UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number (811-05037)

Professionally Managed Portfolios

(Exact name of registrant as specified in charter)

615 East Michigan Street

Milwaukee, WI 53202

(Address of principal executive offices) (Zip code)

Jason Hadler

Professionally Managed Portfolios

c/o U.S. Bank Global Fund Services

777 E. Wisconsin Avenue

Milwaukee, WI 53202

(Name and address of agent for service)

(414) 765-4324

Registrant's telephone number, including area code

Date of fiscal year end: September 30

Date of reporting period: March 31, 2022

Item 1. Reports to Stockholders.

BOSTON COMMON

ESG IMPACT EMERGING MARKETS FUND

(BCEMX)

BOSTON COMMON

ESG IMPACT INTERNATIONAL FUND

(BCAIX)

BOSTON COMMON

ESG IMPACT U.S. EQUITY FUND

(BCAMX)

SEMI-ANNUAL REPORT

March 31, 2022

Table of Contents

| Message from the Adviser | 1 |

| Boston Common ESG Impact Emerging Markets Fund | |

| Investment Outlook | 5 |

| Management’s Discussion of Fund Performance | 7 |

| Country Allocation | 9 |

| Schedule of Investments | 10 |

| Boston Common ESG Impact International Fund | |

| Investment Outlook | 12 |

| Management’s Discussion of Fund Performance | 14 |

| Country Allocation | 16 |

| Schedule of Investments | 17 |

| Boston Common ESG Impact U.S. Equity Fund | |

| Investment Outlook | 19 |

| Management’s Discussion of Fund Performance | 21 |

| Sector Allocation | 23 |

| Schedule of Investments | 24 |

| Statements of Assets and Liabilities | 26 |

| Statements of Operations | 27 |

| Statements of Changes in Net Assets | 28 |

| Financial Highlights | 31 |

| Notes to Financial Statements | 34 |

| Expense Examples | 45 |

| Additional Information | 47 |

| Privacy Notice | Inside Back Cover |

BOSTON COMMON ESG IMPACT FUNDS

Message from the Adviser

Dear Fellow Investors,

The world’s economic outlook has been altered by Russia’s invasion of Ukraine. The war and the ensuing coordinated sanctions have introduced new cross currents to the global economy just as many nations were emerging from the turmoil of the pandemic. These developments have dented investor sentiment and exacerbated inflationary pressures in recent weeks.

The current conflict has underlined the urgent need to address and reduce global dependence on fossil fuels. While increasing supply from renewable energy sources remains the long-term goal, we can embrace demand reduction as the other energy solution critical to energy independence. At Boston Common Asset Management (“Boston Common”), we maintain our focus on companies that provide solutions to cut energy waste, increase renewable energy use, raise energy efficiency, and offer new models for energy productivity.

Sustainable investors can finance a post-Ukraine economy by providing patient capital paired with an impatient voice for change. Hundreds of net-zero carbon commitments, big and small, have been made, but those plans often have multi-decade timelines. Recent events have once again shown that depending on countries with repressive regimes lacking internal accountability poses a high risk to investors and citizens alike. There is now a geopolitically driven urgency to pivot immediately- to cut energy demand in pursuit of energy independence.

Since 2015, Boston Common has engaged companies on the topic of Eco-Efficiency by addressing demand reduction in both energy and water use as well as the development of circular economy principles to eliminate waste. We encourage you to read further for examples of our engagement activities.

As current events play out, we may take additional tactical steps towards a more defensive posture in our shorter-term outlook. We continue to monitor signals for either the endgame to the Russian war or signs of market confidence in the Federal Reserve’s (the “Feds”) actions on inflation. For the longer term, the favorable pre-invasion expectations that were the basis for our “barbell” investment stance are still present: investment spending driven by sustainability and productivity goals, record low unemployment, and the reversal of pandemic-driven disruptions.

Thank you for your interest and investment in the Boston Common ESG Impact Funds and for your continued support as we strive to achieve sustainable financial returns and social change.

|  |

| Geeta Aiyer | Matt Zalosh |

| President & Founder | Chief Investment Officer |

| | International Strategies |

BOSTON COMMON ESG IMPACT FUNDS

Fund Shareowner Engagement

Below, we showcase examples of how our shareowner voice can add value through targeted company and industry engagement and dialogue efforts.

Update: Proxy Season 2022

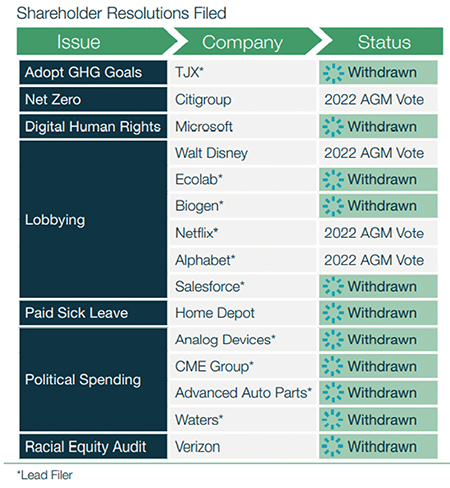

Voting proxies remains one of the key ways that shareowners can voice their opinions and provide feedback to management. But there is more to the process than a vote. Boston Common regularly highlights issue areas on which to engage with companies – looking for constructive dialogue.

A specific focus this year was corporate political activities. Boston Common filed 10 resolutions focused on this area since the insurrection of January 6th, 2021. This year, we were successful on several fronts, withdrawing our proxy initiatives after having productive conversations with company managements. Some examples include:

Net Zero/Climate

| | • | Booking Holdings released its first Climate Action Plan, a key step for a global online travel company – which includes a near-zero emissions target for its operations by 2030 and net zero by 2040. |

Lobbying and Political Contributions

| | • | Salesforce improved its disclosure on lobbying oversight and contributions to trade associations. |

| | | |

| | • | Biogen committed to expand its disclosure on lobbying activities outside the U.S., including the European Union (the “E.U.”). |

| | | |

| | • | Analog Devices updated its political contributions and lobbying policy including detailed disclosure on their current ban on direct political contributions, public policy positions, recent lobbying activity, and oversight. |

| | | |

| | • | CME Group will expand lobbying disclosure and post an overview to its website in early 2022. |

BOSTON COMMON ESG IMPACT FUNDS

Racial and Employee Equity

| | • | Home Depot agreed to put policies in place to offer paid sick leave and has committed to make this publicly accessible. |

| | | |

| | • | Verizon agreed to conduct a third-party racial equity audit, publicly release its findings, and provide updates on its progress. |

Digital Human Rights

| | • | Microsoft will commission an independent human rights assessment report. The report is intended to identify, understand, assess, and address actual or potential adverse human rights impacts of Microsoft’s products & services and business relationships on rights-holders. |

Engaging for Net Zero

As part of Boston Common’s commitment under the Net Zero Asset Managers (NZAM) initiative, we will engage key holdings and improve our portfolios’ financed emissions over time. We are prioritizing engaging portfolio companies that have not established targets and may also engage those with insufficient targets that are not aligned with Net Zero or a 1.5°C by 2050 trajectory.

Some initial engagement with portfolio companies include:

| | • | Magna International agreed to set science-based targets and is mapping Scope 3 emissions. As a result of our dialogue, Magna posted its Carbon Disclosure Project report to allow for greater transparency on its approach to climate change. |

| | | |

| | • | Mohawk hired a head of sustainability and is considering forming an executive Environmental, Social and Governance (“ESG”) committee. |

| | | |

| | • | Steel Dynamics has set goals to reduce carbon emissions and increase renewable energy use for its steel mills. |

| | | |

| | • | Orix established an ESG committee at the board level and disclosed four environmental goals, including the reduction of greenhouse gas (GHG) emissions. |

| | | |

| | • | D.S. Smith adopted Net Zero and science-based targets by 2030. In 2022, D.S. Smith will link executive bonuses to ESG metrics. |

| | | |

| | • | Xinyi Solar took a variety of steps to track and report key ESG metrics and increase resource efficiency. Xinyi promotes use of renewables, green procurement principles, and has engaged stakeholders through materiality processes. |

Additional highlights of Boston Common engagement activity over the last six months include:

| | • | Alibaba is developing a company-wide human rights policy, recently established a board-level sustainability committee, and announced new climate targets. |

BOSTON COMMON ESG IMPACT FUNDS

| | • | Unilever will measure its product sales against major government-endorsed Nutrient Profile Models and report on this data annually, a longstanding request of Boston Common through the Access to Nutrition Index. |

| | | |

| | • | Lloyds integrated sustainability objectives into its core business planning and is linking sustainability to variable compensation for leadership. |

| | | |

| | • | Yamaha is on track to meet its sustainable timber sourcing goal this year and plans to set more ambitious targets next year. Yamaha recently joined the 30% Club of Japan and signed the Women’s Empowerment Principles. |

| | | |

| | • | Shimano has taken positive steps in ESG disclosure, supply chain oversight, and board governance reforms. We recently engaged Shimano on prioritizing its focus on gender diversity after we voted against the board in 2021 on this issue. |

BOSTON COMMON ESG IMPACT EMERGING MARKETS FUND

Investment Outlook

As we entered 2022, the economic outlook for Emerging Markets (“EM”) looked promising: improving economic activity as pandemic disruptions eased, solid growth prospects from global trade and business investment, and stabilization of China economic activities. However, with the global supply shock caused by the Russian embargo and disruption of agricultural commodities, the risks of higher inflation and lower global growth have now risen due to soaring input costs and the negative effects on real incomes. Over the past few months, we adjusted the Boston Common ESG Impact Emerging Markets Fund’s (the “EM Fund”) portfolio to reflect growing uncertainty in the outlook for inflation and economic growth by reducing the overweight to Consumer Discretionary stocks while increasing the allocation to Telecommunication Services. The EM Fund continues to be overweight both Information Technology and Industrials, given our expectation of continued global business investment, but we offset this cyclicality with defensive positioning in Consumer Staples and Health Care.

