Exhibit 99.2

Business Update

September 2016

Refer to kaiseraluminum.com

Forward looking statements

Our earnings release and reports filed with the SEC, including the Company’s most recent Form 10-K and Form 10-Q, provide a summary of the risk factors that could cause results to be materially different than any forward-looking statements in this presentation.

Non-GAAP financial measures

Reconciliations of the non-GAAP financial information in our discussion to the most comparable GAAP financial measures are included in our earnings release and in the investor presentation on our website kaiseraluminum.com.

2

Investment considerations

Leading positions in attractive, growing market segments Strong track record of growth and performance Excellent earnings growth potential Financial strength and flexibility to support continued growth

3

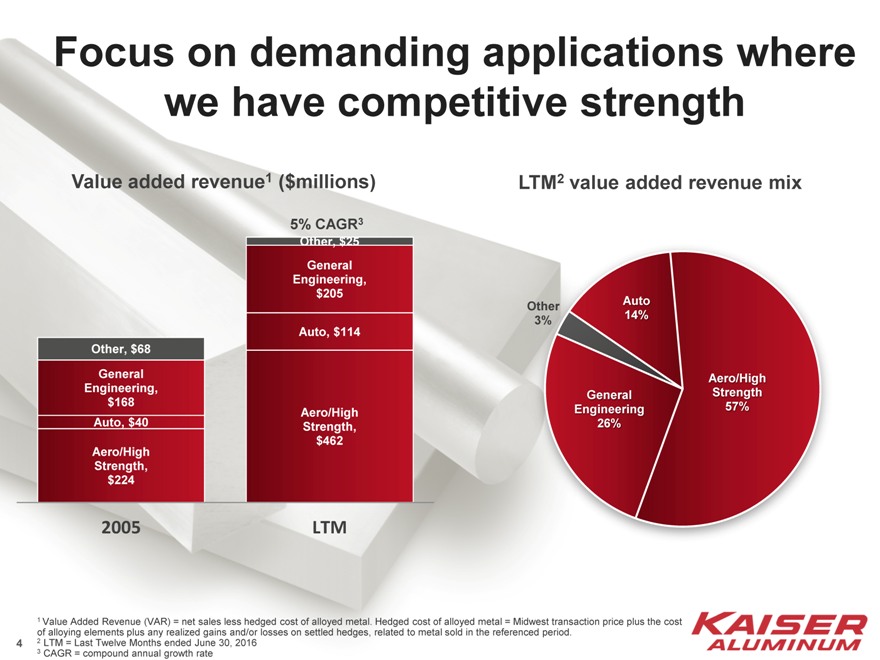

Focus on demanding applications where we have competitive strength

Value added revenue1 ($millions)

Other, $68 General Engineering, $168 Auto, $40

Aero/High Strength, $224

2005

5% CAGR3

Other, $25 General Engineering, $205

Auto, $114

Aero/High Strength, $462

LTM

LTM2 value added revenue mix

Other 3%

Auto 14%

Aero/High Strength 57%

General Engineering 26%

1 Value Added Revenue (VAR) = net sales less hedged cost of alloyed metal. Hedged cost of alloyed metal = Midwest transaction price plus the cost of alloying elements plus any realized gains and/or losses on settled hedges, related to metal sold in the referenced period.

2 LTM = Last Twelve Months ended June 30, 2016

3 CAGR = compound annual growth rate

4

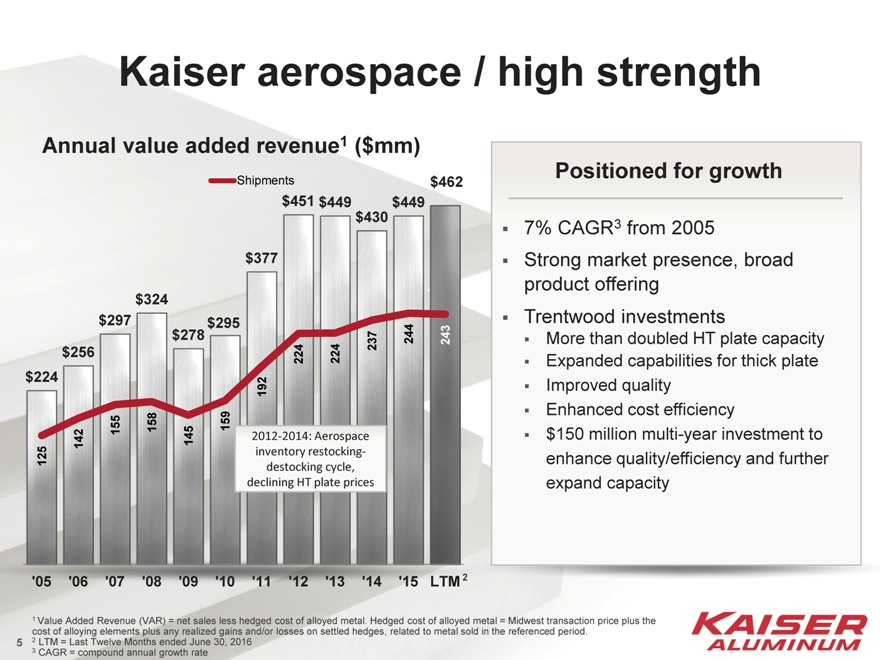

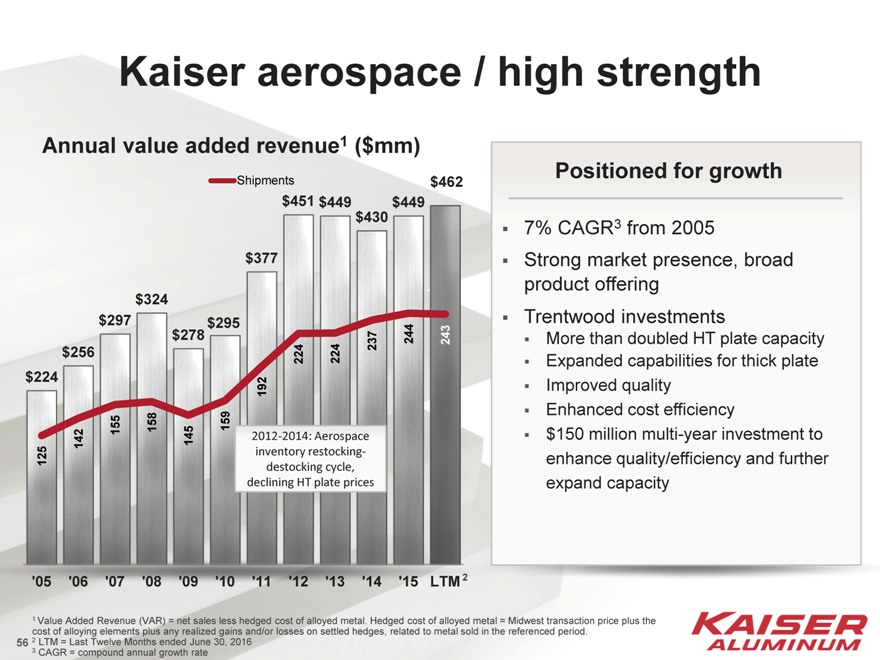

Kaiser aerospace / high strength

Annual value added revenue1 ($mm)

Shipments$462

$451 $449$449

$430

$377

$324

$297$295

$278237244243

$256 224224

$224 192

155158159

142 1452012-2014: Aerospace

125 inventory destocking restocking- cycle,

declining HT plate prices

‘05 ’06 ‘07’08’09’10 ‘11 ‘12 ‘13 ‘14’15LTM 2

Positioned for growth

7% CAGR3 from 2005

Strong market presence, broad product offering Trentwood investments

More than doubled HT plate capacity Expanded capabilities for thick plate Improved quality Enhanced cost efficiency $150 million multi-year investment to enhance quality/efficiency and further expand capacity

1 Value Added Revenue (VAR) = net sales less hedged cost of alloyed metal. Hedged cost of alloyed metal = Midwest transaction price plus the cost of alloying elements plus any realized gains and/or losses on settled hedges, related to metal sold in the referenced period.

2 LTM = Last Twelve Months ended June 30, 2016

3 CAGR = compound annual growth rate

5

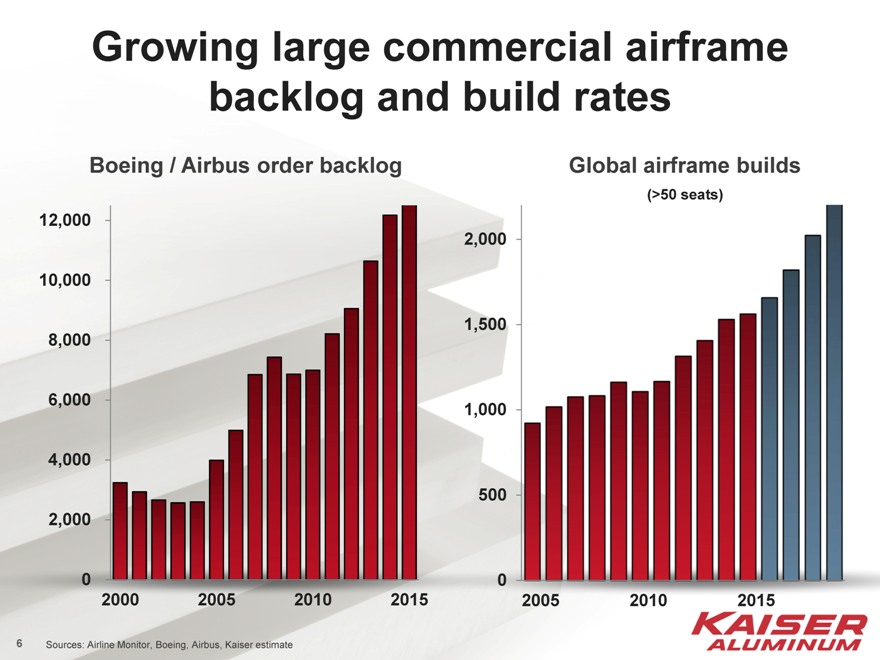

Growing large commercial airframe backlog and build rates

Boeing / Airbus order backlog

12,000 10,000 8,000 6,000 4,000 2,000 0

2000 2005 2010 2015

Global airframe builds

(>50 seats)

2005 2010 2015

2,000 1,500 1,000 500 0

Sources: Airline Monitor, Boeing, Airbus, Kaiser estimate

6

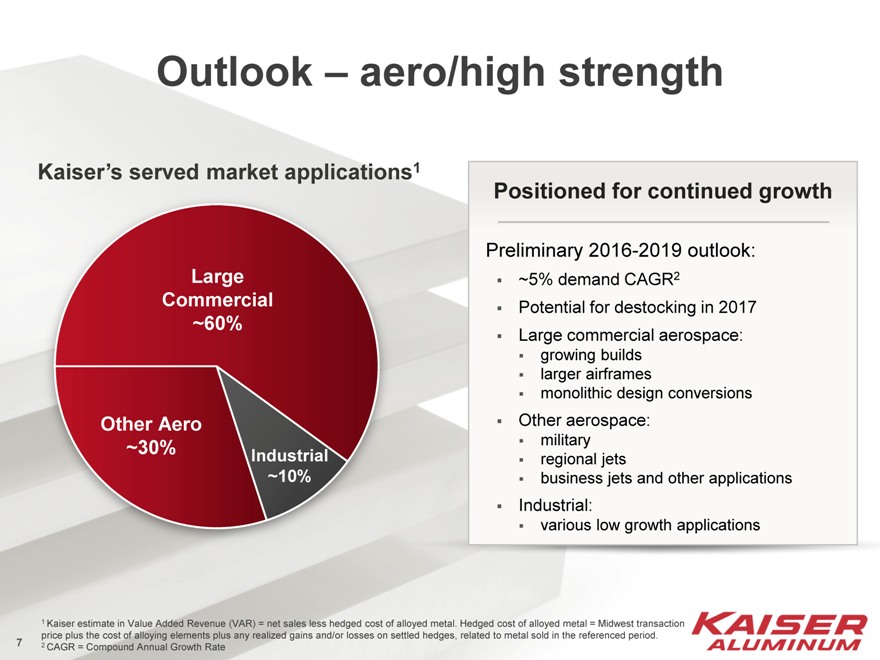

Outlook — aero/high strength

Kaiser’s served market applications1

Large Commercial ~60%

Industrial ~10%

Other Aero ~30%

Positioned for continued growth

Preliminary 2016-2019 outlook:

~5% demand CAGR2

Potential for destocking in 2017 Large commercial aerospace:

growing builds larger airframes monolithic design conversions

Other aerospace:

military regional jets business jets and other applications

Industrial:

various low growth applications

1 Kaiser estimate in Value Added Revenue (VAR) = net sales less hedged cost of alloyed metal. Hedged cost of alloyed metal = Midwest transaction price plus the cost of alloying elements plus any realized gains and/or losses on settled hedges, related to metal sold in the referenced period. 2 CAGR = Compound Annual Growth Rate

7

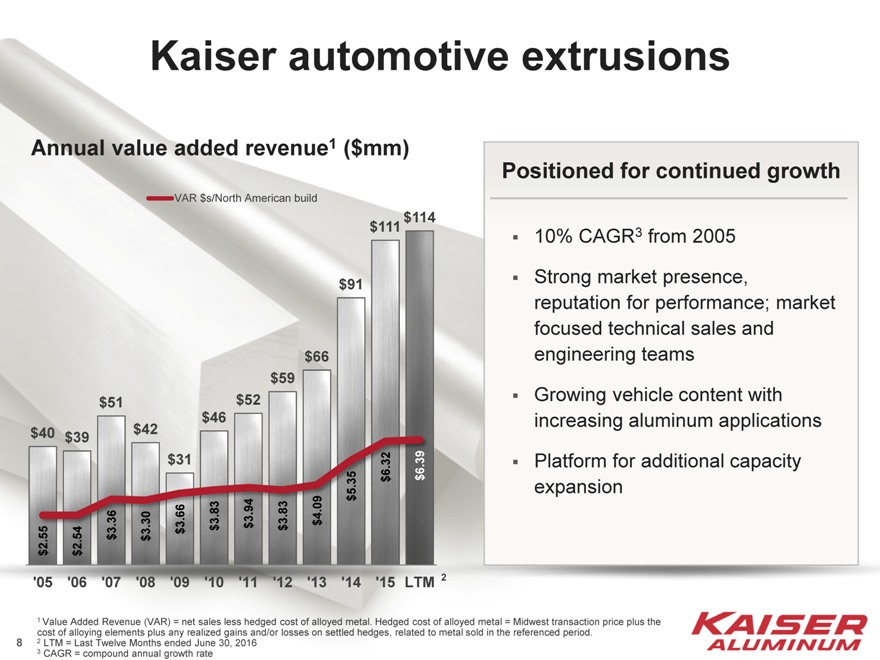

Kaiser automotive extrusions

Annual value added revenue1 ($mm)

VAR $s/North American build

‘05 $2.55 40 $

‘06 $2.54 39 $

‘07 $3.36 51 $

‘08 $3.30 42 $

‘09 $3.66 31 $

‘10 $3.83 46 $

‘11 $3.94 52 $

‘12 $3.83 59 $

‘13 $4.09 66 $

‘14 $5.35 91 $

$

‘15 $6.32111

LTM $6.39114 $

Positioned for continued growth

10% CAGR3 from 2005 Strong market presence, reputation for performance; market focused technical sales and engineering teams Growing vehicle content with increasing aluminum applications Platform for additional capacity expansion

1 Value Added Revenue (VAR) = net sales less hedged cost of alloyed metal. Hedged cost of alloyed metal = Midwest transaction price plus the cost of alloying elements plus any realized gains and/or losses on settled hedges, related to metal sold in the referenced period.

