Exhibit 99.1

CMS ENERGY

2013 Annual Shareholders’ Meeting

CMS ENERGY

Annual Shareholders’ Meeting

John Russell

May 17, 2013

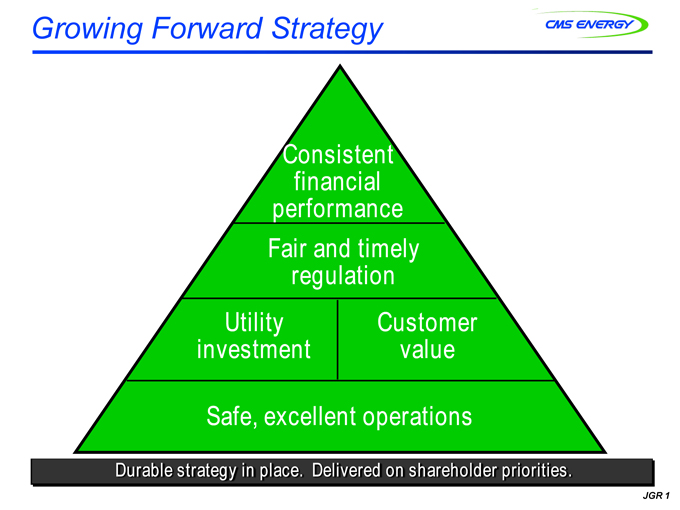

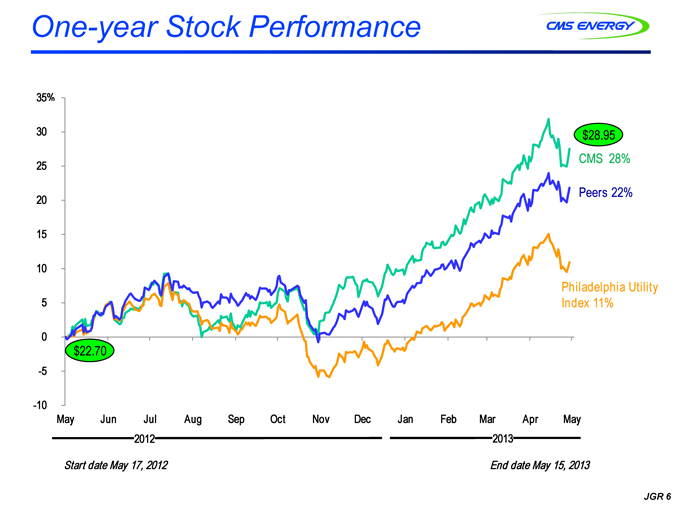

Growing Forward Strategy

CMS ENERGY

Consistent financial performance

Fair and timely regulation

Utility investment

Customer value

Safe, excellent operations

Durable strategy in place. Delivered on shareholder priorities.

