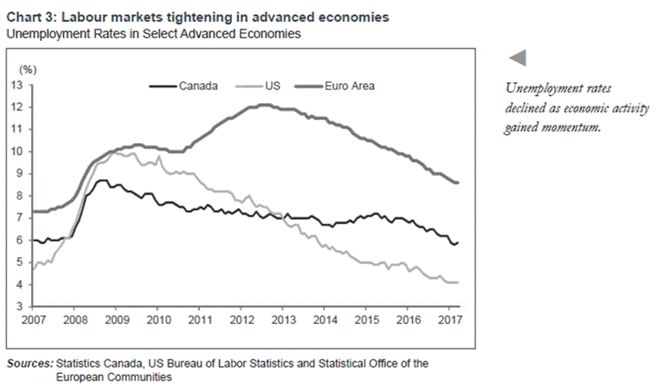

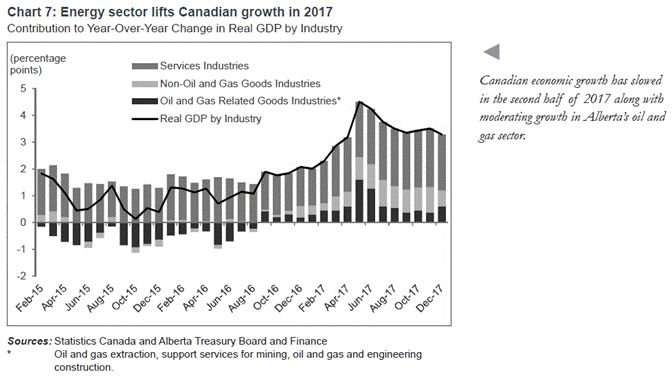

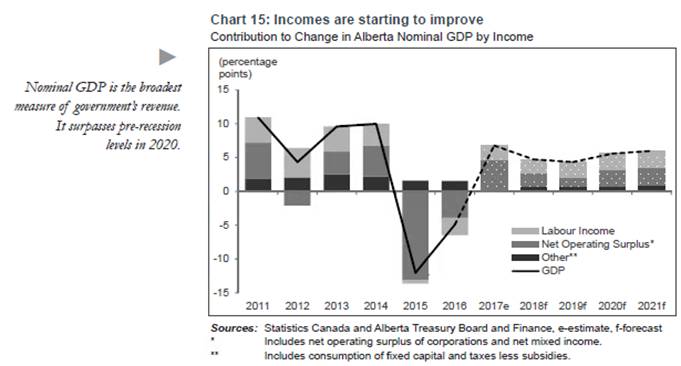

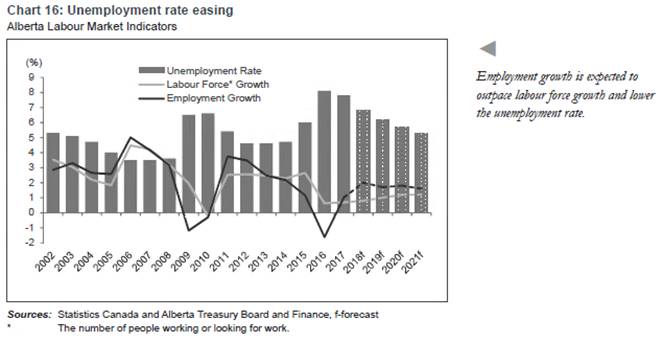

The Alberta economy is well on its way to recovering from one of the worst recessions of the last 40 years. Following impressive real GDP growth estimated at 4.5% in 2017, the economy is forecast to expand by 2.7% in 2018. Rising economic activity led to a marked improvement in the labour market in 2017, with the Alberta economy recovering all of the jobs lost during the recession. This momentum is expected to carry into 2018, supporting employment growth of 2.0%. Continued improvement in the labour market, especially in the high-paying goods sector, should bolster earnings growth. As a result, household incomes this year are expected to exceed 2014 levels.

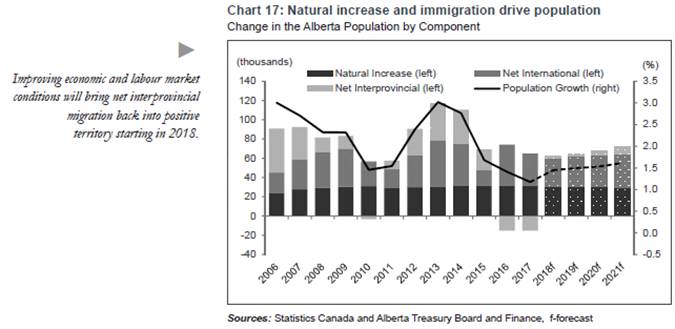

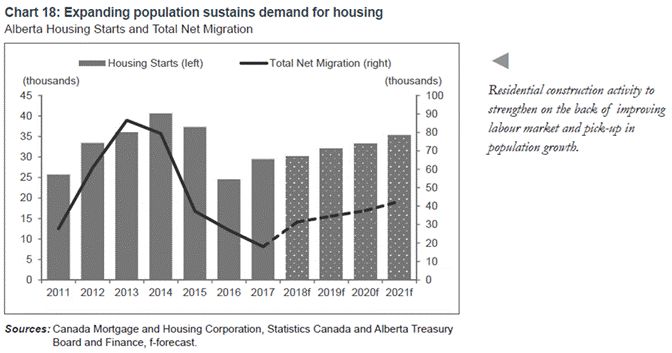

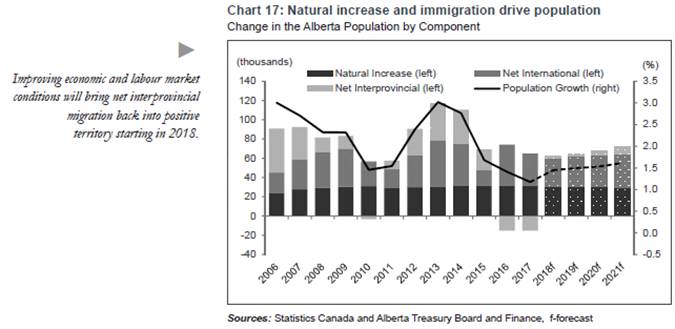

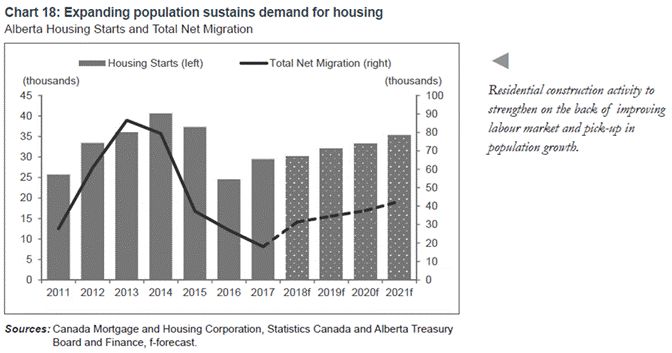

Population growth is forecast to pick up from 1.4% in 2018 to 1.6% by 2021. The improving net inflows of interprovincial migrants will add to strong immigration and natural increase. Population growth is expected to be above the national average.

