Exhibit 99.1

Wells Fargo 2013 Energy Symposium

December 11, 2013

Cross Winds® Energy Park Consumers Smart Energy Program

Gas Combined Cycle Plant

This presentation is made as of the date hereof and contains “forward-looking statements” as defined in Rule 3b-6 of the Securities Exchange Act of 1934, Rule 175 of the Securities Act of 1933, and relevant legal decisions. The forward-looking statements are subject to risks and uncertainties. All forward-looking statements should be considered in the context of the risk and other factors detailed from time to time in CMS Energy’s and Consumers Energy’s Securities and Exchange Commission filings. Forward-looking statements should be read in conjunction with “FORWARD-LOOKING STATEMENTS AND

INFORMATION” and “RISK FACTORS” sections of CMS Energy’s and Consumers Energy’s Form 10-K for the year ended December 31, 2012 and as updated in subsequent 10-Qs. CMS Energy’s and Consumers Energy’s “FORWARD-LOOKING STATEMENTS AND INFORMATION” and “RISK FACTORS” sections are incorporated herein by reference and discuss important factors that could cause CMS Energy’s and Consumers Energy’s results to differ materially from those anticipated in such statements. CMS Energy and Consumers Energy undertake no obligation to update any of the information presented herein to reflect facts, events or circumstances after the date hereof.

The presentation also includes non-GAAP measures when describing CMS Energy’s results of operations and financial performance. A reconciliation of each of these measures to the most directly comparable GAAP measure is included in the appendix and posted on our website at www.cmsenergy.com.

CMS Energy provides historical financial results on both a reported (Generally Accepted Accounting Principles) and adjusted (non-GAAP) basis and provides forward-looking guidance on an adjusted basis. Management views adjusted earnings as a key measure of the company’s present operating financial performance, unaffected by discontinued operations, asset sales, impairments, regulatory items from prior years, or other items. These items have the potential to impact, favorably or unfavorably, the company’s reported earnings in future periods. Because the company is not able to estimate the impact of these matters, the company is not providing a reconciliation to the comparable future period reported earnings.

1

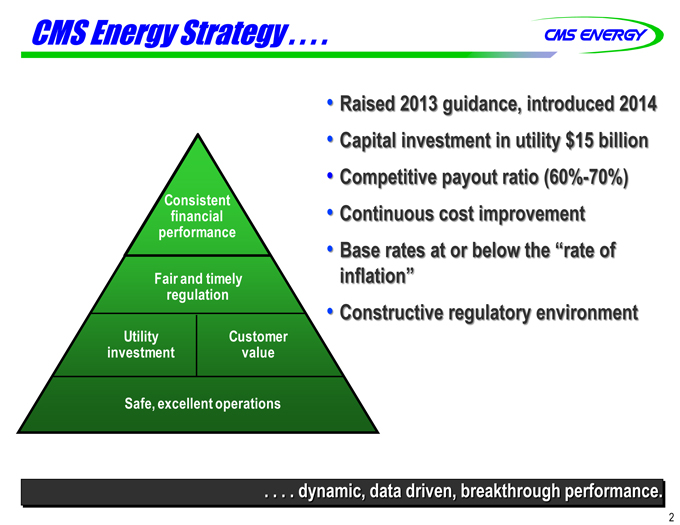

CMS Energy Strategy . . . .

Raised 2013 guidance, introduced 2014

Capital investment in utility $15 billion

Competitive payout ratio (60%-70%)

Continuous cost improvement

Base rates at or below the “rate of inflation”

Constructive regulatory environment

Consistent financial performance

Fair and timely regulation

Utility Customer investment value

Safe, excellent operations

. . . . dynamic,ynamic, data driven, breakthrough performance.

2

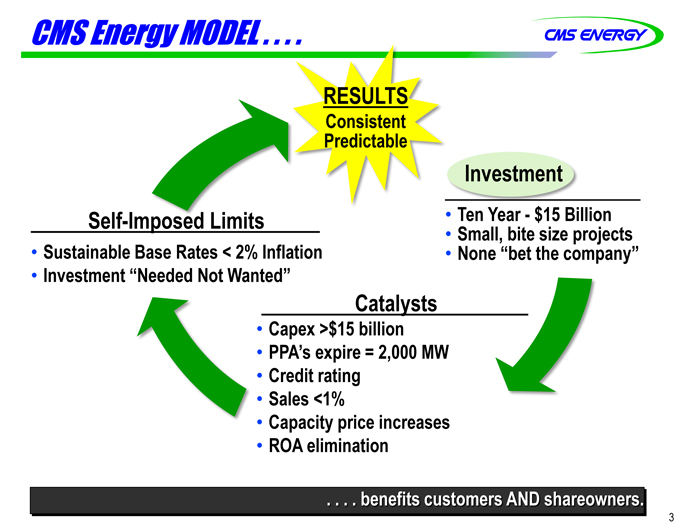

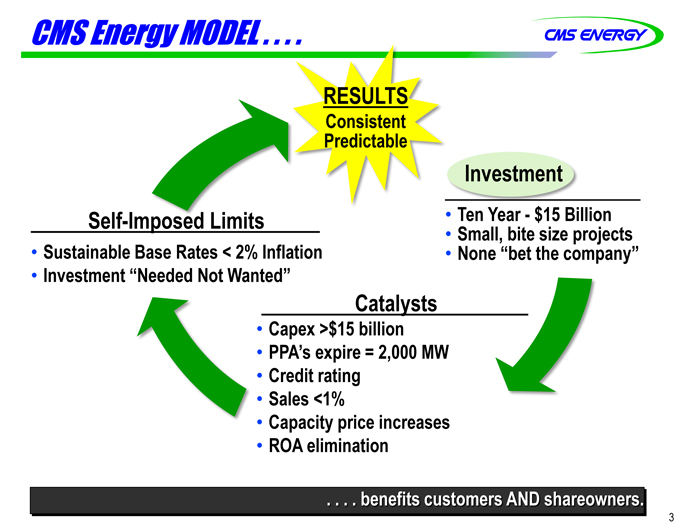

CMS Energy MODEL . . . .

RESULTS

Consistent Predictable

Self-Imposed Limits

Sustainable Base Rates < 2% Inflation

Investment “Needed Not Wanted”

Investment

Ten Year—$15 Billion Small, bite size projects None “bet the company”

Catalysts

Capex >$15 billion

PPA’s expire = 2,000 MW

Credit rating

Sales <1%

Capacity price increases

ROA elimination

. . . . benefitsenefits customers AND shareowners.

3

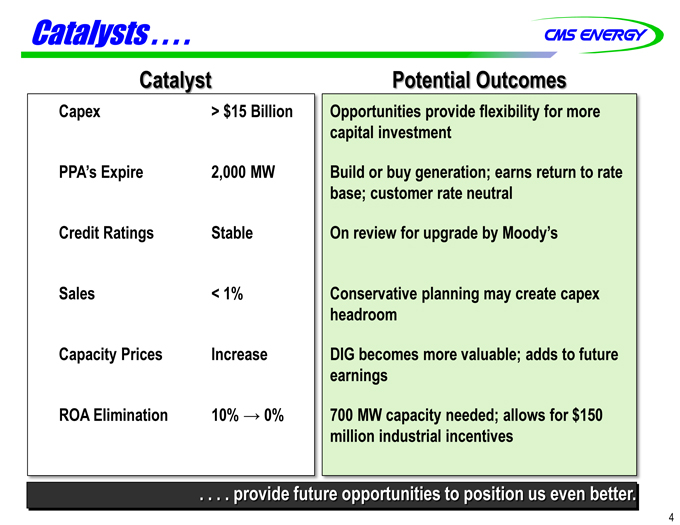

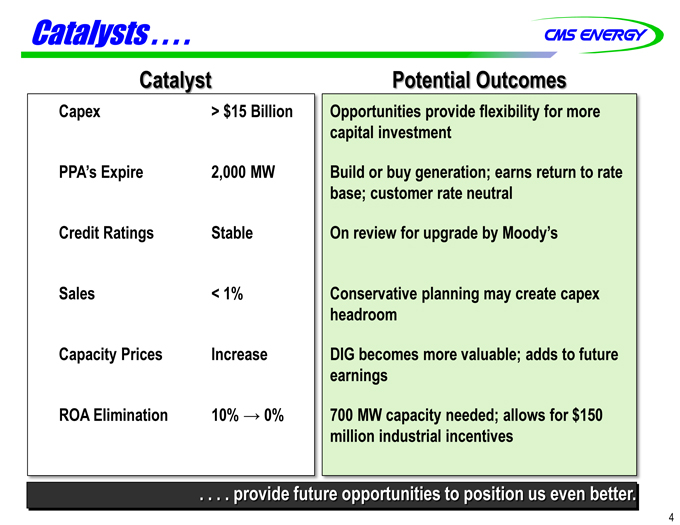

Catalysts .. . . .

Capex > $15 Billion PPA’s Expire 2,000 MW Credit Ratings Stable Sales < 1% Capacity Prices Increase ROA Elimination 10% 0%

Potential Outcomes

Opportunities provide flexibility for more capital investment

Build or buy generation; earns return to rate base; customer rate neutral

On review for upgrade by Moody’s

Conservative planning may create capex headroom

DIG becomes more valuable; adds to future earnings

700 MW capacity needed; allows for $150 million industrial incentives

. . . . providerovide future opportunities to position us even better.

