UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

September 25, 2014

| BHP BILLITON LIMITED | BHP BILLITON PLC | |

| (ABN 49 004 028 077) | (REG. NO. 3196209) | |

| (Exact name of Registrant as specified in its charter) | (Exact name of Registrant as specified in its charter) | |

| VICTORIA, AUSTRALIA | ENGLAND AND WALES | |

| (Jurisdiction of incorporation or organisation) | (Jurisdiction of incorporation or organisation) | |

171 COLLINS STREET, MELBOURNE, VICTORIA 3000 AUSTRALIA | NEATHOUSE PLACE, LONDON, UNITED KINGDOM | |

| (Address of principal executive offices) | (Address of principal executive offices) | |

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F:

x Form 20-F ¨ Form 40-F

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ¨

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ¨

Indicate by check mark whether the registrant by furnishing the information contained in this Form is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934: ¨ Yes x No

If “Yes” is marked, indicate below the file number assigned to the registrant in connection with Rule 12g3-2(b):n/a

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorised.

| BHP Billiton Limited and BHP Billiton Plc | ||||||

| Date: September 25, 2014 | By: | /s/ Nicole Duncan | ||||

| Name: | Nicole Duncan | |||||

| Title: | Company Secretary | |||||

BHP Billiton Plc Notice of Meeting 2014 This document is important and requires your immediate attention. Please read it straight away. If you are in any doubt as to any aspect of the proposals referred to in this document or as to the action you should take, you should immediately consult your stockbroker, solicitor, accountant or other professional adviser authorised under the Financial Services and Markets Act 2000. If you have sold or transferred all your shares in BHP Billiton Plc, please send this document, together with accompanying documents, at once to the purchaser or transferee, or to the stockbroker, bank or other agent through whom the sale or transfer was effected for transmission to the purchaser or transferee.

Our Charter We are BHP Billiton, a leading global resources company. Our purpose is to create long-term shareholder value through the discovery, acquisition, development and marketing of natural resources. Our strategy is to own and operate large, long-life, low-cost, expandable, upstream assets diversi?ed by commodity, geography and market. Our Values Sustainability Putting health and safety ?rst, being environmentally responsible and supporting our communities. Integrity Doing what is right and doing what we say we will do. Respect Embracing openness, trust, teamwork, diversity and relationships that are mutually bene?cial. Performance Achieving superior business results by stretching our capabilities. Simplicity Focusing our efforts on the things that matter most. Accountability De?ning and accepting responsibility and delivering on our commitments. We are successful when: Our people start each day with a sense of purpose and end the day with a sense of accomplishment. Our communities, customers and suppliers value their relationships with us. Our asset portfolio is world-class and sustainably developed. Our operational discipline and ?nancial strength enables our future growth. Our shareholders receive a superior return on their investment. Andrew Mackenzie Chief Executive Of?cer 2 – BHP BILLITON PLC NOTICE OF MEETING 2014

Invitation from the Chairman 11 September 2014 Dear Shareholder I am pleased to invite you to BHP Billiton Plc’s 2014 Annual General Meeting (AGM). The meeting will be held on Thursday, 23 October 2014 at the Queen Elizabeth II Conference Centre, London. The AGM is an important part of BHP Billiton’s overall approach to governance, which is outlined in more detail below. The AGM gives you the opportunity to talk to your Directors and senior management team, ask questions, and vote on items of business. The items of business are explained in this Notice of Meeting. Governance and strategy The Board regularly reviews our strategy of owning and operating large, long-life, low-cost, expandable upstream resource assets diversified by commodity and geography. This strategy has delivered strong performance over time and underpins the continuing creation of long-term sustainable value for shareholders, customers, employees and the communities in which we operate. As part of this ongoing review process, in August 2014, we announced the creation of a separate mining and metals company based on a selection of high-quality aluminium, coal, manganese, nickel and silver assets. Separating these businesses through a proposed demerger has the potential to unlock shareholder value by allowing us to improve the productivity of our largest businesses more quickly and by creating a new company specifically designed to enhance the performance of the demerged assets. We also announced the Chairman of the new company would be David Crawford AO, who will retire from the BHP Billiton Board in November 2014. On behalf of shareholders, I would like to note the exceptional service David has provided to the Board and the Group over many years. BHP BILLITON PLC NOTICE OF MEETING 2014 – 3

Invitation from the Chairman continued As one of Australia’s most respected company directors and chairmen, we thank him and wish him well for the future. It is also intended that Keith Rumble will become a Non-executive Director of the new company and would retire from the BHP Billiton Board at the time shareholders vote on the demerger proposal. Subject to satisfactory third party consents, final Board approval and shareholder approval, the demerger is expected to be completed in the first half of 2015. BHP Billiton has a robust corporate planning process. It is underpinned by detailed scenario planning. This gives us the ability to look at the future more clearly and to take into account a wide range of global uncertainties through to 2035. These include climate change impacts, geopolitical and technological developments. At the core of our corporate planning is our acceptance of the most recent assessment of the Intergovernmental Panel on Climate Change (IPCC) which found that warming of the climate is unequivocal, human influence is clear and physical impacts are unavoidable. We use the IPCC’s assessment as the base case for climate change science that informs our Group’s strategy. Regardless of which direction the world may take, we will always be guided by Our Charter values, including our value of Sustainability, in how we operate our business, interact with our stakeholders and plan for the future. The Company’s scenarios underpin the Board’s assessment of strategy, business portfolio and future investments. Along with associated signposts and triggers, the scenarios interpret technical, economic, political and global governance trends facing the resources industry. By considering extreme downsides, as well as opportunities, we stress test our strategy and the resilience of our diversified asset portfolio over the short and long term. Our planning shows the diversity of our four pillars of copper, petroleum, iron ore, coal, and potentially potash, is our strength. While no-one can be certain about the future, this diversity gives us resilience in downside scenarios while providing opportunities for future growth in others. Board renewal and succession planning The Board believes that orderly succession and renewal is achieved as a result of careful long-term planning, where the appropriate composition of the Board is continually under review. This is necessary to ensure your Board has the required diversity and depth of skills, experience, independence and knowledge to govern BHP Billiton effectively as the Company changes and evolves. As part of the continual Board renewal process, in April 2014, we appointed former Royal Dutch Shell Executive Director, Malcolm Brinded, to the Board. Malcolm brings 37 years’ international business experience and has already made a substantial contribution to the collective decision making of the Board and the Sustainability Committee. Together, your Directors contribute international business and senior executive experience; mining and oil and gas operating experience; knowledge of world capital markets; regulatory and government policy experience; an understanding of the health, safety, environmental and community challenges that we face; experience of successfully managing a global business in the context of uncertainty, and an understanding of the risk environment of the Group, including systemic risk such as financial crises and climate change. Your Board believes that the overall composition of the Board enables it to effectively govern BHP Billiton on behalf of shareholders in the best interests of the Company. 4 – BHP BILLITON PLC NOTICE OF MEETING 2014

As we have adopted a policy of annual re-election, all your Directors are standing for re-election, with the exception of David Crawford who is retiring and Malcolm Brinded, who will stand for election for the first time. Our policy gives shareholders the opportunity to formally vote on all Directors every year. In accordance with our annual review process, the performance of each Director standing for election or re-election has been assessed and all Directors have been unanimously recommended for election or re-election. The Board recommends that you vote in favour of all the Board nominated Directors standing for election or re-election. External nomination Shareholders holding 0.06 per cent of the combined issued share capital of BHP Billiton have nominated Mr Ian Dunlop. Mr Dunlop was also nominated in 2013. The Board, assisted by the Nomination and Governance Committee, has considered Mr Dunlop’s nomination and considers that Mr Dunlop would not add to the effectiveness of your Board. For this reason, the Board does not endorse Mr Dunlop’s nomination and recommends you vote against the election of Mr Dunlop (Item 25). Remuneration For the first time this year, the business of the AGM includes three resolutions relating to the Remuneration Report. The two additional resolutions at Items 7 and 8 stem from new UK remuneration reporting rules introduced during the year. The new legislation gives shareholders a binding vote on the Directors’ remuneration policy and, as in the case of previous years, an advisory vote on the annual report on remuneration. Australian requirements with respect to voting on the Remuneration Report are unchanged and shareholders continue to have an advisory vote on the entire Remuneration Report, which includes the remuneration policy and remuneration arrangements in place for the Directors and members of the Group Management Committee (Item 9). Board Recommendation The Board considers that all resolutions other than Item 25 are in the best interests of shareholders of BHP Billiton, as a whole, and recommends you vote in favour of Items 1 to 24. The Board recommends you vote against Item 25 (the election of Mr Ian Dunlop). I encourage you to join us at the AGM and thank you for your continued support of BHP Billiton. I look forward to meeting as many shareholders as possible. BHP BILLITON PLC NOTICE OF MEETING 2014 – 5

