Mr. K Hiller,

Securities and Exchange Commission,

Division of Corporate Finance,

100 F Street, N.W.,

Washington, D.C. 20549.

Dear Mr. Hiller:

Re: BHP Billiton Limited and BHP Billiton Plc Form 20-F for the fiscal year ended June 30, 2006 (file No. 001-09526)

Thank-you for your letter dated April 3, 2007 setting forth comments from the Staff of the Commission regarding the annual report on Form 20-F for the fiscal year ended June 30, 2006 (the “2006 Form 20-F”) of BHP Billiton Limited and BHP Billiton Plc (together, “the Company”).

Because some of the material the Company is submitting in response to the Staff’s comments is confidential information for which it is seeking confidential treatment by the Commission, the Company is submitting two versions of this letter in response to the Staff’s comments. This version of the letter omits certain information for which we seek confidential treatment. The other version of the letter includes information that is confidential to the Company and is therefore being submitted on a confidential basis.

To facilitate the Staff’s review, we have included in this letter the captions and numbered comments from the Staff’s comment letter and have provided our response immediately following each comment:

Information on the Company, page 10

Base Metals Customer Sector Group, page 24

| 1. | You disclose that the June 2006 copper ore reserves at the Olympic Dam mine were based on a “revised life-of-mine” plan that included only the mining of underground stopes by current methods, excluding quantities that may be obtained by “…mining of lower grade areas by sub-level cave or other alternative underground methods,” which were included in the prior year. Please clarify whether you previously included quantities that did not qualify as reserves in your computations of DD&A for this property. |

Tell us whether you believe this constitutes an error in the previously issued financial statements, or a new policy or change in estimate applied in your 2006 report. Please be sure to explain your rationale, with reference to the relevant sections of IAS 8, and submit the disclosures necessary to comply with paragraphs 28 and 29, 39 and 40, or 49 of this Standard, as applicable.

Response 1:

The Company acquired the Olympic Dam mine as part of the acquisition of the WMC Resources Ltd group (“WMC”) on June 3, 2005. As a result of the timing of this acquisition, it was not possible to fully review and reconcile the previously reported WMC Olympic Dam Ore Reserve with the Company’s internal Ore Reserves and Capital Investment policies. In our annual report on Form 20-F for the fiscal year ended June 30, 2005 (the “2005 Form 20-F”), the Ore Reserve and depreciation and amortisation

1

for the 27 days from acquisition to June 30, 2005 was based on the previously reported WMC Olympic Dam Ore Reserve quoted in WMC's annual report on Form 20-F for the fiscal year ended December 31, 2004. Total depreciation and amortisation for the 27 days was US$19 million.

The reserve estimates used for depreciation and amortisation calculations at June 30, 2005 were based on a mine plan that was the most recent approved plan. Until such time that the mine plan was modified to comply with the Company’s policies, it was considered an acceptable plan on which depreciation charges could be derived. Accordingly, the Company did not previously include quantities that did not qualify as reserves in computations of depreciation and amortisation.

The modification of the mine plan during the 2006 fiscal year resulted in a change in estimated reserves, and consequently a change in accounting estimate for the depreciation of mineral rights in accordance with paragraph 32 of IAS 8. In accordance with paragraph 36 of IAS 8, this change is accounted for on a prospective basis. The financial effect of the change in accounting estimate is an increase in depreciation and amortisation expense of approximately US$6 million per annum.

Paragraph 39 of IAS 8 requires the nature and amount of the change in accounting estimate to be disclosed. However, in accordance with paragraph 31 of IAS 1 which states that “. . . a specific disclosure requirement in a standard or an interpretation need not be satisfied if the information is not material”, the Company did not include any disclosure in its financial statements for the 2006 fiscal year as the impact of the change in estimate is not material to the financial statements.

Diamonds and Specialty Products Customer Sector Group, page 36

| 2. | We note that during fiscal 2006, you removed the minerals exploration and technology functions from the Diamonds and Specialty Products Customer Sector Group. Please disclose the effects this change had on your segment reporting structure for each period presented in Note 2, beginning on page F-23, and provide any additional information necessary to comply with paragraph 76 of lAS 14. |

Response 2:

The Company’s policy in relation to the identification of segments is based primarily on the relevant products produced (which are grouped into Customer Sector Groups as reflected in internal management reporting). For non product specific functions such as exploration and technology, the segment classification of revenues and expenses is based on the management responsibility for the function.

The minerals exploration and technology functions were removed from the Diamonds and Specialty Products Customer Sector Group and are now reported as part of Group and unallocated items following a change in management responsibilities for these functions.

The segment note disclosures beginning on page F-23 have been presented for all periods to reflect the reporting of the minerals exploration and technology functions as part of Group and unallocated items.

The change in management responsibility in fiscal year 2006 resulted in US$71 million of operating loss (2005: US$69 million), which would previously have been included in Diamonds and Specialty Products, being reported as part of Group and unallocated items. The impact of this reclassification is not considered to be material from a Group perspective.

2

Paragraph 79 of IAS 14 provides guidance on changes in accounting policies which relate specifically to segment reporting and provides two examples, being changes in identification of segments and changes in the basis for allocating revenues and expenses to segments.

The exploration and technology functions are discrete business functions that were included in the Diamonds and Specialty Products segment in the 2005 Form 20-F as that is where management responsibility resided. As stated above, segments are identified primarily on the basis of the relevant products produced. The change in management responsibility therefore did not change the identification of a segment. Similarly, the basis of allocating revenues and expenses to segments for non-product specific functions continues to be based on management responsibility.

Accordingly, the Company does not consider removing the exploration and technology functions from Diamonds and Specialty Products to be a change in accounting policy in accordance with paragraph 76 of IAS 14.

Annual Financial Statements, page F- 1

Consolidated Income Statement page F-4

| 3. | Please present all earnings per share amounts rounded to the nearest whole cent, to avoid suggesting that a greater level of precision exists in the underlying amounts. |

Response 3:

As outlined in note 1 to the financial statements on page F-9, of the 2006 Form 20-F, the financial statements are prepared in accordance with the requirements of the UK Companies Act 1985 and Australian Corporations Act 2001. Furthermore, as outlined in the Directors’ Report on page 155 of the 2006 Form 20-F, the Company’s financial statements are governed by the Australian Securities and Investment Commission Class Order No 98/100 “Rounding in financial reports and directors’ reports” which prescribes the basis on which amounts in the financial report may be rounded, rather than stating the numbers exactly. It is a specific requirement of the Class Order that the earnings per share amounts be rounded to one tenth of one cent. As this is a Home Country GAAP requirement, the Company believes that it is required to report earnings per share amounts to one tenth of one cent.

Consolidated Cash Flow Statement page F-7

| 4. | We see that you categorized exploration expenditures, including overburden removal costs capitalized, as investing activities. We understand from your disclosure on page F-86 that $385 million of the $766 million total represents exploration costs other than overburden removal costs. Please tell us the nature of the non-capitalized exploration expenditures you categorized here, and why you believe that such expenditures are an investing activity, rather than an operating activity under paragraph 14 of IAS 7. |

Response 4:

The Company respectfully advises the Staff that in relation to the disclosure on page F-86, the amount of US$381 million representing overburden removal costs are classified as “Purchases of property, plant and equipment” in the cash flow statement, and are not included in the US$766 million of exploration expenditure which is separately disclosed in the cash flow statement.

