Sovereign Bancorp, Inc.

Lehman Brothers 2006

Financial Services Conference

London

May 17, 2006

Forward-Looking Statements

This presentation contains statements of Sovereign Bancorp, Inc.’s

(the “Company”) strategies, plans and objectives, estimates of

future operating results for Sovereign Bancorp, Inc. as well as

estimates of financial condition, operating efficiencies, revenue

creation and shareholder value

These statements and estimates constitute forward-looking

statements (within the meaning of the Private Securities Litigation

Reform Act of 1995) which involve significant risks and

uncertainties. Actual results may differ materially from the results

discussed in these forward-looking statements

Factors that might cause such a difference include, but are not

limited to: general economic conditions, changes in interest rates,

deposit flows, loan demand, real estate values, and competition;

changes in accounting principles, policies, or guidelines; changes in

legislation or regulation; and other economic, competitive,

governmental, regulatory, and other technological factors affecting

the Company’s operations, pricing, products and services

2

Forward-Looking Statements

In addition, this presentation and filing contains forward-looking statements within the meaning

of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities

Exchange Act of 1934, as amended, with respect to the financial condition, results of operations

and business of Sovereign Bancorp, Inc. and the merger of Independence Community Bank Corp.

with and into Sovereign that are subject to various factors which could cause actual results to

differ materially from such projections or estimates. Such factors include, but are not limited to,

the following: (1) the businesses of Independence Community Bank Corp. may not be combined

successfully with Sovereign’s businesses, or such combinations may take longer to accomplish

than expected; (2) expected cost savings from the merger cannot be fully realized or realized

within the expected timeframes; (3) operating costs, customer loss and business disruption

following the merger, including adverse effects on relationships with employees, may be greater

than expected; (4) governmental approvals of the merger may not be obtained, or adverse

regulatory conditions may be imposed in connection with government approvals of the merger;

(5) adverse governmental or regulatory policies may be enacted; (6) the interest rate

environment may adversely impact the expected financial benefits of the merger, and compress

margins and adversely affect net interest income; (7) the risks associated with continued

diversification of assets and adverse changes to credit quality; (8) competitive pressures from

other financial service companies in Independence Community Bank Corp.’s and Sovereign’s

markets may increase significantly; (9) the risk of an economic slowdown that would adversely

affect credit quality and loan originations; (10) other economic, competitive, governmental,

regulatory, and technological factors affecting Sovereign's operations, integrations, pricing,

products and services; and (11) acts of terrorism or domestic or foreign military conflicts; and

acts of God, including natural disasters. Other factors that may cause actual results to differ

from forward-looking statements are described in Sovereign’s filings with the Securities

& Exchange Commission.

3

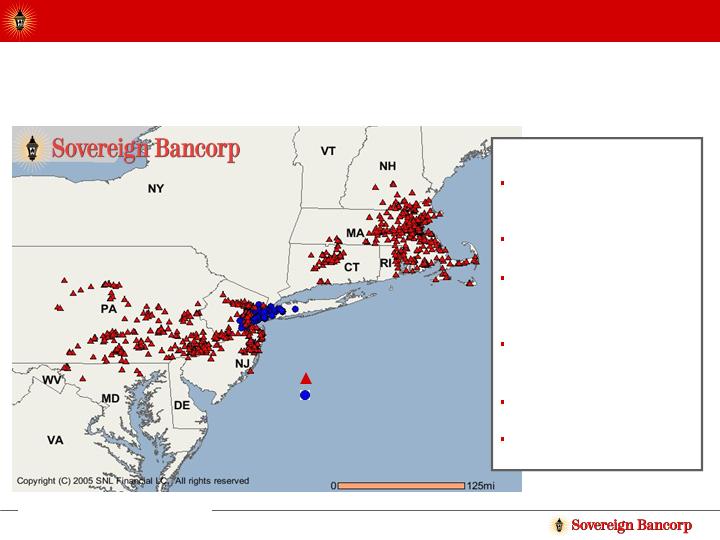

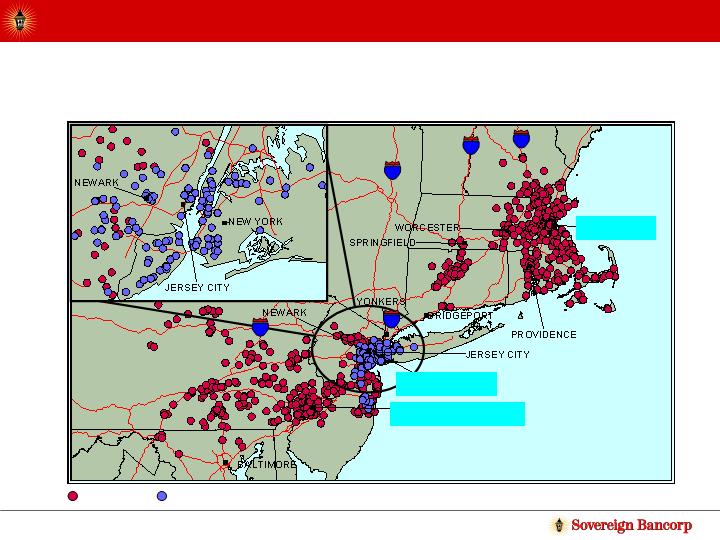

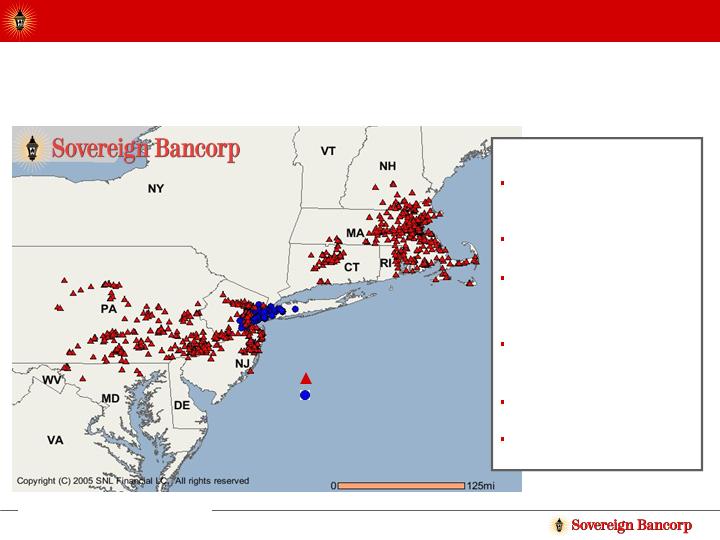

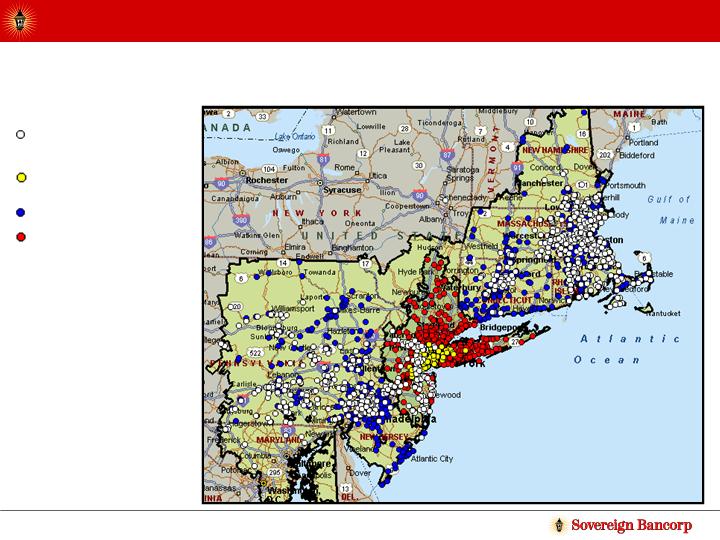

Overview of Sovereign

An Exceptional Franchise Serving the

Northeastern United States

Key: Sovereign Branches

Independence Branches

Sovereign Today

18th largest bank in the

U.S. with $64 billion in

assets

665 branches &

over 1,000 ATM’s

10,000 team members

Sovereign ProForma

Remains 18th largest

bank in U.S. with $83

billion in assets

785 branches &

over 2,000 ATM’s

Approx. 12,000 team

members

Source: SNL DataSource

(1) Includes CT, MA, NH, NJ, Eastern PA and RI

ME

5

Sovereign’s Demographics

14.1

49,747

United States

77,417

13

9.1

49,924

Rhode Island

654,826

262

3.2

48,534

Pennsylvania

1,107,270

307

16.8

51,187

New York

361,733

58

14.3

63,135

New Jersey

68,523

25

1.6

59,545

New

Hampshire

431,224

122

8.3

63,171

Massachusetts

300,269

62

4.7

61,384

Maryland

170,616

45

10.0%

$63,462

Connecticut

Number of

Students4

Number of

Universities3

Hispanic

Population2

(%)

