UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-Q

(Mark one)

| x | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| | For the Quarter Ended March 31, 2009 |

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Commission File No. 0-15474

AMERALIA, INC.

(Exact name of Company as specified in its charter)

| Utah | 87-0403973 |

| (State or other jurisdiction of | (I.R.S. Employer |

| Incorporation or organization) | Identification No.) |

9233 Park Meadows Dr, Suite 431, Lone Tree, CO 80124

(Address of Principal Executive Offices)

| Company's telephone number, including area code: | (720) 876-2373 |

| Company’s Web Page: | www.ameralia.com |

Indicate by check mark whether issuer (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days

Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

Yes o No o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer”. “accelerated filer” and “smaller reporting company’ in Rule 12b-2 of the Exchange Act.

Large accelerated filer ¨ | Accelerated filer ¨ |

Non-accelerated filer ¨ (Do not check if a smaller reporting company) | Smaller reporting company x |

Indicate by a check mark whether the Registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No x

As of May 10, 2009, the number of shares outstanding of the registrant's $.01 par value common stock was 66,259,946.

INDEX TO FORM 10-Q

| | | | Page |

| PART I: | | FINANCIAL STATEMENTS | |

| | | | |

| Item 1: | | Financial Statements | |

| | | | 1 |

| | | | 3 |

| | | | 4 |

| | | | 5 |

| | | | 6 |

| | | | 7 |

| Item 2: | | | 12 |

| Item 4: | | | 18 |

| | | | |

| PART II: | | OTHER INFORMATION | 19 |

| | | | |

| Item 1: | | | 19 |

| Item 6: | | | 20 |

| | | | |

| | | | 20 |

CLOSING OF RESTRUCTURING AGREEMENT

On October 31, 2008 AmerAlia completed the first closing of the Restructuring Agreement AmerAlia had entered into with the Sentient Entities and others as discussed herein. Consequently, AmerAlia now owns 18% of Natural Soda Holdings, Inc. which now owns 100% of Natural Soda, Inc. (collectively “NSHI”). As a result of the closing of this transaction AmerAlia’s financial statements reflect AmerAlia’s and NSHI’s results on a consolidated basis for the period July 1, 2008 to October 31, 2008. After October 31, 2008 AmerAlia’s financial statements reflect AmerAlia’s investment in NSHI using the equity method of accounting. Under the equity method of accounting, only AmerAlia’s investment in and amounts due to and from NSHI are included in AmerAlia’s consolidated balance sheet. As a result, AmerAlia records an asset on AmerAlia’s balance sheet related to AmerAlia’s investment in NSHI and any changes to that value are brought to account through AmerAlia’s statement of operations. The financial statements for NSHI are shown in Note 3 to AmerAlia’s financial statements.

Consolidated Balance Sheet

ASSETS

| | | March 31, 2009 | | | June 30, 2008 | |

| | | (Unaudited) | | | (Audited) | |

| | | | | | | |

| CURRENT ASSETS | | | | | | |

| Cash | | $ | 3,932,407 | | | $ | 43,374 | |

| Loan to Natural Soda Holdings, Inc | | | 806,754 | | | | - | |

| Accounts receivable, net | | | - | | | | 2,898,121 | |

| Inventories | | | - | | | | 742,760 | |

| Prepaid expenses | | | - | | | | 494,498 | |

| Total Current Assets | | | 4,739,161 | | | | 4,178,753 | |

| | | | | | | | | |

| FIXED ASSETS | | | | | | | | |

| Property plant and equipment, net | | | - | | | | 9,463,356 | |

| Cavities and well development, net | | | - | | | | 5,862,227 | |

| Mineral leases | | | - | | | | 4,167,471 | |

| Total Fixed Assets | | | - | | | | 19,493,054 | |

| | | | | | | | | |

| OTHER ASSETS | | | | | | | | |

| Investment in Natural Soda Holdings, Inc. | | | 6,023,789 | | | | - | |

| Water rights | | | - | | | | 3,150,582 | |

| Patents | | | - | | | | 26,238 | |

| Well and well development RSL | | | - | | | | 595,000 | |

| Engineering drawings | | | - | | | | 1,876,000 | |

| Equipment held and not yet placed in service | | | - | | | | 3,197,842 | |

| Deferred financing and acquisition costs | | | - | | | | 770,816 | |

| Rock School Lease and reserves | | | - | | | | 3,300,000 | |

| Deposits and bonds | | | - | | | | 12,000 | |

| Restricted funds | | | 42,863 | | | | 1,122,843 | |

| Total Other Assets | | | 6,066,652 | | | | 14,051,321 | |

| | | | | | | | | |

| TOTAL ASSETS | | $ | 10,805,813 | | | $ | 37,723,128 | |

AMERALIA, INC. AND SUBSIDIARIES

Consolidated Balance Sheet (Continued)

LIABILITIES AND STOCKHOLDERS' EQUITY (DEFICIT)

| | | March 31, 2009 | | | June 30, 2008 | |

| | | (Unaudited) | | | (Audited) | |

| | | | | | | |

| CURRENT LIABILITIES | | | | | | |

| Accounts payable | | $ | 584,659 | | | $ | 2,594,453 | |

| Bank overdraft | | | - | | | | 54,331 | |

| Royalties payable | | | 975,000 | | | | 971,760 | |

| Accrued expenses | | | 123,584 | | | | 1,602,315 | |

| Accrued expenses due to related parties | | | 225,312 | | | | 51,952,899 | |

| Current portion of notes payable to related parties | | | - | | | | 24,392,339 | |

| Notes payable, current portion | | | 4,000 | | | | 5,709,963 | |

| Capital leases payable | | | - | | | | 64,674 | |

| Interest payable | | | 9,675 | | | | 1,007,274 | |

| Total Current Liabilities | | | 1,922,230 | | | | 88,350,008 | |

| | | | | | | | | |

| LONG TERM LIABILITIES | | | | | | | | |

| Notes payable | | | - | | | | 15,561 | |

| Capital lease obligations | | | - | | | | 3,436 | |

| Asset retirement obligations | | | - | | | | 1,036,640 | |

| Total Long Term Liabilities | | | - | | | | 1,055,637 | |

| | | | | | | | | |

| TOTAL LIABILITIES | | | 1,922,230 | | | | 89,405,645 | |

| | | | | | | | | |

| COMMITMENTS AND CONTINGENCIES | | | | | | | | |

| | | | | | | | | |

| MINORITY INTEREST | | | - | | | | 15,376,985 | |

| | | | | | | | | |

| STOCKHOLDERS' EQUITY (DEFICIT) | | | | | | | | |

| Preferred stock, $0.05 par value; 1,000,000 authorized; 82 issued and outstanding | | | 4 | | | | 4 | |

| Common stock, $0.01 par value; 100,000,000 shares authorized; 66,259,946 and 17,298,507 issued and outstanding, respectively | | | 662,599 | | | | 172,985 | |

| Additional paid-in capital | | | 119,222,141 | | | | 38,159,742 | |

| Accumulated deficit | | | (111,001,161 | ) | | | (105,392,233 | ) |

| Total Stockholders' Equity (Deficit) | | | 8,883,583 | | | | (67,059,502 | ) |

| | | | | | | | | |

| TOTAL LIABILITIES AND STOCKHOLDERS' EQUITY | | $ | 10,805,813 | | | $ | 37,723,128 | |

| | | | | | | | | |

AMERALIA, INC. AND SUBSIDIARIES Consolidated Statements of Operations

(Unaudited)