Rising agricultural prices will weigh on food affordability, especially in low-income emerging economies, exacerbating the negative trend in income inequality observed since the pandemic. However, the negative supply shock is not felt evenly across regions. In fact, commodity exporters in Latin America stand to benefit. The EM Fund is overweight to this region and should benefit as investors start to recognize the attractive valuations and economic momentum driven by the commodity tailwinds. We are mindful of the near-term political risks as Brazil goes to the polls in October and a national constitutional rewriting process unfolds in Chile.

China’s focus on supporting its domestic economic growth agenda as well as maintaining integration within the global economy provide little incentive for the direct support - financial or military - of Russia’s war. The recent spike in COVID-19 cases has stalled the economic momentum we have been expecting. The country’s reopening will be a careful and gradual process amidst its prevailing zero-COVID policy, which adds additional risk to the disruption of global supply chains. In the meantime, monetary policy appears accommodative, while recent pronouncements signal a moderation of the previous year’s regulatory tightening stance. For the rest of Asia, we remain constructive on Southeast Asia, especially Indonesia, which is benefiting from rising commodity prices, strong foreign direct investments, and improving economic activities.

Our newer positions over the last six months include two holdings in China. The EM Fund added China Merchants Bank (“CMB”). With a strong presence in retail banking that provides low-cost deposits, a competitive advantage, CMB looks to grow in mortgages, credit cards, and microfinance. Leading Chinese

BOSTON COMMON ESG IMPACT EMERGING MARKETS FUND

auto parts manufacturer Minth Group is a supplier to the global auto makers. The company is transitioning its new materials and surface treatment technologies to include electric vehicles (“EV”) while also developing a battery casing product line.

In addition, the EM Fund added Chilean lithium miner SQM, whose lithium resources in the Atacama Desert are among the lowest cost globally, and Telkom Indonesia, a beneficiary of the expected growth in digital connectivity as only 15% of the country’s households have broadband.

BOSTON COMMON ESG IMPACT EMERGING MARKETS FUND

Management Discussion

Over the past six months ending March 31, 2022, the EM Fund declined -8.32%, in line with the MSCI Emerging Markets Index, which declined -8.20%.

Health Care was the top contributor to relative returns, supported by China TCM, a leading producer of traditional Chinese medicines and PT Kalbe Farma, the Indonesian pharmaceutical manufacturer and retailer. The EM Fund’s holdings in Financials added value as well. Bank holdings in Latin America, including Itau Unibanco in Brazil and Credicorp in Peru, as well as Indonesian microfinance lender Bank Rakyat, Thailand’s Kasikornbank, and China’s Bank of Communication all outperformed. Real Estate also contributed, led by Chinese real estate developer Longfor. Other notable contributors include Korean memory manufacturer SK Hynix, Chilean lithium producer SQM, IT outsourcing beneficiary Infosys, and South African healthcare retailer Clicks Group. The EM Fund has no exposure to conventional Energy, which also helped relative results.

Materials was the largest detractor overall. The EM Fund’s holding in EV battery maker LG Chemical lagged the traditional metals and mining stocks, which lifted the Materials sector especially following the escalation of Russia’s war in Ukraine. Information Technology also detracted from relative returns over the last six months. Chinasoft International, a leading software solutions provider, was pressured by a near-term spike in its cost structure despite experiencing strong revenue growth driven by cloud and AI. Digital payment company PagSeguro came under pressure as rising rates negatively impacted its funding costs. Other notable detractors include Chinese internet companies Alibaba and Trip.com, both of which suffered from regulatory woes. Regulatory concerns around China’s evolving internet policies as well as indirect exposure to Russia weighed on Naspers. We sold out of Yandex NV, the only Russian holding in the portfolio, as the Russian President’s rhetoric raised fears of a potential invasion.

We believe the long-term implications of both the pandemic and Russia’s war in Ukraine will increase the world’s resolve for energy independence and investment in alternative energy, digital transformation, supply chain investment, while supporting the reduction of social inequalities. While the near-term outcome of the geopolitical tension is uncertain, we continue to focus on companies that can provide solutions towards these long-term sustainability challenges. Trading at a 30% discount relative to Developed Markets, a 15-year low, we believe EM equities offer ample opportunities for long-term investors.

BOSTON COMMON ESG IMPACT EMERGING MARKETS FUND

Earnings growth is not representative of the future performance.

Past performance does not guarantee future results.

Must be preceded or accompanied by a current prospectus.

Mutual fund investing involves risk. Principal loss is possible. Investments in foreign securities involve political, economic and currency risks, greater volatility and differences in accounting methods. These risks are greater for investments in emerging markets. The Fund’s sustainability policy could cause it to perform differently compared to similar funds that do not have such a policy. This policy may result in the Fund foregoing opportunities to buy certain securities when it might otherwise be advantageous to do so, or selling securities for reasons when it might be otherwise is advantageous for it to do so. Unexpected events and their aftermaths, such as the spread of deadly diseases; natural, environmental or man-made disasters; financial, political or social disruptions; terrorism and war; and other tragedies or catastrophes, can cause investor fear and panic, which can adversely affect the economies of many companies, sectors, nations, regions and the market in general, in ways that cannot necessarily be foreseen.

Diversification does not assure a profit or protect against loss in a declining market.

Boston Common Asset Management, LLC is the adviser to the Fund, which is distributed by Quasar Distributors, LLC.

The opinions expressed are subject to change, are not guaranteed and should not be considered a recommendation to buy or sell any security.

Fund holdings and sector allocations are subject to change and should not be considered a recommendation to buy or sell any securities. Please refer to the Schedule of Investments included for additional information on securities held within the Boston Common ESG Impact Funds.

The MSCI EM Index is a float-adjusted market capitalization index that is designed to measure equity market performance in 27 global emerging markets.

BOSTON COMMON ESG IMPACT EMERGING MARKETS FUND

COUNTRY ALLOCATION at March 31, 2022 (Unaudited) |

Country | % of Net Assets1 |

| China | | | 29.4 | % | |

| Taiwan | | | 13.3 | % | |

| Republic of Korea | | | 10.5 | % | |

| India | | | 8.6 | % | |

| Brazil | | | 7.1 | % | |

| Indonesia | | | 6.6 | % | |

| South Africa | | | 5.3 | % | |

| Thailand | | | 4.3 | % | |

| Peru | | | 2.7 | % | |

| Hong Kong | | | 2.4 | % | |

| United Kingdom | | | 1.9 | % | |

| Chile | | | 1.7 | % | |

| Colombia | | | 1.3 | % | |

| Mexico | | | 1.0 | % | |

| Hungary | | | 0.9 | % | |

1 | Excludes short-term investments and other assets in excess of liabilities. |

BOSTON COMMON ESG IMPACT EMERGING MARKETS FUND

SCHEDULE OF INVESTMENTS at March 31, 2022 (Unaudited) |

| Shares | | | | Value | |

| COMMON STOCKS – 93.5% | | | |

| | | | |

| Communication Services – 6.7% | | | |

| | 59,410 | | Advanced Info | | | |

| | | | Service PCL | | $ | 416,317 | |

| | 10,426 | | SK Telecom Company | | | | |

| | | | Ltd. – ADR | | | 267,218 | |

| | 874,420 | | Telkom Indonesia | | | | |

| | | | Persero Tbk PT | | | 278,198 | |

| | 7,450 | | Tencent Holdings Ltd. | | | 343,403 | |

| | | | | | | 1,305,136 | |

| Consumer Discretionary – 17.8% | | | | |

| | 2,614,625 | | Ace Hardware | | | | |

| | | | Indonesia Tbk PT | | | 186,596 | |

| | 64,290 | | Alibaba Group | | | | |

| | | | Holding Ltd.1 | | | 877,348 | |

| | 9,620 | | BYD Company | | | | |

| | | | Ltd. – Class H | | | 267,583 | |

| | 2,896 | | Coway Company Ltd. | | | 163,237 | |

| | 24,250 | | Giant Manufacturing | | | | |

| | | | Company Ltd. | | | 219,507 | |

| | 51,233 | | Lojas Renner SA | | | 297,215 | |

| | 8,642 | | MakeMyTrip Ltd.1 | | | 231,865 | |

| | 36,900 | | Midea Group Company | | | | |

| | | | Ltd. – Class A | | | 329,120 | |

| | 57,405 | | Minth Group Ltd. | | | 139,877 | |

| | 3,510 | | Naspers Ltd. – Class N | | | 396,427 | |

| | 16,039 | | Trip.com Group | | | | |

| | | | Ltd. – ADR | | | 370,822 | |

| | | | | | | 3,479,597 | |

| Consumer Staples – 5.9% | | | | |

| | 19,165 | | Clicks Group Ltd. | | | 405,334 | |

| | 54,970 | | Hengan International | | | | |

| | | | Group Company Ltd. | | | 253,289 | |

| | 141,585 | | Kimberly-Clark de | | | | |

| | | | Mexico – Class A | | | 199,671 | |

| | 421 | | LG Household & | | | | |

| | | | Health Care Ltd. | | | 296,979 | |

| | | | | | | 1,155,273 | |

| Financials – 19.0% | | | | |

| | 404,085 | | Bank of | | | | |

| | | | Communications | | | | |

| | | | Company Ltd. – | | | | |

| | | | Class H | | | 289,291 | |

| | 38,750 | | China Merchants | | | | |

| | | | Bank Company | | | | |

| | | | Ltd. – Class H | | | 301,647 | |

| | 3,063 | | Credicorp Ltd. | | | 526,438 | |

| | 13,708 | | HDFC Bank | | | | |

| | | | Ltd. – ADR | | | 840,711 | |

| | 89,670 | | Kasikornbank | | | | |

| | | | PLC – NVDR | | | 432,784 | |

| | 4,731 | | OTP Bank Nyrt | | | 171,631 | |

| | 89,785 | | Ping An Insurance | | | | |

| | | | (Group) Company of | | | | |

| | | | China Ltd. – Class H | | | 627,693 | |

| | 1,650,115 | | PT Bank | | | | |

| | | | Rakyat Indonesia | | | | |

| | | | (Persero) Tbk. | | | 532,962 | |

| | | | | | | 3,723,157 | |

| Health Care – 5.8% | | | | |

| | 675,895 | | China Traditional | | | | |

| | | | Chinese Medicine | | | | |

| | | | Holdings | | | | |

| | | | Company Ltd. | | | 350,963 | |

| | 4,035 | | Dr. Reddy’s | | | | |

| | | | Laboratories | | | | |

| | | | Ltd. – ADR | | | 224,871 | |

| | 2,558,805 | | PT Kalbe Farma Tbk. | | | 286,836 | |

| | 5,786 | | Shenzhen Mindray | | | | |

| | | | Bio-Medical | | | | |

| | | | Electronics Company | | | | |

| | | | Ltd. – Class A1 | | | 279,558 | |

| | | | | | | 1,142,228 | |

| Industrials – 5.3% | | | | |

| | 9,890 | | AirTAC International | | | | |

| | | | Group | | | 317,972 | |

| | 52,219 | | WEG SA | | | 382,782 | |

| | 208,815 | | Weichai Power | | | | |

| | | | Company Ltd. – | | | | |

| | | | Class H | | | 327,296 | |

| | | | | | | 1,028,050 | |

| Information Technology – 24.1% | | | | |

| | 343,750 | | Chinasoft | | | | |

| | | | International Ltd. | | | 281,758 | |

| | 64,280 | | Delta Electronics, Inc. | | | 595,987 | |

| | 15,230 | | Infosys Ltd. – ADR | | | 379,075 | |

| | 14,046 | | Pagseguro Digital | | | | |

| | | | Ltd. – Class A1 | | | 281,622 | |

The accompanying notes are an integral part of these financial statements.