Median

Household

Income1

($)

1 Median Household Income as of 2005

2 Hispanic Population as of 2004

3 Number of degree-granting institutions as of 2004

4 Number of students enrolled in degree-granting institutions as of 2002

6

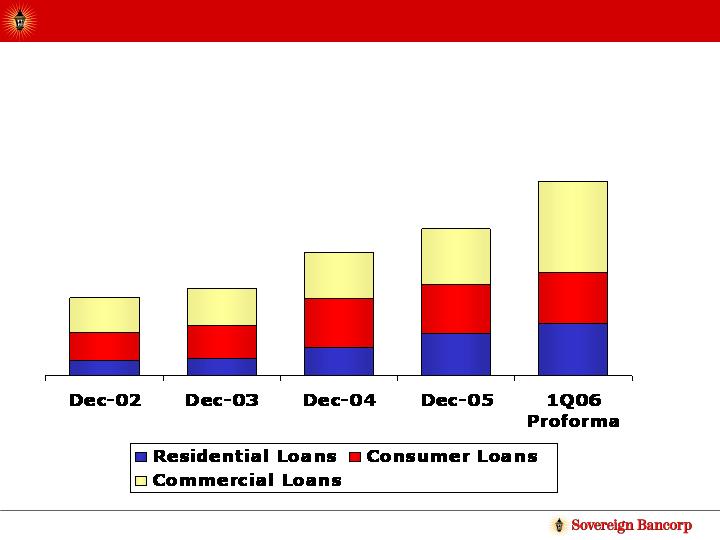

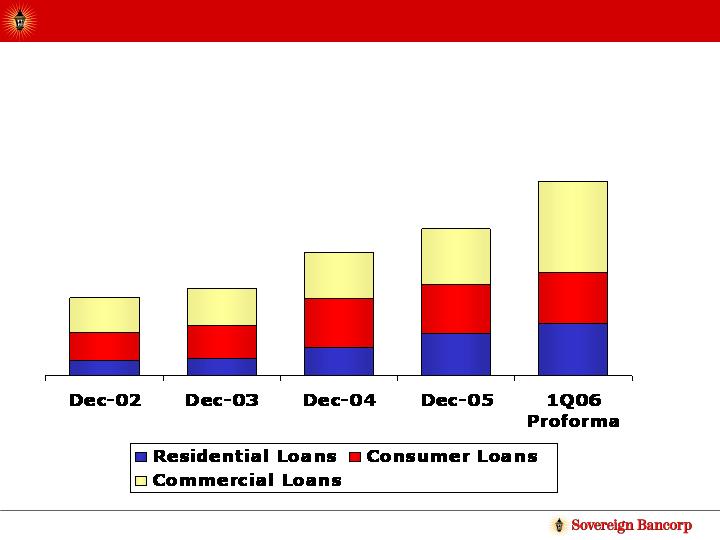

Growing and Diversified Loan Portfolio…

$26.1

$23.1

Diverse Loan Mix

24% Annual Growth*

$36.6

Balances as of December 31. 1Q06 pro forma for ICBC.

* Through year-end 2005; includes completed acquisitions.

$43.8

$57.8

7

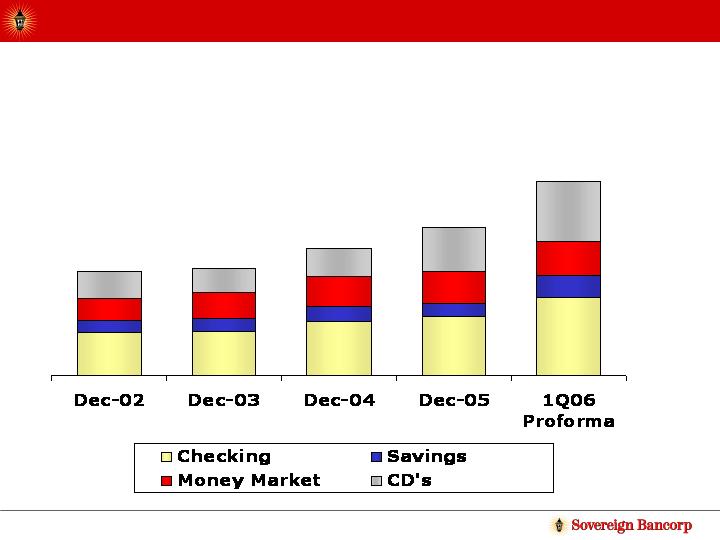

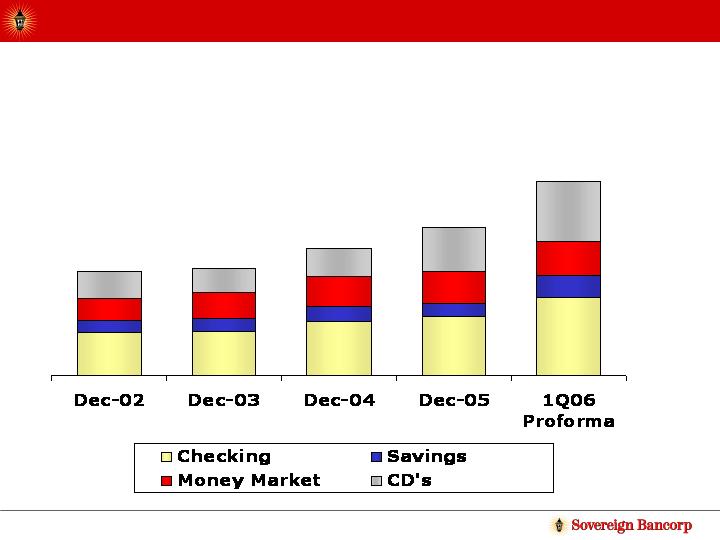

Building Deposits for a Strong Balance

Sheet…

$27.3

$26.9

Attractive Low-Cost

Deposit Base

12% Annual Growth*

$32.6

$38.0

Balances through December 31. 1Q06 pro forma for ICBC.

* Through year-end 2005; includes completed acquisitions.

$49.8

8

Deposits ($ billion)

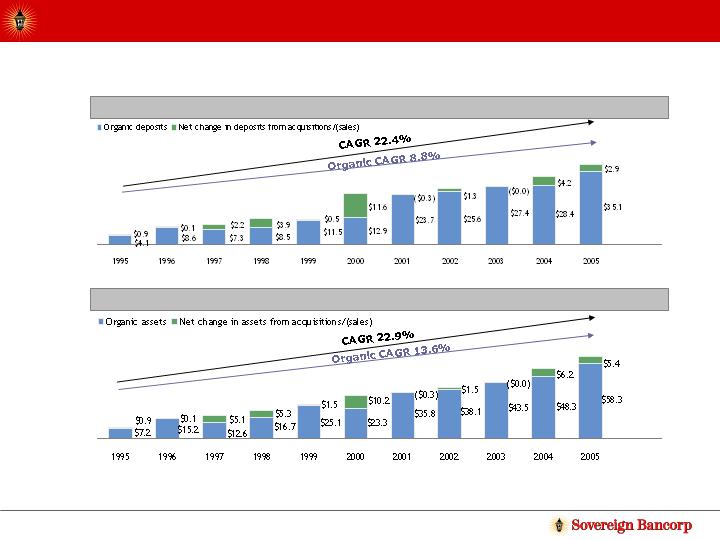

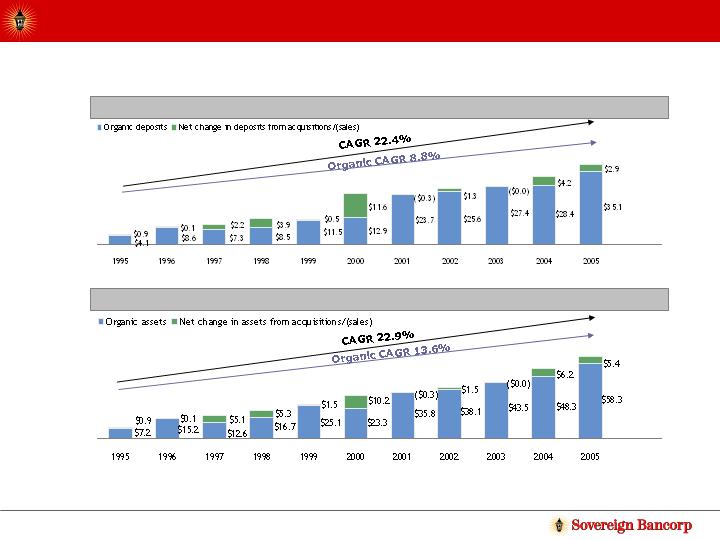

…through a Combination of Organic Growth

and Acquisitions

Assets ($ billion)

