Exhibit 99.1

Investor Meetings

September 4-6, 2013

Cross Winds Energy Park

Gas Combined Cycle Plant

Consumers Smart Energy Program

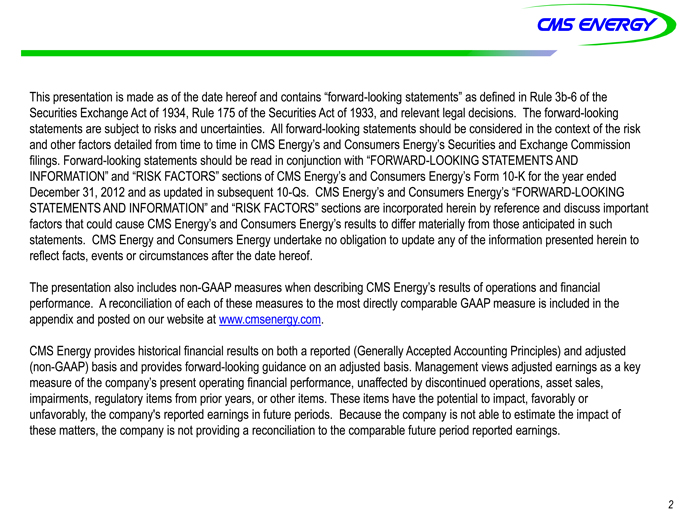

This presentation is made as of the date hereof and contains “forward-looking statements” as defined in Rule 3b-6 of the Securities Exchange Act of 1934, Rule 175 of the Securities Act of 1933, and relevant legal decisions. The forward-looking statements are subject to risks and uncertainties. All forward-looking statements should be considered in the context of the risk and other factors detailed from time to time in CMS Energy’s and Consumers Energy’s Securities and Exchange Commission filings. Forward-looking statements should be read in conjunction with “FORWARD-LOOKING STATEMENTS AND INFORMATION” and “RISK FACTORS” sections of CMS Energy’s and Consumers Energy’s Form 10-K for the year ended December 31, 2012 and as updated in subsequent 10-Qs. CMS Energy’s and Consumers Energy’s “FORWARD-LOOKING STATEMENTS AND INFORMATION” and “RISK FACTORS” sections are incorporated herein by reference and discuss important factors that could cause CMS Energy’s and Consumers Energy’s results to differ materially from those anticipated in such statements. CMS Energy and Consumers Energy undertake no obligation to update any of the information presented herein to reflect facts, events or circumstances after the date hereof.

The presentation also includes non-GAAP measures when describing CMS Energy’s results of operations and financial performance. A reconciliation of each of these measures to the most directly comparable GAAP measure is included in the appendix and posted on our website at www.cmsenergy.com.

CMS Energy provides historical financial results on both a reported (Generally Accepted Accounting Principles) and adjusted (non-GAAP) basis and provides forward-looking guidance on an adjusted basis. Management views adjusted earnings as a key measure of the company’s present operating financial performance, unaffected by discontinued operations, asset sales, impairments, regulatory items from prior years, or other items. These items have the potential to impact, favorably or unfavorably, the company’s reported earnings in future periods. Because the company is not able to estimate the impact of these matters, the company is not providing a reconciliation to the comparable future period reported earnings.

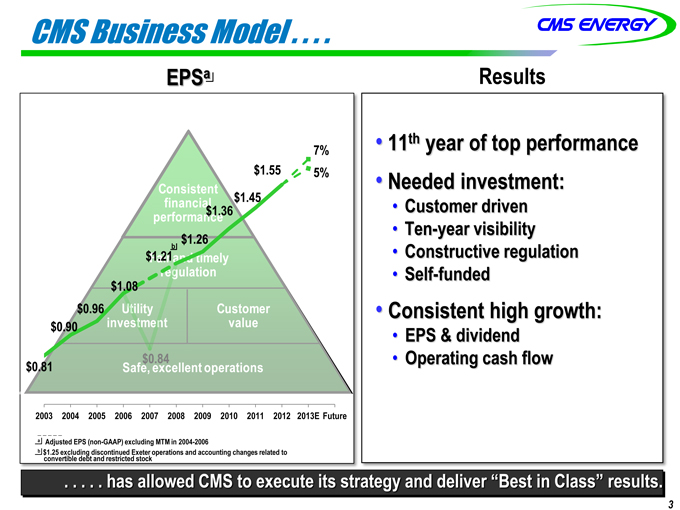

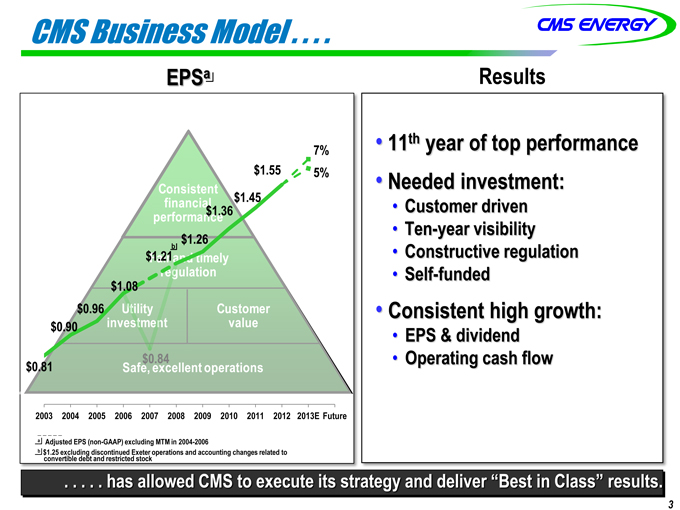

CMS Business Model

EPSa

7%

$1.55 5%

Consistent financial $1.45 performance $1.36

$1.26

b

$Fair 1.21 and timely regulation

$1.08

$0.96 Utility Customer

$0.90 investment value

$0.84

$0.81 Safe, excellent operations

2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013E Future

Consistent financial performance

Fair and timely regulation

Utility investment

Customer value

Safe, excellent operations

a Adjusted EPS (non-GAAP) excluding MTM in 2004-2006

b $1.25 excluding discontinued Exeter operations and accounting changes related to convertible debt and restricted stock

Results

11th year of top performance

Needed investment:

Customer driven

Ten-year visibility

Constructive regulation

Self-funded

Consistent high growth:

EPS & dividend

Operating cash flow

has allowed CMS to execute its strategy and deliver “Best in Class” results.