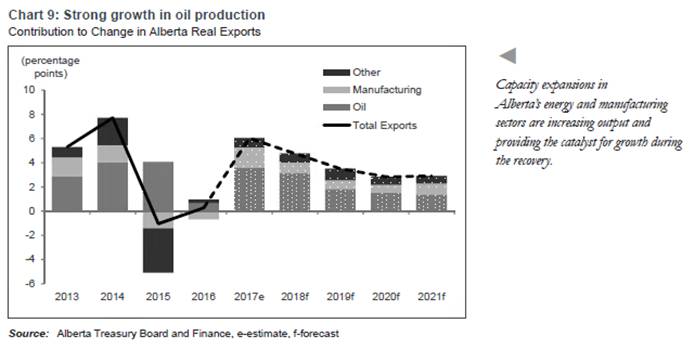

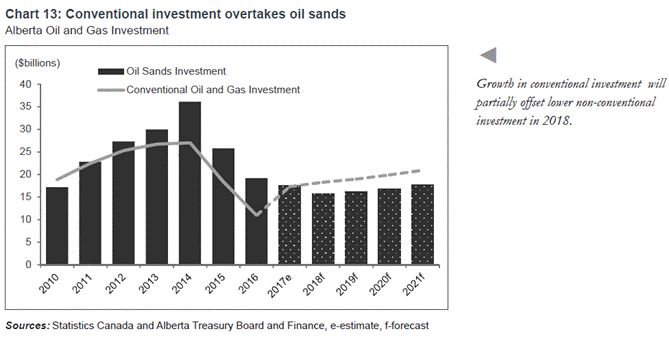

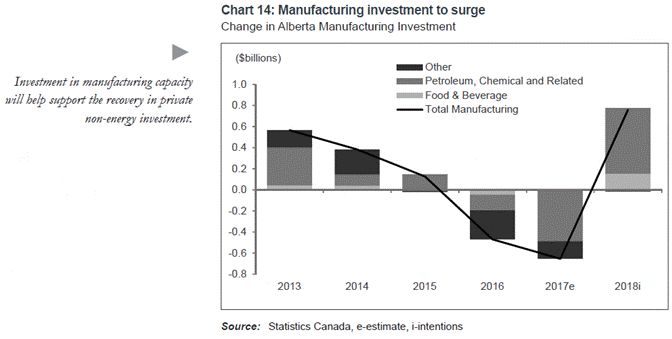

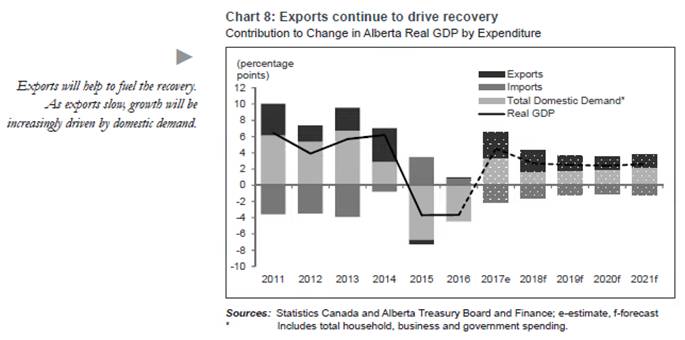

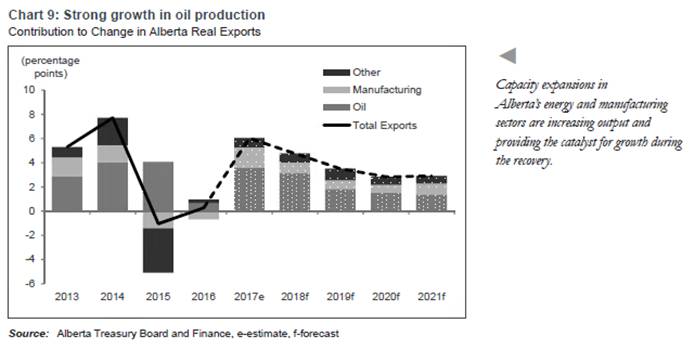

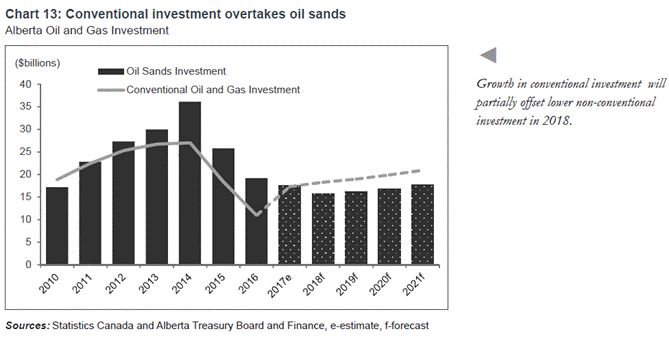

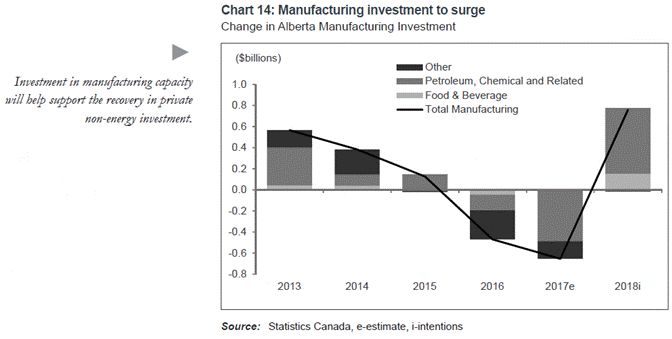

Exports will drive growth in 2018, supported by rising oil sands production and an expanding manufacturing base. Beyond 2018, growth will be driven less by exports and more by households and businesses. After lagging the broader recovery in economic activity, non-residential investment starts to turn around beginning in 2019 when the economy shifts from recovery to expansion. This is expected to support real GDP growth of around 2.5% in the medium term. Investment will be aided by Government of Alberta policies aimed at diversifying the energy sector.

Energy and Economic Assumptions

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | 2016-17 | | 2017-18 | | 2017-18 | | 2018-19 | | 2019-20 | | 2020-21 | | |

| | | | | | | |

| | | Actual | | Budget | | Forecast | | Estimate | | Target | | Target | | |

| | | | | | | |

WTI Oil (US$/bbl) | | | 47.93 | | | | 55.00 | | | | 54.00 | | | | 59.00 | | | | 60.00 | | | | 63.00 | | | | | |

Light-Heavy Differential (US$/bbl) | | | 13.93 | | | | 16.00 | | | | 14.50 | | | | 22.40 | | | | 21.00 | | | | 22.30 | | | | | |

WCS@Hardisty (Cdn$/bbl) | | | 44.67 | | | | 51.30 | | | | 50.40 | | | | 46.00 | | | | 48.80 | | | | 50.90 | | | | | |

Natural Gas (Cdn$/GJ) | | | 2.01 | | | | 2.90 | | | | 1.90 | | | | 2.00 | | | | 2.20 | | | | 2.40 | | | | | |

Conventional Crude Oil Production (000s barrels/day) | | | 431 | | | | 416 | | | | 449 | | | | 461 | | | | 468 | | | | 466 | | | | | |

Raw Bitumen Production (000s barrels/day) | | | 2,549 | | | | 2,906 | | | | 2,855 | | | | 3,163 | | | | 3,302 | | | | 3,462 | | | | | |

Exchange Rate (US¢/Cdn$) | | | 76.2 | | | | 76.0 | | | | 78.0 | | | | 80.0 | | | | 80.0 | | | | 80.0 | | | | | |

Interest Rate (10-year Canada bonds, %) | | | 1.39 | | | | 2.00 | | | | 1.90 | | | | 2.50 | | | | 2.90 | | | | 3.10 | | | | | |

| | | | | | | |

| | | 2016 | | 2017b | | 2017f | | 2018f | | 2019f | | 2020f | | 2021f |

| | | | | | | |

Real GDP (% change) | | | (3.7 | ) | | | 2.6 | | | | 4.5 | | | | 2.7 | | | | 2.5 | | | | 2.4 | | | | 2.6 | |

Employment (% change) | | | (1.6 | ) | | | 0.9 | | | | 1.0 | | | | 2.0 | | | | 1.7 | | | | 1.8 | | | | 1.6 | |

Unemployment Rate (%) | | | 8.1 | | | | 8.0 | | | | 7.8 | | | | 6.8 | | | | 6.2 | | | | 5.7 | | | | 5.3 | |

Primary Household Income (% change) | | | (7.4 | ) | | | 1.8 | | | | 4.4 | | | | 4.5 | | | | 4.7 | | | | 4.8 | | | | 4.9 | |

Net Corporate Operating Surplus (% change) | | | (46.3 | ) | | | 66.4 | | | | 90.6 | | | | 19.1 | | | | 9.8 | | | | 19.5 | | | | 20.2 | |

Alberta Consumer Price Index (% change) | | | 1.1 | | | | 1.9 | | | | 1.6 | | | | 2.1 | | | | 1.9 | | | | 2.0 | | | | 2.0 | |

Population (% change) | | | 1.4 | | | | 1.3 | | | | 1.2 | | | | 1.4 | | | | 1.5 | | | | 1.5 | | | | 1.6 | |

