Exhibit 99.2

Third Quarter 2024 Results & Outlook October 31, 2024

2 Enter “so what” if necessary – Century Gothic, Bold, Size 18 or smaller This presentation is made as of the date hereof and contains “forward - looking statements” as defined in Rule 3b - 6 of the Securit ies Exchange Act of 1934, Rule 175 of the Securities Act of 1933, and relevant legal decisions. The forward - looking statements are subject to risks and uncertainties. All forward - lo oking statements should be considered in the context of the risk and other factors detailed from time to time in CMS Energy’s and Consumers Energy’s Securities and Exchange Commissi on filings. Forward - looking statements should be read in conjunction with “FORWARD - LOOKING STATEMENTS AND INFORMATION” and “RISK FACTORS” sections of CMS Energy’s and Consumers Energy’s most recent Form 10 - K and as updated in reports CMS Energy and Consumers Energy file with the Securities and Exchange Commission. CMS Energy’s and Cons ume rs Energy’s “FORWARD - LOOKING STATEMENTS AND INFORMATION” and “RISK FACTORS” sections are incorporated herein by reference and discuss important factors th at could cause CMS Energy’s and Consumers Energy’s results to differ materially from those anticipated in such statements. CMS Energy and Consumers Energy undertake no ob ligation to update any of the information presented herein to reflect facts, events or circumstances after the date hereof. The presentation also includes non - GAAP measures when describing CMS Energy’s results of operations and financial performance. A reconciliation of each of these measures to the most directly comparable GAAP measure is included in the appendix and posted on our website at www.cmsenergy.com . Investors and others should note that CMS Energy routinely posts important information on its website and considers the Inves tor Relations section, www.cmsenergy.com/investor - relations , a channel of distribution. Presentation endnotes are included after the appendix. 2

3 Investment Thesis . . . . . . is simple, clean and lean. Over two decades of industry - leading financial performance Industry - leading net zero commitments Excellence through the Top - tier regulatory jurisdiction a Premium total shareholder r eturn 6% to 8% adjusted EPS growth + ~3% dividend yield Presentation endnotes are included after the appendix. Strong Cash Flow & Balance Sheet Attractive & Diversified Territory Clean Energy Leader Infrastructure Renewal Constructive Legislation & Regulation Affordable Prices

4 New Michigan Energy Law a . . . Key Items 60% by 2035 (50% by 2030) • Renewable Portfolio Standard • Next Renewable Energy Plan (REP) filing (Nov. 2024) 100% by 2040 (80% by 2035) • Clean Energy Standard (incl. renewables, gas w/ CCS, or nuclear) • Next Integrated Resource Plan filing (2026 ) Pre - tax WACC on permanent capital structure (~9%) • Financial Compensation Mechanism (FCM) on PPAs Up to 25% incentive / >2.17% YoY load reduction • Energy Waste Reduction (EWR) Incentive ~850 MW by 2030 (Consumers Energy portion) • 2.5 GW Storage State Target Benefits Presentation endnotes are included after the appendix. . . . delivers for all stakeholders while maintaining affordability. x Ability to own AND contract throughout MISO x Ensures continued resource adequacy x Unique “capital - light” earnings opportunity x Ability to earn outside rate base x Accelerates storage deployment Notable Changes