4

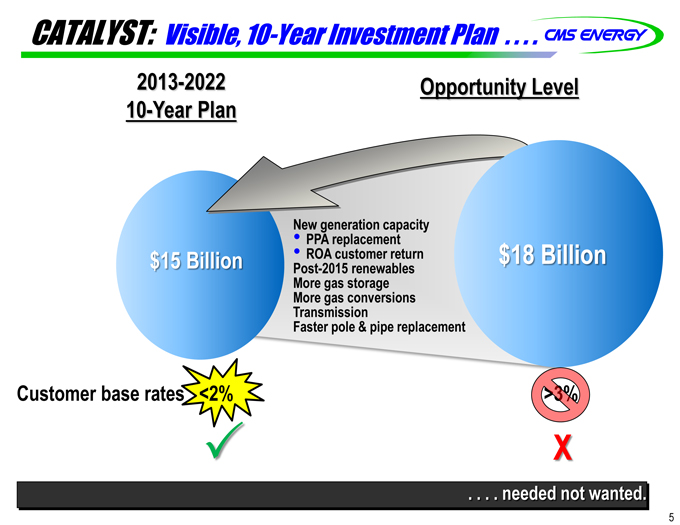

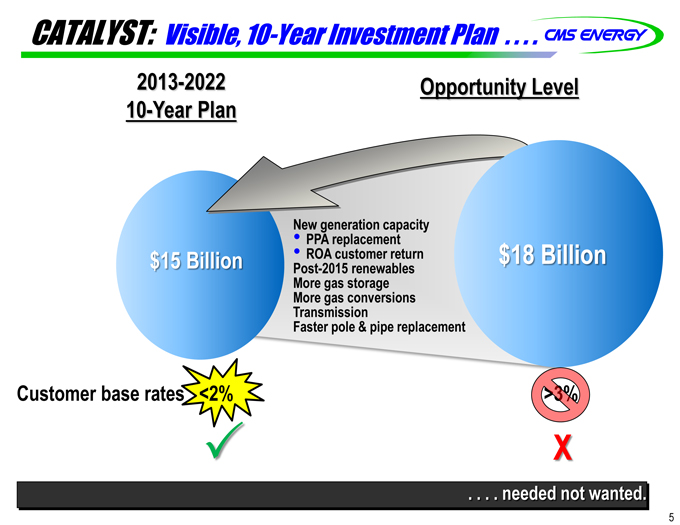

CATALYST: Visible, 10-Year Investment Plan . . . .

2013-2022 Opportunity Level

10-Year Plan

$15 Billion

$18 BillionNew generation capacity

PPA replacement

ROA customer return Post-2015 renewables More gas storage More gas conversions Transmission Faster pole & pipe replacement

Customer base rates <2%

>3%

. . . . needed not wanted.

5

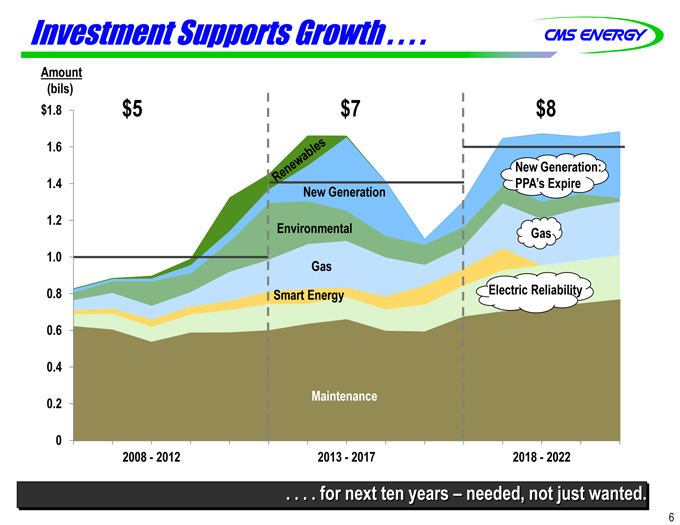

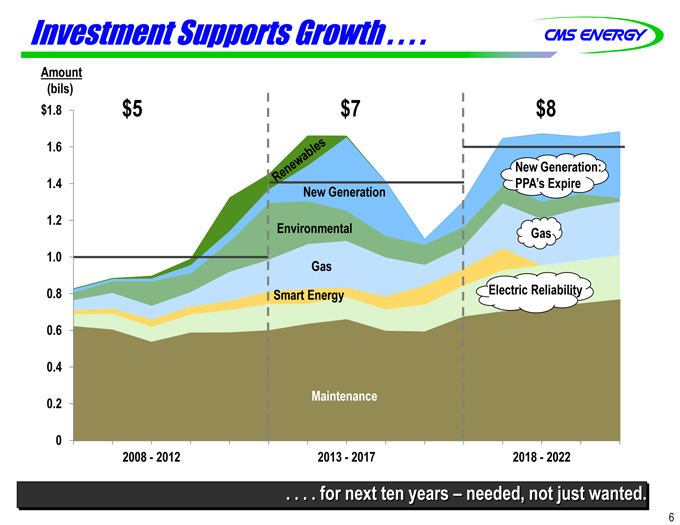

Investment Supports Growth . . . .

Renewables

Amount (bils)

$1.8 $5 $7 $8

1.6

New Generation: 1.4 PPA’s Expire New Generation 1.2 Environmental Gas 1.0 Gas 0.8 Smart Energy Electric Reliability

0.6

0.4

Maintenance 0.2

0

2008—2012 2013—2017 2018—2022

. . .. . for next ten years – needed, eeded, not just wanted.

6

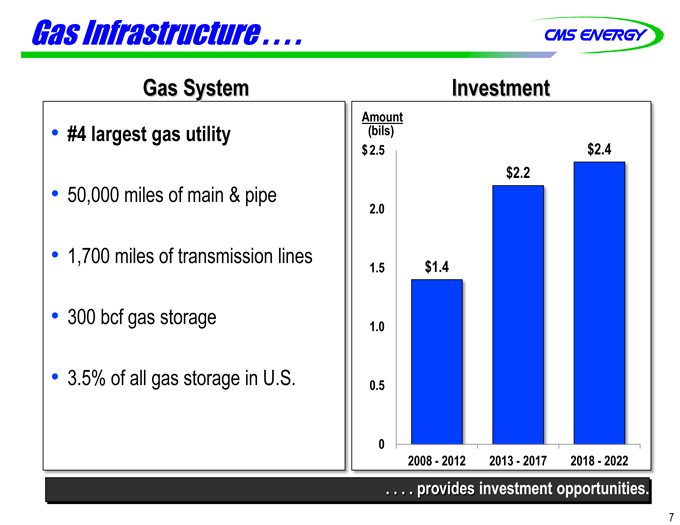

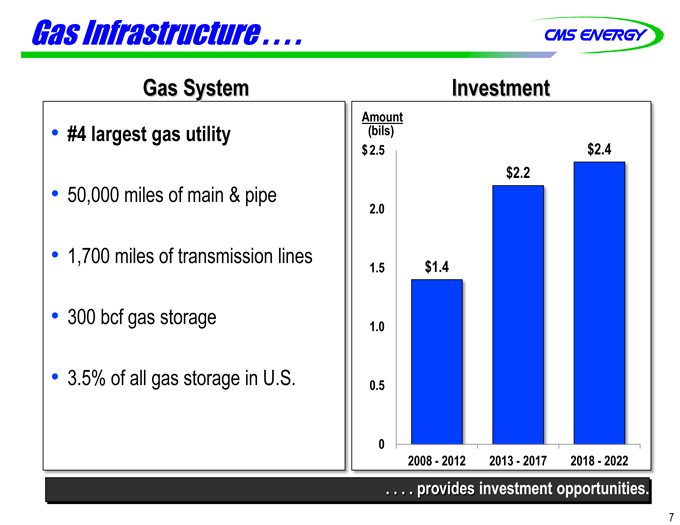

Gas Infrastructure . . . .

Gas System

#4 largest gas utility

50,000 miles of main & pipe

1,700 miles of transmission lines

300 bcf gas storage

3.5% of all gas storage in U.S.

Investment

Amount (bils) $ 2.5 $2.4

$2.2

2.0

1.5 $1.4

1.0

0.5

0

2008—2012 2013—2017 2018—2022

. . .. . provides investment opportunities.

7

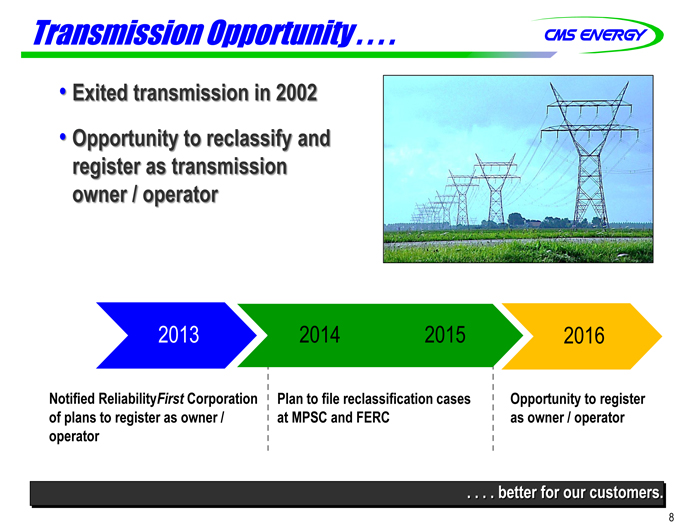

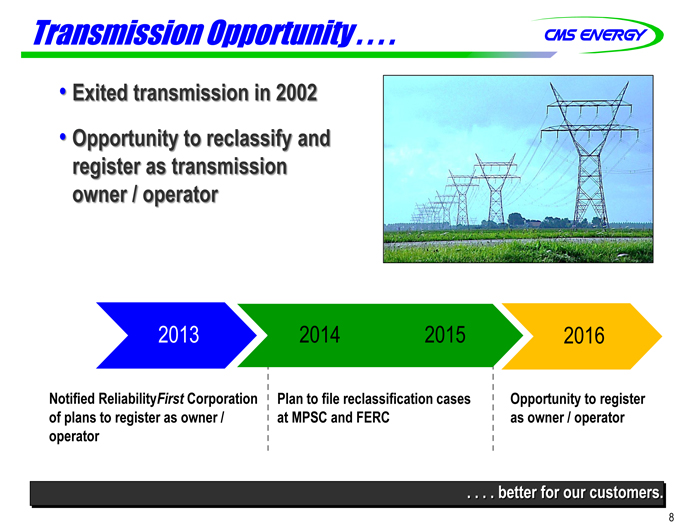

Transmission Opportunity . . . .

