UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number | 811-05041 | |||||||

| ||||||||

CREDIT SUISSE LARGE CAP GROWTH FUND | ||||||||

(Exact name of registrant as specified in charter) | ||||||||

| ||||||||

Eleven Madison Avenue, New York, New York |

| 10010 | ||||||

(Address of principal executive offices) |

| (Zip code) | ||||||

| ||||||||

J. Kevin Gao, Esq. Credit Suisse Large Cap Growth Fund Eleven Madison Avenue New York, New York 10010 | ||||||||

(Name and address of agent for service) | ||||||||

| ||||||||

Registrant’s telephone number, including area code: | (212) 325-2000 |

| ||||||

| ||||||||

Date of fiscal year end: | October 31st |

| ||||||

| ||||||||

Date of reporting period: | November 1, 2008 to October 31, 2009 |

| ||||||

CREDIT SUISSE FUNDS

Annual Report

October 31, 2009

n CREDIT SUISSE

LARGE CAP GROWTH FUND

n CREDIT SUISSE

MID-CAP CORE FUND

The Funds' investment objectives, risks, charges and expenses (which should be considered carefully before investing), and more complete information about the Funds, are provided in the Prospectus, which should be read carefully before investing. You may obtain additional copies by calling 877-870-2874 or by writing to Credit Suisse Funds, P.O. Box 55030, Boston, MA 02205-5030.

Credit Suisse Asset Management Securities, Inc., Distributor, is located at Eleven Madison Avenue, New York, NY 10010. Credit Suisse Funds are advised by Credit Suisse Asset Management, LLC.

Investors in the Credit Suisse Funds should be aware that they may be eligible to purchase Common Class and/or Advisor Class shares (where offered) directly or through certain intermediaries. Such shares are not subject to a sales charge but may be subject to an ongoing service and distribution fee of up to 0.50% of average daily net assets. Investors in the Credit Suisse Funds should also be aware that they may be eligible for a reduction or waiver of the sales charge with respect to Class A, B or C shares (where offered). For more information, please review the revelant prospectuses or consult your financial representative.

The views of the Funds' management are as of the date of the letter and the Fund holdings described in this document are as of October 31, 2009; these views and Fund holdings may have changed subsequent to these dates. Nothing in this document is a recommendation to purchase or sell securities.

Fund shares are not deposits or other obligations of Credit Suisse Asset Management, LLC ("Credit Suisse") or any affiliate, are not FDIC-insured and are not guaranteed by Credit Suisse or any affiliate. Fund investments are subject to investment risks, including loss of your investment.

Credit Suisse Large Cap Growth Fund

Annual Investment Adviser's Report

October 31, 2009 (unaudited)

December 7, 2009

Dear Shareholder:

Performance Summary

11/01/08 – 10/31/09

| Fund and Benchmark | Performance | ||||||

| Common Class1 | 16.80 | % | |||||

| Advisor Class1 | 16.21 | % | |||||

| Class A1,2 | 16.50 | % | |||||

| Class B1,2 | 15.68 | % | |||||

| Class C1,2 | 15.68 | % | |||||

| Russell 1000® Growth Index3 | 17.51 | % | |||||

Performance shown for the Fund's Class A, Class B and Class C Shares does not reflect sales charges, which are a maximum of 5.75%, 4.00% and 1.00%, respectively.2

Market Review: Signs of recovery continue

The 12-month period ended October 31, 2009, was a volatile one for equities. The Russell 1000 Growth Index returned 17.51% for the year.

As of the end of October, several key economic indicators seemed to point to continued weakness in the U.S. economy. For example, the Conference Board Consumer Confidence Index was at 47.7 on October 27, down from 53.4 in September. Additionally, unemployment rates climbed as non-farm payrolls fell by 190,000 jobs in October (with the greatest losses in construction, manufacturing and retail trade), while the household unemployment rate rose to 10.2%. Six out of ten sectors within the S&P 500 posted gains for the year, with the information technology and consumer discretionary sectors up 29.89% and 18.18%, respectively. Financials and utilities were the worst performing sectors, down by 9.61% and 2.64%, respectively.

Strategic Review and Outlook: Maintaining our long-term approach

For the annual period ended October 31, 2009, the Fund underperformed the Russell 1000 Growth Index. Consumer discretionary (one of the Fund's largest overweight positions) was the strongest sector for the time period, adding to Fund performance. Industrials and consumer staples also contributed to performance. Conversely, financials (a large overweight position) detracted from performance. Similarly, the Fund's significant underweight position in information technology also detracted from performance.

Overall, the Fund's performance was fairly steady until July, when the portfolio faced challenges as a result of the rally of stocks with higher volatility.

1

Credit Suisse Large Cap Growth Fund

Annual Investment Adviser's Report (continued)

October 31, 2009 (unaudited)

It was a difficult environment for individual stock picks, but a good environment for taking directional bets due to the rapid shift from a bear market to a bull market. Additionally, low summer volume made it harder to trade effectively as increasing retail flows and decreasing professional trades result in more erratic stock moves. These conditions resulted in the Fund underperforming its benchmark. Despite this trend, we do not believe short-term trading based on trends is sustainable or profitable over the long term. Although, we may experience temporary losses, we believe the better strategy is to continue to enter positions at attractive prices and increase the potential for strong longer-term returns going forward.

During the period, Constantin Filitti and Timothy Schwider joined Jordan Low, the lead manager, as portfolio managers of the Credit Suisse Quantitative Equities Group responsible for the day-to-day portfolio management of the Fund. Please see the supplement to the prospectus for their biographies and other details.

Although we expect the market to remain challenging in the near term, we are comfortable with our proactive, long term-investment strategy going forward.

Credit Suisse Quantitative Equities Group

Jordan Low

Constantin Filitti

Timothy Schwider

The value of investments generally will fluctuate in response to market movements and the Fund's performance will largely depend on the performance of growth stocks, which may be more volatile than the overall market.

In addition to historical information, this report contains forward-looking statements, which may concern, among other things, domestic and foreign market, industry and economic trends and developments and government regulation and their potential impact on the Fund's investments. These statements are subject to risks and uncertainties and actual trends, developments and regulations in the future, and their impact on the Fund could be materially different from those projected, anticipated or implied. The Fund has no obligation to update or revise forward-looking statements.

The Fund adopted new investment strategies effective December 1, 2006 so that its holdings are selected using quantitative stock selection models rather than a more traditional fundamental analysis approach. Investors should be aware that performance information for periods prior to December 1, 2006 does not reflect the current investment strategies.

2

Credit Suisse Large Cap Growth Fund

Annual Investment Adviser's Report (continued)

October 31, 2009 (unaudited)

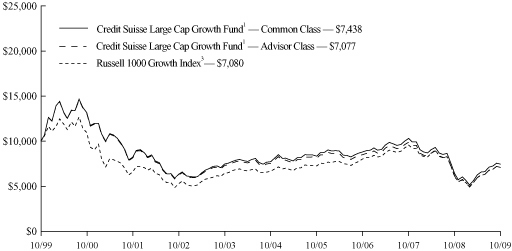

Comparison of Change in Value of $10,000 Investment in the

Credit Suisse Large Cap Growth Fund1 Common Class shares, Advisor

Class shares and the Russell 1000® Growth Index3 for Ten Years.

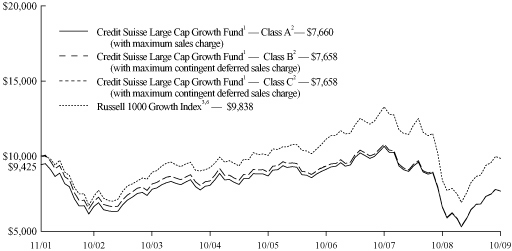

Comparison of Change in Value of $10,000 Investment in the

Credit Suisse Large Cap Growth Fund1 Class A, B, C shares2 and the

Russell 1000® Growth Index3,6 from Inception (11/30/01).

3

Credit Suisse Large Cap Growth Fund

Annual Investment Adviser's Report (continued)

October 31, 2009 (unaudited)

Average Annual Returns as of September 30, 20091

| 1 Year | 5 Years | 10 Years | Since Inception | ||||||||||||||||

| Common Class4 | (1.10 | )% | (0.26 | )% | (2.25 | )% | 7.02 | % | |||||||||||

| Advisor Class5 | (1.59 | )% | (0.78 | )% | (2.74 | )% | 6.21 | % | |||||||||||

| Class A Without Sales Charge | (1.32 | )% | (0.52 | )% | — | (2.42 | )% | ||||||||||||

| Class A With Maximum Sales Charge | (7.02 | )% | (1.69 | )% | — | (3.15 | )% | ||||||||||||

| Class B Without CDSC | (2.10 | )% | (1.28 | )% | — | (3.15 | )% | ||||||||||||

| Class B With CDSC | (5.99 | )% | (1.28 | )% | — | (3.15 | )% | ||||||||||||

| Class C Without CDSC | (2.03 | )% | (1.26 | )% | — | (3.14 | )% | ||||||||||||

| Class C With CDSC | (3.00 | )% | (1.26 | )% | — | (3.14 | )% | ||||||||||||

Average Annual Returns as of October 31, 20091

| 1 Year | 5 Years | 10 Years | Since Inception | ||||||||||||||||

| Common Class4 | 16.80 | % | (0.73 | )% | (2.92 | )% | 6.92 | % | |||||||||||

| Advisor Class5 | 16.21 | % | (1.21 | )% | (3.40 | )% | 6.09 | % | |||||||||||

| Class A Without Sales Charge | 16.50 | % | (0.97 | )% | — | (2.59 | )% | ||||||||||||

| Class A With Maximum Sales Charge | 9.76 | % | (2.13 | )% | — | (3.31 | )% | ||||||||||||

| Class B Without CDSC | 15.68 | % | (1.71 | )% | — | (3.31 | )% | ||||||||||||

| Class B With CDSC | 11.68 | % | (1.71 | )% | — | (3.31 | )% | ||||||||||||

| Class C Without CDSC | 15.68 | % | (1.70 | )% | — | (3.31 | )% | ||||||||||||

| Class C With CDSC | 14.68 | % | (1.70 | )% | — | (3.31 | )% | ||||||||||||

Returns represent past performance and include change in share price and reinvestment of dividends and capital gains. Past performance cannot guarantee future results. The current performance of the Fund may be lower or higher than the figures shown. Returns and share price will fluctuate, and redemption value may be more or less than original cost. The performance results do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. Performance information current to the most recent month-end is available at www.credit-suisse.com/us.

The annualized gross expense ratios are 1.72% for Common Class shares, 2.23% for Advisor Class shares, 1.96% for Class A shares, 2.81% for Class B shares and 2.74% for Class C shares. The annualized net expense ratios after fee waivers and/or expense reimbursements are 1.25% for Common Class shares, 1.75% for Advisor Class shares, 1.50% for Class A shares, 2.25% for Class B shares and 2.25% for Class C shares.

1 Fee waivers and/or expense reimbursements may reduce expenses for the Fund, without which performance would be lower. Waivers and/or reimbursements may be discontinued at any time.

2 Total return for the Fund's Class A shares for the reporting period, based on offering price (including maximum sales charge of 5.75%), was 9.76%. Total return for the Fund's Class B shares for the reporting period, based on redemption value (including maximum contingent deferred sales charge of 4.00%), was 11.68%. Total return for the Fund's Class C shares for the reporting period, based on redemption value (including maximum contingent deferred sales charge of 1.00%), was 14.68%.

