Welcome & Introductions Oscar M. Bean, Chairman of the Board

Recognition of Retiring Directors

Recognition of Employees for Years of Service

Approval of 2015 Annual Meeting Minutes

Judges’ Report Rodney Crider & Christine Smith

Overview of 2015 Financial Performance H. Charles Maddy III, President & CEO

Forward-Looking Statements This presentation contains information that constitutes forward-looking statements (within the meaning of the Private Securities Litigation Act of 1995) that are based on current expectations that involve a number of risks and uncertainties. Words such as “expects”, “anticipates”, “believes”, “estimates” and other similar expressions or future or conditional verbs such as “will”, “should”, “would” and “could” are intended to identify such forward- looking statements. Although we believe the expectations reflected in such forward-looking statements are reasonable, actual results may differ materially. Factors that might cause such a difference include changes in interest rates and interest rate relationships; changes in the national and local economies; demand for products and services; the degree of competition by traditional and non-traditional competitors; changes in banking laws and regulations; changes in tax laws; the impact of technological advances; the outcomes of contingencies; trends in customer behavior as well as their ability to repay loans; and our ability to successfully complete and integrate acquisitions. We undertake no obligation to revise these statements following the date of this presentation.

Hire the best and brightest … hold them accountable and reward them for results Emphasize community banking Emphasize asset quality Emphasize efficiency Emphasize profitability Maintain moderate, but stable organic growth Seek opportune expansion opportunities when they make sense Our Business Model

$1,110 $1,235 $1,436 $1,627 $1,585 $1,478 $1,450 $1,387 $1,386 $1,444 $1,492 $0 $400 $800 $1,200 $1,600 $2,000 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 10 Year CAGR = 3.0% Total Assets $ Millions Our Growth

