Congress Large Cap Growth Fund

Congress Mid Cap Growth Fund

Congress All Cap Opportunity Fund

ANNUAL REPORT

December 31, 2016

CONGRESS FUNDS

| Shareholder Letter | | | 1 | |

| | | | | |

| Sector Allocations | | | 5 | |

| | | | | |

| Historical Performance | | | 6 | |

| | | | | |

| Schedules of Investments | | | | |

| | | | | |

| Congress Large Cap Growth Fund | | | 12 | |

| | | | | |

| Congress Mid Cap Growth Fund | | | 14 | |

| | | | | |

| Congress All Cap Opportunity Fund | | | 16 | |

| | | | | |

| Statements of Assets and Liabilities | | | 18 | |

| | | | | |

| Statements of Operations | | | 20 | |

| | | | | |

| Statements of Changes in Net Assets | | | 22 | |

| | | | | |

| Financial Highlights | | | 28 | |

| | | | | |

| Notes to Financial Statements | | | 34 | |

| | | | | |

| Report of Independent Registered Public Accounting Firm | | | 44 | |

| | | | | |

| Expense Examples | | | 45 | |

| | | | | |

| Approval of Investment Advisory Agreement | | | 47 | |

| | | | | |

| Trustees and Executive Officers | | | 51 | |

| | | | | |

| Additional Information | | | 54 | |

| | | | |

| Privacy Notice | | Inside Back Cover | |

Annual Letter to Mutual Fund Shareholders

For the year January 1, 2016 to December 31, 2016

General Market Commentary:

2016 proved to be a fascinating year from an investment perspective. The stock market withstood fears about a stagnating economy early in the year and the surprise of the Brexit vote in June to enter autumn with a modest gain. November’s election lit the trading pyre in a way that surprised many. Stocks rallied to close the year and bond prices fell, driving yields higher. The “Trump rally” as some called it favored stocks that would conceivably benefit from new infrastructure spending, higher interest rate, and less regulation. The rally was not uniform. Banks and commodity related stocks enjoyed renewed investor interest while pharmaceutical stocks lagged. Size also mattered. Small cap stocks, considered more volatile over time than large cap stocks returned 26.6% for the one year time period ending December 31, 2016 as measured by the S&P Small Cap 600 Index. In comparison, the S&P 500 Index rose 12.0% for the one year time period ending December 31, 2016.

In December, the Federal Reserve increased short term interest rates for the second time in this cycle. This followed December’s reading of quarter gross domestic product (GDP) of 3.5%, the strongest level in two years. With unemployment measuring 4.6%, the prospects for economic growth appear more stable than a couple of years ago.

Performance Highlights:

Large Cap Growth

For the year ending December 31, 2016, the Fund’s Retail Class and Institutional Class shares returned 4.48% and 4.75% respectively, compared with 7.08% for the Russell 1000 Growth Index.

Four stocks mentioned as highlights in our June 30, 2016 letter continued to perform well in the second half of the year. Industrial sector stocks, Illinois Tool Works, J.B Hunt Transport and Rockwell Automation all returned close to 30%, maintaining their momentum from earlier in the year. United Health Group, the nation’s largest health insurer posted impressive third quarter earnings and returned over 35% for the year.

On the negative side both Bristol Myers Squibb and Under Armour weighed on performance. Bristol, the large pharmaceutical company, is a leader in the expanding field of immuno oncology to fight various forms of cancer. The company suffered a setback in July as one of its therapies did not win approval for first line treatment for a specific type of lung cancer. The company continues to test and develop its two immuno oncology drugs as stand-alone therapies and in combination with other treatments.

Under Armour (UA) continues to expand its presence in the athletic and footwear markets. UA has maintained 20% revenue growth but higher distribution

costs and disruptions in the retail chain weighed on margins and profitability. The company continues to develop its direct to consumer and international businesses.

In late December, the Fund distributed $0.20 per retail share and $0.26 per institutional share representing ordinary income and capital gains for the year.

Mid Cap Growth

For the year ending December 31, 2016, the Fund’s Retail Class and Institutional Class shares returned 13.11% and 13.38% respectively, compared with 7.33% for the Russell Mid-Cap Growth Index.

Strong performance from bottom up security selection drove successful portfolio results for 2016. Further aiding returns, two companies in the portfolio were the subject of acquisition offers. These were Linear Technology, a semiconductor company, and B/E Aerospace, a supplier of aircraft interiors.

Selections within consumer discretionary and information technology aided the portfolio. Dorman Auto Products, a supplier to the automotive aftermarket, posted strong results due to increasing average automobile age, increasing miles driven domestically, and broadening product offerings. Apart from Linear Technology, strength in technology came from Cognex, a supplier of machine vision products. Cognex has been capitalizing on the trends of factory automation and manufacturing complexity, and is a major direct and indirect supplier to Apple.

Headwinds to the portfolio included G-III Apparel which suffered from weak outerwear sales at its Wilson’s Leather and G.H. Bass chains, and a perplexing offer for DKNY. Manhattan Associates, a technology supplier for retailers and logistics providers, saw weakening performance due to customer implementation delays.

In late December, the Fund distributed $0.15 per retail share and $0.18 per institutional share representing ordinary income and capital gains for the year.

All Cap Opportunity

For the year ending December 31, 2016, the Fund’s Retail Class and Institutional Class shares returned 13.18% and 13.51% respectively, compared with 12.74% for the Russell 3000 Index.

The best holding for the calendar year of 2016 was NVIDIA Corp. NVIDIA, which designs and manufactures computer graphics chips for use in personal computers, saw its stock rise 227% over the year as their gaming segment saw prodigious results. United Rentals, the largest equipment rental company in the world, also did well posting a 46% gain on an improved domestic outlook for increased construction, maintenance, and infrastructure spending. The stock price of Baker Hughes, a provider of oilfield services, products, and systems to the oil and natural gas industry, increased after it agreed to be acquired by the General Electric Company.

The primary detractors from the portfolio were also varied in nature and all were sold mid-year 2016. Hertz Global Holdings owns and operates auto and equipment rental locations and its stock fell 36% from the beginning of the year to

when it was sold by the Fund in May, amid lackluster operating results. VeriFone Systems, a manufacturer and distributor of point-of-sale electronic payment devices, found its stock price falling until it was sold in mid-July when the company ran into bottlenecks as it rushed to provide electronic chip compliant units to its customers. SUPERVALU, Inc. is a distributor of food and operator of grocery stores and witnessed its stock price falling in the first half of the year before it was sold from the Fund in May as the company faced unrelenting headwinds from depreciating wholesale food prices and slowing turnover.

In late December, the Fund distributed $0.02 per retail share and $0.04 per institutional share representing ordinary income for the year.

Portfolio Commentary:

Large Cap Growth

As of December 31, 2016, the portfolio contains 42 stocks with the technology sector comprising 30% of the portfolio. That sector includes Apple, the largest single holding at 3.3% of the portfolio. The consumer discretionary and health care sectors both represent just over 14% of the portfolio. Amongst other names, the discretionary sector includes two long term holdings, Home Depot and TJX Companies (owner of TJ Maxx and Marshalls) and newly added O’Reilly Automotive. Other recent additions to the portfolio include Chevron in the energy sector and Suntrust Banks in the financial sector. The estimated dividend yield on the portfolio holdings is 1.5% with 74% or 31 of the holdings paying a dividend.

Mid Cap Growth

As of December 31, 2016, the portfolio contains 40 names and turnover in 2016 was below 20%. More than three-quarters of the holdings are from the consumer discretionary, health care, industrial, and information technology sectors. The largest sector, Industrials, is about one-quarter of the portfolio.

Recent additions include Hasbro, a leading toy company, and Masco, a leader in home improvement and building products. Recent removals include Graco, a manufacturer of pumps and fluid dispensing equipment, and ANSYS, an engineering software supplier.

All Cap Opportunity

The Fund’s performance over the second half of the year was much improved over that from the first half of the year.

The boost in performance came from a broad variety of sectors and was accomplished without the need for increased turnover of the Fund’s holdings. Holdings in the portfolio remain concentrated with fewer than 25 stocks but span an eclectic mix of industries and products. Selective elimination of underperforming stocks assisted in the upturn.

Newer names added in the third quarter include Six Flags Entertainment Corporation, an owner and operator of regional theme parks and water parks, Carlisle Companies, a conglomerate that designs, manufactures, and sells a wide range of products that serve a diverse range of markets. Fourth quarter additions

include Broadcom, a supplier of analog and digital semiconductor chips for wired and wireless communications needs, Zayo Group, a provider of bandwidth infrastructure services, and Regal Entertainment Group, an operator of multi-screen theatres.

In Closing:

Thank you for the confidence you place in us and for your investment in the Funds. We look forward to serving your investment needs.

Sincerely,

|  |  |

| | | |

| Daniel A. Lagan, CFA | Todd Solomon, CFA | John Beaver, CFA |

| Large Cap Growth | Mid Cap Growth | All Cap Opportunity |

Important Disclosures

Past performance is not a guarantee of future results.

The opinions provided herein are those of Congress Asset Management Company and are not intended to be a forecast of future events, a guarantee of future results, nor investment advice.

Must be preceded or accompanied by a prospectus.

Investment performance reflects fee waivers. In the absence of such waivers total returns would be reduced.

Mutual fund investing involves risk. Principal loss is possible. The Funds may invest in foreign securities which may involve greater volatility and political, economic, and currency risks and differences in accounting methods. Investments in small and mid-sized companies involve additional risks such as limited liquidity and greater volatility than larger companies. The Congress All Cap Opportunity Fund may invest in debt securities which typically decrease in value when interest rates rise. This risk is usually greater for longer-term debt securities. The Congress Large Cap Growth Fund may invest in Exchange Traded Funds (ETFs), which may trade at a discount to the aggregate value of the underlying securities and although expense ratios for ETFs are generally low, frequent trading of ETFs by the Fund can generate brokerage expenses.

The S&P 500 Index is a broad based unmanaged index of 500 stocks, which is widely recognized as representative of the equity market in general. The Russell 1000 Growth Index measures performance of the large-cap growth segment of the U.S. Equity Universe. The Russell Mid Cap Growth Index measures performance of the mid-cap growth segment of the U.S. Equity Universe. The Russell 3000 Index measures performance of the largest 3,000 U.S. companies representing approximately 98% of the U.S. Equity Universe. The S&P 600 Index is an index of small-cap stocks managed by Standard and Poor’s which covers a broad range of small cap stocks in the United States, is weighted according to market capitalization, and covers about 3-4% of the total market for equities in the United States. One cannot invest directly in an index.

Dividend yield is a financial ratio that indicates how much a company pays out in dividends each year relative to its share price, calculated by dividing the dollar value of dividends paid in a given year per share of stock held by the dollar value of one share of stock.

