Exhibit 99.1

Investor Meeting

December 12, 2012

Foote Hydro 1918

Zeeland 2007

Lake Winds 2012

This presentation is made as of the date hereof and contains “forward-looking statements” as defined in Rule 3b-6 of the Securities Exchange Act of 1934, as amended, Rule 175 of the Securities Act of 1933, as amended, and relevant legal decisions. The forward-looking statements are subject to risks and uncertainties. They should be read in conjunction with “FORWARD-LOOKING STATEMENTS AND INFORMATION” and “RISK FACTORS” sections of CMS Energy’s and Consumers Energy’s Form 10-K for the year ended December 31 and as updated in subsequent 10-Qs. CMS Energy’s and Consumers Energy’s “FORWARD-LOOKING STATEMENTS AND INFORMATION” and “RISK FACTORS” sections are incorporated herein by reference and discuss important factors that could cause CMS Energy’s and Consumers Energy’s results to differ materially from those anticipated in such statements. CMS Energy and Consumers Energy undertake no obligation to update any of the information presented herein to reflect facts, events or circumstances after the date hereof.

The presentation also includes non-GAAP measures when describing CMS Energy’s results of operations and financial performance. A reconciliation of each of these measures to the most directly comparable GAAP measure is included in the appendix and posted on our website at www.cmsenergy.com.

CMS Energy provides financial results on both a reported (Generally Accepted Accounting Principles) and adjusted (non-GAAP) basis. Management views adjusted earnings as a key measure of the company’s present operating financial performance, unaffected by discontinued operations, asset sales, impairments, regulatory items from prior years, or other items. Certain of these items have the potential to impact, favorably or unfavorably, the company’s reported earnings in 2012. The company is not able to estimate the impact of these matters and is not providing reported earnings guidance.

2

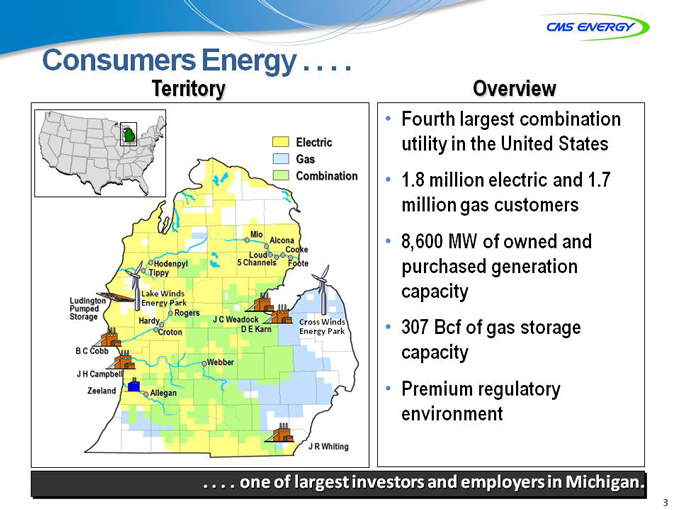

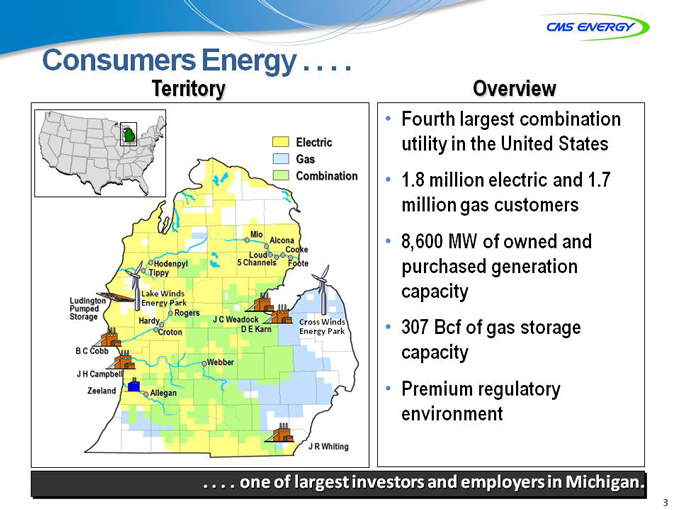

Consumers Energy . . . .

Territory Overview

• Fourth largest combination utility in the United States

• 1.8 million electric and 1.7 million gas customers

• 8,600 MW of owned and purchased generation capacity

• 307 Bcf of gas storage capacity

• Premium regulatory environment

. . . . one of largest investors and employers in Michigan.

