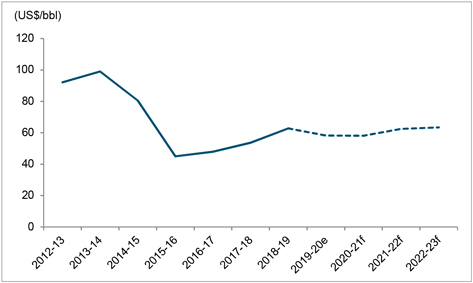

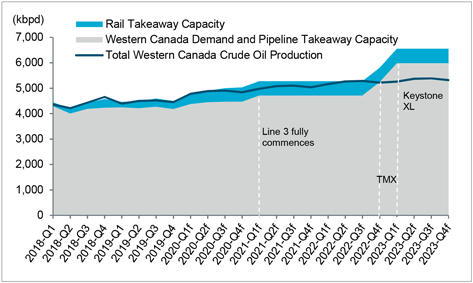

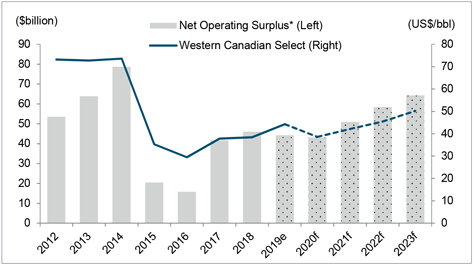

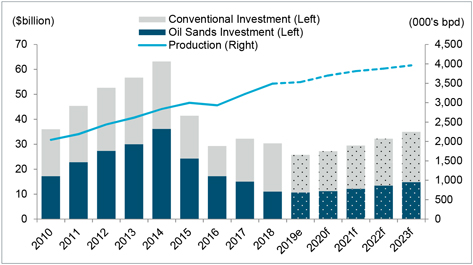

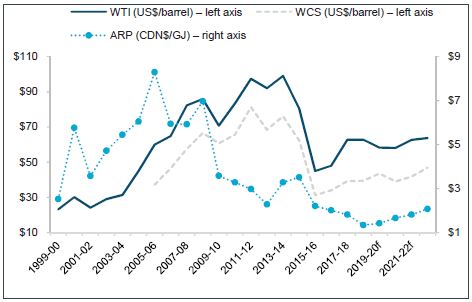

Alberta’s resource revenue royalty structure The Alberta government has substantial non-renewable resource revenue (NRR), including royalties from bitumen, crude oil, natural gas and by-products and coal, as well as revenue from bonuses and sales of Crown leases, and rentals and fees. Alberta’s royalty regimes follow a concession system where mineral rights are owned by the Crown. Companies earn the right to explore mineral rights through land sale auctions, and then pay royalties to the Crown for a share of the resulting production. The share is calculated by applying a royalty formula, which is unique to each commodity. • The generic oil sands royalty regime is based on the revenue of individual projects. The royalty rate is determined by oil prices and whether the project is in pre- or post-payout. Royalty rates are calculated based on the West Texas Intermediate (WTI) oil price expressed in Canadian dollars. An oil sands project reaches payout when its cumulative revenue exceeds its cumulative eligible costs for the first time. Prior to payout, royalties are 1–9 per cent of gross revenue, while after payout, they are the greater of 1–9 per cent of gross revenue or 25–40 per cent of net revenue. • Royalties for natural gas and by-products, and conventional oil, are well-based, and are calculated based on two systems: the former Alberta Royalty Framework (ARF), and the current Modernized Royalty Framework (MRF). Since January 2017, new wells drilled pay under MRF, while most producing wells drilled before then pay under ARF (scheduled to fully transition to MRF by end of 2026). The MRF regime is a revenue minus cost system similar to the oil sands regime, but with a standardized cost (C*) based on an industry average to drill and complete a well. This benefits companies that reduce costs below the industry average. MRF also has a payout feature where pre-payout wells pay a lower royalty rate which increases once the well has recovered its C* costs. Three main factors drive royalty revenue: price, cost to produce, and quantity. The exchange rate is also a driver as most commodities are priced in US dollars. Energy prices, like prices for other goods, are determined by supply and demand. The Alberta | | government uses information and advice from energy analysts, and compares the forecast with those from investment houses, banks and private forecasters. • The most important oil prices to Alberta are WTI and Western Canadian Select (WCS). WTI is the North American price benchmark for light sweet crude oil, which broadly captures global oil pricing trends. WCS is the Western Canadian price benchmark for heavy oil - a heavy Alberta-produced crude composed largely of bitumen blended with diluents. Alberta oil prices trade at a differential to WTI to reflect local market fundamentals, adjustments in quality relative to WTI, and transportation costs. • The most important natural gas and natural gas liquid prices are: Henry Hub, AECO, Alberta Reference Price (ARP) and natural gas liquid prices. Henry Hub is the US and North American price benchmark for natural gas, while AECO is the Western Canadian price benchmark. ARP is the monthly weighted average field price of all Alberta natural gas sales, and is used to calculate royalties. Natural gas by-product or liquid prices, such as propane, butane, and pentanes plus, closely follow WTI prices but with regional discounts reflecting local supply and demand fundamentals. Alberta natural gas prices have remained depressed and volatile, while natural gas by-product prices have provided some relief to natural gas operators as they follow WTI prices. Bitumen production and costs are based on project forecasts submitted annually by oil sands operators, and compared with internal and external forecasts for reasonableness. Forecasts for conventional oil and natural gas production use Alberta Energy Regulator estimates, current market trends and industry activity. Costs are based on C* (the industry average). All these drivers can impact payout status, affecting royalties dramatically. This is especially the case for bitumen. Changes to project costs or revenue may delay pre-payout projects from reaching post-payout status and paying higher royalties on net revenue, while royalties from post-payout projects could be much lower, especially if they are pushed into paying based on gross revenue. |