| | | For the Three Months ended March 31, | |

| | | 2009 | | | 2008 | |

| | | | | | | |

| REVENUES | | $ | - | | | $ | 4,847,006 | |

| | | | | | | | | |

| COST OF GOODS SOLD | | | - | | | | 4,317,371 | |

| | | | | | | | | |

| GROSS PROFIT | | | - | | | | 529,635 | |

| | | | | | | | | |

| EXPENSES | | | | | | | | |

| General and administrative | | | 203,556 | | | | 214,363 | |

| Depreciation and amortization expense | | | - | | | | 479,356 | |

| | | | | | | | | |

| Total Expenses | | | 203,556 | | | | 693,719 | |

| | | | | | | | | |

| LOSS FROM OPERATIONS | | | (203,556 | ) | | | (164,084 | ) |

| | | | | | | | | |

| OTHER INCOME (EXPENSE) | | | | | | | | |

| Gain (loss) on settlement of debt | | | - | | | | - | |

| Interest income | | | 829 | | | | 693 | |

| Other income | | | - | | | | 16,000 | |

| Interest expense | | | (4,796 | ) | | | (38,347,724 | ) |

| | | | | | | | | |

| Total Other Income (Expense) | | | (3,967 | ) | | | (38,330,731 | ) |

| | | | | | | | | |

| NET (LOSS) BEFORE MINORITY INTEREST AND INCOME TAX EXPENSE | | | (207,523 | ) | | | (38,494,815 | ) |

| | | | | | | | | |

| Minority interest in net (income) loss of subsidiary | | | - | | | | 36,573 | |

| Net income from equity investment | | | 124,340 | | | | - | |

| | | | | | | | | |

| LOSS BEFORE INCOME TAX EXPENSE | | | (83,183 | ) | | | (38,458,242 | ) |

| | | | | | | | | |

| Income tax expense | | | - | | | | - | |

| | | | | | | | | |

| NET LOSS | | $ | (83,183 | ) | | $ | (38,458,242 | ) |

| | | | | | | | | |

| BASIC LOSS PER SHARE | | $ | (0.001 | ) | | $ | (2.23 | ) |

| | | | | | | | | |

| WEIGHTED AVERAGE NUMBER OF SHARES OUTSTANDING | | | 66,259,946 | | | | 17,239,437 | |

AMERALIA, INC. AND SUBSIDIARIES Consolidated Statements of Operations

(Unaudited)

| | | For the Nine Months ended March 31, | |

| | | 2009 | | | 2008 | |

| | | | | | | |

| REVENUES | | $ | 6,526,895 | | | $ | 13,368,011 | |

| | | | | | | | | |

| COST OF GOODS SOLD | | | 5,206,712 | | | | 11,513,308 | |

| | | | | | | | | |

| GROSS PROFIT | | | 1,320,183 | | | | 1,854,683 | |

| | | | | | | | | |

| EXPENSES | | | | | | | | |

| General and administrative | | | 775,562 | | | | 717,879 | |

| Depreciation and amortization expense | | | 867,710 | | | | 1,300,060 | |

| | | | | | | | | |

| Total Expenses | | | 1,643,272 | | | | 2,017,939 | |

| | | | | | | | | |

| INCOME (LOSS) FROM OPERATIONS | | | (323,089 | ) | | | (163,256 | ) |

| | | | | | | | | |

| OTHER INCOME (EXPENSE) | | | | | | | | |

| Gain on settlement of debt | | | 1,250,932 | | | | - | |

| Interest income | | | 1,896 | | | | 3,394 | |

| Other income | | | 400,114 | | | | 16,000 | |

| Other financing costs | | | (209,449 | ) | | | - | |

| Interest expense | | | (6,727,159 | ) | | | (40,343,892 | ) |

| | | | | | | | | |

| Total Other Income (Expense) | | | (5,283,666 | ) | | | (40,324,498 | ) |

| | | | | | | | | |

| LOSS BEFORE MINORITY INTEREST AND INCOME TAX EXPENSE | | | (5,606,755 | ) | | | (40,487,754 | ) |

| | | | | | | | | |

| Minority interest in net income of subsidiary | | | (168,274 | ) | | | (127,032 | ) |

| Net income from equity investment | | | 166,101 | | | | - | |

| | | | | | | | | |

| LOSS BEFORE INCOME TAX EXPENSE | | | (5,608,928 | ) | | | (40,614,786 | ) |

| | | | | | | | | |

| Income tax expense | | | - | | | | - | |

| | | | | | | | | |

| NET LOSS | | $ | (5,608,928 | ) | | $ | (40,614,786 | ) |

| | | | | | | | | |

| BASIC LOSS PER SHARE | | $ | (0.13 | ) | | $ | (2.36 | ) |

| | | | | | | | | |

| WEIGHTED AVERAGE NUMBER OF SHARES OUTSTANDING | | | 41,801,232 | | | | 17,239,437 | |

AMERALIA, INC. AND SUBSIDIARIES Consolidated Statement of Stockholders' Equity (Deficit)

| | | | | | | | | | | | | | | Additional | | | | |

| | | Preferred Stock | | | Common Stock | | | Paid-In | | | Accumulated | |

| | | Shares | | | Amount | | | Shares | | | Amount | | | Capital | | | Deficit | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| Balance, June 30, 2008 | | | 82 | | | $ | 4 | | | | 17,298,507 | | | $ | 172,985 | | | $ | 38,159,742 | | | $ | (105,392,233 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Fair value of options granted (unaudited) | | | - | | | | - | | | | - | | | | - | | | | 138,285 | | | | - | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Shares issued to settle related party debts (unaudited) | | | - | | | | - | | | | 18,193,947 | | | | 181,939 | | | | 8,964,616 | | | | - | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Related party contributions to capital on debt settlement (unaudited) | | | - | | | | - | | | | - | | | | - | | | | (361,529 | ) | | | - | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Shares issued to settle debt obligations (unaudited) | | | - | | | | - | | | | 3,340,086 | | | | 33,401 | | | | 1,727,280 | | | | - | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Share issues to related parties for cash (unaudited) | | | - | | | | - | | | | 27,427,406 | | | | 274,274 | | | | 9,599,592 | | | | - | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Elimination of the NSHI additional paid in capital (unaudited) | | | - | | | | - | | | | - | | | | - | | | | (2,574,244 | ) | | | - | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Deconsolidation of investment in NSHI and NSI to equity investment (unaudited) | | | - | | | | - | | | | - | | | | - | | | | 63,568,399 | | | | - | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Net loss for the nine months ended March 31, 2009 (unaudited) | | | - | | | | - | | | | - | | | | - | | | | - | | | | (5,608,928 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Balance, March 31, 2009 (unaudited) | | | 82 | | | $ | 4 | | | | 66,259,946 | | | $ | 662,599 | | | $ | 119,222,141 | | | $ | (111,001,161 | ) |

