Exhibit 99.1

Exhibit 99.1

Investor Meetings

April 30, 2013

Cross Winds Energy Park

Gas Combined Cycle Plant

Consumers Smart Energy Program

This presentation is made as of the date hereof and contains “forward-looking statements” as defined in Rule 3b-6 of the

Securities Exchange Act of 1934, as amended, Rule 175 of the Securities Act of 1933, as amended, and relevant legal decisions. The forward-looking statements are subject to risks and uncertainties. They should be read in conjunction with “FORWARD-LOOKING STATEMENTS AND INFORMATION” and “RISK FACTORS” sections of CMS Energy’s and Consumers Energy’s Form 10-K for the year ended December 31 and as updated in subsequent 10-Qs. CMS Energy’s and Consumers Energy’s “FORWARD-LOOKING STATEMENTS AND INFORMATION” and “RISK FACTORS” sections are incorporated herein by reference and discuss important factors that could cause CMS Energy’s and Consumers Energy’s results to differ materially from those anticipated in such statements. CMS Energy and Consumers Energy undertake no obligation to update any of the information presented herein to reflect facts, events or circumstances after the date hereof.

The presentation also includes non-GAAP measures when describing CMS Energy’s results of operations and financial performance. A reconciliation of each of these measures to the most directly comparable GAAP measure is included in the appendix and posted on our website at www.cmsenergy.com.

CMS Energy provides financial results on both a reported (Generally Accepted Accounting Principles) and adjusted (non-GAAP) basis. Management views adjusted earnings as a key measure of the company’s present operating financial performance, unaffected by discontinued operations, asset sales, impairments, regulatory items from prior years, or other items. Certain of these items have the potential to impact, favorably or unfavorably, the company’s reported earnings in 2013. The company is not able to estimate the impact of these matters and is not providing reported earnings guidance.

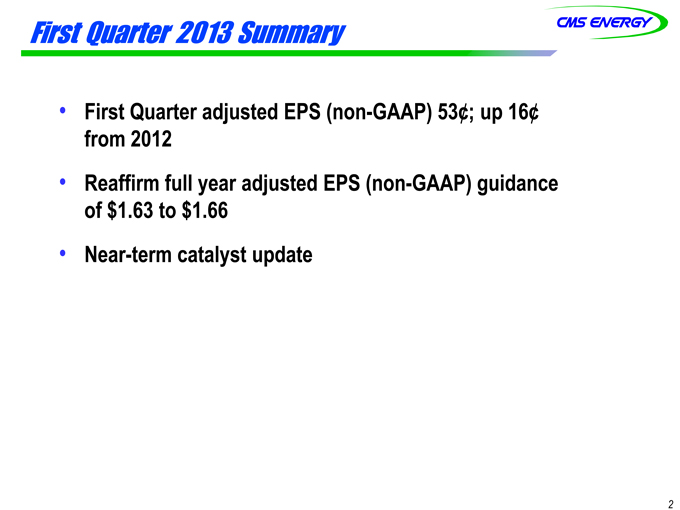

First Quarter 2013 Summary

First Quarter adjusted EPS (non-GAAP) 53¢; up 16¢ from 2012

Reaffirm full year adjusted EPS (non-GAAP) guidance of $1.63 to $1.66

Near-term catalyst update

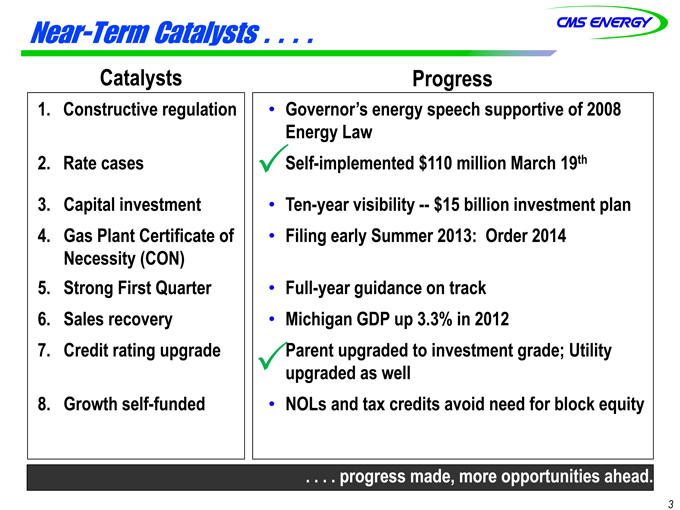

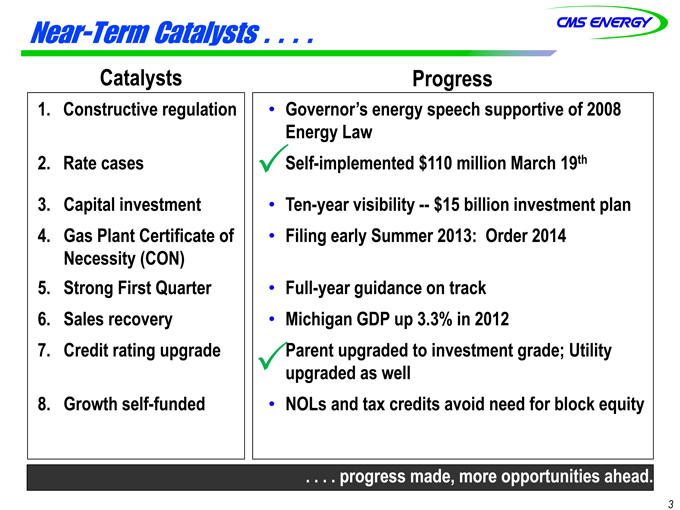

Near-Term Catalysts . . . .

Catalysts

Progress

1. Constructive regulation

Governor’s energy speech supportive of 2008 Energy Law

2. Rate cases

Self-implemented $110 million March 19th

3. Capital investment

Ten-year visibility — $15 billion investment plan

4. Gas Plant Certificate of Necessity (CON)

Filing early Summer 2013: Order 2014

5. Strong First Quarter

Full-year guidance on track

6. Sales recovery

Michigan GDP up 3.3% in 2012

7. Credit rating upgrade

Parent upgraded to investment grade; Utility upgraded as well

8. Growth self-funded

NOLs and tax credits avoid need for block equity

. . . . progressrogress made, more opportunities ahead.

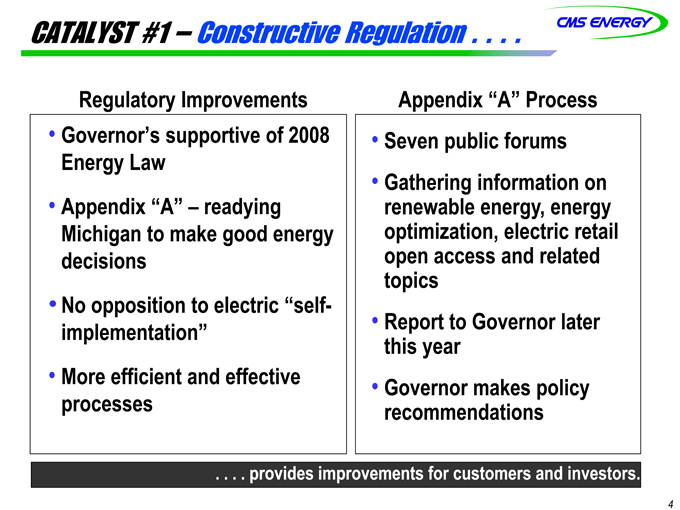

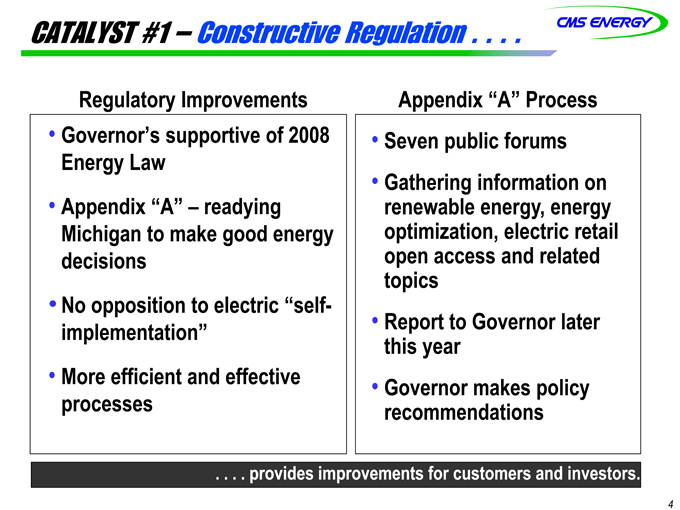

CATALYST #1 – Constructive Regulation . . . .

Regulatory Improvements

Appendix “A” Process

Governor’s supportive of 2008 Energy Law

Seven public forums

Appendix “A” – readying Michigan to make good energy decisions

Gathering information on renewable energy, energy optimization, electric retail open access and related topics

No opposition to electric “self-implementation”

Report to Governor later this year

More efficient and effective processes

Governor makes policy recommendations

. . . . providesrovides improvements for customers and investors.

