Sovereign Bank, N.A. Fixed Income Investor Update 3rd Quarter 2012

2 Disclaimer Banco Santander, S.A. (“Santander”), Santander Holdings USA, Inc. (“SHUSA”), and Sovereign Bank, N.A. (“Sovereign”) caution that this presentation may contain forward-looking statements within the meaning of the U.S. Private Securities Litigation Reform Act of 1995. These forward-looking statements are found in various places throughout this presentation and include, without limitation, statements concerning our future business development and economic performance. While these forward-looking statements represent our judgment and future expectations concerning the development of our business, a number of risks, uncertainties, and other important factors could cause actual developments and results to differ materially from our expectations. These factors include, but are not limited to: (1) domestic and international market, macro-economic, governmental, regulatory conditions and trends; (2) movements in local and international securities markets, currency exchange rates, and interest rates; (3) competitive pressures; (4) technological developments; and (5) changes in the financial position or creditworthiness of our customers, obligors, and counterparties. The risk factors and other key factors that we have indicated in our past and future filings and reports, including our Annual Report on Form 10-K for the year ended December 31, 2011 and other filings and reports with the Securities and Exchange Commission of the United States of America (the “SEC”), could adversely affect our business and financial performance. Other unknown and unpredictable factors could cause actual results to differ materially from those in the forward-looking statements. The information contained in this presentation is not complete. It is subject to, and must be read in conjunction with, all other publicly available information, including reports filed with or furnished to the SEC, press releases, and other relevant information. Because this information is intended only to assist investors, it does not constitute investment advice or an offer to invest or to provide management services. It is subject to correction, completion, and amendment without notice. It is not our intention to state, indicate, or imply in any manner that current or past results are indicative of future results or expectations. As with all investments, there are associated risks, and you could lose money investing. Prior to making any investment, a prospective investor should consult with its own investment, accounting, legal, and tax advisers to evaluate independently the risks, consequences, and suitability of that investment. The information in this presentation is not intended to constitute “research” as that term is defined by applicable regulations. Nothing in this presentation constitutes investment, legal, accounting, or tax advice, or a representation that any investment or strategy is suitable or appropriate to your individual circumstances, or otherwise constitutes a personal recommendation to you. Recipients of this presentation should obtain advice based on their own individual circumstances from their own tax, financial, legal, and other advisers before making an investment decision, and only make such decisions on the basis of the investor’s own objectives, experience, and resources. In making this presentation available, Santander, SHUSA, and Sovereign give no advice and make no recommendation to buy, sell, or otherwise deal in shares or other securities of Santander, SHUSA, or Sovereign, or in any other securities or investments whatsoever. No offering of securities shall be made in the United States except pursuant to registration under the U.S. Securities Act of 1933, as amended, or an exemption therefrom. Nothing contained in this presentation is intended to constitute an invitation or inducement to engage in investment activity for the purposes of the prohibition on financial promotion in the U.K. Financial Services and Markets Act 2000. In this presentation, we may sometimes refer to certain non-GAAP figures or financial ratios to help illustrate certain concepts. These ratios, each of which is defined in this document, if utilized, may include Pre-Tax Pre-Provision Income, the Tangible Common Equity to Tangible Assets Ratio, and the Texas Ratio. This information supplements our results as reported in accordance with GAAP and should not be viewed in isolation from, or as a substitute for, our GAAP results. We believe that this additional information and the reconciliations we provide may be useful to investors, analysts, regulators and others as they evaluate the impact of these items on our results for the periods presented due to the extent to which the items are not indicative of our ongoing operations. Where applicable, we provide GAAP reconciliations for such additional information. Note: Nothing in this presentation should be construed as a profit forecast. Past performance should not be taken as an indication or guarantee of future performance, and no representation or warranty, express or implied, is made regarding performance. Information, opinions, and estimates contained in this presentation reflect a judgment at its original date of publication by Santander, SHUSA, and Sovereign, and are subject to change without notice. Santander, SHUSA, and Sovereign have no obligation to update, modify, or amend this presentation or to otherwise notify a recipient thereof in the event that any information, opinion, or estimate set forth herein changes or subsequently becomes inaccurate. This presentation is provided for information purposes only.