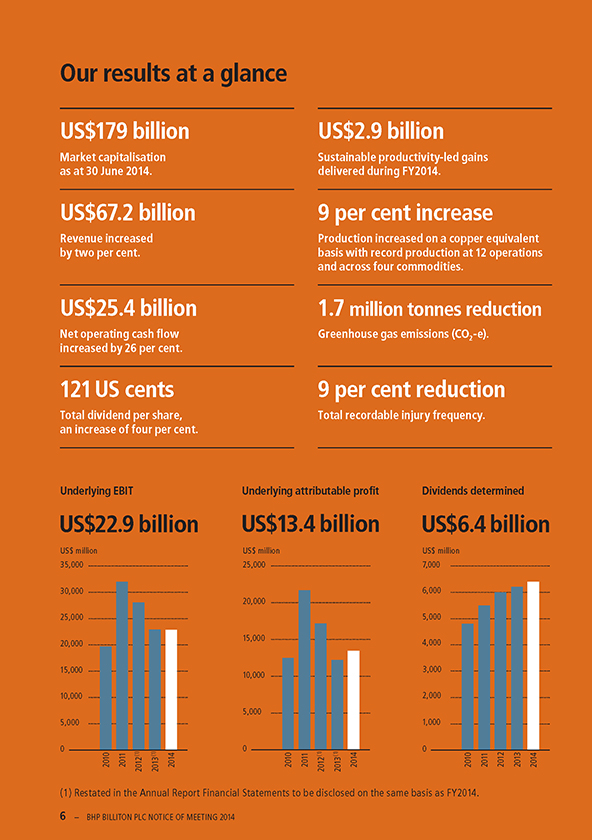

Our results at a glance US$179 billion US$2.9 billion Market capitalisation Sustainable productivity-led gains as at 30 June 2014. delivered during FY2014. US$67.2 billion 9 per cent increase Revenue increased Production increased on a copper equivalent by two per cent. basis with record production at 12 operations and across four commodities. US$25.4 billion 1.7 million tonnes reduction Net operating cash flow Greenhouse gas emissions (CO2-e). increased by 26 per cent. 121 US cents 9 per cent reduction Total dividend per share, Total recordable injury frequency. an increase of four per cent. Underlying EBIT Underlying attributable profit Dividends determined US$22.9 billion US$13.4 billion US$6.4 billion US$ million US$ million US$ million 35,000 25,000 7,000 30,000 6,000 20,000 25,000 5,000 15,000 20,000 4,000 15,000 3,000 10,000 10,000 2,000 5,000 5,000 1,000 0 2010 2011 (1) (1) 2014 0 2010 2011 (1) (1) 2014 0 2010 2011 2012 2013 2014 2012 2013 2012 2013 (1) Restated in the Annual Report Financial Statements to be disclosed on the same basis as FY2014. 6 – BHP BILLITON PLC NOTICE OF MEETING 2014

SUSTAINABILITY FOCUS AREAS Safety performance Community investment Our efforts to protect the health and safety We are committed to making a positive of our people remains unrelenting. In FY2014, contribution to the communities in which we we had no fatalities at our operated assets and operate. In FY2014, our voluntary community improved our total recordable injury frequency investment totalled US$241.7 million, comprising performance by nine per cent to 4.2 injuries US$141.7 million of cash, in-kind support and per million hours worked. We also recorded administrative costs and a US$100 million a 22 per cent decrease in the number of potential contribution to the BHP Billiton Foundation. exposures to carcinogens and airborne More than 8,700 of our employees participated contaminants, if not for the use of personal in the Matched Giving Program which benefited protective equipment, compared with our 1,894 not-for-profit organisations, with funds FY2012 baseline. received from the Program amounting to US$12.1 million. Greenhouse gas emissions We will continue to take action to reduce our greenhouse gas (GHG) emissions and build the resilience of our operations, investments, communities and ecosystems to the impacts of climate change. In FY2014, we reduced our GHG emissions by 1.7 million tonnes (Mt) of carbon dioxide equivalent (CO2-e) to 45.0 Mt of CO2-e. This keeps us in line to achieve our FY2017 target to maintain our emissions below our FY2006 baseline levels. OThER KEY FOCUS AREAS Productivity We are dedicated to working smarter to safely deliver greater volume growth from existing equipment at lower unit cost. We encourage our people to learn from each other and identify more productive ways of working. During FY2014, we delivered US$2.9 billion of benefits attributable to productivity initiatives. This means we have now delivered more than US$6.6 billion of benefits attributable to productivity initiatives over the last two years. Disciplined approach to capital management We have reduced capital and exploration expenditure by 32 per cent and maintained our solid ‘A’ credit rating. Our balance sheet remains strong and we have increased our full-year dividend by four per cent to 121 US cents per share. Simplification of our portfolio We are concentrating our efforts on those world-class basins where we enjoy economies of scale and a competitive advantage. Our focus on four major Businesses of Iron Ore, Petroleum, Copper and Coal, with Potash as a potential fifth, provides the benefits of diversification. On 19 August 2014, we announced a plan to create an independent global metals and mining company based on a selection of our high-quality aluminium, coal, manganese, nickel and silver assets. For additional information refer to our Annual Report, Summary Review and Sustainability Report, which are available online at BHP BILLITON PLC NOTICE OF MEETING 2014 – 7

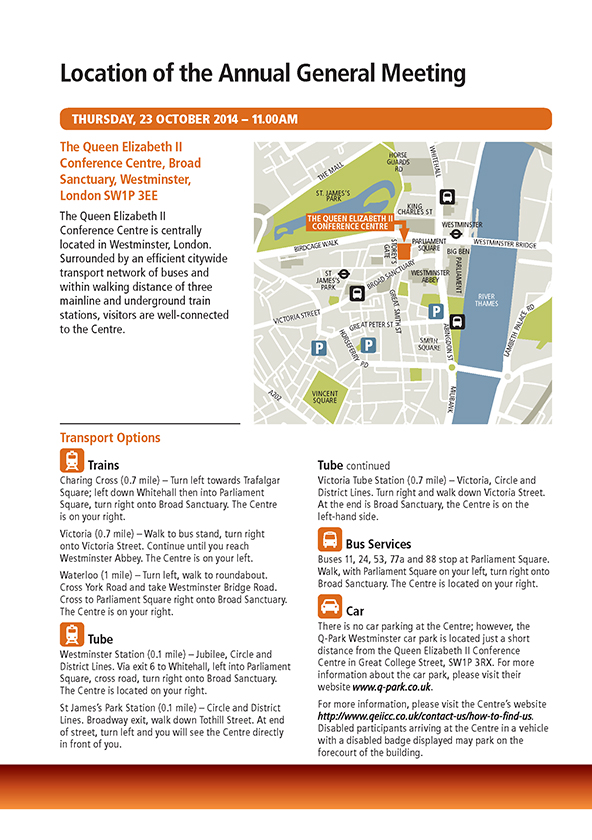

Contents Annual General Meeting agenda?8 Notice of Annual General Meeting?9 Explanatory Notes?14 Voting and participating?41 Accessing information on BHP Billiton ?49 Shareholder information?50 Location of the Annual General Meeting?52 Annual General Meeting agenda ThURSdAY, 23 OCTOBER 2014 9.30am Registration opens 9.45am Morning tea 11.00am Annual General Meeting commences Welcome to shareholders – Chairman Review – Chief Executive Officer Consideration of items of business and questions Please join the Chairman, the Directors and senior management of BHP Billiton for refreshments after the Annual General Meeting. Please refer to the back cover of this Notice of Meeting for further details on the location of the meeting, including the map, and the transport network options. BHP Billiton Plc is a member of the BHP Billiton Group, which is headquartered in Australia. Registered Office: Neathouse Place, London SW1V 1LH. Registered in England and Wales, Number 3196209. In this Notice, BHP Billiton Plc refers to the company listed on the London Stock Exchange and BHP Billiton Limited refers to the company listed on the Australian Securities Exchange. Each is a member of the BHP Billiton Group, which is headquartered in Australia. In this Notice, BHP Billiton Plc and BHP Billiton Limited together are referred to as BHP Billiton. The Boards of BHP Billiton Plc and BHP Billiton Limited must be identical and operate as one. In this Notice, the Board of BHP Billiton Plc and the Board of BHP Billiton Limited are referred to as the Board. 8 – BHP BILLITON PLC NOTICE OF MEETING 2014

Notice of Annual General Meeting Notice is given that the 2014 Annual General Meeting of shareholders of BHP Billiton Plc will be held at The Queen Elizabeth II Conference Centre, Broad Sanctuary, Westminster, London, on Thursday, 23 October 2014 at 11.00am (London time) for the purpose of transacting the following business. Items of business Items 1 to 4, 7, and 10 to 25 will be proposed as ordinary resolutions. Items 5 and 6 will be proposed as special resolutions. Items 8 and 9 will be proposed as non-binding ordinary resolutions. Financial Statements and reports Item 1 To receive the Financial Statements for BHP Billiton Plc and BHP Billiton Limited for the year ended 30 June 2014, together with the Directors’ Report (which includes the Strategic Report) and the Auditor’s Report, as set out in the Annual Report. Reappointment of auditor of BHP Billiton Plc Item 2 To reappoint KPMG LLP as the auditor of BHP Billiton Plc. Remuneration of auditor of BHP Billiton Plc Item 3 To authorise the Risk and Audit Committee to agree the remuneration of KPMG LLP as the auditor of BHP Billiton Plc. BHP BILLITON PLC NOTICE OF MEETING 2014 – 9