3

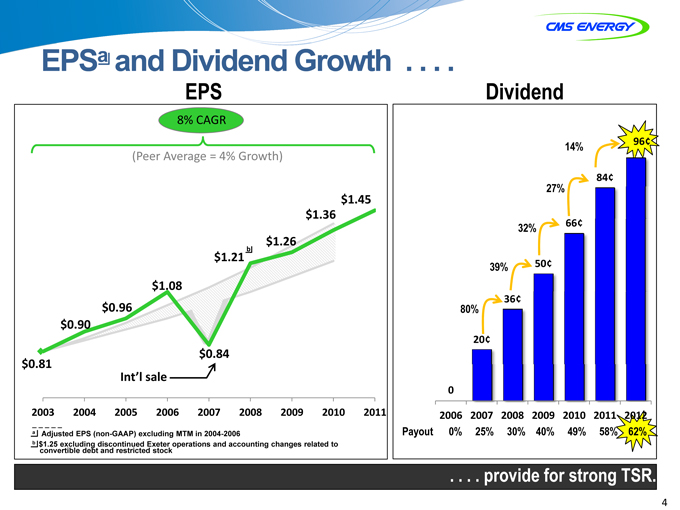

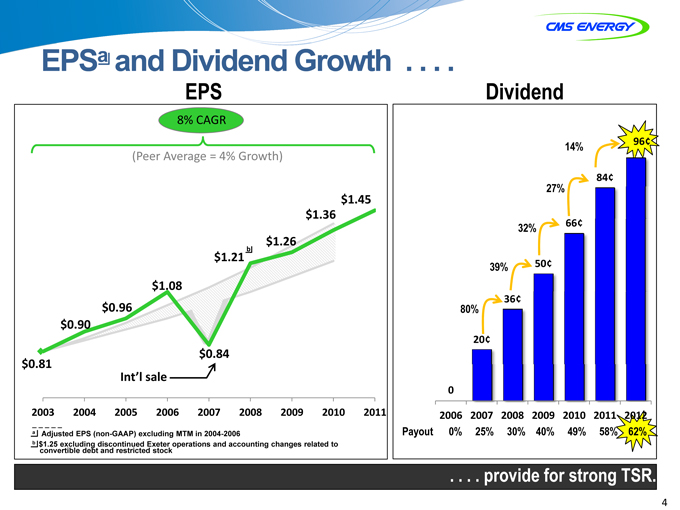

EPSa and Dividend Growth. . . .

EPS

8% CAGR

(Peer Average = 4% Growth)

$1.45

$1.36

$1.26

$1.21 b

$1.08

$0.96

$0.90

$0.84

$0.81

Int’l sale

2003 2004 2005 2006 2007 2008 2009 2010 2011

a Adjusted EPS (non-GAAP) excluding MTM in 2004-2006 b $1.25 excluding discontinued Exeter operations and accounting changes related to convertible debt and restricted stock

Dividend

14% 96¢

84¢

27%

32% 66¢

39% 50¢

36¢

80%

20¢

0

2006 2007 2008 2009 2010 2011 2012

Payout 0% 25% 30% 40% 49% 58% 62%

. . . providerovide for strong TSR.

