Exhibit 99.1

This is the report to Albertans on Budget 2018: A Recovery Built to Last.

It is a permanent public record of the revenue, expense and results achieved by the Government of Alberta for the 2018 – 19 fiscal year.

The Government of Alberta 2018 ��� 19 Annual Report consists of three parts:

| | · | | Budget 2018 Key Results, which provide a description and variance analysis of government’s revenue, spending, assets and liabilities. |

| | · | | Consolidated Financial Statements, which provide an overall accounting of the government’s revenue and spending, and assets and liabilities. |

| | · | | Measuring Up, which reports on the progress that has been made towards achieving the government’s goals. |

Annual reports for each ministry have also been published, providing additional detailed information on performance and financial results.

Copyright © 2019

| | |

| Government of Alberta 2018–19 Annual Report |

| |

ISBN 978-1-4601-4522-7 (print) ISSN 2291-6423 (print) | | ISBN 978-1-4601-4523-4 (PDF) ISSN 2291-6431 (online) |

Preface

The Public Accounts of Alberta are prepared in accordance with the Financial Administration Act and the Fiscal Planning and Transparency Act. The Public Accounts consist of the Annual Report of the Government of Alberta and the annual reports of each of the 21 ministries.

This Annual Report of the Government of Alberta contains Budget 2018 Key Results, the audited Consolidated Financial Statements and the Measuring Up report, which compares actual performance results to desired results set out in the government’s strategic plan.

The annual reports of ministries are released concurrently with the Annual Report of the Government of Alberta. The ministry annual reports contain the financial information of the ministries and a comparison of actual performance results to desired results set out in the ministries’ business plans. Each ministry annual report also includes:

| ∎ | | Financial statements of entities making up the ministry which includes regulated funds, provincial agencies and Crown-controlled corporations for which the minister is responsible; |

| ∎ | | Other financial information as required by the Financial Administration Act and the Fiscal Planning and Transparency Act, as separate reports, to the extent that the ministry has anything to report; |

| ∎ | | Financial information relating to accountable organizations and trust funds. |

In December 2018, government announced changes to the 2018-19 Consolidated Financial Statements and ministry annual reports. Ministry and department audited financial statements previously included in the annual report of ministries have been replaced with the financial information of the ministries. Key information previously contained in the annual reports of each of the 21 ministries is now included in the Schedules to the audited Consolidated Financial Statements.

| | |

| GOVERNMENT OF ALBERTA 2018—19 ANNUAL REPORT | | 1 |

Table of Contents

| | |

| 2 | | GOVERNMENT OF ALBERTA 2018—19 ANNUAL REPORT |

Table of Contents, continued

| | |

| GOVERNMENT OF ALBERTA 2018—19 ANNUAL REPORT | | 3 |

BLANK PAGE

Budget 2018 Key Results

Table of Contents

Note: Amounts presented in tables and text may not add to totals due to rounding.

| | |

| 6 | | GOVERNMENT OF ALBERTA 2018—19 ANNUAL REPORT |

Financial Highlights

The deficit in 2018-19 was $6.7 billion, a decrease of $1.3 billion from 2017-18, and $2.1 billion lower than estimated in Budget 2018.

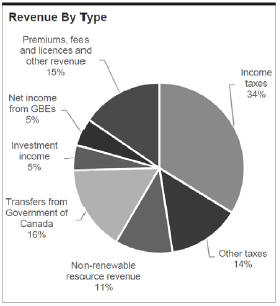

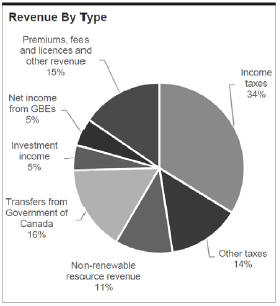

Total Revenue was $49.6 billion in 2018-19, $2.3 billion higher than in 2017-18, and an increase of $1.7 billion from budget.

| ∎ | | Change from 2017-18. Increases of $2.8 billion in income and other taxes, $0.4 billion in non-renewable resource revenue, $0.4 billion in transfers from the federal government, and $0.2 billion in premiums, fees and licences and other revenue, were partly offset by decreases of $0.8 billion in investment income and of $0.8 billion in net income from government business enterprises (GBEs). |

| ∎ | | Change from Budget. Increases of $0.8 billion in income taxes, $1.6 billion in resource revenue, $0.4 billion in other revenue were partly offset by decreases of $0.1 billion in other taxes, $0.5 billion in investment income, $0.2 billion in federal |

transfers, and $0.2 billion in net income from GBEs.

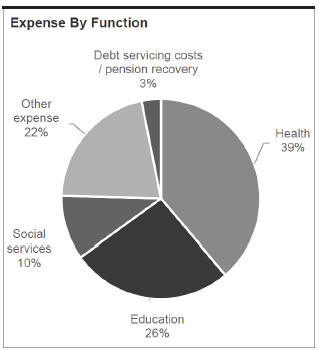

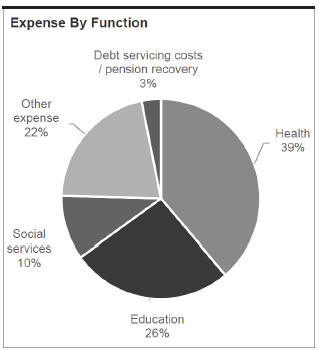

Total Expense was $56.3 billion, a $1 billion increase from 2017-18 and $0.2 billion more than estimated in budget. The following discussion is based on “Expense by Function” categories, not by ministry.

| ∎ | | Change from 2017-18. Comprises increases of $0.7 billion in health, $0.4 billion in education, $0.3 billion in social services, $0.6 billion in debt servicing costs and $0.4 billion lower pension recovery, less a decrease of $1.3 billion in other expense. |

| ∎ | | Change from Budget. Increases of $0.2 billion in education and $0.1 billion in the pension recovery were partly offset by a $0.2 billion decrease in health expense. |

Net Financial Debt. At March 31, 2019, net financial debt was $27.5 billion, an increase of $8.1 billion from March 31, 2018, mainly due to higher borrowing for the fiscal and capital plans.

Fiscal Summary

(millions of dollars)

| | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | Change from | |

| | | 2018-19 | | | 2017-18 | | | | | | 2017-18 | |

| | | | | | | | | | | | |

| | | Budget | | | Actual | | | Actual | | | Budget | | | Actual | |

| |

Revenue | | | | | | | | | | | | | | | | | | | | |

Income taxes | | | 15,938 | | | | 16,745 | | | | 14,223 | | | | 807 | | | | 2,522 | |

Other taxes | | | 6,961 | | | | 6,833 | | | | 6,538 | | | | (128 | ) | | | 295 | |

Non-renewable resource revenue | | | 3,829 | | | | 5,429 | | | | 4,980 | | | | 1,600 | | | | 449 | |

Transfers from Government of Canada | | | 8,218 | | | | 8,013 | | | | 7,605 | | | | (205 | ) | | | 408 | |

Investment income | | | 2,884 | | | | 2,349 | | | | 3,126 | | | | (535 | ) | | | (777) | |

Net income from government business enterprises | | | 2,777 | | | | 2,585 | | | | 3,387 | | | | (102 | ) | | | (802) | |

Premiums, fees and licences | | | 3,857 | | | | 3,909 | | | | 3,843 | | | | 52 | | | | 66 | |

Other revenue | | | 3,415 | | | | 3,761 | | | | 3,593 | | | | 346 | | | | 168 | |

| | | | |

Total Revenue | | | 47,879 | | | | 49,624 | | | | 47,295 | | | | 1,740 | | | | 2,322 | |

| | | | |

Expense by Function | | | | | | | | | | | | | | | | | | | | |

Health | | | 22,099 | | | | 21,921 | | | | 21,239 | | | | (178 | ) | | | 682 | |

Education | | | 14,633 | | | | 14,848 | | | | 14,471 | | | | 215 | | | | 377 | |

Social Services | | | 5,922 | | | | 5,867 | | | | 5,592 | | | | (55 | ) | | | 275 | |

Other expense1 | | | 11,916 | | | | 11,918 | | | | 13,189 | | | | 2 | | | | (1,271) | |

| | | | |

Total Program Expense | | | 54,570 | | | | 54,554 | | | | 54,491 | | | | (16 | ) | | | 63 | |

Debt servicing costs | | | 1,921 | | | | 1,971 | | | | 1,420 | | | | 50 | | | | 551 | |

Pension provisions / (recovery) | | | (310 | ) | | | (190 | ) | | | (593 | ) | | | 120 | | | | 403 | |

| | | | |

Total Expense | | | 56,181 | | | | 56,335 | | | | 55,318 | | | | 154 | | | | 1,017 | |

| |

Risk Adjustment | | | (500 | ) | | | - | | | | - | | | | 500 | | | | - | |

| |

Surplus / (Deficit) | | | (8,802 | ) | | | (6,711 | ) | | | (8,023 | ) | | | 2,086 | | | | 1,305 | |

| |

| | | | | | | | | | | | | | | | | | | | |

| |

Net Financial Debt | | | (29,585 | ) | | | (27,477 | ) | | | (19,344 | ) | | | (2,108 | ) | | | (8,133) | |

| |

| 1 | Other expense by function categories are detailed in the Statement of Operations on page 19 in the Consolidated Financial Statements. |

| | |

| BUDGET 2018 KEY RESULTS | | 7 |

Revenue Highlights

Total revenue was $49.6 billion in 2018-19, 2.3 billion higher than in 2017-18, and an increase of $1.7 billion from the Budget 2018 estimate.

