UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number (811-05037)

Professionally Managed Portfolios

(Exact name of registrant as specified in charter)

615 East Michigan Street

Milwaukee, WI 53202

(Address of principal executive offices) (Zip code)

Jason Hadler

Professionally Managed Portfolios

c/o U.S. Bank Global Fund Services

777 E. Wisconsin Avenue

Milwaukee, WI 53202

(Name and address of agent for service)

(414) 516-1523

Registrant’s telephone number, including area code

Date of fiscal year end: October 31

Date of reporting period: October 31, 2024

Item 1. Report to Stockholders.

| | |

| Congress Intermediate Bond ETF | |

CAFX (Principal U.S. Listing Exchange: NYSE ArcaNYSEArca) |

| Annual Shareholder Report | October 31, 2024 |

This annual shareholder report contains important information about the Congress Intermediate Bond ETF for the period of September 9, 2024, to October 31, 2024. You can find additional information about the Fund at https://etfs.congressasset.com/intermediate-bond-etf.html. You can also request this information by contacting us at (888) 688-1299.

WHAT WERE THE FUND COSTS FOR THE PAST YEAR? (based on a hypothetical $10,000 investment)

| | |

Fund Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| Congress Intermediate Bond ETF | $5 | 0.35% |

HOW DID THE FUND PERFORM LAST YEAR AND WHAT AFFECTED ITS PERFORMANCE?

The Congress Intermediate Bond ETF (CAFX) outperformed the Bloomberg U.S. Intermediate Government/Credit Total Return Index by seven basis points during the period of inception (09/09/24) to October 31, 2024 with a return of -1.40% compared with -1.47% for the index. During this limited period, the U.S. bond markets incurred weak performance as interest rates with maturities longer than six months rose substantially during this period. The US Treasury 2-year rate was up 0.58% and the US Treasury 10-year rate was up 0.64%. The recent movement higher in rates was primarily due to better-than expected economic releases—which lowered or delayed market expectations of future rate cuts by the Federal Reserve. The primary detractor for the Fund during this short period was the security selection within the Banks/Financials sector and US Treasury debt exposure. The primary contributor during the period was the overallocation to the Industrials sector and the asset-backed securities exposure.

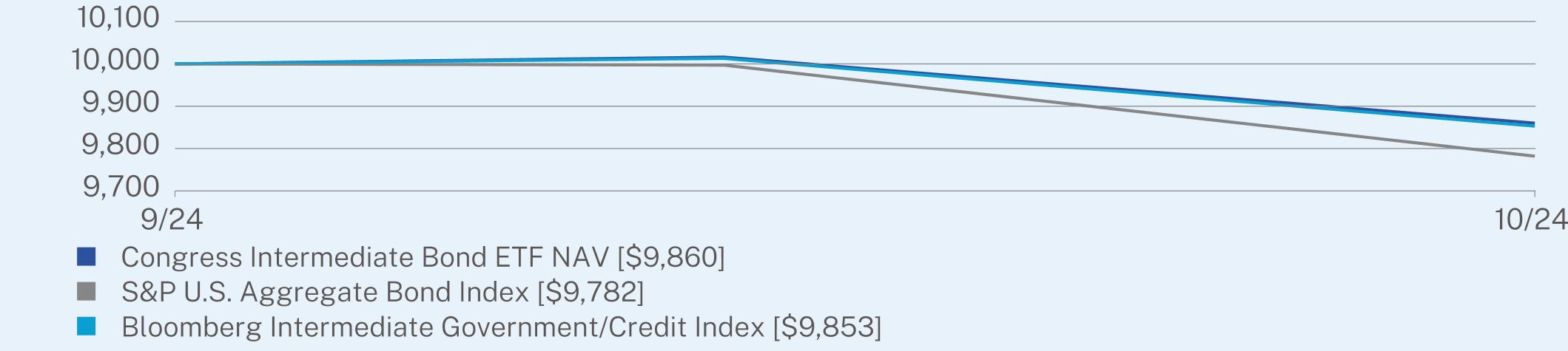

HOW DID THE FUND PERFORM SINCE INCEPTION?*

The $10,000 chart reflects a hypothetical $10,000 investment in the class of shares noted and assumes the maximum sales charge. The chart uses total return NAV performance and assumes reinvestment of dividends and capital gains. Fund expenses, including 12b-1 fees, management fees and other expenses were deducted.

CUMULATIVE PERFORMANCE (Initial Investment of $10,000)

ANNUAL AVERAGE TOTAL RETURN (%)

| |

| | Since Inception

(09/09/2024) |

Congress Intermediate Bond ETF NAV | -1.40 |

S&P U.S. Aggregate Bond Index | -2.18 |

Bloomberg Intermediate Government/Credit Index | -1.47 |

Visit https://etfs.congressasset.com/intermediate-bond-etf.html for more recent performance information.

| Congress Intermediate Bond ETF | PAGE 1 | TSR-AR-74316P587 |

| * | The Fund’s past performance is not a good predictor of how the Fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. |

KEY FUND STATISTICS (as of October 31, 2024)

| |

Net Assets | $85,984,148 |

Number of Holdings | 33 |

Net Advisory Fee | $28,277 |

Portfolio Turnover | 7% |

Average Credit Quality | AA-/A+ |

Effective Duration | 3.63 Years |

30-Day SEC Yield | 4.08% |

30-Day SEC Yield Unsubsidized | 4.08% |

Weighted Average Maturity | 4.34 Years |

Visit https://etfs.congressasset.com/intermediate-bond-etf.html for more recent performance information.

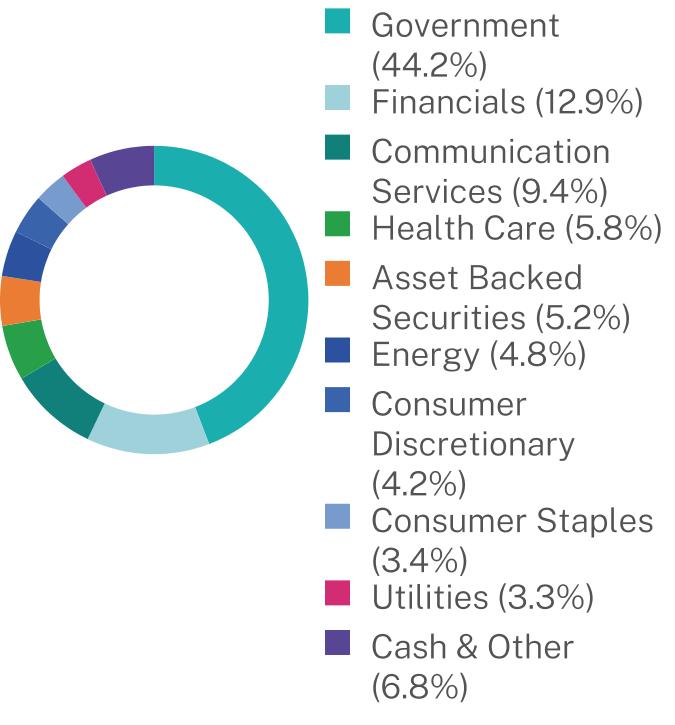

WHAT DID THE FUND INVEST IN? (as of October 31, 2024)

| |

Top Holdings | (% of Net Assets) |

United States Treasury Note/Bond | 5.5% |

United States Treasury Note/Bond | 5.0% |

United States Treasury Note/Bond | 4.7% |

United States Treasury Note/Bond | 4.6% |

United States Treasury Note/Bond | 4.4% |

United States Treasury Note/Bond | 4.2% |

United States Treasury Note/Bond | 4.1% |

United States Treasury Note/Bond | 3.9% |

Comcast Corp. | 3.8% |

Goldman Sachs Group, Inc. | 3.7% |

| |

Industry | (% of Net Assets) |

Sovereign | 36.4% |

Banks | 9.2% |

Public Finance Activities | 7.8% |

Diversified Telecommunication Services | 5.6% |

Automobile ABS | 5.2% |

Auto Manufacturers | 4.2% |

Media | 3.8% |

Capital Markets | 3.7% |

Electric | 3.3% |

Cash & Other | 20.8% |

Sector Breakdown* (% of Net Assets)

| * | The Global Industry Classification Standard (“GICS®”) was developed by and/or is the exclusive property of MSCI, Inc. (“MSCI”) and Standard & Poor’s Financial Services LLC (“S&P”). GICS® is a service mark of MSCI and S&P and has been licensed for use by U.S. Bank Global Fund Services. |

For additional information about the Fund; including its prospectus, financial information, holdings and proxy information, scan the QR code or visit https://etfs.congressasset.com/intermediate-bond-etf.html

HOUSEHOLDING

To reduce Fund expenses, only one copy of most shareholder documents may be mailed to shareholders with multiple accounts at the same address (Householding). If you would prefer that your Congress Asset Management Company documents not be householded, please contact Congress Asset Management Company at (888) 688-1299, or contact your financial intermediary. Your instructions will typically be effective within 30 days of receipt by Congress Asset Management Company or your financial intermediary.

| Congress Intermediate Bond ETF | PAGE 2 | TSR-AR-74316P587 |

98609782985344.212.99.45.85.24.84.23.43.36.8

| | |

| Congress Large Cap Growth ETF | |

CAML (Principal U.S. Listing Exchange: NYSE ArcaNYSEArca) |

| Annual Shareholder Report | October 31, 2024 |

This annual shareholder report contains important information about the Congress Large Cap Growth ETF for the period of November 1, 2023, to October 31, 2024. You can find additional information about the Fund at https://etfs.congressasset.com/large-cap-growth-etf.html. You can also request this information by contacting us at (888) 688-1299.

WHAT WERE THE FUND COSTS FOR THE PAST YEAR? (based on a hypothetical $10,000 investment)

| | |

Fund Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| Congress Large Cap Growth ETF | $77 | 0.65% |

HOW DID THE FUND PERFORM LAST YEAR AND WHAT AFFECTED ITS PERFORMANCE?

The Congress Large Cap Growth ETF underperformed the Russell 1000 growth index by 645 bps during the trailing 1 year period ended October 31, 2024 with a return of 36.55% vs. 43.77% for the index. During this period, U.S. equities emerged as the vanguard of global markets, buoyed by an air of investor optimism and a robust economic landscape. Our nation’s economy displayed remarkable resilience, marked by strong labor markets and easing inflation. The top contributors during the year were security selection with consumer staples, security selection within communication services, and security selection within industrials sector. The primary detractors to performance were security selection within information technology, security selection within financials, and asset allocation in healthcare.

