UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number (811-05037)

Professionally Managed Portfolios

(Exact name of registrant as specified in charter)

615 East Michigan Street

Milwaukee, WI 53202

(Address of principal executive offices) (Zip code)

Jason Hadler

Professionally Managed Portfolios

c/o U.S. Bank Global Fund Services

777 E. Wisconsin Avenue

Milwaukee, WI 53202

(Name and address of agent for service)

(414) 516-1523

Registrant's telephone number, including area code

Date of fiscal year end: September 30

Date of reporting period: March 31, 2023

Item 1. Reports to Stockholders.

BOSTON COMMON

ESG IMPACT EMERGING MARKETS FUND

(BCEMX)

BOSTON COMMON

ESG IMPACT INTERNATIONAL FUND

(BCAIX)

BOSTON COMMON

ESG IMPACT U.S. EQUITY FUND

(BCAMX)

SEMI-ANNUAL REPORT

March 31, 2023

Table of Contents

| Boston Common ESG Impact Emerging Markets Fund | | |

| Investment Outlook | | | 5 |

| Management’s Discussion of Fund Performance | | | 7 |

| Country Allocation | | | 9 |

| Schedule of Investments | | | 10 |

| Boston Common ESG Impact International Fund | | | |

| Investment Outlook | | | 12 |

| Management’s Discussion of Fund Performance | | | 13 |

| Country Allocation | | | 15 |

| Schedule of Investments | | | 16 |

| Boston Common ESG Impact U.S. Equity Fund | | | |

| Investment Outlook | | | 18 |

| Management’s Discussion of Fund Performance | | | 19 |

| Sector Allocation | | | 21 |

| Schedule of Investments | | | 22 |

| Statements of Assets and Liabilities | | | 24 |

| Statements of Operations | | | 25 |

| Statements of Changes in Net Assets | | | 26 |

| Financial Highlights | | | 29 |

| Notes to Financial Statements | | | 32 |

| Expense Examples | | | 43 |

| Additional Information | | | 45 |

| Privacy Notice | Inside Back Cover |

BOSTON COMMON ESG IMPACT FUNDS

Mutual Fund Engagement Highlights

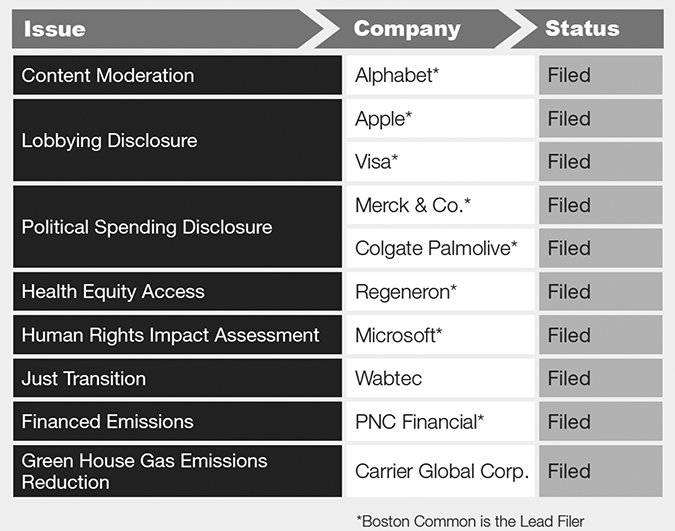

2023 Proxy Season Shareholder Resolutions Filed

2023 US Shareholder Resolution Wins

Adopting a Science-based Target (SBTi) Resolution (Co-Filer)

Carrier – We withdrew our resolution given a public commitment to SBTi and expand its Scope 3 emissions by the end of 20231. We will continue to engage on Scope 3 emissions implementation and refrigerants.

Lobbying Disclosure Resolution (Lead Filer)

Netflix – We received in 2022 a majority vote (60.4%) at Netflix on lobbying. Following this vote, we re-engaged Netflix who adopted enhanced disclosure on its lobbying oversight and process including globe scope, board oversight, alignment, escalation process and trade associations. We recommended the company expand in future disclosure on its public policy positions and alignment due diligence implementation.

_____________

1 | Scope 3 emissions are the result of activities from assets not owned or controlled by the reporting organization, but that the organization indirectly affects in its value chain. |

BOSTON COMMON ESG IMPACT FUNDS

Just Transition Resolution (Co-filer)

Wabtec – We withdrew our resolution given agreement to provide enhanced disclosure in 2023 on worker and communities in its transition plans, stakeholder engagement and workforce composition. Our ongoing focus will be Wabtec’s 2023 disclosure and guidance of the use of transition disclosure frameworks and oversight in 2024.

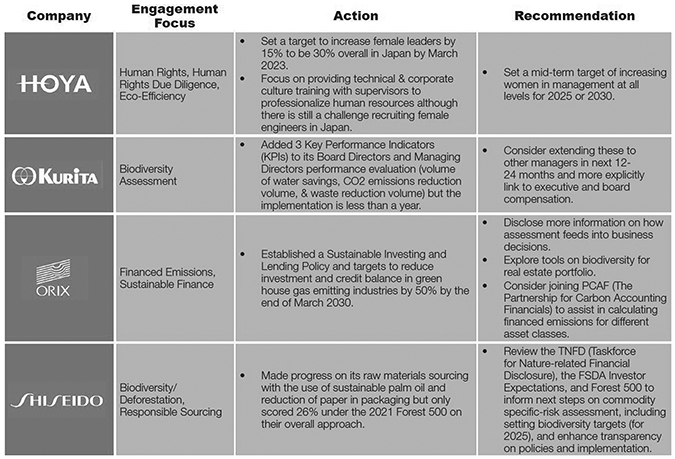

Activating Engagement in Asia

In the autumn of 2022, Lauren Compere, Head of Stewardship & Engagement, had the opportunity to travel to Asia for the first time in three years, visiting Japan and South Korea to continue Boston Common Asset Management’s (the “Adviser” or “Boston Common”) ongoing shareowner engagement work in person.

Boston Common’s engagement approach, conducted mostly in a virtual setting since the start of the pandemic, values in-person company meetings for providing a detailed understanding of corporate culture, sustainability governance, Environmental, Social, and Governance (ESG) momentum, the regulatory environment, and the impact of societal expectations.

To support our sustained dialogue, we used Japan’s Corporate Governance Code Revisions, a new classification of issuers from the Tokyo Stock Exchange which included its new PRIME listing and required Task Force on Climate-Related Financial Disclosure (TCFD). We focused on evolving global investors expectations like Boston Common’s 2022 Prioritizing Gender Investor Guide, the Finance Sector Deforestation Action (FSDA), issue-area benchmarks (i.e., Corporate Human Rights Benchmark, World Benchmarking Alliance (WBA) Digital Inclusion, Global Canopy Forest 500), and leveraging regional or global sector best practices to encourage companies to take needed steps to advance sustainability performance and disclosure.

Building long-term engagement relationships is pivotal to our global shareowner engagement approach. Meeting with companies in person allows us to build relationships and provide insights on knowledge or awareness gaps around emerging global investor expectations.

Across both markets, worker expectations and COVID impacts forced innovation on non-traditional work with companies implementing more flexible, hybrid, and remote work. Younger workers are demanding more work/life balance, and government initiatives in Japan encouraging men to take parental leave are having an impact.

In Japan, there are new regulations supporting governance of sustainability and advancing women in the workplace. While in Korea, regulatory drivers were less of a factor in corporate progress on sustainability issues except the required human rights due diligence related to supply chains. Korean and Japanese companies are, in many cases, subject to EU regulation and will see increased

BOSTON COMMON ESG IMPACT FUNDS

pressure as EU Corporate Sustainability Due Diligence Disclosure (CSDDD) comes into place in 2024, bringing with it due diligence requirements for both climate change and human rights.

Below is a summary of select company engagement:

WBA Digital Inclusion/Ethical AI

Boston Common and Fidelity International are the lead investors for the WBA Digital Inclusion Collective Impact Coalition focused engaging companies to adopt ethical AI policies. In March 2023, WBA released a new benchmark report which highlighted 44 out of 200 companies that had been assessed had adopted ethical AI policies.

We actively engaged SK Telecom and Tencent in 2022 and each adopted an ethical AI policy. We suggested that SK Hynix follow their model. We had substantive dialogue with Alibaba, SK Hynix, and Verizon and will continue to push for progress. Alibaba was the most improved company in the 2022 WBA benchmark given improved transparency in their new ESG report, engagement with WBA (one of Boston Common’s core engagement asks), and initiatives to provide online and offline classes on digital literacy.

BOSTON COMMON ESG IMPACT FUNDS

Deforestation & Biodiversity (Finance Sector Deforestation Action)

In 2021 Boston Common joined the Finance Sector Deforestation Action and in 2022 helped to develop new investor expectations for palm oil, soy, paper and pulp, and cattle-related deforestation. Some recent engagements include:

Essity – Wood pulp is 100% Forest Stewardship Council (FSC) or Programme for the Endorsement of Forest Certification (PEFC) certified primarily from either the Nordic countries or Brazil but never from Indonesia or the US as they cannot get 100% certified fiber. We recommended that Essity review and adopt Finance Sector Deforestation Action (FSDA) on investor expectations to ensure full traceability and integration of human rights and Free, Prior, and Informed Consent (FPIC).

Mondi – Zero Deforestation commitment for its wood fiber with a regional approach to ensure this is done (Third party certification in Brazil given sourcing from plantations versus community-centric approach in South Africa where they own the land). We recommended that Mondi adopt a more explicit integration of human rights and FPIC as part of their efforts.

BOSTON COMMON ESG IMPACT EMERGING MARKETS FUND

Investment Outlook

The rapid interest rate increases over the past year have unveiled vulnerabilities in the financial markets, as seen in the recent bank upheaval in the US and Europe. Emerging Market (EM) banks, while not immune, should be well positioned to weather the turmoil given their overall robust capitalization, better asset-liability matches, and long-term growth potential from their large unbanked populations. While financial stability in most Emerging Markets looks relatively sound, we are actively monitoring contagion risks to capital flows and growth. China’s economic recovery should be a positive development, providing tailwinds for global growth and EM assets.

Steady improvement in China’s service sector should drive the country’s economic momentum, while green shoots in housing activity are important for consumer confidence and spending. South Korea and Taiwan are likely to slow further, as external demand weakens for their globally dominant tech industries. Domestic demand remains resilient in South and Southeast Asian economies, key beneficiaries of a recovering China. Given our more constructive outlook, we have further increased the allocation to Asia while reducing the Europe, the Middle East and Africa (EMEA) overweight.