Notice of Annual General Meeting continued General authority to issue shares in BHP Billiton Plc Item 4 To renew authority and power to allot shares in BHP Billiton Plc or to grant rights to subscribe for or to convert any security into shares in BHP Billiton Plc (rights) conferred on the Directors by Article 9 of BHP Billiton Plc’s Articles of Association in accordance with section 551 of the UK Companies Act 2006 (Companies Act) for the period ending on the later of the conclusion of the Annual General Meeting of BHP Billiton Plc and the Annual General Meeting of BHP Billiton Limited in 2015 (provided that BHP Billiton Plc may, before the expiry of this authority, make offers or agreements which would or might require shares in BHP Billiton Plc to be allotted, or rights to be granted, after such expiry and, notwithstanding such expiry, the Directors may allot shares in BHP Billiton Plc, or grant rights, in pursuance of such offers or agreements) and for such period the section 551 amount (under the Companies Act) shall be US$105,603,590. This authority is in substitution for all previous authorities conferred on the Directors in accordance with section 551 of the Companies Act, but without prejudice to any allotment of shares or grant of rights already made or offered or agreed to be made pursuant to such authorities. Issuing shares in BHP Billiton Plc for cash Item 5 To empower the Directors, pursuant to sections 570 and 573 of the UK Companies Act 2006 (Companies Act), to allot equity securities (as defined in section 560 of the Companies Act) for cash and/or to allot equity securities which are held by BHP Billiton Plc as treasury shares pursuant to the authority given by Item 4 and the power conferred on the Directors by Article 9 of BHP Billiton Plc’s Articles of Association as if section 561 of the Companies Act did not apply to any such allotment, provided that this power shall be limited to the allotment of equity securities: (a) in connection with a rights issue or other issue the subject of an offer or invitation, open for acceptance for a period fixed by the Directors, to (i) holders of ordinary shares on the register on a record date fixed by the Directors in proportion (as nearly as may be practicable) to their respective holdings and (ii) other persons so entitled by virtue of the rights attaching to any other equity securities held by them, but in both cases subject to such exclusions or other arrangements as the Directors may consider necessary or expedient to deal with treasury shares, fractional entitlements or securities represented by depositary receipts or having regard to any legal or practical problems under the laws of, or the requirements of any regulatory body or stock exchange in, any territory or otherwise howsoever; and (b) otherwise than pursuant to paragraph (a) above, up to an aggregate nominal amount of US$52,801,795, and shall expire on the later of the conclusion of the Annual General Meeting of BHP Billiton Plc and the Annual General Meeting of BHP Billiton Limited in 2015 (provided that this authority shall allow BHP Billiton Plc before the expiry of this authority to make offers or agreements which would or might require equity securities to be allotted after such expiry and, notwithstanding such expiry, the Directors may allot equity securities in pursuance of such offers or agreements). 10 – BHP BILLITON PLC NOTICE OF MEETING 2014

Repurchase of shares in BHP Billiton Plc (and cancellation of shares in BHP Billiton Plc purchased by BHP Billiton Limited) Item 6 To generally and unconditionally authorise BHP Billiton Plc in accordance with section 701 of the United Kingdom Companies Act 2006 to make market purchases (as defined in section 693 of that Act) of ordinary shares of US$0.50 nominal value each in the capital of BHP Billiton Plc (shares) provided that: (a) the maximum aggregate number of shares hereby authorised to be purchased will be 211,207,180, representing 10 per cent of BHP Billiton Plc’s issued share capital; (b) the minimum price that may be paid for each share is US$0.50, being the nominal value of such a share; (c) the maximum price that may be paid for any share is not more than five per cent above the average of the middle market quotations for a share taken from the London Stock Exchange Daily Official List for the five business days immediately preceding the date of purchase of the shares; and (d) the authority conferred by this resolution shall, unless renewed prior to such time, expire on the later of the conclusion of the Annual General Meeting of BHP Billiton Plc and the Annual General Meeting of BHP Billiton Limited in 2015 (provided that BHP Billiton Plc may enter into a contract or contracts for the purchase of shares before the expiry of this authority which would or might be completed wholly or partly after such expiry and may make a purchase of shares in pursuance of any such contract or contracts as if the authority conferred hereby had not expired). Approval of the Directors’ remuneration policy Item 7 To approve the Directors’ remuneration policy report set out in section 4.3 of the Annual Report. Approval of the Remuneration Report other than the part containing the Directors’ remuneration policy Item 8 To approve the Remuneration Report for the year ended 30 June 2014 (other than the Directors’ remuneration policy report as per Item 7) as set out in section 4 of the Annual Report. Approval of the Remuneration Report Item 9 To approve the Remuneration Report for the year ended 30 June 2014 as set out in section 4 of the Annual Report. BHP Billiton will disregard any votes cast (in any capacity) on Items 7, 8 and 9 by or on behalf of a member of BHP Billiton’s Key Management Personnel (KMP) or a KMP’s closely related party, unless the vote is cast as proxy for a person entitled to vote in accordance with a direction on the proxy form or by the Chairman of the meeting pursuant to an express authorisation to exercise the proxy. BHP BILLITON PLC NOTICE OF MEETING 2014 – 11

Notice of Annual General Meeting continued Approval of leaving entitlements Item 10 To approve, for all purposes, including sections 200B and 200E of the Corporations Act 2001 (Cth) (Corporations Act), the giving of benefits to any current or future holder of a managerial or executive office in BHP Billiton Limited or a related body corporate in connection with the person ceasing to hold that office, as set out in the Explanatory Notes. If any shareholder is an employee or Director of BHP Billiton Limited or a related body corporate, a potential employee or Director, or an associate of an employee or Director, and wishes to preserve the benefit of this resolution for that person, they should not vote on the resolution, or they will lose the benefit of the resolution as a result of the operation of the Corporations Act. Further, BHP Billiton will disregard any vote cast as a proxy on Item 10 by a member of BHP Billiton’s KMP or a KMP’s closely related party, unless the vote is cast as proxy for a person entitled to vote in accordance with a direction on the proxy form or by the Chairman of the meeting pursuant to an express authorisation to exercise the proxy. Approval of grants to Executive Director Item 11 To approve the grant of awards to Executive Director, Andrew Mackenzie, under the Group’s short and long term incentive plans as set out in the Explanatory Notes. BHP Billiton will disregard any vote cast on Item 11 by Andrew Mackenzie or any of his associates, as well as any votes cast as a proxy on Item 11 by a member of BHP Billiton’s KMP or a KMP’s closely related party, unless the vote is cast as proxy for a person entitled to vote in accordance with a direction on the proxy form or by the Chairman of the meeting pursuant to an express authorisation to exercise the proxy. Election of Board-endorsed Directors Items 12 to 24 The following Directors retire under the Board’s policy on annual election (or, in the case of Malcolm Brinded, under the Articles of Association and the Constitution) and, being eligible, submit themselves for re-election or election. Item 12 To elect Malcolm Brinded as a Director of BHP Billiton. Item 13 To re-elect Malcolm Broomhead as a Director of BHP Billiton. 12 – BHP BILLITON PLC NOTICE OF MEETING 2014

Item 14 To re-elect Sir John Buchanan as a Director of BHP Billiton. Item 15 To re-elect Carlos Cordeiro as a Director of BHP Billiton. Item 16 To re-elect Pat Davies as a Director of BHP Billiton. Item 17 To re-elect Carolyn Hewson as a Director of BHP Billiton. Item 18 To re-elect Andrew Mackenzie as a Director of BHP Billiton. Item 19 To re-elect Lindsay Maxsted as a Director of BHP Billiton. Item 20 To re-elect Wayne Murdy as a Director of BHP Billiton. Item 21 To re-elect Keith Rumble as a Director of BHP Billiton. Item 22 To re-elect John Schubert as a Director of BHP Billiton. Item 23 To re-elect Shriti Vadera as a Director of BHP Billiton. Item 24 To re-elect Jac Nasser as a Director of BHP Billiton. Election of Non-Board endorsed candidate Item 25 To elect Ian Dunlop, an external candidate nominated for election, as a Director of BHP Billiton. BHP BILLITON PLC NOTICE OF MEETING 2014 – 13

Explanatory Notes The Explanatory Notes that follow provide important information regarding the items of business to be considered at the Annual General Meeting (AGM). Your vote is important. By voting, you are involved in the future of BHP Billiton. Business Items 1 to 4, 7 and 10 to 25 will be proposed as ordinary resolutions. Items 5 and 6 will be proposed as special resolutions. Items 8 and 9 will be proposed as non-binding ordinary resolutions. All items of business at the AGM are joint electorate actions. The voting procedure explained on pages 41 to 48 ensures that both BHP Billiton Plc and BHP Billiton Limited shareholders can vote on these matters. Item 1 Financial Statements and reports The law in England and Australia requires Directors to lay before the meeting of shareholders the financial report (or statements), the Directors’ Report (which includes the Strategic Report), the Auditor’s Report and the Remuneration Report for the year. In accordance with BHP Billiton’s approach to corporate governance, shareholders in each of BHP Billiton Plc and BHP Billiton Limited are being asked to receive the reports and accounts of both companies. In the interests of simplicity, one resolution is proposed in respect of the reports and accounts for both BHP Billiton Plc and BHP Billiton Limited, as the accounts for the BHP Billiton Group as a whole are presented in the BHP Billiton Annual Report. Item 2 Reappointment of auditor of BHP Billiton Plc The law in England requires shareholders to approve the appointment of a company’s auditor each year. The appointment runs until the conclusion of the next AGM. KPMG has acted as the sole auditor of BHP Billiton Plc and BHP Billiton Limited since December 2003. Prior to that, KPMG and PricewaterhouseCoopers acted as joint auditors. The law in Australia does not require a similar annual reappointment of an auditor. A resolution to reappoint the auditor of BHP Billiton Limited has, therefore, not been proposed. Item 3 Remuneration of auditor of BHP Billiton Plc The law in England requires shareholders to either agree the remuneration of the auditor or authorise the company’s directors to do so. In accordance with best practice in corporate governance, shareholders are asked to authorise the Risk and Audit Committee to determine the remuneration of the auditor of BHP Billiton Plc. The law in Australia does not impose the same requirement. A resolution in respect of the remuneration of the auditor of BHP Billiton Limited has, therefore, not been proposed. 14 – BHP BILLITON PLC NOTICE OF MEETING 2014