4

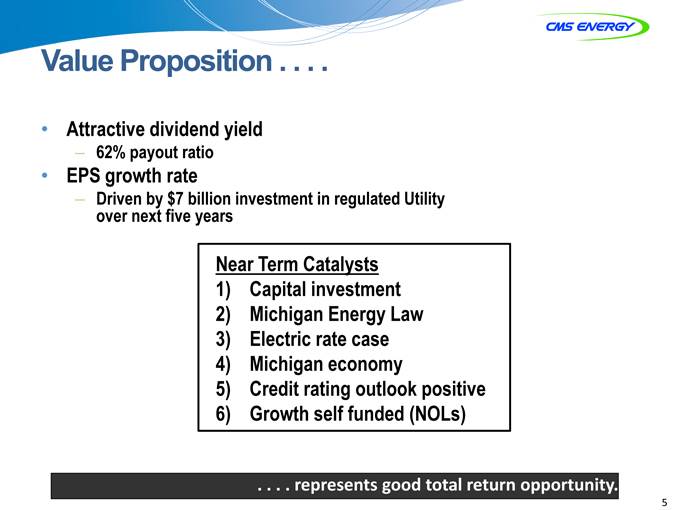

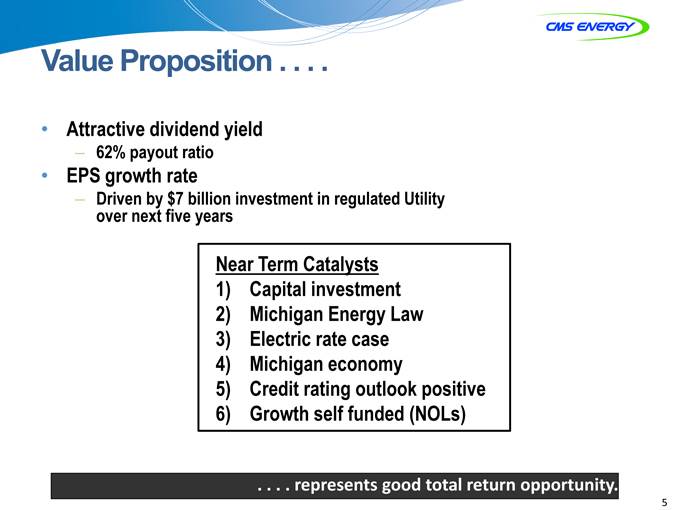

Value Proposition . . .

Attractive dividend yield

62% payout ratio

EPS growth rate

Driven by $7 billion investment in regulated Utility over next five years

Near Term Catalysts

1) Capital investment

2) Michigan Energy Law

3) Electric rate case

4) Michigan economy

5) Credit rating outlook positive

6) Growth self funded (NOLs)

. . . . represents good total return opportunity.

5

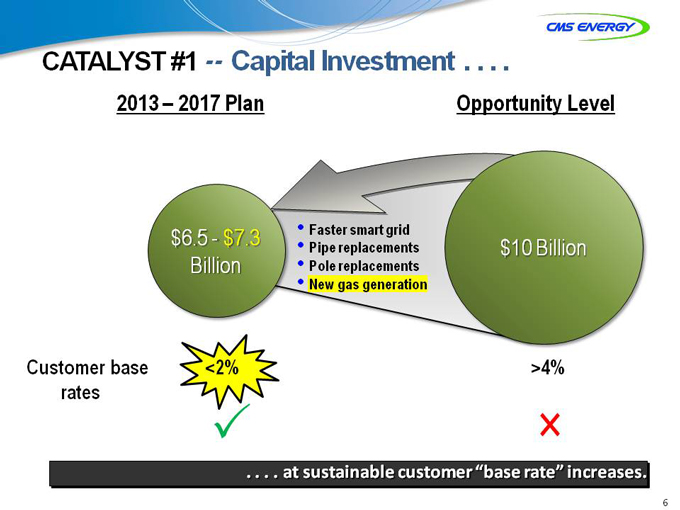

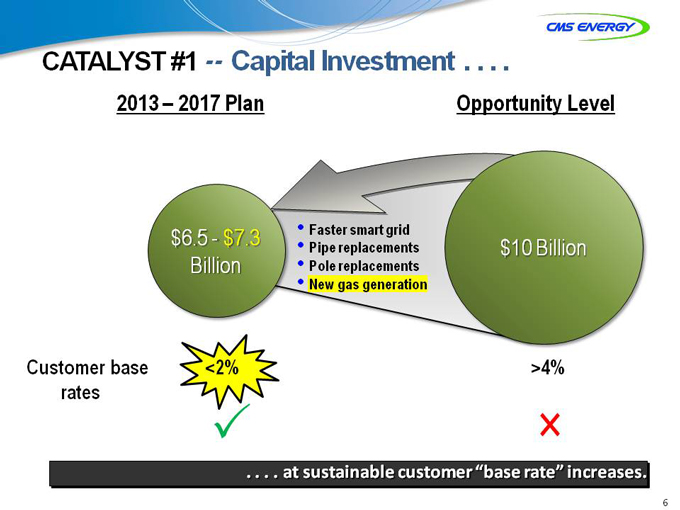

CATALYST #1 — Capital Investment . . . .

2013 – 2017 Plan Opportunity Level

$6.5—$7.3 • Faster smart grid

• Pipe replacements $10 Billion Billion • Pole replacements

• New gas generation

Customer base <2% >4% rates

×

. . . . at sustainable customer “base rate” increases.