Exited transmission in 2002

Opportunity to reclassify and register as transmission owner / operator

2013 2014 2015 2016

Notified ReliabilityFirst Corporation Plan to file reclassification cases Opportunity to register of plans to register as owner / at MPSC and FERC as owner / operator operator

. . . . better for our customers.

8

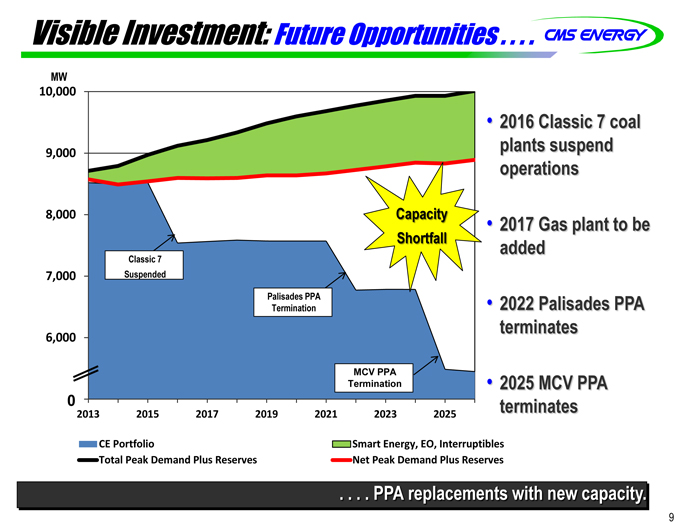

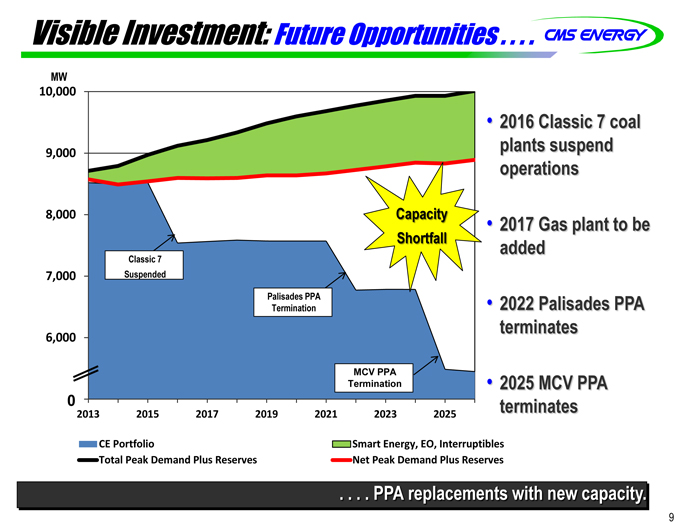

Visible Investment: Future Oppurtunities….

MW

10,000

9,000

8,000

7,000

6,000

0

2013 2015 2017 2019 2021 2023 2025

2016 Classic 7 coal plants suspend operations

2017 Gas plant to be added

2022 Palisades PPA terminates

2025 MCV PPA terminates

CE Portfolio

Total Peak Demand Plus Reserves

Smart Energy, EO, Interruptibles

Net Peak Demand Plus Reserves

…. PPA replacements with new capacity.

9

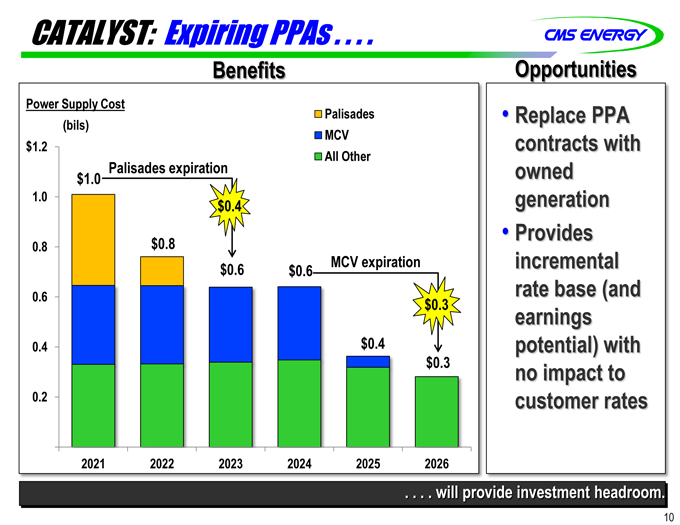

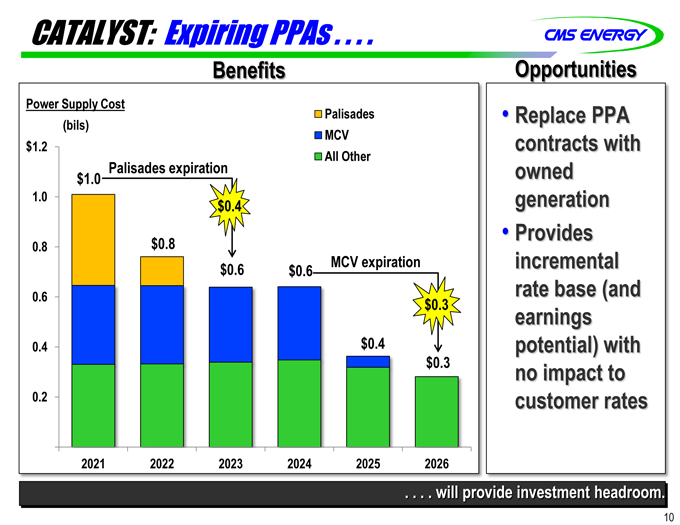

CATALYST: Expiring PPAs . . . .

Benefits

Power Supply Cost

Palisades (bils) MCV $1.2 All Other

Palisades expiration $1.0

1.0

$0.4

0.8 $0.8

MCV expiration $0.6 $0.6

0.6

$0.3

0.4 $0.4 $0.3

0.2

2021 2022 2023 2024 2025 2026

Opportunities

Replace PPA contracts with owned generation

Provides incremental rate base (and earnings potential) with no impact to customer rates

. . . . will provide investment headroom.

10

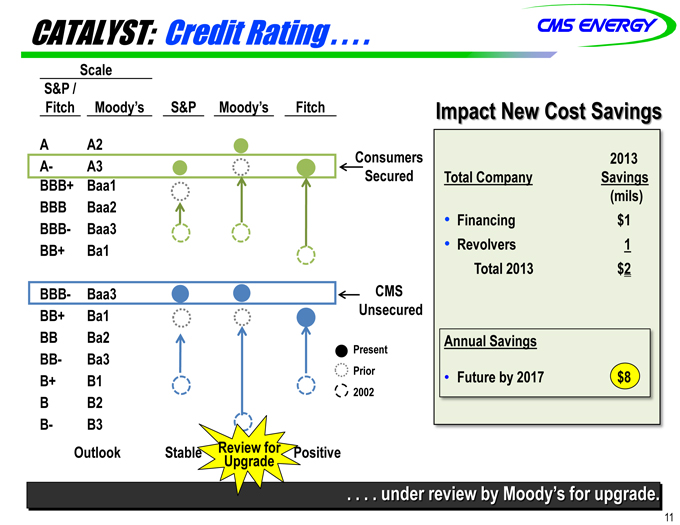

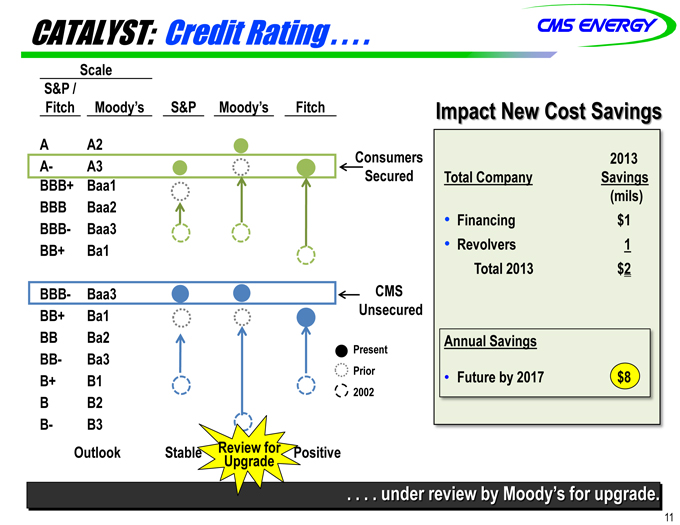

CATALYST: Credit Rating . . . .

Scale

S&P /

Fitch Moody’s S&P Moody’s Fitch

A A2

Consumers A- A3 Secured BBB+ Baa1 BBB Baa2 BBB- Baa3 BB+ Ba1

BBB- Baa3 CMS BB+ Ba1 Unsecured

BB Ba2 Present

BB- Ba3

Prior

B+ B1

2002

B B2 B- B3

Outlook Stable Review for Positive Upgrade

Impact New Cost Savings

2013 Total Company Savings (mils)

Financing $1

Revolvers 1 Total 2013 $2

Annual Savings

Future by 2017 $8

. . . . under review by Moody’s for upgrade.