BOSTON COMMON ESG IMPACT EMERGING MARKETS FUND

SCHEDULE OF INVESTMENTS at March 31, 2022 (Unaudited) (Continued) |

| Shares | | | | Value | |

| COMMON STOCKS – 93.5% (Continued) | | | |

| | | | |

| Information Technology – 24.1% (Continued) | | | |

| | 10,511 | | SK Hynix, Inc. | | $ | 1,011,151 | |

| | 14,090 | | Taiwan Semiconductor | | | | |

| | | | Manufacturing | | | | |

| | | | Company Ltd. – ADR | | | 1,469,024 | |

| | 34,815 | | Win Semiconductors | | | | |

| | | | Corp. | | | 320,388 | |

| | 227,780 | | Xinyi Solar | | | | |

| | | | Holdings Ltd. | | | 396,421 | |

| | | | | | | 4,735,426 | |

| Materials – 5.3% | | | | |

| | 747 | | LG Chem Ltd. | | | 326,414 | |

| | 18,944 | | Mondi PLC | | | 376,424 | |

| | 3,957 | | Sociedad Quimica y | | | | |

| | | | Minera de Chile | | | | |

| | | | SA – ADR | | | 338,719 | |

| | | | | | | 1,041,557 | |

| Real Estate – 3.0% | | | | |

| | 236,422 | | Growthpoint Properties | | | | |

| | | | Ltd. – REIT | | | 238,161 | |

| | 69,500 | | Longfor Group | | | | |

| | | | Holdings Ltd. | | | 355,504 | |

| | | | | | | 593,665 | |

| Utilities – 0.6% | | | | |

| | 396,815 | | Beijing Enterprises | | | | |

| | | | Water Group Ltd. | | | 121,404 | |

| | | | | |

| TOTAL COMMON STOCKS | | | | |

| (Cost $20,000,728) | | | 18,325,493 | |

| | | | | |

| PREFERRED STOCKS – 3.5% | | | | |

| | | | | |

| Financials – 3.5% | | | | |

| | 6,031 | | Bancolombia | | | | |

| | | | SA – ADR | | | 257,282 | |

| | 75,656 | | Itau Unibanco Holding | | | | |

| | | | SA – ADR | | | 431,996 | |

| | | | | |

| TOTAL PREFERRED STOCKS | | | | |

| (Cost $604,964) | | | 689,278 | |

| | | | | |

| SHORT-TERM INVESTMENTS – 2.8% | | | | |

| | | | | |

| Money Market Funds – 2.8% | | | | |

| | 553,832 | | First American | | | | |

| | | | Treasury Obligations | | | | |

| | | | Fund – Class X, | | | | |

| | | | 0.222%2 | |

| 553,832 | |

| | | | | |

| TOTAL SHORT-TERM INVESTMENTS | | | | |

| (Cost $553,832) | | | 553,832 | |

| | | | | |

| TOTAL INVESTMENTS – 99.8% | | | | |

| (Cost $21,159,524) | | | 19,568,603 | |

| Other Assets in Excess | | | | |

| of Liabilities – 0.2% | | | 39,152 | |

| NET ASSETS – 100.0% | | $ | 19,607,755 | |

ADR American Depositary Receipt

NVDR Non-Voting Depositary Receipt

REIT Real Estate Investment Trust

1 | Non-income producing security. |

2 | Annualized seven-day effective yield as of March 31, 2022. |

The Global Industry Classification Standard (GICS®) was developed by and/or is the exclusive property of MSCI, Inc. and Standard & Poor Financial Services, LLC (“S&P”). GICS® is a service mark of MSCI and S&P and has been licensed for use by U.S. Bancorp Fund Services, LLC.

The accompanying notes are an integral part of these financial statements.

BOSTON COMMON ESG IMPACT INTERNATIONAL FUND

Investment Outlook

Geopolitical risk will likely remain elevated as Russia’s invasion evolves into a protracted confrontation. Our base case scenario incorporates weaker growth expectations and stronger inflationary pressures, and we have moderated the cyclicality of the Boston Common ESG Impact International Fund (the “International Fund”). We are mindful of spillover risks from Russia’s war, including supply chain disruptions, tighter monetary policy, and social unrest from displaced migrants and rising costs of living. Simultaneously, many of the healthy pre-invasion conditions that were the basis for the International Fund’s pro-growth posture as we exited 2021 are still present: vibrant industrial activity, record low unemployment, and gradual normalization of pandemic-induced disruptions. When the conflict recedes, those prevailing conditions would be favorable for economies and markets.

One clear consequence of the war is an acceleration of Europe’s transition away from Russian fossil fuels. Alternative sources of energy supply will be used to fill immediate gaps, but ultimately producers of energy-efficient equipment, solar and wind power, and electric vehicles will benefit from robust demand within Europe and across the globe. These opportunities support the International Fund’s overweight of eco-efficiency solutions providers, generally categorized within Industrials, Information Technology, and Specialty Chemicals. The International Fund’s relatively large exposure to Financials reflects our expectations for higher interest rates as well as the group’s improving attention to ESG in credit decisions. In the defensive areas, our fundamental, valuation, and ESG research leads us to favor Health Care and Telecommunication over Consumer Staples and Utilities, on a relative basis. With greater conviction in our fundamental view and lower valuations for many of the holdings, we are increasingly confident in the long-term prospects for the International Fund.

Over the past six months, the International Fund has added two German health care companies: biotech company BioNTech and a supplier to the biotech industry, Sartorius Stedim. BioNTech, in partnership with Pfizer, has developed one of the most highly effective COVID-19 vaccines using mRNA technology, transforming not only our global response to this health crisis but the company’s financial position as well. Broader distribution and a booster market, similar to the seasonal flu shot, support long-term fundamentals, while the company’s pipeline adds option value. Sartorius Stedim is a leading manufacturer of bioprocessing equipment and consumables for innovative drug production. Large molecule biotech therapeutics should continue to grow in share of the pharma industry overall, including the commercial application of novel modalities such as cell & gene therapies. After a significant price decline, the stock’s valuation looks compelling.

BOSTON COMMON ESG IMPACT INTERNATIONAL FUND

Other new holdings include two U.K.-based companies: Lloyds Banking Group and Burberry. Lloyds is the largest retail, mortgage, and commercial lender in the U.K. A new CEO is working to boost its wealth management business and contribute to positive ESG momentum with lending that promotes access to finance and green building practices. The U.K. apparel retailer Burberry has improved merchandise and brand appeal, especially for younger consumers. It also has industry-leading environmental practices to reduce carbon emissions and source 100% certified organic cotton.

Several holdings were eliminated over the past few months as valuation was balanced with fundamentals and macroeconomic considerations. Given its high valuation, the Fund sold Dassault Systemes, a French provider of software for mostly industrial markets and also trimmed several holdings in the Financial and Industrial sectors.

BOSTON COMMON ESG IMPACT INTERNATIONAL FUND

Management Discussion

For the six months ended March 31, 2022, the International Fund declined -13.11%, while the MSCI EAFE Index (the “Index”) declined -3.38% over the same time frame.

The supply shock for many commodities and resulting price surges have been a challenging headwind for the International Fund. A demand-driven cycle typically benefits a broad group of industries. Over the past months, however, the International Fund’s Industrial, Information Technology, and Materials stocks declined, while Energy and Mining stocks led the Index. Surging input costs and bottlenecks compounded pressures on many manufacturers. The rise in interest rates along with expectations of slower growth also weighed on some of the International Fund’s holdings with strong long-term growth prospects.

Poor stock selection across several sectors hurt relative returns. In the Consumer area, discretionary holdings such as Japanese manufacturers of bike parts (Shimano) and musical instruments (Yamaha) and adidas weighed down the International Fund’s returns. French auto parts supplier Valeo suffered, despite its extremely low valuation and large order backlogs, as supply chain dislocations curbed auto manufacturing. The International Fund continues to hold these stocks, as they benefit from strong underlying demand that should be realized as soon as short-term problems are resolved. In Consumer Staples, disappointing relative performance was exacerbated by the International Fund’s underweight of the strong food products industry in the Index. The Materials sector was the largest single detractor, as the metals and mining industry in the Index (nearly equal the weight of the Energy sector) gained +37%, while the International Fund’s holding in electric vehicle battery supplier LG Chem declined on concerns about market share shifts. Japanese lens producer Hoya, German biotech BioNTech, and global medtech Philips detracted value in Health Care. From a regional perspective, Europe ex. U.K. was the largest drag on performance, including French payment processor Worldline and Dutch bank ING.