3 Sovereign Bank: Overview Branches: 721 ATMs: 2,195 Employees (FTEs): 8,334 Sovereign serves a growing number of consumers, large and small businesses across its Northeast footprint Assets: $82.5B Deposits: $51.1B Gross Loans: $53.0B 1. FDIC Market Share of branches; data as of June 2012 (published on annual basis) Source: FDIC Main Market Shares State Branches (#) Branch Market Share1 (%) Rank1 Massachusetts 229 7.0% 4 Pennsylvania 169 2.7% 9 New Jersey 152 3.1% 7 New York 76 0.8% 17 Rhode Island 32 4.4% 6

4 4 Sustained Core Profit Generation Eleventh consecutive quarter of profitability with $123MM Net Income in 3Q12 Robust Loan Production Growth in C&I lending benefitting from charter change in 1Q12 Continued Improvement in Asset Quality One time reclassification in 3Q12 for new OCC rule BK71 Secure Liquidity Position Stable deposit balances Strong Capital Ratios Solid Tier 1 Common Equity base Sovereign Bank: 3Q2012 Highlights IT and Network Transformation IT Core Platform conversion is leading to continued enhancements 1 BK7 impact increased NPLs $111.6MM 3Q12

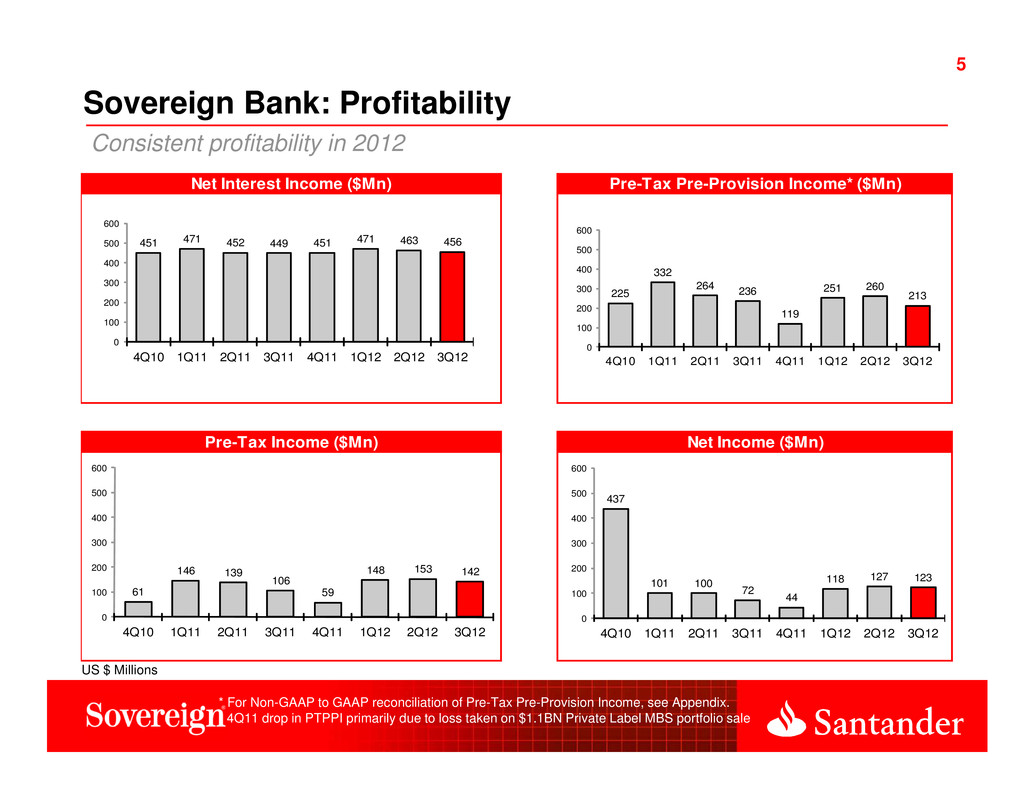

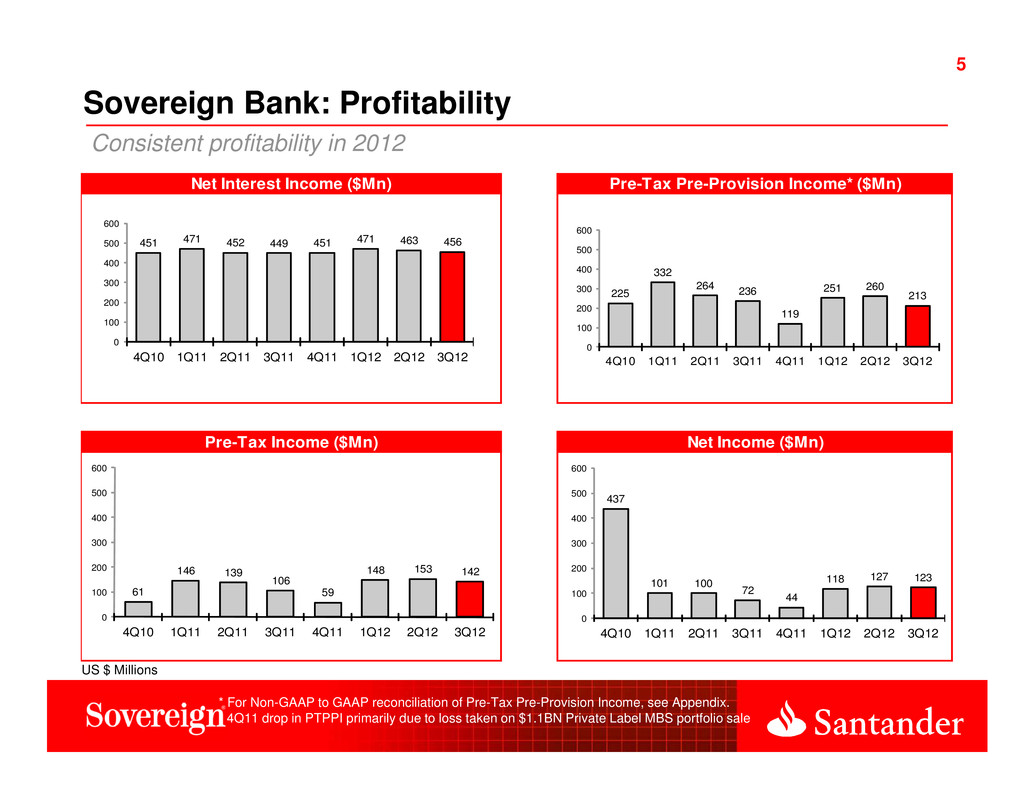

Sovereign Bank: Profitability US $ Millions * For Non-GAAP to GAAP reconciliation of Pre-Tax Pre-Provision Income, see Appendix. • 4Q11 drop in PTPPI primarily due to loss taken on $1.1BN Private Label MBS portfolio sale Net Interest Income ($Mn) Pre-Tax Pre-Provision Income* ($Mn) Pre-Tax Income ($Mn) Net Income ($Mn) 225 332 264 236 119 251 260 213 0 100 200 300 400 500 600 4Q10 1Q11 2Q11 3Q11 4Q11 1Q12 2Q12 3Q12 451 471 452 449 451 471 463 456 0 100 200 300 400 500 600 4Q10 1Q11 2Q11 3Q11 4Q11 1Q12 2Q12 3Q12 61 146 139 106 59 148 153 142 0 100 200 300 400 500 600 4Q10 1Q11 2Q11 3Q11 4Q11 1Q12 2Q12 3Q12 437 101 100 72 44 118 127 123 0 100 200 300 400 500 600 4Q10 1Q11 2Q11 3Q11 4Q11 1Q12 2Q12 3Q12 5 Consistent profitability in 2012