Fund holdings and sector allocations are subject to change and should not be considered a recommendation to buy or sell any security. For a complete list of fund holdings, please refer to the Schedules of Investment in this report.

Congress Funds are distributed by Quasar Distributors, LLC

CONGRESS FUNDS

| SECTOR ALLOCATIONS at December 31, 2016 (Unaudited) |

Congress Large Cap Growth Fund

| Sector Allocation | | Percent of Net Assets |

| Information Technology | | | 30.1 | % |

| Health Care | | | 14.3 | % |

| Consumer Discretionary | | | 14.0 | % |

| Consumer Staples | | | 11.5 | % |

| Industrials | | | 11.1 | % |

| Financials | | | 5.7 | % |

| Materials | | | 4.7 | % |

| Energy | | | 4.0 | % |

| Real Estate | | | 2.3 | % |

| Cash* | | | 2.3 | % |

| Net Assets | | | 100.0 | % |

Congress Mid Cap Growth Fund

| Sector Allocation | | Percent of Net Assets |

| Industrials | | | 24.2 | % |

| Information Technology | | | 19.7 | % |

| Health Care | | | 16.3 | % |

| Consumer Discretionary | | | 16.1 | % |

| Financials | | | 7.7 | % |

| Consumer Staples | | | 3.9 | % |

| Real Estate | | | 2.6 | % |

| Energy | | | 2.4 | % |

| Materials | | | 2.2 | % |

| Cash* | | | 4.9 | % |

| Net Assets | | | 100.0 | % |

Congress All Cap Opportunity Fund

| Sector Allocation | | Percent of Net Assets |

| Information Technology | | | 23.8 | % |

| Consumer Discretionary | | | 20.7 | % |

| Health Care | | | 16.3 | % |

| Industrials | | | 15.6 | % |

| Real Estate | | | 7.9 | % |

| Financials | | | 4.5 | % |

| Energy | | | 3.9 | % |

| Telecommunication Services | | | 3.8 | % |

| Cash* | | | 3.5 | % |

| Net Assets | | | 100.0 | % |

| * | Cash, Cash Equivalents and Other Assets in Excess of Liabilities |

CONGRESS LARGE CAP GROWTH FUND

| HISTORICAL PERFORMANCE (Unaudited) |

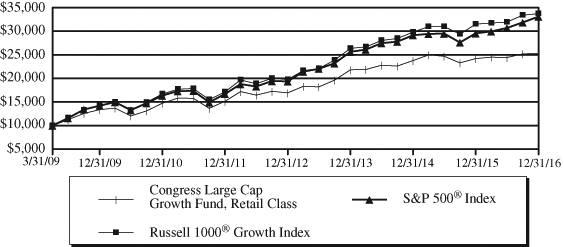

Retail Class

Value of $10,000 vs. Russell 1000® Growth Index and S&P 500® Index

Annualized Returns for the periods ended December 31, 2016

| | | | | Since | Ending |

| | One | Three | Five | Inception | Value |

| | Year | Year | Year | (3/31/2009) | (12/31/2016) |

| Congress Large Cap | | | | | |

| Growth Fund, Retail Class | 4.48% | 5.04% | 10.80% | 12.71% | $25,294 |

Russell 1000® Growth Index | 7.08% | 8.55% | 14.50% | 16.98% | 33,738 |

S&P 500® Index | 11.96% | 8.87% | 14.66% | 16.69% | 33,092 |

This chart illustrates the performance of a hypothetical $10,000 investment made on March 31, 2009, and is not intended to imply any future performance. The returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. The returns reflect fee waivers in effect. In the absence of such waivers, total return would be reduced. The chart assumes reinvestment of capital gains and dividends.

Performance data quoted represents past performance and does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by calling 1-888-688-1299.

The Fund imposed a 1% redemption fee on shares held for less than 90 days, however, effective April 30, 2016, the 1% redemption fee was eliminated. Performance does not reflect the redemption fee. If reflected, the total return would be reduced.

CONGRESS LARGE CAP GROWTH FUND

| HISTORICAL PERFORMANCE (Unaudited) |

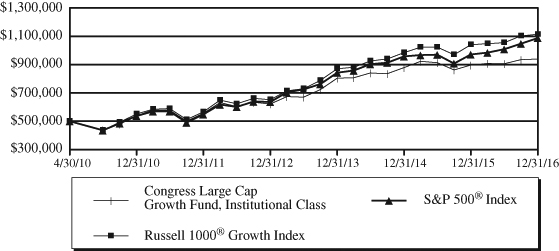

Institutional Class

Value of $500,000 vs. Russell 1000® Growth Index and S&P 500® Index

Annualized Returns for the periods ended December 31, 2016

| | | | | Since | Ending |

| | One | Three | Five | Inception | Value |

| | Year | Year | Year | (4/30/2010) | (12/31/2016) |

| Congress Large Cap Growth | | | | | |

| Fund, Institutional Class | 4.75% | 5.31% | 11.07% | 9.91% | $ 939,385 |

Russell 1000® Growth Index | 7.08% | 8.55% | 14.50% | 12.76% | 1,113,991 |

S&P 500® Index | 11.96% | 8.87% | 14.66% | 12.35% | 1,087,585 |

This chart illustrates the performance of a hypothetical $500,000 investment made on April 30, 2010, and is not intended to imply any future performance. The returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. The returns reflect fee waivers in effect. In the absence of such waivers, total return would be reduced. The chart assumes reinvestment of capital gains and dividends.

Performance data quoted represents past performance and does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by calling 1-888-688-1299.

The Fund imposed a 1% redemption fee on shares held for less than 90 days, however, effective April 30, 2016, the 1% redemption fee was eliminated. Performance does not reflect the redemption fee. If reflected, the total return would be reduced.

CONGRESS MID CAP GROWTH FUND

| HISTORICAL PERFORMANCE (Unaudited) |

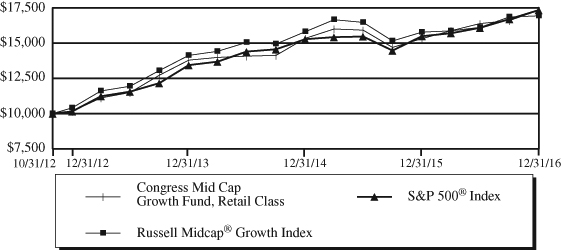

Retail Class

Value of $10,000 vs. Russell Midcap® Growth Index and S&P 500® Index

Annualized Returns for the periods ended December 31, 2016

| | One | Three | Since Inception | Ending Value |

| | Year | Year | (10/31/2012) | (12/31/2016) |

| Congress Mid Cap Growth Fund, | | | | |

| Retail Class | 13.11% | 7.90% | 14.09% | $17,321 |

Russell Midcap® Growth Index | 7.33% | 6.23% | 13.47% | 16,931 |

S&P 500® Index | 11.96% | 8.87% | 14.12% | 17,340 |

This chart illustrates the performance of a hypothetical $10,000 investment made on October 31, 2012, and is not intended to imply any future performance. The returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. The returns reflect fee waivers in effect. In the absence of such waivers, total return would be reduced. The chart assumes reinvestment of capital gains and dividends.

Performance data quoted represents past performance and does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by calling 1-888-688-1299.

The Fund imposed a 1% redemption fee on shares held for less than 90 days, however, effective April 30, 2016, the 1% redemption fee was eliminated. Performance does not reflect the redemption fee. If reflected, the total return would be reduced.

CONGRESS MID CAP GROWTH FUND

| HISTORICAL PERFORMANCE (Unaudited) |

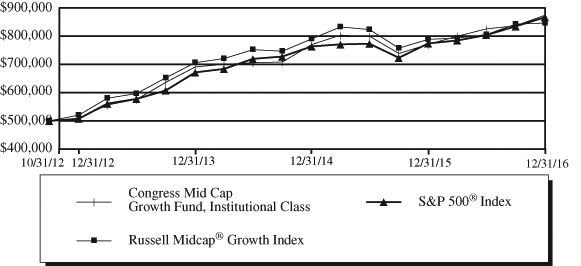

Institutional Class

Value of $500,000 vs. Russell Midcap® Growth Index and S&P 500® Index

Annualized Returns for the periods ended December 31, 2016

| | One | Three | Since Inception | Ending Value |

| | Year | Year | (10/31/2012) | (12/31/2016) |

| Congress Mid Cap Growth Fund, | | | | |

| Institutional Class | 13.38% | 8.16% | 14.35% | $874,309 |

Russell Midcap® Growth Index | 7.33% | 6.23% | 13.47% | 846,577 |

S&P 500® Index | 11.96% | 8.87% | 14.12% | 867,001 |

This chart illustrates the performance of a hypothetical $500,000 investment made on October 31, 2012, and is not intended to imply any future performance. The returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. The returns reflect fee waivers in effect. In the absence of such waivers, total return would be reduced. The chart assumes reinvestment of capital gains and dividends.

Performance data quoted represents past performance and does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by calling 1-888-688-1299.

The Fund imposed a 1% redemption fee on shares held for less than 90 days, however, effective April 30, 2016, the 1% redemption fee was eliminated. Performance does not reflect the redemption fee. If reflected, the total return would be reduced.

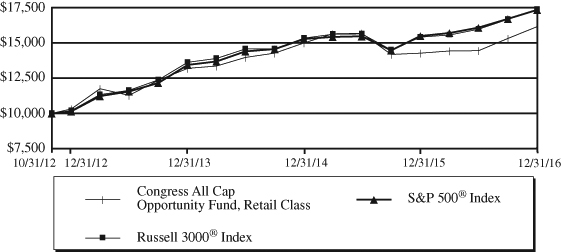

CONGRESS ALL CAP OPPORTUNITY FUND

| HISTORICAL PERFORMANCE (Unaudited) |

Retail Class

Value of $10,000 vs. Russell 3000® Index and S&P 500® Index

Annualized Returns for the periods ended December 31, 2016

| | One | Three | Since Inception | Ending Value |

| | Year | Year | (10/31/2012) | (12/31/2016) |

| Congress All Cap | | | | |

| Opportunity Fund, Retail Class | 13.18% | 6.97% | 12.19% | $16,151 |

Russell 3000® Index | 12.74% | 8.43% | 14.17% | 17,371 |

S&P 500® Index | 11.96% | 8.87% | 14.12% | 17,340 |

This chart illustrates the performance of a hypothetical $10,000 investment made on October 31, 2012, and is not intended to imply any future performance. The returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. The returns reflect fee waivers in effect. In the absence of such waivers, total return would be reduced. The chart assumes reinvestment of capital gains and dividends.

Performance data quoted represents past performance and does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by calling 1-888-688-1299.

The Fund imposed a 1% redemption fee on shares held for less than 90 days, however, effective April 30, 2016, the 1% redemption fee was eliminated. Performance does not reflect the redemption fee. If reflected, the total return would be reduced.