3

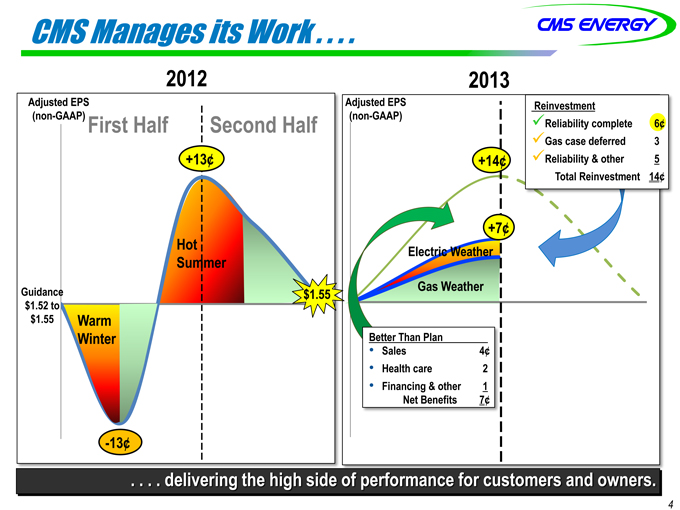

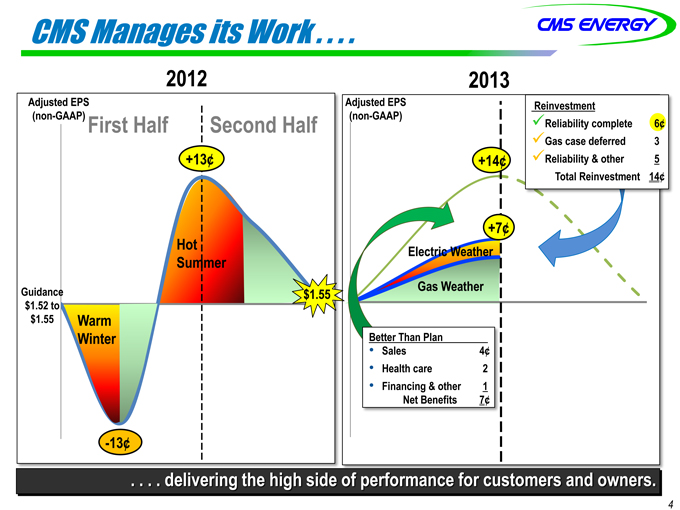

CMS Manages its Work . . . .

2012

Adjusted EPS

(non-GAAP)

First Half Second Half

+13¢

Hot Summer

Guidance $1.55

$1.52 to

$1.55

Warm

Winter

-13¢

2013

Adjusted EPS (non-GAAP)

Reinvestment

Reliability complete 6¢?

Gas case deferred 3 +14¢ ?

Reliability & other 5 Total Reinvestment 14¢

+7¢

Electric Weather

Gas Weather

Better Than Plan

Sales 4¢

Health care 2

Financing & other 1 Net Benefits 7¢

delivering the high side of performance for customers and owners.