6 6 Sovereign Bank: Pre-tax Profit excluding Gains/(Losses) on Sales Improved versus 2011 142 92 133 108 64 119 84 61 81 64 42 Annual quarterly average ($Mn) $122Mn $94Mn $62Mn 1Q10 3Q122Q10 3Q10 4Q10 1Q11 2Q11 3Q11 4Q11 1Q12 2Q12

7 Sovereign Bank: Balance Sheet $69.6B LIABILITIES $12.9B EQUITY $82.5B ASSETS Cash 5% Investments 22% C&I 16% CRE 12% Residential 14% Multi-family 9% Home Equity 8% Other Loans 5% Goodwill/ CDI 4% Other Assets 5% Interest- bearing DDA 11% Noninterest- bearing DDA 11% Savings 5% Money Market 20% CD 15% FHLB 16% Other Borrowings 4% Other Liabilities 3% Equity 15%

8 Asset Quality: Impact of OCC CH7 Bankruptcy Interpretation New OCC interpretation of accounting guidance requires that loans discharged under Chapter 7 Bankruptcy and not reaffirmed by the borrower be reported as nonaccrual regardless of their delinquency status. The guidance requires these loans to be considered collateral dependent Troubled Debt Restructures (TDRs). As such, they must be written down to fair value and maintained as non-accrual/non-performing for the remaining life of the loan. For Q3 reporting purposes, Sovereign has estimated the impact of applying the guidance to its portfolio using fully validated bankruptcy data and estimated collateral values. $111.6MM increase in NPLs $119.2MM increase in TDRs $30.3MM charge-off to ALLL

9 9 Sovereign Bank: Asset Quality NPL = Nonaccruing loans plus accruing loans past due 90+ days Criticized = loans that are categorized as Special Mention, Substandard, Doubtful, and Loss Dollars in millions -35%* *Includes BK 7 Impact for 3Q12 $3,657 $4,801 $4,358 $4,057 $3,868 $3,750 $3,545 9.43% 8.55% 7.84% 7.40% 7.09% 6.90% 6.69% 2Q11 3Q11 4Q11 1Q12 2Q12 3Q12 Classified Balances Sov BK 7 Impact Criticized Balances Classified Ratio Classified Ratio (w/o BK7) Criticized Balances

10 10 Non-Performing Loan RatioDelinquency1 Sovereign Bank: Asset Quality Reserve Coverage (ALLL/NPL1) Texas Ratio2 2.9% 2.6% 2.4% 2.1% 2.3% 3.6% 3.0% 2.8% 2.6% 2.5% 2.4% 2.0% 2Q11 3Q11 4Q11 1Q12 2Q12 3Q12 Sovereign Large Banks Sov (w/o BK7) 77.0% 79.4% 86.3% 93.6% 82.3% 70.9% 92.7% 93.8% 94.2% 94.9% 98.3% 93.6% 2Q11 3Q11 4Q11 1Q12 2Q12 3Q12 Sovereign Large Banks Sov (w/o BK7) 19.4% 12.4% 11.9%13.4%14.3% 16.0% 26.1% 28.8%29.8%29.6%29.7% 11.3% 2Q11 3Q11 4Q11 1Q12 2Q12 3Q12 Sovereign Large Banks Sov (w/o BK7) 2 For Non-GAAP measure reconciliation Texas Ratio see Appendix 1 Delinquency = accruing loans 30-89 DPD plus accruing loans 90+ DPD loans, except loans partially or wholly guaranteed by the US Government; NPL = Nonaccruing loans plus accruing loans past due 90+ days *3Q12 Large Bank Average data not yet available; Source: SNL Bank level data; Large Bank = BAC, COF, C, KEY, BMO, HSBA, PNC, RBS, JPM, UNB, TD, USB, WFC 1.08% 0.92%0.97%0.93% 1.11%1.19% 1.55% 1.81% 2.06%2.05%1.99% 0.96% 2Q11 3Q11 4Q11 1Q12 2Q12 3Q12 Sovereign Large Banks* Sov (w/o BK7)