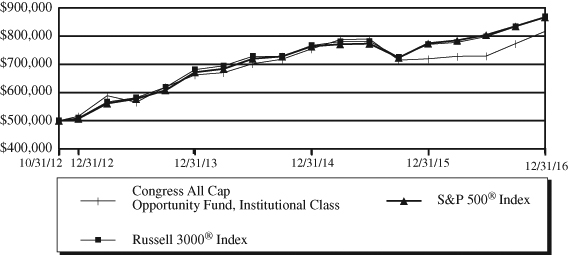

CONGRESS ALL CAP OPPORTUNITY FUND

| HISTORICAL PERFORMANCE (Unaudited) |

Institutional Class

Value of $500,000 vs. Russell 3000® Index and S&P 500® Index

Annualized Returns for the periods ended December 31, 2016

| | One | Three | Since Inception | Ending Value |

| | Year | Year | (10/31/2012) | (12/31/2016) |

| Congress All Cap Opportunity Fund, | | | | |

| Institutional Class | 13.51% | 7.23% | 12.50% | $816,726 |

Russell 3000® Index | 12.74% | 8.43% | 14.17% | 868,529 |

S&P 500® Index | 11.96% | 8.87% | 14.12% | 867,001 |

This chart illustrates the performance of a hypothetical $500,000 investment made on October 31, 2012, and is not intended to imply any future performance. The returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. The returns reflect fee waivers in effect. In the absence of such waivers, total return would be reduced. The chart assumes reinvestment of capital gains and dividends.

Performance data quoted represents past performance and does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by calling 1-888-688-1299.

The Fund imposed a 1% redemption fee on shares held for less than 90 days, however, effective April 30, 2016, the 1% redemption fee was eliminated. Performance does not reflect the redemption fee. If reflected, the total return would be reduced.

CONGRESS LARGE CAP GROWTH FUND

| SCHEDULE OF INVESTMENTS at December 31, 2016 |

| Shares | | | | Value | |

| | |

| COMMON STOCKS: 97.7% | |

| | |

| Banks: 1.2% | |

| | 10,500 | | SunTrust Banks, Inc. | | $ | 575,925 | |

| | | | | | | | |

| | |

| Capital Goods: 8.6% | |

| | 4,600 | | Acuity Brands, Inc. | | | 1,061,956 | |

| | 12,200 | | Illinois Tool Works, Inc. | | | 1,494,012 | |

| | 10,500 | | Rockwell | | | | |

| | | | Automation, Inc. | | | 1,411,200 | |

| | | | | | | 3,967,168 | |

| | |

| Consumer Durables | |

| & Apparel: 1.3% | |

| | 9,769 | | Under Armour, | | | | |

| | | | Inc. - Class A* | | | 245,886 | |

| | 13,000 | | Under Armour, | | | | |

| | | | Inc. - Class C* | | | 377,650 | |

| | | | | | | 623,536 | |

| | |

| Consumer Services: 2.3% | |

| | 8,700 | | McDonald’s Corp. | | | 1,058,964 | |

| | | | | | | | |

| | |

| Diversified Financials: 4.5% | |

| | 7,400 | | CME Group, Inc. | | | 853,590 | |

| | 22,000 | | Intercontinental | | | | |

| | | | Exchange, Inc. | | | 1,241,240 | |

| | | | | | | 2,094,830 | |

| | |

| Energy: 4.0% | |

| | 5,000 | | Chevron Corp. | | | 588,500 | |

| | 15,200 | | Schlumberger Ltd. | | | 1,276,040 | |

| | | | | | | 1,864,540 | |

| Food & Staples Retailing: 2.4% | |

| | 7,000 | | Costco Wholesale Corp. | | | 1,120,770 | |

| | | | | |

| Food, Beverage & Tobacco: 2.5% | | | | |

| | 11,000 | | PepsiCo, Inc. | | | 1,150,930 | |

| | |

| Health Care Equipment | |

| & Services: 5.0% | |

| | 8,500 | | Stryker Corp. | | | 1,018,385 | |

| | 8,000 | | UnitedHealth | | | | |

| | | | Group, Inc. | | | 1,280,320 | |

| | | | | | | 2,298,705 | |

| Household & Personal | |

| Products: 6.6% | |

| | 9,000 | | The Clorox Co. | | | 1,080,180 | |

| | 15,300 | | Colgate-Palmolive Co. | | | 1,001,232 | |

| | 12,800 | | Estée Lauder | | | | |

| | | | Companies, Inc. - | | | | |

| | | | Class A | | | 979,072 | |

| | | | | | | 3,060,484 | |

| | |

| Materials: 4.7% | |

| | 9,300 | | Ecolab, Inc. | | | 1,090,146 | |

| | 11,300 | | PPG Industries, Inc. | | | 1,070,788 | |

| | | | | | | 2,160,934 | |

| | |

| Media: 2.6% | |

| | 11,750 | | The Walt Disney Co. | | | 1,224,585 | |

| | | | | | | | |

| | |

| Pharmaceuticals, Biotechnology | |

| & Life Sciences: 9.3% | |

| | 14,000 | | Bristol-Myers Squibb Co. | | | 818,160 | |

| | 10,000 | | Celgene Corp.* | | | 1,157,500 | |

| | 19,900 | | Merck & Co., Inc. | | | 1,171,513 | |

| | 8,200 | | Thermo Fisher | | | | |

| | | | Scientific, Inc. | | | 1,157,020 | |

| | | | | | | 4,304,193 | |

| | |

| Real Estate: 2.3% | |

| | 12,400 | | Crown Castle | | | | |

| | | | International Corp. - | | | | |

| | | | REIT | | | 1,075,948 | |

| | |

| Retailing: 7.8% | |

| | 9,700 | | The Home Depot, Inc. | | | 1,300,576 | |

| | 4,200 | | O’Reilly | | | | |

| | Automotive, Inc.* | | | 1,169,322 | |

| | 15,100 | | The TJX | | | | |

| | | | Companies, Inc. | | | 1,134,463 | |

| | | | | | | 3,604,361 | |

| Semiconductors & Semiconductor | |

| Equipment: 2.9% | |

| | 18,600 | | Analog Devices, Inc. | | | 1,350,732 | |

| | | | | | | | |

| | |

| Software & Services: 23.9% | |

| | 10,800 | | Accenture PLC | | | 1,265,004 | |

| | 13,200 | | Adobe Systems, Inc.* | | | 1,358,940 | |

| | 14,200 | | Akamai | | | | |

| | | | Technologies, Inc.* | | | 946,856 | |

The accompanying notes are an integral part of these financial statements.

CONGRESS LARGE CAP GROWTH FUND

| SCHEDULE OF INVESTMENTS at December 31, 2016 (Continued) |

| Shares | | | | Value | |

| | |

| Software & Services: 23.9% (Continued) | |

| | 975 | | Alphabet, Inc. - | | | |

| | | | Class A* | | $ | 772,639 | |

| | 777 | | Alphabet, Inc. - | | | | |

| | | | Class C* | | | 599,704 | |

| | 12,700 | | Automatic Data | | | | |

| | | | Processing, Inc. | | | 1,305,306 | |

| | 15,300 | | Electronic Arts, Inc.* | | | 1,205,028 | |

| | 10,300 | | Facebook, Inc.* | | | 1,185,015 | |

| | 28,500 | | PayPal Holdings, Inc.* | | | 1,124,895 | |

| | 17,000 | | Visa, Inc. | | | 1,326,340 | |

| | | | | | | 11,089,727 | |

| | |

| Technology Hardware | |

| & Equipment: 3.3% | |

| | 13,000 | | Apple, Inc. | | | 1,505,660 | |

| | |

| Transportation: 2.5% | |

| | 17,500 | | Canadian National | | | | |

| | | | Railway Co. | | | 1,179,500 | |

| | |

| TOTAL COMMON STOCKS | |

| (Cost $36,170,115) | | | 45,311,492 | |

| | |

| SHORT-TERM INVESTMENTS: 1.9% | |

| | | | | |

| Money Market Funds: 1.9% | | | | |

| | 879,079 | | Invesco Short-Term | | | | |

| | | | Treasury Portfolio - | | | | |

| | | | Institutional Class, | | | | |

| | | | 0.370%(1) | | | 879,079 | |

| | |

| TOTAL SHORT-TERM | |

| INVESTMENTS | | | | |

| (Cost $879,079) | | | 879,079 | |

| | |

| TOTAL INVESTMENTS | |

| IN SECURITIES: 99.6% | |

| (Cost $37,049,194) | | | 46,190,571 | |

| Other Assets in Excess | | | | |

| of Liabilities: 0.4% | | | 170,151 | |

| TOTAL NET | | | | |

| ASSETS: 100.0% | | $ | 46,360,722 | |

REIT – Real Estate Investment Trust

| * | | Non-income producing security |

(1) | | Seven-day yield as of December 31, 2016 |

The Global Industry Classification Standard (“GICS®”) was developed by and/or is the exclusive property of MSCI, Inc. and Standard and Poor’s Financial Services, LLC (“S&P”). GICS® is a service mark of MSCI, Inc and S&P and has been licensed for use by the Fund’s Administrator, U.S. Bancorp Fund Services, LLC.

The accompanying notes are an integral part of these financial statements.

