Santander Holdings USA, Inc. Fixed Income Investors Update Data as of March 31, 2014 June 27, 2014

2 Disclaimer Santander Holdings USA, Inc. (“SHUSA”), and Santander Bank, N.A. (“Santander Bank”) caution that this presentation may contain forward-looking statements within the meaning of the U.S. Private Securities Litigation Reform Act of 1995. These forward-looking statements are found in various places throughout this presentation and include, without limitation, statements concerning our future business development and economic performance. While these forward-looking statements represent our judgment and future expectations concerning the development of our business, a number of risks, uncertainties, and other important factors could cause actual developments and results to differ materially from our expectations. These factors include, but are not limited to: (1) domestic and international market, macro-economic, governmental, regulatory conditions and trends; (2) movements in local and international securities markets, currency exchange rates, and interest rates; (3) competitive pressures; (4) technological developments; and (5) changes in the financial position or creditworthiness of our customers, obligors, and counterparties. The risk factors and other key factors that we have indicated in our past and future filings and reports, including our Annual Report on Form 10-K for the year ended December 31, 2013 and other filings and reports with the Securities and Exchange Commission (the “SEC”), could adversely affect our business and financial performance. Other factors could cause actual results to differ materially from those in the forward-looking statements. The information contained in this presentation is not complete. It is subject to, and must be read in conjunction with, all other publicly available information, including reports filed with or furnished to the SEC, press releases, and other relevant information. Because this information is intended only to assist investors, it does not constitute investment advice or an offer to invest, and in making this presentation available, SHUSA and Santander Bank give no advice and make no recommendation to buy, sell, or otherwise deal in shares or other securities of Banco Santander (“Santander”), SHUSA, or Santander Bank or in any other securities or investments. This presentation is subject to correction, completion, and amendment without notice. It is not our intention to state, indicate, or imply in any manner that current or past results are indicative of future results or expectations. As with all investments, there are associated risks, and you could lose money investing. Prior to making any investment, a prospective investor should consult with its own investment, accounting, legal, and tax advisers to evaluate independently the risks, consequences, and suitability of that investment. The information in this presentation is not intended to constitute “research” as that term is defined by applicable regulations. No offering of securities shall be made in the United States except pursuant to registration under the U.S. Securities Act of 1933, as amended, or an exemption therefrom. Nothing contained in this presentation is intended to constitute an invitation or inducement to engage in investment activity for the purposes of the prohibition on financial promotion in the U.K. Financial Services and Markets Act 2000. In this presentation, we may sometimes refer to certain non-GAAP figures or financial ratios to help illustrate certain concepts. These ratios, each of which is defined in this document, if utilized, may include Pre-Tax Pre-Provision Income, the Tangible Common Equity to Tangible Assets Ratio, and the Texas Ratio. This information supplements our results as reported in accordance with GAAP and should not be viewed in isolation from, or as a substitute for, our GAAP results, among others. We believe that this additional information and the reconciliations we provide may be useful to investors, analysts, regulators and others as they evaluate the impact of these items on our results for the periods presented due to the extent to which the items are indicative of our ongoing operations. Where applicable, we provide GAAP reconciliations for such additional information. This presentation is provided for information purposes only.

