Exhibit 99.1

Exhibit 99.1

European Investor Meetings

October 2012

Foote Hydro 1918

Zeeland 2007

Lake Winds 2012

This presentation is made as of the date hereof and contains “forward-looking statements” as defined in Rule 3b-6 of the Securities Exchange Act of 1934, as amended, Rule 175 of the Securities Act of 1933, as amended, and relevant legal decisions. The forward-looking statements are subject to risks and uncertainties. They should be read in conjunction with “FORWARD-LOOKING STATEMENTS AND INFORMATION” and “RISK FACTORS” sections of CMS Energy’s and Consumers Energy’s Form 10-K for the year ended December 31 and as updated in subsequent

10-Qs. CMS Energy’s and Consumers Energy’s “FORWARD-LOOKING STATEMENTS AND INFORMATION” and “RISK

FACTORS” sections are incorporated herein by reference and discuss important factors that could cause CMS Energy’s and Consumers Energy’s results to differ materially from those anticipated in such statements. CMS Energy and Consumers Energy undertake no obligation to update any of the information presented herein to reflect facts, events or circumstances after the date hereof.

The presentation also includes non-GAAP measures when describing CMS Energy’s results of operations and financial performance. A reconciliation of each of these measures to the most directly comparable GAAP measure is included in the appendix and posted on our website at www.cmsenergy.com.

CMS Energy provides financial results on both a reported (Generally Accepted Accounting Principles) and adjusted (non-GAAP) basis. Management views adjusted earnings as a key measure of the company’s present operating financial performance, unaffected by discontinued operations, asset sales, impairments, regulatory items from prior years, or other items. Certain of these items have the potential to impact, favorably or unfavorably, the company’s reported earnings in 2012. The company is not able to estimate the impact of these matters and is not providing reported earnings guidance.

2

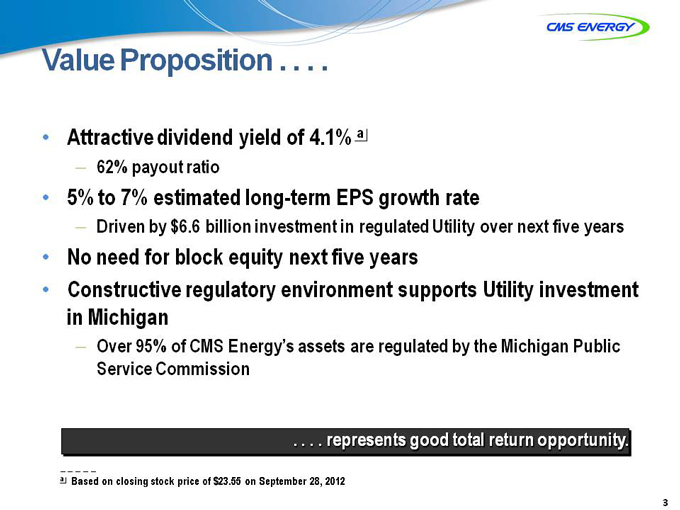

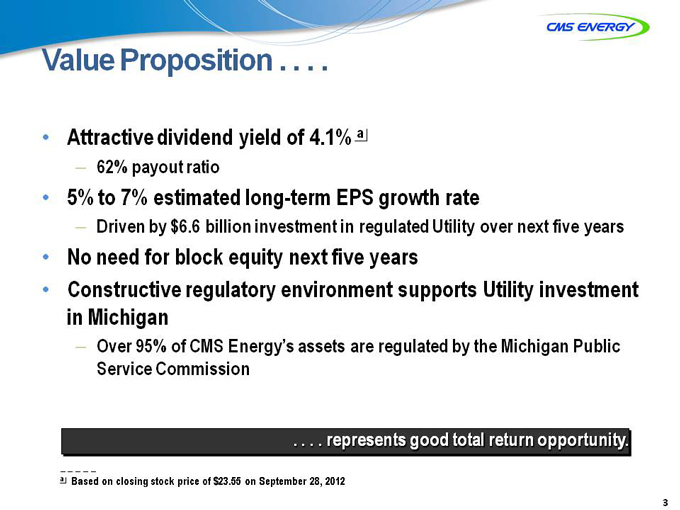

Value Proposition . . . .

Attractive dividend yield of 4.1% a

– 62% payout ratio

5% to 7% estimated long-term EPS growth rate

– Driven by $6.6 billion investment in regulated Utility over next five years

No need for block equity next five years

Constructive regulatory environment supports Utility investment in Michigan

– Over 95% of CMS Energy’s assets are regulated by the Michigan Public Service Commission

. . . . represents good total return opportunity.

a Based on closing stock price of $23.55 on September 28, 2012

3

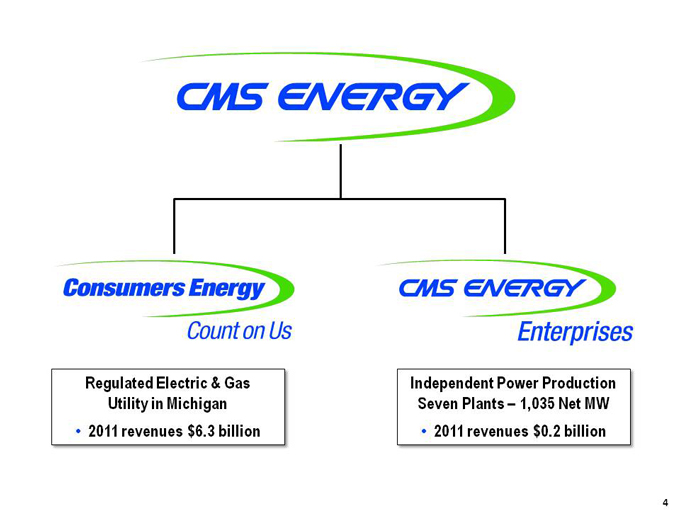

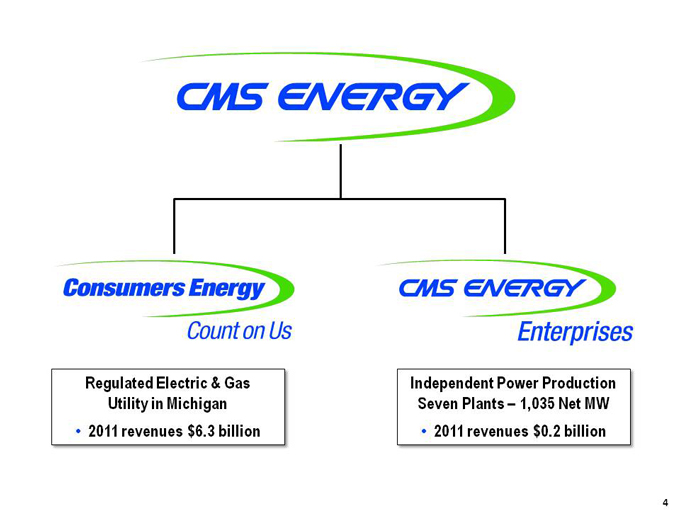

Regulated Electric & Gas Utility in Michigan

• 2011 revenues $6.3 billion

Independent Power Production Seven Plants – 1,035 Net MW

• 2011 revenues $0.2 billion

4

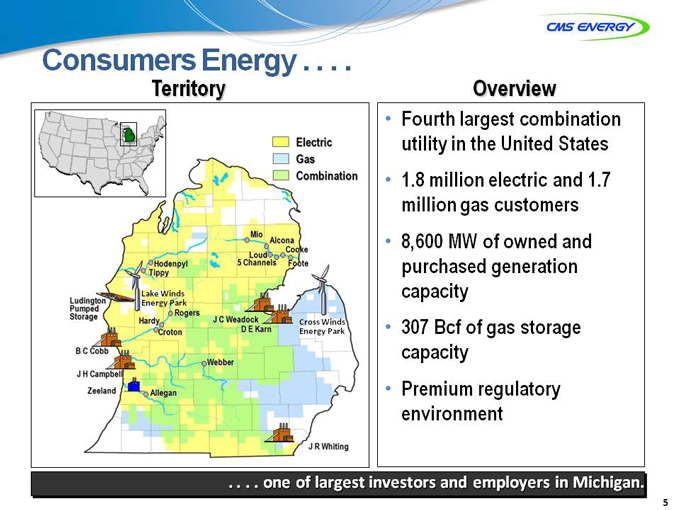

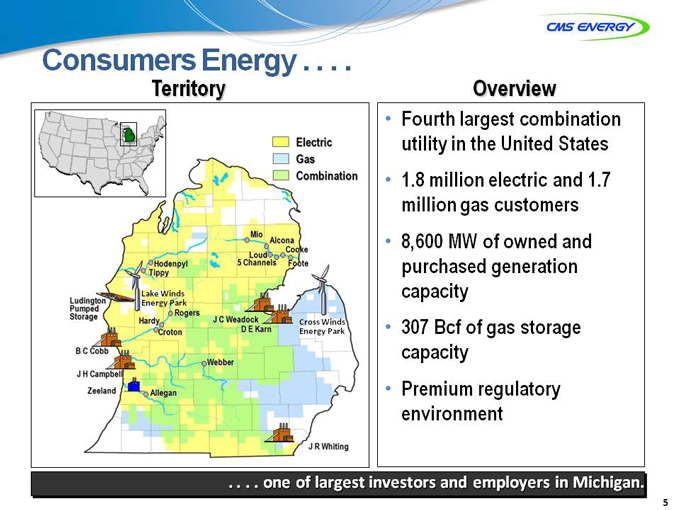

Consumers Energy . . . .

Territory

Overview

Fourth largest combination utility in the United States 1.8 million electric and 1.7 million gas customers 8,600 MW of owned and purchased generation capacity 307 Bcf of gas storage capacity Premium regulatory environment

. . . . one of largest investors and employers in Michigan.

5

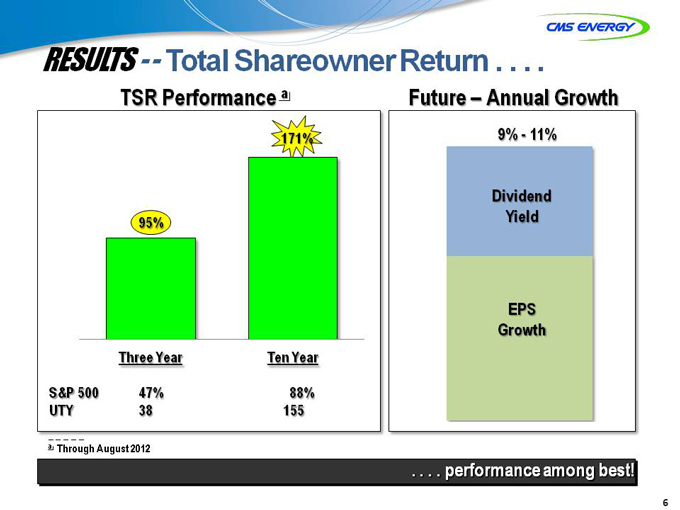

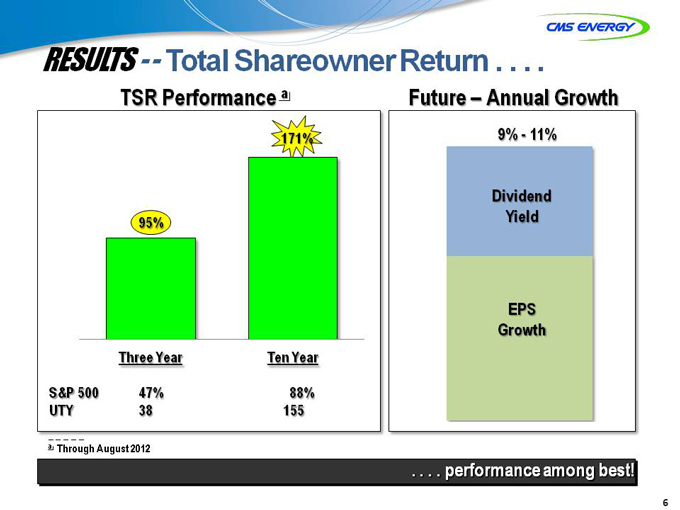

RESULTS —Total Shareowner Return . . . .

TSR Performance a

Three Year Ten Year

S&P 500 47% 88%

UTY 38 155

Future – Annual nnual Growth

9%—11%

Dividend Yield

EPS Growth

. . . . performanceerformance among best!

6

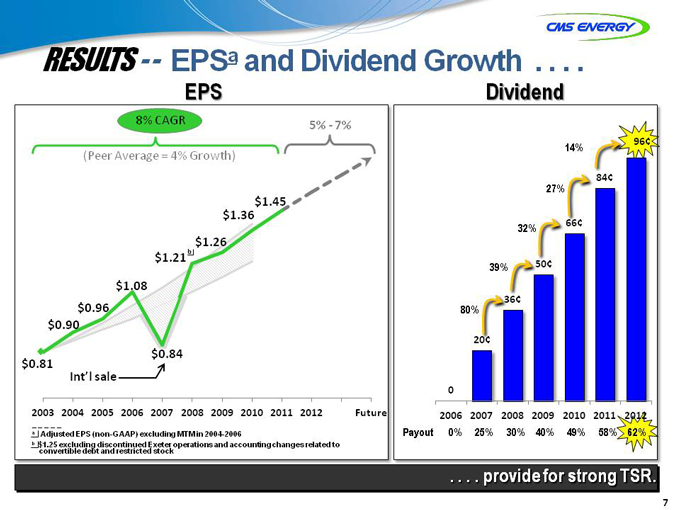

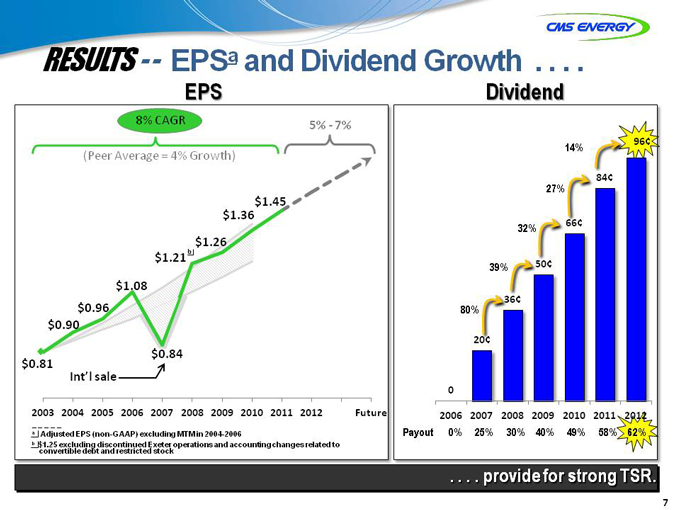

RESULTS — EPSa and Dividend Growth . . . .