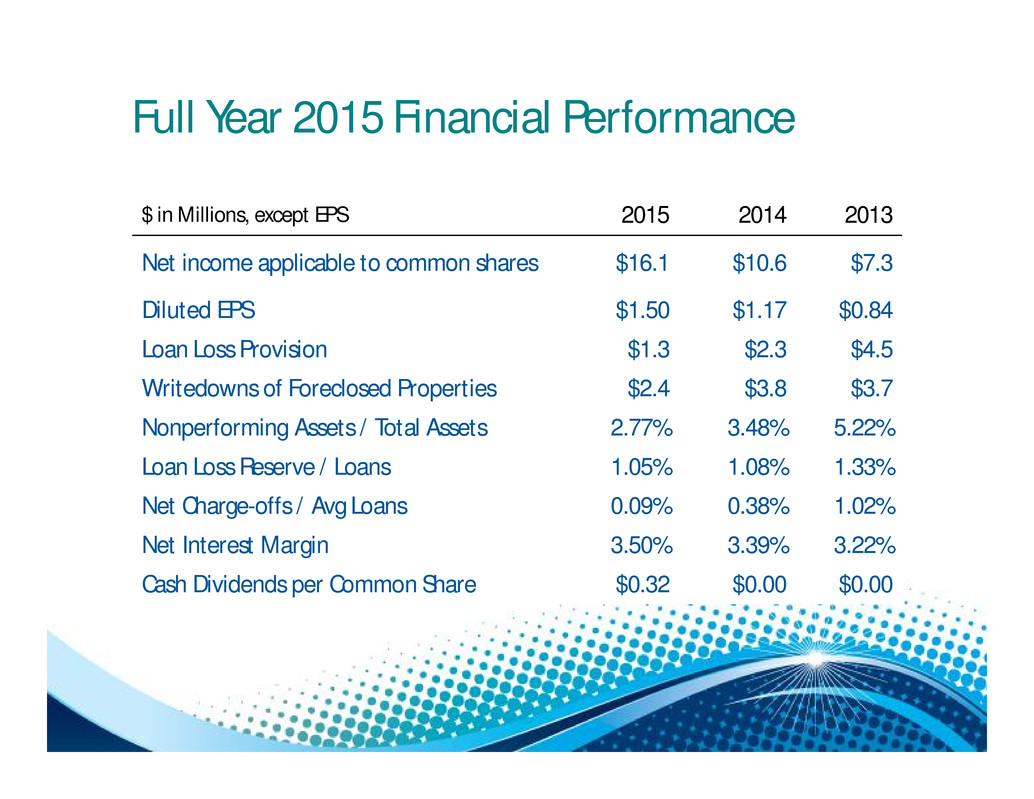

Ø Improved profitability: 2015 was the most profitable year in Summit’s history; net income applicable to common shares was $16.1 million, or $1.50 per share, for 2015 compared to $10.6 million, or $1.17 per share, for 2014; a 29.9% increase in EPS; Ø Improved net interest margin: increased 11 basis points; Ø Core revenue growth: $3.04 million or 5.7 percent in 2015; Ø Improved credit quality: Nonperforming assets (NPAs) declined 17.7% to their lowest level since 2008; 2015: Highlights

2015: Highlights Ø Solid loan growth: loan balances grew 5.8% or $59.8 million in 2015; Ø Strong capital position: our regulatory capital ratios are at their highest level in 16 years and are well in excess of regulatory requirements for “well-capitalized” institutions; Ø Pending acquisition of Highland County Bankshares: announced Feb. 2016 transaction to combine two financially strong banks with similar cultures, core values and guiding principles.