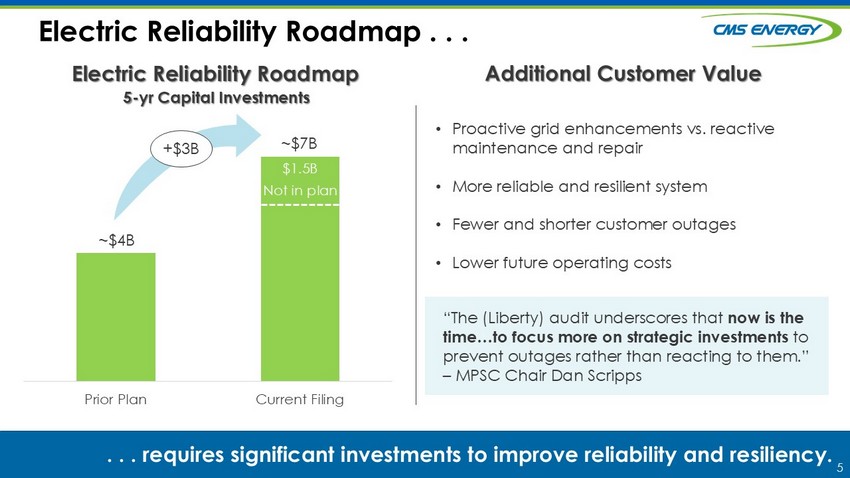

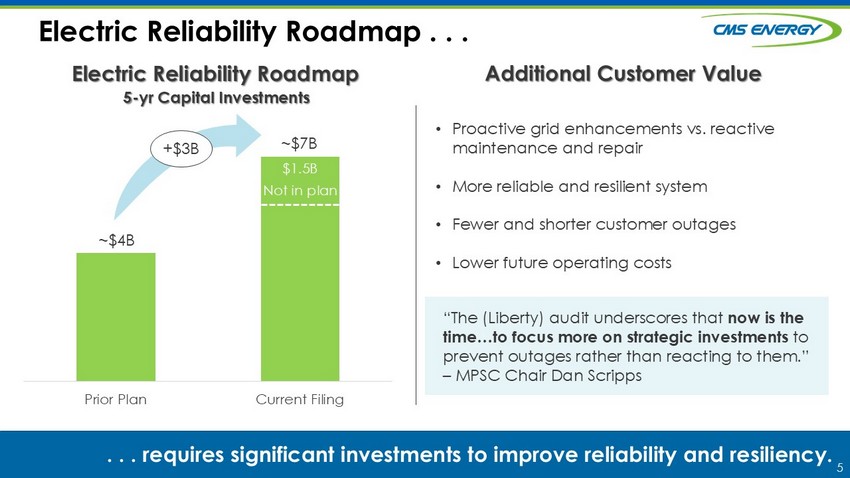

5 Electric Reliability Roadmap . . . . . . r equires significant investments to i mprove reliability and resiliency. Electric Reliability Roadmap Additional Customer Value “ The ( Liberty) audit underscores that now is the time…to focus more on strategic investments to prevent outages rather than reacting to them.” – MPSC Chair Dan Scripps Prior Plan Current Filing ~$4B ~$7B +$3B • Proactive grid enhancements vs. reactive maintenance and repair • More reliable and resilient system • Fewer and shorter customer outages • Lower future operating costs 5 - yr Capital Investments $1.5B Not in plan