EPS

Dividend

8% CAGR

5%—7%

(Peer Average = 4% Growth)

$0.81

$0.90

$0.96

$1.08

b

$1.21

$1.26

$1.36

$1.45

Int’l sale

$0.84

2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 Future

a Adjusted EPS (non-GAAP) excluding MTM in 2004-2006 b $1.25 excluding discontinued Exeter operations and accounting changes related to convertible debt and restricted stock

0

20¢

36¢

50¢

66¢

84¢

96¢

80%

39%

32%

27%

14%

2006 2007 2008 2009 2010 2011 2012

Payout 0% 25% 30% 40% 49% 58% 62%

. . . . providerovide for strong TSR.

7

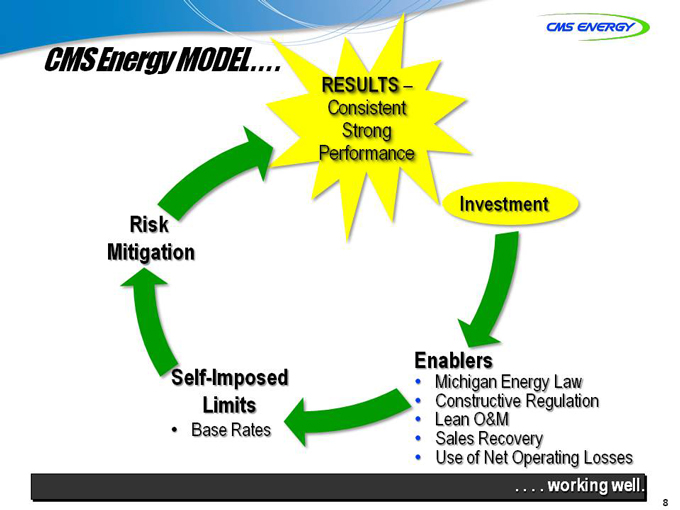

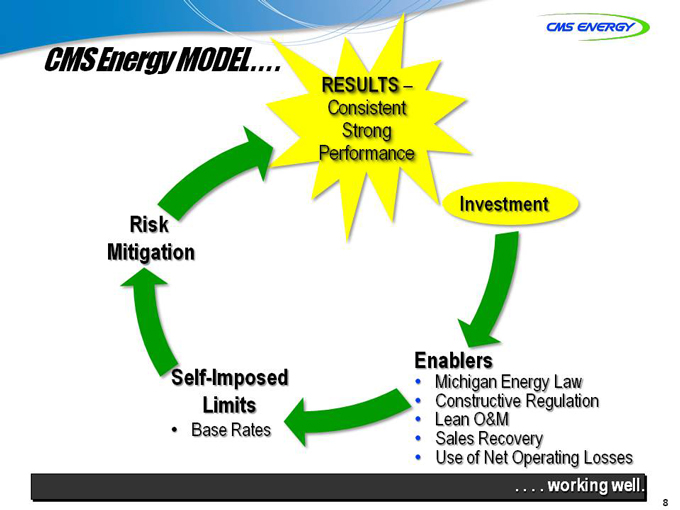

CMS Energy MODEL . .

RESULTS –

Consistent Strong Performance

Risk Mitigation

Investment

Self-Imposed Limits

• Base Rates

Enablers

• Michigan Energy Law

• Constructive Regulation

• Lean O&M

• Sales Recovery

• Use of Net Operating perating Losses s

. . . . workingorking well.

8

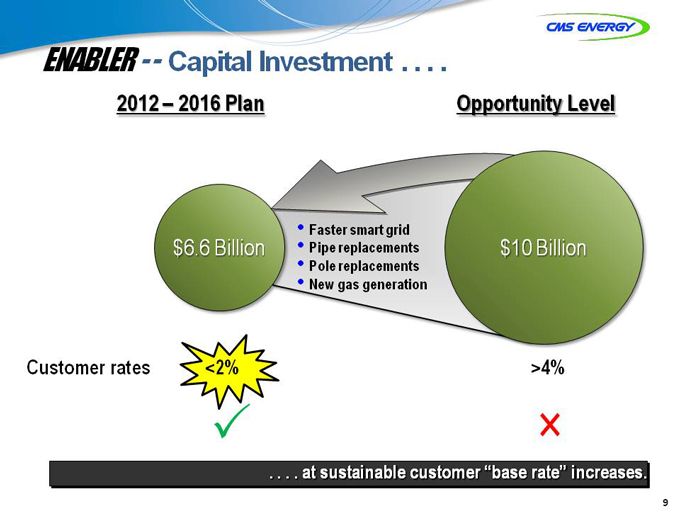

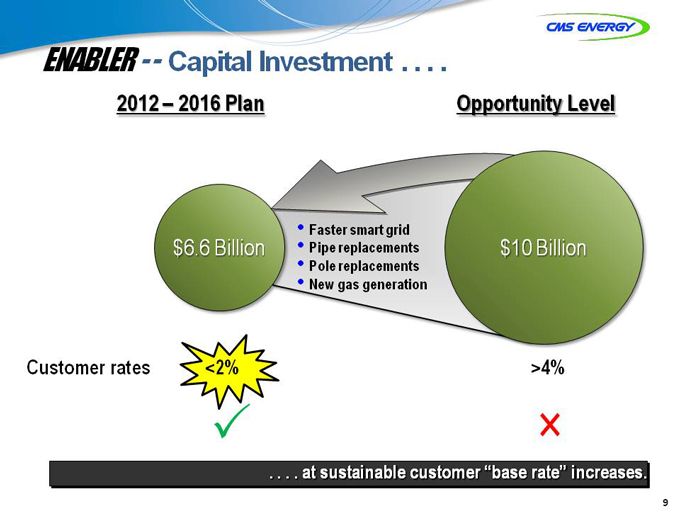

ENABLER — Capital Investment . . . .

2012 – 2016 Plan

Opportunity Level

$6.6 Billion

• Faster smart grid

• Pipe replacements

• Pole replacements

• New gas generation

Customer rates

<2%

$10 Billion

>4%

. . . . att sustainable customer “base rate” increases.

9

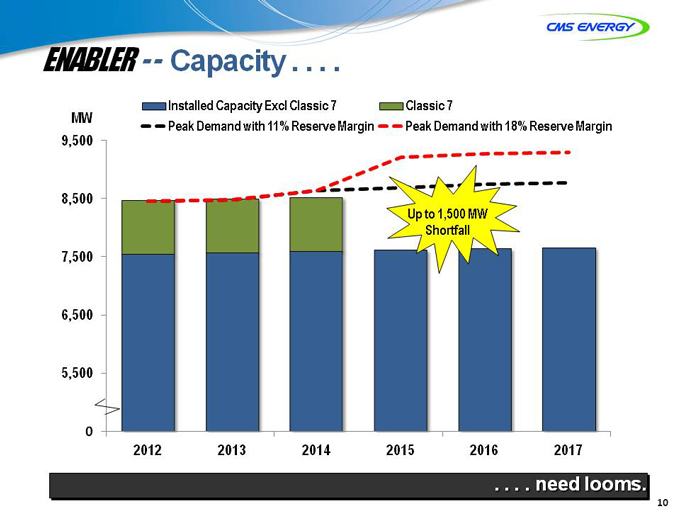

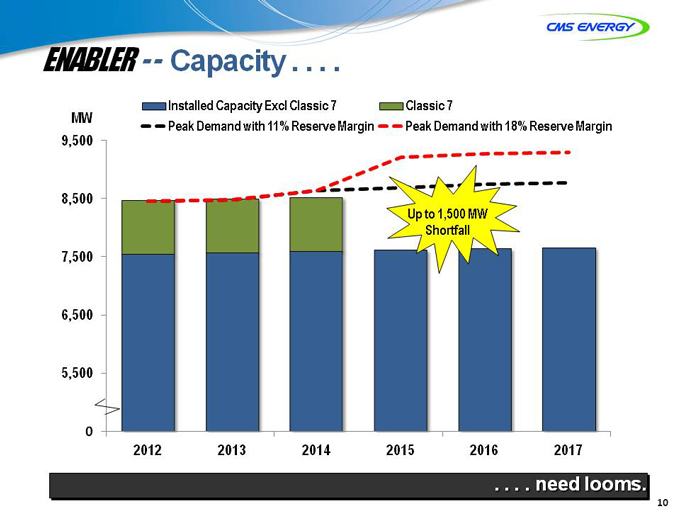

ENABLER — Capacity . . . .

Installed Capacity Excl Classic 7 Peak Demand with 11% Reserve Margin

Classic 7

Peak Demand with 18% Reserve Margin

MW 9,500

8,500 7,500 6,500 5,500

0

Up to 1,500 MW Shortfall

2012 2013 2014 2015 2016 2017

. . . . need looms.

10

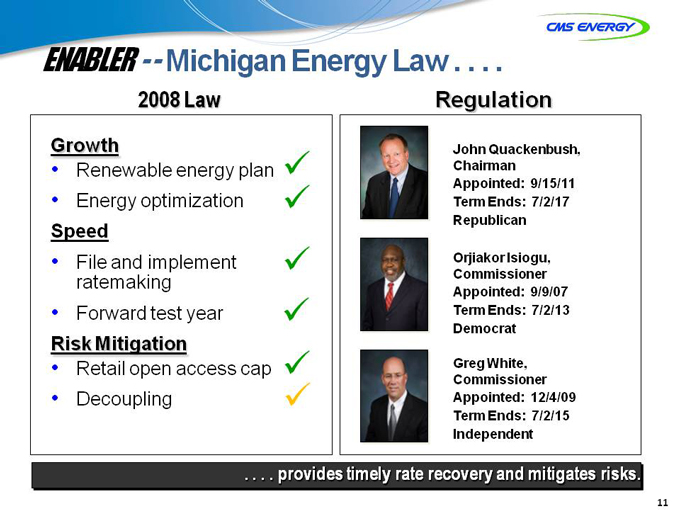

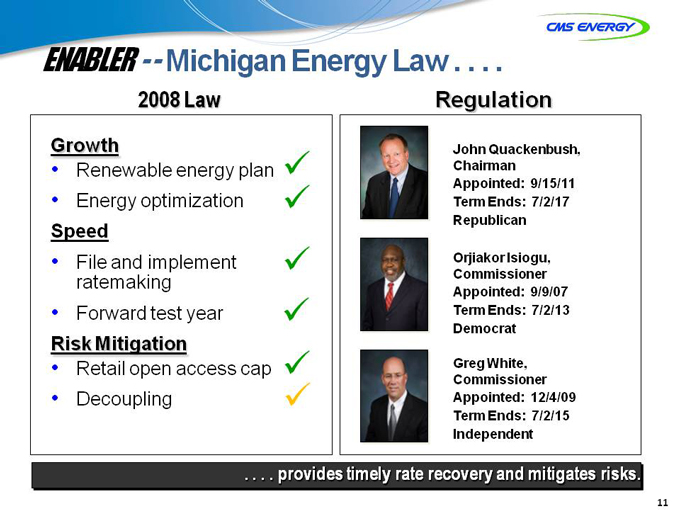

ENABLER —Michigan Energy Law . . . .

2008 Law

Growth

• Renewable energy plan

• Energy optimization

Speed

• File and implement ratemaking

• Forward test year

Risk Mitigation

• Retail open access cap

• Decoupling

Regulation

John Quackenbush, Chairman Appointed: 9/15/11 Term Ends: 7/2/17 Republican

Orjiakor Isiogu, Commissioner Appointed: 9/9/07 Term Ends: 7/2/13 Democrat

Greg White, Commissioner Appointed: 12/4/09 Term Ends: 7/2/15 Independent

. . . . providesrovides timely rate recovery and mitigates risks.