The International Fund’s overweight of the Financials sector added value over the past six months. Australian infrastructure investor Macquarie and Indonesian microfinance lender Bank Rakyat were positively correlated with commodities. Singaporean bank OCBC, French insurer AXA, and Japanese diversified financial services company Orix benefited from solid financial results along with higher interest rates. The International Fund’s holdings in U.K. plumbing distributor Ferguson and power management manufacturer Schneider were positive contributors, and European Pharmaceutical holdings, Novartis, Novo Nordisk, and Roche, were also among the top contributors. Regionally, an underweight to Japan contributed positively.

As we look to the future, we continue to favor opportunities in wind and solar development, electric vehicles, electrification, and green chemicals. Our integrated ESG research process leads us to companies best positioned for the sustainable transition in all sectors.

BOSTON COMMON ESG IMPACT INTERNATIONAL FUND

Earnings growth is not representative of the future performance.

Past performance does not guarantee future results.

Must be preceded or accompanied by a current prospectus.

Mutual fund investing involves risk. Principal loss is possible. Investments in foreign securities involve political, economic and currency risks, greater volatility and differences in accounting methods. The Fund’s sustainability policy could cause it to perform differently compared to similar funds that do not have such a policy. This policy may result in the Fund foregoing opportunities to buy certain securities when it might otherwise be advantageous to do so, or selling securities for reasons when it might be otherwise is advantageous for it to do so. Unexpected events and their aftermaths, such as the spread of deadly diseases; natural, environmental or man-made disasters; financial, political or social disruptions; terrorism and war; and other tragedies or catastrophes, can cause investor fear and panic, which can adversely affect the economies of many companies, sectors, nations, regions and the market in general, in ways that cannot necessarily be foreseen.

Diversification does not assure a profit or protect against loss in a declining market.

Boston Common Asset Management, LLC is the adviser to the Fund, which is distributed by Quasar Distributors, LLC.

The opinions expressed are subject to change, are not guaranteed and should not be considered a recommendation to buy or sell any security. Fund holdings and sector allocations are subject to change and should not be considered a recommendation to buy or sell any securities. Please refer to the Schedule of Investments included for additional information on securities held within the Boston Common ESG Impact Funds.

The MSCI EAFE® Index is a stock market index that is designed to measure the equity market performance of developed markets outside of the U.S. and Canada. Investment grade securities are securities that have been rated as having a relatively low risk of default. It is not possible to invest directly into an index.

BOSTON COMMON ESG IMPACT INTERNATIONAL FUND

COUNTRY ALLOCATION at March 31, 2022 (Unaudited) |

Country | % of Net Assets1 |

| Japan | | | 19.7 | % | |

| United Kingdom | | | 13.4 | % | |

| Germany | | | 11.6 | % | |

| France | | | 8.5 | % | |

| Sweden | | | 6.2 | % | |

| Switzerland | | | 5.7 | % | |

| Australia | | | 4.9 | % | |

| Denmark | | | 4.7 | % | |

| Netherlands | | | 3.5 | % | |

| Finland | | | 2.9 | % | |

| Singapore | | | 2.5 | % | |

| Hong Kong | | | 2.4 | % | |

| China | | | 2.2 | % | |

| Ireland | | | 1.9 | % | |

| Belgium | | | 1.5 | % | |

| Italy | | | 1.5 | % | |

| Indonesia | | | 1.4 | % | |

| Taiwan | | | 1.3 | % | |

| Republic of Korea | | | 1.1 | % | |

| India | | | 1.0 | % | |

1 | Excludes short-term investments and other assets in excess of liabilities. |

BOSTON COMMON ESG IMPACT INTERNATIONAL FUND

SCHEDULE OF INVESTMENTS at March 31, 2022 (Unaudited) |

| Shares | | | | Value | |

| COMMON STOCKS – 97.9% | | | |

| | | | |

| Communication Services – 3.1% | | | |

| | 876,605 | | Deutsche | | | |

| | | | Telekom AG | | $ | 16,326,092 | |

| | | | | |

| Consumer Discretionary – 12.1% | | | | |

| | 38,001 | | Adidas AG | | | 8,855,270 | |

| | 50,375 | | Alibaba Group | | | | |

| | | | Holding | | | | |

| | | | Ltd. – ADR1 | | | 5,480,800 | |

| | 1,323,135 | | Barratt | | | | |

| | | | Developments PLC | | | 9,007,625 | |

| | 190,860 | | Burberry Group PLC | | | 4,166,402 | |

| | 50,900 | | Shimano, Inc. | | | 11,656,526 | |

| | 97,650 | | Sony Group Corp. | | | 10,045,814 | |

| | 322,050 | | Valeo SA | | | 5,948,605 | |

| | 177,040 | | Yamaha Corp. | | | 7,693,464 | |

| | | | | | | 62,854,506 | |

| Consumer Staples – 7.3% | | | | |

| | 305,081 | | Essity AB – Class A | | | 7,199,616 | |

| | 88,526 | | Kerry Group PLC | | | 9,900,967 | |

| | 185,500 | | Shiseido | | | | |

| | | | Company Ltd. | | | 9,369,322 | |

| | 252,795 | | Unilever NV – ADR | | | 11,519,868 | |

| | | | | | | 37,989,773 | |

| Financials – 22.2% | | | | |

| | 744,226 | | AIA Group Ltd. | | | 7,771,123 | |

| | 529,375 | | AXA SA | | | 15,497,181 | |

| | 88,825 | | HDFC Bank | | | | |

| | | | Ltd. – ADR | | | 5,447,637 | |

| | 1,122,494 | | ING Groep NV | | | 11,719,949 | |

| | 16,170,490 | | Lloyds Banking | | | | |

| | | | Group PLC | | | 9,847,273 | |

| | 102,002 | | Macquarie Group Ltd. | | | 15,426,212 | |

| | 720,600 | | ORIX Corp. | | | 14,363,402 | |

| | 1,429,770 | | Oversea-Chinese | | | | |

| | | | Banking Corp Ltd. | | | 12,970,669 | |

| | 23,401,906 | | PT Bank | | | | |

| | | | Rakyat Indonesia | | | | |

| | | | (Persero) Tbk. | | | 7,558,459 | |

| | 309,974 | | Sampo Oyj – Class A | | | 15,146,718 | |

| | | | | | | 115,748,623 | |

| Health Care – 14.6% | | | | |

| | 38,480 | | BioNTech SE – | | | | |

| | | | ADR1 | | | 6,563,149 | |

| | 125,317 | | Dechra | | | | |

| | | | Pharmaceuticals | | | | |

| | | | PLC | | | 6,653,325 | |

| | 85,600 | | Eisai Company Ltd. | | | 3,965,728 | |

| | 97,300 | | Hoya Corp. | | | 11,088,102 | |

| | 205,406 | | Koninklijke | | | | |

| | | | Philips NV | | | 6,263,621 | |

| | 130,170 | | Novartis AG – ADR | | | 11,422,418 | |

| | 85,637 | | Novo Nordisk A/S – | | | | |

| | | | Class B | | | 9,498,526 | |

| | 370,033 | | Roche Holding | | | | |

| | | | Ltd. – ADR | | | 18,283,331 | |

| | 5,804 | | Sartorius Stedim | | | | |

| | | | Biotech | | | 2,376,255 | |

| | | | | | | 76,114,455 | |

| Industrials – 18.7% | | | | |

| | 357,828 | | Assa Abloy AB – | | | | |

| | | | Class B | | | 9,618,268 | |

| | 137,935 | | Atlas Copco AB – | | | | |

| | | | Class B | | | 6,255,289 | |

| | 54,600 | | Daikin Industries | | | 9,915,575 | |

| | 47,079 | | Ferguson PLC | | | 6,378,239 | |

| | 73,270 | | KION Group AG | | | 4,829,042 | |

| | 208,700 | | Kurita Water | | | | |

| | | | Industries Ltd. | | | 7,703,292 | |

| | 225,640 | | Prysmian SpA | | | 7,657,406 | |

| | 188,094 | | Recruit Holdings | | | | |

| | | | Company Ltd. | | | 8,172,129 | |

| | 89,918 | | Schneider Electric SE | | | 15,096,446 | |

| | 39,626 | | Spirax-Sarco | | | | |

| | | | Engineering PLC | | | 6,478,070 | |

| | 227,115 | | Vestas Wind | | | | |

| | | | Systems A/S | | | 6,662,378 | |

| | 483,040 | | Volvo AB – Class B | | | 9,011,280 | |

| | | | | | | 97,777,414 | |

| Information Technology – 8.7% | | | | |

| | 272,818 | | Infineon | | | | |

| | | | Technologies AG | | | 9,229,492 | |

| | 82,183 | | SAP SE – ADR | | | 9,119,026 | |

| | 66,373 | | Taiwan | | | | |

| | | | Semiconductor | | | | |

| | | | Manufacturing | | | | |

| | | | Company Ltd. – | | | | |

| | | | ADR | | | 6,920,049 | |

The accompanying notes are an integral part of these financial statements.

