UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant x Filed by a Party other than the Registrant ¨

Check the appropriate box:

| ¨ | Preliminary Proxy Statement |

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ¨ | Definitive Proxy Statement |

| x | Definitive Additional Materials |

| ¨ | Soliciting Material Pursuant to §240.14a-12 |

Cedar Fair, L.P.

(Name of Registrant as Specified In Its Charter)

N/A

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| x | No fee required. |

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| (1) | Title of each class of securities to which transaction applies: |

| (2) | Aggregate number of securities to which transaction applies: |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| (4) | Proposed maximum aggregate value of transaction: |

| (5) | Total fee paid: |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| (1) | Amount Previously Paid: |

| (2) | Form, Schedule or Registration Statement No.: |

| (3) | Filing Party: |

| (4) | Date Filed: |

This filing relates to the proposed acquisition of Cedar Fair, L.P. (“Cedar Fair”) by an affiliate of Apollo Global Management (“Apollo”) pursuant to the terms of an Agreement and Plan of Merger, dated as of December 16, 2009, by and among Cedar Holdings Ltd (formerly known as Siddur Holdings, Ltd.) (“Parent”), Cedar Merger Sub LLC (formerly known as Siddur Merger Sub, LLC) (“Merger Sub”), Cedar Fair and Cedar Fair Management, Inc. Each of Parent and Merger Sub are affiliates of Apollo.

The following materials are for use in presentations to unitholders of Cedar Fair and certain proxy advisory firms on or after March 2, 2010.

1 Investor Presentation March 2, 2010 Confidential |

2 Forward Looking Statements Some of the statements contained in this presentation (including information included or incorporated by reference herein) may constitute "forward-looking statements" within the meaning of the safe harbor provisions of the United States Private Securities Litigation Reform Act of 1995, including statements as to Cedar Fair L.P.’s (“Cedar Fair” or the “Company”) expectations, beliefs and strategies regarding the future. These forward-looking statements may involve risks and uncertainties that are difficult to predict, may be beyond the Company's control and could cause actual results to differ materially from those described in such statements. Although the Company believes that the expectations reflected in such forward-looking statements are reasonable, we can give no assurance that such expectations will prove to be correct. Important factors could adversely affect the Company's future financial performance and cause actual results to differ materially from the Company's expectations, including uncertainties associated with the proposed sale of the Company to an affiliate of Apollo Global Management, the anticipated timing of filings and approvals relating to the merger, the expected timing of completion of the merger, the ability of third parties to fulfill their obligations relating to the proposed merger, the ability of the parties to satisfy the conditions to closing of the merger agreement to complete the merger and the risk factors discussed from time to time by the Company in reports filed with the Securities and Exchange Commission (the "SEC"). Additional information on risk factors that may affect the business and financial results of the Company can be found in the Company's Annual Report on Form 10-K and in the filings of the Company made from time to time with the SEC. The Company undertakes no obligation to correct or update any forward-looking statements, whether as a result of new information, future events or otherwise. |

3 Additional Information About This Merger This presentation may be deemed to be solicitation material in respect of the proposed merger. In connection with the proposed merger, on February 10, 2010 the Company filed a definitive proxy statement and a form of proxy with the SEC and the definitive proxy statement and a form of proxy are being mailed to the Company’s unitholders of record as of February 12, 2010. In addition, the Company will file with, or furnish, to the SEC all additional relevant materials. BEFORE MAKING ANY VOTING DECISION, INVESTORS AND SECURITY HOLDERS OF THE COMPANY ARE URGED TO READ ALL RELEVANT DOCUMENTS FILED WITH OR FURNISHED TO THE SEC, INCLUDING THE COMPANY’S DEFINITIVE PROXY STATEMENT, BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED MERGER. Investors and security holders will be able to obtain a copy of the definitive proxy statement and other documents filed by the Company free of charge from the SEC’s website, www.sec.gov. The Company’s unitholders will also be able to obtain, without charge, a copy of the definitive proxy statement and other relevant documents by directing a request by mail or telephone to Investor Relations, Cedar Fair, L.P., One Cedar Point Dr., Sandusky, OH 44870, telephone: (419) 627-2233, or from the Company’s website, www.cedarfair.com or by contacting MacKenzie Partners, Inc., by toll-free telephone at (800) 322-2885 or by e-mail at cedarfair@mackenziepartners.com. The Company and its directors and executive officers and certain other members of its management and employees may be deemed to participate in the solicitation of proxies in respect of the proposed merger. Additional information regarding the interests of such potential participants is included in the definitive proxy statement. |