4

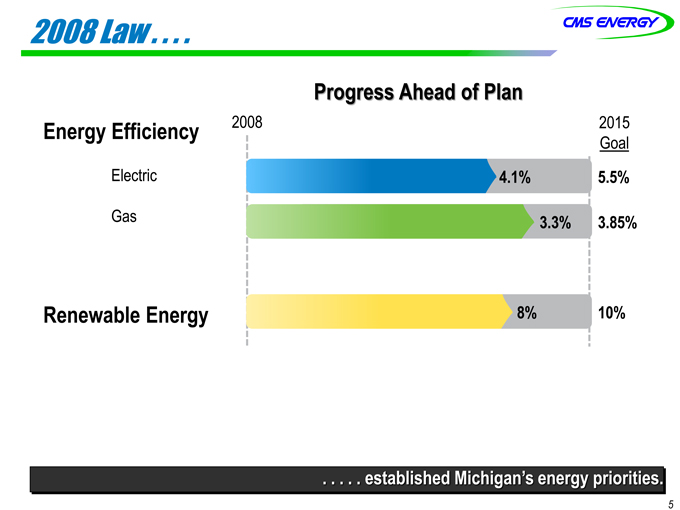

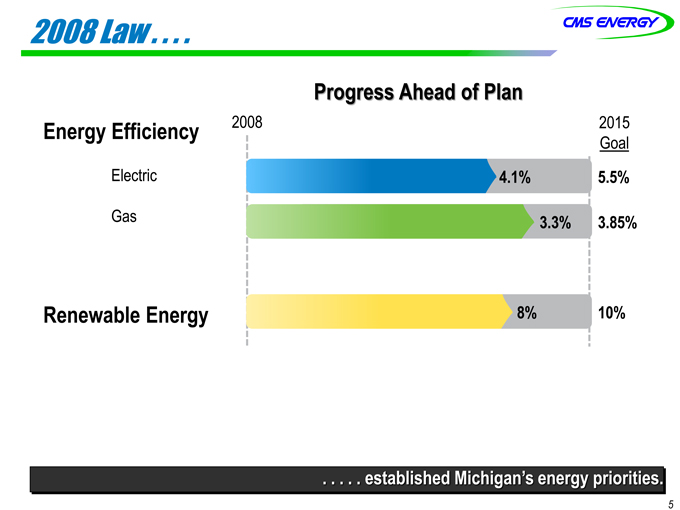

2008 Law . .. . .

Progress Ahead of Plan

Energy Efficiency 2008 2015

Goal Electric 4.1% 5.5%

Gas 3.3% 3.85%

Renewable Energy 8% 10%

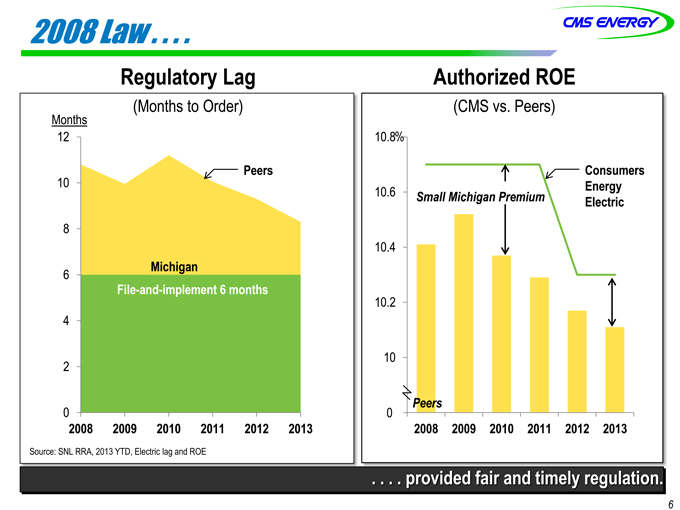

2008 Law . .. . .

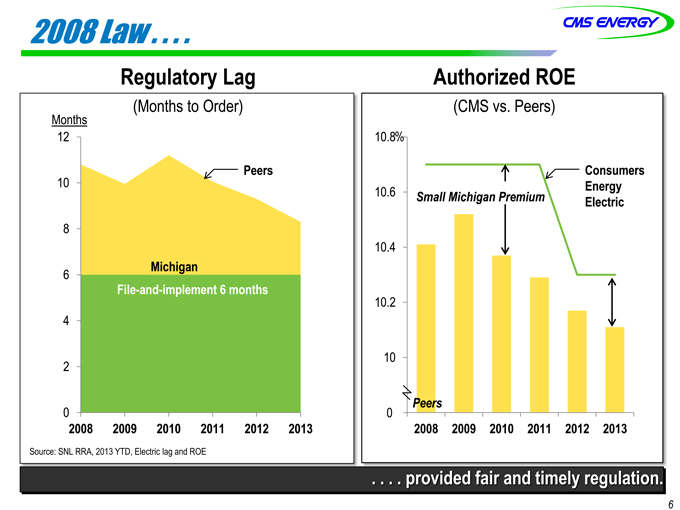

Regulatory Lag

(Months to Order)

Months

12

10 Peers

Michigan

File-and-implement 6 months

File-and-implement 6 months

0

2008 2009 2010 2011 2012 2013

Source: SNL RRA, 2013 YTD, Electric lag and ROE

Authorized ROE

(CMS vs. Peers)

10.8%

Consumers 10.6 Energy Electric

Small Michigan Premium

10.4

10.2

10

Peers

0

2008 2009 2010 2011 2012 2013

. . . . provided fair and timely regulation.

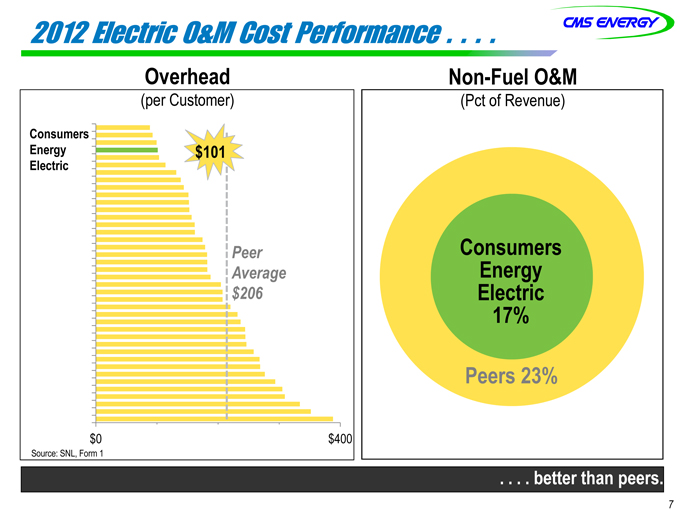

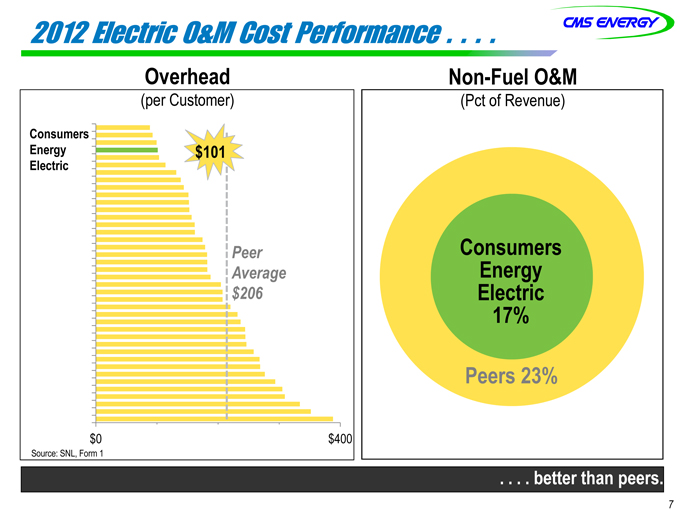

2012 Electric O&M Cost Performance . . . .

Overhead

(per Customer)

Consumers Energy Electric $101

Peer Average $206

$0 $400

Source: SNL, Form 1

Non-Fuel O&M

(Pct of Revenue)

CMS 17%

Peers 23%

. . . . better than peers.

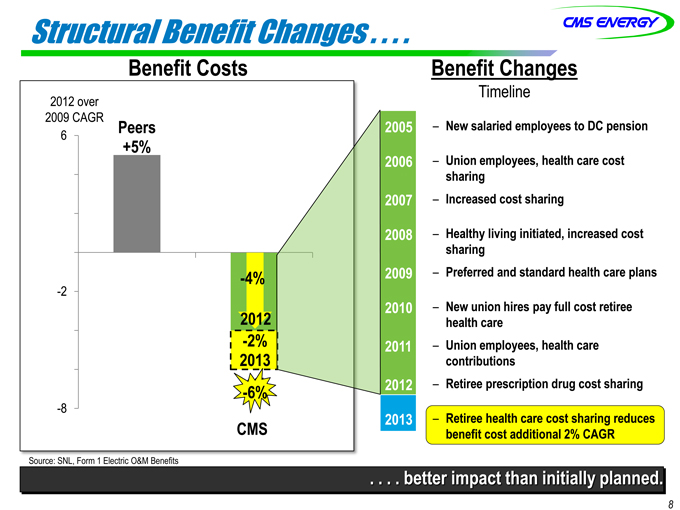

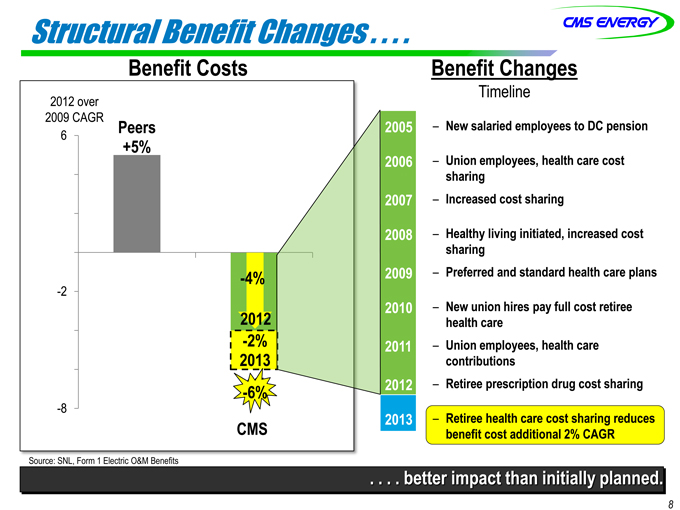

Structural Benefit Changes . . . .

