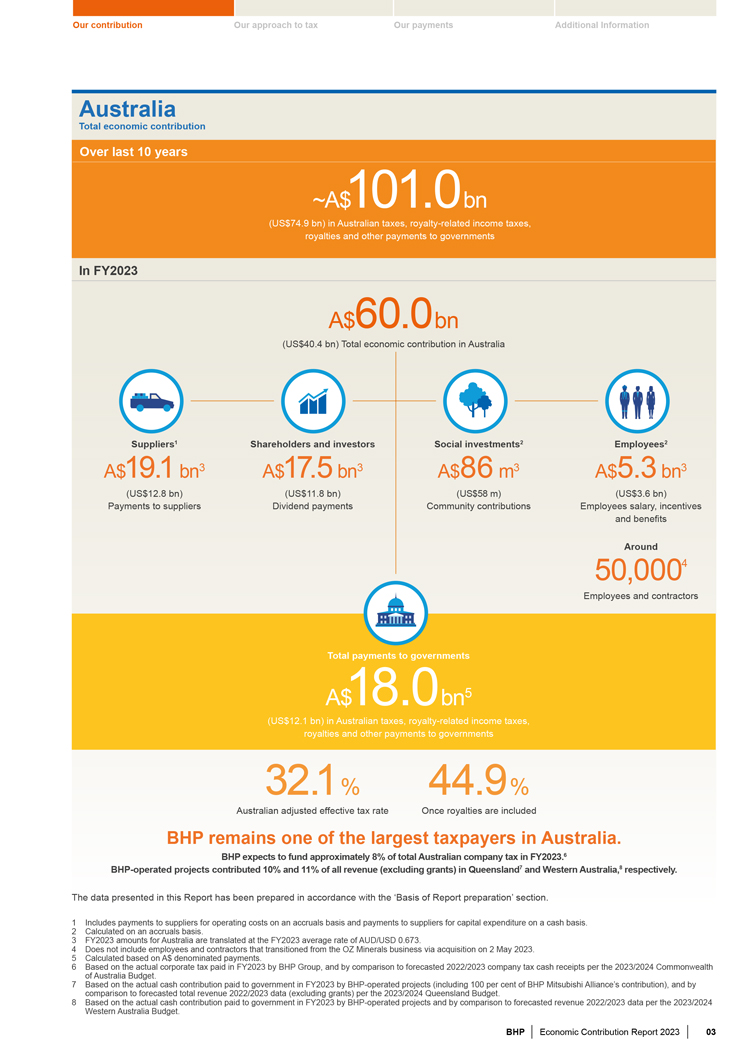

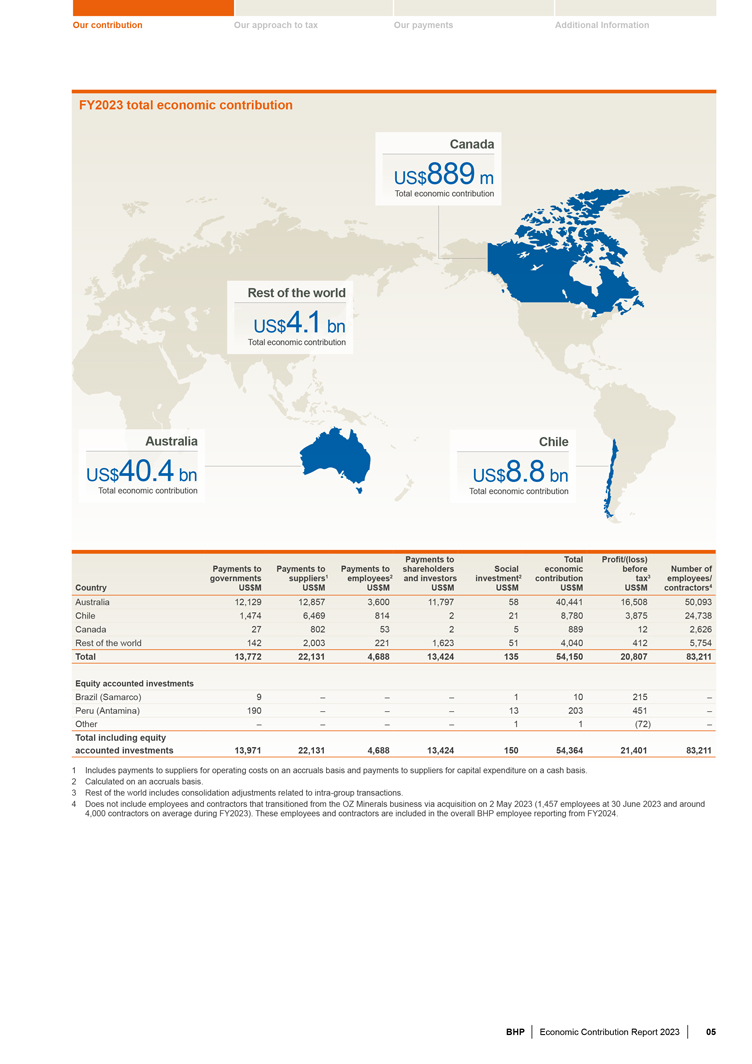

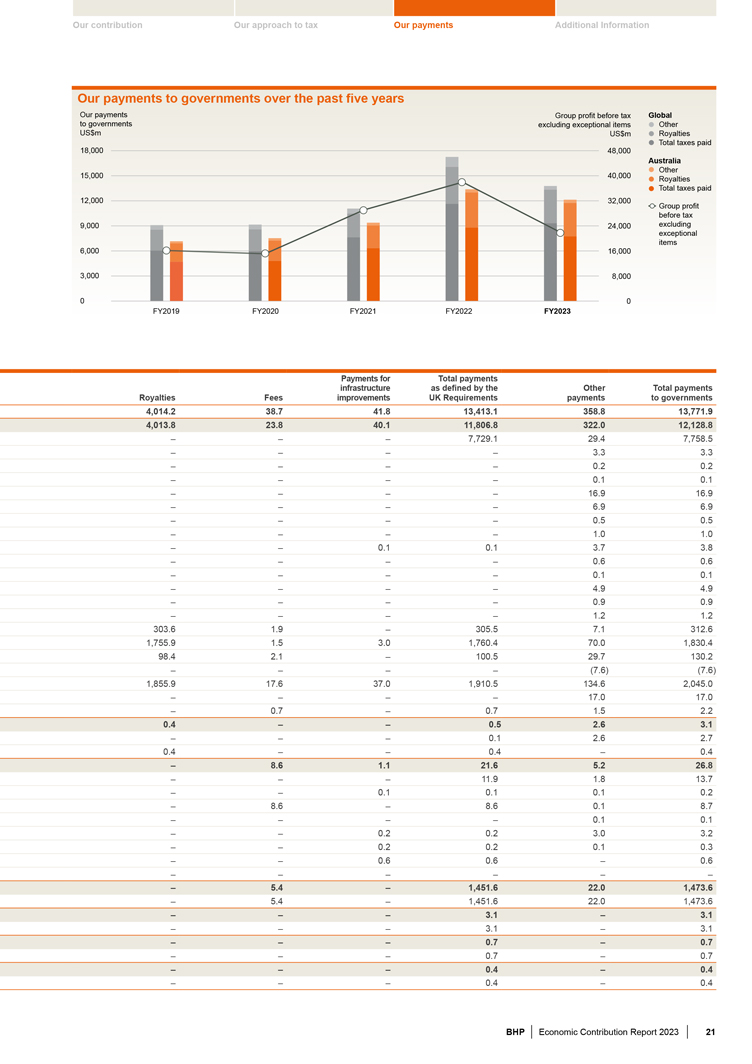

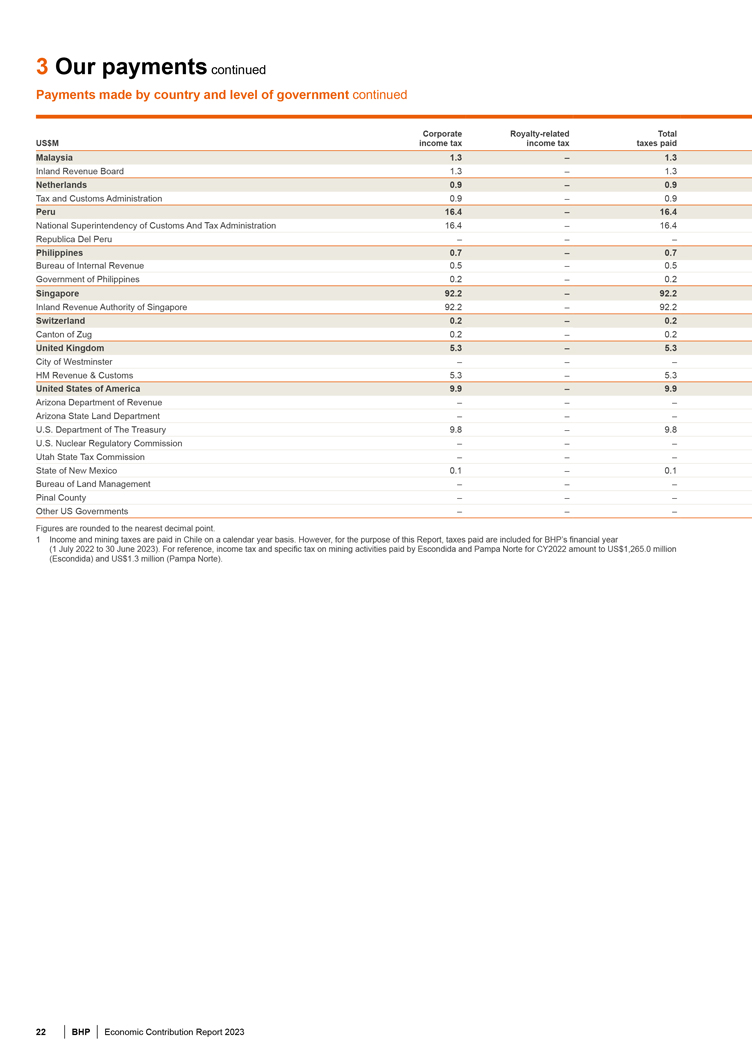

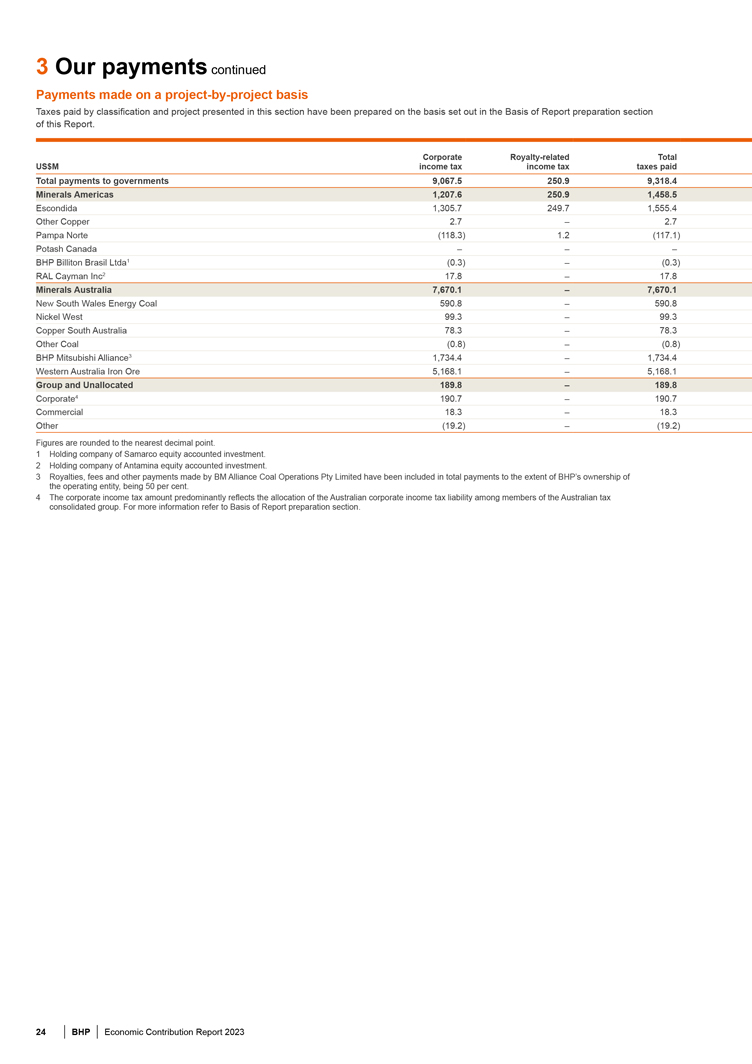

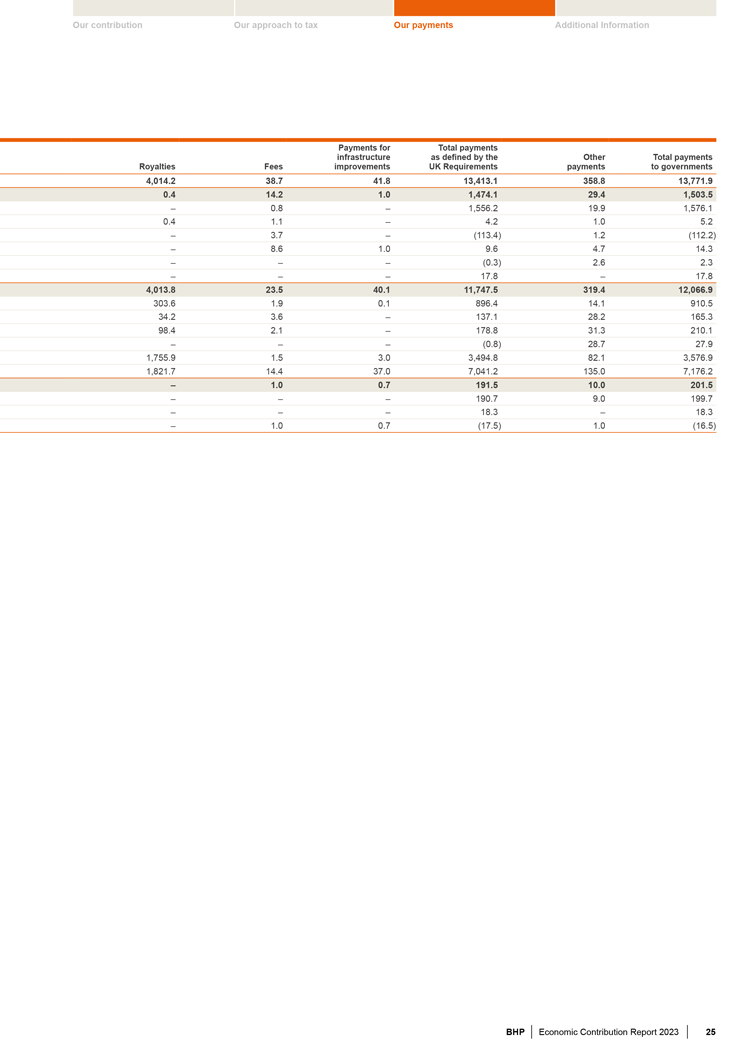

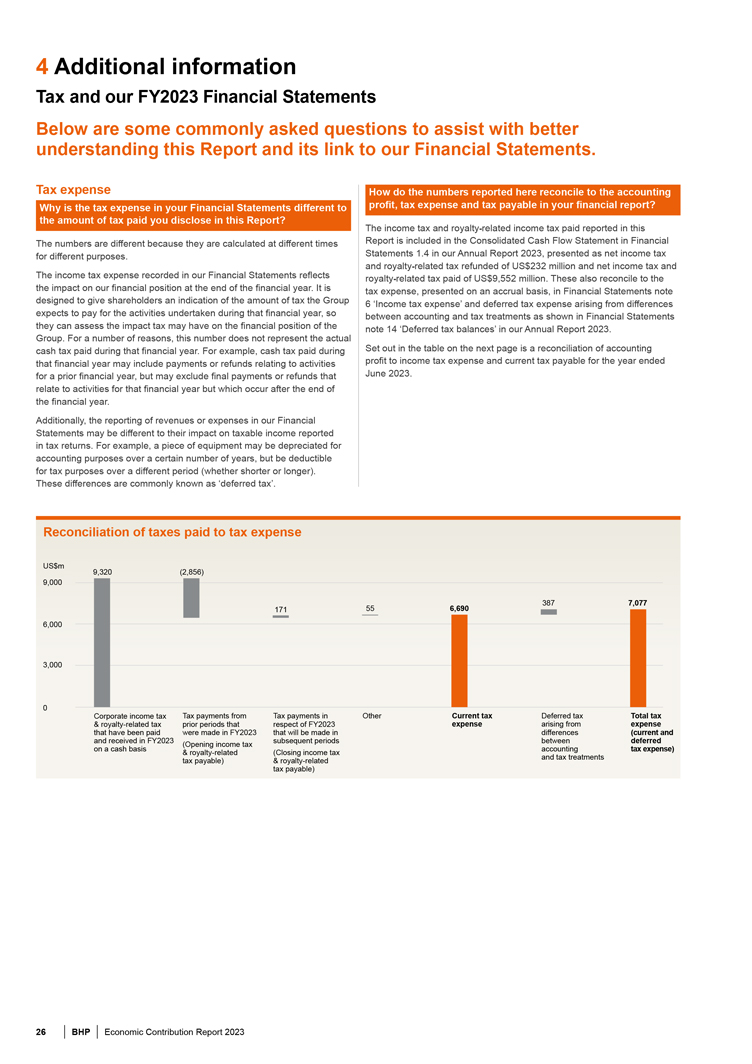

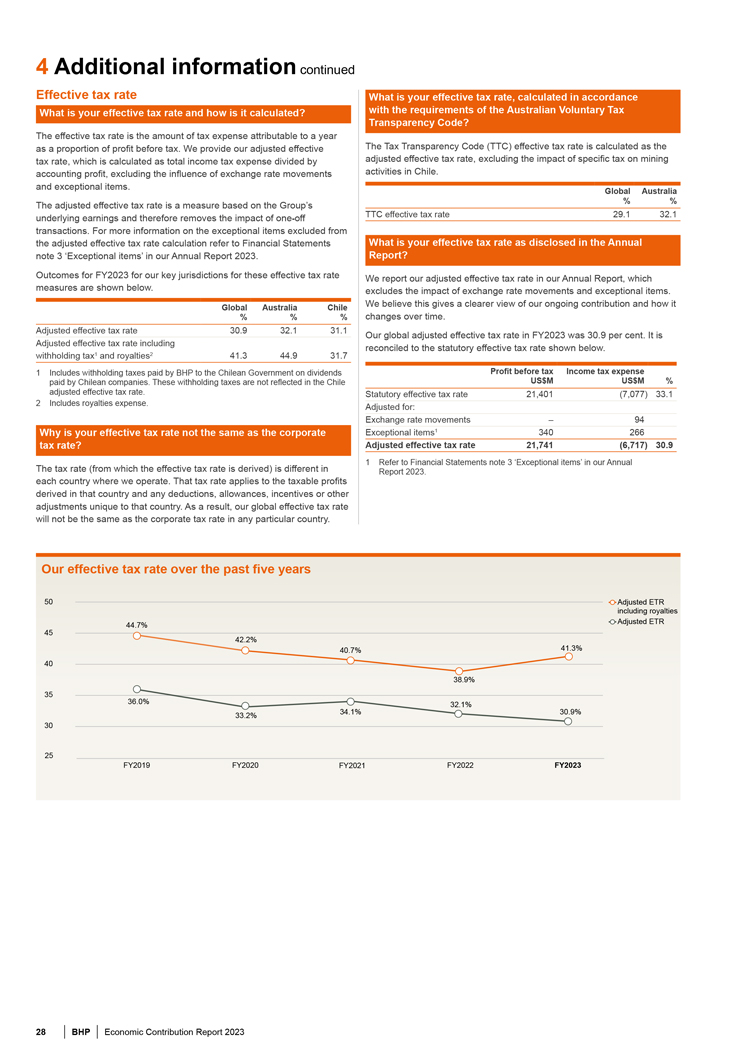

1 Our contribution continued Chief Financial Officer’s review Contribution I am pleased Report to provide . BHP’s FY2023 Economic BHP has delivered a strong set of results in FY2023, against a backdrop of In FY2023, our tax, royalty and economic uncertainty. However, these achievements were overshadowed by the deaths of our colleagues Jody Byrne at our Western Australia Iron Ore other payments to governments operations and Nathan Scholz at Olympic Dam during the year. We recognise totalled US$13.8 billion. the severity and impact of these events and place critical importance on continuing to provide support to families, friends and colleagues of Jody and During the last decade, Nathan. Our highest priority is the safety of our workforce and the communities we paid US$94.2 billion where we operate. In