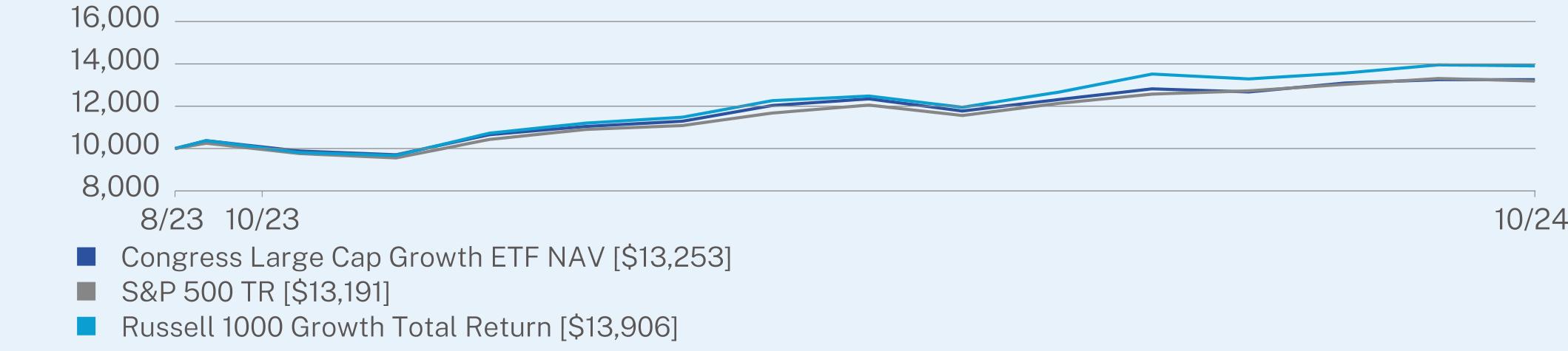

HOW DID THE FUND PERFORM SINCE INCEPTION?*

The $10,000 chart reflects a hypothetical $10,000 investment in the class of shares noted and assumes the maximum sales charge. The chart uses total return NAV performance and assumes reinvestment of dividends and capital gains. Fund expenses, including 12b-1 fees, management fees and other expenses were deducted.

CUMULATIVE PERFORMANCE (Initial Investment of $10,000)

ANNUAL AVERAGE TOTAL RETURN (%)

| | |

| | 1 Year | Since Inception

(08/21/2023) |

Congress Large Cap Growth ETF NAV | 36.55 | 26.58 |

S&P 500 TR | 38.02 | 26.09 |

Russell 1000 Growth Total Return | 43.77 | 31.79 |

Visit https://etfs.congressasset.com/large-cap-growth-etf.html for more recent performance information.

| * | The Fund’s past performance is not a good predictor of how the Fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. |

| Congress Large Cap Growth ETF | PAGE 1 | TSR-AR-74316P637 |

KEY FUND STATISTICS (as of October 31, 2024)

| |

Net Assets | $248,445,687 |

Number of Holdings | 40 |

Net Advisory Fee | $932,371 |

Portfolio Turnover | 33% |

Visit https://etfs.congressasset.com/large-cap-growth-etf.html for more recent performance information.

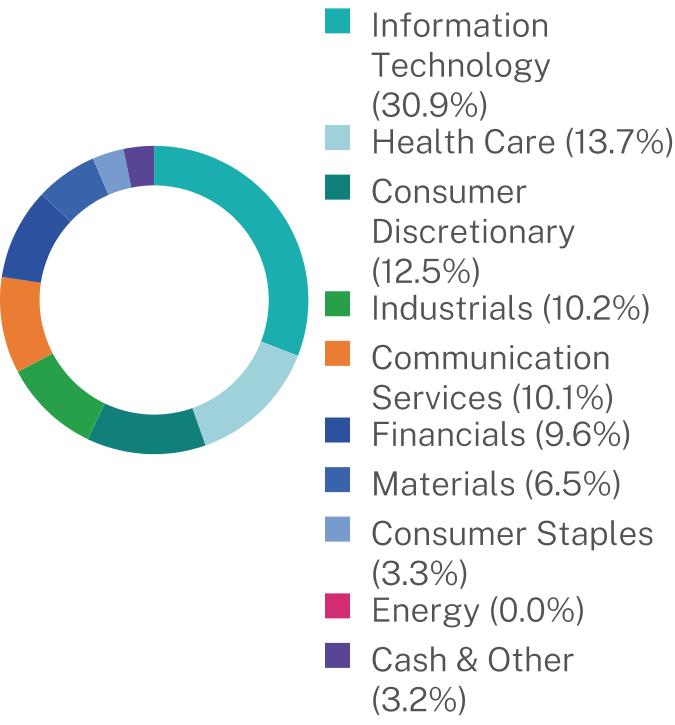

WHAT DID THE FUND INVEST IN? (as of October 31, 2024)

| |

Top Holdings | (% of Net Assets) |

NVIDIA Corp. | 5.2% |

Apple, Inc. | 3.7% |

Costco Wholesale Corp. | 3.3% |

Meta Platforms, Inc. - Class A | 3.3% |

Eli Lilly & Co. | 3.1% |

ServiceNow, Inc. | 3.1% |

Arista Networks, Inc. | 3.1% |

Eaton Corp. PLC | 3.1% |

Microsoft Corp. | 3.1% |

O’Reilly Automotive, Inc. | 2.8% |

| |

Industry | (% of Net Assets) |

Software | 14.8% |

Semiconductors & Semiconductor Equipment | 9.3% |

Specialty Retail | 7.7% |

Interactive Media & Services | 6.0% |

Health Care Equipment & Supplies | 5.2% |

Pharmaceuticals | 5.0% |

Chemicals | 4.5% |

Capital Markets | 4.4% |

Technology Hardware, Storage & Peripherals | 3.7% |

Cash & Other | 39.4% |

Sector Breakdown* (% of Net Assets)

| * | The Global Industry Classification Standard (“GICS®”) was developed by and/or is the exclusive property of MSCI, Inc. (“MSCI”) and Standard & Poor’s Financial Services LLC (“S&P”). GICS® is a service mark of MSCI and S&P and has been licensed for use by U.S. Bank Global Fund Services. |

For additional information about the Fund; including its prospectus, financial information, holdings and proxy information, scan the QR code or visit https://etfs.congressasset.com/large-cap-growth-etf.html

HOUSEHOLDING

To reduce Fund expenses, only one copy of most shareholder documents may be mailed to shareholders with multiple accounts at the same address (Householding). If you would prefer that your Congress Asset Management Company documents not be householded, please contact Congress Asset Management Company at (888) 688-1299, or contact your financial intermediary. Your instructions will typically be effective within 30 days of receipt by Congress Asset Management Company or your financial intermediary.

| Congress Large Cap Growth ETF | PAGE 2 | TSR-AR-74316P637 |

97051325395581319196721390630.913.712.510.210.19.66.53.30.03.2

| | |

| Congress SMid Growth ETF | |

CSMD (Principal U.S. Listing Exchange: NYSE ArcaNYSEArca) |

| Annual Shareholder Report | October 31, 2024 |

This annual shareholder report contains important information about the Congress SMid Growth ETF for the period of November 1, 2023, to October 31, 2024. You can find additional information about the Fund at https://etfs.congressasset.com/smid-growth-etf.html. You can also request this information by contacting us at (888) 688-1299.

WHAT WERE THE FUND COSTS FOR THE PAST YEAR? (based on a hypothetical $10,000 investment)

| | |

Fund Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| Congress SMid Growth ETF | $77 | 0.68% |

HOW DID THE FUND PERFORM LAST YEAR AND WHAT AFFECTED ITS PERFORMANCE?

On a one-year period ending October 31, 2024, the Congress SMid Growth ETF returned 27.78% vs. the Russell 2500 Growth benchmark of 34.21%. The market experienced some volatility in August as investors began to raise concerns on the high costs of developing AI. In addition, the Federal Reserve cut interest rate by 50 basis points spurred a rally that favored lower quality companies. The primary detractor during the period was security selection within Information Technology, primarily not holding Super Micro Computer (+242%) and holding DoubleVerify (-39%). On the other hand, stock selection within Industrial and Consumer Discretionary were positive contributors to the performance. The top individual active contributor was Comfort Systems which returned over 115% in the period.

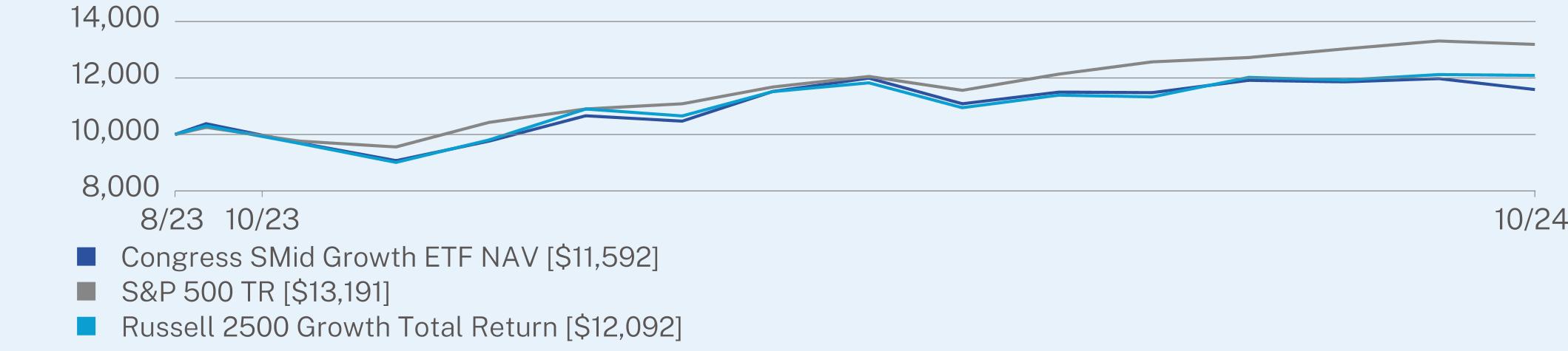

HOW DID THE FUND PERFORM SINCE INCEPTION?*

The $10,000 chart reflects a hypothetical $10,000 investment in the class of shares noted and assumes the maximum sales charge. The chart uses total return NAV performance and assumes reinvestment of dividends and capital gains. Fund expenses, including 12b-1 fees, management fees and other expenses were deducted.

CUMULATIVE PERFORMANCE (Initial Investment of $10,000)

ANNUAL AVERAGE TOTAL RETURN (%)

| | |

| | 1 Year | Since Inception

(08/21/2023) |

Congress SMid Growth ETF NAV | 27.78 | 13.17 |

S&P 500 TR | 38.02 | 26.09 |

Russell 2500 Growth Total Return | 34.21 | 17.24 |

Visit https://etfs.congressasset.com/smid-growth-etf.html for more recent performance information.

| * | The Fund’s past performance is not a good predictor of how the Fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. |

| Congress SMid Growth ETF | PAGE 1 | TSR-AR-74316P645 |

KEY FUND STATISTICS (as of October 31, 2024)

| |

Net Assets | $196,445,627 |

Number of Holdings | 44 |

Net Advisory Fee | $788,744 |

Portfolio Turnover | 23% |

30-Day SEC Yield | -0.05% |

30-Day SEC Yield Unsubsidized | -0.05% |

Visit https://etfs.congressasset.com/smid-growth-etf.html for more recent performance information.