3

As outlined on page 52 of the 2006 Form 20-F, the Company’s minerals exploration program is integral to our growth strategy and is focused on identifying and capturing new world-class projects for future development, or projects that add value to existing operations. The Company classifies expenditure on all such activities as investing activities (comprising both expensed and capitalised amounts) in accordance with paragraph 16 of IAS 7 which states that “The separate identification of cash flows arising from investing activities is important because the cash flows represent the extent to which expenditures have been made for resources intended to generate future income and cash flows.”

In addition, paragraph 14 of IAS 7 states that “cash flows from operating activities are primarily derived from the principal revenue-producing activities of the entity.” The Company’s principal revenue producing activities are the mining, processing and selling of the mineral resources, rather than the exploration and evaluation of future revenue producing activities. Furthermore, whilst the Company’s accounting policy is that exploration and evaluation expenditure is generally expensed, except in particular circumstances, paragraph 14 of IAS 7 acknowledges that some transactions included in profit and loss have cash flows which are classified as cash flows from investing activities.

Note 1 - Accounting Policies, page F-8

Overburden Removal Costs, page F-16

| 5. | We have read your disclosure regarding overburden removal costs, and understand that you capitalize production stripping costs when the current ratio of waste to ore is greater than the corresponding estimated life-of-mine ratio, and expense previously capitalized amounts when it is less in order to establish a smooth pattern of expense recognition for your production stripping costs. |

Explain to us why you believe your production stripping cost model results in an appropriate and fair attribution of production costs to each period, given the nature of the stripping activity and the non-uniform geological formations that naturally introduce variability in the periodic levels of production. Please include reference to the definitions of fixed and variable production overheads, and the examples of costs to be excluded from inventories appearing in paragraphs 12 and 16 of IAS 2, in describing how you arrived at the view that your method is in compliance with IFRS.

Tell us the line item in your financial statements corresponding to the "Other mineral assets" account and the amounts of deferred production stripping costs capitalized as of the end of each period . Please indicate whether these are classified as short-term or long-term assets. Also submit a roll forward of the account covering each period presented, and the underlying computations for the most significant element.

Response 5:

The Company respectfully advises the Staff there are no specific extractive industry standards or principles available under IFRS that directly address stripping of overburden in mining operations. In the absence of specific guidance, paragraphs 10 and 11 of IAS 8 “Accounting Policies, Changes in Accounting Estimates and Errors” require management to use its judgement in developing and applying an accounting policy that results in information that is relevant to the economic decision making needs of users and is reliable. In making these judgements, management shall refer to and consider the applicability of the requirements and

4

guidance dealing with similar and related issues and the definitions, recognition criteria and measurement concepts for assets, liabilities, income and expenses in the Framework for the Preparation and Presentation of Financial Statements.

Paragraph 90 of the Framework requires expenditure to be charged to the income statement where it does not produce a future economic benefit, or the future economic benefit does not qualify for recognition as an asset, in accordance with paragraph 89. In accordance with these requirements, the Company believes that stripping expenditure incurred during the production phase does not meet the definition of an expense when the ratio of waste to ore is greater than the estimated life-of-mine ratio as the expenditure contributes to the capacity to produce ore in future periods. This expenditure satisfies the criteria in paragraph 89 for recognition as an asset as it is probable that the future economic benefits will flow to the Company and the asset has a cost that can be measured reliably.

As a result, the Company has determined that production phase stripping costs when the ratio of waste to ore is greater than the estimated life-of-mine ratio should be considered a non-current asset under IAS 16 “Property, Plant and Equipment”. This is supported by paragraph 3 of IAS 16, which states:

“This standard does not apply to:

| | (a) | property, plant and equipment classified as held for sale in accordance with IFRS 5 “Non-current Assets held for sale and Discontinued Operations”; |

| | (b) | biological assets related to agricultural activity; |

| | (c) | the recognition and measurement of exploration and evaluation assets; |

| | (d) | mineral rights and mineral reserves such as oil, natural gas and similar non-regenerative resources. |

However, this Standard applies to property, plant and equipment used to develop and maintain the assets described in (b) to (d).”

Production phase stripping costs can be seen to be an asset that is used to develop the mineral reserves of the respective mines, and therefore are considered a non-current asset in accordance with IAS 16.

Paragraph 96 of the Framework requires recognition of expenses on a systematic and rational basis where the economic benefits arise over several accounting periods. IAS 16 also requires that the depreciable amount of an asset shall be allocated on a systematic basis over its useful life. The Company believes that the use of the estimated life-of-mine stripping ratio provides a systematic basis on which stripping costs capitalised as an asset as outlined above are allocated to the income statement proportionately over all tonnes of ore which become accessible as a result of the life-of-mine stripping activity.

The Company applies the principles of the Framework as outlined above to production stripping expenditure where the waste-to-ore ratio is greater than the estimated life-of-mine ratio as it does not believe that such expenditure is either a fixed or variable production overhead as defined in paragraph 12 of IAS 2. Production stripping expenditure may be disproportionate, in terms of timing, to the amount of ore mined, and varies from period to period, depending on, amongst other things, the shape of the deposit and how it is best accessed. In addition, as outlined above, this expenditure gives rise to a future economic benefit that may be realised in a number of future periods compared to either fixed or variable overheads which relate to production for the period. Accordingly, the Company believes that this expenditure is best accounted for as outlined above, rather than using the principles of IAS 2. Where the ratio of waste to ore is equal to or less than the estimated life-of-mine ratio for a period, the stripping expenditure is considered to be a direct cost of conversion and is accounted for in accordance with IAS 2.

As outlined above, the Company believes that stripping expenditure incurred during the production phase does not meet the definition of an expense when the ratio of waste-to-ore is greater than the estimated life-of-mine ratio. Accordingly, the examples provided in paragraph 16 of IAS 2 of costs excluded from inventories and recognised as expenses in the period in which they are incurred are not applicable to this expenditure.

5

The amounts of deferred production stripping costs capitalised as at June 30, 2006 and 2005 were US$340 million and US$253 million respectively.