We used the market volatility during the period to increase allocation to what we believe are high-quality growth companies trading at a discount while exiting companies with more challenged outlooks. Among the new purchases were Raia Drogasil, Mercadolibre and BDO Unibank. Raia Drogasil is Brazil’s largest pharmacy operator with about 2,500 stores in a fragmented industry. We believe an aging population and increasing demands for access to healthcare should continue to support secular growth. Raia has the potential to gain market share by expanding locations, widening product selection, and enhancing ecommerce penetration. Profitability should also improve thanks to the efficiency gains. Mercadolibre offers its customers and small businesses throughout Latin America a robust ecommerce platform for online shopping, payment processing, and advertising services. With broadening product assortment, an expanding logistics network, and a strong ecommerce ecosystem, we view Mercadolibre as a key beneficiary of Latin America’s economic potential and rising digital penetration. The recent market sell-off provided a more attractive entry point for this fast-growing company with strong ESG momentum in areas such as financial inclusion and data security practices. BDO Unibank is the largest bank in the Philippines. We expect BDO to benefit from rising interest rates and improving credit quality, while low credit penetration and a young population should be sustainable long-term growth drivers.

BOSTON COMMON ESG IMPACT EMERGING MARKETS FUND

Among the portfolio exits during the period was PagSeguro in Brazil on lowered conviction and less earning visibility within a prolonged high interest rate environment. Another sale was Credicorp, a bank holding in Peru. The stock’s outperformance amid a worsening political environment and earnings headwind was a catalyst. We sold Chilean lithium producer SQM after its strong rally. We remain bullish on long-term EV demand and deployed the proceeds to names in the EV supply chain with better risk-reward prospects. We also sold PT Ace Hardware of Indonesia on concerns about weaker-than-expected demand and increased industry competition.

BOSTON COMMON ESG IMPACT EMERGING MARKETS FUND

Management Discussion

Over the past six months ending March 31, 2023, the Boston Common ESG Impact Emerging Markets Fund (the “EM Fund”) gained +17.49%, strongly outperforming the MSCI Emerging Markets Index2 (the “Index”), which returned +14.04%.

Financials was the top contributor to relative returns. Easing Covid restrictions in China boosted insurance giant Ping An, while OTP Bank in Hungary rebounded on better earnings. Stock selection in Industrials was another positive driver, as Taiwan’s industrial automation company Airtac Int’l and China’s leading engine manufacturer Weichai, both benefited from recovering demand in China. Consumer Discretionary also contributed to relative return, helped by South Africa based media company Naspers and China’s Trip.com, both beneficiaries of China’s reopening. Alibaba, which announced a corporate split likely to enhance shareholder value, also contributed.

Communication Services was the largest detractor overall. Telkom Indonesia declined on weaker-than-expected results and negative sentiment around its failed (but immaterial) investment in GoTo. Investor concerns around competitive pressures for India’s Bharti Airtel weighed on the stock’s relative performance. Technology also detracted from relative returns during the period. Brazilian digital payment provider PagSeguro suffered from higher financial expenses in a high interest rate environment. Chinasoft Int’l declined on weak near-term revenue guidance, as management maintains its focus on profitability and cashflow management. Healthcare was another drag on relative results. Brazilian healthcare provider Hapvida declined sharply on post-merger integration concerns.

The portfolio remains balanced with an overweight in defensive Staples and Healthcare, against an overweight in economically sensitive sectors such as Consumer Discretionary and Industrials. We believe several disruptive forces, such as the shift in global supply chains, sustainable consumption, and climate transition technologies, will drive the post-pandemic recovery in EM. In all sectors, the portfolio focuses on high-quality companies with strong ESG and financial attributes that can innovate and adapt to these opportunities.

_____________

2 | The MSCI EM Index is a float-adjusted market capitalization index that is designed to measure equity market performance in 27 global emerging markets. It is not possible to invest directly in an index. |

BOSTON COMMON ESG IMPACT EMERGING MARKETS FUND

Earnings growth is not representative of the future performance.

Past performance does not guarantee future results.

Must be preceded or accompanied by a current prospectus.

Mutual fund investing involves risk. Principal loss is possible. Investments in foreign securities involve political, economic and currency risks, greater volatility and differences in accounting methods. These risks are greater for investments in emerging markets. The Fund’s sustainability policy could cause it to perform differently compared to similar funds that do not have such a policy. This policy may result in the Fund foregoing opportunities to buy certain securities when it might otherwise be advantageous to do so, or selling securities for reasons when it might be otherwise is advantageous for it to do so. Unexpected events and their aftermaths, such as the spread of deadly diseases; natural, environmental or man-made disasters; financial, political or social disruptions; terrorism and war; and other tragedies or catastrophes, can cause investor fear and panic, which can adversely affect the economies of many companies, sectors, nations, regions and the market in general, in ways that cannot necessarily be foreseen.

Diversification does not assure a profit or protect against loss in a declining market.

Boston Common Asset Management, LLC is the adviser to the Fund, which is distributed by Quasar Distributors, LLC.

The opinions expressed are subject to change, are not guaranteed and should not be considered a recommendation to buy or sell any security.

Fund holdings and sector allocations are subject to change and should not be considered a recommendation to buy or sell any securities. Please refer to the Schedule of Investments included for additional information on securities held within the Boston Common ESG Impact Funds.

BOSTON COMMON ESG IMPACT EMERGING MARKETS FUND

| COUNTRY ALLOCATION at March 31, 2023 (Unaudited) |

Country | | % of Net Assets1 |

| China | | | 30.5 | % |

| India | | | 11.4 | % |

| Taiwan | | | 11.3 | % |

| Republic of Korea | | | 10.6 | % |

| Brazil | | | 6.9 | % |

| South Africa | | | 6.4 | % |

| Indonesia | | | 5.9 | % |

| Thailand | | | 3.6 | % |

| Mexico | | | 2.2 | % |

| Hong Kong | | | 1.7 | % |

| United States | | | 1.5 | % |

| United Kingdom | | | 1.5 | % |

| Colombia | | | 1.2 | % |

| Poland | | | 1.2 | % |

| Philippines | | | 1.1 | % |

| Hungary | | | 0.8 | % |

1 | Excludes short-term investments and liabilities in excess of other assets. |

BOSTON COMMON ESG IMPACT EMERGING MARKETS FUND

| SCHEDULE OF INVESTMENTS at March 31, 2023 (Unaudited) |

| Shares | | | | Value | |

| COMMON STOCKS – 95.0% | |

| | |

| Communication Services – 8.5% | |

| | 102,919 | | Advanced Info | | | |

| | | | Service PLC | | $ | 654,625 | |

| | 70,050 | | Bharti Airtel Ltd. | | | 638,821 | |

| | 21,788 | | SK Telecom | | | | |

| | | | Company Ltd. – ADR | | | 446,872 | |

| | 2,003,877 | | Telkom Indonesia | | | | |

| | | | Persero Tbk PT | | | 544,139 | |

| | 8,035 | | Tencent Holdings Ltd. | | | 392,665 | |

| | | | | | | 2,677,122 | |

| | |

| Consumer Discretionary – 20.0% | |

| | 121,635 | | Alibaba Group | | | | |

| | | | Holding Ltd.1 | | | 1,540,567 | |

| | 18,554 | | BYD Company | | | | |

| | | | Ltd. – Class H | | | 545,787 | |

| | 4,476 | | Coway Company Ltd. | | | 180,650 | |

| | 28,875 | | Giant Manufacturing | | | | |

| | | | Company Ltd. | | | 167,874 | |

| | 125,797 | | Lojas Renner SA | | | 412,006 | |

| | 371 | | MercadoLibre, Inc. | | | 489,000 | |

| | 71,900 | | Midea Group | | | | |

| | | | Company Ltd. – | | | | |

| | | | Class A | | | 562,600 | |

| | 138,320 | | Minth Group Ltd. | | | 419,825 | |

| | 6,809 | | Naspers Ltd. – Class N | | | 1,261,668 | |

| | 19,679 | | Trip.com Group | | | | |

| | | | Ltd. – ADR | | | 741,308 | |

| | | | | | | 6,321,285 | |

| | |

| Consumer Staples – 9.0% | |

| | 33,841 | | Clicks Group Ltd. | | | 486,811 | |

| | 4,174 | | Dino Polska SA1 | | | 379,126 | |

| | 53,929 | | Hengan International | | | | |

| | | | Group Company Ltd. | | | 249,802 | |

| | 323,773 | | Kimberly-Clark de | | | | |

| | | | Mexico – Class A | | | 682,582 | |

| | 1,338 | | LG Household & | | | | |

| | | | Health Care Ltd. | | | 618,154 | |

| | 87,385 | | Raia Drogasil SA | | | 420,507 | |

| | | | | | | 2,836,982 | |

| | |

| Financials – 17.2% | |

| | 56,934 | | Axis Bank Ltd. | | | 596,484 | |

| | 151,579 | | BDO Unibank, Inc. | | | 359,497 | |

| | 141,616 | | China Merchants | | | | |

| | | | Bank Company | | | | |

| | | | Ltd. – Class H | | | 719,129 | |

| | 18,941 | | HDFC Bank | | | | |

| | | | Ltd. – ADR | | | 1,262,796 | |

| | 122,450 | | Kasikornbank | | | | |

| | | | PLC – NVDR | | | 475,003 | |

| | 9,271 | | OTP Bank Nyrt | | | 264,682 | |

| | 138,848 | | Ping An Insurance | | | | |

| | | | (Group) Company | | | | |

| | | | of China Ltd. – | | | | |

| | | | Class H | | | 898,237 | |

| | 2,759,331 | | PT Bank | | | | |

| | | | Rakyat Indonesia | | | | |

| | | | (Persero) Tbk. | | | 874,302 | |

| | | | | | | 5,450,130 | |

| | |

| Health Care – 6.6% | |

| | 114,987 | | Biocon Ltd. | | | 289,233 | |

| | 1,044,664 | | China Traditional | | | | |

| | | | Chinese Medicine | | | | |

| | | | Holdings | | | | |

| | | | Company Ltd. | | | 547,314 | |

| | 260,356 | | Hapvida Participacoes | | | | |

| | | | e Investimentos SA | | | 135,098 | |

| | 3,309,634 | | PT Kalbe Farma Tbk. | | | 463,848 | |

| | 14,286 | | Shenzhen Mindray | | | | |

| | | | Bio-Medical | | | | |

| | | | Electronics Company | | | | |

| | | | Ltd. – Class A | | | 648,187 | |

| | | | | | | 2,083,680 | |

| | |

| Industrials – 8.9% | |

| | 19,434 | | AirTAC International | | | | |

| | | | Group | | | 760,052 | |

| | 47,325 | | Shenzhen Inovance | | | | |

| | | | Technology Company | | | | |

| | | | Ltd. – Class A | | | 484,827 | |

| | 24,204 | | Voltas Ltd. | | | 241,758 | |

| | 89,760 | | WEG SA | | | 717,237 | |

| | 391,376 | | Weichai Power | | | | |

| | | | Company Ltd. – | | | | |

| | | | Class H | | | 628,014 | |

| | | | | | | 2,831,888 | |

| | |

| Information Technology – 19.7% | |

| | 606,744 | | Chinasoft | | | | |

| | | | International Ltd. | | | 384,385 | |

| | 97,306 | | Delta Electronics, Inc. | | | 965,435 | |

| | 32,708 | | Infosys Ltd. – ADR | | | 570,427 | |

| | 21,868 | | SK Hynix, Inc. | | | 1,496,536 | |

The accompanying notes are an integral part of these financial statements.