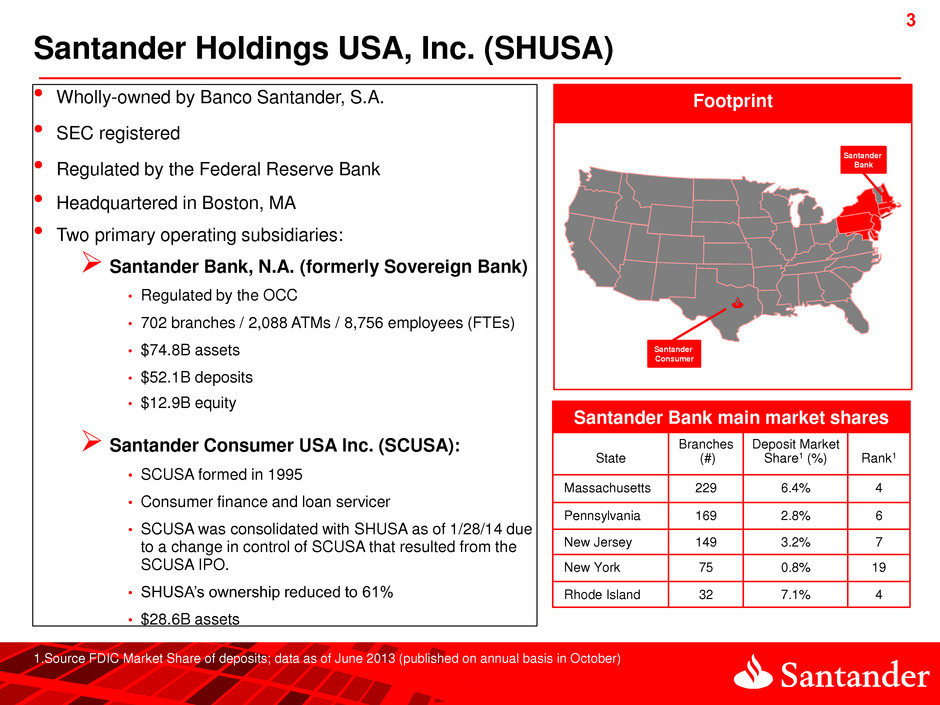

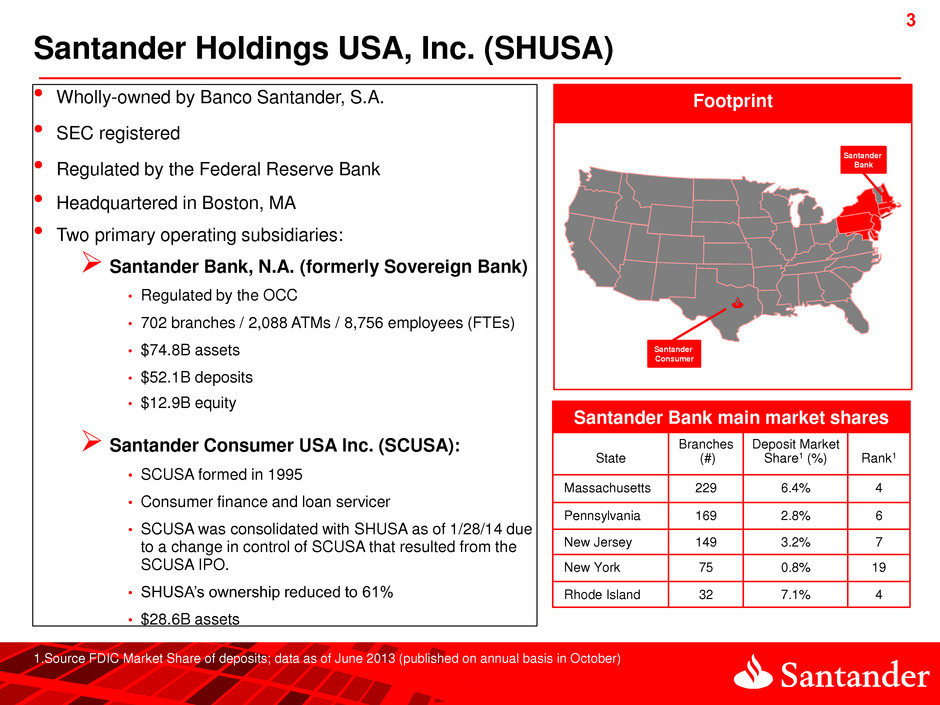

3 3 Footprint 1.Source FDIC Market Share of deposits; data as of June 2013 (published on annual basis in October) Santander Holdings USA, Inc. (SHUSA) • Wholly-owned by Banco Santander, S.A. • SEC registered • Regulated by the Federal Reserve Bank • Headquartered in Boston, MA • Two primary operating subsidiaries: Santander Bank, N.A. (formerly Sovereign Bank) • Regulated by the OCC • 702 branches / 2,088 ATMs / 8,756 employees (FTEs) • $74.8B assets • $52.1B deposits • $12.9B equity Santander Consumer USA Inc. (SCUSA): • SCUSA formed in 1995 • Consumer finance and loan servicer • SCUSA was consolidated with SHUSA as of 1/28/14 due to a change in control of SCUSA that resulted from the SCUSA IPO. • SHUSA’s ownership reduced to 61% • $28.6B assets Santander Bank main market shares State Branches (#) Deposit Market Share1 (%) Rank1 Massachusetts 229 6.4% 4 Pennsylvania 169 2.8% 6 New Jersey 149 3.2% 7 New York 75 0.8% 19 Rhode Island 32 7.1% 4 Santander Bank Santander Consumer