Benefit Costs

2012 over 2009 CAGR

Peers

+5%

-2 -4% 2012 -2% 2013 -6% -6%

-8

CMS

Source: SNL, Form 1 Electric O&M Benefits

Benefit Changes

Timeline

2005 2006 2007 2008 2009 2010

2011 2012 2013

New salaried employees to DC pension

Union employees, health care cost sharing Increased cost sharing

Healthy living initiated, increased cost sharing Preferred and standard health care plans

New union hires pay full cost retiree health care Union employees, health care contributions Retiree prescription drug cost sharing

Retiree health care cost sharing reduces benefit cost additional 2% CAGR

. . . . better impact than initially planned.

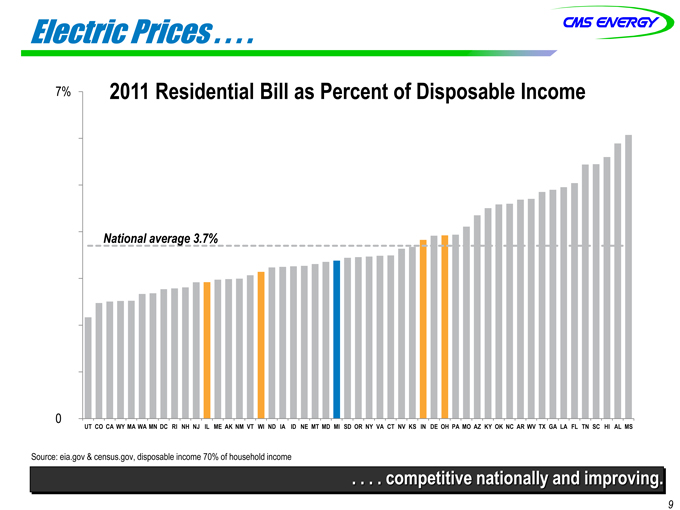

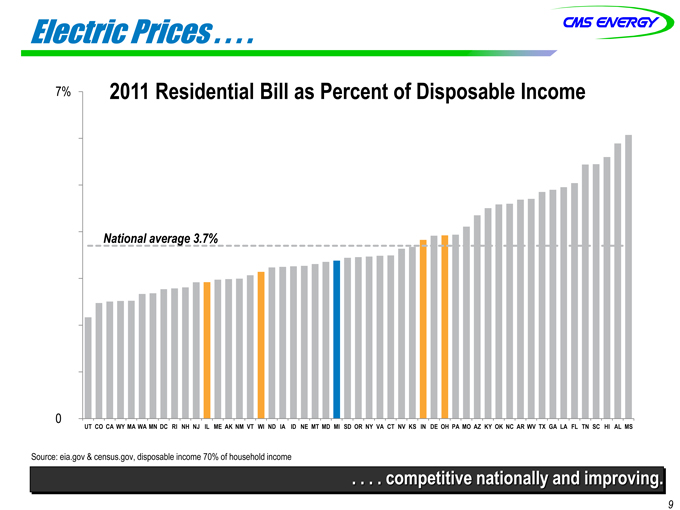

Electric Prices . . . .

2011 Residential Bill as Percent of Disposable Income

7%

National average 3.7%

UT CO CA WY MA WA MN DC RI NH NJ IL ME AK NM VT WI ND IA ID NE MT MD MI SD OR NY VA CT NV KS IN DE OH PA MO AZ KY OK NC AR WV TX GA LA FL TN SC HI AL MS

Source: eia.gov & census.gov, disposable income 70% of household income

. . . . competitive nationally and improving.

9

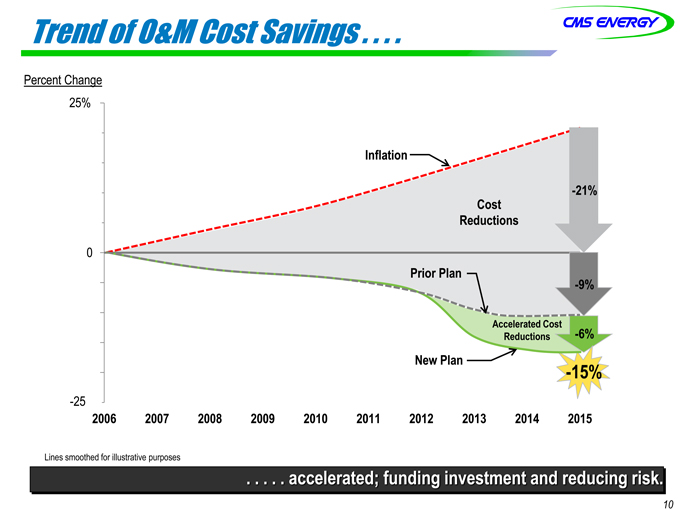

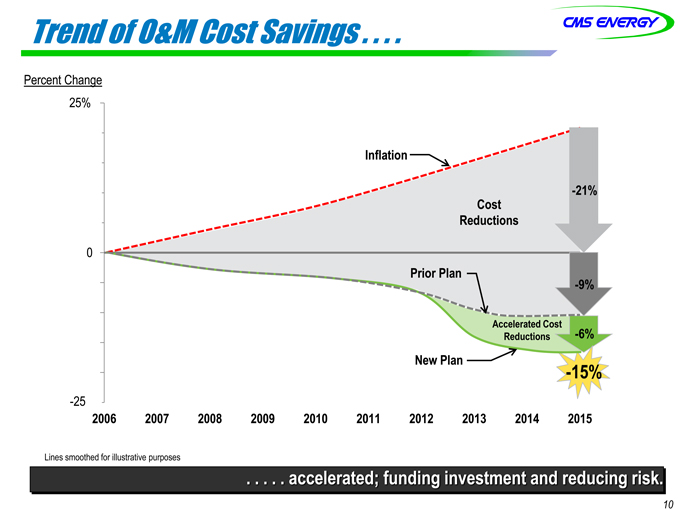

Trend of O&M Cost Savings . . . .