6

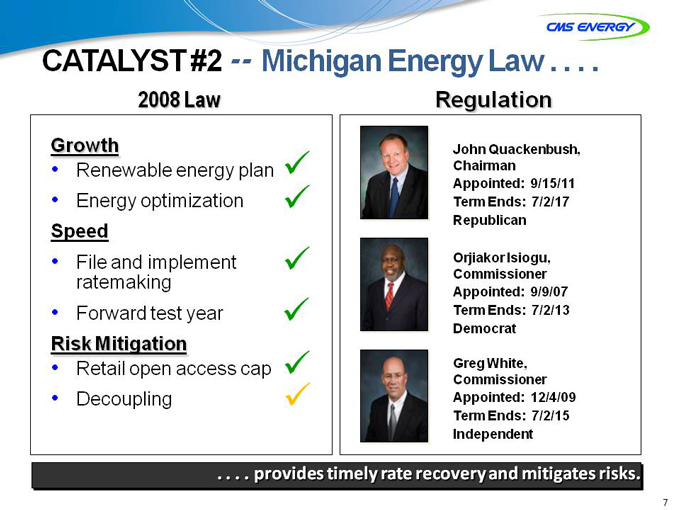

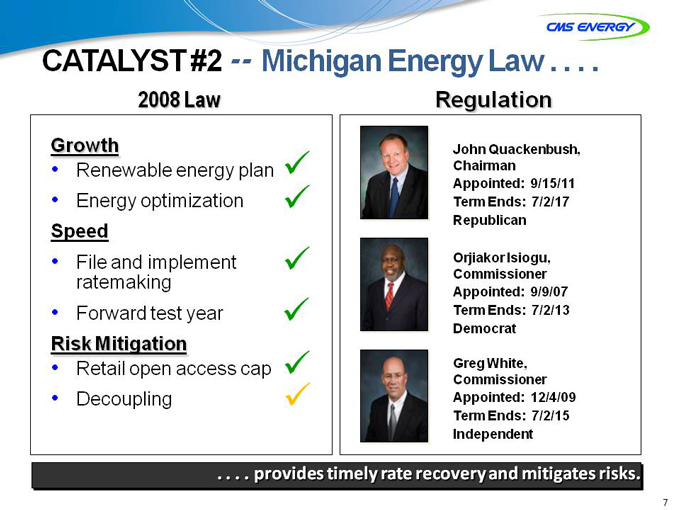

CATALYST #2 — Michigan Energy Law . . . .

2008 Law Regulation

Growth John Quackenbush,

• Renewable energy plan Chairman

Appointed: 9/15/11

• Energy optimization Term Ends: 7/2/17

Republi

can

Speed

• File and implement Orjiakor Isiogu,

ratemaking Commissioner Appointed: 9/9/07

• Forward test year Term Ends: 7/2/13

Risk Mitigation Democrat

• Retail open access cap ?Greg White,

Commissioner

• Decoupling Appointed: 12/4/09 Term Ends: 7/2/15 Independent

. . . . provides timely rate recovery and mitigates risks.