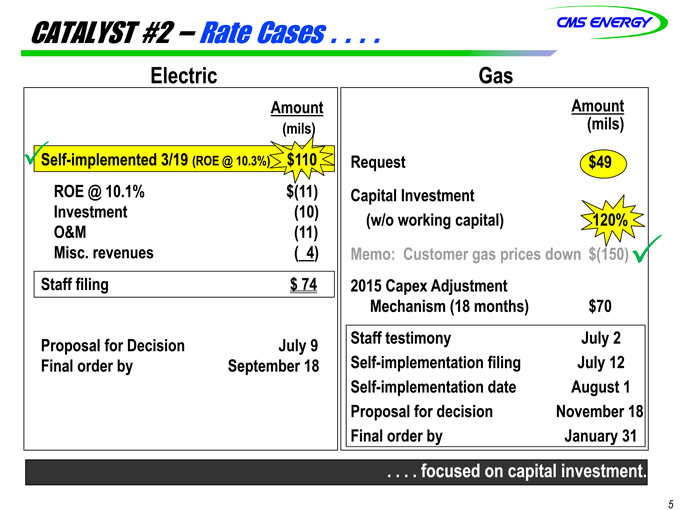

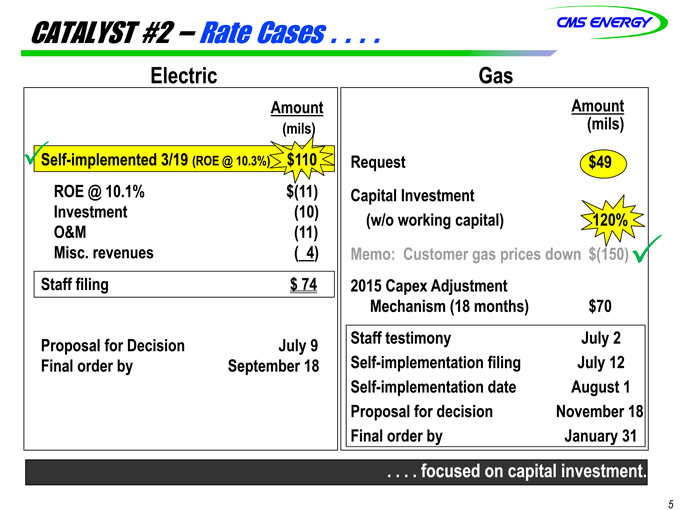

CATALYST #2 – Rate Cases . . . .

Electric

Gas

Amount

(mils)

Self-implemented 3/19 (ROE @ 10.3%)

$110

ROE @ 10.1%

$(11)

Investment

O&M

Misc. revenues

( 4)

Staff filing

$ 74

Proposal for Decision

July 9

Final order by

September 18

Amount

(mils)

Request

$49

Capital Investment

(w/o working capital)

120%

Memo: Customer gas prices down

$(150)

2015 Capex Adjustment Mechanism (18 months)

$70

Staff testimony

July 2

Self-implementation filing

July 12

Self-implementation date

August 1

Proposal for decision

November 18

Final order by

January 31

. . . . focusedocused on capital investment.

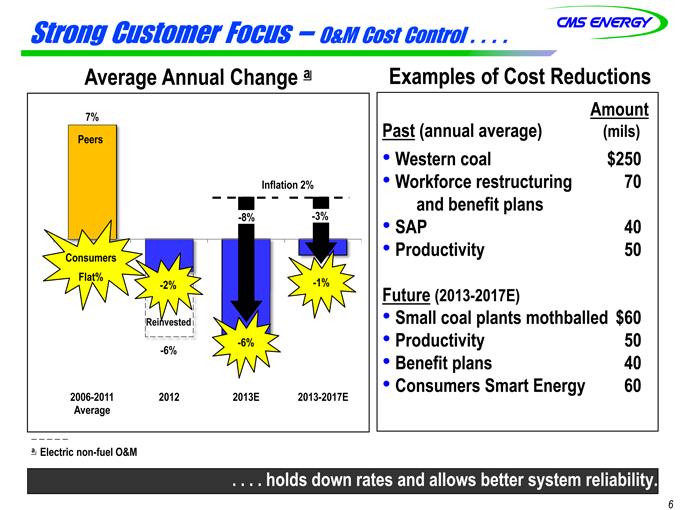

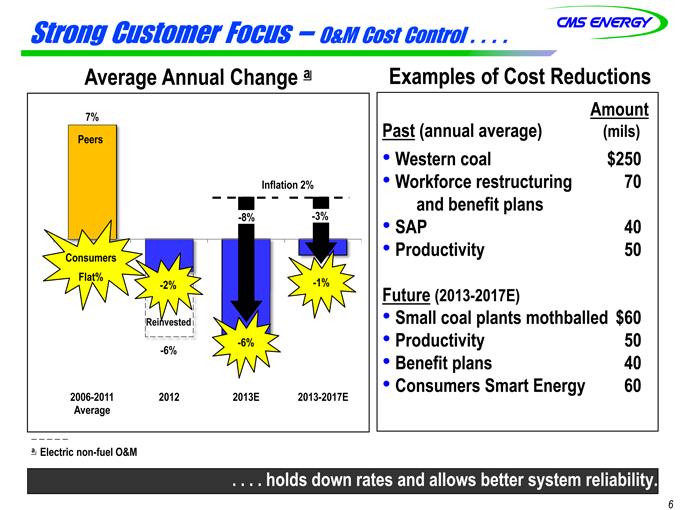

Strong Customer Focus – O&M Cost Control . . . .

Average Annual Change a

7%

Peers

Inflation 2%

-8%

-3%

Consumers Flat%

—2%

-6%

-1%

Reinvested

-6%

2006-2011 Average

2012

2013E

2013-2017E

Examples of Cost Reductions

Amount

(mils)

Past (annual average)

Western coal

$250

Workforce restructuring and benefit plans

70

SAP

40

Productivity

50

Future (2013-2017E)

Small coal plants mothballed

$60

Productivity

50

Benefit plans

40

Consumers Smart Energy

60

a Electric non-fuel O&M

. . . . holds down rates and allows better system reliability.

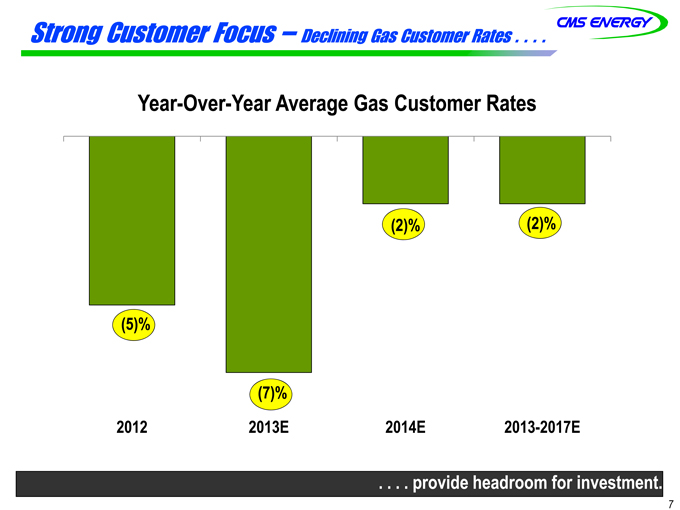

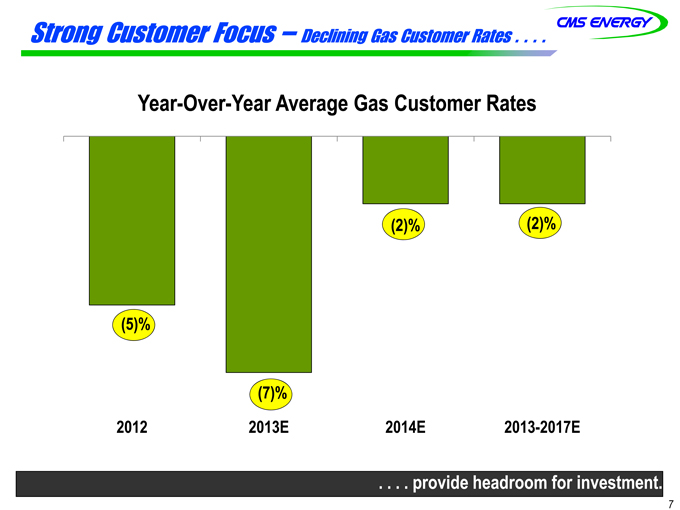

Strong Customer Focus – Declining Gas Customer Rates . . . .

Year-Over-Year ear Average Gas Customer Rates

(5)%

(7)%

(2)%

(2)%

2012

2013E

2014E

2013-2017E

. . . . providerovide headroom for investment.

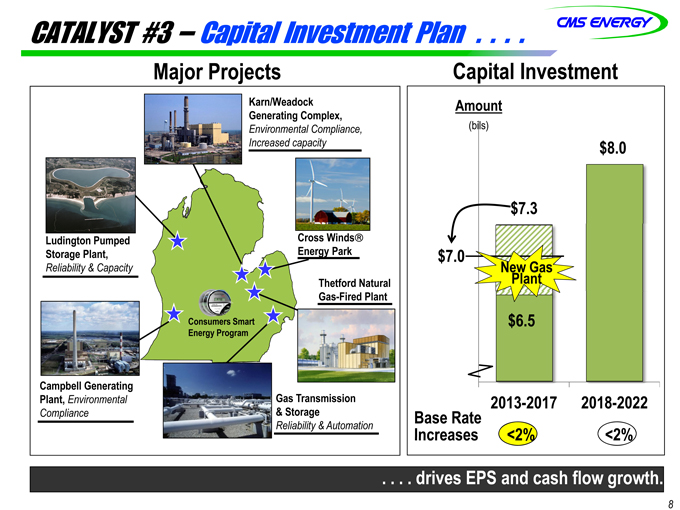

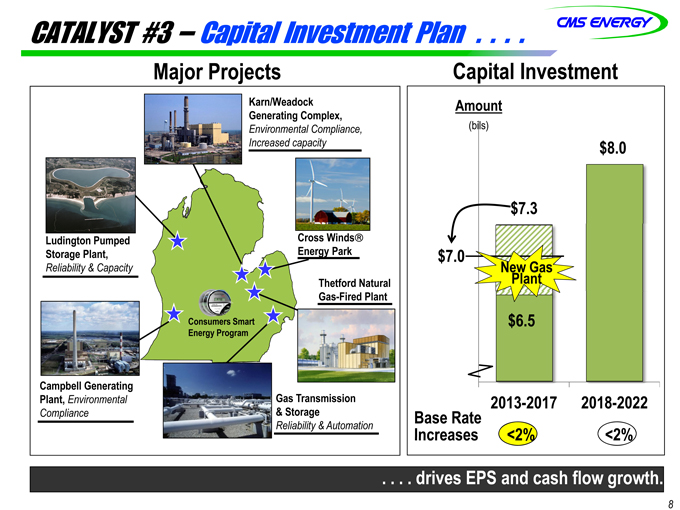

CATALYST #3 – Capital Investment Plan . . . .