11

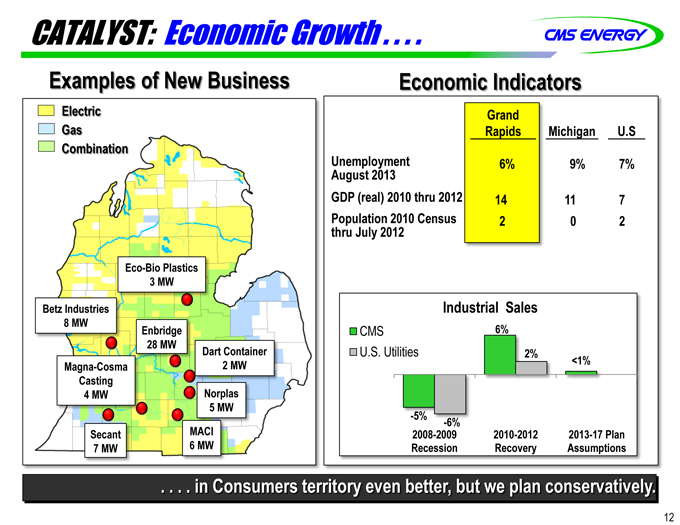

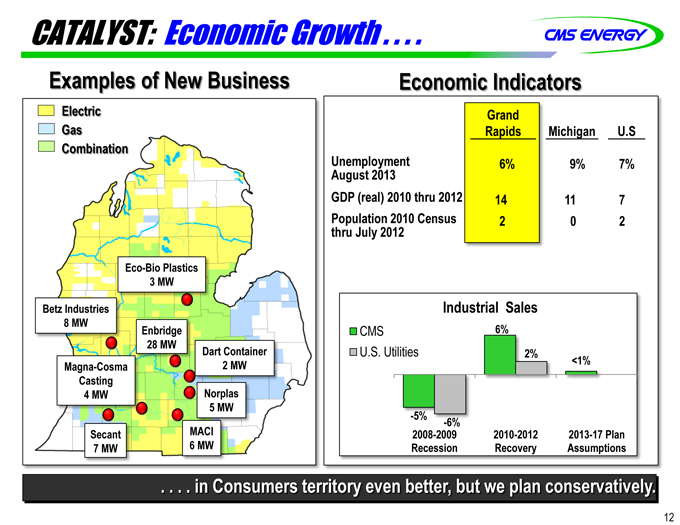

CATALYST: Economic Growth . . . .

Examples of New Business

Electric Gas Combination

Eco-Bio Plastics

3 MW

Betz Industries

8 MW

Enbridge

28 MW

Dart Container Magna-Cosma 2 MW

Casting

4 MW Norplas

5 MW

Secant MACI

7 MW 6 MW

Economic Indicators

Grand

Rapids Michigan U.S

Unemployment 6% 9% 7% August 2013 GDP (real) 2010 thru 2012 14 11 7 Population 2010 Census 2 0 2 thru July 2012

Industrial Sales

CMS 6% U.S. Utilities 2%

<1%

-5% -6%

2008-2009 2010-2012 2013-17 Plan Recession Recovery Assumptions

. . . . in Consumers territory even better, but we plan conservatively.

12

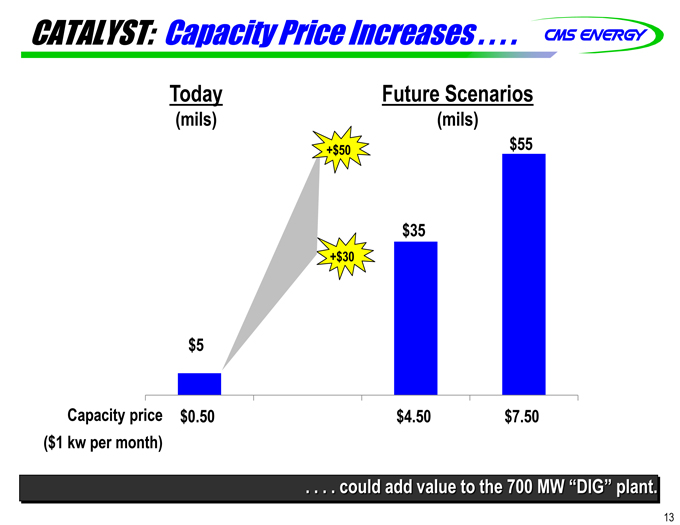

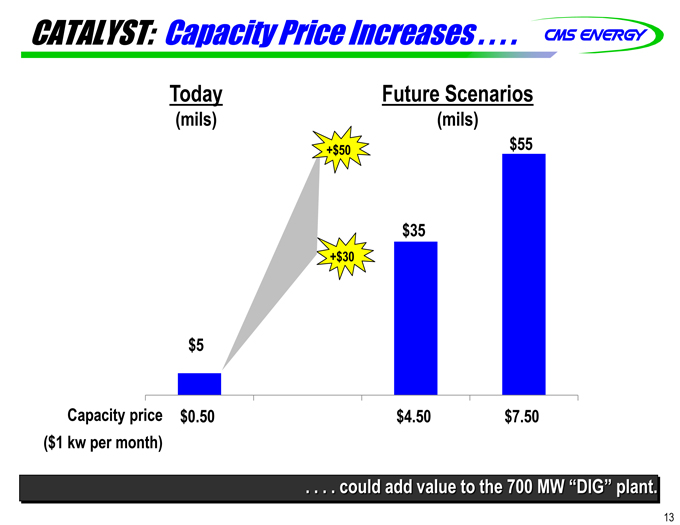

CATALYST: Capacity Price Increases . . . .

Today Future Scenarios

(mils) (mils)

+$50 $55

$35

+$30

$5

Capacity price $0.50 $4.50 $7.50

($1 kw per month)

. . . . could add value to the 700 MW “DIG” plant.

13

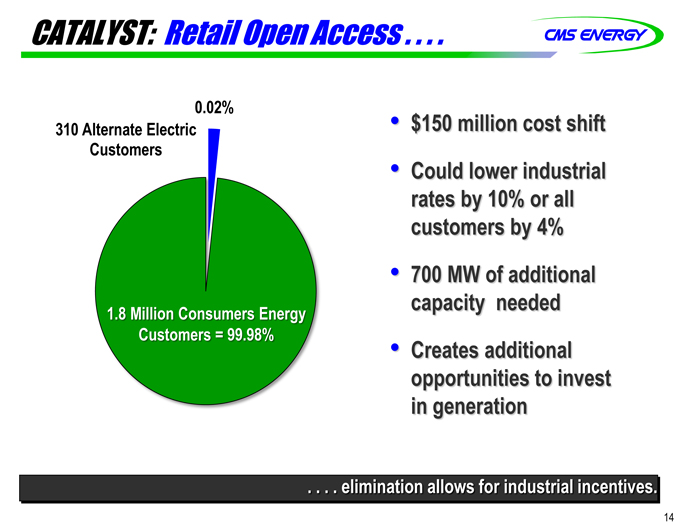

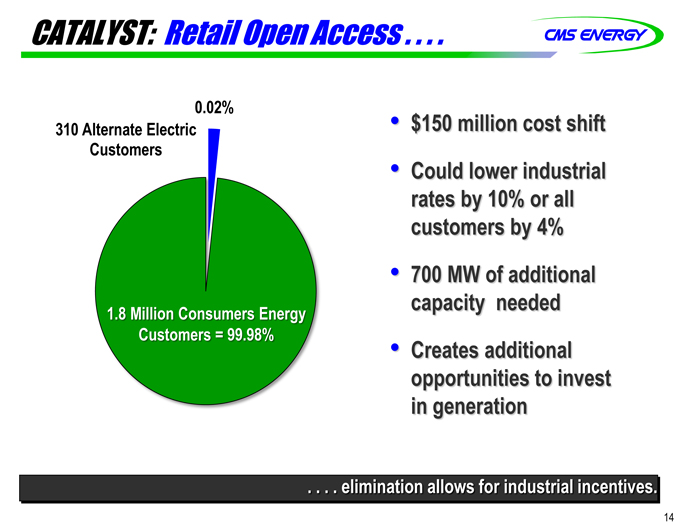

CATALYST: Retail Open Access . . . .

0.02% 310 Alternate Electric Customers

1.8 Million Consumers Energy Customers = 99.98%

$150 million cost shift

Could lower industrial rates by 10% or all customers by 4%

700 MW of additional capacity needed

Creates additional opportunities to invest in generation

. . . . elimination allows for industrial incentives.

14

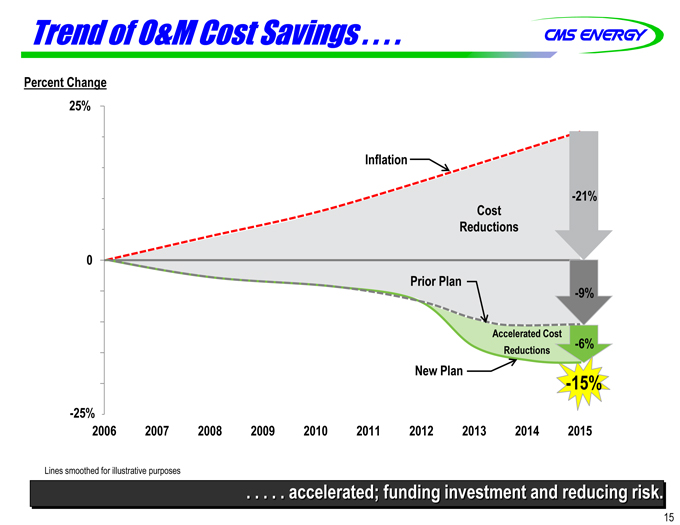

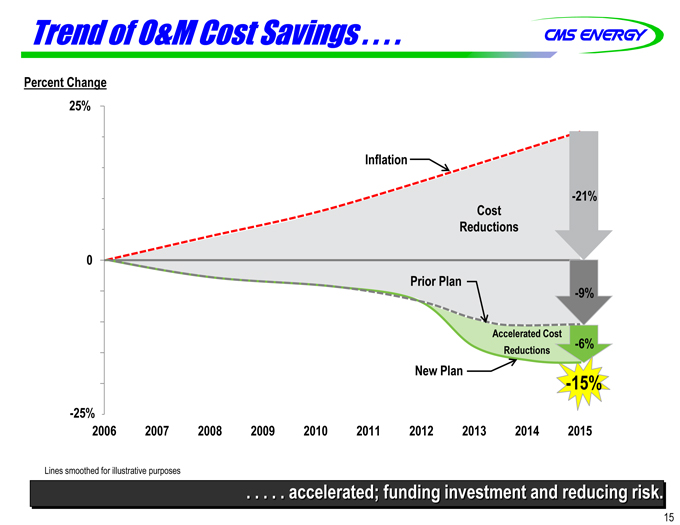

Trend of O&M Cost Savings . . . .