The Company advises the Staff that “Other mineral assets” are included in the line item ‘Property, plant and equipment’ on the face of the Balance Sheet, and are classified as long-term assets. A roll-forward of this account for each period presented is contained in Note 16 to the Financial Statements, and reproduced below for convenience:

| | | | | | |

| | | Year ended

30 June

2006 | | | Year ended

30 June

2005 | |

Other mineral assets | | US$M | | | US$M | |

Cost | | | | | | |

At the beginning of the financial year | | 12,124 | | | 6,543 | |

Additions | | 450 | | | 360 | |

Acquisitions of subsidiaries and operations | | 47 | | | 4,973 | |

Disposals | | (128 | ) | | (6 | ) |

Disposals of subsidiaries and operations | | (257 | ) | | (39 | ) |

Transfer to current asset held for sale | | (208 | ) | | — | |

Exchange variations | | 7 | | | 4 | |

Transfers and other movements | | (670 | ) | | 289 | |

| | | | | | |

At the end of the financial year | | 11,365 | | | 12,124 | |

| | | | | | |

Accumulated depreciation | | | | | | |

At the beginning of the financial year | | 3,178 | | | 2,835 | |

Charge for the year | | 381 | | | 370 | |

Impairments for the year | | — | | | 4 | |

Disposals | | (127 | ) | | (6 | ) |

Disposals of subsidiaries and operations | | (150 | ) | | (26 | ) |

Transfer to current asset held for sale | | (157 | ) | | — | |

Exchange variations | | 6 | | | — | |

Transfers and other movements | | — | | | 1 | |

| | | | | | |

At the end of the financial year | | 3,131 | | | 3,178 | |

| | | | | | |

Net book value at the end of the financial year | | 8,234 | | | 8,946 | |

| | | | | | |

The most significant element in the US$8.2 billion of other mineral assets is the mineral rights balance which represents US$6.6 billion of the total. The major movement in this balance in the periods presented (US$4,973 million for acquisition of subsidiaries and operations) relates to the acquisition of the WMC Resources Ltd group in June 2005, further details of which are outlined in note 36 to the financial statements, beginning on page F-77.

6

Taxation, page F- 17

| 6. | You disclose that the tax effect of certain temporary differences is not recognized, principally with respect to “ . . . temporary differences arising on the initial recognition of assets or liabilities (other than those arising in a business combination or in a manner that initially impacted accounting or taxable profit) . . . .”Tell us the nature of the transactions encompassed in your application of the guidance in paragraph 15(b)(ii) of IAS 12, and how, if it were not for the exception , that establishing the deferred tax asset or liability for each would require an adjustment to the carrying amount of the corresponding asset or liability, as would be the expectation under paragraph 22(c) of IAS 12. |

If decommissioning assets and liabilities or financing-type leases are among those for which you have not established deferred tax assets and liabilities, explain how your presentation is consistent with the guidance in paragraph 13 of IAS 1; and in the case of decommissioning assets and liabilities, whether you have viewed these as being distinct and unrelated to the mining activity giving rise to their recognition. Please also explain how these assets and liabilities are different from similar items acquired in a transaction accounted for as a purchase, if that is your view.

Response 6:

The exception to the recognition of deferred taxes on temporary differences described in the Company’s accounting policy is drawn from the requirements of paragraph 15(b)(ii) of IAS12. The nature of items encompassed by this exception includes expenditure that will never be deductible in the relevant tax jurisdiction in arriving at taxable income (under both income and capital gains tax legislation). Examples of such items include capitalised exploration expenditure, capitalised structural improvements recognised as property, plant and equipment, and provisions for rehabilitation of certain infrastructure (such as decommissioning and rehabilitation of aluminium smelters). At the time of initial acquisition and recognition of each of these items, a difference exists between the carrying amount and the related tax base (because the tax base is nil), which prima facie would indicate the need to recognise a deferred tax amount. However, as each transaction does not affect accounting profit or taxable profit on initial recognition, nor is it recognised as part of a business combination, recognition of the deferred tax is prohibited by IAS12.

If it were not for the exception, the recognition of the deferred tax asset or liability would require a corresponding adjustment to the carrying amount of the associated asset or liability as contemplated by paragraph 22(c) of IAS 12.

With respect to decommissioning assets and liabilities and finance leases, the Company's policy is to recognise deferred tax balances on the associated temporary differences, except only in those limited situations described above in which the decommissioning cost will never be deductible for tax purposes. In all other cases, the initial recognition of decommissioning assets and liabilities is inseparable, therefore it was considered that the deferred tax consequences of those items should be considered together rather than as separate transactions. As such, the deferred tax asset relating to the decommissioning liability, and the deferred tax liability relating to the decommissioning asset, were recognised concurrently with no impact on current period tax expense, pre-tax balances or net deferred tax balances. Changes in temporary differences arising after initial recognition are recognised pursuant to the normal principles of IAS12. The Company believes that this approach addresses the expectations of paragraph 13 of IAS1.

In the case of tax jurisdictions which never allow a tax deduction for decommissioning expenditure, no deductible temporary difference (and therefore no deferred tax asset) exists with respect to the decommissioning liability. Recognition of the deferred tax liability arising on the decommissioning asset without a corresponding deferred tax asset would require an adjustment to the carrying

7

amount of the decommissioning asset, in breach of the requirements of paragraph 22(c) of IAS12. Accordingly, the Company has not recognised the deferred tax effects of capitalised non-tax deductible decommissioning costs. The Company notes the explanation in IAS12 that recognition of a deferred tax liability in such situations would make the financial statements less transparent and for this reason believes that the fair presentation and IFRS compliance requirements of paragraph 13 of IAS1 have been satisfied.

The Company believes that the initial recognition of decommissioning assets and liabilities is inseparable from the mining activity to which it is related. Notwithstanding this, the Company believes that where the future tax consequences of these items is distinct and unrelated to the future tax consequences of the mining operations, recognition of the deferred tax consequences of each item needs to be determined having regard to their unique tax characteristics.

The Company believes that decommissioning liabilities initially recognised on commencement of a mining operation are no different in nature to similar liabilities initially recognised in a purchase transaction. However, in the case of decommissioning assets, the Company does not believe that such assets should be separately recognised in a purchase transaction as the future economic benefits are embodied in the mineral property assets. Notwithstanding this, paragraph 22(c) of IAS12 treats these items differently depending on the manner in which they are acquired.

Note 39 - U.S. Generally Accepted Accounting Principles Disclosures, page F-84

Note (E) Depreciation - Ore Reserves, Rage F-87

| 7. | We note you have a difference in ore reserves used for IFRS and U.S. GAAP, resulting in a difference in depreciation expense. Please submit a schedule showing the differences in reserve quantities, stratified in a manner that allows for a comparison between reserves determined in accordance with the JORC code and those calculated under Industry Guide 7, along with an explanation addressing the nature of the differences in sufficient detail to understand how the degree of sampling and level of confidence relate. |

Explain why you believe reserves prepared in accordance with the JORC code that do not also comply with the guidelines in Industry Guide 7 provide a sufficient basis for applying the units-of-production depreciation methodology under IAS 16. In this regard, to the extent there are different levels of confidence with such quantities, explain your views on the applicability of the guidance in paragraphs BC26 and 46 of this Standard, requiring under some circumstances separate depreciation for parts of an asset when there are varying expectations about useful lives or consumption patterns.

Please also specify the degree of correlation between the adjustment for reserves, and the capitalized costs that are mentioned in reconciling adjustment (H) on page F-88.

Response 7:

The Company advises the Staff that as at June 30, 2006, the differences in reserve estimates between JORC and Industry Guide 7 reserves relate to the Company’s metallurgical coal deposits, which it reports as part of the Carbon Steel Materials Customer Sector Group.