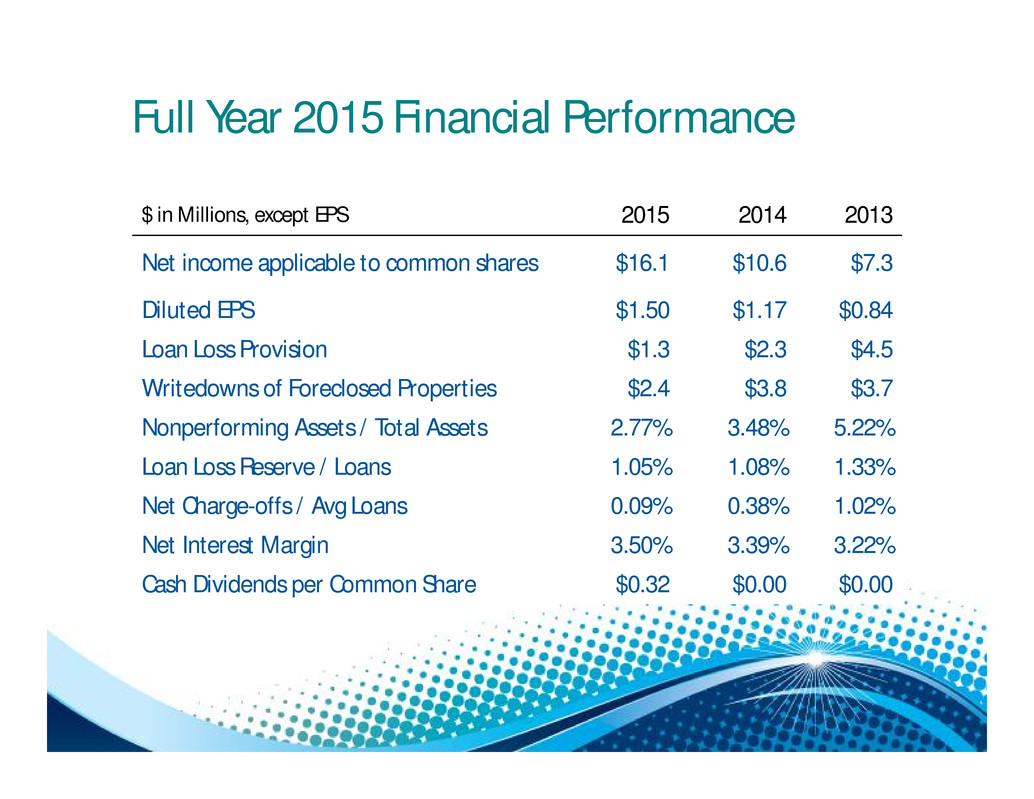

Full Year 2015 Financial Performance $ in Millions, except EPS 2015 2014 2013 Net income applicable to common shares $16.1 $10.6 $7.3 Diluted EPS $1.50 $1.17 $0.84 Loan Loss Provision $1.3 $2.3 $4.5 Writedowns of Foreclosed Properties $2.4 $3.8 $3.7 Nonperforming Assets / Total Assets 2.77% 3.48% 5.22% Loan Loss Reserve / Loans 1.05% 1.08% 1.33% Net Charge-offs / Avg Loans 0.09% 0.38% 1.02% Net Interest Margin 3.50% 3.39% 3.22% Cash Dividends per Common Share $0.32 $0.00 $0.00