Percent Change 25%

Inflation

-21% Cost Reductions

0

Prior Plan

-9%

Accelerated Cost

-6%

Reductions

New Plan

-15%

-25%

2006 2007 2008 2009 2010 2011 2012 2013 2014 2015

Lines smoothed for illustrative purposes

. . . . . accelerated; funding investment and reducing risk.

15

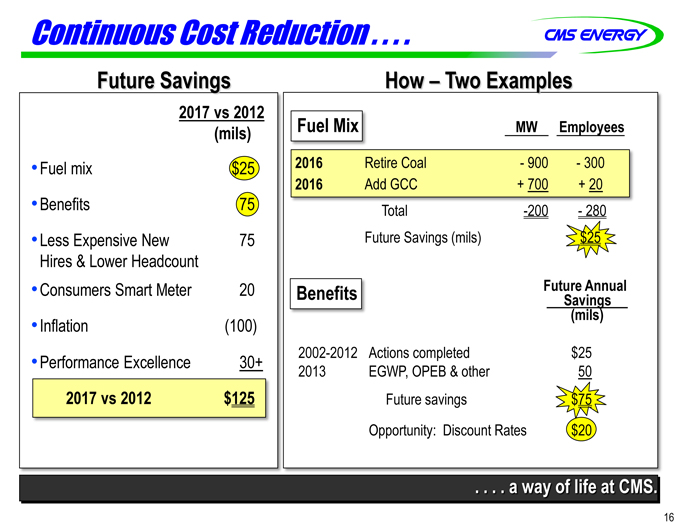

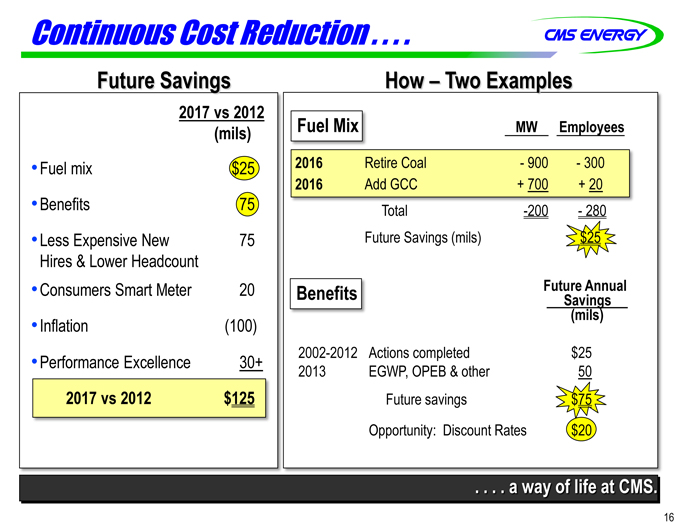

Continuous Cost Reduction . . . .

Future Savings

2017 vs 2012 (mils)

Fuel mix $25

Benefits 75

Less Expensive New 75 Hires & Lower Headcount

Consumers Smart Meter 20

Inflation (100)

Performance Excellence 30+

2017 vs 2012 $125

How – Two Examples

Fuel Mix MW Employees 2016 Retire Coal-900-300 2016 Add GCC + 700 + 20 Total 200-280 Future Savings (mils) $25

Benefits Future Savings Annual (mils)

20022012 Actions completed $25 2013 EGWP, OPEB & other 50 Future savings $75 Opportunity: Discount Rates $20

. . . . a way of life at CMS.

16

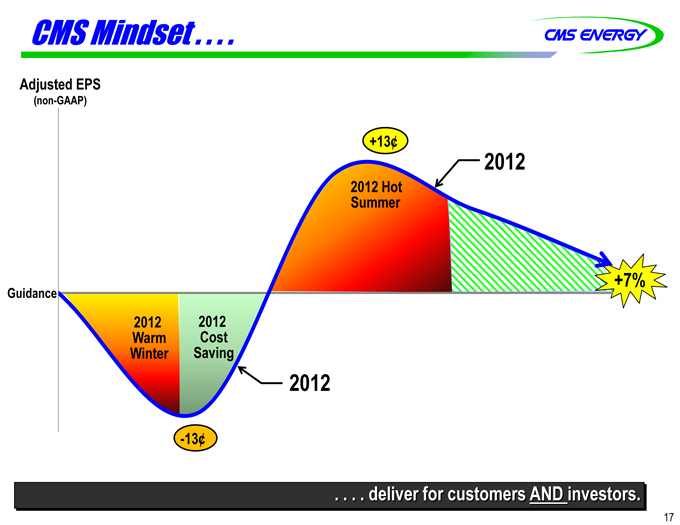

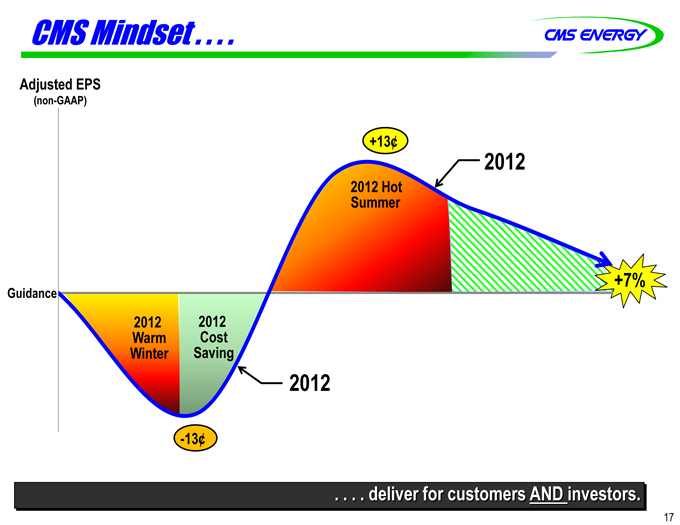

CMS Mindset . . . .

Adjusted EPS

(non-GAAP)

+13¢

2012

2012 Hot Summer

+7%

Guidance

2012 2012 Warm Cost Winter Saving

2012

-13¢

. . . . deliver for customers AND investors.

17

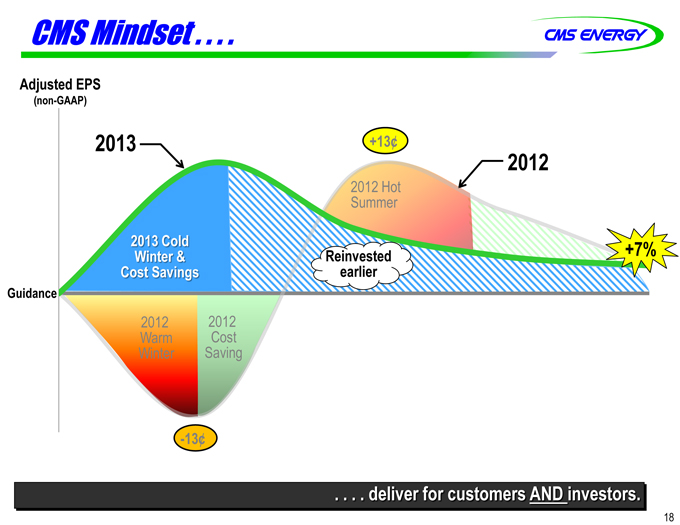

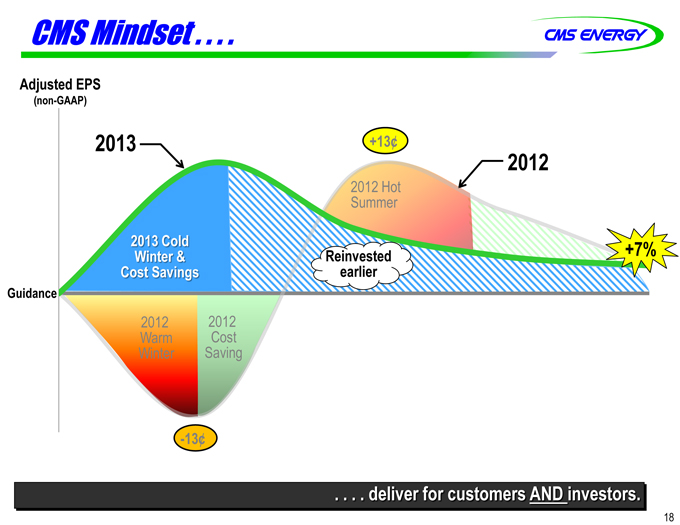

CMS Mindset . . . .

Adjusted EPS

(non-GAAP)

2013 +13¢

2012

2012 Hot Summer

2013 Cold +7% Winter & Reinvested Cost Savings earlier

Guidance

2012 2012 Warm Cost Winter Saving

-13¢

. . . . deliver for customers AND investors.

