Exhibit 99.1

Exhibit 99.1

Investor Meetings

August 16-17, 2012

Foote Hydro 1918

Zeeland 2007

Lake Winds 2012

This presentation is made as of the date hereof and contains “forward-looking statements” as defined in Rule 3b-6 of the Securities Exchange Act of 1934, as amended, Rule 175 of the Securities Act of 1933, as amended, and relevant legal decisions. The forward-looking statements are subject to risks and uncertainties. They should be read in conjunction with “FORWARD-LOOKING STATEMENTS AND INFORMATION” and “RISK FACTORS” sections of CMS Energy’s and Consumers Energy’s Form 10-K for the year ended December 31 and as updated in subsequent 10-Qs. CMS Energy’s and Consumers Energy’s “FORWARD-LOOKING STATEMENTS AND INFORMATION” and “RISK FACTORS” sections are incorporated herein by reference and discuss important factors that could cause CMS Energy’s and Consumers Energy’s results to differ materially from those anticipated in such statements. CMS Energy and Consumers Energy undertake no obligation to update any of the information presented herein to reflect facts, events or circumstances after the date hereof.

The presentation also includes non-GAAP measures when describing CMS Energy’s results of operations and financial performance. A reconciliation of each of these measures to the most directly comparable GAAP measure is included in the appendix and posted on our website at www.cmsenergy.com.

CMS Energy provides financial results on both a reported (Generally Accepted Accounting Principles) and adjusted (non-GAAP) basis. Management views adjusted earnings as a key measure of the company’s present operating financial performance, unaffected by discontinued operations, asset sales, impairments, regulatory items from prior years, or other items. Certain of these items have the potential to impact, favorably or unfavorably, the company’s reported earnings in 2012. The company is not able to estimate the impact of these matters and is not providing reported earnings guidance.

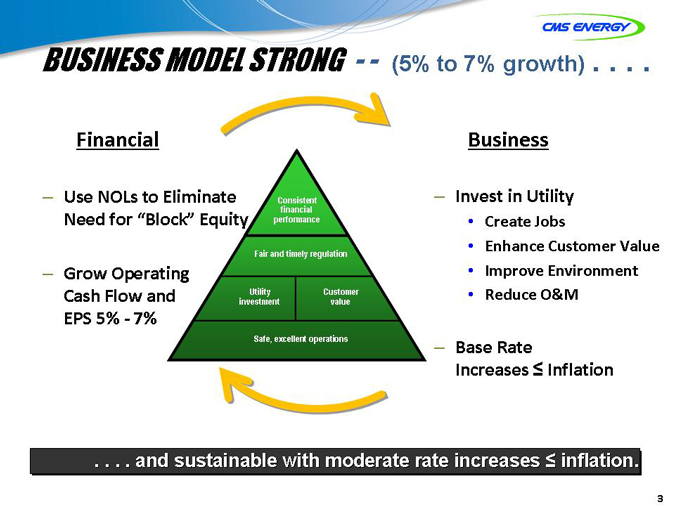

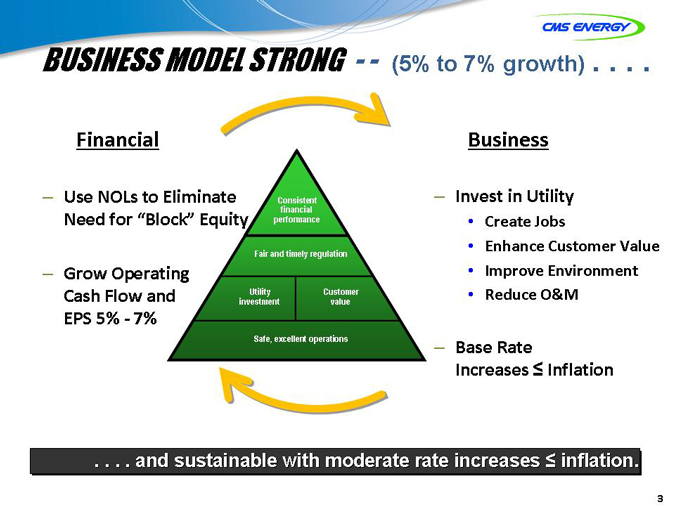

BUSINESS MODEL STRONG —- (5% to 7% growth)

Financial

Use NOLs to Eliminate Need for “Block” Equity

Grow Operating Cash Flow and EPS 5%—7%

Business

Invest in Utility

Create Jobs

Enhance Customer Value

Improve Environment

Reduce O&M

Base Rate Increases ? Inflation

. . . . and sustainable with moderate rate increases ? inflation.

Consistent financial performance

Fair and timely regulation

Utility investment

Customer value

Safe, excellent operations

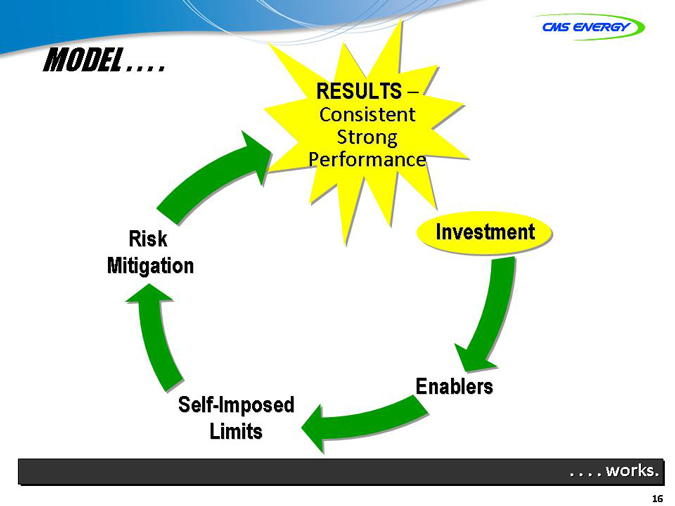

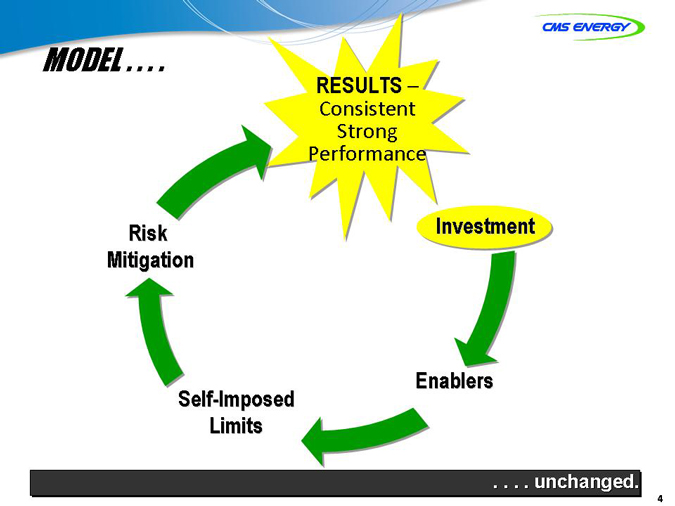

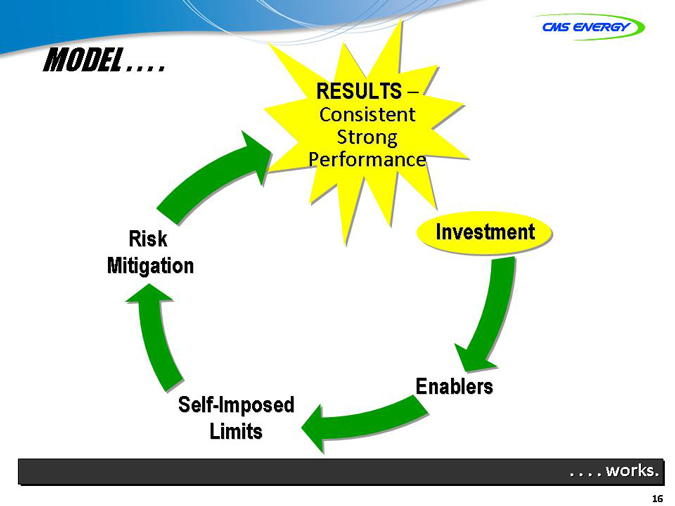

MODEL . . .. .

RESULTS –

Consistent Strong Performance

Risk Mitigation

Self-Imposed Limits

Enablers

Investment

. . . . unchanged.

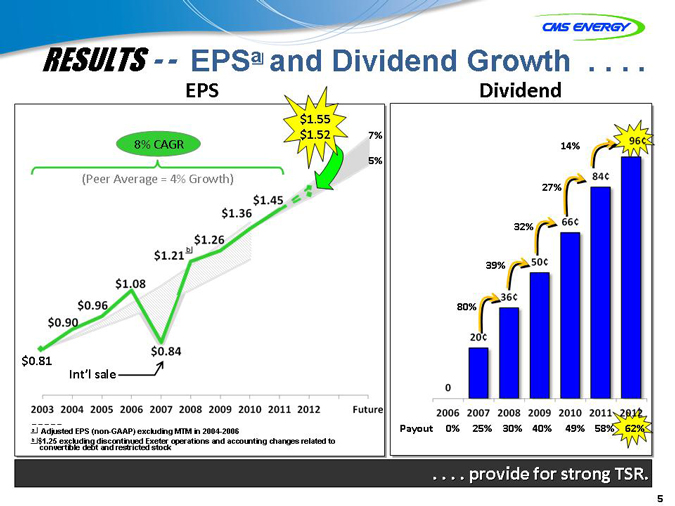

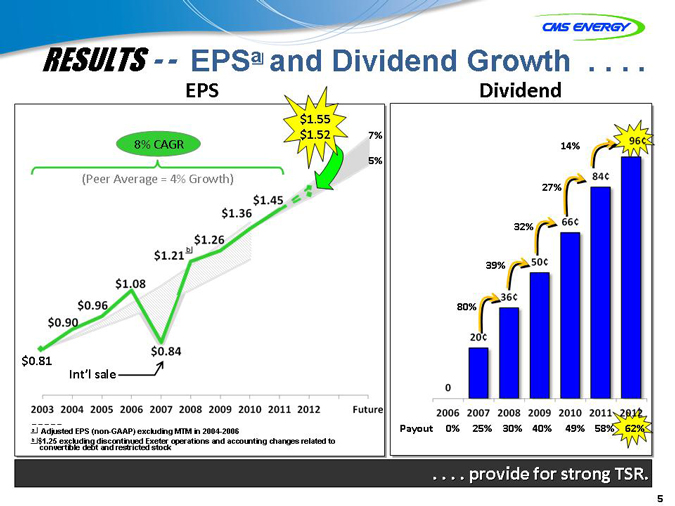

RESULTS—- EPSa and Dividend Growth . . . .

EPS

8% CAGR

$1.55

$1.52

(Peer Average = 4% Growth)

7%

5%

$1.45

$1.36

$1.26

b

$1.21

$1.08

$0.96

$0.90

$0.81

Int’l sale

$0.84

2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 Future

Adjusted EPS (non-GAAP) excluding MTM in 2004-2006

$1.25 excluding discontinued Exeter operations and accounting changes related to convertible debt and restricted stock

Dividend

14%

27%

32%

39%

80%

0

20¢

36¢

50¢

66¢

84¢

96¢

2006 2007 2008 2009 2010 2011 2012

Payout 0% 25% 30% 40% 49% 58% 62%

providerovide for strong TSR.

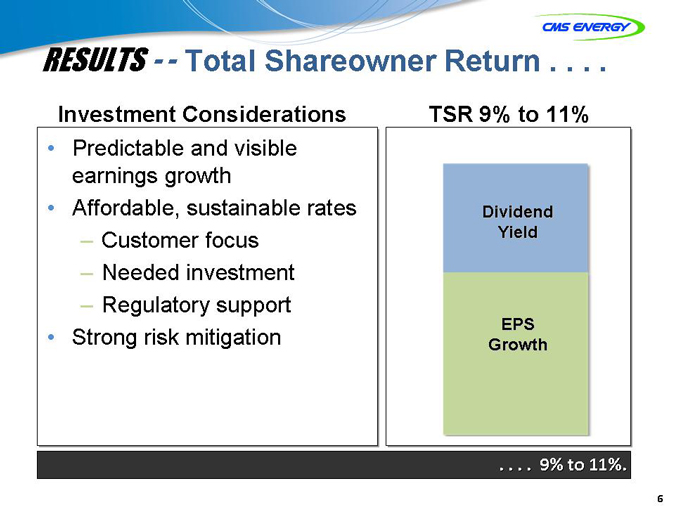

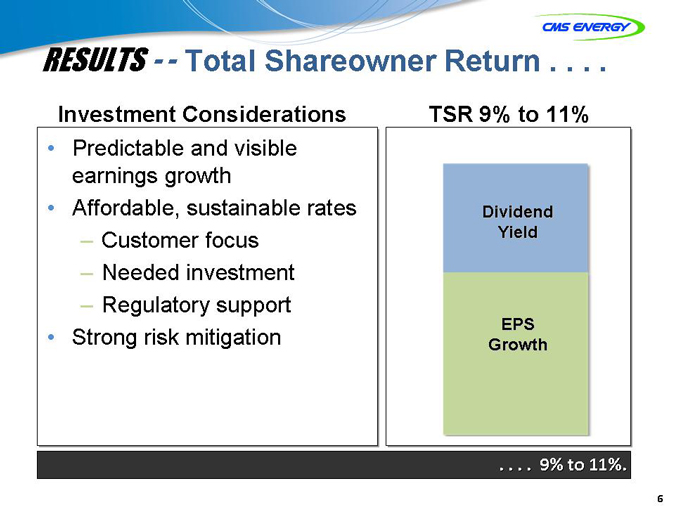

RESULTS—- Total Shareowner Return

Investment Considerations

Predictable and visible earnings growth Affordable, sustainable rates

– Customer focus

– Needed investment

– Regulatory support Strong risk mitigation

TSR 9% to 11%

Dividend Yield

EPS Growth

9% to 11%.