Item 4 General authority to issue shares in BHP Billiton Plc The purpose of this resolution is to renew the authority of the Directors to issue shares and other equity securities in BHP Billiton Plc. The proposed limit is 211,207,180 shares, which: > represents approximately 3.97 per cent of the total combined issued share capital of BHP Billiton Plc and BHP Billiton Limited (or 10 per cent of the total issued share capital of BHP Billiton Plc) as at 5 September 2014, being the latest practicable date before publication of this Notice of Meeting (the Latest Practicable Date); > is considerably lower than the maximum limit specified in the guidelines of major shareholder associations in the United Kingdom – the Investment Management Association and the National Association of Pension Funds permit a maximum limit of one-third of the issued share capital or two-thirds in the case of a pre-emptive rights issue; > is considerably lower than the authority granted at the 2013 AGMs (a limit representing approximately 25 per cent was sought in 2013 and has been sought and granted at previous AGMs, but a limit representing 10 per cent of the total issued share capital of BHP Billiton Plc is being sought this year). The Board considers that the lowered limit strikes the appropriate balance between market practice in South Africa (where investors expect a significantly lower limit on the general authority to issue shares than is acceptable in the United Kingdom) and ensuring that sufficient capacity is retained to finance business opportunities which may arise during the year; and > is subject to the lower limit specified in Item 5 where shares are issued for cash on a non-pre-emptive basis. This authority will expire at the conclusion of the BHP Billiton AGMs in 2015. The Directors have no present plans to issue shares under this authority. No shares were issued under the similar authority granted by shareholders at last year’s AGMs. As at the Latest Practicable Date, the total issued capital of BHP Billiton Plc was 2,112,071,796 shares, and the total combined share capital of BHP Billiton Plc and BHP Billiton Limited was 5,323,762,901 shares. Item 5 Issuing shares in BHP Billiton Plc for cash The purpose of this resolution is to renew the authority of the Directors to issue shares and sell treasury shares in BHP Billiton Plc, for cash, without first offering them to existing shareholders in proportion to their holdings. Paragraph (a) of Item 5 authorises the Board to issue shares and sell treasury shares for cash in connection with a rights issue or other pre-emptive offer. BHP BILLITON PLC NOTICE OF MEETING 2014 – 15

Explanatory Notes continued Item 5 continued Paragraph (b) of Item 5 authorises the Board to make other types of share issues (and sales of treasury shares) for cash – for example, placements to people who are not currently shareholders. However, this authority in paragraph (b) is limited to 105,603,590 shares, which: > represents approximately two per cent of the total combined issued share capital of BHP Billiton Plc and BHP Billiton Limited (or five per cent of the total issued share capital of BHP Billiton Plc) as at the Latest Practicable Date; and > is consistent with the Statement of Principles of the United Kingdom’s Pre-Emption Group, which reflect the views of the Investment Management Association and the National Association of Pension Funds. The Directors confirm their intention to follow the United Kingdom Pre-Emption Group’s Statement of Principles regarding usage of the paragraph (b) authority so that cumulative usage in excess of 7.5 per cent of the total issued share capital of BHP Billiton Plc (excluding treasury shares) within a rolling three-year period should not take place without prior consultation with shareholders. The Directors did not use the equivalent authority granted by shareholders at last year’s AGMs. Item 6 Repurchase of shares in BHP Billiton Plc (and cancellation of shares in BHP Billiton Plc purchased by BHP Billiton Limited) The purpose of this resolution is to renew BHP Billiton Plc’s authority to buy back its own shares, in the market. The authority conferred by this item will only be exercised after considering the effects on earnings per share and the benefits for shareholders in BHP Billiton Plc and BHP Billiton Limited generally. The Directors believe that the authority to acquire shares in BHP Billiton Plc could be exercised in the future (whether by way of direct market purchases by BHP Billiton Plc, by way of the alternative mechanism described below or by way of a combination of both), although there is no present intention to do so as at the date of this Notice of Meeting. The renewal of the authority being sought will expire at the conclusion of the BHP Billiton AGMs in 2015. Shareholders are asked to consent to the purchase by BHP Billiton Plc of up to a maximum of 211,207,180 ordinary shares, which represents 10 per cent of BHP Billiton Plc’s issued share capital as at the Latest Practicable Date. The maximum price that may be paid for an ordinary share is 105 per cent of the average middle market quotation for the five business days preceding the purchase, and the minimum price that may be paid for any ordinary share is its nominal value of US$0.50. If a decision was made to exercise the authority conferred by this Item, the BHP Billiton Plc shares could be bought back directly or, alternatively, by a mechanism whereby BHP Billiton Limited purchases fully paid shares in BHP Billiton Plc on-market and then transfers those shares to BHP Billiton Plc for no consideration, following which BHP Billiton Plc would cancel those shares. This alternative mechanism would not have a different impact on the Group’s cash, gearing or interest levels to a direct buy-back of its own shares by BHP Billiton Plc. The Board wishes to maintain flexibility to pursue strategies that maximise the Group’s value and this form of arrangement may be an attractive option in terms of the Group’s capital management. 16 – BHP BILLITON PLC NOTICE OF MEETING 2014

Item 6 continued However, the aggregate number of BHP Billiton Plc ordinary shares which would be acquired (whether by way of direct market purchases by BHP Billiton Plc or by way of this alternative mechanism) would not exceed the maximum number of BHP Billiton Plc ordinary shares for which the buy-back authority is sought under Item 6 and the same maximum and minimum prices would apply to any purchases of BHP Billiton Plc shares by BHP Billiton Limited which are transferred to BHP Billiton Plc for cancellation. As at the Latest Practicable Date, there were options and other awards under employee share plans outstanding to subscribe for 3,897,772 shares in BHP Billiton Plc. If exercised in full, these would represent 0.18 per cent of the issued share capital of BHP Billiton Plc as at the Latest Practicable Date. If the authority to buy back shares under Item 6 was exercised in full (or the maximum number of ordinary shares in respect of which the authority is given is acquired by the alternative mechanism described above, or by a combination of direct market purchases and the use of such mechanism), these options or other awards would, on exercise, represent 0.21 per cent of the issued share capital of BHP Billiton Plc, net of the shares bought back. The UK Companies Act 2006 (Companies Act) enables companies in the United Kingdom to hold any of their own shares they have purchased as treasury shares with a view to possible resale at a future date, rather than cancelling them. If BHP Billiton Plc were to exercise its buy-back authority, it may decide to hold any shares bought back by it as treasury shares. This would provide BHP Billiton Plc with additional flexibility in the management of its capital base, enabling it either to sell treasury shares quickly and cost-effectively or to use the treasury shares to satisfy awards under BHP Billiton employee share schemes. Any shares acquired by BHP Billiton Plc under the alternative mechanism described above will not be treated as treasury shares. BHP Billiton Plc cancelled 24,113,658 ordinary shares in treasury on 28 August 2014 and currently holds no treasury shares. The Directors did not use the equivalent authority granted by shareholders at last year’s AGMs. Items 7 and 8 Approval of the Remuneration Report Item 7 and Item 8 are ordinary resolutions required under UK law. They arise as a result of changes made to the Companies Act, which require the Remuneration Report to be split into a Directors’ remuneration policy report and a Directors’ annual report on remuneration. Directors’ remuneration policy report Item 7 is an ordinary resolution to approve the Directors’ remuneration policy report in section 4.3 of the Annual Report, which sets out the Company’s forward looking policy on directors’ remuneration (including exit payments). This vote is binding. The Directors’ remuneration policy will commence from the date of the BHP Billiton Limited AGM and all future payments to Directors and former Directors must be made in accordance with the policy (unless the payment is separately approved by shareholders). The Directors must put any changes to the remuneration policy to a shareholder vote and seek re-approval of the remuneration policy at least every three years. BHP BILLITON PLC NOTICE OF MEETING 2014 – 17