2 LTM = Last Twelve Months ended June 30, 2016

3 CAGR = compound annual growth rate

8

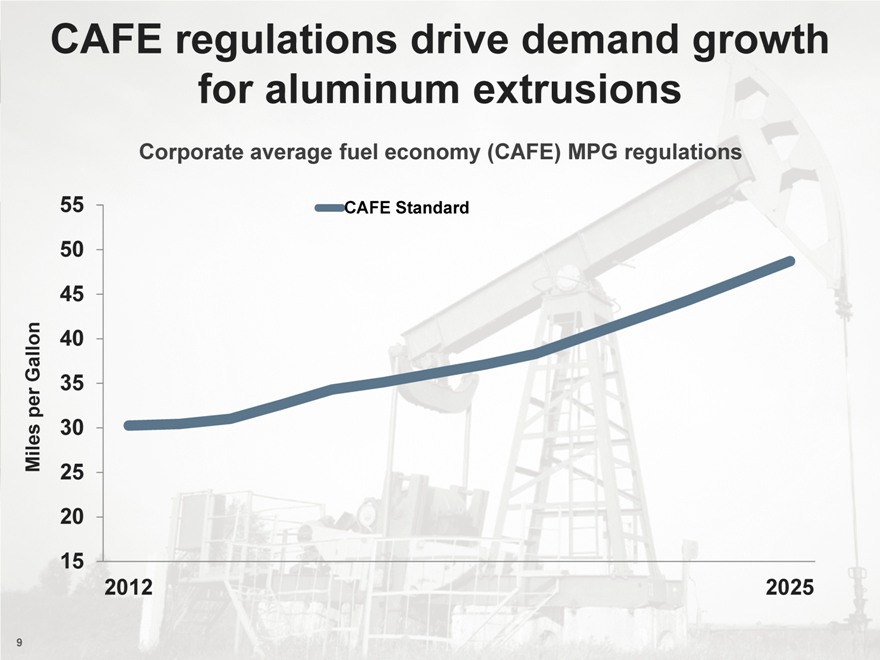

CAFE regulations drive demand growth for aluminum extrusions

Corporate average fuel economy (CAFE) MPG regulations

CAFE Standard

55 50 45

Gallon 40 per 35 Miles 30

25 20 15

2012 2025

9

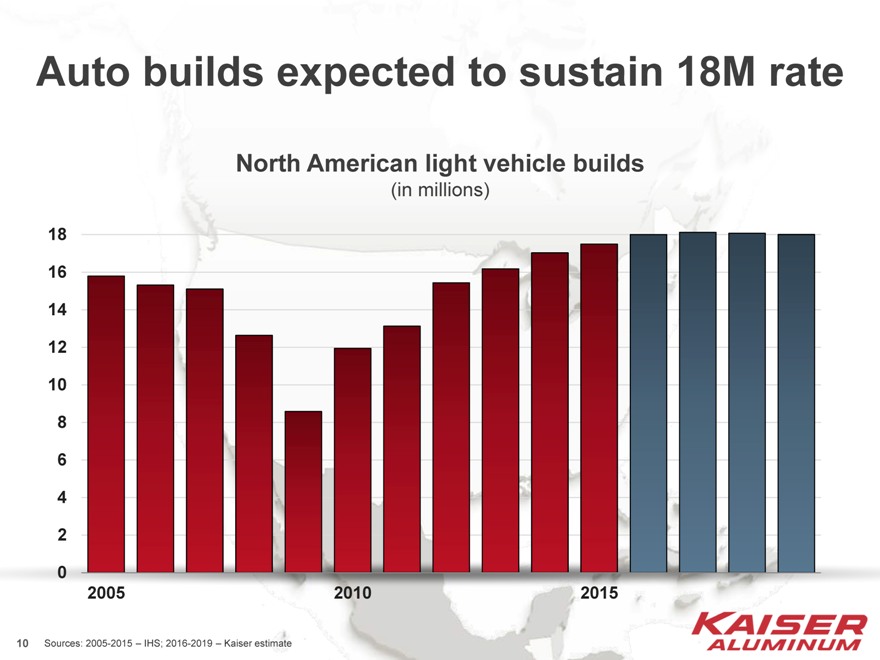

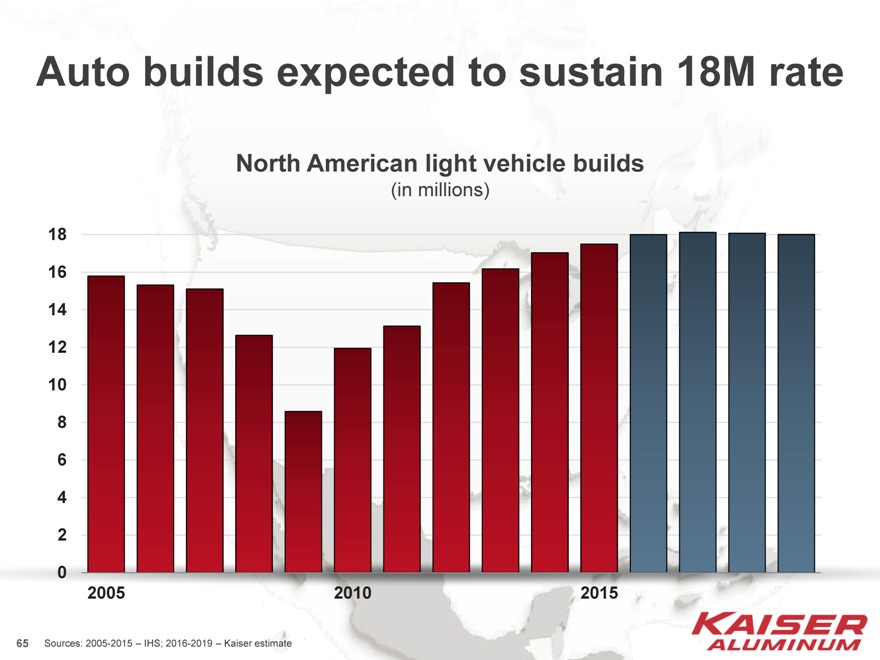

Auto builds expected to sustain 18M rate

North American light vehicle builds

(in millions)

18 16 14 12 10 8 6 4 2 0

2005 2010 2015

Sources: 2005-2015 – IHS; 2016-2019 – Kaiser estimate

10

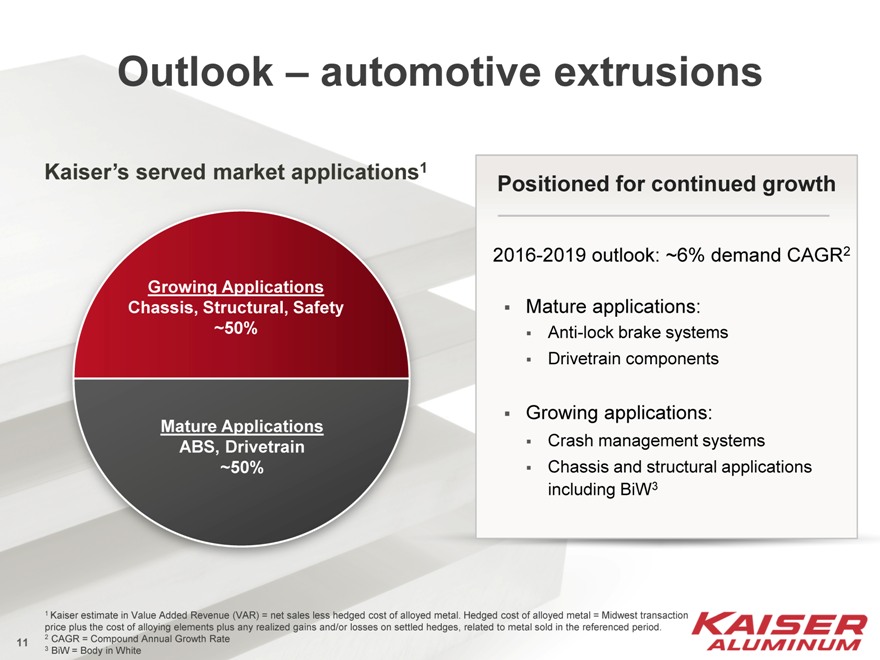

Outlook — automotive extrusions

Kaiser’s served market applications1

Growing Applications Chassis, Structural, Safety ~50%

Mature Applications ABS, Drivetrain ~50%

Positioned for continued growth

2016-2019 outlook: ~6% demand CAGR2

Mature applications:

Anti-lock brake systems Drivetrain components

Growing applications:

Crash management systems Chassis and structural applications including BiW3

1 Kaiser estimate in Value Added Revenue (VAR) = net sales less hedged cost of alloyed metal. Hedged cost of alloyed metal = Midwest transaction price plus the cost of alloying elements plus any realized gains and/or losses on settled hedges, related to metal sold in the referenced period.

2 CAGR = Compound Annual Growth Rate

3 BiW = Body in White

11

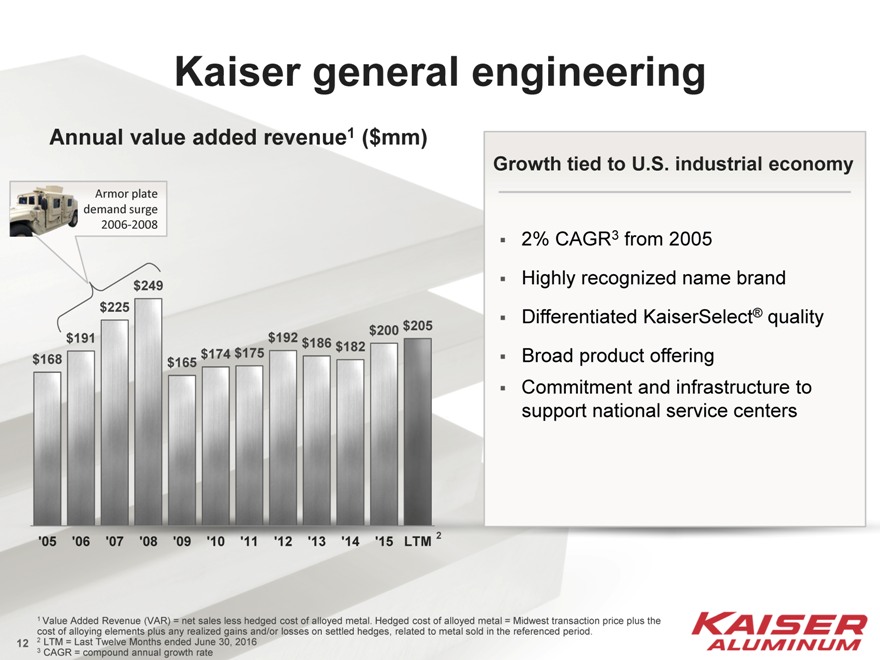

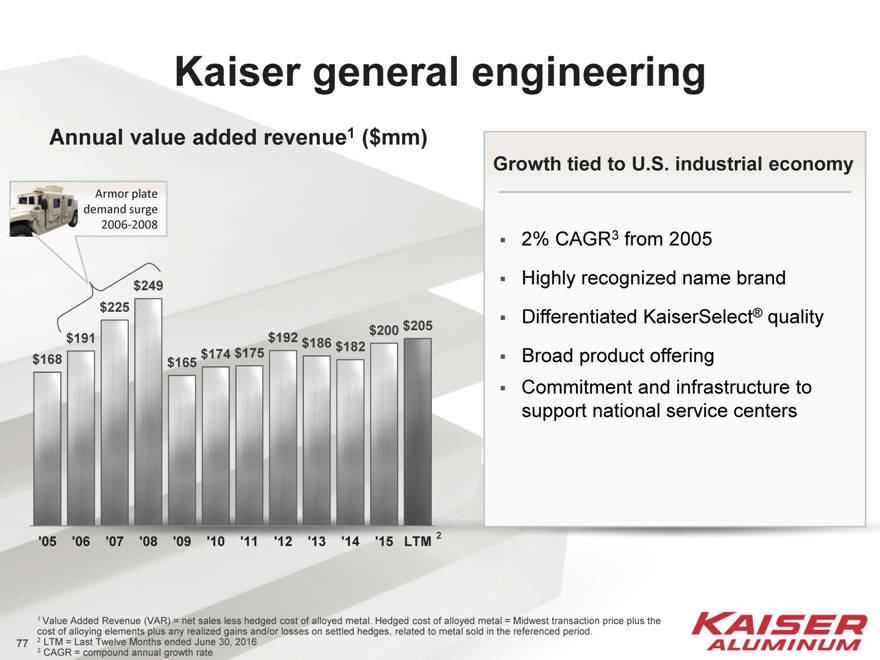

Kaiser general engineering

Annual value added revenue1 ($mm)

Armor plate demand surge 2006-2008

$249

$225

$200 $205

$191 $174 $175 $192 $186 $182

$168 $165

‘05 ’06 ‘07’08’09’10 ‘11 ‘12 ‘13 ‘14’15 LTM 2

Growth tied to U.S. industrial economy

2% CAGR3 from 2005 Highly recognized name brand Differentiated KaiserSelect® quality Broad product offering Commitment and infrastructure to support national service centers

1 Value Added Revenue (VAR) = net sales less hedged cost of alloyed metal. Hedged cost of alloyed metal = Midwest transaction price plus the cost of alloying elements plus any realized gains and/or losses on settled hedges, related to metal sold in the referenced period.

2 LTM = Last Twelve Months ended June 30, 2016

3 CAGR = compound annual growth rate

12

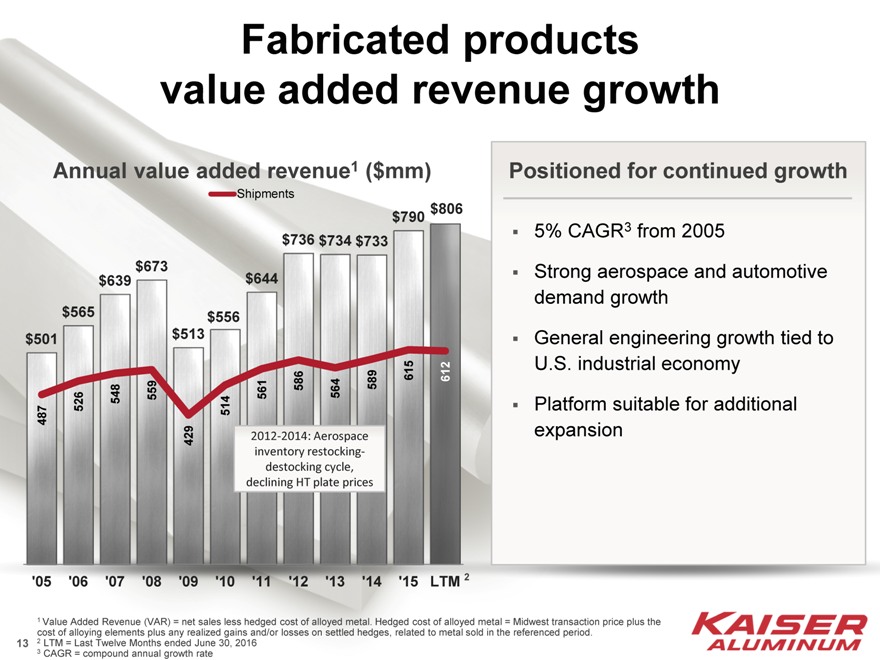

Fabricated products value added revenue growth

Annual value added revenue1 ($mm)

Shipments

$790$806

$736 $734 $733

$673

$639$644

$565 $556

$501 $513

586589615612

526 548559514561564

487

4292012-2014: Aerospace

inventory restocking-

destocking cycle,

declining HT plate prices

‘05 ’06 ‘07’08’09’10’11 ‘12’13 ‘14’15LTM 2

Positioned for continued growth

5% CAGR3 from 2005

Strong aerospace and automotive demand growth General engineering growth tied to U.S. industrial economy Platform suitable for additional expansion

1 Value Added Revenue (VAR) = net sales less hedged cost of alloyed metal. Hedged cost of alloyed metal = Midwest transaction price plus the cost of alloying elements plus any realized gains and/or losses on settled hedges, related to metal sold in the referenced period.

2 LTM = Last Twelve Months ended June 30, 2016

3 CAGR = compound annual growth rate

13

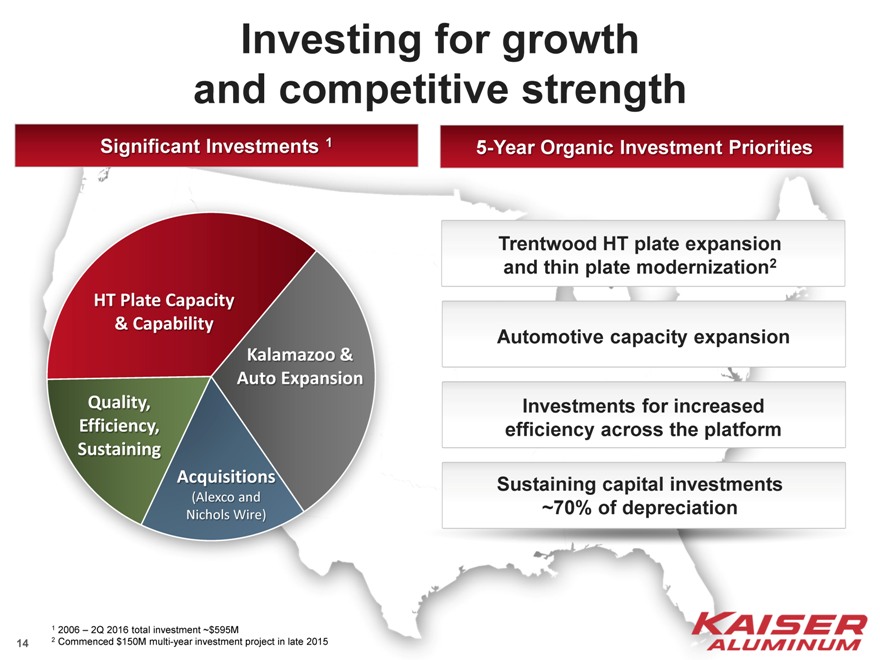

Investing for growth and competitive strength

Significant Investments 1

HT Plate Capacity

& Capability

Kalamazoo &

Auto Expansion

Quality, Efficiency, Sustaining

Acquisitions

(Alexco and Nichols Wire)