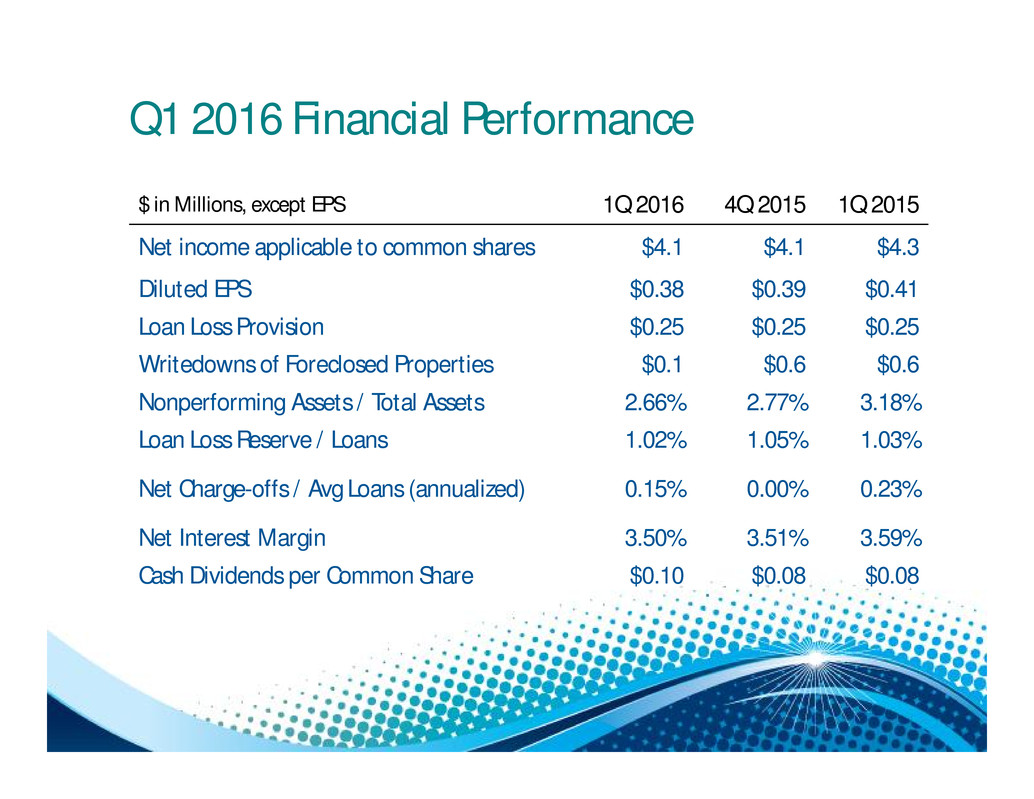

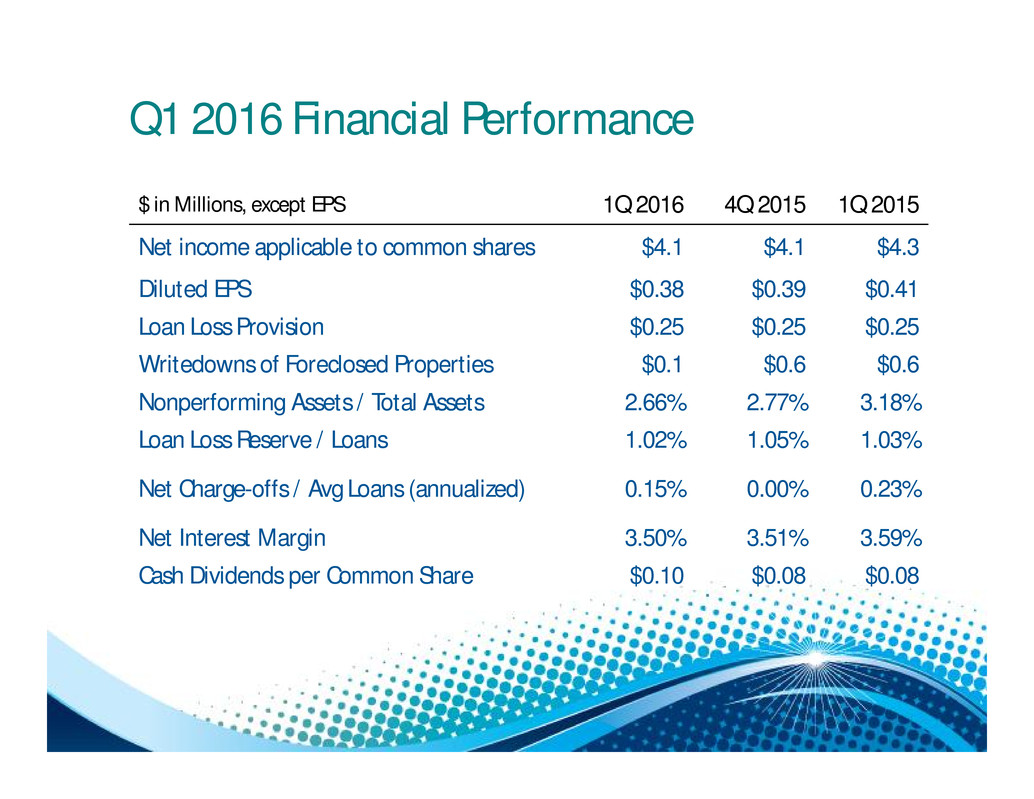

Q1 2016 Financial Performance $ in Millions, except EPS 1Q 2016 4Q 2015 1Q 2015 Net income applicable to common shares $4.1 $4.1 $4.3 Diluted EPS $0.38 $0.39 $0.41 Loan Loss Provision $0.25 $0.25 $0.25 Writedowns of Foreclosed Properties $0.1 $0.6 $0.6 Nonperforming Assets / Total Assets 2.66% 2.77% 3.18% Loan Loss Reserve / Loans 1.02% 1.05% 1.03% Net Charge-offs / Avg Loans (annualized) 0.15% 0.00% 0.23% Net Interest Margin 3.50% 3.51% 3.59% Cash Dividends per Common Share $0.10 $0.08 $0.08