3 The Russell 1000® Growth Index measures the performance of those companies in the Russell 1000® Index with higher price-to-book ratios and higher forecasted growth values. It is an unmanaged index of common stocks that includes reinvestment of dividends and is compiled by Frank Russell Company. Investors cannot invest directly in an index.

4 Inception date 08/17/87.

5 Inception date 04/04/91.

6 Performance for the benchmark is not available for the period beginning November 30, 2001. For that reason, performance for the benchmark is shown for the period beginning December 1, 2001.

4

Credit Suisse Large Cap Growth Fund

Annual Investment Adviser's Report (continued)

October 31, 2009 (unaudited)

Information About Your Fund's Expenses

As an investor of the Fund, you incur two types of costs: ongoing expenses and transaction costs. Ongoing expenses include management fees, distribution and service (12b-1) fees and other Fund expenses. Examples of transaction costs include sales charges (loads), redemption fees and account maintenance fees, which are not shown in this section and which would result in higher total expenses. The following table is intended to help you understand your ongoing expenses of investing in the Fund and to help you compare these expenses with the ongoing expenses of investing in other mutual funds. The table is based on an investment of $1,000 made at the beginning of the six month period ended October 31, 2009.

The table illustrates your Fund's expenses in two ways:

• Actual Fund Return. This helps you estimate the actual dollar amount of ongoing expenses paid on a $1,000 investment in the Fund using the Fund's actual return during the period. To estimate the expenses you paid over the period, simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the "Expenses Paid per $1,000" line under the share class you hold.

• Hypothetical 5% Fund Return. This helps you to compare your Fund's ongoing expenses with those of other mutual funds using the Fund's actual expense ratio and a hypothetical rate of return of 5% per year before expenses. Examples using a 5% hypothetical fund return may be found in the shareholder reports of other mutual funds. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period.

Please note that the expenses shown in these tables are meant to highlight your ongoing expenses only and do not reflect any transaction costs, such as sales charges (loads) or redemption fees. If these transaction costs had been included, your costs would have been higher. The "Expenses Paid per $1,000" line of the tables is useful in comparing ongoing expenses only and will not help you determine the relative total expenses of owning different funds.

5

Credit Suisse Large Cap Growth Fund

Annual Investment Adviser's Report (continued)

October 31, 2009 (unaudited)

Expenses and Value for a $1,000 Investment

for the six month period ended October 31, 2009

| Actual Fund Return | Common Class | Advisor Class | Class A | Class B | Class C | ||||||||||||||||||

| Beginning Account Value 5/1/09 | $ | 1,000.00 | $ | 1,000.00 | $ | 1,000.00 | $ | 1,000.00 | $ | 1,000.00 | |||||||||||||

| Ending Account Value 10/31/09 | $ | 1,193.50 | $ | 1,191.10 | $ | 1,191.90 | $ | 1,188.00 | $ | 1,188.00 | |||||||||||||

| Expenses Paid per $1,000* | $ | 6.91 | $ | 9.66 | $ | 8.29 | $ | 12.41 | $ | 12.41 | |||||||||||||

| Hypothetical 5% Fund Return | |||||||||||||||||||||||

| Beginning Account Value 5/1/09 | $ | 1,000.00 | $ | 1,000.00 | $ | 1,000.00 | $ | 1,000.00 | $ | 1,000.00 | |||||||||||||

| Ending Account Value 10/31/09 | $ | 1,018.90 | $ | 1,016.38 | $ | 1,017.64 | $ | 1,013.86 | $ | 1,013.86 | |||||||||||||

| Expenses Paid per $1,000* | $ | 6.36 | $ | 8.89 | $ | 7.63 | $ | 11.42 | $ | 11.42 | |||||||||||||

| Common Class | Advisor Class | Class A | Class B | Class C | |||||||||||||||||||

| Annualized Expense Ratios* | 1.25 | % | 1.75 | % | 1.50 | % | 2.25 | % | 2.25 | % | |||||||||||||

* Expenses are equal to the Fund's annualized expense ratio for each share class, multiplied by the average account value over the period, multiplied by the number of days in the most recent fiscal half year period, then divided by 365.

The "Expenses Paid per $1,000" and the "Annualized Expense Ratios" in the tables are based on actual expenses paid by the Fund during the period, net of fee waivers and/or expense reimbursements. If those fee waivers and/or expense reimbursements had not been in effect, the Fund's actual expenses would have been higher.

For more information, please refer to the Fund's prospectus.

6

Credit Suisse Large Cap Growth Fund

Annual Investment Adviser's Report (continued)

October 31, 2009 (unaudited)

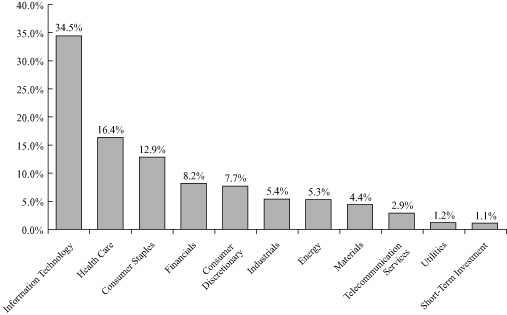

SECTOR BREAKDOWN*

* Expressed as a percentage of total investments (excluding securities lending collateral if applicable) and may vary over time.

7

Credit Suisse Mid-Cap Core Fund

Annual Investment Adviser's Report

October 31, 2009 (unaudited)

December 7, 2009

Dear Shareholder:

Performance Summary

11/01/08 – 10/31/09

| Fund and Benchmark | Performance | ||||||

| Common Class1 | 15.14 | % | |||||

| Advisor Class1 | 14.55 | % | |||||

| Class A1,2 | 14.88 | % | |||||

| Class B1,2 | 14.02 | % | |||||

| Class C1,2 | 14.04 | % | |||||

| Standard & Poor's MidCap 400 Index3 | 18.18 | % | |||||

Performance shown for the Fund's Class A, Class B and Class C Shares does not reflect sales charges, which are a maximum of 5.75%, 4.00% and 1.00%, respectively.2

Market Review: Signs of recovery continue

The 12-month period ended October 31, 2009, was a volatile one for equities. The S&P 400 MidCap Index returned 18.18% for the year.

As of the end of October, several key economic indicators seemed to point to continued weakness in the U.S. economy. For example, the Conference Board Consumer Confidence Index was at 47.7 on October 27, down from 53.4 in September. Additionally, unemployment rates climbed as non-farm payrolls fell by 190,000 jobs in October (with the greatest losses in construction, manufacturing and retail trade), while the household unemployment rate rose to 10.2%. Six out of ten sectors within the S&P 500 posted gains for the year, with the information technology and consumer discretionary sectors up 29.89% and 18.18%, respectively. Financials and utilities were the worst performing sectors, down by 9.61% and 2.64%, respectively.

Strategic Review and Outlook: Maintaining our long-term approach

For the annual period ended October 31, 2009, the Fund underperformed the Standard & Poor's MidCap 400 Index. Consumer discretionary (one of the Fund's largest overweight positions) was the strongest sector for the time period, adding to Fund performance. Consumer staples and financials also contributed to performance. Conversely, materials detracted from performance. Similarly, the Fund's significant underweight position in information technology also detracted from performance.

Overall, the Fund's performance was fairly steady until July, when the portfolio faced challenges as a result of the rally of stocks with higher volatility. It was a

8

Credit Suisse Mid-Cap Core Fund

Annual Investment Adviser's Report (continued)

October 31, 2009 (unaudited)

difficult environment for individual stock picks, but a good environment for taking directional bets due to the rapid shift from a bear market to a bull market. Additionally, low summer volume made it harder to trade effectively as increasing retail flows and decreasing professional trades result in more erratic stock moves. These conditions resulted in the Fund underperforming its benchmark. Despite this trend, we do not believe short-term trading based on trends is sustainable or profitable over the long term. Although we may experience temporary losses, we believe the better strategy is to continue to enter positions at attractive prices and increase the potential for strong longer-term returns going forward.

During the period, Constantin Filitti and Timothy Schwider joined Jordan Low, the lead manager, as portfolio managers of the Credit Suisse Quantitative Equities Group responsible for the day-to-day portfolio management of the Fund. Please see the supplement to the prospectus for their biographies and other details.

Although we expect the market to remain challenging in the near term, we are comfortable with our proactive, long term-investment strategy going forward.

Credit Suisse Quantitative Equities Group

Jordan Low

Constantin Filitti

Timothy Schwider

Investing in small to medium-sized companies may be more volatile and less liquid than investments in larger companies.

In addition to historical information, this report contains forward-looking statements, which may concern, among other things, domestic and foreign market, industry and economic trends and developments and government regulation and their potential impact on the Fund's investments. These statements are subject to risks and uncertainties and actual trends, developments and regulations in the future, and their impact on the Fund could be materially different from those projected, anticipated or implied. The Fund has no obligation to update or revise forward-looking statements.

The Fund adopted new investment strategies effective December 1, 2006 so that its holdings are selected using quantitative stock selection models rather than a more traditional fundamental analysis approach. Investors should be aware that performance information for periods prior to December 1, 2006 does not reflect the current investment strategies.

9

Credit Suisse Mid-Cap Core Fund

Annual Investment Adviser's Report (continued)

October 31, 2009 (unaudited)

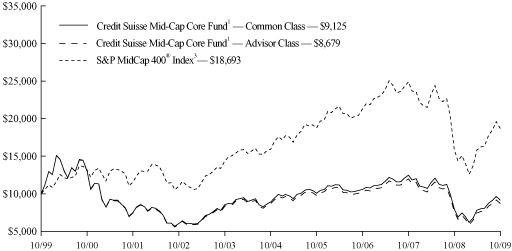

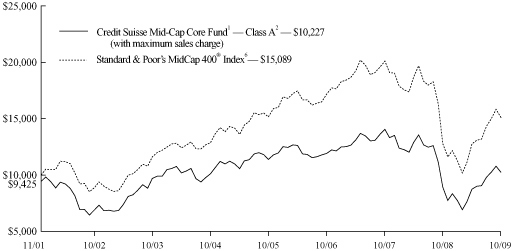

Comparison of Change in Value of $10,000 Investment in the

Credit Suisse Mid-Cap Core Fund1 Common Class shares, Advisor

Class shares and the Standard & Poor's MidCap 400® Index3 for Ten Years.

Comparison of Change in Value of $10,000 Investment in the

Credit Suisse Mid-Cap Core Fund1 Class A shares2 and

the Standard & Poor's MidCap 400® Index3 from Inception (11/30/01).

10

Credit Suisse Mid-Cap Core Fund

Annual Investment Adviser's Report (continued)

October 31, 2009 (unaudited)

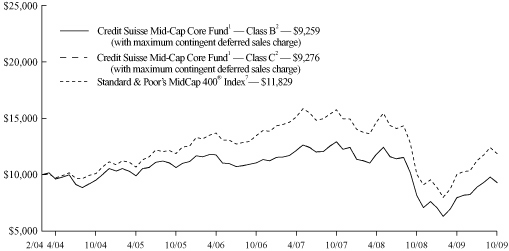

Comparison of Change in Value of $10,000 Investment in the

Credit Suisse Mid-Cap Core Fund1 Class B shares2, Class C shares2 and

the Standard & Poor's MidCap 400® Index3 from Inception (02/27/04).