Trentwood HT plate expansion and thin plate modernization2

Automotive capacity expansion

Investments for increased efficiency across the platform

Sustaining capital investments ~70% of depreciation

1 2006 – 2Q 2016 total investment ~$595M

2 Commenced $150M multi-year investment project in late 2015

14

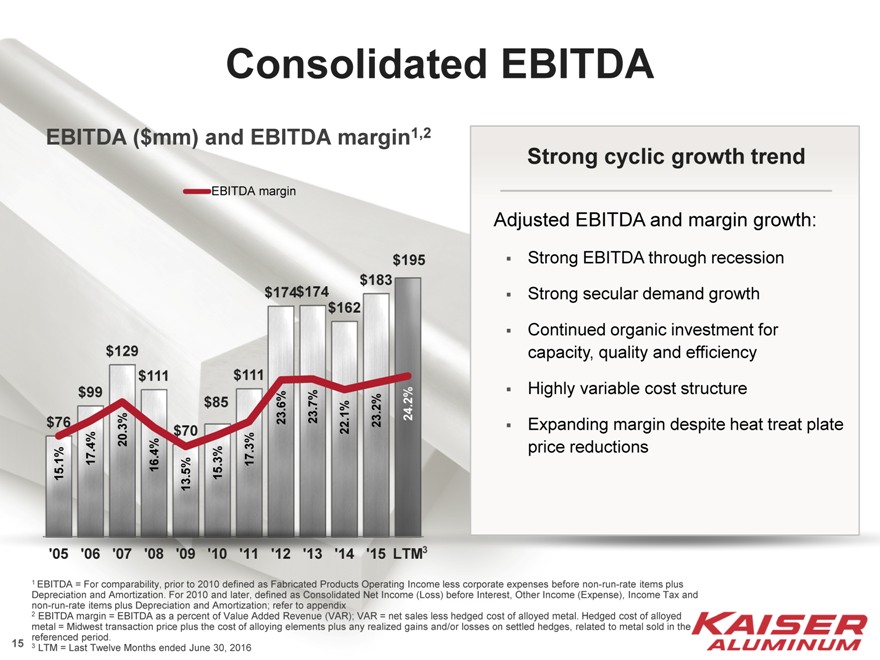

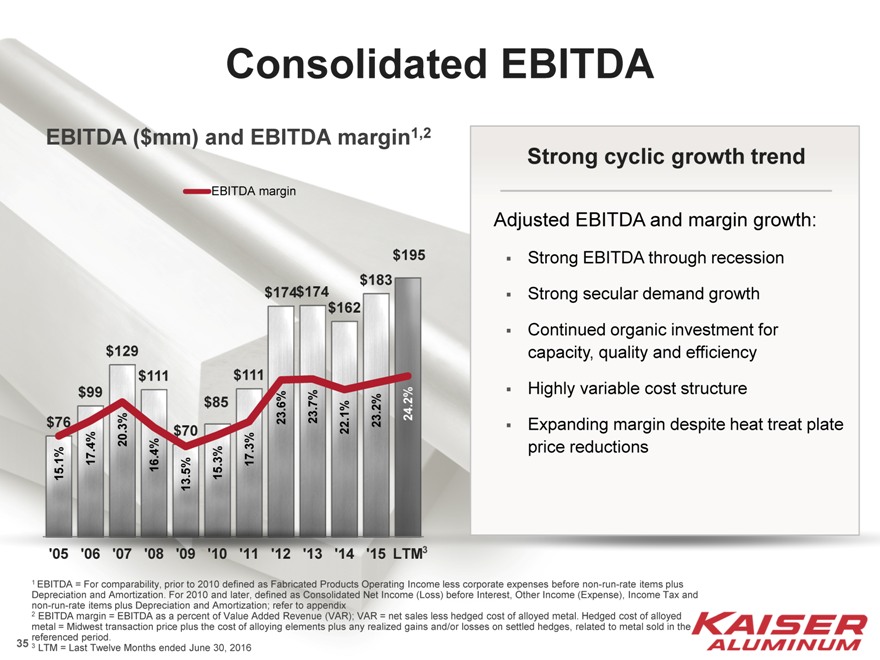

Consolidated EBITDA

EBITDA ($mm) and EBITDA margin1,2

EBITDA margin

$

15.1% 76

$

17.4% 99

$

20.3% 129

$

16.4% 111

$

13.5% 70

$

15.3% 85

$

17.3% 111

$

23.6%174

$

23.7%174

$

22.1%162

$

23.2%183

$

24.2%195

3

Strong cyclic growth trend

Adjusted EBITDA and margin growth:

Strong EBITDA through recession Strong secular demand growth Continued organic investment for capacity, quality and efficiency Highly variable cost structure Expanding margin despite heat treat plate price reductions

1 EBITDA = For comparability, prior to 2010 defined as Fabricated Products Operating Income less corporate expenses before non-run-rate items plus Depreciation and Amortization. For 2010 and later, defined as Consolidated Net Income (Loss) before Interest, Other Income (Expense), Income Tax and non-run-rate items plus Depreciation and Amortization; refer to appendix

2 EBITDA margin = EBITDA as a percent of Value Added Revenue (VAR); VAR = net sales less hedged cost of alloyed metal. Hedged cost of alloyed metal = Midwest transaction price plus the cost of alloying elements plus any realized gains and/or losses on settled hedges, related to metal sold in the referenced period.

3 LTM = Last Twelve Months ended June 30, 2016

15

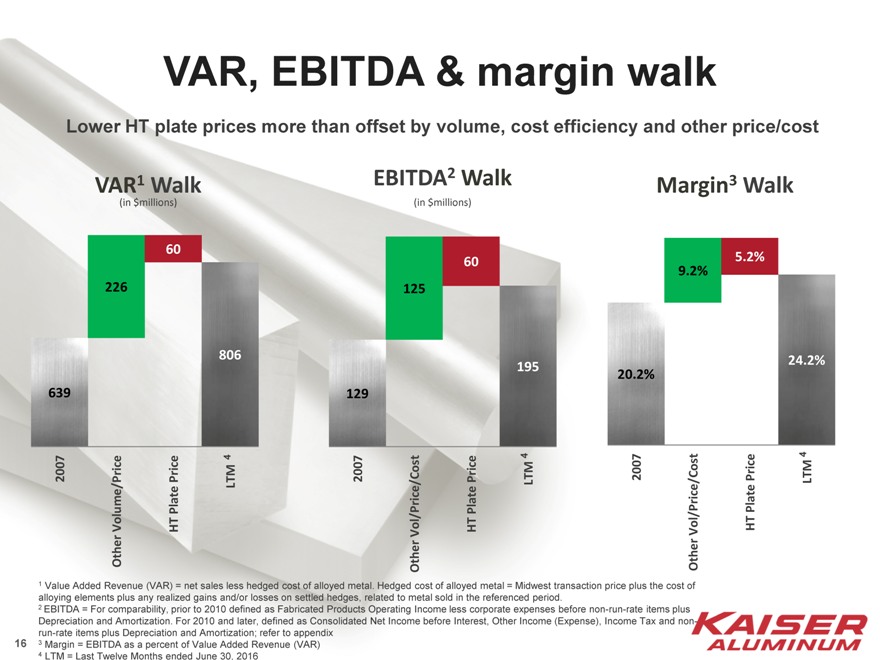

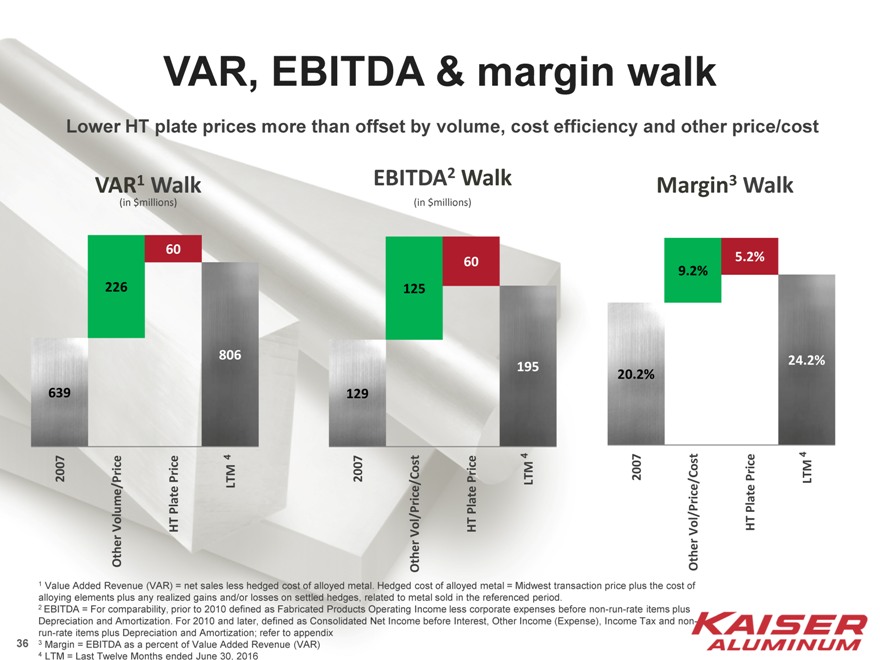

VAR, EBITDA & margin walk

Lower HT plate prices more than offset by volume, cost efficiency and other price/cost

VAR1 Walk

(in $millions)

2007 639

Other Volume/Price 226

HT Plate Price 60

LTM 4 806

EBITDA2 Walk

(in $millions)

2007 129

Other Vol/Price/Cost 125

HT Plate Price 60

LTM 4 195

Margin3 Walk

2007 20.

2%

9.

Other Vol/Price/Cost 2%

5.

HT Plate Price 2%

LTM 4 24.

2%

1 Value Added Revenue (VAR) = net sales less hedged cost of alloyed metal. Hedged cost of alloyed metal = Midwest transaction price plus the cost of alloying elements plus any realized gains and/or losses on settled hedges, related to metal sold in the referenced period.

2 EBITDA = For comparability, prior to 2010 defined as Fabricated Products Operating Income less corporate expenses before non-run-rate items plus Depreciation and Amortization. For 2010 and later, defined as Consolidated Net Income before Interest, Other Income (Expense), Income Tax and non-run-rate items plus Depreciation and Amortization; refer to appendix

3 Margin = EBITDA as a percent of Value Added Revenue (VAR)

4 LTM = Last Twelve Months ended June 30, 2016

16

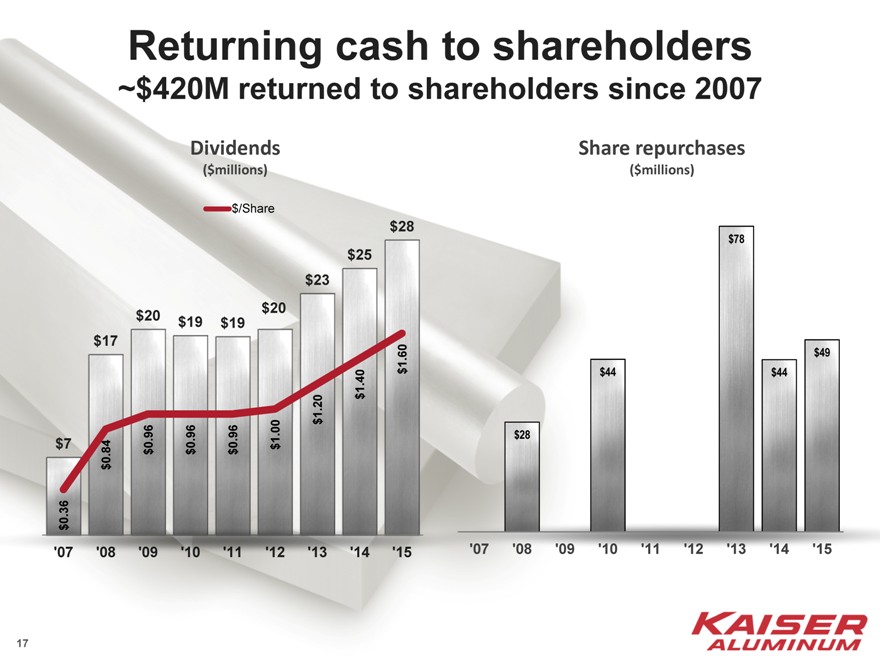

Returning cash to shareholders

~$420M returned to shareholders since 2007

Dividends

($millions)

$/Share

0.36 $

7

$

$0.84 17

$

$0.96 20

$

$0.96 19

$

$0.96 19

$

$1.00 20

$

$1.20 23

$

$1.4025

$

$1.6028

Share repurchases

($millions)

$78

$49

$44$44

$28

‘07 ‘08 ’09 ‘10’11’12’13’14’15

17

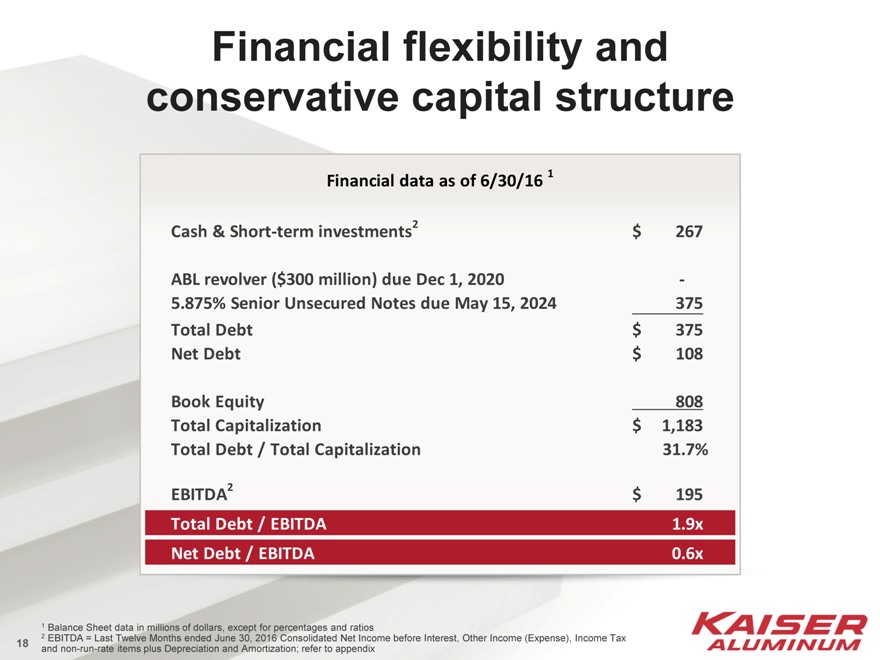

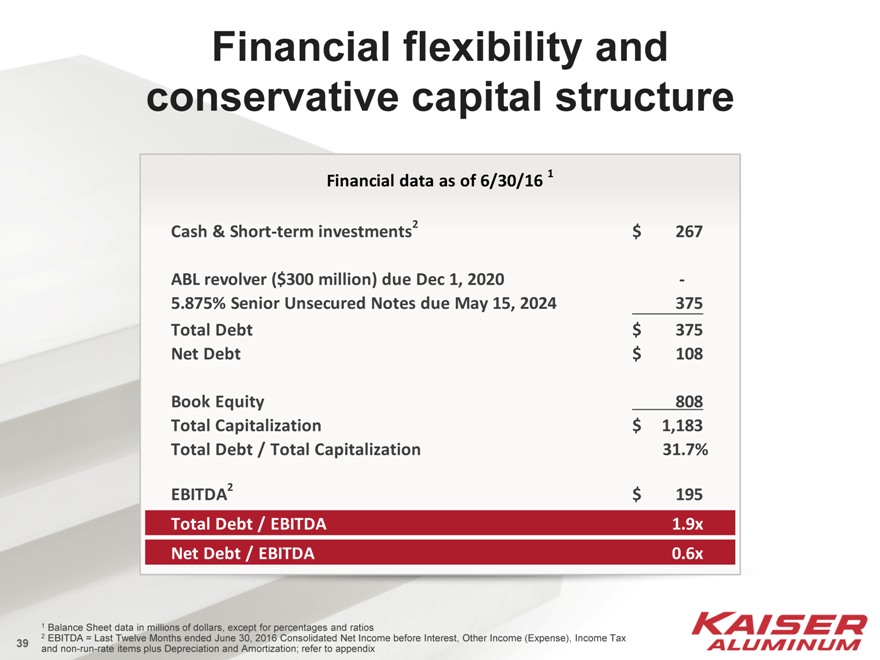

Financial flexibility and conservative capital structure

Financial data as of 6/30/16 1

Cash & Short-term investments2 $267

ABL revolver ($300 million) due Dec 1, 2020 -

5.875% Senior Unsecured Notes due May 15, 2024 375

Total Debt $375

Net Debt $108

Book Equity 808

Total Capitalization $1,183

Total Debt / Total Capitalization 31.7%

EBITDA2 $195

Total Debt / EBITDA 1.9x

Net Debt / EBITDA 0.6x

1 Balance Sheet data in millions of dollars, except for percentages and ratios

2 EBITDA = Last Twelve Months ended June 30, 2016 Consolidated Net Income before Interest, Other Income (Expense), Income Tax and non-run-rate items plus Depreciation and Amortization; refer to appendix

18

Experienced management team

Jack Hockema

CEO & Chairman Kaiser—24 years Industry—47 years

Dan Rinkenberger

EVP & CFO Kaiser—25 years Industry—25 years

John Donnan

EVP Legal, Compliance & Human Resources Kaiser—22 years Industry—22 years

Keith Harvey

President & COO Kaiser—35 years Industry—35 years

John Barneson

SVP Corporate Development Kaiser—41 years Industry—41 years

Senior management team has been together over 20 years; supported by a deep, strong organization

First 10 years: restructured and repositioned the company and business model Past 10 years: achieved steady, long-term growth facilitated by the strong business model

19

Investment considerations

Leading positions in attractive, growing market segments Strong track record of growth and performance Excellent earnings growth potential Financial strength and flexibility to support continued growth

20

Well positioned for further growth

21

Appendix – Company Overview

22

Forward looking statements

The information contained in this presentation includes statements based on management’s current expectations, estimates and projections that constitute “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Such statements include statements regarding the company’s anticipated financial and operating performance, relate to future events and expectations and involve known and unknown risks and uncertainties. The Company cautions that such forward-looking statements are not guarantees of future performance or events and involve significant risks and uncertainties and actual events may vary materially from those expressed or implied in the forward-looking statements as a result of various factors. For a summary of specific risk factors that could cause results to differ materially from those expressed in the forward-looking statements, please refer to the company’s reports filed with the Securities and Exchange Commission, including the company’s most recent Forms 10-Q and 10–K. All information in this presentation is as of the date of the presentation. The company undertakes no duty to update any forward-looking statement to conform the statement to actual results or changes in the company’s expectations except as may be required by law.

23

Non-run-rate items

Non-run-rate items to us are items that, while they may recur from period to period, (1) are particularly material to results, (2) impact costs as a result of external market factors and (3) may not recur in future periods if the same level of underlying performance were to occur. These are part of our business and operating environment but are worthy of being highlighted for the benefit of the users of our financial statements.