BOSTON COMMON ESG IMPACT EMERGING MARKETS FUND

| SCHEDULE OF INVESTMENTS at March 31, 2023 (Unaudited) (Continued) |

| Shares | | | | Value | |

| | |

| COMMON STOCKS – 95.0% (Continued) | |

| | |

| Information Technology – 19.7% (Continued) | |

| | 21,778 | | Taiwan Semiconductor | | | |

| | | | Manufacturing | | | |

| | | | Company | | | |

| | | | Ltd. – ADR | | $ | 2,025,789 | |

| | 71,223 | | Win Semiconductors | | | | |

| | | | Corp. | | | 429,270 | |

| | 290,606 | | Xinyi Solar | | | | |

| | | | Holdings Ltd. | | | 348,378 | |

| | | | | | | 6,220,220 | |

| | |

| Materials – 3.3% | |

| | 1,086 | | LG Chem Ltd. | | | 596,425 | |

| | 28,861 | | Mondi PLC | | | 457,685 | |

| | | | | | | 1,054,110 | |

| | |

| Real Estate – 1.8% | |

| | 365,435 | | Growthpoint Properties | | | | |

| | | | Ltd. – REIT | | | 268,424 | |

| | 113,105 | | Longfor Group | | | | |

| | | | Holdings Ltd. | | | 318,998 | |

| | | | | | | 587,422 | |

| | |

| TOTAL COMMON STOCKS | |

| (Cost $32,080,734) | | | 30,062,839 | |

| | |

| PREFERRED STOCKS – 2.8% | |

| | |

| Financials – 2.8% | |

| | 15,517 | | Bancolombia | | | | |

| | | | SA – ADR | | | 389,942 | |

| | 100,356 | | Itau Unibanco | | | | |

| | | | Holding SA – ADR | | | 488,734 | |

| | |

| TOTAL PREFERRED STOCKS | |

| (Cost $993,151) | | | 878,676 | |

| | | | | | | | |

| SHORT-TERM INVESTMENTS – 4.8% | |

| | |

| Money Market Funds – 4.8% | |

| | 1,528,879 | | First American | | | | |

| | | | Treasury Obligations | | | | |

| | | | Fund – Class X, | | | | |

| |

| 4.720%2 | |

| 1,528,879 | |

| | |

| TOTAL SHORT-TERM INVESTMENTS | |

| (Cost $1,528,879) | | | 1,528,879 | |

| | | | | | | | |

| TOTAL INVESTMENTS – 102.6% | |

| (Cost $34,602,764) | | | 32,470,394 | |

| Liabilities in Excess | |

| of Other Assets – (2.6)% | | | (815,782 | ) |

| NET ASSETS – 100.0% | | $ | 31,654,612 | |

ADR – American Depositary Receipt

NVDR – Non-Voting Depository Receipt

REIT – Real Estate Investment Trust

1 | Non-income producing security. |

2 | Annualized seven-day effective yield as of March 31, 2023. |

The Global Industry Classification Standard (GICS®) sector and industry classifications were developed by and/or is the exclusive property of MSCI, Inc. and Standard & Poor Financial Services, LLC (“S&P”). GICS® is a service mark of MSCI and S&P and has been licensed for use by U.S. Bancorp Fund Service, LLC.

The accompanying notes are an integral part of these financial statements.

BOSTON COMMON ESG IMPACT INTERNATIONAL FUND

Investment Outlook

Global growth expectations have improved but remain modest and subject to volatility. Recent banking turmoil adds to headwinds from inflation, interest rates, and geopolitical risks leaving the probability of recession relatively high. However, European monetary policy should end its tightening cycle soon, while Japan continues to stand out with exceptionally loose conditions. Emergency government spending for the pandemic is receding, but fiscal support for net-zero initiatives should foster a dramatic expansion in green technology investment in coming years, projected in the hundreds of billions to trillions of dollars.

Given uncertain cyclical prospects and valuations in line with history, our portfolios are overweight defensive sectors, especially Healthcare and Consumer Staples, and underweight Energy and Materials. We have more exposure to Financials than the Index, but we emphasize insurance and Asia-Pacific and are underweight European banks. Our modest overweight of the Industrials sector reflects our conviction in long-term growth of electrification, renewable power, and energy efficient equipment like heat pumps.

Over the period, the Fund added Chinese vertically integrated electric vehicle (EV) producer BYD. EV penetration should accelerate globally, and BYD commands top share in the world’s largest market, China, is expanding into Europe, and is now the world’s second-largest EV battery manufacturer. Another purchase was Convatec, a UK medical device company focused on diabetes and chronic care. The company produces the majority of infusion sets globally, which, as part of an automated insulin delivery system, help diabetics improve blood sugar control. Convatec’s wound and other care businesses are benefiting from worsening trends in chronic conditions such as vascular disease and cancer. These stable growth markets support an enviable top-line outlook, and new management has delivered operational improvements that should drive continued profit margin expansion. We also added L’Oreal, the French leader in global beauty, a market supported by demographic trends and rebounding Chinese travel. Continued innovation, savvy digital presence, and product diversification should drive consistent sales and earnings growth. L’Oreal has committed to 100% sustainable packaging by 2025 and actively manages supply chain and climate change risks.

Among portfolio exits include Vonovia, Xinyi Solar and Taiwan Semiconductor. We sold Vonovia based on concerns over its fundamentals and strategy against a challenging interest rate and regulatory backdrop. We exited Xinyi Solar on concerns related to the Chinese company’s entry into the polysilicon business and the potential of solar glass oversupply, and we sold Taiwan Semiconductor to reposition our technology exposure. We also reduced several Financials holdings based on rising funding and credit risks for the sector.

BOSTON COMMON ESG IMPACT INTERNATIONAL FUND

Management Discussion

For the six months ended March 31, 2023, the Boston Common International Fund (the “International Fund”) gained +26.16%, while the MSCI EAFE® Index3 rose +27.27% over the same time frame. Strong stock selection in the Consumer Staples sector was the largest contributor to relative results. Dutch grocery chain Ahold delivered sound financial results thanks to its ability to pass on rising food prices. French cosmetics leader L’Oreal and Swedish personal care company Essity rallied on China’s reopening. Communication Services was another positive driver, as Deutsche Telekom’s US franchise T-Mobile continues to gain market share. Our Technology holdings outperformed. German semiconductor producer Infineon surged thanks to robust sales for its chips used in autos, especially electric vehicles. German software developer SAP and Japanese machine vision company Keyence were also strong performers.

Stock selection in Healthcare was the largest detractor from performance. Swiss pharma Roche and German BioNTech provided disappointing guidance partially driven by lower Covid estimates. Japanese drug company Eisai fell on uncertainty over insurance coverage for its new Alzheimer’s therapy. Consumer Discretionary was a drag on performance. Japanese bike parts maker Shimano and musical instrument manufacturer Yamaha were held back by the strong Yen. Our selection in Financials hurt relative performance. Nordic insurer Sampo fell out of favor with some investors after its recent capital reallocation. Low double digit returns by Singapore based OCBC lagged the strong Financials sector gains over the period. From a regional perspective, Europe ex. UK was the largest drag on performance, while UK added most to relative return.

In all sectors, we favor high-quality companies characterized by leading ESG practices, strong balance sheets, and an appealing balance of earnings prospects and valuation.

_____________

3 | MSCI EAFE® Index definition: The MSCI EAFE® Index is a stock market index that is designed to measure the equity market performance of developed markets outside of the U.S. and Canada. It is not possible to invest directly into an index. |

BOSTON COMMON ESG IMPACT INTERNATIONAL FUND

Earnings growth is not representative of the future performance.

Past performance does not guarantee future results.

Must be preceded or accompanied by a current prospectus.

Mutual fund investing involves risk. Principal loss is possible. Investments in foreign securities involve political, economic and currency risks, greater volatility and differences in accounting methods. The Fund’s sustainability policy could cause it to perform differently compared to similar funds that do not have such a policy. This policy may result in the Fund foregoing opportunities to buy certain securities when it might otherwise be advantageous to do so, or selling securities for reasons when it might be otherwise is advantageous for it to do so. Unexpected events and their aftermaths, such as the spread of deadly diseases; natural, environmental or man-made disasters; financial, political or social disruptions; terrorism and war; and other tragedies or catastrophes, can cause investor fear and panic, which can adversely affect the economies of many companies, sectors, nations, regions and the market in general, in ways that cannot necessarily be foreseen.

Diversification does not assure a profit or protect against loss in a declining market.

Boston Common Asset Management, LLC is the adviser to the Fund, which is distributed by Quasar Distributors, LLC.

The opinions expressed are subject to change, are not guaranteed and should not be considered a recommendation to buy or sell any security.

Fund holdings and sector allocations are subject to change and should not be considered a recommendation to buy or sell any securities. Please refer to the Schedule of Investments included for additional information on securities held within the Boston Common ESG Impact Funds.