JGR 1

Significant Accomplishments

CMS ENERGY

• Operational Performance

Employee Safety

Productivity Improvement

Employee Engagement

• New Records

Peak load – July 17, 2012

Lake Winds Energy Park

Smart Energy

Electric Rate Case Non-contested Settlement

CMS Investment Grade

JGR 2

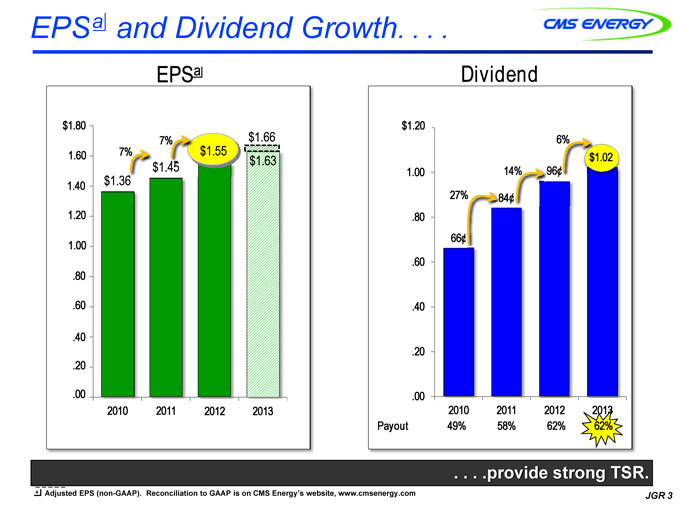

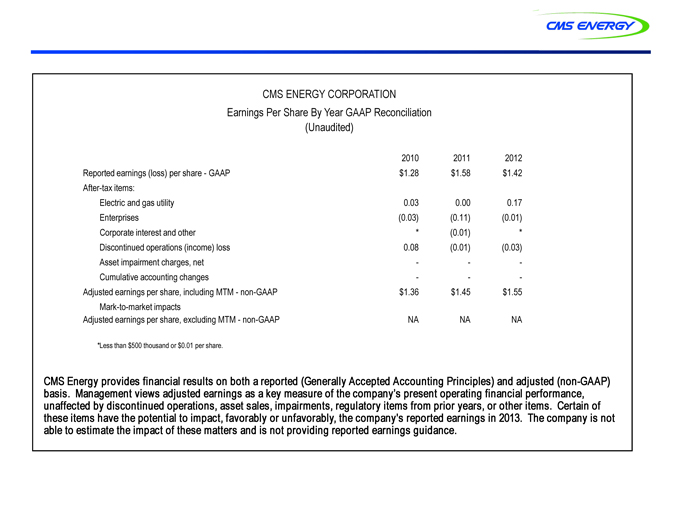

EPS a and Dividend Growth. . . .

CMS ENERGY

EPSa

$1.66

$1.80

7%

$1.55

$1.63

1.60

7%

$1.45

1.40

$1.36

1.20

1.00

.80

.60

.40

.20

.00

2010

2011

2012

2013

Dividend

6%

$1. 02

$1.20

96¢

1.00

14%

.80

27%

84¢

.60

66¢

.40

.20

.00

2010

2011

2012

2013

Payout

49%

58%

62%

62%

. . . .provide strong TSR.

a Adjusted EPS (non-GAAP). Reconciliation to GAAP is on CMS Energy’s website, www.cmsenergy.com

JGR 3

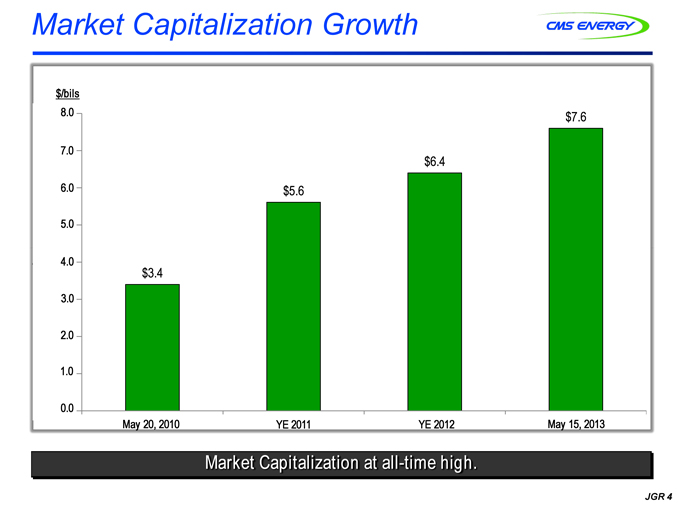

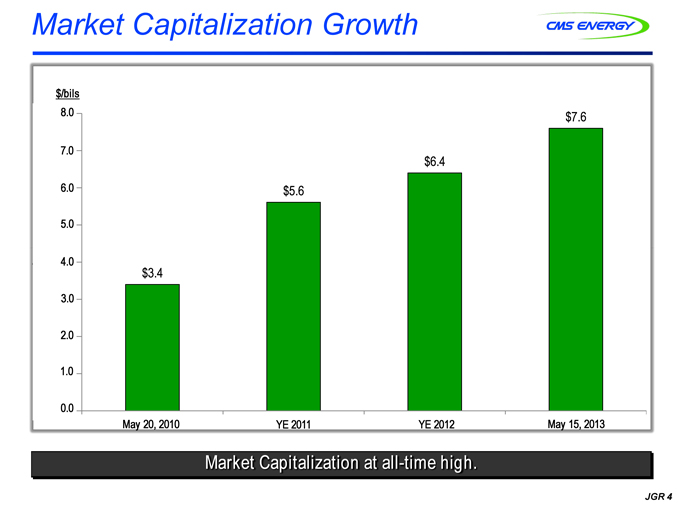

Market Capitalization Growth

CMS ENERGY

$/bils

$7.6

8.0

$6.4

7.0

$5.6

6.0

5.0

4.0

$3.4

3.0

2.0

1.0

0.0

May 20, 2010

YE 2011

YE 2012

May 15, 2013

Market Capitalization at all-time high.