4 Agenda I. Executive Summary II. Rationale for Merger A. Highest and Best Value for Cedar Fair Unitholders B. Challenges Facing Cedar Fair in the Absence of a Transaction a. Suspension of Distribution Inconsistent with Partnership Structure b. Execution Risk in Challenging Economic Environment c. Capital Structure Considerations III. Appendix |

5 Section I Executive Summary |

6 All Cash Merger is in the Best Interests of Unitholders Provides significant premium to public market valuation Premium valuation multiple relative to recent transactions in the industry Unanimous approval by Board after review of alternatives to maximize value Go shop process resulted in no additional proposals for the Company Merger consideration superior to stand-alone value Eliminates execution risk in uncertain economic environment Company is highly levered with limited cushion under its total leverage covenant Distributions are suspended and ability to make future distributions is uncertain Certain unit holders may be required to pay cash taxes on income allocated from the partnership even in the absence of cash distributions Partnership structure and historical distribution policy are unsustainable with the Company’s current financial leverage and capital investment requirements Inability to reduce debt and reduce leverage ratios, as well as a deterioration of current credit market conditions, could result in higher cash interest costs in the future and tighter contractual restrictions, including those related to the payment of distributions |

7 Section II Rationale for Merger |

8 A. Highest and Best Value for Cedar Fair Unitholders |

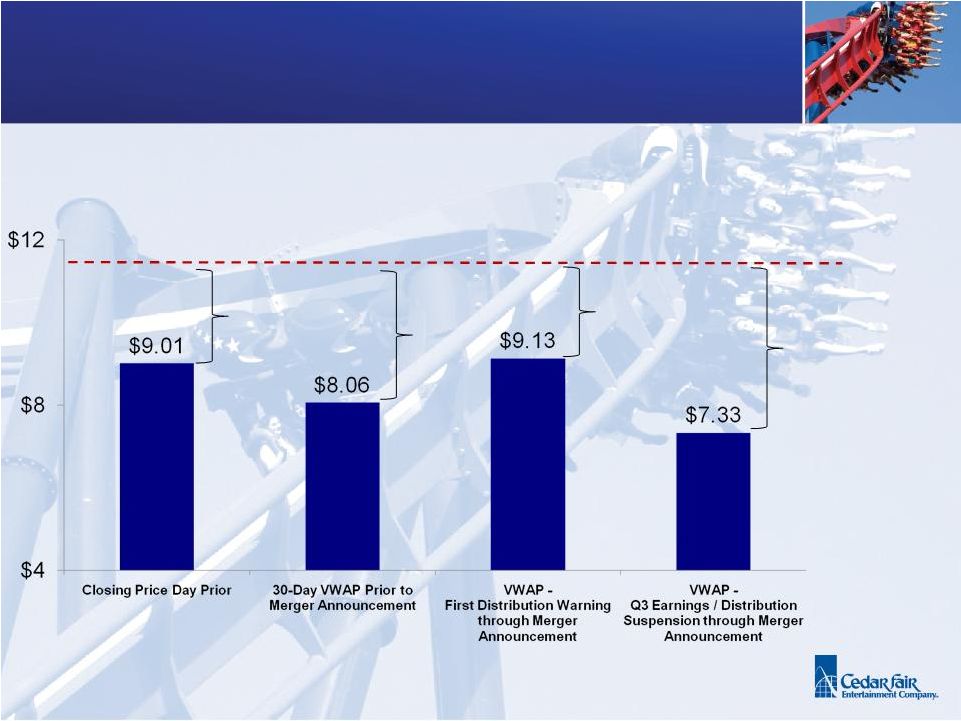

Highest and Best Value for Cedar Fair Unitholders Offer Price: $11.50 28% Premium 43% Premium 26% Premium 57% Premium Source: FactSet. (11/3/2009 - 12/15/2009) (1/23/2009 - 12/15/2009) Offer Price Represents a Significant Premium to Trading Values During the Last Year 9 |