BOSTON COMMON ESG IMPACT INTERNATIONAL FUND

| COUNTRY ALLOCATION at March 31, 2023 (Unaudited) |

Country | | % of Net Assets1 |

| United Kingdom | | | 18.3 | % |

| Japan | | | 16.9 | % |

| France | | | 10.9 | % |

| Germany | | | 9.5 | % |

| Sweden | | | 6.3 | % |

| Netherlands | | | 5.5 | % |

| Switzerland | | | 4.8 | % |

| Denmark | | | 4.5 | % |

| Australia | | | 3.2 | % |

| Singapore | | | 2.9 | % |

| Hong Kong | | | 2.8 | % |

| China | | | 2.4 | % |

| Finland | | | 2.2 | % |

| Spain | | | 2.0 | % |

| Italy | | | 1.9 | % |

| Ireland | | | 1.7 | % |

| Republic of Korea | | | 1.1 | % |

| Indonesia | | | 1.1 | % |

1 | Excludes short-term investments and other assets in excess of liabilities. |

BOSTON COMMON ESG IMPACT INTERNATIONAL FUND

| SCHEDULE OF INVESTMENTS at March 31, 2023 (Unaudited) |

| Shares | | | | Value | |

| COMMON STOCKS – 98.0% | |

| | |

| Communication Services – 3.9% | |

| | 821,899 | | Deutsche | | | |

| | | | Telekom AG | | $ | 19,916,585 | |

| | |

| Consumer Discretionary – 11.5% | |

| | 68,020 | | Alibaba Group | | | | |

| | | | Holding Ltd. – | | | | |

| | | | ADR1 | | | 6,950,284 | |

| | 1,276,286 | | Barratt | | | | |

| | | | Developments PLC | | | 7,344,712 | |

| | 187,538 | | Burberry Group PLC | | | 6,004,902 | |

| | 169,000 | | BYD Company | | | | |

| | | | Ltd. – Class H | | | 4,971,330 | |

| | 293,220 | | Industria de Diseno | | | | |

| | | | Textil SA | | | 9,850,832 | |

| | 25,933 | | Shimano, Inc. | | | 4,496,413 | |

| | 77,961 | | Sony Group Corp. | | | 7,100,952 | |

| | 242,318 | | Valeo SA | | | 4,972,335 | |

| | 173,430 | | Yamaha Corp. | | | 6,698,554 | |

| | | | | | | 58,390,314 | |

| | |

| Consumer Staples – 13.0% | |

| | 313,088 | | Essity AB – Class B | | | 8,943,015 | |

| | 86,937 | | Kerry Group | | | | |

| | | | PLC – Class A | | | 8,669,854 | |

| | 477,291 | | Koninklijke Ahold | | | | |

| | | | Delhaize NV | | | 16,306,778 | |

| | 26,200 | | L’Oreal SA | | | 11,707,329 | |

| | 121,457 | | Shiseido | | | | |

| | | | Company Ltd. | | | 5,694,299 | |

| | 284,079 | | Unilever NV – ADR | | | 14,752,222 | |

| | | | | | | 66,073,497 | |

| | |

| Financials – 19.0% | |

| | 891,350 | | AIA Group Ltd. | | | 9,347,907 | |

| | 467,536 | | AXA SA | | | 14,268,130 | |

| | 987,871 | | ING Groep NV | | | 11,731,360 | |

| | 18,993,511 | | Lloyds Banking | | | | |

| | | | Group PLC | | | 11,167,146 | |

| | 74,477 | | Macquarie | | | | |

| | | | Group Ltd. | | | 8,818,043 | |

| | 563,747 | | ORIX Corp. | | | 9,295,070 | |

| | 1,587,665 | | Oversea-Chinese | | | | |

| | | | Banking Corp. Ltd. | | | 14,799,876 | |

| | 16,965,546 | | PT Bank | | | | |

| | | | Rakyat Indonesia | | | | |

| | | | (Persero) Tbk. | |

| 5,375,581 | |

| | 236,705 | | Sampo Oyj – | | | | |

| | | | Class A | | | 11,169,011 | |

| | | | | | | 95,972,124 | |

| | |

| Health Care – 15.7% | |

| | 96,289 | | AstraZeneca PLC | |

| 13,341,186 | |

| | 37,808 | | BioNTech | | | | |

| | | | SE – ADR1 | | | 4,709,743 | |

| | 1,718,951 | | ConvaTec | | | | |

| | | | Group PLC | | | 4,857,413 | |

| | 171,753 | | Dechra | | | | |

| | | | Pharmaceuticals | | | | |

| | | | PLC | | | 5,623,073 | |

| | 84,517 | | Eisai Company Ltd. | | | 4,800,531 | |

| | 81,624 | | Hoya Corp. | | | 9,020,459 | |

| | 110,864 | | Novartis AG – ADR | | | 10,199,488 | |

| | 57,040 | | Novo Nordisk | | | | |

| | | | A/S – Class B | | | 9,059,172 | |

| | 391,961 | | Roche Holding | | | | |

| | | | Ltd. – ADR | | | 14,055,721 | |

| | 13,116 | | Sartorius Stedim | | | | |

| | | | Biotech | | | 4,023,944 | |

| | | | | | | 79,690,730 | |

| | |

| Industrials – 17.0% | |

| | 356,366 | | Assa Abloy AB – | | | | |

| | | | Class B | | | 8,535,852 | |

| | 561,222 | | Atlas Copco AB – | | | | |

| | | | Class B | | | 6,455,593 | |

| | 64,971 | | Daikin Industries | | | 11,656,224 | |

| | 1 | | Ferguson PLC | | | 132 | |

| | 165,237 | | Kurita Water | | | | |

| | | | Industries Ltd. | | | 7,569,016 | |

| | 232,676 | | Prysmian SpA | | | 9,770,273 | |

| | 185,947 | | Recruit Holdings | | | | |

| | | | Company Ltd. | | | 5,115,223 | |

| | 90,155 | | Schneider | | | | |

| | | | Electric SE | | | 15,067,121 | |

| | 49,981 | | Spirax-Sarco | | | | |

| | | | Engineering PLC | | | 7,338,312 | |

| | 220,031 | | Vestas Wind | | | | |

| | | | Systems A/S | | | 6,412,675 | |

| | 397,688 | | Volvo AB – Class B | | | 8,195,019 | |

| | | | | | | 86,115,440 | |

The accompanying notes are an integral part of these financial statements.

BOSTON COMMON ESG IMPACT INTERNATIONAL FUND

| SCHEDULE OF INVESTMENTS at March 31, 2023 (Unaudited) (Continued) |

| Shares | | | | Value | |

| COMMON STOCKS – 98.0% (Continued) | |

| | |

| Information Technology – 8.5% | |

| | 326,632 | | Infineon | | | |

| | | | Technologies AG | | $ | 13,413,268 | |

| | 17,700 | | Keyence Corp. | | | 8,674,925 | |

| | 80,306 | | SAP SE – ADR | | | 10,162,724 | |

| | 158,089 | | TDK Corp. | | | 5,674,786 | |

| | 115,918 | | Worldline SA1 | | | 4,926,365 | |

| | | | | | | 42,852,068 | |

| | |

| Materials – 2.7% | |

| | 100,478 | | Croda | | | | |

| | | | International PLC | | | 8,075,726 | |

| | 9,910 | | LG Chem Ltd. | | | 5,442,513 | |

| | | | | | | 13,518,239 | |

| | |

| Real Estate – 2.4% | |

| | 2,470,416 | | Hang Lung | | | | |

| | | | Properties Ltd. | | | 4,622,673 | |

| | 5,312,309 | | Mirvac | | | | |

| | | | Group – REIT | | | 7,440,513 | |

| | | | | | | 12,063,186 | |

| | |

| Utilities – 4.3% | |

| | 85,499 | | Orsted A/S | | | 7,290,327 | |

| | 645,475 | | SSE PLC | | | 14,402,956 | |

| | | | | | | 21,693,283 | |

| | |

| TOTAL COMMON STOCKS | |

| (Cost $452,721,693) | | | 496,285,466 | |

| | | | | | | | |

| SHORT-TERM INVESTMENTS – 2.0% | |

| | |

| Money Market Funds – 2.0% | |

| | 10,110,057 | | First American | | | | |

| | | | Treasury | | | | |

| | | | Obligations | | | | |

| | | | Fund – Class X, | | | | |

| | | | 4.720%2 | | $ | 10,110,057 | |

| | |

| TOTAL SHORT-TERM INVESTMENTS | |

| (Cost $10,110,057) | | | 10,110,057 | |

| | |

| TOTAL INVESTMENTS – 100.0% | |

| (Cost $462,831,750) | | | 506,395,523 | |

| Other Assets in Excess | |

| of Liabilities – 0.0% | | | 218,269 | |

| NET ASSETS – 100.0% | | $ | 506,613,792 | |

ADR – American Depositary Receipt

NVDR – Non-Voting Depository Receipt

REIT – Real Estate Investment Trust

1 | Non-income producing security. |

2 | Annualized seven-day effective yield as of March 31, 2023. |

The Global Industry Classification Standard (GICS®) sector and industry classifications were developed by and/or is the exclusive property of MSCI, Inc. and Standard & Poor Financial Services, LLC (“S&P”). GICS® is a service mark of MSCI and S&P and has been licensed for use by U.S. Bancorp Fund Service, LLC.

The accompanying notes are an integral part of these financial statements.

BOSTON COMMON ESG IMPACT U.S. EQUITY FUND

Investment Outlook

Following two years of fiscal policy stimulus, the US’ economic outlook now appears murky. The Fed faces a tough balancing act as it aims to continue raising rates without tipping the country into recession. The US’ recent regional bank failures and a distressed bank takeover in Europe have elevated concerns about systemic risk to the financial system. While we believe today’s concerns are more benign than the 2008 financial crisis, we anticipate increased regulatory scrutiny, particularly for regional banks. Current events will likely create near-term challenges for corporate profit margin expansion and earnings growth; recent corporate results indeed point to slowing profitability.

To reduce Consumer Discretionary exposure to equal weight and further increase the strategy’s market cap, we sold perennial laggard Advanced Auto Parts, whose plans for a multi-year turnaround have failed to manifest. We sold Hasbro, as management seems to have lost its grip on the transition from toy manufacturer to media company. Lastly, we sold smaller-cap Materials company Aptar, a manufacturer of consumer product and drug delivery containers. In its place, we purchased Ball Corporation, whose primary manufacture of aluminum containers offers a long-runway for bottlers’ continued conversion away from single-use plastic.

Continuing to diversify our Healthcare exposure, we purchased Edwards Lifesciences, which provides in-patient medical innovations, specifically minimally invasive artificial heart valves and hemodynamic monitoring. Another Healthcare purchase was Quest Diagnostics, which runs the world’s largest network of diagnostic laboratories that should benefit from increasing visits to physicians and rescheduled surgeries, delayed during the pandemic, as well as seasonal Covid- and flu-related testing. The company also provides access to women’s health via its proprietary breast cancer screening test, BRCA. Other portfolio additions include life insurer Metlife in Financials and Broadcom in Information Technology.