The following schedule shows the differences in reserve quantities determined in accordance with the JORC code and those calculated under Industry Guide 7.

8

Carbon Steel Materials Metallurgical Coal Deposits:

| | | | |

| | | JORC Reserve

Marketable Tonnes

(millions) | | SEC Reserve

Marketable Tonnes

(millions) |

Operating mines | | | | |

Central Queensland Coal Associates JV (Blackwater, Sth Blackwater, Norwich Park, Saraji, Goonyella Riverside Broadmeadow) | | 1,676 | | 1,561 |

Gregory JV (Gregory Crinum) | | 41 | | 40 |

BHP Mitsui Coal (South Walker Creek) | | 44 | | 34 |

Development projects | | | | |

BHP Mitsui Coal (Poitrel) | | 50 | | 45 |

The reason for the differences between the JORC and Industry Guide 7 Ore Reserve estimates are as follows:

| | • | | Central Queensland Coal Associates (CQCA) JV – The JORC estimate is larger than the SEC estimate due to the inclusion of Inferred Resource in defining the economic open-cut pit limit (though not reported as reserve in the JORC estimate). For the Industry Guide 7 reserve estimate, Inferred Resource is given no value and is set to waste, consequently the economic pit limit is reduced in area. |

| | • | | Gregory JV– As for CQCA, the Inferred Resource used to define the JORC estimate economic open-cut pit limit is given no value and is set to waste for Industry Guide 7 reserve estimates. |

| | • | | BHP Mitsui Coal– Four million tonnes of the difference between JORC and SEC estimates is due to Inferred Resource being used to define pit limits in the case of the JORC estimate, and the remainder due to the forecast operating cost used for the JORC estimate being lower than the current operating cost used to estimate the Industry Guide 7 reserves, resulting in a lower Guide 7 estimate. |

| | • | | BHP Mitsui Coal Development Project– As for CQCA, the Inferred Resource used to define the JORC estimate economic open-cut pit limit is given no value and is set to waste for Industry Guide 7 reserve estimates. |

The Company respectfully advises that the difference in reserves at the Company’s Metallurgical Coal operations identified above does not result in a difference in depreciation expense between IFRS and US GAAP as the useful life of the assets at these operations is shorter than the life of mine used in determining either JORC or Industry Guide 7 reserves. This therefore does not form part of the reconciling item “Depreciation - ore reserves” disclosed in the reconciliation of net income from IFRS to US GAAP in note 39 to the financial statements on page F-84 of the 2006 Form 20-F. The difference disclosed in the reconciliation of net income relates to a difference in reserves at June 30, 2005 and prior years at the Company’s 57.5% owned Escondida mine in Chile. A difference existed in the ore reserves between JORC and Industry Guide 7 at June 30, 2005 due to a number of factors including the use of the average copper price for the historic three-year period, the use of current costs and the use of Inferred Resources in the JORC compliant reserves to define the economic pit limit. The June 2006 ore reserve statement differs from the 2005 ore reserve statement by the inclusion of new drilling data, updated cost and price estimates, and increased production rates, and is compliant for both JORC and Industry Guide 7 purposes.

As depreciation is based on the most recently available ore reserves, the depreciation charge for the 2006 fiscal year is based on the 2005 ore reserve statement and therefore a difference between the depreciation charge based on ore reserves determined in accordance with the JORC code and those calculated under Industry Guide 7 has been recognised as a reconciling item in the 2006 Form 20-F (US$11 million decrease in net income for the fiscal year ended June 30, 2006).

9

The Company believes that the reserves prepared in accordance with the JORC code (which is the reporting standard used in our home jurisdictions of Australia and the United Kingdom) that do not also comply with the guidelines in Industry Guide 7 provide a sufficient basis for applying the units-of-production depreciation methodology under IAS 16 on the following basis:

IAS 16 defines useful life in paragraph 6 as “the number of production or similar units expected to be obtained from the asset by an entity”. The Company considers that reserves prepared in accordance with the JORC code meet the definition of production “expected to be obtained from the asset” and are therefore appropriate to use as a basis for applying the units-of-production depreciation methodology.

Paragraphs BC26 and 46 of IAS 16, contemplate depreciating separately some parts of an item of property, plant and equipment where an entity has different expectations for the useful life of the parts. As the Staff indicate, there can be different levels of confidence around quantities within the JORC reserve (i.e. where Inferred Resource is being used to define the economic pit limit and thus allowing additional Measured and Indicated Mineral Resource to be converted to reserve) to those developed under Industry Guide 7. However, in this case, the Company still considers the JORC reserves to meet the requirement of IAS 16 in deriving an expected level of production to be obtained from an asset. In any case, as outlined above, the Company only has minor differences between JORC and Industry Guide 7 reserves and consequently, any impact on depreciation from the differences in reserves is immaterial.

The Company respectfully advises the Staff that there are no longer any differences in reserves at sites which have an adjustment referred to in reconciling adjustment (H) on page F-88.

Note (H) Exploration, Evaluation and Development Expenditure, page F-88

| 8. | You state that “U.S. GAAP permits exploration and evaluation expenditure on mineral properties to be capitalized where a final feasibility study has been completed, indicating the existence of commercially recoverable reserves at new exploratory ‘greenfield’ properties.” Under U.S. GAAP it is important to distinguish between exploration and development costs, and ensure correlation of these terms with your reserve findings. The costs incurred after mineral reserves have been established are commonly developmental in nature, when they relate to constructing the infrastructure necessary to extract the reserves, preparing the mine for production, and are on this basis capitalized. On the other hand, exploratory costs are those typically associated with efforts to search for and establish mineral reserves, beyond those already found, and should be expensed as incurred. Please revise your disclosure and accounting if necessary to clarify. Tell us the amounts of any exploration costs you have capitalized under your policy. |

Response 8:

The Company has reviewed its disclosure and provides the following explanation to clarify its policy under US GAAP:

Under US GAAP exploration and evaluation costs incurred in the pre-feasibility and feasibility stages on mineral properties are expensed.

Costs incurred after the completion of a final feasibility study (and sanctioning of a development project) are capitalised under US GAAP as development costs. In addition, for producing properties, drilling costs are capitalised where they are incurred for the

10

purpose of extending reserves by converting mineralised material (being Total Resources for JORC purposes) to proven and probable reserves, or for further delineation of existing proven and probable reserves, as defined in Industry Guide 7. The Company notes that this policy has been developed following correspondence with the Staff in their letter of March 18, 2002 during their review of our 2001 draft registration statement on Form F-1.

Under the Company’s US GAAP policy there are no costs capitalised for exploration expenditure in relation to minerals properties as at 30 June 2006 and 30 June 2005.

The Company intends to include the above clarification of the policy in future filings.

An example of the application of the above policy for US GAAP can be considered for drilling at producing properties. Drilling for the purpose of improving the category of resource – Inferred moving to Indicated and Indicated moving to Measured – represents a development cost which is capitalised. In contrast, drilling for the purpose of increasing the Total Resources represents an exploration cost which is expensed.