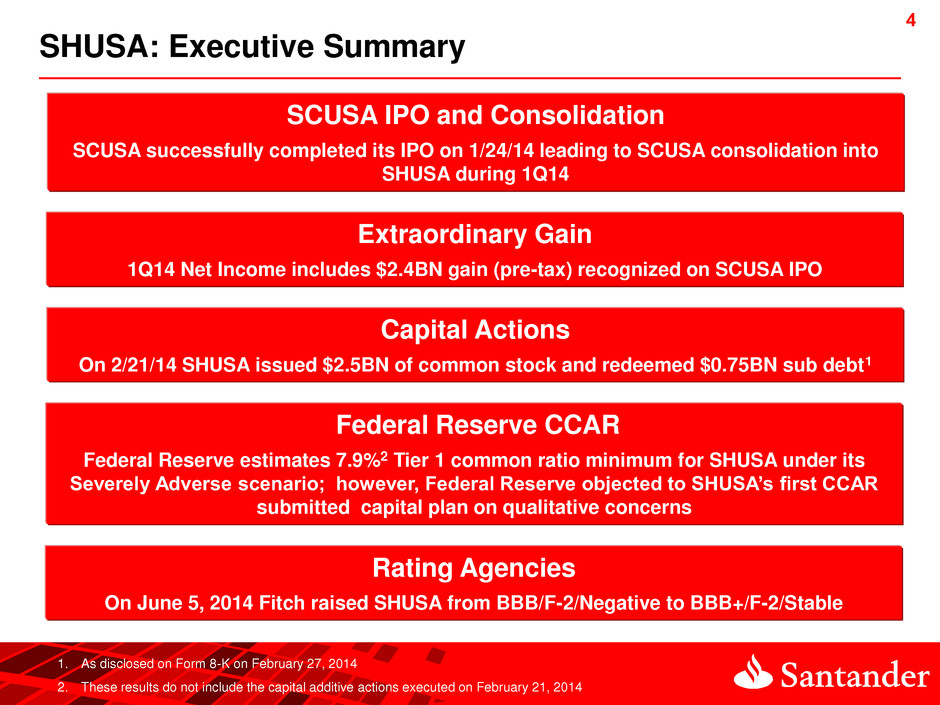

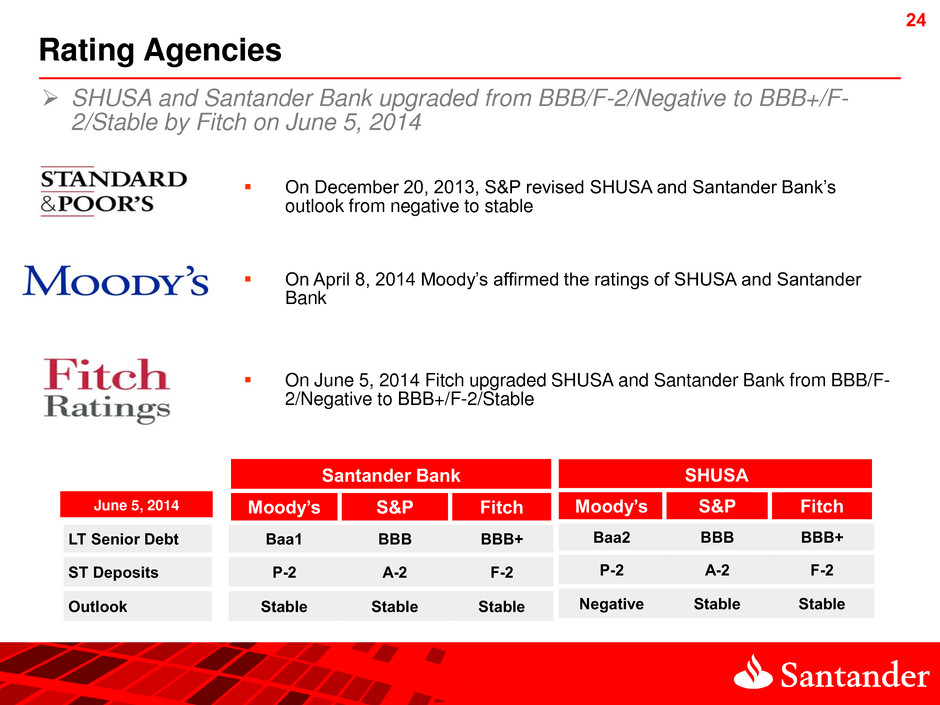

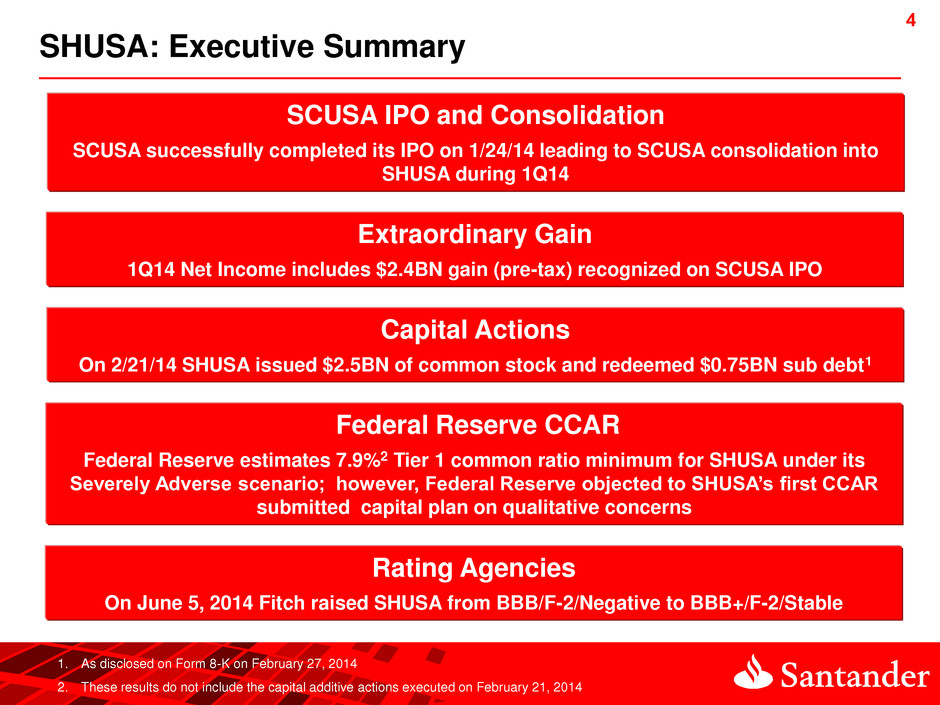

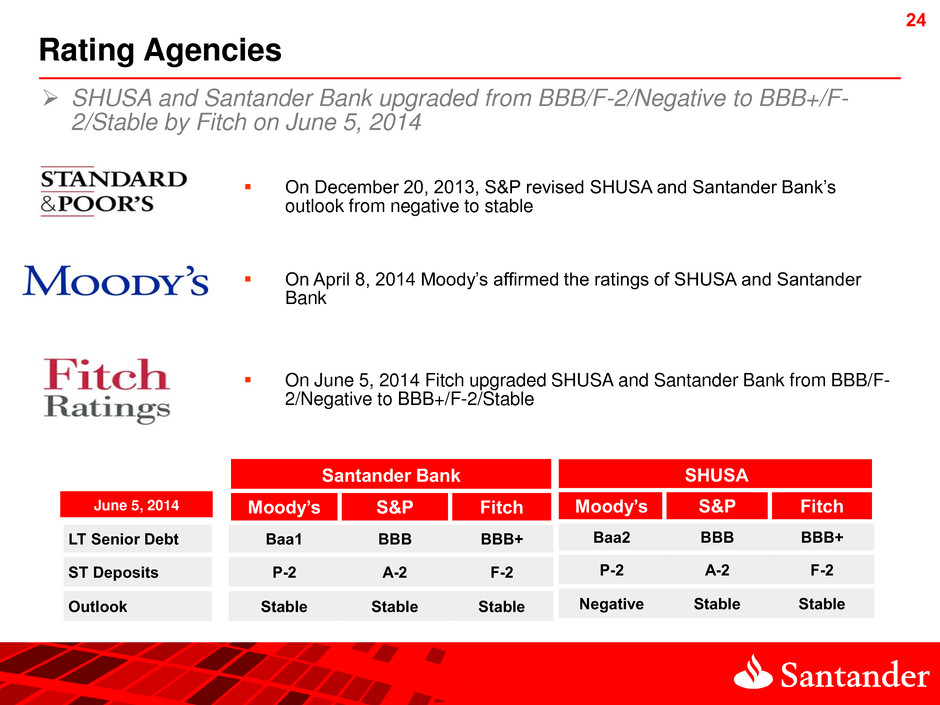

4 4 SHUSA: Executive Summary Extraordinary Gain 1Q14 Net Income includes $2.4BN gain (pre-tax) recognized on SCUSA IPO SCUSA IPO and Consolidation SCUSA successfully completed its IPO on 1/24/14 leading to SCUSA consolidation into SHUSA during 1Q14 Federal Reserve CCAR Federal Reserve estimates 7.9%2 Tier 1 common ratio minimum for SHUSA under its Severely Adverse scenario; however, Federal Reserve objected to SHUSA’s first CCAR submitted capital plan on qualitative concerns 1. As disclosed on Form 8-K on February 27, 2014 2. These results do not include the capital additive actions executed on February 21, 2014 Capital Actions On 2/21/14 SHUSA issued $2.5BN of common stock and redeemed $0.75BN sub debt1 Rating Agencies On June 5, 2014 Fitch raised SHUSA from BBB/F-2/Negative to BBB+/F-2/Stable