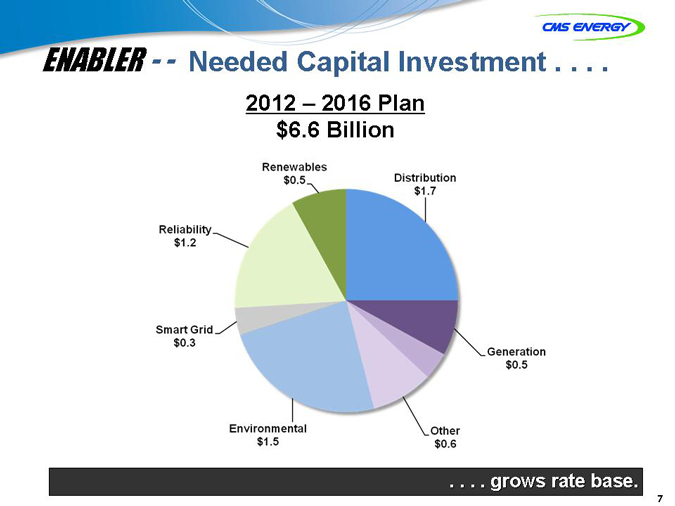

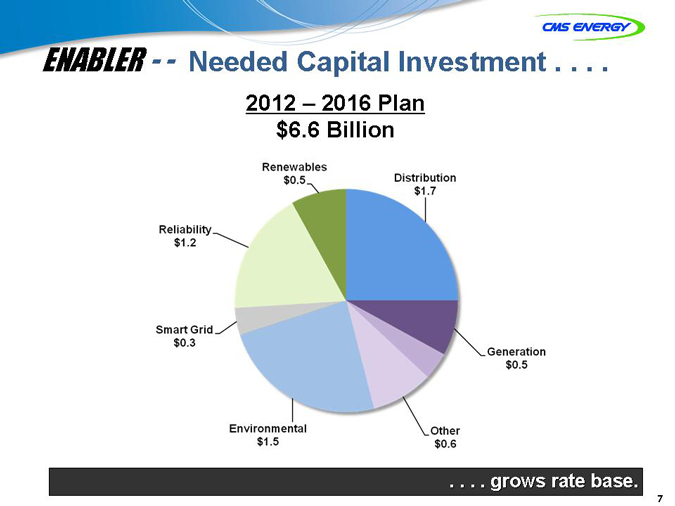

ENABLER—- Needed Capital Investment

2012 – 2016 Plan $6.6 Billion

Renewables $0.5

Reliability $1.2

Smart Grid $0.3

Environmental $1.5

Other $0.6

Generation $0.5

Distribution $1.7

growsrows rate base

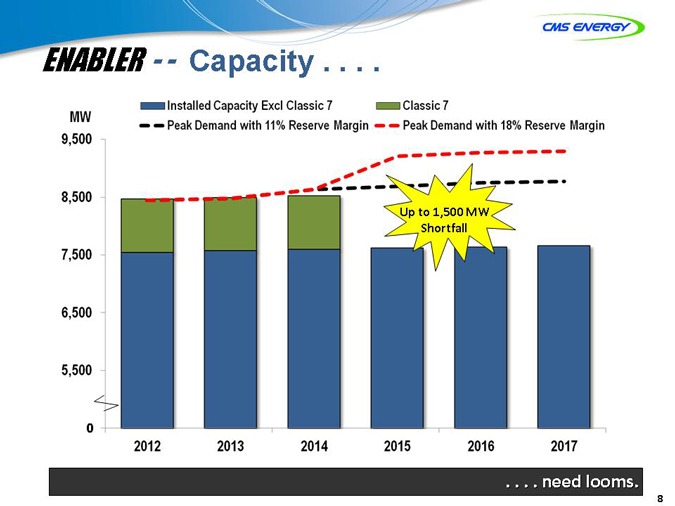

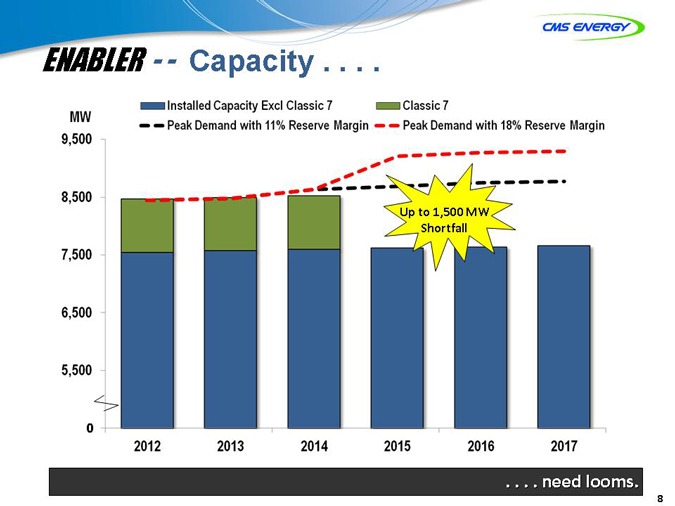

ENABLER—- Capacity

MW 9,500

8,500 7,500 6,500 5,500 4,500 0

2012 2013 2014 2015 2016 2017

Installed Capacity Excl Classic 7 Peak Demand with 11% Reserve Margin

Classic 7

Peak Demand with 18% Reserve Margin

needeed looms.

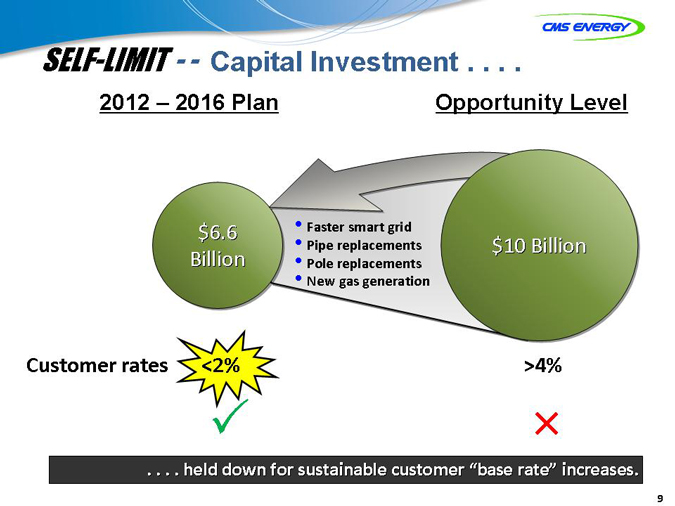

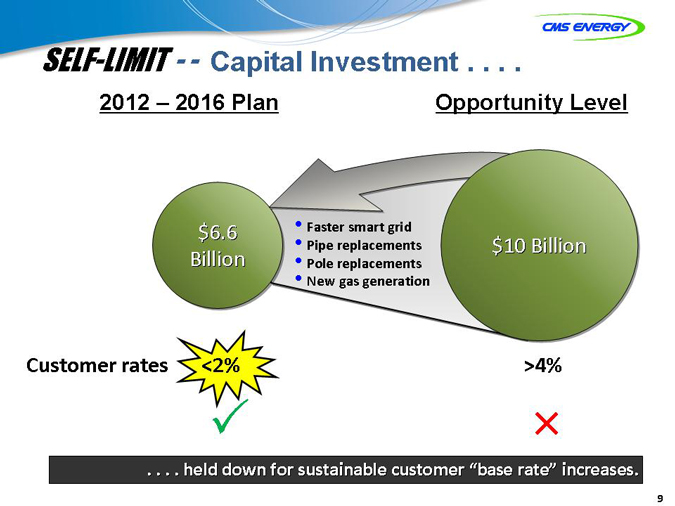

SELF-LIMIT—- Capital Investment .

2012 – 2016 Plan

$6.6 Billion

Faster smart grid Pipe replacements Pole replacements New gas generation

Opportunity Level

$10 Billion

Customer rates <2%

>4%

heldeld down for sustainable customer “base rate” increases

9

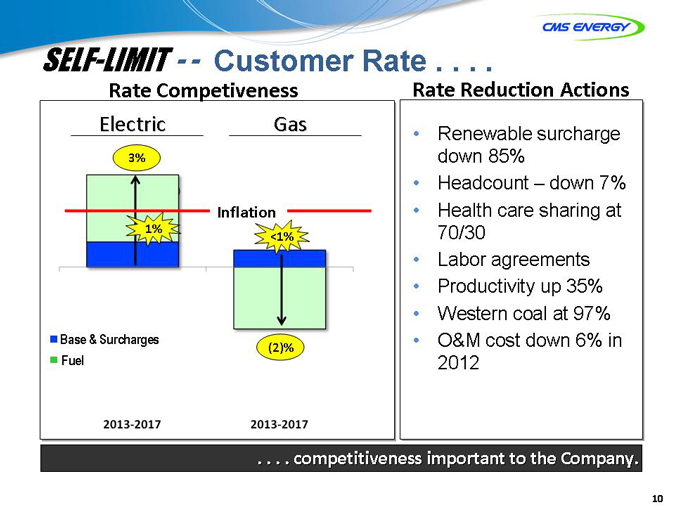

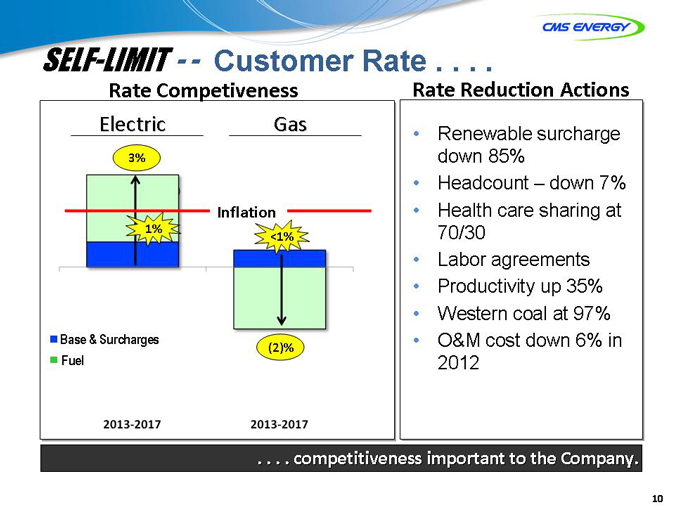

SELF-LIMIT—- Customer Rate

Rate Competiveness

Electric

3% 3.3%

1%

Gas

Inflation

<1%

(2)% .6)%

Base & Surcharges Fuel

2013? 2017 2013? 2017

Rate Reduction Actions

Renewable surcharge down 85% Headcount – down 7% Health care sharing at 70/30 Labor agreements

Productivity up 35%

Western coal at 97% O&M cost down 6% in

2012

competitivenessompetitiveness important to the Company.

10

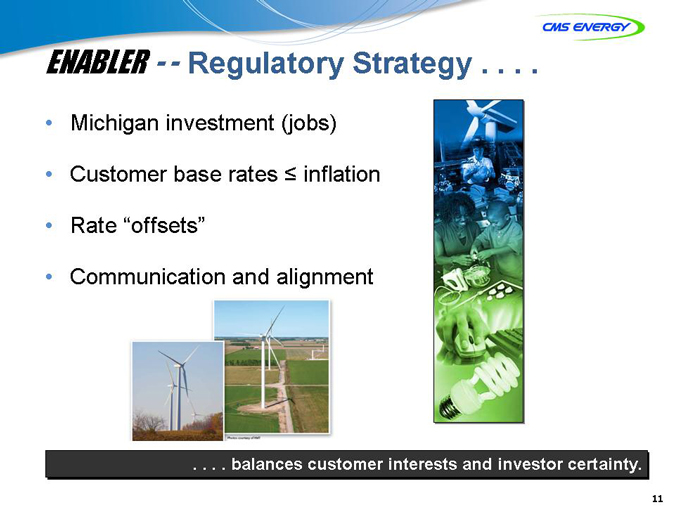

ENABLER—- Regulatory Strategy

Michigan investment (jobs) Customer base rates inflation Rate “offsets” Communication and alignment

balances customer interests and investor certainty.

11

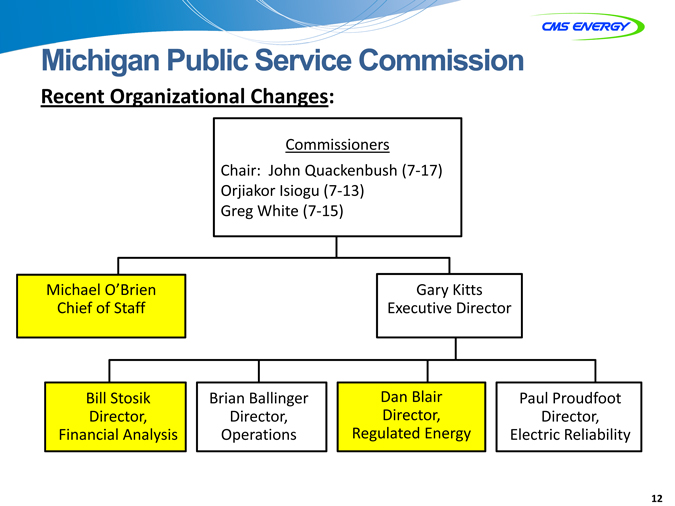

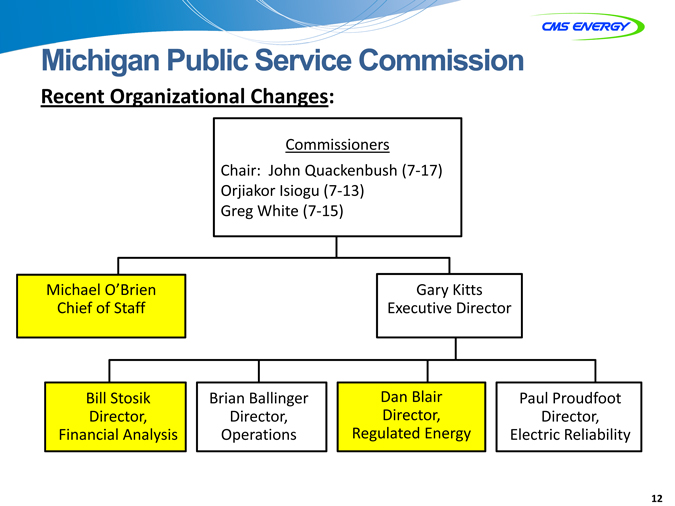

Michigan Public Service Commission

Recent Organizational Changes:

Commissioners Chair: John Quackenbush (7? 17) Orjiakor Isiogu (7? 13) Greg White (7? 15)

Michael O’Brien Chief of Staff

Gary Kitts Executive Director

Bill Stosik Director, Financial Analysis

Brian Ballinger Director, Operations

Dan Blair Director, Regulated Energy

Paul Proudfoot Director, Electric Reliability

12

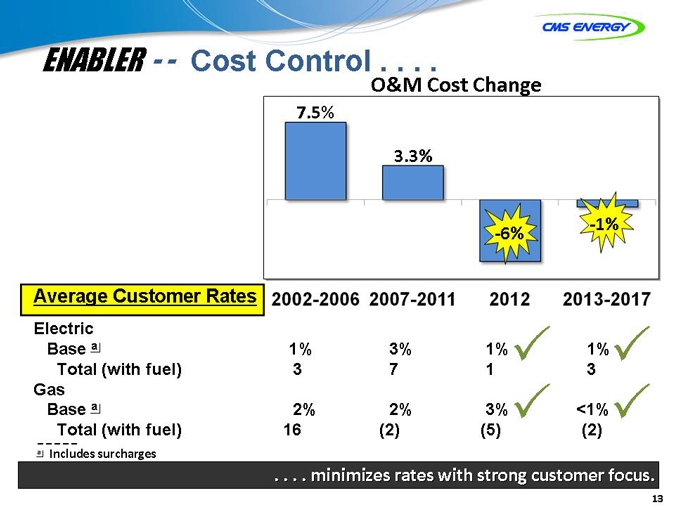

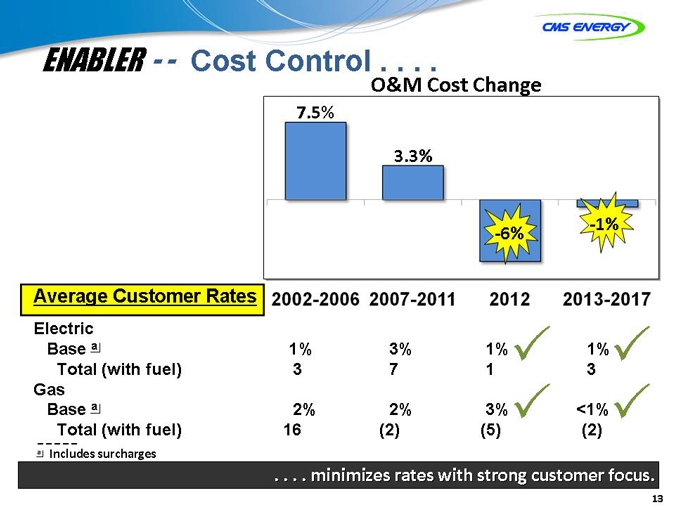

ENABLER—- Cost Control

O&M Cost Change

7.5%

3.3%

? 6%

? 1%

Average Customer Rates

Electric Base a

Total (with fuel) Gas Base a Total (with fuel)

a Includes surcharges

2002-2006 2007-2011

1% 3

2% 16

3% 7

2% (2)

2012 2013-2017

1% 1

3% (5)

1% 3

<1% (2)

minimizesinimizes rates with strong customer focus.

13

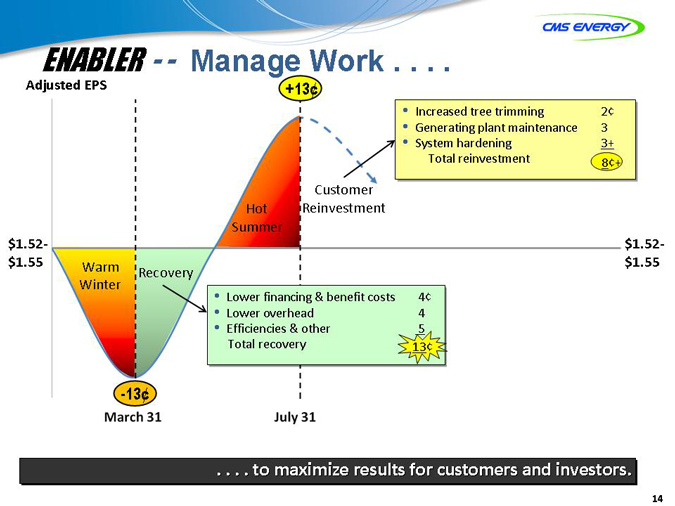

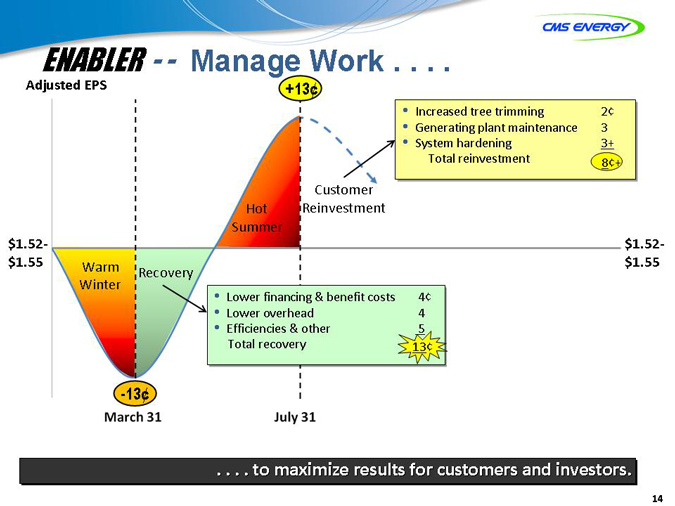

ENABLER—- Manage Work

Adjusted EPS

$1.52 $1.55

Warm Winter

Recovery

? -13¢

March 31

Lower financing & benefit costs 4¢ Lower overhead 4 Efficiencies & other 5 Total recovery 13¢

July 31

Hot Summer

Customer Reinvestment

+13¢

Increased tree trimming 2¢ Generating plant maintenance 3 System hardening 3+ Total reinvestment 7¢ 8¢+

$1.52 $1.55

to maximize results for customers and investors.

