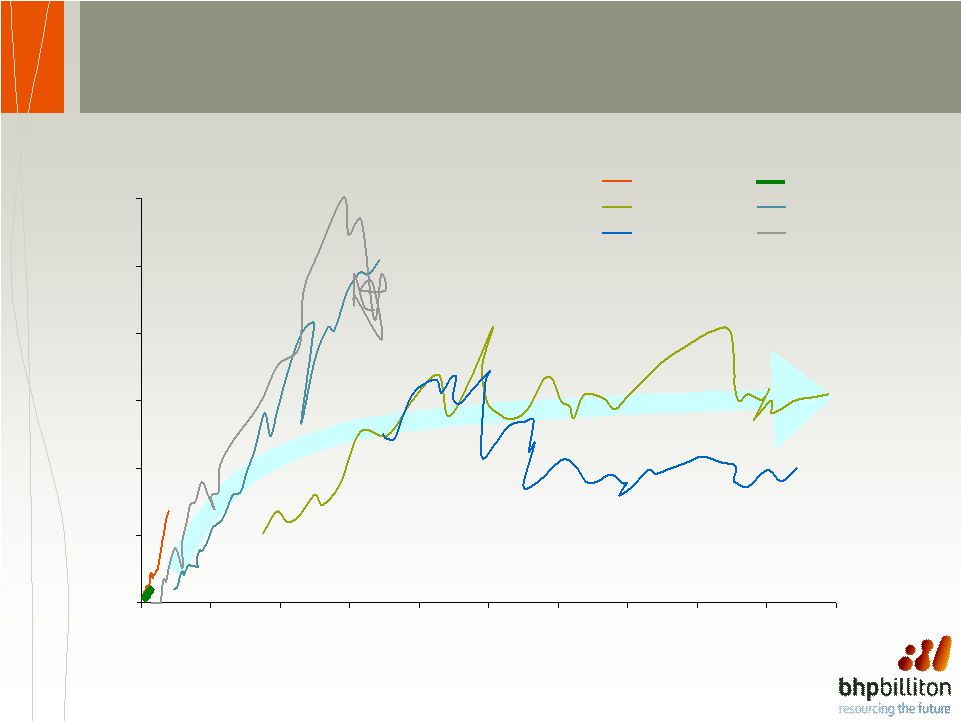

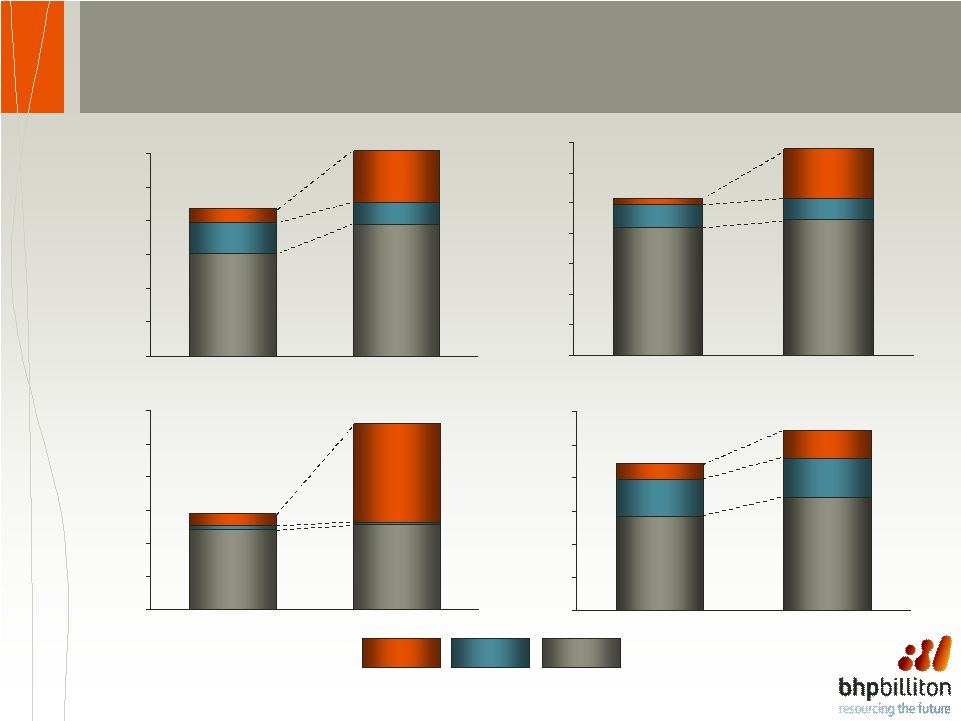

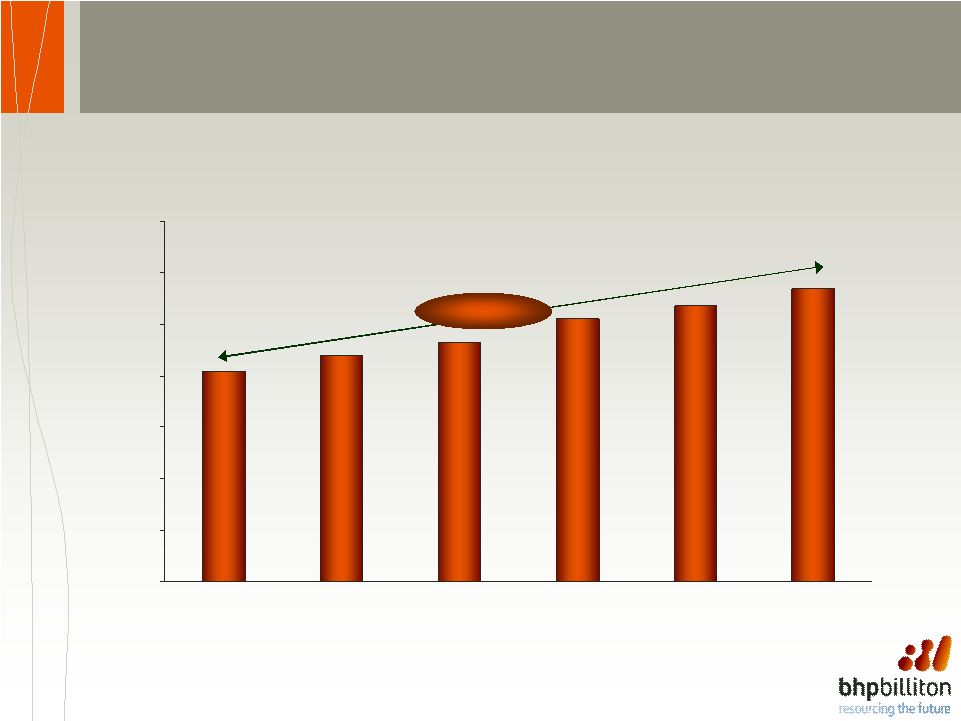

Slide 22 Conclusion – Strength, stability and growth • Strong pricing fundamentals due to increased demand and lagging supply • BHP Billiton’s strategy is unchanged - a diversified upstream portfolio of Tier 1, large, low-cost, expandable assets • BHP Billiton is well positioned to continue to create strong value for shareholders with a large project pipeline, focussed on high margin investments, which will deliver strong growth • The Rio Tinto acquisition can generate additional value for both sets of shareholders and is strongly aligned with BHP Billiton’s strategy and management philosophy of simplicity, accountability and global talent • The combined organisation would deliver: – More production, faster and lower cost, an enhanced set of future growth options and quantifiable synergies - $3.7bn in incremental EBITDA by year 7 – A compelling 45% premium for Rio Tinto shareholders and participation in the world’s largest mining company |