CONGRESS MID CAP GROWTH FUND

| SCHEDULE OF INVESTMENTS at December 31, 2016 |

| Shares | | | | Value | |

| | |

| COMMON STOCKS: 95.1% | |

| | |

| Automobiles & Components: 2.5% | |

| | 205,000 | | Dorman | | | |

| | | | Products, Inc.* | | $ | 14,977,300 | |

| | |

| Banks: 2.7% | |

| | 110,000 | | Signature Bank* | | | 16,522,000 | |

| | |

| Capital Goods: 13.9% | |

| | 55,000 | | Acuity Brands, Inc. | | | 12,697,300 | |

| | 265,000 | | B/E Aerospace, Inc. | | | 15,950,350 | |

| | 95,000 | | Lennox | | | | |

| | | | International Inc. | | | 14,551,150 | |

| | 450,000 | | Masco Corp. | | | 14,229,000 | |

| | 95,000 | | The Middleby Corp.* | | | 12,236,950 | |

| | 85,000 | | Snap-on, Inc. | | | 14,557,950 | |

| | | | | | | 84,222,700 | |

| | |

| Commercial & | |

| Professional Services: 7.7% | |

| | 130,000 | | Cintas Corp. | | | 15,022,800 | |

| | 120,000 | | Equifax Inc. | | | 14,187,600 | |

| | 350,000 | | Robert Half | | | | |

| | | | International Inc. | | | 17,073,000 | |

| | | | | | | 46,283,400 | |

| | |

| Consumer Durables | |

| & Apparel: 6.6% | |

| | 160,000 | | Carter’s, Inc. | | | 13,822,400 | |

| | 450,000 | | G-III Apparel | | | | |

| | | | Group, Ltd.* | | | 13,302,000 | |

| | 165,000 | | Hasbro, Inc. | | | 12,835,350 | |

| | | | | | | 39,959,750 | |

| | |

| Consumer Services: 2.2% | |

| | 270,000 | | Texas Roadhouse, Inc. | | | 13,024,800 | |

| | |

| Diversified Financials: 5.0% | |

| | 90,000 | | FactSet Research | | | | |

| | | | Systems Inc. | | | 14,708,700 | |

| | 225,000 | | Raymond James | | | | |

| | | | Financial, Inc. | | | 15,585,750 | |

| | | | | | | 30,294,450 | |

| | |

| Energy: 2.4% | |

| | 120,000 | | Core | | | | |

| | | | Laboratories N.V. | | | 14,404,800 | |

| | |

| Food, Beverage & Tobacco: 1.5% | |

| | 225,000 | | The Hain Celestial | | | | |

| | | | Group, Inc.* | | | 8,781,750 | |

| | |

| Health Care Equipment | |

| & Services: 9.4% | |

| | 70,000 | | The Cooper | | | | |

| | | | Companies, Inc. | | | 12,245,100 | |

| | 95,000 | | Henry Schein Inc.* | | | 14,412,450 | |

| | 240,000 | | ResMed Inc. | | | 14,892,000 | |

| | 225,000 | | VCA Inc.* | | | 15,446,250 | |

| | | | | | | 56,995,800 | |

| | |

| Household & Personal | |

| Products: 2.4% | |

| | 330,000 | | Church & | | | | |

| | | | Dwight Co., Inc. | | | 14,582,700 | |

| | |

| Materials: 2.2% | |

| | 115,000 | | International Flavors | | | | |

| | | | & Fragrances Inc. | | | 13,550,450 | |

| | |

| Media: 2.5% | |

| | 210,000 | | Scripps Networks | | | | |

| | | | Interactive, Inc. - | | | | |

| | | | Class A | | | 14,987,700 | |

| | |

| Pharmaceuticals, Biotechnology | |

| & Life Sciences: 6.9% | |

| | 310,000 | | Cambrex Corp.* | | | 16,724,500 | |

| | 30,000 | | Mettler-Toledo | | | | |

| | | | International Inc.* | | | 12,556,800 | |

| | 190,000 | | PAREXEL | | | | |

| | | | International Corp.* | | | 12,486,800 | |

| | | | | | | 41,768,100 | |

| | |

| Real Estate: 2.6% | |

| | 185,000 | | Camden Property | | | | |

| | | | Trust - REIT | | | 15,552,950 | |

| | |

| Retailing: 2.3% | |

| | 200,000 | | Foot Locker, Inc. | | | 14,178,000 | |

| | |

| Semiconductors & Semiconductor | |

| Equipment: 2.4% | |

| | 175,000 | | Monolithic Power | | | | |

| | | | Systems, Inc. | | | 14,337,750 | |

The accompanying notes are an integral part of these financial statements.

CONGRESS MID CAP GROWTH FUND

| SCHEDULE OF INVESTMENTS at December 31, 2016 (Continued) |

| Shares | | | | Value | |

| | |

| Software & Services: 9.4% | |

| | 600,000 | | Genpact Ltd* | | $ | 14,604,000 | |

| | 165,000 | | Jack Henry & | | | | |

| | | | Associates, Inc. | | | 14,648,700 | |

| | 265,000 | | Manhattan | | | | |

| | | | Associates, Inc.* | | | 14,052,950 | |

| | 225,000 | | Synopsys, Inc.* | | | 13,243,500 | |

| | | | | | | 56,549,150 | |

| | |

| Technology Hardware | |

| & Equipment: 7.9% | |

| | 250,000 | | Cognex Corp. | | | 15,905,000 | |

| | 110,000 | | F5 Networks, Inc.* | | | 15,919,200 | |

| | 160,000 | | IPG Photonics Corp.* | | | 15,793,600 | |

| | | | | | | 47,617,800 | |

| | |

| Transportation: 2.6% | |

| | 165,000 | | J.B. Hunt Transport | | | | |

| | | | Services, Inc. | | | 16,016,550 | |

| | |

| TOTAL COMMON STOCKS | |

| (Cost $502,049,577) | | | 574,607,900 | |

| | |

| SHORT-TERM INVESTMENTS: 4.0% | |

| | |

| Money Market Funds: 4.0% | |

| | 24,328,121 | | Invesco Short-Term | | | | |

| | | | Treasury Portfolio - | | | | |

| | | | Institutional Class, | | | | |

| | | | 0.370%(1) | | | 24,328,121 | |

| | |

| TOTAL SHORT-TERM | |

| INVESTMENTS | |

| (Cost $24,328,121) | | | 24,328,121 | |

| | |

| TOTAL INVESTMENTS | |

| IN SECURITIES: 99.1% | |

| (Cost $526,377,698) | | | 598,936,021 | |

| Other Assets in Excess | | | | |

| of Liabilities: 0.9% | | | 5,403,078 | |

| TOTAL NET | | | | |

| ASSETS: 100.0% | | $ | 604,339,099 | |

REIT – Real Estate Investment Trust

| * | | Non-income producing security |

(1) | | Seven-day yield as of December 31, 2016 |

The Global Industry Classification Standard (“GICS®”) was developed by and/or is the exclusive property of MSCI, Inc. and Standard and Poor’s Financial Services, LLC (“S&P”). GICS® is a service mark of MSCI, Inc and S&P and has been licensed for use by the Fund’s Administrator, U.S. Bancorp Fund Services, LLC.

The accompanying notes are an integral part of these financial statements.

CONGRESS ALL CAP OPPORTUNITY FUND

| SCHEDULE OF INVESTMENTS at December 31, 2016 |

| Shares | | | | Value | |

| | |

| COMMON STOCKS: 96.5% | |

| | |

| Automobiles & Components: 4.1% | |

| | 32,800 | | Volkswagen AG - ADR | | $ | 940,868 | |

| | | | | | | | |

| | |

| Banks: 4.5% | |

| | 54,500 | | People’s United | | | | |

| | | | Financial, Inc. | | | 1,055,120 | |

| | | | | |

| Capital Goods: 11.9% | | | | |

| | 8,400 | | Carlisle Companies, Inc. | | | 926,436 | |

| | 28,500 | | General Electric Co. | | | 900,600 | |

| | 8,800 | | United Rentals, Inc.* | | | 929,104 | |

| | | | | | | 2,756,140 | |

| | |

| Consumer Services: 9.4% | |

| | 14,800 | | Darden Restaurants, Inc. | | | 1,076,256 | |

| | 18,500 | | Six Flags | | | | |

| | | | Entertainment Corp. | | | 1,109,260 | |

| | | | | | | 2,185,516 | |

| | |

| Energy: 3.9% | |

| | 13,950 | | Baker Hughes, Inc. | | | 906,331 | |

| | | | | | | | |

| | |

| Health Care Equipment | |

| & Services: 12.2% | |

| | 8,000 | | ABIOMED, Inc.* | | | 901,440 | |

| | 20,900 | | Surgical Care | | | | |

| | | | Affiliates, Inc.* | | | 967,043 | |

| | 6,000 | | Teleflex, Inc. | | | 966,900 | |

| | | | | | | 2,835,383 | |

| | |

| Media: 3.7% | |

| | 41,800 | | Regal | | | | |

| | | | Entertainment Group | | | 861,080 | |

| | |

| Pharmaceuticals, Biotechnology | |

| & Life Sciences: 4.1% | |

| | 18,000 | | Zoetis, Inc. | | | 963,540 | |

| | | | | | | | |

| | |

| Real Estate: 7.9% | |

| | 8,500 | | American Tower | | | | |

| | | | Corp. - REIT | | | 898,280 | |

| | 2,650 | | Equinix, Inc. - REIT | | | 947,137 | |

| | | | | | | 1,845,417 | |

| | |

| Retailing: 3.5% | |

| | 97,800 | | J.C. Penney Co., Inc.* | | | 812,718 | |

| | | | | | | | |

| | |

| Semiconductors & Semiconductor | |

| Equipment: 9.1% | |

| | 5,200 | | Broadcom Ltd. | | | 919,204 | |

| | 11,100 | | NVIDIA Corp. | | | 1,184,814 | |

| | | | | | | 2,104,018 | |

| | |

| Software & Services: 11.1% | |

| | 24,500 | | Booz Allen Hamilton | | | | |

| | | | Holding Corp. | | | 883,715 | |

| | 17,300 | | CyberArk Software Ltd.* | | | 787,150 | |

| | 26,000 | | InterXion Holding N.V.* | | | 911,820 | |

| | | | | | | 2,582,685 | |

| | |

| Technology Hardware | |

| & Equipment: 3.6% | |

| | 6,600 | | Palo Alto | | | | |

| | | | Networks, Inc.* | | | 825,330 | |

| | |

| Telecommunication | |

| Services: 3.8% | |

| | 26,700 | | Zayo Group | | | | |

| | | | Holdings, Inc.* | | | 877,362 | |

| | | | | | | | |

| | |

| Transportation: 3.7% | |

| | 6,100 | | Canadian Pacific | | | | |

| | | | Railway Ltd. | | | 870,897 | |

| | |

| TOTAL COMMON STOCKS | |

| (Cost $18,694,444) | | | 22,422,405 | |

The accompanying notes are an integral part of these financial statements.

CONGRESS ALL CAP OPPORTUNITY FUND

| SCHEDULE OF INVESTMENTS at December 31, 2016 (Continued) |

| Shares | | | | Value | |

| | |

| Money Market Funds: 3.5% | |

| | 818,014 | | Invesco Short-Term | | | |

| | | | Treasury Portfolio - | | | |

| | | | Institutional Class, | | | |

| | | | 0.370%(1) | | $ | 818,014 | |

| | |

| TOTAL SHORT-TERM | |

| INVESTMENTS | |

| (Cost $818,014) | | | 818,014 | |

| | |

| TOTAL INVESTMENTS | |

| IN SECURITIES: 100.0% | |

| (Cost $19,512,458) | | | 23,240,419 | |

| Liabilities in Excess | | | | |

of Other Assets: (0.0)%(2) | | | (11,463 | ) |

| TOTAL NET | | | | |

| ASSETS: 100.0% | | $ | 23,228,956 | |

ADR – American Depositary Receipt

REIT – Real Estate Investment Trust

| * | | Non-income producing security. |

(1) | | Seven-day yield as of December 31, 2016 |

(2) | | Does not round to (0.1)% |

The Global Industry Classification Standard (“GICS®”) was developed by and/or is the exclusive property of MSCI, Inc. and Standard and Poor’s Financial Services, LLC (“S&P”). GICS® is a service mark of MSCI, Inc and S&P and has been licensed for use by the Fund’s Administrator, U.S. Bancorp Fund Services, LLC.

The accompanying notes are an integral part of these financial statements.

