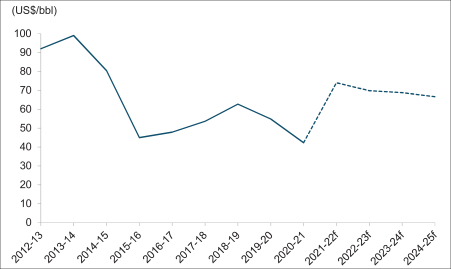

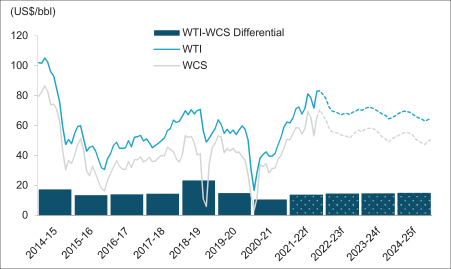

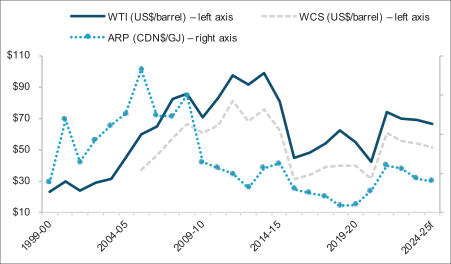

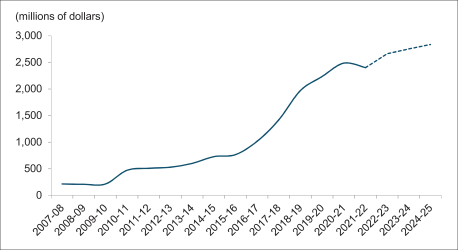

Conventional oil royalties are estimated at $1.7 billion in 2022-23, almost identical to revenue in 2021-22, but then fall by an average of 6% per year, to $1.5 billion by 2024-25, as prices scale back from current levels.

Natural gas and by-product royalties are estimated at $1,458 million in 2022-23, $264 million, or 15% lower than in 2021-22, due primarily to decreasing natural gas and natural gas liquid prices (i.e. natural gas by-products). The natural gas Alberta Reference Price (ARP) climbed an estimated $1.30 per gigajoule (/GJ), relative to 2020-21, and 80 cents relative to the Budget 2021 estimate, to an estimated $3.40/GJ in 2021-22. This is the highest price since 2014-15, when it averaged $3.51. It is forecast to trend down to $3.20/GJ in 2022-23, and to $2.60/GJ by 2024-25. Revenue is forecast to fall also, to $959 million by 2024-25. Prices for natural gas by-products, such as propane, butane and pentanes plus, follow oil prices, which are also retrenching from current highs.

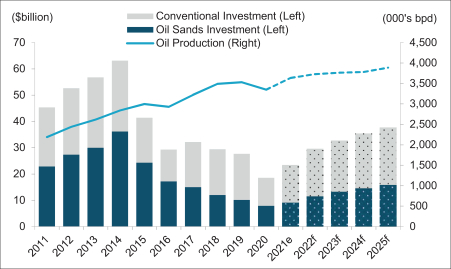

The outlook for natural gas and by-products has improved, with upside demand from oil sands projects and power generation, and with Alberta’s low corporate taxes and overall attractive business climate supporting expansion in the petrochemical sector. Steady production growth in Alberta is forecast.

Bonuses and sales of Crown land leases revenue in 2022-23 is estimated at $236 million, an increase of $51 million from 2021-22, as land sales were suspended for part of 2021. Revenue trends down to $206 million by 2024-25, following energy prices.

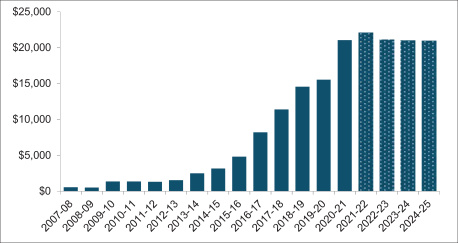

Non-Renewable Resource Revenue

(millions of dollars)

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | |

| | | 2020-21

Actual | | | 2021-22 Budget Forecast | | | 2022-23

Estimate | | | 2023-24

Target | | | 2024-25

Target | |

| | | | | | |

Bitumen royalty | | | 2,006 | | | | 1,482 | | | | 9,515 | | | | 10,349 | | | | 9,213 | | | | 8,160 | |

| | | | | | |

Crude oil royalty | | | 466 | | | | 627 | | | | 1,666 | | | | 1,670 | | | | 1,619 | | | | 1,478 | |

| | | | | | |

Natural gas & by-products royalty | | | 465 | | | | 467 | | | | 1,722 | | | | 1,458 | | | | 1,151 | | | | 959 | |

| | | | | | |

Bonuses & sales of Crown leases | | | 24 | | | | 151 | | | | 185 | | | | 236 | | | | 225 | | | | 206 | |

| | | | | | |

Rentals and fees / coal royalty | | | 130 | | | | 128 | | | | 149 | | | | 127 | | | | 120 | | | | 113 | |

| | | | | | |

Total Resource Revenue | | | 3,091 | | | | 2,856 | | | | 13,237 | | | | 13,840 | | | | 12,328 | | | | 10,916 | |

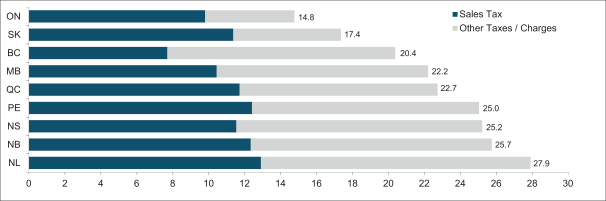

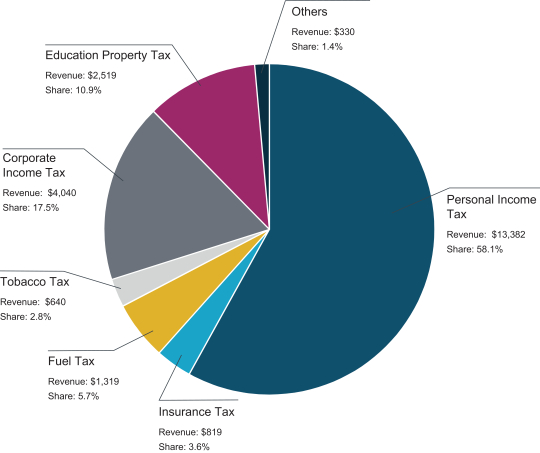

Tax Revenue

Tax revenue is forecast at $23 billion in 2022-23, 37% of total revenue. This is $974 million, or 4.4% higher than in 2021-22, mainly due to increases of $697 million in corporate income tax (CIT), $121 million in personal income tax (PIT), and $120 million in fuel and insurance taxes.

Tax revenue is forecast to grow by an average of 6.8% for the following two years, reaching $26.3 billion by 2024-25. This mainly reflects strong growth in income taxes, particularly CIT. Of the $3.2 billion increase in tax revenue between 2022-23 and 2024-25, $2.9 billion, or 91%, is from income taxes.

Personal income tax revenue in 2022-23 is estimated at $13.4 billion, an increase of $121 million from 2021-22. PIT in 2021-22 is now expected to be $1.6 billion higher than the Budget 2021 forecast due to the rebounding economy, job creation, population and household income growth, propelled