JGR 4

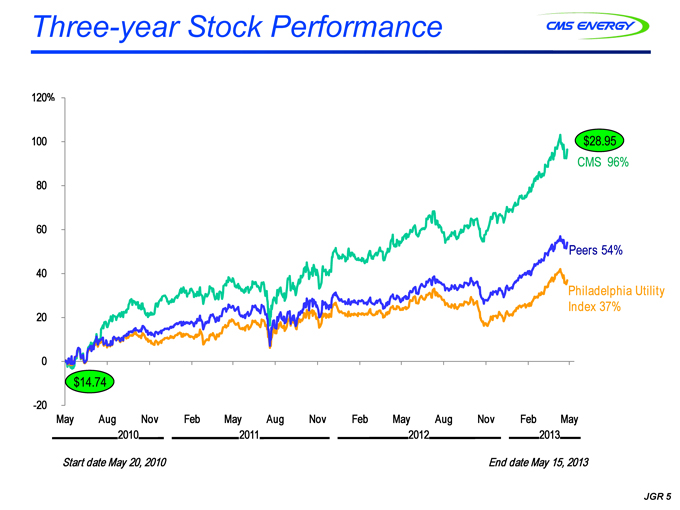

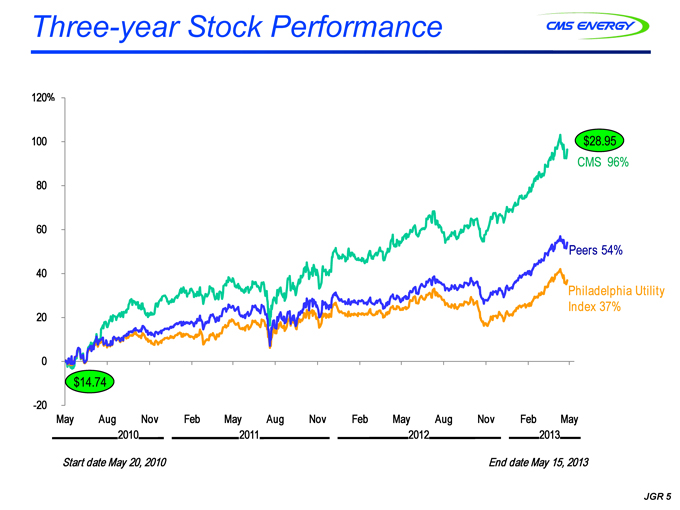

Three-year Stock Performance

CMS ENERGY

120%

$28.95

100

CMS 96%

80

60

40

Peers 54%

Philadelphia Utility

Index 37%

20

0

$14.74

-20

May

Aug

Nov

Feb

May

Aug

Nov

Feb

May

Aug

Nov

Feb

May

2010

2011

2012

2013

Start date May 20, 2010

End date May 15, 2013

JGR 5

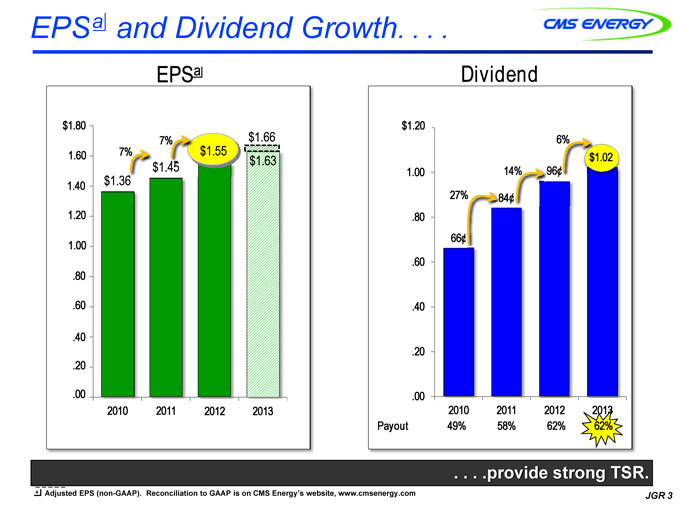

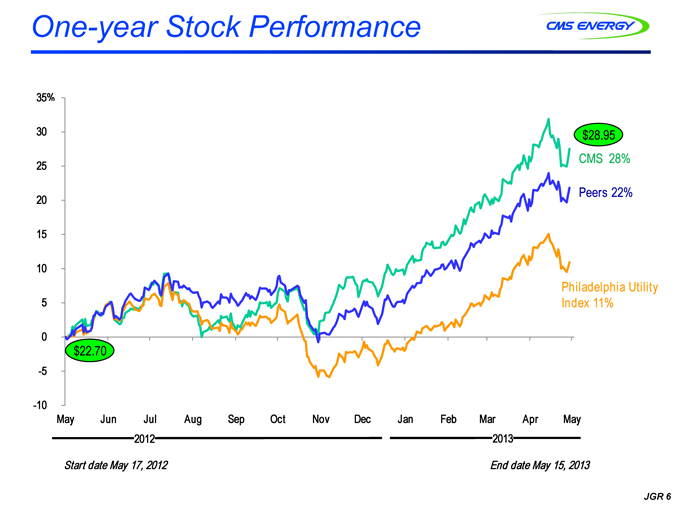

One-year Stock Performance

CMS ENERGY

35%

$28.95

30

CMS 28%

25

Peers 22%

20

15

10

Philadelphia Utility

5

Index 11%

0

$22.70

-5

-10

May

Jun

Jul

Aug

Sep

Oct

Nov

Dec

Jan

Feb

Mar

Apr

May

2012

2013

Start date May 17, 2012

End date May 15, 2013

JGR 6

Q & A

CMS ENERGY

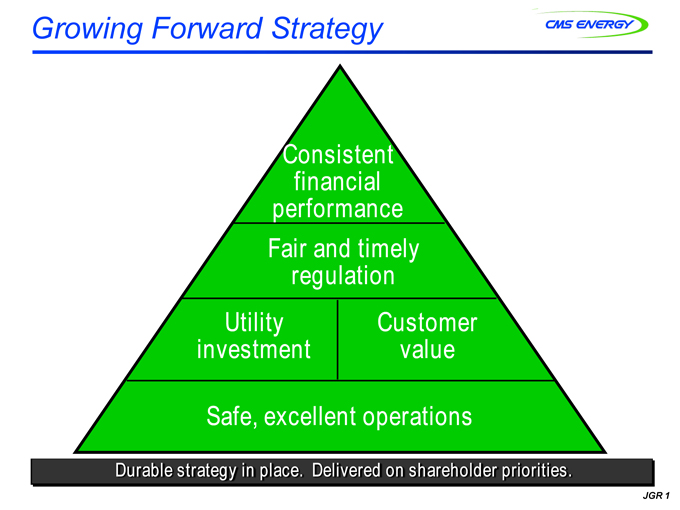

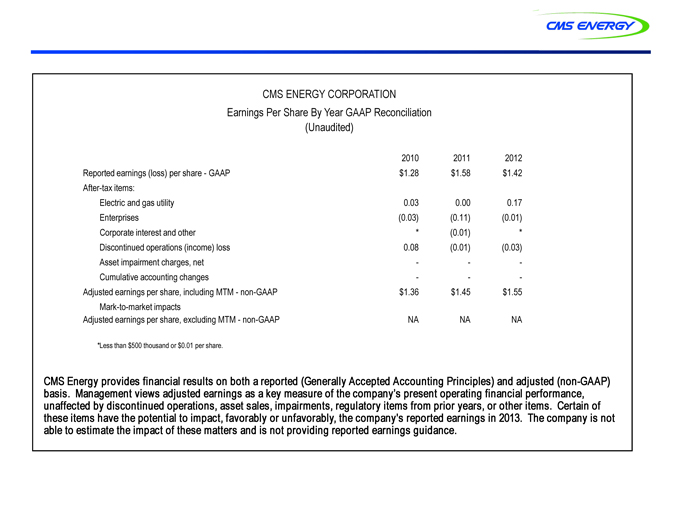

CMS ENERGY CORPORATION

Earnings Per Share By Year GAAP Reconciliation (Unaudited)

2010

2011

2012

Reported earnings (loss) per share - GAAP

$1.28

$1.58

$1.42

After-tax items:

Electric and gas utility

0.03

0.00

0.17

Enterprises

(0.03)

(0.11)

(0.01)

Corporate interest and other *

(0.01) *

Discontinued operations (income) loss

0.08

(0.01)

(0.03)

Asset impairment charges, net

-

-

-

Cumulative accounting changes

-

-

-

Adjusted earnings per share, including MTM - non-GAAP

$1.36

$1.45

$1.55

Mark-to-market impacts

Adjusted earnings per share, excluding MTM - non-GAAP

NA

NA

NA

*Less than $500 thousand or $0.01 per share.

CMS Energy provides financial results on both a reported (Generally Accepted Accounting Principles) and adjusted (non-GAAP) basis. Management views adjusted earnings as a key measure of the company’s present operating financial performance, unaffected by discontinued operations, asset sales, impairments, regulatory items from prior years, or other items. Certain of these items have the potential to impact, favorably or unfavorably, the company’s reported earnings in 2013. The company is not able to estimate the impact of these matters and is not providing reported earnings guidance.