UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number (811-05037)

Professionally Managed Portfolios

(Exact name of registrant as specified in charter)

615 East Michigan Street

Milwaukee, WI 53202

(Address of principal executive offices) (Zip code)

Jason Hadler

Professionally Managed Portfolios

c/o U.S. Bank Global Fund Services

777 E. Wisconsin Avenue

Milwaukee, WI 53202

(Name and address of agent for service)

414-516-1523

Registrant’s telephone number, including area code

Date of fiscal year end: December 31

Date of reporting period: June 30, 2024

Item 1. Report to Stockholders.

| | |

| Muzinich Credit Opportunities Fund | |

| Institutional Class | MZCIX |

| Semi-Annual Shareholder Report | June 30, 2024 |

This semi-annual shareholder report contains important information about the Muzinich Credit Opportunities Fund for the period of January 1, 2024, to June 30, 2024. You can find additional information about the Fund at https://www.muzinichusfunds.com/literature. You can also request this information by contacting us at 1-855-MUZINICH (1-855-689-4642).

This report describes changes to the Fund that occurred during the reporting period.

WHAT WERE THE FUND COSTS FOR THE LAST SIX MONTHS? (based on a hypothetical $10,000 investment)

| | |

Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| Institutional Class | $34 | 0.67% |

KEY FUND STATISTICS (as of June 30, 2024)

| |

Net Assets | $244,730,599 |

Number of Holdings | 345 |

Portfolio Turnover | 86% |

SEC Yield (Subsidized) | 4.71% |

SEC Yield (Unsubsidized) | 4.48% |

Visit https://www.muzinichusfunds.com/literature for more recent performance information.

WHAT DID THE FUND INVEST IN? (as of June 30, 2024)

| |

Top 10 Issuers | (%) |

Ford Motor Credit Co LLC | 1.5% |

T-Mobile USA Inc | 1.4% |

General Motors Financial Co Inc | 1.4% |

Hyundai Capital America | 1.1% |

United States Treasury Note/Bond | 1.1% |

United Kingdom Gilt | 1.1% |

HCA Inc | 1.0% |

Nasdaq Inc | 1.0% |

Barclays PLC | 0.8% |

CaixaBank SA | 0.8% |

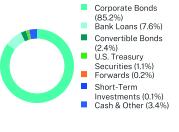

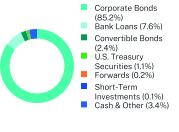

Security Type Breakdown (%)

For additional information about the Fund; including its prospectus, financial information, holdings and proxy information, scan the QR code or visit https://www.muzinichusfunds.com/literature

| Muzinich Credit Opportunities Fund | PAGE 1 | TSR_SAR_74316J573 |

HOUSEHOLDING

To reduce Fund expenses, only one copy of most shareholder documents may be mailed to shareholders with multiple accounts at the same address (Householding). If you would prefer that your Muzinich & Co., Inc. documents not be householded, please contact Muzinich & Co., Inc. at 1-855-MUZINICH (1-855-689-4642), or contact your financial intermediary. Your instructions will typically be effective within 30 days of receipt by Muzinich & Co., Inc. or your financial intermediary.

| Muzinich Credit Opportunities Fund | PAGE 2 | TSR_SAR_74316J573 |

85.27.62.41.10.20.13.413.711.29.29.05.75.55.43.93.532.9

| | |

| Muzinich Credit Opportunities Fund | |

| Supra Institutional Class | MZCSX |

| Semi-Annual Shareholder Report | June 30, 2024 |

This semi-annual shareholder report contains important information about the Muzinich Credit Opportunities Fund for the period of January 1, 2024, to June 30, 2024. You can find additional information about the Fund at https://www.muzinichusfunds.com/literature. You can also request this information by contacting us at 1-855-MUZINICH (1-855-689-4642).

This report describes changes to the Fund that occurred during the reporting period.

WHAT WERE THE FUND COSTS FOR THE LAST SIX MONTHS? (based on a hypothetical $10,000 investment)

| | |

Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| Supra Institutional Class | $30 | 0.60% |

KEY FUND STATISTICS (as of June 30, 2024)

| |

Net Assets | $244,730,599 |

Number of Holdings | 345 |

Portfolio Turnover | 86% |

SEC Yield (Subsidized) | 4.80% |

SEC Yield (Unsubsidized) | 4.57% |

Visit https://www.muzinichusfunds.com/literature for more recent performance information.

WHAT DID THE FUND INVEST IN? (as of June 30, 2024)

| |

Top 10 Issuers | (%) |

Ford Motor Credit Co LLC | 1.5% |

T-Mobile USA Inc | 1.4% |

General Motors Financial Co Inc | 1.4% |

Hyundai Capital America | 1.1% |

United States Treasury Note/Bond | 1.1% |

United Kingdom Gilt | 1.1% |

HCA Inc | 1.0% |

Nasdaq Inc | 1.0% |

Barclays PLC | 0.8% |

CaixaBank SA | 0.8% |

Security Type Breakdown (%)

For additional information about the Fund; including its prospectus, financial information, holdings and proxy information, scan the QR code or visit https://www.muzinichusfunds.com/literature

| Muzinich Credit Opportunities Fund | PAGE 1 | TSR_SAR_74316J573 |

HOUSEHOLDING

To reduce Fund expenses, only one copy of most shareholder documents may be mailed to shareholders with multiple accounts at the same address (Householding). If you would prefer that your Muzinich & Co., Inc. documents not be householded, please contact Muzinich & Co., Inc. at 1-855-MUZINICH (1-855-689-4642), or contact your financial intermediary. Your instructions will typically be effective within 30 days of receipt by Muzinich & Co., Inc. or your financial intermediary.

| Muzinich Credit Opportunities Fund | PAGE 2 | TSR_SAR_74316J573 |

85.27.62.41.10.20.13.413.711.29.29.05.75.55.43.93.532.9

| | |

| Muzinich Flexible U.S. High Yield income Fund | |

| Institutional Class | MZHIX |

| Semi-Annual Shareholder Report | June 30, 2024 |

This semi-annual shareholder report contains important information about the Muzinich Flexible U.S. High Yield income Fund for the period of January 1, 2024, to June 30, 2024. You can find additional information about the Fund at https://www.muzinichusfunds.com/literature. You can also request this information by contacting us at 1-855-MUZINICH (1-855-689-4642).

This report describes changes to the Fund that occurred during the reporting period.

WHAT WERE THE FUND COSTS FOR THE LAST SIX MONTHS? (based on a hypothetical $10,000 investment)

| | |

Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| Institutional Class | $29 | 0.58% |

KEY FUND STATISTICS (as of June 30, 2024)

| |

Net Assets | $47,684,837 |

Number of Holdings | 279 |

Portfolio Turnover | 46% |

SEC Yield (Subsidized) | 7.16% |

SEC Yield (Unsubsidized) | 6.59% |

Visit https://www.muzinichusfunds.com/literature for more recent performance information.

WHAT DID THE FUND INVEST IN? (as of June 30, 2024)

| |

Top 10 Issuers | (%) |

First American Treasury Obligations Fund | 2.4% |

CCO Holdings LLC / CCO Holdings Capital Corp | 1.7% |

Venture Global LNG Inc | 1.6% |

Cloud Software Group Inc | 1.5% |

Crescent Energy Finance LLC | 1.3% |

Carnival Holdings Bermuda Ltd | 1.2% |

Burford Capital Global Finance LLC | 1.1% |

Harvest Midstream I LP | 1.1% |

Mauser Packaging Solutions Holding Co | 1.0% |

Icahn Enterprises LP / Icahn Enterprises Finance Corp | 1.1% |

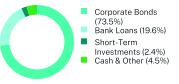

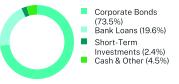

Security Type Breakdown (%)

For additional information about the Fund; including its prospectus, financial information, holdings and proxy information, scan the QR code or visit https://www.muzinichusfunds.com/literature

| Muzinich Flexible U.S. High Yield income Fund | PAGE 1 | TSR_SAR_74316J573 |

HOUSEHOLDING

To reduce Fund expenses, only one copy of most shareholder documents may be mailed to shareholders with multiple accounts at the same address (Householding). If you would prefer that your Muzinich & Co., Inc. documents not be householded, please contact Muzinich & Co., Inc. at 1-855-MUZINICH (1-855-689-4642), or contact your financial intermediary. Your instructions will typically be effective within 30 days of receipt by Muzinich & Co., Inc. or your financial intermediary.

| Muzinich Flexible U.S. High Yield income Fund | PAGE 2 | TSR_SAR_74316J573 |

73.519.62.44.511.27.16.65.65.44.94.54.34.146.3

| | |

| Muzinich Flexible U.S. High Yield income Fund | |

| Supra Institutional Class | MZHSX |

| Semi-Annual Shareholder Report | June 30, 2024 |

This semi-annual shareholder report contains important information about the Muzinich Flexible U.S. High Yield income Fund for the period of January 1, 2024, to June 30, 2024. You can find additional information about the Fund at https://www.muzinichusfunds.com/literature. You can also request this information by contacting us at 1-855-MUZINICH (1-855-689-4642).

This report describes changes to the Fund that occurred during the reporting period.

WHAT WERE THE FUND COSTS FOR THE LAST SIX MONTHS? (based on a hypothetical $10,000 investment)

| | |

Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| Supra Institutional Class | $29 | 0.58% |

KEY FUND STATISTICS (as of June 30, 2024)

| |

Net Assets | $47,684,837 |

Number of Holdings | 279 |

Portfolio Turnover | 46% |

SEC Yield (Subsidized) | 7.16% |

SEC Yield (Unsubsidized) | 6.59% |

Visit https://www.muzinichusfunds.com/literature for more recent performance information.

WHAT DID THE FUND INVEST IN? (as of June 30, 2024)

| |

Top 10 Issuers | (%) |

First American Treasury Obligations Fund | 2.4% |

CCO Holdings LLC / CCO Holdings Capital Corp | 1.7% |

Venture Global LNG Inc | 1.6% |

Cloud Software Group Inc | 1.5% |

Crescent Energy Finance LLC | 1.3% |

Carnival Holdings Bermuda Ltd | 1.2% |

Burford Capital Global Finance LLC | 1.1% |

Harvest Midstream I LP | 1.1% |

Mauser Packaging Solutions Holding Co | 1.0% |

Icahn Enterprises LP / Icahn Enterprises Finance Corp | 1.1% |

Security Type Breakdown (%)

For additional information about the Fund; including its prospectus, financial information, holdings and proxy information, scan the QR code or visit https://www.muzinichusfunds.com/literature

| Muzinich Flexible U.S. High Yield income Fund | PAGE 1 | TSR_SAR_74316J565 |

HOUSEHOLDING

To reduce Fund expenses, only one copy of most shareholder documents may be mailed to shareholders with multiple accounts at the same address (Householding). If you would prefer that your Muzinich & Co., Inc. documents not be householded, please contact Muzinich & Co., Inc. at 1-855-MUZINICH (1-855-689-4642), or contact your financial intermediary. Your instructions will typically be effective within 30 days of receipt by Muzinich & Co., Inc. or your financial intermediary.

| Muzinich Flexible U.S. High Yield income Fund | PAGE 2 | TSR_SAR_74316J565 |

73.519.62.44.511.27.16.65.65.44.94.54.34.146.3

| | |

| Muzinich Low Duration Fund | |

| Supra Institutional Class | MZLSX |

| Semi-Annual Shareholder Report | June 30, 2024 |

This semi-annual shareholder report contains important information about the Muzinich Low Duration Fund for the period of January 1, 2024, to June 30, 2024. You can find additional information about the Fund at https://www.muzinichusfunds.com/literature. You can also request this information by contacting us at 1-855-MUZINICH (1-855-689-4642).

This report describes changes to the Fund that occurred during the reporting period.

WHAT WERE THE FUND COSTS FOR THE LAST SIX MONTHS? (based on a hypothetical $10,000 investment)

| | |

Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| Supra Institutional Class | $25 | 0.50% |

KEY FUND STATISTICS (as of June 30, 2024)

| |

Net Assets | $1,077,471,166 |

Number of Holdings | 485 |

Portfolio Turnover | 34% |

SEC Yield (Subsidized) | 4.73% |

SEC Yield (Unsubsidized) | 4.65% |

Visit https://www.muzinichusfunds.com/literature for more recent performance information.

