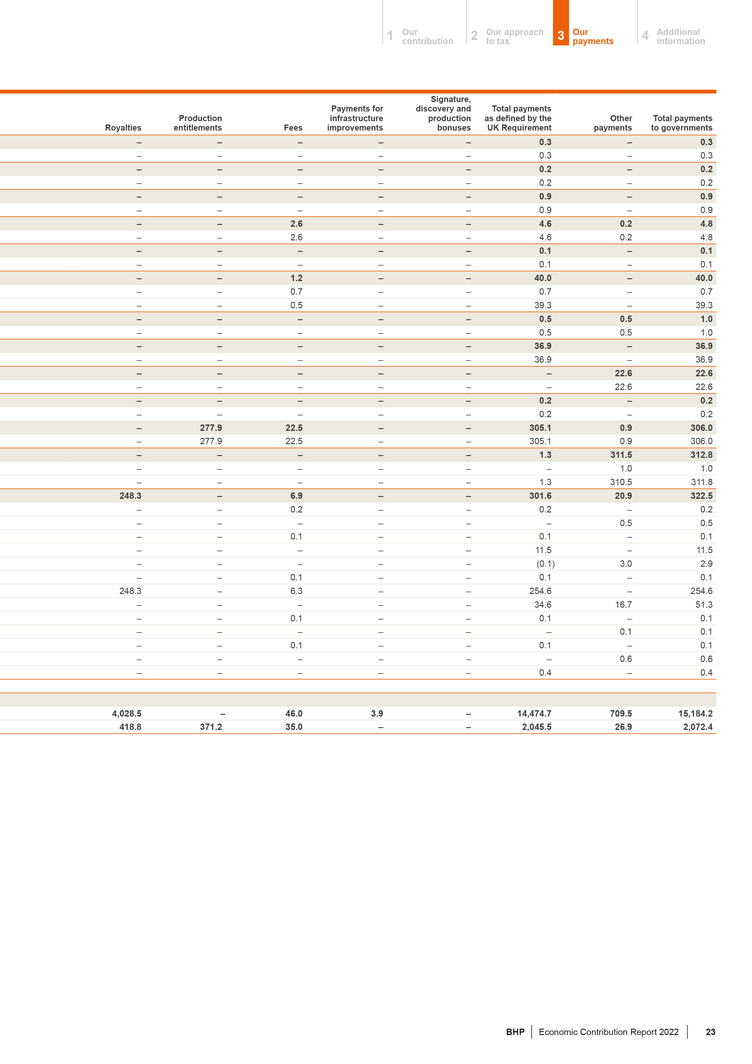

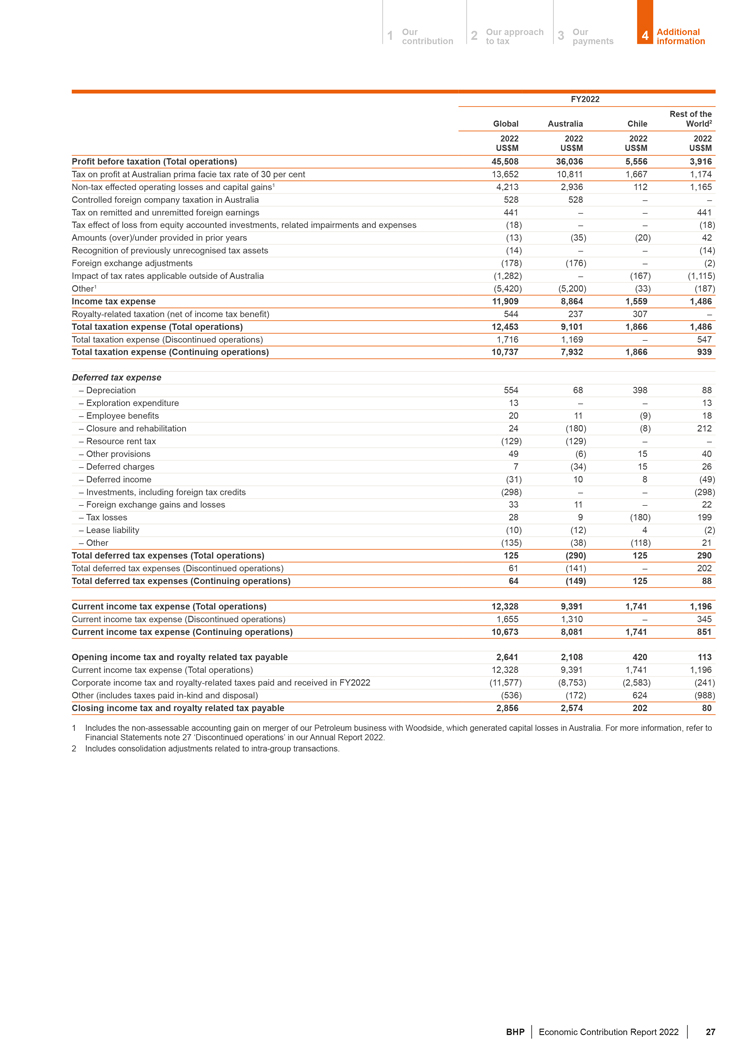

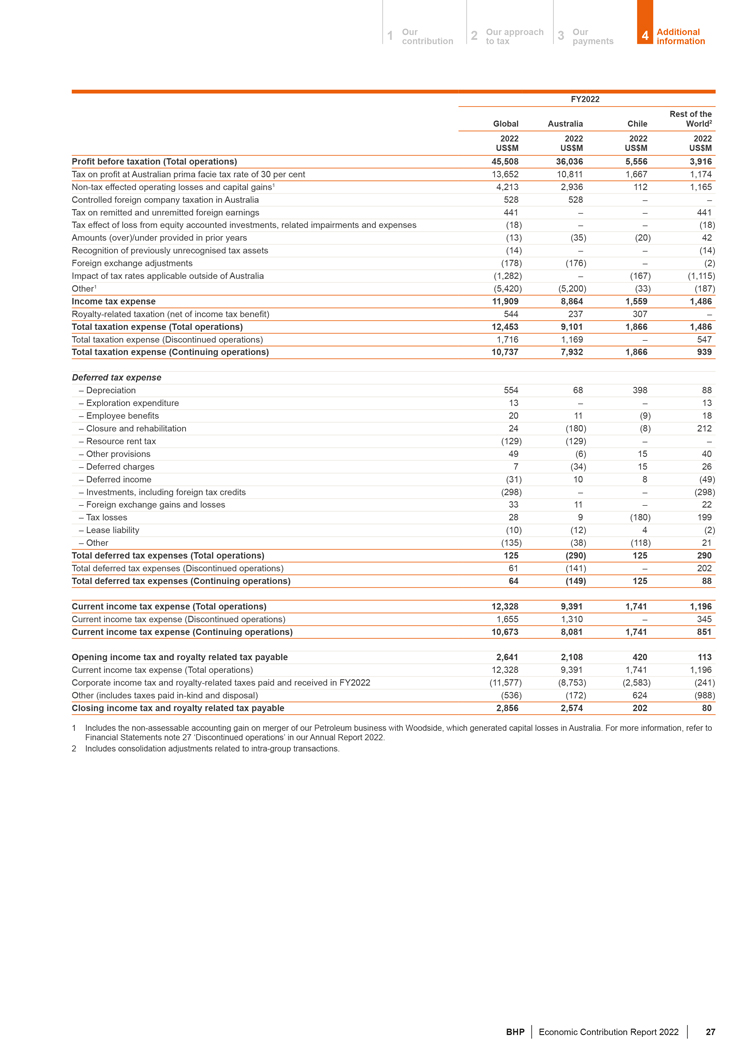

1 Our contribution 2 Our to tax approach 3 Our payments 4 Additional information FY2022 Rest of the Global Australia Chile World2 2022 2022 2022 2022 US$M US$M US$M US$M Profit before taxation (Total operations) 45,508 36,036 5,556 3,916 Tax on profit at Australian prima facie tax rate of 30 per cent 13,652 10,811 1,667 1,174 Non-tax effected operating losses and capital gains1 4,213 2,936 112 1,165 Controlled foreign company taxation in Australia 528 528 – –Tax on remitted and unremitted foreign earnings 441 – – 441 Tax effect of loss from equity accounted investments, related impairments and expenses (18) – – (18) Amounts (over)/under provided in prior years (13) (35) (20) 42 Recognition of previously unrecognised tax assets (14) – – (14) Foreign exchange adjustments (178) (176) – (2) Impact of tax rates applicable outside of Australia (1,282) – (167) (1,115) Other1 (5,420) (5,200) (33) (187) Income tax expense 11,909 8,864 1,559 1,486 Royalty-related taxation (net of income tax benefit) 544 237 307 – Total taxation expense (Total operations) 12,453 9,101 1,866 1,486 Total taxation expense (Discontinued operations) 1,716 1,169 – 547 Total taxation expense (Continuing operations) 10,737 7,932 1,866 939 Deferred tax expense – Depreciation 554 68 398 88 – Exploration expenditure 13 – – 13 – Employee benefits 20 11 (9) 18 – Closure and rehabilitation 24 (180) (8) 