Source: SNL Financial

Note: Data as of December 31, 2005; organic asset and deposit data is adjusted for whole company and branch acquisitions and divestitures.

2005YE data not pro forma for pending acquisition of ICBC

$5.0

$8.7

$9.5

$12.3

$12.0

$24.5

$23.3

$26.9

$27.3

$32.6

$38.0

$8.1

$15.3

$17.7

$21.9

$26.6

$33.5

$35.5

$39.6

$43.5

$54.5

$63.7

7.8%

3.7%

1.9%

9.6%

(3.4%)

7.4%

(6.5%)

(11.0%)

(15.7%)

Organic growth

7.0%

11.0%

10.0%

7.2%

6.9%

(12.5%)

14.7%

(5.7%)

(17.8%)

Organic growth

9

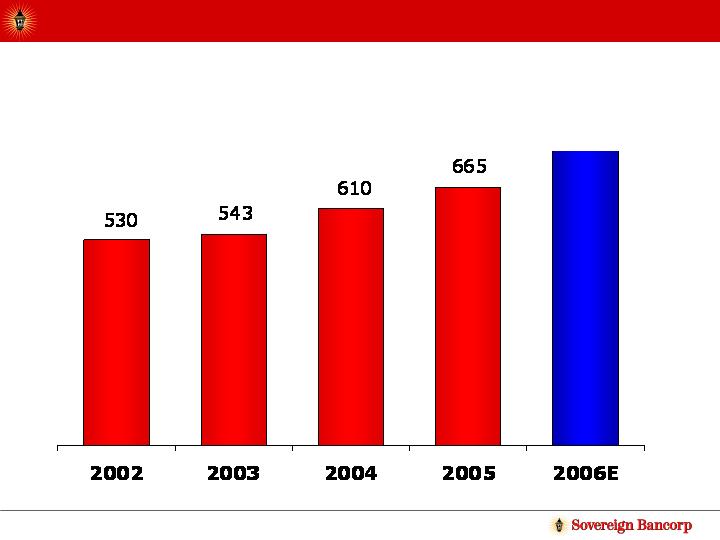

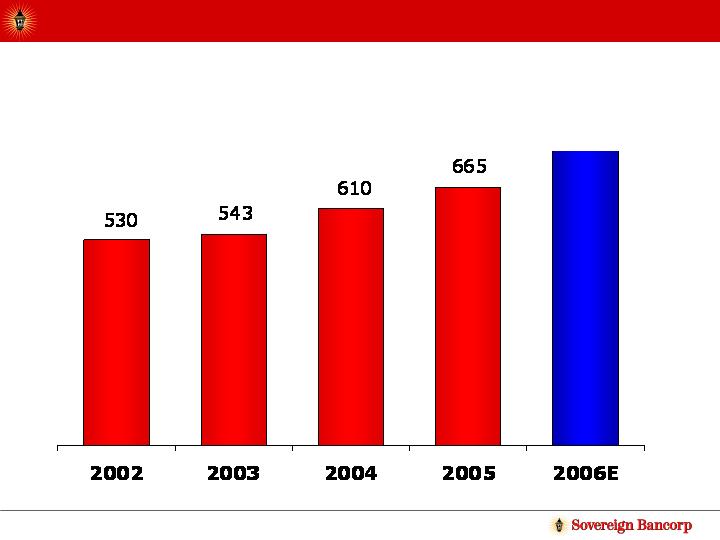

Growing Footprint

Number of Branches

8% Annual Growth*

*Through year-end 2005; includes acquisitions.

(1) Pro forma for pending acquisition of ICBC

790(1)