| | |

| FISCAL PLAN 2018 – 20 • OVERVIEW | | 13 |

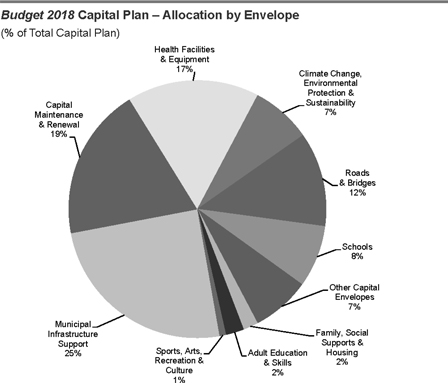

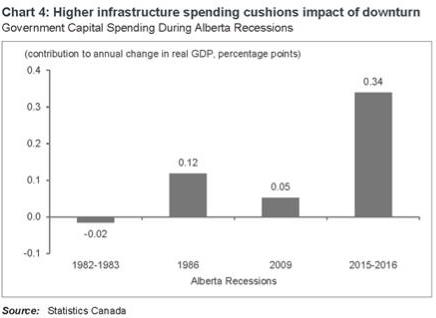

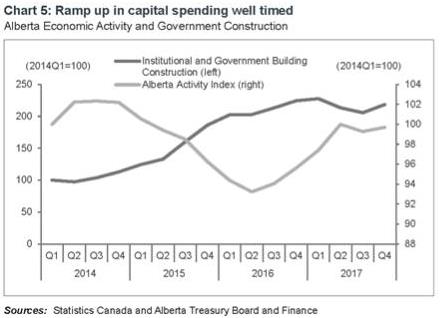

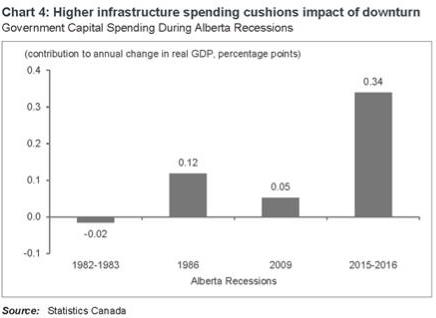

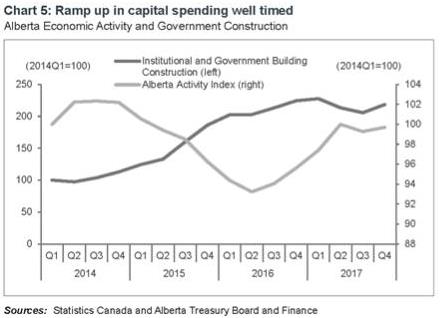

Capital Plan

The government chose to stimulate the economy during the downturn, through a nation-leading Capital Plan. This delivered on the recommendations from the former Bank of Canada governor David Dodge. The government took advantage of record low interest rates and cost pressures to make long-term investments and put Albertans back to work.

As the economy recovers, and consistent with Dodge’s recommendations, government is prudently returning to more normal levels of capital investment. With Alberta’s economic recovery advancing and becoming more broad-based, the Budget 2018 Capital Plan strikes the balance between continuing to deliver on critical public infrastructure projects, while not competing for resources and crowding out investment in private sector infrastructure projects.

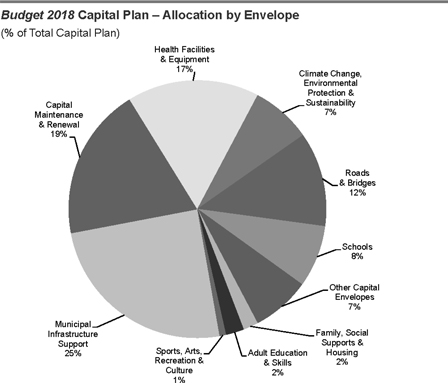

The Budget 2018 Capital Plan is $30 billion over five years. This includes $26.6 billion for the core government and $3.3 billion for the SUCH sector. The Capital Plan provides:

| ∎ | | $4.6 billion over five years for health infrastructure including the new Edmonton hospital and Calgary Cancer Centre. |

| ∎ | | $2.2 billion over five years for schools that support student learning and well-being and address community needs. |

| ∎ | | $2.1 billion for climate change and environmental sustainability. This includes $83 million to make sure First Nations communities in Alberta have the infrastructure necessary to bring safe, clean, reliable drinking water to people. |

| ∎ | | $6.9 billion over five years for municipalities, including $0.9 billion for light rail transit. $3 billion is being committed over the next ten years for light rail transit in Edmonton and Calgary. |

| ∎ | | $3.3 billion for roads and bridges to improve the flow of goods and services throughout the province and make roads safer for Albertans. |

| ∎ | | $5.4 billion for capital maintenance and renewal to ensure public facilities continue to serve the needs of Albertans. |

Budget 2018 – Capital Plan

(billions of dollars)

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | 2018-19 | | 2019-20 | | 2020-21 | | 2021-22 | | 2022-23 | | 5-year |

| | | | | | |

| | | Estimate | | Target | | Target | | Projected | | Projected | | Total |

Capital Plan: | | | | | | | | | | | | | | | | | | | | | | | | |

Core Government | | | 5.5 | | | | 5.2 | | | | 5.3 | | | | 5.9 | | | | 4.7 | | | | 26.6 | |

SUCH Sector - Self-financed Investment | | | 0.9 | | | | 0.7 | | | | 0.7 | | | | 0.5 | | | | 0.5 | | | | 3.3 | |

Total Capital Plan | | | 6.4 | | | | 5.9 | | | | 6.0 | | | | 6.4 | | | | 5.2 | | | | 29.9 | |

| | | | | | |

Capital Plan Financing: | | | | | | | | | | | | | | | | | | | | | | | | |

Direct Borrowing | | | 3.8 | | | | 3.7 | | | | 4.3 | | | | 4.9 | | | | 3.8 | | | | 20.5 | |

Alternative Financing (P3s) | | | 0.1 | | | | 0.2 | | | | 0.2 | | | | 0.2 | | | | 0.2 | | | | 0.9 | |

Other Cash Sources (e.g., retained income) | | | 1.1 | | | | 0.6 | | | | 0.5 | | | | 0.4 | | | | 0.3 | | | | 2.9 | |

Climate Leadership Plan | | | 0.6 | | | | 0.7 | | | | 0.4 | | | | 0.3 | | | | 0.4 | | | | 2.4 | |

SUCH Sector Self-financing | | | 0.9 | | | | 0.7 | | | | 0.7 | | | | 0.5 | | | | 0.5 | | | | 3.3 | |

Total Capital Plan Financing | | | 6.4 | | | | 5.9 | | | | 6.0 | | | | 6.4 | | | | 5.2 | | | | 29.9 | |

| | |

| FISCAL PLAN 2018 – 20 • OVERVIEW | | 14 |

Gender Budgeting

The Government of Alberta is committed to advancing equality by allocating resources based on the needs of Alberta’s diverse population to ensure that all government initiatives, programs, policies, and services are delivered effectively to every Albertan. Gender budgeting includes providing gender analysis in business planning and annual reporting processes, as well as in policies and programs funded by government.

In 2015, government established its first stand-alone Ministry of the Status of Women, dedicated to spearheading the government’s work to advance gender equality in Alberta. Status of Women is leading the initiative to integrate Gender-based Analysis Plus (GBA+) across ministries to increase government’s capacity to apply a gender and intersectional lens to policies, programs and legislation, including budget processes. The GBA+ tool helps ensure that government’s work includes equity measures that address Albertans’ diverse needs depending on where they live, their identities, lived experiences, and abilities, to support equal outcomes.

| | |

| FISCAL PLAN 2018 – 20 • OVERVIEW | | 15 |

Fiscal Plan

Expense

| | |

| FISCAL PLAN 2018 – 20 • OVERVIEW | | 16 |

Table of Contents

EXPENSE

| | | | |

Expense | | | 18 | |

| |

Health | | | 19 | |

| |

Education: Kindergarten to Post-Secondary | | | 21 | |

| |

Social Services and Justice | | | 23 | |

| |

Indigenous Relations, Municipalities and Transportation | | | 28 | |

| |

Agriculture, Resource Management, Recreation and Culture | | | 29 | |

| |

Government Services | | | 32 | |

| |

Climate Leadership and Electricity | | | 33 | |

| |

Electricity Transition | | | 35 | |

| |

Gender Budgeting | | | 36 | |

| |

Cost Containment | | | 39 | |

| | |

| FISCAL PLAN 2018 – 21 • EXPENSE | | 17 |

Expense

Budget 2018 is focused squarely on extending the recovery to all Albertans and continuing to build a more resilient, diversified and stable economy that is less vulnerable to oil price shocks – a recovery that is built to last for working people.

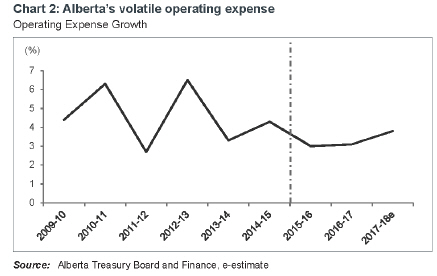

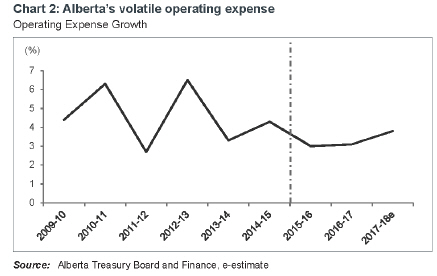

It avoids the province’s history of volatile year-to-year swings in spending and focuses on investing tax dollars where they are needed most and targeting operating expense growth below growth in population and inflation. This is a responsible approach that continues to invest in vital public services including health care, education and social services.

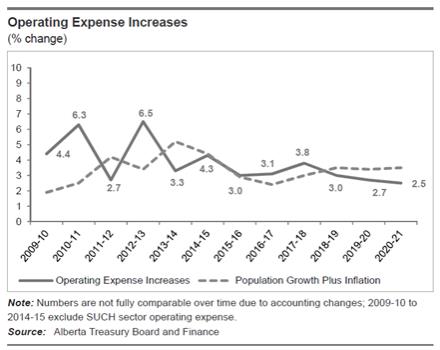

Government will continue to avoid the volatile year-to-year swings of the past and target operating expense growth of 3.0% in 2018-19, 2.7% in 2019-20 and 2.5% in 2020-21. Growth in population and inflation is expected to be 3.5% in 2018-19, 3.4% in 2019-20 and 3.5% in 2020-21.