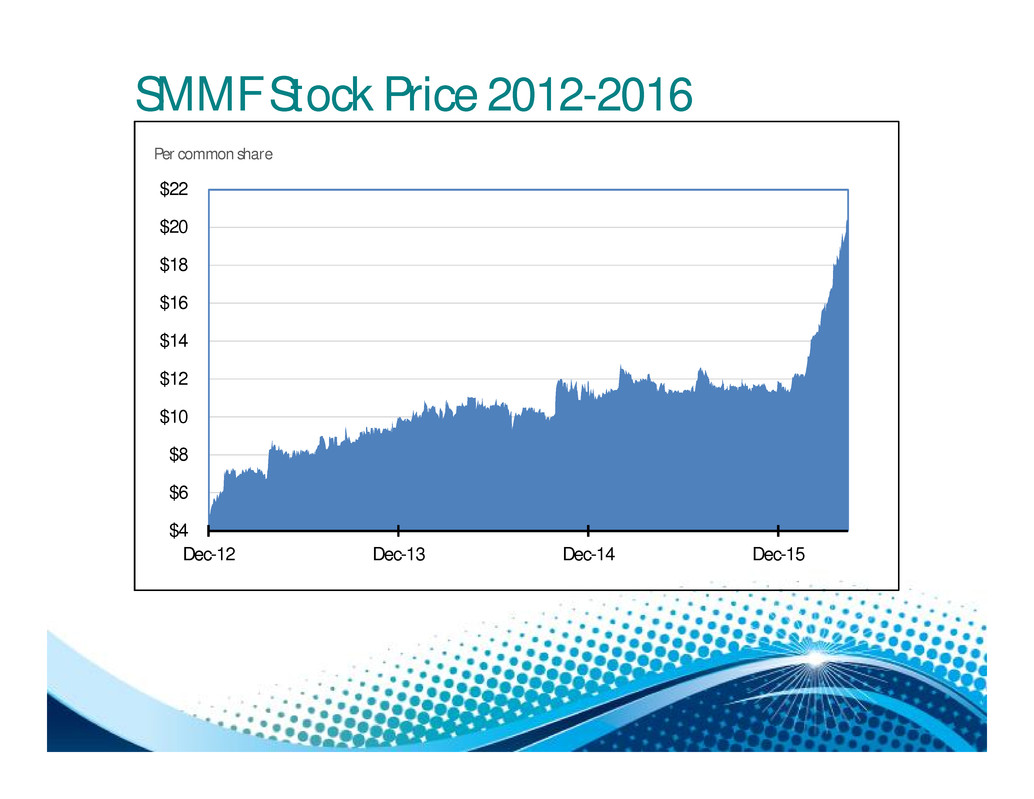

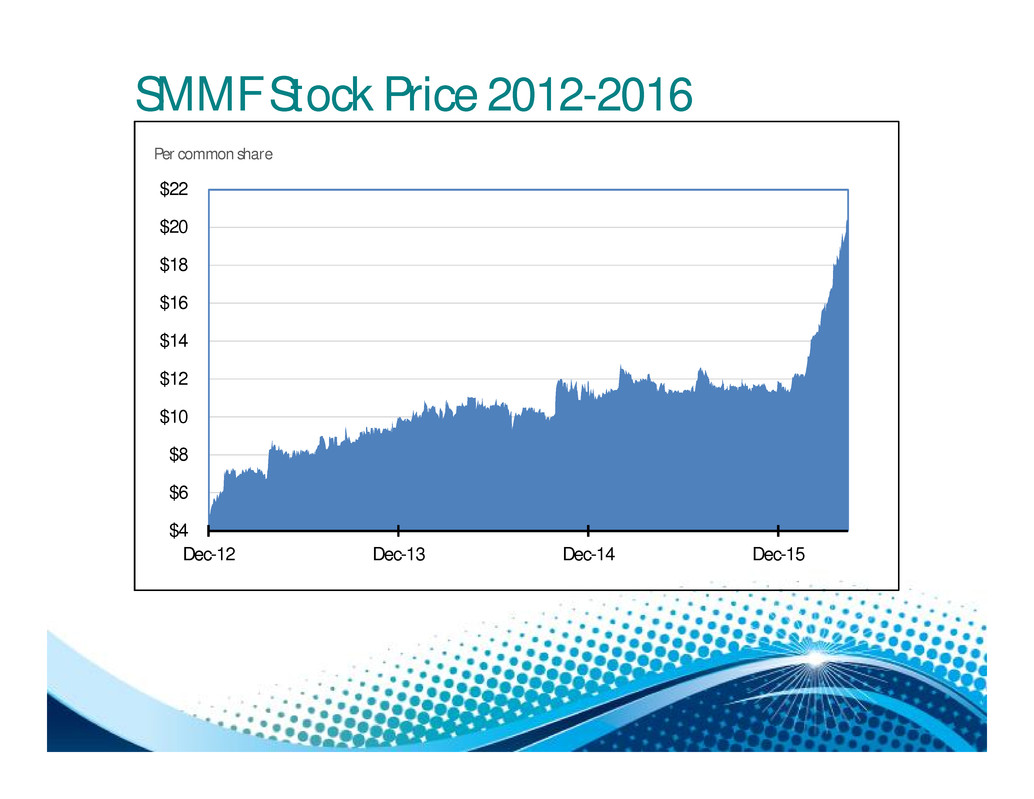

SMMF Stock Price 2012-2016 $4 $6 $8 $10 $12 $14 $16 $18 $20 $22 Dec-12 Dec-13 Dec-14 Dec-15 Per common share

Summit’s Peer Group1 1 Fourteen area publicly-traded bank holding companies closest in asset size to Summit $ in Millions Ticker Assets ROAA ROAE Monarch Financial Holdings MNRK $1,161 1.21% 11.77% C & F Financial Corp. CFFI $1,405 0.92% 9.87% First United Corp. FUNC $1,323 0.83% 9.54% American National Bnkshrs AMNB $1,548 0.99% 7.65% Middleburg Financial Corp MBRG $1,295 0.62% 6.25% Premier Financial Bancorp PFBI $1,245 0.98% 8.41% Community Bankers Trust ESXB $1,181 -0.22% -2.31% Eastern Virginia Bnkshrs EVBS $1,270 0.60% 5.70% Washington First Bnkshrs WFBI $1,674 0.83% 8.48% MVB Financial Corp MVBF $1,384 0.56% 6.08% Southern Nat’l Bankcrp of VA SONA $1,036 0.95% 7.87% Access National Corp ANCX $1,179 1.39% 14.83% National Bankshares Inc. NKSH $1,200 1.37% 9.22% First Community Bankshares FCBC $2,462 0.97% 7.05%

How Summit Compares FY 2015 $ in Millions Summit Peer Average Total Assets Return on Avg Assets Return on Avg Equity Net Interest Margin Efficiency Ratio NPA / Assets Net Charge-off’s / Avg Loans $1,492 1.10% 11.62% 3.50% 52.37% 2.77% 0.09% $1,383 0.86% 7.89% 3.92% 67.54% 0.87% 0.25%