Average Annual Returns as of September 30, 20091

| 1 Year | 5 Years | 10 Years | Since Inception | ||||||||||||||||

| Common Class4 | (3.05 | )% | 2.28 | % | 0.33 | % | 8.33 | % | |||||||||||

| Advisor Class5 | (3.53 | )% | 1.77 | % | (0.17 | )% | 6.46 | % | |||||||||||

| Class A Without Sales Charge | (3.27 | )% | 2.04 | % | — | 1.72 | % | ||||||||||||

| Class A With Maximum Sales Charge | (8.83 | )% | 0.84 | % | — | 0.96 | % | ||||||||||||

| Class B Without CDSC | (4.02 | )% | 1.26 | % | — | (0.43 | )% | ||||||||||||

| Class B With CDSC | (7.85 | )% | 1.26 | % | — | (0.43 | )% | ||||||||||||

| Class C Without CDSC | (4.02 | )% | 1.26 | % | — | (0.40 | )% | ||||||||||||

| Class C With CDSC | (4.97 | )% | 1.26 | % | — | (0.40 | )% | ||||||||||||

11

Credit Suisse Mid-Cap Core Fund

Annual Investment Adviser's Report (continued)

October 31, 2009 (unaudited)

Average Annual Returns as of October 31, 20091

| 1 Year | 5 Years | 10 Years | Since Inception | ||||||||||||||||

| Common Class4 | 15.14 | % | 0.49 | % | (0.91 | )% | 8.04 | % | |||||||||||

| Advisor Class5 | 14.55 | % | (0.01 | )% | (1.41 | )% | 6.13 | % | |||||||||||

| Class A Without Sales Charge | 14.88 | % | 0.25 | % | — | 1.04 | % | ||||||||||||

| Class A With Maximum Sales Charge | 8.29 | % | (0.93 | )% | — | 0.28 | % | ||||||||||||

| Class B Without CDSC | 14.02 | % | (0.51 | )% | — | (1.35 | )% | ||||||||||||

| Class B With CDSC | 10.02 | % | (0.51 | )% | — | (1.35 | )% | ||||||||||||

| Class C Without CDSC | 14.04 | % | (0.49 | )% | — | (1.31 | )% | ||||||||||||

| Class C With CDSC | 13.04 | % | (0.49 | )% | — | (1.31 | )% | ||||||||||||

Returns represent past performance and include change in share price and reinvestment of dividends and capital gains. Past performance cannot guarantee future results. The current performance of the Fund may be lower or higher than the figures shown. Returns and share price will fluctuate, and redemption value may be more or less than original cost. The performance results do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. Performance information current to the most recent month-end is available at www.credit-suisse.com/us.

The annualized gross expense ratios are 1.68% for Common Class shares, 2.17% for Advisor Class shares, 1.92% for Class A shares, 2.72% for Class B shares and 2.70% for Class C shares. The annualized net expense ratios after fee waivers and/or expense reimbursements are 1.45% for Common Class shares, 1.95% for Advisor Class shares, 1.70% for Class A shares, 2.45% for Class B shares and 2.45% for Class C shares.

1 Fee waivers and/or expense reimbursements may reduce expenses for the Fund, without which performance would be lower. Waivers and/or reimbursements may be discontinued at any time.

2 Total return for the Fund's Class A shares for the reporting period, based on offering price (including maximum sales charge of 5.75%), was 8.29%. Total return for the Fund's Class B shares for the reporting period, based on redemption value (including maximum contingent deferred sales charge of 4.00%), was 10.02%. Total return for the Fund's Class C shares for the reporting period, based on redemption value (including maximum contingent deferred sales charge of 1.00%), was 13.04%.

3 The Standard & Poor's MidCap 400 Index is an unmanaged market weighted index of 400 U.S. stocks selected on the basis of capitalization, liquidity, and industry group representation. It is a registered trademark of McGraw-Hill Co., Inc. Investors cannot invest directly in an index.

4 Inception date 01/21/88.

5 Inception date 04/04/91.

6 Performance for the benchmark is not available for the period beginning November 30, 2001. For that reason, performance for the benchmark is shown for the period beginning December 1, 2001.

7 Performance for the benchmark is not available for the period beginning February 27, 2004. For that reason, performance for the benchmark is shown for the period beginning March 1, 2004.

12

Credit Suisse Mid-Cap Core Fund

Annual Investment Adviser's Report (continued)

October 31, 2009 (unaudited)

Information About Your Fund's Expenses

As an investor of the Fund, you incur two types of costs: ongoing expenses and transaction costs. Ongoing expenses include management fees, distribution and service (12b-1) fees and other Fund expenses. Examples of transaction costs include sales charges (loads), redemption fees and account maintenance fees, which are not shown in this section and which would result in higher total expenses. The following table is intended to help you understand your ongoing expenses of investing in the Fund and to help you compare these expenses with the ongoing expenses of investing in other mutual funds. The table is based on an investment of $1,000 made at the beginning of the six month period ended October 31, 2009.

The table illustrates your Fund's expenses in two ways:

• Actual Fund Return. This helps you estimate the actual dollar amount of ongoing expenses paid on a $1,000 investment in the Fund using the Fund's actual return during the period. To estimate the expenses you paid over the period, simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the "Expenses Paid per $1,000" line under the share class you hold.

• Hypothetical 5% Fund Return. This helps you to compare your Fund's ongoing expenses with those of other mutual funds using the Fund's actual expense ratio and a hypothetical rate of return of 5% per year before expenses. Examples using a 5% hypothetical fund return may be found in the shareholder reports of other mutual funds. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period.

Please note that the expenses shown in these tables are meant to highlight your ongoing expenses only and do not reflect any transaction costs, such as sales charges (loads) or redemption fees. If these transaction costs had been included, your costs would have been higher. The "Expenses Paid per $1,000" line of the tables is useful in comparing ongoing expenses only and will not help you determine the relative total expenses of owning different funds.

13

Credit Suisse Mid-Cap Core Fund

Annual Investment Adviser's Report (continued)

October 31, 2009 (unaudited)

Expenses and Value for a $1,000 Investment

for the six month period ended October 31, 2009

| Actual Fund Return | Common Class | Advisor Class | Class A | Class B | Class C | ||||||||||||||||||

| Beginning Account Value 5/1/09 | $ | 1,000.00 | $ | 1,000.00 | $ | 1,000.00 | $ | 1,000.00 | $ | 1,000.00 | |||||||||||||

| Ending Account Value 10/31/09 | $ | 1,173.70 | $ | 1,170.70 | $ | 1,172.30 | $ | 1,167.50 | $ | 1,168.10 | |||||||||||||

| Expenses Paid per $1,000* | $ | 7.94 | $ | 10.67 | $ | 9.31 | $ | 13.39 | $ | 13.39 | |||||||||||||

| Hypothetical 5% Fund Return | |||||||||||||||||||||||

| Beginning Account Value 5/1/09 | $ | 1,000.00 | $ | 1,000.00 | $ | 1,000.00 | $ | 1,000.00 | $ | 1,000.00 | |||||||||||||

| Ending Account Value 10/31/09 | $ | 1,017.90 | $ | 1,015.38 | $ | 1,016.64 | $ | 1,012.85 | $ | 1,012.85 | |||||||||||||

| Expenses Paid per $1,000* | $ | 7.37 | $ | 9.91 | $ | 8.64 | $ | 12.43 | $ | 12.43 | |||||||||||||

| Common Class | Advisor Class | Class A | Class B | Class C | |||||||||||||||||||

| Annualized Expense Ratios* | 1.45 | % | 1.95 | % | 1.70 | % | 2.45 | % | 2.45 | % | |||||||||||||

* Expenses are equal to the Fund's annualized expense ratio for each share class, multiplied by the average account value over the period, multiplied by the number of days in the most recent fiscal half year period, then divided by 365.

The "Expenses Paid per $1,000" and the "Annualized Expense Ratios" in the tables are based on actual expenses paid by the Fund during the period, net of fee waivers and/or expense reimbursements. If those fee waivers and/or expense reimbursements had not been in effect, the Fund's actual expenses would have been higher.

For more information, please refer to the Fund's prospectus.

14

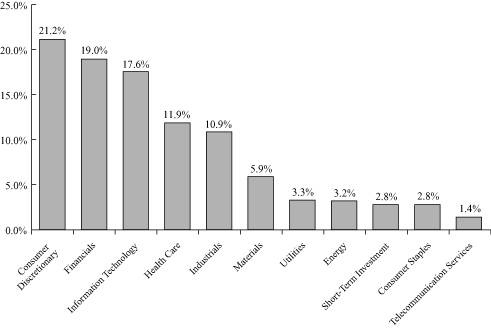

Credit Suisse Mid-Cap Core Fund

Annual Investment Adviser's Report (continued)

October 31, 2009 (unaudited)

SECTOR BREAKDOWN*

* Expressed as a percentage of total investments (excluding securities lending collateral if applicable) and may vary over time.

15

Credit Suisse Large Cap Growth Fund

Schedule of Investments

October 31, 2009

| Number of Shares | Value | ||||||||||

| COMMON STOCKS (98.7%) | |||||||||||

| Aerospace & Defense (1.5%) | |||||||||||

| General Dynamics Corp. | 600 | $ | 37,620 | ||||||||

| Honeywell International, Inc. | 2,000 | 71,780 | |||||||||

| ITT Corp. | 500 | 25,350 | |||||||||

| Lockheed Martin Corp. | 1,200 | 82,548 | |||||||||

| Northrop Grumman Corp. | 4,200 | 210,546 | |||||||||

| Precision Castparts Corp. | 500 | 47,765 | |||||||||

| Raytheon Co. | 3,700 | 167,536 | |||||||||

| Spirit Aerosystems Holdings, Inc. Class A* | 200 | 3,184 | |||||||||

| United Technologies Corp. | 1,700 | 104,465 | |||||||||

| 750,794 | |||||||||||

| Air Freight & Logistics (1.2%) | |||||||||||

| CH Robinson Worldwide, Inc. | 800 | 44,088 | |||||||||

| FedEx Corp. | 2,700 | 196,263 | |||||||||

| United Parcel Service, Inc. Class B | 6,300 | 338,184 | |||||||||

| Uti Worldwide, Inc. | 1,000 | 12,470 | |||||||||

| 591,005 | |||||||||||

| Airlines (0.1%) | |||||||||||

| AMR Corp.* | 600 | 3,234 | |||||||||

| Copa Holdings SA Class A | 300 | 12,669 | |||||||||

| Delta Air Lines, Inc.* | 2,800 | 19,992 | |||||||||

| 35,895 | |||||||||||

| Auto Components (0.1%) | |||||||||||

| Gentex Corp. | 200 | 3,202 | |||||||||

| Johnson Controls, Inc. | 2,000 | 47,840 | |||||||||

| WABCO Holdings, Inc. | 500 | 11,860 | |||||||||

| 62,902 | |||||||||||

| Automobiles (0.0%) | |||||||||||

| Thor Industries, Inc. | 100 | 2,622 | |||||||||

| Beverages (2.7%) | |||||||||||

| Coca-Cola Enterprises, Inc. | 3,600 | 68,652 | |||||||||

| Dr. Pepper Snapple Group, Inc.* | 500 | 13,630 | |||||||||

| Hansen Natural Corp.* | 600 | 21,690 | |||||||||

| Pepsi Bottling Group, Inc. | 800 | 29,952 | |||||||||

| PepsiAmericas, Inc. | 500 | 14,620 | |||||||||

| PepsiCo, Inc. | 15,600 | 944,580 | |||||||||

| The Coca-Cola Co. | 5,800 | 309,198 | |||||||||

| 1,402,322 | |||||||||||

| Biotechnology (3.5%) | |||||||||||

| Amgen, Inc.* | 18,400 | 988,632 | |||||||||

| Biogen Idec, Inc.* | 1,900 | 80,047 | |||||||||

| Celgene Corp.* | 1,300 | 66,365 | |||||||||

| Genzyme Corp.* | 800 | 40,480 | |||||||||

| Gilead Sciences, Inc.* | 14,400 | 612,720 | |||||||||

| 1,788,244 | |||||||||||

See Accompanying Notes to Financial Statements.