| ∎ | | Revenue from income taxes was $16.7 billion in 2018-19, comprising $11.9 billion in personal income tax (PIT) and $4.9 billion in corporate income tax (CIT). PIT was up $0.5 billion from budget and $1.1 billion from 2017-18 mainly due to growth in employment and incomes and $0.4 billion in prior-years’ adjustments. CIT was $1.4 billion higher than it was in 2017-18 and $0.3 billion higher than in budget mainly due to year-end accounting adjustments, such as refund liabilities or accounts payable. |

| ∎ | | Other tax revenue was $6.8 billion in 2018-19, comprising: $2.4 billion in education property tax, which was frozen at the 2017-18 requisition level, $1.4 billion in fuel tax, $1.3 billion in carbon tax and $1.7 billion in other taxes. Other tax revenue was up $0.3 billion from 2017-18, but down $0.1 billion from budget. The 2017-18 change was due almost entirely to the $10 per tonne carbon price increase, effective January 1, 2018, while the change from budget was due to lower demand. |

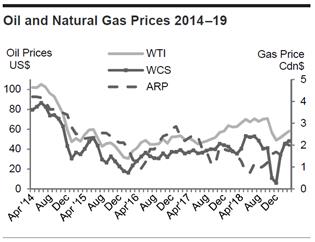

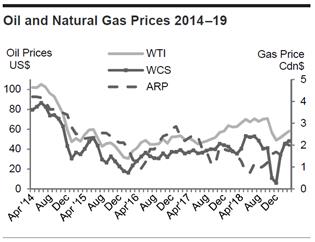

| ∎ | | Non-renewable resource revenue was $5.4 billion, a $0.4 billion increase from 2017-18, and an increase of $1.6 billion from budget, primarily due to higher oil prices and production, and a lower exchange rate. The West Texas Intermediate price averaged US$62.77 in 2018-19, up $9.08 from 2017-18 and $3.77 from the budget estimate. The Western Canadian Select heavy oil price averaged Cdn$51.65, up $1.27 from 2017-18. The average light-heavy differential in 2018-19 was US$23.31, $8.91 wider than 2017-18, but higher oil prices muted the impact. |

| ∎ | | Transfers from the Government of Canada were $8 billion in 2018-19, an increase of $0.4 billion from 2017-18, mainly due to expected growth in the Canada Health Transfer (CHT) and Canada Social Transfer (CST). The $0.2 billion decrease from budget was due to revisions to population numbers, which impact the CHT and CST, as well as re-profiling federal infrastructure funding to future years. |

| ∎ | | Investment income was $2.3 billion in 2018-19, down $0.8 billion from 2017-18 and $0.5 billion from budget, due mainly to weaker market returns. |

| ∎ | | Net income from government business enterprises was $2.6 billion in 2018-19, with $2.3 billion of this from the Alberta Gaming, Liquor and Cannabis Commission. The $0.8 billion decrease from 2017-18 was mainly due to a $0.4 billion decrease in the Balancing Pool net income, which reported a reduction to its liability of $0.8 billion in 2017-18 that was reported as revenue. The $0.2 billion decrease from budget was mainly due to decreases in Alberta Petroleum Marketing Commission and ATB Financial net income, due to delays in opening the Sturgeon Refinery, and to higher credit loss provisions. |

| ∎ | | Premiums, fees and licences and other revenue totalled $7.7 billion in 2018-19, up $0.2 billion from 2017-18 and $0.4 billion from budget. The increase from 2017-18 was primarily due to an increase in compliance payments from large emitters under the new regulation which adjusted the calculation, and the increase from budget was due to an increase in refunds of prior-year expense, recorded as revenue. |

| | |

| 8 | | GOVERNMENT OF ALBERTA 2018—19 ANNUAL REPORT |

Expense Highlights

Total expense in 2018-19 was $56.3 billion. On a functional basis this comprises $21.9 billion for health, $14.8 billion for education, $5.9 billion for social services, $11.9 billion in other program expense, debt servicing costs of $2 billion and negative $0.2 billion in reduced pension liabilities.

| ∎ | | Health expense was $21.9 billion in 2018-19, up $0.7 billion from 2017-18 primarily due to a $0.2 billion increase for home, continuing and community care reflecting increases in volume and enhanced care under the Continuing Care Capacity Plan, and a $0.2 billion increase for physician compensation reflecting higher volumes. The $0.2 billion decrease from budget is primarily due to savings on generic drugs as a result of a new pricing agreement with Canada’s generic drug industry and higher product listing agreement cost recoveries, staff vacancies, and delays in opening continuing care beds. |

| ∎ | | Education expense was $14.8 billion in 2018-19, up $0.4 billion from 2017-18 and $0.2 billion from budget. The increase from 2017-18 was due to enrolment growth and the increase from budget was mainly due to local decisions by school boards using their reserves, partly offset by hiring delays and vacancies in post-secondary institutions. |

| ∎ | | Social services expense was $5.9 billion in 2018-19, up $0.3 billion from 2017-18, and down $0.1 billion from budget. The increase from 2017-18 was primarily due to caseload growth in income support programs, child care, child intervention services, seniors and programs to support disabled individuals, and to benefit rate increases, including indexation to inflation, of various social programs. The $0.1 billion decrease from budget was primarily due to reclassifying information technology. |

| ∎ | | Other expense was $11.9 billion, virtually unchanged from budget, but down $1.3 billion from 2017-18 due to re-profiling of $0.8 billion for the Municipal Sustainability Initiative from future years into 2017-18. |

| ∎ | | Debt servicing costs were $2.0 billion, an increase of $0.6 billion from 2017-18 and $0.1 billion from budget. The increase from 2017-18 is primarily due increased borrowing for the fiscal and capital plans, although $0.1 billion of the increase is due to less favourable results from the Alberta Capital Finance Authority (ACFA) debt rate swaps. ACFA on-lends to municipalities and other local authorities. ACFA’s debt servicing costs are more than offset by investment income. The $0.1 billion increase from budget was due mainly to additional borrowing undertaken in advance for 2019-20 cash management purposes. |

| ∎ | | Public sector pension plan liabilities decreased by $0.2 billion to $9.2 billion at March 31, 2019. This was a $0.4 billion lower change than the change in 2017-18, mainly due to 2017-18 reflecting the impact of healthy financial market returns. The liability reduction of $0.2 billion was reported as a negative expense. |

| | |

BUDGET 2018 KEY RESULTS | | 9 |

Balance Sheet

At March 31, 2019, Government of Alberta financial and non-financial assets exceeded liabilities by $23.3 billion. This was $6.4 billion lower than March 31, 2018, mainly due to an increase in debt that was partly offset by an increase in assets.

Financial assets were $75.7 billion, $4.8 billion higher than on March 31, 2018, mainly due to an increase in cash and cash equivalents from borrowing undertaken for 2019-20 operations.

Liabilities were $103.2 billion in 2018-19, $12.9 billion higher than in 2017-18 mainly due to an increase in debt for the government’s fiscal and capital plans. Total debt for the capital and fiscal plans was $60.0 billion. The majority of the remaining $20.8 billion in debt is primarily related to the Alberta Capital Finance Authority and Agriculture Financial Services Corporation, which on-lend to local authorities and the agriculture sector. Most of this debt is thus offset by the loans receivable (financial asset).

Capital / other non-financial assets net of deferred capital contibutions was $50.7 billion in 2018-19, $1.7 billion above 2017-18, reflecting $4.1 billion in capital asset acquisition and $0.3 billion in pre-paid expense, less $2.5 billion in amortization and disposals. Major capital investment included:

| ∎ | | $1.2 billion for the highway network mainly comprising: $0.3 billion for Calgary’s ring road, with the final, southwest portion about 50% |

| | | complete; $0.3 billion for highway twinning, widening and expansion, which includes the Peace River Bridge twinning and Grande Prairie Highway 43 Bypass, and $0.4 billion for highway rehabilitation. |

| ∎ | | $0.9 billion for health facilities and equipment. The Edson Healthcare Centre was completed in 2018- 19 and construction continued on major projects: Medicine Hat Regional Hospital Redevelopment and Expansion; Grande Prairie Regional Hospital; Fort McMurray Willow Square; Calgary Cancer Centre; Stollery Children’s Hospital Critical Care Program at the University of Alberta (U of A) Hospital. |

| ∎ | | $0.7 billion for schools and other capital asset acquisition in the K-12 education system, including $0.5 billion for schools, $0.2 billion for school capital maintenance and renewal (CMR) and school board funding. Of the 278 projects announced since 2011, 207 have been completed, including 30 schools in 2018-19. |

| ∎ | | $0.7 billion for post-secondary projects, including funding of $0.2 billion for expansion and upgrading, $0.4 billion in post-secondary institution funding and donations and $0.1 billion for CMR. Major projects included University of Calgary MacKimmie Complex, U of A Dentistry / Pharmacy renewal, University of Lethbridge Destination project, Medicine Hat College East Development and Northern Lakes College High Prairie Consolidation. |

| | | | | | | | | | | | |

Balance Sheet Summary | | | | | | | | | | | | |

| (millions of dollars) | | at March 31 | |

| | 2019 Actual | | | 2018 Actual | | | Change from

2018 | |

Financial Assets | | | | | | | | | | | | |

Portfolio investments | | | 31,261 | | | | 30,845 | | | | 416 | |

Equity in government business enterprises | | | 3,062 | | | | 2,527 | | | | 535 | |