CONGRESS FUNDS

| STATEMENTS OF ASSETS AND LIABILITIES at December 31, 2016 |

| | | Large | | | Mid Cap | | | All Cap | |

| | | Cap Growth | | | Growth | | | Opportunity | |

| | | Fund | | | Fund | | | Fund | |

| | | | | | | | | | |

| ASSETS: | |

| Investments in securities, at value | | | | | | | | | |

| (Cost $37,049,194, $526,377,698, and | | | | | | | | | |

| $19,512,458, respectively) | | $ | 46,190,571 | | | $ | 598,936,021 | | | $ | 23,240,419 | |

| Cash | | | 4,147 | | | | — | | | | 5,304 | |

| Receivables: | | | | | | | | | | | | |

| Fund shares sold | | | 172,711 | | | | 6,026,406 | | | | 6,877 | |

| Dividends and interest | | | 82,119 | | | | 343,487 | | | | 14,037 | |

| Due from advisor, net | | | — | | | | — | | | | 4,110 | |

| Prepaid expenses | | | 6,624 | | | | 29,843 | | | | 17,490 | |

| Total assets | | | 46,456,172 | | | | 605,335,757 | | | | 23,288,237 | |

| | | | | | | | | | | | | |

| LIABILITIES: | |

| Payables: | | | | | | | | | | | | |

| Fund shares redeemed | | | 20,132 | | | | 486,063 | | | | 4,398 | |

| Audit fees | | | 23,602 | | | | 23,600 | | | | 23,602 | |

| Transfer agent fees | | | 10,702 | | | | 41,432 | | | | 9,551 | |

| Distribution fees | | | 10,382 | | | | 33,483 | | | | 3,751 | |

| Administration fees | | | 8,157 | | | | 79,324 | | | | 4,307 | |

| Investment advisory fees, net | | | 7,493 | | | | 239,726 | | | | — | |

| Fund accounting fees | | | 6,186 | | | | 25,498 | | | | 6,111 | |

| Trustee fees | | | 2,723 | | | | 5,452 | | | | 2,605 | |

| Chief Compliance Officer fees | | | 1,499 | | | | 1,499 | | | | 1,499 | |

| Custody fees | | | 1,027 | | | | 9,605 | | | | 1,043 | |

| Other accrued expenses | | | 3,547 | | | | 50,976 | | | | 2,414 | |

| Total liabilities | | | 95,450 | | | | 996,658 | | | | 59,281 | |

| NET ASSETS | | $ | 46,360,722 | | | $ | 604,339,099 | | | $ | 23,228,956 | |

The accompanying notes are an integral part of these financial statements.

CONGRESS FUNDS

| STATEMENTS OF ASSETS AND LIABILITIES at December 31, 2016 (Continued) |

| | | Large | | | Mid Cap | | | All Cap | |

| | | Cap Growth | | | Growth | | | Opportunity | |

| | | Fund | | | Fund | | | Fund | |

| | | | | | | | | | |

| COMPONENTS OF NET ASSETS: | |

| Paid-in capital | | $ | 36,793,961 | | | $ | 531,735,660 | | | $ | 19,703,166 | |

| Undistributed net investment income | | | — | | | | — | | | | 37,983 | |

| Undistributed (accumulated) net realized | | | | | | | | | | | | |

| gain (loss) on investments | | | 425,384 | | | | 45,116 | | | | (240,175 | ) |

| Net unrealized appreciation on investments | | | 9,141,377 | | | | 72,558,323 | | | | 3,727,961 | |

| Net unrealized appreciation on translation of | | | | | | | | | | | | |

| other assets and liabilities in foreign currency | | | — | | | | — | | | | 21 | |

| Net assets | | $ | 46,360,722 | | | $ | 604,339,099 | | | $ | 23,228,956 | |

| | | | | | | | | | | | | |

| Retail Class: | | | | | | | | | | | | |

| Net assets | | $ | 10,113,312 | | | $ | 47,958,767 | | | $ | 6,182,040 | |

| Shares issued and outstanding (unlimited number | | | | | | | | | | | | |

| of shares authorized without par value) | | | 458,306 | | | | 2,965,746 | | | | 395,829 | |

| Net asset value, and redemption price per share | | $ | 22.07 | | | $ | 16.17 | | | $ | 15.62 | |

| | | | | | | | | | | | | |

| Institutional Class: | | | | | | | | | | | | |

| Net assets | | $ | 36,247,410 | | | $ | 556,380,332 | | | $ | 17,046,916 | |

| Shares issued and outstanding (unlimited number | | | | | | | | | | | | |

| of shares authorized without par value) | | | 1,643,473 | | | | 34,212,739 | | | | 1,086,759 | |

| Net asset value, and redemption price per share | | $ | 22.06 | | | $ | 16.26 | | | $ | 15.69 | |

The accompanying notes are an integral part of these financial statements.

CONGRESS FUNDS

| STATEMENTS OF OPERATIONS For the Year Ended December 31, 2016 |

| | | Large | | | Mid Cap | | | All Cap | |

| | | Cap Growth | | | Growth | | | Opportunity | |

| | | Fund | | | Fund | | | Fund | |

| | | | | | | | | | |

| INVESTMENT INCOME | |

| Dividends (net of foreign withholding tax | | | | | | | | | |

| of $3,017, $28,050, and $1,630, respectively) | | $ | 708,930 | | | $ | 4,293,442 | | | $ | 231,838 | |

| Interest | | | 3,452 | | | | 58,459 | | | | 2,718 | |

| Total investment income | | | 712,382 | | | | 4,351,901 | | | | 234,556 | |

| | | | | | | | | | | | | |

| EXPENSES | |

| Investment advisory fees | | | 226,999 | | | | 2,623,849 | | | | 135,198 | |

| Transfer agent fees | | | 54,853 | | | | 195,345 | | | | 54,048 | |

| Administration fees | | | 53,736 | | | | 418,410 | | | | 32,089 | |

| Registration fees | | | 43,104 | | | | 95,019 | | | | 42,296 | |

| Fund accounting fees | | | 39,850 | | | | 141,014 | | | | 39,204 | |

| Distribution fees - Retail Class | | | 30,702 | | | | 81,902 | | | | 12,539 | |

| Audit fees | | | 23,592 | | | | 23,590 | | | | 23,592 | |

| Trustee fees | | | 11,896 | | | | 20,861 | | | | 11,371 | |

| Chief Compliance Officer fees | | | 9,000 | | | | 9,000 | | | | 9,000 | |

| Miscellaneous expenses | | | 8,301 | | | | 15,627 | | | | 7,876 | |

| Legal fees | | | 5,983 | | | | 6,911 | | | | 7,509 | |

| Custody fees | | | 5,630 | | | | 47,512 | | | | 5,868 | |

| Reports to shareholders | | | 2,563 | | | | 46,203 | | | | 2,390 | |

| Insurance expense | | | 2,414 | | | | 3,189 | | | | 2,380 | |

| Interest expense | | | — | | | | — | | | | 67 | |

| Total expenses | | | 518,623 | | | | 3,728,432 | | | | 385,427 | |

| Less: fees waived and expenses reimbursed | | | (147,422 | ) | | | (366,720 | ) | | | (203,891 | ) |

| Net expenses | | | 371,201 | | | | 3,361,712 | | | | 181,536 | |

| Net investment income | | | 341,181 | | | | 990,189 | | | | 53,020 | |

| | | | | | | | | | | | | |

| REALIZED & UNREALIZED GAIN (LOSS) ON INVESTMENTS | |

| Net realized gain (loss) on investments | | | 671,107 | | | | 3,610,690 | | | | (116,540 | ) |

| Net increase from payments by affiliates | | | | | | | | | | | | |

| on the disposal of investments | | | | | | | | | | | | |

| in violation of restrictions | | | — | | | | — | | | | 163,910 | |

| Change in net unrealized | | | | | | | | | | | | |

| appreciation/depreciation on investments | | | 1,142,967 | | | | 52,123,786 | | | | 2,630,201 | |

| Change in net unrealized | | | | | | | | | | | | |

| appreciation/depreciation on translation of | | | | | | | | | | | | |

| other assets and liabilities in foreign currency | | | — | | | | — | | | | 13 | |

| Net realized and unrealized gain on investments | | | 1,814,074 | | | | 55,734,476 | | | | 2,677,584 | |

| Net increase in net assets | | | | | | | | | | | | |

| resulting from operations | | $ | 2,155,255 | | | $ | 56,724,665 | | | $ | 2,730,604 | |

The accompanying notes are an integral part of these financial statements.

(This Page Intentionally Left Blank.)

CONGRESS LARGE CAP GROWTH FUND

| STATEMENTS OF CHANGES IN NET ASSETS |

| | | Year Ended | | | Year Ended | |

| | | December 31, | | | December 31, | |

| | | 2016 | | | 2015 | |

| | | | | | | |

| INCREASE (DECREASE) IN NET ASSETS FROM: | |

| OPERATIONS | |

| Net investment income | | $ | 341,181 | | | $ | 250,849 | |

| Net realized gain on investments | | | 671,107 | | | | 1,062,188 | |

| Change in net unrealized | | | | | | | | |

| appreciation/depreciation on investments | | | 1,142,967 | | | | (736,945 | ) |

| Net increase in net assets | | | | | | | | |

| resulting from operations | | | 2,155,255 | | | | 576,092 | |

| | | | | | | | | |

| DISTRIBUTIONS TO SHAREHOLDERS | |

| From net investment income: | | | | | | | | |

| Retail Class | | | (52,596 | ) | | | (58,646 | ) |

| Institutional Class | | | (296,997 | ) | | | (191,924 | ) |

| From net realized gain on investments: | | | | | | | | |

| Retail Class | | | (37,906 | ) | | | (402,134 | ) |

| Institutional Class | | | (134,712 | ) | | | (783,249 | ) |

| Total distributions to shareholders | | | (522,211 | ) | | | (1,435,953 | ) |

| | | | | | | | | |

| CAPITAL SHARE TRANSACTIONS | |

| Decrease in net assets derived from | | | | | | | | |

net change in outstanding shares - Retail Class(1) | | | (5,454,208 | ) | | | (2,010,375 | ) |

| Increase in net assets derived from | | | | | | | | |

net change in outstanding shares - Institutional Class(1) | | | 5,089,319 | | | | 9,103,193 | |

| Total increase (decrease) in net assets | | | | | | | | |

| from capital share transactions | | | (364,889 | ) | | | 7,092,818 | |

| Total increase in net assets | | | 1,268,155 | | | | 6,232,957 | |

| | | | | | | | | |

| NET ASSETS | |

| Beginning of year | | | 45,092,567 | | | | 38,859,610 | |

| End of year | | $ | 46,360,722 | | | $ | 45,092,567 | |

| Undistributed net investment income | | $ | — | | | $ | 900 | |

The accompanying notes are an integral part of these financial statements.