AMERALIA, INC. AND SUBSIDIARIES Consolidated Statements of Cash Flows

(Unaudited)

| | | For the Nine Months ended March 31, | |

| | | 2009 | | | 2008 | |

| CASH FLOWS FROM OPERATING ACTIVITIES | | | | | | |

| | | | | | | |

| Net loss | | $ | (5,608,928 | ) | | $ | (40,614,786 | ) |

| Adjustments to reconcile net loss to net cash used by operating activities: | | | | | | | | |

| Fair value of options granted | | | 138,285 | | | | 66,592 | |

| Depreciation and amortization | | | 867,710 | | | | 1,300,060 | |

| Amortization of debt discount | | | 209,449 | | | | - | |

| Gain on settlement of debt | | | (1,250,932 | ) | | | - | |

| Minority interest in net income | | | 168,274 | | | | 127,032 | |

| Net income from equity investment | | | (166,101 | ) | | | - | |

| Change in Operating Assets and Liabilities: | | | | | | | | |

| (Increase) decrease in restricted funds | | | - | | | | (960,480 | ) |

| Decrease in accounts receivable | | | (46,614 | ) | | | (227,668 | ) |

| (Increase) decrease in inventory | | | (54,370 | ) | | | (225,642 | ) |

| (Increase) decrease in prepaid expenses | | | 155,647 | | | | (198,434 | ) |

| (Increase) in loans to related parties | | | (806,754 | ) | | | - | |

| (Increase) in loans to related party receivable | | | - | | | | (1,406,875 | ) |

| (Decrease) in accounts and royalties payable | | | (1,089,159 | ) | | | (1,685,254 | ) |

| Increase in accrued expenses due to related parties | | | 5,309,573 | | | | 39,588,004 | |

| (Decrease) Increase in accrued liabilities | | | (1,018,445 | ) | | | 221,222 | |

| Increase in interest payable | | | (378,279 | ) | | | 456,775 | |

| | | | | | | | | |

| Net Cash (Used in) Operating Activities | | | (3,570,644 | ) | | | (3,658,707 | ) |

| | | | | | | | | |

| CASH FLOWS FROM INVESTING ACTIVITIES | | | | | | | | |

| | | | | | | | | |

| Cavities and well development | | | (122,380 | ) | | | (36,445 | ) |

| Purchase of property and equipment | | | (26,743 | ) | | | (148,710 | ) |

| | | | | | | | | |

| Net Cash (Used in) Investing Activities | | | (149,123 | ) | | | (185,155 | ) |

| | | | | | | | | |

| CASH FLOWS FROM FINANCING ACTIVITIES | | | | | | | | |

| | | | | | | | | |

| Payments on (Increase in) bank overdraft | | | (54,331 | ) | | | 2,878 | |

| Proceeds from issuance of common stock | | | 9,873,866 | | | | - | |

| Payments on capital leases | | | (29,125 | ) | | | (40,704 | ) |

| Proceeds from sale of debenture and accrued interest | | | - | | | | 2,428,091 | |

| Proceeds from notes payable | | | - | | | | 1,266,005 | |

| Payments on debt | | | (1,444,150 | ) | | | - | |

| Payments on related party debt | | | (980,000 | ) | | | - | |

| Proceeds from related party notes payable | | | 260,000 | | | | 179,986 | |

| | | | | | | | | |

| Net Cash Provided by Financing Activities | | | 7,626,260 | | | | 3,836,256 | |

| | | | | | | | | |

| NET INCREASE (DECREASE) IN CASH | | | 3,906,493 | | | | (7,606 | ) |

| NET CASH OF DECONSOLIDATED SUBSIDIARY | | | (17,460 | ) | | | - | |

| CASH AT BEGINNING OF PERIOD | | | 43,374 | | | | 10,968 | |

| | | | | | | | | |

| CASH AT END OF PERIOD | | $ | 3,932,407 | | | $ | 3,362 | |

| | | | | | | | | |

SUPPLEMENTAL DISCLOSURE OF CASH FLOW INFORMATION | | | | | | | | |

| Income taxes | | $ | - | | | $ | - | |

| Interest | | $ | 1,203,990 | | | $ | 392,735 | |

AMERALIA, INC. AND SUBSIDIARIES Notes to the Consolidated Financial Statements

December 31, 2008

| NOTE 1 - | BASIS OF FINANCIAL STATEMENT PRESENTATION |

Until October 31, 2008, AmerAlia owned 100% of Natural Soda Holdings, Inc. (“NSHI”) and NSHI owned 46.5% of Natural Soda, Inc. (“NSI”). On October 31, 2008 AmerAlia completed a restructuring agreement as discussed in Note 2 wherein AmerAlia and NSHI issued new equity in exchange for cash, settlement of various debt obligations and to enable NSHI to acquire the 46.5% of NSI previously owned by Sentient. As of October 31, 2008, AmerAlia owns 18% of the equity of NSHI which owns 100% of the equity of NSI. Previously, the financial position, operations and cash flows of NSI have been included in the consolidated financial statements primarily because NSI represented AmerAlia’s principle business activity. The “Minority Interest” ownership of the Sentient Entities in NSI was reflected separately in the consolidated balance sheets along with its “Minority Interest” share of income and loss from operations. All material inter-company accounts and transactions have been eliminated in the consolidation accounts.

As a result of the restructuring, AmerAlia became a minority shareholder in NSHI on October 31, 2008 and does not control that company or its direct subsidiary, NSI. Consequently, in accordance with generally accepted accounting principles, AmerAlia’s financial statements reflect AmerAlia’s results on a consolidated basis for the period July 1, 2008 to October 31, 2008. After October 31, 2008 AmerAlia’s financial statements reflect AmerAlia’s investment in NSHI using the equity method of accounting. Nevertheless, AmerAlia’s participation in the management and development of NSHI remains its principle business activity.

The accompanying unaudited condensed consolidated financial statements have been prepared by AmerAlia pursuant to the rules and regulations of the Securities and Exchange Commission. Certain information and footnote disclosures normally included in financial statements prepared in accordance with accounting principles generally accepted in the United States of America have been condensed or omitted in accordance with such rules and regulations. The information furnished in the interim condensed consolidated financial statements includes normal recurring adjustments and reflects all adjustments, which, in the opinion of management, are necessary for a fair presentation of such financial statements. Although management believes the disclosures and information presented are adequate to make the information not misleading, these interim condensed consolidated financial statements should be read in conjunction with AmerAlia's most recent audited financial statements and notes thereto included in its Annual Report on Form 10-KSB for the year ended June 30, 2008. Operating results for the nine months ended March 31, 2009 are not necessarily indicative of the results that may be expected for the year ending June 30, 2009.

| NOTE 2 - | COMPLETED RESTRUCTURING AGREEMENT |

On September 25, 2008 AmerAlia, NSHI and its then 46.5% owned subsidiary, NSI, Bill H. Gunn and Robert van Mourik, Directors and executive officers of AmerAlia (collectively the “AmerAlia parties”) entered into a Restructuring Agreement with the Sentient Entities. On October 31, 2008 the AmerAlia Parties and the Sentient Entities completed an Amendment to the Restructuring Agreement. As a result of the amendment, the restructuring transaction was divided into two closings. In accordance with the amended agreement the first closing occurred as of October 31, 2008. Prior to the first closing, the Sentient Entities transferred their various interests to Sentient USA Resources Fund, L.P. (“Sentient”). In the first closing:

| | 1. | Sentient exchanged all its Series A Debentures and Series B1 Debentures, accrued interest and rights to contingent interest thereon, its one share of NSHI common stock and its 53.5% of the common stock of NSI for 82% of the issued common stock of NSHI. |

| | 2. | AmerAlia exchanged its Series A Debentures and Series C Debentures, accrued interest thereon and its NSHI preferred stock for 12.9% of the issued common stock of NSHI, giving AmerAlia an aggregate ownership position in NSHI of 18%. |

| | 3. | Intercompany loans between AmerAlia and NSHI were extinguished. |

| | 4. | Sentient received an aggregate of 27,875,047 shares of AmerAlia common stock as follows: |

| | (a) | 15,277,778 shares of AmerAlia common stock for a total purchase price of $5,500,000; |

| | (b) | 6,619,469 shares in satisfaction of various promissory notes valued at $2,383,009 and |

| | (c) | 5,977,800 shares in satisfaction of debts valued at $2,853,180, indemnification rights, as discussed below, and obligations acquired from the Mars Trust in August 2007. |

AMERALIA, INC. AND SUBSIDIARIES

Notes to the Consolidated Financial Statements

| NOTE 2 - | COMPLETED RESTRUCTURING AGREEMENT (Continued) |

| | 5. | Officers and Directors acquired 5,100,858 shares of AmerAlia Common Stock in satisfaction of Series A Debenture Secured Promissory Notes, unsecured notes and accrued compensation valued at $1,836,309. |

| | 6. | Other accredited investors acquired 2,433,706 shares in satisfaction of $876,134 worth of Series A Debenture Secured Promissory Notes. |

Sentient no longer holds any debt in either AmerAlia or NSHI. All Series A Debentures, Series B1 Debentures and Series C Debentures issued by NSHI were cancelled. Following the first closing NSI again became a wholly-owned subsidiary of NSHI.