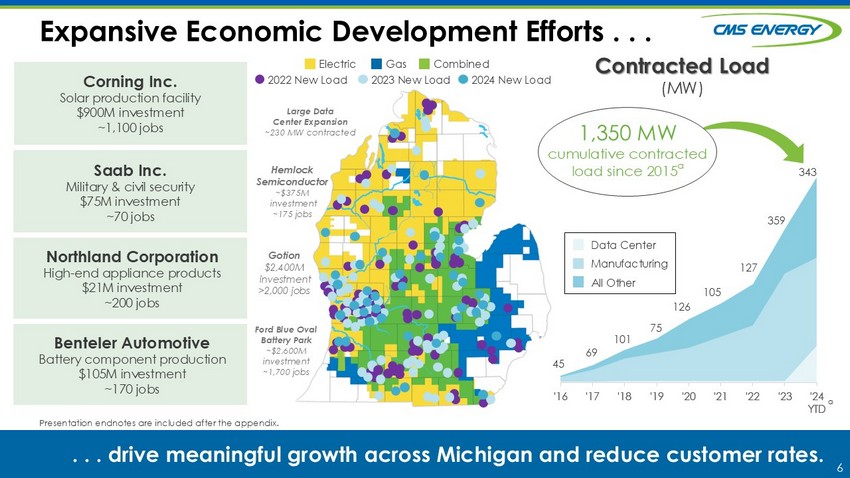

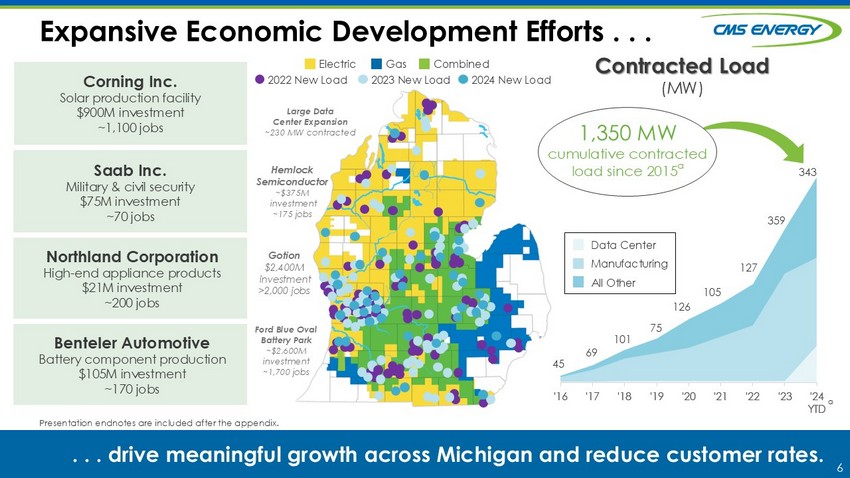

6 '16 '17 '18 '19 '20 '21 '22 '23 '24 YTD '16 '17 '18 '19 '20 '21 '22 '23 '24 YTD Expansive Economic Development Efforts . . . . . . drive meaningful growth across Michigan and reduce customer rates. Electric Gas Combined 2022 New Load 2023 New Load 2024 New Load Corning Inc. Solar production facility $ 900M investment ~1,100 jobs Saab Inc. Military & civil security $75M investment ~70 jobs a Contracted Load (MW) Data Center Manufacturing All Other 1,350 MW cumulative contracted load since 2015 a 126 75 105 45 101 69 359 127 343 Presentation endnotes are included after the appendix. Northland Corporation High - end appliance products $21M investment ~200 jobs Hemlock Semiconductor ~$ 375 M investment ~175 jobs Ford Blue Oval Battery Park ~ $2,600M investment ~1,700 jobs Large Data Center Expansion ~230 MW contracted Gotion $2,400M investment >2,000 jobs Benteler Automotiv e Battery component production $105M investment ~170 jobs

