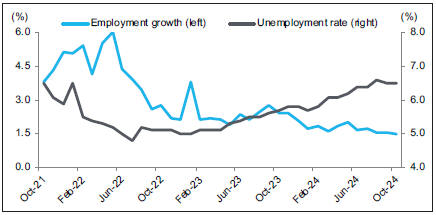

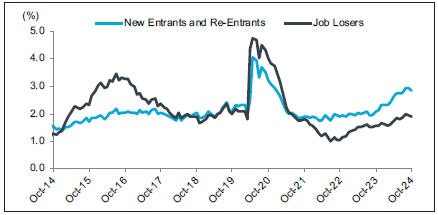

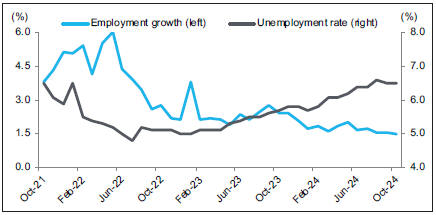

up better than expected in the first half of the year, recent indicators point to slower momentum for the rest of 2024. Job gains have also softened, with year-over-year (y/y) employment growth declining to 1.5 per cent in October – the slowest rate post-COVID (Chart 3). Canadian real GDP growth is now expected to decelerate to 1.1 per cent this year before rising to 1.7 per cent in 2025. The federal government is projecting that the 2025-2027 Immigration Levels Plan targets will result in a population decline of 0.2 per cent in 2025 and 2026 calendar years. This poses downside risks to Canada’s real GDP growth next year.

With inflation back to the two per cent target and economic activity softening, the Bank of Canada (BoC) has accelerated the pace of interest rate cuts. The BoC lowered its policy rate by an outsized 0.5 percentage points in October – the

fourth consecutive reduction since June – which brings the policy rate to 3.75 per cent. Diverging interest rates between Canada and the U.S., along with slower Canadian economic growth relative to the U.S., has weighed on the Loonie. It is now forecast to average US¢73.30/Cdn$ in 2024-25, lower than expected in the first quarter and budget.

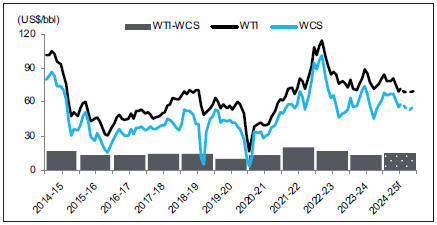

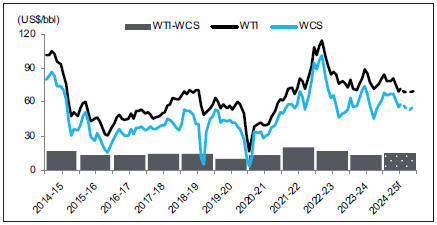

Oil price volatility continues

Oil prices have fluctuated considerably since the first quarter update. Despite a tight supply-demand balance, the West Texas Intermediate (WTI) oil price has oscillated below US$70 per barrel (/bbl) since September on concerns over Chinese demand and increased risks to the global economy (Chart 4). A recent decision by OPEC+ to delay plans to increase output has helped to allay fears

Chart 3: Canada’s labour market is softening

Year-over-year growth in Canadian employment and the unemployment rate*

| Sources: | Statistics Canada and Haver Analytics; *seasonally adjusted |

Chart 4: Demand concerns to weigh on near-term outlook for WTI

Oil prices

| Sources: | Alberta Energy and Alberta Treasury Board and Finance; f-forecast |

of oversupply. However, geopolitical risks, including the potential escalation of the conflict in the Middle East that could reduce supply in the near term, are adding to the volatility in prices. WTI is now forecast to average US$74.00/bbl in 2024-25, same as budget but US$2.50/ bbl lower than the first quarter.

Additional egress capacity from the Trans Mountain Pipeline Expansion (TMX) is helping to strengthen and stabilize Alberta’s heavy oil prices, particularly during periods when the differential typically widens. Higher demand for heavier crude grades has also contributed to a narrower light-heavy differential so far this year. The light-heavy differential is expected to average US$14.00/bbl 2024-25, US$0.40 and US$2.00 narrower than the first quarter and budget forecasts, respectively. This, along with a weaker Canadian dollar, has helped to offset the impact of lower WTI prices. As a result, Western Canadian Select (WCS) price is expected to be higher. It is forecast to average Cdn$81.80/bbl in 2024-25, Cdn$5.00 higher than budget.

Natural gas prices subdued

Natural gas prices in Western Canada remain under pressure. AECO, the Western Canadian natural gas price benchmark, has held mostly below Cdn$1 per gigajoule (/GJ) since the spring. Robust production, coupled with weaker demand, has led to a build-up in storage inventories. The Alberta Reference Price (ARP) is now forecast to average Cdn$1.20/GJ in 2024-25, down from Cdn$1.80/GJ in the first quarter and $2.90/GJ in budget. Looking ahead, the completion of LNG Canada’s Phase 1 in 2025 is anticipated to improve market access for Western Canadian natural gas, providing an outlet for production in the region and potentially supporting price stability over the long term. This expanded export capacity will enable Western Canadian producers to access new international markets, particularly in Asia, where demand for LNG is expected to remain strong.

Oil a key driver of output and investment

Despite the recent volatility in oil prices, Alberta’s energy sector continues to drive growth in business activity and output. Rigs drilling held up throughout the spring break period and advanced 8.9 per cent y/y in October to a five-year seasonal high. Although oil