16

Credit Suisse Large Cap Growth Fund

Schedule of Investments (continued)

October 31, 2009

| Number of Shares | Value | ||||||||||

| COMMON STOCKS | |||||||||||

| Building Products (0.1%) | |||||||||||

| Armstrong World Industries, Inc.* | 700 | $ | 26,075 | ||||||||

| Capital Markets (3.7%) | |||||||||||

| Ameriprise Financial, Inc. | 300 | 10,401 | |||||||||

| BlackRock, Inc. | 300 | 64,947 | |||||||||

| Franklin Resources, Inc. | 500 | 52,315 | |||||||||

| GLG Partners, Inc.* | 1,900 | 4,978 | |||||||||

| Invesco, Ltd. | 100 | 2,115 | |||||||||

| Investment Technology Group, Inc.* | 1,200 | 25,884 | |||||||||

| Lazard, Ltd. Class A | 700 | 26,425 | |||||||||

| Morgan Stanley | 12,600 | 404,712 | |||||||||

| Northern Trust Corp. | 800 | 40,200 | |||||||||

| State Street Corp. | 600 | 25,188 | |||||||||

| T. Rowe Price Group, Inc. | 700 | 34,111 | |||||||||

| TD Ameritrade Holding Corp.* | 700 | 13,510 | |||||||||

| The Bank of New York Mellon Corp. | 17,800 | 474,548 | |||||||||

| The Charles Schwab Corp. | 2,500 | 43,350 | |||||||||

| The Goldman Sachs Group, Inc. | 3,700 | 629,629 | |||||||||

| Waddell & Reed Financial, Inc. Class A | 600 | 16,836 | |||||||||

| 1,869,149 | |||||||||||

| Chemicals (2.6%) | |||||||||||

| Cabot Corp. | 500 | 10,965 | |||||||||

| Calgon Carbon Corp.* | 200 | 3,168 | |||||||||

| CF Industries Holdings, Inc. | 1,500 | 124,875 | |||||||||

| Cytec Industries, Inc. | 500 | 16,585 | |||||||||

| Eastman Chemical Co. | 500 | 26,255 | |||||||||

| Huntsman Corp. | 500 | 3,975 | |||||||||

| Lubrizol Corp. | 700 | 46,592 | |||||||||

| Monsanto Co. | 11,700 | 786,006 | |||||||||

| Praxair, Inc. | 500 | 39,720 | |||||||||

| Sigma-Aldrich Corp. | 200 | 10,386 | |||||||||

| The Dow Chemical Co. | 4,700 | 110,356 | |||||||||

| The Mosaic Co. | 2,600 | 121,498 | |||||||||

| The Scotts Miracle-Gro Co. Class A | 600 | 24,372 | |||||||||

| Valspar Corp. | 500 | 12,685 | |||||||||

| Westlake Chemical Corp. | 500 | 12,145 | |||||||||

| 1,349,583 | |||||||||||

| Commercial Banks (0.6%) | |||||||||||

| U.S. Bancorp | 9,200 | 213,624 | |||||||||

| Wells Fargo & Co. | 3,900 | 107,328 | |||||||||

| 320,952 | |||||||||||

| Commercial Services & Supplies (0.2%) | |||||||||||

| Cintas Corp. | 500 | 13,845 | |||||||||

| R. R. Donnelley & Sons Co. | 700 | 14,056 | |||||||||

| The Brink's Co. | 1,500 | 35,595 | |||||||||

| Waste Management, Inc. | 1,600 | 47,808 | |||||||||

| 111,304 | |||||||||||

See Accompanying Notes to Financial Statements.

17

Credit Suisse Large Cap Growth Fund

Schedule of Investments (continued)

October 31, 2009

| Number of Shares | Value | ||||||||||

| COMMON STOCKS | |||||||||||

| Communications Equipment (4.4%) | |||||||||||

| Cisco Systems, Inc.* | 32,400 | $ | 740,340 | ||||||||

| CommScope, Inc.* | 400 | 10,808 | |||||||||

| Harris Corp. | 100 | 4,172 | |||||||||

| Harris Stratex Networks, Inc. Class A* | 10 | 63 | |||||||||

| Juniper Networks, Inc.* | 4,700 | 119,897 | |||||||||

| Motorola, Inc. | 22,600 | 193,682 | |||||||||

| Polycom, Inc.* | 1,700 | 36,499 | |||||||||

| QUALCOMM, Inc. | 26,900 | 1,113,929 | |||||||||

| Starent Networks Corp.* | 400 | 13,496 | |||||||||

| 2,232,886 | |||||||||||

| Computers & Peripherals (11.4%) | |||||||||||

| Apple, Inc.* | 14,000 | 2,639,000 | |||||||||

| Dell, Inc.* | 4,100 | 59,409 | |||||||||

| EMC Corp.* | 43,800 | 721,386 | |||||||||

| Hewlett-Packard Co. | 12,100 | 574,266 | |||||||||

| International Business Machines Corp. | 11,800 | 1,423,198 | |||||||||

| NCR Corp.* | 200 | 2,030 | |||||||||

| NetApp, Inc.* | 1,300 | 35,165 | |||||||||

| QLogic Corp.* | 1,100 | 19,294 | |||||||||

| SanDisk Corp.* | 900 | 18,432 | |||||||||

| Seagate Technology | 4,500 | 62,775 | |||||||||

| STEC, Inc.* | 4,000 | 85,280 | |||||||||

| Sun Microsystems, Inc.* | 13,800 | 112,884 | |||||||||

| Synaptics, Inc.* | 500 | 11,250 | |||||||||

| Teradata Corp.* | 1,000 | 27,880 | |||||||||

| Western Digital Corp.* | 1,300 | 43,784 | |||||||||

| 5,836,033 | |||||||||||

| Construction & Engineering (0.2%) | |||||||||||

| Dycom Industries, Inc.* | 93 | 919 | |||||||||

| Fluor Corp. | 1,300 | 57,746 | |||||||||

| Granite Construction, Inc. | 200 | 5,712 | |||||||||

| Jacobs Engineering Group, Inc.* | 800 | 33,832 | |||||||||

| Quanta Services, Inc.* | 500 | 10,600 | |||||||||

| The Shaw Group, Inc.* | 700 | 17,962 | |||||||||

| 126,771 | |||||||||||

| Consumer Finance (2.2%) | |||||||||||

| American Express Co. | 21,800 | 759,512 | |||||||||

| Capital One Financial Corp. | 10,300 | 376,980 | |||||||||

| 1,136,492 | |||||||||||

| Containers & Packaging (0.1%) | |||||||||||

| Pactiv Corp.* | 1,200 | 27,708 | |||||||||

| Sealed Air Corp. | 400 | 7,692 | |||||||||

| Temple-Inland, Inc. | 200 | 3,090 | |||||||||

| 38,490 | |||||||||||

See Accompanying Notes to Financial Statements.

18

Credit Suisse Large Cap Growth Fund

Schedule of Investments (continued)

October 31, 2009

| Number of Shares | Value | ||||||||||

| COMMON STOCKS | |||||||||||

| Distributors (0.0%) | |||||||||||

| LKQ Corp.* | 500 | $ | 8,635 | ||||||||

| Diversified Consumer Services (0.6%) | |||||||||||

| Apollo Group, Inc. Class A* | 1,300 | 74,230 | |||||||||

| Brink's Home Security Holdings, Inc.* | 500 | 15,490 | |||||||||

| Career Education Corp.* | 700 | 14,588 | |||||||||

| Corinthian Colleges, Inc.* | 7,700 | 122,122 | |||||||||

| H&R Block, Inc. | 900 | 16,506 | |||||||||

| Hillenbrand, Inc. | 600 | 11,988 | |||||||||

| ITT Educational Services, Inc.* | 700 | 63,245 | |||||||||

| 318,169 | |||||||||||

| Diversified Financial Services (0.5%) | |||||||||||

| JPMorgan Chase & Co. | 4,800 | 200,496 | |||||||||

| Moody's Corp. | 1,300 | 30,784 | |||||||||

| MSCI, Inc. Class A* | 1,100 | 33,440 | |||||||||

| The NASDAQ OMX Group, Inc.* | 600 | 10,836 | |||||||||

| 275,556 | |||||||||||

| Diversified Telecommunication Services (2.6%) | |||||||||||

| AT&T, Inc. | 14,900 | 382,483 | |||||||||

| CenturyTel, Inc. | 100 | 3,246 | |||||||||

| Clearwire Corp. Class A* | 500 | 3,130 | |||||||||

| Fairpoint Communications, Inc. | 77 | 8 | |||||||||

| Verizon Communications, Inc. | 31,800 | 940,962 | |||||||||

| 1,329,829 | |||||||||||

| Electric Utilities (0.2%) | |||||||||||

| American Electric Power Co., Inc. | 500 | 15,110 | |||||||||

| FirstEnergy Corp. | 600 | 25,968 | |||||||||

| Hawaiian Electric Industries, Inc. | 100 | 1,785 | |||||||||

| PPL Corp. | 1,500 | 44,160 | |||||||||

| Southern Co. | 900 | 28,071 | |||||||||

| 115,094 | |||||||||||

| Electrical Equipment (0.6%) | |||||||||||

| Cooper Industries PLC Class A | 4,000 | 154,760 | |||||||||

| Emerson Electric Co. | 1,600 | 60,400 | |||||||||

| First Solar, Inc.* | 500 | 60,965 | |||||||||

| General Cable Corp.* | 500 | 15,570 | |||||||||

| SunPower Corp. Class A* | 1,100 | 27,291 | |||||||||

| 318,986 | |||||||||||

| Electronic Equipment, Instruments & Components (0.7%) | |||||||||||

| Avnet, Inc.* | 700 | 17,346 | |||||||||

| Checkpoint Systems, Inc.* | 500 | 6,785 | |||||||||

| Corning, Inc. | 15,700 | 229,377 | |||||||||

| Dolby Laboratories, Inc. Class A* | 800 | 33,552 | |||||||||

| FLIR Systems, Inc.* | 900 | 25,029 | |||||||||

| Ingram Micro, Inc. Class A* | 500 | 8,825 | |||||||||

See Accompanying Notes to Financial Statements.