FY2023, BHP achieved both production guidance and growth across each of globally in taxes, our commodities, including record annual production at Western Australia Iron royalties and other Ore, Olympic Dam and Spence. Overall, we saw lower revenue in FY2023 due payments to to weaker prices in key commodities. On the cost side, we managed the impact of inflation well, relative to the market, through disciplined cost control. governments.” The strength of our portfolio, our operating excellence, our people and ongoing commitment to social value should position us well to continuegrowing value for our shareholders and support the communities in the countries where This year, we celebrated a milestone of more than A$1 billion spent we operate. with small, local and Indigenous businesses across Australia since the BHP’s economic contribution commencement of our Local Buying Program. The program’s continuing BHP’s total direct economic contribution for FY2023 was US$54.2 billion. success in Australia has seen it expand to our Minerals Americas This includes contribution to suppliers, wages and benefits formore than 80,000 operations in Chile. This milestone comes as the program celebrates 10 employees and contractors, dividends, taxes, royalties and voluntary investment years, with more than 1,600 small businesses joining the BHP supply in social projects across the communities where we operate. chain, with an average payment period of seven days. The Local Buying Program is integral to how BHP supports the economic development of the In FY2023, our tax, royalty and other payments to governments otalled countries we operate in, by providing crucial support for jobs, businesses US$13.8 billion. Of this, 88 per cent or US$12.1 billion was paid in Australia. and families in regional communities, and contributing to the longevity and This made BHP one of the largest corporate taxpayers inAustralia in FY2023. vibrancy of the towns surrounding BHP’s operations. During the last decade, we paid US$94.2 billion globally in taxes, royalties and other payments to governments, including US$74.9 billion (approximately Our commitment to transparency A$101.0 billion) in Australia. Our global adjusted effective tax rate in FY2023 BHP has a long-standing commitment to transparency. We