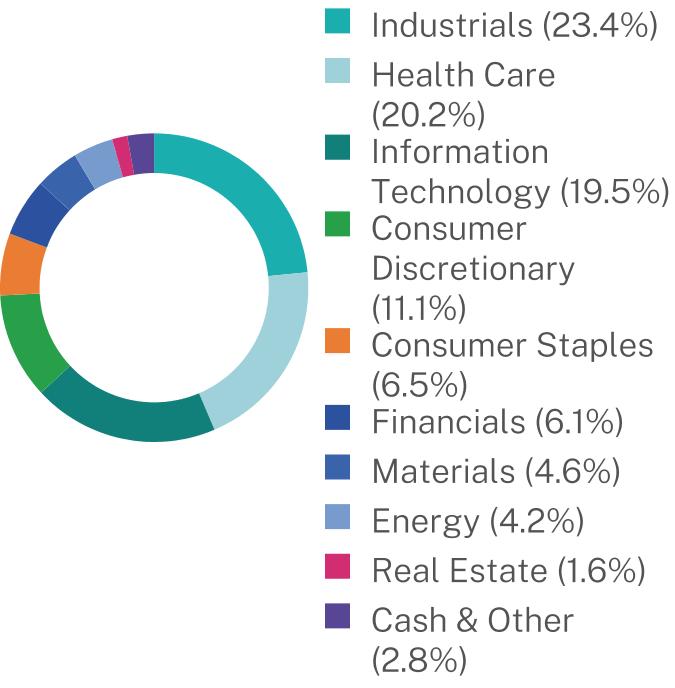

WHAT DID THE FUND INVEST IN? (as of October 31, 2024)

| |

Top Holdings | (% of Net Assets) |

Comfort Systems USA, Inc. | 4.1% |

CyberArk Software Ltd. | 3.6% |

Curtiss-Wright Corp. | 3.4% |

SPS Commerce, Inc. | 3.0% |

Valmont Industries, Inc. | 3.0% |

PTC, Inc. | 3.0% |

Tractor Supply Co. | 2.9% |

First American Treasury Obligations Fund | 2.8% |

BJ’s Wholesale Club Holdings, Inc. | 2.8% |

Summit Materials, Inc. - Class A | 2.7% |

| |

Industry | (% of Net Assets) |

Software | 11.7% |

Health Care Equipment & Supplies | 10.1% |

Construction & Engineering | 9.6% |

Specialty Retail | 5.4% |

Electronic Equipment, Instruments & Components | 4.1% |

Life Sciences Tools & Services | 4.0% |

Aerospace & Defense | 3.4% |

Consumer Staples Distribution & Retail | 2.8% |

Construction Materials | 2.7% |

Cash & Other | 46.2% |

Sector Breakdown* (% of Net Assets)

| * | The Global Industry Classification Standard (“GICS®”) was developed by and/or is the exclusive property of MSCI, Inc. (“MSCI”) and Standard & Poor’s Financial Services LLC (“S&P”). GICS® is a service mark of MSCI and S&P and has been licensed for use by U.S. Bank Global Fund Services. |

For additional information about the Fund; including its prospectus, financial information, holdings and proxy information, scan the QR code or visit https://etfs.congressasset.com/smid-growth-etf.html

HOUSEHOLDING

To reduce Fund expenses, only one copy of most shareholder documents may be mailed to shareholders with multiple accounts at the same address (Householding). If you would prefer that your Congress Asset Management Company documents not be householded, please contact Congress Asset Management Company at (888) 688-1299, or contact your financial intermediary. Your instructions will typically be effective within 30 days of receipt by Congress Asset Management Company or your financial intermediary.

| Congress SMid Growth ETF | PAGE 2 | TSR-AR-74316P645 |

90721159295581319190101209223.420.219.511.16.56.14.64.21.62.8

Item 2. Code of Ethics.

The registrant has adopted a code of ethics that applies to the registrant’s principal executive officer and principal financial officer. The registrant has not made any amendments to its code of ethics during the period covered by this report. The registrant has not granted any waivers from any provisions of the code of ethics during the period covered by this report.

A copy of the registrant’s Code of Ethics is filed herewith.

Item 3. Audit Committee Financial Expert.

The registrant’s Board of Trustees of the Trust has determined that there is at least one audit committee financial expert serving on its audit committee. Ms. Kathleen T. Barr, Ms. Cynthia M. Fornelli, Messrs. Eric W. Falkeis, Steven J. Paggioli and Ashi S. Parikh are each an “audit committee financial expert” and are considered to be “independent” as each term is defined in Item 3 of Form N-CSR.

Item 4. Principal Accountant Fees and Services.

The registrant has engaged its principal accountant to perform audit services, audit-related services, tax services and other services during the past two fiscal years. “Audit services” refer to performing an audit of the registrant’s annual financial statements or services that are normally provided by the accountant in connection with statutory and regulatory filings or engagements for those fiscal years. “Audit-related services” refer to the assurance and related services by the principal accountant that are reasonably related to the performance of the audit. “Tax services” refer to professional services rendered by the principal accountant for tax compliance, tax advice, and tax planning. There were no “Other services” provided by the principal accountant. The following tables detail the aggregate fees billed or expected to be billed for each of the last two fiscal years for audit fees, audit-related fees, tax fees and other fees by the principal accountant.

Congress Large Cap Growth ETF

| | FYE 10/31/2024 | FYE 10/31/2023 |

| Audit Fees | $12,500 | $12,500 |

| Audit-Related Fees | N/A | N/A |

| Tax Fees | $2,500 | $2,500 |

| All Other Fees | N/A | N/A |

Congress SMid Growth ETF

| | FYE 10/31/2024 | FYE 10/31/2023 |

| Audit Fees | $12,500 | $12,500 |

| Audit-Related Fees | N/A | N/A |

| Tax Fees | $2,500 | $2,500 |

| All Other Fees | N/A | N/A |

Congress Intermediate Bond ETF

| | FYE 10/31/2024 | FYE 10/31/2023 |

| Audit Fees | $7,500 | N/A |

| Audit-Related Fees | N/A | N/A |

| Tax Fees | $2,500 | N/A |

| All Other Fees | N/A | N/A |

(e)(1) The audit committee has adopted pre-approval policies and procedures that require the audit committee to pre-approve all audit and non-audit services of the registrant, including services provided to any entity affiliated with the registrant.

(e)(2) The percentages of fees billed by Tait, Weller & Baker LLP applicable to non-audit services pursuant to waiver of pre-approval requirement were as follows:

Congress Large Cap Growth ETF

| | FYE 10/31/2024 | FYE 10/31/2023 |

Audit-Related Fees | 0% | 0% |

| Tax Fees | 0% | 0% |

| All Other Fees | 0% | 0% |

Congress SMid Growth ETF

| | FYE 10/31/2024 | FYE 10/31/2023 |

Audit-Related Fees | 0% | 0% |

| Tax Fees | 0% | 0% |

| All Other Fees | 0% | 0% |

Congress Intermediate Bond ETF

| | FYE 10/31/2024 | FYE 10/31/2023 |

Audit-Related Fees | 0% | N/A |

| Tax Fees | 0% | N/A |

| All Other Fees | 0% | N/A |

(f) N/A

(g) The following table indicates the non-audit fees billed or expected to be billed by the registrant’s accountant for services to the registrant and to the registrant’s investment advisor (and any other controlling entity, etc.—not sub-advisor) for the last two years.

Congress Large Cap Growth ETF

| Non-Audit Related Fees | FYE 10/31/2024 | FYE 10/31/2023 |

| Registrant | N/A | N/A |

| Registrant’s Investment Adviser | N/A | N/A |

Congress SMid Growth ETF

| Non-Audit Related Fees | FYE 10/31/2024 | FYE 10/31/2023 |

| Registrant | N/A | N/A |

| Registrant’s Investment Adviser | N/A | N/A |

Congress Intermediate Bond ETF

| Non-Audit Related Fees | FYE 10/31/2024 | FYE 10/31/2023 |

| Registrant | N/A | N/A |

| Registrant’s Investment Adviser | N/A | N/A |

(h) The audit committee of the board of trustees has considered whether the provision of non-audit services that were rendered to the registrant’s investment advisor is compatible with maintaining the principal accountant’s independence and has concluded that the provision of such non-audit services by the accountant has not compromised the accountant’s independence.

The registrant has not been identified by the U.S. Securities and Exchange Commission as having filed an annual report issued by a registered public accounting firm branch or office that is located in a foreign jurisdiction where the Public Company Accounting Oversight Board is unable to inspect or completely investigate because of a position taken by an authority in that jurisdiction.

The registrant is not a foreign issuer.

Item 5. Audit Committee of Listed Registrants.

Not applicable.

Item 6. Investments.

(a) Schedule of Investments is included within the financial statements filed under Item 7 of this Form.

(b) Not applicable.

Item 7. Financial Statements and Financial Highlights for Open-End Investment Companies.