On December 31, 2008 Sentient purchased an additional 12,149,628 shares of AmerAlia Common Stock for $4,373,866 at the second closing. The proceeds from the second closing have been reserved for use in the following priority: (a) as a working capital reserve for AmerAlia of $1,000,000 and (b) as a reserve solely to fund AmerAlia’s share of an anticipated capital call by NSHI, AmerAlia’s share of which is $2,880,000 and (c) additional working capital for AmerAlia.

In June 2007 AmerAlia’s debt to the Bank of America was repaid by the Mars Trust under a guaranty agreement with the Mars Trust. Consequently, AmerAlia recognized a related party contribution to capital of $9,938,022. The Mars Trust held a right to indemnification from AmerAlia under the guaranty agreement. Sentient acquired this indemnification right from the Mars Trust along with various other debts and shares in August 2007. Any potential claim on AmerAlia under the indemnification right was extinguished at the first closing of the restructuring agreement.

In June 2008 a promissory note with a principal value of $1,200,000 previously due to HPD was acquired by the Sentient Entities. Under the Restructuring Agreement discussed below, Sentient agreed to accept interest at the rate of 6% per year on the note from June 20, 2008, the acquisition date. AmerAlia had previously provided for interest payable to HPD. As a result of the acquisition and by agreement with the related party, this interest provision was extinguished. Consequently, a gain on the forgiveness of debt of $536,640 was recorded as a contribution to capital.

In September 2008 AmerAlia issued 1,402,200 shares of restricted common stock to holders of Series C Debenture secured promissory notes in satisfaction and cancellation of such notes and accrued interest with a total value of $3,311,367. One of the holders was a related party. Consequently, the gain on cancellation of debt resulted in a contribution to capital of $878,397 from the issue of 495,820 shares of AmerAlia’s common stock valued at $297,492. The other holder, an accredited investor accepted 906,380 shares of AmerAlia’s common stock valued at $543,828 and AmerAlia recorded a gain on settlement of debt of $1,591,650.

Following the second closing of the restructuring, Sentient now owns 72.4% of AmerAlia’s common stock. When combined with its additional purchase rights and options, Sentient’s beneficial ownership is 74.7%. In addition, pursuant to the Restructuring Agreement, Sentient has the right to nominate Peter Cassidy and up to three additional suitably qualified persons for election by the shareholders as directors of AmerAlia.

The changes in control of both AmerAlia and NSHI have resulted in restrictions on the companies’ use of their net operating loss carryforwards.

AMERALIA, INC. AND SUBSIDIARIES

Notes to the Consolidated Financial Statements

December 31, 2008

| NOTE 3 - | INVESTMENT IN NATURAL SODA HOLDINGS, INC. |

| | Under the equity method of accounting, only AmerAlia’s investment in and amounts due to and from NSHI and its direct subsidiary, NSI, have been included in AmerAlia’s balance sheet. As a result, AmerAlia recorded an asset in AmerAlia’s balance sheet related to AmerAlia’s investment interest in NSHI. The following is the consolidated balance sheet for NSHI and NSI as of March 31, 2009 and consolidated income statement for the five months ended March 31, 2009: |

| Consolidated Balance Sheet as at March 31, 2009 | |

| | |

| ASSETS | | | |

| Cash | | $ | 121,478 | |

| Accounts receivable | | | 3,073,313 | |

| Inventories | | | 997,390 | |

| Prepaid expenses | | | 375,201 | |

| Total Current Assets | | | 4,567,382 | |

| | | | | |

| Property, plant and equipment, net | | | 9,170,391 | |

| Cavities and well development, net | | | 5,171,996 | |

| Mineral leases | | | 4,167,471 | |

| Total Fixed Assets | | | 18,509,858 | |

| | | | | |

| Water rights | | | 3,150,582 | |

| Patents, net | | | 23,724 | |

| Engineering drawings | | | 1,876,000 | |

| Equipment held and not yet in service | | | 3,197,842 | |

| Well and well development, RSL | | | 595,000 | |

| Acquisition costs, net | | | 741,590 | |

| Rock School Lease & reserves | | | 3,300,000 | |

| Deposits and bonds | | | 9,000 | |

| Restricted funds | | | 1,937,480 | |

| Total Other Assets | | | 14,831,218 | |

| | | | | |

| TOTAL ASSETS | | $ | 37,908,458 | |

| | | | | |

| LIABILITIES | | | | |

| Accounts payable | | $ | 894,502 | |

| Royalties payable | | | 81,400 | |

| Accrued expenses | | | 364,565 | |

| Loan from AmerAlia | | | 806,754 | |

| Notes payable, current | | | 1,380,240 | |

| Capital leases, current portion | | | 22,033 | |

| Total Current Liabilities | | | 3,549,494 | |

| | | | | |

| Notes payable, long term | | | 6,224 | |

| Capital leases, non-current portion | | | 13,478 | |

| Asset retirement obligations | | | 873,759 | |

| Total Long Term Liabilities | | | 893,461 | |

| | | | | |

| TOTAL LIABILITIES | | $ | 4,442,955 | |

| | | | | |

| EQUITY | | | | |

| Common stock | | | 10,000 | |

| Additional paid in capital | | | 116,084,415 | |

| Accumulated deficit | | | (82,628,912 | ) |

| TOTAL EQUITY | | | 33,465,503 | |

| | | | | |

| TOTAL LIABILITIES AND EQUITY | | $ | 37,908,458 | |

AMERALIA, INC. AND SUBSIDIARIES

Notes to the Consolidated Financial Statements

| NOTE 3 - | INVESTMENT IN NATURAL SODA HOLDINGS, INC. (Continued) |

Consolidated Statement of Operations For Five Months ended March 31, 2009 | |

| | |

| Revenues | | $ | 8,097,750 | |

| Cost of sales | | | (5,850,991 | ) |

| Gross Profit | | | 2,246,759 | |

| | | | | |

| General and administrative expenses | | | 68,838 | |

| Depreciation and amortization expense | | | 1,072,532 | |

| Total expenses | | | 1,141,370 | |

| | | | | |

| Income from operations | | | 1,105,389 | |

| | | | | |

| Interest expense | | | (182,962 | ) |

| Interest income | | | 362 | |

| Total Other income (expense) | | | (182,600 | ) |

| | | | | |

| Net Income | | $ | 922,789 | |

| | | | | |

| NOTE 4 - | OUTSTANDING STOCK OPTIONS AND PURCHASE WARRANTS |

During the nine months ended March 31, 2009, AmerAlia granted options to purchase 187,500 shares of AmerAlia common stock. Under the shareholder approved 2001 Directors’ Incentive Plan, each director (who is not an employee or officer) is granted an option to purchase 75,000 shares when joining the Board of Directors. In addition, options to purchase 37,500 shares are granted to each such director sitting at July 1 of each year. The exercise price for these options is the average market price during the month preceding each grant date, and the options have a three-year term. All options under this plan are exercisable six months after the date of grant.