Other ConsumerMortgage and Home Equity Commercial Real Estate1 Outstandings NPL* to Total Loans Net Charge-Offs** *NPL = Nonaccruing loans plus accruing loans past due 90+ days **NCO = Rolling 12 month average for that quarter and the prior 3 quarters; 3Q11 uptick in Mortgage NCO due to one-time charge off of accumulated SVAs related to charter change 1 Commercial Real Estate is comprised of the commercial real estate, continuing care retirement communities, Santander real estate capital and multi-family loan portfolios Sovereign Bank: Asset Quality US $ Billions Other Commercial 11 Sov NPL w/o BK7 Sov NCO w/o BK 7 $18.1 $18.0 $18.1 $18.1 $18.1 $18.0 3.5% 2.8% 2.8% 2.8% 2.8% 2.9% 0.57% 1.14% 1.21% 1.25% 1.28% 0.70% 3.5% 2Q11 3Q11 4Q11 1Q12 2Q12 3Q12 0.80% $15.5 $15.3 $15.4 $15.4 $15.2 $15.3 4.3% 3.6% 3.6% 3.0% 2.6% 2.1% 2.1% 1.8% 1.8% 1.9% 1.4% 1.1% 2Q11 3Q11 4Q11 1Q12 2Q12 3Q12 $13.6 $13.8 $14.5 $15.5 $16.5 $16.8 3.4% 2.7% 1.7% 1.5% 1.0% 1.0%1.4% 1.3% 1.6% 1.3% 1.4% 1.4% 2Q11 3Q11 4Q11 1Q12 2Q12 3Q12

12 12 Average Total Deposit Balances1 ($Mn) Sovereign Bank: Deposits 1Represents average quarterly balance Average Non Maturity Deposit Balances1 ($Mn) $37,348 $37,948 $38,171 $37,912 $37,107 0.43% 0.40% 0.35% 0.35% 0.35% 3Q11 4Q11 1Q12 2Q12 3Q12 Non Maturity Deposit Balances Yield $47,763 $47,799 $49,246 $49,747 $49,348 0.54% 0.51% 0.48% 0.47% 0.48% 3Q11 4Q11 1Q12 2Q12 3Q12 Total Deposits Yield Deposit balances have remained stable

Sovereign Bank: Capital Ratios Capital Ratios. For Non-GAAP reconciliation please see Appendix 1 Beginning January 2012, capital ratios are prepared in accordance with OCC methodology. Prior year capital ratios shown are estimated pro-forma ratios to reflect OCC methodology. 14.4% 14.2% 13.0% 12.9% 12.8% 3Q11 4Q11 1Q12 2Q12 3Q12 14.3% 14.1% 13.0% 12.9% 12.8% 3Q11 4Q11 1Q12 2Q12 3Q12 11.6% 11.2% 10.6% 10.6% 10.5% 3Q11 4Q11 1Q12 2Q12 3Q12 16.7% 16.5% 15.1% 15.0% 14.9% 3Q11 4Q11 1Q12 2Q12 3Q12 Tier 1 Common Ratio Tier 1 Leverage Ratio Tier 1 Risk Based Capital Ratio Total Risk Based Capital Ratio 13 Ratios decreased slightly 3Q12 with asset growth