11

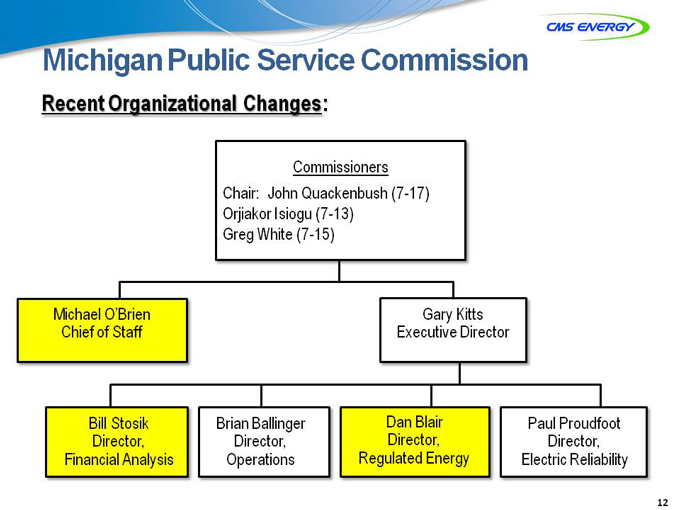

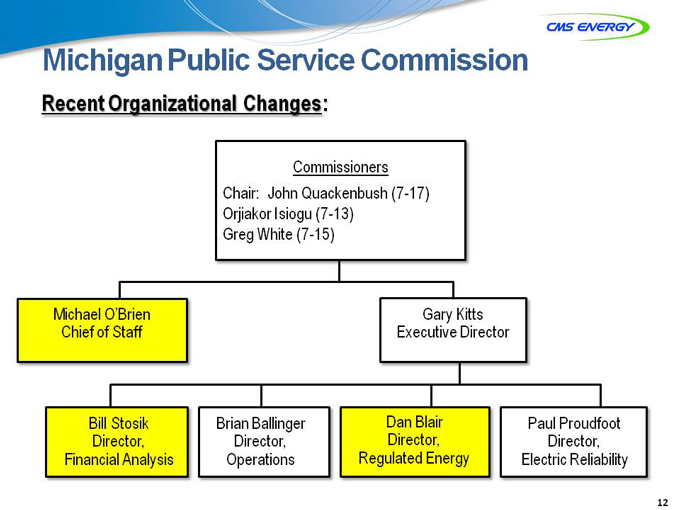

Michigan Public Service Commission

Recent Organizational Changes:

Commissioners Chair: John Quackenbush (7-17) Orjiakor Isiogu (7-13) Greg White (7-15)

Michael O’Brien Chief of Staff

Gary Kitts Executive Director

Bill Stosik Director, Financial Analysis

Brian Ballinger Director, Operations

Dan Blair Director, Regulated Energy

Paul Proudfoot Director, Electric Reliability

12

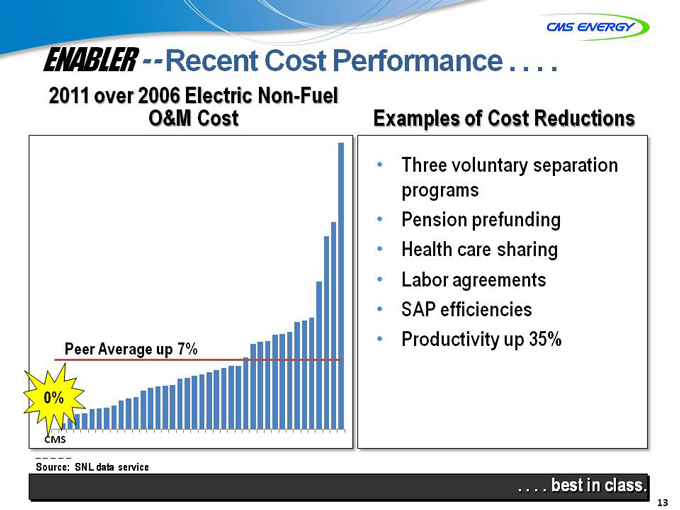

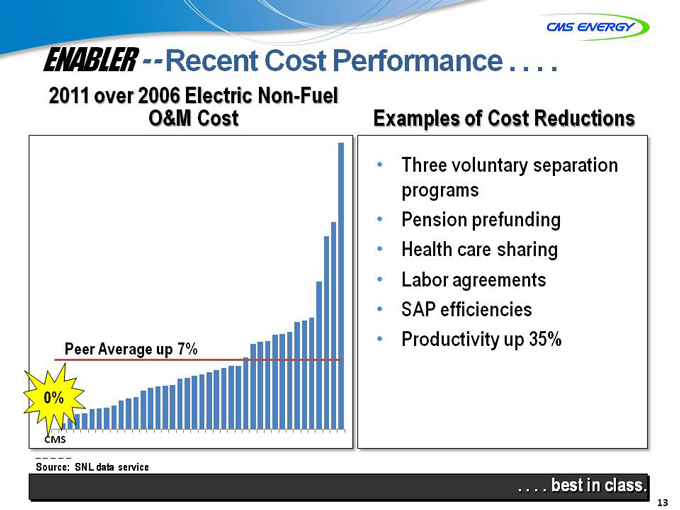

ENABLER —Recent Cost Performance . . . .

2011 over 2006 Electric Non-Fuel O&M Cost

Examples of Cost Reductions

Peer Average up 7%

0%

Source: SNL data service

Three voluntary separation programs Pension prefunding Health care sharing Labor agreements SAP efficiencies Productivity up 35%

. . . . bestest in class.

13

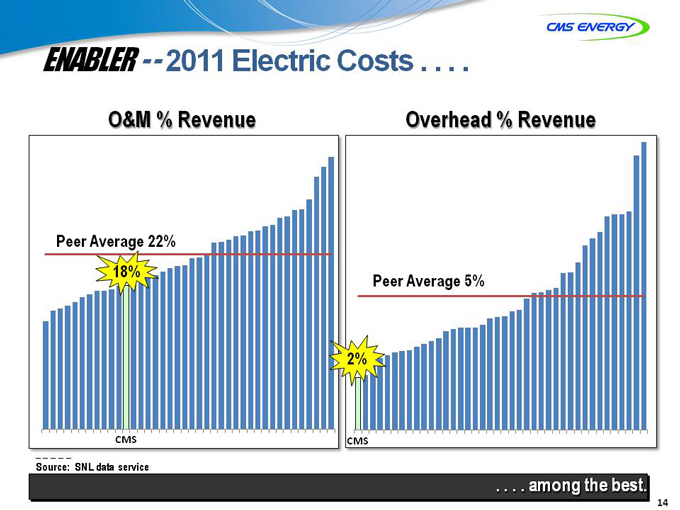

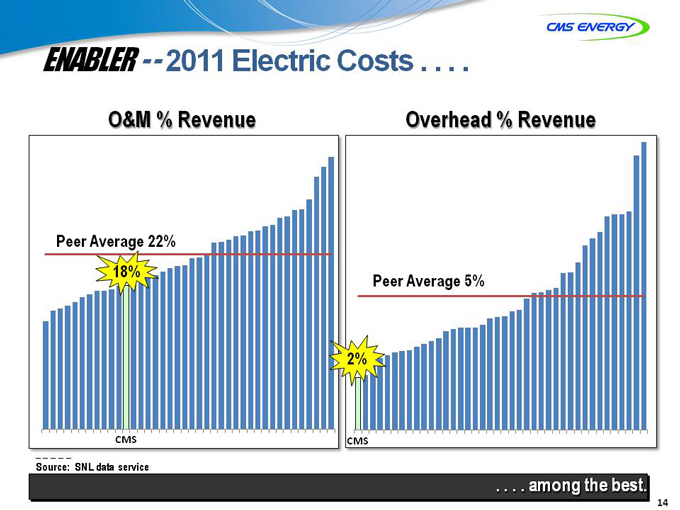

ENABLER —2011 Electric Costs . . . .

O&M % Revenue

Overhead % Revenue

Peer Average 22%

18%

CMS

Source: SNL data service

Peer Average 5%

2%

CMS

. . . . amongmong the best.

14

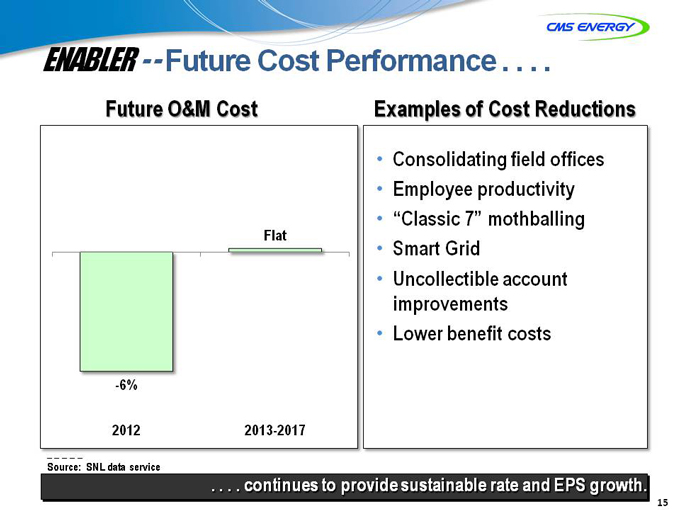

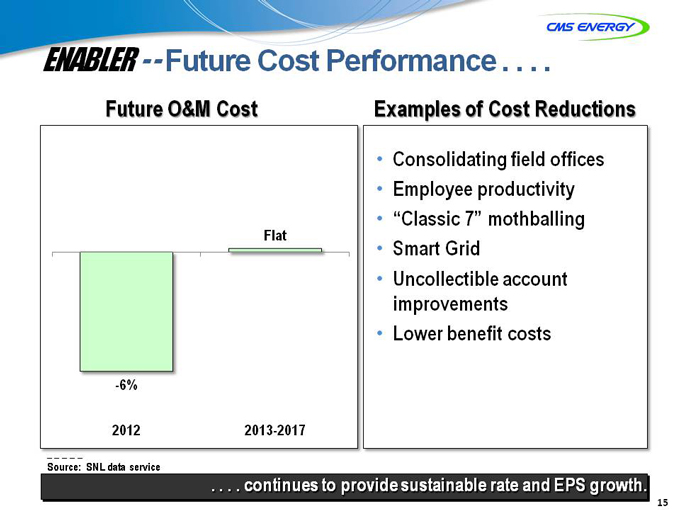

ENABLER —Future Cost Performance . . . .

Future O&M Cost

Flat

-6%

2012

2013-2017

Source: SNL data service

Examples of Cost Reductions

Consolidating field offices Employee productivity “Classic 7” mothballing Smart Grid Uncollectible account improvements Lower benefit costs

. . . . continuesontinues to provide sustainable rate and EPS growth.

15

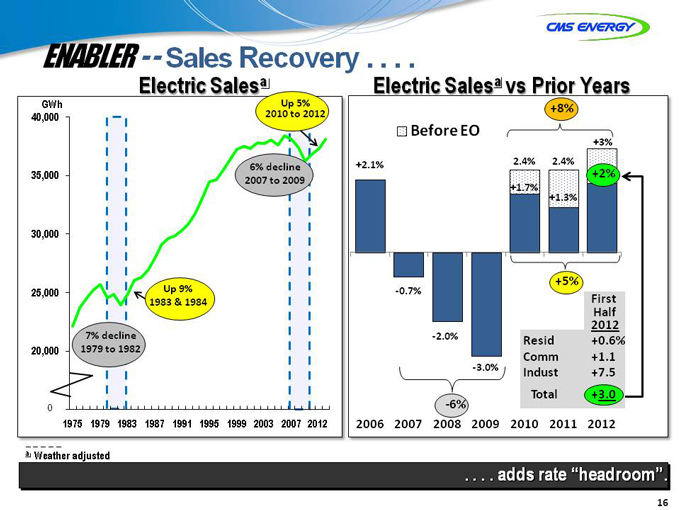

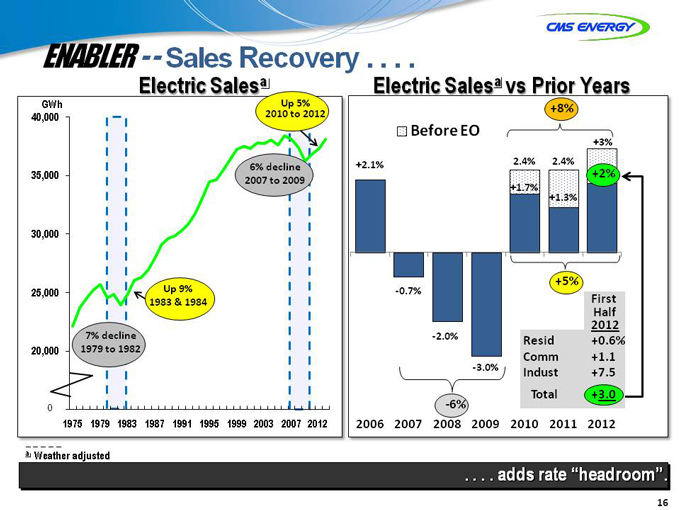

ENABLER —Sales Recovery . . . .

Electric Salesa

GWh 40,000

35,000 30,000 25,000 20,000

0

Up 5% 2010 to 2012

6% decline 2007 to 2009

Up 9% 1983 & 1984

7% decline 1979 to 1982

1975 1979 1983 1987 1991 1995 1999 2003 2007 2012

Electric Salesa vs Prior Years

Before EO

+8%

+2.1%

2.4%

2.4%

+3%

+1.7%

+1.3%

+2%

-0.7%

-2.0%

-3.0%

+5%

First

Half

2012

Resid +0.6%

Comm +1.1

Indust +7.5

Total +3.0

-6%

2006 2007 2008 2009 2010 2011 2012

a Weather adjusted

. . . . adds rate “headroom”.

16

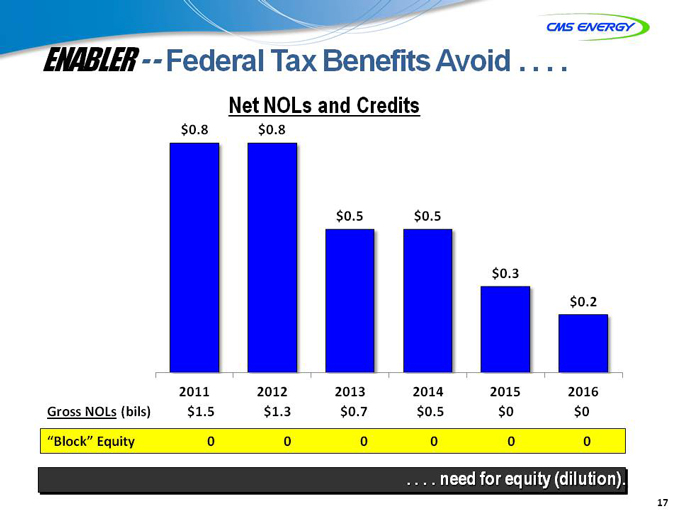

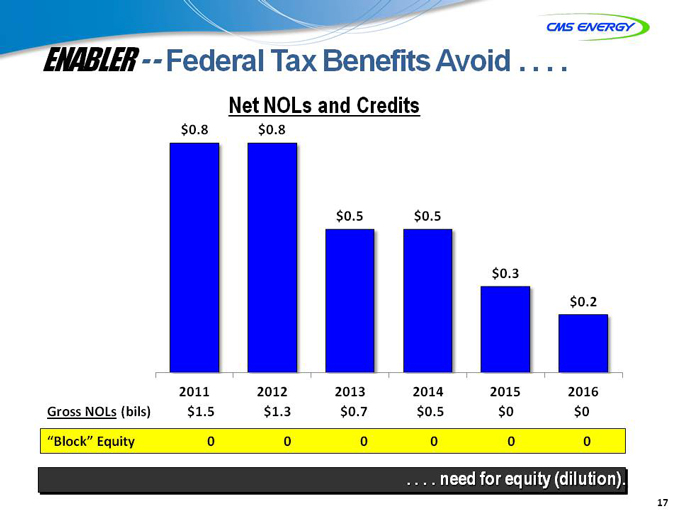

ENABLER —Federal Tax Benefits Avoid . . . .

