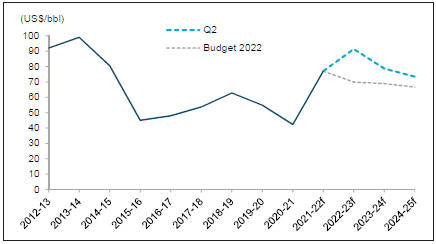

Petroleum Reserve and refinery outages. The differential remains wider than budget in the following two years but declines to US$16.10/bbl by 2024-25.

Conventional oil royalties have also increased by $2.3 billion to $4 billion in 2022-23, due to the forecast higher oil prices and an increase in expected production. The higher revenue continues in 2023-24 and 2024-25.

Natural gas and by-product royalties have also increased, by $2.8 billion in 2022-23, as natural gas and oil prices are higher (by-product prices follow oil prices) and also from increased production. Royalties decrease in the following two years as prices moderate.

Tax Revenue

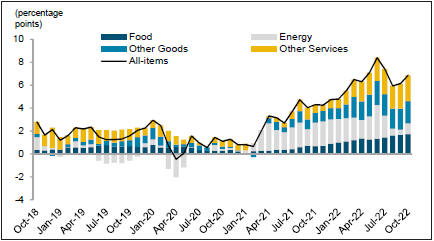

Total tax revenue in 2022-23 is forecast at $24.2 billion, $1.1 billion higher than budget, but only $0.7 billion more than in 2021-22. The increase from budget is due to stronger corporate income tax (CIT) revenue, offset by lower fuel tax revenue from the fuel tax relief program and indexation of the personal income tax (PIT) system to inflation, both to help Albertans with the affordability challenges caused by high inflation.

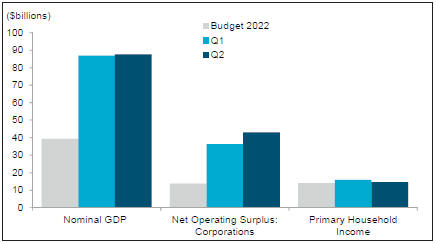

PIT revenue is forecast at $13.3 billion, $83 million lower than estimated in Budget 2022. PIT revenue increases to $14.7 billion by 2024-25, with moderate growth in household income.

CIT revenue of $6.3 billion is forecast for 2022-23, the highest amount ever collected. This is $2.2 billion more than the budget estimate, reflecting strong corporate profits boosted by elevated commodity prices, exports and activity, and encouraged by the Job Creation Tax Cut. CIT revenue remains high, reaching $6.6 billion by 2024-25, but growth is modest as wages rise, companies continue to spend more investing in Alberta and energy prices decline.

Other tax revenue in 2022-23 is estimated at $4.6 billion, $992 million less than the $5.6 billion expected in Budget 2022, almost entirely due to the fuel tax relief program. Other tax revenue is forecast to recover to $5.8 billion by 2024-25 as fuel tax

revenue returns to “normal” levels. Revenue from insurance and tobacco taxes has been revised lower in all years as actual prior-year insurance tax revenue was lower than anticipated when budget forecasts were prepared, and as tobacco prices have increased, possibly inducing substitution with competing vaping and cannabis products.

Transfers from Government of Canada

Federal transfers of $12.5 billion are forecast for 2022-23, $433 million higher than estimated in Budget 2022. Main changes comprise: a $232 million special one-time bump to the Canada Health Transfer (CHT) for surgical backlog, a $50 million donation of personal protective equipment directly to Alberta Health Services, re-profiling of $279 million from 2023-24 for the site rehabilitation program, partially offset by re-profiling of federal infrastructure funds to match project progress.

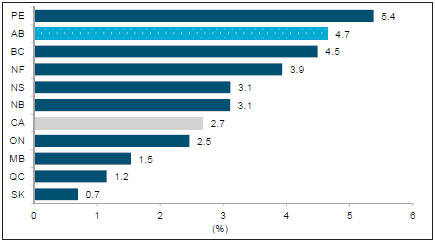

Transfers are $117 million lower than budget in 2023-24, due mainly to moving the site rehabilitation revenue to 2022-23, partly offset by increased CHT and the Canada Social Transfer following upward revisions to Alberta’s share of the national population.

Investment Income

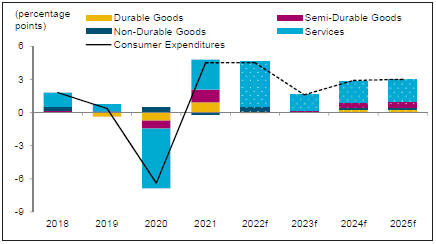

Investment income in 2022-23 is forecast at $1.2 billion, $2 billion lower than budget as financial markets have performed poorly with the global economic malaise, inflation, interest rate increases, ongoing supply chain problems and the war in Ukraine and its impact on Europe’s energy supply. All of the decrease is from the Heritage and endowment funds, with income from other accounts, funds and activities up slightly with the higher interest rates. Income is forecast to improve to $2.3 billion and then $3.4 billion in the following two years, based on markets returning to more “normal” rates of return.

Other Revenue

Net income from government business enterprises in 2022-23 is forecast at

$2.5 billion, $40 million more than budget, primarily due to lower losses from Alberta Petroleum Marketing Commission (APMC), partly offset by reduced ATB Financial net income (increased credit loss provision). Revenue in 2023-24 is up slightly from budget, with lower APMC net losses partly offset by lower Alberta Gaming, Liquor and Cannabis Commission (AGLC) gaming revenue due to higher costs (revised, accelerated amortization expense for gaming assets). In 2024-25, revenue is a net $234 million lower than budget, due to the higher ATB costs and APMC net losses, resulting from forecast declines in diesel prices and Sturgeon Refinery bi-annual maintenance.

Premiums, fees and licences revenue of $4.8 billion is forecast for 2022-23, an increase of $266 million from budget. Timber royalties and fees have increased $221 million from elevated lumber prices, and post-secondary tuition fee revenue has been more than estimated mainly due to higher student enrolments. In 2023-24 and 2024-25, revenue is $128 million and $184 million higher than budget due mainly to continued higher tuition fee revenue, revised estimates for land titles registrations and processing the backlog in 2023-24, and Alberta Health Services fee revenue in 2024-25.

Other revenue of $3.7 billion is up by $112 million from budget, mainly comprising $138 million in higher compliance payments and investment income in the Technology Innovation and Emissions Reduction Fund (TIER), partly offset by lower payments from automobile insurers for health care costs of accident victims, and lower volumes of fines and penalties. Revenue in 2023-24 is $25 million lower than budget, with higher external investment management charges to external clients (e.g. pension plans) more than offset by continued lower fines and penalties revenue, automobile insurance refunds and reduced TIER compliance payments. In 2024-25, revenue is $97 million higher, for similar reasons, except TIER compliance payments have increased.

| | |

| 2022-23 Mid-year Fiscal Update and Economic Statement | | 5 |