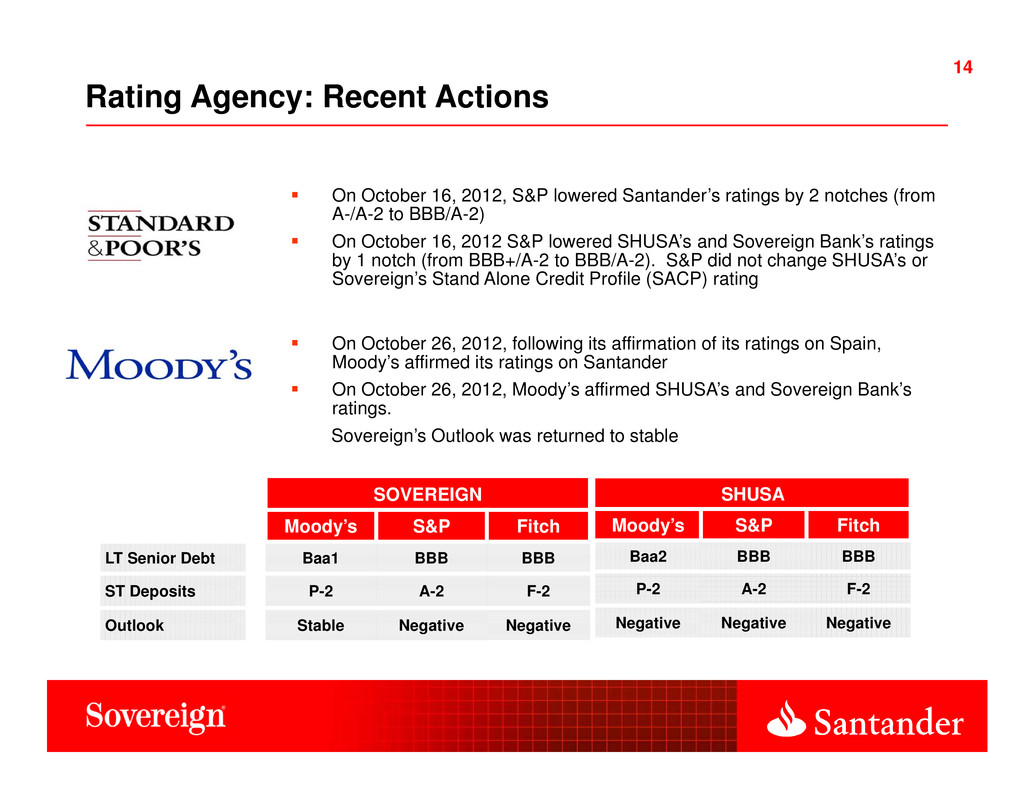

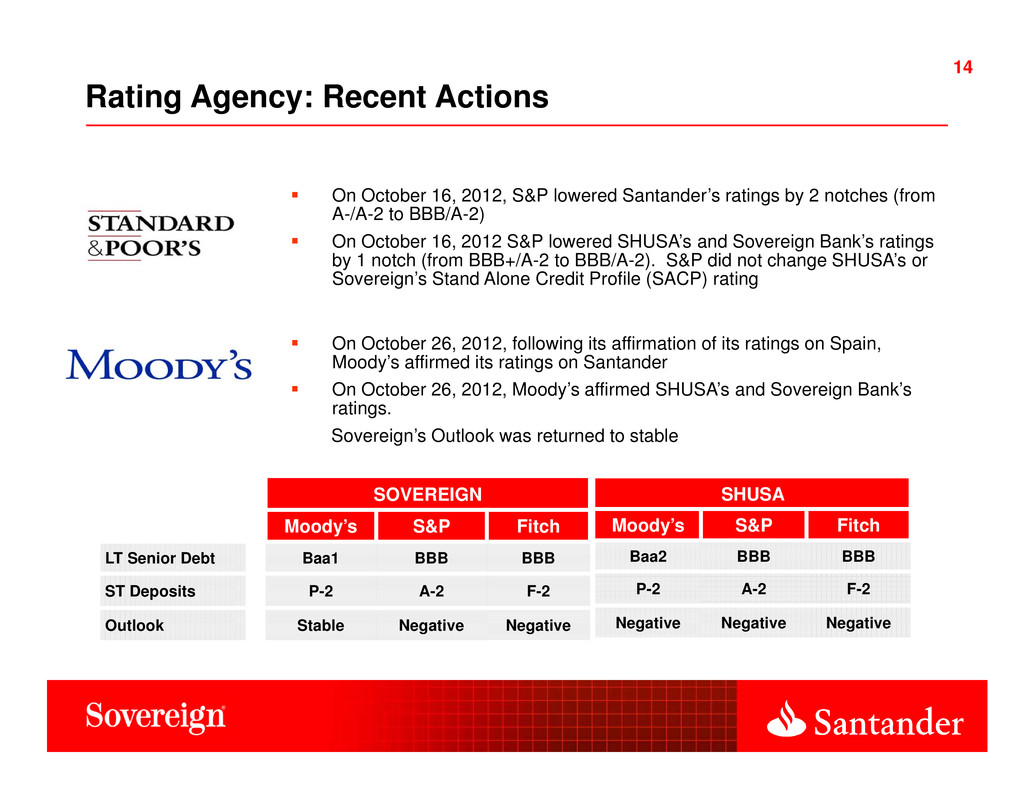

14 14 Rating Agency: Recent Actions SOVEREIGN Text Moody’s S&P Fitch LT Senior Debt Baa1 BBB BBB ST Deposits P-2 A-2 F-2 Outlook Stable Negative Negative SHUSA Moody’s S&P Fitch Baa2 BBB BBB P-2 A-2 F-2 Negative Negative Negative On October 16, 2012, S&P lowered Santander’s ratings by 2 notches (from A-/A-2 to BBB/A-2) On October 16, 2012 S&P lowered SHUSA’s and Sovereign Bank’s ratings by 1 notch (from BBB+/A-2 to BBB/A-2). S&P did not change SHUSA’s or Sovereign’s Stand Alone Credit Profile (SACP) rating On October 26, 2012, following its affirmation of its ratings on Spain, Moody’s affirmed its ratings on Santander On October 26, 2012, Moody’s affirmed SHUSA’s and Sovereign Bank’s ratings. Sovereign’s Outlook was returned to stable

��

Appendix

16 Sovereign Bank: Average Balance Sheet (In millions) Average Yield/ Average Yield/ Average Yield/ Average Yield/ Balance Rate Balance Rate Balance Rate Balance Rate Cash and investments 19,676$ 2.15% 18,903$ 2.25% 773$ -0.10% 15,690$ 