BOSTON COMMON ESG IMPACT INTERNATIONAL FUND

SCHEDULE OF INVESTMENTS at March 31, 2022 (Unaudited) (Continued) |

| Shares | | | | Value | |

| COMMON STOCKS – 97.9% (Continued) | | | |

| | | | |

| Information Technology – 8.7% (Continued) | | | |

| | 246,000 | | TDK Corp. | | $ | 8,874,984 | |

| | 125,618 | | Worldline SA1 | | | 5,451,875 | |

| | 3,408,000 | | Xinyi Solar | | | | |

| | | | Holdings Ltd. | | | 5,931,181 | |

| | | | | | | 45,526,607 | |

| Materials – 5.6% | | | | |

| | 84,490 | | Croda International | | | | |

| | | | PLC | | | 8,691,607 | |

| | 1,668,699 | | DS Smith PLC | | | 7,018,054 | |

| | 13,385 | | LG Chem Ltd. | | | 5,848,798 | |

| | 180,592 | | Umicore SA | | | 7,806,559 | |

| | | | | | | 29,365,018 | |

| Real Estate – 3.9% | | | | |

| | 2,480,000 | | Hang Lung | | | | |

| | | | Properties Ltd. | | | 4,998,630 | |

| | 5,473,370 | | Mirvac Group – | | | | |

| | | | REIT | | | 10,149,056 | |

| | 115,251 | | Vonovia SE | | | 5,371,926 | |

| | | | | | | 20,519,612 | |

| Utilities – 1.7% | | | | |

| | 68,686 | | Orsted A/S | | | 8,597,530 | |

| | | | | |

| TOTAL COMMON STOCKS | | | | |

| (Cost $476,151,087) | | | 510,819,630 | |

| | | | | |

| SHORT-TERM INVESTMENTS – 1.7% | | | | |

| | | | | |

| Money Market Funds – 1.7% | | | | |

| | 8,846,379 | | First American | | | | |

| | | | Treasury Obligations | | | | |

| | | | Fund – Class X, 0.222%2 | | | | |

| | | | |

| 8,846,379 | |

| | | | | |

| TOTAL SHORT-TERM INVESTMENTS | | | | |

| (Cost $8,846,379) | | | 8,846,379 | |

| | | | | |

| TOTAL INVESTMENTS – 99.6% | | | | |

| (Cost $484,997,466) | | | 519,666,009 | |

| Other Assets in Excess | | | | |

| of Liabilities – 0.4% | | | 2,093,957 | |

| NET ASSETS – 100.0% | | $ | 521,759,966 | |

ADR American Depositary Receipt

1 | Non-income producing security. |

2 | Annualized seven-day effective yield as of March 31, 2022. |

The Global Industry Classification Standard (GICS®) was developed by and/or is the exclusive property of MSCI, Inc. and Standard & Poor Financial Services, LLC (“S&P”). GICS® is a service mark of MSCI and S&P and has been licensed for use by U.S. Bancorp Fund Services, LLC.

The accompanying notes are an integral part of these financial statements.

BOSTON COMMON ESG IMPACT U.S. EQUITY FUND

Investment Outlook

Multiple cross currents increased investor unease and led to an overall decline in major global markets over the last few months. In the U.S., growing evidence that inflationary pressures were more structural than transitory offset the economic optimism in place at the end of 2021. In late February, geopolitics intervened, as Russia’s invasion of Ukraine exacerbated inflationary pressures and further dampened the outlook for economic growth.

Markets began the year aware that the Fed’s accommodative monetary policy would begin to reverse. However, the global supply shock caused by punitive Russian economic sanctions, the supply disruption of energy, metals and agricultural commodities, and the follow-on impact of rising costs for corporate profits and consumer wallets, have created more persistent inflation. The Fed will now adopt a more aggressive tightening stance; larger interest-rate increases should follow its first interest-rate hike in March. The yield curve has flattened, highlighting market concerns that the Fed’s actions may not guarantee a “soft landing”.

The U.S. is largely insulated from the most severe consequences of Russia’s invasion – sanctions and a refugee crisis – but domestic growth expectations are now muted. We will continue to prioritize companies with strong balance sheets most exposed to secular growth. For the longer term, favorable pre-invasion expectations underpinning our pro-growth posture in place at the end of 2021 are still present, including vibrant industrial activity, record low unemployment, and continued reversal of pandemic-induced disruptions. With conviction and patience, we remain confident in our holdings.

Portfolio Positioning

The Boston Common ESG Impact U.S. Equity Fund (the “U.S. Equity Fund”) seeks forward-looking companies attuned to the opportunities focused on ESG issues. During periods of market corrections, the U.S. Equity Fund pursues opportunities to buy higher-quality, sustainable companies where stock prices appear unduly depressed. In the most recent period, the U.S. Equity Fund initiated several new positions at attractive price points, including online payment platform PayPal, a dominate player in the payment industry that facilitates online retailing for both large and small enterprises. The U.S. Equity Fund also added Xylem, an industrial with a mission that supports the necessary investment in water infrastructure, and Enphase Energy, a niche, pure play in residential solar growth. Enphase is a leading provider of microinverter systems for the solar industry, helping to support the provision of green, affordable, and reliable energy.

Within the consumer space, the U.S. Equity Fund added global play and entertainment company Hasbro. With its storied past, the company has

BOSTON COMMON ESG IMPACT U.S. EQUITY FUND

successfully transitioned to include many online properties that support strong growth in a digital age. Hasbro’s ESG-related initiatives include plans to eliminate all plastics from new packaging by year end. The U.S. Equity Fund also added to newer holdings McCormick & Co and Sprouts Farmers Markets, both of which should benefit from long-term trends towards healthy eating and at-home cooking.

In late 2021, after a multi-year period of outperformance and multiple expansion, the U.S. Equity Fund reduced its overweight to Information Technology by scaling back software mega-cap holdings such as Alphabet, Microsoft, and Intuit. The U.S. Equity Fund maintains a focus on these innovative software companies that continue to experience very strong business sales momentum, though valuation metrics appear elevated as the U.S. enters a period of a tighter monetary policy.

BOSTON COMMON ESG IMPACT U.S. EQUITY FUND

Management Discussion

Over the past six months ending March 31, 2022, the U.S. Equity Fund declined -0.85%, lagging the S&P 500® Index (the “Index”), which rose +5.92%.

More than half of the underperformance occurred following the Russian invasion during late February. For the period overall, the major detractor from the U.S. Equity Fund’s relative performance was thematic concentration, especially within Consumer Discretionary. With rapidly rising interest rates, housing-related holdings, including homebuilder KB Home and flooring company Mohawk, declined on worries of substantially higher mortgage rates. Apparel manufacturer PVH fell after reducing annual guidance. Within the Financials sector, the overweight in asset gathers, Morgan Stanley and T. Rowe Price, hurt returns, even as futures and option exchange provider CME Group benefited from market volatility. From an allocation perspective, the U.S. Equity Fund’s performance was impacted by the lack of exposure to conventional energy, although this drag was partially offset by its holding in alternative energy, Enphase. The Industrials and Materials sectors also detracted from performance. In Health Care, biotech Biogen sold off amid uncertainty regarding its Alzheimer’s drug, yet medical information company Cerner jumped after receiving a takeover bid from Oracle. Netflix and Citigroup were other positions that held back the U.S. Equity Fund’s performance. The U.S. Equity Fund has since sold its position in Citigroup, but we remain confident in Netflix’s long-term opportunities.

Many of the U.S. Equity Fund’s top and bottom performers over the last six months were in Information Technology, which, overall, detracted from performance. Company-specific issues negatively impacted software companies Adobe Systems and Salesforce. On the positive side, dominant global tech companies Apple and Microsoft continued to perform well on absolute and relative bases. Telecommunication equipment provider Ciena Corporation rallied on very strong earnings. Companies with defensive characteristics were among the U.S. Equity Fund’s better performing holdings, which include pharmaceutical company Vertex, specialty grocer Sprouts Farmers Market, and spice company McCormick. Open-air retail real estate company Kimco was another top performer.

As macro influences play out, we expect to see opportunities to add value through stock selection. Integrating ESG research alongside financial analysis, we continue to lean into companies that seeks to address today’s challenges.

BOSTON COMMON ESG IMPACT U.S. EQUITY FUND

Past performance does not guarantee future results.

Must be preceded or accompanied by a current prospectus.

Mutual fund investing involves risk. Principal loss is possible. Investments in foreign securities involve political, economic and currency risks, greater volatility and differences in accounting methods. The Fund’s sustainability policy could cause it to perform differently compared to similar funds that do not have such a policy. This policy may result in the Fund foregoing opportunities to buy certain securities when it might otherwise be advantageous to do so, or selling securities for reasons when it might be otherwise is advantageous for it to do so. Unexpected events and their aftermaths, such as the spread of deadly diseases; natural, environmental or man-made disasters; financial, political or social disruptions; terrorism and war; and other tragedies or catastrophes, can cause investor fear and panic, which can adversely affect the economies of many companies, sectors, nations, regions and the market in general, in ways that cannot necessarily be foreseen.

Diversification does not assure a profit or protect against loss in a declining market.

Boston Common Asset Management, LLC is the adviser to the Fund, which is distributed by Quasar Distributors, LLC.

The opinions expressed are subject to change, are not guaranteed and should not be considered a recommendation to buy or sell any security.

Fund holdings and sector allocations are subject to change and should not be considered a recommendation to buy or sell any securities. Please refer to the Schedule of Investments included for additional information on securities held within the Boston Common ESG Impact Funds.

The S&P 500® Index is a capitalization weighted index of 500 large capitalization stocks which is designed to measure a broad domestic securities market. It is not possible to invest directly in an index.