10 $11.50 $4.82 $9.88 $0 $3 $6 $9 $12 $15 Cedar Fair Busch Entertainment Six Flags 7.6x 6.3x 7.2x 0x 3x 6x 9x Cedar Fair Busch Entertainment Six Flags Recent transaction activity involving Busch Entertainment and Six Flags provides relevant and timely valuation benchmarks for a change of control transaction in the industry • Reflects the two most comparable assets in the industry in terms of size and business mix • Both transactions involved broad and competitive sale processes that tested availability of debt and equity capital Cedar Fair and Comparable Transaction EV / 2009 EBITDA Multiples Illustrative Cedar Fair Unit Prices at Comparable EV / 2009 EBITDA Multiples (a) Based on 2009 adjusted EBITDA of $299.9mm plus $16.6 million of non-recurring items per Form 8-K filed on February 11, 2010. (b) Based on 2009 EBITDA. Excludes value associated with long-dated and contingent earnout. We estimate the multiple including the present value of this earnout (assuming it is achieved) is 6.8x (c) Based on plan of reorganization, which includes $450 million of new equity investment for control. Shown on a fully diluted basis after giving effect to Long Term Incentive Plan. (d) Equity value based on enterprise value less $1,540 million term debt, less $39 million revolver draw to repay term debt, less $9 million lawsuit settlement to be paid in 2010, less $130 million derivative liability, less $5.3 million Special L.P. interests (d) (d) (c) (a) (b) Merger Delivers a Premium to Recent Transactions in the Industry Highest and Best Value for Cedar Fair Unitholders (continued) |

11 A Thorough Go-Shop Process Confirmed the Merger Maximizes Value for All Unit Holders The Board fully and thoroughly negotiated a transaction with Apollo following its expression of interest The decision to engage in discussions was based on advice from financial advisors regarding other potential interested parties and the ability of Apollo to complete diligence review quickly Required an extensive go shop period and limited break-up fee in the event of a superior proposal Following announcement of the merger, the financial advisors conducted a broad go shop process: 32 parties contacted 6 signed non-disclosure agreements and received confidential information All information made available to Apollo also available to potential bidders No acquisition proposals were received, and the parties generally communicated either a lack of interest in the business or an inability to exceed Apollo’s valuation Highest and Best Value for Cedar Fair Unitholders (continued) |

12 Cedar Fair’s Board, with the help of its Financial Advisors, Rothschild Inc. and Guggenheim Securities, LLC, evaluated a range of other alternatives to fix the Company’s capital structure Sale of the Company Possible strategic combinations Conversion to a C-Corporation Issuance of equity (public or private) Status quo (including refinancing existing capital structure) None of these alternatives were determined to provide a better value to the unit holders than the $11.50 per unit value provided by the Merger Highest and Best Value for Cedar Fair Unitholders (continued) The Board considered all available additional strategic alternatives |

13 B. Challenges Facing Cedar Fair in the Absence of a Transaction |

14 a. Suspension of Distribution Inconsistent with Partnership Structure |

15 Suspension of the Distribution Inconsistent With Partnership Structure On November 3, 2009, Cedar Fair announced it expected to suspend the distribution beginning in 2010 and would continue to focus on reducing leverage This suspension is required by the Company’s credit agreement Maintenance of the distribution required continued growth in free cash flow and reduction of debt, which had not materialized due to continued significant capital investment requirements of the business and declining operating performance The Company believes it would be imprudent to reinstate the distribution (even if financing arrangements allowed) until we are able to reduce our outstanding debt to an appropriate level The suspension of distributions is inconsistent with the Company’s partnership structure and the basis on which many unit holders invested Certain unitholders will be required to report income or loss allocated from the partnership and pay any related tax liability even in the absence of receiving cash distributions Cedar Fair’s distributions to unitholders have been suspended and the return of future cash distributions is uncertain |