Exhibit 12.1

| 9. | When identifying the certifying individual in the text at the beginning of the certification required by Exchange Act Rule 13a-14(a) do not include the title of the individual. |

Response 9:

The Company notes the Staff’s comment and will omit the titles of certifying officers in future filings.

Exhibit 13.1

| 10. | Please amend your filing to include the certifications required under Exchange Act Rule 13a-14(b), covering the report for your fiscal period ended June 30, 2006, rather than 2005, as currently presented. |

Response 10:

The Company acknowledges the error but advises that the Company provided the relevant certification as Exhibit 13.1 to the Form 20-F/A filed on 18 December 2006 with respect to “the Annual Report on Form 20-F, as amended by this Form 20-F/A, of BHP Billiton Limited and BHP Billiton Plc (the “Companies”) for the annual period ended 30 June 2006.” Accordingly, the Company respectfully submits that it has fulfilled the Staff’s request.

11

Engineering Comments

General

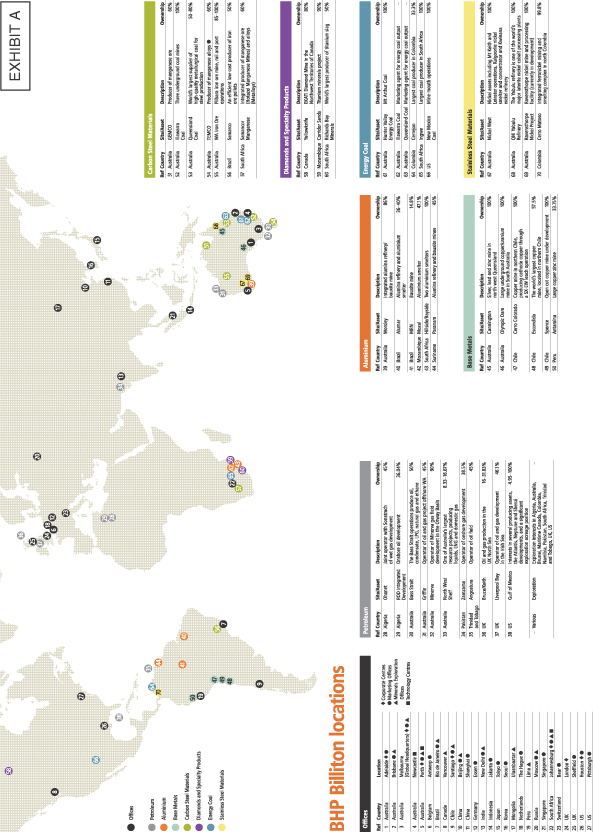

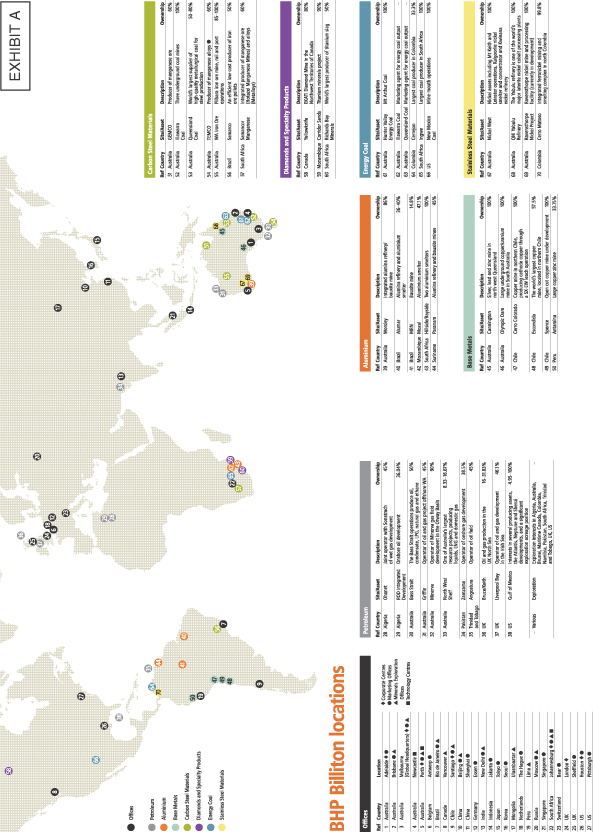

| 11. | Please insert a small-scale map showing the location and access to each property, as indicated by Instruction 1(a) to Item 4.D of Form 20-F. Note that SEC's EDGAR program now accepts Adobe PDF files and digital maps, so please include these maps in any amendments that are uploaded to EDGAR. It is relatively easy to include automatic links at the appropriate locations within the document to GIF or JPEG files, which will allow figures and diagrams to appear in the right location when the document is viewed on the Internet. For more information, please consult the EDGAR manual, and if additional assistance is required, please call Filer Support at 202-551-8900. |

We believe the guidance in Instruction 1(a) to Item 4 .D of Form 20-F would generally require maps and drawings with the following features:

| | • | | A legend or explanation showing, by means of pattern or symbol, every pattern or symbol used on the map or drawing. |

| | • | | A graphical bar scale or representations of scale such as "one inch equals one mile," provided the original scale of the map has not been altered. |

| | • | | An index map showing where the property is situated in relationship to the state, province, or other territory in which it is located. |

| | • | | A title of the map or drawing, and the date on which it was drawn. |

Any drawing should be simple enough or of sufficiently large scale to clearly show all features on the drawing. In the event interpretive data is submitted in conjunction with any map, please also identify the geologist or engineer that prepared such data.

Response 11:

The Company will include a map in the form of Exhibit A to this letter in future Form 20-F filings, and respectfully advises the Staff that narrative information regarding the location and access to each property is included in the Business Overview section starting on page 11.

| 12. | Please disclose within the filing the commodity prices used to estimate ore reserves for your aluminum and manganese divisions. In addition, please disclose your bauxite ore and alumina sales/purchase prices and discuss the dependence of your aluminum smelters on alumina imports/purchases or inter-company transfers. Please tell us the contracted prices for salable products produced at your bauxite, alumina, metallurgical coal, thermal coal, and iron ore properties. |

12

Response 12:

For each of the Aluminium CSG bauxite mining operations the primary Ore Reserve control is the feed specification to the alumina refinery, an aluminium or alumina price is not used in the estimation of reserves. In these cases the feed specification will include the bauxite: available alumina, iron oxides, reactive silica, organic carbon and other specification parameters defined by the refinery. For each refinery the bauxite feed is a minor part of the operating cost, which includes other major inputs such as caustic soda and power. The principal control on mining is therefore providing bauxite within the refinery’s specified operating range to ensure that optimum production is maintained. As a result, a bauxite, aluminium, or alumina price is not used in the estimation of any of the Company’s Aluminium CSGs ore reserves.