19

Credit Suisse Large Cap Growth Fund

Schedule of Investments (continued)

October 31, 2009

| Number of Shares | Value | ||||||||||

| COMMON STOCKS | |||||||||||

| Electronic Equipment, Instruments & Components | |||||||||||

| Jabil Circuit, Inc. | 600 | $ | 8,028 | ||||||||

| SYNNEX Corp.* | 500 | 12,865 | |||||||||

| 341,807 | |||||||||||

| Energy Equipment & Services (0.9%) | |||||||||||

| Atwood Oceanics, Inc.* | 500 | 17,745 | |||||||||

| Baker Hughes, Inc. | 500 | 21,035 | |||||||||

| Diamond Offshore Drilling, Inc. | 100 | 9,525 | |||||||||

| Dresser-Rand Group, Inc.* | 800 | 23,576 | |||||||||

| ENSCO International, Inc. | 617 | 28,253 | |||||||||

| FMC Technologies, Inc.* | 500 | 26,300 | |||||||||

| Global Industries, Ltd.* | 500 | 3,645 | |||||||||

| Halliburton Co. | 500 | 14,605 | |||||||||

| National-Oilwell Varco, Inc.* | 500 | 20,495 | |||||||||

| Oceaneering International, Inc.* | 700 | 35,770 | |||||||||

| Rowan Cos., Inc. | 600 | 13,950 | |||||||||

| Schlumberger, Ltd. | 3,300 | 205,260 | |||||||||

| Tetra Technologies, Inc.* | 300 | 2,838 | |||||||||

| Tidewater, Inc. | 500 | 20,835 | |||||||||

| 443,832 | |||||||||||

| Food & Staples Retailing (2.9%) | |||||||||||

| Costco Wholesale Corp. | 800 | 45,480 | |||||||||

| CVS Caremark Corp. | 2,600 | 91,780 | |||||||||

| SUPERVALU, Inc. | 500 | 7,935 | |||||||||

| Sysco Corp. | 1,200 | 31,740 | |||||||||

| The Kroger Co. | 2,500 | 57,825 | |||||||||

| Wal-Mart Stores, Inc. | 22,900 | 1,137,672 | |||||||||

| Walgreen Co. | 2,200 | 83,226 | |||||||||

| 1,455,658 | |||||||||||

| Food Products (2.2%) | |||||||||||

| Archer-Daniels-Midland Co. | 12,100 | 364,452 | |||||||||

| Chiquita Brands International, Inc.* | 500 | 8,095 | |||||||||

| ConAgra Foods, Inc. | 400 | 8,400 | |||||||||

| Dean Foods Co.* | 1,400 | 25,522 | |||||||||

| Del Monte Foods Co. | 605 | 6,534 | |||||||||

| General Mills, Inc. | 800 | 52,736 | |||||||||

| H.J. Heinz Co. | 1,100 | 44,264 | |||||||||

| Kraft Foods, Inc. Class A | 17,800 | 489,856 | |||||||||

| Lancaster Colony Corp. | 1,955 | 94,974 | |||||||||

| Sara Lee Corp. | 1,300 | 14,677 | |||||||||

| Tyson Foods, Inc. Class A | 900 | 11,268 | |||||||||

| 1,120,778 | |||||||||||

| Health Care Equipment & Supplies (3.1%) | |||||||||||

| Baxter International, Inc. | 4,300 | 232,458 | |||||||||

| Becton, Dickinson and Co. | 1,200 | 82,032 | |||||||||

| Boston Scientific Corp.* | 86,400 | 701,568 | |||||||||

See Accompanying Notes to Financial Statements.

20

Credit Suisse Large Cap Growth Fund

Schedule of Investments (continued)

October 31, 2009

| Number of Shares | Value | ||||||||||

| COMMON STOCKS | |||||||||||

| Health Care Equipment & Supplies | |||||||||||

| CR Bard, Inc. | 400 | $ | 30,028 | ||||||||

| Edwards Lifesciences Corp.* | 100 | 7,694 | |||||||||

| Hologic, Inc.* | 700 | 10,346 | |||||||||

| Invacare Corp. | 500 | 11,215 | |||||||||

| Kinetic Concepts, Inc.* | 600 | 19,914 | |||||||||

| Medtronic, Inc. | 3,500 | 124,950 | |||||||||

| ResMed, Inc.* | 700 | 34,447 | |||||||||

| St. Jude Medical, Inc.* | 2,300 | 78,384 | |||||||||

| STERIS Corp. | 400 | 11,704 | |||||||||

| Stryker Corp. | 900 | 41,400 | |||||||||

| Thoratec Corp.* | 4,500 | 118,170 | |||||||||

| Varian Medical Systems, Inc.* | 1,200 | 49,176 | |||||||||

| Zimmer Holdings, Inc.* | 500 | 26,285 | |||||||||

| 1,579,771 | |||||||||||

| Health Care Providers & Services (0.9%) | |||||||||||

| Aetna, Inc. | 700 | 18,221 | |||||||||

| AmerisourceBergen Corp. | 700 | 15,505 | |||||||||

| CIGNA Corp. | 600 | 16,704 | |||||||||

| Community Health Systems, Inc.* | 400 | 12,512 | |||||||||

| Coventry Health Care, Inc.* | 300 | 5,949 | |||||||||

| Express Scripts, Inc.* | 700 | 55,944 | |||||||||

| Health Management Associates, Inc. Class A* | 900 | 5,490 | |||||||||

| Humana, Inc.* | 500 | 18,790 | |||||||||

| Kindred Healthcare, Inc.* | 500 | 7,350 | |||||||||

| Lincare Holdings, Inc.* | 600 | 18,846 | |||||||||

| McKesson Corp. | 600 | 35,238 | |||||||||

| Medco Health Solutions, Inc.* | 2,400 | 134,688 | |||||||||

| Omnicare, Inc. | 500 | 10,835 | |||||||||

| Patterson Cos., Inc.* | 500 | 12,765 | |||||||||

| Quest Diagnostics, Inc. | 500 | 27,965 | |||||||||

| Tenet Healthcare Corp.* | 1,400 | 7,168 | |||||||||

| UnitedHealth Group, Inc. | 500 | 12,975 | |||||||||

| WellPoint, Inc.* | 500 | 23,380 | |||||||||

| 440,325 | |||||||||||

| Health Care Technology (0.1%) | |||||||||||

| Cerner Corp.* | 400 | 30,416 | |||||||||

| IMS Health, Inc. | 600 | 9,834 | |||||||||

| 40,250 | |||||||||||

| Hotels, Restaurants & Leisure (1.3%) | |||||||||||

| Brinker International, Inc. | 7,100 | 89,744 | |||||||||

| Burger King Holdings, Inc. | 100 | 1,716 | |||||||||

| Carnival Corp. | 4,200 | 122,304 | |||||||||

| McDonald's Corp. | 4,100 | 240,301 | |||||||||

| P.F. Chang's China Bistro, Inc.* | 398 | 11,617 | |||||||||

| Panera Bread Co. Class A* | 1,167 | 69,997 | |||||||||

| Royal Caribbean Cruises, Ltd.* | 400 | 8,092 | |||||||||

See Accompanying Notes to Financial Statements.

21

Credit Suisse Large Cap Growth Fund

Schedule of Investments (continued)

October 31, 2009

| Number of Shares | Value | ||||||||||

| COMMON STOCKS | |||||||||||

| Hotels, Restaurants & Leisure | |||||||||||

| Starbucks Corp.* | 2,600 | $ | 49,348 | ||||||||

| Wendy's/Arby's Group, Inc. Class A | 1,400 | 5,530 | |||||||||

| WMS Industries, Inc.* | 700 | 27,986 | |||||||||

| Yum! Brands, Inc. | 1,600 | 52,720 | |||||||||

| 679,355 | |||||||||||

| Household Durables (0.2%) | |||||||||||

| American Greetings Corp. Class A | 500 | 10,170 | |||||||||

| Garmin, Ltd. | 1,000 | 30,260 | |||||||||

| Leggett & Platt, Inc. | 700 | 13,531 | |||||||||

| Newell Rubbermaid, Inc. | 600 | 8,706 | |||||||||

| Tupperware Brands Corp. | 500 | 22,510 | |||||||||

| 85,177 | |||||||||||

| Household Products (4.0%) | |||||||||||

| Clorox Co. | 800 | 47,384 | |||||||||

| Colgate-Palmolive Co. | 6,700 | 526,821 | |||||||||

| Kimberly-Clark Corp. | 1,100 | 67,276 | |||||||||

| The Procter & Gamble Co. | 24,000 | 1,392,000 | |||||||||

| 2,033,481 | |||||||||||

| Independent Power Producers & Energy Traders (0.1%) | |||||||||||

| Mirant Corp.* | 600 | 8,388 | |||||||||

| Ormat Technologies, Inc. | 300 | 11,340 | |||||||||

| The AES Corp.* | 2,000 | 26,140 | |||||||||

| 45,868 | |||||||||||

| Industrial Conglomerates (0.7%) | |||||||||||

| 3M Co. | 3,300 | 242,781 | |||||||||

| Carlisle Cos., Inc. | 600 | 18,624 | |||||||||

| General Electric Co. | 1,600 | 22,816 | |||||||||

| McDermott International, Inc.* | 2,300 | 51,129 | |||||||||

| 335,350 | |||||||||||

| Insurance (1.1%) | |||||||||||

| Aflac, Inc. | 1,900 | 78,831 | |||||||||

| American International Group, Inc.* | 3,100 | 104,222 | |||||||||

| AON Corp. | 900 | 34,659 | |||||||||

| Arthur J. Gallagher & Co. | 766 | 17,090 | |||||||||

| Axis Capital Holdings, Ltd. | 400 | 11,556 | |||||||||

| CNA Financial Corp.* | 600 | 13,062 | |||||||||

| First American Corp. | 500 | 15,195 | |||||||||

| HCC Insurance Holdings, Inc. | 500 | 13,195 | |||||||||

| Lincoln National Corp. | 1,000 | 23,830 | |||||||||

| Loews Corp. | 600 | 19,860 | |||||||||

| MetLife, Inc. | 1,200 | 40,836 | |||||||||

| Prudential Financial, Inc. | 3,500 | 158,305 | |||||||||

| Unum Group | 900 | 17,955 | |||||||||

| Validus Holdings, Ltd. | 200 | 5,060 | |||||||||

| 553,656 | |||||||||||

See Accompanying Notes to Financial Statements.