16 Several factors may make it difficult to immediately restore the distribution The revolving credit facility and term debt maturing in 2011 and 2012 need to be refinanced The inability to reduce debt and reduce leverage ratios, as well as a deterioration of current credit market conditions, could result in debt terms which reflect both higher overall interest expense and tighter contractual restrictions, including those related to the payment of distributions The Company will have a continual need to invest a meaningful proportion of available cash flow into the business The Company’s cash tax expense is expected to increase significantly, following full depreciation and amortization of basis step-up from the Paramount acquisition Even if the Company’s distribution were to be reinstated after leverage is reduced, the timing of a return to historical levels is uncertain Investor yield requirements are likely to be higher than in historical periods due to a forecasted rising interest rate environment and risks attributable to the Company’s capital structure, barring a restructuring The combination of the suspension of the distribution, the uncertainty surrounding reinstatement of the distribution, our current debt levels and increased investor yield requirements would likely put downward pressure on the Company’s unit price Therefore, the Board has concluded that the merger results in higher value to unit holders than remaining a public company Suspension of the Distribution Inconsistent With Partnership Structure (continued) |

17 b. Execution Risk in Challenging Economic Environment |

18 A number of factors impacting 2009 operating performance remain relevant when evaluating the Company’s future prospects National unemployment rate remains at 10% Consumer discretionary spending is under pressure Group sales were particularly impacted by the economic downturn Cedar Fair management mitigated revenue shortfall through aggressive cost cutting Overall economic environment even more challenging around certain core parks The table below summarizes operating performance in 2009 vs. 2008 ($ in millions) 12 Mos. Ended 12/31/2008 12 Mos. Ended 12/31/2009 % Change Attendance (000s) 22,700 21,100 (7%) Revenue $996.2 $916.1 (8.0%) Adj. EBITDA (b) $355.9 $299.9 (a) (15.7%) (a) Included in the 2009 Adj. EBITDA of $299.9 million is approximately $5.6 million of cash costs related to the merger transaction and $11.0 million in litigation settlements. (b) Reconciliation of Adj. EBITDA to net income is provided in the Appendix on p. 23 Execution Risk in Challenging Economic Environment |

19 Execution Risk in Challenging Economic Environment (continued) The Company’s ability to achieve historical levels of growth in the amusement park space is uncertain Historical value creation driven by acquisitions and expanding margins at acquired parks is likely to be more difficult to achieve going forward Economic outlook and attendance expectations for the future are uncertain The Company is constrained by its current capital structure and future credit market conditions are uncertain There is increasing competition in the leisure market, particularly in the younger demographic groups attracted to thrill rides Merger enables unitholders to maximize cash value today and avoid the uncertainty and execution risks associated with future operating results and the necessary refinancing of the Company’s debt Merger enables unitholders to maximize value today and avoid future risks and uncertainties |

20 c. Capital Structure Considerations |

21 Capital Structure Considerations As of December 31, 2009 Cedar Fair had total debt of $1,626 million During 2008 and 2009, as it became evident that Cedar Fair’s debt load was unsustainable, the Board explored a number of alternatives to reduce its debt and refinancing risk in order to strengthen its balance sheet and preserve the distribution, including: Divestiture of certain parks (not successful) Tender for outstanding term debt below par (not successful) Reduction in the distribution to unit holders from $1.92 per unit to $1.00 per unit in March 2009 followed by the indefinite suspension of the distribution Amendment to the Credit Facility to, among other things, extend the maturity on $900 million of its term loans from 2012 to 2014, which required an increase of the interest the rate on the extended portion from L+200 to L+400 bps Sale of land in Canada for net cash proceeds of $54 million in Q3 2009 ($ in millions) Term Loan $1,540.0 Revolver 86.3 Total Debt $1,626.3 |