In determining the mineral reserve and resource, and corresponding mining profiles for the bauxite operations the following Bauxite major product grade criteria are used to establish the cut off grade criteria that are applied:

| | | | | | |

Deposit | | A.Al2O3 % | | R.SiO2% | | T.SiO2% |

Worsley | | [CONFIDENTIAL INFORMATION HAS BEEN OMITTED AND FURNISHED SEPARATELY TO THE SEC] |

| | | |

| | | | | | | T.Fe2O3% |

Suriname* | | [CONFIDENTIAL INFORMATION HAS BEEN OMITTED AND FURNISHED SEPARATELY TO THE SEC] |

MRN** | |

| * | - This direct feed is a blended product made up from different grade bauxites mined at separate localities, Coermotibo and Onverdacht. |

| ** | - Target specification grades for “washed” bauxite shipment to shareholders as per the JV shareholder agreement. Dry shipments have a nominal moisture content of [CONFIDENTIAL INFORMATION HAS BEEN OMITTED AND FURNISHED SEPARATELY TO THE SEC] and Wet shipments [CONFIDENTIAL INFORMATION HAS BEEN OMITTED AND FURNISHED SEPARATELY TO THE SEC] moisture content. |

A.Al2O3Avaliable alumina; R.SiO2 - Reactive silica; T.SiO2– Total silica; and T.Fe2O3 – Total Iron oxide.

For the Manganese CSG mining operations at Wessels and Mamatwan the reserve is based upon geological features / boundaries, following which grade control ore is categorized according to a range of Product Types and the reserves are estimated accordingly; a direct manganese price is not used in the estimation of the reserve. For GEMCO the reserve is tested against the BHP Billiton Japan benchmark average 3 year historical price for 48% Manganese lump product which for the 2006 filing was [CONFIDENTIAL INFORMATION HAS BEEN OMITTED AND FURNISHED SEPARATELY TO THE SEC] per metric tonne unit.

Manganese – Product Specification used for Reserve determination, 2006

| | | | | | | | | | | | | | |

Mine | | Product | | Mn % | | Fe % | | SiO2 % | | Al2O3 % | | P % | | Sizing (topsize) |

| | | | | Min | | Max | | Max | | Max | | Max | | mm |

Wessels | | High Grade Lump | | [CONFIDENTIAL INFORMATION HAS BEEN OMITTED AND FURNISHED SEPARATELY TO THE SEC] |

| | Low Grade Lump W4L40 | |

| | Low Grade Lump W4L38 | |

| | High Grade Fines | |

| | Fines W1F | |

| | Fines W4F | |

| | Concentrate | |

Mamatwan | | Lump | |

| | Fines | |

| | Concentrate | |

| | Sinter – MHS | |

| | Sinter – MMS | |

| | Sinter - MSS | |

13

The bauxite we mine is predominantly used in our own refineries, which are treated as integrated operations; a small amount is sold externally from our Brazilian operations (approximately [CONFIDENTIAL INFORMATION HAS BEEN OMITTED AND FURNISHED SEPARATELY TO THE SEC] tonnes for fiscal year 2006). The Company does not purchase bauxite for use in its refineries.

The Alumina feed to our smelters is primarily sourced from within the Company and transferred at arms-length prices. We have an excess of Alumina (approximately [CONFIDENTIAL INFORMATION HAS BEEN OMITTED AND FURNISHED SEPARATELY TO THE SEC] of Alumina production for fiscal year 2006) which is sold externally under term and spot contracts. In addition we supplement our own feed from time to time by 3rd party purchases under both term and spot contracts depending on grade or particular Alumina characteristics, location (freight charge) and price.

At the time of reporting, the three year average historical prices (based on calendar year to December 31, 2005) for the requested saleable products were:

| | | | | | |

Aluminium | | Cash | | $US/lb | | [CONFIDENTIAL

INFORMATION

HAS BEEN

OMITTED AND

FURNISHED

SEPARATELY

TO THE SEC] |

Alumina (MB, King) | | Spot | | $US/tonne | |

Manganese - Ferro Manganese | | CRU Benchmark, 78% mn | | $US/tonne | |

Manganese Ore | | Japan benchmark (BHP, 48%, $/mtu FOB) | | $US/mtu | |

Iron Ore - Fines | | Port Hedland, FOB | | USc/dmtu | |

Iron Ore - Lump | | Port Hedland, FOB | | USc/dmtu | |

Hard Coking Coal | | Goonyella, FOB | | $US/tonne | |

Thermal Coal - RBCT | | FOB, 6000 kcal/tonne NAR | | $US/tonne | |

At our Queensland coal operations, the Hard Coking Coal average shown above is used as a benchmark. The historical average prices used to estimate the SEC reserves in these operations is based on the actual historical coal sales price for the individual operation. These are listed below:

| | | | | | |

| | | FY2006 SEC Reserve Estimate Coal Price (US$/tonne FOB) |

Queensland Coal Operation | | Coking | | Weak Coking | | Thermal |

Blackwater | | [CONFIDENTIAL INFORMATION HAS BEEN OMITTED AND FURNISHED SEPARATELY TO THE SEC] |

Goonyella | |

Peak Downs | |

Saraji | |

Norwich Park | |

Gregory Crinum | |

Riverside | |

South Walker Creek | |

Poitrel | |

14

Illawarra Coal operations also use the Hard Coking Coal average as a benchmark. They have however used the historical average on a financial year basis rather than a calendar year basis. The historical average prices they used are listed below:

| | | | | | |

| | | FY2006 SEC Reserve Estimate Coal Price (US$/tonne) |

| | | Coking | | Weak Coking | | Thermal |

| Illawarra Coal (Appin, WestCliff, Dendrobium) | | [CONFIDENTIAL INFORMATION HAS BEEN OMITTED AND FURNISHED SEPARATELY TO THE SEC] |

| 13. | We note you have disclosed proven and probable reserves for the following marines, development projects, or feasibility studies: Worsley (Boddington), MRN, Coermotibo, Onverdacht, GEMCO, Wessels, Mamatwan, Cerro Matoso, Leinster, Mt Keith, and Ravensthorpe. |

Please forward to our engineer, as supplemental information, summary information concerning these areas, such as the annual reserve report or executive summary that establishes the legal, technical and economic feasibility of the materials designated as reserves, pursuant to paragraph (c) of Industry Guide 7. We generally find that the following types of information are helpful in demonstrating compliance.

| | • | | Property and geologic maps. |

| | • | | Description of your sampling and assaying procedures. |

| | • | | Drill-hole maps showing drill intercepts. |

| | • | | Representative geologic cross-sections and drill logs. |

| | • | | Description and examples of your cut-off calculation procedures. |

| | • | | Cutoffs used for each category of reserve and resource. |

| | • | | Justifications for the drill hole spacing used at various classification levels. |

| | • | | A detailed description of your procedures for estimating reserves. |

| | • | | Copies of pertinent engineering and geological reports, and feasibility studies or mine plans (including cash flow analyses). |

| | • | | A detailed permitting and government approval schedule for the project, identifying the primary environmental or construction approval(s) required, and your current status relative to the schedule. |

To minimize the transfer of paper, please provide the requested information on a CD, formatted as Adobe PDF files, and provide the name and phone number for a technical person our engineer may call, if he has technical questions about your reserves. In the event you desire the return of the supplemental material, please make a written request with the letter of transmittal. It would be helpful to have a prepaid, pre-addressed shipping label to facilitate the return of the supplemental information.