Further, presentations including such terms as net income, operating income, or earnings before interest, tax, depreciation and amortization (“EBITDA”) “before non-run-rate”, “after adjustments” or “adjusted”, are not intended to be (and should not be relied on) in lieu of the comparable caption under generally accepted accounting principles (“GAAP”) to which it is reconciled. Such presentations are solely intended to provide greater clarity of the impact of certain material items on the GAAP measure and are not intended to imply such items should be excluded.

24

Non-GAAP financial measures

This information contains certain non-GAAP financial measures. A “non-GAAP financial measure” is defined as a numerical measure of a company’s financial performance that excludes or includes amounts so as to be different than the most directly comparable measure calculated and presented in accordance with GAAP in the statements of income, balance sheets or statements of cash flow of the Company. The company has provided a reconciliation of non-GAAP financial measures to the most directly comparable financial measure in the accompanying tables.

The non-GAAP financial measures used within this presentation are value added revenue, EBITDA, Adjusted EBITDA, operating income excluding non-run-rate items, adjusted net income and earnings per diluted share, excluding non-run-rate items and ratios related thereto. These measures are presented because management uses this information to monitor and evaluate financial results and trends and believes this information to also be useful for investors.

25

Investment considerations

Leading positions in attractive, growing market segments

Demanding applications Strong market presence Competitive strength

Excellent earnings growth potential

Attractive, growing market segments Significant investments Platform for organic and acquisition growth

Financial strength and

flexibility to support

continued growth

Strong Liquidity

Moderate leverage

Significant tax attributes

Consistent cash flow

generation

Strong track record of growth and performance

26

Leading North American semi-fabricated specialty aluminum mill products company

Twelve North American manufacturing locations

Flat rolled products Extrusions Drawn products

27

Focused on strategic applications

Commercial Aerospace

Other Aerospace

Automotive

General Engineering

28

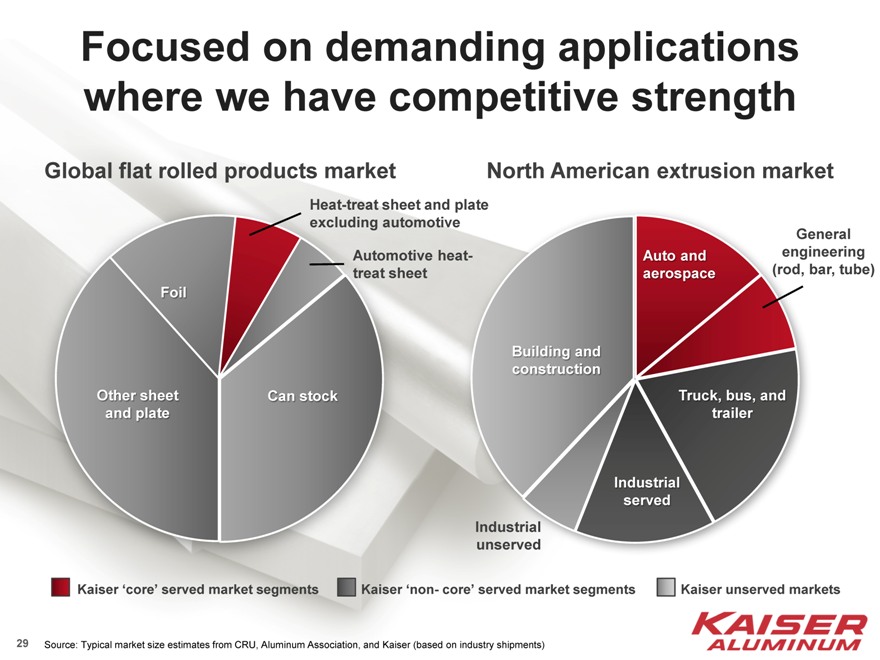

Focused on demanding applications where we have competitive strength

Global flat rolled products market

Heat-treat sheet and plate excluding automotive Automotive heat-treat sheet

Foil

Other sheet Can stock

and plate

North American extrusion market

General engineering (rod, bar, tube)

Auto and aerospace

Truck, bus, and trailer

Industrial served

Building and construction

Industrial unserved

Kaiser ‘core’ served market segments

Kaiser ‘non- core’ served market segments

Kaiser unserved markets

Source: Typical market size estimates from CRU, Aluminum Association, and Kaiser (based on industry shipments)

29

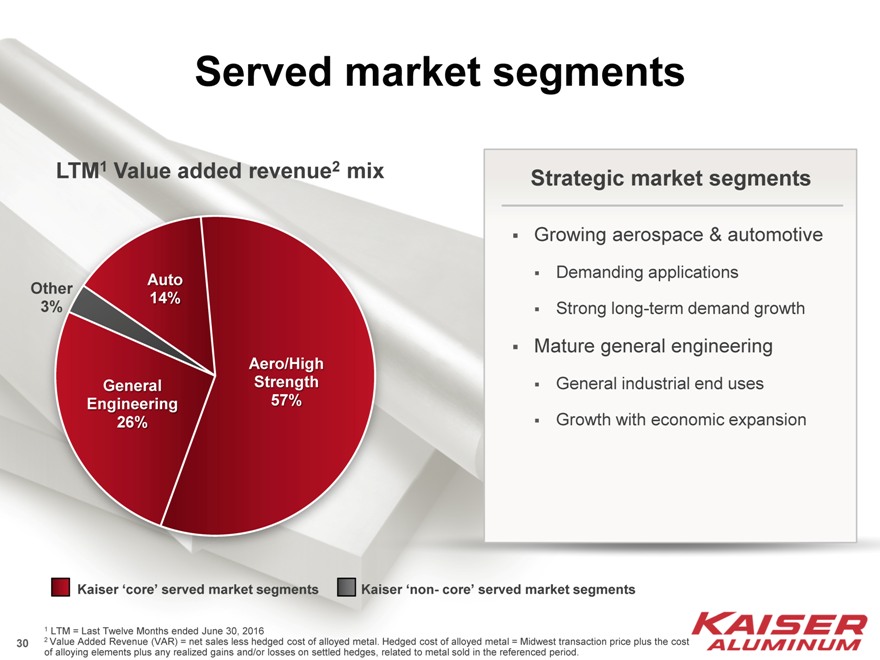

Served market segments

LTM1 Value added revenue2 mix

Auto 14%

Aero/High Strength 57%

General Engineering 26%

Other

3%

Strategic market segments

Growing aerospace & automotive

Demanding applications Strong long-term demand growth

Mature general engineering

General industrial end uses Growth with economic expansion

Kaiser ‘core’ served market segments

Kaiser ‘non- core’ served market segments

1 LTM = Last Twelve Months ended June 30, 2016

2 Value Added Revenue (VAR) = net sales less hedged cost of alloyed metal. Hedged cost of alloyed metal = Midwest transaction price plus the cost of alloying elements plus any realized gains and/or losses on settled hedges, related to metal sold in the referenced period.

30

Creating value with

KaiserSelect ® products

Differentiate with KaiserSelect®

KaiserSelect® products with reliable machinability or other characteristics help create value for customers by improving their manufacturing processes and profitability

We can offer KaiserSelect® products due to Kaiser’s standard work and recipe-driven controls… commercializing the result of our disciplined manufacturing process

31

Blue chip customer base

Original equipment manufacturers

Service centers

32

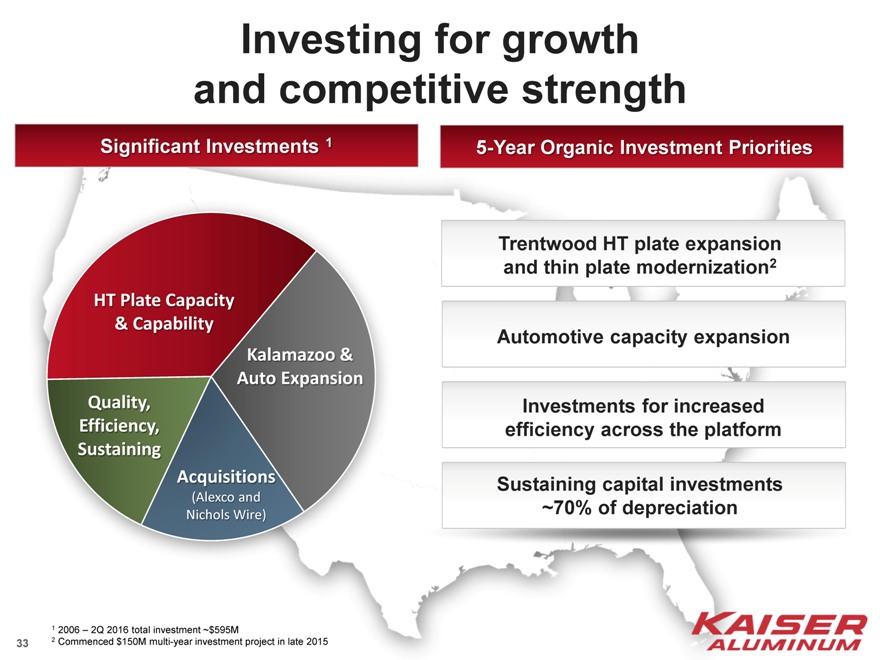

Investing for growth and competitive strength

Significant Investments 1

HT Plate Capacity

& Capability

Kalamazoo &

Auto Expansion

Quality, Efficiency, Sustaining

Acquisitions

(Alexco and Nichols Wire)

Trentwood HT plate expansion and thin plate modernization2

Automotive capacity expansion

Investments for increased efficiency across the platform

Sustaining capital investments ~70% of depreciation

1 2006 – 2Q 2016 total investment ~$595M

2 Commenced $150M multi-year investment project in late 2015

33

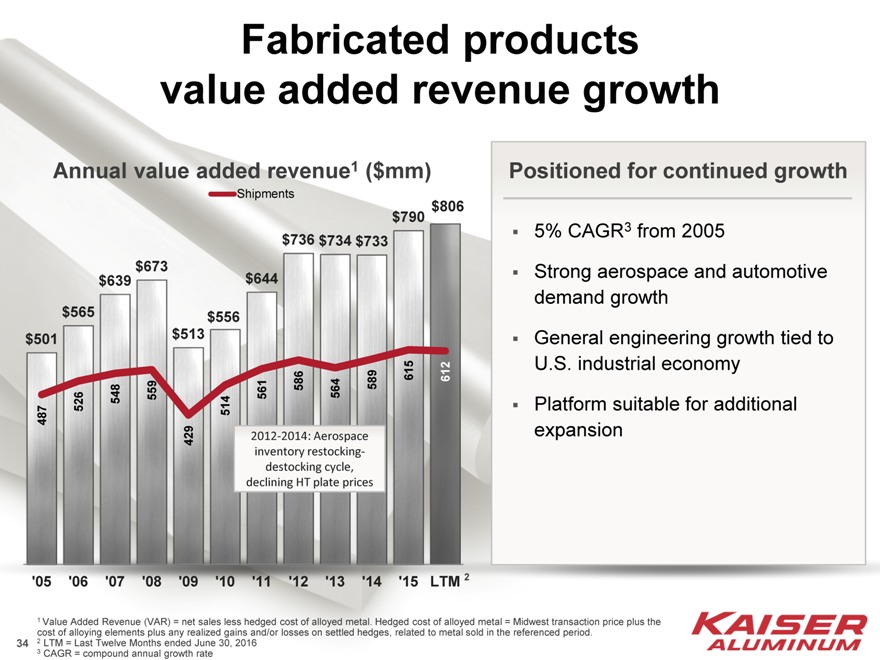

Fabricated products value added revenue growth

Annual value added revenue1 ($mm)

Shipments

$806 $790 $736 $734 $733 $673 $639 $644 $565 $556 $501 $513

586 589 615 612 548 559 561 564 487 526 514 429 2012-2014: Aerospace inventory restocking-destocking cycle, declining HT plate prices

‘05 ‘06 ‘07 ‘08 ‘09 ‘10 ‘11 ‘12 ‘13 ‘14 ‘15 LTM 2

Positioned for continued growth

5% CAGR3 from 2005

Strong aerospace and automotive demand growth General engineering growth tied to U.S. industrial economy Platform suitable for additional expansion

1 Value Added Revenue (VAR) = net sales less hedged cost of alloyed metal. Hedged cost of alloyed metal = Midwest transaction price plus the cost of alloying elements plus any realized gains and/or losses on settled hedges, related to metal sold in the referenced period.

2 LTM = Last Twelve Months ended June 30, 2016

3 CAGR = compound annual growth rate

34

Consolidated EBITDA

EBITDA ($mm) and EBITDA margin1,2

EBITDA margin

$

15.1% 76

$

17.4% 99

20.3% 129 $

$

16.4% 111

$

13.5% 70

$

15.3% 85

17.3% 111 $

$

23.6% 174

23.7% 174 $

$

22.1% 162

$

23.2% 183

$

24.2% 195

3

Strong cyclic growth trend

Adjusted EBITDA and margin growth:

Strong EBITDA through recession Strong secular demand growth Continued organic investment for capacity, quality and efficiency Highly variable cost structure Expanding margin despite heat treat plate price reductions

1 EBITDA = For comparability, prior to 2010 defined as Fabricated Products Operating Income less corporate expenses before non-run-rate items plus Depreciation and Amortization. For 2010 and later, defined as Consolidated Net Income (Loss) before Interest, Other Income (Expense), Income Tax and non-run-rate items plus Depreciation and Amortization; refer to appendix

2 EBITDA margin = EBITDA as a percent of Value Added Revenue (VAR); VAR = net sales less hedged cost of alloyed metal. Hedged cost of alloyed metal = Midwest transaction price plus the cost of alloying elements plus any realized gains and/or losses on settled hedges, related to metal sold in the referenced period.

3 LTM = Last Twelve Months ended June 30, 2016

35

VAR, EBITDA & margin walk

Lower HT plate prices more than offset by volume, cost efficiency and other price/cost

VAR1 Walk

(in $millions)

2007 639

Other Volume/Price 226

HT Plate Price 60

LTM 4 806

EBITDA2 Walk

(in $millions)

2007 129

Other Vol/Price/Cost 125

HT Plate Price 60

LTM 4 195

Margin3 Walk

9.2% 5.2%

20.2% 24.2%

4

2007Price LTM Plate Vol/Price/Cost HT

Other

1 Value Added Revenue (VAR) = net sales less hedged cost of alloyed metal. Hedged cost of alloyed metal = Midwest transaction price plus the cost of alloying elements plus any realized gains and/or losses on settled hedges, related to metal sold in the referenced period.

2 EBITDA = For comparability, prior to 2010 defined as Fabricated Products Operating Income less corporate expenses before non-run-rate items plus Depreciation and Amortization. For 2010 and later, defined as Consolidated Net Income before Interest, Other Income (Expense), Income Tax and non-run-rate items plus Depreciation and Amortization; refer to appendix

3 Margin = EBITDA as a percent of Value Added Revenue (VAR)

4 LTM = Last Twelve Months ended June 30, 2016

36

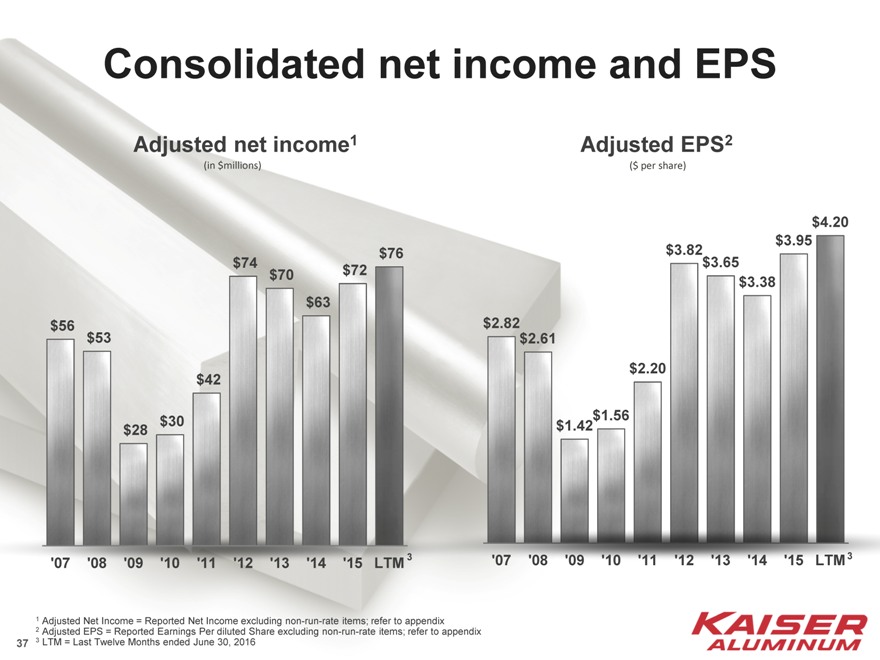

Consolidated net income and EPS

Adjusted net income1

(in $millions)

$76

$74 $72 $70 $63 $56 $53

$42

$30 $28

‘07 ‘08 ‘09 ‘10 ‘11 ‘12 ‘13 ‘14 ‘15 LTM 3

Adjusted EPS2

($ per share)