14

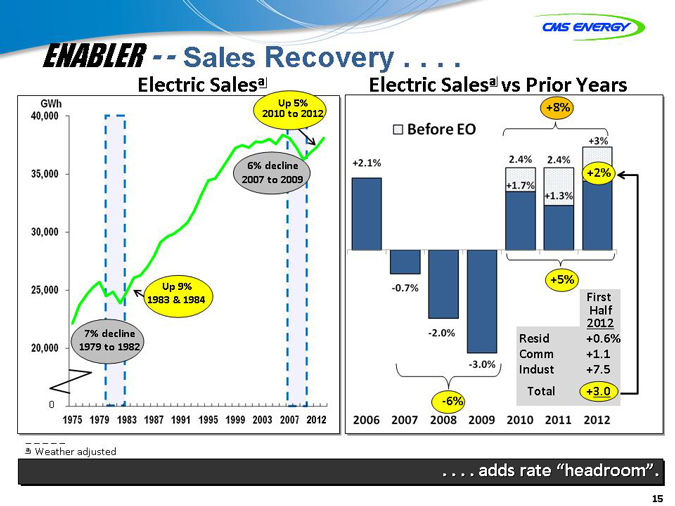

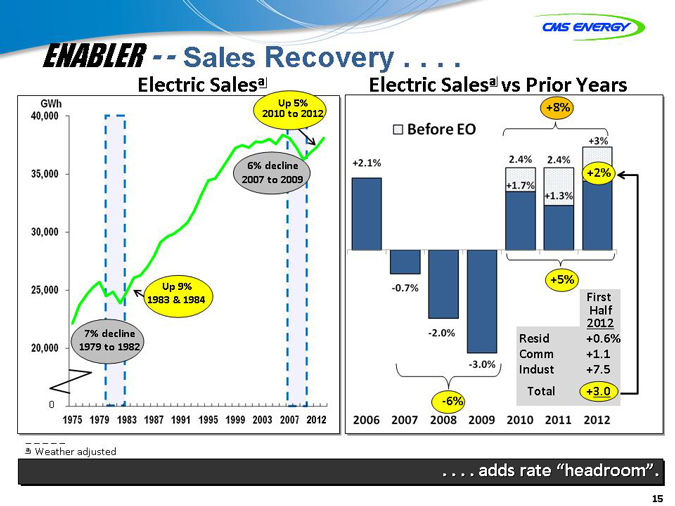

ENABLER—- Sales Recovery

Electric Salesa

GWh 40,000

35,000 30,000 25,000 20,000 15,000 0

1975 1979 1983 1987 1991 1995 1999 2003 2007 20122011

Up 5% 2010 to 2012

6% decline 2007 to 2009

Up 9% 1983 & 1984

7% decline 1979 to 1982

+1.7%

2.4%

.3%

+5%

Resid Comm Indust Total

Half 2012 +0.6% +1.1 +7.5 +3.0

2006 2007 2008 2009 2010 2011 2012

adds rate “headroom”.

15

MODEL

RESULTS –

Consistent Strong Performance

Risk Mitigation

Self-Imposed Limits

16

works.

Enablers

Investment

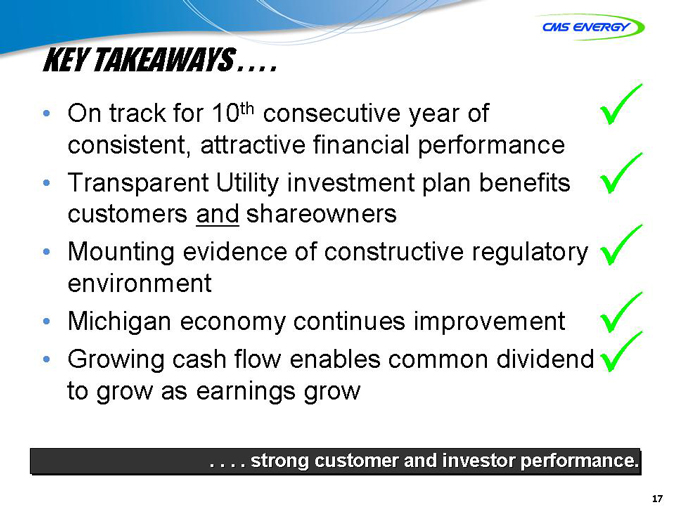

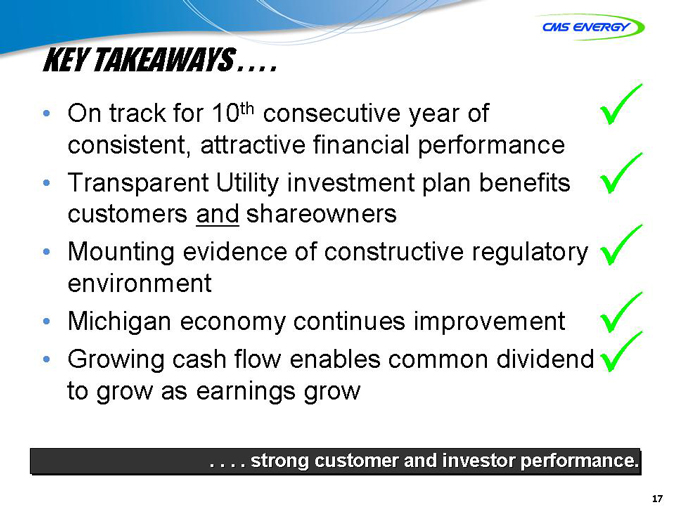

KEY TAKEAWAYS . . . .

On track for 10th consecutive year of consistent, attractive financial performance

Transparent Utility investment plan benefits customers and shareowners Mounting evidence of constructive regulatory environment Michigan economy continues improvement

Growing cash flow enables common dividend to grow as earnings grow

strongtrong customer and investor performance

17

APPENDIX

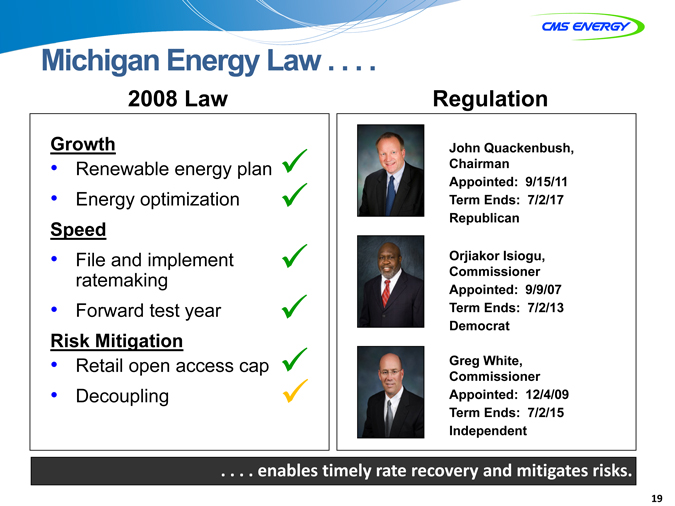

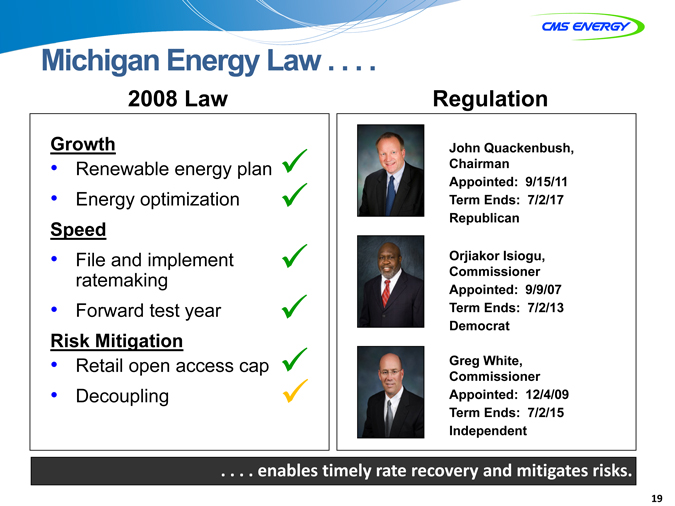

Michigan Energy Law

2008 Law

Regulation

Growth

• Renewable energy plan

• Energy optimization

Speed

• File and implement ratemaking

• Forward test year

Risk Mitigation

• Retail open access cap

• Decoupling

John Quackenbush, Chairman Appointed: 9/15/11 Term Ends: 7/2/17 Republican

Orjiakor Isiogu, Commissioner Appointed: 9/9/07 Term Ends: 7/2/13 Democrat

Greg White, Commissioner Appointed: 12/4/09 Term Ends: 7/2/15 Independent

enables timely rate recovery and mitigates risks.

19

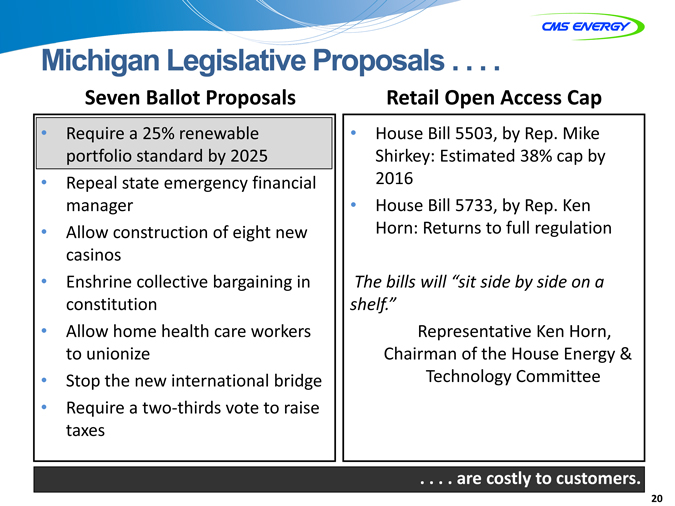

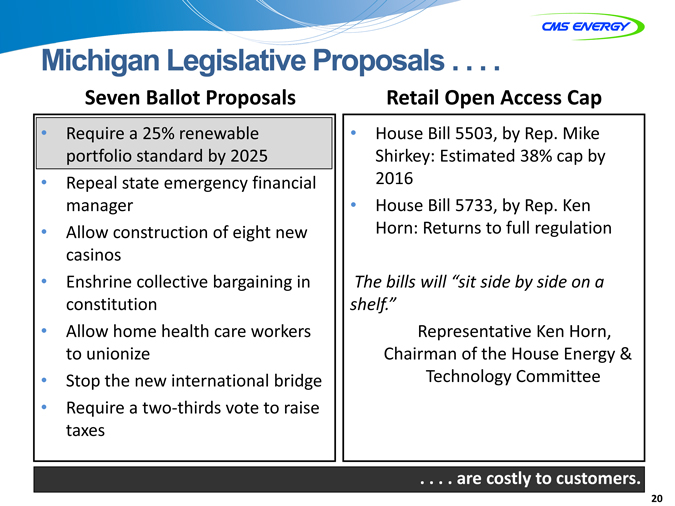

Michigan Legislative Proposals

Seven Ballot Proposals

Require a 25% renewable portfolio standard by 2025 Repeal state emergency financial manager Allow construction of eight new casinos Enshrine collective bargaining in constitution Allow home health care workers to unionize Stop the new international bridge Require a two? thirds vote to raise taxes

Retail Open Access Cap

House Bill 5503, by Rep. Mike Shirkey: Estimated 38% cap by 2016 House Bill 5733, by Rep. Ken Horn: Returns to full regulation

Representative Ken Horn, Chairman of the House Energy & Technology Committee

are costly to customers

20

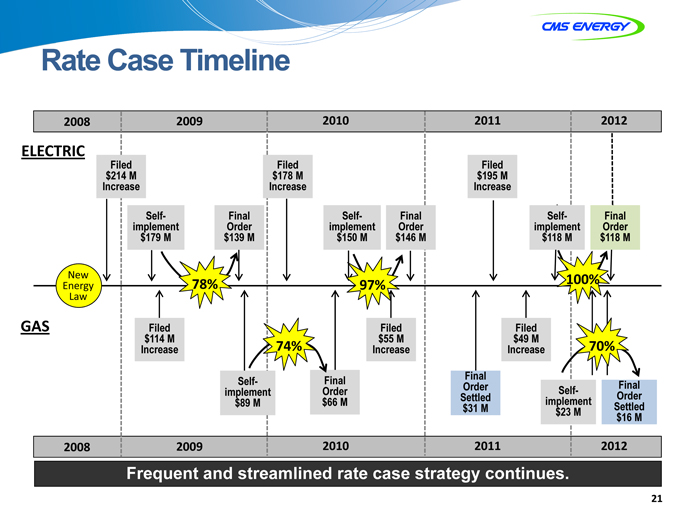

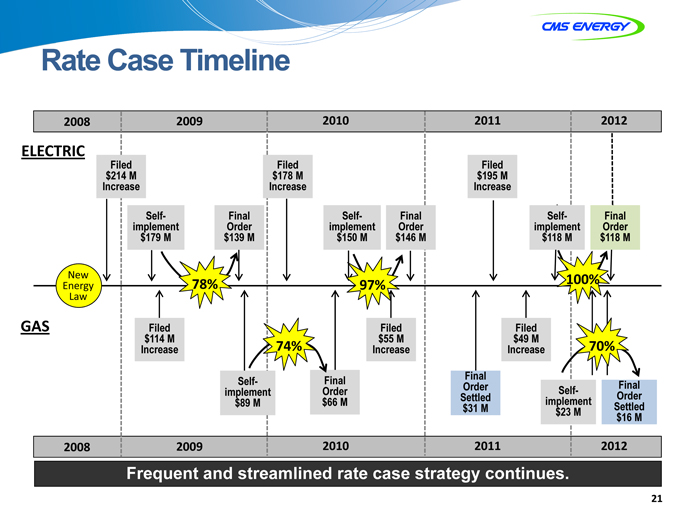

Rate Case Timeline

2008 2009 2010 2011 2012

ELECTRIC

$Filed 214 M Increase

implement Self$179 M

Order Final $139 M

$Filed 178 M Increase

implement Self- $150 M

Order Final $146 M

$Filed 195 M Increase

implement Self$118 M

Order Final $118 M

New Energy Law

78%

97%

100%

GAS

$Filed 114 M Increase

implement Self-

$89 M

74%

Order Final

$66 M

$ Filed 55 M Increase

Settled Order

$31 M

$ Filed 49 M Increase

implement Self-

$23 M

70%

Order Final Settled $16 M

2008

2009

2010

2011

2012

Frequent and streamlined rate case strategy continues.