As a result of applying SFAS No. 123(R) to these stock options granted to board members, AmerAlia recorded an expense of $138,285 for the nine months ended March 31, 2009. This expense is included in the general and administrative amount of the statement of operations. Under FASB Statement 123, AmerAlia estimates the fair value of each stock option award at the grant date by using the Black-Scholes option pricing model with the following weighted average assumptions used for grants: dividend yield of zero percent for all years; expected volatility of 172.58%, risk-free interest rate of 2.50 percent and expected life of 3.0 years.

A summary of the status of AmerAlia’s stock options and warrants as of June 30, 2008 and changes during the nine months ended March 31, 2009 is presented below:

| | | | | | Weighted | |

| | | Options, | | | Average | |

| | | Warrants | | | Exercise | |

| | | and SARs | | | Price | |

| Outstanding June 30, 2008 | | | 3,615,000 | | | $ | 1.01 | |

| Granted (Unaudited) | | | 187,500 | | | $ | 0.88 | |

| Expired/Cancelled | | | (2,500,000 | ) | | $ | 1.00 | |

| Exercised | | | - | | | | - | |

| Outstanding, March 31, 2009 (Unaudited) | | | 1,302,500 | | | $ | 1.00 | |

| Vested, March 31, 2009 (Unaudited) | | | 1,302,500 | | | $ | 1.00 | |

AMERALIA, INC. AND SUBSIDIARIES

Notes to the Consolidated Financial Statements

December 31, 2008

NOTE 4 - - OUTSTANDING STOCK OPTIONS AND PURCHASE WARRANTS (continued)

The following summarizes the exercise price per share and expiration date of AmerAlia's outstanding options and warrants to purchase common stock at March 31, 2009:

| Expiration Date | | Price | | | Number | |

| | | | | | | |

| April 18, 2009 | | $ | 0.71 | | | | 540,000 | |

| April 18, 2009 | | $ | 3.00 | | | | 200,000 | |

| June 30, 2009 | | $ | 0.41 | | | | 187,500 | |

| June 30, 2010 | | $ | 0.40 | | | | 187,500 | |

| June 30, 2011 | | $ | 0.88 | | | | 187,500 | |

| | | | | | | | 1,302,500 | |

NOTE 5 - - LIQUIDITY

AmerAlia’s financial statements are prepared using generally accepted accounting principles applicable to a going concern which contemplate the realization of assets and liquidation of liabilities in the normal course of business. As a result of the recent restructuring, AmerAlia holds an investment in NSHI which is unlikely to produce sufficient distributions of income to meet AmerAlia’s overhead expenses in the short term. As the effect of the restructuring has been to repay nearly all of AmerAlia’s obligations, AmerAlia expect that the operating costs of AmerAlia will be reduced to approximately $1,000,000 annually. In addition, NSHI may call on its shareholders for additional capital. While AmerAlia has reserved $2,880,000 to meet an anticipated capital call, its remaining cash reserves are required to sustain AmerAlia’s operations and repay obligations.

Under the Restructuring Agreement, Sentient has the right to purchase up to a total of 5,500,000 additional shares of AmerAlia’s common stock at $0.36 per share until October 31, 2011. This right can only be exercised to resolve obligations of AmerAlia that existed at the first closing and have not been discharged, and only then if the holders of the unpaid obligations pursue or threaten to pursue claims against AmerAlia or AmerAlia’s affiliates.

In view of these conditions, AmerAlia’s ability to continue as a going concern is dependent upon its ability to obtain additional financing or capital sAmerAlia’sces to meet its ongoing obligations. AmerAlia’s ability to obtain further financing through the offer and sale of AmerAlia’s securities is subject to market conditions and other factors beyond AmerAlia’s control. There is no assurance AmerAlia will be able to obtain financing on favorable terms or at all. If cash is insufficient to fund its business operations, they could be adversely affected. Insufficient funds may require delay, scaling back or eliminating expenses and/or employees.

| ITEM 2: | MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS |

The information in this Quarterly Report on Form 10-Q contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These forward-looking statements involve risks and uncertainties regarding the intent, belief or current expectations of us, AmerAlia’s directors or AmerAlia’s officers. Any statements contained herein that are not statements of historical facts may be deemed to be forward-looking statements. In some cases, you can identify forward-looking statements by terminology such as "may", "will", "should", "expect", "plan", "intend", "anticipate", "believe", "estimate", "predict", "potential" or "continue", the negative of such terms or other comparable terminology. Actual events or results may differ materially. In evaluating these statements, you should consider various factors, including the risks AmerAlia outlines from time to time in other reports AmerAlia files with the Securities and Exchange Commission (the “SEC”) including AmerAlia’s Annual Report on Form 10-KSB. These factors may cause AmerAlia’s actual results to differ materially from any forward-looking statement. AmerAlia disclaims any obligation to publicly update these statements, or disclose any difference between AmerAlia’s actual results and those reflected in these statements. The information constitutes forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Given these uncertainties, readers are cautioned not to place undue reliance on such forward-looking statements.

Cautionary Note to US Investors - The SEC limits disclosure for U.S. reporting purposes to mineral deposits that a company can economically and legally extract or produce. The reader is cautioned that the terms "resource," "indicated" and "inferred" are not terms recognized by SEC guidelines for disclosure of mineral properties.

AmerAlia’s business is to identify and develop natural resource assets. AmerAlia participates in the management and development of the natural sodium bicarbonate resources and water rights owned by AmerAlia’s former direct subsidiary, Natural Soda Holdings, Inc. and its subsidiary, Natural Soda, Inc. (collectively, “NSHI”). As discussed below, AmerAlia has recently completed a recapitalisation of its capital structure, its assets and its debt obligations.

In summary, NSHI expanded its capital so that 82% of its equity is held by Sentient in exchange for:

| | · | settling various debt obligations totalling $72,133,921 owed to Sentient, and |

| | · | transferring the 46.5% ownership of Natural Soda held by Sentient to NSHI so that Natural Soda is again wholly owned by NSHI. |

NSHI also issued equity to extinguish outstanding obligations due to AmerAlia so that AmerAlia now owns the remaining 18% of NSHI. Except for the existing credit facility with the Wells Fargo Bank and trade creditor obligations and normal provisions as shown in the accompanying financial statements, NSHI is free of debt.

In connection with this restructuring, AmerAlia also raised approximately $10 million in cash, settled approximately $12 million of debt, terminated indemnification rights relating to the extinguishment of a $9.9 million bank loan last year and extinguished other obligations in exchange for the issue of 48,961,439 shares of its common stock. AmerAlia now has 66,259,946 shares of its common stock issued and outstanding of which Sentient now owns 72.4%.

This restructuring is discussed more fully below at Liquidity and Capital resources. AmerAlia has used the cash to significantly reduce AmerAlia’s creditor obligations while AmerAlia has reserved $1,000,000 for working capital and $2,880,000 for AmerAlia’s share of up to $16 million of further investment in NSHI.