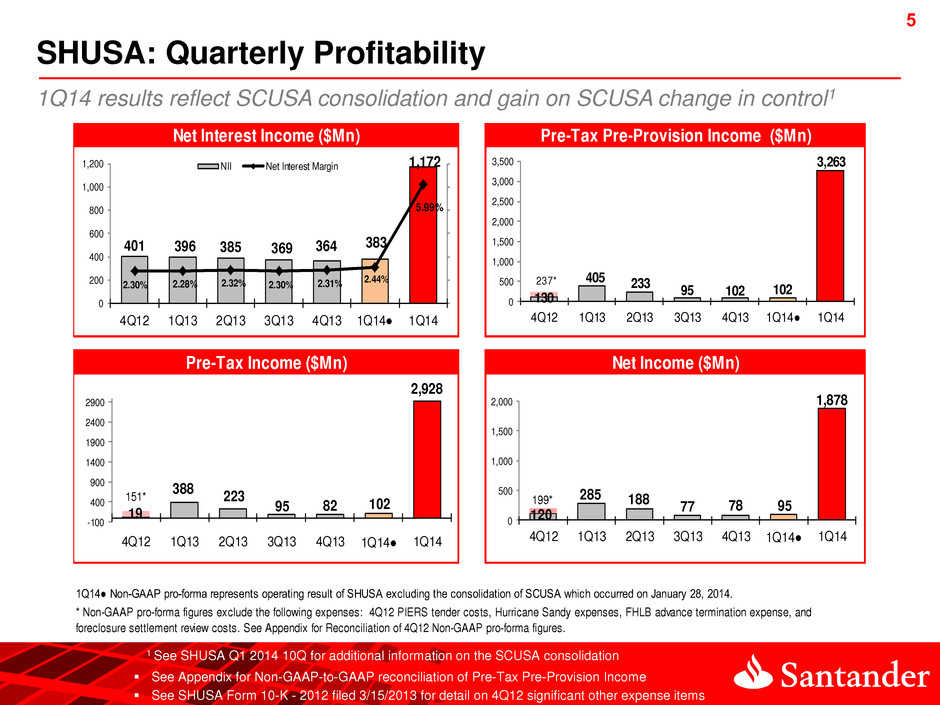

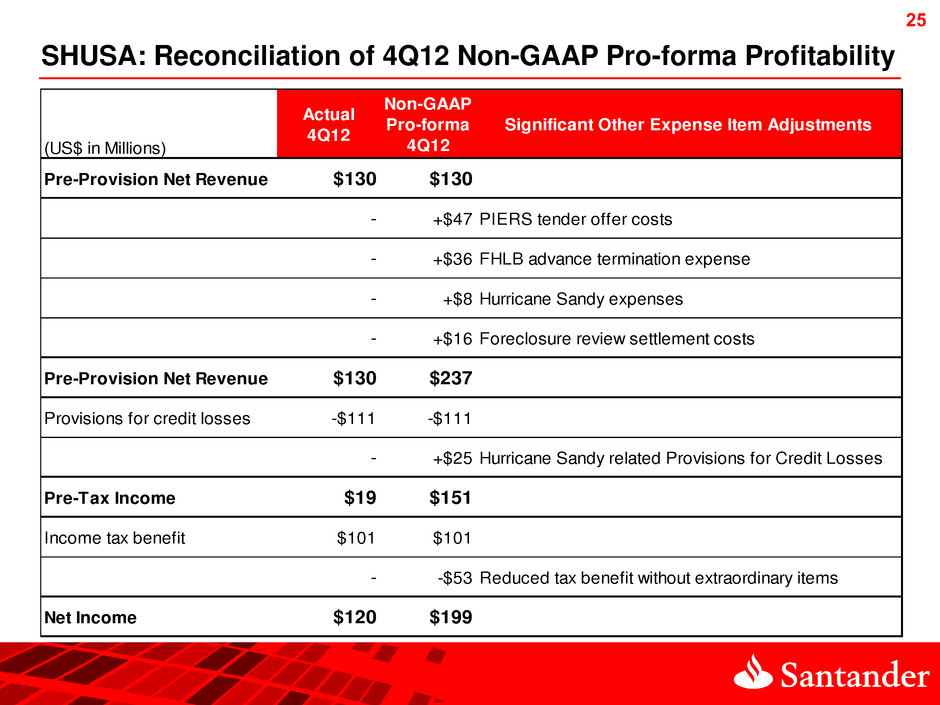

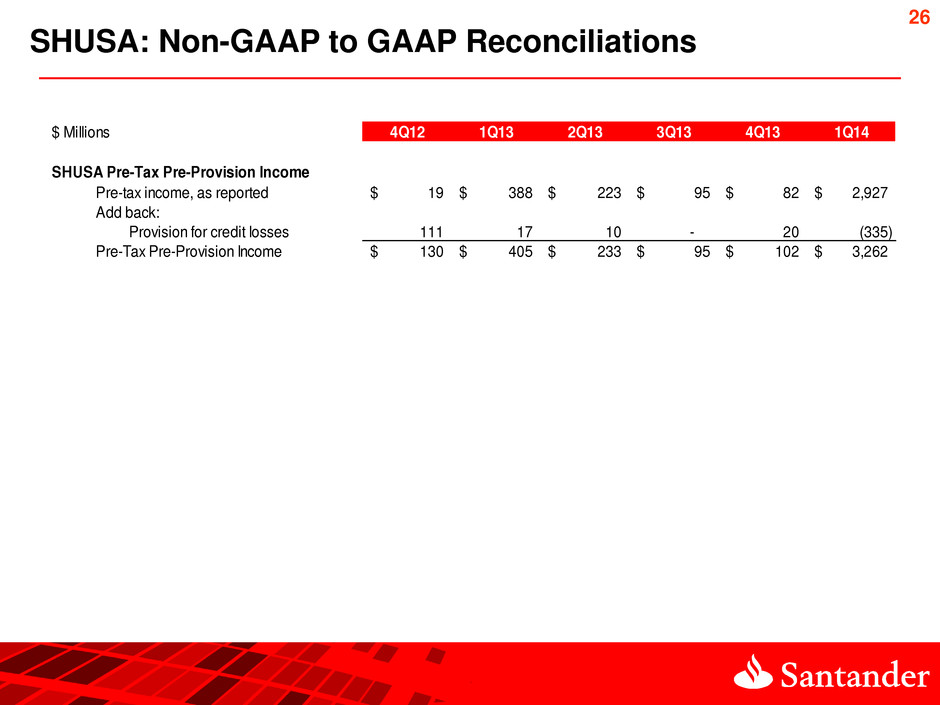

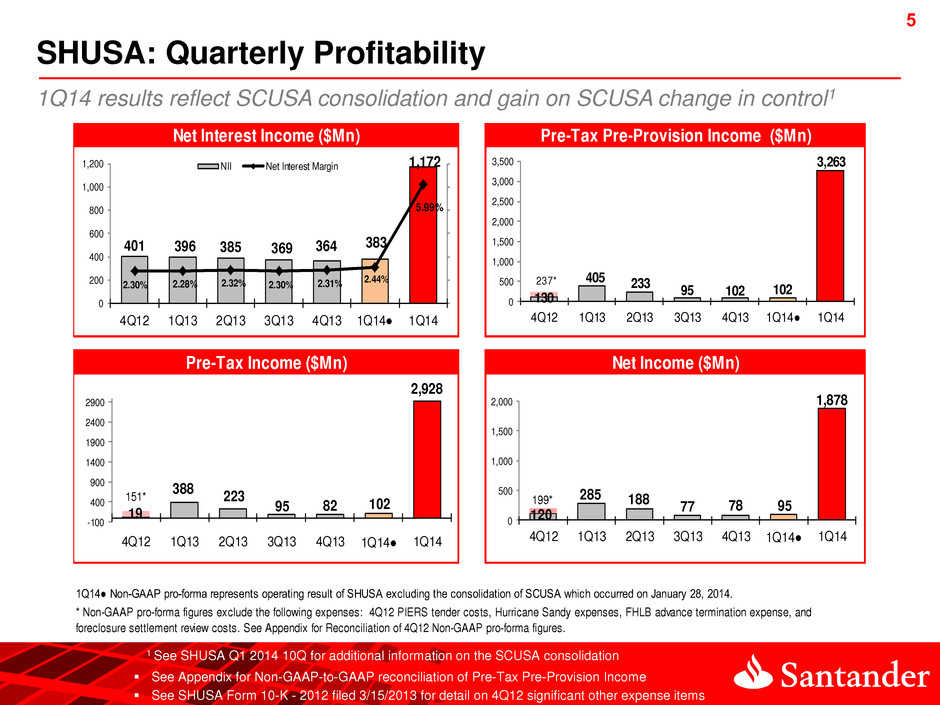

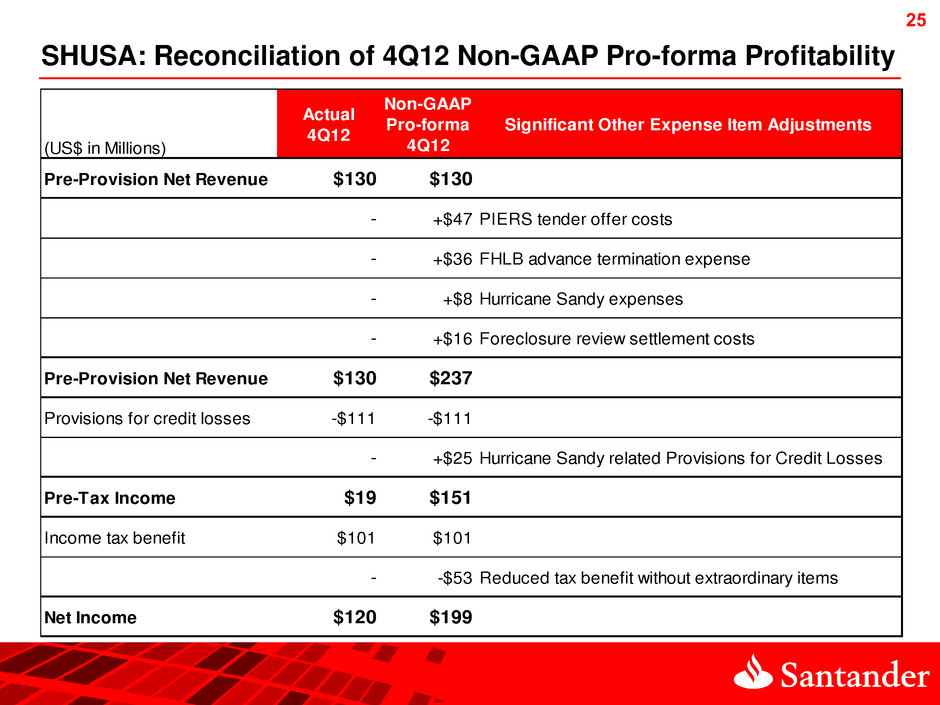

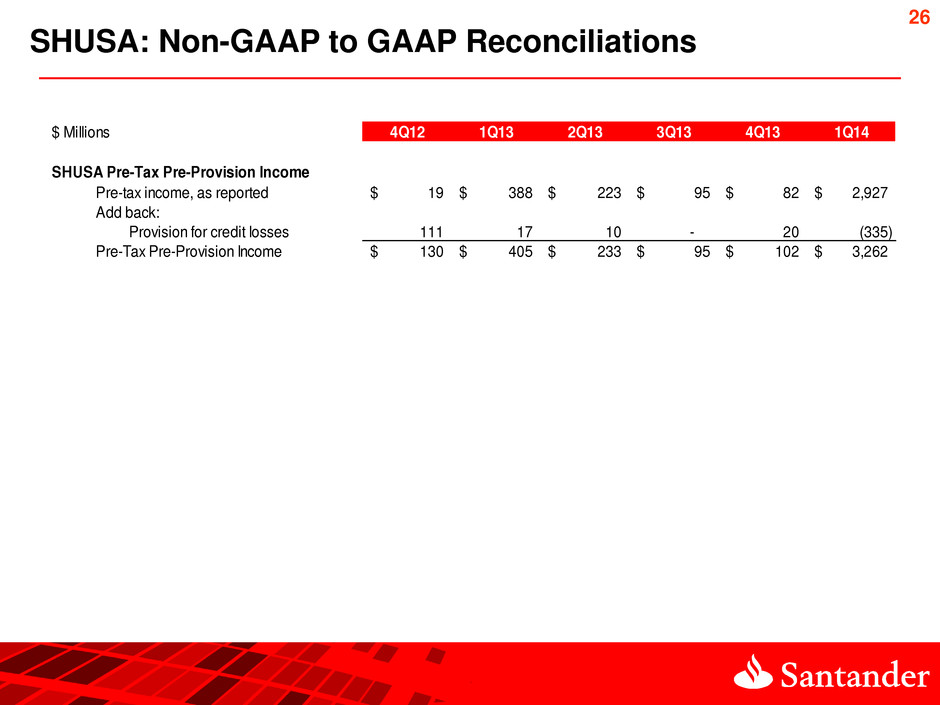

5 5 SHUSA: Quarterly Profitability 2 See Appendix for Non-GAAP-to-GAAP reconciliation of Pre-Tax Pre-Provision Income See SHUSA Form 10-K - 