21

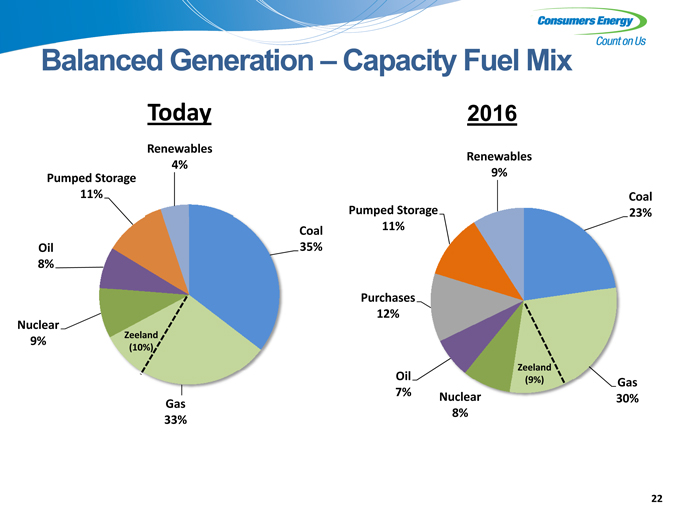

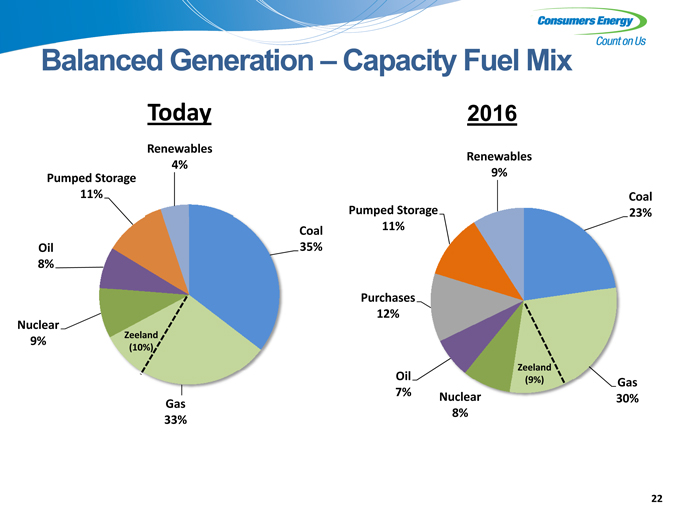

Balanced Generation – Capacity Fuel Mix

Present Today

Renewables 4%

Pumped Storage 11%

Oil 8%

Nuclear 9%

Zeeland (10%)

Gas 33%

Coal 35%

2016

Renewables 9%

Pumped Storage 11%

Purchases 12%

Oil 7%

Nuclear 8%

Zeeland (9%)

Gas 30%

Coal 23%

22

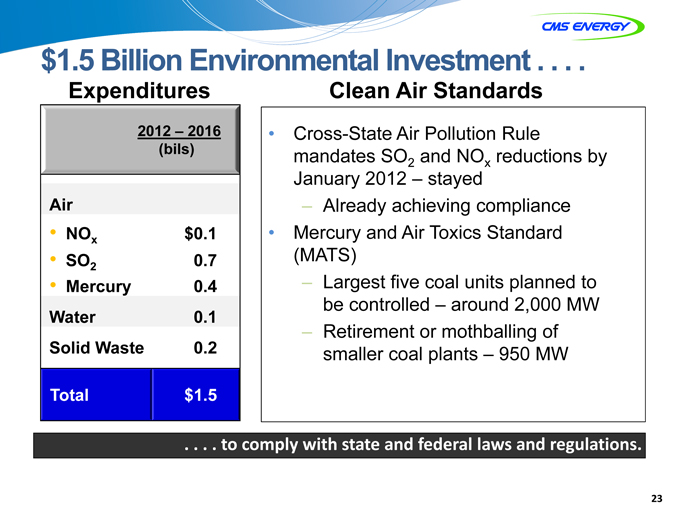

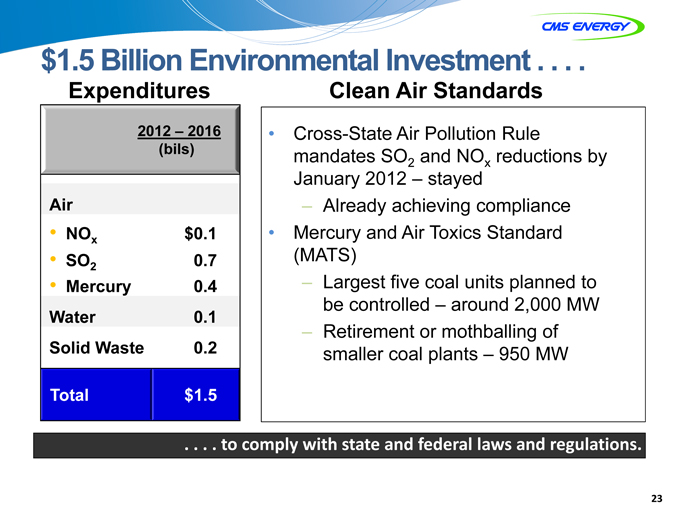

$1.5 Billion Environmental Investment

Expenditures

2012 – 2016 (bils)

Air

NOx SO2 Mercury

Water Solid Waste

$0.1 0.7 0.4 0.1 0.2

Total $1.5

Clean Air Standards

Cross-State Air Pollution Rule mandates SO2 and NOx reductions by January 2012 – stayed

– Already achieving compliance Mercury and Air Toxics Standard (MATS)

– Largest five coal units planned to be controlled – around 2,000 MW

– Retirement or mothballing of smaller coal plants – 950 MW

to comply with state and federal laws and regulations

23

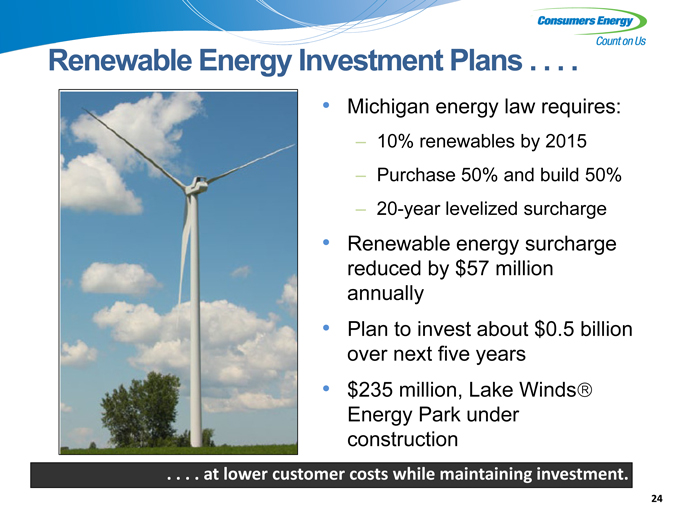

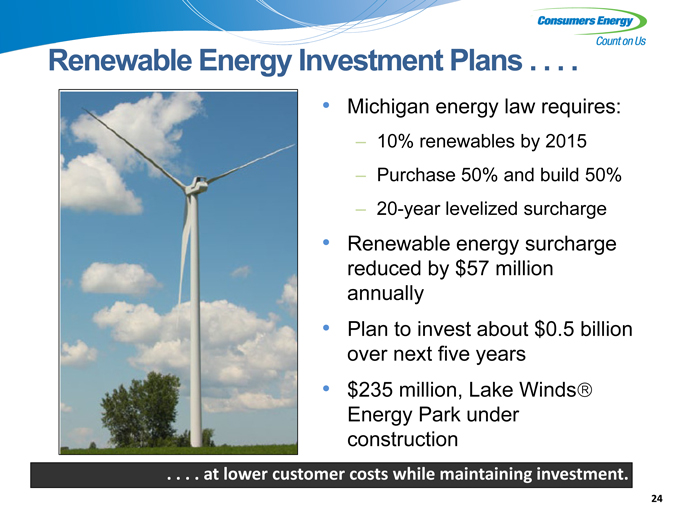

Renewable Energy Investment Plans

Michigan energy law requires:

– 10% renewables by 2015

– Purchase 50% and build 50%

– 20-year levelized surcharge

Renewable energy surcharge reduced by $57 million annually Plan to invest about $0.5 billion over next five years $235 million, Lake WindsR Energy Park under construction

at lower customer costs while maintaining investment

24

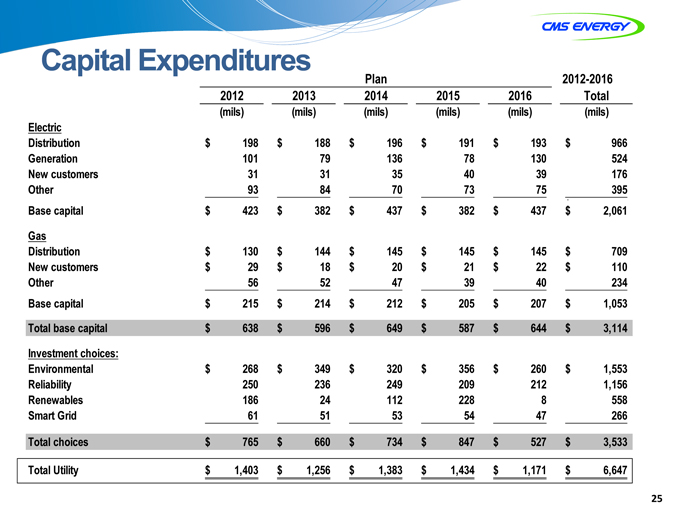

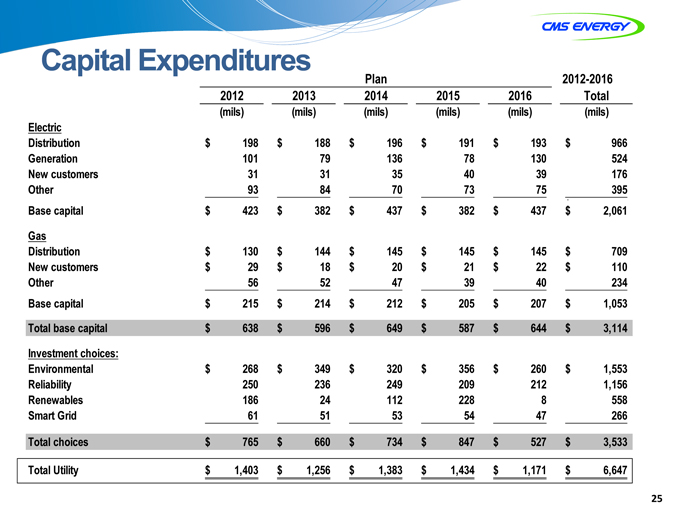

Capital Expenditures

Plan 2012-2016

2012 2013 2014 2015 2016 Total

(mils) (mils) (mils) (mils) (mils) (mils)

Electric

Distribution $ 198 $ 188 $ 196 $ 191 $ 193 $ 966

Generation 101 79 136 78 130 524

New customers 31 31 35 40 39 176

Other 93 84 70 73 75 $ 395

Base capital $ 423 $ 382 $ 437 $ 382 $ 437 $ 2,061

Gas

Distribution $ 130 $ 144 $ 145 $ 145 $ 145 $ 709

New customers $ 29 $ 18 $ 20 $ 21 $ 22 $ 110

Other 56 52 47 39 40 234

Base capital $ 215 $ 214 $ 212 $ 205 $ 207 $ 1,053

Total base capital $ 638 $ 596 $ 649 $ 587 $ 644 $ 3,114

Investment choices:

Environmental $ 268 $ 349 $ 320 $ 356 $ 260 $ 1,553

Reliability 250 236 249 209 212 1,156

Renewables 186 24 112 228 8 558

Smart Grid 61 51 53 54 47 266

Total choices $ 765 $ 660 $ 734 $ 847 $ 527 $ 3,533

Total Utility $ 1,403 $ 1,256 $ 1,383 $ 1,434 $ 1,171 $ 6,647

25

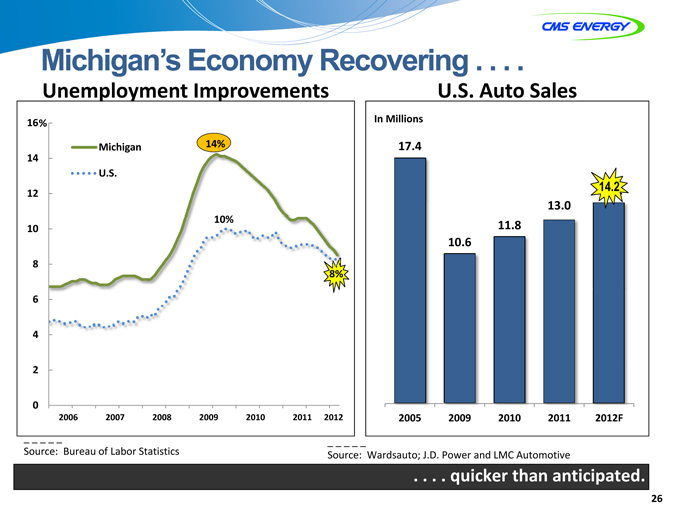

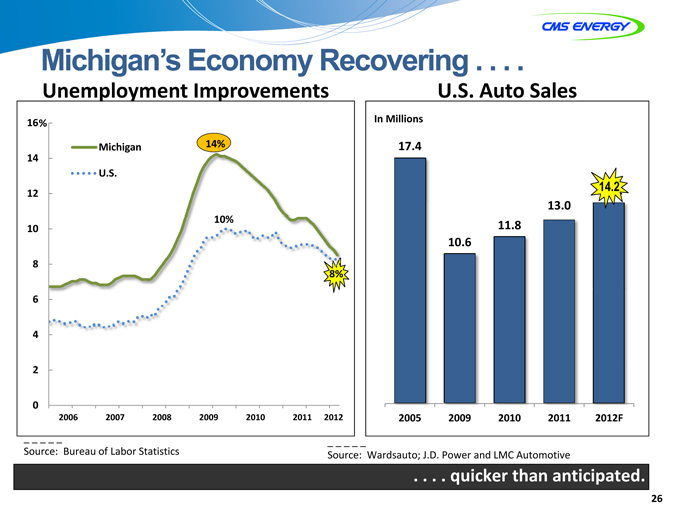

Michigan’s Economy Recovering

Unemployment Improvements

16%

14

12

10

0

Michigan

U.S.

14%

10%

8%

2006 2007 2008 2009 2010 2011 2012

U.S. Auto Sales

U.S. Auto Sales

In Millions

17.4

10.6

11.8

13.0

14.2 14.2

2005 2009 2010 2011 2012F

Source: Bureau of Labor Statistics

Source: Wardsauto; J.D. Power and LMC Automotive

quicker than anticipated

26

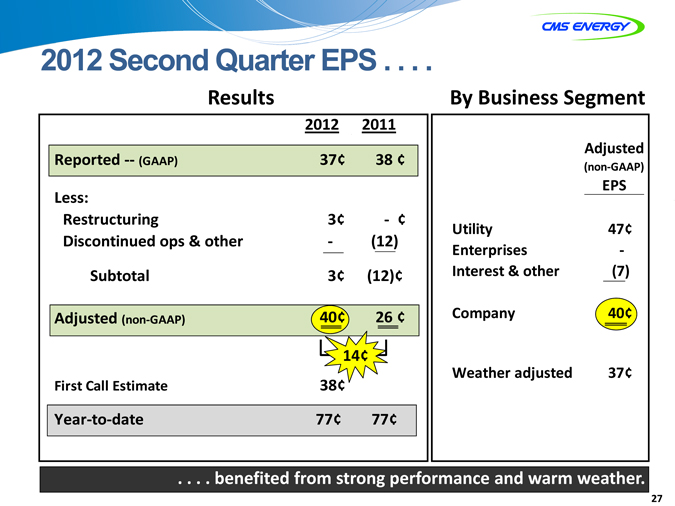

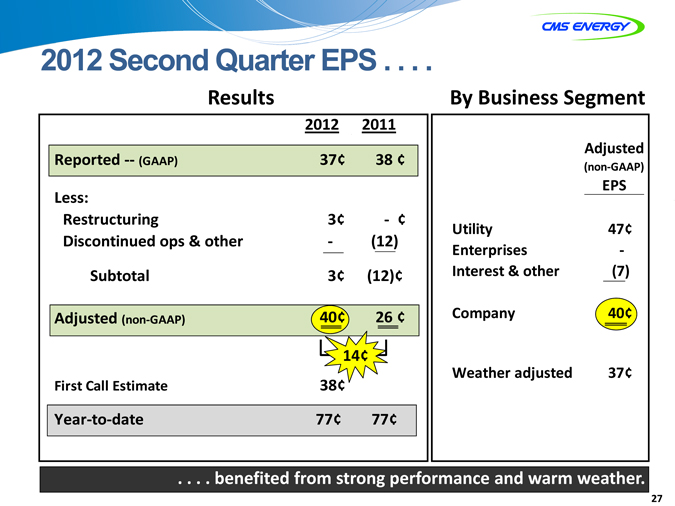

2012 Second Quarter EPS

Results

2012 2011

Reported ?? (GAAP) 37¢ 38 ¢

Less:

Restructuring 3¢ ¢

Discontinued ops & other ? (12)

Subtotal 3¢ (12)¢

Adjusted (non? GAAP) 40¢ 26 ¢

14¢

Year? to? date 77¢ 77¢

By Business Segment

Adjusted

(non? GAAP)

EPS

?