BOSTON COMMON ESG IMPACT U.S. EQUITY FUND

Management Discussion

Over the past six months ending March 31, 2023, the Boston Common ESG Impact U.S. Equity Fund (the “US Fund”) gained +15.55%, modestly in line with the S&P 500® Index4 (the “Index”), which rose +15.62%.

Stock selection in Consumer Discretionary added most to relative return, helped by Booking’s exposure to China’s reopening, as well as apparel manufacturer Ralph Lauren and off-price retailer TJX. Healthcare positively contributed, thanks to pharmaceutical companies Merck and Novo-Nordisk. Merck benefited from its Keytruda franchise while Novo Nordisk, a pharmaceutical company with products focused on treating diabetes in the US, was a portfolio standout during the period.

Technology detracted most, partly reflecting what the portfolio did not own, including AI-focused Nvidia. Following strong performance in early 2022, fund holding Enphase, the solar panel microinverter maker, recently declined on lower guidance, despite a robust production profile. Online payments system PayPal also weighed on performance. Selection in Communications Services lagged as Alphabet and Verizon did not keep up with the strong sector returns over the period, driven primarily by Facebook parent, Meta, which we do not own over concerns about governance, data security and social media’s impact on mental health.

We remain confident in our defensive tilt, especially regarding our equal and slightly underweight positioning in Consumer Discretionary and Information Technology, respectively. In every sector, we continue to seek high-quality, recession-agnostic operating models with opportunities to participate in expanding end markets or capture greater market share. These companies should likewise exhibit strong balance sheets, improving return-on-equity, and disciplined capital management that includes a commitment to dividend growth. As always, we view companies that both articulate and integrate the merits of understanding ESG criteria into their long-term strategic visions as potential secular winners.

_____________

4 | The S&P 500® Index is a capitalization weighted index of 500 large capitalization stocks which is designed to measure a broad domestic securities market. It is not possible to invest directly in an index. |

BOSTON COMMON ESG IMPACT U.S. EQUITY FUND

Earnings growth is not representative of the future performance.

Past performance does not guarantee future results.

Must be preceded or accompanied by a current prospectus.

Mutual fund investing involves risk. Principal loss is possible. Larger, more established companies are sometimes unable to attain the high growth rates of successful, smaller companies, especially during extended periods of economic expansion. The Fund’s sustainability policy could cause it to perform differently compared to similar funds that do not have such a policy. This policy may result in the Fund foregoing opportunities to buy certain securities when it might otherwise be advantageous to do so, or selling securities for reasons when it might be otherwise is advantageous for it to do so. Unexpected events and their aftermaths, such as the spread of deadly diseases; natural, environmental or man-made disasters; financial, political or social disruptions; terrorism and war; and other tragedies or catastrophes, can cause investor fear and panic, which can adversely affect the economies of many companies, sectors, nations, regions and the market in general, in ways that cannot necessarily be foreseen.

Diversification does not assure a profit or protect against loss in a declining market.

Boston Common Asset Management, LLC is the adviser to the Fund, which is distributed by Quasar Distributors, LLC.

The opinions expressed are subject to change, are not guaranteed and should not be considered a recommendation to buy or sell any security.

Fund holdings and sector allocations are subject to change and should not be considered a recommendation to buy or sell any securities. Please refer to the Schedule of Investments included for additional information on securities held within the Boston Common ESG Impact Funds.

BOSTON COMMON ESG IMPACT U.S. EQUITY FUND

| SECTOR ALLOCATION at March 31, 2023 (Unaudited) |

Sector | | % of Net Assets1 |

| Information Technology | | | 28.0 | % |

| Health Care | | | 16.7 | % |

| Financials | | | 10.6 | % |

| Consumer Discretionary | | | 10.0 | % |

| Industrials | | | 8.1 | % |

| Consumer Staples | | | 8.0 | % |

| Communication Services | | | 7.7 | % |

| Utilities | | | 3.6 | % |

| Real Estate | | | 2.6 | % |

| Materials | | | 2.2 | % |

1 | Excludes short-term investments and other assets in excess of liabilities. |

BOSTON COMMON ESG IMPACT U.S. EQUITY FUND

| SCHEDULE OF INVESTMENTS at March 31, 2023 (Unaudited) |

| Shares | | | | Value | |

| COMMON STOCKS – 97.5% | |

| | |

| Communication Services – 7.7% | |

| | 300 | | Alphabet, Inc. – | | | |

| | | | Class A1 | | $ | 31,119 | |

| | 21,605 | | Alphabet, Inc. – | | | | |

| | | | Class C1 | | | 2,246,920 | |

| | 2,699 | | Netflix, Inc.1 | | | 932,451 | |

| | 21,116 | | Verizon | | | | |

| | | | Communications, Inc. | | | 821,201 | |

| | 50 | | Walt Disney Company | | | 5,006 | |

| | | | | | | 4,036,697 | |

| | |

| Consumer Discretionary – 10.0% | |

| | 400 | | Booking | | | | |

| | | | Holdings, Inc.1 | | | 1,060,964 | |

| | 3,403 | | Home Depot, Inc. | | | 1,004,293 | |

| | 8,064 | | Ralph Lauren Corp. | | | 940,827 | |

| | 4,256 | | Target Corp. | | | 704,921 | |

| | 19,882 | | TJX Companies, Inc. | | | 1,557,954 | |

| | | | | | | 5,268,959 | |

| | |

| Consumer Staples – 8.0% | |

| | 7,437 | | Colgate-Palmolive | | | | |

| | | | Company | | | 558,891 | |

| | 1,996 | | Costco Wholesale Corp. | | | 991,752 | |

| | 4,935 | | The Estee Lauder | | | | |

| | | | Companies, Inc. – | | | | |

| | | | Class A | | | 1,216,280 | |

| | 6,517 | | McCormick & | | | | |

| | | | Company, Inc. | | | 542,280 | |

| | 13,260 | | Mondelez | | | | |

| | | | International, Inc. – | | | | |

| | | | Class A | | | 924,487 | |

| | | | | | | 4,233,690 | |

| | |

| Financials – 10.6% | |

| | 2,403 | | Ameriprise | | | | |

| | | | Financial, Inc. | | | 736,519 | |

| | 3,602 | | Aon PLC – Class A | | | 1,135,675 | |

| | 176 | | Citigroup, Inc. | | | 8,253 | |

| | 5,707 | | CME Group, Inc. – | | | | |

| | | | Class A | | | 1,093,005 | |

| | 14,096 | | MetLife, Inc. | | | 816,722 | |

| | 9,449 | | Morgan Stanley | | | 829,622 | |

| | 7,532 | | PNC Financial Services | | | | |

| | | | Group, Inc. | | | 957,317 | |

| | | | | | | 5,577,113 | |

| | |

| Health Care – 16.7% | |

| | 6,388 | | Agilent | | | | |

| | | | Technologies, Inc. | |

| 883,716 | |

| | 116 | | Biogen, Inc.1 | | | 32,252 | |

| | 3,776 | | Danaher Corp. | | | 951,703 | |

| | 8,302 | | Edwards Lifesciences | | | | |

| | | | Corp.1 | | | 686,824 | |

| | 22,060 | | Merck & | | | | |

| | | | Company, Inc. | | | 2,346,963 | |

| | 5,179 | | Novo Nordisk | | | | |

| | | | A/S – ADR | | | 824,186 | |

| | 5,795 | | Quest Diagnostics, Inc. | | | 819,877 | |

| | 1,367 | | Regeneron | | | | |

| | | | Pharmaceuticals, Inc.1 | | | 1,123,223 | |

| | 3,426 | | Vertex | | | | |

| | | | Pharmaceuticals, Inc.1 | | | 1,079,430 | |

| | | | | | | 8,748,174 | |

| | |

| Industrials – 8.1% | |

| | 16,184 | | Carrier Global Corp. | | | 740,418 | |

| | 3,735 | | Cummins, Inc. | | | 892,217 | |

| | 11,364 | | Emerson Electric | | | | |

| | | | Company | | | 990,259 | |

| | 7,854 | | Wabtec Corp. | | | 793,725 | |

| | 8,229 | | Xylem, Inc. | | | 861,576 | |

| | | | | | | 4,278,195 | |

| | |

| Information Technology – 28.0% | |

| | 2,232 | | Adobe, Inc.1 | | | 860,146 | |

| | 3,397 | | Analog Devices, Inc. | | | 669,956 | |

| | 22,278 | | Apple, Inc. | | | 3,673,642 | |

| | 3,206 | | Applied Materials, Inc. | | | 393,793 | |

| | 1,277 | | Broadcom, Inc. | | | 819,247 | |

| | 3,296 | | Enphase Energy, Inc.1 | | | 693,083 | |

| | 738 | | First Solar, Inc.1 | | | 160,515 | |

| | 2,220 | | Intuit, Inc. | | | 989,743 | |

| | 13,381 | | Microsoft Corp. | | | 3,857,742 | |

| | 7,371 | | PayPal Holdings, Inc. | | | 559,754 | |

| | 222 | | salesforce.com, Inc.1 | | | 44,351 | |

| | 8,658 | | Visa, Inc. – Class A | | | 1,952,033 | |

| | | | | | | 14,674,005 | |

| | |

| Materials – 2.2% | |

| | 7,076 | | Ball Corp. | | | 389,959 | |

| | 4,512 | | Ecolab, Inc. | | | 746,871 | |

| | | | | | | 1,136,830 | |

The accompanying notes are an integral part of these financial statements.