NSHI owns the largest Bureau of Land Management (“BLM”) leases in the Piceance Creek basin which contains the largest known deposits of nahcolite, naturally occurring sodium bicarbonate, in the world. Its leases are located near the depositional center of the basin where the nahcolite beds are thickest and most concentrated. Consequently, AmerAlia believes these deposits are unique and capable of producing sodium bicarbonate and related sodium products for many generations. NSHI also has water rights in the Piceance Creek basin, a part of the Colorado River drainage system. These various rights allow us under certain circumstances to draw up to a maximum of 108,812 acre feet (35.46 million gallons) annually and to store up to 7,980 acre feet of water.

NSHI produces various grades of sodium bicarbonate recovered from its nahcolite resource using solution mining. AmerAlia’s efforts to improve NSHI’s business performance are based on NSHI’s three objectives of being a low cost producer of all grades of sodium bicarbonate, increasing NSHI’s market penetration of the North American market and increasing the price at which NSHI sells its product. AmerAlia believes that NSHI is now the second largest supplier of sodium bicarbonate in North America. AmerAlia considers that while NSHI has demonstrated progress toward these objectives, NSHI has not yet achieved its full capabilities. AmerAlia has invested heavily in NSHI’s production capacity, particularly NSHI’s cavities which are the source of both NSHI’s natural sodium bicarbonate and NSHI’s strategic low cash cost of production advantage over its competitors. NSHI intends to secure its production capability by installing further cavities and improving or increasing its surface processing capability.

NSHI acquired the majority of its assets in February 2002 and since then AmerAlia has accomplished much to develop NSHI’s business. NSHI’s annual sales in tonnages and gross revenues have grown as shown in the following tables:

| | | |

| Fiscal | Sales (tons) | % Change |

| Year | | on prior FY |

| 2004 | 84,103 | |

| 2005 | 85,038 | + 1.1 |

| 2006 | 88,910 | + 4.6 |

| 2007 | 101,970 | +14.7 |

| 2008 | 101,614 | -0.4 |

| | | |

| Fiscal | Gross Revenues | % Change |

| Year | ($) | on prior FY |

| 2004 | 12,609,041 | |

| 2005 | 14,141,500 | + 12.2 |

| 2006 | 15,293,688 | + 8.1 |

| 2007 | 16,951,997 | + 10.8 |

| 2008 | 17,947,800 | + 5.9 |

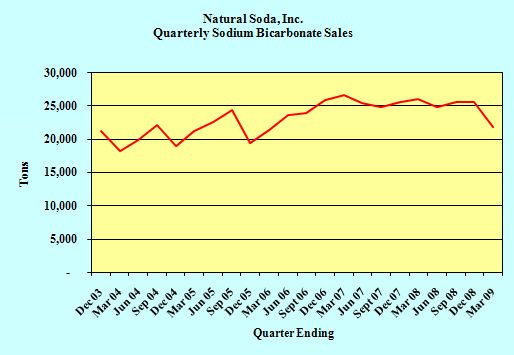

NSHI’s current sales have generally been limited by NSHI’s production capacity and customer orders. This performance is illustrated on a quarterly basis in the following graph.

NSHI’s plant has a nameplate capacity of 125,000 tons of production per year. The facility has, because of limitations in the capacity of the cavities to deliver an adequate volume and concentration of brine and the occasional limitations of the market, never produced at or near nameplate capacity. Its highest production ever achieved was 102,514 tons in CY2008. NSHI does not know the actual current capacity of the mine and plant although NSHI believes that it may exceed 103,000 tons per year with the current configuration of the facilities.

NSHI’s operations to recover sodium products from these leases are governed by a BLM approved mine plan. Currently, NSHI is recovering sodium bicarbonate from three cavities. As the need for an additional cavity arises, NSHI proposes a new cavity in accordance with the Mine Plan and after a period of consultation, the BLM authorizes the recovery of an amount of additional sodium bicarbonate. Consequently, NSHI is able to maintain its operations and retain access to this resource. The following table illustrates this process for the last three years:

Authorized Recovery (tons) | |

| | | | | | | | | |

| December 31, 2005 | | | | | | | | | 425,493 | |

| December 31, 2006 | | | - | | | | (98,740 | ) | | | 326,753 | |

| December 31, 2007 | | | - | | | | (99,065 | ) | | | 227,688 | |

| December 31, 2008 | | | 150,000 | | | | (102,515 | ) | | | 275,173 | |

During the three months ended March 31, 2009 NSHI removed a further 23,275 tons so that the remaining balance at March 31, 2009 was 251,898 tons. From time to time the amount of the sodium bicarbonate in the brine and the recovery rate from the cavities varies which can cause lower production rates. To ensure a reliable supply of feed liquor NSHI plans to install more cavities.

As AmerAlia’s investment and participation in NSHI is AmerAlia’s principal business activity, a review of NSHI’s performance is warranted. The following data shows that in both the last quarter and the last nine months, the primary factor improving business performance over comparable prior periods has been the higher sale prices increasing revenue at a rate greater than increasing cost of sales. These gains have been partly offset by higher depreciation and amortization expense due to higher amortization costs of NSHI’s well field capital expenditures and result from amortising capital expenditures previously classified as construction in progress. However, particularly noteworthy, the following data demonstrates the strong improvement in NSHI’s operating performance in the last quarter relative to the fiscal year to date. Approximately one half of the gross profit for the nine months has been earned in the last quarter when NSHI increased its list prices and achieved further wide ranging reductions in its costs. The resulting income from operations for the nine months represents a $679,986 improvement over the comparable period last year.

| NSHI Operating Results Nine Months ended | |

| | | March 31, 2009 | | | March 31, 2008 | |

| Tonnage Sold | | | 76,669 | | | | 75,801 | |

| Revenues | | $ | 17,479,936 | | | $ | 13,735,089 | |

| Cost of Sales | | $ | 15,381,714 | | | $ | 12,888,614 | |

| Gross Profit | | $ | 2,098,222 | | | $ | 846,475 | |

| General & administrative expenses | | $ | 190,382 | | | $ | 140,577 | |

| Depreciation and amortization | | $ | 1,939,242 | | | $ | 1,417,286 | |

| Total expenses | | $ | 2,129,624 | | | $ | 1,557,863 | |

| Income (Loss) from operations | | $ | (31,402 | ) | | $ | (711,388 | ) |

| | | | | | | | | |

| NSHI Operating Results Three Months ended | |

| | | March 31, 2009 | | | March 31, 2008 | |

| Tonnage Sold | | | 25,404 | | | | 26,163 | |

| Revenues | | $ | 5,653,321 | | | $ | 4,579,789 | |

| Cost of Sales | | | 4,611,630 | | | | 4,817,005 | |

| Gross Profit (Loss) | | | 1,041,691 | | | | (237,216 | ) |

| General & administrative expenses | | | 41,706 | | | | 2,891 | |

| Depreciation and amortization | | | 623,974 | | | | 470,825 | |

| Total expenses | | | 665,680 | | | | 473,716 | |

| Income (Loss) from operations | | $ | 376,011 | | | $ | (710,932 | ) |

| | | | | | | | | |

As a result of the closing of the restructuring agreement AmerAlia’s financial statements reflect AmerAlia’s results with NSHI’s results on a consolidated basis for the period July 1, 2008 to October 31, 2008 and thereafter using the equity method of accounting. AmerAlia’s revenues received through October 31, 2008 were $6,526,895 and AmerAlia’s cost of goods sold, $5,206,712 resulting in a gross profit of $1,320,183. Depreciation and amortization charges were $867,710. After general and administrative expenses of $775,562 for the entire nine months AmerAlia’s net loss from operations was $323,089. AmerAlia recorded a net gain on debt settlements of $1,250,932 and other income of $400,114 associated with AmerAlia’s restructuring transactions. In addition, AmerAlia earned interest income of $1,896 and recorded a financing cost associated with a discount on a note payable of $209,449 that was subsequently exchanged for equity. AmerAlia’s resulting net loss for the nine months was $5,606,755 largely attributable to interest expense of $6,727,159. AmerAlia’s net loss for the third quarter was $85,183 after providing for minority interests.