18

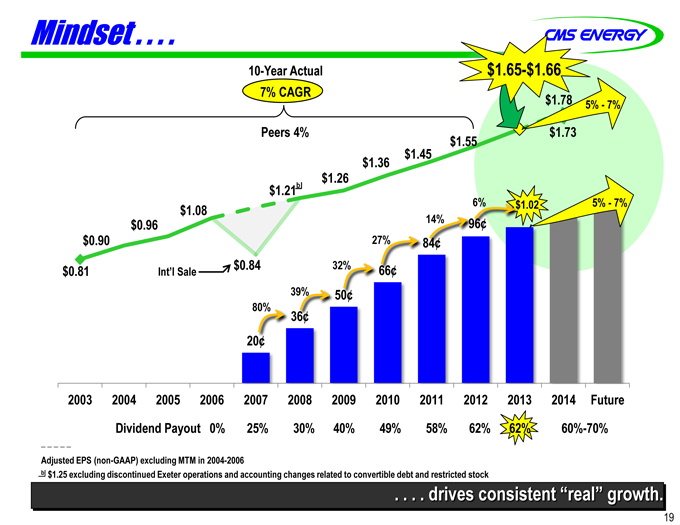

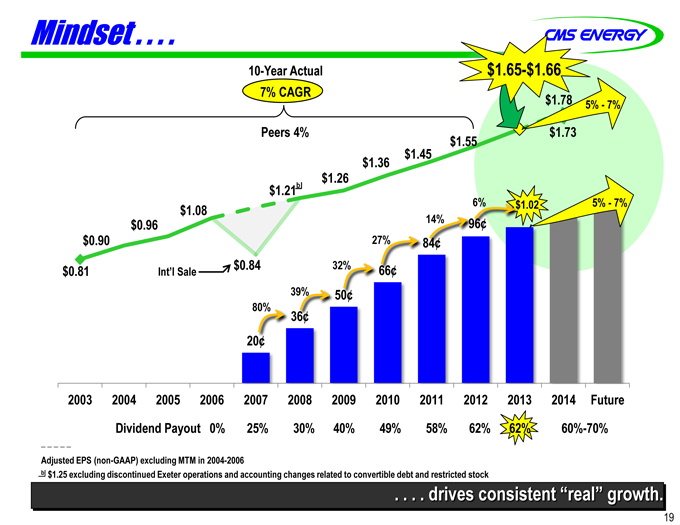

Mindset . .. . .

10-Year Actual $1.65-$1.66

7% CAGR $1.78 5%—7% Peers 4% $1.73 $1.45 $1.55 $1.36 $1.26 $1.21b

6% $1.02 5%—7% $1.08 $0.96 14% 96¢ $0.90 27% 84¢ $0.84 32% 66¢ $0.81 Int’l Sale 39% 50¢ 80%

36¢ 20¢

2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 Future Dividend Payout 0% 25% 30% 40% 49% 58% 62% 62% 60%-70%

Adjusted EPS (non-GAAP) excluding MTM in 2004-2006 b $1.25 excluding discontinued Exeter operations and accounting changes related to convertible debt and restricted stock

. . . . drives consistent “real” growth.

19

APPENDIX

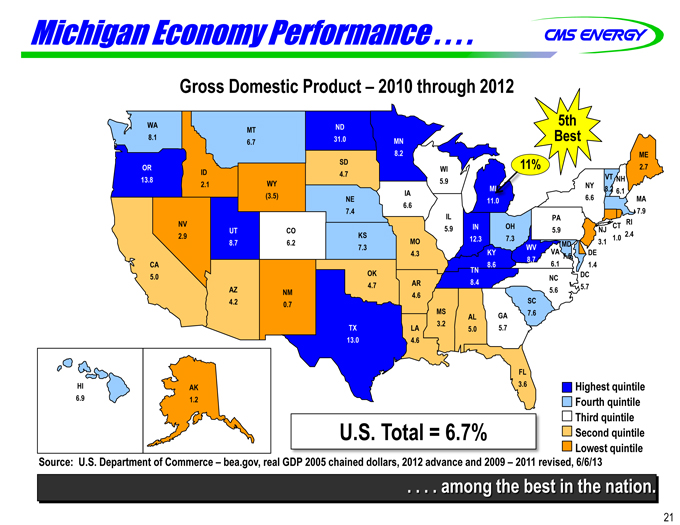

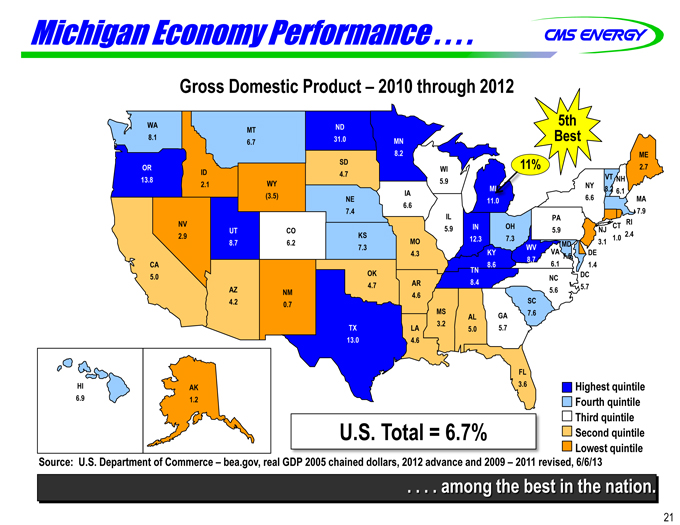

Michigan Economy Performance . . . .

Gross Domestic Product – 2010 through 2012

WA 5th

MT ND

8.1 31.0 Best 6.7 MN

8.2 ME

SD 11%

OR WI 2.7 ID 4.7

13.8 VT NH

2.1 WY 5.9

MI NY 8.2 IA 6.1

(3.5) NE 6.6 MA

11.0 6.6

7.4 7.9 IL PA

NV RI 5.9 IN OH CT

UT CO 5.9 NJ

2.9 KS 2.4

12.3 7.3 1.0 8.7 6.2 MO MD 3.1 7.3 WV

4.3 KY VA DE 8.7 6.1 7.5 CA 8.6 1.4 OK TN

5.0 8.4 NC DC 4.7 AR 5.7 AZ NM 5.6 4.6 4.2 SC

0.7 MS

GA 7.6 AL

3.2

TX LA 5.0 5.7

13.0 4.6

FL

HI AK 3.6 Highest quintile 6.9 1.2 Fourth quintile Third quintile

U.S. Total = 6.7% Second quintile

Lowest quintile

Source: U.S. Department of Commerce – bea.gov, real GDP 2005 chained dollars, 2012 advance and 2009 – 2011 revised, 6/6/13

. . . . among the best in the nation.

21

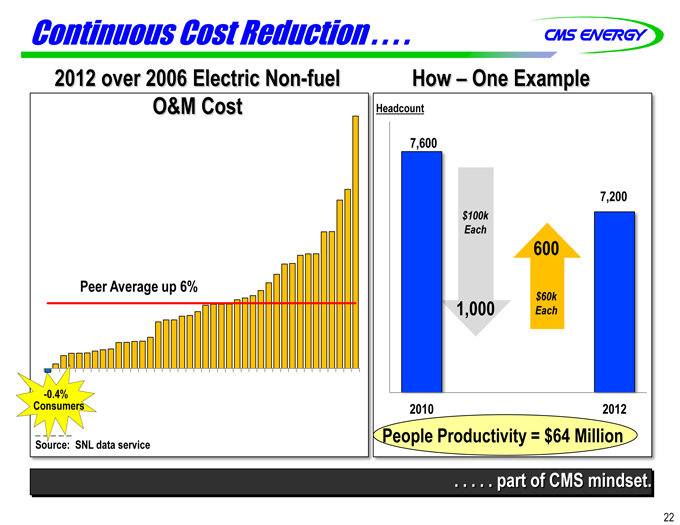

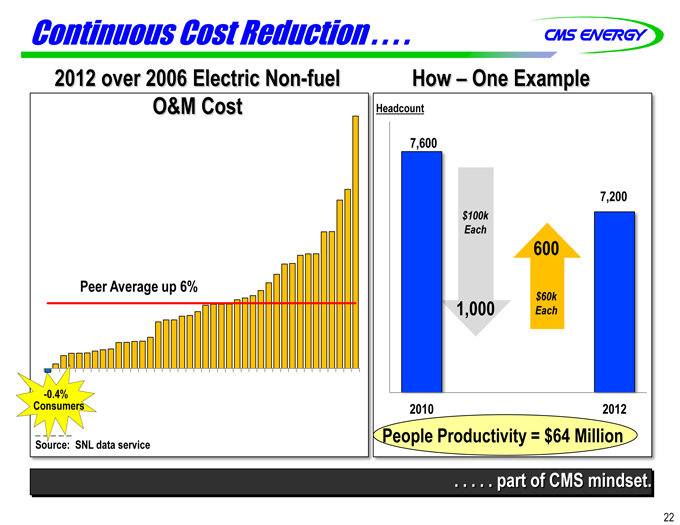

Continuous Cost Reduction . . . .

2012 over 2006 Electric Non-fuel

O&M Cost

Peer Average up 6%

-0.4% Consumers

Source: SNL data service

How – One Example

Headcount

7,600

7,200 $100k Each

600

$60k

1,000 Each

2010 2012

People Productivity = $64 Million

. . . . . part of CMS mindset.