$4.20

$3.95

$3.82

$3.65

$3.38

$2.82$ 2.61

$2.20

$1.56

$1.42

‘07 ‘08 ‘09 ‘10 ‘11 ‘12 ‘13 ‘14 ‘15 LTM3

1 Adjusted Net Income = Reported Net Income excluding non-run-rate items; refer to appendix

2 Adjusted EPS = Reported Earnings Per diluted Share excluding non-run-rate items; refer to appendix

3 LTM = Last Twelve Months ended June 30, 2016

37

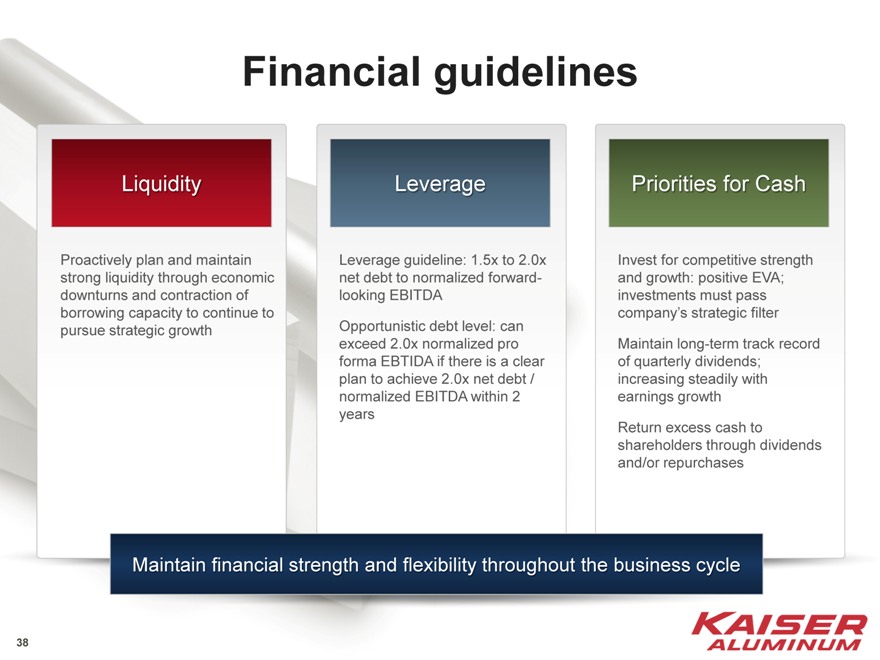

Financial guidelines

Liquidity

Proactively plan and maintain

strong liquidity through economic

downturns and contraction of

borrowing capacity to continue to

pursue strategic growth

Leverage

Leverage guideline: 1.5x to 2.0x net debt to normalized forward-looking EBITDA

Opportunistic debt level: can exceed 2.0x normalized pro forma EBTIDA if there is a clear plan to achieve 2.0x net debt / normalized EBITDA within 2 years

Priorities for Cash

Invest for competitive strength and growth: positive EVA; investments must pass company’s strategic filter Maintain long-term track record of quarterly dividends; increasing steadily with earnings growth Return excess cash to shareholders through dividends and/or repurchases

Maintain financial strength and flexibility throughout the business cycle

38

Financial flexibility and conservative capital structure

Financial data as of 6/30/16 1

Cash & Short-term investments2 $267

ABL revolver ($300 million) due Dec 1, 2020 -

5.875% Senior Unsecured Notes due May 15, 2024 375

Total Debt $375

Net Debt $108

Book Equity 808

Total Capitalization $1,183

Total Debt / Total Capitalization 31.7%

EBITDA2 $195

Total Debt / EBITDA 1.9x

Net Debt / EBITDA 0.6x

1 Balance Sheet data in millions of dollars, except for percentages and ratios

2 EBITDA = Last Twelve Months ended June 30, 2016 Consolidated Net Income before Interest, Other Income (Expense), Income Tax and non-run-rate items plus Depreciation and Amortization; refer to appendix

39

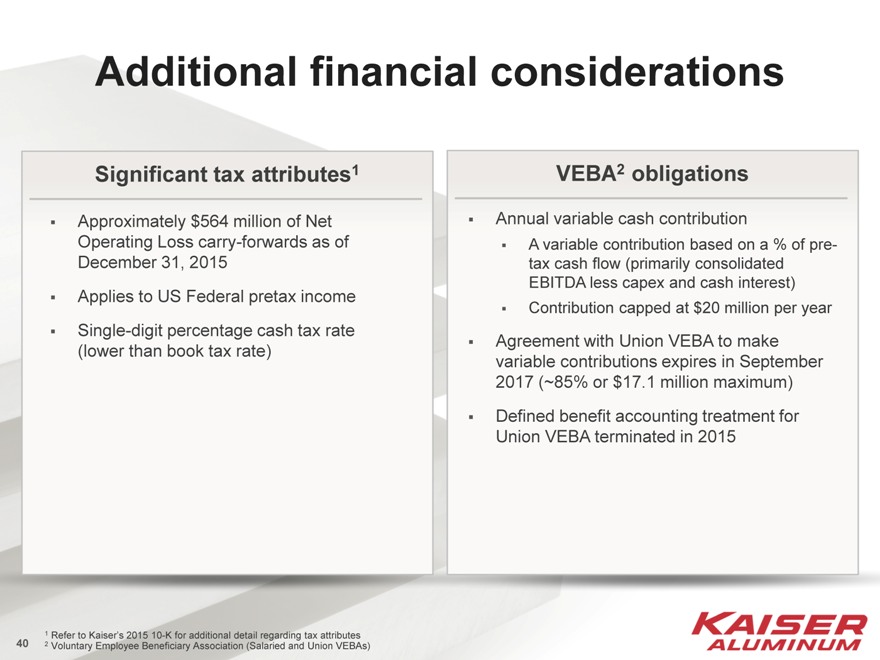

Additional financial considerations

Significant tax attributes1

Approximately $564 million of Net Operating Loss carry-forwards as of December 31, 2015 Applies to US Federal pretax income Single-digit percentage cash tax rate (lower than book tax rate)

VEBA2 obligations

Annual variable cash contribution

A variable contribution based on a % of pre-

tax cash flow (primarily consolidated

EBITDA less capex and cash interest)

Contribution capped at $20 million per year

Agreement with Union VEBA to make

variable contributions expires in September

2017 (~85% or $17.1 million maximum)

Defined benefit accounting treatment for

Union VEBA terminated in 2015

1 Refer to Kaiser’s 2015 10-K for additional detail regarding tax attributes

2 Voluntary Employee Beneficiary Association (Salaried and Union VEBAs)

40

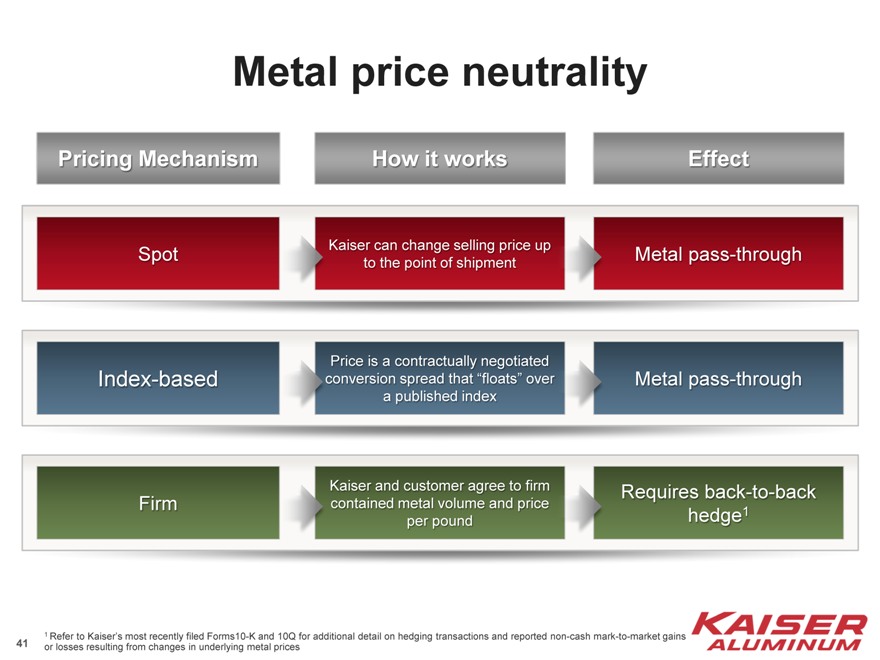

Metal price neutrality

Pricing Mechanism How it work Effe

Spot Kaiser can change selling price up Metalpass-through

to the point of shipment

Price is a contractually negotiated

Index-based conversion spread that “floats” over Metalpass-through

a published index

Kaiser and customer agree to firm Requires back-to-back

Firm contained metal volume and price

per pound hedge1

1 Refer to Kaiser’s most recently filed Forms10-K and 10Q for additional detail on hedging transactions and reported non-cash mark-to-market gains or losses resulting from changes in underlying metal prices

41

Experienced management team

Jack Hockema

CEO & Chairman Kaiser—24 years Industry—47 years

Dan Rinkenberger

EVP & CFO Kaiser—25 years Industry—25 years

John Donnan

EVP Legal, Compliance & Human Resources Kaiser—22 years Industry—22 years

Keith Harvey

President & COO Kaiser—35 years Industry—35 years

John Barneson

SVP Corporate Development Kaiser—41 years Industry—41 years

Senior management team has been together over 20 years; supported by a deep, strong organization

First 10 years: restructured and repositioned the company and business model Past 10 years: achieved steady, long-term growth facilitated by the strong business model

42

Appendix—Aerospace

43

Strong outlook for commercial aerospace demand

Commercial aerospace attributes

Broad product offering

High barriers to entry

Growth drivers

44

Aluminum demand drivers for commercial aerospace applications

Build rates

Aluminum content

45

Airframe build rates expected to grow

Increasing global travel

Need for more fuel efficient aircraft

Build rates

46

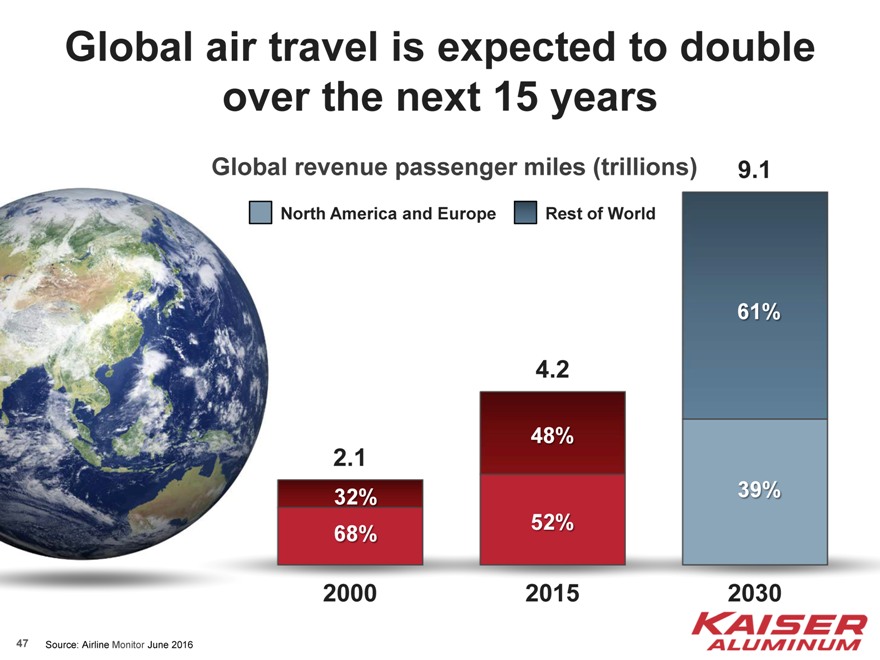

Global air travel is expected to double over the next 15 years

Global air travel is expected to double over the next 15 years

North America and Europe

Rest of World

9.1

61%

4.2

48%

2.1

32% 39% 52% 68%

2000 2015 2030

Source: Airline Monitor June 2016

47

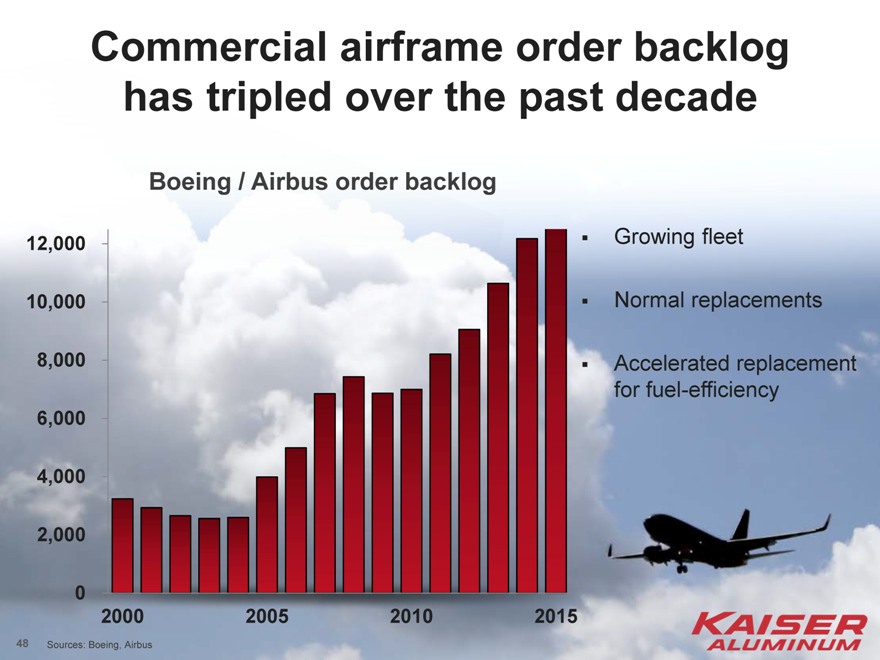

Commercial airframe order backlog has tripled over the past decade

Boeing / Airbus order backlog

Growing fleet

Normal replacements

Accelerated replacement for fuel-efficiency

12,000 10,000 8,000 6,000 4,000 2,000

0

2000 2005 2010 2015

Sources: Boeing, Airbus

48

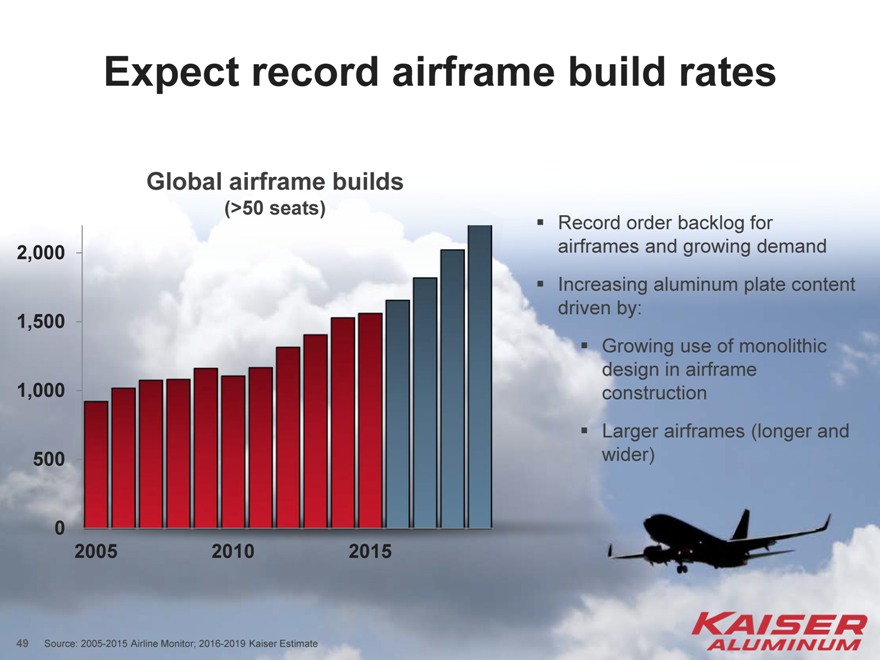

Expect record airframe build rates

Global airframe builds

(>50 seats)

Record order backlog for airframes and growing demand Increasing aluminum plate content driven by:

Growing use of monolithic design in airframe construction Larger airframes (longer and wider)

2,000 1,500 1,000 500

0

2005 2010 2015

Source: 2005-2015 Airline Monitor; 2016-2019 Kaiser Estimate

49

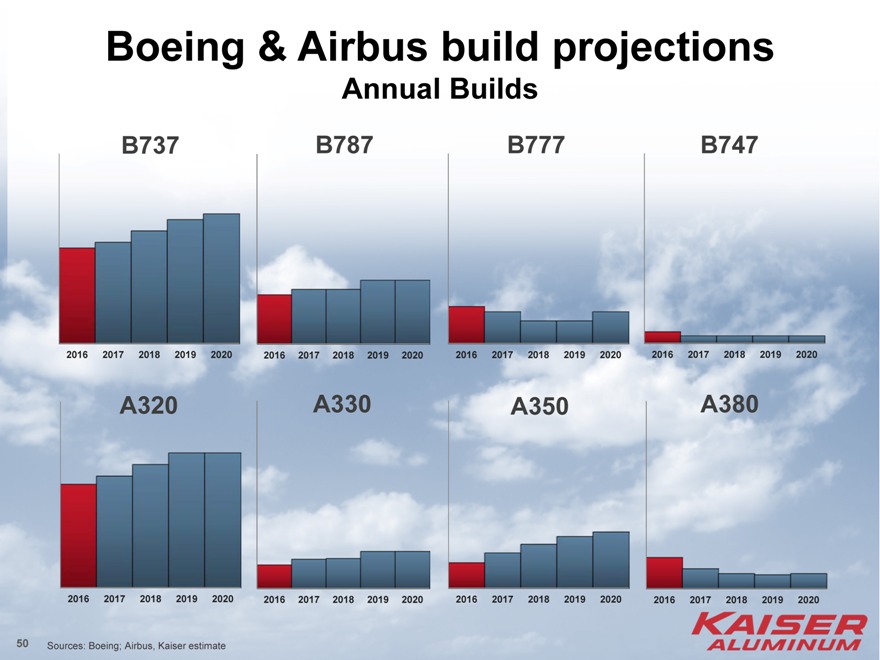

Boeing & Airbus build projections Annual Builds

B737 B787 B777 B747

2016 2017 2018 2019 2020 2016 2017 2018 2019 2020 2016 2017 2018 2019 2020 2016 2017 2018 2019 2020