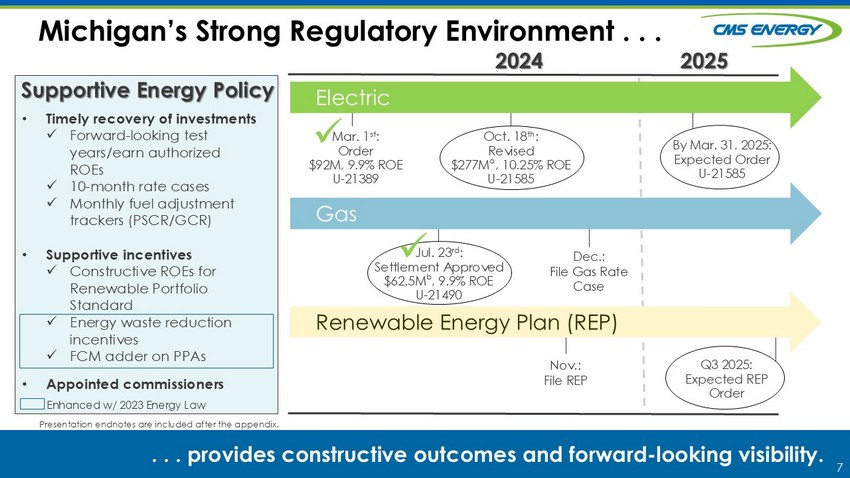

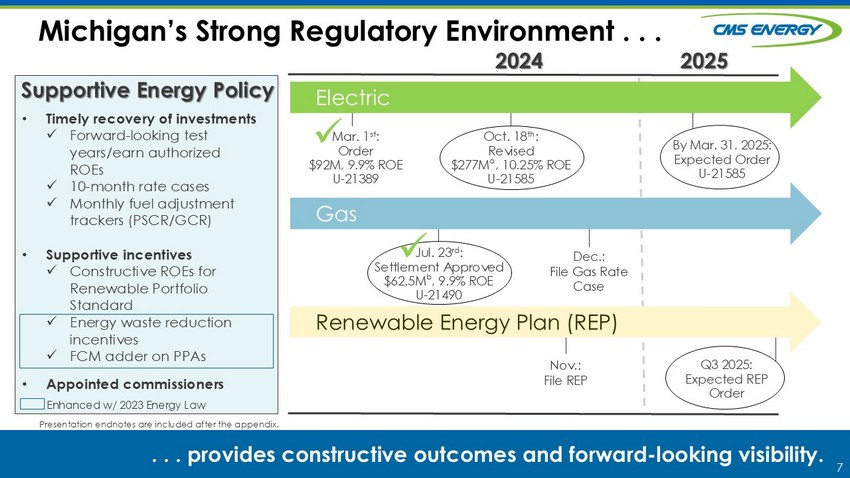

7 Dec.: File Gas Rate Case 2024 2025 Michigan’s Strong Regulatory Environment . . . . . . provides constructive outcomes and forward - looking visibility. Electric Gas Supportive Energy Policy • Timely recovery of investments x Forward - looking test years/earn authorized ROEs x 10 - month rate cases x Monthly fuel adjustment trackers (PSCR/GCR) • Supportive incentives x Constructive ROEs for Renewable Portfolio Standard x Energy waste reduction incentives x FCM adder on PPAs • Appointed commissioners Renewable Energy Plan (REP) Enhanced w/ 2023 Energy Law Mar. 1 st : Order $92M, 9.9% ROE U - 21389 x Nov.: File REP By Mar. 31, 2025: Expected Order U - 21585 Jul. 23 rd : Settlement Approved $62.5M b , 9.9% ROE U - 21490 Presentation endnotes are included after the appendix. x Oct. 18 th : Revised $277M a , 10.25% ROE U - 21585 Q3 2025: Expected REP Order

