Tax Revenue

Total tax revenue in 2021-22 is forecast at $21.4 billion, $2.3 billion higher than budget, and $1.8 billion more than in 2020-21. The increase from budget is due to stronger personal (PIT) and corporate (CIT) income taxes, while the increase from last year is primarily from growth in reported PIT.

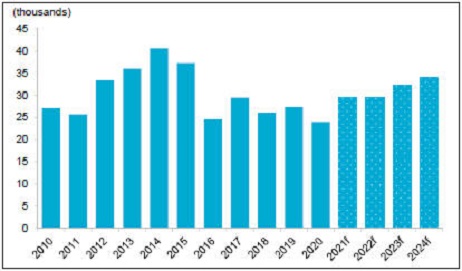

PIT revenue is forecast at $13.1 billion, $1.4 billion higher than estimated in Budget 2021, and $1.8 billion more than in 2020-21. Revenue grows to $13.8 billion by 2023-24. Improving employment and household income, including federal COVID-19 transfers this fiscal year, are contributing to PIT growth. In 2021-22, reported PIT revenue also includes a $717 million prior-years’ adjustment. As 2020 assessments are only now being finalized, 2019-20 and 2020-21 PIT reported in those years’ financial statements contained estimates for 2020 and 2021 which were too low. This requires an adjustment reported in 2021-22 PIT.

CIT revenue of $2.9 billion is forecast for 2021-22, $1 billion more than the budget estimate but $121 million lower than 2020-21. CIT then increases rapidly, by an average of 19% per year and reaches $4.1 billion by 2023-24, driven by economic recovery and an attractive business climate. The decrease in 2021-22 from last year results from positive 2020-21 year-end accounting adjustments not expected at the same level this year

(e.g. accounts receivable accruals, refund liabilities).

Other tax revenue in 2021-22 is estimated at $5.4 billion, $106 million less than expected in Budget 2021, but an increase of $136 from 2020-21. Other tax revenue is forecast to grow $405 million, to $5.8 billion, over the next two years. The decline from budget is mainly due to the impact of lower consumption on fuel and tobacco taxes, and the tourism levy. Fuel tax revenue growth is expected to slow over the medium term, as people transition to more fuel-efficient or electric vehicles and working from home. Education

property tax revenue is lower than budget in all three years, as municipal credits have been increased under the Provincial Education Requisition Credit for uncollectible education property tax on delinquent oil and gas properties. These are partly offset by increased revenue from insurance, cannabis and freehold mineral rights taxes, due to higher-than-expected revenue in 2020, increased consumption and higher oil and natural gas price forecasts, respectively.

Transfers from Government of Canada

Federal transfers of $11.4 billion are forecast for 2021-22, $1.2 billion higher than estimated in Budget 2021. Main changes comprise: a $465 million special one-time bump to the Canada Health Transfer (CHT) for COVID-19, and $44 million added following usual revisions to the provincial-allocation calculation (Alberta’s share of the national population, and Canadian GDP growth); $116 million onetime transfer for immunization costs; a net $145 million increase in infrastructure support, reflecting a one-time supplement of $244 million to the Canada Community-Building Fund, partly offset by re-profiling of various projects under the array of federal infrastructure programs, mostly for municipalities; $208 million in agriculture support, primarily for livestock producers; labour market agreement funding re-profiled from 2020-21; a net $261 million in other increases including Safe Return to Class funding, early learning workforce support and flood assistance, partly offset by re-profiling a net $50 million in site rehabilitation funding.

Transfers are $0.5 billion higher than budget in 2022-23, due mainly to the revised CHT and re-profiling of infrastructure and site rehabilitation funds, with revenue in 2022-23 relatively close to budget, with the main variance the usual CHT revision.

Investment Income

Investment income in 2021-22 is forecast at $4 billion, $1.8 billion more than budget as financial market returns have been strong. Almost all the increase is from the Heritage and endowment funds. Income is forecast to decrease to $3.1 billion and $2.8 billion in the following two years, based on market returns moderating to more “normal” rates, although investment income is still $785 million and $344 million greater than the budget forecasts.

Other Revenue

Net income from government business enterprises in 2021-22 is forecast at $2.3 billion, $407 million more than budget, primarily due to higher income from ATB Financial (mainly reduced credit loss provision), Alberta Petroleum Marketing Commission (APMC, optimization transaction of Sturgeon Refinery) and gaming. Revenue is higher than budget in 2022-23, and slightly higher in 2023-24, due to the ATB and APMC improvements.

Premiums, fees and licences revenue of $4.3 billion is forecast for 2021-22, an increase of $150 million from budget. Timber royalties and fees have increased $117 million from elevated lumber prices, though prices have now dropped (revenue is $202 million lower than first quarter forecast). Other increases are from the ATB payment-in-lieu-of-taxes, based on higher net income, and parks fees and the 911 call levy. These are partly offset by lower Alberta Health Services fees, mainly from out-of-province patients.

Other revenue of $3.7 billion is up by $289 million from budget, comprising: $207 million in external investment management charges arising from increased income, charged to external clients (e.g. pension plans), which also impacts Treasury Board and Finance operating expense; $138 million in compliance payments to the Technology Innovation and Emissions Reduction Fund, from higher activity; partially offset by decreases of $56 million, mainly in fines and penalties revenue.

| | |

| 2021-22 Mid-year Fiscal Update and Economic Statement | | 5 |