7

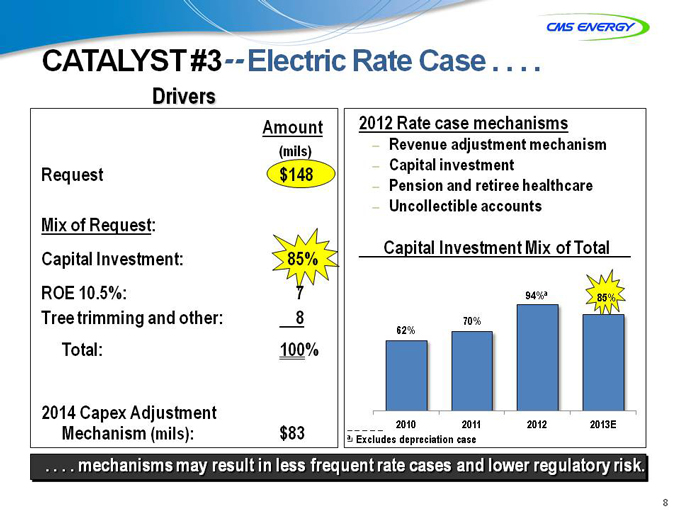

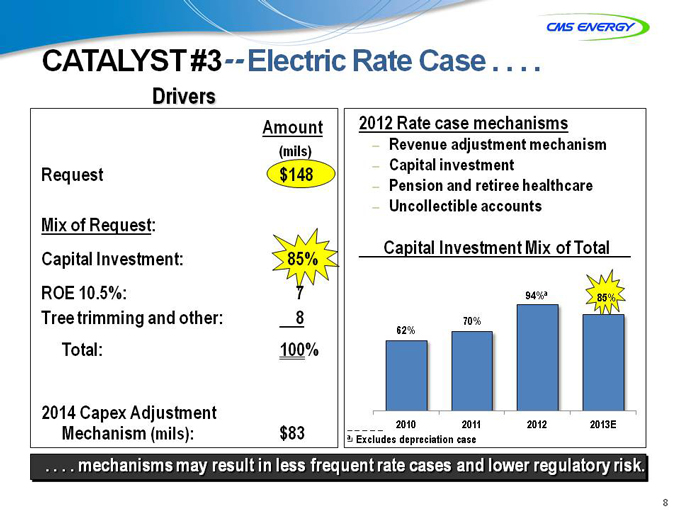

CATALYST #3— Electric Rate Case . . . .

Drivers

Amount 2012 Rate case mechanisms

(mils) Revenue adjustment mechanism

– Capital investment

Request $148

– Pension and retiree healthcare

– Uncollectible accounts

Mix of Request:

Capital Investment Mix of Total Capital Investment: 85% ROE 10.5%: 7

94%a 85% Tree trimming and other: 8 62% 70% Total: 100%

2014 Capex Adjustment

Mechanism (mils): $83 2010 2011 2012 2013E a Excludes depreciation case

. . . . mechanismsechanisms may result in less frequent rate cases and lower regulatory risk.

8

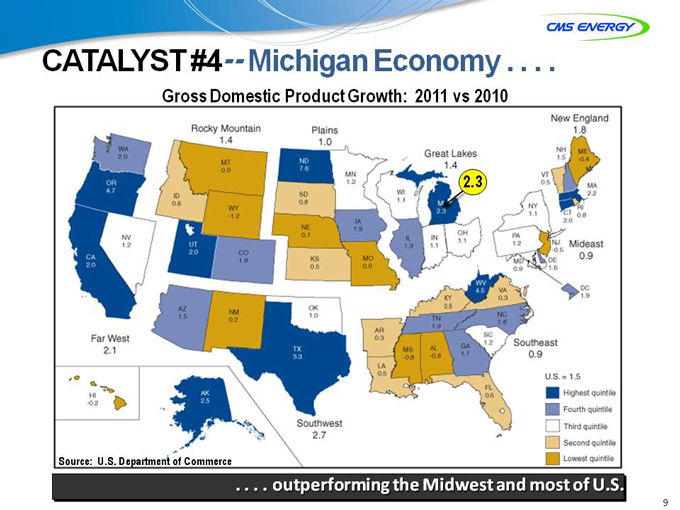

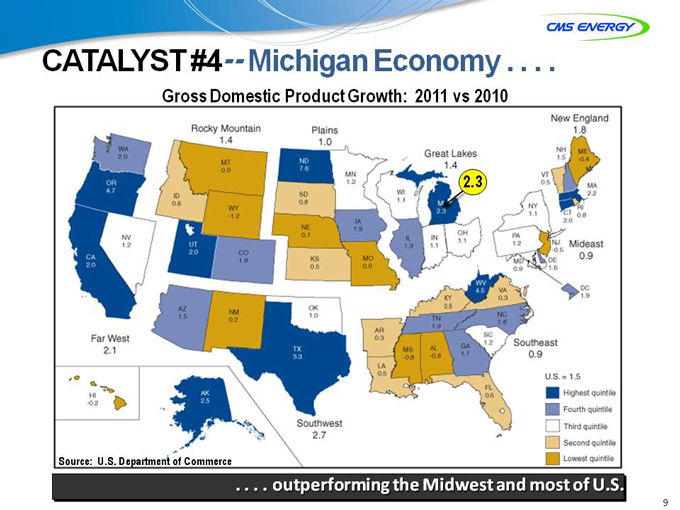

CATALYST #4— Michigan Economy . . . .

Gross Domestic Product Growth: 2011 vs 2010

2.3

Source: U.S. Department of Commerce

. . . . outperforming the Midwest and most of U.S.