Other | | | 41,420 | | | | 37,605 | | | | 3,815 | |

| | | 75,743 | | | | 70,977 | | | | 4,766 | |

| | | |

Liabilities | | | | | | | | | | | | |

Debt and liabilities under public private partnerships | | | 80,791 | | | | 66,414 | | | | 14,377 | |

Pension liabilities | | | 9,240 | | | | 9,430 | | | | (190 | ) |

Other | | | 13,189 | | | | 14,477 | | | | (1,288 | ) |

| | | | 103,220 | | | | 90,321 | | | | 12,899 | |

Net Financial Debt | | | (27,477 | ) | | | (19,344 | ) | | | (8,133 | ) |

Capital / Other Non-financial Assets | | | 53,908 | | | | 52,024 | | | | 1,884 | |

Spent deferred capital contributions | | | (3,164 | ) | | | (3,009 | ) | | | (155 | ) |

Net Assets | | | 23,267 | | | | 29,671 | | | | (6,404 | ) |

Change in Net Assets | | | (6,404 | ) | | | (8,050 | ) | | | | |

| | |

| 10 | | GOVERNMENT OF ALBERTA 2018—19 ANNUAL REPORT |

Financial Indicators and Risks

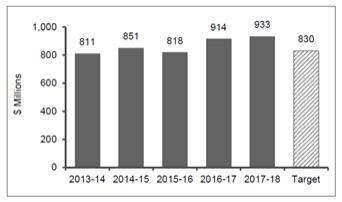

| ∎ | | Net financial debt on March 31, 2019 was $27.5 billion, or $6,380 per person. This is a deterioration of $40.5 billion over five years, when the government reported net financial assets of $13.1 billion. |

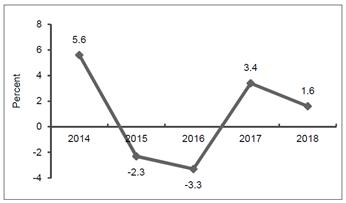

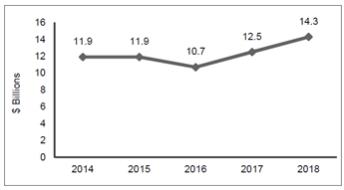

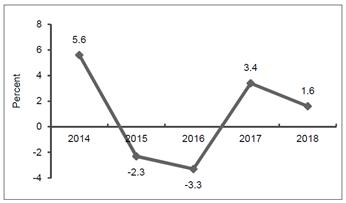

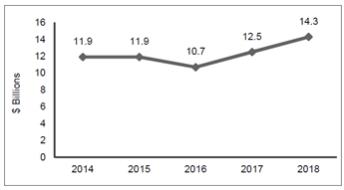

| ∎ | | Over the same period revenue has remained unchanged. The government reported revenue of $49.5 billion in 2014-15. Revenue then dipped to a low of $42.3 billion in 2016-17 before returning to $49.6 billion in 2018-19. |

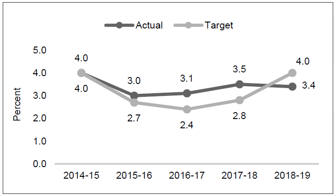

| ∎ | | Expense has grown by a total of 16.5% or an average of 3.9% per year since 2014-15. Expense varies by program, but many are demand-driven (e.g. enrolment growth, physician costs) and others are driven by emergencies such as wildfires and floods. |

| ∎ | | Alberta relies heavily on revenue that is volatile and unpredictable, including non-renewable resources, corporate income tax and investment income. Since 2004-05, these have accounted for up to 55% of total revenue, while over the last five years they have averaged 26%. The revenue volatility is linked to numerous factors, some of which are described below. |

| ∎ | | Oil prices depend on various assumptions for supply and demand. Factors influencing demand include economic growth, pipeline or refinery outages, and speculative market activities by traders. Supply is mainly impacted by production cuts and the US response to higher prices. Other factors include drilling and investment decisions, geopolitical events, economic sanctions, or weather related disruptions. WTI prices increased in the first half of 2018-19, and then decreased sharply due to continued supply growth coupled with concerns about weakening global demand growth. Likewise, market access bottlenecks led to rising inventories and lower WCS prices in late 2018. Short-term reductions in Alberta’s oil production and US sanctions on Venezuelan heavy oil supply, narrowed the light-heavy differential to within US$1 of the budget estimate. |

| ∎ | | Weaker-than-forecast global and US growth harms Alberta’s revenue forecast, as oil prices would remain lower for longer. |

| ∎ | | A decrease in Alberta’s population reduces many revenue sources and demand-driven expense. In |

| | 2018-19, a Statistics Canada revision to population resulted in lower federal transfers. |

| ∎ | | Higher interest rates typically discourage business investment and economic activity, which contribute to lower income tax revenue. |

| ∎ | | A lower exchange rate increases the value of exports and positively impacts government revenue. |

| ∎ | | Equity markets have performed well over the last several years, and government investment income has benefited. Markets can be affected by a wide range of factors, such as strength in global economies, fluctuations in commodity prices, and interest rates. Investment income decreased from 2017-18 and from the budget estimate as market performance was not as strong. |

| ∎ | | Improvements to net corporate operating surplus positively impact revenue, but can be difficult to predict as taxable income can vary significantly from corporate profits due to discretionary deductions or prior-year losses that can be carried forward or back. |

| ∎ | | The degree of revenue uncertainty means the Alberta government must assess the degree of risk associated with its revenue and spending decisions. For the last two years, the government included an annual risk adjustment, which was $0.5 billion in 2018-19. |

| ∎ | | These highlights should be read in conjunction with the budget and quarterly updates https://www.alberta.ca/budget-documents.aspx. |

| | |

| BUDGET 2018 KEY RESULTS | | 11 |

Historical Fiscal Summary, 2008-09 to 2018-19 a

(millions of dollars)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | 2008-09 | | | 2009-10 | | | 2010-11 | | | 2011-12 | | | 2012-13 | | | 2013-14 | | | 2014-15 | | | 2015-16 | | | 2016-17 | | | 2017-18 | | | 2018-19 | |

Income Statement | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Revenue | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| 1 | | Personal income tax | | | 8,708 | | | | 7,877 | | | | 7,631 | | | | 8,563 | | | | 9,621 | | | | 10,537 | | | | 11,042 | | | | 11,357 | | | | 10,763 | | | | 10,775 | | | | 11,874 | |

| 2 | | Corporate income tax | | | 4,252 | | | | 4,754 | | | | 3,334 | | | | 3,678 | | | | 4,756 | | | | 5,488 | | | | 5,796 | | | | 4,195 | | | | 3,769 | | | | 3,448 | | | | 4,871 | |

| 3 | | Other tax revenue | | | 3,817 | | | | 3,746 | | | | 3,820 | | | | 4,099 | | | | 4,333 | | | | 4,500 | | | | 4,598 | | | | 5,168 | | | | 5,649 | | | | 6,538 | | | | 6,833 | |

| 4 | | Resource revenue | | | 11,915 | | | | 6,768 | | | | 8,428 | | | | 11,636 | | | | 7,779 | | | | 9,578 | | | | 8,948 | | | | 2,789 | | | | 3,097 | | | | 4,980 | | | | 5,429 | |

| 5 | | Investment income | | | (1,888 | ) | | | 3,541 | | | | 2,486 | | | | 2,168 | | | | 2,595 | | | | 3,423 | | | | 3,113 | | | | 2,544 | | | | 3,698 | | | | 3,126 | | | | 2,349 | |

| 6 | | Premiums, fees and licences | | | 3,356 | | | | 2,857 | | | | 2,922 | | | | 2,931 | | | | 3,184 | | | | 3,437 | | | | 2,665 | | | | 3,574 | | | | 3,701 | | | | 3,839 | | | | 3,911 | |

| 7 | | Other own-source revenue | | | 4,587 | | | | 4,627 | | | | 4,903 | | | | 5,128 | | | | 5,234 | | | | 5,412 | | | | 7,337 | | | | 5,850 | | | | 3,637 | | | | 6,982 | | | | 6,344 | |

| 8 | | Total own-source revenue | | | 34,747 | | | | 34,170 | | | | 33,524 | | | | 38,203 | | | | 37,502 | | | | 42,375 | | | | 43,499 | | | | 35,477 | | | | 34,314 | | | | 39,688 | | | | 41,611 | |

| 9 | | Federal transfers | | | 4,578 | | | | 5,342 | | | | 5,452 | | | | 5,192 | | | | 5,042 | | | | 7,059 | | | | 5,982 | | | | 7,142 | | | | 7,979 | | | | 7,606 | | | | 8,013 | |