Percent Change

25%

Inflation

-21% Cost Reductions

0

Prior Plan

-9%

Accelerated Cost

Reductions -6%

New Plan

-15%

-25%

2006 2007 2008 2009 2010 2011 2012 2013 2014 2015

Lines smoothed for illustrative purposes

. . . . . accelerated; funding investment and reducing risk.

10

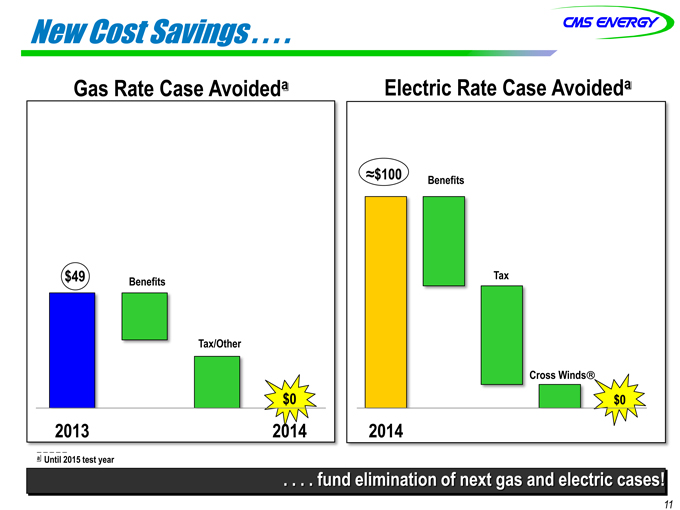

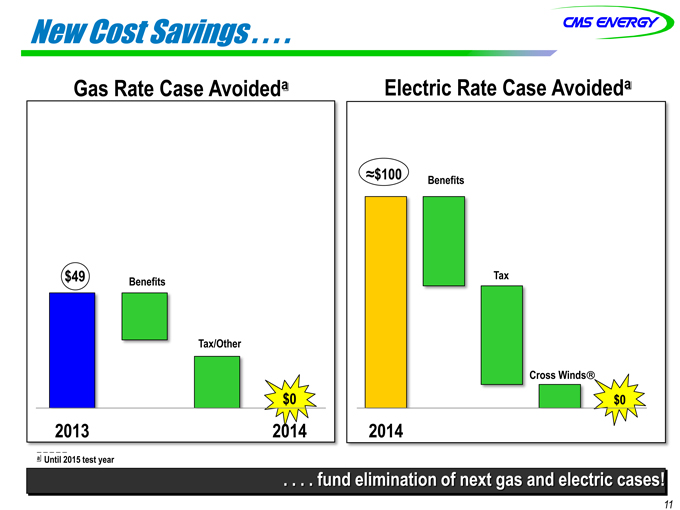

New Cost Savings . . . .

Gas Rate Case Avoideda

$49 Benefits

Tax/Other

$0

2013 2014

a Until 2015 test year

Electric Rate Case Avoideda

$100 Benefits

Tax

Cross Winds?

$0

2014

. . . . fund elimination of next gas and electric cases!

11

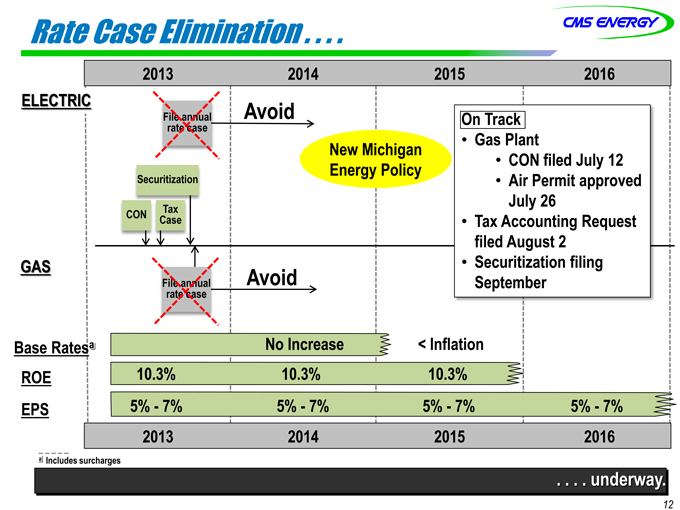

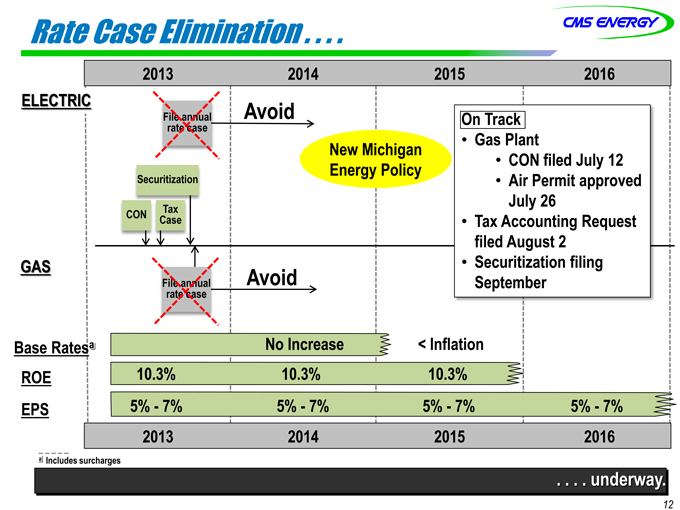

Rate Case Elimination . . . .

2013 2014 2015 2016

ELECTRIC Avoid

File annual On Track

rate case

New Michigan • Gas Plant

Energy Policy • CON filed July 12

Securitization • Air Permit approved

July 26

CON Case Tax • Tax Accounting Request

filed August 2

GAS • Securitization filing

File annual Avoid September

rate case

Base Ratesa No Increase < Inflation

ROE 10.3% 10.3% 10.3%

EPS 5%—7% 5%—7% 5%—7% 5% -5%7%- 7%

2013 2014 2015 2016

a Includes surcharges

. . . . underway.