(a)

CONGRESS FUNDS

Congress Intermediate Bond ETF

Congress Large Cap Growth ETF

Congress SMid Growth ETF

Core Financial Statements

October 31, 2024

TABLE OF CONTENTS

Congress Intermediate Bond ETF

Schedule of Investments

October 31, 2024

| | | | | | | |

CORPORATE BONDS - 47.1%

| | | | | | |

Auto Manufacturers - 4.2%

| | | | | | |

Mercedes-Benz Finance North America LLC, 3.45%, 01/06/2027(a) | | | $450,000 | | | $439,379 |

Toyota Motor Credit Corp.,

5.05%, 05/16/2029 | | | 3,100,000 | | | 3,141,274 |

| | | | | | 3,580,653 |

Banks - 9.2%

| | | | | | |

Bank of America Corp.,

3.42% to 12/20/2027 then 3 mo. Term SOFR + 1.30%, 12/20/2028 | | | 2,901,000 | | | 2,781,669 |

JPMorgan Chase & Co.,

5.57% to 04/22/2027 then SOFR + 0.93%, 04/22/2028 | | | 2,069,000 | | | 2,105,957 |

Wells Fargo & Co., 3.00%, 04/22/2026 | | | 3,125,000 | | | 3,050,368 |

| | | | | | 7,937,994 |

Beverages - 0.8%

| | | | | | |

Diageo Capital PLC,

2.00%, 04/29/2030 | | | 750,000 | | | 652,287 |

Capital Markets - 3.7%

| | | | | | |

Goldman Sachs Group, Inc.,

3.50%, 11/16/2026 | | | 3,223,000 | | | 3,146,561 |

Consumer Staples Distribution &

Retail - 2.6%

| | | | | | |

Target Corp., 3.38%, 04/15/2029 | | | 2,361,000 | | | 2,257,119 |

Diversified Telecommunication

Services - 5.6%

| | | | | | |

AT&T, Inc., 2.75%, 06/01/2031 | | | 2,670,000 | | | 2,345,468 |

Verizon Communications, Inc.,

3.15%, 03/22/2030 | | | 2,661,000 | | | 2,443,939 |

| | | | | | 4,789,407 |

Electric - 3.3%

| | | | | | |

Florida Power & Light Co.,

5.05%, 04/01/2028 | | | 2,782,000 | | | 2,820,562 |

Health Care Providers &

Services - 3.2%

| | | | | | |

UnitedHealth Group, Inc.,

4.90%, 04/15/2031 | | | 2,736,000 | | | 2,751,212 |

Machinery - Diversified - 0.9%

| | | | | | |

John Deere Capital Corp.,

4.75%, 01/20/2028 | | | 800,000 | | | 806,745 |

Media - 3.8%

| | | | | | |

Comcast Corp., 4.15%, 10/15/2028 | | | 3,340,000 | | | 3,280,409 |

Mining - 2.4%

| | | | | | |

BHP Billiton Finance USA Ltd.,

5.25%, 09/08/2033 | | | 2,065,000 | | | 2,099,214 |

Oil & Gas - 2.6%

| | | | | | |

BP Capital Markets America, Inc.,

2.72%, 01/12/2032 | | | 2,606,000 | | | 2,257,496 |

| | | | | | | |

| | | | | | | |

Oil, Gas & Consumable Fuels - 2.2%

| | | | | | |

Kinder Morgan, Inc.,

5.00%, 02/01/2029 | | | $1,921,000 | | | $1,922,871 |

Pharmaceuticals - 2.6%

| | | | | | |

Bristol-Myers Squibb Co.,

5.20%, 02/22/2034 | | | 2,157,000 | | | 2,195,616 |

TOTAL CORPORATE BONDS

(Cost $41,296,259) | | | | | | 40,498,146 |

U.S. TREASURY SECURITIES - 44.2%

|

United States Treasury Note/Bond

| | | | | | |

2.13%, 05/15/2025 | | | 4,080,000 | | | 4,029,717 |

2.13%, 05/31/2026 | | | 4,924,000 | | | 4,769,355 |

3.75%, 08/31/2026 | | | 3,945,000 | | | 3,914,950 |

4.13%, 09/30/2027 | | | 4,334,000 | | | 4,334,677 |

4.13%, 07/31/2028 | | | 1,750,000 | | | 1,747,676 |

3.63%, 08/31/2029 | | | 1,566,000 | | | 1,530,398 |

3.88%, 09/30/2029 | | | 3,672,000 | | | 3,623,662 |

4.63%, 09/30/2030 | | | 3,716,000 | | | 3,797,723 |

4.25%, 02/28/2031 | | | 2,716,000 | | | 2,720,986 |

3.63%, 09/30/2031 | | | 750,000 | | | 723,164 |

4.13%, 11/15/2032 | | | 3,545,000 | | | 3,518,136 |

4.50%, 11/15/2033 | | | 3,279,000 | | | 3,333,565 |

TOTAL U.S. TREASURY SECURITIES

(Cost $38,797,719) | | | | | | 38,044,009 |

ASSET-BACKED SECURITIES - 5.2%

|

Ford Credit Auto Owner Trust,

Series 2023-A, Class A3,

4.65%, 02/15/2028 | | | 2,000,000 | | | 2,001,004 |

GM Financial Leasing Trust,

Series 2024-2, Class A2A,

5.43%, 09/21/2026 | | | 2,489,450 | | | 2,500,130 |

TOTAL ASSET-BACKED SECURITIES

(Cost $4,511,022) | | | | | | 4,501,134 |

| | | Shares | |

SHORT-TERM INVESTMENTS - 2.6%

|

Money Market Funds - 2.6%

| | | | | | |

First American Treasury Obligations Fund - Class X, 4.79%(b) | | | 2,193,534 | | | 2,193,534 |

TOTAL SHORT-TERM INVESTMENTS

(Cost $2,193,534) | | | | | | 2,193,534 |

TOTAL INVESTMENTS - 99.1%

(Cost $86,798,534) | | | | | | $85,236,823 |

Other Assets in Excess of

Liabilities - 0.9% | | | | | | 747,325 |

TOTAL NET ASSETS - 100.0% | | | | | | $85,984,148 |

| | | | | | | |

The accompanying notes are an integral part of these financial statements.

TABLE OF CONTENTS

Congress Intermediate Bond ETF

Schedule of Investments

October 31, 2024(Continued)

Percentages are stated as a percent of net assets.

The Global Industry Classification Standard (“GICS®”) was developed by and/or is the exclusive property of MSCI, Inc. (“MSCI”) and Standard & Poor’s Financial Services LLC (“S&P”). GICS® is a service mark of

MSCI and S&P and has been licensed for use by U.S. Bank Global Fund Services.

PLC - Public Limited Company

SOFR - Secured Overnight Financing Rate

(a)

| Security is exempt from registration pursuant to Rule 144A under the Securities Act of 1933, as amended. These securities may only be resold in transactions exempt from registration to qualified institutional investors. As of October 31, 2024, the value of these securities total $439,379 or 0.5% of the Fund’s net assets. |

(b)

| The rate shown represents the 7-day annualized effective yield as of October 31, 2024. |

The accompanying notes are an integral part of these financial statements.

TABLE OF CONTENTS

Congress Large Cap Growth ETF

Schedule of Investments

October 31, 2024

| | | | | | | |

COMMON STOCKS - 96.8%

| | | | | | |

Aerospace & Defense - 2.7%

| | | | | | |

Howmet Aerospace, Inc. | | | 66,970 | | | $6,678,249 |

Biotechnology - 1.8%

| | | | | | |

Vertex Pharmaceuticals, Inc.(a) | | | 9,494 | | | 4,518,954 |

Broadline Retail - 2.7%

| | | | | | |

Amazon.com, Inc.(a) | | | 35,297 | | | 6,579,361 |

Capital Markets - 4.4%

| | | | | | |

Goldman Sachs Group, Inc. | | | 11,645 | | | 6,029,664 |

Moody’s Corp. | | | 10,514 | | | 4,773,777 |

| | | | | | 10,803,441 |

Chemicals - 4.5%

| | | | | | |

Ecolab, Inc. | | | 23,632 | | | 5,807,091 |

Sherwin-Williams Co. | | | 15,020 | | | 5,388,726 |

| | | | | | 11,195,817 |

Commercial Services &

Supplies - 2.3%

| | | | | | |

Cintas Corp. | | | 28,168 | | | 5,797,256 |

Communications Equipment - 3.1%

| | | | | | |

Arista Networks, Inc.(a) | | | 19,832 | | | 7,663,878 |

Construction Materials - 2.0%

| | | | | | |

Martin Marietta Materials, Inc. | | | 8,512 | | | 5,041,998 |

Consumer Staples Distribution & Retail - 3.3%

| | | | | | |

Costco Wholesale Corp. | | | 9,312 | | | 8,140,364 |

Electrical Equipment - 3.1%

| | | | | | |

Eaton Corp. PLC | | | 23,030 | | | 7,636,287 |

Entertainment - 2.1%

| | | | | | |

Netflix, Inc.(a) | | | 6,969 | | | 5,268,773 |

Financial Services - 2.6%

| | | | | | |

Visa, Inc. - Class A | | | 21,779 | | | 6,312,643 |

Health Care Equipment &

Supplies - 5.2%

| | | | | | |

Boston Scientific Corp.(a) | | | 73,598 | | | 6,183,704 |

Intuitive Surgical, Inc.(a) | | | 13,518 | | | 6,810,909 |

| | | | | | 12,994,613 |

Hotels, Restaurants & Leisure - 2.1%

| | | | | | |

Chipotle Mexican Grill, Inc.(a) | | | 94,987 | | | 5,297,425 |

Insurance - 2.6%

| | | | | | |

Arthur J Gallagher & Co. | | | 22,871 | | | 6,431,325 |

Interactive Media & Services - 6.0%

| | | | | | |

Alphabet, Inc. - Class A | | | 39,052 | | | 6,682,188 |

Meta Platforms, Inc. - Class A | | | 14,283 | | | 8,106,745 |

| | | | | | 14,788,933 |

| | | | | | | |

| | | | | | | |

Life Sciences Tools & Services -1.7%

| | | |

Thermo Fisher Scientific, Inc. | | | 7,865 | | | $4,296,807 |

Machinery - 2.1%

| | | | | | |

Parker-Hannifin Corp. | | | 8,385 | | | 5,316,677 |

Media - 2.0%

| | | | | | |

Trade Desk, Inc. - Class A(a) | | | 42,056 | | | 5,055,552 |

Oil Gas & Consumable Fuels - 0.0%(b)

| | | | | | |

Exxon Mobil Corp. | | | 480 | | | 56,055 |

Pharmaceuticals - 5.0%

| | | | | | |

Eli Lilly & Co. | | | 9,412 | | | 7,809,513 |

Zoetis, Inc. | | | 26,285 | | | 4,699,232 |

| | | | | | 12,508,745 |

Semiconductors & Semiconductor Equipment - 9.3%

| | | | | | |

NVIDIA Corp. | | | 97,118 | | | 12,893,386 |

NXP Semiconductors NV | | | 24,032 | | | 5,635,504 |

Onto Innovation, Inc.(a) | | | 22,580 | | | 4,478,291 |

| | | | | | 23,007,181 |

Software - 14.8%

| | | | | | |

Intuit, Inc. | | | 9,763 | | | 5,958,359 |

Microsoft Corp. | | | 18,775 | | | 7,629,221 |

Palo Alto Networks, Inc.(a) | | | 13,588 | | | 4,896,164 |

Salesforce, Inc. | | | 15,170 | | | 4,420,083 |

ServiceNow, Inc.(a) | | | 8,261 | | | 7,707,430 |

Synopsys, Inc.(a) | | | 12,016 | | | 6,171,538 |

| | | | | | 36,782,795 |

Specialty Retail - 7.7%

| | | | | | |

O’Reilly Automotive, Inc.(a) | | | 6,018 | | | 6,939,596 |

The Home Depot, Inc. | | | 15,020 | | | 5,914,125 |

TJX Cos., Inc. | | | 55,826 | | | 6,310,013 |

| | | | | | 19,163,734 |

Technology Hardware, Storage & Peripherals - 3.7%

| | | | | | |

Apple, Inc. | | | 40,554 | | | 9,161,554 |

TOTAL COMMON STOCKS

(Cost $209,653,776) | | | | | | 240,498,417 |

SHORT-TERM INVESTMENTS - 1.1%

|

Money Market Funds - 1.1%

| | | | | | |

First American Treasury Obligations Fund - Class X, 4.79%(c) | | | 2,805,651 | | | 2,805,651 |

TOTAL SHORT-TERM INVESTMENTS

(Cost $2,805,651) | | | | | | 2,805,651 |

TOTAL INVESTMENTS - 97.9% (Cost $212,459,427) | | | | | | $243,304,068 |

Other Assets in Excess of

Liabilities - 2.1% | | | | | | 5,141,619 |

TOTAL NET ASSETS - 100.0% | | | | | | $248,445,687 |

| | | | | | | |

The accompanying notes are an integral part of these financial statements.