A320 A330 A350 A380

2016 2017 2018 2019 2020 2016 2017 2018 2019 2020 2016 2017 2018 2019 2020 2016 2017 2018 2019 2020

Sources: Boeing; Airbus, Kaiser estimate

50

Several factors influence airframe aluminum content

Size of airframes Monolithic design Material selection

Aluminum content

51

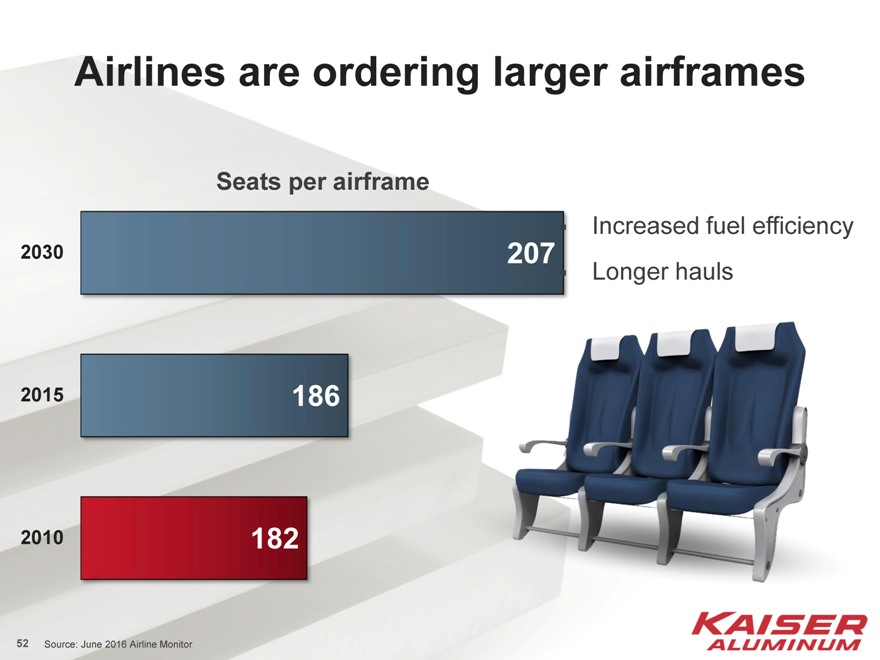

Seats per airframe

207 2030

2015 186

2010 182

Source: June 2016 Airline Monitor

52

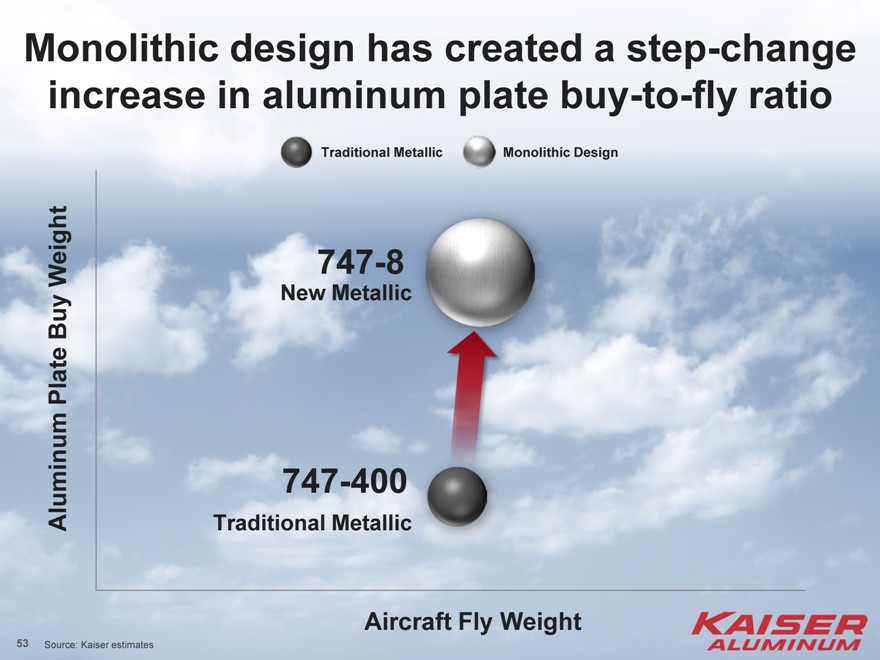

Monolithic design has created a step-change increase in aluminum plate buy-to-fly ratio

Traditional Metallic

Monolithic Design

Aluminum Plate Buy Weight

747-8

New Metallic

747-400

Traditional Metallic

Aircraft Fly Weight

Source: Kaiser estimates

53

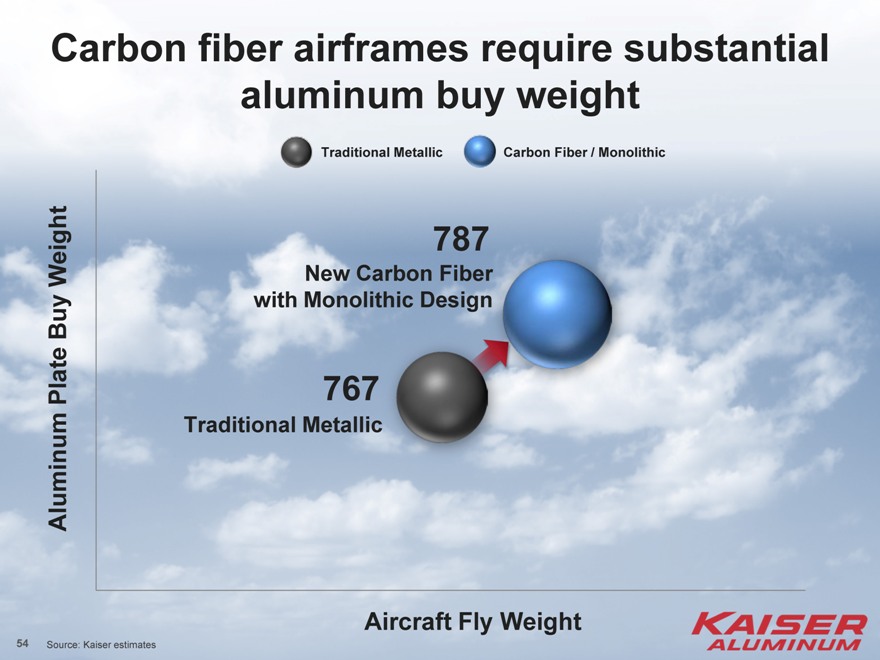

Carbon fiber airframes require substantial aluminum buy weight

Traditional Metallic

Carbon Fiber / Monolithic

787

New Carbon Fiber with Monolithic Design

767

Traditional Metallic

Aluminum Plate Buy Weight

Aircraft Fly Weight

Source: Kaiser estimates

54

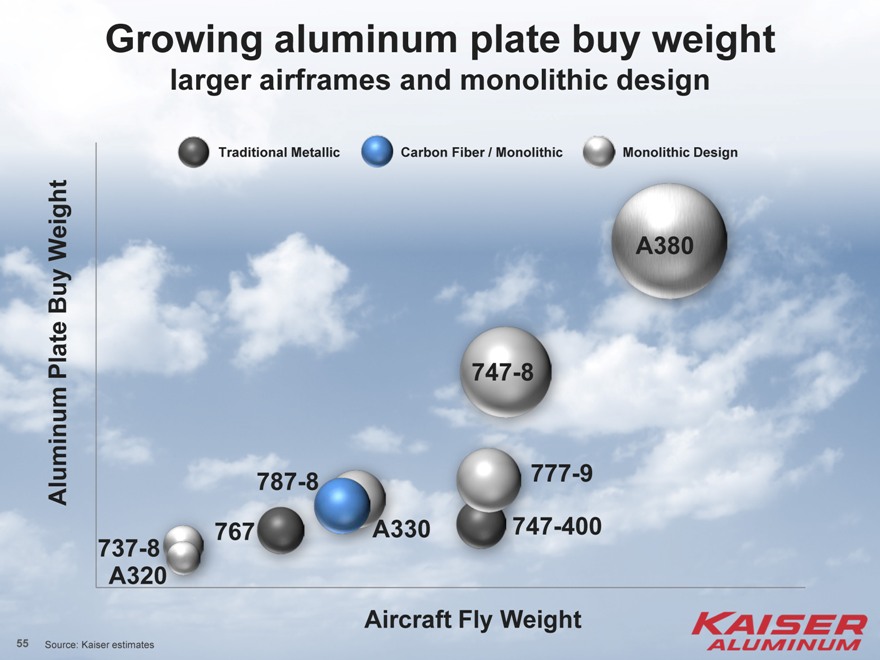

Growing aluminum plate buy weight

larger airframes and monolithic design

Traditional Metallic

Carbon Fiber / Monolithic

Monolithic Design

Aluminum Plate Buy Weight

A380

747-8

787-8 777-9 767 A330 747-400 737-8 A320

Aircraft Fly Weight

Source: Kaiser estimates

55

Kaiser aerospace / high strength

Annual value added revenue1 ($mm)

Shipments $462

$451 $449 $449 $430

$377

$324 $297 $295 $278

237 244 243 $256 224 224

$224 192

155 158 159

145 2012-2014: Aerospace 125 142 inventory restocking-destocking cycle, declining HT plate prices

‘05 ‘06 ‘07 ‘08 ‘09 ‘10 ‘11 ‘12 ‘13 ‘14 ‘15 LTM2

Positioned for growth

7% CAGR3 from 2005

Strong market presence, broad product offering Trentwood investments

More than doubled HT plate capacity Expanded capabilities for thick plate Improved quality Enhanced cost efficiency $150 million multi-year investment to enhance quality/efficiency and further expand capacity

1 Value Added Revenue (VAR) = net sales less hedged cost of alloyed metal. Hedged cost of alloyed metal = Midwest transaction price plus the cost of alloying elements plus any realized gains and/or losses on settled hedges, related to metal sold in the referenced period.

2 LTM = Last Twelve Months ended June 30, 2016

3 CAGR = compound annual growth rate

56

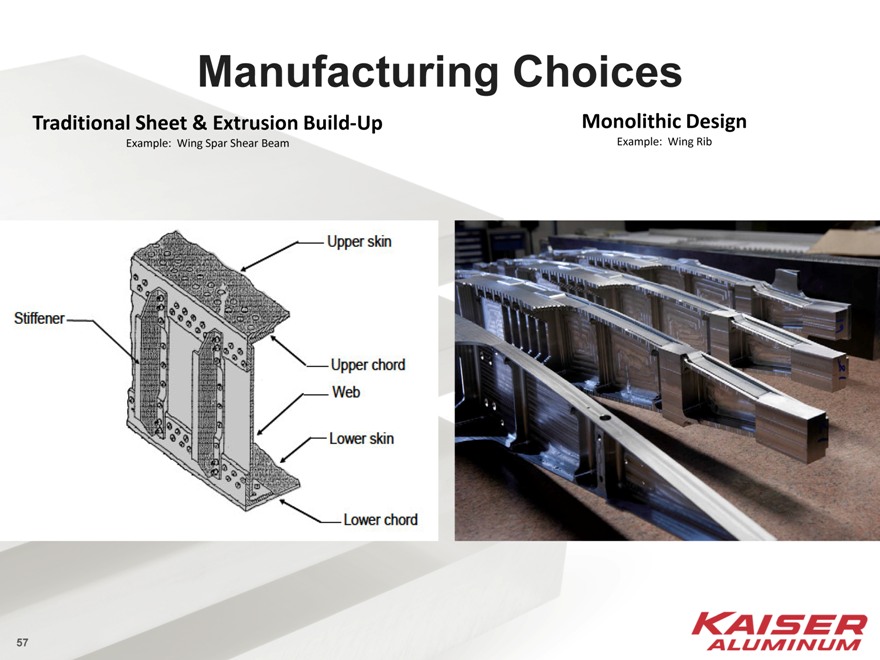

Manufacturing Choices

Traditional Sheet & Extrusion Build-Up

Example: Wing Spar Shear Beam

Monolithic Design

Example: Wing Rib

57

KaiserLiner aircraft applications

PLATE

1 Wing Ribs 2 Wing Spars 3 Leading Edge Ribs 6 Winglet Attach Structure 7 Trailing Edge Ribs 8 Wing Skins

12 Fuselage Frames

13 Bulkheads

14 Tailcone Components

15 Cargo Floor Beam

21 Door Components

25 Wing to Body Fairing Components

26 Engine Support Structure

27 Baggage Bin Structure

28 Seat Legs

39 Vertical Tail Ribs & Spars

40 Horizontal Tail Fittings

FORGE STOCK

19 Windows Attach Structure

24 Landing Gear Components

36 Actuator Components

37 Brake Components

SHEET

4 Leading Edge Skins

11 Fuselage Stringers

12 Fuselage Frames

16 Fuselage Brackets

17 Fuselage Skins

21 Door Components

22 Engine Inlet Lip Skins

23 Engine Cowl Skins

32 Seat Pans

HARD ALLOY EXTRUDED SHAPES

5 Wing Stringers 9 Floor Beams

10 Seat Tracks

11 Fuselage Stringers

12 Fuselage Frames

14 Tailcone Components

15 Cargo Floor Beam

20 Cargo Door Hinge

25 Wing to Body Fairing Components

REDRAW ROD

18 Rivet Fastener Stock

HARD ALLOY DRAWN TUBE

29 Seat Backs

30 Seat Beams

31 Seat Baggage Bars

33 Air Ducts

34 Hydraulic Tubing

35 Fuel Lines

38 Torque Tubes

SOFT ALLOY EXTRUSIONS

28 Seat Legs

HARD ALLOY EXTRUSIONS

36 Actuator Components

41 Hydraulic Manifolds

© 2015 Kaiser Aluminum All Rights Reserved.

Appendix—Automotive

59

Strong outlook for automotive extrusion demand

Automotive extrusion attributes

Demanding applications

Key factors for success

Growth drivers

60

Aluminum demand drivers for automotive applications

Build rates

Aluminum content

61

Increasing N.A. vehicle build rates

Vehicle production

Sales Imports Exports

Vehicle production

Build rates

62

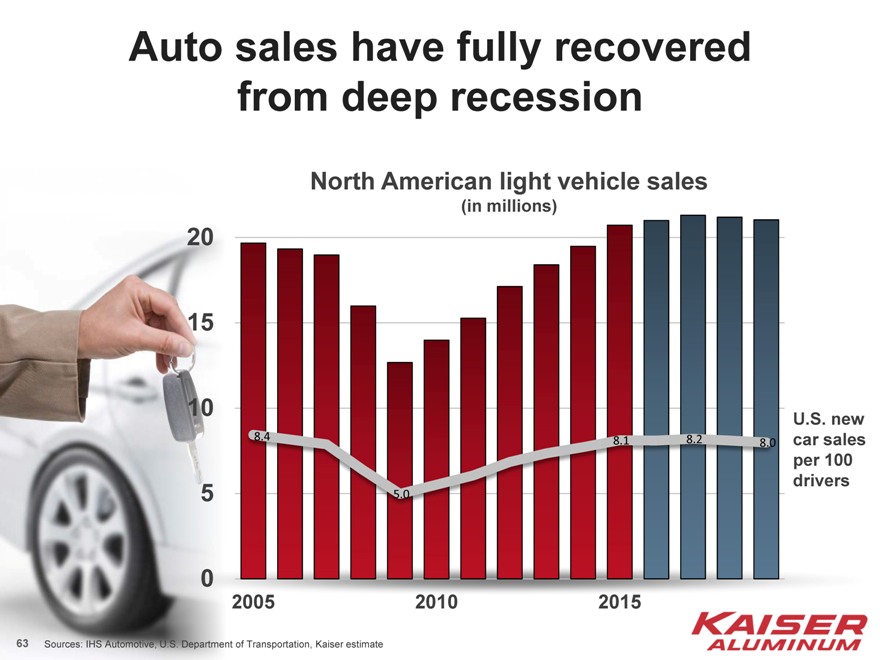

Auto sales have fully recovered from deep recession

North American light vehicle sales

(in millions)

20

15

10

U.S. new

8.4 8.1 8.2 car sales

8.0

per 100

5 5.0 drivers

0

2005 2010 2015

Sources: IHS Automotive, U.S. Department of Transportation, Kaiser estimate

63

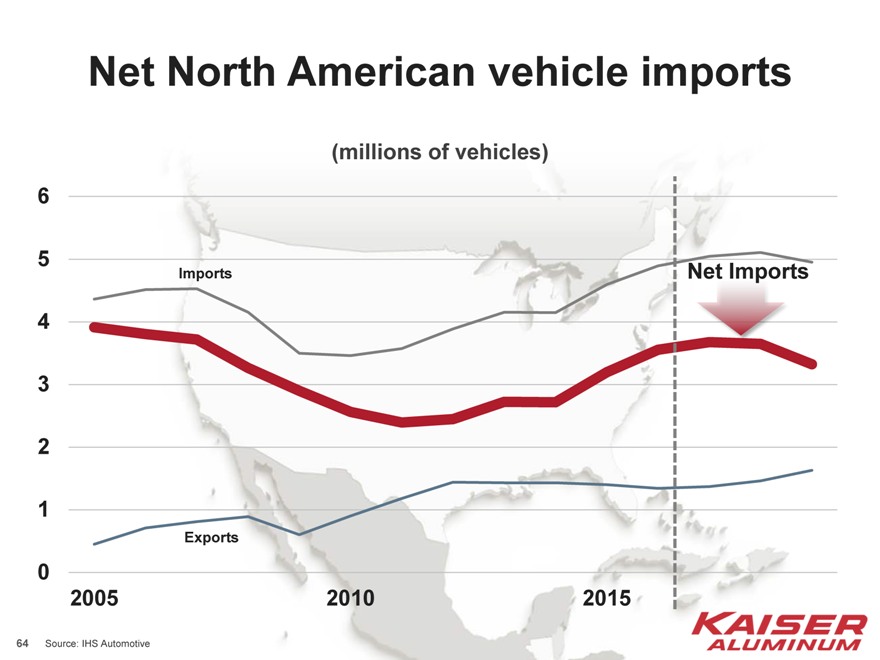

Net North American vehicle imports

(millions of vehicles)