BOSTON COMMON ESG IMPACT U.S. EQUITY FUND

SECTOR ALLOCATION at March 31, 2022 (Unaudited) |

Sector | % of Net Assets1 |

| Information Technology | | | 32.2 | % | |

| Consumer Discretionary | | | 12.1 | % | |

| Health Care | | | 11.9 | % | |

| Communication Services | | | 10.8 | % | |

| Financials | | | 9.1 | % | |

| Industrials | | | 7.2 | % | |

| Consumer Staples | | | 6.6 | % | |

| Real Estate | | | 5.0 | % | |

| Materials | | | 1.8 | % | |

| Utilities | | | 1.2 | % | |

1 | Excludes short-term investments and other assets in excess of liabilities. |

BOSTON COMMON ESG IMPACT U.S. EQUITY FUND

SCHEDULE OF INVESTMENTS at March 31, 2022 (Unaudited) |

| Shares | | | | Value | |

| COMMON STOCKS – 97.9% | | | |

| | | | |

| Communication Services – 10.8% | | | |

| | 9 | | Alphabet, Inc. – | | | |

| | | | Class A1 | | $ | 25,032 | |

| | 1,195 | | Alphabet, Inc. – | | | | |

| | | | Class C1 | | | 3,337,623 | |

| | 3,028 | | Netflix, Inc.1 | | | 1,134,258 | |

| | 12,250 | | The New York Times | | | | |

| | | | Company – Class A | | | 561,540 | |

| | 22,755 | | Verizon | | | | |

| | | | Communications, Inc. | | | 1,159,140 | |

| | 50 | | Walt Disney Company | | | 6,858 | |

| | | | | | | 6,224,451 | |

| Consumer Discretionary – 12.1% | | | | |

| | 3,560 | | Advance Auto | | | | |

| | | | Parts, Inc. | | | 736,778 | |

| | 280 | | Booking | | | | |

| | | | Holdings, Inc.1 | | | 657,566 | |

| | 7,120 | | Hasbro, Inc. | | | 583,270 | |

| | 1,585 | | Home Depot, Inc. | | | 474,438 | |

| | 20,385 | | KB Home | | | 660,066 | |

| | 8,645 | | Magna | | | | |

| | | | International, Inc. | | | 555,960 | |

| | 3,900 | | Mohawk | | | | |

| | | | Industries, Inc.1 | | | 484,380 | |

| | 6,525 | | PVH Corp. | | | 499,880 | |

| | 4,416 | | Target Corp. | | | 937,164 | |

| | 13,475 | | TJX Companies, Inc. | | | 816,315 | |

| | 3,297 | | TopBuild Corp.1 | | | 598,043 | |

| | | | | | | 7,003,860 | |

| Consumer Staples – 6.6% | | | | |

| | 7,620 | | Colgate-Palmolive | | | | |

| | | | Company | | | 577,825 | |

| | 2,628 | | The Estee Lauder | | | | |

| | | | Companies, Inc. – | | | | |

| | | | Class A | | | 715,657 | |

| | 9,973 | | McCormick & | | | | |

| | | | Company, Inc. – | | | | |

| | | | NVDR | | | 995,305 | |

| | 12,410 | | Mondelez | | | | |

| | | | International, Inc. – | | | | |

| | | | Class A | | | 779,100 | |

| | 23,710 | | Sprouts Farmers | | | | |

| | | | Market, Inc.1 | | | 758,246 | |

| | | | | | | 3,826,133 | |

| Financials – 9.1% | | | | |

| | 2,501 | | Ameriprise | | | | |

| | | | Financial, Inc. | | | 751,201 | |

| | 2,510 | | Aon PLC – Class A | | | 817,331 | |

| | 175 | | Citigroup, Inc. | | | 9,345 | |

| | 2,565 | | CME Group, Inc. – | | | | |

| | | | Class A | | | 610,111 | |

| | 16,550 | | Morgan Stanley | | | 1,446,470 | |

| | 5,260 | | PNC Financial | | | | |

| | | | Services Group, Inc. | | | 970,207 | |

| | 4,475 | | T. Rowe Price | | | | |

| | | | Group, Inc. | | | 676,575 | |

| | | | | | | 5,281,240 | |

| Health Care – 11.9% | | | | |

| | 5,790 | | Agilent | | | | |

| | | | Technologies, Inc. | | | 766,191 | |

| | 2,338 | | Biogen, Inc.1 | | | 492,383 | |

| | 2,855 | | Danaher Corp. | | | 837,457 | |

| | 21,400 | | Merck & | | | | |

| | | | Company, Inc. | | | 1,755,870 | |

| | 5,345 | | Novo Nordisk | | | | |

| | | | A/S – ADR | | | 593,562 | |

| | 1,498 | | Regeneron | | | | |

| | | | Pharmaceuticals, | | | | |

| | | | Inc.1 | | | 1,046,233 | |

| | 3,607 | | Vertex | | | | |

| | | | Pharmaceuticals, Inc.1 | | | 941,319 | |

| | 1,550 | | Waters Corp.1 | | | 481,104 | |

| | | | | | | 6,914,119 | |

| Industrials – 7.2% | | | | |

| | 18,555 | | Carrier Global Corp. | | | 851,118 | |

| | 3,825 | | Cummins, Inc. | | | 784,546 | |

| | 12,161 | | Emerson Electric | | | | |

| | | | Company | | | 1,192,386 | |

| | 8,226 | | Wabtec Corp. | | | 791,094 | |

| | 6,495 | | Xylem, Inc. | | | 553,764 | |

| | | | | | | 4,172,908 | |

| Information Technology – 32.2% | | | | |

| | 2,450 | | Adobe, Inc.1 | | | 1,116,269 | |

| | 3,720 | | Analog Devices, Inc. | | | 614,469 | |

| | 22,600 | | Apple, Inc. | | | 3,946,186 | |

| | 6,995 | | Applied Materials, Inc. | | | 921,941 | |

| | 14,430 | | Ciena Corp.1 | | | 874,891 | |

| | 3,030 | | Enphase Energy, Inc.1 | | | 611,393 | |

| | 6,890 | | First Solar, Inc.1 | | | 576,969 | |

| | 2,052 | | Intuit, Inc. | | | 986,684 | |

The accompanying notes are an integral part of these financial statements.

BOSTON COMMON ESG IMPACT U.S. EQUITY FUND

SCHEDULE OF INVESTMENTS at March 31, 2022 (Unaudited) (Continued) |

| Shares | | | | Value | |

| COMMON STOCKS – 97.9% (Continued) | | | |

| | | | |

| Information Technology – 32.2% (Continued) | | | |

| | 12,640 | | Micron | | | |

| | | | Technology, Inc. | | $ | 984,530 | |

| | 14,406 | | Microsoft Corp. | | | 4,441,514 | |

| | 5,805 | | PayPal Holdings, Inc.1 | | | 671,348 | |

| | 4,296 | | salesforce.com, Inc.1 | | | 912,127 | |

| | 8,870 | | Visa, Inc. – Class A | | | 1,967,100 | |

| | | | | | | 18,625,421 | |

| Materials – 1.8% | | | | |

| | 4,525 | | AptarGroup, Inc. | | | 531,688 | |

| | 2,802 | | Ecolab, Inc. | | | 494,721 | |

| | | | | | | 1,026,409 | |

| Real Estate – 5.0% | | | | |

| | 22,265 | | Hannon Armstrong | | | | |

| | | | Sustainable | | | | |

| | | | Infrastructure Capital, | | | | |

| | | | Inc. – REIT | | | 1,056,029 | |

| | 33,762 | | Kimco Realty | | | | |

| | | | Corp. – REIT | | | 833,921 | |

| | 26,710 | | Weyerhaeuser | | | | |

| | | | Company – REIT | | | 1,012,309 | |

| | | | | | | 2,902,259 | |

| Utilities – 1.2% | | | | |

| | 4,231 | | American Water | | | | |

| | | | Works Company, Inc. | | | 700,357 | |

| | | | | |

| TOTAL COMMON STOCKS | | | | |

| (Cost $34,673,989) | | | 56,677,157 | |

| | | | | |

| SHORT-TERM INVESTMENTS – 2.1% | | | | |

| | | | | |

| Money Market Funds – 2.1% | | | | |

| | 1,241,136 | | First American | | | | |

| | | | Treasury Obligations | | | | |

| | | | Fund – Class X, 0.222%2 | | | | |

| | | | | | 1,241,136 | |

| | | | | |

| TOTAL SHORT-TERM INVESTMENTS | | | | |

| (Cost $1,241,136) | | | 1,241,136 | |

| | | | | |

| TOTAL INVESTMENTS – 100.0% | | | | |

| (Cost $35,915,125) | | | 57,918,293 | |

| Other Assets in Excess | | | | |

of Liabilities – 0.0%3 | | | 12,221 | |

| NET ASSETS – 100.0% | | $ | 57,930,514 | |

NVDR Non-Voting Depositary Receipt

ADR American Depositary Receipt

1 | Non-income producing security. |

2 | Annualized seven-day effective yield as of March 31, 2022. |

3 | Does not round to 0.1% or (0.1)%, as applicable. |

The Global Industry Classification Standard (GICS®) was developed by and/or is the exclusive property of MSCI, Inc. and Standard & Poor Financial Services, LLC (“S&P”). GICS® is a service mark of MSCI and S&P and has been licensed for use by U.S. Bancorp Fund Services, LLC.

The accompanying notes are an integral part of these financial statements.

BOSTON COMMON ESG IMPACT FUNDS

STATEMENTS OF ASSETS AND LIABILITIES at March 31, 2022 (Unaudited) |

| | | Emerging | | | International | | | U.S. Equity | |

| | | Markets Fund | | | Fund | | | Fund | |

| ASSETS: | | | | | | | | | |

| Investments in securities, at value | | | | | | | | | |

| (cost $21,159,524, $484,997,466 | | | | | | | | | |

| and $35,915,125, respectively) | | $ | 19,568,603 | | | $ | 519,666,009 | | | $ | 57,918,293 | |

| Cash | | | — | | | | 195,454 | | | | — | |

| Receivables: | | | | | | | | | | | | |

| Fund shares sold | | | — | | | | 859,387 | | | | 43,083 | |

| Dividends and interest | | | 60,222 | | | | 2,021,206 | | | | 33,521 | |

| Prepaid expenses | | | 11,010 | | | | 47,556 | | | | 21,349 | |

| Total assets | | | 19,639,835 | | | | 522,789,612 | | | | 58,016,246 | |

| | | | | | | | | | | | | |

| LIABILITIES: | | | | | | | | | | | | |

| Payables: | | | | | | | | | | | | |

| Investment securities purchased | | | 51 | | | | 2,394 | | | | — | |

| Fund shares redeemed | | | — | | | | 592,325 | | | | — | |

| Investment advisory fees, net | | | 1,097 | | | | 312,615 | | | | 31,578 | |

| Fund administration & fund accounting fees | | | — | | | | 43,465 | | | | 10,529 | |

| Audit fees | | | 19,179 | | | | 33,668 | | | | 33,668 | |

| Transfer agent fees | | | 1,166 | | | | 10,364 | | | | 2,925 | |

| Custody fees | | | 7,225 | | | | 22,056 | | | | 920 | |

| Registration fees | | | 1,173 | | | | 1,727 | | | | 240 | |

| Printing and mailing expenses | | | — | | | | 5,849 | | | | 1,193 | |

| Trustee fees | | | — | | | | 3,611 | | | | 2,846 | |

| Miscellaneous expenses | | | — | | | | — | | | | 261 | |

| Chief Compliance Officer fees | | | 1,457 | | | | 1,572 | | | | 1,572 | |

| Legal fees | | | 732 | | | | — | | | | — | |

| Total liabilities | | | 32,080 | | | | 1,029,646 | | | | 85,732 | |

| NET ASSETS | | $ | 19,607,755 | | | $ | 521,759,966 | | | $ | 57,930,514 | |

| | | | | | | | | | | | | |

| COMPONENTS OF NET ASSETS: | | | | | | | | | | | | |

| Paid-in capital | | $ | 21,537,755 | | | $ | 496,021,575 | | | $ | 33,759,340 | |

| Total distributable (accumulated) | | | | | | | | | | | | |

| earnings (losses) | | | (1,930,000 | ) | | | 25,738,391 | | | | 24,171,174 | |

| Net assets | | $ | 19,607,755 | | | $ | 521,759,966 | | | $ | 57,930,514 | |

| Net assets value (unlimited shares authorized): | | | | | | | | | | | | |

| Net assets | | $ | 19,607,755 | | | $ | 521,759,966 | | | $ | 57,930,514 | |

| Shares of beneficial interest | | | | | | | | | | | | |

| issued and outstanding | | | 858,904 | | | | 16,104,496 | | | | 984,326 | |

| Net asset value, offering, and | | | | | | | | | | | | |

| redemption price per share | | $ | 22.83 | | | $ | 32.40 | | | $ | 58.85 | |

The accompanying notes are an integral part of these financial statements.