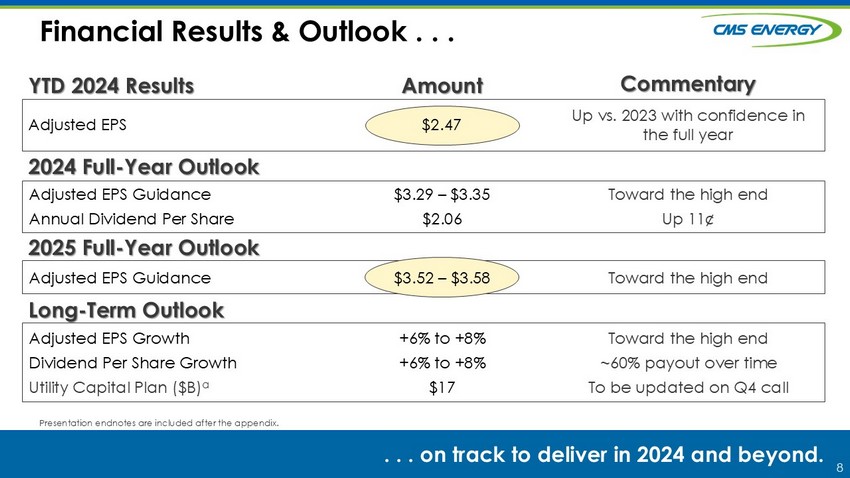

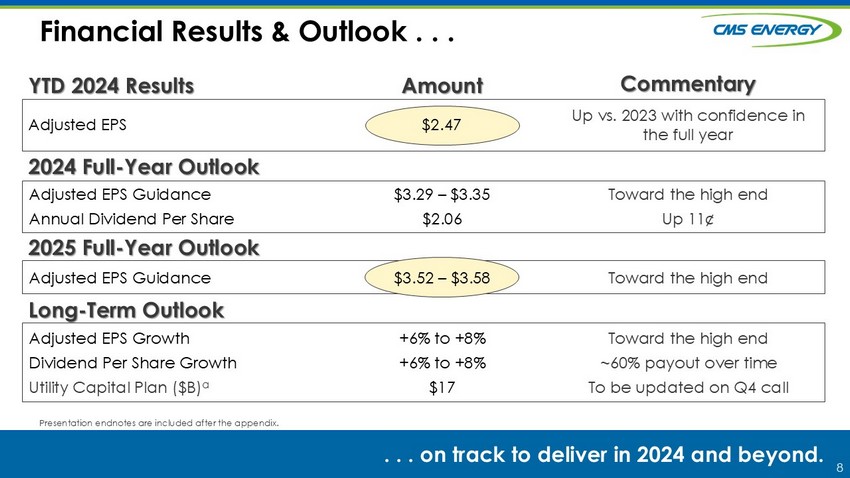

8 . . . on track to deliver in 2024 and beyond. Commentary Amount Financial Results & Outlook . . . YTD 2 024 Results ` Long - Term Outlook 2024 Full - Year Outlook 2025 Full - Year Outlook Presentation endnotes are included after the appendix. Adjusted EPS $2. 47 Up vs. 2023 with confidence in the full year Adjusted EPS Guidance Annual Dividend Per Share $3.29 – $3.35 $2.06 Toward the high end Up 11¢ Adjusted EPS Guidance $3. 52 – $3. 58 Toward the high end Adjusted EPS Growth Dividend Per Share Growth Utility Capital Plan ($B) a +6% to +8% +6% to +8% $17 Toward the high end ~60% payout over time To be updated on Q4 call