10

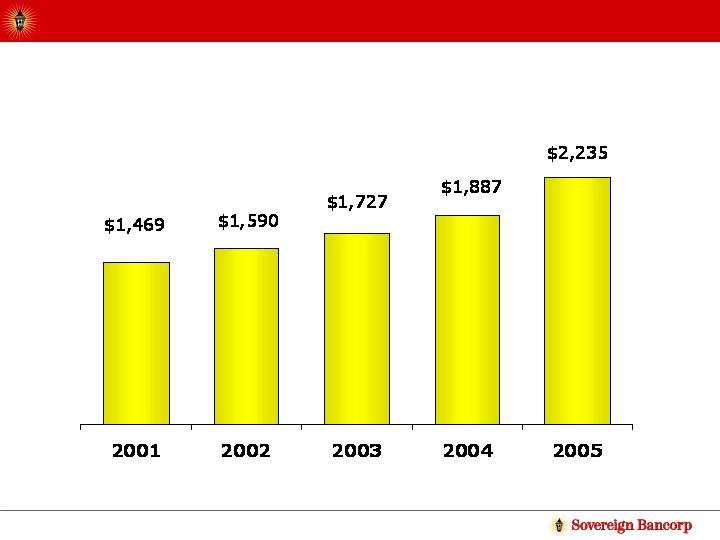

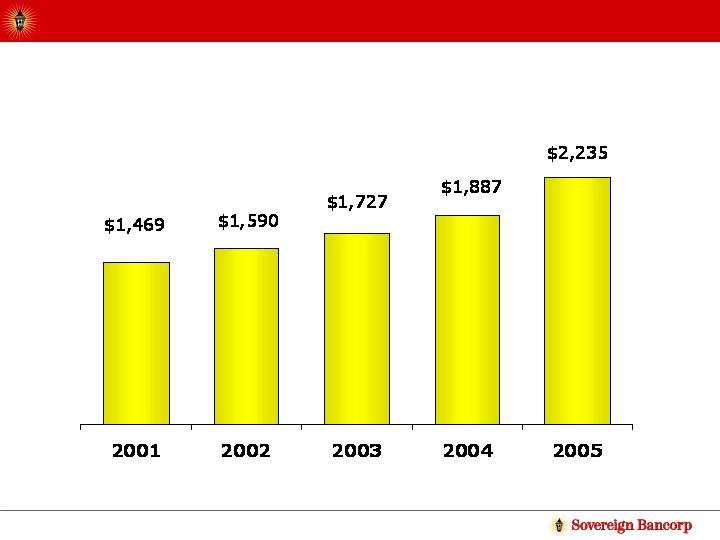

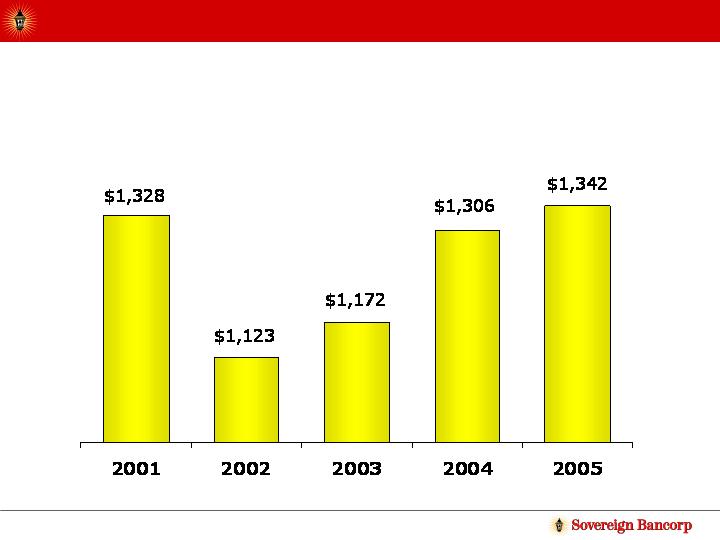

Total Revenue Growth

Revenue Growth

11% Annual Growth

11

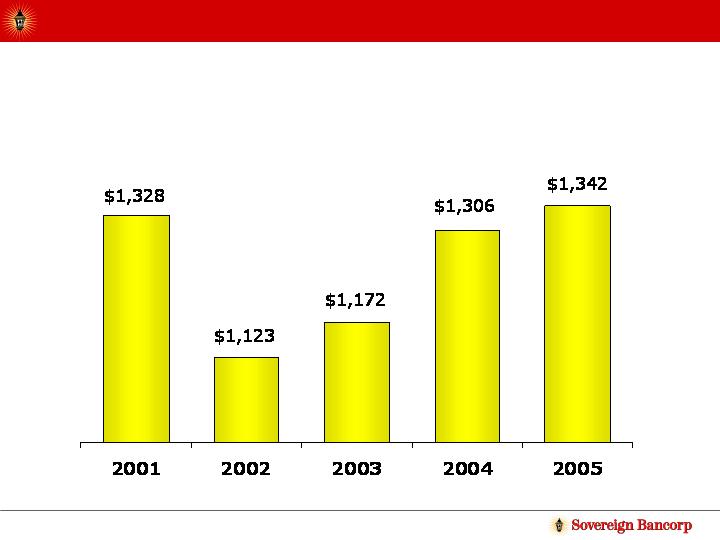

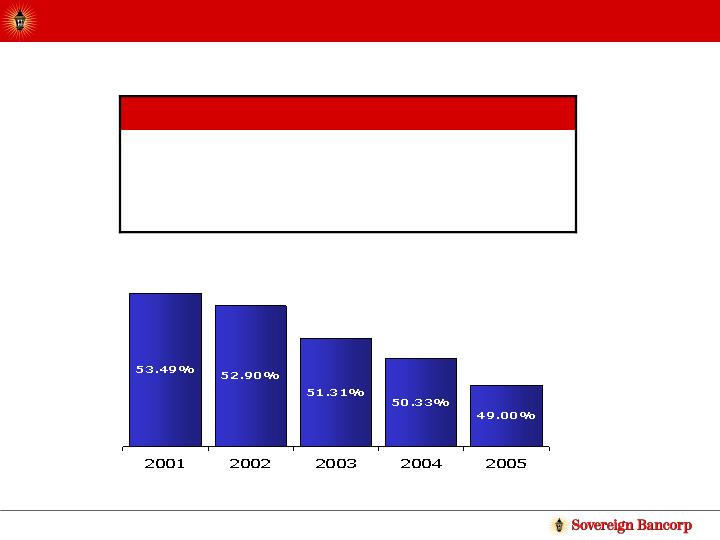

Total Expense Growth

Total Expense Growth

0% Annual Growth since 2001; 6% annual growth since 2002

Includes Provision for credit losses, G&A expense and Other Expense

12

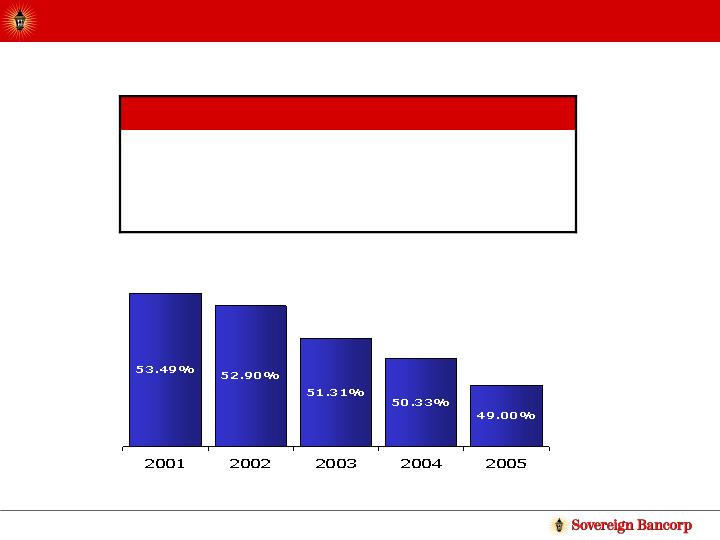

Positive Operating Leverage

Results in Continued Improvement

in Efficiency Ratio

1.2x

Operating Leverage

15.5%

$ .9bn

$1.1bn

G&A Expenses

18.7%

$1.9bn

$2.2bn

Total Revenue

% Change

2004

2005

Efficiency ratio equals G&A expenses as a percentage of total revenue, defined as the sum of

net interest income and total fees and other income before securities transactions

13

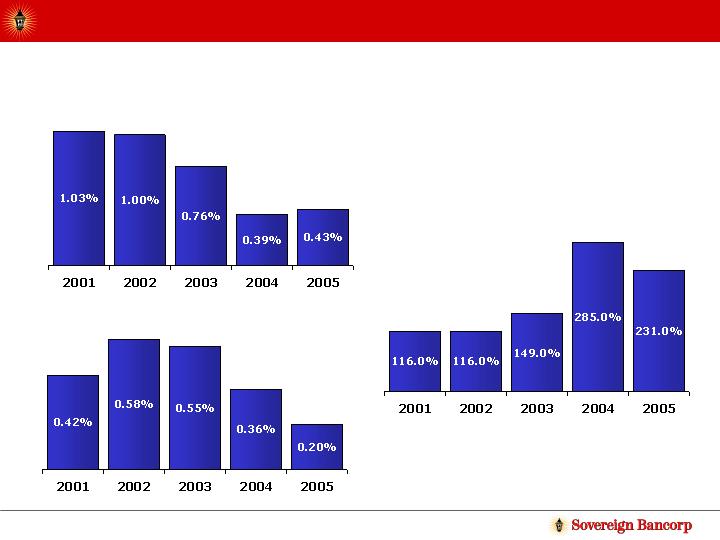

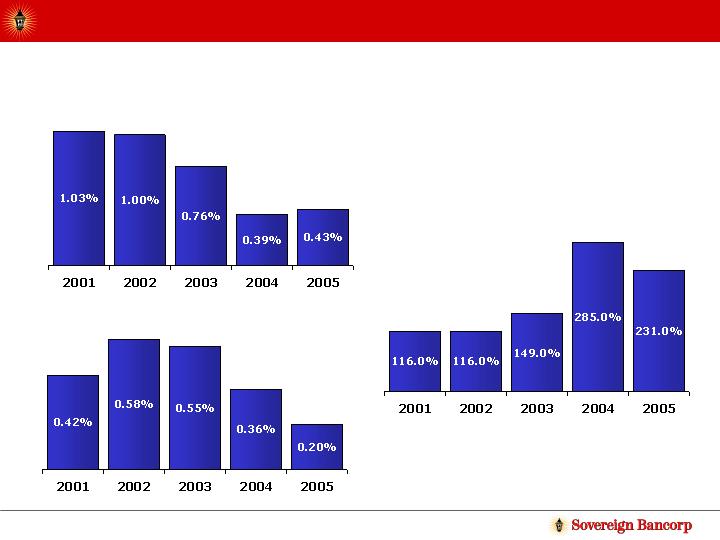

Improving Credit Quality

Non-Performing Loans to

Total Loans

Net Charge-offs

to Average Loans

Allowance to

Non-Performing Assets

14

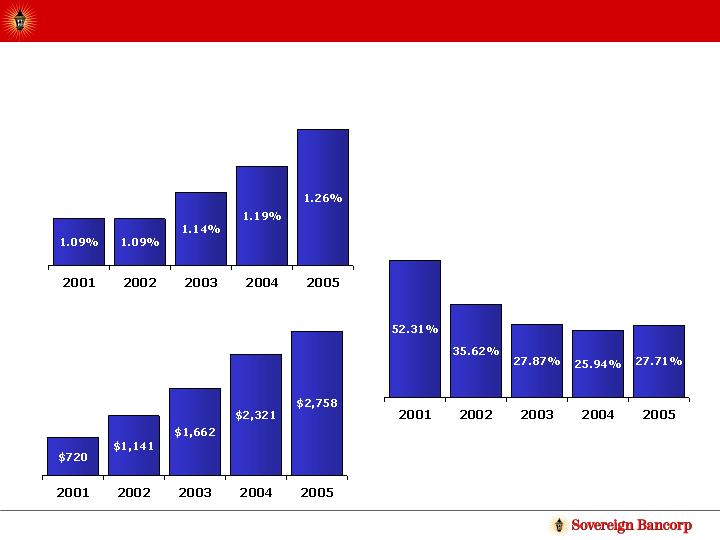

Consistent Growth in Operating/Cash Earnings

4-year CAGR Total EPS

GAAP Net Income – 55% 41%

Operating/Cash Earnings – 19% 7%

Operating/cash earnings excludes most non-cash, non-operating charges. Please see appendix for

reconciliation of net income to operating/cash earnings, as well as related per share amounts.