Net NOLs and Credits

$0.8

$0.8

$0.5

$0.5

$0.3

$0.2

2011 2012 2013 2014 2015 2016 Gross NOLs (bils) $1.5 $1.3 $0.7 $0.5 $0 $0

“Block” Equity 0 0 0 0 0 0

. . . . need for equity (dilution).

17

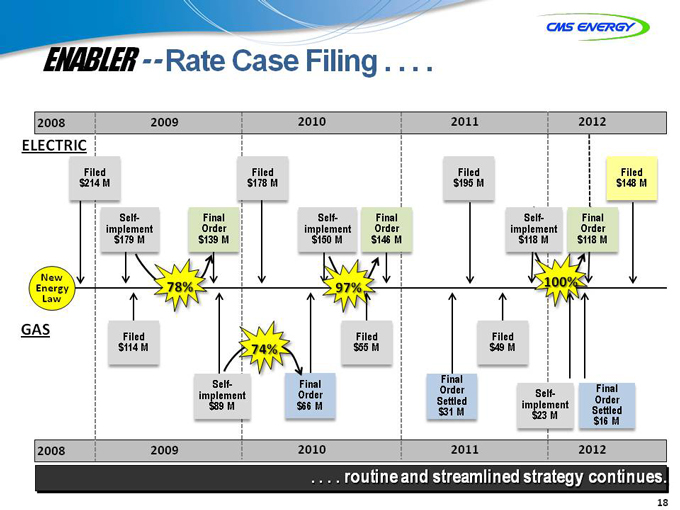

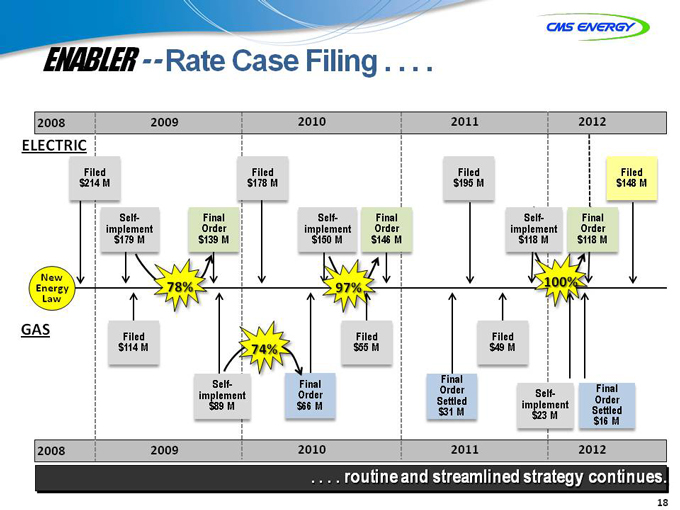

ENABLER —Rate Case Filing . . . .

2008 2009 2010 2011 2012

ELECTRIC

$Filed 214 M

implement Self- $179 M

Order Final $139 M

$Filed 178 M

implement Self- $150 M

Order Final $146 M

$Filed 195 M

implement Self- $118 M

Order Final $118 M

$Filed 148 M

New Energy Law

78%

97%

100%

GAS

$Filed 114 M

implement Self-

$89 M

74%

Order Final

$66 M

$ Filed 55 M

$ Filed 49 M

Order Final Settled $31 M

implement Self-

$23 M

Order Final Settled $16 M

[Graphic Appears Here]

. . . . routine and streamlined strategy continues.

18

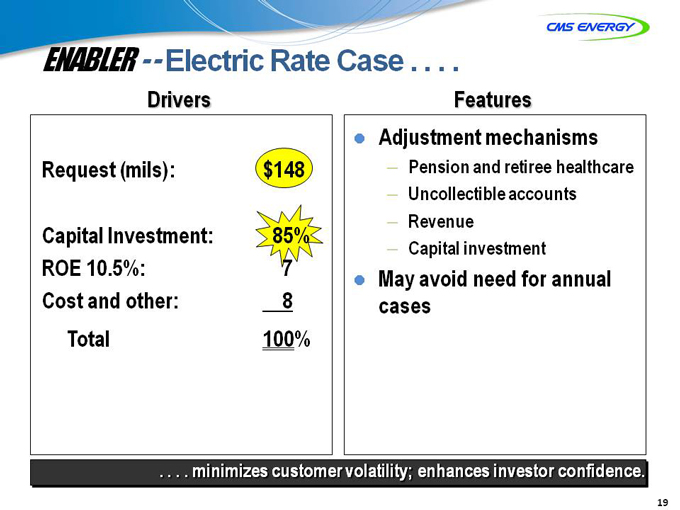

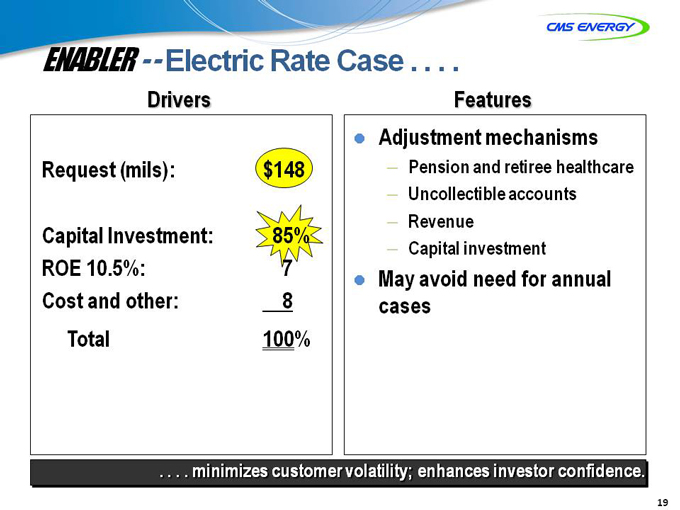

ENABLER —Electric Rate Case . . . .

Drivers

Request (mils): $148

Capital Investment: 85%

ROE 10.5%: 7

Cost and other: 8

Total 100%

Features

Adjustment mechanisms

– Pension and retiree healthcare

– Uncollectible accounts

– Revenue

– Capital investment

May avoid need for annual cases

. . . . minimizes customer volatility; enhances investor confidence.

19

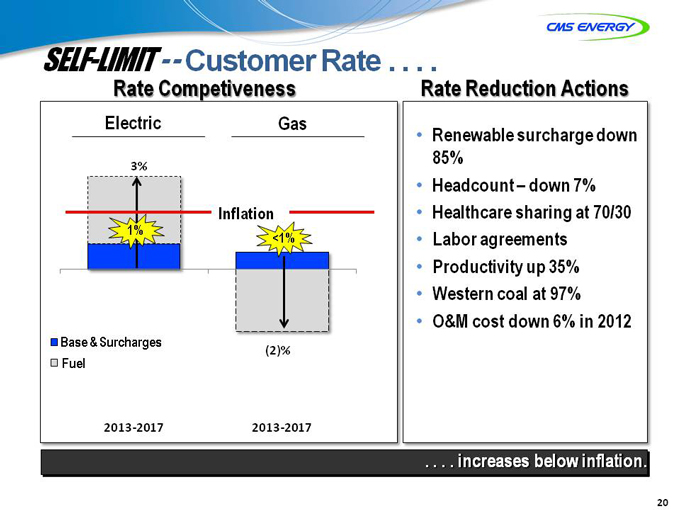

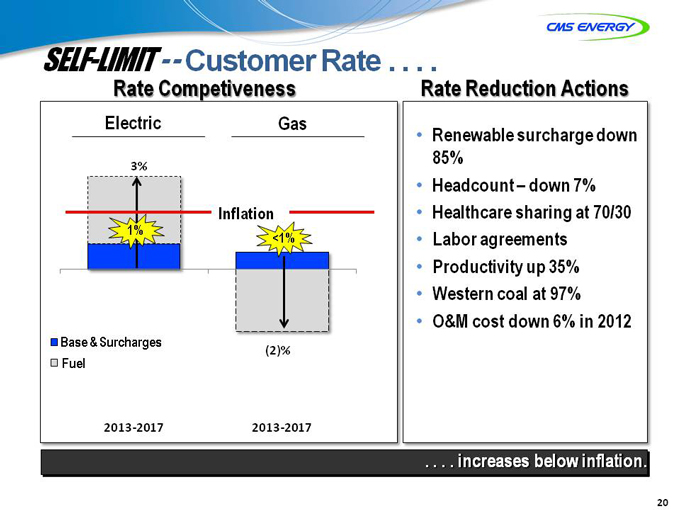

SELF-LIMIT —Customer Rate . . . .

Rate Competiveness

Electric

Gas

3%

1%

Inflation

<1%

Base & Surcharges Fuel

(2)%

2013-2017

2013-2017

Rate Reduction Actions

Renewable surcharge down 85% Headcount – down 7% Healthcare sharing at 70/30 Labor agreements Productivity up 35% Western coal at 97% O&M cost down 6% in 2012

. . . . increasesncreases below inflation.

20

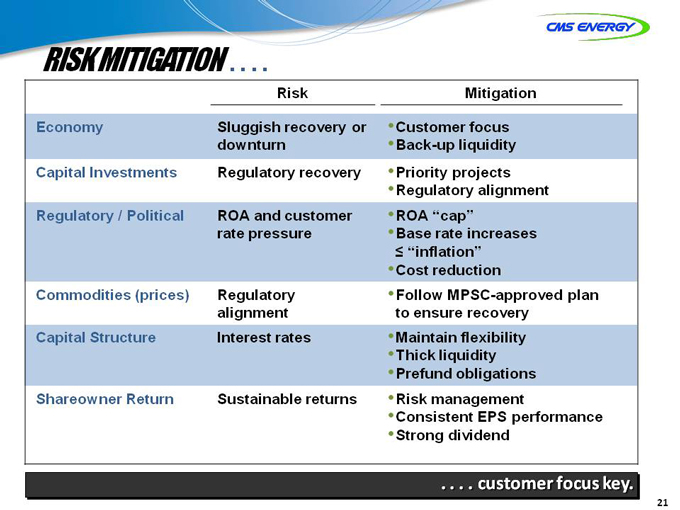

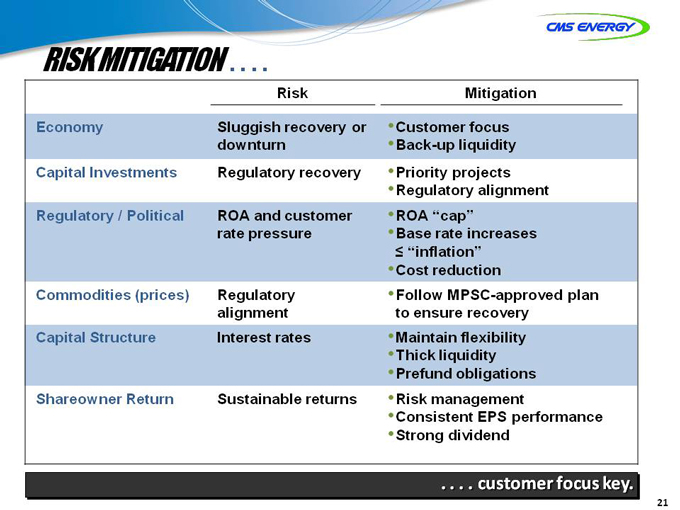

RISK MITIGATION . . . .

Risk Mitigation

Economy Sluggish recovery or •Customer focus downturn •Back-up liquidity

Capital Investments Regulatory recovery •Priority projects •Regulatory alignment

Regulatory / Political ROA and customer •ROA “cap” rate pressure •Base rate increases

“inflation” •Cost reduction

Commodities (prices) Regulatory •Follow MPSC-approved plan alignment to ensure recovery

Capital Structure Interest rates •Maintain flexibility •Thick liquidity •Prefund obligations

Shareowner Return Sustainable returns •Risk management

•Consistent EPS performance •Strong dividend

. . . . customer focus key.

21

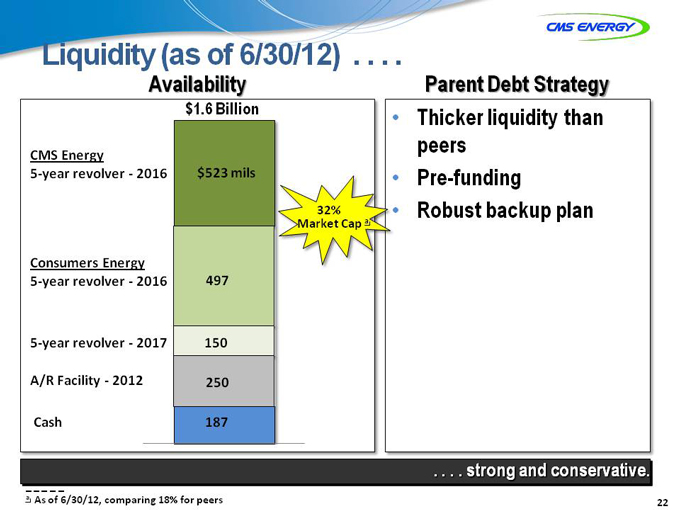

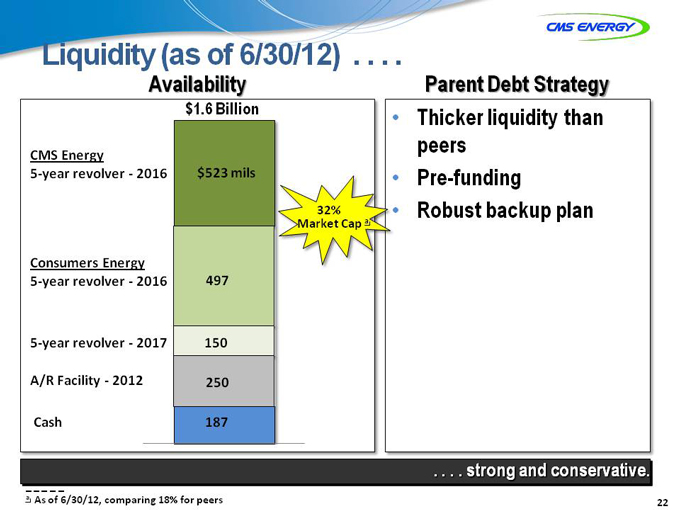

Liquidity (as of 6/30/12) . . . .