12

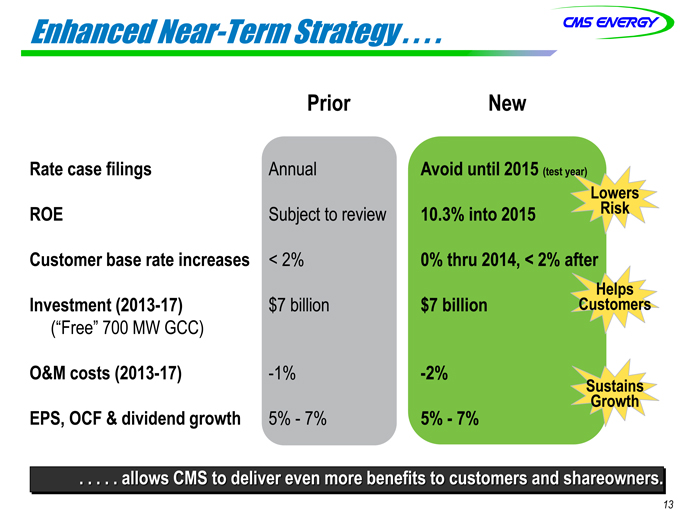

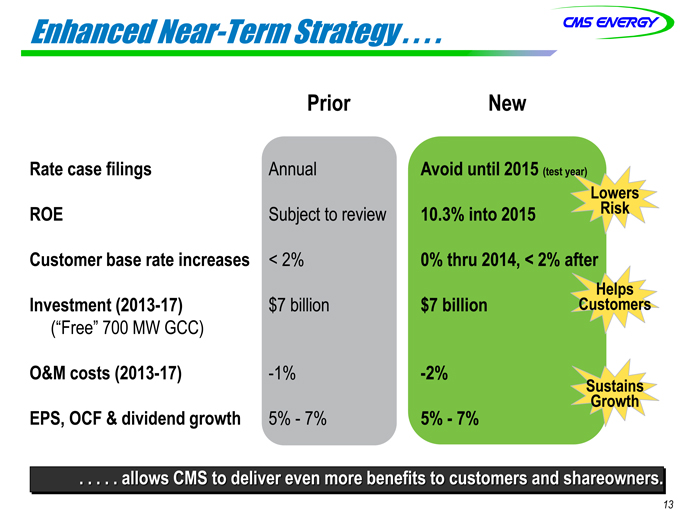

Enhanced Near-Term Strategy . . . .

Prior New

Rate case filings Annual Avoid until 2015 (test year)

Lowers

ROE Subject to review 10.3% into 2015 Risk

Customer base rate increases < 2% 0% thru 2014, < 2% after

Helps

Investment (2013-17) $7 billion $7 billion Customers

(“Free” 700 MW GCC)

O&M costs (2013-17) -1% -2%

Sustains

Growth

EPS, OCF & dividend growth 5%—7% 5%—7%

. . . . . allows CMS to deliver even more benefits to customers and shareowners.

13

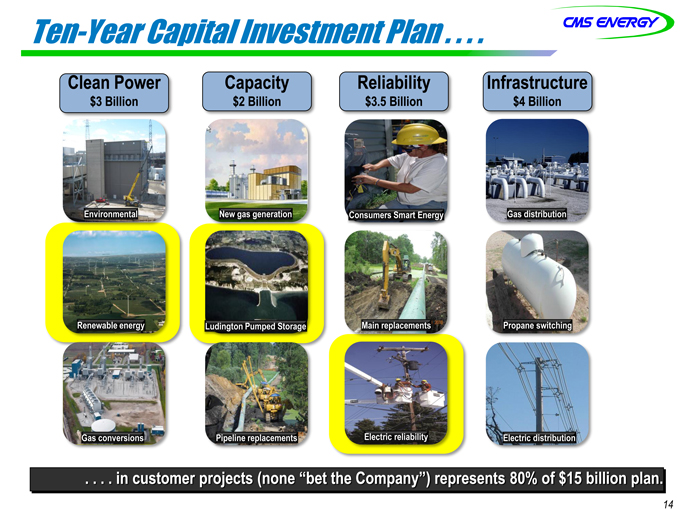

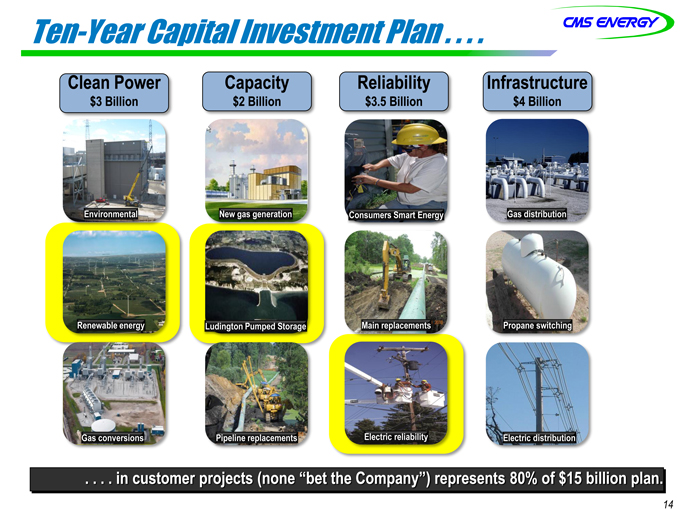

Ten-Year Capital Investment Plan . . . .

Clean Power Capacity Reliability Infrastructure

$3 Billion $2 Billion $3.5 Billion $4 Billion

Environmental New gas generation Consumers Smart Energy Gas distribution

Renewable energy Ludington Pumped Storage Main replacements Propane switching

Gas conversions Pipeline replacements Electric reliability Electric distribution

. . . . in customer projects (none “bet the Company”) represents 80% of $15 billion plan.