TABLE OF CONTENTS

Congress Large Cap Growth ETF

Schedule of Investments

October 31, 2024(Continued)

Percentages are stated as a percent of net assets.

NV - Naamloze Vennootschap

PLC - Public Limited Company

(a)

| Non-income producing security.

|

(b)

| Represents less than 0.05% of net assets.

|

(c)

| The rate shown represents the 7-day annualized effective yield as of October 31, 2024. |

The accompanying notes are an integral part of these financial statements.

TABLE OF CONTENTS

Congress SMid Growth ETF

Schedule of Investments

October 31, 2024

| | | | | | | |

COMMON STOCKS - 95.6%

| | | | | | |

Aerospace & Defense - 3.4%

| | | | | | |

Curtiss-Wright Corp. | | | 19,473 | | | $6,717,406 |

Banks - 2.0%

| | | | | | |

Western Alliance Bancorp | | | 46,831 | | | 3,896,808 |

Biotechnology - 2.4%

| | | | | | |

Halozyme Therapeutics, Inc.(a) | | | 93,839 | | | 4,745,438 |

Broadline Retail - 2.0%

| | | | | | |

Ollie’s Bargain Outlet Holdings, Inc.(a) | | | 42,070 | | | 3,863,288 |

Building Products - 2.4%

| | | | | | |

AZEK Co., Inc.(a) | | | 106,990 | | | 4,707,560 |

Capital Markets - 2.4%

| | | | | | |

Morningstar, Inc. | | | 14,149 | | | 4,641,580 |

Communications Equipment - 1.3%

| | | | | | |

Calix, Inc.(a) | | | 73,382 | | | 2,596,255 |

Construction & Engineering - 9.6%

| | | | | | |

Comfort Systems USA, Inc. | | | 20,720 | | | 8,102,349 |

Sterling Infrastructure, Inc.(a) | | | 32,314 | | | 4,990,897 |

Valmont Industries, Inc. | | | 18,784 | | | 5,854,597 |

| | | | | | 18,947,843 |

Construction Materials - 2.7%

| | | | | | |

Summit Materials, Inc. - Class A(a) | | | 111,708 | | | 5,296,076 |

Consumer Staples Distribution &

Retail - 2.8%

| | | | | | |

BJ’s Wholesale Club Holdings, Inc.(a) | | | 63,942 | | | 5,417,806 |

Containers & Packaging - 1.9%

| | | | | | |

Avery Dennison Corp. | | | 18,110 | | | 3,749,313 |

Distributors - 2.0%

| | | | | | |

Pool Corp. | | | 10,696 | | | 3,868,101 |

Electrical Equipment - 2.3%

| | | | | | |

nVent Electric PLC | | | 59,967 | | | 4,471,739 |

Electronic Equipment, Instruments & Components - 4.1%

| | | | | | |

Badger Meter, Inc. | | | 19,628 | | | 3,926,581 |

CDW Corp./DE | | | 22,154 | | | 4,170,048 |

| | | | | | 8,096,629 |

Energy Equipment & Services - 2.4%

| | | | | | |

Cactus, Inc. - Class A | | | 79,444 | | | 4,710,235 |

Food Products - 1.6%

| | | | | | |

Simply Good Foods Co.(a) | | | 92,263 | | | 3,105,573 |

Ground Transportation - 1.5%

| | | | | | |

Werner Enterprises, Inc. | | | 82,814 | | | 3,055,009 |

| | | | | | | |

| | | | | | | |

Health Care Equipment &

Supplies - 10.1%

| | | | | | |

Cooper Cos., Inc.(a) | | | 44,400 | | | $4,647,792 |

Insulet Corp.(a) | | | 19,458 | | | 4,505,111 |

Penumbra, Inc.(a) | | | 10,292 | | | 2,355,530 |

STERIS PLC | | | 17,436 | | | 3,868,176 |

UFP Technologies, Inc.(a) | | | 16,795 | | | 4,484,265 |

| | | | | | 19,860,874 |

Health Care Providers &

Services - 1.3%

| | | | | | |

Option Care Health, Inc.(a) | | | 111,084 | | | 2,559,375 |

Hotels, Restaurants & Leisure - 1.7%

| | | | | | |

Choice Hotels International, Inc. | | | 24,200 | | | 3,376,142 |

Insurance - 1.7%

| | | | | | |

Kinsale Capital Group, Inc. | | | 7,630 | | | 3,266,479 |

Life Sciences Tools & Services - 4.0%

| | | | | | |

Medpace Holdings, Inc.(a) | | | 15,871 | | | 4,986,986 |

Repligen Corp.(a) | | | 20,831 | | | 2,796,978 |

| | | | | | 7,783,964 |

Machinery - 1.8%

| | | | | | |

Lincoln Electric Holdings, Inc. | | | 18,522 | | | 3,566,596 |

Oil, Gas & Consumable Fuels - 1.8%

| | | | | | |

Range Resources Corp. | | | 118,495 | | | 3,558,405 |

Personal Care Products - 2.1%

| | | | | | |

e.l.f Beauty, Inc.(a) | | | 38,549 | | | 4,057,282 |

Pharmaceuticals - 2.4%

| | | | | | |

Prestige Consumer Healthcare, Inc.(a) | | | 64,616 | | | 4,765,430 |

Professional Services - 2.4%

| | | | | | |

KBR, Inc. | | | 71,356 | | | 4,781,566 |

Semiconductors & Semiconductor

Equipment - 2.4%

| |

Entegris, Inc. | | | 45,070 | | | 4,719,280 |

Software - 11.7%

| | | | | | |

CommVault Systems, Inc.(a) | | | 26,297 | | | 4,107,328 |

CyberArk Software Ltd.(a) | | | 25,524 | | | 7,057,897 |

PTC, Inc.(a) | | | 31,590 | | | 5,854,575 |

SPS Commerce, Inc.(a) | | | 35,634 | | | 5,879,610 |

| | | | | | 22,899,410 |

Specialty Retail - 5.4%

| | | | | | |

Tractor Supply Co. | | | 21,480 | | | 5,703,155 |

Williams-Sonoma, Inc. | | | 37,109 | | | 4,977,430 |

| | | | | | 10,680,585 |

TOTAL COMMON STOCKS

(Cost $175,794,478) | | | | | | 187,762,047 |

| | | | | | | |

The accompanying notes are an integral part of these financial statements.

TABLE OF CONTENTS

Congress SMid Growth ETF

Schedule of Investments

October 31, 2024(Continued)

| | | | | | | |

REAL ESTATE INVESTMENT TRUSTS - 1.6%

|

Terreno Realty Corp. | | | 53,832 | | | $3,227,228 |

TOTAL REAL ESTATE INVESTMENT TRUSTS

(Cost $3,255,342) | | | | | | 3,227,228 |

SHORT-TERM INVESTMENTS - 2.8%

| | | |

Money Market Funds - 2.8%

| | | | | | |

First American Treasury Obligations Fund - Class X, 4.79%(b) | | | 5,462,196 | | | 5,462,196 |

TOTAL SHORT-TERM INVESTMENTS

(Cost $5,462,196) | | | | | | 5,462,196 |

TOTAL INVESTMENTS - 100.0%

(Cost $184,512,016) | | | | | | $196,451,471 |

Liabilities in Excess of Other

Assets - (0.0)%(c) | | | | | | (5,844) |

TOTAL NET ASSETS - 100.0% | | | | | | $196,445,627 |

| | | | | | | |

Percentages are stated as a percent of net assets.

PLC - Public Limited Company

(a)

| Non-income producing security.

|

(b)

| The rate shown represents the 7-day annualized effective yield as of October 31, 2024.

|

(c)

| Represents less than 0.05% of net assets.

|

The accompanying notes are an integral part of these financial statements.

TABLE OF CONTENTS

CONGRESS FUNDS

Statements of Assets and Liabilities

October 31, 2024

| | | | | | | | | | |

ASSETS:

| | | | | | | | | |

Investments, at value | | | $85,236,823 | | | $243,304,068 | | | $196,451,471 |

Interest receivable | | | 686,768 | | | 10,643 | | | 20,756 |

Cash | | | 84,800 | | | — | | | — |

Receivable for investments sold | | | — | | | 5,233,182 | | | — |

Receivable for fund shares sold | | | — | | | 992,412 | | | 1,158,972 |

Dividends receivable | | | — | | | 11,310 | | | 35,981 |

Receivable for transaction fee | | | — | | | 59 | | | — |

Prepaid expenses and other assets | | | — | | | 104 | | | 104 |

Total assets | | | 86,008,391 | | | 249,551,778 | | | 197,667,284 |

LIABILITIES:

| | | | | | | | | |

Payable to adviser | | | 24,075 | | | 133,785 | | | 111,466 |

Payable for transaction fee | | | 168 | | | — | | | — |

Payable for investments purchased | | | — | | | 972,306 | | | 1,110,191 |

Total liabilities | | | 24,243 | | | 1,106,091 | | | 1,221,657 |

NET ASSETS | | | $85,984,148 | | | $248,445,687 | | | $196,445,627 |

NET ASSETS CONSISTS OF:

| | | | | | | | | |

Paid-in capital | | | $87,549,804 | | | $220,991,766 | | | $185,440,655 |

Total distributable earnings/(accumulated losses) | | | (1,565,656) | | | 27,453,921 | | | 11,004,972 |

Total net assets | | | $85,984,148 | | | $248,445,687 | | | $196,445,627 |

Net assets | | | $85,984,148 | | | $248,445,687 | | | $196,445,627 |

Shares issued and outstanding | | | 3,500,000 | | | 7,510,000 | | | 6,780,000 |

Net asset value per share | | | $24.57 | | | $33.08 | | | $28.97 |

Cost:

| | | | | | | | | |

Investments, at cost | | | $86,798,534 | | | $212,459,427 | | | $184,512,016 |

| | | | | | | | | | |

The accompanying notes are an integral part of these financial statements.