Availability

Parent Debt Strategy

$1.6 Billion

CMS Energy

5-year revolver—2016 $523 mils

Consumers Energy

5-year revolver—2016 497

5-year revolver—2017 150

A/R Facility—2012 250

Cash 187

32% Market Cap a

• Thicker liquidity than peers

• Pre-funding

• Robust backup plan

. . . . strong and conservative.

a As of 6/30/12, comparing 18% for peers

22

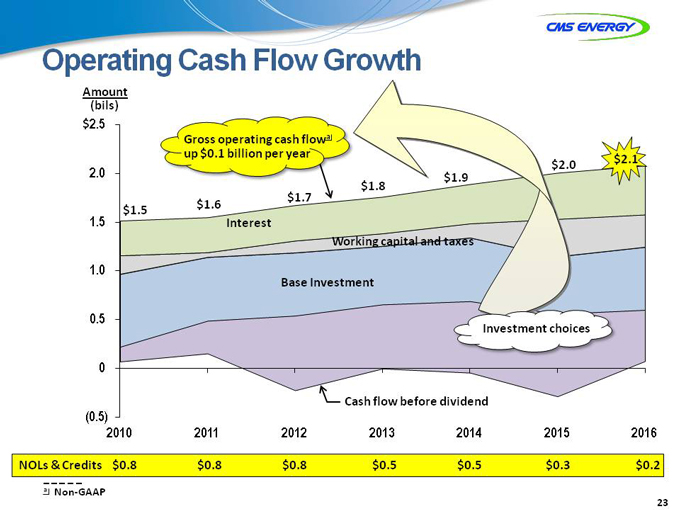

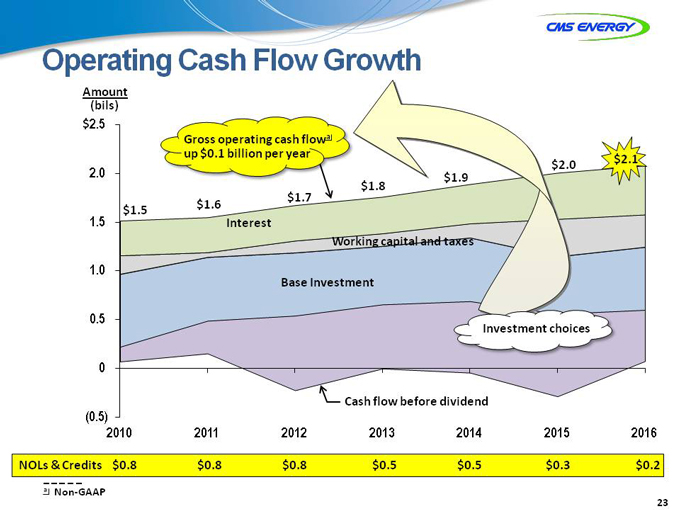

Operating Cash Flow Growth

Amount (bils)

$2.5 2.0 1.5 1.0 0.5 0 (0.5)

Gross operating cash flow a up $0.1 billion per year

$1.7 $1.6 $1.5 $1.8 $1.9 $2.0 $2.1

Interest

Working capital and taxes

Base Investment

Investment choices

Cash flow before dividend

2010 2011 2012 2013 2014 2015 2016

NOLs & Credits $0.8 $0.8 $0.8 $0.5 $0.5 $0.3 $0.2

a Non-GAAP

23

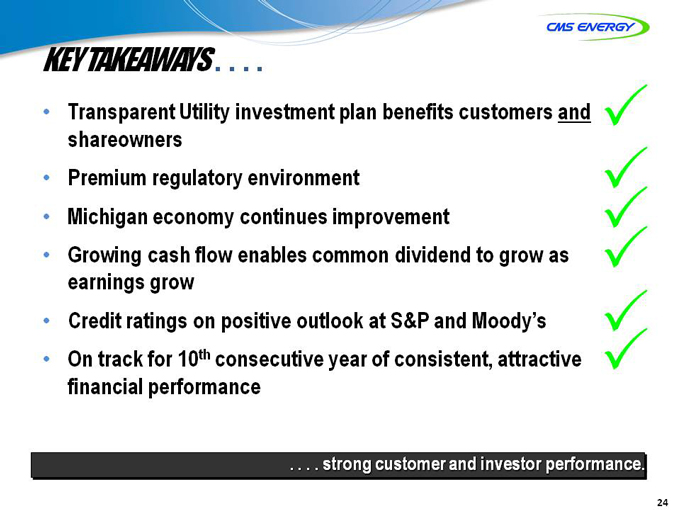

KEY TAKEAWAYS . . . .

Transparent Utility investment plan benefits customers and shareowners

Premium regulatory environment

Michigan economy continues improvement

Growing cash flow enables common dividend to grow as earnings grow

Credit ratings on positive outlook at S&P and Moody’s

On track for 10th consecutive year of consistent, attractive financial performance

. . . . strong customer and investor performance.

24

APPENDIX

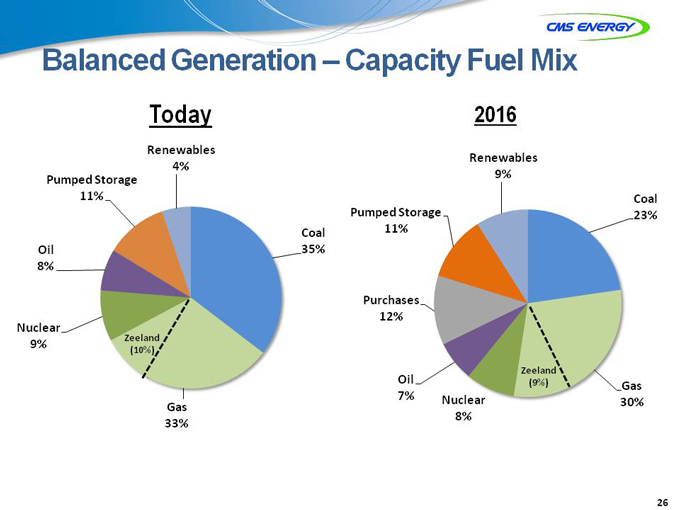

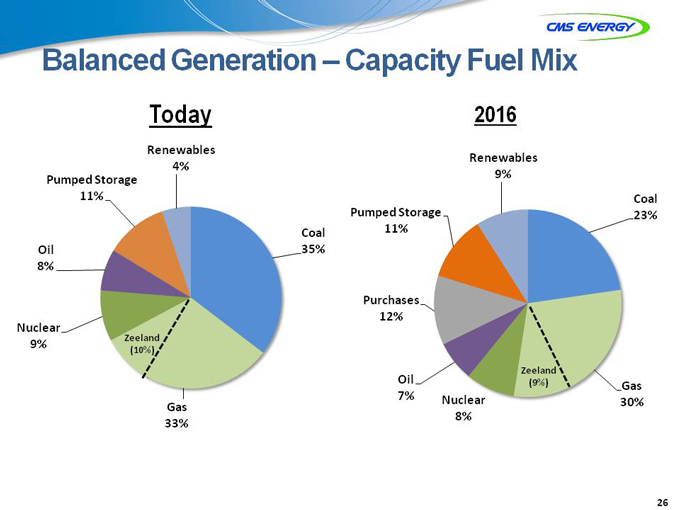

Balanced Generation – Capacity Fuel Mix

Today 2016

Renewables 4% Pumped Storage 11%

Coal Oil 35% 8%

Nuclear

Zeeland

9%

(10%)

Gas 33%

Renewables 9%

Coal Pumped Storage 23% 11%

Purchases 12%

Oil Zeeland

(9%) Gas

7% Nuclear

30% 8%

26

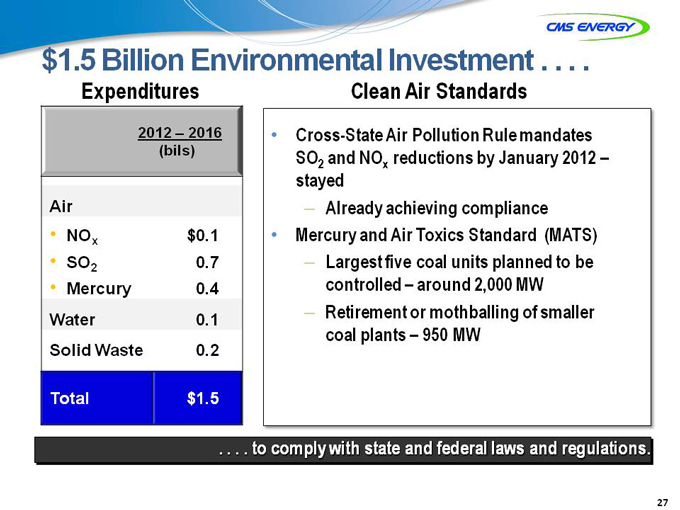

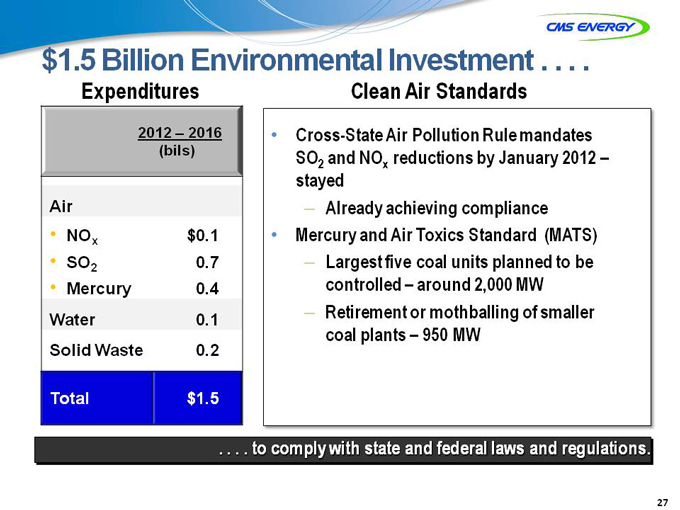

$1.5 Billion Environmental Investment . . . .

Expenditures Clean Air Standards

2012 – 2016 (bils)

Air

• NOx $0.1

• SO2 0.7

• Mercury 04.

Water 0.1 Solid Waste 0.2

Total $1.5

• Cross-State Air Pollution Rule mandates SO2 and NOx reductions by January 2012 –stayed

– Already achieving compliance

• Mercury and Air Toxics Standard (MATS)

– Largest five coal units planned to be controlled – around 2,000 MW

– Retirement or mothballing of smaller coal plants – 950 MW

. . . . to comply with state and federal laws and regulations.

27

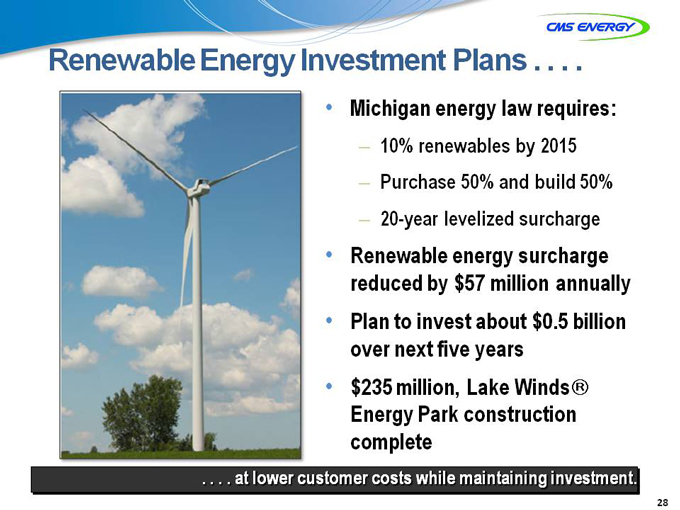

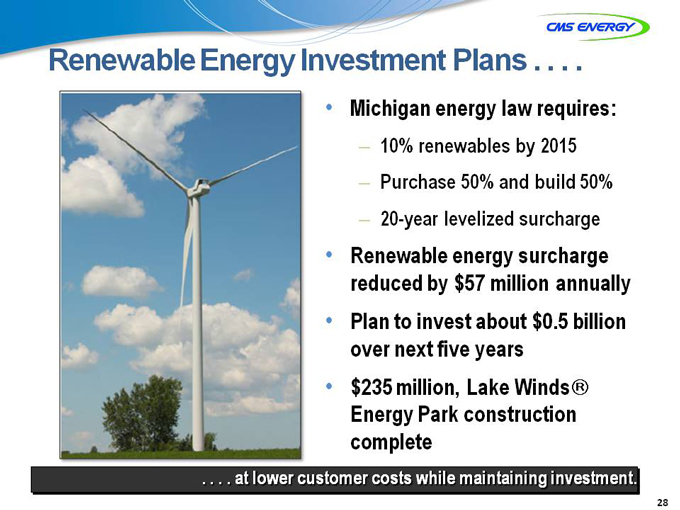

Renewable Energy Investment Plans . . . .

• Michigan energy law requires:

10% renewables by 2015

– Purchase 50% and build 50%

20-year levelized surcharge

• Renewable energy surcharge reduced by $57 million annually

• Plan to invest about $0.5 billion over next five years

• $235 million, Lake Winds® Energy Park construction complete

. . . . at lower customer costs while maintaining investment.