9

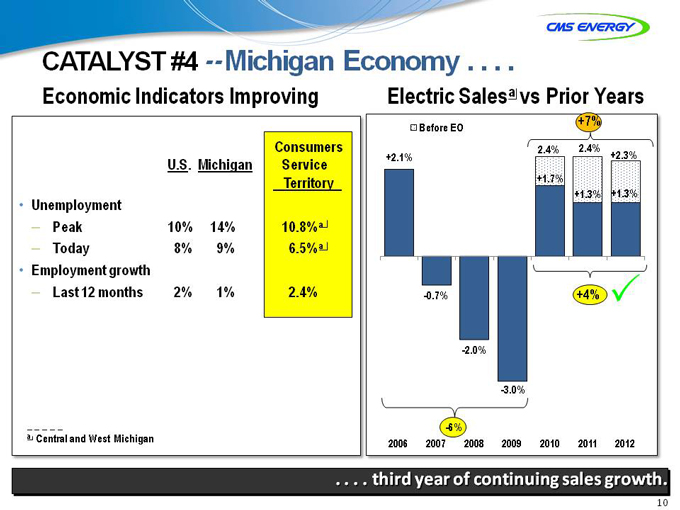

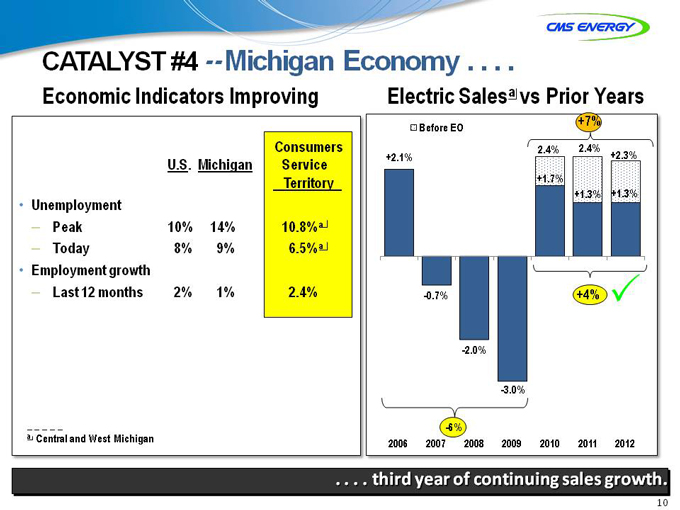

CATALYST #4 — Michigan Economy . . . .

Economic Indicators Improving Electric Salesa vs Prior Years

Consumers U.S. Michigan Service Territory

• Unemployment

– Peak 10% 14% 10.8% a

– Today 8% 9% 6.5% a

• Employment growth

Last 12 months 2% 1% 2.4%

a Central and West Michigan

Before EO +7% 2.4% 2.4%

+2.1% +2.3%

+1.7%

+1.3% +1.3%

-0.7% +4% -2.0%

-3.0%

-6%

2006 2007 2008 2009 2010 2011 2012

. . . . third year of continuing sales growth.