BOSTON COMMON ESG IMPACT FUNDS

STATEMENTS OF OPERATIONS For the Six Months Ended March 31, 2022 (Unaudited) |

| | | Emerging | | | International | | | U.S. Equity | |

| | | Markets Fund | | | Fund | | | Fund | |

| INVESTMENT INCOME | | | | | | | | | |

| Income: | | | | | | | | | |

| Dividends (net of foreign withholding tax | | | | | | | | | |

| and issuance fees of $20,389, $480,934 | | | | | | | | | |

| and $1,846, respectively) | | $ | 188,647 | | | $ | 3,745,404 | | | $ | 337,295 | |

| Interest | | | 11 | | | | 1,274 | | | | 310 | |

| Total investment income | | | 188,658 | | | | 3,746,678 | | | | 337,605 | |

| | | | | | | | | | | | | |

| Expenses: | | | | | | | | | | | | |

| Investment advisory fees | | | 82,289 | | | | 2,084,875 | | | | 221,247 | |

| Custody fees | | | 24,474 | | | | 68,513 | | | | 2,589 | |

| Fund administration & fund accounting fees | | | 20,132 | | | | 193,746 | | | | 39,670 | |

| Professional fees | | | 15,446 | | | | 15,540 | | | | 15,480 | |

| Registration fees | | | 13,952 | | | | 16,812 | | | | 10,933 | |

| Chief Compliance Officer fees | | | 5,980 | | | | 6,116 | | | | 6,116 | |

| Miscellaneous expense | | | 4,405 | | | | 10,792 | | | | 2,436 | |

| Insurance expenses | | | 3,401 | | | | 3,355 | | | | 2,652 | |

| Trustee fees | | | 1,607 | | | | 12,003 | | | | 8,916 | |

| Transfer agent fees | | | 1,243 | | | | 42,178 | | | | 10,974 | |

| Reports to shareholders | | | 1,125 | | | | 8,523 | | | | 1,106 | |

| Total expenses | | | 174,054 | | | | 2,462,453 | | | | 322,119 | |

| Less: fees waived | | | (78,212 | ) | | | (36,981 | ) | | | (27,122 | ) |

| Net expenses | | | 95,842 | | | | 2,425,472 | | | | 294,997 | |

| Net investment income (loss) | | | 92,816 | | | | 1,321,206 | | | | 42,608 | |

| | | | | | | | | | | | | |

| REALIZED AND UNREALIZED GAIN (LOSS) ON INVESTMENTS AND FOREIGN CURRENCY | | | | | | | | | | | | |

| Net realized gain (loss) on investments | | | | | | | | | | | | |

| and foreign currency | | | (343,706 | ) | | | 660,269 | | | | 2,389,190 | |

| Net change in unrealized | | | | | | | | | | | | |

| appreciation/depreciation on investments | | | | | | | | | | | | |

| and foreign currency | | | (1,591,639 | ) | | | (78,256,303 | ) | | | (2,821,578 | ) |

| Net realized and unrealized gain (loss) | | | | | | | | | | | | |

| on investments and foreign currency | | | (1,935,345 | ) | | | (77,596,034 | ) | | | (432,388 | ) |

| NET INCREASE (DECREASE) IN | | | | | | | | | | | | |

| NET ASSETS RESULTING | | | | | | | | | | | | |

| FROM OPERATIONS | | $ | (1,842,529 | ) | | $ | (76,274,828 | ) | | $ | (389,780 | ) |

The accompanying notes are an integral part of these financial statements.

BOSTON COMMON ESG IMPACT EMERGING MARKETS FUND

| STATEMENTS OF CHANGES IN NET ASSETS |

| | | Six Months Ended | | | | |

| | | March 31, | | | Period Ended | |

| | | 2022 | | | September 30, | |

| | | (Unaudited) | | | 20211 | |

| NET INCREASE (DECREASE) IN NET ASSETS FROM: | | | | | | |

| | | | | | | |

| OPERATIONS | | | | | | |

| Net investment income (loss) | | $ | 92,816 | | | $ | 568 | |

| Net realized gain (loss) on investments | | | | | | | | |

| and foreign currency | | | (343,706 | ) | | | (292 | ) |

| Net change in unrealized appreciation/depreciation | | | | | | | | |

| on investments and foreign currency | | | (1,591,639 | ) | | | 282 | |

| Net increase (decrease) in net assets | | | | | | | | |

| resulting from operations | | | (1,842,529 | ) | | | 558 | |

| | | | | | | | | |

| DISTRIBUTIONS TO SHAREHOLDERS | | | | | | | | |

| Net distributions to shareholders | | | (88,029 | ) | | | — | |

| | | | | | | | | |

| CAPITAL SHARE TRANSACTIONS | | | | | | | | |

Net increase (decrease) from capital share transactions2 | | | 20,787,705 | | | | 750,050 | |

| Total increase (decrease) in net assets | | | 18,857,147 | | | | 750,608 | |

| | | | | | | | | |

| NET ASSETS | | | | | | | | |

| Beginning of period | | | 750,608 | | | | — | |

| End of period | | $ | 19,607,755 | | | $ | 750,608 | |

1 | Emerging Markets Fund commenced operations on September 21, 2021. Information presented is for the period from September 21, 2021 to September 30, 2021. |

2 | A summary of share transactions is as follows: |

| | | | Six Months Ended | | | | | | | |

| | | | March 31, 2022 | | | Period Ended | |

| | | | (Unaudited) | | | September 30, 20211 | |

| | | | Shares | | | Value | | | Shares | | | Value | |

| | Shares sold | | | 828,902 | | | $ | 20,787,705 | | | | 30,002 | | | $ | 750,050 | |

| | Shares issued to holders | | | | | | | | | | | | | | | | |

| | in reinvestment | | | | | | | | | | | | | | | | |

| | of distributions | | | — | | | | — | | | | — | | | | — | |

| | Shares redeemed | | | — | | | | — | | | | — | | | | — | |

| | Net increase (decrease) | | | 828,902 | | | $ | 20,787,705 | | | | 30,002 | | | $ | 750,050 | |

| | Beginning shares | | | 30,002 | | | | | | | | — | | | | | |

| | Ending shares | | | 858,904 | | | | | | | | 30,002 | | | | | |

The accompanying notes are an integral part of these financial statements.

BOSTON COMMON ESG IMPACT INTERNATIONAL FUND

| STATEMENTS OF CHANGES IN NET ASSETS |

| | | Six Months Ended | | | Year Ended | |

| | | March 31, 2022 | | | September 30, | |

| | | (Unaudited) | | | 2021 | |

| NET INCREASE (DECREASE) IN NET ASSETS FROM: | | | | | | |

| | | | | | | |

| OPERATIONS | | | | | | |

| Net investment income (loss) | | $ | 1,321,206 | | | $ | 4,581,376 | |

| Net realized gain (loss) on investments | | | | | | | | |

| and foreign currency | | | 660,269 | | | | 19,368,544 | |

| Net change in unrealized appreciation/depreciation | | | | | | | | |

| on investments and foreign currency | | | (78,256,303 | ) | | | 39,390,751 | |

| Net increase (decrease) in net assets | | | | | | | | |

| resulting from operations | | | (76,274,828 | ) | | | 63,340,671 | |

| | | | | | | | | |

| DISTRIBUTIONS TO SHAREHOLDERS | | | | | | | | |

| Net distributions to shareholders | | | (16,589,883 | ) | | | (2,338,866 | ) |

| | | | | | | | | |

| CAPITAL SHARE TRANSACTIONS | | | | | | | | |

Net increase (decrease) from capital share transactions1 | | | 119,427,613 | | | | 113,669,434 | |

| Total increase (decrease) in net assets | | | 26,562,902 | | | | 174,671,239 | |

| | | | | | | | | |

| NET ASSETS | | | | | | | | |

| Beginning of period/year | | | 495,197,064 | | | | 320,525,825 | |

| End of period/year | | $ | 521,759,966 | | | $ | 495,197,064 | |

1 | A summary of share transactions is as follows: |

| | | | Six Months Ended | | | | | | | |

| | | | March 31, 2022 | | | Year Ended | |

| | | | (Unaudited) | | | September 30, 2021 | |

| | | | Shares | | | Value | | | Shares | | | Value | |

| | Shares sold | | | 4,332,200 | | | $ | 156,330,296 | | | | 4,232,060 | | | $ | 161,052,129 | |

| | Shares issued to holder | | | | | | | | | | | | | | | | |

| | in reinvestment | | | | | | | | | | | | | | | | |

| | of distributions | | | 350,363 | | | | 12,819,778 | | | | 47,872 | | | | 1,758,818 | |

| | Shares redeemed2 | | | (1,420,853 | ) | | | (49,722,461 | ) | | | (1,304,685 | ) | | | (49,141,513 | ) |

| | Net increase (decrease) | | | 3,261,710 | | | $ | 119,427,613 | | | | 2,975,247 | | | $ | 113,669,434 | |

| | Beginning shares | | | 12,842,786 | | | | | | | | 9,867,539 | | | | | |

| | Ending shares | | | 16,104,496 | | | | | | | | 12,842,786 | | | | | |

2 | Net of redemption fees of $3,872 and $2,936, respectively. |

The accompanying notes are an integral part of these financial statements.