The low growth in total expense and operating expense also reflects actions government is taking to contain costs. Key actions include: managing public sector compensation through the negotiation of practical agreements with labour unions, a non-union wage freeze across the public sector and hiring restraint in the public service; implementation of strategies to manage health spending; normalizing the size of the capital plan; and a range of complementary actions to clean up waste, like reductions to discretionary spending and the review of Alberta’s agencies, boards and commissions.

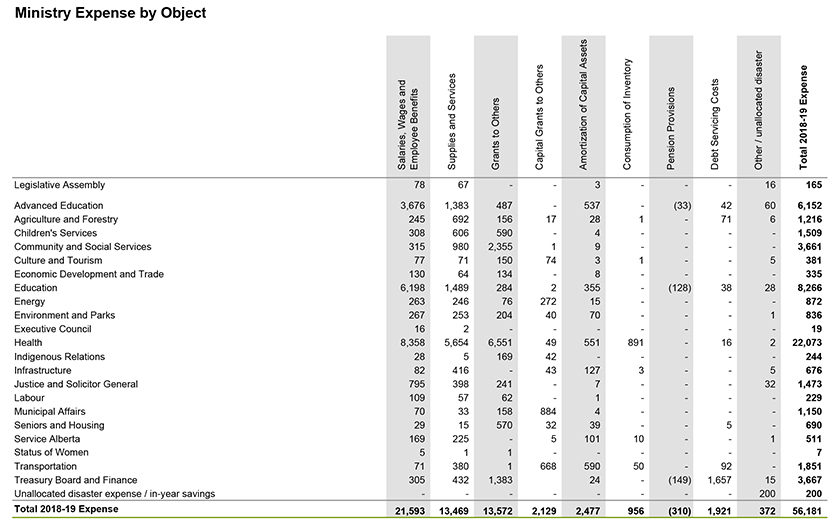

Budget 2018 – Expense1

(millions of dollars)

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | 2016-17 | | 2017-18 | | 2017-18 | | 2018-19 | | 2019-20 | | 2020-21 |

| | | | | | |

| | | Actual | | Budget | | Forecast | | Estimate | | Target | | Target |

| | | | | | |

Operating expense (net of in-year savings) | | | 44,661 | | | | 45,906 | | | | 46,370 | | | | 47,765 | | | | 49,053 | | | | 50,291 | |

Climate Leadership Plan operating expense | | | 1,379 | | | | 868 | | | | 577 | | | | 1,035 | | | | 1,132 | | | | 1,198 | |

Disaster assistance (with operating 2013 flood support) | | | 1,191 | | | | 235 | | | | 495 | | | | 206 | | | | 200 | | | | 200 | |

Capital grants | | | 2,159 | | | | 3,302 | | | | 3,729 | | | | 1,706 | | | | 1,352 | | | | 1,596 | |

Climate Leadership Plan capital grants | | | 2 | | | | 68 | | | | 391 | | | | 423 | | | | 446 | | | | 286 | |

Amortization / inventory consumption / disposal loss | | | 3,210 | | | | 3,375 | | | | 3,362 | | | | 3,434 | | | | 3,577 | | | | 3,677 | |

Debt servicing costs | | | 1,018 | | | | 1,398 | | | | 1,355 | | | | 1,921 | | | | 2,434 | | | | 2,937 | |

Pension provisions | | | (543 | ) | | | (237 | ) | | | (332) | | | | (310 | ) | | | (366 | ) | | | (365 | ) |

Total Expense | | | 53,077 | | | | 54,915 | | | | 55,947 | | | | 56,181 | | | | 57,827 | | | | 59,818 | |

| 1 | Adjusted for government reorganization. |

| | |

| FISCAL PLAN 2018 – 21 • EXPENSE | | 18 |

Budget 2018 provides stable

funding for health care.

In 2016-17 and 2017-18, as Alberta recovered from a severe recession, population growth and inflation were lower than forecast at 2.4% and 3.0%, respectively. Operating expense grew 3.1% in 2016-17 and is forecast to grow at 3.8% in 2017-18, due to significant pressures on health, education and social services. The pressures resulted from high growth in specific populations such as school-aged children and Albertans with disabilities, and income support caseloads arising from the recession.

Health

The Ministry of Health provides a wide range of services that Alberta families rely on, including public health, community and home care, primary care, acute care and continuing and long-term care.

Health’s expense1 is budgeted at $22.1 billion. Budget 2018 continues the government’s ongoing commitment to provide stable funding for health care, with Health’s operating expense budget increasing by 3% in 2018-19, a reflection of government’s close management of health spending. In comparison, health spending grew by approximately 6% per year from 2008-09 to 2014-15. From 2015-16 to 2017-18, spending was contained with growth of only 3.3% a year.

KEY INVESTMENTS

Through government investments, hundreds of Continuing Care beds are expected to come on-line in 2018-19 to support the shift to community-based care.

There is $248 million budgeted in 2018-19 to support Primary Health Care, and a consolidated total of $668 million for Population and Public Health throughout the ministry.

There is $87 million budgeted for Addictions and Mental Health in 2018-19. Mental health issues affect 20% of Albertans and it is estimated that over 10% of the population will require addiction treatment at some point in their lives. Government is working closely with health and community partners to improve how programs and services are coordinated within the health sector and connected with social services such as housing and employment supports.

Opioid use continues to be an urgent public health crisis, requiring an ongoing and coordinated response across multiple levels of government, the health sector and social support organizations. In collaboration with health and community partners, the government continues to lead an aggressive response to the opioid crisis, focusing on prevention, harm reduction, targeted actions and expanded access to treatment.

1 Ministry expense, unless otherwise stated, includes as applicable, operating expense, capital grants, amortization, inventory consumption and loss on disposal of capital assets. Some ministries also have funds under Climate Leadership Plan, disaster assistance, debt servicing costs and pension provisions, which are not counted here.

| | |

| FISCAL PLAN 2018 – 21 • EXPENSE | | 19 |

ALBERTA HEALTH SERVICES (AHS)

In 2018-19, a total of $15.2 billion is budgeted for AHS operations. AHS continues to drive improvements in both efficiency and outcomes for Albertans. In 2017-18, AHS implemented Operational and Clinical Best Practice initiatives, which identify opportunities for improvement through benchmarking against comparators. As a result, $37 million was recognized as costs savings in 2017-18 and these initiatives will continue in 2018-19. The shift from acute care to community-based services is also expected to help moderate long-term healthcare cost increases. As part of Budget 2018, the government is increasing investments in community care with an added emphasis on home care.

PHYSICIAN COMPENSATION AND DEVELOPMENT

Through the amended agreement with the Alberta Medical Association (AMA), the government is working cooperatively with physicians to slow

Budget 2018 increases investments

in community care with an added

emphasis on home care.

Ministry of Health – Expense

(excluding debt servicing costs, pension provisions and flood recovery initiatives)

(millions of dollars)

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | 2016-17 | | 2017-18 | | 2017-18 | | 2018-19 | | 2019-20 | | 2020-21 |

| | | | | | |

| | | Actual | | Budget | | Forecast | | Estimate | | Target | | Target |

Alberta Health Services’ Operations: | | | | | | | | | | | | | | | | | | | | | | | | |

Acute Care | | | 3,933 | | | | 3,872 | | | | 3,981 | | | | 3,945 | | | | 4,066 | | | | 4,143 | |

Support Services | | | 2,134 | | | | 2,143 | | | | 2,175 | | | | 2,190 | | | | 2,267 | | | | 2,318 | |

Diagnostic, Therapeutic and Other Patient Services | | | 2,102 | | | | 2,065 | | | | 2,106 | | | | 2,154 | | | | 2,216 | | | | 2,265 | |

Community Care | | | 1,239 | | | | 1,389 | | | | 1,336 | | | | 1,482 | | | | 1,543 | | | | 1,593 | |

Physician Compensation and Development | | | 1,003 | | | | 1,013 | | | | 1,158 | | | | 1,146 | | | | 1,147 | | | | 1,149 | |

Continuing Care | | | 1,031 | | | | 1,072 | | | | 1,047 | | | | 1,107 | | | | 1,133 | | | | 1,155 | |

Home Care | | | 582 | | | | 646 | | | | 631 | | | | 691 | | | | 740 | | | | 830 | |

Ambulance Services | | | 495 | | | | 478 | | | | 495 | | | | 524 | | | | 546 | | | | 576 | |

Administration | | | 476 | | | | 503 | | | | 494 | | | | 509 | | | | 514 | | | | 518 | |