Utility 47¢ Enterprises Interest & other (7)

Company 40¢

Weather adjusted 37¢

benefitedenefited from strong performance and warm weather

27

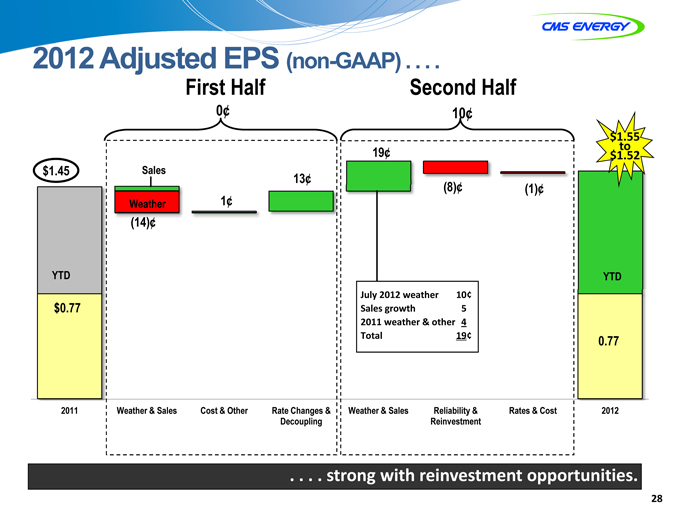

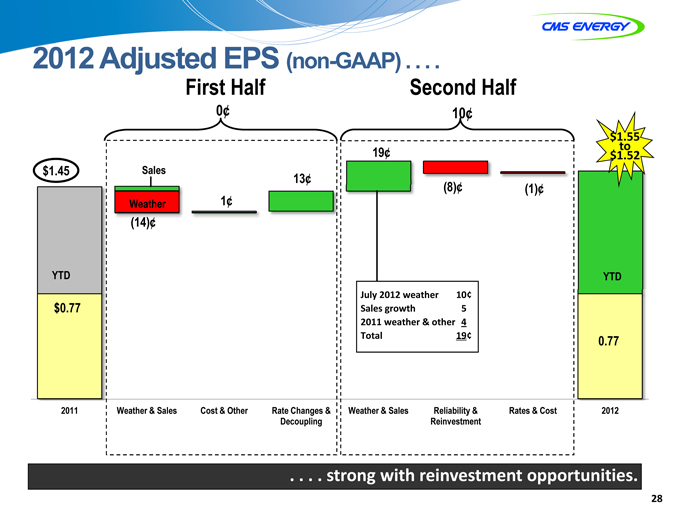

2012 Adjusted EPS (non-GAAP)

First Half

0¢

$1.45

YTD

$0.77

Weather (14)¢

Sales

13¢

2011

Weather & Sales

Cost & Other

Rate Changes & Decoupling

Second Half

10¢

19¢

July 2012 weather 10¢ Sales growth 5 2011 weather & other 4 Total 19¢

Weather & Sales Reliability & Rates & Cost Reinvestment

$1.55 to $1.52

YTD

0.77

2012

strongtrong with reinvestment opportunities

28

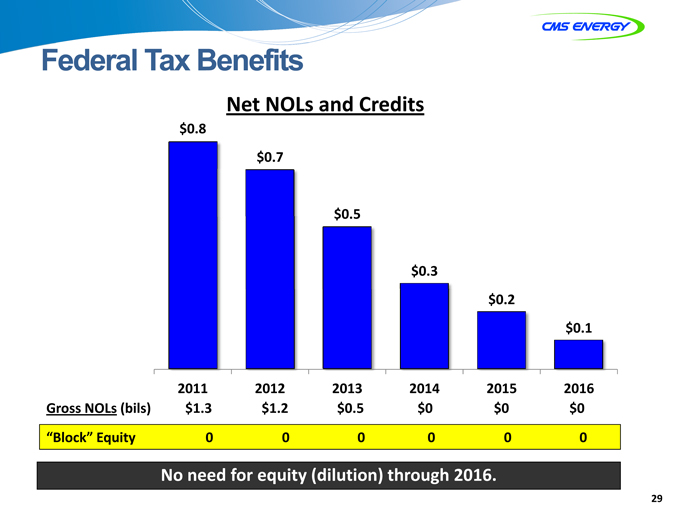

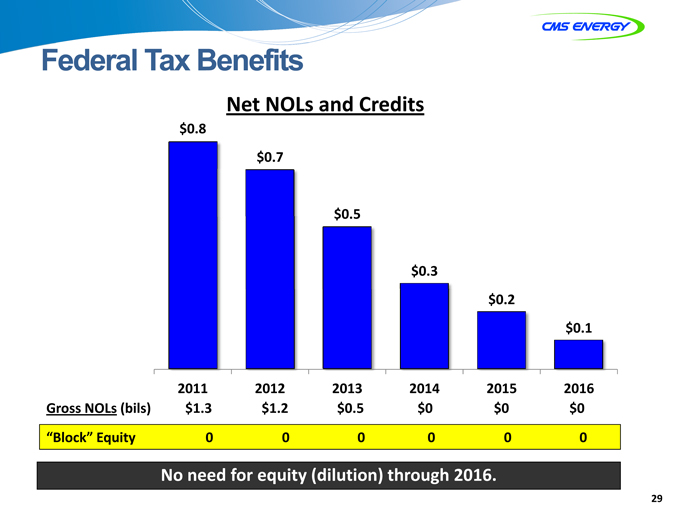

Federal Tax Benefits

Net NOLs and Credits

$0.8

$0.7

$0.5

$0.3

$0.2

$0.1

2011 2012 2013 2014 2015 2016 Gross NOLs (bils) $1.3 $1.2 $0.5 $0 $0 $0

“Block” Equity 0 0 0 0 0 0

No need for equity (dilution) through 2016.

29

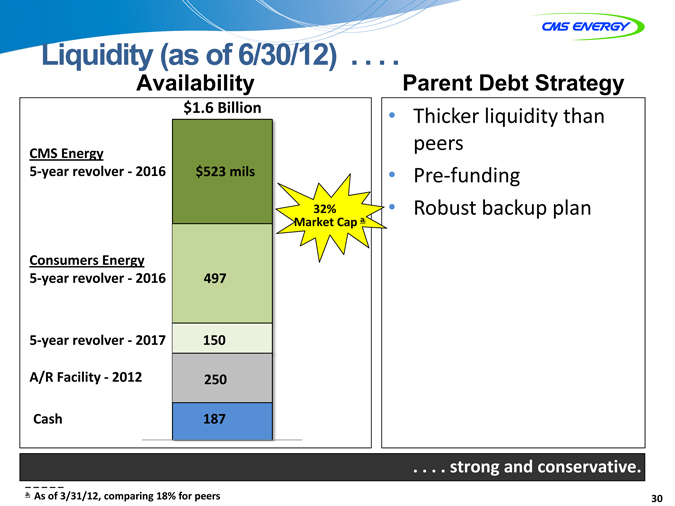

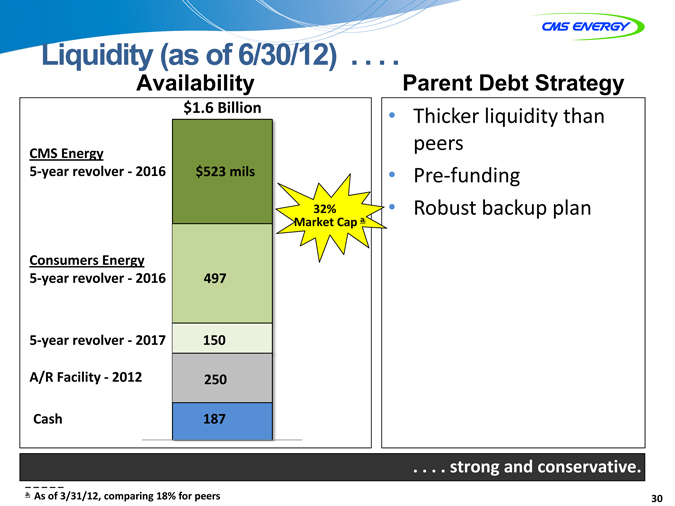

Liquidity (as of 6/30/12)

Availability

$1.6 Billion

CMS Energy

5? year revolver 2016 ? $523 mils

Consumers Energy

5? year revolver 2016 ? 497

5? year revolver 2017 ? 150

A/R Facility 2012 ? 250

Cash 187

32% Market Cap a

a As of 3/31/12, comparing 18% for peers

Thicker liquidity than peers Pre? funding Robust backup plan

Parent Debt Strategy

strongtrong and conservative

30

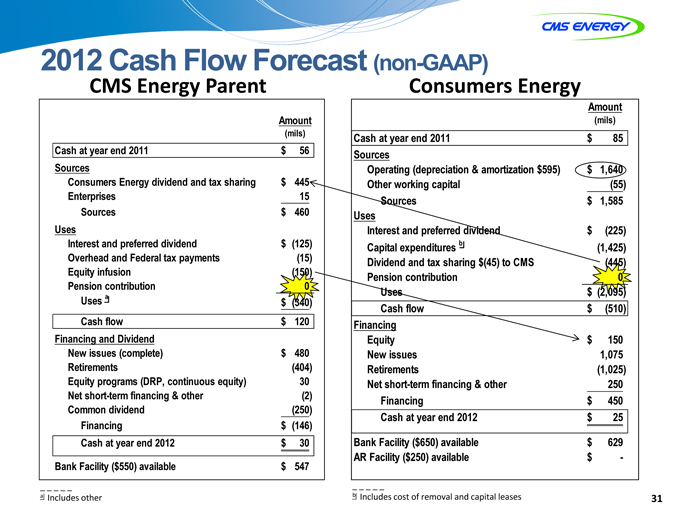

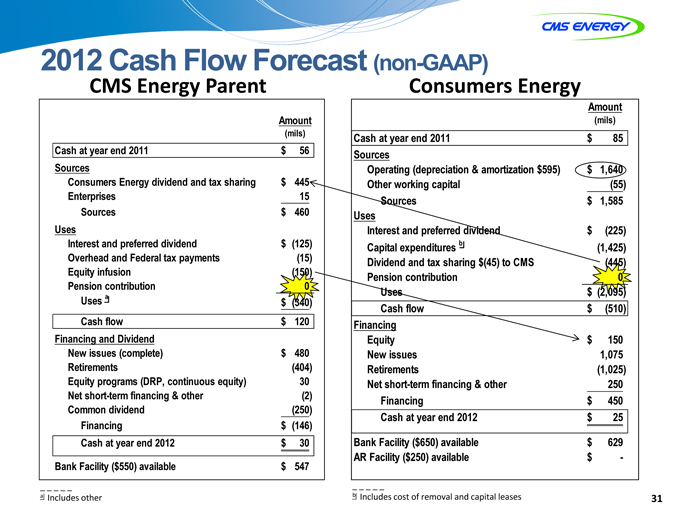

2012 Cash Flow Forecast (non-GAAP)

CMS Energy Parent

Amount

(mils)

Cash at year end 2011 $ 56

Sources

Consumers Energy dividend and tax sharing $ 445

Enterprises 15

Sources $ 460

Uses

Interest and preferred dividend $ (125)

Overhead and Federal tax payments (15)

Equity infusion (150)

Pension contribution 0

Uses a $ (340)

Cash flow $ 120

Financing and Dividend

New issues (complete) $ 480

Retirements (404)

Equity programs (DRP, continuous equity) 30

Net short-term financing & other (2)

Common dividend (250)

Financing $ (146)

Cash at year end 2012 $ 30

Bank Facility ($550) available $ 547

Consumers Energy

Amount

(mils)

Cash at year end 2011 $ 85

Sources

Operating (depreciation & amortization $595) $ 1,640

Other working capital (55)

Sources $ 1,585

Uses

Interest and preferred dividend $ (225)

Capital expenditures b (1,425)

Dividend and tax sharing $(45) to CMS (445)

Pension contribution 0

Uses $ (2,095)

Cash flow $ (510)

Financing

Equity $ 150

New issues 1,075

Retirements (1,025)

Net short-term financing & other 250

Financing $ 450

Cash at year end 2012 $ 25

Bank Facility ($650) available $ 629

AR Facility ($250) available $ -

a Includes other

b Includes cost of removal and capital leases

31

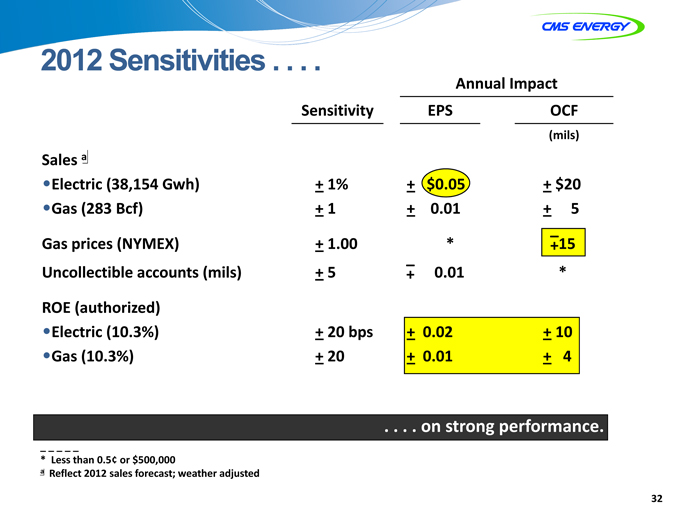

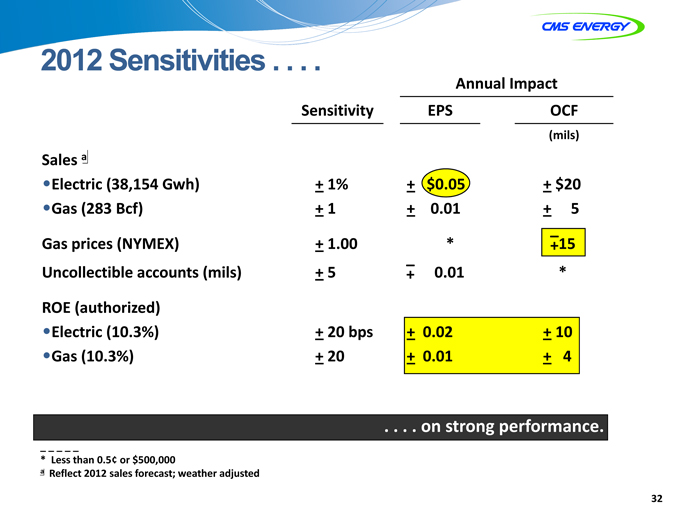

2012 Sensitivities

Annual Impact

Sensitivity EPS OCF

(mils)

Sales a

•Electric (38,154 Gwh) + 1% + $0.05 + $20

•Gas (283 Bcf) + 1 + 0.01 + 5

Gas prices (NYMEX) + 1.00 * –+15

Uncollectible accounts (mils) + 5 –+ 0.01 *

ROE (authorized)

•Electric (10.3%) + 20 bps + 0.02 + 10

•Gas (10.3%) + 20 + 0.01 + 4

onn strong performance.

