Elevated residential construction activity

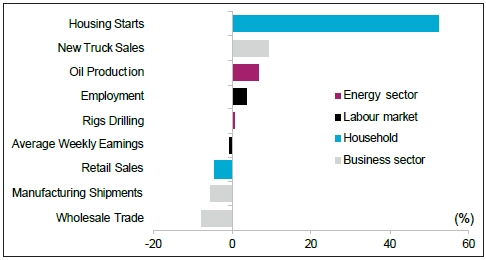

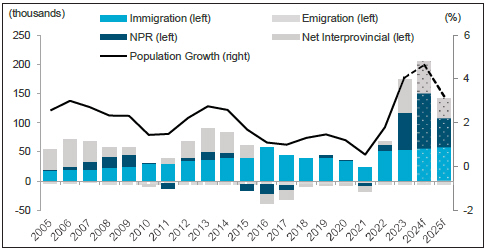

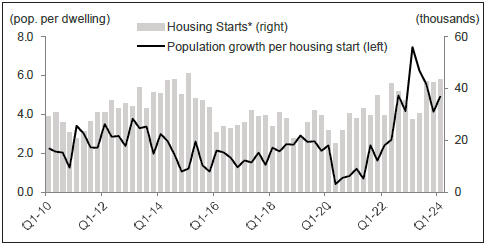

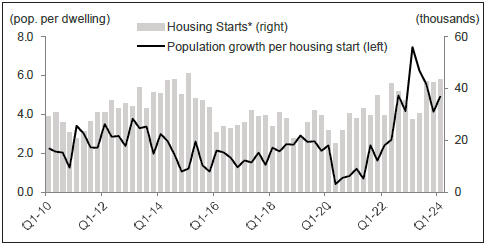

Activity in Alberta’s residential construction sector is booming as home builders respond to record-setting migration and tight housing conditions. Housing starts averaged more than 45,000 units (annualized) in the first seven months of 2024, up nearly 50 per cent from the same period last year, before momentum really picked up. All categories have seen strong growth so far this year, led by the multi-family segment, which is benefitting from strong rental demand and homebuyers’ shift to lower-priced homes amid high interest rates. Despite the ramp up in construction, supply continues to lag behind demand. As a result, the ratio of housing starts to population growth has climbed over the past year (Chart 6). This is well above the historical average. Stronger-than-expected population growth suggests that housing supply will need to catch up further. However, the response from the construction sector will continue to be constrained by the lack of skilled labour and high construction costs. Housing starts are now expected to average 42,500 in 2024 and 42,900 in 2025, up from the budget forecast of about 39,000 units annually.

The surge in new housing construction, along with strong resale housing activity, are expected to boost growth in real residential investment to almost 14 per cent this year before moderating to around 5 per cent in 2025. Growth this year will be dampened by renovation spending, which has pulled back sharply as households curtail discretionary and

big-ticket spending. With interest rates expected to fall further and consumer sentiment improving, renovation spending is poised to see a modest pickup next year.

Job gains moderating but solid

Employment is on track to expand at a solid pace. Despite a pull back in the services sector and slowing momentum in the goods sector in the second quarter, headline employment has grown at a strong clip of 3.2 per cent YTD through July. While oil & gas employment has rebounded, the slowdown in consumer spending has weighed on employment in the retail & wholesale trade and transportation & warehousing sectors. Nonetheless, Alberta’s employment growth has outperformed the national average, with the province accounting for nearly all of the increase in Canada’s private sector employment over the past year. With job vacancies easing and the job finding rate slowing, employment is anticipated to see more modest growth for the remainder of the year. Employment is forecast to rise 3.0 per cent in 2024, in line with budget expectations. A pick up in business investment and consumer spending should see employment grow 3.1 per cent next year.

Unemployment rising sharply

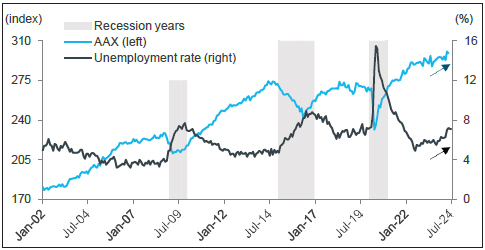

The unemployment rate has climbed significantly with more people looking for work in Alberta. The labour force has grown at an exceptionally strong pace over the past year, well above the levels seen in recent population booms. This

Chart 6: Housing supply has improved but still trails behind demand

Alberta housing starts and population per dwelling

Sources: Statistics Canada and Haver Analytics; *seasonally adjusted at annual rate

has outstripped job gains and put upward pressure on the unemployment rate, which averaged 6.7 per cent in the first seven months of the year. Moderating labour demand, combined with strong growth in labour supply, is expected to push the unemployment rate higher in the second half of the year. The rising unemployment rate also appears to be discouraging some segments of the population from looking for work. As such, the labour force participation rate has been lower-than-expected this year, which will keep the unemployment rate contained. The unemployment rate is now forecast to average 7.0 per cent for 2024, an increase of 0.5 ppts from budget. The unemployment rate is forecast to subside to 6.8 per cent next year as employment growth catches up with the increase in labour force.

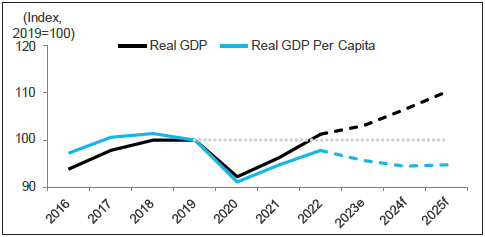

While the unemployment rate is expected to be elevated in the near term, labour market conditions in the province are stronger compared with previous periods of increased labour market slack. Alberta has experienced high unemployment during times of economic weakness, such as the 2015-16 downturn and COVID-19 pandemic. Rising unemployment during these years was driven by job losses and contraction in economic activity. This time, however, the increase in unemployment has been accompanied by rising output and employment gains (Chart 7). Job separation rates have been muted, which means that employers are not laying off staff. Wage growth has also been very strong so far this year.

Consequently, the slack in the labour market has been uneven, with unemployment rising disproportionately among new entrants such as youth and newcomers. Newcomers, in particular, tend to face difficulties integrating into the labour market after they arrive due to a variety of factors such as credential recognition, language barriers and lack of Canadian work experience.

| | |

| | |

| 2024–25 First Quarter Fiscal Update and Economic Statement | | 21 |