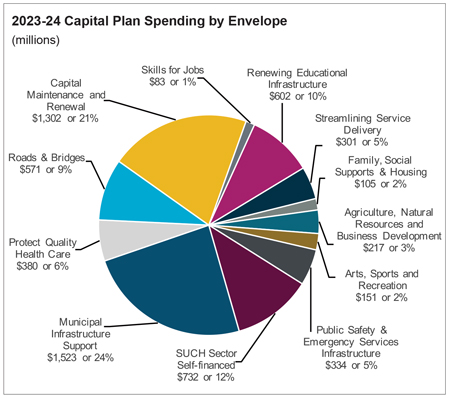

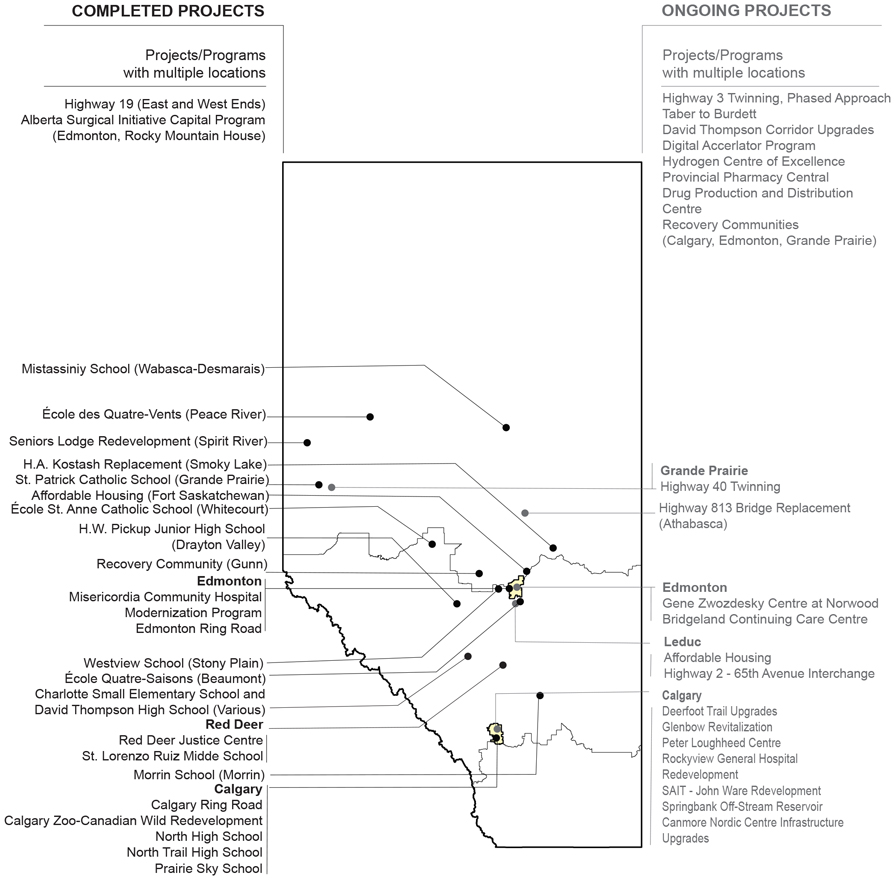

• $47 million decrease in Arts, Sports, and Recreation, Family and Social Supports and Housing, Skillsfor Jobs and Public Safety and Emergency Infrastructure primarily to re-align cash flow requirements with project progress and timelines. The decrease was partially offset by increase from budget in several areas: • $98 million net increase in self-financed investment by University, Schools, Technology and Innovation, and Health entities self-financed, driven by $115 million in higher spending on capital projects for education and post-secondary institutions, was partially offset by a $17 million decrease in spending by primarily in Alberta Health Services. Overall, the 2023-24 Capital Plan envelope spending comprised of: • $1.5 billion in Municipal Infrastructure Support: - $571 million in federal and provincial funding for LRT projects; - $487 million to support municipalities through the Municipal Sustainability Initiative; - $265 million from the federally funded Canada Community Building Fund; - $96 million in other capital grants program including various ICIP projects, transportation grant programs, and other federal grant programs; - $52 million for water supply, treatment, wastewater treatment and disposal system grants; - $52 million for the Calgary Event Centre project. • $1.3 billion in Capital Maintenance and Renewal: - $658 million for bridge and highway rehabilitation; - $197 million for parks, government facilities preservation, and information technology; - $147 million for health facilities; | | - $146 million for post-secondary institutions; - $112 million for school facilities; and - $43 million for family, social support, and housing. • $0.6 billion for Renewing Educational Infrastructure: - 57 school projects currently underway, and 14 completed in 2023-24. • $0.6 billion for Roads and Bridges: - $402 million for highway twinning, widening and expansion projects including Deerfoot Trail Upgrades, QEII and 65th Avenue interchange in Leduc, and twinning projects including Highway 3, 11, 19, and 40; - $112 million for Calgary and Edmonton Ring Roads; - $57 million for other municipal road support related to Yellowhead Trail, Terwillegar Expansion and 50th Street overpass in Edmonton. • $0.4 billion for Protecting Quality Health Care: | | - Recovery Communities in Edmonton, Grande Prairie, Calgary, Gunn, Red Deer, Blood Tribe, Enoch, Lethbridge, Central Alberta, Siksika, and Tsuut’ina First Nations. • $0.3 billion for Streamlining Service Delivery: - $269 million for General Capital and Information Technology; and - $31 million for Alberta Broadband Strategy. • $0.7 billion in SUCH sector self-financed projects: - $346 million in projects self-funded by post-secondary institutions; - $241 million in health facilities; - $145 million in school board funded, and Technology and Alberta Innovates projects. • $0.9 billion for Agriculture, Natural Resources and Business Development, Family, Social Supports and Housing, Public Safety and Emergency Infrastructure, Skills for Jobs, Arts, Sports, and Recreation. |