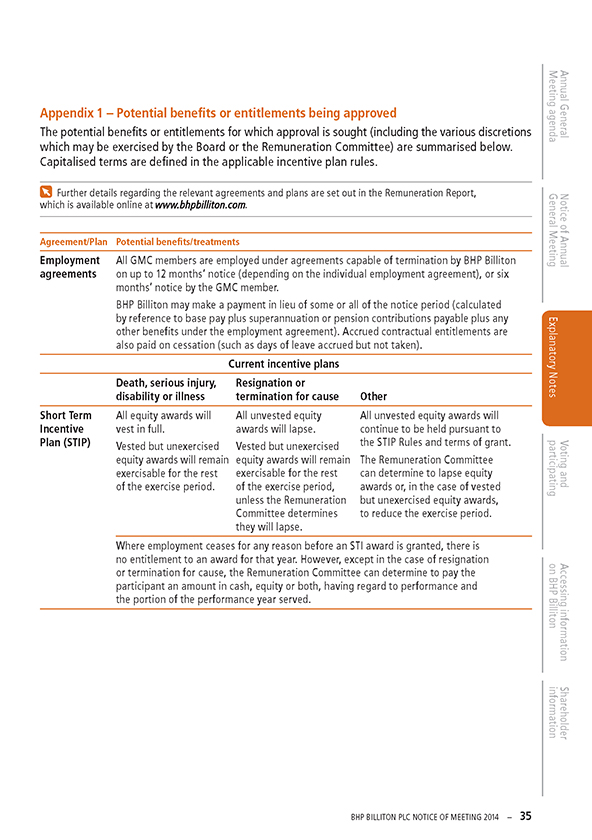

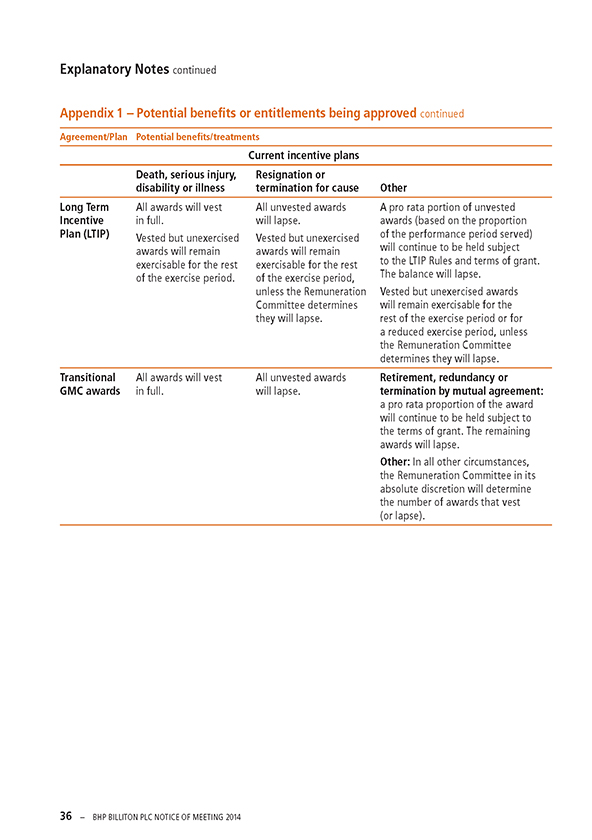

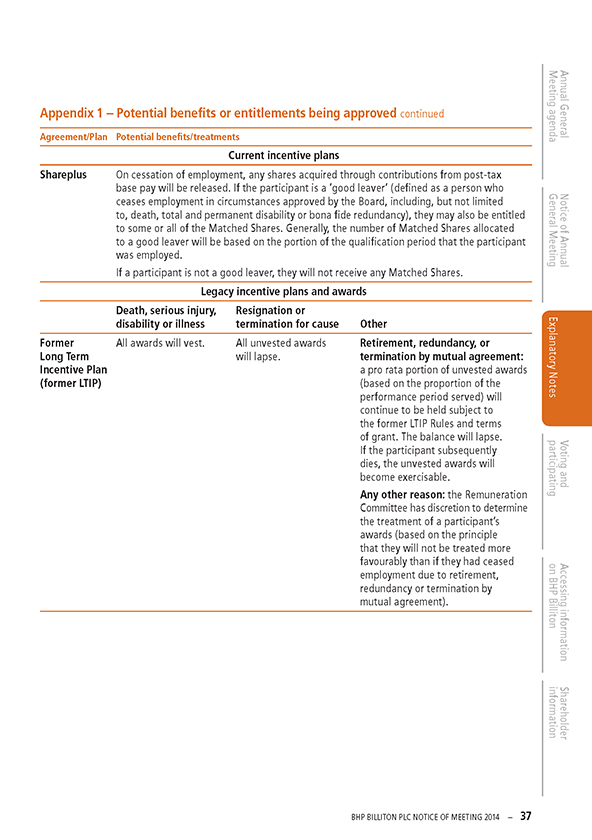

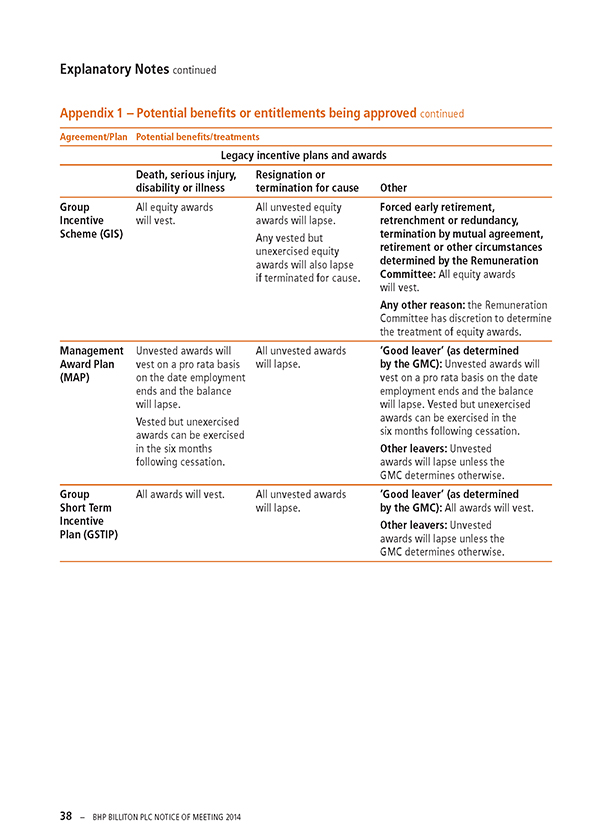

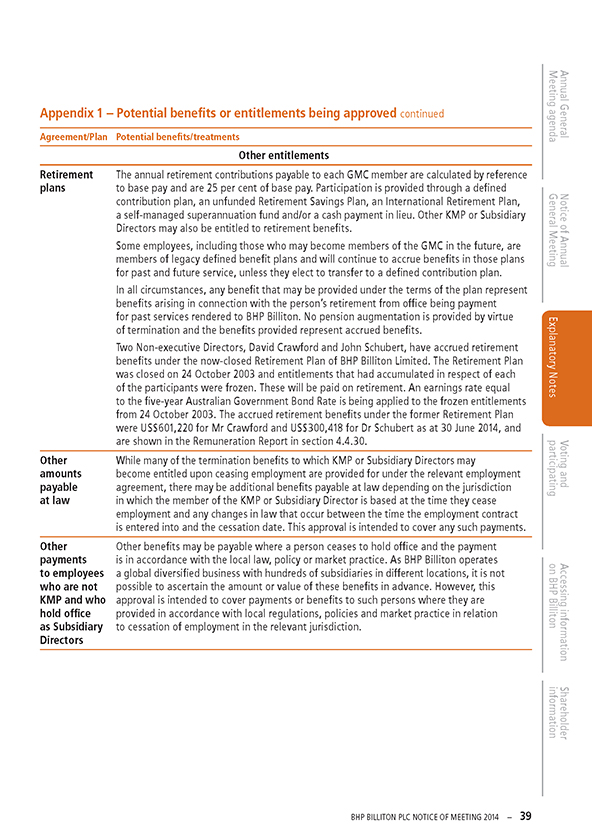

Explanatory Notes continued Items 7 and 8 continued Directors’ annual report on remuneration Item 8 is an ordinary resolution to approve the remainder of the Remuneration Report for the year ended 30 June 2014 (i.e. other than the part containing the Directors’ remuneration policy report in section 4.3 as per Item 7). Item 8 is an advisory vote. Item 9 Approval of the Remuneration Report Item 9 is an ordinary resolution required under Australian law and is an advisory vote. For Australian law purposes, the Remuneration Report for the year ended 30 June 2014 comprises the whole of section 4 of the Annual Report. The Remuneration Report is set out in section 4 of the Annual Report and is available online at Item 10 Approval of leaving entitlements Why shareholder approval is sought Australian law restricts the benefits that can be given without shareholder approval to individuals who hold a managerial or executive office on cessation of their employment with BHP Billiton Limited and its related bodies corporate. BHP Billiton’s policy in relation to leaving entitlements is to treat departing employees and Key Management Personnel (KMP) appropriately and in accordance with applicable laws, market practice and company policy. KMP includes each of the Directors and members of the Group Management Committee (GMC). To ensure that BHP Billiton is able to meet this objective, shareholder approval is sought in respect of the leaving entitlements outlined in these Explanatory Notes. General approval was last obtained at the 2011 AGMs for three years, and specific approval of benefits under the new Long Term Incentive Plan was obtained at last year’s AGMs. The approval sought this year is to refresh all leaving entitlements potentially payable where a member of the KMP ceases to hold office. Approval is also sought in relation to leaving entitlements to employees who are not KMP, but who are directors of a BHP Billiton Limited subsidiary (Subsidiary Directors). While the Australian laws governing leaving entitlements may not apply to benefits where they relate only to the cessation of the Subsidiary Director’s office of employment, the breadth of the provisions are unclear. As employees who fall within this category are sometimes based in foreign jurisdictions where the local requirements and policies in relation to leaving entitlements are very different to those of Australia, the Board considers it appropriate and prudent to also seek shareholder approval for leaving entitlements that may be payable to these individuals. 18 – BHP BILLITON PLC NOTICE OF MEETING 2014