22

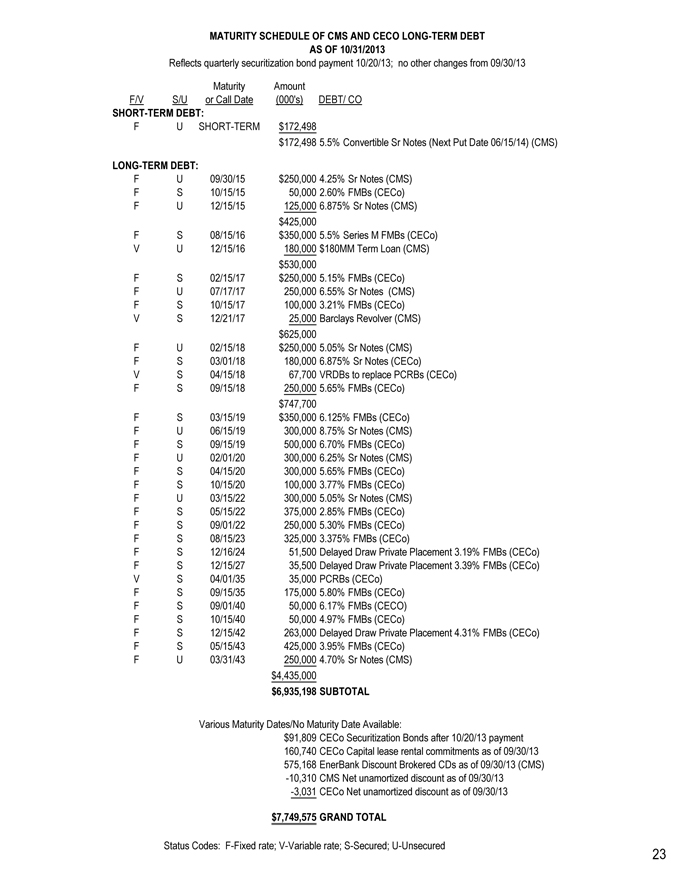

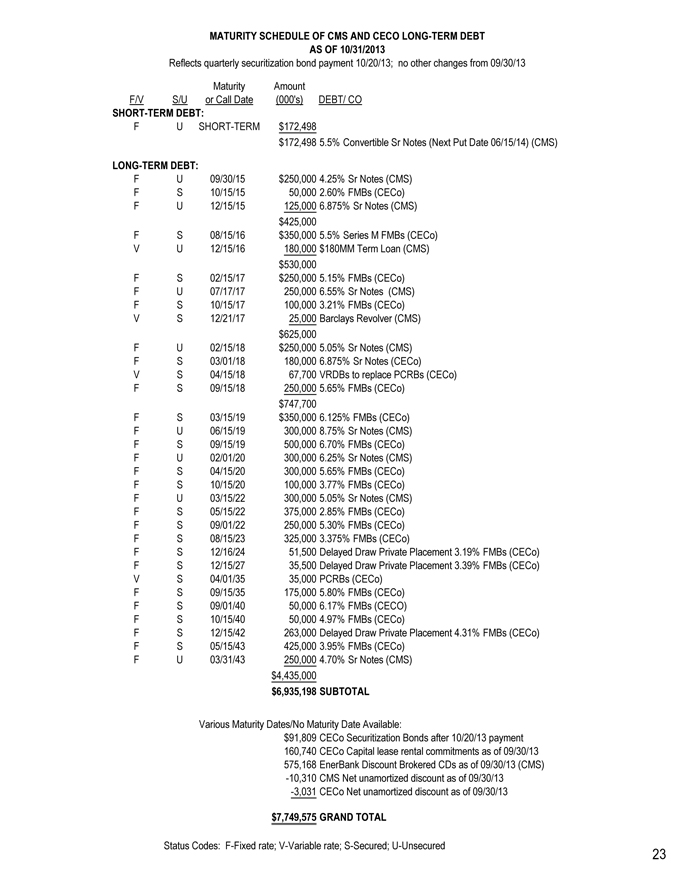

MATURITY SCHEDULE OF CMS AND CECO LONG-TERM DEBT AS OF 10/31/2013

Reflects quarterly securitization bond payment 10/20/13; no other changes from 09/30/13

Maturity Amount

F/V S/U or Call Date (000’s) DEBT/ CO

SHORT-TERM DEBT:

FU SHORT-TERM $172,498 $172,498 5.5% Convertible Sr Notes (Next Put Date 06/15/14) (CMS)

LONG-TERM DEBT:

FU 09/30/15 $250,000 4.25% Sr Notes (CMS) FS 10/15/15 50,000 2.60% FMBs (CECo) FU 12/15/15 125,000 6.875% Sr Notes (CMS) $425,000 FS 08/15/16 $350,000 5.5% Series M FMBs (CECo) VU 12/15/16 180,000 $180MM Term Loan (CMS) $530,000 FS 02/15/17 $250,000 5.15% FMBs (CECo) FU 07/17/17 250,000 6.55% Sr Notes (CMS) FS 10/15/17 100,000 3.21% FMBs (CECo) VS 12/21/17 25,000 Barclays Revolver (CMS) $625,000 FU 02/15/18 $250,000 5.05% Sr Notes (CMS) FS 03/01/18 180,000 6.875% Sr Notes (CECo) VS 04/15/18 67,700 VRDBs to replace PCRBs (CECo) FS 09/15/18 250,000 5.65% FMBs (CECo) $747,700 FS 03/15/19 $350,000 6.125% FMBs (CECo) FU 06/15/19 300,000 8.75% Sr Notes (CMS) FS 09/15/19 500,000 6.70% FMBs (CECo) FU 02/01/20 300,000 6.25% Sr Notes (CMS) FS 04/15/20 300,000 5.65% FMBs (CECo) FS 10/15/20 100,000 3.77% FMBs (CECo) FU 03/15/22 300,000 5.05% Sr Notes (CMS) FS 05/15/22 375,000 2.85% FMBs (CECo) FS 09/01/22 250,000 5.30% FMBs (CECo) FS 08/15/23 325,000 3.375% FMBs (CECo)

FS 12/16/24 51,500 Delayed Draw Private Placement 3.19% FMBs (CECo) FS 12/15/27 35,500 Delayed Draw Private Placement 3.39% FMBs (CECo) VS 04/01/35 35,000 PCRBs (CECo) FS 09/15/35 175,000 5.80% FMBs (CECo) FS 09/01/40 50,000 6.17% FMBs (CECO) FS 10/15/40 50,000 4.97% FMBs (CECo) FS 12/15/42 263,000 Delayed Draw Private Placement 4.31% FMBs (CECo) FS 05/15/43 425,000 3.95% FMBs (CECo) FU 03/31/43 250,000 4.70% Sr Notes (CMS) $4,435,000 $6,935,198 SUBTOTAL

Various Maturity Dates/No Maturity Date Available: $91,809 CECo Securitization Bonds after 10/20/13 payment 160,740 CECo Capital lease rental commitments as of 09/30/13 575,168 EnerBank Discount Brokered CDs as of 09/30/13 (CMS) -10,310 CMS Net unamortized discount as of 09/30/13 -3,031 CECo Net unamortized discount as of 09/30/13

$7,749,575 GRAND TOTAL

Status Codes: F-Fixed rate; V-Variable rate; S-Secured; U-Unsecured

23

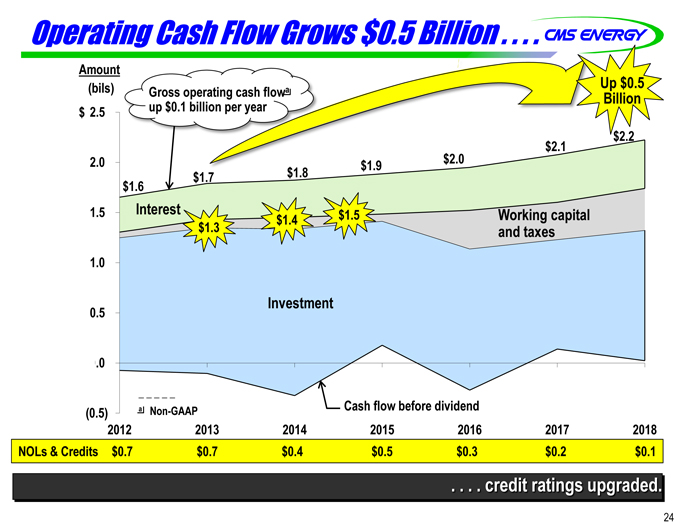

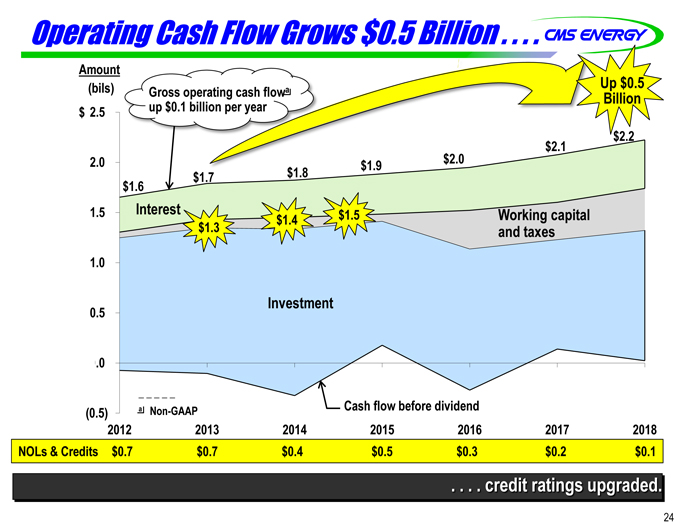

Operating Cash Flow Grows $0.5 Billion . . . .

Amount

(bils) Up $0.5

Gross operating cash flowa

Billion

$ 2.5 up $0.1 billion per year $2.2 $2.0 $2.1 2.0 $1.9 $1.7 $1.8 $1.6

1.5 Interest $1.5 Working capital

$1.4

$1.3 and taxes

1.0

Investment

0.5

.0

a Non-GAAP Cash flow before dividend

(0.5)

2012 2013 2014 2015 2016 2017 2018 NOLs & Credits $0.7 $0.7 $0.4 $0.5 $0.3 $0.2 $0.1

. . . . credit ratings upgraded.