* | Less than 0.5¢ or $500,000 a Reflect 2012 sales forecast; weather adjusted |

32

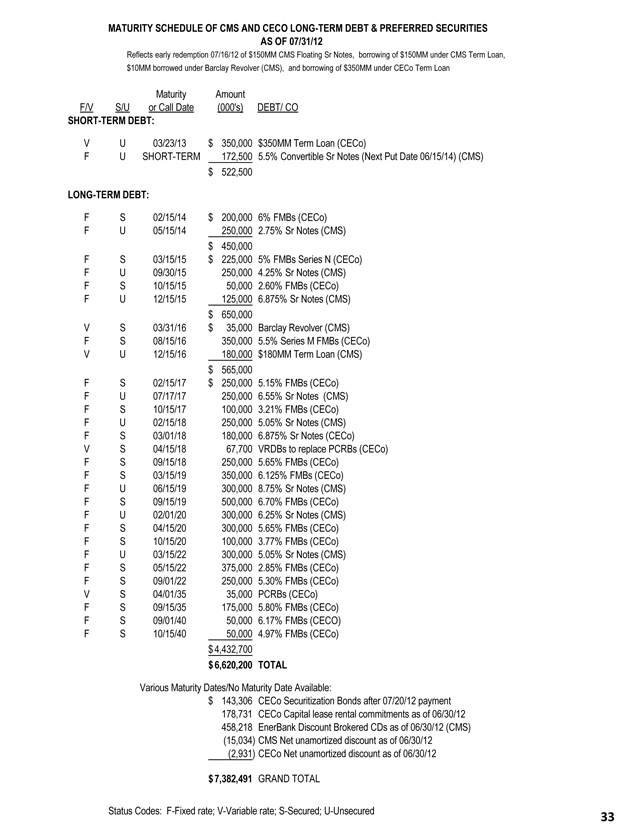

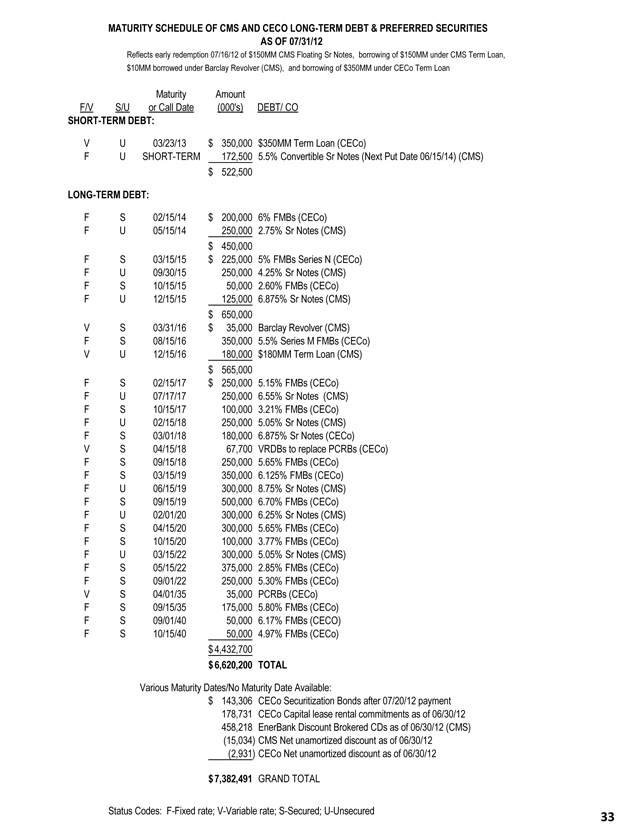

MATURITY SCHEDULE OF CMS AND CECO LONG-TERM DEBT & PREFERRED SECURITIES

AS OF 07/31/12

Reflects early redemption 07/16/12 of $150MM CMS Floating Sr Notes, borrowing of $150MM under CMS Term Loan,

$10MM borrowed under Barclay Revolver (CMS), and borrowing of $350MM under CECo Term Loan

Maturity Amount

F/V S/U or Call Date (000’s) DEBT/ CO

SHORT-TERM DEBT:

V U 03/23/13 $ 350,000 $350MM Term Loan (CECo)

F U SHORT-TERM 172,500 5.5% Convertible Sr Notes (Next Put Date 06/15/14) (CMS)

$ 522,500

LONG-TERM DEBT:

F S 02/15/14 $ 200,000 6% FMBs (CECo)

F U 05/15/14 250,000 2.75% Sr Notes (CMS)

$ 450,000

F S 03/15/15 $ 225,000 5% FMBs Series N (CECo)

F U 09/30/15 250,000 4.25% Sr Notes (CMS)

F S 10/15/15 50,000 2.60% FMBs (CECo)

F U 12/15/15 125,000 6.875% Sr Notes (CMS)

$ 650,000

V S 03/31/16 $ 35,000 Barclay Revolver (CMS)

F S 08/15/16 350,000 5.5% Series M FMBs (CECo)

V U 12/15/16 180,000 $180MM Term Loan (CMS)

$ 565,000

F S 02/15/17 $ 250,000 5.15% FMBs (CECo)

F U 07/17/17 250,000 6.55% Sr Notes (CMS)

F S 10/15/17 100,000 3.21% FMBs (CECo)

F U 02/15/18 250,000 5.05% Sr Notes (CMS)

F S 03/01/18 180,000 6.875% Sr Notes (CECo)

V S 04/15/18 67,700 VRDBs to replace PCRBs (CECo)

F S 09/15/18 250,000 5.65% FMBs (CECo)

F S 03/15/19 350,000 6.125% FMBs (CECo)

F U 06/15/19 300,000 8.75% Sr Notes (CMS)

F S 09/15/19 500,000 6.70% FMBs (CECo)

F U 02/01/20 300,000 6.25% Sr Notes (CMS)

F S 04/15/20 300,000 5.65% FMBs (CECo)

F S 10/15/20 100,000 3.77% FMBs (CECo)

F U 03/15/22 300,000 5.05% Sr Notes (CMS)

F S 05/15/22 375,000 2.85% FMBs (CECo)

F S 09/01/22 250,000 5.30% FMBs (CECo)

V S 04/01/35 35,000 PCRBs (CECo)

F S 09/15/35 175,000 5.80% FMBs (CECo)

F S 09/01/40 50,000 6.17% FMBs (CECO)

F S 10/15/40 50,000 4.97% FMBs (CECo)

$ 4,432,700

$ 6,620,200 TOTAL

Various Maturity Dates/No Maturity Date Available:

$ 143,306 CECo Securitization Bonds after 07/20/12 payment

178,731 CECo Capital lease rental commitments as of 06/30/12

458,218 EnerBank Discount Brokered CDs as of 06/30/12 (CMS)

(15,034) CMS Net unamortized discount as of 06/30/12

(2,931) CECo Net unamortized discount as of 06/30/12

$ 7,382,491 GRAND TOTAL

Status Codes: F-Fixed rate; V-Variable rate; S-Secured; U-Unsecured

33

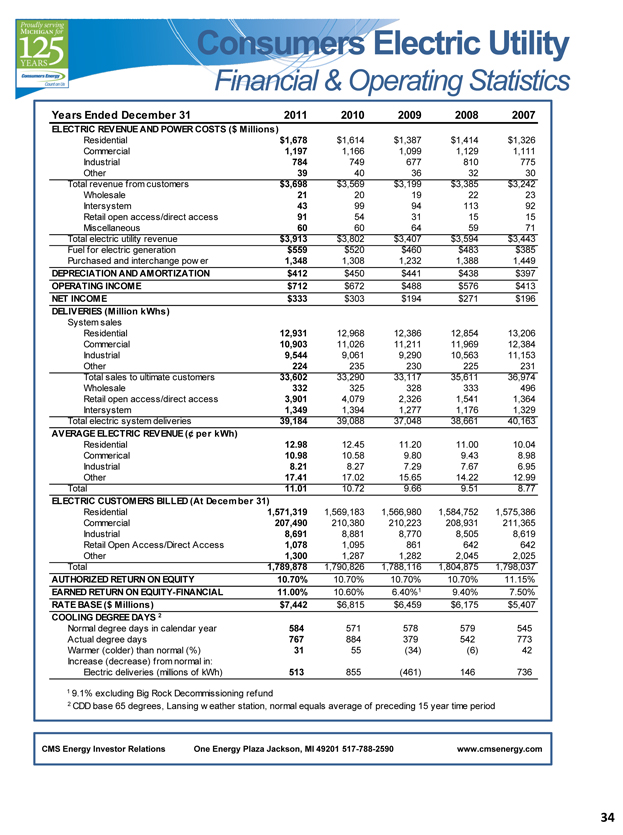

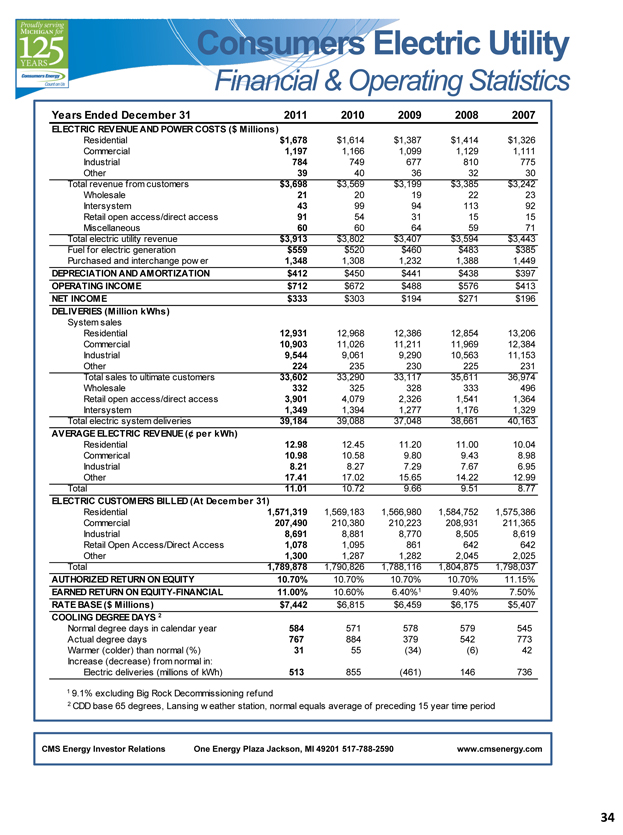

Financial & Operating Statistics

Years Ended December 31 2011 2010 2009 2008 2007

ELECTRIC REVENUE AND POWER COSTS ($ Millions)

Residential $1,678 $1,614 $1,387 $1,414 $1,326

Commercial 1,197 1,166 1,099 1,129 1,111

Industrial 784 749 677 810 775

Other 39 40 36 32 30

Total revenue from customers $3,698 $3,569 $3,199 $3,385 $3,242

Wholesale 21 20 19 22 23

Intersystem 43 99 94 113 92

Retail open access/direct access 91 54 31 15 15

Miscellaneous 60 60 64 59 71

Total electric utility revenue $3,913 $3,802 $3,407 $3,594 $3,443

Fuel for electric generation $559 $520 $460 $483 $385

Purchased and interchange pow er 1,348 1,308 1,232 1,388 1,449

DEPRECIATION AND AMORTIZATION $412 $450 $441 $438 $397

OPERATING INCOME $712 $672 $488 $576 $413

NET INCOME $333 $303 $194 $271 $196

DELIVERIES (Million kWhs)

System sales

Residential 12,931 12,968 12,386 12,854 13,206

Commercial 10,903 11,026 11,211 11,969 12,384

Industrial 9,544 9,061 9,290 10,563 11,153

Other 224 235 230 225 231

Total sales to ultimate customers 33,602 33,290 33,117 35,611 36,974

Wholesale 332 325 328 333 496

Retail open access/direct access 3,901 4,079 2,326 1,541 1,364

Intersystem 1,349 1,394 1,277 1,176 1,329

Total electric system deliveries 39,184 39,088 37,048 38,661 40,163

AVERAGE ELECTRIC REVENUE (¢ per kWh)

Residential 12.98 12.45 11.20 11.00 10.04

Commerical 10.98 10.58 9.80 9.43 8.98

Industrial 8.21 8.27 7.29 7.67 6.95

Other 17.41 17.02 15.65 14.22 12.99

Total 11.01 10.72 9.66 9.51 8.77

ELECTRIC CUSTOMERS BILLED (At December 31)

Residential 1,571,319 1,569,183 1,566,980 1,584,752 1,575,386

Commercial 207,490 210,380 210,223 208,931 211,365

Industrial 8,691 8,881 8,770 8,505 8,619

Retail Open Access/Direct Access 1,078 1,095 861 642 642

Other 1,300 1,287 1,282 2,045 2,025

Total 1,789,878 1,790,826 1,788,116 1,804,875 1,798,037

AUTHORIZED RETURN ON EQUITY 10.70% 10.70% 10.70% 10.70% 11.15%

EARNED RETURN ON EQUITY-FINANCIAL 11.00% 10.60% 6.40%1 9.40% 7.50%

RATE BASE ($ Millions) $7,442 $6,815 $6,459 $6,175 $5,407

COOLING DEGREE DAYS 2

Normal degree days in calendar year 584 571 578 579 545

Actual degree days 767 884 379 542 773

Warmer (colder) than normal (%) 31 55 (34) (6) 42

Increase (decrease) from normal in:

Electric deliveries (millions of kWh) 513 855 (461) 146 736

1 | 9.1% excluding Big Rock Decommissioning refund |

2 | CDD base 65 degrees, Lansing w eather station, normal equals average of preceding 15 year time period |

CMS Energy Investor Relations One Energy Plaza Jackson, MI 49201 517-788-2590 www.cmsenergy.com

34

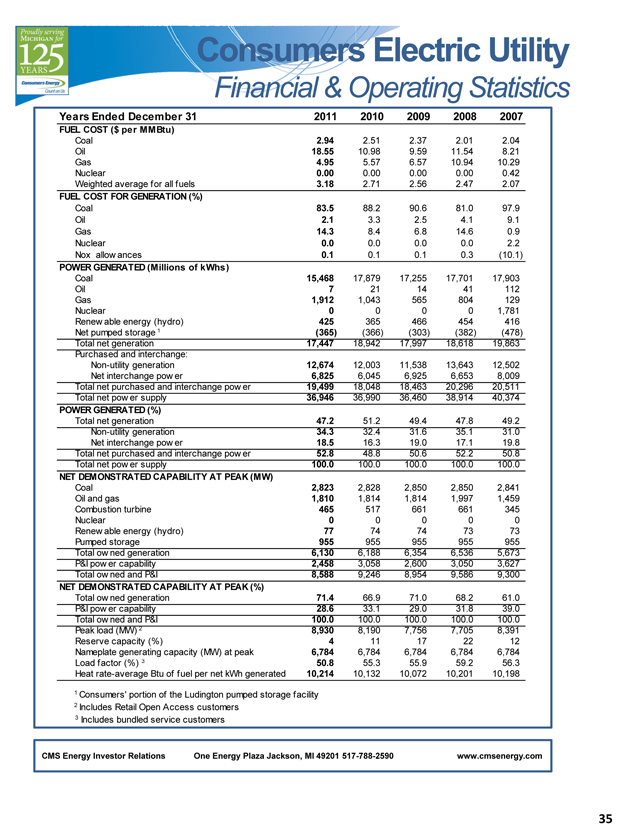

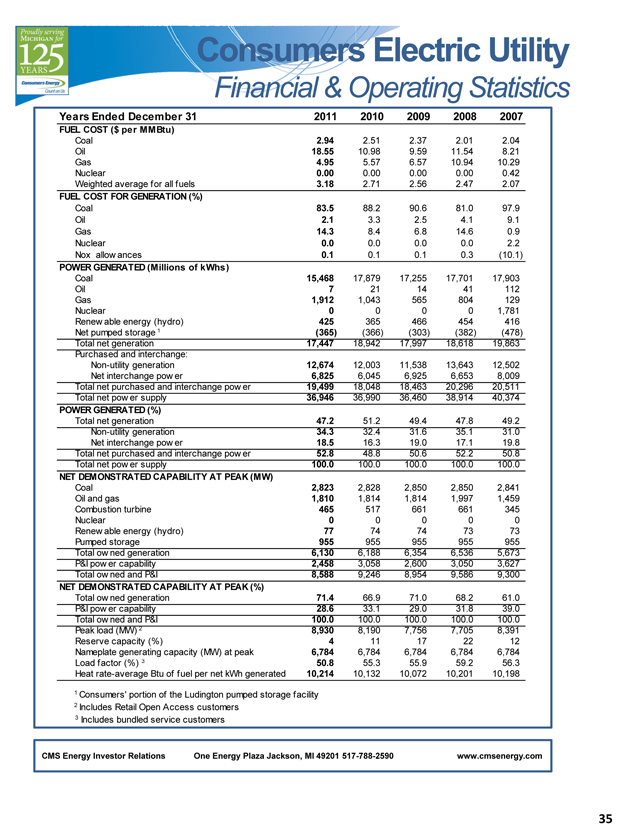

Financial & Operating Statistics

Years Ended December 31 2011 2010 2009 2008 2007

FUEL COST ($ per MMBtu)

Coal 2.94 2.51 2.37 2.01 2.04

Oil 18.55 10.98 9.59 11.54 8.21

Gas 4.95 5.57 6.57 10.94 10.29

Nuclear 0.00 0.00 0.00 0.00 0.42

Weighted average for all fuels 3.18 2.71 2.56 2.47 2.07

FUEL COST FOR GENERATION (%)

Coal 83.5 88.2 90.6 81.0 97.9

Oil 2.1 3.3 2.5 4.1 9.1

Gas 14.3 8.4 6.8 14.6 0.9

Nuclear 0.0 0.0 0.0 0.0 2.2

Nox allow ances 0.1 0.1 0.1 0.3 (10.1)

POWER GENERATED (Millions of kWhs)

Coal 15,468 17,879 17,255 17,701 17,903

Oil 7 21 14 41 112

Gas 1,912 1,043 565 804 129

Nuclear 0 0 0 0 1,781

Renew able energy (hydro) 425 365 466 454 416

Net pumped storage 1 (365) (366) (303) (382) (478)