22

Credit Suisse Large Cap Growth Fund

Schedule of Investments (continued)

October 31, 2009

| Number of Shares | Value | ||||||||||

| COMMON STOCKS | |||||||||||

| Internet & Catalog Retail (0.9%) | |||||||||||

| Amazon.com, Inc.* | 1,900 | $ | 225,739 | ||||||||

| Expedia, Inc.* | 1,600 | 36,272 | |||||||||

| NetFlix, Inc.* | 2,200 | 117,590 | |||||||||

| priceline.com, Inc.* | 600 | 94,674 | |||||||||

| 474,275 | |||||||||||

| Internet Software & Services (3.5%) | |||||||||||

| eBay, Inc.* | 1,100 | 24,497 | |||||||||

| Google, Inc. Class A* | 2,800 | 1,501,136 | |||||||||

| Sohu.com, Inc.* | 1,900 | 105,640 | |||||||||

| VeriSign, Inc.* | 1,200 | 27,372 | |||||||||

| WebMD Health Corp. Class A* | 23 | 783 | |||||||||

| Yahoo!, Inc.* | 7,500 | 119,250 | |||||||||

| 1,778,678 | |||||||||||

| IT Services (3.0%) | |||||||||||

| Accenture PLC Class A | 6,400 | 237,312 | |||||||||

| Acxiom Corp.* | 500 | 5,740 | |||||||||

| Amdocs, Ltd.* | 200 | 5,040 | |||||||||

| Automatic Data Processing, Inc. | 1,000 | 39,800 | |||||||||

| Broadridge Financial Solutions, Inc. | 900 | 18,729 | |||||||||

| Cognizant Technology Solutions Corp. Class A* | 1,200 | 46,380 | |||||||||

| Computer Sciences Corp.* | 300 | 15,213 | |||||||||

| Fidelity National Information Services, Inc. | 500 | 10,880 | |||||||||

| Genpact, Ltd.* | 600 | 7,146 | |||||||||

| Global Cash Access Holdings, Inc.* | 503 | 3,184 | |||||||||

| Hewitt Associates, Inc. Class A* | 600 | 21,312 | |||||||||

| Lender Processing Services, Inc. | 600 | 23,880 | |||||||||

| Mastercard, Inc. Class A | 900 | 197,118 | |||||||||

| Paychex, Inc. | 1,800 | 51,138 | |||||||||

| SAIC, Inc.* | 900 | 15,939 | |||||||||

| The Western Union Co. | 1,500 | 27,255 | |||||||||

| Visa, Inc. Class A | 10,100 | 765,176 | |||||||||

| Wright Express Corp.* | 500 | 13,955 | |||||||||

| 1,505,197 | |||||||||||

| Leisure Equipment & Products (0.1%) | |||||||||||

| Callaway Golf Co. | 500 | 3,420 | |||||||||

| Mattel, Inc. | 2,700 | 51,111 | |||||||||

| 54,531 | |||||||||||

| Life Sciences Tools & Services (0.1%) | |||||||||||

| Pharmaceutical Product Development, Inc. | 300 | 6,465 | |||||||||

| Thermo Fisher Scientific, Inc.* | 600 | 27,000 | |||||||||

| Waters Corp.* | 700 | 40,201 | |||||||||

| 73,666 | |||||||||||

See Accompanying Notes to Financial Statements.

23

Credit Suisse Large Cap Growth Fund

Schedule of Investments (continued)

October 31, 2009

| Number of Shares | Value | ||||||||||

| COMMON STOCKS | |||||||||||

| Machinery (0.6%) | |||||||||||

| Bucyrus International, Inc. | 400 | $ | 17,768 | ||||||||

| Caterpillar, Inc. | 1,300 | 71,578 | |||||||||

| Crane Co. | 1,300 | 36,205 | |||||||||

| Danaher Corp. | 500 | 34,115 | |||||||||

| Flowserve Corp. | 700 | 68,747 | |||||||||

| Lincoln Electric Holdings, Inc. | 200 | 9,488 | |||||||||

| Navistar International Corp.* | 400 | 13,256 | |||||||||

| Oshkosh Corp. | 400 | 12,504 | |||||||||

| The Manitowoc Co., Inc. | 3,000 | 27,420 | |||||||||

| The Timken Co. | 500 | 11,015 | |||||||||

| 302,096 | |||||||||||

| Marine (0.0%) | |||||||||||

| Kirby Corp.* | 500 | 16,900 | |||||||||

| Media (1.3%) | |||||||||||

| Clear Channel Outdoor Holdings, Inc. Class A* | 100 | 682 | |||||||||

| Comcast Corp. Class A | 27,400 | 397,300 | |||||||||

| CTC Media, Inc.* | 400 | 6,432 | |||||||||

| DISH Network Corp. Class A* | 500 | 8,700 | |||||||||

| Harte-Hanks, Inc. | 500 | 5,870 | |||||||||

| Interpublic Group of Cos., Inc.* | 500 | 3,010 | |||||||||

| Liberty Global, Inc. Class A* | 500 | 10,265 | |||||||||

| Liberty Media Corp. - Entertainment Series A* | 500 | 15,410 | |||||||||

| Marvel Entertainment, Inc.* | 700 | 34,979 | |||||||||

| Morningstar, Inc.* | 100 | 5,102 | |||||||||

| Omnicom Group, Inc. | 900 | 30,852 | |||||||||

| Scripps Networks Interactive, Inc. Class A | 500 | 18,880 | |||||||||

| The DIRECTV Group, Inc.* | 3,600 | 94,680 | |||||||||

| The McGraw-Hill Cos., Inc. | 1,000 | 28,780 | |||||||||

| Time Warner, Inc. | 500 | 15,060 | |||||||||

| 676,002 | |||||||||||

| Metals & Mining (1.7%) | |||||||||||

| Alcoa, Inc. | 1,900 | 23,598 | |||||||||

| Allegheny Technologies, Inc. | 500 | 15,430 | |||||||||

| Cliffs Natural Resources, Inc. | 500 | 17,785 | |||||||||

| Compass Minerals International, Inc. | 100 | 6,232 | |||||||||

| Freeport-McMoRan Copper & Gold, Inc.* | 1,500 | 110,040 | |||||||||

| Newmont Mining Corp. | 10,600 | 460,676 | |||||||||

| Nucor Corp. | 600 | 23,910 | |||||||||

| Royal Gold, Inc. | 100 | 4,417 | |||||||||

| Schnitzer Steel Industries, Inc. Class A | 3,100 | 134,044 | |||||||||

| Southern Copper Corp. | 500 | 15,750 | |||||||||

| Steel Dynamics, Inc. | 400 | 5,356 | |||||||||

| Walter Energy, Inc. | 600 | 35,100 | |||||||||

| Worthington Industries, Inc. | 500 | 5,525 | |||||||||

| 857,863 | |||||||||||

See Accompanying Notes to Financial Statements.

24

Credit Suisse Large Cap Growth Fund

Schedule of Investments (continued)

October 31, 2009

| Number of Shares | Value | ||||||||||

| COMMON STOCKS | |||||||||||

| Multi-Utilities (0.8%) | |||||||||||

| PG&E Corp. | 800 | $ | 32,712 | ||||||||

| Public Service Enterprise Group, Inc. | 11,900 | 354,620 | |||||||||

| Sempra Energy | 500 | 25,725 | |||||||||

| Xcel Energy, Inc. | 400 | 7,544 | |||||||||

| 420,601 | |||||||||||

| Multiline Retail (0.8%) | |||||||||||

| 99 Cents Only Stores* | 500 | 5,685 | |||||||||

| Big Lots, Inc.* | 500 | 12,525 | |||||||||

| Dollar Tree, Inc.* | 500 | 22,565 | |||||||||

| Family Dollar Stores, Inc. | 2,900 | 82,070 | |||||||||

| J.C. Penney Co., Inc. | 500 | 16,565 | |||||||||

| Kohl's Corp.* | 1,900 | 108,718 | |||||||||

| Target Corp. | 2,900 | 140,447 | |||||||||

| 388,575 | |||||||||||

| Oil, Gas & Consumable Fuels (4.5%) | |||||||||||

| Alpha Natural Resources, Inc.* | 800 | 27,176 | |||||||||

| Anadarko Petroleum Corp. | 900 | 54,837 | |||||||||

| Apache Corp. | 500 | 47,060 | |||||||||

| Chesapeake Energy Corp. | 500 | 12,250 | |||||||||

| Chevron Corp. | 600 | 45,924 | |||||||||

| ConocoPhillips | 4,500 | 225,810 | |||||||||

| Consol Energy, Inc. | 600 | 25,686 | |||||||||

| Devon Energy Corp. | 500 | 32,355 | |||||||||

| Exxon Mobil Corp. | 22,700 | 1,626,909 | |||||||||

| Murphy Oil Corp. | 500 | 30,570 | |||||||||

| Newfield Exploration Co.* | 500 | 20,510 | |||||||||

| Occidental Petroleum Corp. | 600 | 45,528 | |||||||||

| SandRidge Energy, Inc.* | 600 | 6,138 | |||||||||

| Southwestern Energy Co.* | 600 | 26,148 | |||||||||

| Teekay Corp. | 100 | 2,075 | |||||||||

| Tesoro Corp. | 300 | 4,242 | |||||||||

| Valero Energy Corp. | 500 | 9,050 | |||||||||

| W&T Offshore, Inc. | 600 | 6,990 | |||||||||

| XTO Energy, Inc. | 500 | 20,780 | |||||||||

| 2,270,038 | |||||||||||

| Paper & Forest Products (0.0%) | |||||||||||

| International Paper Co. | 500 | 11,155 | |||||||||

| Personal Products (0.1%) | |||||||||||

| Herbalife, Ltd. | 600 | 20,190 | |||||||||

| Mead Johnson Nutrition Co. Class A | 200 | 8,408 | |||||||||

| The Estee Lauder Cos., Inc. Class A | 600 | 25,500 | |||||||||

| 54,098 | |||||||||||

See Accompanying Notes to Financial Statements.

25

Credit Suisse Large Cap Growth Fund

Schedule of Investments (continued)

October 31, 2009

| Number of Shares | Value | ||||||||||

| COMMON STOCKS | |||||||||||

| Pharmaceuticals (8.7%) | |||||||||||

| Abbott Laboratories | 10,200 | $ | 515,814 | ||||||||

| Allergan, Inc. | 1,100 | 61,875 | |||||||||

| Bristol-Myers Squibb Co. | 62,200 | 1,355,960 | |||||||||

| Eli Lilly & Co. | 1,000 | 34,010 | |||||||||

| Johnson & Johnson | 27,700 | 1,635,685 | |||||||||

| Merck & Co., Inc. | 700 | 21,651 | |||||||||

| Mylan, Inc.* | 1,900 | 30,856 | |||||||||

| Pfizer, Inc. | 7,041 | 119,908 | |||||||||

| Schering-Plough Corp. | 21,000 | 592,200 | |||||||||

| Valeant Pharmaceuticals International* | 2,100 | 61,740 | |||||||||

| 4,429,699 | |||||||||||

| Professional Services (0.1%) | |||||||||||

| FTI Consulting, Inc.* | 800 | 32,648 | |||||||||

| Real Estate Investment Trusts (0.0%) | |||||||||||

| Walter Investment Management Corp. | 36 | 469 | |||||||||

| Road & Rail (0.2%) | |||||||||||

| CSX Corp. | 800 | 33,744 | |||||||||

| Knight Transportation, Inc. | 400 | 6,416 | |||||||||

| Union Pacific Corp. | 700 | 38,598 | |||||||||

| 78,758 | |||||||||||

| Semiconductors & Semiconductor Equipment (4.6%) | |||||||||||

| Advanced Micro Devices, Inc.* | 3,200 | 14,720 | |||||||||

| Analog Devices, Inc. | 1,200 | 30,756 | |||||||||

| Broadcom Corp. Class A* | 4,100 | 109,101 | |||||||||

| Cypress Semiconductor Corp.* | 800 | 6,744 | |||||||||

| Integrated Device Technology, Inc.* | 700 | 4,116 | |||||||||

| Intel Corp. | 35,600 | 680,316 | |||||||||

| Intersil Corp. Class A | 1,100 | 13,805 | |||||||||

| Linear Technology Corp. | 1,500 | 38,820 | |||||||||

| Marvell Technology Group, Ltd.* | 4,700 | 64,484 | |||||||||

| Maxim Integrated Products, Inc. | 1,200 | 20,004 | |||||||||

| Micron Technology, Inc.* | 800 | 5,432 | |||||||||

| Novellus Systems, Inc.* | 700 | 14,406 | |||||||||

| Nvidia Corp.* | 2,300 | 27,508 | |||||||||

| Silicon Laboratories, Inc.* | 1,200 | 50,280 | |||||||||

| Teradyne, Inc.* | 600 | 5,022 | |||||||||

| Tessera Technologies, Inc.* | 600 | 13,266 | |||||||||

| Texas Instruments, Inc. | 51,800 | 1,214,710 | |||||||||

| Xilinx, Inc. | 400 | 8,700 | |||||||||

| 2,322,190 | |||||||||||

| Software (7.0%) | |||||||||||

| Activision Blizzard, Inc.* | 1,400 | 15,162 | |||||||||

| Adobe Systems, Inc.* | 1,600 | 52,704 | |||||||||

| Autodesk, Inc.* | 1,500 | 37,395 | |||||||||

| Electronic Arts, Inc.* | 2,300 | 41,952 | |||||||||

| Microsoft Corp. | 58,600 | 1,624,978 | |||||||||

See Accompanying Notes to Financial Statements.