15

Response 13:

The Company has forwarded the requested information on a CD to Mr G Schuler.

16

Business Overview, page 11

Petroleum Customer Service Group, page 11

Information on Petroleum Operations, page 1 2

| 14. | We note that you have disclosed several fields and projects in which you have an interest, but for which you have not disclosed any production or reserve information. Please revise your document to include this information for each field or project, or explain why you believe this would be unnecessary to comply with Item 4.D of Form 20-F. |

Response 14:

The Company advises the Staff that the production and reserve information on pages 47 and pages 63-64 respectively of the 2006 Form 20-F includes production and reserve data grouped by geographic region for all fields and projects in which the company has an interest. The information on petroleum operations section starting on page 12, of the 2006 Form 20-F, presents a description of every producing asset within Petroleum by each geographic region, and is meant to be an operational overview. The Company considers that the provision of production and reserve information by geographic region meets the requirements of Item 4D of Form 20-F which requires the provision of “material information about production, reserves, locations, developments and the nature of your interest.” The numerous individual fields that make up the geographic regions are not individually material to the Company as a whole.

Petroleum Reserves, page 62

| 15. | You state that proved reserves include volumes calculated by probabilistic aggregation of certain fields that share common infrastructure, and that these aggregation procedures result in enterprise-wide proved reserves volumes which may not be realized upon divestment on an individual property basis. Please tell us what percentage of your total reserves these probabilistic aggregations represent. |

On our website we provide guidance on the use of probabilistic reserve estimates. Please refer to that guidance, and tell us if you have honored the limiting criteria in the SEC definitions, such as "lowest known hydrocarbons," in making your probabilistic reserve estimates. You may locate the guidance referenced above at the following address.

http://www.sec.gov/divisions/corpfin/guidance/cfactfaq.htm#P279_57537

Given that probabilistic aggregation of proved reserves can result in larger reserve estimates (although with increased uncertainty of recovery) than simple addition would yield, please disclose the underlying assumptions and estimation methodology sufficiently to understand the reasons your reported proved volumes may not be realized upon divestment of an individual property, and the implications of this for the prospect of recovering such volumes through future production.

17

Response 15:

The probabilistic aggregation volumes included in our 2006 Form 20-F amount to 3.4 per cent of our total proved reserves. The specific volumes associated with the probabilistic aggregations are reported in footnote (c) to the reserves tables starting on page 63 of the 2006 Form 20-F.

The Company has followed the guidance provided in Section 3(i) of the “Division of Corporation Finance: Frequently Requested Accounting and Financial Reporting Interpretations and Guidance” document from the website that the Staff referenced, and has honoured the limiting criteria as stated therein. Only four assets have included probabilistic aggregations in their reported proved volumes. All four assets are integrated projects developing several fields through shared infrastructure. All four assets have been producing for some time and their hydrocarbon-water contacts are clearly established.

The specific wording used in our Form 20-F regarding the inclusion of probabilistic aggregation in our proved volumes was based upon wording supplied by the Staff in their letter of 27 March 2002 during their review of our 2001 draft registration statement on Form F-1. The Company adopted the Staff’s recommended wording and has used it since that time.

As the Staff has noted, the outcome of the probabilistic aggregation procedure is larger Proved reserve estimates than simple addition would yield. However, the procedure also ensures that this larger Proved volume still has 90 per cent probability of being exceeded.

The probabilistic aggregation methodology used by the Company is based upon distributions for all the volumetric input parameters for each of the aggregated reservoirs. These distributions have been constructed based upon all available seismic, well and production data, constrained to exclude unreasonable outcomes. In addition, dependency factors have been used, where appropriate, to ensure that related parameters are linked, rather than assuming that all parameters are independent. For the Company’s projects, the output distribution range of recoverable volumes and the associated probabilistic aggregation volumes are primarily a function of the uncertainty in the gross hydrocarbon rock volume, and to a smaller degree of the uncertainty in recovery factor, and to a still lesser extent of the uncertainty in the rock properties within each accumulation.

| 16. | We note that in September 2005 you suffered severe hurricane damage to your Typhoon facility resulting in loss of the platform and a permanent loss of production from the Typhoon and Boris fields. Tell us how many proved reserves were lost from these fields and how you accounted for that loss in the reserve reconciliation table. |

Response 16:

The Typhoon facility was the hub for the Typhoon, Boris and Little Burn fields, and the facility was producing until it suffered severe hurricane damage in September 2005. Although the facility was damaged beyond repair, the fields were assessed to be capable of producing hydrocarbons once a suitable replacement facility was installed. As of June 30, 2006 the Company had a re-development plan for the Typhoon facility evaluated, which showed positive standardized measure economics to re-develop the proved volumes. Therefore, the Company did not record any decrease in reserves in the Typhoon, Boris and Little Burn fields due to the damage suffered by the production facilities.

Subsequent to the filing of our 2006 Form 20-F, the Company and co-venturers sold the property to Energy Resource Technology, Inc. (“ERT”). ERT has obtained a Suspension of Production for the three fields and has filed a development plan with the U. S. Minerals Management Service, and is estimating that the fields will be back on line during calendar year 2008.

18

| 17. | Please tell us the quantity of your proved undeveloped reserves that were converted to proved developed reserves in each of 2005 and 2006 ; and how much development capital was spent in each of these years for converting proved undeveloped reserves to proved developed reserves. Please tell us when your proved reserves were initially booked as proved, and when you anticipate the date of first production for each field or project that you carried as proved undeveloped reserves in 2005 and 2006. |

Response 17:

We are assembling the data required to respond to this question. As discussed with Mr K Hiller, a response will be submitted by 11 May 2007.

19

In connection with responding to the Staff’s comments, the company acknowledges that:

| | • | | the Company is responsible for the adequacy and accuracy of the disclosure in the filing; |

| | • | | Staff comments or changes to disclosure in response to Staff comments do not foreclose the Commission from taking any action with respect to the filing; and |

| | • | | the Company may not assert Staff comments as a defence in any proceeding initiated by the Commission or any person under the federal securities laws of the United States. |

If you have any questions or need any further information with respect to matters set forth in this letter, please contact me in Australia on (011) (613) 9609 3821, or by email atNigel.Chadwick@BHPBilliton.com.

Given that the Company is now into the final quarter of its 2007 fiscal year, and in light of the nature of the changes in disclosure requested by the Staff, which we respectfully submit, would not be material to a reader’s understanding of the Company’s results and financial position, the Company would like to propose to respond to such requests for amended disclosure by reflecting the amendments in the Form 20-F for the fiscal year ending June 30, 2007, rather than further amending the 2006 Form 20-F.