TABLE OF CONTENTS

CONGRESS FUNDS

Statements of Operations

For the Period Ended October 31, 2024

| | | | | | | | | | |

INVESTMENT INCOME:

| | | | | | | | | |

Dividend income | | | $— | | | $1,022,914 | | | $555,012 |

Less: Dividend withholding taxes | | | — | | | (8,918) | | | — |

Interest income | | | 338,887 | | | 85,361 | | | 128,190 |

Other income | | | — | | | 654 | | | 644 |

Total investment income | | | 338,887 | | | 1,100,011 | | | 683,846 |

EXPENSES:

| | | | | | | | | |

Investment advisory fee | | | 28,277 | | | 932,371 | | | 788,744 |

Total expenses | | | 28,277 | | | 932,371 | | | 788,744 |

Net investment income/(loss) | | | 310,610 | | | 167,640 | | | (104,898) |

REALIZED AND UNREALIZED GAIN/(LOSS)

| |

Net realized gain/(loss) from:

| | | | | | | | | |

Investments | | | (25,464) | | | (3,480,481) | | | (818,331) |

Redemptions in-kind | | | — | | | 1,231,235 | | | 324,652 |

Net realized loss | | | (25,464) | | | (2,249,246) | | | (493,679) |

Net change in unrealized appreciation/(depreciation) on:

| | | | | | | | | |

Investments | | | (1,561,711) | | | 30,890,150 | | | 12,196,029 |

Net change in unrealized appreciation/(depreciation) | | | (1,561,711) | | | 30,890,150 | | | 12,196,029 |

Net realized and unrealized gain/(loss) | | | (1,587,175) | | | 28,640,904 | | | 11,702,350 |

NET INCREASE/(DECREASE) IN NET ASSETS RESULTING FROM OPERATIONS | | | $(1,276,565) | | | $28,808,544 | | | $11,597,452 |

| | | | | | | | | | |

(a)

| Inception date of the Fund was September 9, 2024. |

The accompanying notes are an integral part of these financial statements.

TABLE OF CONTENTS

CONGRESS FUNDS

Statements of Changes in Net Assets

October 31, 2024

| | | | | | | |

OPERATIONS:

| | | | | | | | | |

Net investment income | | | $310,610 | | | $167,640 | | | $798 |

Net realized loss | | | (25,464) | | | (2,249,246) | | | (5,838) |

Net change in unrealized appreciation/(depreciation) | | | (1,561,711) | | | 30,890,150 | | | (45,509) |

Net increase/(decrease) in net assets from operations | | | (1,276,565) | | | 28,808,544 | | | (50,549) |

DISTRIBUTIONS TO SHAREHOLDERS:

| | | | | | | | | |

Distributions to shareholders | | | (289,091) | | | (72,862) | | | — |

Total distributions to shareholders | | | (289,091) | | | (72,862) | | | — |

CAPITAL TRANSACTIONS:

| | | | | | | | | |

Subscriptions | | | 87,545,786 | | | 211,147,173 | | | 13,152,129 |

Redemptions | | | — | | | (4,539,517) | | | — |

ETF transaction fees (See Note #6) | | | 4,018 | | | 769 | | | — |

Net increase in net assets from capital transactions | | | 87,549,804 | | | 206,608,425 | | | 13,152,129 |

Net increase in net assets | | | 85,984,148 | | | 235,344,107 | | | 13,101,580 |

NET ASSETS:

| | | | | | | | | |

Beginning of the period | | | — | | | 13,101,580 | | | — |

End of the period | | | $85,984,148 | | | $248,445,687 | | | $13,101,580 |

SHARES TRANSACTIONS | | | | | | | | | |

Subscriptions | | | 3,500,000 | | | 7,110,000 | | | 540,000 |

Redemptions | | | — | | | (140,000) | | | — |

Total increase in shares outstanding | | | 3,500,000 | | | 6,970,000 | | | 540,000 |

| | | | | | | | | | |

(a)

| Inception date of the Fund was September 9, 2024. |

(b)

| Inception date of the Fund was August 21, 2023. |

The accompanying notes are an integral part of these financial statements.

TABLE OF CONTENTS

CONGRESS FUNDS

Statements of Changes in Net Assets

October 31, 2024(Continued)

| | | | |

OPERATIONS:

| | | | | | |

Net investment income/(loss) | | | $(104,898) | | | $230 |

Net realized loss | | | (493,679) | | | (2,806) |

Net change in unrealized appreciation/(depreciation) | | | (12,196,029) | | | (256,574) |

Net increase/(decrease) in net assets from operations | | | 11,597,452 | | | (259,150) |

DISTRIBUTIONS TO SHAREHOLDERS:

| | | | | | |

Distributions to shareholders | | | (8,678) | | | — |

Total distributions to shareholders | | | (8,678) | | | — |

CAPITAL TRANSACTIONS:

| | | | | | |

Subscriptions | | | 174,707,781 | | | 11,598,562 |

Redemptions | | | (1,190,340) | | | — |

Net increase in net assets from capital transactions | | | 173,517,441 | | | 11,598,562 |

Net increase in net assets | | | 185,106,215 | | | 11,339,412 |

NET ASSETS:

| | | | | | |

Beginning of the period | | | 11,339,412 | | | — |

End of the period | | | $196,445,627 | | | $11,339,412 |

SHARES TRANSACTIONS

| | | | | | |

Subscriptions | | | 6,320,000 | | | 500,000 |

Redemptions | | | (40,000) | | | — |

Total increase in shares outstanding | | | 6,280,000 | | | 500,000 |

| | | | | | | |

(a)

| Inception date of the Fund was August 21, 2023. |

The accompanying notes are an integral part of these financial statements.

TABLE OF CONTENTS

Congress Intermediate Bond ETF

Financial Highlights

| | | | |

PER SHARE DATA:

| | | |

Net asset value, beginning of period | | | $25.00 |

INVESTMENT OPERATIONS:

| | | |

Net investment income(b) | | | 0.14 |

Net realized and unrealized loss on investments(c) | | | (0.49) |

Total from investment operations | | | (0.35) |

LESS DISTRIBUTIONS FROM

| | | |

Net investment income | | | (0.08) |

Total distributions | | | (0.08) |

ETF transaction fees per share | | | 0.00(d) |

Net asset value, end of period | | | $24.57 |

Total return at NAV(e)(h) | | | −1.40% |

Total return at MKT(e)(h) | | | −1.28% |

SUPPLEMENTAL DATA AND RATIOS:

| | | |

Net assets, end of period (in thousands) | | | $85,984 |

Ratio of expenses to average net assets(f) | | | 0.35% |

Ratio of net investment income to average net assets(f) | | | 3.84% |

Portfolio turnover rate(e)(g) | | | 7% |

| | | | |

(a)

| Inception date of the Fund was September 9, 2024. |

(b)

| Net investment income per share has been calculated based on average shares outstanding during the period. |

(c)

| Realized and unrealized gains and losses per share in the caption are balancing amounts necessary to reconcile the change in net asset value per share for the years, and may not reconcile with the aggregate gains and losses in the Statement of Operations due to share transactions for the year. |

(d)

| Amount represents less than $0.005 per share. |

(e)

| Not annualized for periods less than one year. |

(f)

| Annualized for periods less than one year. |

(g)

| Portfolio turnover rate excludes in-kind transactions. |

(h)

| Net asset value total investment return is calculated assuming an initial investment made at the net asset value at the beginning of the period, reinvestment of all dividends and distributions, if any, at net asset value during the period, and redemption at the net asset value on the last day of the period. Market value total return is calculated assuming an initial investment made at the market value at the beginning of the period, reinvestment of all dividends and distributions at the net asset value during the period, and sale at the market value on the last day of the period. The market price per share as of October 31, 2024 was $24.60. |

The accompanying notes are an integral part of these financial statements.

TABLE OF CONTENTS

Congress Large Cap Growth ETF

Financial Highlights

| | | | | | | |

PER SHARE DATA:

| | | | | | |

Net asset value, beginning of period | | | $24.26 | | | $25.00 |

INVESTMENT OPERATIONS:

| | | | | | |

Net investment income(b) | | | 0.04 | | | 0.01 |

Net realized and unrealized gain (loss) on investments(c) | | | 8.82 | | | (0.75) |

Total from investment operations | | | 8.86 | | | (0.74) |

LESS DISTRIBUTIONS FROM:

| | | | | | |

Net investment income | | | (0.04) | | | — |

Total distributions | | | (0.04) | | | — |

ETF transaction fees per share | | | 0.00(d) | | | — |

Net asset value, end of period | | | $33.08 | | | $24.26 |

Total return at NAV(f)(h) | | | 36.55% | | | −2.95% |

Total return at MKT(f)(h) | | | 36.44% | | | — |

SUPPLEMENTAL DATA AND RATIOS:

| | | | | | |

Net assets, end of period (in thousands) | | | $248,446 | | | $13,102 |

Ratio of expenses to average net assets(e) | | | 0.65% | | | 0.65% |

Ratio of net investment income to average net assets(e) | | | 0.12% | | | 0.20% |

Portfolio turnover rate(g) | | | 33% | | | 7% |

| | | | | | | |

(a)

| Inception date of the Fund was August 21, 2023. |

(b)

| Net investment income per share has been calculated based on average shares outstanding during the year. |

(c)

| Realized and unrealized gains and losses per share in the caption are balancing amounts necessary to reconcile the change in net asset value per share for the years, and may not reconcile with the aggregate gains and losses in the Statement of Operations due to share transactions for the year. |

(d)

| Amount represents less than $0.005 per share. |

(e)

| Annualized for periods less than one year. |

(f)

| Not annualized for periods less than one year. |

(g)

| Portfolio turnover rate excludes in-kind transactions. |

(h)

| Net asset value total investment return is calculated assuming an initial investment made at the net asset value at the beginning of the period, reinvestment of all dividends and distributions, if any, at net asset value during the period, and redemption at the net asset value on the last day of the period. Market value total return is calculated assuming an initial investment made at the market value at the beginning of the period, reinvestment of all dividends and distributions at the net asset value during the period, and sale at the market value on the last day of the period. The market price per share as of October 31, 2024 was $33.06. |

The accompanying notes are an integral part of these financial statements.