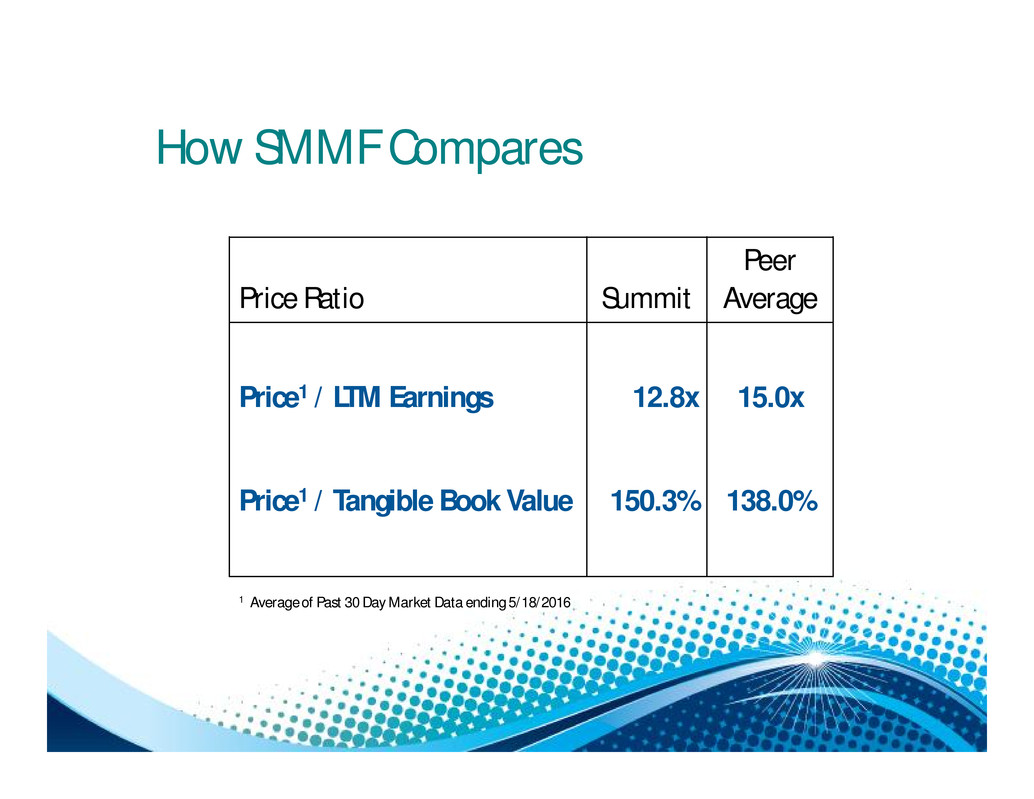

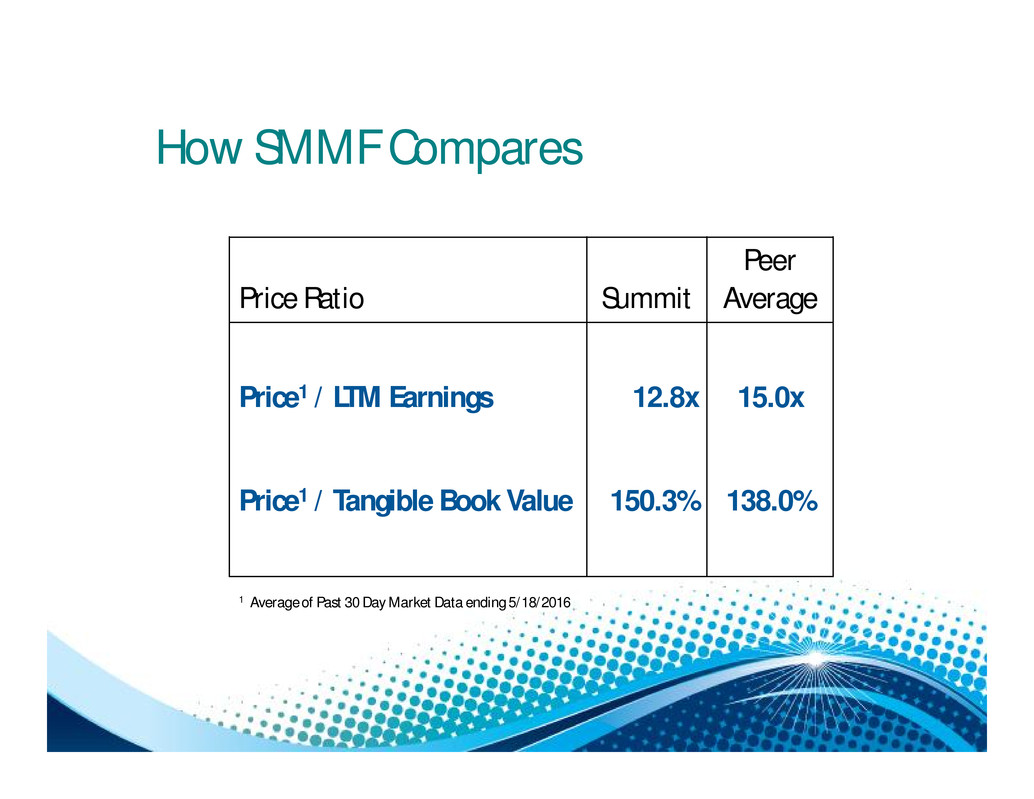

How SMMF Compares Price Ratio Summit Peer Average Price1 / LTM Earnings Price1 / Tangible Book Value 12.8x 150.3% 15.0x 138.0% 1 Average of Past 30 Day Market Data ending 5/18/2016

Let’s Now Hear From You Q&A