WHAT DID THE FUND INVEST IN? (as of June 30, 2024)

| |

Top 10 Issuers | (%) |

First American Treasury Obligations Fund | 2.0% |

Ford Motor Credit Co LLC | 1.6% |

AIB Group PLC | 1.4% |

RCI Banque SA | 1.1% |

CaixaBank SA | 1.0% |

BPCE SA | 1.0% |

Hyatt Hotels Corp | 1.0% |

Bank of Ireland Group PLC | 1.0% |

Leasys SPA | 0.9% |

General Motors Financial Co Inc | 1.0% |

For additional information about the Fund; including its prospectus, financial information, holdings and proxy information, scan the QR code or visit https://www.muzinichusfunds.com/literature

| Muzinich Low Duration Fund | PAGE 1 | TSR_SAR_74316J573 |

HOUSEHOLDING

To reduce Fund expenses, only one copy of most shareholder documents may be mailed to shareholders with multiple accounts at the same address (Householding). If you would prefer that your Muzinich & Co., Inc. documents not be householded, please contact Muzinich & Co., Inc. at 1-855-MUZINICH (1-855-689-4642), or contact your financial intermediary. Your instructions will typically be effective within 30 days of receipt by Muzinich & Co., Inc. or your financial intermediary.

| Muzinich Low Duration Fund | PAGE 2 | TSR_SAR_74316J573 |

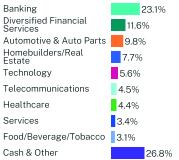

23.111.69.87.75.64.54.43.43.126.8

Item 2. Code of Ethics.

Not applicable for semi-annual reports.

Item 3. Audit Committee Financial Expert.

Not applicable for semi-annual reports.

Item 4. Principal Accountant Fees and Services.

Not applicable for semi-annual reports.

Item 5. Audit Committee of Listed Registrants.

Not applicable to registrants who are not listed issuers (as defined in Rule 10A-3 under the Securities Exchange Act of 1934).

Item 6. Investments.

| (a) | Schedule of Investments is included as part of the report to shareholders filed under Item 7 of this Form. |

Item 7. Financial Statements and Financial Highlights for Open-End Investment Companies.

Muzinich Credit Opportunities Fund

Muzinich Flexible U.S. High Yield Income Fund

Muzinich Low Duration Fund

Core Financial Statements

June 30, 2024

TABLE OF CONTENTS

Muzinich Credit Opportunities Fund

Schedule of Investments

June 30, 2024 (Unaudited)

| | | | | | | |

CORPORATE BONDS - 85.2%

|

Aerospace/Defense - 0.6%

|

TransDigm Inc, 6.63%, 03/01/2032(a) | | | | | | $1,350,000 | | | $ 1,365,323 |

Agency - 0.4%

|

Indian Railway Finance Corp Ltd, 3.57%, 01/21/2032 | | | | | | 1,050,000 | | | 935,639 |

Airlines - 1.6%

|

Air France-KLM, 7.25%, 05/31/2026 | | | EUR | | | 900,000 | | | 1,013,414 |

American Airlines Inc/AAdvantage Loyalty IP Ltd

|

5.50%, 04/20/2026(a) | | | | | | 366,667 | | | 363,675 |

5.75%, 04/20/2029(a) | | | | | | 1,075,000 | | | 1,047,579 |

Emirates Airline, 4.50%, 02/06/2025 | | | | | | 215,197 | | | 214,166 |

Mileage Plus Holdings LLC / Mileage Plus Intellectual Property Assets Ltd, 6.50%, 06/20/2027(a) | | | | | | 540,000 | | | 541,417 |

Wizz Air Finance Co BV, 1.00%, 01/19/2026 | | | EUR | | | 650,000 | | | 660,818 |

| | | 3,841,069 |

Automotive & Auto Parts - 8.9%

|

Ford Motor Credit Co LLC

|

7.35%, 11/04/2027 | | | | | | 1,300,000 | | | 1,355,410 |

6.05%, 03/05/2031 | | | | | | 900,000 | | | 902,400 |

7.12%, 11/07/2033 | | | | | | 1,500,000 | | | 1,589,658 |

Ford Otomotiv Sanayi AS, 7.13%, 04/25/2029 | | | | | | 250,000 | | | 252,816 |

Forvia SE, 2.75%, 02/15/2027 | | | EUR | | | 700,000 | | | 717,014 |

General Motors Financial Co Inc

|

2.35%, 01/08/2031 | | | | | | 1,425,000 | | | 1,171,446 |

6.10%, 01/07/2034 | | | | | | 1,200,000 | | | 1,215,815 |

5.95%, 04/04/2034 | | | | | | 1,000,000 | | | 1,003,089 |

Hyundai Capital America

|

1.65%, 09/17/2026(a) | | | | | | 1,698,000 | | | 1,564,084 |

5.40%, 01/08/2031(a) | | | | | | 1,300,000 | | | 1,293,174 |

IHO Verwaltungs GmbH, 3.75% (includes 4.50% PIK), 09/15/2026 | | | EUR | | | 400,000 | | | 422,747 |

Kia Corp, 3.25%, 04/21/2026 | | | | | | 470,000 | | | 452,766 |

Magna International Inc, 4.38%, 03/17/2032 | | | EUR | | | 500,000 | | | 558,972 |

Nissan Motor Acceptance Co LLC, 7.05%, 09/15/2028 | | | | | | 400,000 | | | 416,684 |

Nissan Motor Co Ltd, 4.81%, 09/17/2030(a) | | | | | | 850,000 | | | 790,665 |

Phinia Inc, 6.75%, 04/15/2029(a) | | | | | | 650,000 | | | 660,468 |

Porsche Automobil Holding SE, 4.13%, 09/27/2032 | | | EUR | | | 925,000 | | | 986,557 |

RCI Banque SA, 4.13%, 04/04/2031 | | | EUR | | | 800,000 | | | 852,811 |

Schaeffler AG, 2.88%, 03/26/2027 | | | EUR | | | 900,000 | | | 937,538 |

Stellantis NV

|

4.25%, 06/16/2031 | | | EUR | | | 975,000 | | | 1,063,908 |

2.75%, 04/01/2032 | | | EUR | | | 500,000 | | | 492,972 |

Valeo SE, 5.88%, 04/12/2029 | | | EUR | | | 800,000 | | | 899,938 |

| | | | | | | | | | |

The accompanying notes are an integral part of these financial statements.

TABLE OF CONTENTS

Muzinich Credit Opportunities Fund

Schedule of Investments

June 30, 2024 (Unaudited) (Continued)

| | | | | | | |

CORPORATE BONDS - (Continued)

|

Automotive & Auto Parts - (Continued)

|

Volkswagen International Finance NV

|

4.63% to 1.000000000 then 10 yr. Swap Rate EUR + 3.98%, Perpetual | | | EUR | | | 200,000 | | | $210,309 |

7.50% to 1.000000000 then 5 yr. Swap Rate EUR + 4.29%, Perpetual | | | EUR | | | 200,000 | | | 231,879 |

Volvo Car AB, 4.75%, 05/08/2030 | | | EUR | | | 600,000 | | | 644,538 |

ZF Europe Finance BV, 6.13%, 03/13/2029 | | | EUR | | | 1,000,000 | | | 1,134,231 |

| | | 21,821,889 |

Banking - 11.4%

|

AIB Group PLC, 2.88% to 1.000000000 then 5 yr. Swap Rate EUR + 3.30%, 05/30/2031 | | | EUR | | | 1,200,000 | | | 1,246,821 |

Banco BPM SPA, 4.88% to 01/17/2029 then 3 mo. EURIBOR + 2.35%, 01/17/2030 | | | EUR | | | 225,000 | | | 246,622 |

Banco Santander SA, 9.63% to 1.000000000 then 5 yr. CMT Rate + 5.30%, Perpetual | | | | | | 800,000 | | | 888,911 |

Bancolombia SA, 6.91% to 1.000000000 then 5 yr. CMT Rate + 2.93%, 10/18/2027 | | | | | | 500,000 | | | 494,120 |

Bank of America Corp, 1.90% to 1.000000000 then SOFR + 1.53%, 07/23/2031 | | | | | | 1,275,000 | | | 1,051,577 |

Barclays PLC

|

6.49% to 1.000000000 then SOFR + 2.22%, 09/13/2029 | | | | | | 1,300,000 | | | 1,346,686 |

9.63% to 1.000000000 then USISSO05 + 5.78%, Perpetual | | | | | | 800,000 | | | 869,542 |

BBVA Bancomer SA, 8.13% to 1.000000000 then 5 yr. CMT Rate + 4.21%, 01/08/2039 | | | | | | 650,000 | | | 659,797 |

BPCE SA

|

1.65% to 1.000000000 then SOFR + 1.52%, 10/06/2026(a) | | | | | | 700,000 | | | 662,507 |

1.50% to 1.000000000 then 5 yr. Swap Rate EUR + 1.75%, 01/13/2042 | | | EUR | | | 600,000 | | | 592,542 |

CaixaBank SA

|

2.25% to 1.000000000 then 5 yr. Swap Rate EUR + 1.68%, 04/17/2030 | | | EUR | | | 1,200,000 | | | 1,258,258 |

6.88% to 1.000000000 then UK Government Bonds 5 Year Note Generic Bid Yield + 3.70%, 10/25/2033 | | | GBP | | | 600,000 | | | 774,610 |

Citigroup Inc, 4.70% to 1.000000000 then SOFR + 3.23%, Perpetual | | | | | | 750,000 | | | 734,865 |

Commerzbank AG

|

4.00% to 1.000000000 then 5 yr. Swap Rate EUR + 4.35%, 12/05/2030 | | | EUR | | | 700,000 | | | 743,435 |

1.38% to 1.000000000 then 5 yr. Swap Rate EUR + 1.73%, 12/29/2031 | | | EUR | | | 600,000 | | | 594,213 |

4.88% to 1.000000000 then 5 yr. Swap Rate EUR + 2.15%, 10/16/2034 | | | EUR | | | 400,000 | | | 427,367 |

Danske Bank AS, 1.38% to 1.000000000 then 5 yr. Swap Rate EUR + 1.70%, 02/12/2030 | | | EUR | | | 1,200,000 | | | 1,261,199 |

First Abu Dhabi Bank PJSC, 6.32% to 1.000000000 then 5 yr. CMT Rate + 1.70%, 04/04/2034 | | | | | | 1,350,000 | | | 1,378,269 |

ING Groep NV, 7.50% to 1.000000000 then 5 yr. CMT Rate + 3.71%, Perpetual | | | | | | 450,000 | | | 450,035 |

JPMorgan Chase & Co, 3.11% to 1.000000000 then SOFR + 2.44%, 04/22/2051 | | | | | | 950,000 | | | 650,973 |

KBC Group NV, 0.63% to 1.000000000 then 5 yr. Swap Rate EUR + 0.95%, 12/07/2031 | | | EUR | | | 600,000 | | | 592,337 |

Lloyds Banking Group PLC, 4.38% to 1.000000000 then 5 yr. Swap Rate

EUR + 2.05%, 04/05/2034 | | | EUR | | | 900,000 | | | 957,720 |

Mizuho Financial Group Inc, 5.58% to 1.000000000 then 1 yr. CMT Rate + 1.30%, 05/26/2035 | | | | | | 1,300,000 | | | 1,302,277 |

| | | | | | | | | | |

The accompanying notes are an integral part of these financial statements.