10

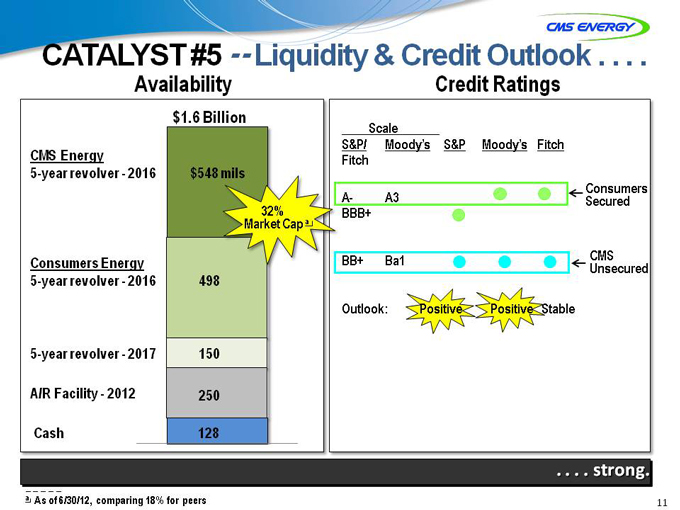

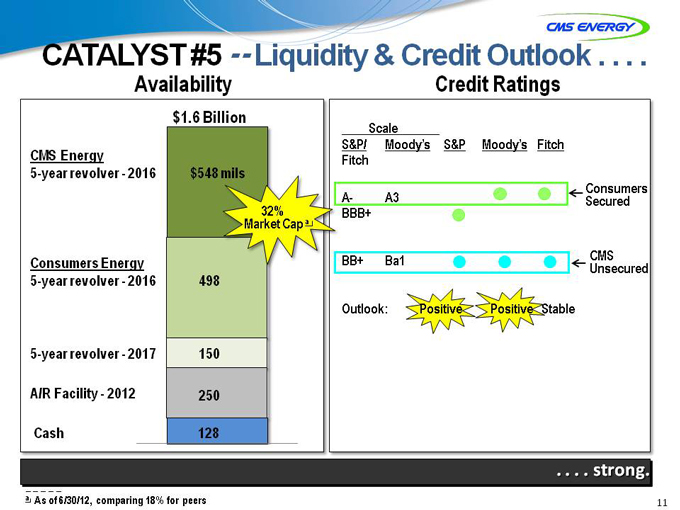

CATALYST #5 — Liquidity & Credit Outlook . . . .

Availability Credit Ratings

$1.6 Billion

CMS Energy

5-year revolver—2016 $548 mils

32% Market Cap a

Consumers Energy

5-year revolver—2016 498

5-year revolver—2017 150 A/R Facility—2012 250 Cash 128

Scale

S&P/ Moody’s S&P Moody’s Fitch Fitch

Consumers A- A3 Secured BBB+

CMS BB+ Ba1 Unsecured

Outlook: Positive Positive Stable

. . . . strong.

. . . . strong.

a As of 6/30/12, comparing 18% for peers

11

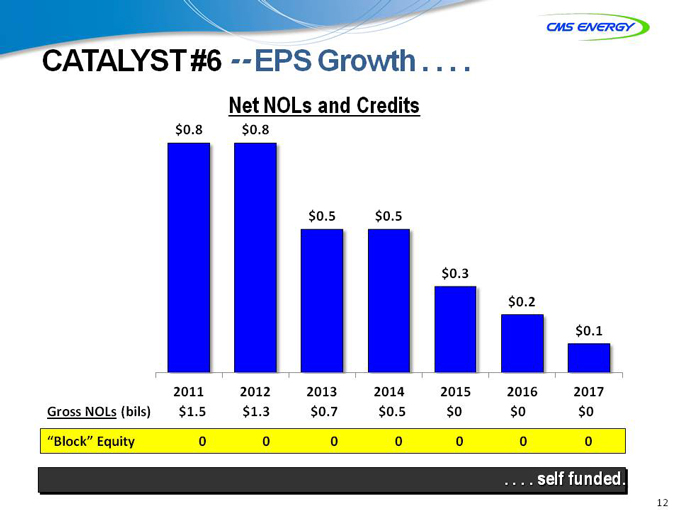

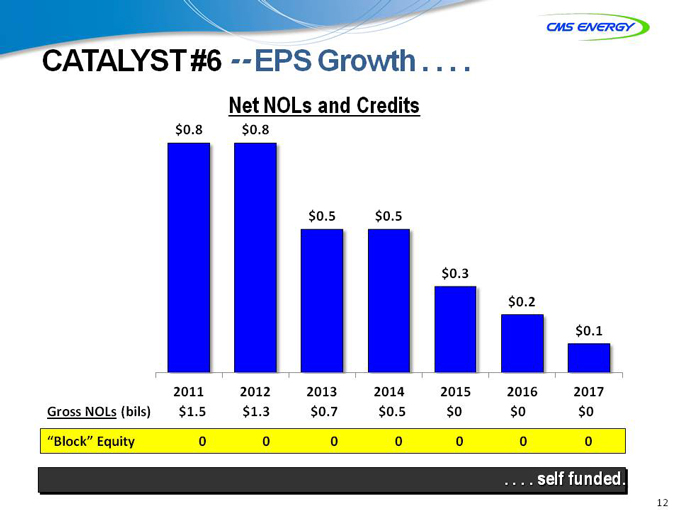

CATALYST #6 — EPS Growth . . . .

Net NOLs and Credits

$0.8 $0.8

$0.5 $0.5

$0.3 $0.2 $0.1

2011 2012 2013 2014 2015 2016 2017 Gross NOLs (bils) $1.5 $1.3 $0.7 $0.5 $0 $0 $0

“Block” Equity 0 0 0 0 0 0 0

. . . . selfelf funded.