We would of course welcome the opportunity to discuss any of these matters further with the Staff in the event further clarification is required.

|

Yours sincerely, |

|

/s/ Nigel Chadwick |

Group Financial Controller |

20

| | | | | | | | |

Carbon Steel Materials |

Ref | | Country | | Site/Asset | | Description | | Ownership |

51 | | Australia | | GEMCO | | Producer of manganese ore | | 60% |

52 | | Australia | | Illawarra Coal | | Three underground coal mines | | 100% |

53 | | Australia | | Queensland Coal | | World’s largest supplier of high-quality metallurgical coal for steel production | | 50-

80% |

54 | | Australia | | TEMCO | | Producer of manganese alloys Š | | 60% |

55 | | Australia | | WA Iron Ore | | Pilbara iron ore mine, rail and port operations | | 85-

100% |

56 | | Brazil | | Samarco | | An efficient low-cost producer of iron ore pellets | | 50% |

57 | | South Africa | | Samancor Manganese | | Integrated producer of manganese ore (Hotazel Manganese Mines) and alloys (Metalloys) | | 60% |

|

Diamonds and Specialty Products |

Ref | | Country | | Site/Asset | | Description | | Ownership |

58 | | Canada | | Yellowknife | | EKATI Diamond Mine in the Northwest Territories of Canada | | 80% |

59 | | Mozambique | | Corridor Sands | | Titanium minerals project | | 90% |

60 | | South Africa | | Richards Bay Minerals | | World’s largest producer of titanium slag | | 50% |

|

Energy Coal |

Ref | | Country | | Site/Asset | | Description | | Ownership |

61 | | Australia | | Hunter Valley Energy Coal | | Mt Arthur Coal | | 100% |

62 | | Australia | | Illawarra Coal | | Marketing agent for energy coal output | | — |

63 | | Australia | | Queensland Coal | | Marketing agent for energy coal output | | — |

64 | | Colombia | | Cerrejon | | Largest coal producer in Colombia | | 33.3% |

65 | | South Africa | | Ingwe | | Largest coal producer in South Africa | | 100% |

66 | | US | | New Mexico Coal | | Mine-mouth operations | | 100% |

|

Stainless Steel Materials |

Ref | | Country | | Site/Asset | | Description | | Ownership |

67 | | Australia | | Nickel West | | Nickel assets including Mt Keith and Leinster operations, Kalgoorlie nickel smelter and concentrator and Kwinana nickel refinery | | 100% |

68 | | Australia | | QNI Yabulu Refinery | | The Yabulu refinery is one of the world’s major laterite nickel-cobalt processing plants | | 100% |

69 | | Australia | | Ravensthorpe Nickel Project | | Ravensthorpe nickel mine and processing facility (currently in development) | | 100% |

70 | | Colombia | | Cerro Matoso | | Integrated ferronickel mining and smelting complex in north Colombia | | 99.8% |

| | | | | | |

|

BHP Billiton locations |

|

Offices |

Ref | | Country | | Location | | |

1 | | Australia | | Adelaide¨ Š | | ¨ Corporate Centres Š Marketing Offices |

2 | | Australia | | Brisbane Š < | | < Minerals Exploration Offices |

3 | | Australia | | Melbourne (Global Headquarters)¨ Š < | | n Technology Centres |

4 | | Australia | | Newcastle n | | |

5 | | Australia | | Perth¨ Š < n | | |

6 | | Belgium | | Antwerp Š | | |

7 | | Brazil | | Rio de Janeiro Š < | | |

8 | | Canada | | Vancouver < | | |

9 | | Chile | | Santiago ¨ Š < | | |

10 | | China | | Beijing Š < | | |

11 | | China | | Shanghai Š | | |

12 | | Germany | | Essen Š | | |

13 | | India | | New Delhi Š < | | |

14 | | Indonesia | | Jakarta Š | | |

15 | | Japan | | Tokyo Š | | |

16 | | Korea | | Seoul Š | | |

17 | | Mongolia | | Ulaanbaatar < | | |

18 | | Netherlands | | The Hague Š | | |

19 | | Peru | | Lima < | | |

20 | | Russia | | Moscow Š < | | |

21 | | Singapore | | Singapore Š | | |

22 | | South Africa | | Johannesburg ¨ Š < n | | |

23 | | Switzerland | | Baar Š | | |

24 | | UK | | London ¨ | | |

25 | | UK | | Sheffield Š | | |

26 | | US | | Houston ¨ Š | | |

27 | | US | | Pittsburgh Š | | |

| | | | | | | | |

Petroleum | | | | | | | | |

Ref | | Country | | Site/Asset | | Description | | Ownership |

28 | | Algeria | | Ohanet | | Joint operator with Sonatrach of wet gas development | | 45% |

29 | | Algeria | | ROD Integrated Development | | Onshore oil development | | 36.04% |

30 | | Australia | | Bass Strait | | The Bass Strait operations produce oil, condensate, LPG, natural gas and ethane | | 50% |

31 | | Australia | | Griffin | | Operator of oil and gas project offshore WA | | 45% |

32 | | Australia | | Minerva | | Operator of Minerva gas field development in the Otway Basin | | 90% |

33 | | Australia | | North West Shelf | | One of Australia’s largest resource projects, producing liquids, LNG and domestic gas | | 8.33-16.67% |

34 | | Pakistan | | Zamzama | | Operator of onshore gas development | | 38.5% |

35 | | Trinidad and Tobago | | Angostura | | Operator of oil field | | 45% |

36 | | UK | | Bruce/Keith | | Oil and gas production in the UK North Sea | | 16-31.83% |

37 | | UK | | Liverpool Bay | | Operator of oil and gas development in the Irish Sea | | 46.1% |

38 | | US | | Gulf of Mexico | | Interests in several producing assets, the Atlantis, Neptune and Shenzi developments, and a significant exploration acreage position | | 4.95-100% |

- | | Various | | Exploration | | Exploration interests in Algeria, Australia, Brunei, Maritime Canada, Colombia, Namibia, Pakistan, South Africa, Trinidad and Tobago, UK, US | | — |

| | | | | | | | |

Aluminium |

Ref | | Country | | Site/Asset | | Description | | Ownership |

39 | | Australia | | Worsley | | Integrated alumina refinery/ bauxite mine | | 86% |

40 | | Brazil | | Alumar | | Alumina refinery and aluminium smelter | | 36-

40% |

41 | | Brazil | | MRN | | Bauxite mine | | 14.8% |

42 | | Mozambique | | Mozal | | Aluminium smelter | | 47.1% |

43 | | South Africa | | Hillside/Bayside | | Two aluminium smelters | | 100% |

44 | | Suriname | | Paranam | | Alumina refinery and bauxite mines | | 45% |

Base Metals |

Ref | | Country | | Site/Asset | | Description | | Ownership |

45 | | Australia | | Cannington | | Silver, lead and zinc mine in north-west Queensland | | 100% |

46 | | Australia | | Olympic Dam | | Large underground copper/uranium mine in South Australia | | 100% |

47 | | Chile | | Cerro Colorado | | Copper mine in northern Chile, producing cathode copper through a SX-EW leach operation | | 100% |

48 | | Chile | | Escondida | | The world’s largest copper mine, located in northern Chile | | 57.5% |

49 | | Chile | | Spence | | Open cut copper mine under development | | 100% |

50 | | Peru | | Antamina | | Large copper-zinc mine | | 33.75% |