CONGRESS LARGE CAP GROWTH FUND

| STATEMENTS OF CHANGES IN NET ASSETS (Continued) |

(1) | Summary of capital share transactions is as follows: |

| | | | Year Ended | | | Year Ended | |

| | | | December 31, 2016 | | | December 31, 2015 | |

| | | | Shares | | | Value | | | Shares | | | Value | |

| | Retail Class | | | | | | | | | | | | |

| | Shares sold | | | 46,657 | | | $ | 967,020 | | | | 41,249 | | | $ | 906,710 | |

| | Shares issued in | | | | | | | | | | | | | | | | |

| | reinvestment of distributions | | | 1,636 | | | | 36,548 | | | | 12,376 | | | | 267,806 | |

| | Shares redeemed(2) | | | (299,887 | ) | | | (6,457,776 | ) | | | (143,520 | ) | | | (3,184,891 | ) |

| | Net decrease | | | (251,594 | ) | | $ | (5,454,208 | ) | | | (89,895 | ) | | $ | (2,010,375 | ) |

(2) | Net of redemption fees of $271 and $88, respectively. Effective April 30, 2016, the 1% redemption fee was eliminated. |

| | | | Year Ended | | | Year Ended | |

| | | | December 31, 2016 | | | December 31, 2015 | |

| | | | Shares | | | Value | | | Shares | | | Value | |

| | Institutional Class | | | | | | | | | | | | |

| | Shares sold | | | 629,829 | | | $ | 13,446,703 | | | | 548,816 | | | $ | 12,319,785 | |

| | Shares issued in | | | | | | | | | | | | | | | | |

| | reinvestment of distributions | | | 14,611 | | | | 326,265 | | | | 32,745 | | | | 708,282 | |

| | Shares redeemed(3) | | | (407,511 | ) | | | (8,683,649 | ) | | | (176,763 | ) | | | (3,924,874 | ) |

| | Net increase | | | 236,929 | | | $ | 5,089,319 | | | | 404,798 | | | $ | 9,103,193 | |

(3) | Net of redemption fees of $— and $200, respectively. Effective April 30, 2016, the 1% redemption fee was eliminated. |

The accompanying notes are an integral part of these financial statements.

CONGRESS MID CAP GROWTH FUND

| STATEMENTS OF CHANGES IN NET ASSETS |

| | | Year Ended | | | Year Ended | |

| | | December 31, | | | December 31, | |

| | | 2016 | | | 2015 | |

| | | | | | | |

| INCREASE (DECREASE) IN NET ASSETS FROM: | |

| OPERATIONS | |

| Net investment income | | $ | 990,189 | | | $ | 278,228 | |

| Net realized gain on investments | | | 3,610,690 | | | | 3,793,767 | |

| Change in net unrealized | | | | | | | | |

| appreciation/depreciation on investments | | | 52,123,786 | | | | (5,629,346 | ) |

| Net increase (decrease) in net assets | | | | | | | | |

| resulting from operations | | | 56,724,665 | | | | (1,557,351 | ) |

| | | | | | | | | |

| DISTRIBUTIONS TO SHAREHOLDERS | |

| From net investment income: | | | | | | | | |

| Retail Class | | | (5,607 | ) | | | — | |

| Institutional Class | | | (997,481 | ) | | | (307,756 | ) |

| From net realized gain on investments: | | | | | | | | |

| Retail Class | | | (445,693 | ) | | | (118,699 | ) |

| Institutional Class | | | (5,030,213 | ) | | | (1,823,973 | ) |

| Total distributions to shareholders | | | (6,478,994 | ) | | | (2,250,428 | ) |

| | | | | | | | | |

| CAPITAL SHARE TRANSACTIONS | |

| Increase in net assets derived from | | | | | | | | |

net change in outstanding shares - Retail Class(1) | | | 25,972,338 | | | | 5,535,356 | |

| Increase in net assets derived from | | | | | | | | |

net change in outstanding shares - Institutional Class(1) | | | 237,279,898 | | | | 85,607,664 | |

| Total increase in net assets | | | | | | | | |

| from capital share transactions | | | 263,252,236 | | | | 91,143,020 | |

| Total increase in net assets | | | 313,497,907 | | | | 87,335,241 | |

| | | | | | | | | |

| NET ASSETS | |

| Beginning of year | | | 290,841,192 | | | | 203,505,951 | |

| End of year | | $ | 604,339,099 | | | $ | 290,841,192 | |

The accompanying notes are an integral part of these financial statements.

CONGRESS MID CAP GROWTH FUND

| STATEMENTS OF CHANGES IN NET ASSETS (Continued) |

(1) | Summary of capital share transactions is as follows: |

| | | | Year Ended | | | Year Ended | |

| | | | December 31, 2016 | | | December 31, 2015 | |

| | | | Shares | | | Value | | | Shares | | | Value | |

| | Retail Class | | | | | | | | | | | | |

| | Shares sold | | | 2,164,791 | | | $ | 33,224,753 | | | | 1,034,154 | | | $ | 15,158,492 | |

| | Shares issued in | | | | | | | | | | | | | | | | |

| | reinvestment of distributions | | | 22,775 | | | | 371,921 | | | | 6,687 | | | | 97,301 | |

| | Shares redeemed(2) | | | (490,691 | ) | | | (7,624,336 | ) | | | (663,667 | ) | | | (9,720,437 | ) |

| | Net increase | | | 1,696,875 | | | $ | 25,972,338 | | | | 377,174 | | | $ | 5,535,356 | |

(2) | Net of redemption fees of $946 and $2,097, respectively. Effective April 30, 2016, the 1% redemption fee was eliminated. |

| | | | Year Ended | | | Year Ended | |

| | | | December 31, 2016 | | | December 31, 2015 | |

| | | | Shares | | | Value | | | Shares | | | Value | |

| | Institutional Class | | | | | | | | | | | | |

| | Shares sold | | | 21,310,515 | | | $ | 326,400,822 | | | | 8,299,965 | | | $ | 123,488,033 | |

| | Shares issued in | | | | | | | | | | | | | | | | |

| | reinvestment of distributions | | | 212,607 | | | | 3,491,008 | | | | 65,590 | | | | 958,925 | |

| | Shares redeemed(3) | | | (6,111,162 | ) | | | (92,611,932 | ) | | | (2,618,528 | ) | | | (38,839,294 | ) |

| | Net increase | | | 15,411,960 | | | $ | 237,279,898 | | | | 5,747,027 | | | $ | 85,607,664 | |

(3) | Net of redemption fees of $6,606 and $12,817, respectively. Effective April 30, 2016, the 1% redemption fee was eliminated. |

The accompanying notes are an integral part of these financial statements.

CONGRESS ALL CAP OPPORTUNITY FUND

| STATEMENTS OF CHANGES IN NET ASSETS |

| | | Year Ended | | | Year Ended | |

| | | December 31, | | | December 31, | |

| | | 2016 | | | 2015 | |

| | | | | | | |

| INCREASE (DECREASE) IN NET ASSETS FROM: | |

| OPERATIONS | |

| Net investment income | | $ | 53,020 | | | $ | 261,195 | |

| Net realized loss on investments | | | (116,540 | ) | | | (366,757 | ) |

| Net increase from payments by affiliates on the | | | | | | | | |

| disposal of investments in violation of restrictions | | | 163,910 | | | | — | |

| Change in net unrealized | | | | | | | | |

| appreciation/depreciation on investments | | | 2,630,201 | | | | (1,619,945 | ) |

| Change in net unrealized | | | | | | | | |

| appreciation/depreciation on translation of | | | | | | | | |

| other assets and liabilities in foreign currency | | | 13 | | | | 8 | |

| Net increase (decrease) in net assets | | | | | | | | |

| resulting from operations | | | 2,730,604 | | | | (1,725,499 | ) |

| | | | | | | | | |

| DISTRIBUTIONS TO SHAREHOLDERS | |

| From net investment income: | | | | | | | | |

| Retail Class | | | (8,319 | ) | | | (38,245 | ) |

| Institutional Class | | | (45,847 | ) | | | (200,742 | ) |

| From net realized gain on investments: | | | | | | | | |

| Retail Class | | | — | | | | (4,123 | ) |

| Institutional Class | | | — | | | | (18,123 | ) |

| Total distributions to shareholders | | | (54,166 | ) | | | (261,233 | ) |

| | | | | | | | | |

| CAPITAL SHARE TRANSACTIONS | |

| Increase in net assets derived from | | | | | | | | |

net change in outstanding shares - Retail Class(1) | | | 827,031 | | | | 1,867,177 | |

| Increase (decrease) in net assets derived from | | | | | | | | |

net change in outstanding shares - Institutional Class(1) | | | (4,506,010 | ) | | | 8,288,246 | |

| Total increase (decrease) in net assets | | | | | | | | |

| from capital share transactions | | | (3,678,979 | ) | | | 10,155,423 | |

| Total increase (decrease) in net assets | | | (1,002,541 | ) | | | 8,168,691 | |

| | | | | | | | | |

| NET ASSETS | |

| Beginning of year | | | 24,231,497 | | | | 16,062,806 | |

| End of year | | $ | 23,228,956 | | | $ | 24,231,497 | |

| Undistributed net investment income | | $ | 37,983 | | | $ | 39,206 | |

The accompanying notes are an integral part of these financial statements.

CONGRESS ALL CAP OPPORTUNITY FUND

| STATEMENTS OF CHANGES IN NET ASSETS (Continued) |

(1) | Summary of capital share transactions is as follows: |

| | | | Year Ended | | | Year Ended | |

| | | | December 31, 2016 | | | December 31, 2015 | |

| | | | Shares | | | Value | | | Shares | | | Value | |

| | Retail Class | | | | | | | | | | | | |

| | Shares sold | | | 183,259 | | | $ | 2,571,118 | | | | 208,369 | | | $ | 3,008,925 | |

| | Shares issued in | | | | | | | | | | | | | | | | |

| | reinvestment of distributions | | | 451 | | | | 7,054 | | | | 2,464 | | | | 34,098 | |

| | Shares redeemed(2) | | | (126,843 | ) | | | (1,751,141 | ) | | | (77,102 | ) | | | (1,175,846 | ) |

| | Net increase | | | 56,867 | | | $ | 827,031 | | | | 133,731 | | | $ | 1,867,177 | |

(2) | Net of redemption fees of $135 and $892, respectively. Effective April 30, 2016, the 1% redemption fee was eliminated. |

| | | | Year Ended | | | Year Ended | |

| | | | December 31, 2016 | | | December 31, 2015 | |

| | | | Shares | | | Value | | | Shares | | | Value | |

| | Institutional Class | | | | | | | | | | | | |

| | Shares sold | | | 330,601 | | | $ | 4,411,802 | | | | 939,179 | | | $ | 14,145,340 | |

| | Shares issued in | | | | | | | | | | | | | | | | |

| | reinvestment of distributions | | | 2,112 | | | | 33,201 | | | | 11,751 | | | | 163,216 | |

| | Shares redeemed(3) | | | (656,340 | ) | | | (8,951,013 | ) | | | (428,357 | ) | | | (6,020,310 | ) |

| | Net increase (decrease) | | | (323,627 | ) | | $ | (4,506,010 | ) | | | 522,573 | | | $ | 8,288,246 | |

(3) | Net of redemption fees of $70 and $197, respectively. Effective April 30, 2016, the 1% redemption fee was eliminated. |

The accompanying notes are an integral part of these financial statements.

