50% of the total voting power of the resulting company; (ii) the sale, transfer or other disposition of all or substantially all of the Company’s assets; or (iii) an acquisition of more than 50% of the total voting power of the Company’s outstanding securities pursuant to a tender or exchange offer made directly to our stockholders.

Effective Date, Termination and Amendment

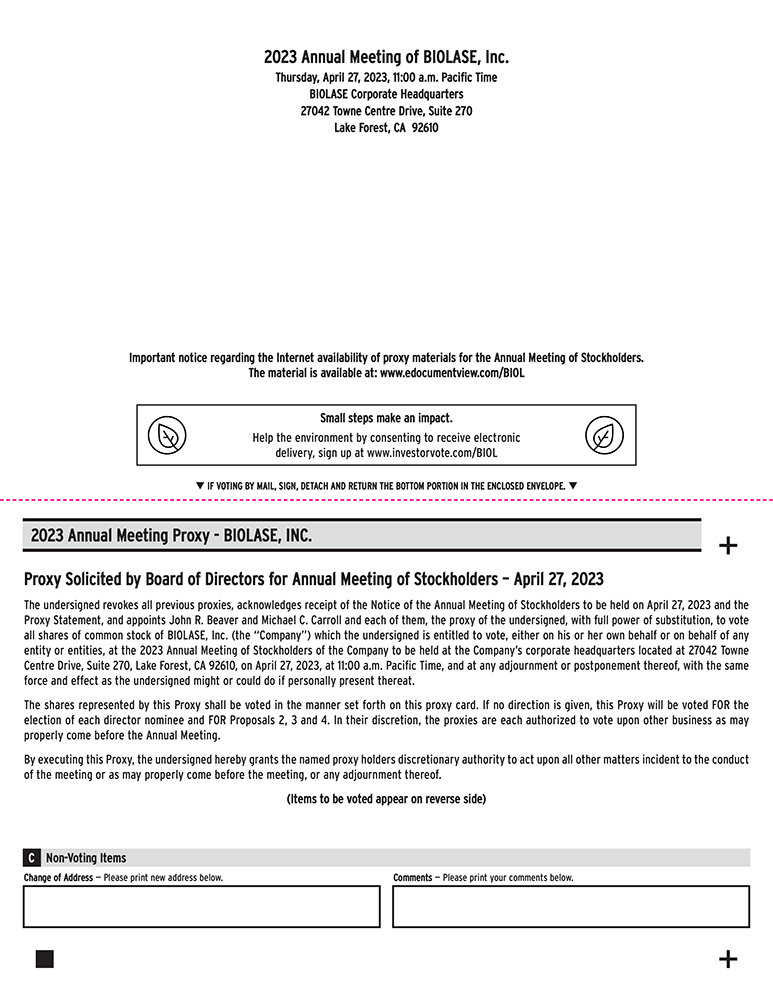

If approved by the affirmative vote of a majority of the shares of our common stock present in person or represented by proxy at the annual meeting, the Amended 2018 Plan will become effective as of the date on which the Amendment is approved by our stockholders. The 2018 Plan became effective as of May 9, 2018 when it was approved by our stockholders, and it will terminate as of the first annual meeting to occur on or after May 9, 2028, unless earlier terminated by our Board. Awards under the Amended 2018 Plan may be made at any time prior to the termination of the Amended 2018 Plan, provided that no incentive stock option may be granted later than ten years after February 14, 2018, the date on which our Board approved the 2018 Plan. Our Board may amend the Amended 2018 Plan at any time, subject to stockholder approval if (i) required by applicable law, rule or regulation, including any Nasdaq Rule or any other stock exchange on which our common stock is then traded, or (ii) our Board seeks to modify the stock option and SAR repricing provisions in the Amended 2018 Plan. No amendment may materially impair the rights of a holder of an outstanding award without the consent of such holder.

Eligibility

Participants in the Amended 2018 Plan will consist of such officers, other employees, non-employee directors, consultants, independent contractors and agents and persons expected to become officers, other employees, non-employee directors, consultants, independent contractors and agents of the Company and its subsidiaries, as selected by the Plan Committee.

Stock Options and SARs

The Amended 2018 Plan provides for the grant of non-qualified stock options, incentive stock options and SARs. The Plan Committee will determine the conditions to the exercisability of each stock option and SAR.

Each stock option will be exercisable for no more than ten years after its date of grant, unless the stock option is an incentive stock option and the optionee owns greater than ten percent (10%) of the voting power of all shares of our capital stock (a “ten percent holder”), in which case the stock option will be exercisable for no more than five years after its date of grant. Except in the case of substitute awards granted in connection with a corporate transaction, the exercise price of a stock option will not be less than 100% of the fair market value of a share of our common stock on the date of grant, unless the stock option is an incentive stock option and the optionee is a ten percent holder, in which case the stock option exercise price will be the price required by the Code, currently 110% of fair market value.

Each SAR will be exercisable for no more than ten years after its date of grant provided that no SAR granted in tandem with a stock option (a “tandem SAR”) will be exercisable later than the expiration, termination, cancellation, forfeiture or other termination of the related stock option. The base price of an SAR will not be less than 100% of the fair market value of a share of our common stock on the date of grant (or, if earlier, the date of grant of the stock option for which the SAR is exchanged or substituted), provided that the base price of a tandem SAR will be the exercise price of the related stock option. An SAR entitles the holder to receive upon exercise (subject to withholding taxes) shares of our common stock (which may be restricted stock), cash or a combination thereof with a value equal to the difference between the fair market value of our common stock on the exercise date and the base price of the SAR.

All of the terms relating to the exercise, cancellation or other disposition of stock options and SARs following the termination of employment of a participant, whether by reason of disability, retirement, death or any other reason, will be determined by the Plan Committee.

31