22 Despite Cedar Fair’s efforts to strengthen its balance sheet, as of December 31, 2009, the Company had a Total Debt to EBITDA ratio of 5.14x (a) which caused it to trigger its distribution covenant and provided limited cushion versus its total leverage covenant The distribution is required to be suspended if Total Debt/EBITDA (a) exceeds 4.75x, implying an EBITDA shortfall of $25mm The Company also has a total leverage maintenance covenant of 5.25x Total Debt/EBITDA (a) , implying $6mm of EBITDA cushion as of December 31, 2009 These covenants step down again to more restrictive levels at the end of 2010 Cedar Fair required certain measures to achieve the levels described above In the fourth quarter of 2009, the Company made a $39 million draw under its revolver to prepay term loans The Company sold land around its park in Canada for proceeds of $54 million These measures were necessary to provide the Company with adequate cushion to ensure compliance with the total leverage covenant under its credit agreement The Company anticipates again needing to draw on the revolver and prepay term debt during the first quarter of 2010 to provide adequate cushion to ensure compliance with the total leverage covenant under its credit agreement Capital Structure Considerations (continued) (a) Total Debt / EBITDA is calculated in accordance with the Company’s credit agreement which excludes balance under revolving credit facility from Total Debt |

23 All Cash Merger is in the Best Interests of Unit Holders Provides significant premium to public market valuation Premium valuation multiple relative to recent transactions in the industry Unanimous approval by Board after review of alternatives to maximize value Go shop process resulted in no additional proposals for the Company Merger consideration superior to stand-alone value Eliminates execution risk in uncertain economic environment Company is highly levered with limited cushion under its total leverage covenant Distributions are suspended and ability to make future distributions is uncertain Certain unit holders may be required to pay cash taxes on income allocated from the partnership even in the absence of cash distributions Partnership structure and historical distribution policy are unsustainable with the Company’s current financial leverage and capital investment requirements Inability to reduce debt and reduce leverage ratios, as well as a deterioration of current credit market conditions, could result in higher cash interest costs in the future and tighter contractual restrictions, including those related to the payment of distributions |

24 Cedar Fair’s Board Unanimously Recommends Unit Holders Vote to Support the Merger |

25 Section III Appendix |

26 Merger Summary ($ in millions, except per share data) As of December 31, 2009 Offer Price Per Share $11.50 Fully Diluted Shares Outstanding (millions) (a) 56 Special LP Equity Interests $5 Total Equity Consideration $652 Revolver $86 Term Loans $1,540 Derivative Liability Termination $130 Total Debt and Derivative Liability $1,756 Less: Existing Cash ($12) Total Enterprise Value $2,396 (a) Includes dilution from options and phantom units |

27 Reconciliation of Adjusted EBITDA $355,890 $299,908 Adjusted EBITDA (1)(2)(3) — (23,098) (Gain) on sale of other assets 8,425 244 (Gain) loss on impairment / retirement of fixed assets 86,988 4,500 Loss on impairment of goodwill and other intangibles 716 (26) Equity-based compensation (409) 1,260 Other (income) expense 125,838 132,745 Depreciation and amortization (935) 14,978 Provision (benefit) for taxes — 9,170 Net change in fair value of swaps 129,561 124,706 Interest expense $5,706 $35,429 Net income (loss) 12/31/2008 12/31/2009 (In thousands) Twelve Months Ended |

28 Reconciliation of Adjusted EBITDA (1) Adjusted EBITDA represents earnings before interest, taxes, depreciation, and other non-cash items. The Partnership believes adjusted EBITDA is a meaningful measure of park-level operating profitability. Adjusted EBITDA is not a measurement of operating performance computed in accordance with generally accepted accounting principles and is not intended to be a substitute for operating income, net income or cash flow from operating activities, as defined under generally accepted accounting principles. In addition, adjusted EBITDA may not be comparable to similarly titled measures of other companies. (2) A form of Adjusted EBITDA, defined in the Company’s credit agreement, is used for debt covenant compliance purposes, which has additional adjustments to Adjusted EBITDA which may decrease or increase Adjusted EBITDA for purposes of these financial covenants. (3) Included in the 2009 Adjusted EBITDA of $299.9 million is approximately $5.6 million of cash costs related to the merger transaction and $11.0 million in litigation settlements. |