Major Projects

Karn/Weadock Generating Complex,

Environmental Compliance, Increased capacity

Ludington Pumped Storage Plant,

Reliability & Capacity

Cross Winds??Energy Park

Thetford Natural Gas-Fired Plant

Campbell Generating Plant, Environmental Compliance

Gas Transmission

& Storage

Reliability & Automation

Consumers Smart Energy Program

Capital Investment

Amount

(bils)

$7.0

$7.3

$808.0

New Gas Plant

$6.5

2013-2017

2018-2022

Base Rate Increases

<2%

<2%

. . . . drivesrives EPS and cash flow growth.

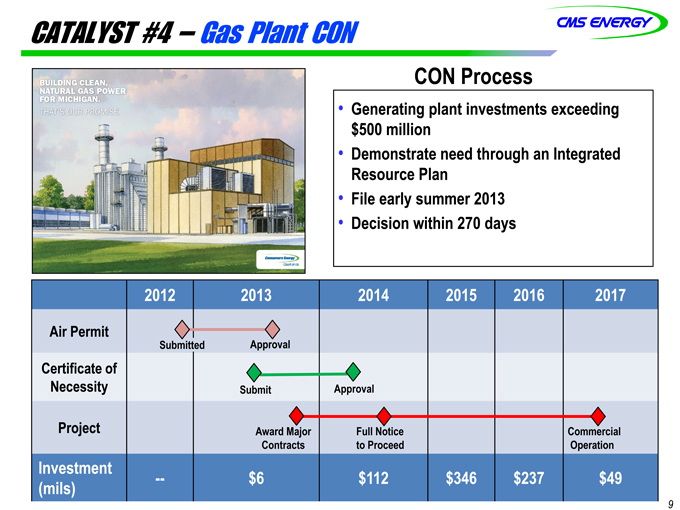

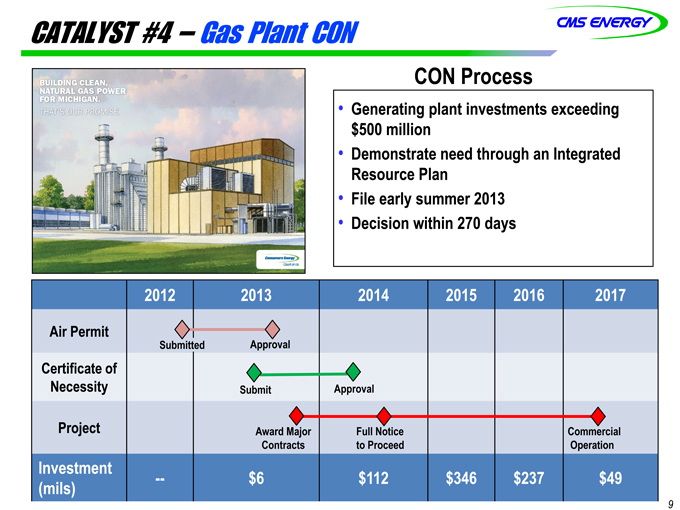

CATALYST #4 – Gas Plant CON

CON Process

Generating plant investments exceeding $500 million

Demonstrate need through an Integrated Resource Plan

File early summer 2013

Decision within 270 days

2012 2013 2014 2015 2016 2017

Air Permit

Submitted

Approval

Certificate of Necessity

Submit

Approval

Project

Award Major Contracts

Full Notice to Proceed

Commercial Operation

Investment

— $6 $112 $346 $237 $49 (mils)

9

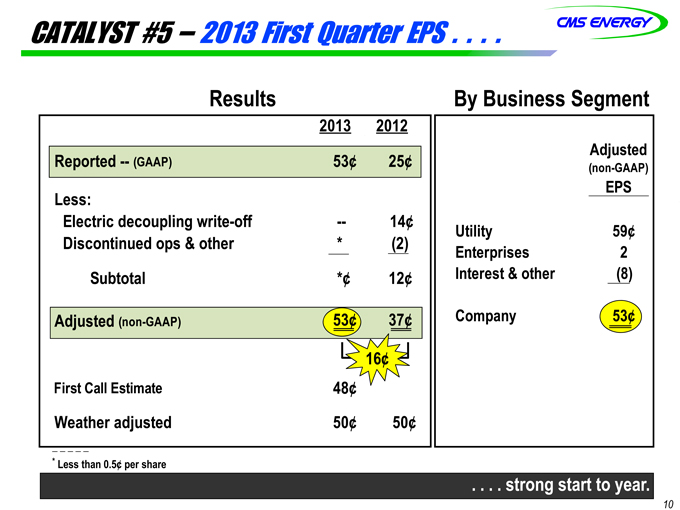

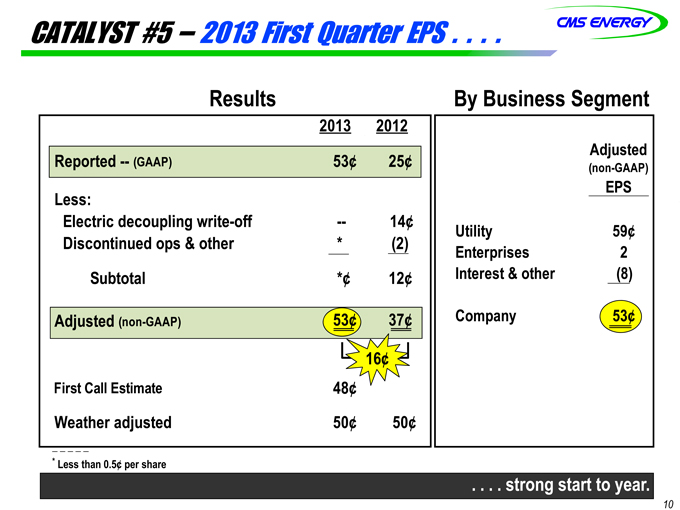

CATALYST #5 – 2013 First Quarter EPS . . . .

Results

2013 2012

Reported — (GAAP) 53¢ 25¢

Less:

Electric decoupling write-off

—

14¢

Discontinued ops & other

Subtotal *¢ 12¢

Adjusted (non-GAAP) 53¢ 37¢

16¢

First Call Estimate 48¢

Weather adjusted 50¢ 50¢

By Business Segment

Adjusted

(non-GAAP)

EPS

Utility 59¢

Enterprises 2

Interest & other (8)

Company 53¢

* | | Less than 0.5¢ per share |

. . . . strong start to year.

10

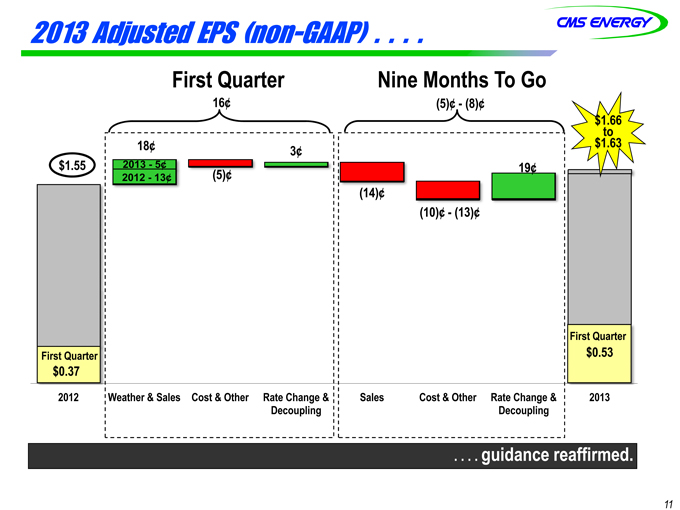

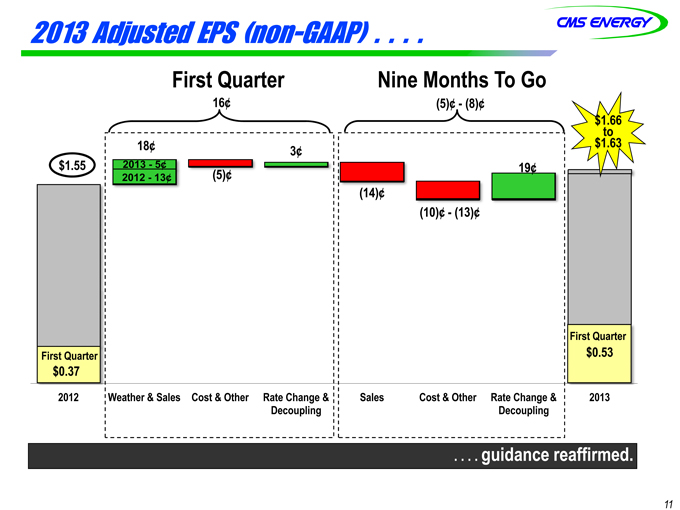

2013 Adjusted EPS (non-GAAP) . . . .

First Quarter

16¢

$1.55

18¢

2013—5¢ 2012 -13¢

First Quarter $0.37

2012

Weather & Sales Cost & Other Rate Change & Decoupling

Nine Months To Go

19¢

$1.66 to $1.63

First Quarter $0.53

2013

Sales

Cost & Other

Rate Change & Decoupling

. . . . guidance reaffirmed.