14

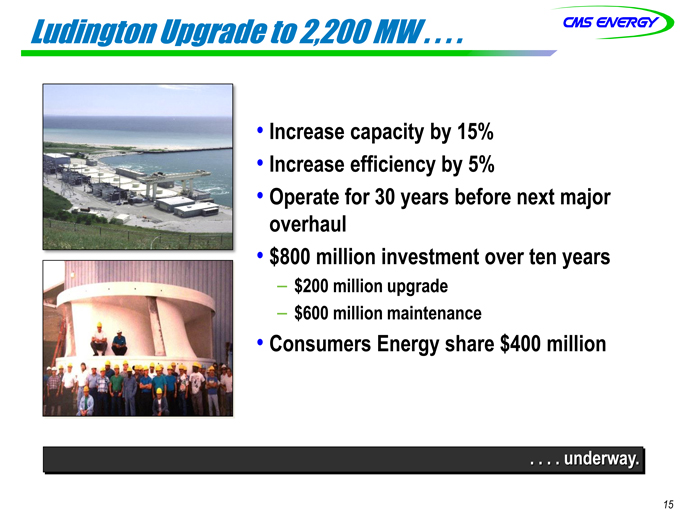

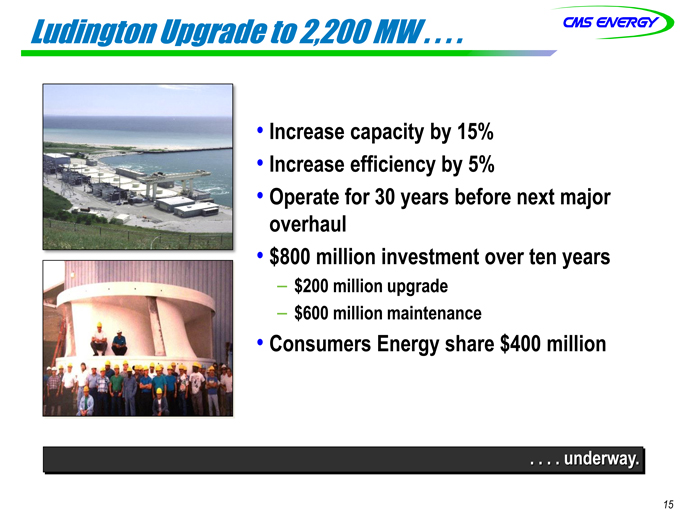

Ludington Upgrade to 2,200 MW . . . .

Increase capacity by 15%

Increase efficiency by 5%

Operate for 30 years before next major overhaul

$800 million investment over ten years

$200 million upgrade

$600 million maintenance

Consumers Energy share $400 million

. . . . underway.

15

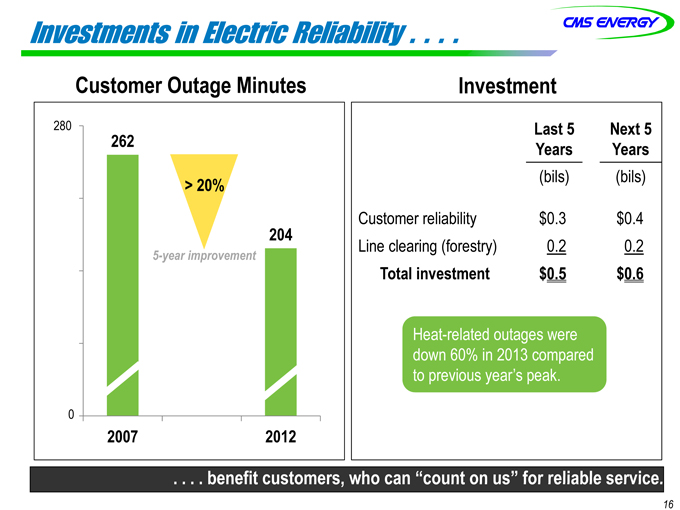

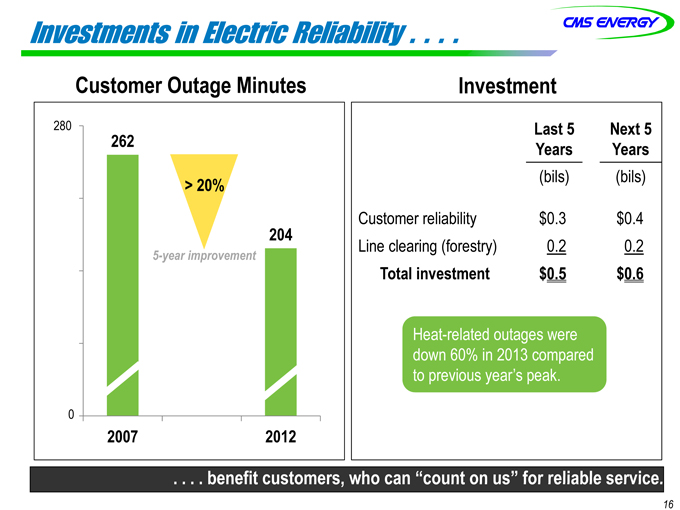

Investments in Electric Reliability . . . .

Customer Outage Minutes

280

262

> 20%

204

5-year improvement

0

2007 2012

Investment

Last 5 years

(bils)

Next 5 Years

(bils)

Customer reliability $0.3 $0.4

Line clearing (forestry) 0.2 0.2

Total investment $0.5 $0.6

Heat-related outages were

down 60% in 2013 compared

to previous year’s peak.

. . . . benefit customers, who can “count on us” for reliable service.

16

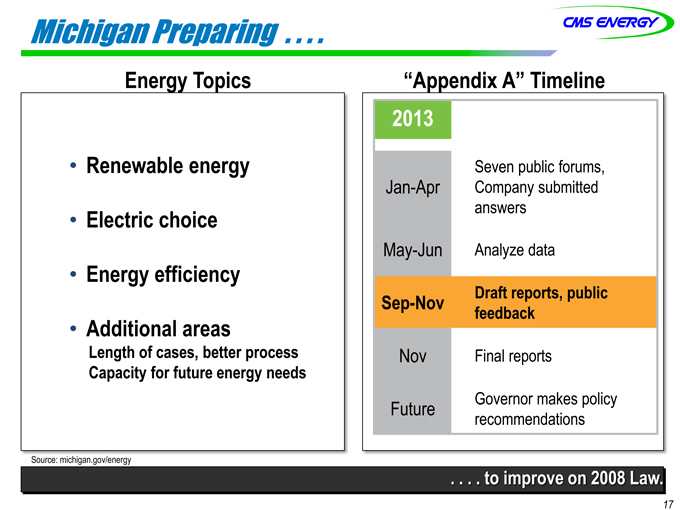

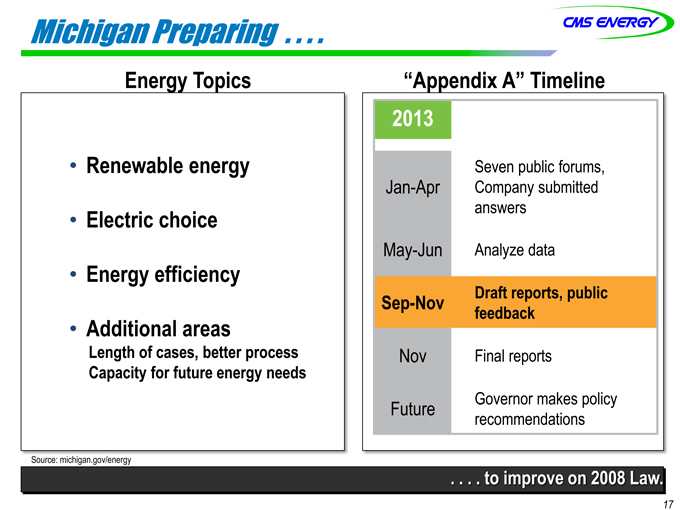

Michigan Preparing . . . .