TABLE OF CONTENTS

Muzinich Credit Opportunities Fund

Schedule of Investments

June 30, 2024 (Unaudited) (Continued)

| | | | | | | |

CORPORATE BONDS - (Continued)

|

Banking - (Continued)

|

Permanent TSB Group Holdings PLC, 6.63% to 1.000000000 then EURIBOR ICE Swap Rate + 3.50%, 04/25/2028 | | | EUR | | | 800,000 | | | $903,379 |

Powszechna Kasa Oszczednosci Bank Polski SA, 4.50% to 1.000000000 then

3 mo. EURIBOR + 1.60%, 03/27/2028 | | | EUR | | | 750,000 | | | 804,650 |

QNB Finance Ltd, 6.55% (SOFR + 1.20%), 04/02/2029 | | | | | | 1,200,000 | | | 1,209,049 |

Societe Generale SA, 1.13% to 1.000000000 then 5 yr. Swap Rate EUR + 1.60%, 06/30/2031 | | | EUR | | | 700,000 | | | 700,692 |

Standard Chartered PLC

|

7.28% (SOFR + 1.93%), 07/06/2027 | | | | | | 270,000 | | | 274,963 |

6.54% (SOFR + 1.17%), 05/14/2028 | | | | | | 500,000 | | | 502,178 |

1.20% to 1.000000000 then 5 yr. Swap Rate EUR + 1.55%, 09/23/2031 | | | EUR | | | 800,000 | | | 792,997 |

Swedbank AB, 7.63% to 1.000000000 then 5 yr. CMT Rate + 3.59%,

Perpetual | | | | | | 400,000 | | | 399,250 |

UniCredit SPA, 2.00% to 1.000000000 then 5 yr. Swap Rate EUR + 2.40%, 09/23/2029 | | | EUR | | | 600,000 | | | 638,135 |

United Overseas Bank Ltd, 3.86% to 1.000000000 then 5 yr. CMT Rate + 1.45%, 10/07/2032 | | | | | | 900,000 | | | 857,219 |

Virgin Money UK PLC, 5.13% to 1.000000000 then UK Government Bonds

5 Year Note Generic Bid Yield + 5.25%, 12/11/2030 | | | GBP | | | 900,000 | | | 1,120,475 |

Volksbank Wien AG, 5.75% to 1.000000000 then 5 yr. Swap Rate EUR + 3.10%, 06/21/2034 | | | EUR | | | 500,000 | | | 531,898 |

| | | 27,919,568 |

Broadcasting - 0.6%

|

TEGNA Inc

|

4.75%, 03/15/2026(a) | | | | | | 875,000 | | | 856,327 |

4.63%, 03/15/2028 | | | | | | 550,000 | | | 497,517 |

| | | 1,353,844 |

Building Materials - 0.7%

|

Builders FirstSource Inc

|

4.25%, 02/01/2032(a) | | | | | | 500,000 | | | 442,481 |

6.38%, 03/01/2034(a) | | | | | | 425,000 | | | 421,541 |

Standard Industries Inc, 5.00%, 02/15/2027(a) | | | | | | 900,000 | | | 875,936 |

| | | 1,739,958 |

Cable/Satellite TV - 0.7%

|

CCO Holdings LLC / CCO Holdings Capital Corp, 5.13%, 05/01/2027(a) | | | | | | 700,000 | | | 672,676 |

Charter Communications Operating LLC / Charter Communications Operating Capital, 6.55%, 06/01/2034 | | | | | | 750,000 | | | 752,789 |

Grupo Televisa SAB, 6.63%, 01/15/2040 | | | | | | 400,000 | | | 397,394 |

| | | 1,822,859 |

Capital Goods - 1.1%

|

EMRLD Borrower LP / Emerald Co-Issuer Inc, 6.75%, 07/15/2031(a) | | | | | | 250,000 | | | 253,659 |

Hillenbrand Inc, 6.25%, 02/15/2029 | | | | | | 500,000 | | | 503,129 |

Ingersoll Rand Inc, 5.45%, 06/15/2034 | | | | | | 300,000 | | | 303,347 |

Regal Rexnord Corp, 6.05%, 04/15/2028 | | | | | | 1,350,000 | | | 1,367,297 |

| | | | | | | | | | |

The accompanying notes are an integral part of these financial statements.

TABLE OF CONTENTS

Muzinich Credit Opportunities Fund

Schedule of Investments

June 30, 2024 (Unaudited) (Continued)

| | | | | | | |

CORPORATE BONDS - (Continued)

|

Capital Goods - (Continued)

|

Trane Technologies Financing Ltd, 5.10%, 06/13/2034 | | | | | | $ 375,000 | | | $ 374,593 |

| | | 2,802,025 |

Chemicals - 2.5%

|

Alpek SAB de CV, 4.25%, 09/18/2029 | | | | | | 868,000 | | | 799,419 |

Celanese US Holdings LLC, 6.55%, 11/15/2030 | | | | | | 1,025,000 | | | 1,072,440 |

DuPont de Nemours Inc, 5.42%, 11/15/2048 | | | | | | 500,000 | | | 520,626 |

International Flavors & Fragrances Inc, 2.30%, 11/01/2030(a) | | | | | | 1,225,000 | | | 1,022,768 |

Orbia Advance Corp SAB de CV, 4.00%, 10/04/2027 | | | | | | 1,400,000 | | | 1,326,352 |

Sherwin-Williams Co, 2.95%, 08/15/2029 | | | | | | 1,450,000 | | | 1,308,453 |

| | | 6,050,058 |

Consumer-Products - 0.2%

|

Hasbro Inc, 6.05%, 05/14/2034 | | | | | | 600,000 | | | 600,173 |

Containers - 0.2%

|

Berry Global Inc, 5.65%, 01/15/2034(a) | | | | | | 525,000 | | | 514,226 |

Diversified Financial Services - 8.1%

|

AerCap Ireland Capital DAC / AerCap Global Aviation Trust,

6.15%, 09/30/2030 | | | | | | 900,000 | | | 931,455 |

Block Inc, 6.50%, 05/15/2032(a) | | | | | | 475,000 | | | 481,222 |

CBRE Global Investors Open-Ended Funds SCA SICAV-SIF-Pan European Core Fund, 4.75%, 03/27/2034 | | | EUR | | | 600,000 | | | 651,754 |

DAE Funding LLC, 3.38%, 03/20/2028 | | | | | | 1,400,000 | | | 1,287,918 |

Esic Sukuk Ltd, 5.83%, 02/14/2029 | | | | | | 1,060,000 | | | 1,061,199 |

Fortress Transportation and Infrastructure Investors LLC,

7.00%, 06/15/2032(a) | | | | | | 1,075,000 | | | 1,091,341 |

Grupo de Inversiones Suramericana SA, 5.50%, 04/29/2026 | | | | | | 1,500,000 | | | 1,478,258 |

GTCR W-2 Merger Sub LLC, 7.50%, 01/15/2031(a) | | | | | | 400,000 | | | 417,438 |

Hyundai Card Co Ltd, 5.75%, 04/24/2029 | | | | | | 210,000 | | | 211,629 |

ICD Funding Ltd, 3.22%, 04/28/2026 | | | | | | 1,900,000 | | | 1,819,914 |

India Vehicle Finance, 5.85%, 03/25/2029 | | | | | | 410,000 | | | 401,341 |

JAB Holdings BV, 4.38%, 04/25/2034 | | | EUR | | | 200,000 | | | 215,324 |

Macquarie Airfinance Holdings Ltd, 8.38%, 05/01/2028(a) | | | | | | 725,000 | | | 764,866 |

MDGH GMTN RSC Ltd

|

2.88%, 11/07/2029 | | | | | | 880,000 | | | 793,025 |

3.70%, 11/07/2049 | | | | | | 790,000 | | | 600,268 |

Morgan Stanley

|

5.17% to 1.000000000 then SOFR + 1.45%, 01/16/2030 | | | | | | 775,000 | | | 773,661 |

5.25% to 1.000000000 then SOFR + 1.87%, 04/21/2034 | | | | | | 450,000 | | | 444,038 |

5.47% to 1.000000000 then SOFR + 1.73%, 01/18/2035 | | | | | | 675,000 | | | 674,796 |

Motability Operations Group PLC, 3.88%, 01/24/2034 | | | EUR | | | 700,000 | | | 742,362 |

Nasdaq Inc

|

5.55%, 02/15/2034 | | | | | | 1,125,000 | | | 1,128,847 |

6.10%, 06/28/2063 | | | | | | 1,250,000 | | | 1,281,516 |

SoftBank Group Corp, 6.75%, 07/08/2029 | | | | | | 800,000 | | | 795,952 |

| | | | | | | | | | |

The accompanying notes are an integral part of these financial statements.

TABLE OF CONTENTS

Muzinich Credit Opportunities Fund

Schedule of Investments

June 30, 2024 (Unaudited) (Continued)

| | | | | | | |

CORPORATE BONDS - (Continued)

|

Diversified Financial Services - (Continued)

|

UBS Group AG, 9.25% to 1.000000000 then 5 yr. CMT Rate + 4.76%, Perpetual(a) | | | | | | $1,500,000 | | | $1,683,618 |

| | | 19,731,742 |

Energy - 11.2%

|

Aker BP ASA, 4.00%, 05/29/2032 | | | EUR | | | 1,000,000 | | | 1,065,835 |

BP Capital Markets BV, 4.32%, 05/12/2035 | | | EUR | | | 350,000 | | | 388,038 |

Cheniere Corpus Christi Holdings LLC, 5.13%, 06/30/2027 | | | | | | 1,275,000 | | | 1,273,827 |

Cheniere Energy Partners LP

|

4.50%, 10/01/2029 | | | | | | 1,000,000 | | | 953,297 |

5.95%, 06/30/2033 | | | | | | 500,000 | | | 507,267 |

Chesapeake Energy Corp, 5.50%, 02/01/2026(a) | | | | | | 600,000 | | | 595,102 |

Ecopetrol SA, 8.88%, 01/13/2033 | | | | | | 670,000 | | | 692,555 |

Energy Transfer LP, 5.55%, 05/15/2034 | | | | | | 750,000 | | | 742,811 |

Galaxy Pipeline Assets Bidco Ltd, 2.63%, 03/31/2036 | | | | | | 1,400,000 | | | 1,141,751 |

Kinder Morgan Inc

|

4.30%, 03/01/2028 | | | | | | 675,000 | | | 656,048 |

5.20%, 06/01/2033 | | | | | | 1,300,000 | | | 1,265,465 |

Lion/Polaris Lux 4 SA, 3.25%, 09/30/2040 | | | | | | 959,000 | | | 730,996 |

Occidental Petroleum Corp, 7.88%, 09/15/2031 | | | | | | 875,000 | | | 982,325 |

Oleoducto Central SA, 4.00%, 07/14/2027 | | | | | | 924,000 | | | 857,281 |

ONEOK Inc

|

6.05%, 09/01/2033 | | | | | | 700,000 | | | 722,412 |

6.63%, 09/01/2053 | | | | | | 600,000 | | | 644,037 |

Ovintiv Inc, 7.10%, 07/15/2053 | | | | | | 525,000 | | | 579,391 |

Pertamina Persero PT

|

3.65%, 07/30/2029 | | | | | | 700,000 | | | 651,413 |

4.15%, 02/25/2060 | | | | | | 850,000 | | | 628,404 |

Plains All American Pipeline LP / PAA Finance Corp, 3.55%, 12/15/2029 | | | | | | 1,950,000 | | | 1,782,528 |

QatarEnergy, 2.25%, 07/12/2031 | | | | | | 1,700,000 | | | 1,422,271 |

Repsol International Finance BV

|

3.75% to 1.000000000 then 5 yr. Swap Rate EUR + 4.00%, Perpetual | | | EUR | | | 200,000 | | | 211,612 |

2.50% to 1.000000000 then 5 yr. Swap Rate EUR + 2.77%, Perpetual | | | EUR | | | 875,000 | | | 892,389 |

Rockies Express Pipeline LLC, 3.60%, 05/15/2025(a) | | | | | | 1,375,000 | | | 1,344,282 |

Shell International Finance BV, 1.88%, 04/07/2032 | | | EUR | | | 600,000 | | | 572,749 |

Targa Resources Corp, 6.50%, 03/30/2034 | | | | | | 700,000 | | | 742,515 |

TotalEnergies SE, 2.63% to 1.000000000 then 5 yr. Swap Rate EUR + 2.15%, Perpetual | | | EUR | | | 1,475,000 | | | 1,559,009 |

Venture Global LNG Inc, 8.13%, 06/01/2028(a) | | | | | | 1,400,000 | | | 1,444,632 |

Williams Cos Inc, 5.30%, 08/15/2028 | | | | | | 775,000 | | | 778,010 |

Wintershall Dea Finance 2 BV, 2.50% to 1.000000000 then 5 yr. Swap Rate EUR + 2.92%, Perpetual | | | EUR | | | 1,500,000 | | | 1,505,317 |

| | | 27,333,569 |

Food & Drug Retail - 1.1%

|

Albertsons Cos Inc / Safeway Inc / New Albertsons LP / Albertsons LLC, 6.50%, 02/15/2028(a) | | | | | | 750,000 | | | 755,141 |

| | | | | | | | | | |

The accompanying notes are an integral part of these financial statements.