11

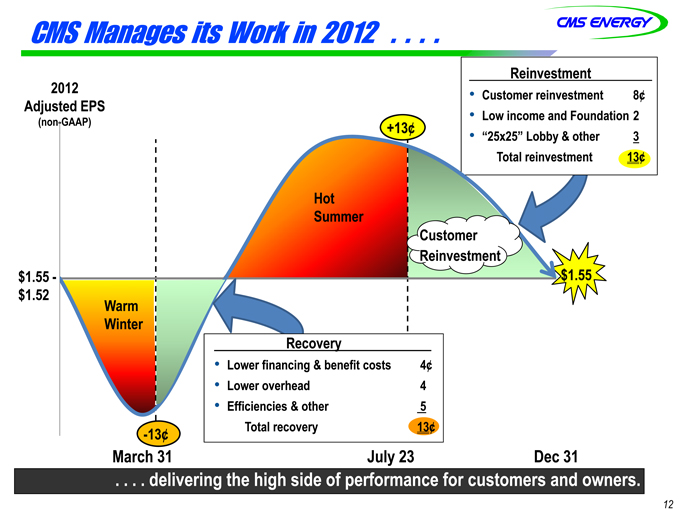

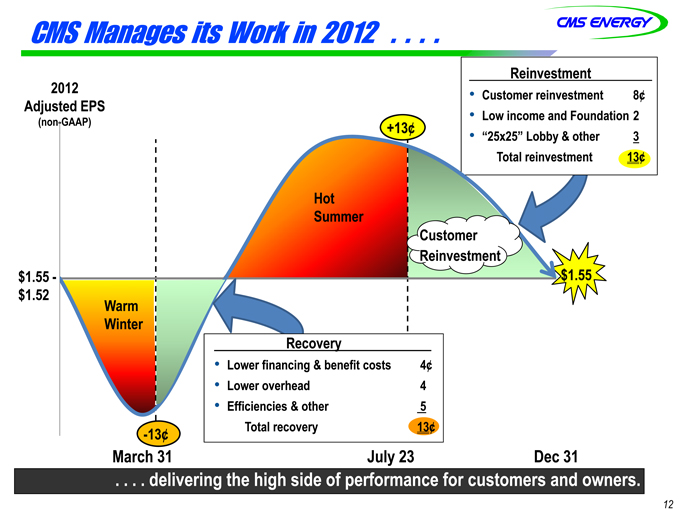

CMS Manages its Work in 2012 . . . .

2012 Adjusted EPS

(non-GAAP)

Reinvestment

Customer reinvestment 8¢

Low income and Foundation 2

“25x25” Lobby & other 3

Total reinvestment 13?

$1.55 -$1.52

+13¢

Hot Summer

Customer Reinvestment

$1.55

Warm Winter

-13¢

March 31

July 23

Dec 31

Recovery

Lower financing & benefit costs 4¢

Lower overhead 4

Efficiencies & other 5

Total recovery 13¢

. . . . deliveringelivering the high side of performance for customers and owners.

12

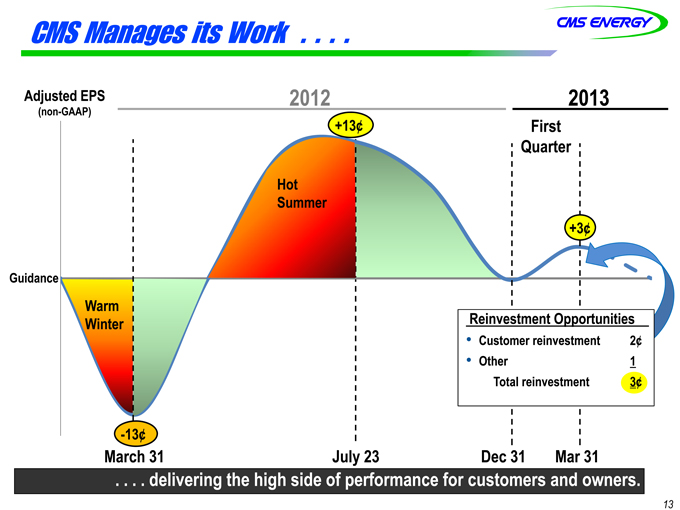

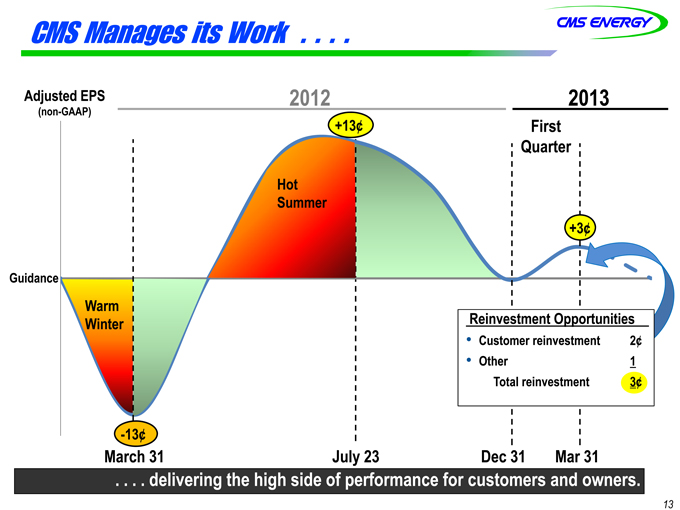

CMS Manages its Work . . . .

Adjusted EPS

(non-GAAP)

2012

2013

+13¢

First Quarter

Hot Summer

+3¢

Guidance

Warm Winter

-13¢

Reinvestment Opportunities

Customer reinvestment 2¢

Other 1

Total reinvestment 3¢

March 31 July 23 Dec 31 Mar 31

. . . . deliveringelivering the high side of performance for customers and owners.

13

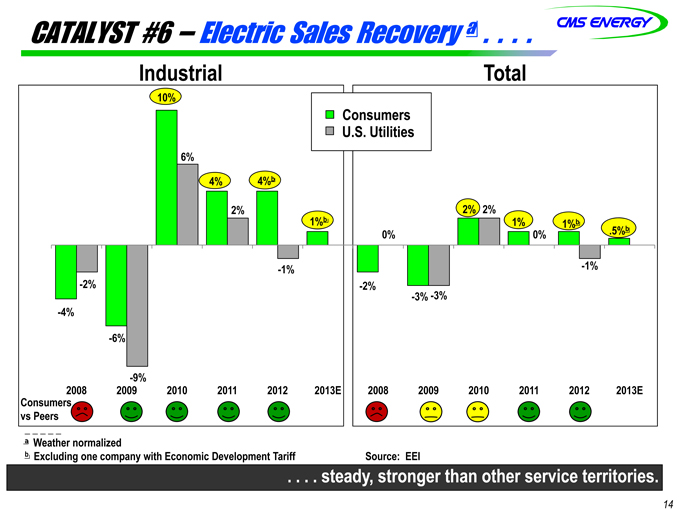

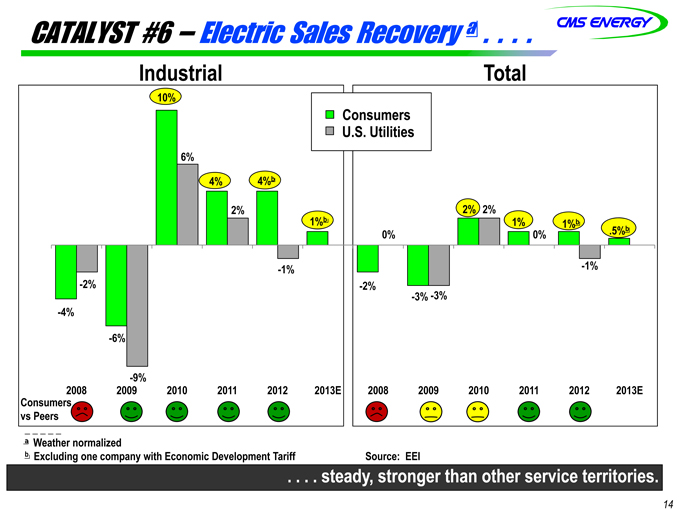

CATALYST #6 – Electric Sales Recovery a . . . .

Industrial

10%

6%

4% 4%b

2%

1%b

-1%

Consumers U.S. Utilities

-1% -2%

-4%

-6%

-9%

2008 2009 2010 2011 2012 2013E

Consumers vs Peers

2% 2%

1% 1%b .5%b

0% 0%

-1% -2% -3% -3%

Total

2008 2009 2010 2011 2012 2013E

a Weather normalized b Excluding one company with Economic Development Tariff Source: EEI

. . . . steady, stronger than other service territories.