Drugs and Supplemental Health Benefits | | | 450 | | | | 462 | | | | 450 | | | | 496 | | | | 533 | | | | 566 | |

Information Technology | | | 511 | | | | 514 | | | | 516 | | | | 494 | | | | 492 | | | | 488 | |

Population and Public Health | | | 332 | | | | 336 | | | | 333 | | | | 332 | | | | 336 | | | | 339 | |

Research and Education | | | 99 | | | | 162 | | | | 106 | | | | 154 | | | | 154 | | | | 154 | |

Alberta Health Services Sub-total | | | 14,387 | | | | 14,654 | | | | 14,828 | | | | 15,224 | | | | 15,687 | | | | 16,094 | |

| | | | | | |

Department of Health: | | | | | | | | | | | | | | | | | | | | | | | | |

Physician Compensation and Development | | | 4,079 | | | | 4,184 | | | | 4,092 | | | | 4,150 | | | | 4,247 | | | | 4,357 | |

Drugs and Supplemental Health Benefits | | | 1,549 | | | | 1,681 | | | | 1,705 | | | | 1,778 | | | | 1,856 | | | | 1,935 | |

Population and Public Health | | | 228 | | | | 346 | | | | 317 | | | | 336 | | | | 347 | | | | 375 | |

Diagnostic, Therapeutic and Other Patient Services | | | 298 | | | | 326 | | | | 315 | | | | 305 | | | | 325 | | | | 359 | |

Acute Care | | | 162 | | | | 167 | | | | 165 | | | | 172 | | | | 188 | | | | 219 | |

Information Technology | | | 67 | | | | 86 | | | | 73 | | | | 85 | | | | 85 | | | | 85 | |

Ministry Support Services | | | 62 | | | | 80 | | | | 67 | | | | 77 | | | | 77 | | | | 77 | |

Infrastructure Support | | | 59 | | | | 122 | | | | 49 | | | | 49 | | | | 47 | | | | 51 | |

Administration | | | 29 | | | | 41 | | | | 34 | | | | 43 | | | | 43 | | | | 43 | |

Cancer Research and Prevention Investment | | | 8 | | | | 12 | | | | 1 | | | | 13 | | | | 13 | | | | 16 | |

Department of Health Sub-total | | | 6,541 | | | | 7,045 | | | | 6,818 | | | | 7,009 | | | | 7,229 | | | | 7,517 | |

| | | | | | |

Health Quality Council of Alberta | | | 8 | | | | 7 | | | | 7 | | | | 7 | | | | 7 | | | | 7 | |

| | | | | | |

Consolidation and Accounting Policy Adjustments | | | (255 | ) | | | (232 | ) | | | (229) | | | | (183 | ) | | | (184 | ) | | | (182 | ) |

Totals | | | 20,681 | | | | 21,474 | | | | 21,423 | | | | 22,057 | | | | 22,739 | | | | 23,435 | |

| | |

| FISCAL PLAN 2018 – 21 • EXPENSE | | 20 |

Budget 2018 fully funds

enrolment growth.

spending increases while preserving access to high quality primary care for Albertans. The amending agreement with the AMA expires on March 31, 2018 and negotiations are underway on a new agreement to enable government and physicians to continue to reflect a shared responsibility to provide quality health care within a financially sustainable framework. There is a total of $5.3 billion budgeted in 2018-19 for various compensation and development programs for physicians and medical residents. This includes physicians employed by AHS and those on a fee for service contract.

DRUGS AND SUPPLEMENTAL HEALTH BENEFITS

Budget 2018 budgets a total of $2.3 billion for drugs and supplemental benefits in 2018-19, including $575 million for prescription drugs and $130 million in dental, optical and other supplemental health benefits for seniors. This budget also includes a total of $337 million for outpatient cancer and specialized high cost drugs. A new collaborative funding agreement between the province and the Alberta Pharmacists’ Association will save $150 million over the next two years, and reducing the cost of generic drug prices continues to be an important focus.

Education: Kindergarten to Post-Secondary

EDUCATION

Education’s expense is budgeted at $8.4 billion. Alberta’s young population continued to grow through the recession and government is continuing to fully fund enrolment growth, expand the school nutrition program, and invest in safe, caring, and inclusive classrooms so that our students get the best education possible.

In Budget 2018, $6.2 billion is committed for public Early Childhood Services to Grade 12 instruction. This funds enrolment growth of 2.2%, or nearly 15,000 students, in 2018-19. Enrolment growth of 2.5% is forecast in each year of

Ministry of Education – Expense

(excluding debt servicing costs and pension provisions)

(millions of dollars)

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | 2016-17 | | 2017-18 | | 2017-18 | | 2018-19 | | 2019-20 | | 2020-21 |

| | | | | | |

| | | Actual | | Budget | | Forecast | | Estimate | | Target | | Target |

School Board Operations: | | | | | | | | | | | | | | | | | | | | | | | | |

Instruction – Early Childhood Services to Grade 12 | | | 6,011 | | | | 6,040 | | | | 6,052 | | | | 6,208 | | | | 6,425 | | | | 6,622 | |

Operations and Maintenance | | | 756 | | | | 746 | | | | 719 | | | | 723 | | | | 730 | | | | 745 | |

School Facilities Amortization | | | 329 | | | | 364 | | | | 364 | | | | 347 | | | | 347 | | | | 348 | |

Student Transportation | | | 348 | | | | 351 | | | | 348 | | | | 353 | | | | 361 | | | | 365 | |

Governance and System Administration | | | 249 | | | | 249 | | | | 249 | | | | 249 | | | | 249 | | | | 249 | |

Program Support Services | | | 94 | | | | 93 | | | | 93 | | | | 94 | | | | 95 | | | | 95 | |

School Board Operations Sub-total | | | 7,787 | | | | 7,843 | | | | 7,825 | | | | 7,974 | | | | 8,207 | | | | 8,424 | |

| | | | | | |

Accredited Private Schools and ECS Operators | | | 261 | | | | 263 | | | | 268 | | | | 274 | | | | 284 | | | | 292 | |

Departmental Program Support and Amortization | | | 101 | | | | 118 | | | | 117 | | | | 118 | | | | 119 | | | | 119 | |

Ministry Support Services | | | 13 | | | | 12 | | | | 12 | | | | 11 | | | | 11 | | | | 11 | |

School Facilities (includes planning) | | | - | | | | 3 | | | | 3 | | | | 2 | | | | 2 | | | | 2 | |

Consolidation Adjustments | | | (41) | | | | (22) | | | | (22) | | | | (22) | | | | (22) | | | | (22) | |

Totals | | | 8,120 | | | | 8,216 | | | | 8,202 | | | | 8,356 | | | | 8,601 | | | | 8,825 | |

| | |

| FISCAL PLAN 2018 – 21 • EXPENSE | | 21 |

2019-20 and 2020-21. Also included is $461 million for inclusive education to ensure that no student gets left behind. In addition, school authorities will support the establishment of Gay Straight Alliances to help ensure students feel safe and welcome at school.

We owe it to our students to provide them the best education possible, which requires a modern curriculum. The Ministry of Education will continue to develop and prepare for the implementation of a new provincial curriculum for Kindergarten to Grade 12, in English and French. The ministry will continue to take action to ensure that our students succeed in mathematics.

Working collaboratively with Indigenous communities continues to be a priority for the ministry. Budget 2018 will invest more than $80 million in each of the next three years to ensure all students, teachers and school leaders learn about First Nations, Métis and Inuit perspectives and experiences, treaties, agreements and the history and legacy of residential schools. Included is funding of $37 million per year to support key initiatives to strengthen educational outcomes and create opportunities for Indigenous students, including the Innovation in First Nations Education (IFNE) grant program.

To ensure our students have safe schools, in 2018-19, $723 million is allocated to operate and maintain schools and $353 million is allocated to support student transportation services.

In 2016-17, a school nutrition program was piloted with 14 public and separate school authorities. Each authority received $250,000 in grant funding and more than 5,000 students in 33 schools received a daily nutritious meal. In the 2017-18 school year, $10 million was allocated to the school nutrition program as the program expanded to all school boards in the province. More than 22,000 students in over 210 schools participated in the program. Students receive a daily nutritious meal that follows the Alberta Nutrition Guidelines for Children and Youth. $16 million is allocated for the 2018-19 school year and is expected to provide daily meals to approximately 30,000 students.

ADVANCED EDUCATION

Through investments in post-secondary institutions, First Nations colleges, and community adult learning providers, the Ministry of Advanced Education supports high quality adult education, innovation and research,

The school nutrition program

will feed about 30,000 students.