recognise taxes was 30.9 per cent. Once royalties are included, our FY2023 rate increases to are important sources of government revenue and are central to the fiscal 41.3 per cent. policy and macroeconomic stability of countries. Paying the right amount of taxes and royalties enables governments to finance and deliver on national This significant contribution of tax and royalty revenue to thecountries where development plans for the benefit of the broader community to promote we operate gives governments the opportunity to provide essential services to sustainable economic growth, full and productive employment, and reduce their citizens and invest in their communities for the future.We also create value poverty and inequality within and among countries. We have disclosed for our shareholders and investors through the returns we provide, such as details of our tax and royalty payments for more than 20 years and we dividends. In FY2023, we paid US$13.4 billion in cash dividends to shareholders have continually updated and expanded our disclosures. The Economic (FY2022 final dividend and FY2023 interim dividend), including many millions of Contribution Report aims to provide a greater understanding of BHP’s Australians who hold BHP shares directly or via their superannuation. In FY2023, we contributed US$22.1 billion to our suppliers globally, with global tax profile, tax contributions and the manner in which we govern US$2.6 billion spent with local suppliers in the communities where we operate. and manage our tax obligations. BHP is subject to the different tax regimes and complies with applicable This investment typically has a multiplier effect by creating new jobs within tax laws in all the countries where we operate, including the Organisation our operations and also for the suppliers they rely on. for Economic Co-operation and Development (OECD) Country-by-Country reporting. This information provides tax authorities around the world with details of how we conduct our business and how BHP’s entities transact with each other. Our total economic contribution for FY2023 We believe companies should pay their fair share of tax and countries should have taxing rights commensurate with value created in those countries. We also believe it is important that a country’s tax policy settings remain stable US$54.2 bn to provide businesses with the certainty needed to invest and continue to operate and support the communities in the countries where they operate. Our tax, royalty and other payments We support the work undertaken by the OECD to achieve a global solution to governments to address the tax challenges of the digitalisation of the economy. For the extractives industry, as the right to extract commodities is inherently and substantially connected with the country where the commodities are US$13.8 bn located, such countries should continue to have the right to tax profits associated with those commodities. We continue to contribute to the development and implementation of a solution that provides for a globally Employees and contractors competitive tax system that supports economic growth, job creation and viable long-term tax contributions. We are proud of our efforts to support the communities where we operate, over 80,000 and look forward to continuing to make a positive contribution in the future. David Lamont Chief Financial Officer 04 BHP Economic Contribution Report 2023