14

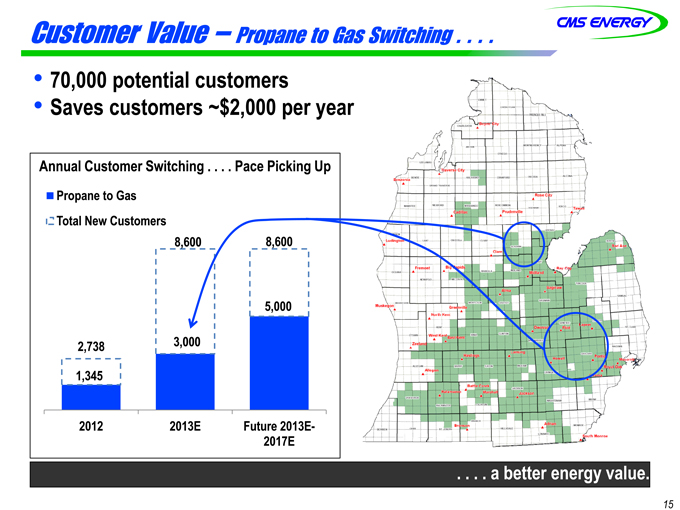

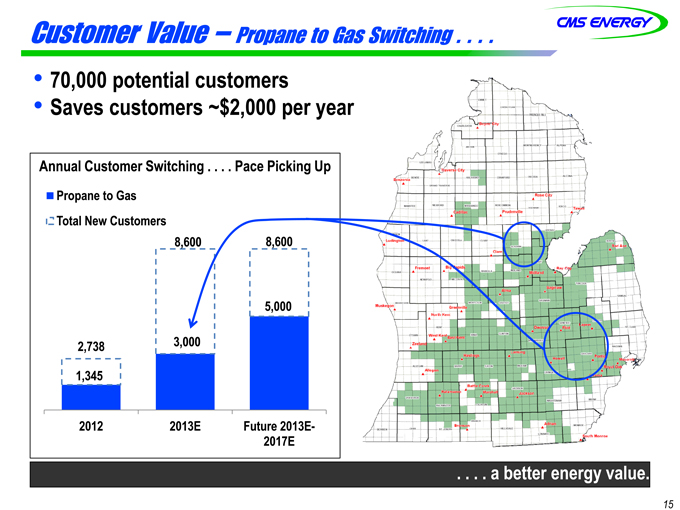

Customer Value – Propane to Gas Switching . . . .

70,000 potential customers Saves customers ~$2,000 per year

Annual Customer Switching . . . . Pace Picking Up

Propane to Gas Total New Customers

8,600 8,600

5,000

2,738 3,000 1,345

2012 2013E Future 2013E-2017E

. . . . a better etter energy value.

15

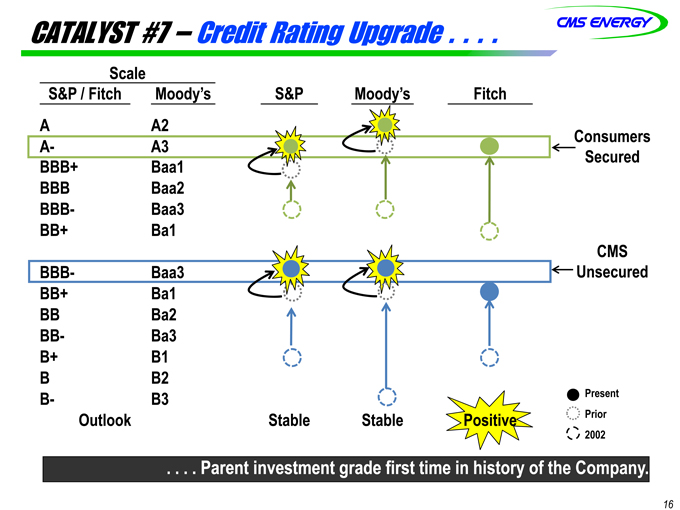

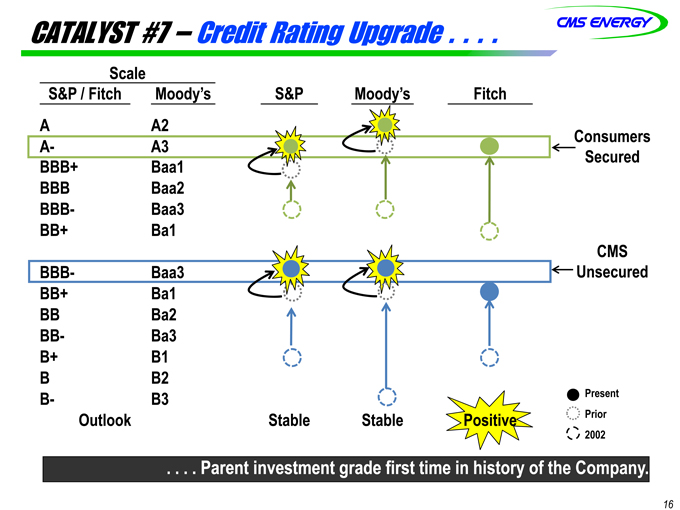

CATALYST #7 – Credit Rating Upgrade . . . .

Scale

S&P / Fitch Moody’s S&P Moody’s Fitch

A A2

A- A3 Consumers

BBB+ Baa1 Secured

BBB Baa2

BBB- Baa3

BB+ Ba1

CMS

BBB- Baa3 Unsecured

BB+ Ba1

BB Ba2

BB- Ba3

B+ B1

B B2

B- B3 Present

Outlook Stable Stable Positive Prior

2002

. . . . Parent investment grade first time in history of the Company.

16

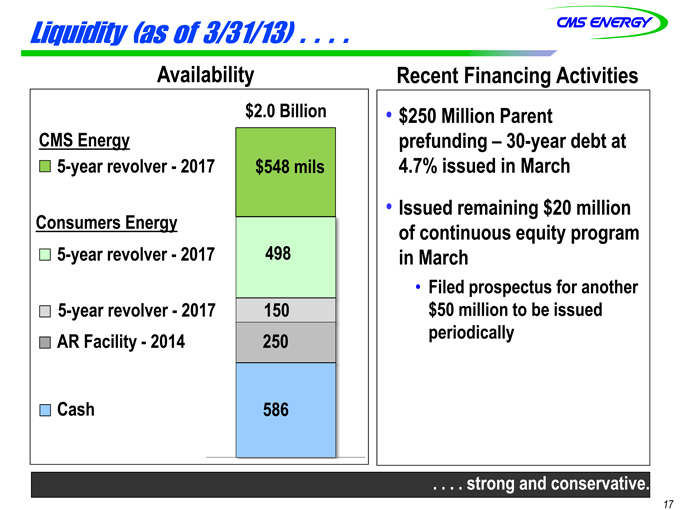

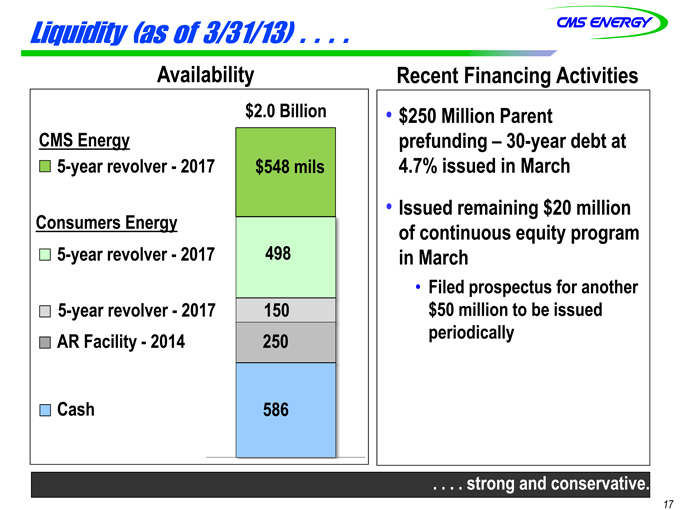

Liquidity (as of 3/31/13) . . . .

Availability Recent Financing Activities

$2.0 Billion

CMS Energy

5-year revolver—2017 $548 mils

Consumers Energy

5-year revolver—2017 498

5-year revolver—2017 150

AR Facility—2014 250

Cash 586

$250 Million Parent prefunding – 30-year debt at 4.7% issued in March

Issued remaining $20 million of continuous equity program in March

Filed prospectus for another $50 million to be issued periodically

. . . . strong and conservative.

17

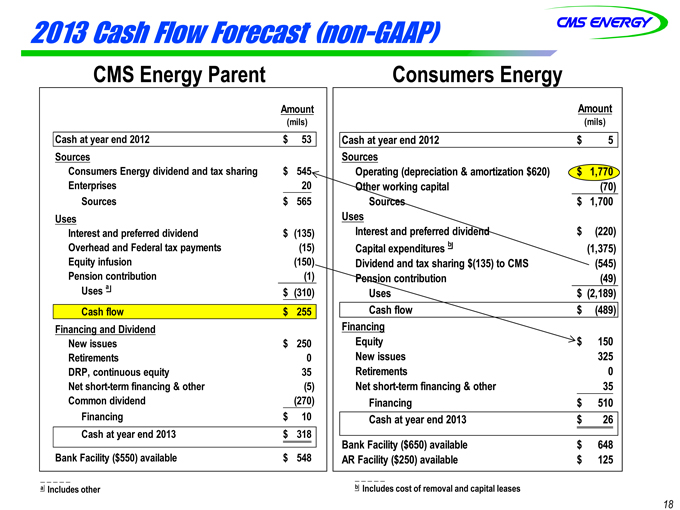

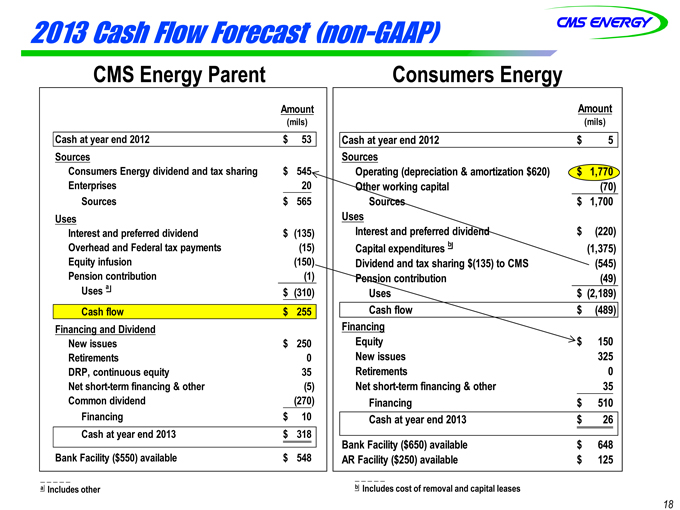

2013 Cash Flow Forecast (non-GAAP)

CMS Energy Parent Consumers Energy

Amount

(mils)