TABLE OF CONTENTS

Muzinich Credit Opportunities Fund

Schedule of Investments

June 30, 2024 (Unaudited) (Continued)

| | | | | | | |

CORPORATE BONDS - (Continued)

|

Food & Drug Retail - (Continued)

|

Cencosud SA, 5.95%, 05/28/2031 | | | | | | $ 820,000 | | | $ 823,969 |

Roadster Finance DAC, 1.63%, 12/09/2024 | | | EUR | | | 525,000 | | | 555,278 |

Tesco Corporate Treasury Services PLC, 5.13%, 05/22/2034 | | | GBP | | | 450,000 | | | 550,481 |

| | | 2,684,869 |

Food/Beverage/Tobacco - 3.7%

|

Anheuser-Busch InBev Worldwide Inc, 5.45%, 01/23/2039 | | | | | | 650,000 | | | 661,309 |

Bacardi Ltd / Bacardi-Martini BV

|

5.25%, 01/15/2029(a) | | | | | | 750,000 | | | 740,918 |

5.40%, 06/15/2033(a) | | | | | | 1,125,000 | | | 1,100,660 |

Bimbo Bakeries USA Inc, 6.40%, 01/15/2034 | | | | | | 1,500,000 | | | 1,589,297 |

Constellation Brands Inc, 4.90%, 05/01/2033 | | | | | | 1,550,000 | | | 1,500,390 |

Indofood BCP Sukses, 3.40%, 06/09/2031 | | | | | | 1,510,000 | | | 1,317,523 |

Keurig Dr Pepper Inc

|

3.95%, 04/15/2029 | | | | | | 700,000 | | | 666,589 |

5.20%, 03/15/2031 | | | | | | 1,150,000 | | | 1,148,922 |

Tereos Finance Groupe I SA, 5.88%, 04/30/2030 | | | EUR | | | 300,000 | | | 321,860 |

| | | 9,047,468 |

Healthcare - 5.4%

|

AbbVie Inc, 5.50%, 03/15/2064 | | | | | | 1,450,000 | | | 1,441,311 |

Amgen Inc, 5.65%, 03/02/2053 | | | | | | 975,000 | | | 966,104 |

Bayer AG

|

4.50% to 1.000000000 then 5 yr. Swap Rate EUR + 3.75%, 03/25/2082 | | | EUR | | | 400,000 | | | 413,142 |

6.63% to 1.000000000 then 5 yr. Swap Rate EUR + 3.43%, 09/25/2083 | | | EUR | | | 800,000 | | | 868,163 |

Bristol-Myers Squibb Co, 5.55%, 02/22/2054 | | | | | | 1,325,000 | | | 1,314,293 |

Cheplapharm Arzneimittel GmbH, 4.38%, 01/15/2028 | | | EUR | | | 800,000 | | | 815,237 |

Elevance Health Inc

|

5.38%, 06/15/2034 | | | | | | 650,000 | | | 654,680 |

5.65%, 06/15/2054 | | | | | | 625,000 | | | 622,096 |

Eli Lilly & Co, 5.00%, 02/09/2054 | | | | | | 1,200,000 | | | 1,153,326 |

Fortrea Holdings Inc, 7.50%, 07/01/2030(a) | | | | | | 600,000 | | | 597,404 |

GN Store Nord AS, 0.88%, 11/25/2024 | | | EUR | | | 500,000 | | | 525,823 |

HCA Inc

|

5.50%, 06/01/2033 | | | | | | 1,050,000 | | | 1,043,756 |

5.25%, 06/15/2049 | | | | | | 1,525,000 | | | 1,367,242 |

Medline Borrower LP/Medline Co-Issuer Inc, 6.25%, 04/01/2029(a) | | | | | | 350,000 | | | 354,580 |

Medtronic Inc, 4.15%, 10/15/2053 | | | EUR | | | 500,000 | | | 543,210 |

Werfen SA, 4.25%, 05/03/2030 | | | EUR | | | 600,000 | | | 647,043 |

| | | 13,327,410 |

Homebuilders/Real Estate - 5.2%

|

Aldar Investment Properties Sukuk Ltd, 4.88%, 05/24/2033 | | | | | | 200,000 | | | 192,940 |

American Tower Corp

|

5.25%, 07/15/2028 | | | | | | 1,025,000 | | | 1,023,787 |

5.45%, 02/15/2034 | | | | | | 1,000,000 | | | 993,773 |

| | | | | | | | | | |

The accompanying notes are an integral part of these financial statements.

TABLE OF CONTENTS

Muzinich Credit Opportunities Fund

Schedule of Investments

June 30, 2024 (Unaudited) (Continued)

| | | | | | | |

CORPORATE BONDS - (Continued)

|

Homebuilders/Real Estate - (Continued)

|

Aroundtown SA

|

0.63%, 07/09/2025 | | | EUR | | | 700,000 | | | $719,512 |

0.38%, 04/15/2027 | | | EUR | | | 300,000 | | | 279,017 |

Balder Finland Oyj, 1.00%, 01/18/2027 | | | EUR | | | 975,000 | | | 949,969 |

Blackstone Property Partners Europe Holdings SARL, 1.00%, 10/20/2026 | | | EUR | | | 900,000 | | | 895,118 |

Castellum Helsinki Finance Holding Abp, 2.00%, 03/24/2025 | | | EUR | | | 800,000 | | | 841,543 |

CTP NV, 0.63%, 09/27/2026 | | | EUR | | | 1,025,000 | | | 1,022,111 |

Fastighets AB Balder, 1.88%, 03/14/2025 | | | EUR | | | 400,000 | | | 421,228 |

Hammerson PLC, 3.50%, 10/27/2025 | | | GBP | | | 500,000 | | | 612,183 |

Heimstaden Bostad Treasury BV

|

0.25%, 10/13/2024 | | | EUR | | | 400,000 | | | 420,014 |

1.00%, 04/13/2028 | | | EUR | | | 600,000 | | | 525,512 |

Logicor Financing SARL, 1.50%, 07/13/2026 | | | EUR | | | 200,000 | | | 202,147 |

MasTec Inc, 4.50%, 08/15/2028(a) | | | | | | 925,000 | | | 883,009 |

P3 Group SARL, 4.63%, 02/13/2030 | | | EUR | | | 350,000 | | | 376,239 |

RHP Hotel Properties LP / RHP Finance Corp, 6.50%, 04/01/2032(a) | | | | | | 1,325,000 | | | 1,328,093 |

VIA Outlets BV, 1.75%, 11/15/2028 | | | EUR | | | 675,000 | | | 646,693 |

Vonovia SE, 5.00%, 11/23/2030 | | | EUR | | | 300,000 | | | 336,336 |

| | | 12,669,224 |

Hotels - 0.8%

|

Hilton Grand Vacations Borrower Escrow LLC / Hilton Grand Vacations Borrower Esc, 6.63%, 01/15/2032(a) | | | | | | 625,000 | | | 628,362 |

IHG Finance LLC, 4.38%, 11/28/2029 | | | EUR | | | 400,000 | | | 438,929 |

Whitbread Group PLC, 3.38%, 10/16/2025 | | | GBP | | | 700,000 | | | 859,039 |

| | | 1,926,330 |

Insurance - 0.6%

|

Allianz SE, 2.63% to 1.000000000 then 5 yr. Swap Rate EUR + 2.77%, Perpetual | | | EUR | | | 800,000 | | | 667,956 |

Cathaylife Singapore Pte Ltd, 5.95%, 07/05/2034 | | | | | | 300,000 | | | 300,786 |

FWD Group Holdings Ltd, 7.64%, 07/02/2031 | | | | | | 600,000 | | | 611,028 |

| | | 1,579,770 |

Leisure - 0.1%

|

Royal Caribbean Cruises Ltd, 6.25%, 03/15/2032(a) | | | | | | 325,000 | | | 327,939 |

Metals/Mining - 0.9%

|

Corp Nacional del Cobre de Chile

|

5.95%, 01/08/2034 | | | | | | 700,000 | | | 701,637 |

6.44%, 01/26/2036 | | | | | | 200,000 | | | 207,094 |

Gold Fields Orogen Holdings BVI Ltd, 6.13%, 05/15/2029 | | | | | | 1,185,000 | | | 1,201,201 |

| | | 2,109,932 |

Paper - 1.0%

|

Inversiones CMPC SA, 6.13%, 06/23/2033 | | | | | | 1,500,000 | | | 1,528,461 |

Suzano Austria GmbH, 3.75%, 01/15/2031 | | | | | | 1,200,000 | | | 1,046,217 |

| | | 2,574,678 |

| | | | |

The accompanying notes are an integral part of these financial statements.

TABLE OF CONTENTS

Muzinich Credit Opportunities Fund

Schedule of Investments

June 30, 2024 (Unaudited) (Continued)

| | | | | | | |

CORPORATE BONDS - (Continued)

|

Services - 1.2%

|

Bureau Veritas SA, 3.50%, 05/22/2036 | | | EUR | | | 500,000 | | | $ 521,513 |

RAC Bond Co PLC, 4.87%, 05/06/2026 | | | GBP | | | 600,000 | | | 745,230 |

United Rentals North America Inc, 5.25%, 01/15/2030 | | | | | | 775,000 | | | 751,726 |

Verisure Holding AB, 3.88%, 07/15/2026 | | | EUR | | | 950,000 | | | 1,006,542 |

| | | 3,025,011 |

Sovereign - 1.1%

|

United Kingdom Gilt, 4.50%, 09/07/2034 | | | GBP | | | 2,000,000 | | | 2,588,651 |

Steel - 0.8%

|

ABJA Investment Co Pte Ltd, 5.45%, 01/24/2028 | | | | | | 812,000 | | | 806,454 |

GUSAP III LP, 4.25%, 01/21/2030 | | | | | | 1,200,000 | | | 1,128,006 |

| | | 1,934,460 |

Super Retail - 1.3%

|

El Corte Ingles SA, 4.25%, 06/26/2031 | | | EUR | | | 400,000 | | | 428,601 |

Home Depot Inc, 5.40%, 06/25/2064 | | | | | | 925,000 | | | 907,704 |

Lowe’s Cos Inc

|

5.15%, 07/01/2033 | | | | | | 650,000 | | | 648,315 |

5.85%, 04/01/2063 | | | | | | 400,000 | | | 392,059 |

REWE International Finance BV, 4.88%, 09/13/2030 | | | EUR | | | 700,000 | | | 779,713 |

| | | 3,156,392 |

Technology - 2.7%

|

Broadcom Inc, 3.47%, 04/15/2034(a) | | | | | | 750,000 | | | 641,097 |

Fortress Intermediate 3 Inc, 7.50%, 06/01/2031(a) | | | | | | 950,000 | | | 974,510 |

Insight Enterprises Inc, 6.63%, 05/15/2032(a) | | | | | | 350,000 | | | 355,782 |

LG Energy Solution Ltd, 5.75%, 09/25/2028 | | | | | | 870,000 | | | 881,278 |

SK Hynix Inc

|

6.38%, 01/17/2028 | | | | | | 200,000 | | | 205,966 |

6.50%, 01/17/2033 | | | | | | 600,000 | | | 633,845 |

SK On Co Ltd, 5.38%, 05/11/2026 | | | | | | 1,250,000 | | | 1,248,919 |

TDF Infrastructure SASU, 5.63%, 07/21/2028 | | | EUR | | | 700,000 | | | 783,688 |

Teleperformance SE

|

5.25%, 11/22/2028 | | | EUR | | | 500,000 | | | 548,680 |

5.75%, 11/22/2031 | | | EUR | | | 200,000 | | | 220,518 |

| | | 6,494,283 |

Telecommunications - 4.9%

|

America Movil SAB de CV, 4.38%, 04/22/2049 | | | | | | 1,140,000 | | | 953,844 |

AT&T Inc, 3.50%, 09/15/2053 | | | | | | 1,150,000 | | | 785,614 |

Bharti Airtel Ltd, 3.25%, 06/03/2031 | | | | | | 1,500,000 | | | 1,322,856 |

iliad SA, 5.38%, 02/15/2029 | | | EUR | | | 400,000 | | | 436,318 |

PPF Telecom Group BV, 3.25%, 09/29/2027 | | | EUR | | | 195,000 | | | 203,223 |

SES SA, 3.50%, 01/14/2029 | | | EUR | | | 650,000 | | | 673,644 |

TDC Net AS, 5.19%, 08/02/2029 | | | EUR | | | 250,000 | | | 272,099 |

Telefonica Europe BV, 3.88% to 1.000000000 then 8 yr. Swap Rate EUR + 2.97%, Perpetual | | | EUR | | | 1,200,000 | | | 1,270,193 |

| | | | | | | | | | |

The accompanying notes are an integral part of these financial statements.