In addition to the development of the sodium bicarbonate business, AmerAlia has identified potential value in NSHI’s extensive water rights and while NSHI has completed an agreement to sell water to NSHI’s neighbor, Shell, for its oil shale research facility, NSHI’s initial sales have not been significant and NSHI intends to devote more attention to generating more sales from this resource.

AmerAlia also believes, based on third party reports, that the Piceance Creek Basin, where NSHI’s leases are located, holds a significant amount of oil shale and that some of NSHI’s sodium leases are intermingled with significant amounts of oil shale. In the Cole report described on Page 5 of AmerAlia’s Annual Report on Form 10K for the year ended June 30, 2008, discussing one of NSHI’s sodium leases, the author reports “Shale-Oil resources for the Saline zone under the lease are between 12 and 14 billion barrels.” Also, a USGS fact sheet, “Assessment of In-Place Oil Shale Resources of the Green River Formation, Piceance Basin, Western Colorado”, issued in March 2009, reported that the US Geological Survey estimated a total of 1,525 trillion barrels of oil in place in the seventeen oil shale zones in the Eocene Green River Formation in the Piceance Basin, western Colorado.

NSHI currently does not have the right to evaluate or extract these oil shale resources and the Department of Interior does not have any current rules for applying for a lease to evaluate or extract these resources, even on a research basis. If the Department of Interior issues rules for applying for oil shale research leases, NSHI may apply for a lease to evaluate these oil shale resources to determine whether NSHI can extract the oil shale on a commercially viable basis. The Department of Interior may never issue new rules for leases to evaluate or extract oil shale and if they do, NSHI may not qualify for such a lease.

Since the exploitation of natural resources is a goal of AmerAlia, AmerAlia believes it is important to alert AmerAlia’s shareholders to the existence of these oil shale resources in the region of the Piceance Creek basin even though NSHI does not have any rights to extract oil shale resources; including those AmerAlia believes are intermingled with NSHI’s sodium bicarbonate resources. Neither AmerAlia nor NSHI has conducted any additional studies on oil shale resources on the Rock School lease or the other Wolf Ridge leases or exploration to confirm their existence, nor have AmerAlia or NSHI attempted to confirm the viability of recovering oil from oil shale.

Liquidity and Capital Resources

As summarized above, AmerAlia, NSHI and its then 46.5% owned subsidiary, NSI; Bill H. Gunn and Robert van Mourik, Directors and executive officers of AmerAlia (collectively the “AmerAlia parties”) entered into a Restructuring Agreement with the Sentient Entities on September 25, 2008. On October 31, 2008 the AmerAlia Parties and the Sentient Entities completed an Amendment to the Restructuring Agreement. As a result of the amendment, the restructuring transaction was divided into two closings. In accordance with the amended agreement the first closing occurred as of October 31, 2008. Prior to the first closing, the Sentient Entities transferred their various interests to Sentient USA Resources Fund, L.P. (“Sentient”). In the first closing:

| 1. | Sentient exchanged all its Series A Debentures and Series B1 Debentures, accrued interest and rights to contingent interest thereon, its one share of NSHI common stock and its 53.5% of the common stock of NSI for 82% of the issued common stock of NSHI. |

| 2. | AmerAlia exchanged its Series A Debentures and Series C Debentures, accrued interest thereon and its NSHI preferred stock for 12.9% of the issued common stock of NSHI, giving AmerAlia an aggregate ownership position in NSHI of 18%. |

| 3. | Intercompany loans between AmerAlia and NSHI were extinguished. |

| 4. | Sentient received an aggregate of 27,875,047 shares of AmerAlia common stock as follows: |

| | (a) | 15,277,778 shares of AmerAlia common stock for a total purchase price of $5,500,000; |

| | (b) | 6,619,469 shares in satisfaction of various promissory notes valued at $2,383,009 and |

| | (c) | 5,977,800 shares in satisfaction of debts valued at $2,853,180, indemnification rights, as discussed below, and obligations acquired from the Mars Trust in August 2007. |

| 5. | Officers and Directors acquired 5,100,858 shares of AmerAlia Common Stock in satisfaction of Series A Debenture Secured Promissory Notes, unsecured notes and accrued compensation valued at $1,836,309. |

| 6. | Other accredited investors acquired 2,433,706 shares in satisfaction of $876,134 worth of Series A Debenture Secured Promissory Notes. |

Sentient no longer holds any debt in either AmerAlia or NSHI. All Series A Debentures, Series B1 Debentures and Series C Debentures issued by NSHI were cancelled. Following the first closing NSI again became a wholly-owned subsidiary of NSHI.

On December 31, 2008 Sentient purchased an additional 12,149,628 shares of AmerAlia Common Stock for $4,373,866 at the second closing. The proceeds from the second closing have been reserved for use in the following priority: (a) as a working capital reserve for AmerAlia of $1,000,000 (b) as a reserve solely to fund AmerAlia’s share of an anticipated capital call by NSHI, AmerAlia’s share of which is $2,880,000 and (c) additional working capital for AmerAlia.

In June 2007 AmerAlia’s debt to the Bank of America was repaid by the Mars Trust under a guaranty agreement with the Mars Trust. Consequently, AmerAlia recognized a related party contribution to capital of $9,938,022. The Mars Trust held a right to indemnification from AmerAlia under the guaranty agreement. Sentient acquired this indemnification right from the Mars Trust along with various other debts and shares in August 2007. Any potential claim on AmerAlia under the indemnification right was extinguished at the first closing of the restructuring agreement.

In June 2008 a promissory note with a principal value of $1,200,000 previously due to HPD was acquired by the Sentient Entities. Under the Restructuring Agreement discussed below, Sentient agreed to accept interest at the rate of 6% per year on the note from June 20, 2008, the acquisition date. AmerAlia had previously provided for interest payable to HPD. As a result of the acquisition and by agreement with the related party, this interest provision was extinguished. Consequently, a gain on the forgiveness of debt of $536,640 was recorded as a contribution to capital.

In September 2008 AmerAlia issued 1,402,200 shares of restricted common stock to holders of Series C Debenture secured promissory notes in satisfaction and cancellation of such notes and accrued interest with a total value of $3,311,367. One of the holders was a related party. Consequently, the gain on cancellation of debt resulted in a contribution to capital of $878,397 from the issue of 495,820 shares of AmerAlia’s common stock valued at $297,492. The other holder, an accredited investor accepted 906,380 shares of AmerAlia’s common stock valued at $543,828 and AmerAlia recorded a gain on settlement of debt of $1,591,650.

Following the second closing of the restructuring, Sentient now owns 72.4% of AmerAlia’s common stock. When combined with its additional purchase rights and options, Sentient’s beneficial ownership is 74.7%. In addition, pursuant to the Restructuring Agreement, Sentient has the right to nominate Peter Cassidy and up to three additional suitably qualified persons for election by the shareholders as directors of AmerAlia.

The changes in control of both AmerAlia and NSHI have resulted in restrictions on the companies’ use of their net operating loss carryforwards.