| 10 | | Total Revenue | | | 39,325 | | | | 39,512 | | | | 38,976 | | | | 43,395 | | | | 42,544 | | | | 49,434 | | | | 49,481 | | | | 42,619 | | | | 42,293 | | | | 47,295 | | | | 49,624 | |

| | Expense by Function | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| 11 | | Health | | | 13,674 | | | | 14,636 | | | | 15,393 | | | | 16,284 | | | | 17,254 | | | | 17,967 | | | | 19,366 | | | | 20,115 | | | | 20,687 | | | | 21,239 | | | | 21,921 | |

| 12 | | Basic / advanced education | | | 10,438 | | | | 11,067 | | | | 11,362 | | | | 11,951 | | | | 12,394 | | | | 12,782 | | | | 13,103 | | | | 13,673 | | | | 14,110 | | | | 14,471 | | | | 14,848 | |

| 13 | | Social services | | | 3,417 | | | | 3,807 | | | | 4,129 | | | | 4,278 | | | | 4,641 | | | | 4,668 | | | | 4,548 | | | | 4,752 | | | | 5,198 | | | | 5,592 | | | | 5,867 | |

| 14 | | Other program expense | | | 10,386 | | | | 9,834 | | | | 9,443 | | | | 9,853 | | | | 10,528 | | | | 12,970 | | | | 11,031 | | | | 10,375 | | | | 12,607 | | | | 13,189 | | | | 11,918 | |

| 15 | | Total program expense | | | 37,915 | | | | 39,344 | | | | 40,327 | | | | 42,366 | | | | 44,817 | | | | 48,387 | | | | 48,048 | | | | 48,915 | | | | 52,602 | | | | 54,491 | | | | 54,554 | |

| 16 | | Debt servicing costs | | | 208 | | | | 214 | | | | 472 | | | | 509 | | | | 530 | | | | 601 | | | | 722 | | | | 776 | | | | 1,018 | | | | 1,420 | | | | 1,971 | |

| 17 | | Pension provisions | | | 2,133 | | | | 430 | | | | 439 | | | | 634 | | | | 296 | | | | 748 | | | | (404 | ) | | | (630 | ) | | | (543 | ) | | | (593 | ) | | | (190 | ) |

| 18 | | Total Expense | | | 40,256 | | | | 39,988 | | | | 41,238 | | | | 43,509 | | | | 45,643 | | | | 49,736 | | | | 48,366 | | | | 49,061 | | | | 53,077 | | | | 55,318 | | | | 56,335 | |

| 19 | | Surplus / (Deficit) | | | (931 | ) | | | (476 | ) | | | (2,262 | ) | | | (114 | ) | | | (3,099 | ) | | | (302 | ) | | | 1,115 | | | | (6,442 | ) | | | (10,784 | ) | | | (8,023 | ) | | | (6,711 | ) |

| Capital Plan b | | | 7,943 | | | | 8,000 | | | | 7,544 | | | | 6,884 | | | | 6,062 | | | | 5,770 | | | | 6,181 | | | | 6,558 | | | | 6,578 | | | | 9,016 | | | | 6,127 | |

| | | | | | | | | | | |

| Balance Sheet (at March 31) | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| 20 | | Heritage / endowment funds | | | 16,900 | | | | 17,077 | | | | 17,500 | | | | 17,936 | | | | 18,176 | | | | 18,562 | | | | 18,860 | | | | 19,262 | | | | 19,836 | | | | 20,306 | | | | 20,716 | |

| 21 | | Contingency Account | | | 16,822 | | | | 14,983 | | | | 11,192 | | | | 7,497 | | | | 3,326 | | | | 4,658 | | | | 6,529 | | | | 3,625 | | | | 2,399 | | | | 1,661 | | | | 6,342 | |

| 22 | | Other financial assets | | | 28,868 | | | | 30,338 | | | | 30,799 | | | | 32,972 | | | | 34,734 | | | | 40,039 | | | | 40,688 | | | | 40,990 | | | | 44,052 | | | | 49,010 | | | | 48,685 | |

| 23 | | Capital Plan liabilities | | | (880 | ) | | | (2,888 | ) | | | (3,199 | ) | | | (3,442 | ) | | | (4,594 | ) | | | (8,724 | ) | | | (11,922 | ) | | | (19,040 | ) | | | (23,769 | ) | | | (29,339 | ) | | | (33,597 | ) |

| 24 | | Fiscal Plan liabilities (borrowing / pre-1992 TPP) | | | 0 | | | | (1,187 | ) | | | (1,187 | ) | | | (1,187 | ) | | | (1,187 | ) | | | (1,187 | ) | | | (943 | ) | | | (944 | ) | | | (95,29 | ) | | | (14,023 | ) | | | (26,374 | ) |

| 25 | | Pension obligations | | | (10,239 | ) | | | (9,483 | ) | | | (9,922 | ) | | | (10,556 | ) | | | (10,852 | ) | | | (11,600 | ) | | | (11,196 | ) | | | (10,566 | ) | | | (10,023 | ) | | | (9,430 | ) | | | (9,240 | ) |

| 26 | | Other liabilities | | | (19,770 | ) | | | (21,523 | ) | | | (23,530 | ) | | | (24,229 | ) | | | (25,148 | ) | | | (28,716 | ) | | | (28,962 | ) | | | (29,408 | ) | | | (31,867 | ) | | | (37,529 | ) | | | (34,009 | ) |

| 27 | | Net Financial Assets / (Debt) | | | 31,701 | | | | 27,317 | | | | 21,653 | | | | 18,991 | | | | 14,455 | | | | 13,032 | | | | 13,054 | | | | 3,919 | | | | (8,901 | ) | | | (19,344 | ) | | | (27,477 | ) |

| 28 | | Capital (net of defer, Contrib.) / non-fin. assets | | | 30,275 | | | | 34,217 | | | | 37,607 | | | | 40,122 | | | | 39,517 | | | | 40,839 | | | | 42,197 | | | | 44,623 | | | | 46,622 | | | | 49,015 | | | | 50,744 | |

| 29 | | Net Assets c | | | 61,976 | | | | 61,534 | | | | 59,260 | | | | 59,113 | | | | 53,972 | | | | 53,871 | | | | 55,251 | | | | 48,542 | | | | 37,721 | | | | 29,671 | | | | 23,267 | |

| a | Numbers are not strictly comparable due to numerous accounting policy changes over time. Examples include reporting certain items (transfers through the tax system, crude oil marketing and transportation costs, allowance for corporate income tax doubtful accounts) as expense, instead of netting the amounts from related revenue, increasing both revenue and expense, but not impacting the surplus / (deficit), 2015-16 revenue and expense have been increased by $119 million to correct a consolidation adjustment eliminating those amounts at year-end, with no deficit impact, 2016-17 revenue and expense have been reduced by $111 million resulting from an accounting treatment change such that drug cost rebates under Product Listing Agreements are netted from operating expense instead of being reported as revenue and gross expense. |

| b | Reflects capital grants and other support included in expense, and capital investment in government-owned assets not included in expense. Capital investment adds to capital assets, which are depreciated over time through amortization expense. Numbers for 2008-09 to 2013-14 are estimates as details required to consolidate SUCH sector capital spending with full accuracy are not readily available. |

| c | The change in net assets / (debt) year over year does not match the surplus / (deficit) exactly in most years, due to various balance sheet adjustments, most of which are minor. A significant adjustment reducing net assets by $2 billion was made in 2012-13, to recognize the accumulated deferred capital contribution liability when the accounting standard was adopted. |

| | |

| 12 | | GOVERNMENT OF ALBERTA 2018—19 ANNUAL REPORT |

Consolidated Financial Statements

BLANK PAGE

| | |

| CONSOLIDATED FINANCIAL STATEMENTS | | 15 |

Table of Contents, continued

| | |

| 16 | | GOVERNMENT OF ALBERTA 2018—19 ANNUAL REPORT |

Management’s Responsibility

for the Consolidated Financial Statements

The consolidated financial statements are prepared by the Controller under the general direction of the Deputy Minister of Treasury Board and Finance as authorized by the President of Treasury Board and Minister of Finance pursuant to the Financial Administration Act. The consolidated financial statements are prepared in accordance with Canadian Public Sector Accounting Standards, and of necessity include some amounts that are based on estimates and judgments. As required by the Fiscal Planning and Transparency Act, the consolidated financial statements are included in the consolidated annual report of the Province of Alberta that forms part of the Public Accounts.

To fulfill its accounting and reporting responsibilities, management maintains systems of financial management and internal control which give consideration to costs, benefits and risks, and which are designed to:

| ∎ | | Provide reasonable assurance that transactions are properly authorized, executed in accordance with prescribed legislation and regulations, and properly recorded so as to maintain accountability for public money, and |

| ∎ | | Safeguard the assets and properties of the Province of Alberta under government administration. |

Under the Financial Administration Act, deputy heads are responsible for the collection of revenue payable to the Crown, and for making and controlling disbursements with respect to their departments. They are also responsible for prescribing the accounting systems to be used in their departments. In order to meet government accounting and reporting requirements, the Controller obtains information relating to departments, regulated funds, provincial agencies, Crown-controlled corporations, schools, universities, colleges, technical institutes, Alberta Health Services and other health entities from ministries as necessary.