Source: 2005 annual report

15

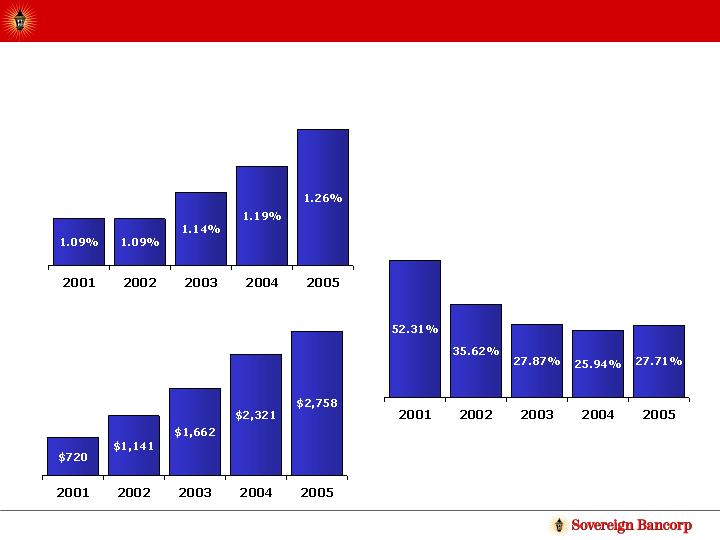

Improving Operating Metrics

Improved Operating Return

on Average Assets

Operating/Cash Return on

Average Tangible Equity

Average Tangible Equity

($ in millions)