Total net generation 17,447 18,942 17,997 18,618 19,863

Purchased and interchange:

Non-utility generation 12,674 12,003 11,538 13,643 12,502

Net interchange pow er 6,825 6,045 6,925 6,653 8,009

Total net purchased and interchange pow er 19,499 18,048 18,463 20,296 20,511

Total net pow er supply 36,946 36,990 36,460 38,914 40,374

POWER GENERATED (%)

Total net generation 47.2 51.2 49.4 47.8 49.2

Non-utility generation 34.3 32.4 31.6 35.1 31.0

Net interchange pow er 18.5 16.3 19.0 17.1 19.8

Total net purchased and interchange pow er 52.8 48.8 50.6 52.2 50.8

Total net pow er supply 100.0 100.0 100.0 100.0 100.0

NET DEMONSTRATED CAPABILITY AT PEAK (M W)

Coal 2,823 2,828 2,850 2,850 2,841

Oil and gas 1,810 1,814 1,814 1,997 1,459

Combustion turbine 465 517 661 661 345

Nuclear 0 0 0 0 0

Renew able energy (hydro) 77 74 74 73 73

Pumped storage 955 955 955 955 955

Total ow ned generation 6,130 6,188 6,354 6,536 5,673

P&I pow er capability 2,458 3,058 2,600 3,050 3,627

Total ow ned and P&I 8,588 9,246 8,954 9,586 9,300

NET DEMONSTRATED CAPABILITY AT PEAK (%)

Total ow ned generation 71.4 66.9 71.0 68.2 61.0

P&I pow er capability 28.6 33.1 29.0 31.8 39.0

Total ow ned and P&I 100.0 100.0 100.0 100.0 100.0

Peak load (MW) 2 8,930 8,190 7,756 7,705 8,391

Reserve capacity (%) 4 11 17 22 12

Nameplate generating capacity (MW) at peak 6,784 6,784 6,784 6,784 6,784

Load factor (%) 3 50.8 55.3 55.9 59.2 56.3

Heat rate-average Btu of fuel per net kWh generated 10,214 10,132 10,072 10,201 10,198

1 | Consumers’ portion of the Ludington pumped storage facility |

2 | Includes Retail Open Access customers |

3 | Includes bundled service customers |

CMS Energy Investor Relations One Energy Plaza Jackson, MI 49201 517-788-2590 www.cmsenergy.com

35

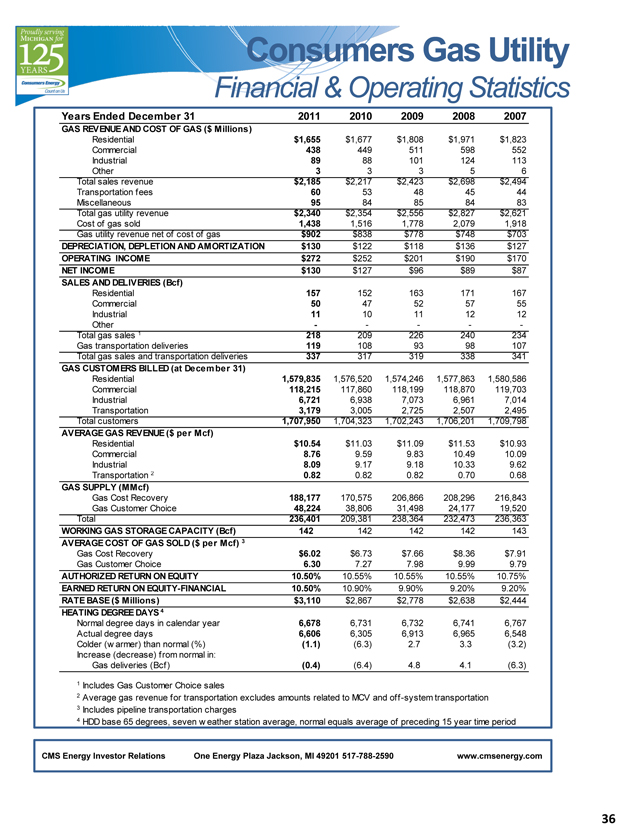

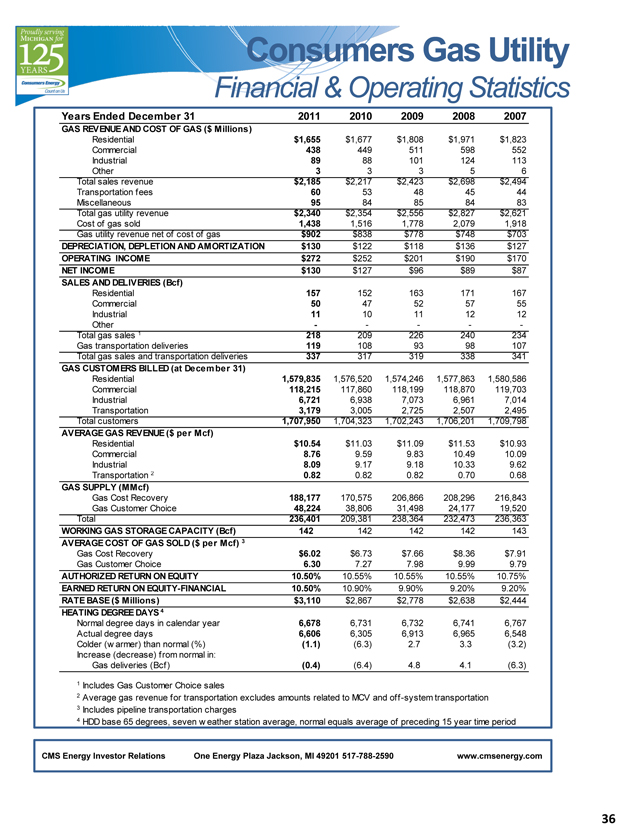

Financial & Operating Statistics

Years Ended December 31 2011 2010 2009 2008 2007

GAS REVENUE AND COST OF GAS ($ Millions)

Residential $1,655 $1,677 $1,808 $1,971 $1,823

Commercial 438 449 511 598 552

Industrial 89 88 101 124 113

Other 3 3 3 5 6

Total sales revenue $2,185 $2,217 $2,423 $2,698 $2,494

Transportation fees 60 53 48 45 44

Miscellaneous 95 84 85 84 83

Total gas utility revenue $2,340 $2,354 $2,556 $2,827 $2,621

Cost of gas sold 1,438 1,516 1,778 2,079 1,918

Gas utility revenue net of cost of gas $902 $838 $778 $748 $703

DEPRECIATION, DEPLETION AND AMORTIZATION $130 $122 $118 $136 $127

OPERATING INCOME $272 $252 $201 $190 $170

NET INCOME $130 $127 $96 $89 $87

SALES AND DELIVERIES (Bcf)

Residential 157 152 163 171 167

Commercial 50 47 52 57 55

Industrial 11 10 11 12 12

Other ———— -

Total gas sales 1 218 209 226 240 234

Gas transportation deliveries 119 108 93 98 107

Total gas sales and transportation deliveries 337 317 319 338 341

GAS CUSTOMERS BILLED (at December 31)

Residential 1,579,835 1,576,520 1,574,246 1,577,863 1,580,586

Commercial 118,215 117,860 118,199 118,870 119,703

Industrial 6,721 6,938 7,073 6,961 7,014

Transportation 3,179 3,005 2,725 2,507 2,495

Total customers 1,707,950 1,704,323 1,702,243 1,706,201 1,709,798

AVERAGE GAS REVENUE ($ per Mcf)

Residential $10.54 $11.03 $11.09 $11.53 $10.93

Commercial 8.76 9.59 9.83 10.49 10.09

Industrial 8.09 9.17 9.18 10.33 9.62

Transportation 2 0.82 0.82 0.82 0.70 0.68

GAS SUPPLY (MMcf)

Gas Cost Recovery 188,177 170,575 206,866 208,296 216,843

Gas Customer Choice 48,224 38,806 31,498 24,177 19,520

Total 236,401 209,381 238,364 232,473 236,363

WORKING GAS STORAGE CAPACITY (Bcf) 142 142 142 142 143

AVERAGE COST OF GAS SOLD ($ per Mcf) 3

Gas Cost Recovery $6.02 $6.73 $7.66 $8.36 $7.91

Gas Customer Choice 6.30 7.27 7.98 9.99 9.79

AUTHORIZED RETURN ON EQUITY 10.50% 10.55% 10.55% 10.55% 10.75%

EARNED RETURN ON EQUITY-FINANCIAL 10.50% 10.90% 9.90% 9.20% 9.20%

RATE BASE ($ Millions) $3,110 $2,867 $2,778 $2,638 $2,444

HEATING DEGREE DAYS 4

Normal degree days in calendar year 6,678 6,731 6,732 6,741 6,767

Actual degree days 6,606 6,305 6,913 6,965 6,548

Colder (w armer) than normal (%) (1.1) (6.3) 2.7 3.3 (3.2)

Increase (decrease) from normal in:

Gas deliveries (Bcf) (0.4) (6.4) 4.8 4.1 (6.3)

1 | Includes Gas Customer Choice sales |

2 | Average gas revenue for transportation excludes amounts related to MCV and off-system transportation |

3 | Includes pipeline transportation charges |

4 | HDD base 65 degrees, seven w eather station average, normal equals average of preceding 15 year time period |

CMS Energy Investor Relations One Energy Plaza Jackson, MI 49201 517-788-2590 www.cmsenergy.com

36

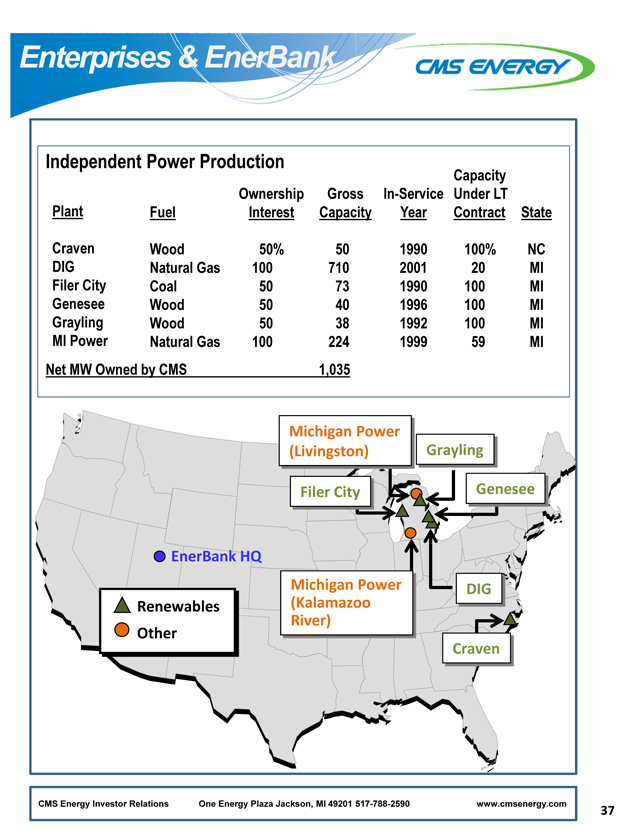

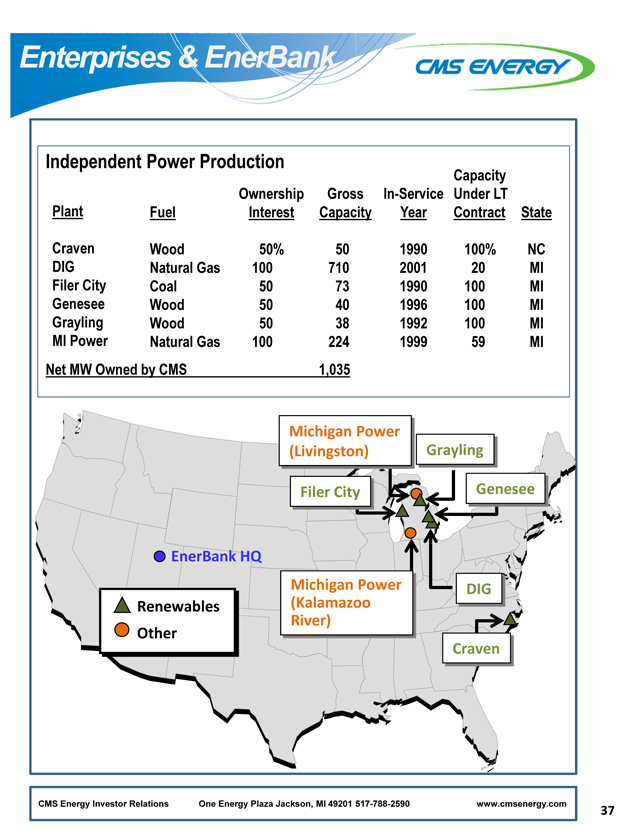

Independent Power Production

Capacity

Ownership Gross In-Service Under LT

Plant Fuel Interest Capacity Year Contract State

Craven Wood 50% 50 1990 100% NC

DIG Natural Gas 100 710 2001 20 MI

Filer City Coal 50 73 1990 100 MI

Genesee Wood 50 40 1996 100 MI

Grayling Wood 50 38 1992 100 MI

MI Power Natural Gas 100 224 1999 59 MI

Net MW Owned by CMS 1,035

Michigan Power (Livingston)

Grayling

Filer City

Genesee

EnerBank HQ

Renewables Other

Michigan Power (Kalamazoo River)

DIG

Craven

CMS Energy Investor Relations One Energy Plaza Jackson, MI 49201 517-788-2590 www.cmsenergy.com

37

GAAP RECONCILIATION

CMS ENERGY CORPORATION

Earnings Per Share By Year GAAP Reconciliation

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | 2003 | | | 2004 | | | 2005 | | | 2006 | | | 2007 | | | 2008 | | | 2009 | | | 2010 | | | 2011 | |

Reported earnings (loss) per share - GAAP | | ($ | 0.30 | ) | | $ | 0.64 | | | ($ | 0.44 | ) | | ($ | 0.41 | ) | | ($ | 1.02 | ) | | $ | 1.20 | | | $ | 0.91 | | | $ | 1.28 | | | $ | 1.58 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

After-tax items: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Electric and gas utility | | | 0.21 | | | | (0.39 | ) | | | — | | | | — | | | | (0.07 | ) | | | 0.05 | | | | 0.33 | | | | 0.03 | | | | 0.00 | |

Enterprises | | | 0.74 | | | | 0.62 | | | | 0.04 | | | | (0.02 | ) | | | 1.25 | | | | (0.02 | ) | | | 0.09 | | | | (0.03 | ) | | | (0.11 | ) |

Corporate interest and other | | | 0.16 | | | | (0.03 | ) | | | 0.04 | | | | 0.27 | | | | (0.32 | ) | | | (0.02 | ) | | | 0.01 | | | | * | | | | (0.01 | ) |

Discontinued operations (income) loss | | | (0.16 | ) | | | 0.02 | | | | (0.07 | ) | | | (0.03 | ) | | | 0.40 | | | | (*) | | | | (0.08 | ) | | | 0.08 | | | | (0.01 | ) |

Asset impairment charges, net | | | — | | | | — | | | | 1.82 | | | | 0.76 | | | | 0.60 | | | | — | | | | — | | | | — | | | | — | |

Cumulative accounting changes | | | 0.16 | | | | 0.01 | | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Adjusted earnings per share, including MTM - non-GAAP | | $ | 0.81 | | | $ | 0.87 | | | $ | 1.39 | | | $ | 0.57 | | | $ | 0.84 | | | $ | 1.21 | (a) | | $ | 1.26 | | | $ | 1.36 | | | $ | 1.45 | |

Mark-to-market impacts | | | | | | | 0.03 | | | | (0.43 | ) | | | 0.51 | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Adjusted earnings per share, excluding MTM - non-GAAP | | | NA | | | $ | 0.90 | | | $ | 0.96 | | | $ | 1.08 | | | | NA | | | | NA | | | | NA | | | | NA | | | | NA | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| * | Less than $500 thousand or $0.01 per share. |

| (a) | $1.25 excluding discontinued Exeter operations and accounting changes related to convertible debt and restricted stock. |