Energy Topics

Renewable energy

Electric choice

Energy efficiency

Additional areas

Length of cases, better process Capacity for future energy needs

“Appendix A” Timeline

2013

Seven public forums,

Jan-Apr Company submitted

answers

May-Jun Analyze data

Sep-Nov Draft reports, public

feedback

Nov Final reports

Future Governor makes policy

recommendations

Source: michigan.gov/energy

. . . . to improve on 2008 Law.

17

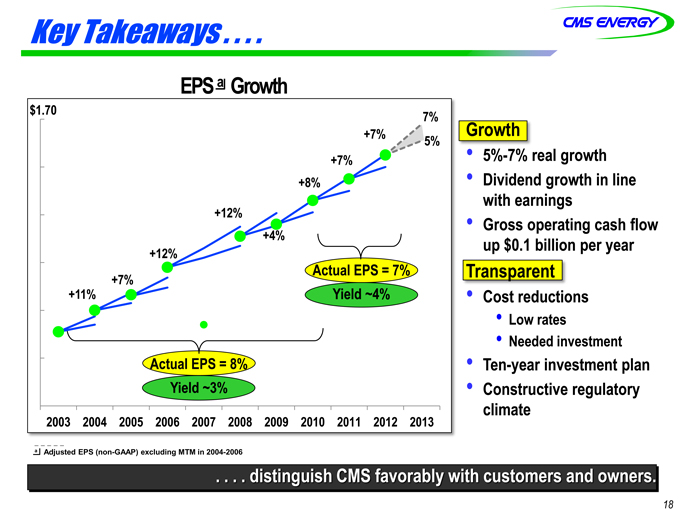

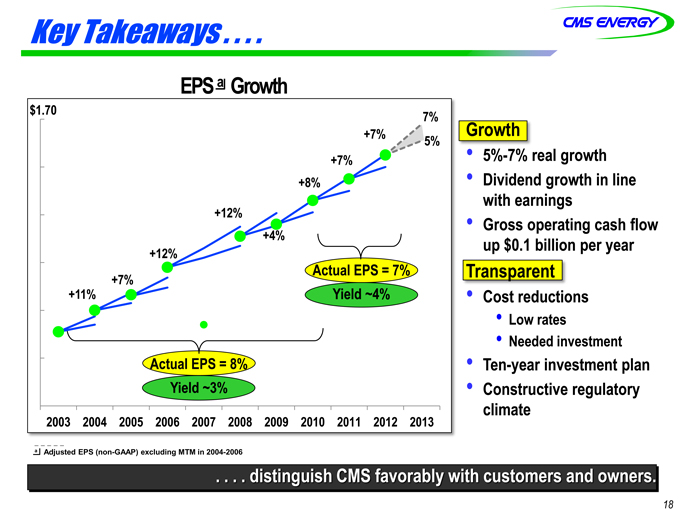

Key Takeaways . . . .

EPS a Growth

$1.70

7%

+7%

5%

+7% +8%

+12%

+4%

+12%

Actual EPS = 7%

+7%

+11% Yield ~4%

Actual EPS = 8% Yield ~3%

2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013

Growth

5%-7% real growth

Dividend growth in line with earnings

Gross operating cash flow up $0.1 billion per year

Transparent

Cost reductions

Low rates

Needed investment

Ten-year investment plan

Constructive regulatory climate

a Adjusted EPS (non-GAAP) excluding MTM in 2004-2006

. . . . distinguish CMS favorably with customers and owners.

18

GAAP Reconciliation

CMS ENERGY CORPORATION

Earnings Per Share By Year GAAP Reconciliation

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | 2003

| | | 2004

| | | 2005

| | | 2006

| | | 2007

| | | 2008

| | | 2009

| | | 2010

| | | 2011

| | | 2012

| |

Reported earnings (loss) per share - GAAP | | ($ | 0.30 | ) | | $ | 0.64 | | | ($ | 0.44 | ) | | ($ | 0.41 | ) | | ($ | 1.02 | ) | | $ | 1.20 | | | $ | 0.91 | | | $ | 1.28 | | | $ | 1.58 | | | $ | 1.42 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

After-tax items: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Electric and gas utility | | | 0.21 | | | | (0.39 | ) | | | — | | | | — | | | | (0.07 | ) | | | 0.05 | | | | 0.33 | | | | 0.03 | | | | 0.00 | | | | 0.17 | |

Enterprises | | | 0.74 | | | | 0.62 | | | | 0.04 | | | | (0.02 | ) | | | 1.25 | | | | (0.02 | ) | | | 0.09 | | | | (0.03 | ) | | | (0.11 | ) | | | (0.01 | ) |

Corporate interest and other | | | 0.16 | | | | (0.03 | ) | | | 0.04 | | | | 0.27 | | | | (0.32 | ) | | | (0.02 | ) | | | 0.01 | | | | * | | | | (0.01 | ) | | | * | |

Discontinued operations (income) loss | | | (0.16 | ) | | | 0.02 | | | | (0.07 | ) | | | (0.03 | ) | | | 0.40 | | | | ( | *) | | | (0.08 | ) | | | 0.08 | | | | (0.01 | ) | | | (0.03 | ) |

Asset impairment charges, net | | | — | | | | — | | | | 1.82 | | | | 0.76 | | | | 0.60 | | | | — | | | | — | | | | — | | | | — | | | | — | |

Cumulative accounting changes | | | 0.16 | | | | 0.01 | | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Adjusted earnings per share, including MTM - non-GAAP | | $ | 0.81 | | | $ | 0.87 | | | $ | 1.39 | | | $ | 0.57 | | | $ | 0.84 | | | $ | 1.21 | (a) | | $ | 1.26 | | | $ | 1.36 | | | $ | 1.45 | | | $ | 1.55 | |

Mark-to-market impacts | | | | | | | 0.03 | | | | (0.43 | ) | | | 0.51 | | | | | | | | | | | | | | | | | | | | | | | | | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Adjusted earnings per share, excluding MTM - non-GAAP | | | NA | | | $ | 0.90 | | | $ | 0.96 | | | $ | 1.08 | | | | NA | | | | NA | | | | NA | | | | NA | | | | NA | | | | NA | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

| * | | Less than $500 thousand or $0.01 per share. |

| (a) | | $1.25 excluding discontinued Exeter operations and accounting changes related to convertible debt and restricted stock. |

2003-12 EPS