The consolidated financial statements are reviewed by the Audit Committee established under the Auditor General Act. The Audit Committee advises the Lieutenant Governor in Council on the scope and results of the Auditor General’s audit of the consolidated financial statements of the Province.

The Auditor General of Alberta provides an independent opinion on the consolidated financial statements. The duties of the Auditor General in that respect are contained in the Auditor General Act.

Annually, the consolidated annual report is tabled in the Legislature as a part of the Public Accounts and is referred to the Standing Committee on Public Accounts of the Legislative Assembly.

Approved by:

Athana Mentzelopoulos

Deputy Minister of Treasury Board and Finance

Dan Stadlwieser, CPA, CA

Controller

Edmonton, Alberta

June 18, 2019

| | |

| CONSOLIDATED FINANCIAL STATEMENTS | | 17 |

| | |

| Independent Auditor’s Report | |

|

To the Members of the Legislative Assembly

Report on the Consolidated Financial Statements

Opinion

I have audited the consolidated financial statements of the Province of Alberta, which comprise the consolidated statement of financial position as at March 31, 2019, and the consolidated statements of operations, change in net debt, and cash flows for the year then ended, and notes and schedules to the consolidated financial statements, including a summary of significant accounting policies.

In my opinion, the accompanying consolidated financial statements present fairly, in all material respects, the consolidated financial position of the Province of Alberta as at March 31, 2019, and the results of its operations, its changes in net debt, and its cash flows for the year then ended in accordance with Canadian public sector accounting standards.

Basis for opinion

I conducted my audit in accordance with Canadian generally accepted auditing standards. My responsibilities under those standards are further described in the Auditor’s Responsibilities for the Audit of the Consolidated Financial Statements section of my report. I am independent of the Province of Alberta in accordance with the ethical requirements that are relevant to my audit of the consolidated financial statements in Canada, and I have fulfilled my other ethical responsibilities in accordance with these requirements. I believe that the audit evidence I have obtained is sufficient and appropriate to provide a basis for my opinion.

Other information

Management is responsible for the other information. The other information comprises the information included in the Government of Alberta 2018-19 Annual Report, but does not include the consolidated financial statements and my auditor’s report thereon.

My opinion on the consolidated financial statements does not cover the other information and I do not express any form of assurance conclusion thereon.

In connection with my audit of the consolidated financial statements, my responsibility is to read the other information and, in doing so, consider whether the other information is materially inconsistent with the consolidated financial statements or my knowledge obtained in the audit or otherwise appears to be materially misstated. If, based on the work I have performed, I conclude that there is a material misstatement of this other information, I am required to report that fact. I have nothing to report in this regard.

| | |

| 18 | | GOVERNMENT OF ALBERTA 2018—19 ANNUAL REPORT |

Independent Auditor’s Report, continued

Responsibilities of management and those charged with governance for the consolidated financial statements

Management is responsible for the preparation and fair presentation of the consolidated financial statements in accordance with Canadian public sector accounting standards, and for such internal control as management determines is necessary to enable the preparation of the consolidated financial statements that are free from material misstatement, whether due to fraud or error.

In preparing the consolidated financial statements, management is responsible for assessing the Province of Alberta’s ability to continue as a going concern, disclosing, as applicable, matters related to going concern, and using the going concern basis of accounting unless an intention exist to liquidate or to cease operations, or there is no realistic alternative but to do so.

Those charged with governance are responsible for overseeing the Province’s financial reporting process.

Auditor’s responsibilities for the audit of the consolidated financial statements

My objectives are to obtain reasonable assurance about whether the consolidated financial statements as a whole are free from material misstatement, whether due to fraud or error, and to issue an auditor’s report that includes my opinion. Reasonable assurance is a high level of assurance, but is not a guarantee that an audit conducted in accordance with Canadian generally accepted auditing standards will always detect a material misstatement when it exists. Misstatements can arise from fraud or error and are considered matetial if, individually or in the aggregate, they could reasonably be expected to influence the economic decisions of users taken on the basis of these consolidated financial statements.

As part of an audit in accordance with Canadian generally accepted auditing standards, I exercise professional judgment and maintain professional skepticism throughout the audit. I also:

| · | | Identify and assess the risks of material misstatement of the consolidated financial statements, whether due to fraud or error, design and perform audit procedures responsive to those risks, and obtain audit evidence that is sufficient and appropriate to provide a basis for my opinion. The risk of not detecting a material misstatement resulting from fraud is higher than for one resulting from error, as fraud may involve collusion, forgery, intentional omissions, misrepresentations, or the override of internal control. |

| · | | Obtain an understanding of internal control relevant to the audit in order to design audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the Province of Alberta’s internal control. |

| · | | Evaluate the appropriateness of accounting policies used and the reasonableness of accounting estimates and related disclosures made by management. |

| | |

| CONSOLIDATED FINANCIAL STATEMENTS | | 19 |

Independent Auditor’s Report, continued

| · | | Conclude on the appropriateness of management’s use of the going concern basis of accounting and, based on the audit evidence obtained, whether a material uncertainty exists related to events or conditions that may cast significant doubt on the Province’s ability to continue as a going concern. If I conclude that a material uncertainty exists, I am required to draw attention in my auditor’s report to the related disclosures in the consolidated financial statements or, if such disclosures are inadequate, to modify my opinion. My conclusions are based on the audit evidence obtained up to the date of my auditor’s report. However, future events or conditions may cause the Province to cease to continue as a going concern. |

| · | | Evaluate the overall presentation, structure and content of the consolidated financial statements, including the disclosures, and whether the consolidated financial statements represent the underlying transactions and events in a manner that achieves fair presentation. |

| · | | Obtain sufficient appropriate audit evidence regarding the financial information of the entities and business activities within the consolidated financial statements, to express an opinion on the consolidated financial statements. I am responsible for the direction, supervision and performance of the group audit. I remain solely responsible for my audit opinion. |

I communicate with those charged with governance regarding, among other matters, the planned scope and timing of the audit and significant audit findings, including any significant deficiencies in internal control that I identify during my audit.

I also provide those charged with governance with a statement that I have complied with relevant ethical requirements regarding independence, and to communicate with them all relationships and other matters that may reasonably be thought to bear on my independence, and where applicable, related safeguards.

In accordance with the Auditor General Act, I am responsible to report the independent opinion on the consolidated financial statements of the Province of Alberta completed by my office.

[Original signed by W. Doug Wylie FCPA, FCMA, ICD.D]

Auditor General

June 18, 2019

Edmonton, Alberta

| | |

| 20 | | GOVERNMENT OF ALBERTA 2018—19 ANNUAL REPORT |

Consolidated Statement of Operations

| | | | | | | | | | | | |

| Year Ended March 31 | | | | | | |

| | | 2019 | | | 2018 | |

| | | Budget | | | Actual | | | Actual | |

| | | In millions | | | | |

| | | |

Revenues (Schedules 1 and 2) | | | | | | | | | | | | |

| | | |

Income taxes | | $ | 15,938 | | | $ | 16,745 | | | $ | 14,223 | |

| | | |

Other taxes | | | 6,961 | | | | 6,833 | | | | 6,538 | |

| | | |

Non-renewable resource revenue | | | 3,829 | | | | 5,429 | | | | 4,980 | |

| | | |

Transfers from Government of Canada | | | 8,218 | | | | 8,013 | | | | 7,605 | |

| | | |

Net income from government business enterprises (Schedule 8) | | | 2,777 | | | | 2,585 | | | | 3,387 | |

| | | |

Investment income | | | 2,884 | | | | 2,349 | | | | 3,126 | |

| | | |

Premiums, fees and licences | | | 3,857 | | | | 3,909 | | | | 3,843 | |

| | | |

Other | | | 3,415 | | | | 3,761 | | | | 3,593 | |

| | | |

| | | 47,879 | | | | 49,624 | | | | 47,295 | |

| | | |

Expenses by function (Schedule 3) | | | | | | | | | | | | |

| | | |

Health | | | 22,099 | | | | 21,921 | | | | 21,239 | |

| | | |

Education | | | 14,633 | | | | 14,848 | | | | 14,471 | |

| | | |

Social services | | | 5,922 | | | | 5,867 | | | | 5,592 | |

| | | |

General government | | | 2,508 | | | | 2,617 | | | | 2,238 | |

| | | |

Agriculture, resource management and economic development | | | 2,479 | | | | 2,319 | | | | 2,291 | |

| | | |

Protection of persons and property | | | 2,034 | | | | 2,021 | | | | 1,951 | |

| | | |

Transportation, communications and utilities | | | 1,757 | | | | 1,696 | | | | 2,204 | |

| | | |

Environment | | | 1,334 | | | | 1,299 | | | | 1,221 | |

| | | |

Regional planning and development | | | 1,190 | | | | 1,207 | | | | 2,518 | |

| | | |

Recreation and culture | | | 408 | | | | 458 | | | | 459 | |

| | | |

Housing | | | 206 | | | | 301 | | | | 307 | |

| | | |

Debt servicing costs | | | 1,921 | | | | 1,971 | | | | 1,420 | |

| | | |

Pension recovery (Schedule 12) | | | (310 | ) | | | (190 | ) | | | (593 | ) |

| | | |

| | | 56,181 | | | | 56,335 | | | | 55,318 | |

| | | |

Risk adjustment (Note 1c) | | | (500 | ) | | | - | | | | - | |

| | | |

Annual deficit | | | (8,802 | ) | | | (6,711 | ) | | | (8,023 | ) |

| | | |

Net assets at beginning of year – as previously reported | | | 29,671 | | | | 29,671 | | | | 37,721 | |

| | | |

Adjustments to net assets (Schedule 16) | | | - | | | | 307 | | | | (27 | ) |

| | | |

Net assets at end of year | | $ | 20,869 | | | $ | 23,267 | | | $ | 29,671 | |

The accompanying notes and schedules are part of these consolidated financial statements.