BOSTON COMMON ESG IMPACT U.S. EQUITY FUND

| SCHEDULE OF INVESTMENTS at March 31, 2023 (Unaudited) (Continued) |

| Shares | | | | Value | |

| COMMON STOCKS – 97.5% (Continued) | |

| | |

| Real Estate – 2.6% | |

| | 30,717 | | Kimco Realty | | | |

| | | | Corp. – REIT | | $ | 599,903 | |

| | 24,810 | | Weyerhaeuser | | | | |

| | | | Company – REIT | | | 747,525 | |

| | | | | | | 1,347,428 | |

| | |

| Utilities – 3.6% | |

| | 6,322 | | American Water Works | | | | |

| | | | Company, Inc. | | | 926,110 | |

| | 9,984 | | Consolidated | | | | |

| | | | Edison, Inc. | | | 955,169 | |

| | | | | | | 1,881,279 | |

| | |

| TOTAL COMMON STOCKS | |

| (Cost $33,063,379) | | | 51,182,370 | |

| | | | | | | | |

| SHORT-TERM INVESTMENTS – 2.5% | |

| | |

| Money Market Funds – 2.5% | |

| | 1,300,694 | | First American | | | | |

| | | | Treasury Obligations | | | | |

| | | | Fund – Class X, | | | | |

| | | | 4.720%2 | | $ | 1,300,694 | |

| | |

| TOTAL SHORT-TERM INVESTMENTS | |

| (Cost $1,300,694) | | | 1,300,694 | |

| | |

| TOTAL INVESTMENTS – 100.0% | |

| (Cost $34,364,073) | | | 52,483,064 | |

| Other Assets in Excess | |

| of Liabilities – 0.0% | | | 2,394 | |

| NET ASSETS – 100.0% | | $ | 52,485,458 | |

ADR – American Depositary Receipt

NVDR – Non-Voting Depository Receipt

REIT – Real Estate Investment Trust

1 | Non-income producing security. |

2 | Annualized seven-day effective yield as of March 31, 2023. |

The Global Industry Classification Standard (GICS®) sector and industry classifications were developed by and/or is the exclusive property of MSCI, Inc. and Standard & Poor Financial Services, LLC (“S&P”). GICS® is a service mark of MSCI and S&P and has been licensed for use by U.S. Bancorp Fund Service, LLC.

The accompanying notes are an integral part of these financial statements.

BOSTON COMMON ESG IMPACT FUNDS

| STATEMENTS OF ASSETS AND LIABILITIES at March 31, 2023 (Unaudited) |

| | | Emerging | | | International | | | U.S. Equity | |

| | | Markets Fund | | | Fund | | | Fund | |

| ASSETS: | | | | | | | | | |

| Investments in securities, at value | | | | | | | | | |

| (cost $34,602,764, $462,831,750 | | | | | | | | | |

| and $34,364,073, respectively) | | $ | 32,470,394 | | | $ | 506,395,523 | | | $ | 52,483,064 | |

| Receivables: | | | | | | | | | | | | |

| Foreign cash | | | 41,283 | | | | 2,792 | | | | — | |

| Fund shares sold | | | — | | | | 387,338 | | | | 26,766 | |

| Dividends and interest | | | 106,359 | | | | 2,092,253 | | | | 48,424 | |

| Prepaid expenses | | | 20,546 | | | | 38,267 | | | | 21,142 | |

| Total assets | | | 32,638,582 | | | | 508,916,173 | | | | 52,579,396 | |

| | | | | | | | | | | | | |

| LIABILITIES: | | | | | | | | | | | | |

| Payables: | | | | | | | | | | | | |

| Investment securities purchased | | | 955,746 | | | | — | | | | — | |

| Fund shares redeemed | | | — | | | | 1,933,037 | | | | 45,209 | |

| Investment advisory fees, net | | | 3,487 | | | | 285,774 | | | | 24,163 | |

| Audit fees | | | 8,922 | | | | 11,711 | | | | 11,711 | |

| Fund administration & fund accounting fees | | | 7,127 | | | | 25,125 | | | | 5,427 | |

| Custody fees | | | 5,370 | | | | 20,998 | | | | 537 | |

| Trustee fees | | | 1,459 | | | | 5,377 | | | | 3,092 | |

| Legal fees | | | 1,065 | | | | 910 | | | | 1,143 | |

| Chief Compliance Officer fees | | | 312 | | | | 312 | | | | 217 | |

| Registration fees | | | 142 | | | | 549 | | | | 286 | |

| Printing and mailing expenses | | | 111 | | | | 4,376 | | | | 369 | |

| Transfer agent fees | | | 229 | | | | 13,831 | | | | 1,169 | |

| Miscellaneous expenses | | | — | | | | 381 | | | | 615 | |

| Total liabilities | | | 983,970 | | | | 2,302,381 | | | | 93,938 | |

| NET ASSETS | | $ | 31,654,612 | | | $ | 506,613,792 | | | $ | 52,485,458 | |

| | | | | | | | | | | | | |

| COMPONENTS OF NET ASSETS: | | | | | | | | | | | | |

| Paid-in capital | | $ | 35,262,453 | | | $ | 503,835,216 | | | $ | 34,299,553 | |

| Total distributable (accumulated) | | | | | | | | | | | | |

| earnings (losses) | | | (3,607,841 | ) | | | 2,778,576 | | | | 18,185,905 | |

| Net assets | | $ | 31,654,612 | | | $ | 506,613,792 | | | $ | 52,485,458 | |

| Net assets value (unlimited shares authorized): | | | | | | | | | | | | |

| Net assets | | $ | 31,654,612 | | | $ | 506,613,792 | | | $ | 52,485,458 | |

| Shares of beneficial interest | | | | | | | | | | | | |

| issued and outstanding | | | 1,525,666 | | | | 16,237,562 | | | | 996,650 | |

| Net asset value, offering, and | | | | | | | | | | | | |

| redemption price per share | | $ | 20.75 | | | $ | 31.20 | | | $ | 52.66 | |

The accompanying notes are an integral part of these financial statements.

BOSTON COMMON ESG IMPACT FUNDS

| STATEMENTS OF OPERATIONS For the Six Months Ended March 31, 2023 (Unaudited) |

| | | Emerging | | | International | | | U.S. Equity | |

| | | Markets Fund | | | Fund | | | Fund | |

| INVESTMENT INCOME | | | | | | | | | |

| Income: | | | | | | | | | |

| Dividends (net of foreign withholding tax | | | | | | | | | |

| and issuance fees of $31,367, $382,158 | | | | | | | | | |

| and $906, respectively) | | $ | 203,566 | | | $ | 3,456,249 | | | $ | 410,888 | |

| Interest | | | 13,352 | | | | 102,489 | | | | 19,537 | |

| Total investment income | | | 216,918 | | | | 3,558,738 | | | | 430,425 | |

| | | | | | | | | | | | | |

| Expenses: | | | | | | | | | | | | |

| Investment advisory fees | | | 109,779 | | | | 1,891,551 | | | | 190,042 | |

| Fund administration & fund accounting fees | | | 49,992 | | | | 205,971 | | | | 43,524 | |

| Custody fees | | | 20,105 | | | | 62,498 | | | | 1,817 | |

| Professional fees | | | 12,869 | | | | 15,675 | | | | 15,829 | |

| Registration fees | | | 10,926 | | | | 20,613 | | | | 10,643 | |

| Trustee fees | | | 9,309 | | | | 12,255 | | | | 8,196 | |

| Chief Compliance Officer fees | | | 6,827 | | | | 6,826 | | | | 6,732 | |

| Miscellaneous expense | | | 5,312 | | | | 22,744 | | | | 5,248 | |

| Transfer agent fees | | | 1,065 | | | | 45,531 | | | | 11,804 | |

| Reports to shareholders | | | 949 | | | | 9,578 | | | | 1,327 | |

| Insurance expenses | | | 833 | | | | 3,741 | | | | 2,746 | |

| Interest expenses | | | — | | | | 2,685 | | | | — | |

| Total expenses | | | 227,966 | | | | 2,299,668 | | | | 297,908 | |

| Less: fees waived | | | (100,104 | ) | | | (263,568 | ) | | | (44,516 | ) |

| Net expenses | | | 127,862 | | | | 2,036,100 | | | | 253,392 | |

| Net investment income (loss) | | | 89,056 | | | | 1,522,638 | | | | 177,033 | |

| | | | | | | | | | | | | |

| REALIZED AND UNREALIZED GAIN (LOSS) ON INVESTMENTS AND FOREIGN CURRENCY | | | | | | | | | | | | |

| Net realized gain (loss) on investments | | | | | | | | | | | | |

| and foreign currency | | | (506,774 | ) | | | (27,862,061 | ) | | | 13,881 | |

| Net change in unrealized | | | | | | | | | | | | |

| appreciation/depreciation on investments | | | | | | | | | | | | |

| and foreign currency | | | 4,191,380 | | | | 132,233,507 | | | | 7,035,585 | |

| Net realized and unrealized gain (loss) | | | | | | | | | | | | |

| on investments and foreign currency | | | 3,684,606 | | | | 104,371,446 | | | | 7,049,466 | |

| NET INCREASE (DECREASE) IN | | | | | | | | | | | | |

| NET ASSETS RESULTING | | | | | | | | | | | | |

| FROM OPERATIONS | | $ | 3,773,662 | | | $ | 105,894,084 | | | $ | 7,226,499 | |

The accompanying notes are an integral part of these financial statements.

BOSTON COMMON ESG IMPACT EMERGING MARKETS FUND

| STATEMENTS OF CHANGES IN NET ASSETS |

| | | Six Months Ended | | | Year Ended | |

| | | March 31, 2023 | | | September 30, | |

| | | (Unaudited) | | | 2022 | |

| NET INCREASE (DECREASE) IN NET ASSETS FROM: | | | | | | |

| Net investment income (loss) | | $ | 89,056 | | | $ | 322,110 | |

| Net realized gain (loss) on investments | | | | | | | | |

| and foreign currency | | | (506,774 | ) | | | (788,246 | ) |

| Net change in unrealized appreciation/depreciation | | | | | | | | |

| on investments and foreign currency | | | 4,191,380 | | | | (6,324,041 | ) |

| Net increase (decrease) in net assets | | | | | | | | |

| resulting from operations | | | 3,773,662 | | | | (6,790,177 | ) |

| | | | | | | | | |

| DISTRIBUTIONS TO SHAREHOLDERS | | | | | | | | |

| Net distributions to shareholders | | | (503,855 | ) | | | (88,029 | ) |

| | | | | | | | | |

| CAPITAL SHARE TRANSACTIONS | | | | | | | | |

Net increase (decrease) from capital share transactions1 | | | 7,342,974 | | | | 27,169,429 | |

| Total increase (decrease) in net assets | | | 10,612,781 | | | | 20,291,223 | |

| | | | | | | | | |

| NET ASSETS | | | | | | | | |

| Beginning of period/year | | | 21,041,831 | | | | 750,608 | |

| End of period/year | | $ | 31,654,612 | | | $ | 21,041,831 | |

1 | A summary of share transactions is as follows: |

| | | | Six Months Ended | | | | | | | |

| | | | March 31, 2023 | | | Year Ended | |

| | | | (Unaudited) | | | September 30, 2022 | |

| | | | Shares | | | Value | | | Shares | | | Value | |

| | Shares sold | | | 353,237 | | | $ | 7,246,929 | | | | 1,137,570 | | | $ | 27,169,429 | |

| | Shares issued to holders | | | | | | | | | | | | | | | | |

| | in reinvestment | | | | | | | | | | | | | | | | |

| | of distributions | | | 7,661 | | | | 151,464 | | | | — | | | | — | |

| | Shares redeemed | | | (2,804 | ) | | | (55,419 | ) | | | — | | | | — | |

| | Net increase (decrease) | | | 358,094 | | | $ | 7,342,974 | | | | 1,137,570 | | | $ | 27,169,429 | |

| | Beginning shares | | | 1,167,572 | | | | | | | | 30,002 | | | | | |

| | Ending shares | | | 1,525,666 | | | | | | | | 1,167,572 | | | | | |

The accompanying notes are an integral part of these financial statements.