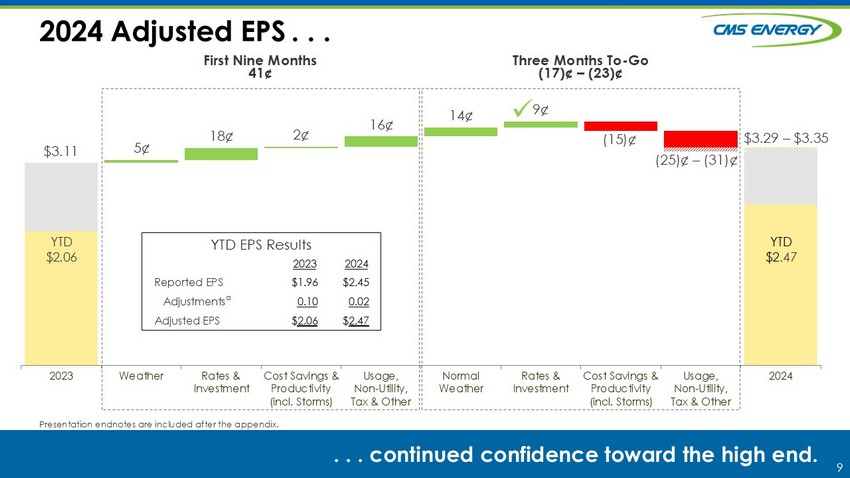

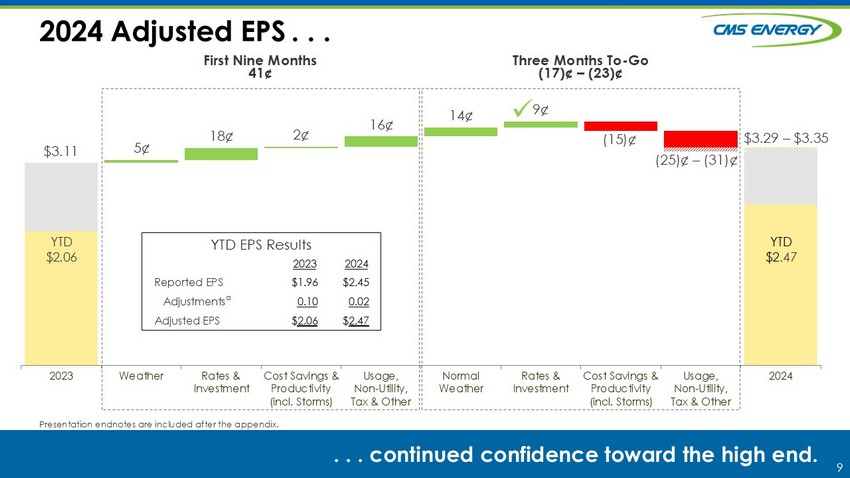

9 2023 Weather Rates & Investment Cost Savings & Productivity (incl. Storms) Usage, Non-Utility, Tax & Other Normal Weather Rates & Investment Cost Savings & Productivity (incl. Storms) Usage, Non-Utility, Tax & Other 2024 2024 Adjusted EPS . . . . . . continued confidence toward the high end. First Nine Months 41 ¢ Three Months To - Go (17)¢ – ( 23) ¢ Presentation endnotes are included after the appendix. $3. 29 – $3.35 5¢ $3.11 18 ¢ 16¢ 14¢ 9¢ (25) ¢ – (31 ) ¢ 2 ¢ ( 15 ) ¢ YTD $2 .47 YTD $ 2.06 2024 2023 $2.45 $1.96 Reported EPS 0.02 0.10 Adjustments a $ 2.47 $ 2.06 Adjusted EPS YTD EPS Results x

10 . Strong Balance Sheet . . . . . . m aintains credit metrics and solid investment - grade ratings. Consumers Energy CMS Energy Senior Secured Commercial Paper Outlook Senior Unsecured Junior Subordinated Outlook Last Review A1 P - 2 Stable Baa2 Baa3 Stable Mar. 2024 A+ F - 2 Stable BBB BB+ Stable Apr . 2024 S&P Moody’s Fitch x Forward - looking recovery x Constructive rate construct x Strong operating cash flow generation x 100% fixed rate debt x Hybrid debt (w/ equity credit) x Limited near - term maturities Key Strengths A A - 2 Stable BBB BBB - Stable Aug. 2024 Aug. 2024

11 $1,100M (Dec - 2027) $550M (Dec - 2027) $250M (Nov - 2025) Consumers Energy CMS Energy 2024 Planned Financings Completed . . . Financings a . . . and provide ample liquidity. Presentation endnotes are included after the appendix. ~$2 .2 B b of net liquidity ~4.65% c x ~$70/ sh x x YTD Plan ($M) ($M) Consumers Energy: $1,300 ~$1,275 First Mortgage Bonds CMS Energy: ~266 ~266 Contracted Equity (issued) Retirements: 250 302 Consumers Energy 250 250 CMS Energy

12 Recession Industry - Leading Financial Performance . . . . . . for over two decades, regardless of conditions. 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023 2024+ Recession Adjusted EPS Dividend +6% to +8% Weather Help Hurt Cold winter Mild summer Warm winter Hot summer Mild summer Cold winter Polar vortex Mild summer Warm winter Hot summer Hot summer Summer - less Storms Hot summer Storms Hot summer Warm winter Warm winter Mild winter Governor (D) Governor (R) Governor (D) Commission (D) Commission (D) Commission (R) Commission (I) Commission (D) Dave Joos John Russell Patti Poppe K. Whipple Recession / Pandemic Garrick Rochow Mild w/ storms Hot summer

13 Q&A See you at EEI! 13

14 14 ENDNOTES

15 Slide 3: a UBS Research, 2024 state rankings and D.C. Slide 4: a New energy law effective June 1, 2024 Slide 6: a New or expanding load since 2015 as of October 15, 2024 Slide 7: a $277M position includes a $22M surcharge related to distribution investments made in 2023 above prior approved levels. b $62.5M of effective rate relief ($35M of higher revenue as permanent rate relief and $27.5M retained gain share from the Appliance Service Plan ( ASP ) business sale used as an offset in lieu of additional rate relief during the test year) Slide 8: a $17B utility capital investment plan (2024 - 2028), up $1.5B from prior plan (2023 - 2027) Slide 9: a Adjusted EPS; see GAAP reconciliation on slide 17 Slide 11 : a Excludes tax - exempt remarketing in October 2024 b $1,786M in unreserved revolvers + $385M of unrestricted cash; excludes cash unavailable for debt retirement, such as cash held at NorthStar c Weighted average Presentation Endnotes 15