16

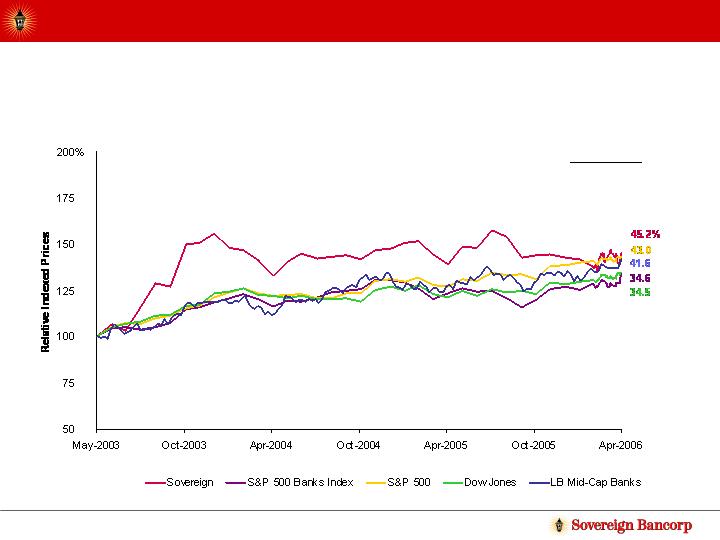

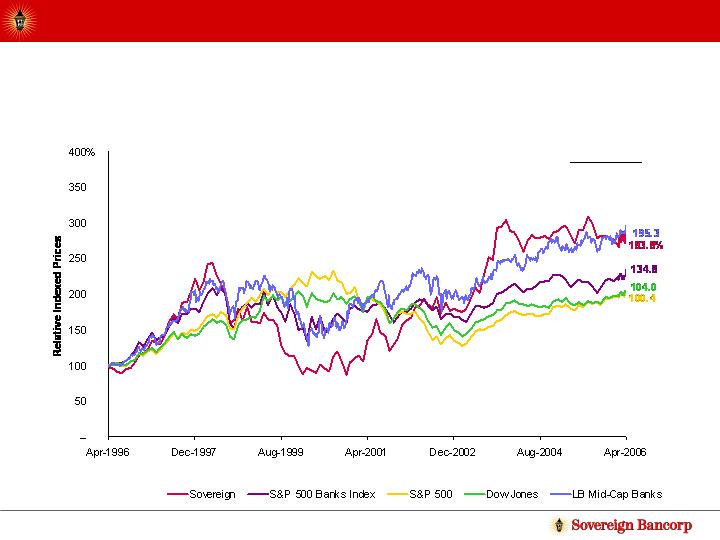

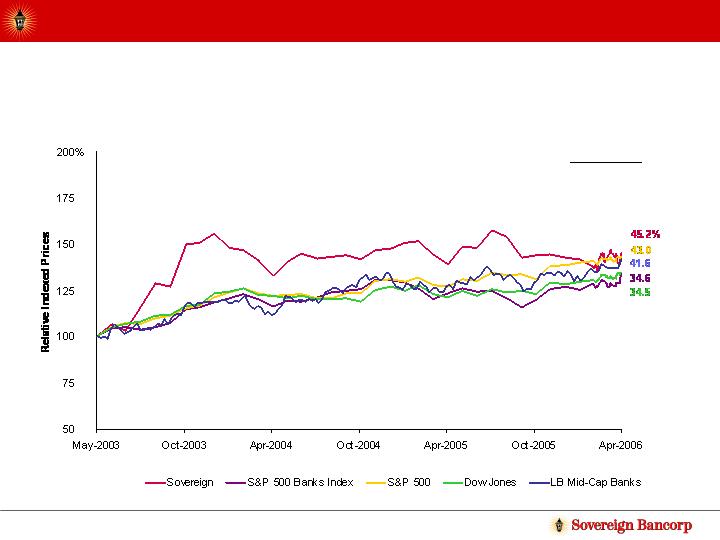

Above Average Shareholder Value Creation

04/28/06 closing price of $22.17

3-Year Stock Price Performance

Percent

Appreciation

17

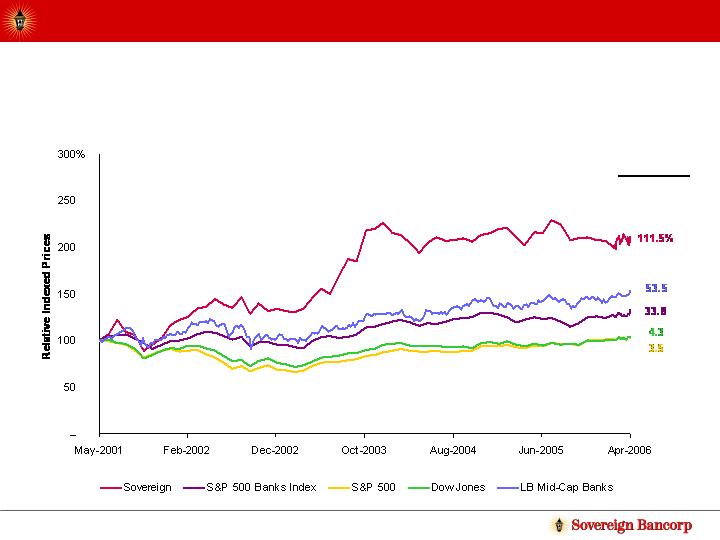

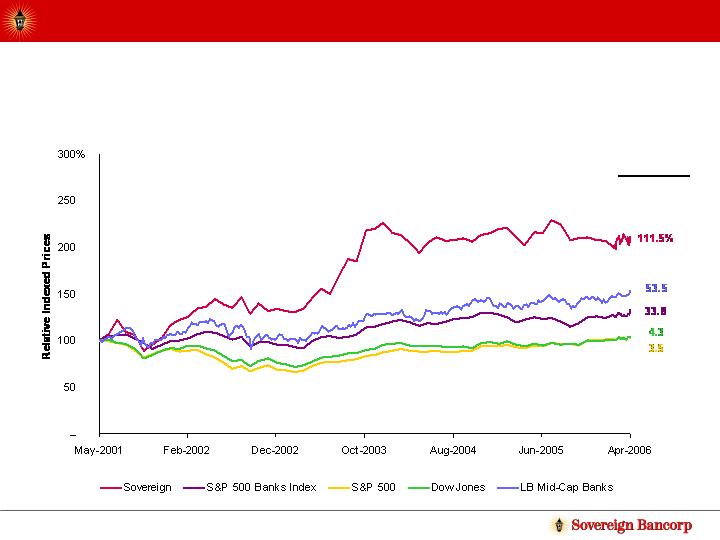

Above Average Shareholder Value Creation

5-Year Stock Price Performance

04/28/06 closing price of $22.17

Percent

Appreciation

18

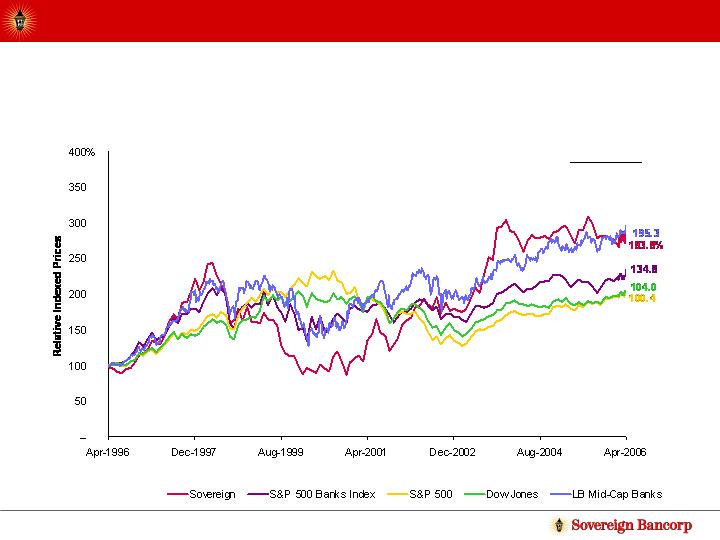

Above Average Shareholder Value Creation

10-Year Stock Price Performance

04/28/06 closing price of $22.17

Percent

Appreciation

19

Sovereign’s Strategy

Sovereign’s Business Strategy

Combining the best of a large bank with the best of a

smaller community bank.

Best of a Large Bank:

Products and services

Technology

Brand

Delivery channels and distribution system

Talent

Diversification

Sophistication of risk management

Best of a Small Bank:

Flat structure

Local decision making

Cross functional lines to deliver bank to customer

Treat customers as “individuals”

Active community involvement culture

21

Summary of Sovereign’s Business Model

Local community bankers with authority

to make local decisions

Community banking delivery model in

all markets

11 local markets, each with a Market

CEO

Local decision making by experienced

commercial bankers

Consumer banking emphasizes

convenience and customer service

Many markets offer 7 day banking

Appointment banking

24/7/365 phone and internet availability

Guaranteed minimum customer service

standards/”Red Carpet” service

Best-in-class customer/product makeup

Full product suite

Customer mapping/segmentation

Targeting 6+ services sold/used

Extremely attractive

franchise in one of

the most desired

geographic markets

in the world

Consistent growth in

operating/cash

earnings, improving

operating metrics

and high internal

generation of capital

22

Sovereign’s Banking Structure (11 markets)

Market

CEO

Commercial Real Estate

Lenders

Commercial

Lenders

Small Business

Lenders

Financial

Consultants

Cash Management

Representatives

Retail

Branches

23

Local Market Tactics

Presidents calling on small/medium sized businesses

Small community banking, commercial real estate and C&I focus

Courier pick-up service for small businesses in many markets

Localized banking for consumers

Localized marketing compliments bank-wide brand advertising

Free checking for consumers, businesses and not-for-profit

organizations

Free bill pay

Local market private banking services

Sales results are monitored on a daily basis

24

What We Measure For Each Market

Market ROA

Asset Quality:

Loan delinquency

Non-performing loans to

total loans

Net charge-offs

Interest Rate Risk:

Net interest income

Average deposits

Net loan yields

Net deposit costs

Market core margin

Coupon on new loans

Number of DDA accounts

Productivity:

Net income

Efficiency ratio

Other income vs. budget

New commitments booked

Investment services

G&A vs. budget

Fee retention

Sales & Service

Red Carpet Service

Team members

Team member retention

25

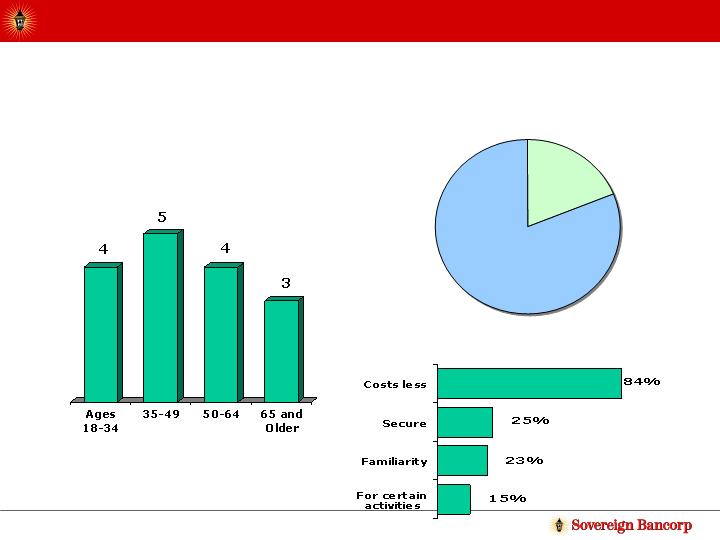

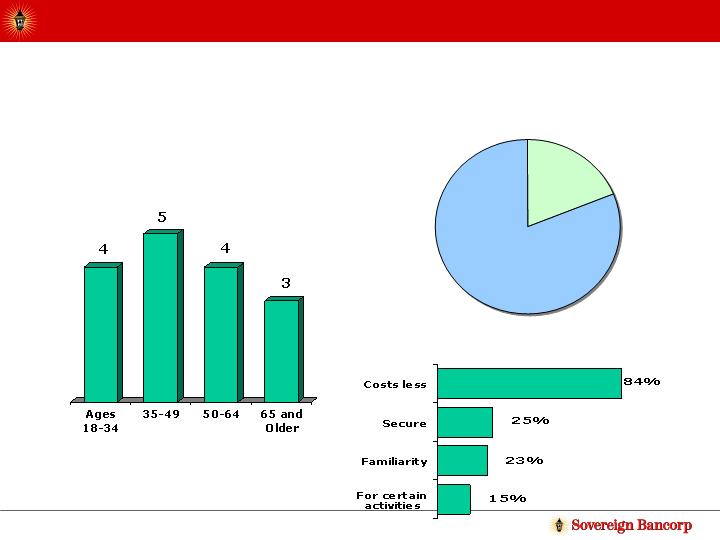

Redefining Convenience

Automated Teller Machines

Most consumers use ATMs an

average of four times a month…

…and over 80% prefer to use their

banks’ machines…

Own

institution

81%

Most

convenient

19%

…because they are less expensive,

though security was a factor too.

Source: Synergistics Research Corp.