CONGRESS LARGE CAP GROWTH FUND

| FINANCIAL HIGHLIGHTS For a capital share outstanding throughout each year |

RETAIL CLASS

| | | Year Ended December 31, | |

| | | 2016 | | | 2015 | | | 2014 | | | 2013 | | | 2012 | |

| Net asset value, | | | | | | | | | | | | | | | |

| beginning of year | | $ | 21.31 | | | $ | 21.57 | | | $ | 21.10 | | | $ | 16.66 | | | $ | 14.97 | |

| | | | | | | | | | | | | | | | | | | | | |

| INCOME FROM INVESTMENT OPERATIONS: | |

Net investment income(1) | | | 0.12 | | | | 0.10 | | | | 0.03 | | | | 0.06 | | | | 0.08 | |

| Net realized and unrealized | | | | | | | | | | | | | | | | | | | | |

| gain on investments | | | 0.84 | | | | 0.29 | | | | 1.88 | | | | 4.74 | | | | 1.69 | |

| Total from investment operations | | | 0.96 | | | | 0.39 | | | | 1.91 | | | | 4.80 | | | | 1.77 | |

| | | | | | | | | | | | | | | | | | | | | |

| LESS DISTRIBUTIONS: | |

| From net investment income | | | (0.12 | ) | | | (0.08 | ) | | | (0.03 | ) | | | (0.04 | ) | | | (0.08 | ) |

| From net realized gain | | | (0.08 | ) | | | (0.57 | ) | | | (1.41 | ) | | | (0.32 | ) | | | — | |

| Total distributions | | | (0.20 | ) | | | (0.65 | ) | | | (1.44 | ) | | | (0.36 | ) | | | (0.08 | ) |

| Paid-in capital from | | | | | | | | | | | | | | | | | | | | |

| redemption fees | | | 0.00 | (2) | | | 0.00 | (2) | | | 0.00 | (2) | | | 0.00 | (2) | | | 0.00 | (2) |

| Net asset value, end of year | | $ | 22.07 | | | $ | 21.31 | | | $ | 21.57 | | | $ | 21.10 | | | $ | 16.66 | |

| Total return | | | 4.48 | % | | | 1.79 | % | | | 8.98 | % | | | 28.84 | % | | | 11.81 | % |

| | | | | | | | | | | | | | | | | | | | | |

| SUPPLEMENTAL DATA: | |

| Net assets, end of year (millions) | | $ | 10.1 | | | $ | 15.1 | | | $ | 17.3 | | | $ | 19.7 | | | $ | 18.1 | |

| Portfolio turnover rate | | | 33 | % | | | 31 | % | | | 36 | % | | | 51 | % | | | 52 | % |

| | | | | | | | | | | | | | | | | | | | | |

| RATIO OF EXPENSES TO AVERAGE NET ASSETS | |

| Before fees waived and | | | | | | | | | | | | | | | | | | | | |

| expenses absorbed | | | 1.32 | % | | | 1.33 | % | | | 1.42 | % | | | 1.70 | % | | | 1.97 | % |

| After fees waived and | | | | | | | | | | | | | | | | | | | | |

| expenses absorbed | | | 1.00 | % | | | 1.00 | % | | | 1.00 | % | | | 1.00 | % | | | 1.00 | % |

| | | | | | | | | | | | | | | | | | | | | |

| RATIO OF NET INVESTMENT INCOME (LOSS) | |

| TO AVERAGE NET ASSETS | |

| Before fees waived and | | | | | | | | | | | | | | | | | | | | |

| expenses absorbed | | | 0.24 | % | | | 0.10 | % | | | (0.27 | )% | | | (0.38 | )% | | | (0.46 | )% |

| After fees waived and | | | | | | | | | | | | | | | | | | | | |

| expenses absorbed | | | 0.56 | % | | | 0.43 | % | | | 0.15 | % | | | 0.32 | % | | | 0.51 | % |

(1) | Calculated based on the average number of shares outstanding |

(2) | Does not round to $0.01 |

The accompanying notes are an integral part of these financial statements.

CONGRESS LARGE CAP GROWTH FUND

| FINANCIAL HIGHLIGHTS For a capital share outstanding throughout each year |

INSTITUTIONAL CLASS

| | | Year Ended December 31, | |

| | | 2016 | | | 2015 | | | 2014 | | | 2013 | | | 2012 | |

| Net asset value, | | | | | | | | | | | | | | | |

| beginning of year | | $ | 21.31 | | | $ | 21.57 | | | $ | 21.10 | | | $ | 16.64 | | | $ | 14.97 | |

| | | | | | | | | | | | | | | | | | | | | |

| INCOME FROM INVESTMENT OPERATIONS: | |

Net investment income(1) | | | 0.18 | | | | 0.15 | | | | 0.09 | | | | 0.11 | | | | 0.01 | |

| Net realized and unrealized | | | | | | | | | | | | | | | | | | | | |

| gain on investments | | | 0.83 | | | | 0.30 | | | | 1.88 | | | | 4.76 | | | | 1.78 | |

| Total from investment operations | | | 1.01 | | | | 0.45 | | | | 1.97 | | | | 4.87 | | | | 1.79 | |

| | | | | | | | | | | | | | | | | | | | | |

| LESS DISTRIBUTIONS: | |

| From net investment income | | | (0.18 | ) | | | (0.14 | ) | | | (0.09 | ) | | | (0.09 | ) | | | (0.12 | ) |

| From net realized gain | | | (0.08 | ) | | | (0.57 | ) | | | (1.41 | ) | | | (0.32 | ) | | | — | |

| Total distributions | | | (0.26 | ) | | | (0.71 | ) | | | (1.50 | ) | | | (0.41 | ) | | | (0.12 | ) |

| Paid-in capital from | | | | | | | | | | | | | | | | | | | | |

| redemption fees | | | — | | | | 0.00 | (2) | | | — | | | | 0.00 | (2) | | | — | |

| Net asset value, end of year | | $ | 22.06 | | | $ | 21.31 | | | $ | 21.57 | | | $ | 21.10 | | | $ | 16.64 | |

| Total return | | | 4.75 | % | | | 2.05 | % | | | 9.27 | % | | | 29.27 | % | | | 11.94 | % |

| | | | | | | | | | | | | | | | | | | | | |

| SUPPLEMENTAL DATA: | |

| Net assets, end of year (millions) | | $ | 36.2 | | | $ | 30.0 | | | $ | 21.6 | | | $ | 14.8 | | | $ | 0.7 | |

| Portfolio turnover rate | | | 33 | % | | | 31 | % | | | 36 | % | | | 51 | % | | | 52 | % |

| | | | | | | | | | | | | | | | | | | | | |

| RATIO OF EXPENSES TO AVERAGE NET ASSETS | |

| Before fees waived and | | | | | | | | | | | | | | | | | | | | |

| expenses absorbed | | | 1.07 | % | | | 1.08 | % | | | 1.17 | % | | | 1.45 | % | | | 1.72 | % |

| After fees waived and | | | | | | | | | | | | | | | | | | | | |

| expenses absorbed | | | 0.75 | % | | | 0.75 | % | | | 0.75 | % | | | 0.75 | % | | | 0.75 | % |

| | | | | | | | | | | | | | | | | | | | | |

| RATIO OF NET INVESTMENT INCOME (LOSS) | |

| TO AVERAGE NET ASSETS | |

| Before fees waived and | | | | | | | | | | | | | | | | | | | | |

| expenses absorbed | | | 0.50 | % | | | 0.36 | % | | | 0.01 | % | | | (0.10 | )% | | | (0.93 | )% |

| After fees waived and | | | | | | | | | | | | | | | | | | | | |

| expenses absorbed | | | 0.82 | % | | | 0.69 | % | | | 0.43 | % | | | 0.60 | % | | | 0.04 | % |

(1) | Calculated based on the average number of shares outstanding |

(2) | Does not round to $0.01 |

The accompanying notes are an integral part of these financial statements.

CONGRESS MID CAP GROWTH FUND

| FINANCIAL HIGHLIGHTS For a capital share outstanding throughout each year/period |

RETAIL CLASS

| | | | | | | | | | | | | | | Period Ended | |

| | | Year Ended December 31, | | | December 31, | |

| | | 2016 | | | 2015 | | | 2014 | | | 2013 | | | | 2012* | |

| Net asset value, | | | | | | | | | | | | | | | | |

| beginning of year/period | | $ | 14.43 | | | $ | 14.55 | | | $ | 13.58 | | | $ | 10.16 | | | $ | 10.00 | |

| | | | | | | | | | | | | | | | | | | | | |

| INCOME FROM INVESTMENT OPERATIONS: | |

Net investment income (loss)(1) | | | 0.00 | (2) | | | (0.02 | ) | | | (0.01 | ) | | | (0.02 | ) | | | 0.03 | |

| Net realized and unrealized | | | | | | | | | | | | | | | | | | | | |

| gain (loss) on investments | | | 1.89 | | | | (0.00 | )(3) | | | 1.53 | | | | 3.63 | | | | 0.13 | |

| Total from investment operations | | | 1.89 | | | | (0.02 | ) | | | 1.52 | | | | 3.61 | | | | 0.16 | |

| | | | | | | | | | | | | | | | | | | | | |

| LESS DISTRIBUTIONS: | |

| From net investment income | | | (0.00 | )(3) | | | — | | | | — | | | | — | | | | — | |

| From net realized gain | | | (0.15 | ) | | | (0.10 | ) | | | (0.56 | ) | | | (0.21 | ) | | | — | |

| Total distributions | | | (0.15 | ) | | | (0.10 | ) | | | (0.56 | ) | | | (0.21 | ) | | | — | |

| Paid-in capital from | | | | | | | | | | | | | | | | | | | | |

| redemption fees | | | 0.00 | (2) | | | 0.00 | (2) | | | 0.01 | | | | 0.02 | | | | — | |

| Net asset value, end of year/period | | $ | 16.17 | | | $ | 14.43 | | | $ | 14.55 | | | $ | 13.58 | | | $ | 10.16 | |

| Total return | | | 13.11 | % | | | (0.15 | )% | | | 11.22 | % | | | 35.72 | % | | 1.60 | %^ |