TABLE OF CONTENTS

Muzinich Credit Opportunities Fund

Schedule of Investments

June 30, 2024 (Unaudited) (Continued)

| | | | | | | |

CORPORATE BONDS - (Continued)

|

Telecommunications - (Continued)

|

T-Mobile USA Inc

|

3.88%, 04/15/2030 | | | | | | $1,025,000 | | | $ 959,049 |

2.55%, 02/15/2031 | | | | | | 1,800,000 | | | 1,530,905 |

5.05%, 07/15/2033 | | | | | | 1,100,000 | | | 1,078,703 |

Vmed O2 UK Financing I PLC, 4.00%, 01/31/2029 | | | GBP | | | 800,000 | | | 876,061 |

Vodafone Group PLC, 2.63% to 1.000000000 then 5 yr. Swap Rate EUR + 3.00%, 08/27/2080 | | | EUR | | | 700,000 | | | 722,514 |

Ziggo BV, 2.88%, 01/15/2030 | | | EUR | | | 900,000 | | | 846,108 |

| | | 11,931,131 |

Transportation Excluding Air/Rail - 3.3%

|

Australia Pacific Airports Melbourne Pty Ltd, 4.38%, 05/24/2033 | | | EUR | | | 1,000,000 | | | 1,107,930 |

Autostrade per l’Italia SPA, 5.13%, 06/14/2033 | | | EUR | | | 875,000 | | | 974,479 |

DP World Ltd, 6.85%, 07/02/2037 | | | | | | 1,730,000 | | | 1,876,653 |

Gatwick Funding Ltd, 5.50%, 04/04/2040 | | | GBP | | | 600,000 | | | 732,648 |

Heathrow Finance PLC, 3.88%, 03/01/2027(b) | | | GBP | | | 250,000 | | | 297,852 |

Heathrow Funding Ltd, 4.50%, 07/11/2033 | | | EUR | | | 900,000 | | | 990,898 |

International Distributions Services PLC, 5.25%, 09/14/2028 | | | EUR | | | 575,000 | | | 633,352 |

Stagecoach Group Ltd, 4.00%, 09/29/2025 | | | GBP | | | 505,000 | | | 620,992 |

United Parcel Service Inc, 5.50%, 05/22/2054 | | | | | | 925,000 | | | 920,970 |

| | | 8,155,774 |

Utilities - 2.9%

|

Acquirente Unico SPA, 2.80%, 02/20/2026 | | | EUR | | | 850,000 | | | 889,637 |

Elia Transmission Belgium SA, 3.63%, 01/18/2033 | | | EUR | | | 600,000 | | | 641,844 |

FLUVIUS System Operator CV, 3.88%, 05/02/2034 | | | EUR | | | 400,000 | | | 428,217 |

Italgas SPA, 4.13%, 06/08/2032 | | | EUR | | | 600,000 | | | 646,577 |

National Central Cooling Co PJSC, 2.50%, 10/21/2027 | | | | | | 1,600,000 | | | 1,447,344 |

Pacific Gas and Electric Co, 5.80%, 05/15/2034 | | | | | | 825,000 | | | 821,718 |

Redexis SAU, 4.38%, 05/30/2031 | | | EUR | | | 600,000 | | | 637,651 |

Veolia Environnement SA, 1.25%, 05/14/2035 | | | EUR | | | 800,000 | | | 678,158 |

Vistra Operations Co LLC, 6.88%, 04/15/2032(a) | | | | | | 875,000 | | | 888,935 |

| | | 7,080,081 |

TOTAL CORPORATE BONDS

(Cost $208,166,354) | | | | | | | | | 208,445,345 |

BANK LOANS - 7.6%

| | | | | | |

Aerospace/Defense - 0.2%

|

KBR Inc TL, Senior Secured First Lien, 7.59% (1 mo. SOFR US + 2.25%), 01/17/2031 | | | | | | 349,125 | | | 351,176 |

Science Applications International Corp TL, Senior Secured First Lien, 7.22%

(1 mo. SOFR US + 1.88%), 02/10/2031 | | | | | | 146,766 | | | 147,752 |

TransDigm Inc TL, Senior Secured First Lien, 7.84% (3 mo. SOFR US + 2.50%), 02/28/2031 | | | | | | 92,269 | | | 92,569 |

| | | 591,497 |

| | | | |

The accompanying notes are an integral part of these financial statements.

TABLE OF CONTENTS

Muzinich Credit Opportunities Fund

Schedule of Investments

June 30, 2024 (Unaudited) (Continued)

| | | | | | | |

BANK LOANS - (Continued)

|

Broadcasting - 0.0%(c)

|

WMG Acquisition Corp TL, Senior Secured First Lien, 7.34% (1 mo. SOFR US + 2.00%), 01/24/2031 | | | | | | $ 50,000 | | | $ 50,149 |

Building Materials - 0.2%

|

MIWD Holdco II LLC TL, Senior Secured First Lien, 8.84% (1 mo. SOFR US + 3.50%), 03/28/2031 | | | | | | 400,000 | | | 402,918 |

Cable/Satellite TV - 0.2%

|

Charter Communications Operating LLC TL, Senior Secured First Lien, 7.05% (3 mo. SOFR US + 1.75%), 02/01/2027 | | | | | | 272,852 | | | 272,826 |

Directv Financing LLC TL, Senior Secured First Lien, 10.71% (1 mo. SOFR US + 5.25%), 08/02/2029 | | | | | | 232,199 | | | 231,473 |

| | | 504,299 |

Capital Goods - 0.5%

|

Ali Group North America Corp TL, Senior Secured First Lien, 7.46%

(1 mo. SOFR US + 2.00%), 07/23/2029 | | | | | | 474,930 | | | 477,348 |

Chart Industries Inc TL, Senior Secured First Lien, 8.68% (1 mo. SOFR US + 3.25%), 03/18/2030 | | | | | | 400,000 | | | 402,000 |

Emrld Borrower LP TL, Senior Secured First Lien, 7.84% (1 mo. SOFR US + 2.50%), 05/31/2030 | | | | | | 374,060 | | | 374,488 |

| | | 1,253,836 |

Chemicals - 0.2%

|

Axalta Coating Systems US Holdings Inc TL, Senior Secured First Lien, 7.33% (3 mo. SOFR US + 2.00%), 12/20/2029 | | | | | | 463,608 | | | 465,001 |

Commercial Services - 0.1%

|

NAB Holdings LLC TL First Lien, 8.21% (3 mo. Term SOFR + 2.75%), 11/24/2028 | | | | | | 200,000 | | | 200,403 |

Containers - 0.1%

|

Pactiv Evergreen Group Holdings Inc TL, Senior Secured First Lien

|

7.82% (1 mo. SOFR US + 2.50%), 09/25/2028 | | | | | | 169,173 | | | 169,568 |

7.82% (1 mo. SOFR US + 2.50%), 09/25/2028 | | | | | | 43,233 | | | 43,334 |

7.82% (1 mo. SOFR US + 2.50%), 09/25/2028 | | | | | | 37,594 | | | 37,682 |

| | | 250,584 |

Diversified Financial Services - 1.1%

|

Castlelake Aviation One DAC TL, Senior Secured First Lien, 8.09%

(3 mo. SOFR US + 2.75%), 10/22/2027 | | | | | | 243,081 | | | 243,841 |

Citadel Securities LP TL, Senior Secured First Lien, 7.59% (1 mo. SOFR US + 2.25%), 07/29/2030 | | | | | | 497,550 | | | 499,540 |

DRW Holdings TL (2/21) TL First Lien, 9.18% (1 mo. Term SOFR + 3.75%), 03/01/2028 | | | | | | 346,429 | | | 346,971 |

Focus Financial Partners LLC TL, Senior Secured First Lien, 8.09%

(1 mo. SOFR US + 2.75%), 06/30/2028 | | | | | | 99,749 | | | 99,764 |

| | | | | | | | | | |

The accompanying notes are an integral part of these financial statements.

TABLE OF CONTENTS

Muzinich Credit Opportunities Fund

Schedule of Investments

June 30, 2024 (Unaudited) (Continued)

| | | | | | | |

BANK LOANS - (Continued)

|

Diversified Financial Services - (Continued)

|

GTCR W Merger Sub LLC TL, Senior Secured First Lien, 8.33% (3 mo. SOFR US + 3.00%), 01/31/2031 | | | | | | $ 250,000 | | | $ 250,660 |

Jane Street Group LLC TL, Senior Secured First Lien, 7.96% (1 mo. SOFR US + 2.50%), 01/26/2028 | | | | | | 398,452 | | | 398,554 |

NAB Holdings LLC TL First Lien, 8.08% (1 mo. Term SOFR + 2.75%), 11/24/2028 | | | | | | 250,000 | | | 250,521 |

Nuvei Technologies Corp TL, Senior Secured First Lien

|

8.44% (1 mo. SOFR US + 3.00%), 12/19/2030 | | | | | | 145,579 | | | 145,929 |

8.44% (1 mo. SOFR US + 3.00%), 12/19/2030 | | | | | | 97,787 | | | 98,022 |

8.44% (1 mo. SOFR US + 3.00%), 12/19/2030 | | | | | | 25,285 | | | 25,346 |

Trans Union LLC TL, Senior Secured First Lien, 7.34% (1 mo. SOFR US + 2.00%), 12/01/2028 | | | | | | 212,009 | | | 212,331 |

Wec US Holdings Ltd TL, Senior Secured First Lien, 8.09% (1 mo. SOFR US + 2.75%), 01/27/2031 | | | | | | 225,000 | | | 225,471 |

| | | 2,796,950 |

Environmental - 0.2%

|

Clean Harbors Inc TL, Senior Secured First Lien, 7.21% (1 mo. SOFR US + 1.75%), 10/10/2028 | | | | | | 348,214 | | | 350,390 |

Covanta Holding Corp TL, Senior Secured First Lien

|

8.08% (1 mo. SOFR US + 2.75%), 11/30/2028 | | | | | | 76,932 | | | 77,032 |

8.08% (1 mo. SOFR US + 2.75%), 11/30/2028 | | | | | | 4,208 | | | 4,214 |

| | | 431,636 |

Food/Beverage/Tobacco - 0.2%

|

B&G Foods 6/24 B TL, 8.84%, 10/10/2029(b) | | | | | | 500,000 | | | 496,250 |

Gaming - 0.1%

|

Flutter Financing BV TL, Senior Secured First Lien, 7.58% (3 mo. SOFR US + 2.25%), 11/29/2030 | | | | | | 149,250 | | | 149,515 |

Station Casinos LLC TL, Senior Secured First Lien, 7.59% (1 mo. SOFR US + 2.25%), 03/14/2031 | | | | | | 49,875 | | | 49,913 |

| | | 199,428 |

Healthcare - 0.3%

|

Jazz Financing Lux SARL TL, Senior Secured First Lien, 8.46% (1 mo. SOFR US + 3.00%), 05/05/2028 | | | | | | 135,935 | | | 136,190 |

Phoenix Guarantor Inc TL First Lien, 8.58% (1 mo. Term SOFR + 3.25%), 02/21/2031 | | | | | | 550,000 | | | 549,247 |

| | | 685,437 |

Homebuilders/Real Estate - 0.4%

|

Iron Mountain Inc TL, Senior Secured First Lien, 7.59% (1 mo. SOFR US + 2.25%), 01/31/2031 | | | | | | 497,500 | | | 496,047 |

SBA Senior Finance II LLC TL, Senior Secured First Lien, 7.35% (1 mo. SOFR US + 2.00%), 01/27/2031 | | | | | | 409,973 | | | 410,903 |

| | | 906,950 |

| | | | |

The accompanying notes are an integral part of these financial statements.