27

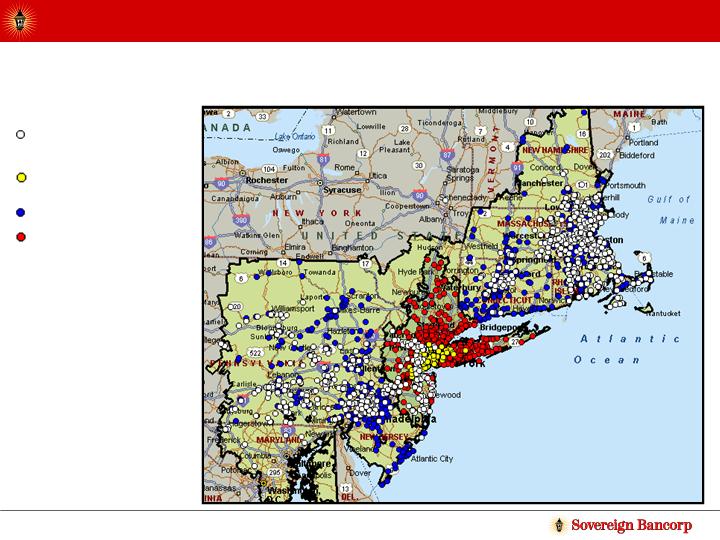

Sovereign ATMs in CVS/pharmacy Locations

Enables Sovereign to brand nearly 1,300 ATMs in

CVS/pharmacy locations throughout northeastern

United States including Massachusetts, Rhode Island,

northern Connecticut, New Hampshire, eastern

Pennsylvania and southern New Jersey

Opportunity exists to brand ATMs at any new

CVS/pharmacy locations within the same footprint

Surcharge-free to Sovereign customers

Significantly expands ATM network and provides huge

opportunity to attract new customers

28

Combined ATM Branding Opportunities

Sovereign ATM sites -

905

CVS Locations - 879

ICBC ATMs sites -

237

NY/NJ CVS -

484

29

Partnership to offer payroll, tax filing and other value-

added services to small business customers

ADP will dedicate over 200 sales professionals directly

to Sovereign

Sovereign will be the first bank in the marketplace to

have a state-of-the-art, web-based, payroll product

Sovereign will become the preferred provider of

Healthcare Savings Accounts (HSAs) for ADP’s Small

Business Division throughout the nation

Additional commercial and retail opportunities for

Sovereign

Expected to add between 5,000 to 10,000 new clients per year

Highlights of the ADP Partnership

30

American Express Partnership

Offering American Express Rewards and co-branded

cards to Sovereign’s small business customers

Sovereign is the first bank in the Northeast to offer a

co-branded card with American Express

Objective is to leverage the American Express brand to

help generate core deposits and retain small-business

relationships

31

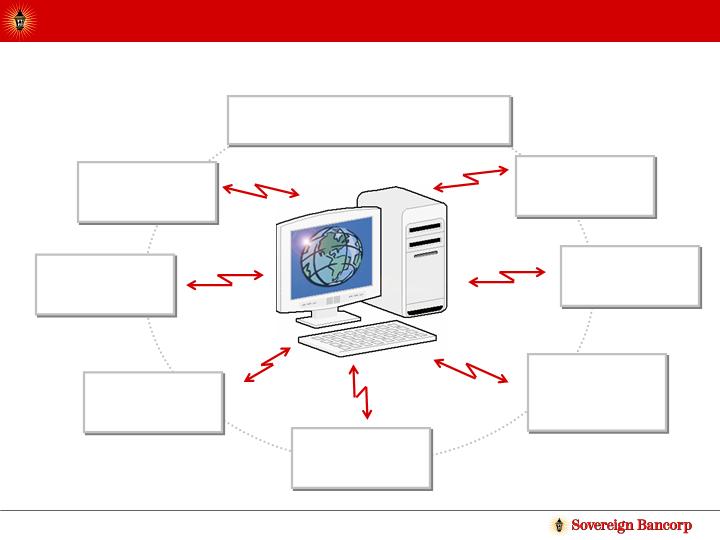

Bringing Sovereign Bank

to our business customers

Onsite

Check

Deposit

Onsite

Official

Check

Health

Savings

Accounts

Small

Business

Cash

Management

Onsite Banking

Account

Opening

Automated

Customer

Alerts

Online

Payroll

Delivery

Convenience Beyond Customers Expectations

32

Expanded Niche Lending Functions

Health Care Lending

Asset Based Lending

Automotive Finance Business

Sports Lending

Global Cash Management

33

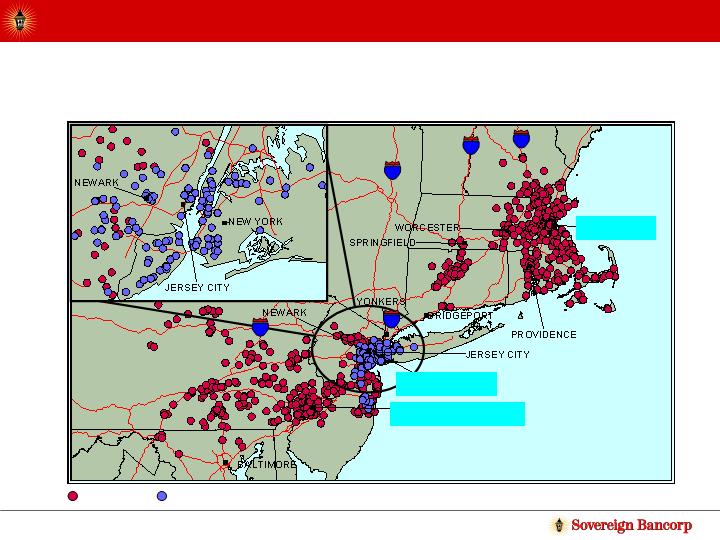

Independence Improves

Sovereign’s Franchise

Independence Improves Sovereign’s Footprint

Sovereign

Independence Community

787

91

287

81

293

PHILADELPHIA

NEW YORK

BOSTON

35

Creates a Leading Northeast-Based Bank

Improves Sovereign’s franchise value

Adds $7.9bn NY deposits and $2.6bn NJ deposits – total proforma NJ

deposits of approximately $10bn

Enhances distribution – 125 branches with an average branch size of

$84MM

Independence has attractive deposit mix

70% of deposits are non-CD deposits

Strong demographics

Serves 300,000 households

Average household income of $59.4K vs. U.S. average of $49.7K

Sovereign now a major player in the 5 largest MSAs in the Northeast

Creates a “New Fleet”

New York

Philadelphia

Boston

Providence

Hartford

MSA

18.9

5.8

4.5

1.6

1.2

222

84

175

55

30

16.2

6.8

9.3

3.2

1.3

Population

(MM)

Branches

Deposits

($Bn)