Cash at year end 2012 $ 53

Sources

Consumers Energy dividend and tax sharing $ 545

Enterprises 20

Sources $ 565

Uses

Interest and preferred dividend $ (135)

Overhead and Federal tax payments (15)

Equity infusion (150)

Pension contribution (1)

Uses a $ (310)

Cash flow $ 255

Financing and Dividend

New issues $ 250

Retirements 0

DRP, continuous equity 35

Net short-term financing & other (5)

Common dividend (270)

Financing $ 10

Cash at year end 2013 $ 318

Bank Facility ($550) available $ 548

Amount

(mils)

Cash at year end 2012 $ 5

Sources

Operating (depreciation & amortization $620) $ 1,770

Other working capital (70)

Sources $ 1,700

Uses

Interest and preferred dividend $ (220)

Capital expenditures b (1,375)

Dividend and tax sharing $(135) to CMS (545)

Pension contribution (49)

Uses $ (2,189)

Cash flow $ (489)

Financing

Equity $ 150

New issues 325

Retirements 0

Net short-term financing & other 35

Financing $ 510

Cash at year end 2013 $ 26

Bank Facility ($650) available $ 648

AR Facility ($250) available $ 125

a Includes other

b Includes cost of removal and capital leases

18

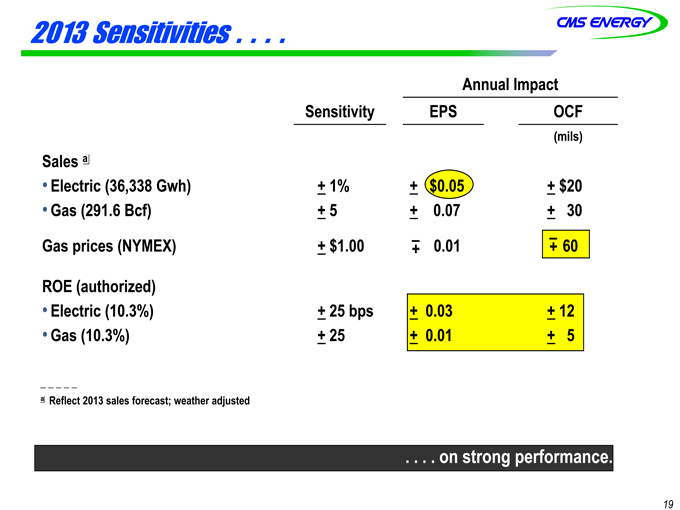

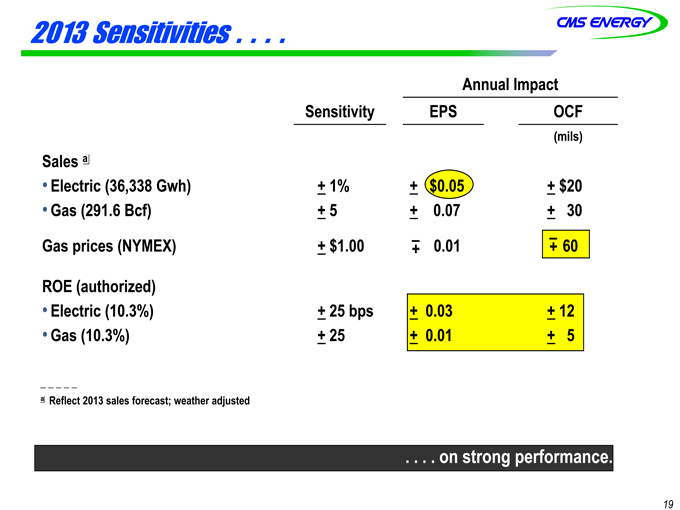

2013 Sensitivities . . . .

Annual Impact

Sensitivity EPS OCF

(mils)

Sales a

Electric (36,338 Gwh) + 1% + $0.05 + $20

Gas (291.6 Bcf) + 5 + 0.07 + 30

Gas prices (NYMEX) + $1.00 –+ 0.01 –+ 60

ROE (authorized)

Electric (10.3%) + 25 bps + 0.03 + 12

Gas (10.3%) + 25 + 0.01 + 5

a Reflect 2013 sales forecast; weather adjusted

. . . . on strong performance.

19

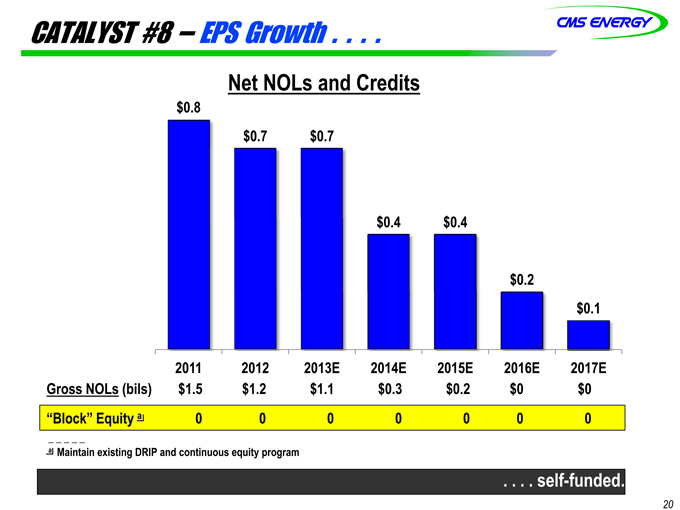

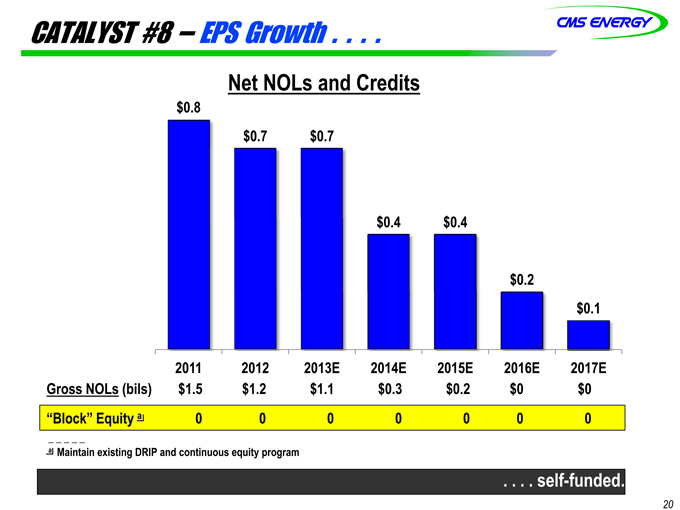

CATALYST #8 – EPS Growth . . . .

Net NOLs and Credits

$0.8

$0.7 $0.7

$0.4 $0.4

$0.2

$0.1

2011 2012 2013E 2014E 2015E 2016E 2017E Gross NOLs (bils) $1.5 $1.2 $1.1 $0.3 $0.2 $0 $0 “Block” Equity a 0 0 0 0 0 0 0

a Maintain existing DRIP and continuous equity program

. . . . self-funded.

20

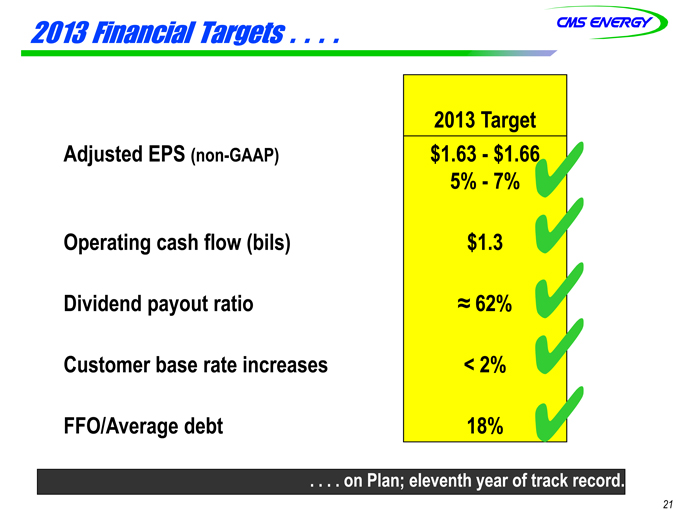

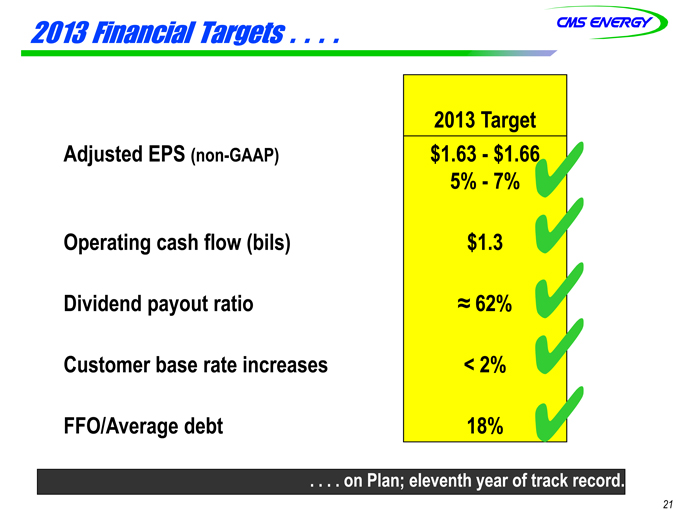

2013 Financial Targets . . . .

2013 Target

Adjusted EPS (non-GAAP) $1.63—$1.66

5%—7%

Operating cash flow (bils) $1.3

Dividend payout ratio ? 62%

Customer base rate increases < 2%

FFO/Average debt 18%

. . . . on Plan; eleventh year of track record.