2.57% Self-originated MBS portfolio 182 3.30% 383 3.27% (201) 0.03% 824 3.81% Loans (non run-off portfolio) 51,279 4.02% 50,819 4.11% 460 -0.09% 48,118 4.30% Loans (run-off portfolio) 1,456 5.92% 1,696 5.83% (240) 0.09% 2,526 5.87% Allowance for loan losses (1,044) --- (1,076) --- 32 --- (1,271) --- Other assets 9,522 --- 9,678 --- (156) --- 9,452 --- TOTAL ASSETS 81,071$ 3.18% 80,403$ 3.26% 668$ -0.08% 75,339$ 3.52% Interest-bearing demand deposits 8,782 0.14% 9,221 0.16% (439) -0.02% 9,373 0.22% Noninterest-bearing demand deposits 8,409 --- 8,111 --- 298 --- 7,744 --- Savings 3,830 0.14% 3,812 0.18% 18 -0.04% 3,506 0.13% Money market 16,086 0.51% 16,767 0.50% (681) 0.01% 16,726 0.61% Certificates of deposit 12,241 1.10% 11,836 1.09% 405 0.01% 10,414 1.27% Borrowed funds 16,882 2.82% 15,778 3.07% 1,104 -0.25% 13,059 4.26% Other liabilities 1,986 --- 2,100 --- (114) --- 1,987 --- Equity 12,855 --- 12,778 --- 77 --- 12,530 --- TOTAL LIABILITIES & SE 81,071$ 0.88% 80,403$ 0.89% 668$ -0.01% 75,339$ 1.08% NET INTEREST MARGIN 2.61% 2.70% -0.09% 2.78% 3Q12 3Q112Q12 Change