6

5

Imports Net Imports 4

3

2

1

Exports

0

2005 2010 2015

Source: IHS Automotive

64

Auto builds expected to sustain 18M rate

North American light vehicle builds

(in millions)

18 16 14 12 10 8 6 4 2 0

2005 2010 2015

Sources: 2005-2015 – IHS; 2016-2019 – Kaiser estimate

65

Auto aluminum content is growing

CAFE regulations Light weighting with aluminum

Aluminum content

66

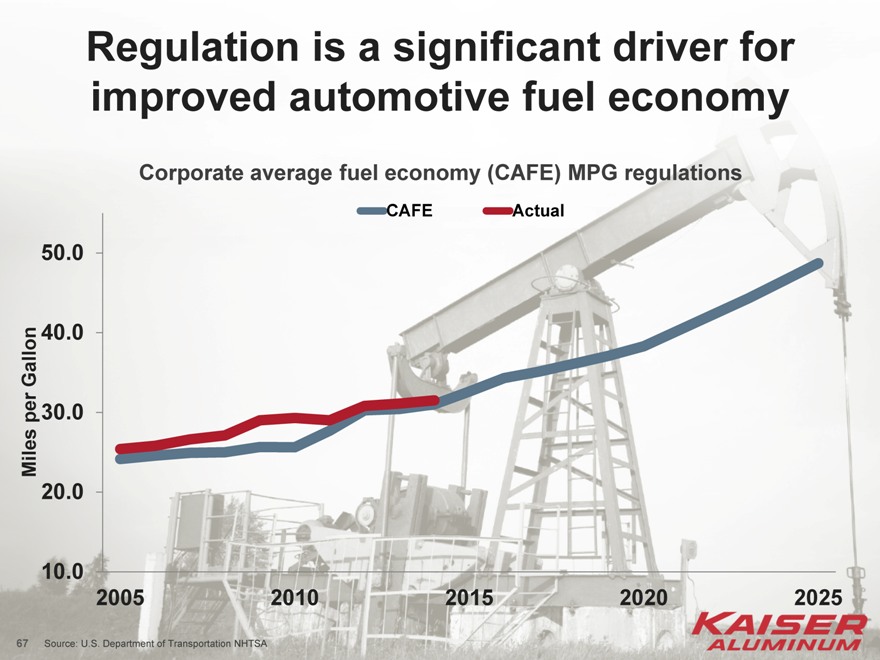

Regulation is a significant driver for improved automotive fuel economy

Corporate average fuel economy (CAFE) MPG regulations

CAFE Actual

50.0

Gallon 40.0

per 30.0

Miles

20.0

10.0

2005 2010 2015 2020 2025

Source: U.S. Department of Transportation NHTSA

67

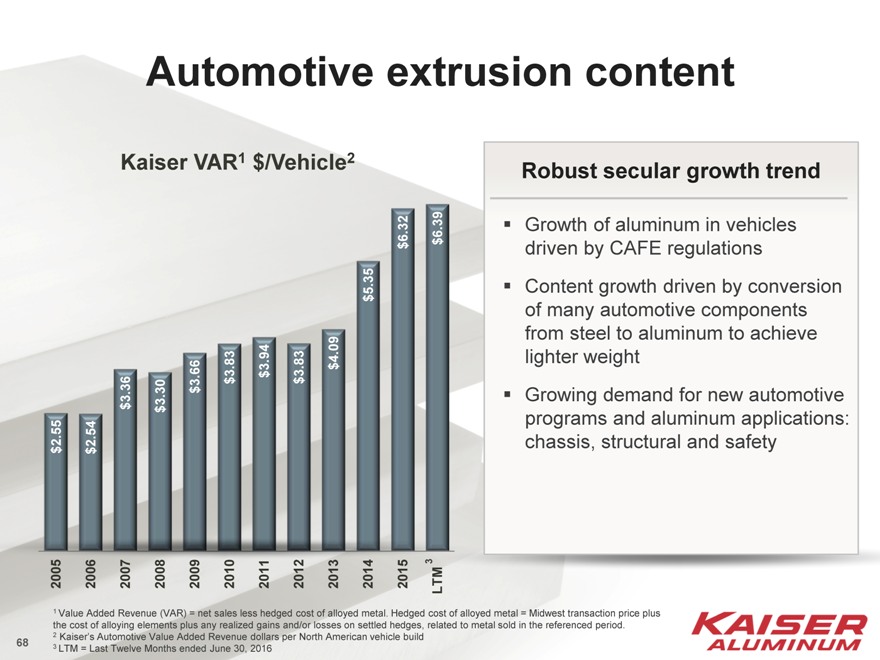

Automotive extrusion content

Kaiser VAR1 $/Vehicle2

2005 $2.55 2006 $2.54 2007 $3.36 2008 $3.30 2009 $3.66 2010 $3.83 2011 $3.94 2012 $3.83 2013 $4.09

2014 $5.35

2015 $6.32

3

LTM $6.39

Robust secular growth trend

Growth of aluminum in vehicles driven by CAFE regulations Content growth driven by conversion of many automotive components from steel to aluminum to achieve lighter weight Growing demand for new automotive programs and aluminum applications: chassis, structural and safety

1 Value Added Revenue (VAR) = net sales less hedged cost of alloyed metal. Hedged cost of alloyed metal = Midwest transaction price plus the cost of alloying elements plus any realized gains and/or losses on settled hedges, related to metal sold in the referenced period.

2 Kaiser’s Automotive Value Added Revenue dollars per North American vehicle build 3 LTM = Last Twelve Months ended June 30, 2016

68

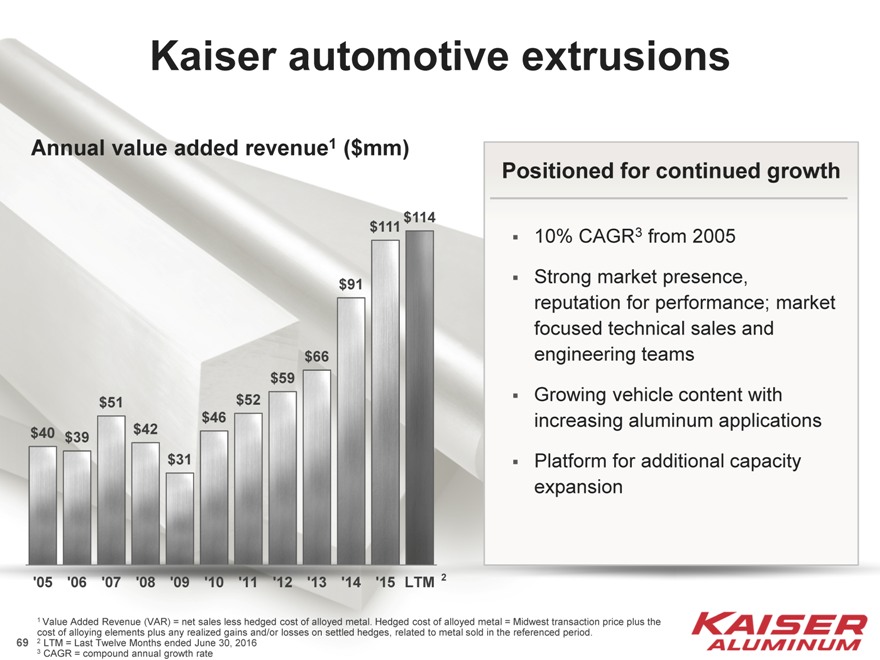

Kaiser automotive extrusions

Annual value added revenue1 ($mm)

$114

$111

$91

$66

$59

$51 $52

$46

$40 $42

$39

$31

‘05 ‘06 ‘07 ‘08 ‘09 ‘10 ‘11 ‘12 ‘13 ‘14 ‘15 LTM 2

Positioned for continued growth

10% CAGR3 from 2005 Strong market presence, reputation for performance; market focused technical sales and engineering teams Growing vehicle content with increasing aluminum applications Platform for additional capacity expansion

1 Value Added Revenue (VAR) = net sales less hedged cost of alloyed metal. Hedged cost of alloyed metal = Midwest transaction price plus the cost of alloying elements plus any realized gains and/or losses on settled hedges, related to metal sold in the referenced period.

2 LTM = Last Twelve Months ended June 30, 2016

3 CAGR = compound annual growth rate

69

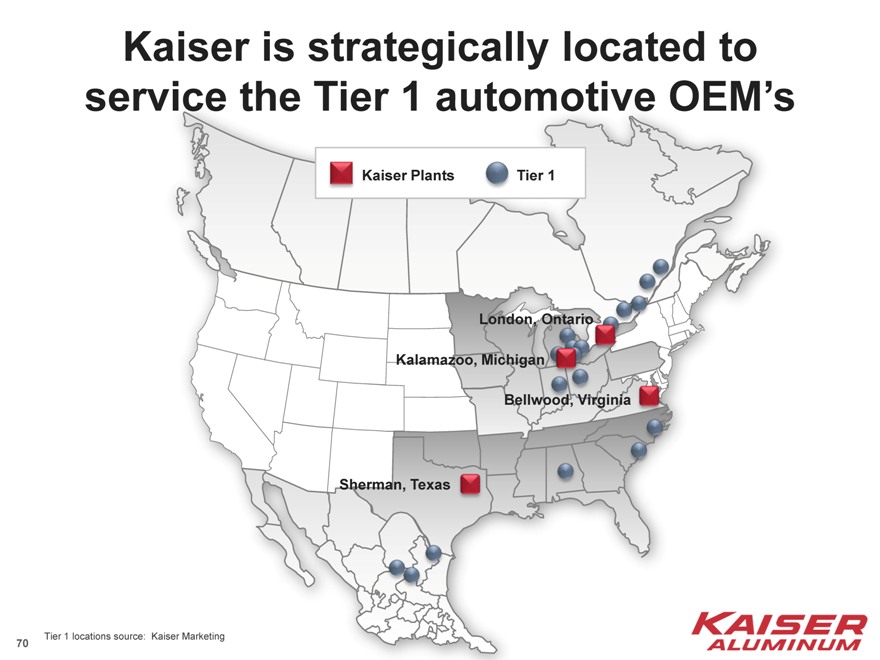

Kaiser is strategically located to service the Tier 1 automotive OEM’s

Kaiser Plants Tier 1

London, Ontario Kalamazoo, Michigan Bellwood, Virginia

Sherman, Texas

Tier 1 locations source: Kaiser Marketing

70

Kaiser light vehicle extrusions

Rocker (structural)

Control Arm1 (chassis)

ABS Valve Body

6xxx 7xxx Bumpers

Driveshaft

Roof Header Shotgun (structural)

Radiator Support

1 Control arm designed and produced by Raufoss Neuman © Copyright 2015 Kaiser Aluminum. All Rights Reserved.

71

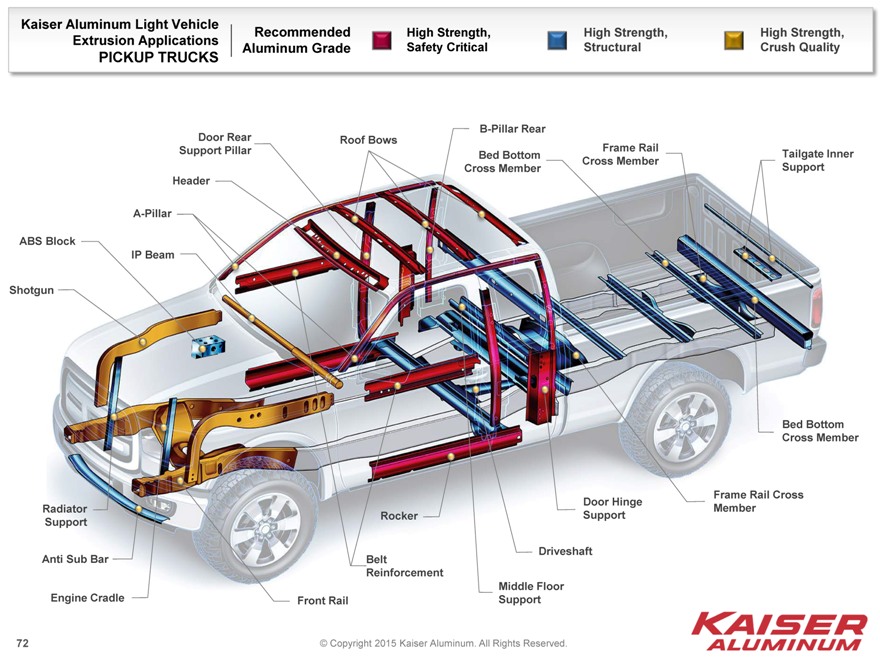

Kaiser Aluminum Light Vehicle

Extrusion Applications

PICKUP TRUCKS

Recommended

Aluminum Grade

High Strength, Safety Critical

High Strength, Structural

High Strength, Crush Quality

B-Pillar Rear

Door Rear Roof Bows Frame Rail

Support Pillar Bed Bottom Cross Member Tailgate Inner Cross Member Support Header

A-Pillar

ABS Block

IP Beam

Shotgun

Bed Bottom Cross Member

Frame Rail Cross Door Hinge Radiator Member Rocker Support Support

Driveshaft Anti Sub Bar Belt Reinforcement Engine Cradle Middle Floor Front Rail Support

© Copyright 2015 Kaiser Aluminum. All Rights Reserved.

72

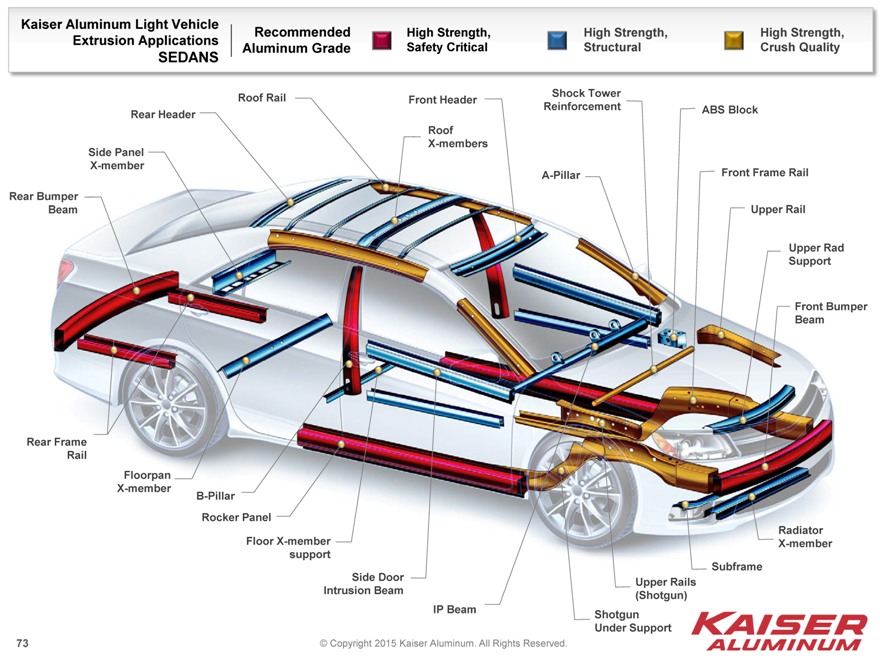

Kaiser Aluminum Light Vehicle

Recommended High Strength, High Strength, High Strength,

Extrusion Applications

Aluminum Grade Safety Critical Structural Crush Quality

SEDANS

Roof Rail Shock Tower Front Header

Reinforcement ABS Block Rear Header Roof X-members Side Panel X-member

A-Pillar Front Frame Rail Rear Bumper Beam Upper Rail

Upper Rad Support

Front Bumper Beam

Rear Frame Rail

Floorpan X-member

B-Pillar Rocker Panel

Floor X-member Radiator support X-member Side Door Subframe Upper Rails Intrusion Beam (Shotgun) IP Beam Shotgun Under Support

© Copyright 2015 Kaiser Aluminum. All Rights Reserved.