212 – Resource rent tax (129) (129) – – – Other provisions 49 (6) 15 40 – Deferred charges 7 (34) 15 26 – Deferred income (31) 10 8 (49) – Investments, including foreign tax credits (298) – – (298) – Foreign exchange gains and losses 33 11 – 22 – Tax losses 28 9 (180) 199 – Lease liability (10) (12) 4 (2) – Other (135) (38) (118) 21 Total deferred tax expenses (Total operations) 125 (290) 125 290 Total deferred tax expenses (Discontinued operations) 61 (141) – 202 Total deferred tax expenses (Continuing operations) 64 (149) 125 88 Current income tax expense (Total operations) 12,328 9,391 1,741 1,196 Current income tax expense (Discontinued operations) 1,655 1,310 – 345 Current income tax expense (Continuing operations) 10,673 8,081 1,741 851 Opening income tax and royalty related tax payable 2,641 2,108 420 113 Current income tax expense (Total operations) 12,328 9,391 1,741 1,196 Corporate income tax and royalty-related taxes paid and received in FY2022 (11,577) (8,753) (2,583) (241) Other (includes taxes paid in-kind and disposal) (536) (172) 624 (988) Closing income tax and royalty related tax payable 2,856 2,574 202 80 1 Includes the non-assessable accounting gain on merger of our Petroleum business with Woodside, which generated capital losses in Australia. For more information, refer to Financial Statements note 27 ‘Discontinued operations’ in our Annual Report 2022. 2 Includes consolidation adjustments related to intra-group transactions. BHP Economic Contribution Report 2022 27