17 Sovereign Bank: Trended Statement of Operations 1 For Non-GAAP to GAAP reconciliation, see page 18 (US$ in Millions) 3Q11 4Q11 1Q12 2Q12 3Q12 Net interest income 449$ 451$ 471$ 463$ 456$ Fees & other income 125 108 160 145 143 Other non-interest income 42 (49) 15 61 - Net revenue 616 510 646 669 599 General & administrative expenses (329) (353) (349) (371) (347) Other expenses (51) (38) (46) (38) (39) Provisions for credit losses (130) (60) (103) (108) (71) Income before taxes 106 59 148 152 142 Income tax expense (34) (14) (30) (26) (19) Net income 72$ 45$ 118$ 126$ 123$ 3Q11 4Q11 1Q12 2Q12 3Q12 Net interest margin 2.78% 2.79% 2.80% 2.70% 2.61% Efficiency ratio1 61.7% 76.7% 61.1% 61.1% 64.4% GAAP effective tax rate 32.1% 23.7% 20.3% 17.1% 13.4%

18 Sovereign Bank: Non-GAAP to GAAP Reconciliations $ Millions 3Q11 4Q11 1Q12 2Q12 3Q12 Sovereign Bank Texas Ratio Total Equity 12,554$ 12,494$ 12,646$ 12,721$ 12,868$ Less: Goodwill and CDI, net of Deferrred Tax Liability (3,233) (3,220) (3,501) (3,522) (3,547) Tangible Common Equity 9,321$ 9,274$ 9,145$ 9,199$ 9,321$ Nonperforming Assets 1,673$ 1,478$ 1,371$ 1,216$ 1,274$ . . . . . Allowance for loan losses 1,152$ 1,083$ 1,082$ 1,056$ 980$ 90+ DPD accruing 4$ 5$ 4$ 3$ 2$ Texas Ratio 16.01% 14.32% 13.44% 11.89% 12.39% Efficiency Ratio G&A Expenses 329$ 353$ 349$ 371$ 347$ Other Expenses 51 38 46 38 39 380 391 395 409 386 Net interest income 449 451 471 463 456 Fees & other income 125 108 160 145 143 Other non-interest expenses 42 (49) 15 61 - 616$ 510$ 646$ 669$ 599$ Ratio 61.7% 76.7% 61.1% 61.1% 64.4%

19 Sovereign Bank: Non-GAAP to GAAP Reconciliations (cont) $ Millions 3Q11 4Q11 1Q12 2Q12 3Q12 Tier 1 Common to Risk Weighted Assets Tier 1 Common Capital 8,150$ 8,066$ 7,871$ 7,966$ 8,001$ Risk Weighted Assets 57,097 57,311 60,537 61,588 62,330 Ratio 14.3% 14.1% 13.0% 12.9% 12.8% Tier 1 Leverage Tier 1 Capital 8,300$ 8,216$ 7,871$ 7,966$ 8,001$ 71,694 73,692 74,386 75,471 76,050 Ratio 11.6% 11.2% 10.6% 10.6% 10.5% Tier 1 Risk Based Tier 1 Capital 8,300$ 8,216$ 7,871$ 7,966$ 8,001$ Low Level Recourse Deduction (72) (57) - - - 8,228 8,159 7,871 7,966 8,001 Risk Weighted Assets 57,097 57,311 60,537 61,588 62,330 Ratio 14.4% 14.2% 13.0% 12.9% 12.8% Total Risk Based Risk Based Capital 9,540$ 9,430$ 9,133$ 9,241$ 9,283$ Risk Weighted Assets 57,097 57,311 60,537 61,588 62,330 Ratio 16.7% 16.5% 15.1% 15.0% 14.9% Average total assets for leverage capital purposes (1) (1) Total assets adjusted for intangible assets and other regulatory deductions