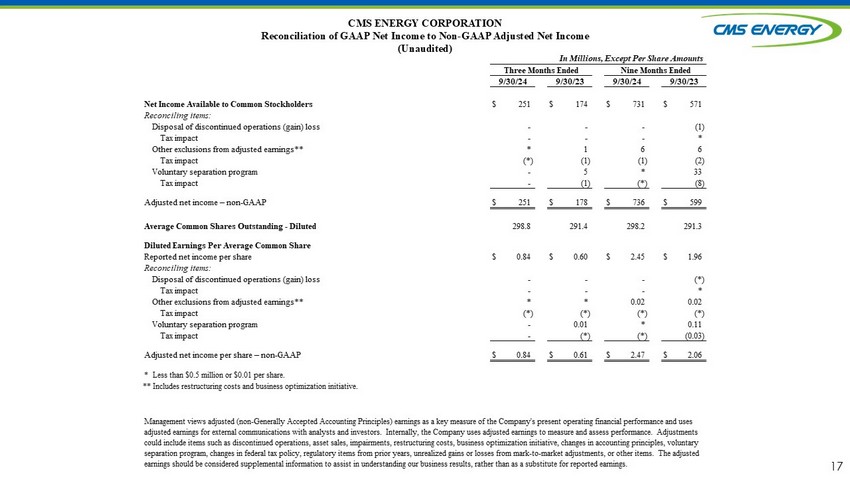

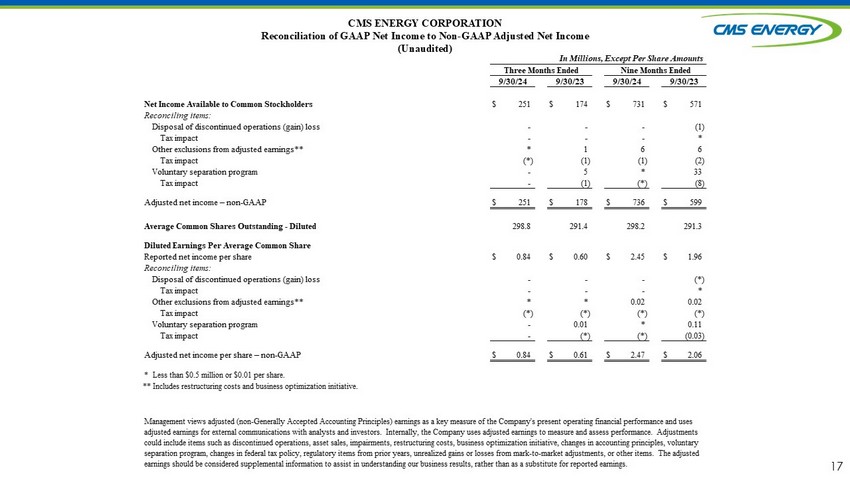

16 GAAP Reconciliation CMS Energy provides historical financial results on both a reported (GAAP) and adjusted (non - GAAP) basis and provides forward - lo oking guidance on an adjusted basis. During an oral presentation, references to “earnings” are on an adjusted basis. All references to net income refer to net income ava ila ble to common stockholders and references to earnings per share are on a diluted basis. Adjustments could include items such as discontinued operations, asset sales, impa irm ents, restructuring costs, business optimization initiative, changes in accounting principles, voluntary separation program, changes in federal tax policy, regulatory items f rom prior years, unrealized gains or losses from mark - to - market adjustments, or other items. Management views adjusted earnings as a key measure of the company’s present operating fi nancial performance and uses adjusted earnings for external communications with analysts and investors. Internally, the company uses adjusted earnings to measure a nd assess performance. Because the company is not able to estimate the impact of specific line items, which have the potential to significantly impact, favorably or unfavo rab ly, the company's reported earnings in future periods, the company is not providing reported earnings guidance nor is it providing a reconciliation for the comparable futu re period earnings. The adjusted earnings should be considered supplemental information to assist in understanding our business results, rather than as a substitute for the r epo rted earnings. 16