BOSTON COMMON ESG IMPACT U.S. EQUITY FUND

| STATEMENTS OF CHANGES IN NET ASSETS |

| | | Six Months Ended | | | Year Ended | |

| | | March 31, 2022 | | | September 30, | |

| | | (Unaudited) | | | 2021 | |

| NET INCREASE (DECREASE) IN NET ASSETS FROM: | | | | | | |

| | | | | | | |

| OPERATIONS | | | | | | |

| Net investment income (loss) | | $ | 42,608 | | | $ | 71,534 | |

| Net realized gain (loss) on investments | | | | | | | | |

| and foreign currency and foreign currency | | | 2,389,190 | | | | 2,596,084 | |

| Net change in unrealized appreciation/depreciation | | | | | | | | |

| of investments and foreign currency | | | (2,821,578 | ) | | | 10,367,665 | |

| Net increase (decrease) in net assets | | | | | | | | |

| resulting from operations | | | (389,780 | ) | | | 13,035,283 | |

| | | | | | | | | |

| DISTRIBUTIONS TO SHAREHOLDERS | | | | | | | | |

| Net distributions to shareholders | | | (2,542,396 | ) | | | (171,071 | ) |

| | | | | | | | | |

| CAPITAL SHARE TRANSACTIONS | | | | | | | | |

| Net increase (decrease) from | | | | | | | | |

capital share transactions1 | | | 3,371,021 | | | | 1,414,574 | |

| Total increase (decrease) in net assets | | | 438,845 | | | $ | 14,278,786 | |

| | | | | | | | | |

| NET ASSETS | | | | | | | | |

| Beginning of period/year | | | 57,491,669 | | | | 43,212,883 | |

| End of period/year | | $ | 57,930,514 | | | $ | 57,491,669 | |

1 | A summary of share transactions is as follows: |

| | | | Six Months Ended | | | | | | | |

| | | | March 31, 2022 | | | Year Ended | |

| | | | (Unaudited) | | | September 30, 2021 | |

| | | | Shares | | | Value | | | Shares | | | Value | |

| | Shares sold | | | 51,130 | | | $ | 3,049,837 | | | | 99,589 | | | $ | 5,716,250 | |

| | Shares issued to holders | | | | | | | | | | | | | | | | |

| | in reinvestment | | | | | | | | | | | | | | | | |

| | of distributions | | | 34,244 | | | | 2,147,805 | | | | 2,600 | | | | 139,573 | |

| | Shares redeemed | | | (28,958 | ) | | | (1,826,621 | ) | | | (75,076 | ) | | | (4,441,249 | ) |

| | Net increase (decrease) | | | 56,416 | | | $ | 3,371,021 | | | | 27,113 | | | $ | 1,414,574 | |

| | Beginning shares | | | 927,910 | | | | | | | | 900,797 | | | | | |

| | Ending shares | | | 984,326 | | | | | | | | 927,910 | | | | | |

The accompanying notes are an integral part of these financial statements.

BOSTON COMMON ESG IMPACT EMERGING MARKETS FUND

FINANCIAL HIGHLIGHTS For a capital share outstanding throughout each period |

| | | Six Months Ended | | | | |

| | | March 31, | | | Period Ended | |

| | | 2022 | | | September 30, | |

| | | (Unaudited) | | | 20211 | |

| Net asset value, beginning of period | | $ | 25.02 | | | $ | 25.00 | |

| | | | | | | | | |

| INCOME (LOSS) FROM INVESTMENT OPERATIONS: | | | | | | | | |

Net investment income (loss)2 | | | 0.12 | | | | 0.02 | |

| Net realized and unrealized gain (loss) on investments | | | (2.91 | ) | | | — | |

| Total from operations | | | (2.79 | ) | | | 0.02 | |

| | | | | | | | | |

| LESS DISTRIBUTIONS: | | | | | | | | |

| Distributions from net investment income | | | — | | | | — | |

| Distributions from net realized gain | | | 0.60 | | | | — | |

| Total distributions | | | 0.60 | | | | — | |

| Net asset value, end of period | | $ | 22.83 | | | $ | 25.02 | |

| Total return | | | (8.32 | )%3 | | | 0.08 | %3 |

| | | | | | | | | |

| SUPPLEMENTAL DATA: | | | | | | | | |

| Net assets, end of period (000’s) | | $ | 19,608 | | | $ | 751 | |

| Expenses before fees waived | | | 1.80 | %4 | | | 63.49 | %4 |

| Expenses after fees waived | | | 0.99 | %4 | | | 0.99 | %4 |

| Net investment income before fees waived | | | 0.15 | %4 | | | (59.75 | )%4 |

| Net investment income after fees waived | | | 0.96 | %4 | | | 2.75 | %4 |

| Portfolio turnover rate | | | 0 | %3 | | | 0 | %3 |

1 | Emerging Markets Fund commenced operations on September 21, 2021. Information presented is for the period from September 21, 2021 to September 30, 2021. |

2 | Calculated based on average shares outstanding during the period. |

3 | Not Annualized. |

4 | Annualized. |

The accompanying notes are an integral part of these financial statements.

BOSTON COMMON ESG IMPACT INTERNATIONAL FUND

FINANCIAL HIGHLIGHTS For a capital share outstanding throughout each period/year |

| | | Six Months | | | | | | | | | | | | | | | | |

| | | Ended | | | | | | | | | | | | | | | | |

| | | March 31, | | | | | | | | | | | | | | | | |

| | | 2022 | | | Year Ended September 30, | |

| | | (Unaudited) | | | 2021 | | | 2020 | | | 2019 | | | 2018 | | | 2017 | |

| Net asset value, beginning | | | | | | | | | | | | | | | | | | |

| of period/year | | $ | 38.56 | | | $ | 32.48 | | | $ | 29.32 | | | $ | 30.51 | | | $ | 30.14 | | | $ | 26.12 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| INCOME (LOSS) FROM INVESTMENT OPERATIONS: | | | | | | | | | | | | | | | | | |

| Net investment | | | | | | | | | | | | | | | | | | | | | | | | |

income (loss)1 | | | 0.09 | | | | 0.40 | | | | 0.23 | | | | 0.59 | | | | 0.42 | | | | 0.35 | |

| Net realized and unrealized | | | | | | | | | | | | | | | | | | | | | | | | |

| gain (loss) on investments | | | (6.20 | ) | | | 5.92 | | | | 3.64 | | | | (1.41 | ) | | | 0.31 | | | | 4.07 | |

| Total from operations | | | (6.11 | ) | | | 6.32 | | | | 3.87 | | | | (0.82 | ) | | | 0.73 | | | | 4.42 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| LESS DISTRIBUTIONS: | | | | | | | | | | | | | | | | | | | | | | | | |

| Distributions from net | | | | | | | | | | | | | | | | | | | | | | | | |

| investment income | | | (0.65 | ) | | | (0.24 | ) | | | (0.71 | ) | | | (0.37 | ) | | | (0.36 | ) | | | (0.40 | ) |

| Distributions from | | | | | | | | | | | | | | | | | | | | | | | | |

| net realized gain | | | 0.60 | | | | — | | | | — | | | | — | | | | — | | | | — | |

| Total distributions | | | (0.05 | ) | | | (0.24 | ) | | | (0.71 | ) | | | (0.37 | ) | | | (0.36 | ) | | | (0.40 | ) |

| Paid-in capital from | | | | | | | | | | | | | | | | | | | | | | | | |

| redemption fees | | | 0.00 | 2 | | | 0.00 | 2 | | | 0.00 | 2 | | | 0.00 | 2 | | | 0.00 | 2 | | | 0.00 | 2 |

| Net asset value, | | | | | | | | | | | | | | | | | | | | | | | | |

| end of period/year | | $ | 32.40 | | | $ | 38.56 | | | $ | 32.48 | | | $ | 29.32 | | | $ | 30.51 | | | $ | 30.14 | |

| Total return | | | (13.11 | )%3 | | | 19.48 | % | | | 13.29 | % | | | (2.53 | )% | | | 2.43 | % | | | 17.26 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| SUPPLEMENTAL DATA: | | | | | | | | | | | | | | | | | | | | | | | | |

| Net assets, end of | | | | | | | | | | | | | | | | | | | | | | | | |

| period/year (000’s) | | $ | 521,760 | | | $ | 495,197 | | | $ | 320,526 | | | $ | 234,114 | | | $ | 250,694 | | | $ | 219,225 | |

| Expenses before | | | | | | | | | | | | | | | | | | | | | | | | |

| fees waived | | | 0.96 | %4 | | | 0.97 | % | | | 1.00 | % | | | 1.00 | % | | | 1.04 | % | | | 1.13 | % |

| Expenses after | | | | | | | | | | | | | | | | | | | | | | | | |

| fees waived | | | 0.95 | %4,5 | | | 0.97 | % | | | 1.00 | % | | | 1.00 | % | | | 1.04 | % | | | 1.13 | % |

| Net investment income | | | | | | | | | | | | | | | | | | | | | | | | |

| before fees waived | | | 0.49 | %4 | | | 1.07 | % | | | 0.75 | % | | | 2.09 | % | | | 1.38 | % | | | 1.28 | % |

| Net investment income | | | | | | | | | | | | | | | | | | | | | | | | |

| after fees waived | | | 0.51 | %4 | | | 1.07 | % | | | 0.75 | % | | | 2.09 | % | | | 1.38 | % | | | 1.28 | % |

| Portfolio turnover rate | | | 24 | %3 | | | 24 | % | | | 33 | % | | | 32 | % | | | 26 | % | | | 33 | % |

1 | Calculated based on average shares outstanding during the period. |

2 | Less than $0.01 or $(0.01) per share, as applicable. |

3 | Not Annualized. |

4 | Annualized. |