AmerAlia’s financial statements reflect these activities and the deconsolidation of AmerAlia’s subsidiaries. In summary, AmerAlia raised cash through the sale of shares netting $9,873,866 and drawing down the balance of a related party note payable for $260,000. AmerAlia used cash to reduce AmerAlia’s accounts payable by $1,089,156, accrued liabilities by $1,018,445 and interest payable by $378,279. AmerAlia invested $122,380 in NSHI’s cavities and $26,743 on plant and equipment. AmerAlia repaid AmerAlia’s bank overdraft of $54,113, related party debts with $980,000 and other debt obligations with $1,444,150. AmerAlia provided a short term loan to NSHI of $806,754 to enable it to meet a demand by the BLM to increase the amount of security bonding required to sustain its operations. NSHI is currently establishing alternative arrangements to repay this loan. AmerAlia had $3,932,407 in cash at the end of March.

As a result of this restructuring, AmerAlia holds an investment in NSHI which is unlikely to produce sufficient distributions of income to meet AmerAlia’s overhead expenses in the short term. As the effect of the restructuring has been to repay nearly all of AmerAlia’s obligations, AmerAlia expect that AmerAlia’s operating costs will be reduced to approximately $1,000,000 annually. In addition, NSHI may call on its shareholders for additional capital. While AmerAlia have reserved $2,880,000 to meet an anticipated capital call, AmerAlia’s remaining cash reserves are required to sustain AmerAlia’s operations and repay remaining obligations.

Under the Restructuring Agreement, Sentient has the right to purchase up to a total of 5,500,000 additional shares of AmerAlia’s common stock at $0.36 per share until October 31, 2011. This right can only be exercised to resolve obligations of AmerAlia that existed at the first closing and have not been discharged, and only then if the holders of the unpaid obligations pursue or threaten to pursue claims against us or AmerAlia’s affiliates.

In view of these conditions, AmerAlia’s ability to continue as a going concern is dependent upon obtaining additional financing or capital sources. AmerAlia’s ability to obtain further financing through the offer and sale of AmerAlia’s securities is subject to market conditions and other factors beyond AmerAlia’s control. AmerAlia cannot assure you that AmerAlia will be able to obtain financing on favorable terms or at all. If AmerAlia’s cash is insufficient to fund AmerAlia’s business operations, AmerAlia’s business operations could be adversely affected. Insufficient funds may require us to delay, scale back or eliminate expenses and or employees.

AmerAlia does not expect any significant change in the number of employees in AmerAlia. In NSHI, AmerAlia does not expect the sale of any significant equipment nor any significant change in the number of NSHI’s employees now that NSHI has established its staffing requirements. NSHI’s objective in product research and development is to identify customer needs that present opportunities for securing improved prices and tonnages while continuing to improve plant output through additional cavities and plant improvements.

Off-Balance Sheet Arrangements

AmerAlia does not have any significant off-balance sheet arrangements that have or are reasonably likely to have a current or future effect on AmerAlia’s financial condition, changes in financial condition, revenues or expenses, results of operations, liquidity, capital expenditures or capital resources that is material to investors. From time to time, NSHI may enter into forward purchases of gas to secure fixed prices.

ITEM 4: CONTROLS AND PROCEDURES

As required by Rule 13a-15 under the Securities Exchange Act of 1934 and Item 307 of Regulation S-K AmerAlia carried out an evaluation of the effectiveness of the design and operation of AmerAlia’s disclosure controls and procedures within the 90 days prior to filing this report. This evaluation was carried out under the supervision and with the participation of AmerAlia’s Chief Executive Officer and AmerAlia’s Chief Financial Officer who concluded that AmerAlia’s disclosure controls and procedures are not effective.

Disclosure controls and procedures are controls and other procedures that are designed to ensure that information required to be disclosed in AmerAlia’s reports filed or submitted under the Exchange Act is recorded, processed, summarized and reported within the time periods specified in the Securities and Exchange Commission’s rules and forms. Disclosure controls and procedures include, without limitation, controls and procedures designed to ensure that information required to be disclosed in AmerAlia’s reports filed under the Exchange Act is accumulated and communicated to management, including AmerAlia’s Chief Executive Officer and AmerAlia’s Chief Financial Officer as appropriate, to allow timely decisions regarding required disclosure.

AmerAlia’s material weaknesses in AmerAlia’s disclosure controls relate to AmerAlia’s and NSHI’s failure to retain sufficient qualified accounting professionals, insufficient segregation of duties and improper implementation of appropriate processes for recording transactions. Throughout 2006 and 2007 NSHI experienced difficulties in retaining qualified accounting professionals to supervise accounting functions at NSI resulting in the engagement of an external contractor in November 2007 with adequate resources and qualifications to fulfill that role. A lack of financial resources and personnel caused insufficient segregation of duties and an inability to properly record transactions and ensure (i) the accuracy of AmerAlia’s financial reports without requiring additional analyses and other post-closing procedures and (ii) compliance with generally accepted accounting principles.

In response to these material weaknesses AmerAlia and NSHI have been strengthening their accounting functions and have provided additional resources for their operation. AmerAlia and NSHI have implemented several improvements to their procedures and NSHI is continuing to train staff and introduce new procedures to overcome these deficiencies.

There has been no change in AmerAlia’s internal control over financial reporting, except as described above, during the three months ended March 31, 2009 that has materially affected, or is reasonably likely to materially affect, AmerAlia’s internal control over financial reporting.

PART II: OTHER INFORMATION.

ITEM 1: LEGAL PROCEEDINGS

NSI owns water rights located in the Piceance Creek, Yellow Creek and White River basins within Colorado. NSI is involved in several cases pending in the District Court in and for Water Division No. 5 (“Water Court”). The proceedings in Water Court pertain to applications for water rights filed by NSI and objections to water rights applications by third parties. In addition, under Colorado law, the owner of conditional water rights must periodically file an application for determination of reasonable diligence in the development of the conditional water rights. The proceedings pertaining to the conditional water right must be filed within six years following the determination by the Court regarding the prior proceeding, or the water right is considered abandoned.

NSI is the applicant in the following cases: 1998CW315, 2005CW41, 2006CW135, 2006CW136 and 2007CW91:

NSI has filed a statement of opposition in the following cases: 2003CW82–Exxon Mobile Corporation, 2003CW309–Encana Oil & Gas (USA), Inc., 2003CW318–Encana Oil & Gas (USA), Inc., 2004CW110–Shell Frontier Oil & Gas, Inc., 2005CW285–Exxon Mobile Corporation, 2005CW294–Exxon Mobile Corporation, 2006CW263–Exxon Mobile Corporation, 2006CW265–Exxon Mobile Corporation, 2007CW242–Puckett Land Company, 2007CW253–XTO Energy Inc. and 2007CW254–Williams Production RMT Company.

Of the cases in which NSI has filed a statement of opposition the principal one is the objection to Shell Frontier Oil & Gas, Inc.’s application to move a water right from a tributary of the White River to a point on the White River lower down river than the off take point for NSI’s White River direct pumping right. If Shell were to be successful in their application it might adversely impact the value of NSI’s White River rights. NSI intends to vigorously oppose this move.

(a) Exhibits

| Certification of Chief Executive Officer pursuant to Section 302 of the Sarbanes Oxley Act of 2002 (filed herewith). |

| Certification of Chief Financial Officer pursuant to Section 302 of the Sarbanes Oxley Act of 2002 (filed herewith). |

| Certification of Chief Executive Officer pursuant to 18 U.S.C. Section 1350 (filed herewith). |

| Certification of Chief Financial Officer pursuant to 18 U.S.C. Section 1350 (filed herewith). |

Pursuant to the requirements of Section 13 or 15(d) of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

| Date: May 14, 2009 | AMERALIA, INC. |

| | By: /s/ Bill H Gunn |

| | Bill H. Gunn, President |