26

Credit Suisse Large Cap Growth Fund

Schedule of Investments (continued)

October 31, 2009

| Number of Shares | Value | ||||||||||

| COMMON STOCKS | |||||||||||

| Software | |||||||||||

| Novell, Inc.* | 1,500 | $ | 6,135 | ||||||||

| Oracle Corp. | 23,400 | 493,740 | |||||||||

| Red Hat, Inc.* | 21,400 | 552,334 | |||||||||

| Rovi Corp.* | 100 | 2,755 | |||||||||

| Salesforce.com, Inc.* | 1,500 | 85,125 | |||||||||

| Sybase, Inc.* | 1,200 | 47,472 | |||||||||

| Symantec Corp.* | 31,100 | 546,738 | |||||||||

| Tyler Technologies, Inc.* | 300 | 5,706 | |||||||||

| VMware, Inc. Class A* | 1,000 | 38,430 | |||||||||

| 3,550,626 | |||||||||||

| Specialty Retail (1.7%) | |||||||||||

| Aaron's, Inc. | 2,200 | 55,110 | |||||||||

| Advance Auto Parts, Inc. | 200 | 7,452 | |||||||||

| Aeropostale, Inc.* | 4,000 | 150,120 | |||||||||

| AutoNation, Inc.* | 600 | 10,344 | |||||||||

| Barnes & Noble, Inc. | 2,500 | 41,525 | |||||||||

| Best Buy Co., Inc. | 1,400 | 53,452 | |||||||||

| Dick's Sporting Goods, Inc.* | 500 | 11,345 | |||||||||

| Foot Locker, Inc. | 700 | 7,336 | |||||||||

| GameStop Corp. Class A* | 900 | 21,861 | |||||||||

| Guess?, Inc. | 600 | 21,930 | |||||||||

| Home Depot, Inc. | 2,800 | 70,252 | |||||||||

| Lowe's Cos., Inc. | 1,000 | 19,570 | |||||||||

| Office Depot, Inc.* | 500 | 3,025 | |||||||||

| Penske Auto Group, Inc. | 1,100 | 17,226 | |||||||||

| PetSmart, Inc. | 900 | 21,177 | |||||||||

| RadioShack Corp. | 1,000 | 16,890 | |||||||||

| Rent-A-Center, Inc.* | 500 | 9,180 | |||||||||

| Ross Stores, Inc. | 1,600 | 70,416 | |||||||||

| Staples, Inc. | 1,600 | 34,720 | |||||||||

| The Buckle, Inc. | 1,700 | 51,017 | |||||||||

| The Gap, Inc. | 3,300 | 70,422 | |||||||||

| The Gymboree Corp.* | 1,400 | 59,598 | |||||||||

| TJX Cos., Inc. | 1,600 | 59,760 | |||||||||

| 883,728 | |||||||||||

| Textiles, Apparel & Luxury Goods (0.5%) | |||||||||||

| Coach, Inc. | 500 | 16,485 | |||||||||

| NIKE, Inc. Class B | 3,000 | 186,540 | |||||||||

| Phillips-Van Heusen Corp. | 600 | 24,090 | |||||||||

| Polo Ralph Lauren Corp. | 200 | 14,884 | |||||||||

| The Warnaco Group, Inc.* | 800 | 32,424 | |||||||||

| 274,423 | |||||||||||

| Thrifts & Mortgage Finance (0.0%) | |||||||||||

| New York Community Bancorp, Inc. | 500 | 5,395 | |||||||||

| NewAlliance Bancshares, Inc. | 500 | 5,540 | |||||||||

| 10,935 | |||||||||||

See Accompanying Notes to Financial Statements.

27

Credit Suisse Large Cap Growth Fund

Schedule of Investments (continued)

October 31, 2009

| Number of Shares | Value | ||||||||||

| COMMON STOCKS | |||||||||||

| Tobacco (0.9%) | |||||||||||

| Altria Group, Inc. | 4,900 | $ | 88,739 | ||||||||

| Lorillard, Inc. | 700 | 54,404 | |||||||||

| Philip Morris International, Inc. | 6,500 | 307,840 | |||||||||

| Reynolds American, Inc. | 500 | 24,240 | |||||||||

| 475,223 | |||||||||||

| Trading Companies & Distributors (0.0%) | |||||||||||

| WESCO International, Inc.* | 200 | 5,112 | |||||||||

| Water Utilities (0.0%) | |||||||||||

| American Water Works Co., Inc. | 500 | 9,485 | |||||||||

| Wireless Telecommunication Services (0.3%) | |||||||||||

| American Tower Corp. Class A* | 2,100 | 77,322 | |||||||||

| Centennial Communications Corp.* | 500 | 4,230 | |||||||||

| Leap Wireless International, Inc.* | 400 | 5,288 | |||||||||

| Syniverse Holdings, Inc.* | 2,500 | 42,825 | |||||||||

| United States Cellular Corp.* | 461 | 16,877 | |||||||||

| 146,542 | |||||||||||

| TOTAL COMMON STOCKS (Cost $47,108,738) | 50,306,609 | ||||||||||

| PREFERRED STOCK (0.0%) | |||||||||||

| Personal Products (0.0%) | |||||||||||

| Revlon, Inc.*^ (Cost $4,223) | 800 | 3,760 | |||||||||

| Par (000) | |||||||||||

| SHORT-TERM INVESTMENT (1.1%) | |||||||||||

| State Street Bank and Trust Co. Euro Time Deposit, 0.010%, 11/02/09 (Cost $570,000) | $ | 570 | 570,000 | ||||||||

| TOTAL INVESTMENTS AT VALUE (99.8%) (Cost $47,682,961) | 50,880,369 | ||||||||||

| OTHER ASSETS IN EXCESS OF LIABILITIES (0.2%) | 102,120 | ||||||||||

| NET ASSETS (100.0%) | $ | 50,982,489 | |||||||||

* Non-income producing security.

^ Not readily marketable security; security is valued at fair value as determined in good faith by, or under the direction of, the Board of Trustees.

See Accompanying Notes to Financial Statements.

28

Credit Suisse Mid-Cap Core Fund

Schedule of Investments

October 31, 2009

| Number of Shares | Value | ||||||||||

| COMMON STOCKS (98.0%) | |||||||||||

| Aerospace & Defense (0.2%) | |||||||||||

| Alliant Techsystems, Inc.* | 1,400 | $ | 108,892 | ||||||||

| BE Aerospace, Inc.* | 2,700 | 47,871 | |||||||||

| 156,763 | |||||||||||

| Airlines (1.3%) | |||||||||||

| Airtran Holdings, Inc.* | 75,400 | 318,942 | |||||||||

| Alaska Air Group, Inc.* | 6,300 | 162,036 | |||||||||

| Allegiant Travel Co.* | 3,900 | 147,069 | |||||||||

| JetBlue Airways Corp.* | 98,800 | 490,048 | |||||||||

| 1,118,095 | |||||||||||

| Auto Components (1.2%) | |||||||||||

| BorgWarner, Inc. | 3,300 | 100,056 | |||||||||

| Drew Industries, Inc.* | 100 | 1,914 | |||||||||

| Exide Technologies* | 2,800 | 17,136 | |||||||||

| Gentex Corp. | 59,500 | 952,595 | |||||||||

| Superior Industries International, Inc. | 100 | 1,328 | |||||||||

| 1,073,029 | |||||||||||

| Automobiles (0.0%) | |||||||||||

| Thor Industries, Inc. | 900 | 23,598 | |||||||||

| Beverages (0.1%) | |||||||||||

| Hansen Natural Corp.* | 1,900 | 68,685 | |||||||||

| PepsiAmericas, Inc. | 1,400 | 40,936 | |||||||||

| 109,621 | |||||||||||

| Biotechnology (3.5%) | |||||||||||

| Cephalon, Inc.* | 44,800 | 2,445,184 | |||||||||

| Facet Biotech Corp.* | 18,260 | 312,794 | |||||||||

| Incyte Corp., Ltd.* | 100 | 589 | |||||||||

| OSI Pharmaceuticals, Inc.* | 1,500 | 48,330 | |||||||||

| United Therapeutics Corp.* | 2,800 | 119,112 | |||||||||

| Vertex Pharmaceuticals, Inc.* | 4,900 | 164,444 | |||||||||

| 3,090,453 | |||||||||||

| Building Products (0.3%) | |||||||||||

| Ameron International Corp. | 200 | 11,796 | |||||||||

| Griffon Corp.* | 100 | 877 | |||||||||

| Lennox International, Inc. | 6,500 | 218,855 | |||||||||

| 231,528 | |||||||||||

| Capital Markets (1.0%) | |||||||||||

| Affiliated Managers Group, Inc.* | 1,400 | 88,886 | |||||||||

| Apollo Investment Corp. | 18,394 | 165,546 | |||||||||

| Eaton Vance Corp. | 4,200 | 119,238 | |||||||||

| Invesco, Ltd. | 8,400 | 177,660 | |||||||||

| Jefferies Group, Inc.* | 3,400 | 88,740 | |||||||||

| Raymond James Financial, Inc. | 3,500 | 82,635 | |||||||||

See Accompanying Notes to Financial Statements.