24

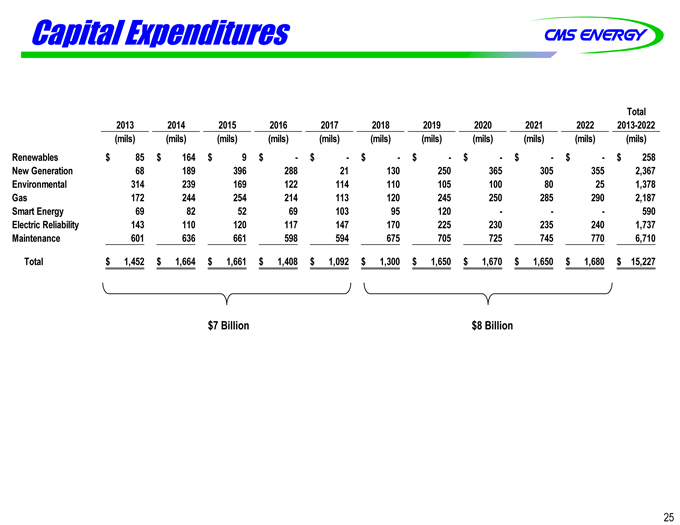

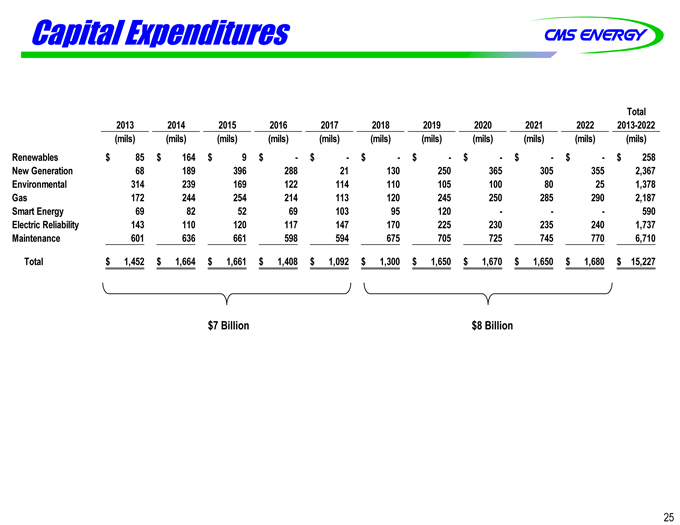

Capital Expenditures

Total

2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 2013-2022

(mils)(mils)(mils)(mils)(mils)(mils)(mils)(mils)(mils)(mils)(mils)

Renewables $ 85 $ 164 $ 9 $—$—$—$—$—$—$—$ 258

New Generation 68 189 396 288 21 130 250 365 305 355 2,367

Environmental 314 239 169 122 114 110 105 100 80 25 1,378

Gas 172 244 254 214 113 120 245 250 285 290 2,187

Smart Energy 69 82 52 69 103 95 120 - - - 590

Electric Reliability 143 110 120 117 147 170 225 230 235 240 1,737

Maintenance 601 636 661 598 594 675 705 725 745 770 6,710

Total $ 1,452 $ 1,664 $ 1,661 $ 1,408 $ 1,092 $ 1,300 $ 1,650 $ 1,670 $ 1,650 $ 1,680 $ 15,227

$ 7 Billion $8 Billion

25

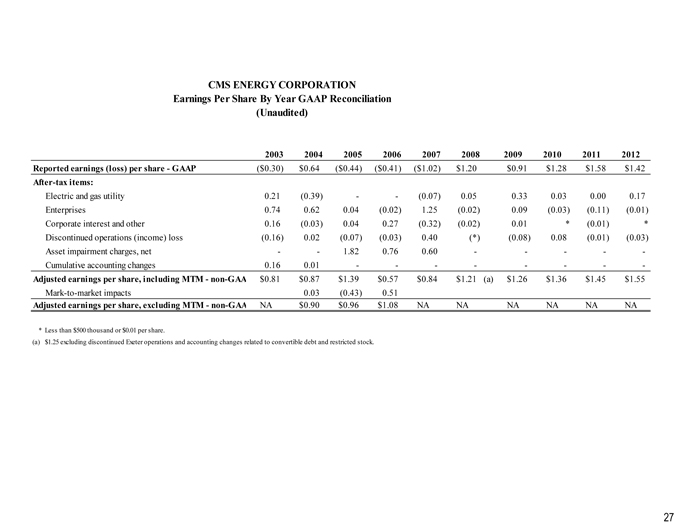

GAAP RECONCILIATION

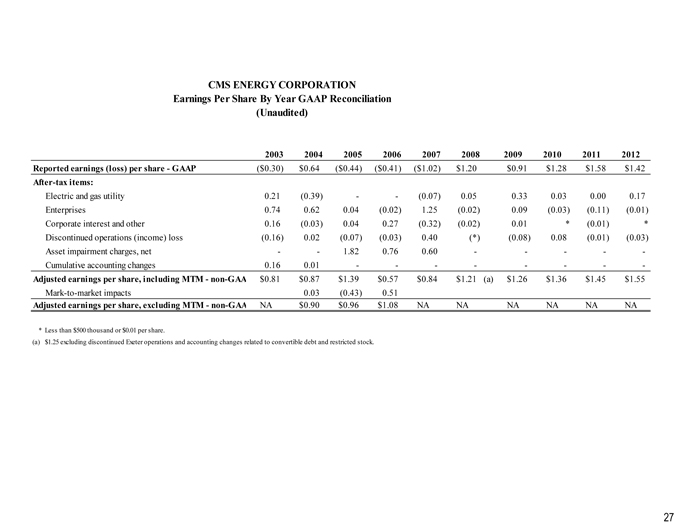

CMS ENERGY CORPORATION

Earnings Per Share By Year GAAP Reconciliation

(Unaudited)

2003 2004 2005 2006 2007 2008 2009 2010 2011 2012

Reported earnings (loss) per share - GAAP($0.30) $0.64($0.44)($0.41)($1.02) $1.20 $0.91 $1.28 $1.58 $1.42

After-tax items:

Electric and gas utility 0.21(0.39) - - (0.07) 0.05 0.33 0.03 0.00 0.17

Enterprises 0.74 0.62 0.04 (0.02) 1.25 (0.02) 0.09 (0.03) (0.11) (0.01)

Corporate interest and other 0.16 (0.03) 0.04 0.27 (0.32) (0.02) 0.01 * (0.01) *

Discontinued operations (income) loss (0.16) 0.02 (0.07) (0.03) 0.40 (*) (0.08) 0.08 (0.01) (0.03)

Asset impairment charges, net - - 1.82 0.76 0.60 - - - - -

Cumulative accounting changes 0.16 0.01 - - - - - - - -

Adjusted earnings per share, including MTM non-GAA $0.81 $0.87 $1.39 $0.57 $0.84 $1.21 (a) $1.26 $1.36 $1.45 $1.55

Mark-to-market impacts 0.03 (0.43) 0.51

Adjusted earnings per share, excluding MTM non-GAA NA $0.90 $0.96 $1.08 NA NA NA NA NA NA

* Less than $500 thousand or $0.01 per share.

(a) $1.25 excluding discontinued Exeter operations and accounting changes related to convertible debt and restricted stock.

27

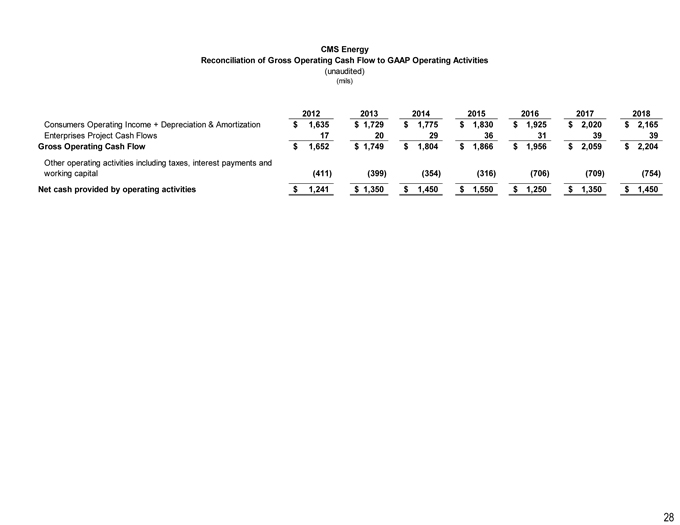

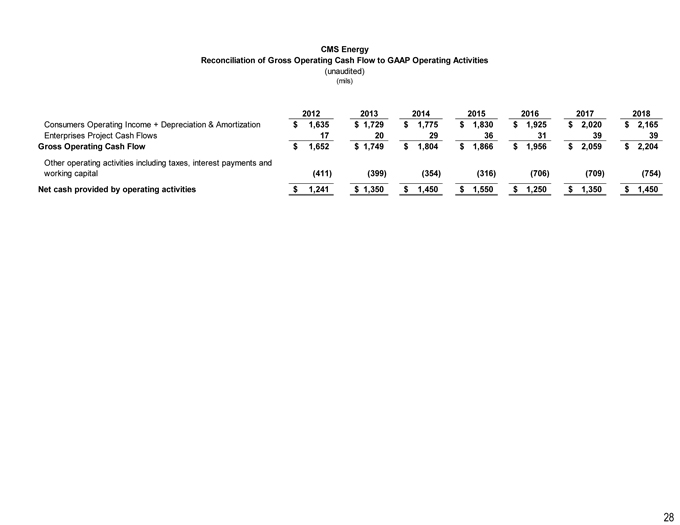

CMS Energy

Reconciliation of Gross Operating Cash Flow to GAAP Operating Activities

(unaudited)

(mils)

2012 2013 2014 2015 2016 2017 2018

Consumers Operating Income + Depreciation & Amortization $ 1,635 $ 1,729 $ 1,775 $ 1,830 $ 1,925 $ 2,020 $ 2,165

Enterprises Project Cash Flows 17 20 29 36 31 39 39

Gross Operating Cash Flow $ 1,652 $ 1,749 $ 1,804 $ 1,866 $ 1,956 $ 2,059 $ 2,204

Other operating activities including taxes, interest payments and

working capital (411) (399) (354) (316) (706) (709) (754)

Net cash provided by operating activities $ 1,241 $ 1,350 $ 1,450 $ 1,550 $ 1,250 $ 1,350 $ 1,450

28