| | |

| CONSOLIDATED FINANCIAL STATEMENTS | | 21 |

Consolidated Statement of Financial Position

| | | | | | | | |

| As at March 31 | | | | | | |

| | | 2019 | | | 2018 | |

| | | In | | | millions | |

| | |

Financial assets | | | | | | | | |

| | |

Cash and cash equivalents (Schedule 4) | | $ | 14,695 | | | $ | 12,391 | |

| | |

Accounts receivable (Schedule 5) | | | 6,460 | | | | 5,771 | |

| | |

Portfolio investments (Schedule 6) | | | | | | | | |

| | |

Operating | | | 26,689 | | | | 28,428 | |

| | |

Endowments (Schedule 7) | | | 2,572 | | | | 2,417 | |

| | |

Equity in government business enterprises (Schedule 8) | | | 3,062 | | | | 2,527 | |

| | |

Loans and advances (Schedule 9) | | | 20,231 | | | | 19,405 | |

| | |

Inventories for resale and other | | | 34 | | | | 38 | |

| | |

| | | 75,743 | | | | 70,977 | |

| | |

Liabilities | | | | | | | | |

| | |

Accounts payable and other accrued liabilities (Schedule 10) | | | 11,814 | | | | 13,233 | |

| | |

Debt and liabilities under public private partnerships (Schedules 11 and 14) | | | 80,791 | | | | 66,414 | |

| | |

Pension liabilities (Schedule 12) | | | 9,240 | | | | 9,430 | |

| | |

Unspent deferred contributions (Schedule 13) | | | 1,375 | | | | 1,244 | |

| | |

| | | 103,220 | | | | 90,321 | |

| | |

Net debt | | | (27,477 | ) | | | (19,344 | ) |

| | |

Non-financial assets | | | | | | | | |

| | |

Tangible capital assets (Schedule 15) | | | 52,925 | | | | 51,399 | |

| | |

Prepaid expenses | | | 618 | | | | 284 | |

| | |

Inventories of supplies and other | | | 365 | | | | 341 | |

| | |

| | | 53,908 | | | | 52,024 | |

| | |

Net assets before spent deferred capital contributions | | | 26,431 | | | | 32,680 | |

| | |

Spent deferred capital contributions (Schedule 13) | | | 3,164 | | | | 3,009 | |

| | |

Net assets | | $ | 23,267 | | | $ | 29,671 | |

Contractual rights and obligations (Notes 4 and 6)

Contingent assets and liabilities (Notes 5 and 7)

The accompanying notes and schedules are part of these consolidated financial statements.

| | |

| 22 | | GOVERNMENT OF ALBERTA 2018–19 ANNUAL REPORT |

Consolidated Statement of Change in Net Debt

| | | | | | | | | | | | |

| Year Ended March 31 | | | | | | | | | |

| | | 2019 | | | 2018 | |

| | | Budget | | | Actual | | | Actual | |

| | | | | | In millions | | | | |

| | | |

Annual deficit | | $ | (8,802 | ) | | $ | (6,711 | ) | | $ | (8,023 | ) |

| | | |

Acquisition of tangible capital assets | | | (4,187 | ) | | | (3,837 | ) | | | (4,780 | ) |

| | | |

Additions to public private partnerships, capital leases, donated capital assets and other | | | (128 | ) | | | (268 | ) | | | (225 | ) |

| | | |

Amortization of tangible capital assets | | | 2,477 | | | | 2,472 | | | | 2,337 | |

| | | |

Net (gain)/loss on disposal and write-down of tangible capital assets | | | - | | | | (13 | ) | | | 28 | |

| | | |

Proceeds on sale of tangible capital assets | | | - | | | | 120 | | | | 38 | |

| | | |

(Increase)/decrease in inventory of supplies | | | - | | | | (24 | ) | | | 20 | |

| | | |

Increase in prepaid expenses | | | - | | | | (334 | ) | | | (36 | ) |

| | | |

Net increase in spent deferred capital contributions | | | 574 | | | | 155 | | | | 225 | |

| | | |

Change in accumulated unrealized gains/(losses) (Schedule 8) | | | - | | | | 166 | | | | (137 | ) |

| | | |

Other (Schedule 16) | | | - | | | | 141 | | | | 110 | |

| | | |

Increase in net debt | | | (10,066 | ) | | | (8,133 | ) | | | (10,443 | ) |

| | | |

Net debt at beginning of year | | | (19,344 | ) | | | (19,344 | ) | | | (8,901 | ) |

| | | |

Net debt at end of year | | $ | (29,410 | ) | | $ | (27,477 | ) | | $ | (19,344 | ) |

The accompanying notes and schedules are part of these consolidated financial statements.

| | |

| CONSOLIDATED FINANCIAL STATEMENTS | | 23 |

Consolidated Statement of Cash Flows

| | | | | | | | |

| Year Ended March 31 | | | | | | |

| | | 2019 | | | 2018 | |

| | | In | | | millions | |

| | |

Operating transactions | | | | | | | | |

| | |

Annual deficit | | $ | (6,711 | ) | | $ | (8,023 | ) |

| | |

Non-cash items | | | | | | | | |

| | |

Amortization of tangible capital assets | | | 2,472 | | | | 2,337 | |

| | |

Deferred contributions recognized as revenue | | | (1,652 | ) | | | (1,423 | ) |

| | |

Pension recovery | | | (190 | ) | | | (593 | ) |

| | |

Net income from government business enterprises | | | (2,585 | ) | | | (3,387 | ) |

| | |

Other non-cash items included in annual deficit | | | (122 | ) | | | 90 | |

| | |

| | | (8,788 | ) | | | (10,999 | ) |

| | |

Increase in accounts receivable, inventories and prepaids | | | (915 | ) | | | (638 | ) |

| | |

(Decrease)/increase in accounts payable and other accrued liabilities | | | (1,562 | ) | | | 1,522 | |

| | |

Distribution from government business enterprises | | | 2,165 | | | | 2,246 | |

| | |

Cash used by operating transactions | | | (9,100 | ) | | | (7,869 | ) |

| | |

Capital transactions | | | | | | | | |

| | |

Acquisition of tangible capital assets | | | (3,837 | ) | | | (4,780 | ) |

| | |

Proceeds on sale of tangible capital assets | | | 120 | | | | 38 | |

| | |

Cash used by capital transactions | | | (3,717 | ) | | | (4,742 | ) |

| | |

Investing transactions | | | | | | | | |

| | |

Purchases of portfolio investments | | | (8,589 | ) | | | (10,218 | ) |

| | |

Disposals of portfolio investments | | | 8,638 | | | | 10,103 | |

| | |

Loans and advances made | | | (2,482 | ) | | | (2,115 | ) |

| | |

Repayment of loans and advances | | | 1,576 | | | | 1,498 | |

| | |

Cash invested by investing transactions | | | (857 | ) | | | (732 | ) |

| | |

Financing transactions | | | | | | | | |

| | |

Debt retirements | | | (36,932 | ) | | | (29,920 | ) |

| | |

Debt issues | | | 51,036 | | | | 43,805 | |

| | |

Contributions restricted for capital and operations | | | 1,942 | | | | 1,604 | |

| | |

Repayment of liabilities under capital leases and

public private partnerships | | | (64 | ) | | | (62 | ) |

| | |

Other | | | (4 | ) | | | (6 | ) |

| | |

Cash provided by financing transactions | | | 15,978 | | | | 15,421 | |

| | |

Increase in cash and cash equivalents | | | 2,304 | | | | 2,078 | |

| | |

Cash and cash equivalents at beginning of year | | | 12,391 | | | | 10,313 | |

| | |

Cash and cash equivalents at end of year | | $ | 14,695 | | | $ | 12,391 | |

The accompanying notes and schedules are part of these consolidated financial statements.

| | |

| 24 | | GOVERNMENT OF ALBERTA 2018–19 ANNUAL REPORT |

Notes to the Consolidated Financial Statements

| NOTE 1 | SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES AND REPORTING PRACTICES |

These consolidated financial statements are prepared in accordance with Canadian Public Sector Accounting Standards (PSAS).

The consolidated financial statements of the Province of Alberta (Province) include the accounts of organizations that meet the criteria of control as established under PSAS. The consolidated financial statements also include the accounts of the Offices of the Legislative Assembly.