Item 10 continued These are not new entitlements Shareholders are not being asked to approve any change or increase in the remuneration or benefits or entitlements for KMP or Subsidiary Directors, or any variations to the existing discretions of the Board and the Remuneration Committee. This approval is in relation to BHP Billiton’s existing obligations and to preserve the discretion of the Board and Remuneration Committee to determine the most appropriate leaving package under the relevant employment agreements, incentive plans and retirement plans. Approval of these benefits does not guarantee that any specific individual will receive them. Leaving entitlements and benefits in respect of the KMP have been described in BHP Billiton’s Remuneration Report for many years. The Remuneration Report has received strong support from shareholders and other key stakeholders. The Directors considered the leaving entitlements to be fair and reasonable at the time that they were agreed, and believe that they continue to be fair and reasonable. Not all of these benefits require shareholder approval under the Corporations Act 2001 (Cth) (Corporations Act). In addition, depending on the circumstances of cessation, any specific individual may not ultimately receive many of the benefits covered by this approval. However, in the interests of good governance and transparency, the Board considers it appropriate to seek approval for all leaving benefits that are potentially payable upon a member of the KMP or a Subsidiary Director ceasing to hold office. Approval is being sought for the following benefits or entitlements Shareholder approval is being sought for the purposes of sections 200B and 200E of the Corporations Act for any ‘termination benefits’ that may be provided to KMP or Subsidiary Directors under: > the relevant employment or service agreement; > BHP Billiton’s incentive plans; and > the defined contribution plans, defined benefit plans and other retirement plans as well as any amounts required to be paid by law (for example accrued annual and long service leave). If approval is obtained, the Board intends that no other leaving entitlements will be provided to KMP or Subsidiary Directors in connection with their ceasing to hold a managerial or executive office, other than those covered by this approval or which are exempt from section 200B. However, BHP Billiton and an individual may agree not to rely on this approval and to rely solely on the provisions of the Corporations Act, in which case any benefits provided would be capped at the maximum amount payable under the Corporations Act without shareholder approval. The value of the benefits or entitlements The amount and value of the leaving entitlements being approved is the maximum potential benefit that could be provided under the relevant employment agreement, incentive plans and retirement plans, as well as any benefits payable by law. The potential leaving entitlements and the discretions that may be exercised in respect of these are summarised in Appendix 1. The amount and value of the benefits or entitlements that may be provided cannot be ascertained in advance. This is because various matters, events and circumstances will or are likely to affect the calculation of the amount and value. These are set out in Appendix 2. BHP BILLITON PLC NOTICE OF MEETING 2014 – 19

Explanatory Notes continued Item 10 continued Approval is sought for a three-year period If approval is obtained, it will be effective for three years from the date the resolution is passed. That is, shareholder approval will be effective: > if the Board or Remuneration Committee exercises certain discretions under BHP Billiton’s incentive plans (refer to Appendix 1); > in relation to any equity awards (including conditional rights, options and shares) granted under BHP Billiton’s incentive plans; or > if the member of the KMP or Subsidiary Director ceases to hold office, during the period beginning at the conclusion of the BHP Billiton AGMs in 2014 and expiring at the conclusion of the AGMs in 2017. If considered appropriate, the Directors may seek a new shareholder approval at the AGMs in 2017. It can be reasonably anticipated that aspects of the relevant employment agreements, incentive plans and retirement plans will be amended from time to time in line with market practice and changing governance standards and, where relevant, changes in relation to KMP will be reported in the Remuneration Report. However, it is intended that this approval will remain valid for as long as these agreements, incentive plans and retirement plans provide for the treatment on cessation of holding office as set out in Appendix 1. Item 11 Approval of grants to Executive Director It is proposed that Andrew Mackenzie, an Executive Director of BHP Billiton, be awarded securities under the Group’s incentive plans. If Item 11 is approved by shareholders, the awards will be made under the Short Term Incentive Plan (STIP) and the Long Term Incentive Plan (LTIP). Each award under the STIP and LTIP is a conditional right to one ordinary fully paid share in BHP Billiton Limited. Under the Australian Securities Exchange (ASX) Listing Rules, only an issue of BHP Billiton Limited securities to Directors is required to be approved by shareholders. Approval is not required where the terms of the scheme under which the grants are made require that the underlying shares are purchased on-market and the terms applying to Mr Mackenzie’s awards (comprising the terms of grant and the applicable plan rules) satisfy this requirement. There is also no requirement for shareholders to approve the specific issue of BHP Billiton Plc securities to a Director on the terms proposed under United Kingdom law or the UK Listing Authority’s Listing Rules. Nonetheless, the Board wishes, as a matter of good governance, to seek approval for the acquisition of securities under the Group’s STIP and LTIP by the Chief Executive Officer (CEO). (a) STIP award: The maximum value of the STIP award will be US$1,568,080. This maximum value has been determined based on deferral of 50 per cent of Mr Mackenzie’s maximum STI amount of US$3,136,160 for performance during FY2014. How the number of rights will be calculated: The actual number of rights granted to Mr Mackenzie will be calculated using the following formula: The maximum value of the STIP award (being US$1,568,080) will be multiplied by the US$/A$ exchange rate, being the average daily exchange rate over the five days immediately prior to the grant date to convert the 20 – BHP BILLITON PLC NOTICE OF MEETING 2014

Item 11 continued award value into Australian dollars. This amount will then be divided by the volume weighted average price of BHP Billiton Limited shares traded on the ASX over the five trading days immediately prior to the grant date, and rounded down to the nearest whole number of rights. An example calculation using the above formula as at 29 August 2014: If an STIP award was granted based on the five-day share price and exchange rate immediately prior to 29 August 2014 (A$37.36; and A$1.0722 to US$1.00), 45,002 rights would be granted after the AGMs. For information on the STIP, refer to section 4 of the Annual Report. (b) LTIP award: The Board, on the advice of the Remuneration Committee, has approved an LTIP award with a face value equal to 400 per cent of Mr Mackenzie’s annual base salary (i.e. US$1,700,000 x 400 per cent = US$6,800,000). This value was determined with the input of the Remuneration Committee’s independent adviser, and takes into account the appropriate level of total remuneration, as assessed by reference to a number of factors, including the extent to which the total remuneration is appropriate for Mr Mackenzie’s role and the extent to which it is market competitive. The fair value of the award is estimated at US$2,788,000 based on the fair value factor of 41 per cent as described below (i.e. US$6,800,000 x 41 per cent = US$2,788,000). The LTIP award will be granted following the AGMs (if shareholder approval is provided). How the number of rights will be calculated: The actual number of rights granted to Mr Mackenzie will be calculated using the following formula: The face value of the LTIP award approved by the Board as described above (being US$6,800,000) will be multiplied by the US$/A$ exchange rate, being the average daily exchange rate over the 12 months immediately prior to the grant date to convert the award value into Australian dollars. This amount will then be divided by the average daily closing price of BHP Billiton Limited shares traded on the ASX over the 12 months immediately prior to the grant date, and rounded down to the nearest whole number of rights. An example calculation using the above formula as at 29 August 2014: If an LTIP award was granted based on the 12-month share price and exchange rate immediately prior to 29 August 2014 (A$37.09; and A$1.0838 to US$1.00), 198,701 rights would be granted after the AGMs. For information on the LTIP, refer to section 4 of the Annual Report. The LTIP Rules are available online at Maximum award: The LTIP Rules limit the maximum award to an Expected Value (or fair value) of two times base salary based on the fair value factor. A fair value factor of 41 per cent has been calculated by the Remuneration Committee’s independent adviser in respect of the current plan design. This takes into account the likelihood that the LTIP performance conditions are met (under the terms and conditions set out in sections 4.3.3 and 4.4.8 of the Remuneration Report). The maximum award is calculated using the same 12-month exchange rate and share price as described above. BHP BILLITON PLC NOTICE OF MEETING 2014 – 21