2003-11 EPS

CMS ENERGY CORPORATION

Earnings By Quarter and Year GAAP Reconciliation

(Unaudited)

| | | | | | | | | | | | | | | | | | | | |

(In millions, except per share amounts) | | 2011 | |

| | | 1Q | | | 2Q | | | 3Q | | | 4Q | | | YTD Dec | |

Reported net income - GAAP | | $ | 135 | | | $ | 100 | | | $ | 139 | | | $ | 41 | | | $ | 415 | |

| | | | | | | | | | | | | | | | | | | | |

After-tax items: | | | | | | | | | | | | | | | | | | | | |

Electric and gas utility | | | — | | | | — | | | | — | | | | — | | | | — | |

Enterprises | | | * | | | | (28 | ) | | | * | | | | 1 | | | | (27 | ) |

Corporate interest and other | | | — | | | | (4 | ) | | | — | | | | * | | | | (4 | ) |

Discontinued operations income | | | (2 | ) | | | * | | | | * | | | | * | | | | (2 | ) |

| | | | | | | | | | | | | | | | | | | | |

Adjusted income - non-GAAP | | $ | 133 | | | $ | 68 | | | $ | 139 | | | $ | 42 | | | $ | 382 | |

| | | | | | | | | | | | | | | | | | | | |

Average shares outstanding, basic | | | 250.0 | | | | 250.3 | | | | 251.3 | | | | 251.7 | | | | 250.8 | |

Average shares outstanding, diluted | | | 261.7 | | | | 261.9 | | | | 263.9 | | | | 265.5 | | | | 263.4 | |

| | | | | | | | | | | | | | | | | | | | |

Reported earnings per share - GAAP | | $ | 0.52 | | | $ | 0.38 | | | $ | 0.53 | | | $ | 0.15 | | | $ | 1.58 | |

| | | | | | | | | | | | | | | | | | | | |

After-tax items: | | | | | | | | | | | | | | | | | | | | |

Electric and gas utility | | | — | | | | — | | | | — | | | | — | | | | — | |

Enterprises | | | * | | | | (0.11 | ) | | | * | | | | * | | | | (0.11 | ) |

Corporate interest and other | | | — | | | | (0.01 | ) | | | — | | | | * | | | | (0.01 | ) |

Discontinued operations income | | | (0.01 | ) | | | * | | | | * | | | | * | | | | (0.01 | ) |

| | | | | | | | | | | | | | | | | | | | |

Adjusted earnings per share - non-GAAP | | $ | 0.51 | | | $ | 0.26 | | | $ | 0.53 | | | $ | 0.15 | | | $ | 1.45 | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | | | | |

(In millions, except per share amounts) | | 2012 | |

| | | 1Q | | | 2Q | |

Reported net income - GAAP | | $ | 67 | | | | $100 | |

| | | | | | | | |

After-tax items: | | | | | | | | |

Electric and gas utility | | | 36 | | | | 7 | |

Enterprises | | | 1 | | | | 1 | |

Corporate interest and other | | | — | | | | — | |

Discontinued operations income | | | (7 | ) | | | * | |

| | | | | | | | |

Adjusted income - non-GAAP | | $ | 97 | | | $ | 108 | |

| | | | | | | | |

Average shares outstanding, basic | | | 255.6 | | | | 261.2 | |

Average shares outstanding, diluted | | | 266.9 | | | | 268.2 | |

| | | | | | | | |

Reported earnings per share - GAAP | | $ | 0.25 | | | $ | 0.37 | |

| | | | | | | | |

After-tax items: | | | | | | | | |

Electric and gas utility | | | 0.14 | | | | 0.03 | |

Enterprises | | | 0.01 | | | | * | |

Corporate interest and other | | | — | | | | — | |

Discontinued operations income | | | (0.03 | ) | | | * | |

| | | | | | | | |

Adjusted earnings per share - non-GAAP | | $ | 0.37 | | | $ | 0.40 | |

| | | | | | | | |

Note: Year-to-date (YTD) EPS may not equal sum of quarters due to share count differences.

| * | Less than $500 thousand or $0.01 per share. |

2012 A-1

CMS Energy Corporation

Earnings Segment Results GAAP Reconciliation

(Unaudited)

| | | | | | | | | | | | | | | | |

| | | Three Months Ended | | | Six Months Ended | |

June 30 | | 2012 | | | 2011 | | | 2012 | | | 2011 | |

Electric Utility | | | | | | | | | | | | | | | | |

Reported | | $ | 0.41 | | | $ | 0.32 | | | $ | 0.49 | | | $ | 0.57 | |

Electric Decoupling Court Order | | | — | | | | — | | | | 0.14 | | | | — | |

Downsizing Program | | | 0.02 | | | | — | | | | 0.02 | | | | — | |

| | | | | | | | | | | | | | | | |

Adjusted | | $ | 0.43 | | | $ | 0.32 | | | $ | 0.65 | | | $ | 0.57 | |

| | | | | | | | | | | | | | | | |

Gas Utility | | | | | | | | | | | | | | | | |

Reported | | $ | 0.03 | | | $ | 0.02 | | | $ | 0.24 | | | $ | 0.36 | |

Downsizing Program | | | 0.01 | | | | — | | | | 0.01 | | | | — | |

| | | | | | | | | | | | | | | | |

Adjusted | | $ | 0.04 | | | $ | 0.02 | | | $ | 0.25 | | | $ | 0.36 | |

| | | | | | | | | | | | | | | | |

Enterprises | | | | | | | | | | | | | | | | |

Reported | | $ | — | | | $ | 0.11 | | | $ | 0.01 | | | $ | 0.12 | |

Downsizing Program | | | * | | | | — | | | | * | | | | — | |

Restructuring Costs | | | * | | | | — | | | | 0.01 | | | | — | |

Tax Changes | | | — | | | | (0.11 | ) | | | — | | | | (0.11 | ) |

Asset Sales Gains and Other | | | — | | | | * | | | | — | | | | * | |

| | | | | | | | | | | | | | | | |

Adjusted | | $ | — | | | $ | * | | | $ | 0.02 | | | $ | 0.01 | |

| | | | | | | | | | | | | | | | |

Corporate Interest and Other | | | | | | | | | | | | | | | | |

Reported | | $ | (0.07 | ) | | $ | (0.07 | ) | | $ | (0.15 | ) | | $ | (0.16 | ) |

Tax Changes | | | — | | | | (0.01 | ) | | | — | | | | (0.01 | ) |

| | | | | | | | | | | | | | | | |

Adjusted | | $ | (0.07 | ) | | $ | (0.08 | ) | | $ | (0.15 | ) | | $ | (0.17 | ) |

| | | | | | | | | | | | | | | | |

Discontinued Operations | | | | | | | | | | | | | | | | |

Reported | | $ | * | | | $ | * | | | $ | 0.03 | | | $ | 0.01 | |

Discontinued Operations Income | | | * | | | | * | | | | (0.03 | ) | | | (0.01 | ) |

| | | | | | | | | | | | | | | | |

Adjusted | | $ | — | | | $ | — | | | $ | — | | | $ | — | |

| | | | | | | | | | | | | | | | |

Totals | | | | | | | | | | | | | | | | |

Reported | | $ | 0.37 | | | $ | 0.38 | | | $ | 0.62 | | | $ | 0.90 | |

Discontinued Operations Income | | | * | | | | * | | | | (0.03 | ) | | | (0.01 | ) |

Electric Decoupling Court Order | | | — | | | | — | | | | 0.14 | | | | — | |

Downsizing Program | | | 0.03 | | | | — | | | | 0.03 | | | | — | |

Restructuring Costs | | | * | | | | — | | | | 0.01 | | | | — | |

Tax Changes | | | — | | | | (0.12 | ) | | | — | | | | (0.12 | ) |

Asset Sales Gains and Other | | | — | | | | * | | | | — | | | | * | |

| | | | | | | | | | | | | | | | |

Adjusted | | $ | 0.40 | | | $ | 0.26 | | | $ | 0.77 | | | $ | 0.77 | |

| | | | | | | | | | | | | | | | |

Average Common Shares Outstanding - Diluted (in millions) | | | 268.2 | | | | 261.9 | | | | 267.7 | | | | 261.5 | |

| | | | | | | | | | | | | | | | |

| * | Less than $0.01 per share. |

2012 A-2

Consumers Energy

2012 Forecasted Cash Flow GAAP Reconciliation (in millions) (unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | Reclassifications From Sources and Uses to Statement of Cash Flows | | | |

Presentation Sources and Uses | | | Tax

Sharing

Operating | | | Interest

Payments

as Operating | | | Premium on Early

Debt Retirement

As Operating | | | Other Working

Capital

as Investing | | | Capital

Lease Pymts

as Financing | | | Securitization

Debt Pymts

as Financing | | | Preferred

Dividends

as Financing | | | Common

Dividends

as Financing | | | Consolidated Statements of Cash Flows |

Description | | non-GAAP

Amount | | | | | | | | | | | GAAP

Amount | | | Description |

Cash at year end 2011 | | $ | 85 | | | $ | — | | | $ | — | | | $ | — | | | $ | — | | | $ | — | | | $ | — | | | $ | — | | | $ | — | | | $ | 85 | | | Cash at year end 2011 |

Sources | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Operating (dep & amort $595) | | $ | 1,640 | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Other working capital | | | (55 | ) | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | Net cash provided by

operating activities |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Sources | | $ | 1,585 | | | $ | (45 | ) | | $ | (223 | ) | | $ | (15 | ) | | $ | 9 | | | $ | 30 | | | $ | 39 | | | $ | — | | | $ | — | | | $ | 1,380 | | | |

Uses | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Interest and preferred dividends | | $ | (225 | ) | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Capital expenditures a | | | | | | | (1,425 | ) | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Dividends/tax sharing to CMS | | | | | | | (445 | ) | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | Net cash provided by

investing activities |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Uses | | $ | (2,095 | ) | | $ | 45 | | | $ | 223 | | | $ | — | | | $ | (9 | ) | | $ | — | | | $ | — | | | $ | 2 | | | $ | 400 | | | $ | (1,434 | ) | | Cash flow from

operating and

investing activities |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Cash flow | | $ | (510 | ) | | $ | — | | | $ | — | | | $ | (15 | ) | | $ | — | | | $ | 30 | | | $ | 39 | | | $ | 2 | | | $ | 400 | | | $ | (54 | ) | | |

Financing | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Equity | | $ | 150 | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

New Issues | | | 1,075 | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Retirements | | | (1,025 | ) | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Net short-term financing & other | | | 250 | | | | | | | | | | | | 15 | | | | | | | | | | | | | | | | | | | | | | | | | | | Net cash provided by

financing activities |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Financing | | $ | 450 | | | $ | — | | | $ | — | | | $ | 15 | | | $ | — | | | $ | (30 | ) | | $ | (39 | ) | | $ | (2 | ) | | $ | (400 | ) | | $ | (6 | ) | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Net change in cash | | $ | (60 | ) | | $ | — | | | $ | — | | | $ | — | | | $ | — | | | $ | — | | | $ | — | | | $ | — | | | $ | — | | | $ | (60 | ) | | Net change in cash |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Cash at year end 2012 | | $ | 25 | | | $ | — | | | $ | — | | | $ | — | | | $ | — | | | $ | — | | | $ | — | | | $ | — | | | $ | — | | | $ | 25 | | | Cash at year end 2012 |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| a | Includes cost of removal and capital leases |

2012 B-1

CMS Energy Parent

2012 Forecasted Cash Flow GAAP Reconciliation (in millions) (unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | Reclassifications From Sources and Uses to Statement of Cash Flows | | | |

Presentation Sources and Uses | | | Interest

Payments

as Operating | | | Overheads &

Tax Payments

as Operating | | | Other

Uses (a)

as Operating | | | Financing

as Operating | | | Cash From

Consolidated

Companies | | | Consolidated Statements of Cash Flows |

Description | | non-GAAP

Amount | | | | | | | | GAAP

Amount | | | Description |

Cash at year end 2011 | | $ | 56 | | | $ | — | | | $ | — | | | $ | — | | | $ | — | | | $ | 20 | | | $ | 76 | | | Cash at year end 2011 |

Sources | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Consumers Energy dividends/tax sharing | | $ | 445 | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Enterprises | | | 15 | | | | | | | | | | | | | | | | | | | | | | | | | | | Net cash provided by

operating activities |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Sources | | $ | 460 | | | $ | (125 | ) | | $ | (15 | ) | | $ | (41 | ) | | $ | (35 | ) | | $ | 8 | | | $ | 252 | | | |

Uses | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Interest and preferred dividends | | $ | (125 | ) | | | | | | | | | | | | | | | | | | | | | | | | | | |

Overhead and Federal tax payments | | | (15 | ) | | | | | | | | | | | | | | | | | | | | | | | | | | |

Equity infusions | | | (150 | ) | | | | | | | | | | | | | | | | | | | | | | | | | | Net cash provided by

investing activities |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Uses (a) | | $ | (340 | ) | | $ | 125 | | | $ | 15 | | | $ | 41 | | | $ | — | | | $ | (141 | ) | | $ | (300 | ) | | Cash flow from

operating and

investing activities |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Cash flow | | $ | 120 | | | $ | — | | | $ | — | | | $ | — | | | $ | (35 | ) | | $ | (133 | ) | | $ | (48 | ) | | |

Financing and dividends | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

New Issues (complete) | | $ | 480 | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Retirements | | | (404 | ) | | | | | | | | | | | | | | | | | | | | | | | | | | |

Equity programs (DRP, continuous equity) | | | 30 | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Net short-term financing & other | | | (2 | ) | | | | | | | | | | | | | | | | | | | | | | | | | | |

Common dividend | | | (250 | ) | | | | | | | | | | | | | | | | | | | | | | | | | | Net cash provided by

financing activities |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Financing | | $ | (146 | ) | | $ | — | | | $ | — | | | $ | — | | | $ | 35 | | | $ | 155 | | | $ | 44 | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Net change in cash | | $ | (26 | ) | | $ | — | | | $ | — | | | $ | — | | | $ | — | | | $ | 22 | | | $ | (4 | ) | | Net change in cash |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Cash at year end 2012 | | $ | 30 | | | $ | — | | | $ | — | | | $ | — | | | $ | — | | | $ | 42 | | | $ | 72 | | | Cash at year end 2012 |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| (a) | Includes other and roundings |

2012-B-2

Consolidated CMS Energy

2012 Forecasted Consolidation of Consumers Energy and CMS Energy Parent Statements of Cash Flow (in millions) (unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | |

Statements of Cash Flows | | | Eliminations/Reclassifications to Arrive at the

Consolidated Statement of Cash Flows | | | Consolidated Statements of Cash Flows |

| | Consumers

Common Dividend

as Financing | | | Consumers

Preferred Dividend

as Operating | | | Equity

Infusions to

Consumers | | |

Description | | Consumers

Amount | | | CMS Parent

Amount | | | | | |

| | | | | | | Amount | | | Description |

Cash at year end 2011 | | $ | 85 | | | $ | 76 | | | $ | — | | | $ | — | | | $ | — | | | $ | 161 | | | Cash at year end 2011 |

Net cash provided by operating activities | | $ | 1,380 | | | $ | 252 | | | $ | (400 | ) | | $ | (2 | ) | | $ | — | | | $ | 1,230 | | | Net cash provided by

operating activities |

Net cash provided by investing activities | | | (1,434 | ) | | | (300 | ) | | | — | | | | — | | | | 150 | | | | (1,584 | ) | | Net cash provided by

investing activities |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

Cash flow from operating and investing activities | | $ | (54 | ) | | $ | (48 | ) | | $ | (400 | ) | | $ | (2 | ) | | $ | 150 | | | $ | (354 | ) | | Cash flow from

operating and

investing activities |

Net cash provided by financing activities | | $ | (6 | ) | | $ | 44 | | | $ | 400 | | | $ | 2 | | | $ | (150 | ) | | $ | 290 | | | Net cash provided by

financing activities |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

Net change in cash | | $ | (60 | ) | | $ | (4 | ) | | $ | — | | | $ | — | | | $ | — | | | $ | (64 | ) | | Net change in cash |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

Cash at year end 2012 | | $ | 25 | | | $ | 72 | | | $ | — | | | $ | — | | | $ | — | | | $ | 97 | | | Cash at year end 2012 |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

2012 B-3

CMS Energy

2012 Reconciliation of Gross Operating Cash Flow to GAAP Operating Activities

(unaudited)

(mils)

| | | | |

| | | 2012 | |

Consumers Operating Income + Depreciation & Amortization | | $ | 1,640 | (a) |

Enterprises Project Cash Flows | | | 15 | |

| | | | |

Gross Operating Cash Flow | | $ | 1,655 | |

Other operating activities including taxes, interest payments and working capital | | | (425 | ) |

| | | | |

Net cash provided by operating activities | | $ | 1,230 | |

| | | | |

| (a) | Excludes impact of $59 million electric decoupling write off |

2012 B-4