A list of organizations included in these consolidated financial statements can be found in Schedule 18.

| | (b) | METHOD OF CONSOLIDATION |

The accounts of government sector entities, except those designated as government business enterprises, are consolidated using the line-by-line method. Under this method, accounting policies of the consolidated entities are adjusted to conform to government accounting policies and the results of each line item in their financial statements (revenue, expense, assets and liabilities) are included in the Province’s results. Revenue, expense, capital, investing and financing transactions, as well as related asset and liability balances between consolidated entities have been eliminated.

Schools, colleges, technical institutes, some government business enterprises and some government organizations have year ends that are other than March 31. The significant transactions of these organizations that have occurred during the period between their year ends and the Province’s year end of March 31, 2019, have been recorded in these financial statements. Organizations that the Province controls for reporting purposes through its consolidated organizations, but that do not meet the materiality threshold of $6 million in assets, liabilities, revenues or expenses after eliminating inter-entity transactions and balances, are not consolidated in these financial statements. These organizations are reviewed annually to determine if they meet the materiality threshold and after two years of exceeding the threshold will be considered for consolidation.

The accounts of provincial agencies designated as government business enterprises, such as ATB Financial (Schedule 8), are accounted for on the modified equity basis, with the equity being computed in accordance with International Financial Reporting Standards (IFRS). Under the modified equity method, the accounting policies of government business enterprises are not adjusted to conform to those of the government sector entities. Inter-entity revenue and expense transactions and related asset and liability balances are not eliminated except for inter-entity gains and losses, which are eliminated on assets and liabilities remaining within the government reporting entity at the financial statement date.

| | (c) | BUDGET AND LEGISLATIVE AUTHORITY |

PSAS require that financial statements contain a comparison of the actual and budgeted results for the year. The Province’s fiscal plan is prepared in accordance with the Fiscal Planning and Transparency Act consistent with the scope and accounting policies used in the Province’s consolidated financial statements. The Fiscal Plan documents, which describe the Province’s budget for the 2019 fiscal year, were tabled in the Legislature on March 22, 2018.

| | |

| CONSOLIDATED FINANCIAL STATEMENTS | | 25 |

The budget contains an annual risk adjustment of $500 million. The Province relies on revenue sources that are volatile and unpredictable, including non-renewable resources, income taxes and investment income. This revenue is linked to factors such as energy prices, equity markets, exchange rates, geopolitical events and global economic swings. The annual risk adjustment is a way to signal the possible extent of a revenue shortfall.

| | (d) | ADOPTION OF NEW ACCOUNTING STANDARD |

The Province has prospectively adopted PS 3430 Restructuring Transactions with an effective date of April 1, 2018. This standard did not significantly impact the consolidated financial statements.

| | (e) | FUTURE CHANGES IN ACCOUNTING STANDARDS |

PS 3450 Financial Instruments

The effective date of this standard has been extended to April 1, 2021. Adoption of this standard requires corresponding adoption of PS 2601 Foreign Currency Translation, PS 1201 Financial Statement Presentation and PS 3041 Portfolio Investments in the same fiscal period. These standards provide guidance on: recognition, measurement and disclosure of financial instruments; standards on how to account for and report transactions that are denominated in a foreign currency; general reporting principles and standards for the disclosure of information in financial statements; and how to account for and report portfolio investments. However, the Public Sector Accounting Board issued an exposure draft in January 2019 and proposed narrow scope amendments to this standard. The proposed revision to the treatment of debt buybacks will affect how the annual surplus/deficit is calculated and the presentation of assets and liabilities on the Consolidated Statement of Financial Position without impacting net debt.

The Province, including all government components, except for government organizations and some regulated funds that manage their investments on a fair value basis, have not yet adopted this standard.

Items within the scope of the financial instruments section are assigned to one of the following measurement categories: fair value, cost or amortized cost. Fair value measurement will apply to derivatives and portfolio investments in equity instruments that are quoted in an active market. Also, when groups of financial assets and financial liabilities are managed on a fair value basis, they may be reported on that basis. Other financial assets and financial liabilities will generally be measured at cost or amortized cost. Until an item is derecognized, gains and losses arising due to fair value remeasurement will be reported in the Consolidated Statement of Remeasurement Gains and Losses.

PS 3280 Asset Retirement Obligations

Effective April 1, 2021, this standard provides guidance on how to account for and report liabilities for retirement of tangible capital assets.

PS 3400 Revenue

Effective April 1, 2022, this standard provides guidance on how to account for and report revenue, and specifically, it differentiates between revenue arising from exchange and non-exchange transactions.

The Province has not yet adopted these standards. The Province is currently assessing the impact of these standards on the consolidated financial statements.

| | |

| 26 | | GOVERNMENT OF ALBERTA 2018–19 ANNUAL REPORT |

| | (f) | BASIS OF FINANCIAL REPORTING |

Revenues

All revenues are reported on the accrual basis of accounting. Cash received for which goods or services have not been provided by year end is recognized as unearned revenue and recorded in accounts payable and other accrued liabilities.

The provincial tax system is predicated on self-assessment where taxpayers are expected to understand the tax laws and comply with them. This has an impact on the completeness of tax revenues when taxpayers fail to comply with tax laws, for example, if they do not report all of their income. The Province has implemented systems and controls in order to detect and correct situations where taxpayers are not complying with the various Acts it administers. These systems and controls include performing audits of taxpayer records when determined necessary. However, such procedures cannot identify all sources of unreported income or other cases of non- compliance with tax laws. The Province does not estimate the amount of unreported tax.

Tax revenues are reported net of applicable tax concessions. Tax concessions are defined as tax credits that provide relief to taxpayers from taxes previously paid or currently owing.

Tax credits that provide a financial benefit through the tax system but do not change a taxpayer’s tax liability amount are defined as transfers through the tax system and reported as expenses.

Personal income tax is recognized on an accrual basis based on an economic estimate of the various components of personal income tax for the fiscal year. Gross personal income tax growth for the taxation year is a key component of the estimate for the fiscal year.

Corporate income tax revenue is recognized when installments are received from taxpayer corporations. A receivable is established for tax assessments that are outstanding. Revenue and tax receivables will be adjusted in the year in which any additional information becomes available from resulting audits, appeals and court decisions. Corporate income tax refunds payable are accrued based primarily on the prior year’s corporate income tax refunds paid on assessments. Corporate income tax receipts from corporations in anticipation of an upward reassessment of Alberta income tax payable are described as corporate income tax receipts in abeyance and recognized as accounts payable and other accrued liabilities.

The Province calculates an allowance for corporate income taxes based on the difference between the actual corporate income tax receivable and the estimate of the collectability. The adjustment to the allowance is recorded as an expense. The adjustment may increase or decrease the allowance as tax receivables are revalued in subsequent years based on resulting audits, appeals and court decisions.

Other taxes are recognized during the period in which the taxable event occurs and when authorized by legislation.

The provincial royalty system is predicated on self-reporting where the petroleum and natural gas industry is expected to understand the relevant energy legislation (statutes and regulations) and comply with them. This has an impact on the completeness of revenue when the petroleum and natural gas industry does not fully meet the legislative requirements, for example, by reporting inaccurate or incomplete production data. The Province has implemented systems and controls in order to detect and correct situations where the petroleum and natural gas industry has not complied with the various Acts and Regulations the Province administers. These systems and controls, based on areas of highest risk, include performing audits of the petroleum and natural gas industry records when determined necessary. The Province does not estimate the effect of

| | |

| CONSOLIDATED FINANCIAL STATEMENTS | | 27 |

misreported revenue. Any impacts on revenue of refiling by industry are recognized in the year of refiling.

Royalty revenues are reported net of expenses incurred by provincial oil and gas royalty reduction programs. These programs aim to encourage industry to produce from wells which otherwise would not be economically productive.

Bitumen royalty is determined based on revenues from production sold by projects less the costs of that production and costs of selling the Crown’s royalty share. Crude oil and natural gas royalties are determined based on monthly production. Revenue is recognized when the resource is produced by the mineral right holders. Revenue from bonuses and sales of Crown leases is recognized when the Crown leases are sold.

Transfers from the Government of Canada for capital purposes and donated assets with restrictions for their use are recognized as deferred capital contributions. Transfers for operating purposes with stipulations for their use are recognized as deferred operating contributions. These deferred contributions are recognized as revenue in the Consolidated Statement of Operations based on relevant stipulations of the transfer taken together with the actions and communications of the Province. All other transfers, without stipulations for their use, are recognized as revenue in the Consolidated Statement of Operations when authorized and eligibility criteria, if any, are met.

Endowment contributions, matching contributions and associated investment income allocated for preservation of endowment capital purchasing power are recognized as other revenue in the Consolidated Statement of Operations in the period in which they are received.

Expenses

Expenses represent the cost of resources consumed during the year on government operations. Expenses include amortization of tangible capital assets and expenses incurred in accordance with the terms of approved grant programs. Grants are recognized as expenses when authorized, eligibility criteria, if any, are met and a reasonable estimate of the amounts can be made.

Pension expenses comprise the cost of pension benefits earned by employees during the year, interest on the Province’s share of the unfunded pension liabilities, and the amortization of deferred adjustments arising from experience gains and losses and changes in actuarial assumptions over the expected average remaining service life of employees. Pension recovery represents the change in pension liabilities. Schedule 12 provides additional information on the components of pension expenses and liabilities.

In the Consolidated Statement of Operations, pension costs of government sector entities which are funded are included in expenses by function and costs which have not been funded are recognized as pension provisions.