28

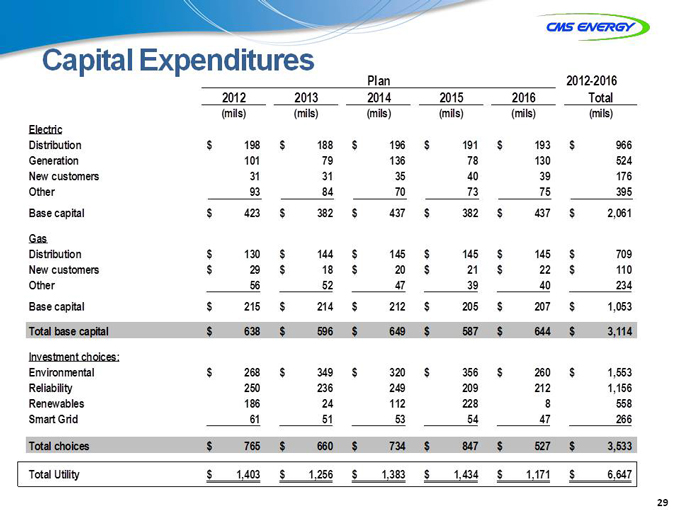

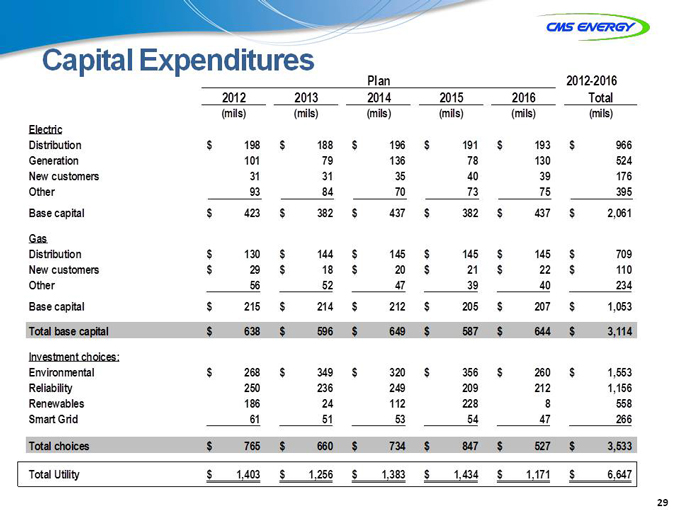

Capital Expenditures

Plan 2012-2016 2012 2013 2014 2015 2016 Total

(mils) (mils) (mils) (mils) (mils) (mils) Electric Distribution $ 198 $ 188 $ 196 $ 191 $ 193 $ 966 Generation 101 79 136 78 130 524 New customers 31 31 35 40 39 176 Other 93 84 70 73 75 395 Base capital $ 423 $ 382 $ 437 $ 382 $ 437 $ 2,061 Gas Distribution $ 130 $ 144 $ 145 $ 145 $ 145 $ 709 New customers $ 29 $ 18 $ 20 $ 21 $ 22 $ 110 Other 56 52 47 39 40 234 Base capital $ 215 $ 214 $ 212 $ 205 $ 207 $ 1,053 Total base capital $ 638 $ 596 $ 649 $ 587 $ 644 $ 3,114 Investment choices: Environmental $ 268 $ 349 $ 320 $ 356 $ 260 $ 1,553 Reliability 250 236 249 209 212 1,156 Renewables 186 24 112 228 8 558 Smart Grid 61 51 53 54 47 266

Total choices $ 765 $ 660 $ 734 $ 847 $ 527 $ 3,533

Total Utility $ 1,403 $ 1,256 $ 1,383 $ 1,434 $ 1,171 $ 6,647

29

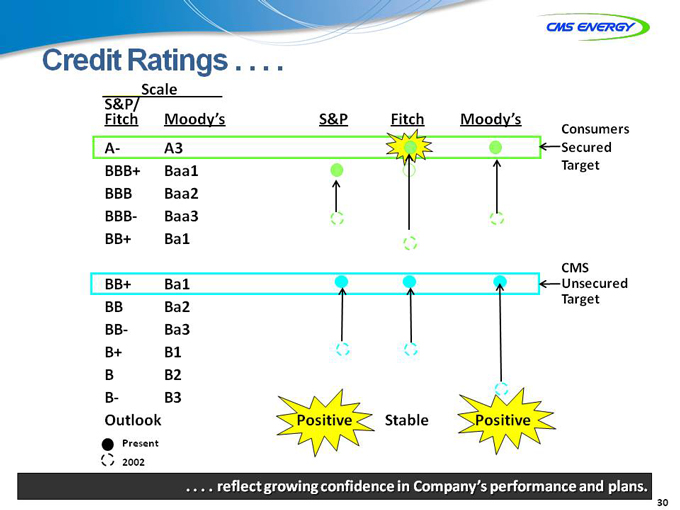

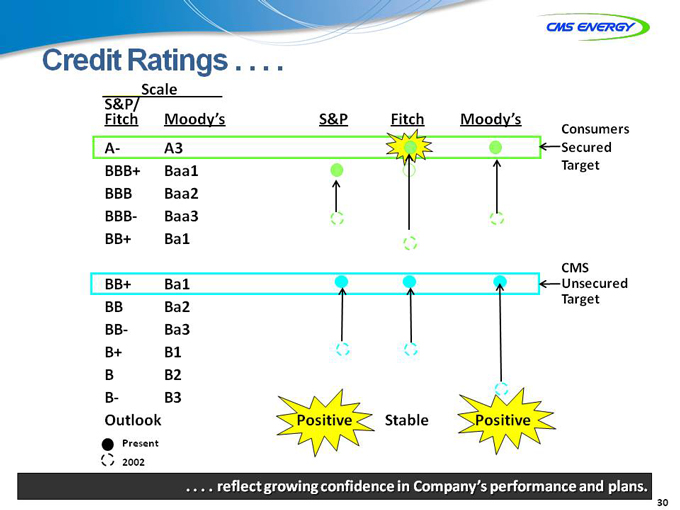

Credit Ratings . . . .

Scale

S&P/

Fitch Moody’s

A- A3 BBB+ Baa1 BBB Baa2 BBB- Baa3 BB+ Ba1

BB+ Ba1 BB Ba2 BB- Ba3 B+ B1 B B2 B- B3 Outlook

S&P Fitch Moody’s

Consumers Secured Target

CMS Unsecured Target

Positive Stable Positive

Present 2002

. . . . reflect growing confidence in Company’s performance and plans.

30

2012 Sensitivities . . . .

Annual Impact

Sensitivity EPS OCF

(mils)

Sales a

•Electric (38,154 Gwh) + 1% + $0.05 + $20

•Gas (283 Bcf) + 1 + 0.01 + 5 –Gas prices (NYMEX) + 1.00 * +15 –Uncollectible accounts (mils) + 5 + 0.01 *

ROE (authorized)

•Electric (10.3%) + 20 bps + 0.02 + 10

•Gas (10.3%) + 20 + 0.01 + 4

. . . . on strong performance.

* Less than 0.5 or $500,000 a Reflect 2012 sales forecast; weather adjusted

31

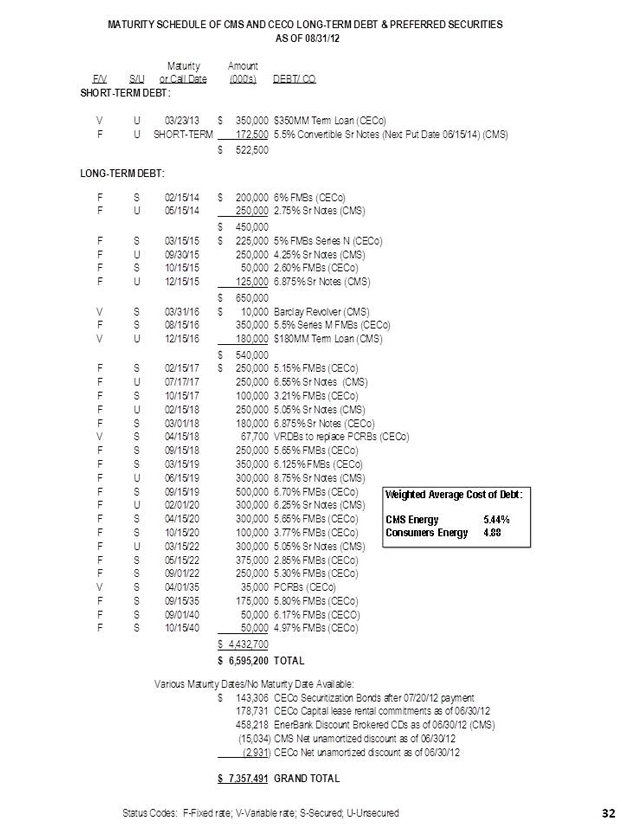

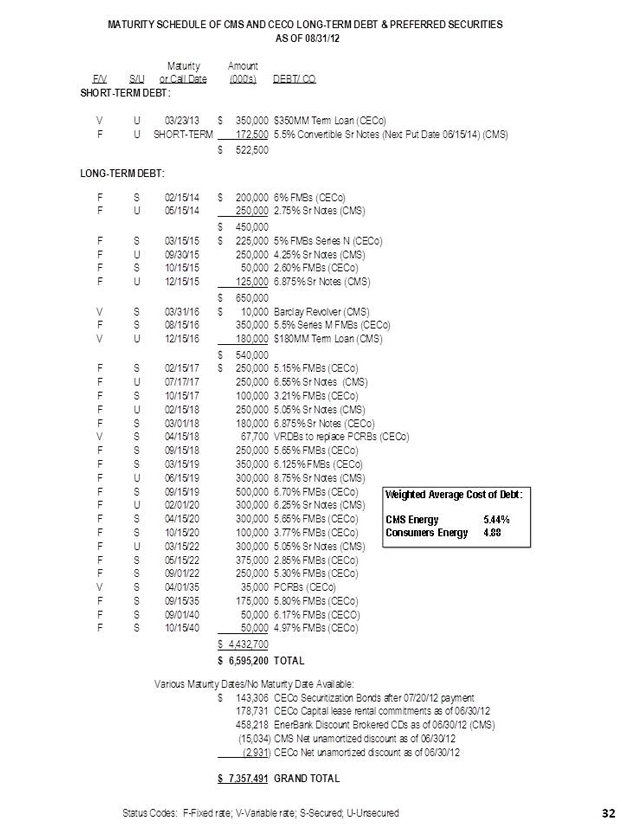

MATURITY SCHEDULE OF CMS AND CECO LONG-TERM DEBT & PREFERRED SECURITIES AS OF 08/31/12

Maturity Amount

F/V S/U or Call Date (000’s) DEBT/ CO

SHORT-TERM DEBT:

V U 03/23/13 $ 350,000 $350MM Term Loan (CECo)

F U SHORT-TERM 172,500 5.5% Convertible Sr Notes (Next Put Date 06/15/14) (CMS) $ 522,500

LONG-TERM DEBT:

F S 02/15/14 $ 200,000 6% FMBs (CECo) F U 05/15/14 250,000 2.75% Sr Notes (CMS) $ 450,000 F S 03/15/15 $ 225,000 5% FMBs Series N (CECo) F U 09/30/15 250,000 4.25% Sr Notes (CMS) F S 10/15/15 50,000 2.60% FMBs (CECo) F U 12/15/15 125,000 6.875% Sr Notes (CMS) $ 650,000 V S 03/31/16 $ 10,000 Barclay Revolver (CMS) F S 08/15/16 350,000 5.5% Series M FMBs (CECo) V U 12/15/16 180,000 $180MM Term Loan (CMS) $ 540,000 F S 02/15/17 $ 250,000 5.15% FMBs (CECo) F U 07/17/17 250,000 6.55% Sr Notes (CMS) F S 10/15/17 100,000 3.21% FMBs (CECo) F U 02/15/18 250,000 5.05% Sr Notes (CMS) F S 03/01/18 180,000 6.875% Sr Notes (CECo) V S 04/15/18 67,700 VRDBs to replace PCRBs (CECo)

F S 09/15/18 250,000 5.65% FMBs (CECo) F S 03/15/19 350,000 6.125% FMBs (CECo) F U 06/15/19 300,000 8.75% Sr Notes (CMS) F S 09/15/19 500,000 6.70% FMBs (CECo) F U 02/01/20 300,000 6.25% Sr Notes (CMS) F S 04/15/20 300,000 5.65% FMBs (CECo) F S 10/15/20 100,000 3.77% FMBs (CECo) F U 03/15/22 300,000 5.05% Sr Notes (CMS) F S 05/15/22 375,000 2.85% FMBs (CECo) F S 09/01/22 250,000 5.30% FMBs (CECo) V S 04/01/35 35,000 PCRBs (CECo) F S 09/15/35 175,000 5.80% FMBs (CECo) F S 09/01/40 50,000 6.17% FMBs (CECO) F S 10/15/40 50,000 4.97% FMBs (CECo) $ 4,432,700 $ 6,595,200 TOTAL

Weighted Average Cost of Debt:

CMS Energy 5.44% Consumers Energy 4.88

Various Maturity Dates/No Maturity Date Available: $ 143,306 CECo Securitization Bonds after 07/20/12 payment 178,731 CECo Capital lease rental commitments as of 06/30/12 458,218 EnerBank Discount Brokered CDs as of 06/30/12 (CMS) (15,034) CMS Net unamortized discount as of 06/30/12 (2,931) CECo Net unamortized discount as of 06/30/12