| | | | | | | | | | | | | | | | | | | | | |

| SUPPLEMENTAL DATA: | |

| Net assets, end of | | | | | | | | | | | | | | | | | | | | |

| year/period (millions) | | $ | 48.0 | | | $ | 18.3 | | | $ | 13.0 | | | $ | 3.7 | | | $ | 0.4 | |

| Portfolio turnover rate | | | 18 | % | | | 24 | % | | | 35 | % | | | 31 | % | | 0 | %^‡ |

| | | | | | | | | | | | | | | | | | | | | |

| RATIO OF EXPENSES TO AVERAGE NET ASSETS | |

| Before fees waived and | | | | | | | | | | | | | | | | | | | | |

| expenses absorbed | | | 1.08 | % | | | 1.12 | % | | | 1.15 | % | | | 1.42 | % | | | 3.83 | %+ |

| After fees waived and | | | | | | | | | | | | | | | | | | | | |

| expenses absorbed | | | 1.00 | % | | | 1.00 | % | | | 1.00 | % | | | 1.00 | % | | | 1.00 | %+ |

| | | | | | | | | | | | | | | | | | | | | |

| RATIO OF NET INVESTMENT INCOME (LOSS) | |

| TO AVERAGE NET ASSETS | |

| Before fees waived and | | | | | | | | | | | | | | | | | | | | |

| expenses absorbed | | | (0.07 | )% | | | (0.25 | )% | | | (0.22 | )% | | | (0.62 | )% | | | (0.95 | )%+ |

| After fees waived and | | | | | | | | | | | | | | | | | | | | |

| expenses absorbed | | | 0.01 | % | | | (0.13 | )% | | | (0.07 | )% | | | (0.20 | )% | | | 1.88 | %+ |

| * | | The Fund commenced operations on October 31, 2012. |

(1) | | Calculated based on the average number of shares outstanding |

(2) | | Does not round to $0.01 |

(3) | | Does not round to $(0.01) |

| ^ | | Not annualized |

+ | | Annualized |

| ‡ | | Does not round to 1% |

The accompanying notes are an integral part of these financial statements.

CONGRESS MID CAP GROWTH FUND

| FINANCIAL HIGHLIGHTS For a capital share outstanding throughout each year/period |

INSTITUTIONAL CLASS

| | | | | | | | | | | | | | | Period Ended | |

| | | Year Ended December 31, | | | December 31, | |

| | | 2016 | | | 2015 | | | 2014 | | | 2013 | | | | 2012* | |

| Net asset value, | | | | | | | | | | | | | | | | |

| beginning of year/period | | $ | 14.50 | | | $ | 14.60 | | | $ | 13.61 | | | $ | 10.17 | | | $ | 10.00 | |

| | | | | | | | | | | | | | | | | | | | | |

| INCOME FROM INVESTMENT OPERATIONS: | |

Net investment income (loss)(1) | | | 0.04 | | | | 0.02 | | | | 0.02 | | | | 0.00 | (2) | | | (0.00 | )(3) |

| Net realized and unrealized | | | | | | | | | | | | | | | | | | | | |

| gain (loss) on investments | | | 1.90 | | | | (0.00 | )(3) | | | 1.55 | | | | 3.65 | | | | 0.17 | |

| Total from investment operations | | | 1.94 | | | | 0.02 | | | | 1.57 | | | | 3.65 | | | | 0.17 | |

| | | | | | | | | | | | | | | | | | | | | |

| LESS DISTRIBUTIONS: | |

| From net investment income | | | (0.03 | ) | | | (0.02 | ) | | | (0.02 | ) | | | — | | | | — | |

| From net realized gain | | | (0.15 | ) | | | (0.10 | ) | | | (0.56 | ) | | | (0.21 | ) | | | — | |

| Total distributions | | | (0.18 | ) | | | (0.12 | ) | | | (0.58 | ) | | | (0.21 | ) | | | — | |

| Paid-in capital from | | | | | | | | | | | | | | | | | | | | |

| redemption fees | | | 0.00 | (2) | | | 0.00 | (2) | | | 0.00 | (2) | | | 0.00 | (2) | | | 0.00 | (2) |

| Net asset value, end of year/period | | $ | 16.26 | | | $ | 14.50 | | | $ | 14.60 | | | $ | 13.61 | | | $ | 10.17 | |

| Total return | | | 13.38 | % | | | 0.10 | % | | | 11.49 | % | | | 35.88 | % | | 1.70 | %^ |

| | | | | | | | | | | | | | | | | | | | |

| SUPPLEMENTAL DATA: | |

| Net assets, end of | | | | | | | | | | | | | | | | | | | | |

| year/period (millions) | | $ | 556.4 | | | $ | 272.5 | | | $ | 190.5 | | | $ | 58.2 | | | $ | 30.4 | |

| Portfolio turnover rate | | | 18 | % | | | 24 | % | | | 35 | % | | | 31 | % | | 0 | %^‡ |

| | | | | | | | | | | | | | | | | | | | |

| RATIO OF EXPENSES TO AVERAGE NET ASSETS | |

| Before fees waived and | | | | | | | | | | | | | | | | | | | | |

| expenses absorbed | | | 0.83 | % | | | 0.87 | % | | | 0.90 | % | | | 1.17 | % | | | 3.58 | %+ |

| After fees waived and | | | | | | | | | | | | | | | | | | | | |

| expenses absorbed | | | 0.75 | % | | | 0.75 | % | | | 0.75 | % | | | 0.75 | % | | | 0.75 | %+ |

| | | | | | | | | | | | | | | | | | | | | |

| RATIO OF NET INVESTMENT INCOME (LOSS) | |

| TO AVERAGE NET ASSETS | |

| Before fees waived and | | | | | | | | | | | | | | | | | | | | |

| expenses absorbed | | | 0.16 | % | | | 0.00 | %(4) | | | 0.02 | % | | | (0.42 | )% | | | (3.12 | )%+ |

| After fees waived and | | | | | | | | | | | | | | | | | | | | |

| expenses absorbed | | | 0.24 | % | | | 0.12 | % | | | 0.17 | % | | | 0.00 | %(4) | | | (0.29 | )%+ |

| * | | The Fund commenced operations on October 31, 2012. |

(1) | | Calculated based on the average number of shares outstanding |

(2) | | Does not round to $0.01 |

(3) | | Does not round to $(0.01) |

(4) | | Does not round to 0.01% |

| ^ | | Not annualized |

+ | | Annualized |

| ‡ | | Does not round to 1% |

The accompanying notes are an integral part of these financial statements.

CONGRESS ALL CAP OPPORTUNITY FUND

| FINANCIAL HIGHLIGHTS For a capital share outstanding throughout each year/period |

RETAIL CLASS

| | | | | | | | | | | | | | | Period Ended | |

| | | Year Ended December 31, | | | December 31, | |

| | | 2016 | | | 2015 | | | 2014 | | | 2013 | | | | 2012* | |

| Net asset value, | | | | | | | | | | | | | | | | |

| beginning of year/period | | $ | 13.82 | | | $ | 14.66 | | | $ | 12.95 | | | $ | 10.29 | | | $ | 10.00 | |

| | | | | | | | | | | | | | | | | | | | | |

| INCOME FROM INVESTMENT OPERATIONS: | |

Net investment income(1) | | | 0.01 | | | | 0.16 | | | | 0.03 | | | | 0.03 | | | | 0.03 | |

| Net realized and unrealized | | | | | | | | | | | | | | | | | | | | |

| gain (loss) on investments | | | 1.72 | | | | (0.87 | ) | | | 1.74 | | | | 2.84 | | | | 0.29 | |

| Total from investment operations | | | 1.73 | | | | (0.71 | ) | | | 1.77 | | | | 2.87 | | | | 0.32 | |

| | | | | | | | | | | | | | | | | | | | | |

| LESS DISTRIBUTIONS: | |

| From net investment income | | | (0.02 | ) | | | (0.12 | ) | | | (0.00 | )(2) | | | (0.02 | ) | | | (0.03 | ) |

| From net realized gain | | | — | | | | (0.01 | ) | | | (0.06 | ) | | | (0.19 | ) | | | — | |

| Total distributions | | | (0.02 | ) | | | (0.13 | ) | | | (0.06 | ) | | | (0.21 | ) | | | (0.03 | ) |

| Paid-in capital from | | | | | | | | | | | | | | | | | | | | |

| redemption fees | | | 0.00 | (3) | | | 0.00 | (3) | | | 0.00 | (3) | | | 0.00 | (3) | | | — | |

| Reimbursement by Advisor | | | 0.09 | | | | — | | | | — | | | | — | | | | — | |

| Net asset value, end of year/period | | $ | 15.62 | | | $ | 13.82 | | | $ | 14.66 | | | $ | 12.95 | | | $ | 10.29 | |

| Total return | | | 13.18 | %(4) | | | (4.84 | )% | | | 13.67 | % | | | 27.89 | % | | 3.15 | %^ |

| | | | | | | | | | | | | | | | | | | | | |

| SUPPLEMENTAL DATA: | |

| Net assets, end of | | | | | | | | | | | | | | | | | | | | |

| year/period (millions) | | $ | 6.2 | | | $ | 4.7 | | | $ | 3.0 | | | $ | 2.1 | | | $ | 0.4 | |

| Portfolio turnover rate | | | 68 | % | | | 37 | % | | | 31 | % | | | 41 | % | | 9 | %^ |

| | | | | | | | | | | | | | | | | | | | | |

| RATIO OF EXPENSES TO AVERAGE NET ASSETS | |

| Before fees waived and | | | | | | | | | | | | | | | | | | | | |

| expenses absorbed | | | 1.91 | % | | | 1.89 | % | | | 3.01 | % | | | 5.20 | % | | | 21.16 | %+ |

| After fees waived and | | | | | | | | | | | | | | | | | | | | |

| expenses absorbed | | | 1.00 | % | | | 1.00 | % | | | 1.00 | % | | | 1.00 | % | | | 1.00 | %+ |

| | | | | | | | | | | | | | | | | | | | | |

| RATIO OF NET INVESTMENT INCOME (LOSS) | |

| TO AVERAGE NET ASSETS | |

| Before fees waived and | | | | | | | | | | | | | | | | | | | | |

| expenses absorbed | | | (0.85 | )% | | | 0.17 | % | | | (1.81 | )% | | | (3.95 | )% | | | (18.68 | )%+ |

| After fees waived and | | | | | | | | | | | | | | | | | | | | |

| expenses absorbed | | | 0.06 | % | | | 1.06 | % | | | 0.20 | % | | | 0.25 | % | | | 1.48 | %+ |

| * | | The Fund commenced operations on October 31, 2012. |

(1) | | Calculated based on the average number of shares outstanding |

(2) | | Does not round to $(0.01) |

(3) | | Does not round to $0.01 |

(4) | | Net increase from payments by affiliates on the disposal of investments in violation of investment restrictions contributed 0.65% to this return. |

| ^ | | Not annualized |