Pro Forma

36

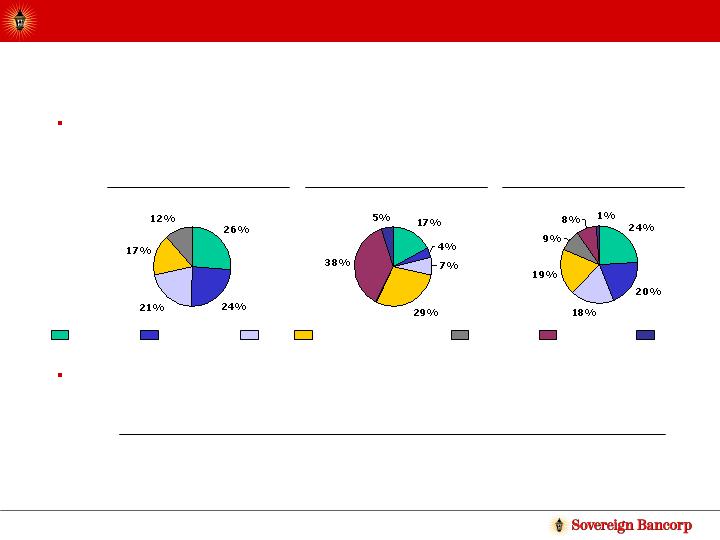

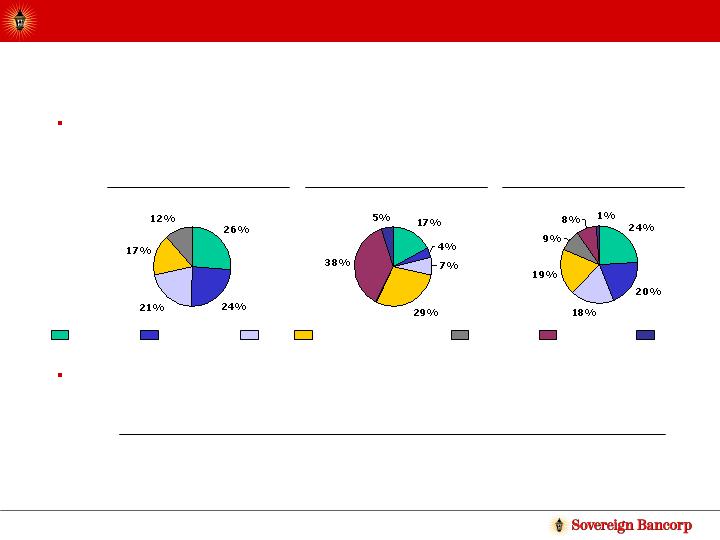

Diversifies loan mix with extension into multi-family lending –

unique relationship with Meridian Capital is strengthened through larger

balance sheet

Strong asset quality – low risk business model has produced exceptional

credit quality

Improved Asset Mix with Low Risk

Sovereign

Independence

Combined

1-4 Family

Home Equity

C&I

Commercial Real Estate

Consumer

Multi Family

Other

$42.7Bn

$12.3Bn

$55.0Bn

240%

235%

241%

Reserves/NPAs

0.16%

0.02%

0.20%

NCOs/Avg Loans

0.41%

0.35%

0.42%

NPAs/Loans+OREO

Combined

Independence

Sovereign

As of 9/30/05

37

Financially Attractive

Consistent with Sovereign’s stated acquisition criteria

Internal Rate of Return of 15%

15% cost saves vs. 29%(a) in announced New York MSA

transactions since 2001

Substantial revenue enhancements identified not assumed

Expansion of multi-family lending in Sovereign markets

(e.g., Philadelphia, Boston)

Open new markets to deliver broader array of products (cash

management, capital markets, commercial lending and

government banking)

(a) Source: SNL.

38

The Santander Partnership -

Building a Better Bank for

Shareholders, Customers

and Community

Global Footprint of Santander

40

Santander Partnership Makes Independence

Acquisition Attractive

Santander

Mkt. Cap: $80.1 bn

Independence

Mkt. Cap: $2.7 bn

Sovereign

Mkt. Cap: $9.0 bn

Cash ($2.4 bn)

Cash ($3.6 bn)

19.8% Ownership

$27.00 per SOV share

$462 million premium (1)

$1.2 bn of cash provided through

issuance of Tier 1 Capital or debt

100% Ownership

$42.00 per ICBC share

N.B. Market Cap statistics as of announcement.

1)

Based on 20-day trailing average price.

41

Benefits of the Santander Transaction

Allows Sovereign to acquire Independence, which would have

been difficult without Santander’s investment, at a premium

Access to capital; Santander has committed to “backstop”

financing

Santander partnership provides sharing of best practices and

operational know-how

Positioned for “full” price possible sale to Santander or

another party over 2-5 year period after closing

42

Examples of Opportunities to Share Best Practices

Hispanic Market

40% of Hispanics in Sovereign and Independence footprint are Puerto

Ricans, Santander has the second largest bank in Puerto Rico

Auto Finance

Santander is the largest non-captive auto finance player in Europe,

financing 1 million cars; Sovereign is a leading auto finance player in the

northeastern U.S.

Cash Management

Sovereign and Santander are discussing the outsourcing of all Santander’s

U.S. dollar cash management business to Sovereign

Funding/Access to Capital

S&P anticipates raising Sovereign’s ratings one notch following the deal

giving consideration to the foothold the Independence acquisitions

provides Sovereign in the desirable NY/NJ marketplace and Sovereign’s

commitment to rebuild capital. We hope other rating agencies will follow.

Operational Enhancements and Technology Sharing

Santander is the 9th largest bank in the world with world-class banking

related technology systems which Santander intends to share with

Sovereign and a well-respected global partner

43

Potential Shareholder

Value Creation

Clear and Consistent Strategy and Tactics for

the Future

Strong, experienced and deep management team in place

Exceptional franchise and strategy to seize superior growth

opportunities

Focus remains on superior execution and taking advantage of

“emerging markets” within the United States

As we execute, we will remain committed to our critical

success factors of:

Superior asset quality

Superior risk management

Strong sales and service culture that aligns team member

performance with a recognition and rewards system

High level of productivity through revenue growth and

efficient expense control

45

Major Goals for 2006 – 2007

Positive operating/cash earnings growth in a flat yield

curve

Achieve or exceed financial assumptions of

Independence acquisition

Embark on strategy for capturing larger share of the

Hispanic market

Maintain expense control discipline

Stable asset quality

46

Sovereign is committed to building

above-average short-term and long-term

shareholder value while building a better

bank for our customers, communities

and team members.

47

Appendix

Operating and Cash Earnings Per Share

This presentation contains financial information determined by methods

other than in accordance with U.S. Generally Accepted Accounting

Principles (“GAAP”)

Sovereign’s management uses the non-GAAP measures of Operating

Earnings and Cash Earnings in its analysis of the company’s

performance. These measures typically adjust net income determined

in accordance with GAAP to exclude the effects of special items,

including significant gains or losses that are unusual in nature or are

associated with acquiring and integrating businesses, and certain non-

cash charges

Since certain of these items and their impact on Sovereign’s

performance are difficult to predict, management believes presentations

of financial measures excluding the impact of these items provide useful

supplemental information in evaluating the operating results of

Sovereign’s core businesses

These disclosures should not be viewed as a substitute for net income

determined in accordance with GAAP, nor are they necessarily

comparable to non-GAAP performance measures, which may be

presented by other companies

49

One Non-GAAP Financial Measure

Effective in the fourth quarter of 2004, Sovereign moved to

one non-GAAP financial measure – Operating/Cash Earnings

Provides greater financial transparency

Provides useful supplemental information when evaluating

Sovereign’s core businesses

Consistent with SEC’s publicly stated desire for fewer non-GAAP

disclosures

Operating/Cash Earnings represent net income adjusted for

after-tax effects of merger-related and integration charges,

any other non-recurring charges and the amortization of

intangible assets

50

Reconciliation of Operating/Cash Earnings

to GAAP Earnings - Actual

51

(1)

(1) Net Income for EPS purposes

($ in thousands, all numbers shown net of tax)

Year Ended December 31,

2005

2004

2003

2002

2001

Net Income/(loss) as reported

701,587

$

453,552

$

401,851

$

341,985

$

116,821

$

Merger-related and

integration costs

8,284

30,134

10,316

Provision for Loan Loss

3,900

3,900

Restructuring of Balance Sheet

42,605

18,838

6,549

Restructuring Charges

2,589

5,525

Impairment Charge for FNMA and

FHLMC Preferred Stock

20,891

Financing-Related Adjustments

Non-solicitation Expense

158,106

Proxy and related professional fees

3,788

Amoritzation of Intangibles

47,984

51,186

50,100

54,121

89,408

Operating/Cash Earnings for EPS

purposes

764,232

$

602,268

$

470,789

$

410,322

$

376,409

$

Note: Further details are available on our web site at www.sovereignbank.com and in our Annual Reports to

Shareholders

Reconciliation of Operating/Cash EPS to

GAAP EPS - Actual

52

Year Ended December 31,

2005

2004

2003

2002

2001

Diluted Earnings per Share

1.77

$

1.38

$

1.38

$

1.23

$

0.45

$

Merger-related and

integration costs

0.02

$

0.09

$

0.04

$

Provision for Loan Loss

0.01

$

0.01

$

Restructuring of Balance Sheet

0.13

$

0.07

$

0.03

$

Restructuring Charges

0.01

$

0.02

$

Impairment Charge for FNMA and

FHLMC Preferred Stock

0.06

$

Financing-Related Adjustments

Non-solicitation Expense

0.62

$

Proxy and related professional fees

0.01

$

Amoritzation of Intangibles

0.12

$

0.16

$

0.17

$

0.19

$

0.35

$

Operating/Cash Earnings per Share

1.93

$

1.83

$

1.62

$

1.47

$

1.47

$

Note: Further details are available on our web site at www.sovereignbank.com and in our Annual Reports to Shareholders

Sovereign Bancorp, Inc.