$ 7,357,491 GRAND TOTAL

Status Codes: F-Fixed rate; V-Variable rate; S-Secured; U-Unsecured

32

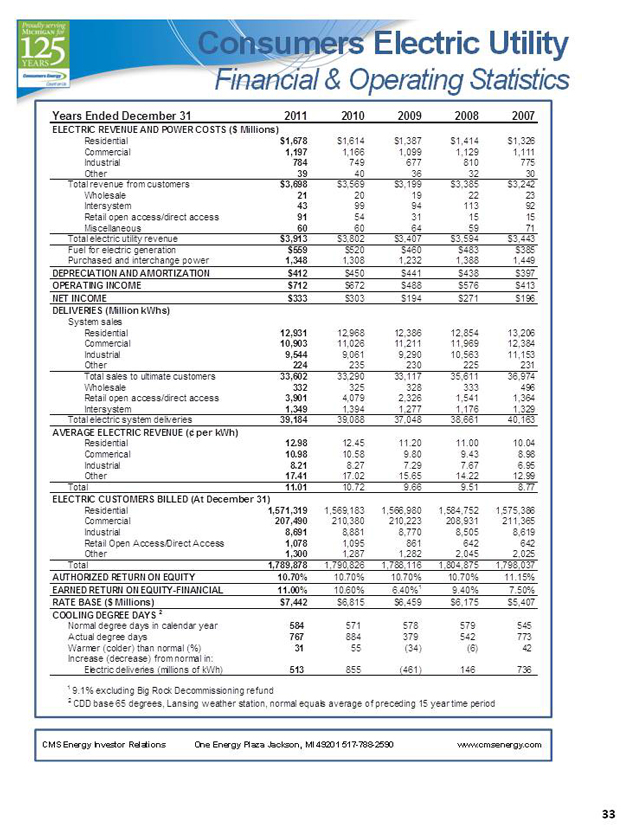

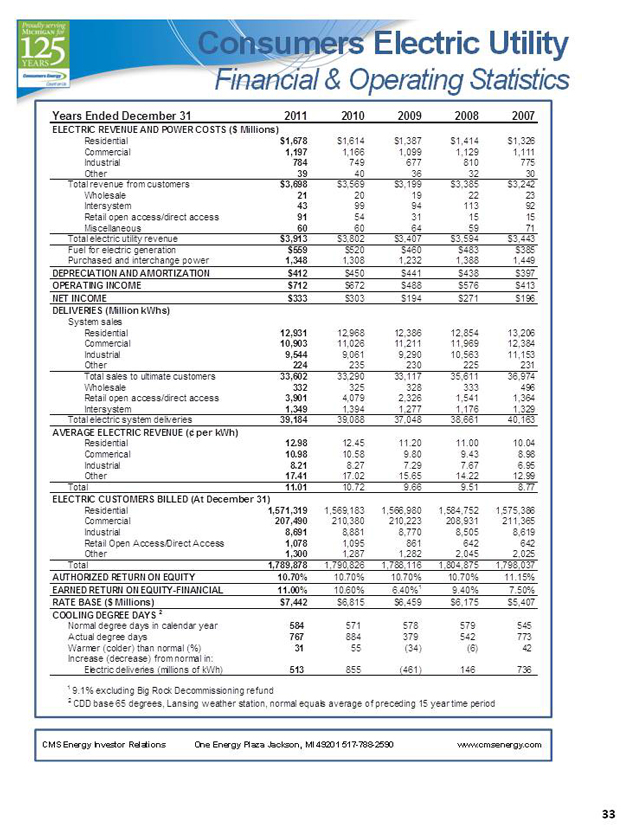

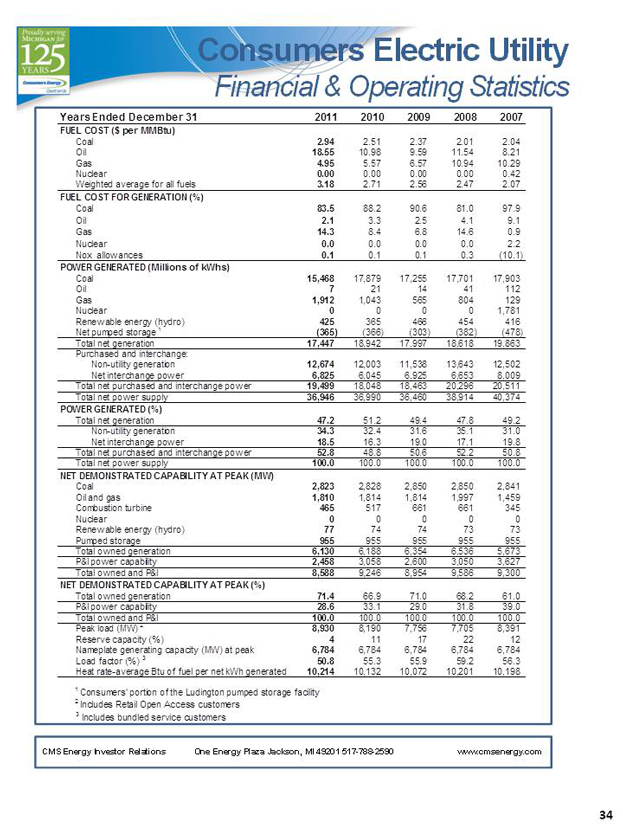

Consumers Electric Utility

Financial & Operating Statistics

Years Ended December 31 2011 2010 2009 2008 2007

ELECTRIC REVENUE AND POWER COSTS ($ Millions)

Residential $1,678 $1,614 $1,387 $1,414 $1,326 Commercial 1,197 1,166 1,099 1,129 1,111 Industrial 784 749 677 810 775 Other 39 40 36 32 30 Total revenue from customers $3,698 $3,569 $3,199 $3,385 $3,242 Wholesale 21 20 19 22 23 Intersystem 43 99 94 113 92 Retail open access/direct access 91 54 31 15 15 Miscellaneous 60 60 64 59 71 Total electric utility revenue $3,913 $3,802 $3,407 $3,594 $3,443 Fuel for electric generation $559 $520 $460 $483 $385 Purchased and interchange pow er 1,348 1,308 1,232 1,388 1,449

DEPRECIATION AND AMORTIZATION $412 $450 $441 $438 $397 OPERATING INCOME $712 $672 $488 $576 $413

NET INCOME $333 $303 $194 $271 $196

DELIVERIES (Million kWhs)

System sales

Residential 12,931 12,968 12,386 12,854 13,206 Commercial 10,903 11,026 11,211 11,969 12,384 Industrial 9,544 9,061 9,290 10,563 11,153 Other 224 235 230 225 231 Total sales to ultimate customers 33,602 33,290 33,117 35,611 36,974 Wholesale 332 325 328 333 496 Retail open access/direct access 3,901 4,079 2,326 1,541 1,364 Intersystem 1,349 1,394 1,277 1,176 1,329 Total electric system deliveries 39,184 39,088 37,048 38,661 40,163

AVERAGE ELECTRIC REVENUE (¢ per kWh)

Residential 12.98 12.45 11.20 11.00 10.04 Commerical 10.98 10.58 9.80 9.43 8.98 Industrial 8.21 8.27 7.29 7.67 6.95 Other 17.41 17.02 15.65 14.22 12.99 Total 11.01 10.72 9.66 9.51 8.77

ELECTRIC CUSTOMERS BILLED (At December 31)

Residential 1,571,319 1,569,183 1,566,980 1,584,752 1,575,386 Commercial 207,490 210,380 210,223 208,931 211,365 Industrial 8,691 8,881 8,770 8,505 8,619 Retail Open Access/Direct Access 1,078 1,095 861 642 642 Other 1,300 1,287 1,282 2,045 2,025 Total 1,789,878 1,790,826 1,788,116 1,804,875 1,798,037

AUTHORIZED RETURN ON EQUITY 10.70% 10.70% 10.70% 10.70% 11.15% EARNED RETURN ON EQUITY-FINANCIAL 11.00% 10.60% 6.40%1 9.40% 7.50% RATE BASE ($ Millions) $7,442 $6,815 $6,459 $6,175 $5,407 COOLING DEGREE DAYS 2

Normal degree days in calendar year 584 571 578 579 545 Actual degree days 767 884 379 542 773 Warmer (colder) than normal (%) 31 55 (34) (6) 42 Increase (decrease) from normal in: Electric deliveries (millions of kWh) 513 855 (461) 146 736

1 9.1% excluding Big Rock Decommissioning refund

2 CDD base 65 degrees, Lansing w eather station, normal equals average of preceding 15 year time period

CMS Energy Investor Relations One Energy Plaza Jackson, MI 49201 517-788-2590 www.cmsenergy.com

33

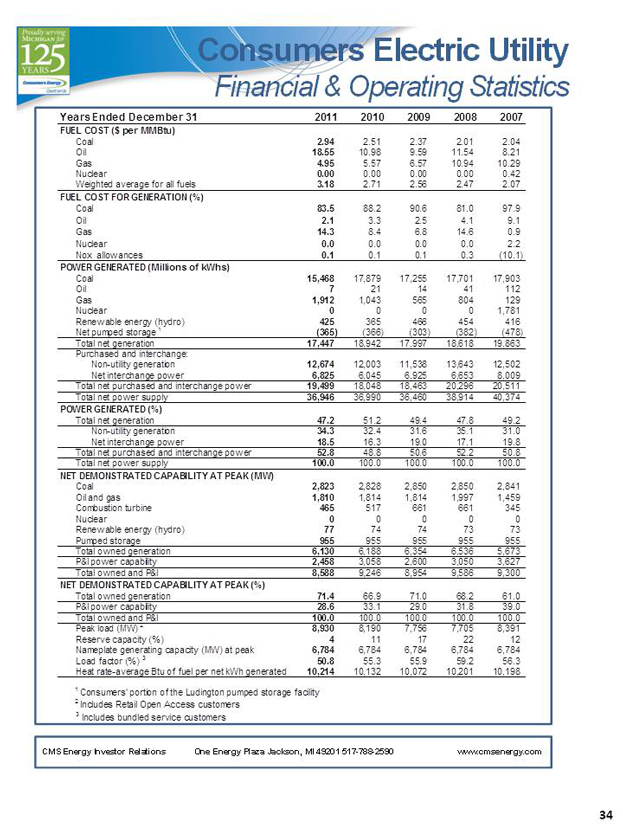

Consumers Electric Utility

Financial & Operating Statistics

Years Ended December 31 2011 2010 2009 2008 2007

FUEL COST ($ per MMBtu)

Coal 2.94 2.51 2.37 2.01 2.04 Oil 18.55 10.98 9.59 11.54 8.21 Gas 4.95 5.57 6.57 10.94 10.29 Nuclear 0.00 0.00 0.00 0.00 0.42 Weighted average for all fuels 3.18 2.71 2.56 2.47 2.07

FUEL COST FOR GENERATION (%)

Coal 83.5 88.2 90.6 81.0 97.9 Oil 2.1 3.3 2.5 4.1 9.1 Gas 14.3 8.4 6.8 14.6 0.9 Nuclear 0.0 0.0 0.0 0.0 2.2 Nox allow ances 0.1 0.1 0.1 0.3 (10.1)

POWER GENERATED (Millions of kWhs)

Coal 15,468 17,879 17,255 17,701 17,903 Oil 7 21 14 41 112 Gas 1,912 1,043 565 804 129 Nuclear 0 0 0 0 1,781 Renew able energy (hydr ) 425 365 466 454 416 Net pumped storage 1 (365) (366) (303) (382) (478) Total net generation 17,447 18,942 17,997 18,618 19,863 Purchased and interchan e: Non-utility generation 12,674 12,003 11,538 13,643 12,502 Net interchange pow er 6,825 6,045 6,925 6,653 8,009 Total net purchased and interchange pow er 19,499 18,048 18,463 20,296 20,511 Total net pow er supply 36,946 36,990 36,460 38,914 40,374

POWER GENERATED (%)

Total net generation 47.2 51.2 49.4 47.8 49.2 Non-utility generation 34.3 32.4 31.6 35.1 31.0 Net interchange pow er 18.5 16.3 19.0 17.1 19.8 Total net purchased and interchange pow er 52.8 48.8 50.6 52.2 50.8 Total net pow er supply 100.0 100.0 100.0 100.0 100.0

NET DEMONSTRATED CAPABILITY AT PEAK (MW)

Coal 2,823 2,828 2,850 2,850 2,841 Oil and gas 1,810 1,814 1,814 1,997 1,459 Combustion turbine 465 517 661 661 345 Nuclear 0 0 0 0 0 Renew able energy (hydr ) 77 74 74 73 73 Pu ped storage 955 955 955 955 955 Total ow ned generation 6,130 6,188 6,354 6,536 5,673 P&I pow er capability 2,458 3,058 2,600 3,050 3,627 Total ow ned and P&I 8,588 9,246 8,954 9,586 9,300

NET DEMONSTRATED CAPABILITY AT PEAK (%)

Total ow ned generation 71.4 66.9 71.0 68.2 61.0 P&I pow er capability 28.6 33.1 29.0 31.8 39.0 Total ow ned and P&I 100.0 100.0 100.0 100.0 100.0 Peak load (MW) 2 8,930 8,190 7,756 7,705 8,391 Reserve capacity (%) 4 11 17 22 12 Nameplate generating capacity (MW) at peak 6,784 6,784 6,784 6,784 6,784 Load factor (%) 3 50.8 55.3 55.9 59.2 56.3 Heat rate-average Btu of fuel per net kWh generated 10,214 10,132 10,072 10,201 10,198

1 Consumers’ portion of the Ludington pumped storage facility

2 Includes Retail Open Access customers

3 Includes bundled service customers

CMS Energy Investor Relations One Energy Plaza Jackson, MI 49201 517-788-2590 www.cmsenergy.com

