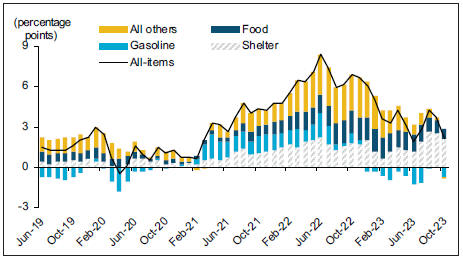

Inflation is now forecast to average 3.5% this year, up 0.2 percentage points from budget. Inflation projections have also been revised up by 0.3 percentage points from budget to 2.5% in 2024, before returning to around 2% over the medium term.

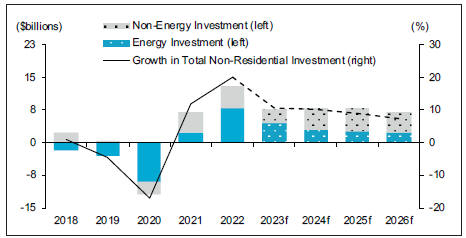

Consumer spending softening

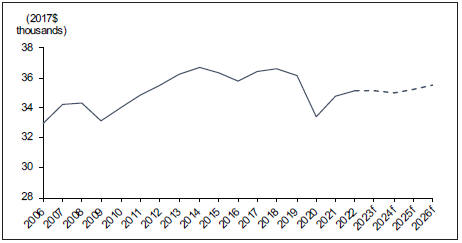

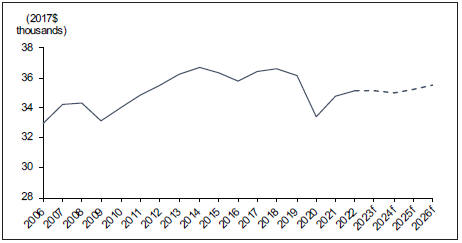

Consumers are curtailing their spending in response to interest rate increases over the past year, elevated prices, and waning sentiment. Consumer confidence remains subdued despite the improvement in September. Declining sentiment toward major purchases has translated to weaker spending on big-ticket items such as motor vehicles and housing-related categories, where sales have slowed considerably compared to a year ago. On an inflation-adjusted basis, spending on food and beverage stores has also stagnated so far this year. Despite these headwinds, staggering population growth is supporting overall consumption, and real consumer spending is now forecast to rise 3.4% in 2023, up 1.3 percentage points from budget. On a per capita basis, however, real consumer spending is set to decline this year, reflecting the impact of rising borrowing costs and high inflation on goods spending (Chart 9). Services spending, on the other hand, is expected to rise in line with strong population growth.

With inflation slower to return to target, the Bank of Canada is not expected to begin cutting rates until the third quarter of 2024. This means that households are expected to increasingly feel the impact of higher for longer interest rates next year, which will lead to slower consumer spending. Real consumer spending is forecast to slow to 2.5% next year before bouncing back in 2025 and boosting overall real GDP growth.

Homebuilding activity gains momentum

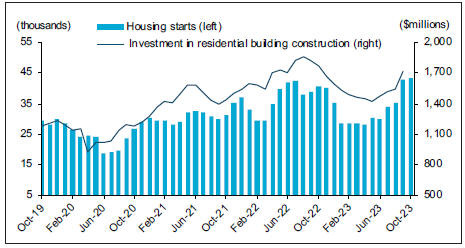

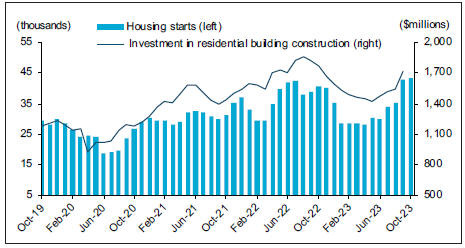

Residential construction is finally responding to low inventories after being weighed down by higher interest rates, labour shortages and elevated costs in the construction sector. Housing starts posted a significant turnaround, averaging at a annualized pace of over 42,000 units in the last four months to October. While the robust growth has primarily been driven by a surge in apartment starts, single-family dwellings have also picked up. Residential building investment have

also trended higher in recent months (Chart 10). With the recent pickup in activity and construction intentions, housing starts in the province are now expected to average 34,000 units this year. This is higher than the first quarter forecast of 31,000 but still lower than 38,000 at budget.

Housing construction in the province has not kept up with the pace of recent population growth during the 2023 census year. Between July 1, 2022 and 2023, there were 33,300 units that started construction in the province even as population grew more than 184,000 people. This translated to 5.5 people per housing start, exceeding the approximate 2.5 people per dwelling each census has record since 2001. The catch-up in supply will buoy housing starts in the next few years. Housing starts are expected to

gradually rise to 35,200 in 2024, 36,000 in 2025 and 36,800 in 2025, buoyed by faster population growth and declining interest rates. Despite the upswing, real residential investment is expected to decline about 10% this year. This reflects subdued renovation activity and weakness in new housing construction in the first half of 2023, in addition to the shifting composition of housing starts towards lower-priced, multi-family dwellings. However, strong momentum in residential construction during the second half of this year is expected to carry over into the next, resulting in a projected 4% rebound in real residential investment in 2024.

Chart 9: Higher interest rates a drag on per capita consumer spending

Real per capita consumption in Alberta

Sources: Statistics Canada, Haver Analytics and Alberta Treasury Board and Finance; f-forecast

Chart 10: Residential construction turning a corner

Residential construction investment and 3-month MA* housing starts

Sources: Statistics Canada and Haver Analytics; * Moving average