TABLE OF CONTENTS

Muzinich Credit Opportunities Fund

Schedule of Investments

June 30, 2024 (Unaudited) (Continued)

| | | | | | | |

BANK LOANS - (Continued)

|

Hotels - 0.4%

|

Hilton Grand Vacations Borrower LLC TL, Senior Secured First Lien, 7.84%

(1 mo. SOFR US + 2.50%), 08/02/2028 | | | | | | $ 496,173 | | | $ 496,749 |

Hilton Hotels (10/23) TL B4 TL, Senior Secured First Lien, 7.10% (1 mo. SOFR US + 1.75%), 11/08/2030 | | | | | | 113,650 | | | 113,894 |

Travel + Leisure Co TL, Senior Secured First Lien, 8.69% (1 mo. SOFR US + 3.25%), 12/14/2029 | | | | | | 99,750 | | | 100,174 |

Wyndham Hotels & Resorts Inc TL, Senior Secured First Lien, 7.09%

(1 mo. SOFR US + 1.75%), 05/28/2030 | | | | | | 374,058 | | | 374,967 |

| | | 1,085,784 |

Leisure - 0.2%

|

Delta 2 Lux SARL TL, Senior Secured First Lien, 7.58% (3 mo. SOFR US + 2.25%), 01/15/2030 | | | | | | 500,000 | | | 501,875 |

Metals/Mining - 0.0%(c)

|

Arsenal AIC Parent LLC TL, Senior Secured First Lien, 9.09% (1 mo. SOFR US + 3.75%), 08/19/2030 | | | | | | 24,875 | | | 25,055 |

Publishing/Printing - 0.1%

|

Cimpress USA Inc TL, Senior Secured First Lien

|

8.33% (1 mo. SOFR US + 3.00%), 05/17/2028 | | | | | | 135,904 | | | 136,328 |

8.34% (1 mo. SOFR US + 3.00%), 05/17/2028 | | | | | | 113,471 | | | 113,826 |

| | | 250,154 |

Railroads - 0.2%

|

Genesee & Wyoming Inc TL, Senior Secured First Lien, 7.33% (3 mo. SOFR US + 2.00%), 04/10/2031 | | | | | | 450,000 | | | 450,043 |

Restaurants - 0.4%

|

1011778 BC ULC TL, Senior Secured First Lien, 7.09% (1 mo. SOFR US + 1.75%), 09/23/2030 | | | | | | 498,750 | | | 498,119 |

KFC Holding Co TL, Senior Secured First Lien, 7.20% (1 mo. SOFR US + 1.75%), 03/15/2028 | | | | | | 496,154 | | | 496,685 |

| | | 994,804 |

Services - 0.5%

|

APi Group DE Inc TL, Senior Secured First Lien, 7.34% (1 mo. SOFR US + 2.00%), 01/03/2029 | | | | | | 300,000 | | | 300,215 |

Camelot US Acquisition LLC TL, Senior Secured First Lien

|

8.08% (1 mo. SOFR US + 2.75%), 01/31/2031 | | | | | | 46,395 | | | 46,535 |

8.09% (1 mo. SOFR US + 2.75%), 01/31/2031 | | | | | | 199,036 | | | 199,633 |

8.09% (1 mo. SOFR US + 2.75%), 01/31/2031 | | | | | | 3,944 | | | 3,955 |

Core & Main LP TL, Senior Secured First Lien, 7.59% (3 mo. SOFR US + 2.25%), 02/10/2031 | | | | | | 273,315 | | | 274,171 |

PG Investment Co 59 SARL TL, Senior Secured First Lien, 8.83% (3 mo. SOFR US + 3.50%), 03/24/2031 | | | | | | 75,000 | | | 75,594 |

| | | | | | | | | | |

The accompanying notes are an integral part of these financial statements.

TABLE OF CONTENTS

Muzinich Credit Opportunities Fund

Schedule of Investments

June 30, 2024 (Unaudited) (Continued)

| | | | | | | |

BANK LOANS - (Continued)

|

Services - (Continued)

|

Thevelia US LLC TL, Senior Secured First Lien, 9.08% (3 mo. SOFR US + 3.75%), 06/18/2029 | | | | | | $74,625 | | | $75,138 |

United Rentals North America Inc TL, Senior Secured First Lien, 7.09%

(1 mo. SOFR US + 1.75%), 02/14/2031 | | | | | | 374,063 | | | 377,745 |

| | | 1,352,986 |

Super Retail - 0.2%

|

Hanesbrands Inc TL, Senior Secured First Lien, 9.09% (1 mo. SOFR US + 3.75%), 03/08/2030 | | | | | | 248,116 | | | 249,201 |

Leslie’s Poolmart Inc TL First Lien, 8.19% (1 mo. Term SOFR + 2.75%), 03/09/2028 | | | | | | 200,000 | | | 198,413 |

| | | 447,614 |

Technology - 0.7%

|

AppLovin Corp TL, Senior Secured First Lien, 7.84% (1 mo. SOFR US + 2.50%), 10/25/2028 | | | | | | 374,062 | | | 375,325 |

Cloud Software Group Inc TL First Lien, 9.93% (1 mo. Term SOFR + 4.50%), 03/24/2031 | | | | | | 500,000 | | | 501,992 |

Coherent Corp TL, Senior Secured First Lien, 7.84% (1 mo. SOFR US + 2.50%), 07/02/2029 | | | | | | 349,348 | | | 350,047 |

Constant Contact TL First Lien, 9.56% (1 mo. Term SOFR + 4.00%), 02/10/2028 | | | | | | 12 | | | 12 |

Go Daddy Operating Co LLC TL, Senior Secured First Lien, 7.34%

(1 mo. SOFR US + 2.00%), 11/13/2029 | | | | | | 209,696 | | | 210,249 |

Open Text TL B (08/23) TARGET TL, Senior Secured First Lien, 7.59%

(1 mo. SOFR US + 2.25%), 01/31/2030 | | | | | | 312,135 | | | 313,849 |

| | | 1,751,474 |

Telecommunications - 0.5%

|

Crown Subsea Communications Holding Inc TL, Senior Secured First Lien, 10.08% (3 mo. SOFR US + 4.75%), 01/30/2031 | | | | | | 290,000 | | | 291,147 |

Iridium Satellite LLC TL, Senior Secured First Lien, 7.59% (1 mo. SOFR US + 2.25%), 09/20/2030 | | | | | | 498,747 | | | 498,782 |

Lorca Finco (04/24) TL, 8.82% (1 mo. Term SOFR + 3.50%), 04/17/2031 | | | | | | 140,000 | | | 140,525 |

Virgin Media Bristol LLC TL, Senior Secured First Lien, 8.66% (6 mo. SOFR US + 3.25%), 03/31/2031 | | | | | | 200,000 | | | 189,321 |

| | | 1,119,775 |

Transportation Excluding Air/Rail - 0.2%

|

XPO Inc TL, Senior Secured First Lien, 7.34% (1 mo. SOFR US + 2.00%), 05/24/2028 | | | | | | 250,000 | | | 251,023 |

XPO TL B (12/23) TL, Senior Secured First Lien, 7.33% (1 mo. SOFR US + 2.00%), 02/28/2031 | | | | | | 250,000 | | | 250,964 |

| | | 501,987 |

| | | | |

The accompanying notes are an integral part of these financial statements.

TABLE OF CONTENTS

Muzinich Credit Opportunities Fund

Schedule of Investments

June 30, 2024 (Unaudited) (Continued)

| | | | | | | |

BANK LOANS - (Continued)

|

Utilities - 0.4%

|

Edgewater (Spade Facilities) TL First Lien, 9.19% (1 mo. Term SOFR + 3.75%), 12/15/2025 | | | | | | $500,000 | | | $499,725 |

Exgen Renewables/ Exelon (12/20) TL First Lien, 8.10% (3 mo. Term SOFR + 2.50%), 12/15/2027 | | | | | | 250,000 | | | 250,815 |

Vistra Zero Operating Co LLC TL, Senior Secured First Lien, 8.09% (1 mo. SOFR US + 2.75%), 04/30/2031 | | | | | | 124,688 | | | 125,420 |

| | | 875,960 |

TOTAL BANK LOANS

(Cost $18,560,353) | | | | | | | | | 18,592,849 |

CONVERTIBLE BONDS - 2.4%

| | | | | | |

Banking - 2.4%

|

Australia & New Zealand Banking Group Ltd, 1.81% to 1.000000000 then UK Government Bonds 5 Year Note Generic Bid Yield + 1.45%, 09/16/2031 | | | GBP | | | 600,000 | | | 694,622 |

Banco Bilbao Vizcaya Argentaria SA, 4.88% to 1.000000000 then 5 yr. Swap Rate EUR + 2.40%, 02/08/2036 | | | EUR | | | 300,000 | | | 323,973 |

Banco Santander SA, 5.00% to 1.000000000 then 5 yr. Swap Rate EUR + 2.50%, 04/22/2034 | | | EUR | | | 700,000 | | | 763,000 |

Bank of Ireland Group PLC, 4.75% to 1.000000000 then 5 yr. Swap Rate EUR + 1.85%, 08/10/2034 | | | EUR | | | 450,000 | | | 481,771 |

Deutsche Bank AG, 5.63% to 1.000000000 then 5 yr. Swap Rate EUR + 6.00%, 05/19/2031 | | | EUR | | | 300,000 | | | 326,181 |

ING Groep NV, 1.00% to 1.000000000 then 5 yr. Swap Rate EUR + 1.15%, 11/16/2032 | | | EUR | | | 1,300,000 | | | 1,254,046 |

Jyske Bank AS, 5.13% to 1.000000000 then 5 yr. Swap Rate EUR + 2.50%, 05/01/2035 | | | EUR | | | 325,000 | | | 355,721 |

Nationwide Building Society, 4.38% to 1.000000000 then 5 yr. Swap Rate EUR + 1.65%, 04/16/2034 | | | EUR | | | 750,000 | | | 802,062 |

Swedbank AB, 7.27% to 1.000000000 then UK Government Bonds 5 Year Note Generic Bid Yield + 3.80%, 11/15/2032 | | | GBP | | | 600,000 | | | 784,693 |

| | | 5,786,069 |

TOTAL CONVERTIBLE BONDS

(Cost $5,771,753) | | | | | | | | | 5,786,069 |

U.S. TREASURY SECURITIES - 1.1%

|

United States Treasury Note/Bond, 4.63%, 05/15/2054 | | | | | | 2,750,000 | | | 2,805,215 |

TOTAL U.S. TREASURY SECURITIES

(Cost $2,810,032) | | | | | | | | | 2,805,215 |

| | | | | | | | | | |

The accompanying notes are an integral part of these financial statements.

TABLE OF CONTENTS

Muzinich Credit Opportunities Fund

Schedule of Investments

June 30, 2024 (Unaudited) (Continued)

| | | | | | | | | | |

SHORT-TERM INVESTMENTS - 0.1%

| |

Money Market Funds - 0.1%

| |

First American Treasury Obligations Fund - Class X, 5.20% (d) | | | | | | 198,937 | | | $198,937 | |

TOTAL SHORT-TERM INVESTMENTS

(Cost $198,937) | | | | | | | | | 198,937 | |

TOTAL INVESTMENTS - 96.4%

(Cost $235,507,429) | | | | | | | | | $235,828,415 | |

Other Assets in Excess of Liabilities - 3.6% | | | | | | | | | 8,902,184 | |

TOTAL NET ASSETS - 100.0% | | | | | | | | | $244,730,599 | |

| | | | | | | | | | | |

Percentages are stated as a percent of net assets.

Par amount is in USD unless otherwise indicated.

AG - Aktiengesellschaft

ASA - Advanced Subscription Agreement

CMT - Constant Maturity Treasury Rate

GMTN Global Medium Term Note

NV - Naamloze Vennootschap

PIK - Payment in Kind

PJSC - Public Joint Stock Company

PLC - Public Limited Company

SA - Sociedad Anónima

SAB de CV - Sociedad Anónima Bursátil de Capital Variable

SOFR - Secured Overnight Financing Rate

USISSO05 - 5 Year US Dollar SOFR Swap Rate

EUR - Euro

GBP - British Pound

(a)

| Security is exempt from registration pursuant to Rule 144A under the Securities Act of 1933, as amended. These securities may only be resold in transactions exempt from registration to qualified institutional investors. As of June 30, 2024, the value of these securities total $30,747,437 or 12.6% of the Fund’s net assets. |

(b)

| Coupon rate is variable or floats based on components including but not limited to reference rate and spread. These securities may not indicate a reference rate and/or spread in their description. The rate disclosed is as of June 30, 2024. |

(c)

| Represents less than 0.05% of net assets. |

(d)

| The rate shown represents the 7-day annualized effective yield as of June 30, 2024. |

The accompanying notes are an integral part of these financial statements.