Ministry of Advanced Education – Expense

(excluding debt servicing costs and pension provisions)

(millions of dollars)

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | 2016-17 | | 2017-18 | | 2017-18 | | 2018-19 | | 2019-20 | | 2020-21 |

| | | | | | |

| | | Actual | | Budget | | Forecast | | Estimate | | Target | | Target |

Post-Secondary Operations | | | 5,451 | | | | 5,598 | | | | 5,596 | | | | 5,747 | | | | 5,893 | | | | 6,092 | |

| | | | | | |

Student Aid | | | 221 | | | | 243 | | | | 223 | | | | 228 | | | | 235 | | | | 241 | |

Other Support for Adult Learning | | | 73 | | | | 76 | | | | 75 | | | | 78 | | | | 82 | | | | 82 | |

Foundational Learning Supports | | | 79 | | | | 85 | | | | 90 | | | | 94 | | | | 105 | | | | 112 | |

Apprenticeship Delivery | | | 28 | | | | 32 | | | | 31 | | | | 31 | | | | 38 | | | | 38 | |

Ministry Support Services | | | 14 | | | | 15 | | | | 15 | | | | 15 | | | | 15 | | | | 15 | |

Consolidation Adjustments | | | (8) | | | | (57) | | | | (57) | | | | (51) | | | | (51) | | | | (51) | |

Totals | | | 5,857 | | | | 5,991 | | | | 5,973 | | | | 6,142 | | | | 6,316 | | | | 6,530 | |

| | |

| FISCAL PLAN 2018 – 21 • EXPENSE | | 22 |

$31 million is

budgeted for delivery of

apprenticeship programs.

skills development, apprenticeship, literacy and foundational training for all Albertans. Budget 2018 keeps government’s commitments to provide stable and predictable funding to institutions and ensure the post-secondary system is accessible and affordable for Alberta students and families by extending the tuition freeze into a fourth year.

Advanced Education’s expense is budgeted at $6.1 billion, which includes $2.4 billion in support for post-secondary institutions, including a 2% increase from last year and an additional $17 million in back-fill funding to provide for the continuation of the tuition freeze. Budget 2018 provides $6 million to begin investing in 3,000 new technology-related post-secondary program seats, which will grow to $43 million per year by 2022-23. New funding will attract investment to the province and bolster programs that will help create good jobs for everyday Albertans and enhanced training to grow a high-tech workforce. Coupled with this, the ministry will provide new scholarships that grow to $7 million per year by 2022-23 to support technology and other emerging sectors like life sciences, clean technology and health innovation. Alberta’s Student Aid and Foundational Learning programs ensure affordable post-secondary education by providing financial supports to adult learners to enable access and encourage progression in post-secondary, apprenticeship, and foundational learning programs.

Budget 2018 continues to provide funding to public post-secondary institutions to enhance their capacity to provide supports, services and accommodations for all backgrounds and abilities. Investments in supports for Indigenous adult learners, including $11 million for Indigenous training providers and targeted financial supports for learners, will ensure that Indigenous students have meaningful and relevant learning experiences.

Fostering healthy and safe campuses continues to be a priority. Funding of $8 million is provided to ensure that mental health supports are accessible and available when post-secondary students need them.

Apprenticeship delivery funding of $31 million allows Alberta’s apprenticeship system to ensure the next generation of skilled tradespeople receive the training and work experience they need to meet future jobsite demands and support the economic recovery.

Social Services and Justice

COMMUNITY AND SOCIAL SERVICES

The Ministry of Community and Social Services provides adaptive, innovative and person-centred programs and services to ensure that all Albertans are enabled and empowered to be successful.

Community and Social Services’ expense is budgeted at $3.7 billion. There is $1.3 billion allocated in 2018-19 for the delivery of disability services programs, including persons with developmental disabilities, family support for children with disabilities and fetal alcohol spectrum disorder initiatives. Also included is a newly established disability advocate who will be responsible for promoting the rights and interests of people with disabilities while examining broader issues affecting the community. This represents an increase of $64 million

| | |

| FISCAL PLAN 2018 – 21 • EXPENSE | | 23 |

from the 2017-18 forecast to address expected caseload growth. A review of the Persons with Developmental Disabilities program, announced in January 2018, will explore ways the system can be improved to ensure individuals and families get the best supports available.

The Assured Income for the Severely Handicapped (AISH) program is budgeted at $1.1 billion in 2018-19 and will help nearly 62,000 adults live more independently. This represents an increase of $62 million from the 2017-18 forecast to address expected caseload growth.

Community and Social Services provides income support to low-income Albertans to cover their basic costs of living and help them to find a job or improve the one they have, so they can support themselves and their family. Income support programs are budgeted at $939 million, which represents an increase of $33 million from the 2017-18 forecast, to ensure those basic needs are met.

Funding in Budget 2018 provides secure, stable housing for Albertans affected by homelessness while delivering the services and supports to remain housed. There is $197 million budgeted in 2018-19 for Homeless and Outreach Support Services. This budget will support more than 100 new permanent supportive housing spaces – set to open in 2018-19. Budget 2018 ensures that Albertans in need will be safe, with funding for 28 homeless shelters, 30 women’s emergency shelters, 12 second-stage shelters, and trauma informed programming serving women and children leaving family violence. Budget 2018 continues to invest approximately $50 million per year in women’s shelters, as a result of a $15 million funding increase in 2015.

The ministry continues to support initiatives that make Alberta’s communities strong, resilient and violence-free. There is $123 million budgeted in 2018-19 for Community Supports and Family Safety, which includes funding of $101 million for Family and Community Support Services (FCSS), keeping government’s commitment to support these 80/20 partnerships between the province and 317 municipalities and Métis settlements organized within 206 local FCSS programs. At the community level, this funding encourages citizen participation, self-help and volunteerism, and enables communities to be innovative and creative in responding to local challenges.

Budget 2018 supports the basic needs

of low-income Albertans.

Ministry of Community and Social Services – Expense

(excluding flood recovery initiatives)

(millions of dollars)

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | 2016-17 | | 2017-18 | | 2017-18 | | 2018-19 | | 2019-20 | | 2020-21 |

| | | | | | |

| | | Actual | | Budget | | Forecast | | Estimate | | Target | | Target |

Disability Services | | | 1,120 | | | | 1,130 | | | | 1,193 | | | | 1,257 | | | | 1,285 | | | | 1,313 | |

Assured Income for the Severely Handicapped | | | 1,004 | | | | 1,048 | | | | 1,071 | | | | 1,133 | | | | 1,190 | | | | 1,249 | |

Employment and Income Support | | | 827 | | | | 825 | | | | 906 | | | | 939 | | | | 1,012 | | | | 1,042 | |

Homeless and Outreach Support Services | | | 184 | | | | 193 | | | | 192 | | | | 197 | | | | 196 | | | | 196 | |

Community Supports and Family Safety | | | 122 | | | | 123 | | | | 129 | | | | 123 | | | | 128 | | | | 128 | |

Services Provided to Other Ministries | | | - | | | | - | | | | 62 | | | | 51 | | | | 51 | | | | 51 | |

Ministry Support Services | | | 21 | | | | 24 | | | | 24 | | | | 24 | | | | 24 | | | | 24 | |

Consolidation Adjustments | | | (20) | | | | (13) | | | | (75) | | | | (63) | | | | (63) | | | | (63) | |

Totals | | | 3,258 | | | | 3,330 | | | | 3,502 | | | | 3,661 | | | | 3,823 | | | | 3,940 | |

| | |

| FISCAL PLAN 2018 – 21 • EXPENSE | | 24 |

The Alberta Child Benefit

supports 120,000 families.

CHILDREN’S SERVICES

The Ministry of Children’s Services is dedicated to the well-being of Alberta’s children and youth by helping ensure they get the services and supports they need to thrive in healthy families and healthy communities.

Children’s Services’ expense is budgeted at $1.5 billion. There is $826 million allocated towards strengthening the child intervention system in 2018-19. These funds will deliver both prevention and intervention programs to enhance the safety and well-being of children and youth at-risk across Alberta. Following a year of engagement with families, youth, communities including Indigenous peoples, stakeholders and experts in the system, the all-party Ministerial Panel on Child Intervention delivered its final recommendations to the Minister of Children’s Services. In response, the ministry will work alongside Indigenous communities, frontline workers and community partners to strengthen supports for children and families.

The ministry is helping families meet the cost of early childhood education by investing $393 million in 2018-19 for child care programs. This reflects an increase of $22 million from the 2017-18 forecast and underscores the commitment to make quality, accessible and affordable child care available to Alberta’s youngest citizens. Based on federal investment of approximately $46 million for each of the three years under the Canada-Alberta Early Learning and Child Care Bilateral Agreement, 78 additional Early Learning and Child Care Centres were announced in December 2017, bringing the total number to 100. This means 4,500 additional children and their families will have access to quality, affordable $25-per-day child care.

Budget 2018 also includes $175 million for the Alberta Child Benefit program. This benefit will provide up to $2,820 each year, supporting about 120,000 vulnerable families across the province, to help augment the cost of living.