TABLE OF CONTENTS

Congress SMid Growth ETF

Financial Highlights

| | | | | | | |

PER SHARE DATA:

| | | | | | |

Net asset value, beginning of period | | | $22.68 | | | $25.00 |

INVESTMENT OPERATIONS:

| | | | | | |

Net investment loss(b) | | | (0.03) | | | — |

Net realized and unrealized gain (loss) on investments(c) | | | 6.33 | | | (2.32) |

Total from investment operations | | | 6.30 | | | (2.32) |

Net investment income | | | (0.01) | | | — |

Total distributions | | | (0.01) | | | — |

Net asset value, end of period | | | $28.97 | | | $22.68 |

Total return at NAV(f)(g) | | | 27.78% | | | −9.28% |

Total return at MKT(f)(g) | | | 27.89% | | | — |

SUPPLEMENTAL DATA AND RATIOS:

| | | | | | |

Net assets, end of period (in thousands) | | | $196,446 | | | $11,339 |

Ratio of expenses to average net assets(d) | | | 0.68% | | | 0.68% |

Ratio of net investment income (loss) to average net assets(d) | | | (0.09)% | | | 0.06% |

Portfolio turnover rate(e) | | | 23% | | | 1% |

| | | | | | | |

(a)

| Inception date of the Fund was August 21, 2023. |

(b)

| Net investment income per share has been calculated based on average shares outstanding during the year. |

(c)

| Realized and unrealized gains and losses per share in the caption are balancing amounts necessary to reconcile the change in net asset value per share for the years, and may not reconcile with the aggregate gains and losses in the Statement of Operations due to share transactions for the year. |

(d)

| Annualized for periods less than one year. |

(e)

| Portfolio turnover rate excludes in-kind transactions. |

(f)

| Not annualized for periods less than one year. |

(g)

| Net asset value total investment return is calculated assuming an initial investment made at the net asset value at the beginning of the period, reinvestment of all dividends and distributions, if any, at net asset value during the period, and redemption at the net asset value on the last day of the period. Market value total return is calculated assuming an initial investment made at the market value at the beginning of the period, reinvestment of all dividends and distributions at the net asset value during the period, and sale at the market value on the last day of the period. The market price per share as of October 31, 2024 was $29.01. |

The accompanying notes are an integral part of these financial statements.

TABLE OF CONTENTS

CONGRESS FUNDS

NOTES TO FINANCIAL STATEMENTS

October 31, 2024

NOTE 1 – ORGANIZATION

Large Cap Growth ETF, SMid Growth ETF, and Intermediate Bond ETF (the “Funds”) are each a diversified series of shares of beneficial interest of Professionally Managed Portfolios (the “Trust”), which is registered under the Investment Company Act of 1940, as amended (the “1940 Act”), as an open-end management investment company. Each Fund is an investment company and accordingly follows the investment company accounting and reporting guidance of the Financial Accounting Standards Board (FASB) Accounting Standard Codification Topic 946 “Financial Services—Investment Companies.” The Large Cap Growth ETF and SMid Growth ETF commenced operations on August 22, 2023. The Intermediate Bond ETF commenced operations on September 9, 2024.

Large Cap Growth ETF’s investment objective is to seek long-term capital growth. SMid Growth ETF’s investment objective is to seek long-term capital appreciation. Intermediate Bond ETF’s investment objective is to seek maximize total return.

NOTE 2 – SIGNIFICANT ACCOUNTING POLICIES

The following is a summary of significant accounting policies consistently followed by the Funds. These policies are in conformity with accounting principles generally accepted in the United States of America (“U.S. GAAP”).

A.

| Security Valuation. All equity securities, which may include Real Estate Investment Trusts (“REITs”), Business Development Companies (“BDCs”), and Master Limited Partnerships (“MLPs”), that are traded on U.S. or foreign national securities exchanges are valued at the last reported sale price on the exchange on which the security is principally traded or the exchange’s official closing price, if applicable. If, on a particular day, an exchange-traded security does not trade, then the mean between the most recent quoted bid and asked prices will be used. All equity securities, which may include REITs, BDCs, and MLPs, that are not traded on a listed exchange are valued at the last sale price in the over the counter market. If a non-exchange traded security does not trade on a particular day, then the mean between the last quoted closing bid price and asked price will be used. |

Effective September 8, 2022, the Board approved Congress Asset Management Company, LLP (the “Advisor”), as the Funds’ valuation designee under Rule 2a-5.

As described above, the Funds utilize various methods to measure the fair value of their investments on a recurring basis. U.S. GAAP establishes a hierarchy that prioritizes inputs to valuation methods. The three levels of inputs are:

Level 1 –

| Unadjusted quoted prices in active markets for identical assets or liabilities that the Funds have the ability to access. |

Level 2 –

| Observable inputs other than quoted prices included in Level 1 that are observable for the asset or liability, either directly or indirectly. These inputs may include quoted prices for the identical instrument on an inactive market, prices for similar instruments, interest rates, prepayment speeds, credit risk, yield curves, default rates and similar data. |

Level 3 –

| Unobservable inputs for the asset or liability, to the extent relevant observable inputs are not available; representing the Funds’ own assumptions about the assumptions a market participant would use in valuing the asset or liability, and would be based on the best information available. |

The availability of observable inputs can vary from security to security and is affected by a wide variety of factors, including, for example, the type of security, whether the security is new and not yet established in the marketplace, the liquidity of markets and other characteristics particular to the security. To the extent that valuation is based on models or inputs that are less observable or unobservable in the market, the determination of fair value requires more judgment. Accordingly, the degree of judgment exercised in determining fair value is greatest for instruments categorized in Level 3.

TABLE OF CONTENTS

CONGRESS FUNDS

NOTES TO FINANCIAL STATEMENTS

October 31, 2024(Continued)

The inputs used to measure fair value may fall into different levels of the fair value hierarchy. In such cases, for disclosure purposes, the level in the fair value hierarchy within which the fair value measurement falls in its entirety, is determined based on the lowest level input that is significant to the fair value measurement in its entirety.

The following is a summary of the inputs used to value the Funds’ investments as of October 31, 2024. See the Schedules of Investments for industry breakouts.

Intermediate Bond ETF

| | | | | | | | | | | | | |

Corporate Bonds | | | $— | | | $40,498,146 | | | $ — | | | $ 40,498,146 |

U.S. Treasury Securities | | | — | | | 38,044,009 | | | — | | | 38,044,009 |

Asset-Backed Securities | | | — | | | 4,501,134 | | | — | | | 4,501,134 |

Money Market Funds | | | 2,193,534 | | | — | | | — | | | 2,193,534 |

Total Investments in Securities | | | $2,193,534 | | | $83,043,289 | | | $— | | | $85,236,823 |

| | | | | | | | | | | | | |

Large Cap Growth ETF

| | | | | | | | | | | | | |

Common Stocks | | | $240,498,417 | | | $ — | | | $ — | | | $240,498,417 |

Short-Term Investments | | | 2,805,651 | | | — | | | — | | | 2,805,651 |

Total Investments in Securities | | | $243,304,068 | | | $— | | | $— | | | $243,304,068 |

| | | | | | | | | | | | | |

SMid Growth ETF

| | | | | | | | | | | | | |

Common Stocks | | | $187,762,047 | | | $ — | | | $ — | | | $187,762,047 |

Real Estate Investment Trusts | | | 3,227,228 | | | — | | | — | | | 3,227,228 |

Money Market Funds | | | 5,462,196 | | | — | | | — | | | 5,462,196 |

Total Investments in Securities | | | $196,451,471 | | | $— | | | $— | | | $196,451,471 |

| | | | | | | | | | | | | |

B.

| Foreign Currency. Investment securities and other assets and liabilities denominated in foreign currencies are translated into U.S. dollar amounts at the date of valuation. Purchases and sales of investment securities and income and expense items denominated in foreign currencies are translated into U.S. dollar amounts on the respective dates of such transactions. |

The Funds do not isolate that portion of the results of operations resulting from changes in foreign exchange rates on investments from the fluctuations arising from changes in market prices of securities held. Such fluctuations are included with the net unrealized and realized gain or loss from investments.

The Funds do not isolate net realized foreign exchange gains or losses that arise from sales of foreign currencies, currency gains or losses realized between the trade and settlement dates on securities transactions, and the difference between the amounts of dividends, interest, and foreign withholding taxes recorded on the Funds’ books and the U.S. dollar equivalent of the amounts received or paid. Net unrealized foreign exchange gains and losses arise from changes in the fair values of assets and liabilities, other than investments in securities at fiscal period end, resulting from changes in exchange rates.

C.

| Federal Income Taxes. Each Fund has elected to be taxed as a “regulated investment company” and intends to distribute substantially all taxable income to its shareholders and otherwise comply with the provisions of the Internal Revenue Code applicable to regulated investment companies. Therefore, no provisions for federal income taxes or excise taxes have been made. |

TABLE OF CONTENTS

CONGRESS FUNDS

NOTES TO FINANCIAL STATEMENTS

October 31, 2024(Continued)

In order to avoid imposition of the excise tax applicable to regulated investment companies, each Fund intends to declare each year as dividends in each calendar year at least 98.0% of its net investment income (earned during the calendar year) and 98.2% of its net realized capital gains (earned during the twelve months ended October 31) plus undistributed amounts, if any, from prior years.

Net income losses incurred after December 31 and within the taxable year are deemed to arise on the first business day of the Funds’ next taxable year.

As of the year and period ended October 31, 2024, the Funds had capital loss carry-forward and deferred post-October and late year losses as follows:

| | | | | | | |

Intermediate Bond ETF | | | $24,806 | | | $ — | | | $ — | | | $ — |

Large Cap Growth ETF | | | 3,440,995 | | | — | | | — | | | — |

SMid Growth ETF | | | 795,954 | | | — | | | — | | | 113,346 |

| | | | | | | | | | | | | |

As of October 31, 2024, the Funds did not have any tax positions that did not meet the threshold of being sustained by the applicable tax authority. Generally, tax authorities can examine all the tax returns filed for the last three years. The Funds identify their major tax jurisdictions as U.S. Federal and the Commonwealth of Massachusetts. As of October 31, 2024, the Funds are not aware of any tax positions for which it is reasonably possible that the total amounts of unrecognized tax benefits will change materially.

D.

| Security Transactions and Investment Income. Investment securities transactions are accounted for on the trade date. Gains and losses realized on sales of securities are determined on a specific identification basis. Discounts/premiums on debt securities purchased are accreted/amortized over the life of the respective securities using the effective interest method. Dividend income is recorded on the ex- dividend date. Dividends received from MLPs & REITs generally are comprised of ordinary income, capital gains, and may include return of capital. Interest income is recorded on an accrual basis. Other non-cash dividends are recognized as investment income at the fair value of the property received. Withholding taxes on foreign dividends have been provided for in accordance with the Trust’s understanding of the applicable country’s tax rules and rates. |

E.

| Distributions to Shareholders. Distributions to shareholders from net investment income and net realized gains on securities for the Funds are normally declared and paid on an annual basis. Distributions are recorded on the ex-dividend date. |

F.

| Use of Estimates. The preparation of financial statements in conformity with U.S. GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities at the date of the financial statements and the reported amount of revenue and expenses during the reporting period. Actual results could differ from those estimates. |

G.

| Share Valuation. The net asset value (“NAV”) per share of the Funds are calculated by dividing the sum of the value of the securities held by the Funds, plus cash or other assets, minus all liabilities (including estimated accrued expenses) by the total number of shares outstanding for the Funds, rounded to the nearest cent. The Funds’ shares will not be priced on the days on which the New York Stock Exchange is closed for trading. |

H.

| Guarantees and Indemnifications. In the normal course of business, the Funds enter into contracts with service providers that contain general indemnification clauses. The Funds’ maximum exposure under these arrangements is unknown as this would involve future claims that may be made against the Funds that have not yet occurred. However, based on experience, the Funds expect the risk of loss to be remote. |

I.

| Illiquid Securities: Pursuant to Rule 22e-4 under the 1940 Act, the Funds have adopted a Board approved liquidity risk management program (the “program”) that requires, among other things, that the Funds limit |

TABLE OF CONTENTS

CONGRESS FUNDS

NOTES TO FINANCIAL STATEMENTS

October 31, 2024(Continued)

their illiquid investments that are assets to no more than 15% of net assets. An illiquid investment is any investment that each Fund reasonably expects cannot be sold or disposed of in current market conditions in seven calendar days or less without the sale or disposition significantly changing the market value of the investment.