TABLE OF CONTENTS

Muzinich Credit Opportunities Fund

Schedule of Forward Currency Contracts

June 30, 2024 (Unaudited)

| | | | | | | | | | | | | |

U.S. Bancorp Investments, Inc. | | | 09/17/2024 | | | EUR | | | 7,500,000 | | | USD | | | 8,083,811 | | | $(19,668) |

U.S. Bancorp Investments, Inc. | | | 09/17/2024 | | | GBP | | | 2,300,000 | | | USD | | | 2,921,871 | | | (12,668) |

U.S. Bancorp Investments, Inc. | | | 09/17/2024 | | | USD | | | 81,093,372 | | | EUR | | | 75,100,000 | | | 344,418 |

U.S. Bancorp Investments, Inc. | | | 09/17/2024 | | | USD | | | 14,393,929 | | | GBP | | | 11,300,000 | | | 100,887 |

Total Unrealized Appreciation (Depreciation) | | | $412,969 |

| | | | |

EUR - Euro

GBP - British Pound

USD - United States Dollar

The accompanying notes are an integral part of these financial statements.

TABLE OF CONTENTS

Muzinich Flexible U.S. High Yield Income Fund

Schedule of Investments

June 30, 2024 (Unaudited)

| | | | | | | |

CORPORATE BONDS - 73.5%

|

Aerospace/Defense - 1.8%

|

Bombardier Inc

|

7.88%, 04/15/2027(a) | | | $ 140,000 | | | $ 140,445 |

7.25%, 07/01/2031(a) | | | 150,000 | | | 154,256 |

7.00%, 06/01/2032(a) | | | 50,000 | | | 50,747 |

PM General Purchaser LLC, 9.50%, 10/01/2028(a) | | | 125,000 | | | 127,849 |

Spirit AeroSystems Inc, 9.38%, 11/30/2029(a) | | | 125,000 | | | 134,712 |

TransDigm Inc

|

6.38%, 03/01/2029(a) | | | 125,000 | | | 125,786 |

6.63%, 03/01/2032(a) | | | 125,000 | | | 126,419 |

| | | 860,214 |

Airlines - 1.7%

|

American Airlines Inc/AAdvantage Loyalty IP Ltd, 5.75%, 04/20/2029(a) | | | 375,000 | | | 365,434 |

Hawaiian Brand Intellectual Property Ltd / HawaiianMiles Loyalty Ltd,

5.75%, 01/20/2026(a) | | | 225,000 | | | 214,608 |

VistaJet Malta Finance PLC / Vista Management Holding Inc

|

7.88%, 05/01/2027(a) | | | 125,000 | | | 110,624 |

9.50%, 06/01/2028(a) | | | 125,000 | | | 109,768 |

| | | 800,434 |

Automotive & Auto Parts - 2.6%

|

American Axle & Manufacturing Inc, 6.88%, 07/01/2028 | | | 150,000 | | | 149,847 |

Benteler International AG, 10.50%, 05/15/2028(a) | | | 200,000 | | | 215,004 |

Champions Financing Inc, 8.75%, 02/15/2029(a) | | | 125,000 | | | 128,297 |

Dana Inc, 4.50%, 02/15/2032 | | | 100,000 | | | 85,976 |

Goodyear Tire & Rubber Co, 5.25%, 07/15/2031 | | | 250,000 | | | 227,824 |

Jaguar Land Rover Automotive PLC, 5.50%, 07/15/2029(a) | | | 250,000 | | | 239,872 |

Phinia Inc, 6.75%, 04/15/2029(a) | | | 75,000 | | | 76,208 |

Tenneco Inc, 8.00%, 11/17/2028(a) | | | 125,000 | | | 113,875 |

| | | 1,236,903 |

Broadcasting - 1.3%

|

Belo Corp, 7.75%, 06/01/2027 | | | 75,000 | | | 77,045 |

Gray Escrow II Inc, 5.38%, 11/15/2031(a) | | | 75,000 | | | 42,601 |

Sirius XM Radio Inc, 4.00%, 07/15/2028(a) | | | 150,000 | | | 135,634 |

TEGNA Inc, 4.63%, 03/15/2028 | | | 118,000 | | | 106,740 |

Univision Communications Inc

|

8.00%, 08/15/2028(a) | | | 175,000 | | | 170,824 |

4.50%, 05/01/2029(a) | | | 125,000 | | | 105,212 |

| | | 638,056 |

Building Materials - 3.0%

|

Builders FirstSource Inc, 6.38%, 03/01/2034(a) | | | 175,000 | | | 173,576 |

Camelot Return Merger Sub Inc, 8.75%, 08/01/2028(a) | | | 350,000 | | | 343,266 |

Cornerstone Building Brands Inc, 6.13%, 01/15/2029(a) | | | 50,000 | | | 41,184 |

MIWD Holdco II LLC / MIWD Finance Corp, 5.50%, 02/01/2030(a) | | | 500,000 | | | 462,686 |

New Enterprise Stone & Lime Co Inc, 5.25%, 07/15/2028(a) | | | 250,000 | | | 236,337 |

Standard Industries Inc, 3.38%, 01/15/2031(a) | | | 175,000 | | | 147,637 |

| | | 1,404,686 |

| | | | |

The accompanying notes are an integral part of these financial statements.

TABLE OF CONTENTS

Muzinich Flexible U.S. High Yield Income Fund

Schedule of Investments

June 30, 2024 (Unaudited) (Continued)

| | | | | | | |

CORPORATE BONDS - (Continued)

|

Cable/Satellite TV - 2.7%

|

CCO Holdings LLC / CCO Holdings Capital Corp

|

5.00%, 02/01/2028(a) | | | $ 250,000 | | | $ 233,923 |

5.38%, 06/01/2029(a) | | | 400,000 | | | 364,329 |

4.75%, 03/01/2030(a) | | | 250,000 | | | 216,687 |

DISH Network Corp, 11.75%, 11/15/2027(a) | | | 250,000 | | | 245,359 |

Midcontinent Communications / Midcontinent Finance Corp, 5.38%, 08/15/2027(a) | | | 250,000 | | | 240,191 |

| | | 1,300,489 |

Capital Goods - 0.6%

|

EMRLD Borrower LP / Emerald Co-Issuer Inc, 6.75%, 07/15/2031(a) | | | 50,000 | | | 50,732 |

Esab Corp, 6.25%, 04/15/2029(a) | | | 150,000 | | | 151,103 |

Husky Injection Molding Systems Ltd / Titan Co-Borrower LLC, 9.00%, 02/15/2029(a) | | | 100,000 | | | 103,685 |

| | | 305,520 |

Chemicals - 1.7%

|

NOVA Chemicals Corp

|

5.00%, 05/01/2025(a) | | | 200,000 | | | 198,283 |

5.25%, 06/01/2027(a) | | | 150,000 | | | 143,609 |

Olympus Water US Holding Corp, 9.75%, 11/15/2028(a) | | | 200,000 | | | 212,262 |

Rain Carbon Inc, 12.25%, 09/01/2029(a) | | | 250,000 | | | 269,351 |

| | | 823,505 |

Consumer-Products - 1.0%

|

Central Garden & Pet Co

|

4.13%, 10/15/2030 | | | 50,000 | | | 44,623 |

4.13%, 04/30/2031(a) | | | 75,000 | | | 66,228 |

Coty Inc/HFC Prestige Products Inc/HFC Prestige International US LLC, 6.63%, 07/15/2030(a) | | | 75,000 | | | 76,178 |

Kronos Acquisition Holdings Inc, 8.25%, 06/30/2031(a) | | | 175,000 | | | 175,394 |

Kronos Acquisition Holdings Inc / KIK Custom Products Inc, 5.00%, 12/31/2026(a) | | | 100,000 | | | 102,416 |

| | | 464,839 |

Containers - 2.3%

|

Ball Corp, 6.00%, 06/15/2029 | | | 125,000 | | | 125,878 |

Canpack SA / Canpack US LLC, 3.88%, 11/15/2029(a) | | | 200,000 | | | 179,542 |

Mauser Packaging Solutions Holding Co

|

7.88%, 04/15/2027(a) | | | 250,000 | | | 255,437 |

9.25%, 04/15/2027(a) | | | 250,000 | | | 250,460 |

Owens-Brockway Glass Container Inc, 7.25%, 05/15/2031(a) | | | 250,000 | | | 249,799 |

Verde Purchaser LLC, 10.50%, 11/30/2030(a) | | | 25,000 | | | 26,456 |

| | | 1,087,572 |

Diversified Financial Services - 4.8%

|

Block Inc, 6.50%, 05/15/2032(a) | | | 100,000 | | | 101,310 |

Bread Financial Holdings Inc

|

7.00%, 01/15/2026(a) | | | 48,000 | | | 47,985 |

9.75%, 03/15/2029(a) | | | 175,000 | | | 184,042 |

| | | | | | | |

The accompanying notes are an integral part of these financial statements.

TABLE OF CONTENTS

Muzinich Flexible U.S. High Yield Income Fund

Schedule of Investments

June 30, 2024 (Unaudited) (Continued)

| | | | | | | |

CORPORATE BONDS - (Continued)

|

Diversified Financial Services - (Continued)

|

Burford Capital Global Finance LLC

|

6.25%, 04/15/2028(a) | | | $ 200,000 | | | $ 193,600 |

9.25%, 07/01/2031(a) | | | 300,000 | | | 316,106 |

Fortress Transportation and Infrastructure Investors LLC

|

7.00%, 05/01/2031(a) | | | 75,000 | | | 76,739 |

7.00%, 06/15/2032(a) | | | 75,000 | | | 76,140 |

Icahn Enterprises LP / Icahn Enterprises Finance Corp

|

6.25%, 05/15/2026 | | | 125,000 | | | 124,126 |

9.75%, 01/15/2029(a) | | | 125,000 | | | 129,657 |

9.00%, 06/15/2030(a) | | | 250,000 | | | 249,012 |

Macquarie Airfinance Holdings Ltd

|

8.38%, 05/01/2028(a) | | | 150,000 | | | 158,248 |

6.50%, 03/26/2031(a) | | | 25,000 | | | 25,738 |

OneMain Finance Corp

|

3.88%, 09/15/2028 | | | 125,000 | | | 112,199 |

7.88%, 03/15/2030 | | | 125,000 | | | 128,951 |

PennyMac Financial Services Inc, 7.88%, 12/15/2029(a) | | | 125,000 | | | 128,987 |

PRA Group Inc, 8.38%, 02/01/2028(a) | | | 125,000 | | | 124,669 |

United Wholesale Mortgage LLC, 5.75%, 06/15/2027(a) | | | 125,000 | | | 122,144 |

| | | 2,299,653 |

Diversified Media - 1.2%

|

Clear Channel Outdoor Holdings Inc

|

5.13%, 08/15/2027(a) | | | 225,000 | | | 215,082 |

9.00%, 09/15/2028(a) | | | 175,000 | | | 183,392 |

7.88%, 04/01/2030(a) | | | 75,000 | | | 75,522 |

Match Group Holdings II LLC, 5.63%, 02/15/2029(a) | | | 100,000 | | | 96,221 |

| | | 570,217 |

Energy - 11.2%

|

Ascent Resources Utica Holdings LLC / ARU Finance Corp

|

7.00%, 11/01/2026(a) | | | 125,000 | | | 125,205 |

5.88%, 06/30/2029(a) | | | 125,000 | | | 122,247 |

Baytex Energy Corp

|

8.50%, 04/30/2030(a) | | | 250,000 | | | 261,639 |

7.38%, 03/15/2032(a) | | | 75,000 | | | 76,274 |

Blue Racer Midstream LLC / Blue Racer Finance Corp, 7.25%, 07/15/2032(a) | | | 75,000 | | | 77,060 |

Civitas Resources Inc, 8.63%, 11/01/2030(a) | | | 375,000 | | | 402,716 |

Crescent Energy Finance LLC

|

9.25%, 02/15/2028(a) | | | 250,000 | | | 264,820 |

7.63%, 04/01/2032(a) | | | 200,000 | | | 203,975 |

7.38%, 01/15/2033(a) | | | 175,000 | | | 175,622 |

Delek Logistics Partners LP / Delek Logistics Finance Corp, 8.63%, 03/15/2029(a) | | | 125,000 | | | 128,748 |

EQM Midstream Partners LP

|

7.50%, 06/01/2027(a) | | | 50,000 | | | 51,093 |

6.50%, 07/01/2027(a) | | | 50,000 | | | 50,565 |

| | | | | | | |

The accompanying notes are an integral part of these financial statements.