12

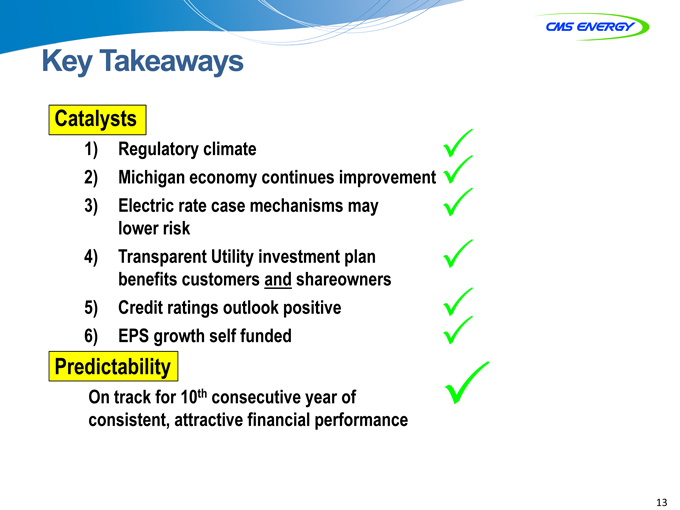

Key Takeaways

Catalysts

1) Regulatory climate

2) Michigan economy continues improvement

3) Electric rate case mechanisms may lower risk

4) Transparent Utility investment plan benefits customers and shareowners

5) Credit ratings outlook positive

6) EPS growth self funded

Predictability

On track for 10th consecutive year of consistent, attractive financial performance

13

GAAP Reconciliation

CMS ENERGY CORPORATION

Earnings Per Share By Year GAAP Reconciliation

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | 2003

| | | 2004

| | | 2005

| | | 2006

| | | 2007

| | | 2008

| | | 2009

| | | 2010

| | | 2011

| |

Reported earnings (loss) per share - GAAP | | ($ | 0.30 | ) | | $ | 0.64 | | | ($ | 0.44 | ) | | ($ | 0.41 | ) | | ($ | 1.02 | ) | | $ | 1.20 | | | $ | 0.91 | | | $ | 1.28 | | | $ | 1.58 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

After-tax items: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Electric and gas utility | | | 0.21 | | | | (0.39 | ) | | | — | | | | — | | | | (0.07 | ) | | | 0.05 | | | | 0.33 | | | | 0.03 | | | | 0.00 | |

Enterprises | | | 0.74 | | | | 0.62 | | | | 0.04 | | | | (0.02 | ) | | | 1.25 | | | | (0.02 | ) | | | 0.09 | | | | (0.03 | ) | | | (0.11 | ) |

Corporate interest and other | | | 0.16 | | | | (0.03 | ) | | | 0.04 | | | | 0.27 | | | | (0.32 | ) | | | (0.02 | ) | | | 0.01 | | | | * | | | | (0.01 | ) |

Discontinued operations (income) loss | | | (0.16 | ) | | | 0.02 | | | | (0.07 | ) | | | (0.03 | ) | | | 0.40 | | | | ( | *) | | | (0.08 | ) | | | 0.08 | | | | (0.01 | ) |

Asset impairment charges, net | | | — | | | | — | | | | 1.82 | | | | 0.76 | | | | 0.60 | | | | — | | | | — | | | | — | | | | — | |

Cumulative accounting changes | | | 0.16 | | | | 0.01 | | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Adjusted earnings per share, including MTM - non-GAAP | | $ | 0.81 | | | $ | 0.87 | | | $ | 1.39 | | | $ | 0.57 | | | $ | 0.84 | | | $ | 1.21 | (a) | | $ | 1.26 | | | $ | 1.36 | | | $ | 1.45 | |

Mark-to-market impacts | | | | | | | 0.03 | | | | (0.43 | ) | | | 0.51 | | | | | | | | | | | | | | | | | | | | | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Adjusted earnings per share, excluding MTM - non-GAAP | | | NA | | | $ | 0.90 | | | $ | 0.96 | | | $ | 1.08 | | | | NA | | | | NA | | | | NA | | | | NA | | | | NA | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

| * | | Less than $500 thousand or $0.01 per share. |

| (a) | | $1.25 excluding discontinued Exeter operations and accounting changes related to convertible debt and restricted stock. |

2003–11 EPS