With an investment of $108 million, Children’s Services is providing culturally appropriate community based early childhood services, parenting resources such as the Positive Parenting Program (Triple P) through Parent Link Centres, and youth services that will support the safety, well-being and resiliency of children, youth and families in their homes and in their communities, and reduce the need for more intensive crisis based services in the future.

Ministry of Children’s Services – Expense

(millions of dollars)

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | 2016-17 | | 2017-18 | | 2017-18 | | 2018-19 | | 2019-20 | | 2020-21 |

| | | | | | |

| | | Actual | | Budget | | Forecast | | Estimate | | Target | | Target |

Child Intervention | | | 771 | | | | 766 | | | | 813 | | | | 826 | | | | 847 | | | | 863 | |

Child Care | | | 311 | | | | 321 | | | | 371 | | | | 393 | | | | 406 | | | | 420 | |

Alberta Child Benefit | | | 106 | | | | 174 | | | | 170 | | | | 175 | | | | 179 | | | | 182 | |

Early Intervention Services for Children and Youth | | | 96 | | | | 103 | | | | 103 | | | | 108 | | | | 108 | | | | 108 | |

Ministry Support Services | | | 16 | | | | 18 | | | | 18 | | | | 18 | | | | 18 | | | | 18 | |

Services Provided to Other Ministries | | | - | | | | - | | | | - | | | | 10 | | | | 10 | | | | 10 | |

Consolidation Adjustments | | | (9) | | | | (11) | | | | (11) | | | | (21) | | | | (21) | | | | (21) | |

Totals | | | 1,291 | | | | 1,371 | | | | 1,464 | | | | 1,509 | | | | 1,547 | | | | 1,580 | |

| | |

| FISCAL PLAN 2018 – 21 • EXPENSE | | 25 |

SENIORS AND HOUSING

The Ministry of Seniors and Housing works with seniors, Albertans who require housing supports and others in the network of support: families and caregivers, communities, senior-serving organizations, housing management bodies, housing providers and other government partners.

Seniors and Housing’s expense is budgeted at $683 million. Budget 2018 continues the government’s commitment to a sustainable affordable housing system, providing safe homes for vulnerable Albertans and promoting well-being for Alberta’s aging population. The majority of the budget is made up of financial benefit programs that directly support Albertans with low income, and currently provides supports to over 155,000 seniors with low income and 75,000 Albertans (47,000 households) in need of affordable housing. The Seniors Services budget provides $366 million in financial assistance to seniors with low income through the Alberta Seniors Benefit program. This program has two components, including a monthly income supplement currently provided to 155,000 seniors and a supplementary benefit for seniors living in long-term care or designated supportive living.

The ministry has also committed $27 million in funding for Special Needs Assistance Grants, the Seniors Home Adaptation and Repair Program, and for Seniors Community Grants.

Budget 2018 has $256 million, delivered through the Alberta Social Housing Corporation, to support 47,000 households in securing affordable housing in Alberta. This includes $132 million for family and seniors housing, $68 million towards rental assistance and $16 million targeted towards special needs housing.

This budget also provides $12 million in maintenance and renewal funding for Housing Management Bodies across the province.

Seniors and Housing has developed the Affordable Housing Energy Savings Program (AHESP), which will enable retrofits in affordable housing units. This program will reduce greenhouse gas emissions, make buildings more environmentally and financially sustainable, and reduce utility costs for eligible affordable housing providers and tenants. There is $25 million allocated over three years to deliver this program.

JUSTICE AND SOLICITOR GENERAL

The Ministry of Justice and Solicitor General helps ensure that all Albertans can live in safe and secure communities while having access to a fair and impartial justice system. Working alongside its partners in law enforcement, the judiciary, family justice, health, the criminal justice system and other stakeholders, the ministry has a direct or shared responsibility in all elements of the justice system in Alberta. Its programs and services help ensure Albertans’ security and access to justice through efficient functioning of courts, corrections and law enforcement.

Justice and Solicitor General’s expense is budgeted at $1.47 billion. This budget includes $520 million for Public Security programs including policing, provincial sheriffs and enforcement branches. Funding for provincial contract

AHESP will reduce utility costs for eligible providers and tenants.

| | |

| FISCAL PLAN 2018 – 21 • EXPENSE | | 26 |

Funding will address staffing

pressures in courts and

prosecution services.

The fair practices and medical panels

offices will ensure the workers’

compensation system is fair and

supports injured workers.

policing increases to $256 million in 2018-19, including new funding for the RCMP salary settlement, new RCMP officers, and policing services provided at no direct cost to all rural municipalities, including municipal districts, counties and Métis settlements, regardless of population, as well as towns, villages and summer villages with populations of 5,000 or less. A new seven-point action plan geared toward reducing rural crime will put resources where they are most needed. In addition, the current funding model assists urban municipalities with the cost of policing in several ways, including Municipal Policing Assistance Grants and Police Officer Grants.

Provincial contract policing also includes additional funding for rural crime reduction initiatives through new officers, civilian staff and equipment in key locations around the province; an additional $10 million will be spent in 2018-19. This budget includes $288 million for Correctional Services, $208 million for Resolution and Court Administration Services, $89 million in Support for Legal Aid and $104 million for the Crown prosecution service. The increased funding for the courts and prosecution service will allow critical staffing pressures to be addressed which will assist in prioritizing resources on serious and violent cases and holding offenders to account.

LABOUR

The Ministry of Labour protects workers’ rights by ensuring fair and modern legislation and regulating Alberta’s workplaces. The ministry also supports the continued development of Alberta’s skilled workforce and an efficient labour market that enables a thriving and diverse economy.

Labour’s expense is budgeted at nearly $223 million. This budget provides $78 million for safe, fair and healthy workplaces, which includes additional funding to support updated labour laws. More Employment Standards Officers will be hired to effectively implement changes resulting from the Fair and Family-friendly Workplaces Act. The additional staff are required to manage complaint resolution, proactive inspections, education and prevention, and administrative penalties.

As a result of the Occupational Health and Safety (OHS) system review and Workers’ Compensation Board (WCB) review, additional OHS officers will be hired to ensure Alberta workplaces are safe and healthy. In addition, a new fair practices office and medical panels office will be established to ensure the workers’ compensation system is fair and provides greater benefits to support injured workers.

The budget also includes $114 million for workforce strategies, including $41 million for skills and training support which will help workers be well- prepared to participate in the labour market.

| | |

| FISCAL PLAN 2018 – 21 • EXPENSE | | 27 |

Indigenous Relations, Municipalities and Transportation

INDIGENOUS RELATIONS

The Ministry of Indigenous Relations is integral to leading the development of government-wide policies, strategies and partnerships with Indigenous organizations, governments and industry to support strong, vibrant Indigenous communities and people who fully participate in a prosperous, competitive and diverse Alberta.

Indigenous Relations’ expense is budgeted at $190 million. Alberta is committed to reconciliation with Indigenous peoples and implementing the principles of the United Nations Declaration on the Rights of Indigenous Peoples (United Nations Declaration). Budget 2018 allocates $3 million to help foster relationships with Indigenous peoples and support initiatives in response to the United Nations Declaration, including efforts to supporting implementation of Alberta’s Protocol Agreements.

This budget provides $123 million for the First Nations Development Fund which provides grants to support First Nations’ economic, social and community priorities. Approximately $24 million is allocated for First Nations and Métis Relations to provide grant funding, for example the Aboriginal Economic Partnerships Program and the Employment Partnerships Program, to provide advice and support to Indigenous communities and organizations, as well as for implementing relationship agreements to improve the lives of Métis peoples.

The First Nations Consultation Capacity Investment Program includes $7 million for assisting First Nations and Treaty organizations with continued development of consultation structures, including capacity building for consultation staff, to fulfill their responsibilities within Alberta’s consultation process. Consultation and engagement is taking place in a number of priority areas such as climate change adaptation, natural resource development, and caribou range planning, as well as steps to include Indigenous perspectives in land use planning, implementation and management.

MUNICIPAL AFFAIRS

The Ministry of Municipal Affairs builds and maintains relationships with municipalities that strengthen Alberta’s communities.

Municipal Affairs’ expense is budgeted at almost $1.2 billion. This includes the Municipal Sustainability Initiative (MSI) that provides grants to municipalities to help meet long-term infrastructure needs. A total of $800 million of MSI was provided in March 2018 from future years – $400 million from each of 2018-19 and 2019-20. Re-profiling these grants to 2017-18 provided local governments with flexibility in planning capital projects and adjusting to new fiscal arrangements. As government addresses its fiscal challenges, and as the end of the MSI approaches, funding arrangements with municipalities will be reviewed. Pending those discussions, funding under the MSI has been reduced by $152 million each year.

Budget 2018 provides $123 million for

the First Nations Development Fund.

| | |

| FISCAL PLAN 2018 – 21 • EXPENSE | | 28 |

Over $423 million is budgeted

for highway maintenance.