34

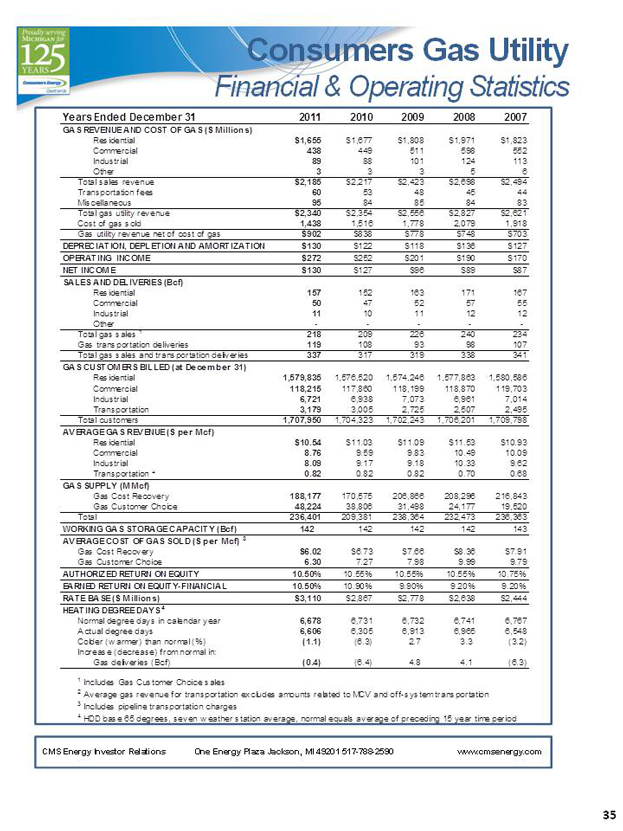

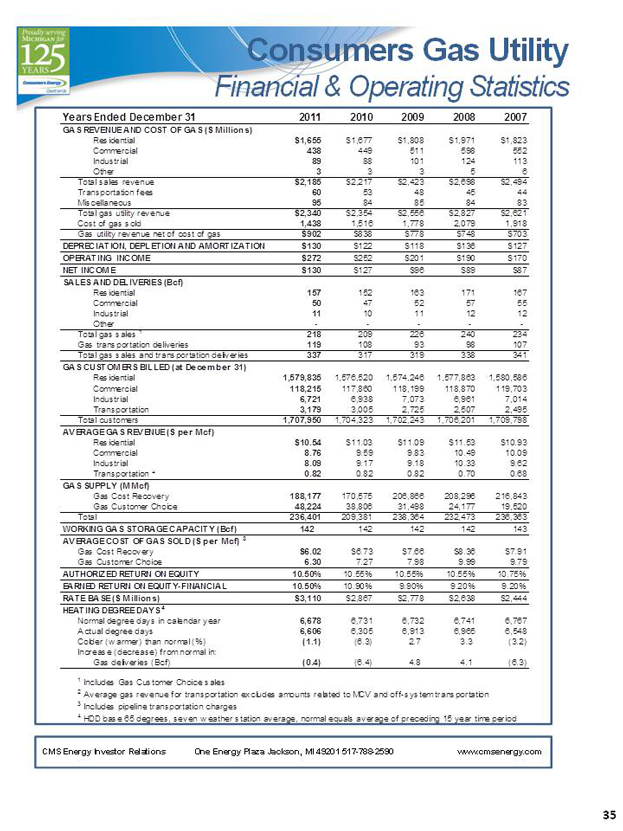

Consumers Gas Utility

Financial & Operating Statistics

Years Ended December 31 2011 2010 2009 2008 2007

GAS REVENUE AND COST OF GAS ($ Millions)

Residential $1,655 $1,677 $1,808 $1,971 $1,823 Commercial 438 449 511 598 552 Industrial 89 88 101 124 113 Other 3 3 3 5 6 Total sales revenue $2,185 $2,217 $2,423 $2,698 $2,494 Transportation fees 60 53 48 45 44 Miscellaneous 95 84 85 84 83 Total gas utility revenue $2,340 $2,354 $2,556 $2,827 $2,621 Cost of gas sold 1,438 1,516 1,778 2,079 1,918 Gas utility revenue net of cost of gas $902 $838 $778 $748 $703

DEPRECIATION, DEPLETION AND AMORTIZATION $130 $122 $118 $136 $127 OPERATING INCOME $272 $252 $201 $190 $170 NET INCOME $130 $127 $96 $89 $87 SALES AND DELIVERIES (Bcf)

Residential 157 152 163 171 167 Commercial 50 47 52 57 55 Industrial 11 10 11 12 12 Other -Total gas sales 1 218 209 226 240 234 Gas transportation deliveries 119 108 93 98 107 Total gas sales and transportation deliveries 337 317 319 338 341

GAS CUSTOMERS BILLED (at December 31)

Residential 1,579,835 1,576,520 1,574,246 1,577,863 1,580,586 Commercial 118,215 117,860 118,199 118,870 119,703 Industrial 6,721 6,938 7,073 6,961 7,014 Transportation 3,179 3,005 2,725 2,507 2,495 Total customers 1,707,950 1,704,323 1,702,243 1,706,201 1,709,798

AVERAGE GAS REVENUE ($ per Mcf)

Residential $10.54 $11.03 $11.09 $11.53 $10.93 Commercial 8.76 9.59 9.83 10.49 10.09 Industrial 8.09 9.17 9.18 10.33 9.62 Transportation 2 0.82 0.82 0.82 0.70 0.68

GAS SUPPLY (MMcf)

Gas Cost Recovery 188,177 170,575 206,866 208,296 216,843 Gas Customer Choice 48,224 38,806 31,498 24,177 19,520 Total 236,401 209,381 238,364 232,473 236,363

WORKING GAS STORAGE CAPACITY (Bcf) 142 142 142 142 143 AVERAGE COST OF GAS SOLD ($ per Mcf) 3

Gas Cost Recovery $6.02 $6.73 $7.66 $8.36 $7.91 Gas Customer Choice 6.30 7.27 7.98 9.99 9.79

AUTHORIZED RETURN ON EQUITY 10.50% 10.55% 10.55% 10.55% 10.75% EARNED RETURN ON EQUITY-FINANCIAL 10.50% 10.90% 9.90% 9.20% 9.20% RATE BASE ($ Millions) $3,110 $2,867 $2,778 $2,638 $2,444 HEATING DEGREE DAYS 4

Normal degree days in calendar year 6,678 6,731 6,732 6,741 6,767 Actual degree days 6,606 6,305 6,913 6,965 6,548 Colder (w armer) than normal (%) (1.1) (6.3) 2.7 3.3 (3.2) Increase (decrease) from normal in: Gas deliveries (Bcf) (0.4) (6.4) 4.8 4.1 (6.3)

1 Includes Gas Customer Choice sales

2 Average gas revenue for transportation excludes amounts related to MCV and off-system transportation

3 Includes pipeline transportation charges

4 HDD base 65 degrees, seven w eather station average, normal equals average of preceding 15 year time period

CMS Energy Investor Relations One Energy Plaza Jackson, MI 49201 517-788-2590 www.cmsenergy.com

35

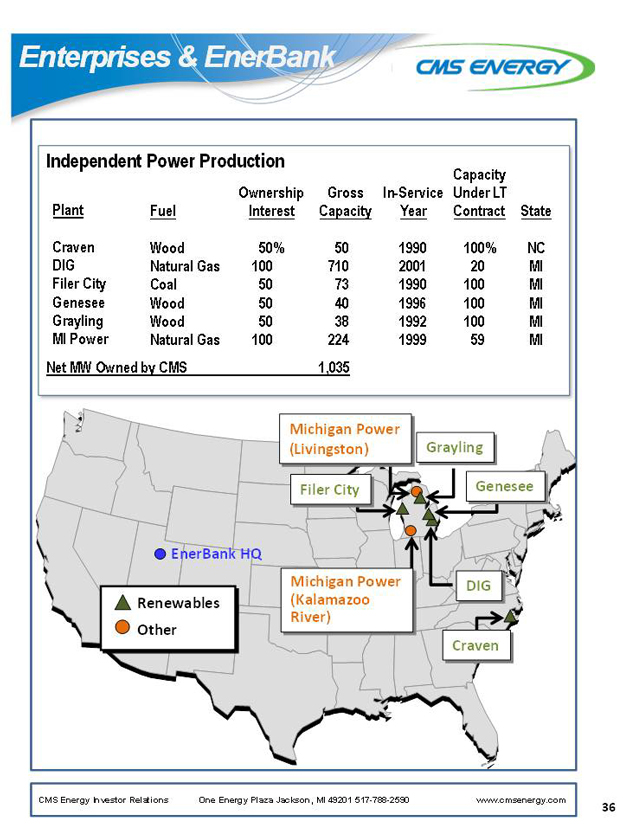

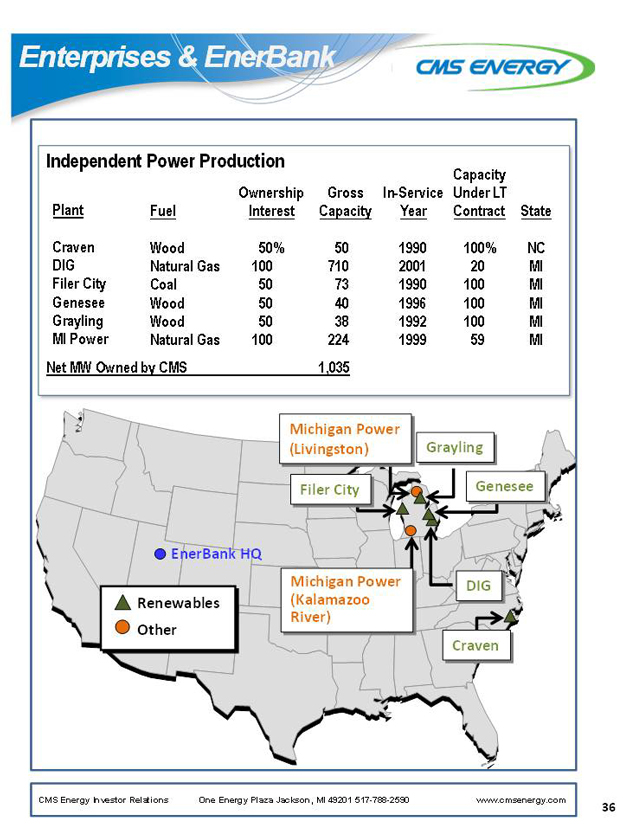

Enterprises & EnerBank

Independent Power Production

Capacity Ownership Gross In-Service Under LT

Plant Fuel Interest Capacity Year Contract State

Craven Wood 50% 50 1990 100% NC DIG Natural Gas 100 710 2001 20 MI Filer City Coal 50 73 1990 100 MI Genesee Wood 50 40 1996 100 MI Grayling Wood 50 38 1992 100 MI MI Power Natural Gas 100 224 1999 59 MI Net MW Owned by CMS 1,035

Michigan Power

(Livingston) Grayling

Filer City Genesee

EnerBank HQ

Michigan Power DIG Renewables (Kalamazoo Other River) Craven

CMS Energy Investor Relations One Energy Plaza Jackson, MI 49201 517-788-2590 www.cmsenergy.com

36

GAAP RECONCILIATION

CMS ENERGY CORPORATION

Earnings Per Share By Year GAAP Reconciliation

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | 2003

| | | 2004

| | | 2005

| | | 2006

| | | 2007

| | | 2008

| | | 2009

| | | 2010

| | | 2011

| |

Reported earnings (loss) per share - GAAP | | ($ | 0.30 | ) | | $ | 0.64 | | | ($ | 0.44 | ) | | ($ | 0.41 | ) | | ($ | 1.02 | ) | | $ | 1.20 | | | $ | 0.91 | | | $ | 1.28 | | | $ | 1.58 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

After-tax items: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Electric and gas utility | | | 0.21 | | | | (0.39 | ) | | | — | | | | — | | | | (0.07 | ) | | | 0.05 | | | | 0.33 | | | | 0.03 | | | | 0.00 | |

Enterprises | | | 0.74 | | | | 0.62 | | | | 0.04 | | | | (0.02 | ) | | | 1.25 | | | | (0.02 | ) | | | 0.09 | | | | (0.03 | ) | | | (0.11 | ) |

Corporate interest and other | | | 0.16 | | | | (0.03 | ) | | | 0.04 | | | | 0.27 | | | | (0.32 | ) | | | (0.02 | ) | | | 0.01 | | | | * | | | | (0.01 | ) |

Discontinued operations (income) loss | | | (0.16 | ) | | | 0.02 | | | | (0.07 | ) | | | (0.03 | ) | | | 0.40 | | | | (*) | | | | (0.08 | ) | | | 0.08 | | | | (0.01 | ) |

Asset impairment charges, net | | | — | | | | — | | | | 1.82 | | | | 0.76 | | | | 0.60 | | | | — | | | | — | | | | — | | | | — | |

Cumulative accounting changes | | | 0.16 | | | | 0.01 | | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Adjusted earnings per share, including MTM - non-GAAP | | $ | 0.81 | | | $ | 0.87 | | | $ | 1.39 | | | $ | 0.57 | | | $ | 0.84 | | | | $1.21 | (a) | | $ | 1.26 | | | $ | 1.36 | | | $ | 1.45 | |

Mark-to-market impacts | | | | | | | 0.03 | | | | (0.43 | ) | | | 0.51 | | | | | | | | | | | | | | | | | | | | | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Adjusted earnings per share, excluding MTM - non-GAAP | | | NA | | | $ | 0.90 | | | $ | 0.96 | | | $ | 1.08 | | | | NA | | | | NA | | | | NA | | | | NA | | | | NA | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

| * | | Less than $500 thousand or $0.01 per share. |

| (a) | | $1.25 excluding discontinued Exeter operations and accounting changes related to convertible debt and restricted stock. |

2003-11 EPS

CMS Energy

Reconciliation of Gross Operating Cash Flow to GAAP Operating Activities

(unaudited)

(mils)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | 2009

| | | 2010

| | | 2011

| | | 2012

| | | 2013

| | | 2014

| | | 2015

| | | 2016

| |

Consumers Operating Income + Depreciation & Amortization | | $ | 1,248 | | | $ | 1,498 | | | $ | 1,527 | | | $ | 1,651 | | | $ | 1,735 | | | $ | 1,860 | | | $ | 1,977 | | | $ | 2,051 | |

Enterprises Project Cash Flows | | | 16 | | | | 39 | | | | 24 | | | | 25 | | | | 27 | | | | 33 | | | | 35 | | | | 35 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Gross Operating Cash Flow | | $ | 1,264 | | | $ | 1,537 | | | $ | 1,551 | | | $ | 1,676 | | | $ | 1,762 | | | $ | 1,893 | | | $ | 2,012 | | | $ | 2,086 | |

Other operating activities including taxes, interest payments and working capital | | | (416 | ) | | | (578 | ) | | | (382 | ) | | | (426 | ) | | | (412 | ) | | | (443 | ) | | | (757 | ) | | | (776 | ) |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Net cash provided by operating activities | | $ | 848 | | | $ | 959 | | | $ | 1,169 | | | $ | 1,250 | | | $ | 1,350 | | | $ | 1,450 | | | $ | 1,255 | | | $ | 1,310 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

2009-16 OCF