Explanatory Notes continued Item 11 continued (c) It is not possible to specify a maximum number of rights which will be granted to Mr Mackenzie. As described above, the actual number of rights granted depends on the share price and exchange rate over the relevant period for each grant which can only be determined after the AGMs, when the rights are granted to Mr Mackenzie. However, the indicative examples above illustrate how many rights would have been granted if the grant date had been 29 August 2014. (d) There is no cost to Mr Mackenzie on the grant of the STIP or LTIP awards. The awards will not have an exercise price and accordingly do not raise capital. (e) Mr Mackenzie is the only Director (or associate of a Director) who has received securities under the employee equity plans since shareholder approval was last obtained in relation to the grant of awards to Mr Mackenzie under the Group Incentive Scheme (GIS) (which has now been replaced by the STIP) and LTIP at the 2013 AGMs. Mr Mackenzie was granted 28,157 rights under the GIS and 198,514 rights under the LTIP in accordance with those approvals and no consideration was payable by Mr Mackenzie in respect of those grants (full details of which are set out in sections 4.4.20 and 4.4.21 of the Remuneration Report). No other Director or associate of a Director has received securities under the employee equity plans. (f) The name of the only Director entitled to participate in the STIP and the LTIP in 2014 is Mr Andrew Mackenzie. No associates of Mr Mackenzie are eligible to participate in these plans. (g) No loan will be made by BHP Billiton in connection with the grants of STIP and LTIP awards or the allocation to Mr Mackenzie of any shares on vesting of those awards. (h) In relation to the operation of the employee equity plans for the current financial year, the STIP and LTIP awards may be granted up to 20 November 2015. Underlying shares may be allocated as a result of the (i) STIP award from the date of grant to August 2019 and (ii) LTIP award from the date of grant to August 2024. Items 12 to 24 Election of Board-endorsed Directors Director election framework The Boards of BHP Billiton Plc and BHP Billiton Limited must be identical and operate as one. In the interests of simplicity, one resolution is proposed in respect of the election of each candidate to both the Board of BHP Billiton Plc and to the Board of BHP Billiton Limited. Accordingly, in each resolution, reference to ‘BHP Billiton’ is a reference to both BHP Billiton Plc and BHP Billiton Limited. The resolution to appoint each candidate is proposed as a separate resolution. Under the Articles of Association of BHP Billiton Plc and the Constitution of BHP Billiton Limited, at least one-third of Directors must retire (and may seek re-election) at each AGM. However, taking account of the recommendations in the United Kingdom Corporate Governance Code, the Board has adopted a policy under which all Directors seek re-election annually. In August 2014, we announced that David Crawford will retire from the BHP Billiton Board in November 2014, and as such he will not offer himself for re-election. All other continuing Directors are retiring and offering themselves for re-election, with the exception of Malcolm Brinded, who is seeking election by shareholders for the first time (having been appointed a Director since the 2013 AGMs). 22 – BHP BILLITON PLC NOTICE OF MEETING 2014

Items 12 to 24 continued The Nomination and Governance Committee of the Board oversaw a review of the performance of all retiring Non-executive Directors (in the absence of the Director where that Director is a member of the Nomination and Governance Committee), which was designed to assess the effectiveness of each person. All Directors contributed to that review. The Nomination and Governance Committee has also reviewed the skills, backgrounds, knowledge, experience and diversity of geographic location, nationality and gender represented on the Board. In undertaking that review, the Board took into account the skills and experience profile of the current Directors set out in the table in section 3.8 of the Annual Report. As that table indicates, each Director contributes experience of managing in the context of uncertainty, and an understanding of the risk environment of the Group, and the potential for risk to impact our health and safety, environment, community, reputation, regulatory, market and financial performance. They also all have a track record in developing an asset or business portfolio over the long term that remains resilient to systemic risk. In addition, the Chairman, drawing on guidance from the Remuneration Committee, leads an evaluation of the performance of the CEO on behalf of all Non-executive Directors. The criteria used to assess the CEO’s performance are set out in sections 3.16 and 4 of the Annual Report. On the basis of these reviews, the Board considers that all retiring Directors demonstrate commitment to their role, that each Director continues to make a valuable contribution to the Board and that the Board as a whole has an appropriate mix of skills, backgrounds, knowledge, experience and diversity to operate effectively. Accordingly, the Board recommends to shareholders the re-election of all retiring Directors who offer themselves for re-election. The Board also recommends to shareholders the election of Malcolm Brinded. In recommending each of Sir John Buchanan, Carlos Cordeiro and John Schubert for re-election, the Nomination and Governance Committee and the Board took into account their respective tenures. The Board is satisfied for each of these Directors that their tenure has not in any way compromised their ability to effectively discharge their obligations as a Non-executive Director, nor has it impaired their independence of character and judgement. The Board believes that each of these Directors continues to make an outstanding contribution to the Board and the relevant Committees. In recommending Lindsay Maxsted for re-election, the Nomination and Governance Committee and the Board took into account Mr Maxsted’s former association with KPMG, details of which are set out in section 3.10 of the Annual Report. The Board is satisfied that his previous association with KPMG has not in any way compromised his ability to effectively discharge his obligations as a Non-executive Director, nor has it impaired his independence of character and judgement. All Non-executive Directors are considered by the Board to be independent in character and judgement and free from any business or other relationship that could materially interfere with the exercise of their objective, unfettered or independent judgement. The Annual Report contains further information on the independence of Directors in section 3.10. The biographical details, skills and experience of each of the Directors standing for election are set out below and in section 3.2.1 of the Annual Report. BHP BILLITON PLC NOTICE OF MEETING 2014 – 23

Explanatory Notes continued Item 12 Malcolm Brinded MA, 61 Malcolm Brinded has extensive experience in energy, governance and sustainability. He served as a member of the Board of Directors of Royal Dutch Shell plc from 2002 to 2012. During his 37-year career with Shell, he held various leadership positions in the United Kingdom, Europe, the Middle East and Asia, including Executive Director of Exploration and Production, Executive Director of Upstream International and Chairman and Upstream Managing Director of Shell UK. Mr Brinded is a former Director of Shell Petroleum N.V., and a current Director of CH2M Hill Inc and Network Rail Infrastructure Limited. He is Chairman of the Shell Foundation (from July 2009 and Trustee from June 2004) and Vice President of The Energy Institute, UK. He has been a Director of BHP Billiton since April 2014 and is a member of the Sustainability Committee. Mr Brinded says: ‘The combination of outstanding assets, a clear strategy, strong focus on operational excellence, and high calibre, committed leadership, are key attributes of BHP Billiton, which already greatly impress me. Drawing on my experience running a global upstream oil and gas business and serving on diverse Boards, I hope to contribute to effective Board governance to maximise long-term shareholder returns, founded on continuous safety improvement and strong community relationships.’ The Board recommends the election of Mr Brinded. Item 13 Malcolm Broomhead MBA, BE, 62 Malcolm Broomhead has extensive experience in running industrial and mining companies with a global footprint and broad global experience in project development in many of the countries in which BHP Billiton operates. Mr Broomhead was Managing Director and Chief Executive Officer of Orica Limited from 2001 until September 2005. Prior to joining Orica, Mr Broomhead held a number of senior positions at North Limited, including Managing Director and Chief Executive Officer and, prior to that, held senior management positions with Halcrow (UK), MIM Holdings, Peko Wallsend and Industrial Equity. Mr Broomhead is currently Chairman of Asciano Limited and is a former Director of Coates Group Holdings Pty Ltd. He has been a Director of BHP Billiton since March 2010 and is a member of the Sustainability Committee and the Finance Committee. Mr Broomhead says: ‘BHP Billiton is dedicated to the creation of long-term shareholder value in a sustainable manner, underpinned by a framework of excellent corporate governance that will further drive productivity. Within this context, my experience as a CEO and Board member of global resource and industrial companies helps me contribute to the deliberations of the Sustainability Committee and the Board.’ The Board recommends the re-election of Mr Broomhead. 24 – BHP BILLITON PLC NOTICE OF MEETING 2014

Item 14 Sir John Buchanan BSc, MSc (Hons 1), PhD, 71 Educated at Auckland, Oxford and Harvard, Sir John Buchanan has broad international business experience gained in large and complex international businesses, substantial experience in the petroleum industry and knowledge of the international investor community. He has held various leadership roles in strategic, financial, operational and marketing positions, including executive experience in different countries. He is a former Executive Director and Group Chief Financial Officer of BP. Sir John is the former Chairman of Smith & Nephew Plc, the former Chairman of ARM Holdings Plc, the former Deputy Chairman and Senior Independent Director of Vodafone Group Plc and a former Director of AstraZeneca Plc. Sir John is Chairman of the International Chamber of Commerce (UK) and a former Chairman of the UK Trustees for the Christchurch Earthquake appeal. He has been a Director of BHP Billiton since February 2003. He is the Senior Independent Director of BHP Billiton Plc, the Chairman of the Remuneration Committee and a member of the Nomination and Governance Committee. Sir John says: ‘High performance companies reward shareholders while meeting the needs of customers, employees and the communities in which they operate, always with high governance standards. Independent Directors, sharing wide-ranging experiences, contribute to strategy development and performance goals with appropriate support and challenges to management, focusing on both what is done and how it is done. My experiences as an Executive Director, as well as a Chairman and Non-executive Director on various global boards, provide a broad base from which to contribute to the success of BHP Billiton. Dealing with the investor community as a Chairman, and formerly as the CFO of a major resources company provides additional experience in my role as the London-based Senior Independent Director of BHP Billiton Plc.’ The Board recommends the re-election of Sir John Buchanan. Item 15 Carlos Cordeiro AB, MBA, 58 Carlos Cordeiro brings to the Board more than 30 years’ experience in providing strategic and financial advice to corporations, financial institutions and governments around the world. Mr Cordeiro was previously Partner and Managing Director of Goldman Sachs Group Inc and Vice Chairman of Goldman Sachs (Asia) LLC. Mr Cordeiro remains an Advisory Director of The Goldman Sachs Group Inc and Non-executive Vice Chairman of Goldman Sachs (Asia) LLC. He has been a Director of BHP Billiton since February 2005 and is a member of the Remuneration Committee. Mr Cordeiro says: ‘BHP Billiton’s success stems from a dedication to the creation of long-term shareholder value, good corporate governance, and a mindful focus on the environment and communities in which it operates. Given the increasing complexity of the world in which we live, it will be even more important for the Company to maintain a relentless commitment to these key success factors’. The Board recommends the re-election of Mr Cordeiro. BHP BILLITON PLC NOTICE OF MEETING 2014 – 25