BOSTON COMMON ESG IMPACT INTERNATIONAL FUND

| STATEMENTS OF CHANGES IN NET ASSETS |

| | | Six Months Ended | | | Year Ended | |

| | | March 31, 2023 | | | September 30, | |

| | | (Unaudited) | | | 2022 | |

| NET INCREASE (DECREASE) IN NET ASSETS FROM: | | | | | | |

| Net investment income (loss) | | $ | 1,522,638 | | | $ | 9,580,733 | |

| Net realized gain (loss) on investments | | | | | | | | |

| and foreign currency | | | (27,862,061 | ) | | | (7,217,996 | ) |

| Net change in unrealized appreciation/depreciation | | | | | | | | |

| on investments and foreign currency | | | 132,233,507 | | | | (201,593,405 | ) |

| Net increase (decrease) in net assets | | | | | | | | |

| resulting from operations | | | 105,894,084 | | | | (199,230,668 | ) |

| | | | | | | | | |

| DISTRIBUTIONS TO SHAREHOLDERS | | | | | | | | |

| Net distributions to shareholders | | | (5,898,059 | ) | | | (16,589,883 | ) |

| | | | | | | | | |

| CAPITAL SHARE TRANSACTIONS | | | | | | | | |

Net increase (decrease) from capital share transactions1 | | | (7,619,182 | ) | | | 134,860,436 | |

| Total increase (decrease) in net assets | | | 92,376,843 | | | | (80,960,115 | ) |

| | | | | | | | | |

| NET ASSETS | | | | | | | | |

| Beginning of period/year | | | 414,236,949 | | | | 495,197,064 | |

| End of period/year | | $ | 506,613,792 | | | $ | 414,236,949 | |

1 | A summary of share transactions is as follows: |

| | | Six Months Ended | | | | | | | |

| | | March 31, 2023 | | | Year Ended | |

| | | (Unaudited) | | | September 30, 2022 | |

| | | Shares | | | Value | | | Shares | | | Value | |

| Shares sold | | | 2,015,375 | | | $ | 59,443,097 | | | | 7,196,432 | | | $ | 240,538,947 | |

| Shares issued to holders | | | | | | | | | | | | | | | | |

| in reinvestment | | | | | | | | | | | | | | | | |

| of distributions | | | 171,754 | | | | 4,991,170 | | | | 350,363 | | | | 12,819,778 | |

Shares redeemed2 | | | (2,494,842 | ) | | | (72,053,449 | ) | | | (3,844,306 | ) | | | (118,498,289 | ) |

| Net increase (decrease) | | | (307,713 | ) | | $ | (7,619,182 | ) | | | 3,702,489 | | | $ | 134,860,436 | |

| Beginning shares | | | 16,545,275 | | | | | | | | 12,842,786 | | | | | |

| Ending shares | | | 16,237,562 | | | | | | | | 16,545,275 | | | | | |

| | |

2 | Net of redemption fees of $2,828 and $18,834, respectively. |

The accompanying notes are an integral part of these financial statements.

BOSTON COMMON ESG IMPACT U.S. EQUITY FUND

| STATEMENTS OF CHANGES IN NET ASSETS |

| | | Six Months Ended | | | Year Ended | |

| | | March 31, 2023 | | | September 30, | |

| | | (Unaudited) | | | 2022 | |

| NET INCREASE (DECREASE) IN NET ASSETS FROM: | | | | | | |

| Net investment income (loss) | | $ | 177,033 | | | $ | 140,791 | |

| Net realized gain (loss) on investments | | | | | | | | |

| and foreign currency | | | 13,881 | | | | 3,188,979 | |

| Net change in unrealized appreciation/depreciation | | | | | | | | |

| of investments and foreign currency | | | 7,035,585 | | | | (13,741,339 | ) |

| Net increase (decrease) in net assets | | | | | | | | |

| resulting from operations | | | 7,226,499 | | | | (10,411,569 | ) |

| | | | | | | | | |

| DISTRIBUTIONS TO SHAREHOLDERS | | | | | | | | |

| Net distributions to shareholders | | | (3,014,672 | ) | | | (2,542,396 | ) |

| | | | | | | | | |

| CAPITAL SHARE TRANSACTIONS | | | | | | | | |

Net increase (decrease) from capital share transactions1 | | | 1,603,864 | | | | 2,132,063 | |

| Total increase (decrease) in net assets | | | 5,815,691 | | | | (10,821,902 | ) |

| | | | | | | | | |

| NET ASSETS | | | | | | | | |

| Beginning of period/year | | | 46,669,767 | | | | 57,491,669 | |

| End of period/year | | $ | 52,485,458 | | | $ | 46,669,767 | |

1 | A summary of share transactions is as follows: |

| | | | Six Months Ended | | | | | | | |

| | | | March 31, 2023 | | | Year Ended | |

| | | | (Unaudited) | | | September 30, 2022 | |

| | | | Shares | | | Value | | | Shares | | | Value | |

| | Shares sold | | | 25,320 | | | $ | 1,290,630 | | | | 86,209 | | | $ | 4,917,029 | |

| | Shares issued to holders | | | | | | | | | | | | | | | | |

| | in reinvestment | | | | | | | | | | | | | | | | |

| | of distributions | | | 50,546 | | | | 2,528,835 | | | | 34,244 | | | | 2,147,805 | |

| | Shares redeemed2 | | | (42,764 | ) | | | (2,215,601 | ) | | | (84,815 | ) | | | (4,932,771 | ) |

| | Net increase (decrease) | | | 33,102 | | | $ | 1,603,864 | | | | 35,638 | | | $ | 2,132,063 | |

| | Beginning shares | | | 963,548 | | | | | | | | 927,910 | | | | | |

| | Ending shares | | | 996,650 | | | | | | | | 963,548 | | | | | |

2 | Net of redemption fees of $0 and $7,064, respectively. |

The accompanying notes are an integral part of these financial statements.

BOSTON COMMON ESG IMPACT EMERGING MARKETS FUND

| FINANCIAL HIGHLIGHTS For a capital share outstanding throughout each period/year |

| | | Six Months Ended | | | Year Ended | | | Period Ended | |

| | | March 31, 2023 | | | September 30, | | | September 30, | |

| | | (Unaudited) | | | 2022 | | | | 20211 | |

| Net asset value, | | | | | | | | | | |

| beginning of period/year | | $ | 18.02 | | | $ | 25.02 | | | $ | 25.00 | |

| | | | | | | | | | | | | |

| INCOME (LOSS) FROM INVESTMENT OPERATIONS: | | | | | | | | | | | | |

| Net investment income (loss)2 | | | 0.07 | | | | 0.35 | | | | 0.02 | |

| Net realized and unrealized | | | | | | | | | | | | |

| gain (loss) on investments | | | 3.06 | | | | (7.24 | ) | | | — | |

| Total from operations | | | 3.13 | | | | (6.89 | ) | | | 0.02 | |

| | | | | | | | | | | | | |

| LESS DISTRIBUTIONS: | | | | | | | | | | | | |

| Distributions from | | | | | | | | | | | | |

| net investment income | | | (0.40 | ) | | | (0.11 | ) | | | — | |

| Distributions from net realized gain | | | — | | | | — | | | | — | |

| Total distributions | | | (0.40 | ) | | | (0.11 | ) | | | — | |

| Paid-in capital from redemption fees | | | — | | | | — | | | | — | |

| Net asset value, end of period/year | | $ | 20.75 | | | $ | 18.02 | | | $ | 25.02 | |

| Total return | | | 17.49 | %3 | | | (27.64 | )% | | | 0.08 | %3 |

| | | | | | | | | | | | | |

| SUPPLEMENTAL DATA: | | | | | | | | | | | | |

| Net assets, end of period/year (000’s) | | $ | 31,655 | | | $ | 21,042 | | | $ | 751 | |

| Expenses before fees waived | | | 1.77 | %4 | | | 1.94 | % | | | 63.49 | %4 |

| Expenses after fees waived | | | 0.99 | %4 | | | 0.99 | % | | | 0.99 | %4 |

| Net investment income | | | | | | | | | | | | |

| before fees waived | | | (0.09 | %)4 | | | 0.63 | % | | | (59.75 | %)4 |

| Net investment income | | | | | | | | | | | | |

| after fees waived | | | 0.69 | %4 | | | 1.58 | % | | | 2.75 | %4 |

| Portfolio turnover rate | | | 14 | %3 | | | 36 | % | | | 0 | %3 |

1 | Emerging Markets Fund commenced operations on September 21, 2021. Information presented is for the period from September 21, 2021 to September 30, 2021. |

2 | Calculated based on average shares outstanding during the period. |

3 | Not Annualized. |

4 | Annualized. |

The accompanying notes are an integral part of these financial statements.