21

GAAP Reconciliation

CMS ENERGY CORPORATION

Earnings Per Share By Year GAAP Reconciliation

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | 2003

| | | 2004

| | | 2005

| | | 2006

| | | 2007

| | | 2008

| | | 2009

| | | 2010

| | | 2011

| | | 2012

| |

Reported earnings (loss) per

share - GAAP | | ($ | 0.30 | ) | | $ | 0.64 | | | ($ | 0.44 | ) | | ($ | 0.41 | ) | | ($ | 1.02 | ) | | $ | 1.20 | | | $ | 0.91 | | | $ | 1.28 | | | $ | 1.58 | | | $ | 1.42 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

After-tax items: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Electric and gas utility | | | 0.21 | | | | (0.39 | ) | | | — | | | | — | | | | (0.07 | ) | | | 0.05 | | | | 0.33 | | | | 0.03 | | | | 0.00 | | | | 0.17 | |

Enterprises | | | 0.74 | | | | 0.62 | | | | 0.04 | | | | (0.02 | ) | | | 1.25 | | | | (0.02 | ) | | | 0.09 | | | | (0.03 | ) | | | (0.11 | ) | | | (0.01 | ) |

Corporate interest and other | | | 0.16 | | | | (0.03 | ) | | | 0.04 | | | | 0.27 | | | | (0.32 | ) | | | (0.02 | ) | | | 0.01 | | | | * | | | | (0.01 | ) | | | * | |

Discontinued operations (income) loss | | | (0.16 | ) | | | 0.02 | | | | (0.07 | ) | | | (0.03 | ) | | | 0.40 | | | | ( | *) | | | (0.08 | ) | | | 0.08 | | | | (0.01 | ) | | | (0.03 | ) |

Asset impairment charges, net | | | — | | | | — | | | | 1.82 | | | | 0.76 | | | | 0.60 | | | | — | | | | — | | | | — | | | | — | | | | — | |

Cumulative accounting changes | | | 0.16 | | | | 0.01 | | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Adjusted earnings per share, including MTM - non-GAAP | | $ | 0.81 | | | $ | 0.87 | | | $ | 1.39 | | | $ | 0.57 | | | $ | 0.84 | | | $ | 1.21 | (a) | | $ | 1.26 | | | $ | 1.36 | | | $ | 1.45 | | | $ | 1.55 | |

Mark-to-market impacts | | | | | | | 0.03 | | | | (0.43 | ) | | | 0.51 | | | | | | | | | | | | | | | | | | | | | | | | | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Adjusted earnings per share, excluding MTM - non-GAAP | | | NA | | | $ | 0.90 | | | $ | 0.96 | | | $ | 1.08 | | | | NA | | | | NA | | | | NA | | | | NA | | | | NA | | | | NA | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

| * | | Less than $500 thousand or $0.01 per share. |

| (a) | | $1.25 excluding discontinued Exeter operations and accounting changes related to convertible debt and restricted stock. |

2003-12 EPS

CMS ENERGY CORPORATION

Earnings By Quarter and Year GAAP Reconciliation

(Unaudited)

| | | | | | | | | | | | | | | | | | | | |

(In Millions, Except Per Share Amounts)

| | 2012

| |

| | | 1Q

| | | 2Q

| | | 3Q

| | | 4Q

| | | YTD Dec

| |

Reported net income - GAAP | | $ | 67 | | | $ | 100 | | | $ | 148 | | | $ | 67 | | | $ | 382 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

After-tax items: | | | | | | | | | | | | | | | | | | | | |

Electric and gas utility | | | 36 | | | | 7 | | | | * | | | | ( | *) | | | 43 | |

Enterprises | | | 1 | | | | 1 | | | | (3 | ) | | | ( | *) | | | (1 | ) |

Corporate interest and other | | | — | | | | — | | | | — | | | | * | | | | * | |

Discontinued operations income | | | (7 | ) | | | * | | | | * | | | | * | | | | (7 | ) |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Adjusted income - non-GAAP | | $ | 97 | | | $ | 108 | | | $ | 145 | | | $ | 67 | | | $ | 417 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Average shares outstanding, basic | | | 255.6 | | | | 261.2 | | | | 262.9 | | | | 263.0 | | | | 260.7 | |

Average shares outstanding, diluted | | | 266.8 | | | | 268.2 | | | | 269.0 | | | | 269.5 | | | | 268.6 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Reported earnings per share - GAAP | | $ | 0.25 | | | $ | 0.37 | | | $ | 0.55 | | | $ | 0.25 | | | $ | 1.42 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

After-tax items: | | | | | | | | | | | | | | | | | | | | |

Electric and gas utility | | | 0.14 | | | | 0.03 | | | | * | | | | ( | *) | | | 0.17 | |

Enterprises | | | 0.01 | | | | * | | | | (0.01 | ) | | | ( | *) | | | (0.01 | ) |

Corporate interest and other | | | — | | | | — | | | | — | | | | * | | | | * | |

Discontinued operations income | | | (0.03 | ) | | | * | | | | * | | | | * | | | | (0.03 | ) |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Adjusted earnings per share - non-GAAP | | $ | 0.37 | | | $ | 0.40 | | | $ | 0.54 | | | $ | 0.25 | | | $ | 1.55 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

| | | | | |

(In Millions, Except Per Share Amounts)

| | 2013

| | | | | | | | | | | | | |

| | | 1Q

| | | | | | | | | | | | | |

Reported net income - GAAP | | $ | 144 | | | | | | | | | | | | | | | | | |

| | |

|

|

| | | | | | | | | | | | | | | | |

After-tax items: | | | | | | | | | | | | | | | | | | | | |

Electric and gas utility | | | — | | | | | | | | | | | | | | | | | |

Enterprises | | | * | | | | | | | | | | | | | | | | | |

Corporate interest and other | | | — | | | | | | | | | | | | | | | | | |

Discontinued operations loss | | | * | | | | | | | | | | | | | | | | | |

| | |

|

|

| | | | | | | | | | | | | | | | |

Adjusted income - non-GAAP | | $ | 144 | | | | | | | | | | | | | | | | | |

| | |

|

|

| | | | | | | | | | | | | | | | |

Average shares outstanding, basic | | | 263.6 | | | | | | | | | | | | | | | | | |

Average shares outstanding, diluted | | | 270.9 | | | | | | | | | | | | | | | | | |

| | |

|

|

| | | | | | | | | | | | | | | | |

Reported earnings per share - GAAP | | $ | 0.53 | | | | | | | | | | | | | | | | | |

| | |

|

|

| | | | | | | | | | | | | | | | |

After-tax items: | | | | | | | | | | | | | | | | | | | | |

Electric and gas utility | | | — | | | | | | | | | | | | | | | | | |

Enterprises | | | * | | | | | | | | | | | | | | | | | |

Corporate interest and other | | | — | | | | | | | | | | | | | | | | | |

Discontinued operations loss | | | * | | | | | | | | | | | | | | | | | |

| | |

|

|

| | | | | | | | | | | | | | | | |

Adjusted earnings per share - non-GAAP | | $ | 0.53 | | | | | | | | | | | | | | | | | |

| | |

|

|

| | | | | | | | | | | | | | | | |

Note: Year-to-date (YTD) EPS may not equal sum of quarters due to share count differences.

| * | | Less than $500 thousand or $0.01 per share. |

2013 A-1

CMS Energy Corporation

Earnings Segment Results GAAP Reconciliation

(Unaudited)

| | | | | | | | |

| | Three Months Ended

| |

March 31

| | 2013

| | | 2012

| |

Electric Utility | | | | | | | | |

Reported | | $ | 0.24 | | | $ | 0.08 | |

Electric Decoupling Court Order | | | — | | | | 0.14 | |

| | |

|

|

| |

|

|

|

Adjusted | | $ | 0.24 | | | $ | 0.22 | |

| | |

|

|

| |

|

|

|

Gas Utility | | | | | | | | |

Reported | | $ | 0.35 | | | $ | 0.21 | |

Restructuring Costs | | | — | | | | — | |

| | |

|

|

| |

|

|

|

Adjusted | | $ | 0.35 | | | $ | 0.21 | |

| | |

|

|

| |

|

|

|

Enterprises | | | | | | | | |

Reported | | $ | 0.02 | | | $ | 0.01 | |

Restructuring Costs | | | * | | | | 0.01 | |

| | |

|

|

| |

|

|

|

Adjusted | | $ | 0.02 | | | $ | 0.02 | |

| | |

|

|

| |

|

|

|

Corporate Interest and Other | | | | | | | | |

Reported | | $ | (0.08 | ) | | $ | (0.08 | ) |

Restructuring Costs | | | — | | | | — | |

| | |

|

|

| |

|

|

|

Adjusted | | $ | (0.08 | ) | | $ | (0.08 | ) |

| | |

|

|

| |

|

|

|

Discontinued Operations | | | | | | | | |

Reported | | | (* | ) | | $ | 0.03 | |

Discontinued Operations Income | | | * | | | | (0.03 | ) |

| | |

|

|

| |

|

|

|

Adjusted | | $ | — | | | $ | — | |

| | |

|

|

| |

|

|

|

Totals | | | | | | | | |

Reported | | $ | 0.53 | | | $ | 0.25 | |

Discontinued Operations Income | | | * | | | | (0.03 | ) |

Electric Decoupling Court Order | | | — | | | | 0.14 | |

Restructuring Costs | | | * | | | | 0.01 | |

| | |

|

|

| |

|

|

|

Adjusted | | $ | 0.53 | | | $ | 0.37 | |

| | |

|

|

| |

|

|

|

Average Common Shares Outstanding - Diluted (in millions) | | | 270.9 | | | | 266.8 | |

| | |

|

|

| |

|

|

|

* Less than $0.01 per share.