Explanatory Notes continued Item 16 Pat Davies BSc (Mechanical Engineering), 63 Pat Davies has broad experience in the natural resources sector across a number of geographies, commodities and markets. From July 2005 until June 2011, Mr Davies was Chief Executive of Sasol Limited, an international energy, chemical and mining company with operations in 38 countries and listings on the Johannesburg and New York stock exchanges. Mr Davies began his career at Sasol in 1975 and held a number of diverse roles, including managing the group’s oil and gas businesses, before becoming Chief Executive in July 2005. Mr Davies was a Director of Sasol Limited from August 1997 to June 2011 and is a former Director of various Sasol Group companies and joint ventures. Mr Davies has been a Director of BHP Billiton since June 2012 and is a member of the Remuneration Committee. Mr Davies says: ’My previous experience leading an organisation that operates in sectors similar to BHP Billiton enables me to assist the Board as it provides the strategic direction and sound governance needed to create sustainable value for shareholders and all other stakeholders. Continuous improvement in many areas, including the management of people, operations, corporate governance, safety and environmental care, is essential to ensure an enduring competitive advantage. Given the long-term nature of investment decisions in the resources sector, it is particularly important that these decisions be well considered and effectively implemented. I hope to continue to make a contribution in this area.’ The Board recommends the re-election of Mr Davies. Item 17 Carolyn Hewson AO, BEc (Hons), MA (Econ), 59 Carolyn Hewson is a former investment banker and has over 30 years’ experience in the finance sector. Ms Hewson was previously an Executive Director of Schroders Australia Limited and has extensive financial markets, risk management and investment management expertise. Ms Hewson is a member of the Australian Federal Government Financial Systems Inquiry and is a Non-executive Director of Stockland Group. Ms Hewson is a former Director of BT Investment Management Limited, Westpac Banking Corporation, AMP Limited, CSR Limited, AGL Energy Limited, the Australian Gas Light Company, South Australia Water and the Economic Development Board of South Australia. Ms Hewson is currently a member of the Advisory Board of Nanosonics Limited. She has been a Director of BHP Billiton since March 2010 and is a member of the Risk and Audit Committee and the Remuneration Committee. 26 – BHP BILLITON PLC NOTICE OF MEETING 2014

Item 17 continued Ms Hewson says: ‘At BHP Billiton the management team and Board are constantly mindful of the important responsibilities that accompany our position of significant global influence and size. We carry the clear objective to create long-term value for our shareholders, along with the responsibility to always have the highest regard for the safety of our people, to understand the needs of the communities and the environments in which we operate and to follow exemplary governance practices. In this way we aim to create long-term value in a sustainable manner. Appropriately, our Board members bring a wide range of skills, experience and backgrounds to the Company, but we are united in our focus on the Company’s objectives and responsibilities. My background in finance and risk management as well as my experience across a number of sectors as a Non-executive Director provides a helpful base from which to complement the existing skills and experience of the Board.’ The Board recommends the re-election of Ms Hewson. Item 18 Andrew Mackenzie BSc (Geology), PhD (Chemistry), 57 Andrew Mackenzie has been the Chief Executive Officer of BHP Billiton since 10 May 2013 and was appointed to the Board on that date. Mr Mackenzie joined BHP Billiton in November 2008 as Chief Executive Non-Ferrous. During his 30-year career in oil and gas, petrochemicals and minerals, Mr Mackenzie has held a variety of senior leadership roles. Mr Mackenzie’s prior career included time with Rio Tinto, where he was Chief Executive of Diamonds and Minerals, and with BP, where he held a number of senior roles, including Group Vice President of Technology and Engineering and Group Vice President for Chemicals. Mr Mackenzie is a Director of the Grattan Institute, Director of the International Council on Mining and Metals and a former Non-executive Director of Centrica plc. Mr Mackenzie says: ‘It is a privilege to lead one of Australia’s great companies and the world’s leading diversified natural resources company as we play our role in providing the commodities necessary for economic growth and development. As Chief Executive Officer I have continued to meet and engage with our people, our shareholders and many other stakeholders who are critical to our company’s success. I look forward to continuing the focus on our strategy of owning and safely operating large, low-cost, long-life assets diversified by commodity, geography and market. We will continue to look to Our Charter to guide our decision-making on all aspects of our business, ensuring full consideration of environmental and social issues.’ The Board recommends the re-election of Mr Mackenzie. BHP BILLITON PLC NOTICE OF MEETING 2014 – 27

Explanatory Notes continued Item 19 Lindsay Maxsted DipBus (Gordon), FCA, 60 Lindsay Maxsted is a corporate recovery specialist who has managed a number of Australia’s largest corporate insolvency and restructuring engagements and, until 2011, continued to undertake consultancy work in the restructuring advisory field. Mr Maxsted was Chief Executive Officer of KPMG Australia between 2001 and 2007. Mr Maxsted is currently the Chairman of Westpac Banking Corporation and of Transurban Group. He is also a Fellow of the Australian Institute of Company Directors and a Director and Honorary Treasurer of Baker IDI Heart and Diabetes Institute. Mr Maxsted was on the Board of the Public Transport Corporation from 1995 to 2001 and in his capacity as Chairman from 1997 to 2001 had the responsibility of guiding the Public Transport Corporation through the final stages of a significant reform process. He has been a Director of BHP Billiton since March 2011. He is Chairman of the Risk and Audit Committee and a member of the Finance Committee. Mr Maxsted says: ‘Those companies which consistently outperform their competitors and the market generally are usually underpinned by a superior vision and strategy, great values, and high-quality people. The Board of BHP Billiton has, through focusing on these and the related issues of risk, sustainability and an appropriate governance framework, created an environment for success. Our risks are managed on an enterprise-wide basis. The natural diversification in our portfolio of commodities, geographies, currencies, assets and liabilities is a key element in our risk management approach. My professional background as a CEO, as an adviser on large and complex corporate restructurings and, more recently, as a Non-executive Director in the banking and finance and infrastructure sectors, has provided me with a diverse range of skills and experience, particularly in a financial context, to draw upon and contribute as a Board member. I feel very privileged to be offering myself for re-election.’ The Board recommends the re-election of Mr Maxsted. Item 20 Wayne Murdy BSc (Business Administration), CPA, 70 Wayne Murdy has a background in finance and accounting, where he gained comprehensive experience in the financial management of mining, oil and gas companies during his career with Getty Oil, Apache Corporation and Newmont Mining Corporation. Mr Murdy served as the Chief Executive Officer of Newmont Mining Corporation from 2001 to 2007 and as Chairman from 2002 to 2007. Mr Murdy is also a former Chairman of the International Council on Mining and Metals, a former Director of the US National Mining Association, a former member of the Manufacturing Council of the US Department of Commerce and a former Director of Qwest Communications International Inc. Mr Murdy is a Non-executive Director of Weyerhaeuser Company. He has been a Director of BHP Billiton since June 2009 and is a member of the Risk and Audit Committee and the Finance Committee. 28 – BHP BILLITON PLC NOTICE OF MEETING 2014

Item 20 continued Mr Murdy says: ‘BHP Billiton is one of the most valuable companies in the world, due to its ability to successfully invest and reinvest capital in tier one assets in the natural resource sector. This has been achieved by financial and operating discipline, while focusing on continuous improvement in safety, environmental protection and community relations. Strong Board commitment to strategy review, leadership development and governance best practices should continue to generate strong shareholder value. My background in the international minerals and petroleum industries, as well as financial and capital investment decisions, provides a wide range of experiences from which to contribute to Board discussions.’ The Board recommends the re-election of Mr Murdy. Item 21 Keith Rumble BSc, MSc (Geology), 60 Keith Rumble was previously the Chief Executive Officer of SUN Mining, a wholly owned entity of the SUN Group, a principal investor and private equity fund manager in Russia, India and other emerging and transforming markets. Mr Rumble has over 30 years’ experience in the resources industry, specifically in titanium and platinum mining, and is a former Chief Executive Officer of Impala Platinum (Pty) Ltd and former Chief Executive Officer of Rio Tinto Iron and Titanium Inc in Canada. Mr Rumble began his career at Richards Bay Minerals in 1980 and held various management positions before becoming Chief Executive Officer in 1996. Mr Rumble is a Director of Enzyme Technologies (Pty) Ltd and Elite Wealth (Pty) Limited. He serves on the Board of Governors of Rhodes University and is a Trustee of the World Wildlife Fund (South Africa). He is a former Director of Aveng Group Limited. He has been a Director of BHP Billiton since September 2008 and is a member of the Sustainability Committee. It is intended that Mr Rumble will become a Non-executive Director of the new company that BHP Billiton plans to form in the proposed demerger. Mr Rumble would retire from the BHP Billiton Board at the time the shareholders vote on this demerger proposal. Mr Rumble says: ‘In order to drive the creation of shareholder value, effective Boards require a diverse range of skills to ensure constructive dialogue around the complex and wide-ranging issues facing companies operating in the global arena. My experience in the mining industry as the Chief Executive and Board member of highly successful world-class mining companies and, more recently, managing a private equity investment portfolio in the mining industry has provided me with an appropriate background which complements the other skills represented on the BHP Billiton Board and enables me to contribute effectively to the strategic direction and deliberations of the Board. My background in operations, portfolio management and investment provides an ideal platform to contribute to the broader strategic debate on matters such as risk management and sustainability.’ The Board recommends the re-election of Mr Rumble. BHP BILLITON PLC NOTICE OF MEETING 2014 – 29