TABLE OF CONTENTS

Muzinich Flexible U.S. High Yield Income Fund

Schedule of Investments

June 30, 2024 (Unaudited) (Continued)

| | | | | | | |

CORPORATE BONDS - (Continued)

|

Energy - (Continued)

|

7.50%, 06/01/2030(a) | | | $ 50,000 | | | $ 53,392 |

4.75%, 01/15/2031(a) | | | 50,000 | | | 46,788 |

Gulfport Energy Corp, 8.00%, 05/17/2026(a) | | | 125,000 | | | 126,521 |

Harvest Midstream I LP, 7.50%, 09/01/2028(a) | | | 500,000 | | | 508,430 |

Hilcorp Energy I LP / Hilcorp Finance Co, 6.00%, 02/01/2031(a) | | | 375,000 | | | 359,322 |

Northern Oil and Gas Inc

|

8.13%, 03/01/2028(a) | | | 125,000 | | | 126,560 |

8.75%, 06/15/2031(a) | | | 250,000 | | | 262,609 |

Tallgrass Energy Partners LP / Tallgrass Energy Finance Corp,

6.00%, 12/31/2030(a) | | | 375,000 | | | 350,386 |

USA Compression Partners LP / USA Compression Finance Corp,

7.13%, 03/15/2029(a) | | | 150,000 | | | 151,266 |

Venture Global Calcasieu Pass LLC

|

3.88%, 08/15/2029(a) | | | 50,000 | | | 45,571 |

6.25%, 01/15/2030(a) | | | 75,000 | | | 76,167 |

4.13%, 08/15/2031(a) | | | 50,000 | | | 44,902 |

Venture Global LNG Inc

|

8.13%, 06/01/2028(a) | | | 250,000 | | | 257,970 |

9.50%, 02/01/2029(a) | | | 250,000 | | | 274,164 |

8.38%, 06/01/2031(a) | | | 250,000 | | | 259,470 |

Vital Energy Inc

|

9.75%, 10/15/2030 | | | 250,000 | | | 273,209 |

7.88%, 04/15/2032(a) | | | 200,000 | | | 203,457 |

| | | 5,360,148 |

Food & Drug Retail - 0.6%

|

Albertsons Cos Inc / Safeway Inc / New Albertsons LP / Albertsons LLC

|

6.50%, 02/15/2028(a) | | | 125,000 | | | 125,857 |

3.50%, 03/15/2029(a) | | | 175,000 | | | 157,538 |

| | | 283,395 |

Food/Beverage/Tobacco - 0.9%

|

Post Holdings Inc

|

4.63%, 04/15/2030(a) | | | 125,000 | | | 114,938 |

6.25%, 02/15/2032(a) | | | 75,000 | | | 75,193 |

Simmons Foods Inc/Simmons Prepared Foods Inc/Simmons Pet Food Inc/Simmons Feed, 4.63%, 03/01/2029(a) | | | 250,000 | | | 220,051 |

| | | 410,182 |

Gaming - 2.5%

|

Caesars Entertainment Inc

|

8.13%, 07/01/2027(a) | | | 125,000 | | | 127,625 |

7.00%, 02/15/2030(a) | | | 125,000 | | | 127,787 |

Churchill Downs Inc

|

5.50%, 04/01/2027(a) | | | 125,000 | | | 123,039 |

4.75%, 01/15/2028(a) | | | 125,000 | | | 119,502 |

Light & Wonder International Inc, 7.50%, 09/01/2031(a) | | | 100,000 | | | 103,384 |

| | | | | | | |

The accompanying notes are an integral part of these financial statements.

TABLE OF CONTENTS

Muzinich Flexible U.S. High Yield Income Fund

Schedule of Investments

June 30, 2024 (Unaudited) (Continued)

| | | | | | | |

CORPORATE BONDS - (Continued)

|

Gaming - (Continued)

|

MGM Resorts International, 6.50%, 04/15/2032 | | | $ 75,000 | | | $ 74,708 |

Ontario Gaming GTA LP, 8.00%, 08/01/2030(a) | | | 125,000 | | | 128,378 |

Penn Entertainment Inc, 5.63%, 01/15/2027(a) | | | 375,000 | | | 362,285 |

| | | 1,166,708 |

Healthcare - 4.3%

|

AdaptHealth LLC, 6.13%, 08/01/2028(a) | | | 250,000 | | | 238,953 |

AMN Healthcare Inc, 4.63%, 10/01/2027(a) | | | 125,000 | | | 119,226 |

Catalent Pharma Solutions Inc, 3.13%, 02/15/2029(a) | | | 75,000 | | | 71,840 |

CHS/Community Health Systems Inc

|

5.63%, 03/15/2027(a) | | | 125,000 | | | 116,522 |

8.00%, 12/15/2027(a) | | | 125,000 | | | 124,073 |

5.25%, 05/15/2030(a) | | | 125,000 | | | 103,066 |

DaVita Inc

|

4.63%, 06/01/2030(a) | | | 50,000 | | | 45,221 |

3.75%, 02/15/2031(a) | | | 125,000 | | | 106,864 |

Endo Finance Holdings Inc, 8.50%, 04/15/2031(a) | | | 50,000 | | | 51,656 |

Legacy LifePoint Health LLC, 4.38%, 02/15/2027(a) | | | 125,000 | | | 119,577 |

Medline Borrower LP, 3.88%, 04/01/2029(a) | | | 125,000 | | | 115,196 |

MPT Operating Partnership LP / MPT Finance Corp, 4.63%, 08/01/2029 | | | 175,000 | | | 127,196 |

Prestige Brands Inc, 3.75%, 04/01/2031(a) | | | 125,000 | | | 108,907 |

Prime Healthcare Services Inc, 7.25%, 11/01/2025(a) | | | 375,000 | | | 374,749 |

Tenet Healthcare Corp

|

5.13%, 11/01/2027 | | | 125,000 | | | 122,440 |

4.25%, 06/01/2029 | | | 125,000 | | | 116,653 |

| | | 2,062,139 |

Homebuilders/Real Estate - 4.6%

|

Brookfield Residential Properties Inc / Brookfield Residential US LLC, 6.25%, 09/15/2027(a) | | | 125,000 | | | 123,149 |

Global Infrastructure Solutions Inc, 5.63%, 06/01/2029(a) | | | 187,000 | | | 176,679 |

Iron Mountain Inc, 5.25%, 07/15/2030(a) | | | 125,000 | | | 118,884 |

Kennedy-Wilson Inc, 5.00%, 03/01/2031 | | | 175,000 | | | 143,182 |

Ladder Capital Finance Holdings LLLP / Ladder Capital Finance Corp

|

5.25%, 10/01/2025(a) | | | 125,000 | | | 124,020 |

4.75%, 06/15/2029(a) | | | 125,000 | | | 115,705 |

7.00%, 07/15/2031(a) | | | 75,000 | | | 75,659 |

MasTec Inc, 6.63%, 08/15/2029(a) | | | 75,000 | | | 74,011 |

RHP Hotel Properties LP / RHP Finance Corp, 6.50%, 04/01/2032(a) | | | 125,000 | | | 125,292 |

Service Properties Trust

|

5.25%, 02/15/2026 | | | 250,000 | | | 242,261 |

4.95%, 02/15/2027 | | | 225,000 | | | 204,682 |

5.50%, 12/15/2027 | | | 25,000 | | | 23,213 |

Starwood Property Trust Inc

|

3.75%, 12/31/2024(a) | | | 50,000 | | | 49,385 |

3.63%, 07/15/2026(a) | | | 125,000 | | | 117,698 |

7.25%, 04/01/2029(a) | | | 125,000 | | | 126,326 |

| | | | | | | |

The accompanying notes are an integral part of these financial statements.

TABLE OF CONTENTS

Muzinich Flexible U.S. High Yield Income Fund

Schedule of Investments

June 30, 2024 (Unaudited) (Continued)

| | | | | | | |

CORPORATE BONDS - (Continued)

|

Homebuilders/Real Estate - (Continued)

|

Uniti Group LP / Uniti Group Finance Inc / CSL Capital LLC

|

10.50%, 02/15/2028(a) | | | $ 250,000 | | | $ 245,084 |

6.50%, 02/15/2029(a) | | | 175,000 | | | 111,755 |

| | | 2,196,985 |

Hotels - 0.9%

|

Hilton Grand Vacations Borrower Escrow LLC / Hilton Grand Vacations Borrower Esc, 4.88%, 07/01/2031(a) | | | 500,000 | | | 443,026 |

Insurance - 1.3%

|

Acrisure LLC / Acrisure Finance Inc, 4.25%, 02/15/2029(a) | | | 150,000 | | | 136,430 |

Alliant Holdings Intermediate LLC / Alliant Holdings Co-Issuer

|

6.75%, 04/15/2028(a) | | | 125,000 | | | 125,363 |

7.00%, 01/15/2031(a) | | | 250,000 | | | 253,100 |

Baldwin Insurance Group Holdings LLC / Baldwin Insurance Group Holdings Finance, 7.13%, 05/15/2031(a) | | | 125,000 | | | 126,619 |

| | | 641,512 |

Leisure - 3.2%

|

Carnival Corp, 5.75%, 03/01/2027(a) | | | 375,000 | | | 370,719 |

Carnival Holdings Bermuda Ltd, 10.38%, 05/01/2028(a) | | | 500,000 | | | 541,572 |

Royal Caribbean Cruises Ltd

|

9.25%, 01/15/2029(a) | | | 100,000 | | | 106,834 |

6.25%, 03/15/2032(a) | | | 250,000 | | | 252,261 |

Six Flags Entertainment Corp, 7.25%, 05/15/2031(a) | | | 250,000 | | | 254,714 |

| | | 1,526,100 |

Metals/Mining - 1.6%

|

ERO Copper Corp, 6.50%, 02/15/2030(a) | | | 250,000 | | | 243,309 |

Kaiser Aluminum Corp, 4.50%, 06/01/2031(a) | | | 250,000 | | | 221,632 |

Mineral Resources Ltd, 9.25%, 10/01/2028(a) | | | 125,000 | | | 131,339 |

Perenti Finance Pty Ltd, 6.50%, 10/07/2025(a) | | | 187,457 | | | 187,137 |

| | | 783,417 |

Publishing/Printing - 0.3%

|

Cimpress PLC, 7.00%, 06/15/2026 | | | 150,000 | | | 150,037 |

Restaurants - 1.4%

|

Brinker International Inc, 8.25%, 07/15/2030(a) | | | 150,000 | | | 157,702 |

IRB Holding Corp, 7.00%, 06/15/2025(a) | | | 125,000 | | | 125,141 |

Raising Cane's Restaurants LLC, 9.38%, 05/01/2029(a) | | | 250,000 | | | 270,386 |

Yum! Brands Inc, 5.38%, 04/01/2032 | | | 125,000 | | | 120,275 |

| | | 673,504 |

Services - 3.5%

|

Allied Universal Holdco LLC, 7.88%, 02/15/2031(a) | | | 100,000 | | | 100,360 |

Brink's Co, 6.75%, 06/15/2032(a) | | | 200,000 | | | 201,764 |

EquipmentSharecom Inc, 9.00%, 05/15/2028(a) | | | 125,000 | | | 129,176 |

Maxim Crane Works Holdings Capital LLC, 11.50%, 09/01/2028(a) | | | 125,000 | | | 128,666 |

| | | | | | | |

The accompanying notes are an integral part of these financial statements.

TABLE OF CONTENTS

Muzinich Flexible U.S. High Yield Income Fund

Schedule of Investments

June 30, 2024 (Unaudited) (Continued)

| | | | | | | |

CORPORATE BONDS - (Continued)

|

Services - (Continued)

|

Ritchie Bros Holdings Inc, 6.75%, 03/15/2028(a) | | | $ 100,000 | | | $ 101,935 |

Summer BC Bidco B LLC, 5.50%, 10/31/2026(a) | | | 250,000 | | | 244,321 |