73

Appendix – General Engineering

74

General engineering product offering

General engineering attributes

Broad product Performance

Growth drivers

offering attributes

Plate Rod and Pipe and

and bar Tube

sheet

Seamless

and Standard

structural shapes

extruded (angles,

channels, T, I)

tube

75

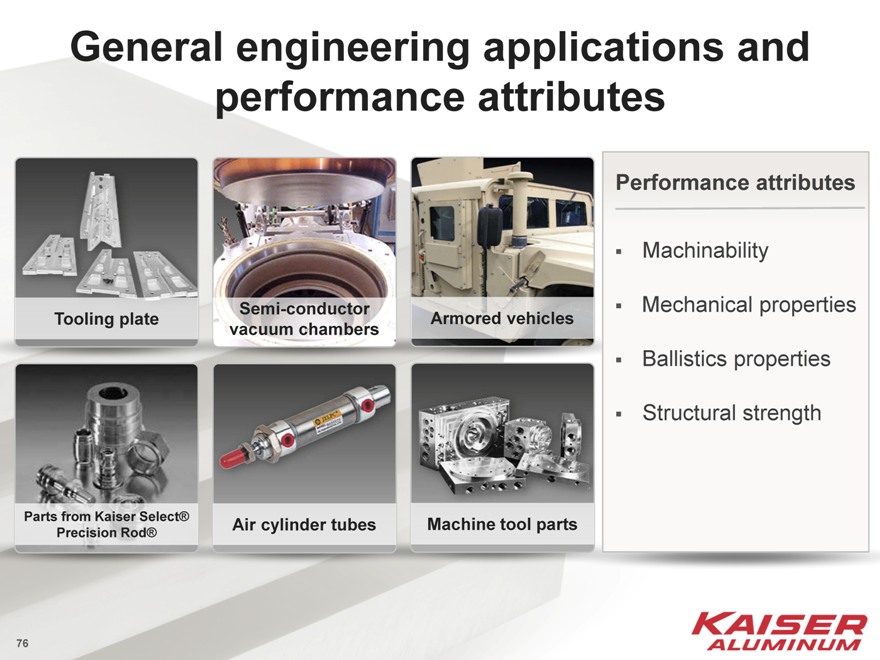

General engineering applications and performance attributes

Performance attributes

Machinability

Mechanical properties Ballistics properties Structural strength

Semi-conductor

Tooling plate Armored vehicles

vacuum chambers

Parts from Kaiser Select® Air cylinder tubes Machine tool parts

Precision Rod®

76

Kaiser general engineering

Annual value added revenue1 ($mm)

Growth tied to U.S. industrial economy

2% CAGR3 from 2005 Highly recognized name brand Differentiated KaiserSelect® quality Broad product offering Commitment and infrastructure to support national service centers

Armor plate

demand surge

2006-2008

$249

$225

$200 $205

$191 $192 $186

$175 $182

$168 $174

$165

‘05 ‘06 ‘07 ‘08 ‘09 ‘10 ‘11 ‘12 ‘13 ‘14 ‘15 LTM 2

1 Value Added Revenue (VAR) = net sales less hedged cost of alloyed metal. Hedged cost of alloyed metal = Midwest transaction price plus the cost of alloying elements plus any realized gains and/or losses on settled hedges, related to metal sold in the referenced period.

2 LTM = Last Twelve Months ended June 30, 2016

3 CAGR = compound annual growth rate

77

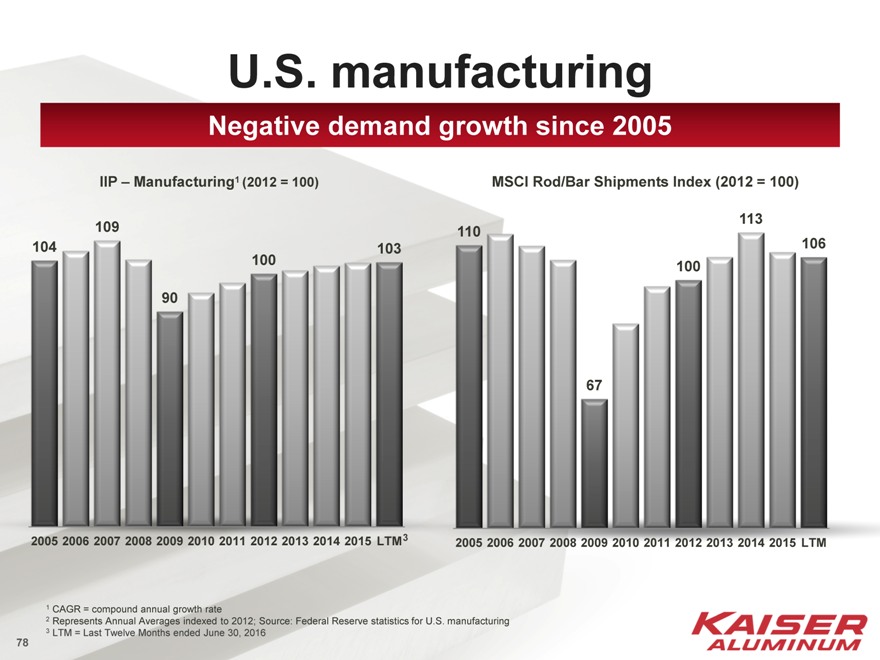

U.S. manufacturing

Negative demand growth since 2005

IIP – Manufacturing1 (2012 = 100) MSCI Rod/Bar Shipments Index (2012 = 100)

113

109 110

104 103 106

100 100

90

67

2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 LTM3 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 LTM

1 CAGR = compound annual growth rate

2 Represents Annual Averages indexed to 2012; Source: Federal Reserve statistics for U.S. manufacturing

3 LTM = Last Twelve Months ended June 30, 2016

78

Appendix – Financial Reconciliation

79

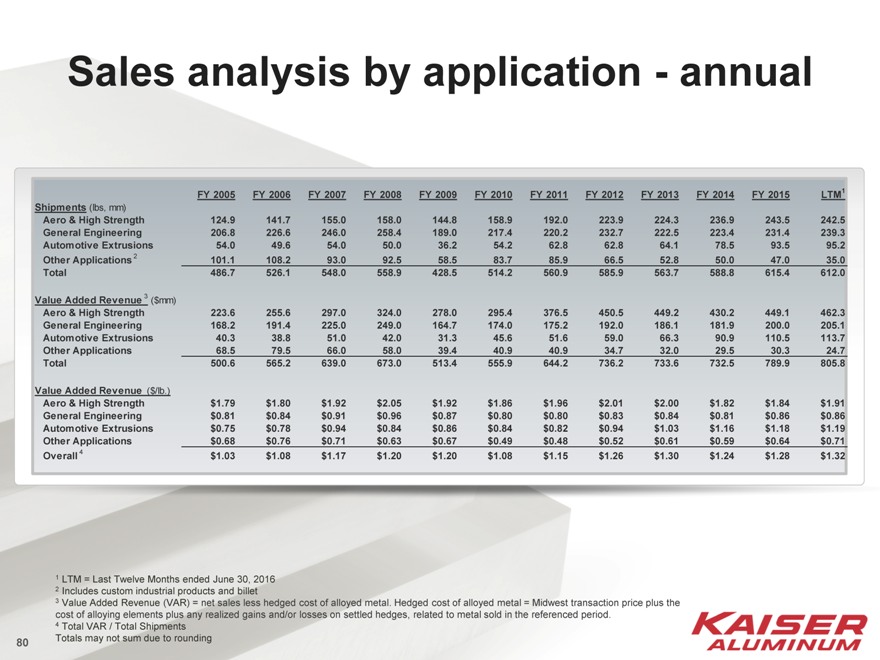

Sales analysis by application—annual

FY 2005 FY 2006FY 2007FY 2008FY 2009FY 2010FY 2011FY 2012FY 2013FY 2014FY 2015LTM1

Shipments (lbs, mm)

Aero & High Strength 124.9 141.7155.0158.0144.8158.9192.0223.9224.3236.9243.5242.5

General Engineering 206.8 226.6246.0258.4189.0217.4220.2232.7222.5223.4231.4239.3

Automotive Extrusions 54.049.654.050.036.254.262.862.864.178.593.595.2

Other Applications 2 101.1 108.293.092.558.583.785.966.552.850.047.035.0

Total 486.7 526.1548.0558.9428.5514.2560.9585.9563.7588.8615.4612.0

Value Added Revenue 3 ($mm)

Aero & High Strength 223.6 255.6297.0324.0278.0295.4376.5450.5449.2430.2449.1462.3

General Engineering 168.2 191.4225.0249.0164.7174.0175.2192.0186.1181.9200.0205.1

Automotive Extrusions 40.338.851.042.031.345.651.659.066.390.9110.5113.7

Other Applications 68.579.566.058.039.440.940.934.732.029.530.324.7

Total 500.6 565.2639.0673.0513.4555.9644.2736.2733.6732.5789.9805.8

Value Added Revenue ($/lb.)

Aero & High Strength $1.79$1.80$1.92$2.05$1.92$1.86$1.96$2.01$2.00$1.82$1.84$1.91

General Engineering $0.81$0.84$0.91$0.96$0.87$0.80$0.80$0.83$0.84$0.81$0.86$0.86

Automotive Extrusions $0.75$0.78$0.94$0.84$0.86$0.84$0.82$0.94$1.03$1.16$1.18$1.19

Other Applications $0.68$0.76$0.71$0.63$0.67$0.49$0.48$0.52$0.61$0.59$0.64$0.71

Overall 4 $1.03$1.08$1.17$1.20$1.20$1.08$1.15$1.26$1.30$1.24$1.28$1.32

1 LTM = Last Twelve Months ended June 30, 2016

2 Includes custom industrial products and billet

3 Value Added Revenue (VAR) = net sales less hedged cost of alloyed metal. Hedged cost of alloyed metal = Midwest transaction price plus the cost of alloying elements plus any realized gains and/or losses on settled hedges, related to metal sold in the referenced period.

4 Total VAR / Total Shipments Totals may not sum due to rounding

80

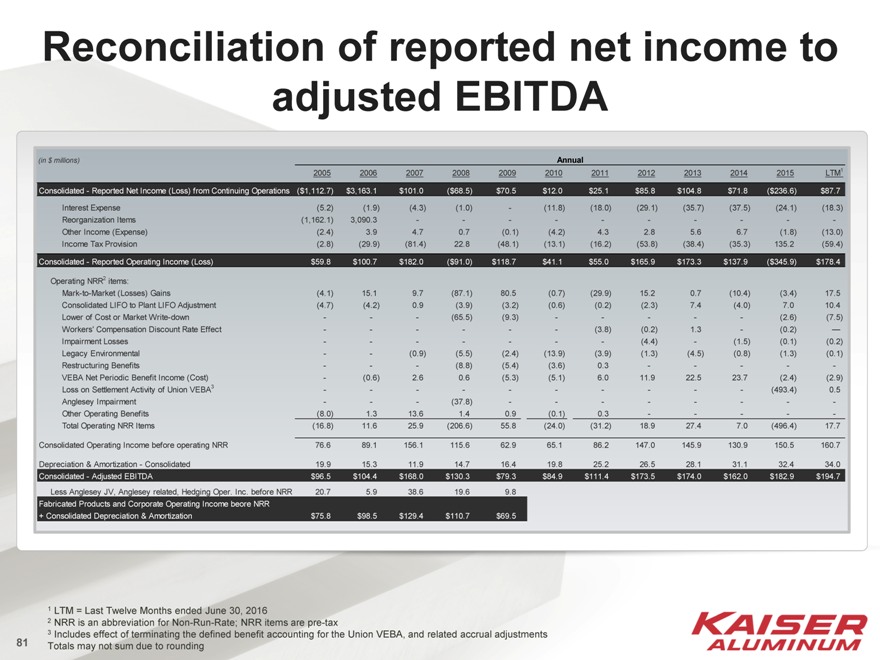

Reconciliation of reported net income to adjusted EBITDA

(in $ millions) Annual

2005 2006200720082009201020112012201320142015LTM1

Consolidated—Reported Net Income (Loss) from Continuing Operations ($1,112.7) $3,163.1 $101.0($68.5)$70.5$12.0$25.1$85.8$104.8$71.8($236.6)$87.7

Interest Expense (5.2) (1.9)(4.3)(1.0)-(11.8)(18.0)(29.1)(35.7)(37.5)(24.1)(18.3)

Reorganization Items (1,162.1) 3,090.3----------

Other Income (Expense) (2.4) 3.94.70.7(0.1)(4.2)4.32.85.66.7(1.8)(13.0)

Income Tax Provision (2.8) (29.9)(81.4)22.8(48.1)(13.1)(16.2)(53.8)(38.4)(35.3)135.2(59.4)

Consolidated—Reported Operating Income (Loss) $59.8 $100.7$182.0($91.0)$118.7$41.1$55.0$165.9$173.3$137.9($345.9)$178.4

Operating NRR2 items:

Mark-to-Market (Losses) Gains (4.1) 15.19.7(87.1)80.5(0.7)(29.9)15.20.7(10.4)(3.4)17.5

Consolidated LIFO to Plant LIFO Adjustment (4.7) (4.2)0.9(3.9)(3.2)(0.6)(0.2)(2.3)7.4(4.0)7.010.4

Lower of Cost or Market Write-down - --(65.5)(9.3)-----(2.6)(7.5)

Workers’ Compensation Discount Rate Effect - -----(3.8)(0.2)1.3-(0.2)—

Impairment Losses - ------(4.4)-(1.5)(0.1)(0.2)

Legacy Environmental - -(0.9)(5.5)(2.4)(13.9)(3.9)(1.3)(4.5)(0.8)(1.3)(0.1)

Restructuring Benefits - --(8.8)(5.4)(3.6)0.3-----

VEBA Net Periodic Benefit Income (Cost) - (0.6)2.60.6(5.3)(5.1)6.011.922.523.7(2.4)(2.9)

Loss on Settlement Activity of Union VEBA3 - ---------(493.4)0.5

Anglesey Impairment - --(37.8)--------

Other Operating Benefits (8.0) 1.313.61.40.9(0.1)0.3-----

Total Operating NRR Items (16.8) 11.625.9(206.6)55.8(24.0)(31.2)18.927.47.0(496.4)17.7

Consolidated Operating Income before operating NRR 76.6 89.1156.1115.662.965.186.2147.0145.9130.9150.5160.7

Depreciation & Amortization—Consolidated 19.9 15.311.914.716.419.825.226.528.131.132.434.0

Consolidated—Adjusted EBITDA $96.5 $104.4$168.0$130.3$79.3$84.9$111.4$173.5$174.0$162.0$182.9$194.7

Less Anglesey JV, Anglesey related, Hedging Oper. Inc. before NRR 20.7 5.938.619.69.8

Fabricated Products and Corporate Operating Income beore NRR

+ Consolidated Depreciation & Amortization $75.8 $98.5$129.4$110.7$69.5

1 LTM = Last Twelve Months ended June 30, 2016

2 NRR is an abbreviation for Non-Run-Rate; NRR items are pre-tax

3 Includes effect of terminating the defined benefit accounting for the Union VEBA, and related accrual adjustments Totals may not sum due to rounding

81

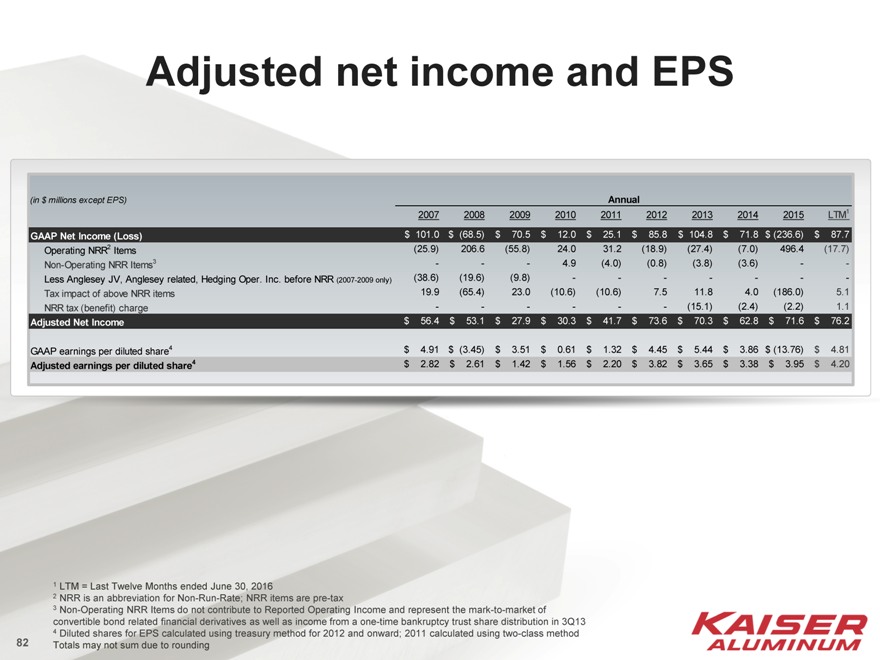

Adjusted net income and EPS

(in $ millions except EPS) Annual

2007 2008 2009 2010 2011 2012 2013 2014 2015 LTM1

GAAP Net Income (Loss) $ 101.0 $ (68.5) $ 70.5 $ 12.0 $ 25.1 $ 85.8 $ 104.8 $ 71.8 $ (236.6) $ 87.7

Operating NRR2 Items (25.9) 206.6 (55.8) 24.0 31.2 (18.9) (27.4) (7.0) 496.4 (17.7)

Non-Operating NRR Items3 — — — 4.9 (4.0) (0.8) (3.8) (3.6) — -

Less Anglesey JV, Anglesey related, Hedging Oper. Inc. before NRR (2007-2009 only) (38.6) (19.6) (9.8) — — — — — — -

Tax impact of above NRR items 19.9 (65.4) 23.0 (10.6) (10.6) 7.5 11.8 4.0 (186.0) 5.1

NRR tax (benefit) charge — — — — — — (15.1) (2.4) (2.2) 1.1

Adjusted Net Income $ 56.4 $ 53.1 $ 27.9 $ 30.3 $ 41.7 $ 73.6 $ 70.3 $ 62.8 $ 71.6 $ 76.2

GAAP earnings per diluted share4 $ 4.91 $ (3.45) $ 3.51 $ 0.61 $ 1.32 $ 4.45 $ 5.44 $ 3.86 $ (13.76) $ 4.81

Adjusted earnings per diluted share4 $ 2.82 $ 2.61 $ 1.42 $ 1.56 $ 2.20 $ 3.82 $ 3.65 $ 3.38 $ 3.95 $ 4.20

1 LTM = Last Twelve Months ended June 30, 2016

2 NRR is an abbreviation for Non-Run-Rate; NRR items are pre-tax

3 Non-Operating NRR Items do not contribute to Reported Operating Income and represent the mark-to-market of convertible bond related financial derivatives as well as income from a one-time bankruptcy trust share distribution in 3Q13

4 Diluted shares for EPS calculated using treasury method for 2012 and onward; 2011 calculated using two-class method Totals may not sum due to rounding

82