BOSTON COMMON ESG IMPACT INTERNATIONAL FUND

| FINANCIAL HIGHLIGHTS For a capital share outstanding throughout each period/year |

| | | Six Months | | | | | | | | | | | | | | | | |

| | | Ended | | | | | | | | | | | | | | | | |

| | | March 31, | | | | | | | | | | | | | | | | |

| | | 2023 | | | Year Ended September 30, | |

| | | (Unaudited) | | | 2022 | | | 2021 | | | 2020 | | | 2019 | | | 2018 | |

| Net asset value, beginning | | | | | | | | | | | | | | | | | | |

| of period/year | | $ | 25.04 | | | $ | 38.56 | | | $ | 32.48 | | | $ | 29.32 | | | $ | 30.51 | | | $ | 30.14 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| INCOME (LOSS) FROM INVESTMENT OPERATIONS: | |

| Net investment | | | | | | | | | | | | | | | | | | | | | | | | |

income (loss)1 | | | 0.09 | | | | 0.62 | | | | 0.40 | | | | 0.23 | | | | 0.59 | | | | 0.42 | |

| Net realized and unrealized | | | | | | | | | | | | | | | | | | | | | | | | |

| gain (loss) on investments | | | 6.43 | | | | (12.89 | ) | | | 5.92 | | | | 3.64 | | | | (1.41 | ) | | | 0.31 | |

| Total from operations | | | 6.52 | | | | (12.27 | ) | | | 6.32 | | | | 3.87 | | | | (0.82 | ) | | | 0.73 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| LESS DISTRIBUTIONS: | | | | | | | | | | | | | | | | | | | | | | | | |

| Distributions from | | | | | | | | | | | | | | | | | | | | | | | | |

| net investment income | | | (0.36 | ) | | | (0.65 | ) | | | (0.24 | ) | | | (0.71 | ) | | | (0.37 | ) | | | (0.36 | ) |

| Distributions from | | | | | | | | | | | | | | | | | | | | | | | | |

| net realized gain | | | — | | | | (0.60 | ) | | | — | | | | — | | | | — | | | | — | |

| Total distributions | | | (0.36 | ) | | | (1.25 | ) | | | (0.24 | ) | | | (0.71 | ) | | | (0.37 | ) | | | (0.36 | ) |

| Paid-in capital from | | | | | | | | | | | | | | | | | | | | | | | | |

| redemption fees | | | 0.00 | 2 | | | 0.00 | 2 | | | 0.00 | 2 | | | 0.00 | 2 | | | 0.00 | 2 | | | 0.00 | 2 |

| Net asset value, | | | | | | | | | | | | | | | | | | | | | | | | |

| end of period/year | | $ | 31.20 | | | $ | 25.04 | | | $ | 38.56 | | | $ | 32.48 | | | $ | 29.32 | | | $ | 30.51 | |

| Total return | | | 26.16 | %3 | | | (32.85 | )% | | | 19.48 | % | | | 13.29 | % | | | (2.53 | )% | | | 2.43 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| SUPPLEMENTAL DATA: | | | | | | | | | | | | | | | | | | | | | | | | |

| Net assets, end of | | | | | | | | | | | | | | | | | | | | | | | | |

| period/year (000’s) | | $ | 506,614 | | | $ | 414,237 | | | $ | 495,197 | | | $ | 320,526 | | | $ | 234,114 | | | $ | 250,694 | |

| Expenses before | | | | | | | | | | | | | | | | | | | | | | | | |

| fees waived | | | 0.98 | %4 | | | 0.97 | % | | | 0.97 | % | | | 1.00 | % | | | 1.00 | % | | | 1.04 | % |

| Expenses after | | | | | | | | | | | | | | | | | | | | | | | | |

| fees waived | | | 0.86 | %4 | | | 0.90 | %5 | | | 0.97 | % | | | 1.00 | % | | | 1.00 | % | | | 1.04 | % |

| Net investment income | | | | | | | | | | | | | | | | | | | | | | | | |

| before fees waived | | | 0.53 | %4 | | | 1.84 | % | | | 1.07 | % | | | 0.75 | % | | | 2.09 | % | | | 1.38 | % |

| Net investment income | | | | | | | | | | | | | | | | | | | | | | | | |

| after fees waived | | | 0.65 | %4 | | | 1.91 | % | | | 1.07 | % | | | 0.75 | % | | | 2.09 | % | | | 1.38 | % |

| Portfolio turnover rate | | | 8 | %3 | | | 22 | % | | | 24 | % | | | 33 | % | | | 32 | % | | | 26 | % |

1 | Calculated based on average shares outstanding during the period. |

2 | Less than $0.01 or $(0.01) per share, as applicable. |

3 | Not Annualized. |

4 | Annualized. |

5 | Prior to March 1, 2022, the expense cap was 0.99%. Effective March 1, 2022, the expense cap is 0.86%. |

The accompanying notes are an integral part of these financial statements.

BOSTON COMMON ESG IMPACT U.S. EQUITY FUND

| FINANCIAL HIGHLIGHTS For a capital share outstanding throughout each period/year |

| | | Six Months | | | | | | | | | | | | | | | | |

| | | Ended | | | | | | | | | | | | | | | | |

| | | March 31, | | | | | | | | | | | | | | | | |

| | | 2023 | | | Year Ended September 30, | |

| | | (Unaudited) | | | 2022 | | | 2021 | | | 2020 | | | 2019 | | | 2018 | |

| Net asset value, beginning | | | | | | | | | | | | | | | | | | |

| of period/year | | $ | 48.44 | | | $ | 61.96 | | | $ | 47.97 | | | $ | 43.69 | | | $ | 45.18 | | | $ | 41.77 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| INCOME (LOSS) FROM INVESTMENT OPERATIONS: | |

| Net investment | | | | | | | | | | | | | | | | | | | | | | | | |

income (loss)1 | | | 0.18 | | | | 0.15 | | | | 0.08 | | | | 0.23 | | | | 0.29 | | | | 0.28 | |

| Net realized and unrealized | | | | | | | | | | | | | | | | | | | | | | | | |

| gain (loss) on investments | | | 7.19 | | | | (10.92 | ) | | | 14.10 | | | | 5.85 | | | | 0.25 | | | | 4.47 | |

| Total from operations | | | 7.37 | | | | (10.77 | ) | | | 14.18 | | | | 6.08 | | | | 0.54 | | | | 4.75 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| LESS DISTRIBUTIONS: | |

| Distributions from net | | | | | | | | | | | | | | | | | | | | | | | | |

| investment income | | | (0.12 | ) | | | (0.06 | ) | | | (0.19 | ) | | | (0.27 | ) | | | (0.29 | ) | | | (0.37 | ) |

| Distributions from | | | | | | | | | | | | | | | | | | | | | | | | |

| net realized gain | | | (3.03 | ) | | | (2.69 | ) | | | — | | | | (1.53 | ) | | | (1.74 | ) | | | (0.97 | ) |

| Total distributions | | | (3.15 | ) | | | (2.75 | ) | | | (0.19 | ) | | | (1.80 | ) | | | (2.03 | ) | | | (1.34 | ) |

| Paid-in capital from | | | | | | | | | | | | | | | | | | | | | | | | |

| redemption fees | | | — | | | | 0.00 | 2 | | | — | | | | — | | | | — | | | | — | |

| Net asset value, | | | | | | | | | | | | | | | | | | | | | | | | |

| end of period/year | | $ | 52.66 | | | $ | 48.44 | | | $ | 61.96 | | | $ | 47.97 | | | $ | 43.69 | | | $ | 45.18 | |

| Total return | | | 15.55 | %3 | | | (18.38 | )% | | | 29.62 | % | | | 14.17 | % | | | 2.02 | % | | | 11.50 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| SUPPLEMENTAL DATA: | |

| Net assets, end | | | | | | | | | | | | | | | | | | | | | | | | |

| of period/year (000’s) | | $ | 52,485 | | | $ | 46,670 | | | $ | 57,492 | | | $ | 43,213 | | | $ | 37,974 | | | $ | 36,181 | |

| Expenses before | | | | | | | | | | | | | | | | | | | | | | | | |

| fees waived | | | 1.18 | %4 | | | 1.14 | % | | | 1.14 | % | | | 1.27 | % | | | 1.25 | % | | | 1.30 | % |

| Expenses after | | | | | | | | | | | | | | | | | | | | | | | | |

| fees waived | | | 1.00 | %4 | | | 1.00 | % | | | 1.00 | % | | | 1.00 | % | | | 1.00 | % | | | 1.00 | % |

| Net investment income | | | | | | | | | | | | | | | | | | | | | | | | |

| before fees waived | | | 0.52 | %4 | | | 0.11 | % | | | (0.01 | )% | | | 0.23 | % | | | 0.43 | % | | | 0.34 | % |

| Net investment income | | | | | | | | | | | | | | | | | | | | | | | | |

| after fees waived | | | 0.70 | %4 | | | 0.25 | % | | | 0.13 | % | | | 0.50 | % | | | 0.68 | % | | | 0.64 | % |

| Portfolio turnover rate | | | 11 | %3 | | | 29 | % | | | 19 | % | | | 38 | % | | | 28 | % | | | 27 | % |

1 | Calculated based on average shares outstanding during the period. |

2 | Does not round to $0.01 or $(0.01), as applicable. |

3 | Not annualized. |

4 | Annualized. |

The accompanying notes are an integral part of these financial statements.

BOSTON COMMON ESG IMPACT FUNDS

| NOTES TO FINANCIAL STATEMENTS March 31, 2023 (Unaudited) |

The Emerging Markets Fund, International Fund and the U.S. Equity Fund (collectively the “Funds”) are each a diversified series of shares of beneficial interest of Professionally Managed Portfolios (the “Trust”), which is registered under the Investment Company Act of 1940, as amended, (the “1940 Act”) as an open-end management investment company. The Funds commenced operations on September 21, 2021, December 29, 2010 and April 30, 2012, respectively. Each Fund is an investment company and accordingly follows the investment company accounting and reporting guidance of the Financial Accounting Standards Board (FASB) Accounting Standard Codification Topic 946 “Financial Services — Investment Companies.”

The Funds’ investment objective is to seek long-term capital appreciation. The Funds seek to preserve and build capital over the long-term through investing in a diversified portfolio of common stocks and American Depositary Receipts (“ADR”) of companies it believes are high quality, sustainable and undervalued. The Emerging Markets Fund and the International Fund invest in European Depositary Receipts and Global Depositary Receipts.

| NOTE 2 – SIGNIFICANT ACCOUNTING POLICIES |

The following is a summary of significant accounting policies consistently followed by the Funds. These policies are in conformity with accounting principles generally accepted in the United States of America (“U.S. GAAP”).

| | A. | Security Valuation. All equity securities, which may include Real Estate Investment Trusts (“REITs”), Business Development Companies (“BDCs”) and Master Limited Partnerships (“MLPs”), that are traded on U.S. or foreign national securities exchanges are valued at the last reported sale price on the exchange on which the security is principally traded or the exchange’s official closing price, if applicable. If, on a particular day, an exchange-traded security does not trade, then the mean between the most recent quoted bid and asked prices will be used. All equity securities, which may include REITs, BDCs and MLPs, that are not traded on a listed exchange are valued at the last sale price in the over-the-counter market. If a non- exchange traded security does not trade on a particular day, then the mean between the last quoted closing bid and asked price will be used. |

| | | |