CMS ENERGY CORPORATION Reconciliation of GAAP Net Income to Non - GAAP Adjusted Net Income (Unaudited) 17 Net Income Available to Common Stockholders $ 251 $ 174 $ 731 $ 571 Reconciling items: Disposal of discontinued operations (gain) loss - - - (1) Tax impact - - - * Other exclusions from adjusted earnings** * 1 6 6 Tax impact (*) (1) (1) (2) Voluntary separation program - 5 * 33 Tax impact - (1) (*) (8) Adjusted net income – non-GAAP $ 251 $ 178 $ 736 $ 599 Average Common Shares Outstanding - Diluted 298.8 291.4 298.2 291.3 Diluted Earnings Per Average Common Share Reported net income per share $ 0.84 $ 0.60 $ 2.45 $ 1.96 Reconciling items: Disposal of discontinued operations (gain) loss - - - (*) Tax impact - - - * Other exclusions from adjusted earnings** * * 0.02 0.02 Tax impact (*) (*) (*) (*) Voluntary separation program - 0.01 * 0.11 Tax impact - (*) (*) (0.03) Adjusted net income per share – non-GAAP $ 0.84 $ 0.61 $ 2.47 $ 2.06 * Less than $0.5 million or $0.01 per share. **Includes restructuring costs and business optimization initiative. Management views adjusted (non-Generally Accepted Accounting Principles) earnings as a key measure of the Company's present operating financial performance and uses adjusted earnings for external communications with analysts and investors. Internally, the Company uses adjusted earnings to measure and assess performance. Adjustments could include items such as discontinued operations, asset sales, impairments, restructuring costs, business optimization initiative, changes in accounting principles, voluntary separation program, changes in federal tax policy, regulatory items from prior years, unrealized gains or losses from mark-to-market adjustments, or other items. The adjusted earnings should be considered supplemental information to assist in understanding our business results, rather than as a substitute for reported earnings. In Millions, Except Per Share Amounts Three Months Ended Nine Months Ended 9/30/24 9/30/23 9/30/24 9/30/23

18 CMS ENERGY CORPORATION Reconciliation of GAAP Net Income to Non - GAAP Adjusted Net Income by Quarter (Unaudited) Net Income Available to Common Stockholders $ 285 $ 195 $ 251 $ 202 $ 195 $ 174 $ 306 Reconciling items: Electric utility and gas utility 4 2 * 3 30 6 3 Tax impact (1) (*) (*) (1) (7) (2) (1) NorthStar Clean Energy - - - - - - - Tax impact - - - - - - - Corporate interest and other - - - - - - - Tax impact - - - - - - - Adjusted Net Income – Non-GAAP $ 288 $ 197 $ 251 $ 204 $ 217 $ 178 $ 308 Average Common Shares Outstanding – Diluted 297.2 298.5 298.8 291.2 291.3 291.4 292.7 Diluted Earnings Per Average Common Share $ 0.96 $ 0.65 $ 0.84 $ 0.69 $ 0.67 $ 0.60 $ 1.05 Reconciling items: Electric utility and gas utility 0.01 0.01 * 0.01 0.10 0.01 0.01 Tax impact (*) (*) (*) (*) (0.02) (*) (0.01) NorthStar Clean Energy - - - - - - - Tax impact - - - - - - - Corporate interest and other - - - - - - - Tax impact - - - - - - - Adjusted Diluted Earnings Per Average Common Share – Non-GAAP $ 0.97 $ 0.66 $ 0.84 $ 0.70 $ 0.75 $ 0.61 $ 1.05 * Less than $0.5 million or $0.01 per share. 2024 2023 2Q 3Q 4Q 1Q 2Q 3Q 1Q In Millions, Except Per Share Amounts