29

Credit Suisse Mid-Cap Core Fund

Schedule of Investments (continued)

October 31, 2009

| Number of Shares | Value | ||||||||||

| COMMON STOCKS | |||||||||||

| Capital Markets | |||||||||||

| SEI Investments Co. | 3,500 | $ | 61,145 | ||||||||

| Waddell & Reed Financial, Inc. Class A | 3,890 | 109,153 | |||||||||

| 893,003 | |||||||||||

| Chemicals (2.5%) | |||||||||||

| Airgas, Inc. | 100 | 4,436 | |||||||||

| Albemarle Corp. | 2,500 | 78,950 | |||||||||

| Ashland, Inc. | 2,400 | 82,896 | |||||||||

| Cabot Corp. | 18,400 | 403,512 | |||||||||

| Chemtura Corp.* | 29,700 | 28,512 | |||||||||

| Cytec Industries, Inc. | 3,649 | 121,037 | |||||||||

| Huntsman Corp. | 7,500 | 59,625 | |||||||||

| Lubrizol Corp. | 3,300 | 219,648 | |||||||||

| Minerals Technologies, Inc. | 400 | 19,704 | |||||||||

| NL Industries, Inc. | 100 | 620 | |||||||||

| Olin Corp. | 2,100 | 32,067 | |||||||||

| RPM International, Inc. | 5,600 | 98,672 | |||||||||

| Sensient Technologies Corp. | 2,300 | 58,167 | |||||||||

| Terra Industries, Inc. | 22,900 | 727,533 | |||||||||

| The Scotts Miracle-Gro Co. Class A | 1,100 | 44,682 | |||||||||

| Valspar Corp. | 8,800 | 223,256 | |||||||||

| 2,203,317 | |||||||||||

| Commercial Banks (2.4%) | |||||||||||

| 1st Source Corp. | 100 | 1,482 | |||||||||

| Associated Banc-Corp. | 9,910 | 126,947 | |||||||||

| Bancorpsouth, Inc. | 2,000 | 45,160 | |||||||||

| Bank of Hawaii Corp. | 1,200 | 53,280 | |||||||||

| Cathay General Bancorp | 1,300 | 11,479 | |||||||||

| City National Corp. | 1,200 | 45,204 | |||||||||

| Comerica, Inc. | 3,900 | 108,225 | |||||||||

| Commerce Bancshares, Inc. | 2,395 | 91,872 | |||||||||

| Cullen/Frost Bankers, Inc. | 1,500 | 70,185 | |||||||||

| Fifth Third Bancorp | 21,600 | 193,104 | |||||||||

| FirstMerit Corp. | 4,808 | 91,112 | |||||||||

| Fulton Financial Corp. | 30,000 | 247,800 | |||||||||

| International Bancshares Corp. | 10,500 | 155,925 | |||||||||

| PacWest Bancorp | 800 | 13,584 | |||||||||

| SVB Financial Group* | 1,500 | 61,875 | |||||||||

| Synovus Financial Corp. | 52,600 | 116,772 | |||||||||

| TCF Financial Corp. | 3,300 | 39,039 | |||||||||

| Trustmark Corp. | 8,800 | 166,760 | |||||||||

| Valley National Bancorp | 9,675 | 128,484 | |||||||||

| Webster Financial Corp. | 1,700 | 19,227 | |||||||||

| Westamerica BanCorporation | 5,200 | 248,560 | |||||||||

| Wilmington Trust Corp. | 5,644 | 68,010 | |||||||||

| 2,104,086 | |||||||||||

See Accompanying Notes to Financial Statements.

30

Credit Suisse Mid-Cap Core Fund

Schedule of Investments (continued)

October 31, 2009

| Number of Shares | Value | ||||||||||

| COMMON STOCKS | |||||||||||

| Commercial Services & Supplies (1.0%) | |||||||||||

| Clean Harbors, Inc.* | 500 | $ | 28,225 | ||||||||

| Copart, Inc.* | 1,800 | 57,906 | |||||||||

| Corrections Corp. of America* | 3,045 | 72,897 | |||||||||

| Courier Corp. | 100 | 1,483 | |||||||||

| Deluxe Corp. | 14,200 | 202,066 | |||||||||

| Herman Miller, Inc. | 1,500 | 23,175 | |||||||||

| HNI Corp. | 2,200 | 57,904 | |||||||||

| Interface, Inc. Class A | 100 | 776 | |||||||||

| Mine Safety Appliances Co. | 7,500 | 191,175 | |||||||||

| Rollins, Inc. | 7,300 | 131,984 | |||||||||

| Standard Parking Corp.* | 20 | 352 | |||||||||

| The Brink's Co. | 1,200 | 28,476 | |||||||||

| Waste Connections, Inc.* | 2,100 | 66,003 | |||||||||

| 862,422 | |||||||||||

| Communications Equipment (2.9%) | |||||||||||

| 3Com Corp.* | 42,900 | 220,506 | |||||||||

| Acme Packet, Inc.* | 100 | 979 | |||||||||

| ADC Telecommunications, Inc.* | 63,200 | 410,168 | |||||||||

| ADTRAN, Inc. | 3,300 | 76,032 | |||||||||

| Avocent Corp.* | 5,600 | 139,272 | |||||||||

| CommScope, Inc.* | 3,000 | 81,060 | |||||||||

| EchoStar Corp. Class A* | 100 | 1,816 | |||||||||

| Emulex Corp.* | 10,300 | 104,030 | |||||||||

| F5 Networks, Inc.* | 2,200 | 98,758 | |||||||||

| Palm, Inc.* | 4,600 | 53,406 | |||||||||

| Plantronics, Inc. | 1,300 | 31,343 | |||||||||

| Polycom, Inc.* | 46,200 | 991,914 | |||||||||

| Riverbed Technology, Inc.* | 7,100 | 145,479 | |||||||||

| Starent Networks Corp.* | 4,900 | 165,326 | |||||||||

| Unity Wireless Corp.* | 712,201 | 427 | |||||||||

| 2,520,516 | |||||||||||

| Computers & Peripherals (1.2%) | |||||||||||

| Avid Technology, Inc.* | 100 | 1,263 | |||||||||

| Diebold, Inc. | 1,700 | 51,408 | |||||||||

| NCR Corp.* | 5,100 | 51,765 | |||||||||

| NetApp, Inc.* | 4,500 | 121,725 | |||||||||

| SanDisk Corp.* | 200 | 4,096 | |||||||||

| STEC, Inc.* | 29,400 | 626,808 | |||||||||

| Sun Microsystems, Inc.* | 23,800 | 194,684 | |||||||||

| Teradata Corp.* | 1,800 | 50,184 | |||||||||

| 1,101,933 | |||||||||||

| Construction & Engineering (2.4%) | |||||||||||

| Aecom Technology Corp.* | 5,400 | 136,296 | |||||||||

| Dycom Industries, Inc.* | 4,200 | 41,496 | |||||||||

| Granite Construction, Inc. | 3,400 | 97,104 | |||||||||

| KBR, Inc. | 5,200 | 106,444 | |||||||||

See Accompanying Notes to Financial Statements.

31

Credit Suisse Mid-Cap Core Fund

Schedule of Investments (continued)

October 31, 2009

| Number of Shares | Value | ||||||||||

| COMMON STOCKS | |||||||||||

| Construction & Engineering | |||||||||||

| The Shaw Group, Inc.* | 22,900 | $ | 587,614 | ||||||||

| URS Corp.* | 29,100 | 1,130,826 | |||||||||

| 2,099,780 | |||||||||||

| Construction Materials (0.1%) | |||||||||||

| Martin Marietta Materials, Inc. | 1,400 | 116,648 | |||||||||

| Consumer Finance (1.0%) | |||||||||||

| AmeriCredit Corp.* | 22,000 | 388,300 | |||||||||

| Discover Financial Services | 15,100 | 213,514 | |||||||||

| SLM Corp.* | 25,700 | 249,290 | |||||||||

| 851,104 | |||||||||||

| Containers & Packaging (0.4%) | |||||||||||

| Aptargroup, Inc. | 2,500 | 88,275 | |||||||||

| Crown Holdings, Inc.* | 100 | 2,665 | |||||||||

| Greif, Inc. Class A | 900 | 48,168 | |||||||||

| Packaging Corp. of America | 2,900 | 53,012 | |||||||||

| Sonoco Products Co. | 3,600 | 96,300 | |||||||||

| Temple-Inland, Inc. | 5,000 | 77,250 | |||||||||

| 365,670 | |||||||||||

| Distributors (0.1%) | |||||||||||

| LKQ Corp.* | 3,900 | 67,353 | |||||||||

| Diversified Consumer Services (2.1%) | |||||||||||

| Brink's Home Security Holdings, Inc.* | 4,700 | 145,606 | |||||||||

| Career Education Corp.* | 19,200 | 400,128 | |||||||||

| Corinthian Colleges, Inc.* | 50,200 | 796,172 | |||||||||

| ITT Educational Services, Inc.* | 1,100 | 99,385 | |||||||||

| Matthews International Corp. Class A | 800 | 29,384 | |||||||||

| Regis Corp. | 12,200 | 198,128 | |||||||||

| Service Corp. International | 18,400 | 126,408 | |||||||||

| Sotheby's | 1,800 | 28,548 | |||||||||

| Strayer Education, Inc. | 300 | 60,891 | |||||||||

| 1,884,650 | |||||||||||

| Diversified Financial Services (0.5%) | |||||||||||

| Interactive Brokers Group, Inc. Class A* | 6,000 | 96,060 | |||||||||

| MSCI, Inc. Class A* | 1,900 | 57,760 | |||||||||

| The NASDAQ OMX Group, Inc.* | 16,800 | 303,408 | |||||||||

| 457,228 | |||||||||||

| Diversified Telecommunication Services (0.1%) | |||||||||||

| Cbeyond, Inc.* | 100 | 1,335 | |||||||||

| Cincinnati Bell, Inc.* | 24,600 | 75,768 | |||||||||

| Cogent Communications Group, Inc.* | 120 | 1,216 | |||||||||

| General Communication, Inc. Class A* | 100 | 615 | |||||||||

| 78,934 | |||||||||||

See Accompanying Notes to Financial Statements.

32

Credit Suisse Mid-Cap Core Fund

Schedule of Investments (continued)

October 31, 2009

| Number of Shares | Value | ||||||||||

| COMMON STOCKS | |||||||||||

| Electric Utilities (1.1%) | |||||||||||

| Cleco Corp. | 1,600 | $ | 39,600 | ||||||||

| DPL, Inc. | 7,700 | 195,118 | |||||||||

| Great Plains Energy, Inc. | 3,600 | 62,280 | |||||||||

| Hawaiian Electric Industries, Inc. | 14,557 | 259,842 | |||||||||

| IDACORP, Inc. | 1,400 | 39,326 | |||||||||

| NV Energy, Inc. | 11,300 | 129,498 | |||||||||

| PNM Resources, Inc. | 20,000 | 214,400 | |||||||||

| Westar Energy, Inc. | 2,900 | 55,535 | |||||||||

| 995,599 | |||||||||||

| Electrical Equipment (0.6%) | |||||||||||

| AMETEK, Inc. | 3,100 | 108,159 | |||||||||

| EnerSys* | 1,800 | 39,780 | |||||||||

| Roper Industries, Inc. | 4,000 | 202,200 | |||||||||

| SunPower Corp. Class B* | 1,042 | 22,570 | |||||||||

| Thomas & Betts Corp.* | 1,500 | 51,315 | |||||||||

| Woodward Governor Co. | 3,500 | 82,285 | |||||||||

| 506,309 | |||||||||||

| Electronic Equipment, Instruments & Components (1.4%) | |||||||||||

| Arrow Electronics, Inc.* | 3,200 | 81,088 | |||||||||

| Avnet, Inc.* | 4,400 | 109,032 | |||||||||

| Brightpoint, Inc.* | 100 | 737 | |||||||||

| Checkpoint Systems, Inc.* | 100 | 1,357 | |||||||||

| Ingram Micro, Inc. Class A* | 11,100 | 195,915 | |||||||||

| Itron, Inc.* | 1,000 | 60,040 | |||||||||

| National Instruments Corp. | 1,500 | 40,050 | |||||||||

| Tech Data Corp.* | 14,700 | 564,921 | |||||||||

| Technitrol, Inc. | 100 | 779 | |||||||||

| Trimble Navigation, Ltd.* | 3,200 | 67,104 | |||||||||

| Vishay Intertechnology, Inc.* | 24,900 | 155,127 | |||||||||

| 1,276,150 | |||||||||||

| Energy Equipment & Services (1.3%) | |||||||||||

| Complete Production Services, Inc.* | 100 | 953 | |||||||||

| Exterran Holdings, Inc.* | 1,700 | 34,731 | |||||||||

| Global Industries, Ltd.* | 19,200 | 139,968 | |||||||||

| Helix Energy Solutions Group, Inc.* | 2,500 | 34,325 | |||||||||

| Helmerich & Payne, Inc. | 2,900 | 110,258 | |||||||||