J.

| Reclassification of Capital Accounts. U.S. GAAP requires that certain components of net assets relating to permanent differences be reclassified between financial and tax reporting. These reclassifications have no effect on net assets or net asset value per share. For the year and period ended October 31, 2024, the following adjustments were made1: |

| | | | | | | |

Intermediate Bond ETF | | | $— | | | $ — |

Large Cap Growth ETF | | | (1,231,212) | | | 1,231,212 |

SMid Growth ETF | | | (324,652) | | | 324,652 |

| | | | | | | |

K.

| Subsequent Events. In preparing these financial statements, the Funds have evaluated events and transactions for potential recognition or disclosure through the date the financial statements were issued. The Funds have determined that there were no subsequent events that would need to be disclosed in the Funds financial statements. |

NOTE 3 – COMMITMENTS AND OTHER RELATED PARTY TRANSACTIONS

Congress Asset Management Company, LLP (the “Advisor”) provides each Fund with investment management services under an Investment Advisory Agreement (the “Advisory Agreement”). Under the Advisory Agreement, the Advisor furnishes all investment advice, office space, and certain administrative services, and provides most of the personnel needed by the Funds. As compensation for its services, the Advisor is entitled to a monthly unitary fee. For each of the Funds, the Advisor is entitled to a monthly unitary fee as compensation for its services at the annual rates shown in the following table:

| | | | |

Intermediate Bond ETF | | | 0.35% |

Large Cap Growth ETF | | | 0.65% |

SMid Growth ETF | | | 0.68% |

| | | | |

The advisory fees incurred during the year and period ended October 31, 2024, are disclosed in the Statements of Operations. The investment advisory fees incurred are paid monthly to the Advisor.

U.S. Bancorp Fund Services, LLC, doing business as U.S. Bank Global Fund Services (“Fund Services”), serves as the Funds’ administrator, fund accountant, and transfer agent. In those capacities, Fund Services maintains the Funds’ books and records, calculates each Fund’s NAV, prepares various federal and state regulatory filings, coordinates the payment of the Funds’ expenses, reviews expense accruals, and prepares materials supplied to the Board. The officers of the Trust and the Chief Compliance Officer are also employees of Fund Services.

Quasar Distributors, LLC (the “Distributor”) acts as the Funds’ principal underwriter in a continuous public offering of the Funds’ shares. U.S. Bank N.A. serves as custodian to the Funds. U.S. Bank N.A. is an affiliate of Fund Services.

TABLE OF CONTENTS

CONGRESS FUNDS

NOTES TO FINANCIAL STATEMENTS

October 31, 2024(Continued)

NOTE 4 – PURCHASES AND SALES OF SECURITIES

The cost of purchases and the proceeds from the sale or maturity of securities, excluding government and short-term securities, for the year and period ended October 31, 2024, were as follows:

| | | | | | | | | | | | | |

Intermediate Bond ETF | | | $8,367,367 | | | $5,211,205 | | | $42,665,718 | | | — |

Large Cap Growth ETF | | | 46,167,497 | | | 50,242,902 | | | 207,458,063 | | | 4,444,221 |

SMid Growth ETF | | | 26,966,337 | | | 26,201,278 | | | 168,785,426 | | | 1,153,408 |

| | | | | | | | | | | | | |

There were no purchases or sales of long-term U.S. Government securities for Large Cap Growth ETF and SMid Growth ETF for the year ended October 31, 2024. There were $34,765,731 of in-kind purchases and no sales of long-term U.S. Government securities for Intermediate Bond ETF for the period ended October 31, 2024.

NOTE 5 – DISTRIBUTIONS TO SHAREHOLDERS

The tax character of distributions paid during the year and period ended October 31, 2024, as applicable, were as follows:

Intermediate Bond ETF:

| | | | |

Distributions paid from:

| | | |

Ordinary income | | | $289,091 |

Long-term capital gain1 | | | — |

| | | $289,091 |

| | | | |

Large Cap Growth ETF:

| | | | |

Distributions paid from:

| | | |

Ordinary income | | | $72,862 |

Long-term capital gain1 | | | — |

| | | $72,862 |

| | | | |

SMid Growth ETF:

| | | | |

Distributions paid from:

| | | |

Ordinary income | | | $ 8,678 |

Long-term capital gain1 | | | — |

| | | $8,678 |

| | | | |

1 Designated as long-term capital gain dividend, pursuant of Internal Revenue Code Section 852(b)(3).

TABLE OF CONTENTS

CONGRESS FUNDS

NOTES TO FINANCIAL STATEMENTS

October 31, 2024(Continued)

The components of accumulated earnings (losses) on a tax basis as of the most recent fiscal period ended October 31, 2024, were as follows 2:

| | | | | | | | | | |

Cost of investments | | | $86,799,262 | | | $212,504,728 | | | $184,537,199 |

Gross tax unrealized appreciation | | | — | | | 33,454,526 | | | 20,995,304 |

Gross tax unrealized depreciation | | | (1,562,439) | | | (2,655,186) | | | (9,081,032) |

Net unrealized appreciation (depreciation) | | | (1,562,439) | | | 30,799,340 | | | 11,914,272 |

Undistributed ordinary income | | | 21,589 | | | 95,576 | | | — |

Undistributed long-term capital gain | | | — | | | — | | | — |

Total distributable earnings | | | 21,589 | | | 95,576 | | | — |

Other accumulated gains (losses) | | | (24,806) | | | (3,440,995) | | | (909,300) |

Total distributable (accumulated) earnings (losses) | | | $(1,565,656) | | | $27,453,921 | | | $11,004,972 |

| | | | | | | | | | |

2 The differences between book and tax basis were primarily due to wash sale and transfer-in-kind adjustments.

NOTE 6 – SHARE TRANSACTIONS

Shares of the Funds are listed on a national securities exchange, NYSE Arca, Inc. (the “Exchange”), and trade throughout the day on the Exchange and other secondary markets at market prices that may differ from NAV. The Funds issue and redeem Shares (“Shares”) at net asset value per share (“NAV”) only in large blocks of Shares (“Creation Units” or “Creation Unit Aggregations”). Each Creation Units is made up of at least 10,000 Shares, though these amounts may change from time to time. The Funds generally offer and issue Shares in exchange for a basket of securities (“Deposit Securities”) together with the deposit of a specified cash payment (“Cash Component”). The Trust reserves the right to permit or require the substitution of a “cash in lieu” amount (“Deposit Cash”) to be added to the Cash Component to replace any Deposit Security. Shares are also redeemable only in Creation Unit aggregations, principally for a basket of Deposit Securities together with a Cash Component. As a practical matter, only institutions or large investors (authorized participants) who have entered into agreements with the Trust’s distributor, can purchase or redeem Creation Units. Except when aggregated in Creation Units, Shares of the Funds are not redeemable securities.

TABLE OF CONTENTS

Congress Funds

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To the Board of Trustees of Professionally Managed Portfolios

and Shareholders of the Congress Funds

Opinion on the Financial Statements

We have audited the accompanying statements of assets and liabilities of Congress Intermediate Bond ETF, Congress Large Cap Growth ETF, Congress SMID Growth ETF, (the “Funds”), each a series of Professionally Managed Portfolios (the “Trust”), including the schedules of investments, as of October 31, 2024, and the related statements of operations, the statements of changes in net assets and the financial highlights for each of the periods indicated in the table below, and the related notes (collectively referred to as the “financial statements”). In our opinion, the financial statements present fairly, in all material respects, the financial position of the Funds as of October 31, 2024, the results of their operations, the changes in their net assets and their financial highlights for the periods indicated in the table below, in conformity with accounting principles generally accepted in the United States of America.

| | | | | | | | | | |

Congress Intermediate Bond ETF | | | For the period September 9, 2024 (commencement of operations) through October 31, 2024 | | | For the period September 9, 2024 (commencement of operations) through October 31, 2024 | | | For the period September 9, 2024 (commencement of operations) through October 31, 2024 |

Congress Large Cap Growth ETF, Congress SMID Growth ETF | | | For the year ended October 31, 2024 | | | For the year ended October 31, 2024 and for the period August 21, 2023 (commencement of operations) through October 31, 2023 | | | For the year ended October 31, 2024 and for the period August 21, 2023 (commencement of operations) through October 31, 2023 |

| | | | | | | | | | |

Basis for Opinion

These financial statements are the responsibility of the Funds’ management. Our responsibility is to express an opinion on the Funds’ financial statements based on our audits. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) (“PCAOB”) and are required to be independent with respect to the Funds in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB. We have served as the auditor of one or more of the funds in the Trust since 1995.

We conducted our audits in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audits to obtain reasonable assurance about whether the financial statements are free of material misstatement, whether due to error or fraud. The Funds are not required to have, nor were we engaged to perform, an audit of the Funds’ internal control over financial reporting. As part of our audits, we are required to obtain an understanding of internal control over financial reporting, but not for the purpose of expressing an opinion on the effectiveness of the Funds’ internal control over financial reporting. Accordingly, we express no such opinion.

Our audits included performing procedures to assess the risks of material misstatement of the financial statements, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements. Our audits also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the financial statements. Our procedures included confirmation of securities

TABLE OF CONTENTS

Congress Funds

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM(Continued)

owned as of October 31, 2024 by correspondence with the custodian and brokers; when replies were not received from brokers, we performed other auditing procedures. We believe that our audits provide a reasonable basis for our opinion.

TAIT, WELLER & BAKER LLP

Philadelphia, Pennsylvania

December 27, 2024

TABLE OF CONTENTS

CONGRESS FUNDS

Approval of Investment Advisory Agreement (Unaudited)

Appendix A

Congress Large Cap Growth ETF

Congress SMid Growth ETF