Costs arising from obligations under guarantees and indemnities are recognized as expenses when management determines that the Province will likely be called upon to make payment. The expense represents management’s best estimate of future payments less recoveries.

The estimated increase or decrease for the year in accrued employee vacation entitlements is recognized in the related expense function.

Financial Assets

Financial assets are the Province’s financial claims on external organizations and individuals, and inventories for resale at year end.

| | |

| 28 | | GOVERNMENT OF ALBERTA 2018–19 ANNUAL REPORT |

Cash includes deposits in banks and cash-in-transit. Cash equivalents include directly held interest-bearing securities with terms to maturity of primarily less than three months.

Accounts receivable is recognized at the lower of cost or net recoverable value. A valuation allowance is recognized when recovery is uncertain.

Portfolio investments are recognized at cost. Cost includes the amortization of a discount or premium using the straight-line method over the life of the investments. Realized gains and losses on disposal of these investments are included in calculating the net operating results for the year. If an investment loses value that is other than a temporary decline, its recognized value is reduced to reflect the loss. The reduced value is deemed to be the new cost.

Portfolio investments restricted for endowments (Schedule 7) are from donors who have placed restrictions on their contributions to the endowment funds, for example, capital preservation. The principal restriction is that the original contribution should be maintained intact in perpetuity. Other restrictions may include spending investment income earned by endowments for specific operational or capital purposes, or capitalizing a certain amount of investment income to maintain and grow the real value of endowments.

Loans are recognized at cost less any discounts and allowance for credit loss. Where there is no longer reasonable assurance of timely collection of the full amount of principal and interest of a loan, a provision for credit loss is made and the carrying amount of the loan is reduced to its estimated realizable amount.

Inventories for resale representing the Province’s share of royalty oil in feeder and trunk pipelines are recognized at the lower of cost or net realizable value. Other inventories for resale are valued at the lower of cost, determined on a first-in, first-out basis, and estimated net realizable value.

Liabilities

Liabilities represent present obligations of the Province to external organizations and individuals arising from past transactions or events occurring before year end, the settlement of which is expected to result in the future sacrifice of economic benefits. They are recognized when there is an appropriate basis of measurement and management can reasonably estimate the amount.

The value of pension liabilities and associated changes during the year are based on an actuarial extrapolation of the most recent actuarial valuation. This valuation technique uses the projected benefit method pro-rated on service and management’s best estimate as at the extrapolation date of various economic and non-economic assumptions. Where the Province is a participating employer in the plan, experience gains and losses to the extent of the Province’s employer share are amortized over the estimated average remaining service life of employees. Where the Province has a liability for pre-1992 pension obligations, experience gains or losses are recognized in the year incurred.

Debentures included in debt are recognized at the face amount of the issue less unamortized discount, which includes issuance and hedging costs.

Income or expense on derivatives used to manage interest rate or foreign currency exposure is recognized as an adjustment to debt servicing costs.

Coal phase-out agreements liabilities are valued at the net present value of the future payments, discounted using the Province’s borrowing rate for long term debt at the time of signing the agreements.

| | |

| CONSOLIDATED FINANCIAL STATEMENTS | | 29 |

Public private partnerships (P3) are legally-binding contracts between the Province and one or more public/private/not-for-profit partners for the provision of assets and the delivery of services that allocates responsibilities and business risks among various partners.

The Province accounts for P3 projects in accordance with the substance of the underlying agreements. These agreements are accounted for in the same way as capital leases as follows:

| | ∎ | | The capital asset is valued at the total of progress payments made during construction and net present value of the future payments, discounted using the Province’s estimated borrowing rate for long term debt at the time of signing the P3 agreement. |

| | ∎ | | The liability is valued at the net present value of the future payments, discounted using the Province’s borrowing rate for long term debt at the time of signing the P3 agreement. |

| | ∎ | | During construction, the capital asset (classified as work-in-progress) and the corresponding liability are recorded based on the estimated percentage complete or the term of the agreement. |

| | ∎ | | Amortization on a straight-line basis over the estimated useful life commences when the asset is put into service. |

Liabilities also include:

| | ∎ | | All financial claims payable by the Province at year end; |

| | ∎ | | Contingent liabilities where future liabilities are likely and the amount can be reasonably estimated; |

| | ∎ | | Estimates of the Province’s liabilities for contaminated sites; |

| | ∎ | | Accrued employee vacation entitlements; |

| | ∎ | | Asset retirement obligations recognized by some organizations based on their accounting policies or terms of contract; |

| | ∎ | | Unspent deferred contributions for capital and operating purposes; and |

| | ∎ | | Spent deferred capital contributions which are excluded from net debt. |

Non-financial Assets

Non-financial assets include tangible capital assets, prepaid expenses, inventories of supplies and other non-financial assets.

Tangible capital assets are valued at cost less accumulated amortization. Cost is the gross amount of consideration given up to acquire an asset and includes all costs directly attributable to acquisition, construction, development or betterment of the tangible capital asset. Amortization is provided on a straight-line basis over estimated useful lives of the assets (Schedule 15). The annual amortization costs are allocated to the functions of the Province that employ those assets and are reported on the Consolidated Statement of Operations.

Prepaid expenses are recorded at cost and amortized based on the terms of the agreement.

Inventories of supplies are valued at the lower of cost, determined on a weighted average or first-in, first-out basis, and replacement cost.

Other Assets

Intangible assets, collections of historical artifacts, provincial, national and international works of art and tangible capital assets acquired by right, such as Crown lands, forests, water and mineral resources, are not included in the Consolidated Statement of Financial Position as a reasonable estimate of the amounts involved cannot be made.

| | |

| 30 | | GOVERNMENT OF ALBERTA 2018–19 ANNUAL REPORT |

Derivative Contracts

Derivative contracts are held directly for hedging purposes to manage specific loan receivable and debt related risks, or indirectly through pooled funds included in portfolio investments. Types of derivative contracts and their classification in these financial statements are described further in Note 3.

Derivative contracts used for hedging purposes, where there is an underlying matching asset or liability, are recognized at cost plus accrued interest. The estimated amounts receivable or payable related to derivative contracts are included in accrued interest receivable or payable respectively. Derivative contracts without an underlying matching asset or liability are recognized at fair value and are included in portfolio investments. Gains and losses from derivative contracts are included in investment income or debt servicing costs, based on their intended purpose.

Foreign Currency

Unhedged monetary items denominated in a foreign currency are translated at the year end rate of exchange. Hedged assets and liabilities denominated in foreign currencies are translated at the rate of exchange established by the terms of the hedging agreement.

Foreign currency transactions are translated into Canadian dollars using the average exchange rate for the day, except for hedged foreign currency transactions, which are translated at exchange rates established by the terms of the hedging agreement.

Exchange gains and losses that arise on translation of fixed-term foreign currency denominated monetary items are deferred and amortized over the life of the contract.

Amortization of deferred exchange gains and losses and other exchange differences on unhedged transactions are included in the determination of the net operating results for the year.

Measurement Uncertainty

Estimates are used in accruing revenues, expenses, assets and liabilities in circumstances where the actual results are unknown at the time the financial statements are prepared. Uncertainty in the determination of the amount at which an item is recognized in financial statements is known as measurement uncertainty. Such uncertainty exists when there is a variance between the recognized amount and another reasonably possible amount, whenever estimates are used.

Measurement uncertainty that is material to these financial statements exists in the accrual of personal and corporate income taxes; royalties derived from non-renewable resources; health transfers; private investments, inflation sensitive and alternative investments; loans receivable; and pension liabilities.

Personal income tax revenue (Schedule 1) of $11,874 million (2018: $10,775 million) is subject to measurement uncertainty due primarily to the use of economic estimates of personal income growth. Personal income growth is inherently difficult to estimate due to subsequent revisions to personal income data. The current fiscal year estimate of primary household income growth used in determining personal income tax is 3.3% for 2018 calendar year and 3.2% for 2019 calendar year (the 2018 estimate was 4.5% for 2018 calendar year and 3.9% for 2017 calendar year. Based on historical data, there is an uncertainty of plus or minus $586 million (2018: $518 million) in the personal income tax revenue estimate.

Corporate income tax revenue (Schedule 1) of $4,702 million (2018: $3,360 million), the related amount receivable (Schedule 5) of $1,048 million (2018: $840 million) and refunds payable (Schedule 10) of $500 million (2018: $698 million) are subject to measurement uncertainty due

| | |

| CONSOLIDATED FINANCIAL STATEMENTS | | 31 |

to estimates of amounts not yet assessed based on cash received as well as taxpayer objections to assessed taxes (Note 7). Estimates are based on cash received from tax installments, payments with a filed return, current year refunds paid, and amounts assessed where payment has not yet been received. The methodology of calculating the refund liability estimate is back tested and the estimate is revised as necessary. Final assessed taxes may differ from original estimates due to reassessments in subsequent years. The impact of future reassessments cannot reasonably be determined. The amounts included in the corporate income tax accounts receivable are evaluated for collectability annually. A valuation allowance of $119 million (2018: $200 million) is the reduction to receivables to determine the estimated net recoverable amount. The methodology to calculate the allowance is back tested and revised as required.