2013 A-2

Consumers Energy

2013 Forecasted Cash Flow GAAP Reconciliation (in millions) (unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | Reclassifications From Sources and Uses to Statement of Cash Flows

| | | | | | |

Presentation Sources and Uses

| | | Tax | | | Interest | | | Other Working | | | Capital | | | Securitization | | | Preferred | | | Common | | | Consolidated Statements of Cash Flows

|

Description

| | non-GAAP

Amount

| | | Sharing

Operating

| | | Payments

as Operating

| | | Capital

as Investing

| | | Lease Pymts

as Financing

| | | Debt Pymts

as Financing

| | | Dividends

as Financing

| | | Dividends

as Financing

| | | GAAP

Amount

| | | Description

|

Cash at year end 2012 | | $ | 5 | | | $ | — | | | $ | — | | | $ | — | | | $ | — | | | $ | — | | | $ | — | | | $ | — | | | $ | 5 | | | Cash at year end 2012 |

Sources | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Operating (dep & amort $620) | | $ | 1,770 | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Other working capital | | | (70 | ) | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| | |

Sources | | $ | 1,700 | | | $ | (135 | ) | | $ | (218 | ) | | $ | (108 | ) | | $ | 28 | | | $ | 41 | | | $ | — | | | $ | — | | | $ | 1,308 | | | Net cash provided by operating activities |

Uses | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Interest and preferred dividend | | $ | (220 | ) | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Capital expendituresa | | | (1,375 | ) | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Dividends and tax sharing $(135) to CMS | | | (545 | ) | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Pension Contribution | | | (49 | ) | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| | |

Uses | | $ | (2,189 | ) | | $ | 135 | | | $ | 218 | | | $ | 108 | | | $ | — | | | $ | — | | | $ | 2 | | | $ | 410 | | | $ | (1,316 | ) | | Net cash provided by investing activities |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| | |

Cash flow | | $ | (489 | ) | | $ | — | | | $ | — | | | $ | — | | | $ | 28 | | | $ | 41 | | | $ | 2 | | | $ | 410 | | | $ | (8 | ) | | Cash flow from operating and investing activities |

Financing | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Equity | | $ | 150 | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

New Issues | | | 325 | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Retirements | | | — | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Net short-term financing & other | | | 35 | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| | |

Financing | | $ | 510 | | | $ | — | | | $ | — | | | $ | — | | | $ | (28 | ) | | $ | (41 | ) | | $ | (2 | ) | | $ | (410 | ) | | $ | 29 | | | Net cash provided by financing activities |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| | |

Net change in cash | | $ | 21 | | | $ | — | | | $ | — | | | $ | — | | | $ | — | | | $ | — | | | $ | — | | | $ | — | | | $ | 21 | | | Net change in cash |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| | |

Cash at year end 2013 | | $ | 26 | | | $ | — | | | $ | — | | | $ | — | | | $ | — | | | $ | — | | | $ | — | | | $ | — | | | $ | 26 | | | Cash at year end 2013 |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| | |

a Includes cost of removal and capital leases

2013 B-1

CMS Energy Parent

2013 Forecasted Cash Flow GAAP Reconciliation (in millions) (unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Reclassifications From Sources and Uses to Statement of Cash Flows

| | | | | | |

Presentation Sources and Uses

| | | Interest | | | Overheads & | | | Other | | | Cash From | | | Consolidated Statements of Cash Flows

|

Description

| | non-GAAP

Amount

| | | Payments

as Operating

| | | Tax Payments

as Operating

| | | Uses (a)

as Operating

| | | Consolidated

Companies

| | | GAAP

Amount

| | | Description

|

Cash at year end 2012 | | $ | 53 | | | $ | — | | | $ | — | | | $ | — | | | $ | 35 | | | $ | 88 | | | Cash at year end 2012 |

| | | | | | | |

Sources | | | | | | | | | | | | | | | | | | | | | | | | | | |

Consumers Energy dividends/tax sharing | | $ | 545 | | | | | | | | | | | | | | | | | | | | | | | |

Enterprises | | | 20 | | | | | | | | | | | | | | | | | | | | | | | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| | |

Sources | | $ | 565 | | | $ | (135 | ) | | $ | (15 | ) | | $ | (9 | ) | | $ | 23 | | | $ | 429 | | | Net cash provided by operating activities |

| | | | | | | |

Uses | | | | | | | | | | | | | | | | | | | | | | | | | | |

Interest and preferred dividends | | $ | (135 | ) | | | | | | | | | | | | | | | | | | | | | | |

Overhead and Federal tax payments | | | (15 | ) | | | | | | | | | | | | | | | | | | | | | | |

Equity infusions | | | (150 | ) | | | | | | | | | | | | | | | | | | | | | | |

Pension Contribution | | | (1 | ) | | | | | | | | | | | | | | | | | | | | | | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| | |

Uses (a) | | $ | (310 | ) | | $ | 135 | | | $ | 15 | | | $ | 9 | | | $ | (86 | ) | | $ | (237 | ) | | Net cash provided by investing activities |

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| | |

| | | | | | | |

Cash flow | | $ | 255 | | | $ | — | | | $ | — | | | $ | — | | | $ | (63 | ) | | $ | 192 | | | Cash flow from operating and investing activities |

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | |

Financing and dividends | | | | | | | | | | | | | | | | | | | | | | | | | | |

New Issues | | $ | 250 | | | | | | | | | | | | | | | | | | | | | | | |

Retirements | | | — | | | | | | | | | | | | | | | | | | | | | | | |

DRP, continuous equity | | | 35 | | | | | | | | | | | | | | | | | | | | | | | |

Net short-term financing & other | | | (5 | ) | | | | | | | | | | | | | | | | | | | | | | |

Common dividend | | | (270 | ) | | | | | | | | | | | | | | | | | | | | | | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| | |

Financing | | $ | 10 | | | $ | — | | | $ | — | | | $ | — | | | $ | 72 | | | $ | 82 | | | Net cash provided by financing activities |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| | |

Net change in cash | | $ | 265 | | | $ | — | | | $ | — | | | $ | — | | | $ | 9 | | | $ | 274 | | | Net change in cash |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| | |

Cash at year end 2013 | | $ | 318 | | | $ | — | | | $ | — | | | $ | — | | | $ | 44 | | | $ | 362 | | | Cash at year end 2013 |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| | |

2013 B-2

Consolidated CMS Energy

2013 Forecasted Consolidation of Consumers Energy and CMS Energy Parent Statements of Cash Flow (in millions) (unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | |

Statements of Cash Flows

| | | Eliminations/Reclassifications to Arrive at the

Consolidated Statement of Cash Flows

| | | Consolidated Statements of Cash Flows

|

| | Consumers

Common Dividend

as Financing

| | | Consumers

Preferred Dividend

as Operating

| | | Equity

Infusions to

Consumers

| | |

| | | Consumers

Amount

| | | CMS Parent

Amount

| | | | | |

Description

| | | | | | | Amount

| | | Description

|

Cash at year end 2012 | | $ | 5 | | | $ | 88 | | | $ | — | | | $ | — | | | $ | — | | | $ | 93 | | | Cash at year end 2012 |

Net cash provided by operating activities | | $ | 1,308 | | | $ | 429 | | | $ | (410 | ) | | $ | (2 | ) | | $ | — | | | $ | 1,325 | | | Net cash provided by operating activities |

Net cash provided by investing activities | | | (1,316 | ) | | | (237 | ) | | | — | | | | — | | | | 150 | | | | (1,403 | ) | | Net cash provided by investing activities |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| | |

Cash flow from operating and investing activities | | $ | (8 | ) | | $ | 192 | | | $ | (410 | ) | | $ | (2 | ) | | $ | 150 | | | $ | (78 | ) | | Cash flow from operating and investing activities |

Net cash provided by financing activities | | $ | 29 | | | $ | 82 | | | $ | 410 | | | $ | 2 | | | $ | (150 | ) | | $ | 373 | | | Net cash provided by financing activities |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| | |

Net change in cash | | $ | 21 | | | $ | 274 | | | $ | — | | | $ | — | | | $ | — | | | $ | 295 | | | Net change in cash |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| | |

Cash at year end 2013 | | $ | 26 | | | $ | 362 | | | $ | — | | | $ | — | | | $ | — | | | $ | 388 | | | Cash at year end 2013 |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| | |

2013 B-3