The adjustment sees the $11.3 billion MSI program continuing until 2021-22. The government is committed to working with municipalities, over the coming months, to replace the MSI with a new infrastructure grant program, with a funding formula based on revenue sharing. The MSI is budgeted at $668 million in 2018-19. ($1,068 million, once the $400 million re-profiled to 2017-18 is included).

This budget will enhance public safety through ongoing updates to building codes and continued oversight in fire safety, while strategic investments in emergency management boost Alberta’s ability to safeguard against and respond to disasters. A total of $37 million in support to the provincial library network and operating grants will expand public library resources and services available to Albertans and their families, including Indigenous communities.

TRANSPORTATION

The Ministry of Transportation is making smart investments in the transportation system to create good jobs and contribute to Alberta’s economic recovery. Transportation’s expense is budgeted at nearly $1.5 billion. The ministry is developing key economic corridors, modern public transportation, roads, bridges and other critical infrastructure. Transportation will launch a rural transportation pilot program to connect residents in rural communities, and lay the foundation for a permanent program.

Over $667 million is allocated in capital grants (including Climate Leadership Plan and flood recovery initiatives) and supports the Government of Alberta’s Climate Leadership Plan while helping to create planning, engineering and construction jobs. The capital grants are for priority municipal public transit projects and critical drinking water and wastewater facilities. Provincial support for these projects will be partly achieved through the new Alberta Community Transit Fund and the First Nations Water Tie-In Program, which is part of Alberta’s commitment to the United Nations Declaration on the Rights of Indigenous Peoples.

Transportation manages more than 31,400 kilometers of highways, the largest number of kilometers per capita in Canada. More than $423 million is budgeted for on-going provincial highway maintenance to ensure the safe movement of people and goods throughout the province, and foster economic growth. Almost $35 million is committed to enhancing transportation safety through educational, regulatory, technological and infrastructure improvements to ensure Alberta highways remain amongst the safest in the country.

Agriculture, Resource Management,

Recreation and Culture

AGRICULTURE AND FORESTRY

The Ministry of Agriculture and Forestry provides the framework and services necessary for Alberta’s agriculture and forest industries to excel, inspire public confidence in the quality and safety of food and wildfire management, support environmentally sustainable practices, and lead the collaboration that enables resilient rural communities.

| | |

| FISCAL PLAN 2018 – 21 • EXPENSE | | 29 |

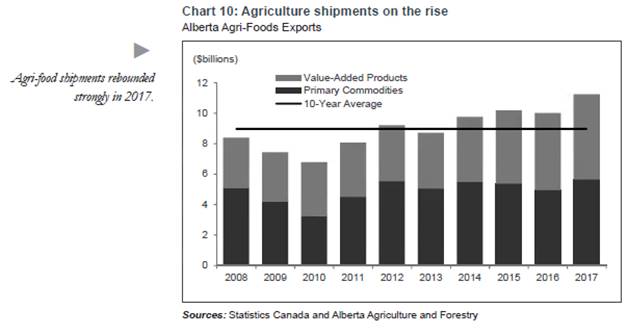

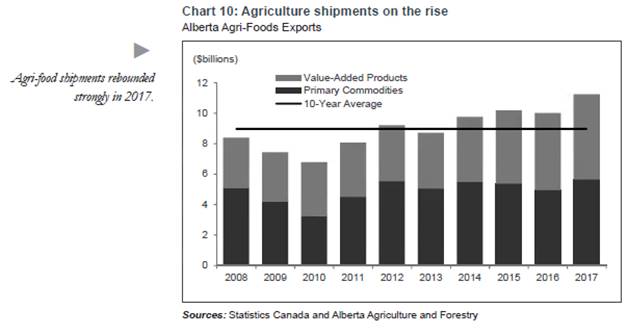

Agriculture and Forestry’s expense is budgeted at $1.1 billion. This budget will support sustainable development in the agriculture and forestry sectors by focusing on sustainable growth through innovation, economic diversification, competitiveness and market access, as well as ensuring food safety and animal health. With a ministry focus to actively adopt innovative processes and technologies and promote value-added production and commercialization, Alberta is delivering a variety of high quality agriculture and forestry products and services that drive growth and economic diversification. The new Canadian Agricultural Partnership (CAP), a bilateral agreement with the Government of Canada will provide $47 million towards supporting sustainable growth, innovation and competitiveness in the agriculture industry.

Government promotes economic diversification through a suite of programs aimed at Alberta small liquor manufacturers. $25 million in the Alberta Small Brewers Development Program will support Alberta’s small brewers by providing flexibility to invest in their businesses, launch new products, and develop new markets. $200 million in forestry programs will provide funding for wildfire prevention, wildfire suppression initiatives as well as forest management initiatives, such as mitigating the mountain pine beetle, that help to maintain productive and sustainable forestry ecosystems. The department will continue investing in Alberta’s rural communities through $64 million in funding for the delivery of rural development programming, such as support to Agricultural Societies and Service Boards, local food initiatives, education, and rural electric and gas infrastructure. The Agriculture Financial Services Corporation will provide financial products to agricultural producers, including $528 million for crop, hail and livestock insurance and lending services as well as $120 million for agriculture income support.

ENVIRONMENT AND PARKS

The Ministry of Environment and Parks works to manage the province’s land and natural resources which is necessary to achieve Alberta’s long-term economic, environmental and social goals.

Environment and Parks’ expense is budgeted at $526 million. This budget provides $10 million for the development and implementation of regional plans including the North and South Saskatchewan, Lower and Upper Athabasca, Lower Peace and recreational use frameworks and management plans for priority areas including Porcupine/Livingstone, Moose Lake, Bighorn, Castle Wildland Provincial Park and Castle Provincial Park.

Parks and protected areas are essential tools for conserving nature and improving the status of biodiversity. They protect the habitat that species need to survive and thrive and this is an essential step toward conserving Canada’s ecosystems in the long term. $15 million is provided for species recovery plans and ecosystem plans and associated landscape recovery actions.

$107 million is provided for parks including funding to advance cooperative management of Alberta’s Parks with Indigenous peoples, and developing new Alberta Parks capital infrastructure through the Capital Maintenance and Renewal Program. This funding includes Alberta’s response to “Pathway to Canada Target 1 – Achieving Canada Target 1 in Alberta” to conserve 17% of Alberta’s terrestrial area and inland waters.

Budget 2018 continues investing

in rural communities.

Parks funding advances cooperative management with Indigenous peoples.

| | |

| FISCAL PLAN 2018 – 21 • EXPENSE | | 30 |

The Alberta Screen-Based Production Grant program supports cultural and commercial productions.

This budget also provides $33 million for ongoing policy, plans and programs to better anticipate and minimize the impact of catastrophic events such as floods, droughts, human-wildlife conflicts and invasive species.

CULTURE AND TOURISM

The Ministry of Culture and Tourism supports the development and sustainability of Alberta’s cultural industries, tourism, the arts, recreation and sport, heritage, non-profit/voluntary sector and Alberta’s French’ speaking population.

Culture and Tourism’s expense is budgeted at $381 million. This budget provides $101 million for arts and cultural industries. Through the Alberta Media Fund, the ministry provides financial incentives to support screen-based production (such as Heartland and Fargo), book and magazine publishing, sound recordings, and interactive digital media. This investment creates, sustains and attracts skilled workers and helps diversify the economy.

Budget 2018 provides $56 million for tourism development and marketing. The ministry works in collaboration with internal and external stakeholders to support the growth of new and expanded tourism attractions, destinations and experiences, as well as developing tourism opportunities with China and other countries. The ministry collaborates with partners in the recreation, physical activity and sport sectors on quality programs and policies that support the Framework for Recreation in Canada and provincial sport initiatives, such as hosting the 2019 Canada Winter Games in Red Deer.

The ministry showcases Alberta’s heritage through its network of 20 museums, historic sites and archives, which collaborate with Education to enhance the K–12 curriculum. The ministry is continuing work with government partners to finalize the development of the Royal Alberta Museum, and expand the Royal Tyrrell Museum of Paleontology and the Reynolds-Alberta Museum. The ministry also regulates potential impacts to historic buildings, archaeological and paleontological sites, and Indigenous traditional use sites. Funding of $63 million allocated in Budget 2018 will help to ensure Albertans and visitors from around the world have continued access to our museums, archives and historic resources.

The ministry works to strengthen the capacity of Alberta’s non-profit/ voluntary sector by providing financial support, consultation, and skill development services. Budget 2018 provides $132 million in funding through Community Grants programs, including the Community Facility Enhancement Program, the Community Initiatives Program, and the Major Fairs Program.

In its role as a liaison between government and Alberta’s French-speaking population, the Francophone Secretariat represents the needs of the Francophonie in Alberta. The Secretariat collaborates with government departments, agencies, boards and commissions, and Francophone stakeholders to implement a French Policy for Alberta to guide the development and delivery of government services in French.

| | |

| FISCAL PLAN 2018 – 21 • EXPENSE | | 31 |

Government Services

SERVICE ALBERTA