2012 filed 3/15/2013 for detail on 4Q12 significant other expense items 1Q14● Non-GAAP pro-forma represents operating result of SHUSA excluding the consolidation of SCUSA which occurred on January 28, 2014. * Non-GAAP pro-forma figures exclude the following expenses: 4Q12 PIERS tender costs, Hurricane Sandy expenses, FHLB advance termination expense, and foreclosure settlement review costs. See Appendix for Reconciliation of 4Q12 Non-GAAP pro-forma figures. Net Interest Income ($Mn) Pre-Tax Pre-Provision Income ($Mn) Pre-Tax Income ($Mn) Net Income ($Mn) 130 405 233 95 102 102 3,263 237* 0 500 1,000 1,500 2,000 2,500 3,000 3,500 4Q12 1Q13 2Q13 3Q13 4Q13 1Q14● 1Q14 401 396 385 369 364 383 1,172 2.30% 2.28% 2.32% 2.30% 2.31% 2.44% 5.99% 0 200 400 600 800 1,000 1,200 4Q12 1Q13 2Q13 3Q13 4Q13 1Q14● 1Q14 NII Net Interest Margin 19 388 223 95 82 102 2,928 151* -100 400 900 1400 1900 2400 2900 4Q12 1Q13 2Q13 3Q13 4Q13 1Q14● 1Q14 120 285 188 77 78 95 1,878 199* 0 500 1,000 1,500 2,000 4Q12 1Q13 2Q13 3Q13 4Q13 1Q14● 1Q14 1Q14 results reflect SCUSA consolidation and gain on SCUSA change in control1 1 See SHUSA Q1 2014 10Q for additional information on the SCUSA consolidation

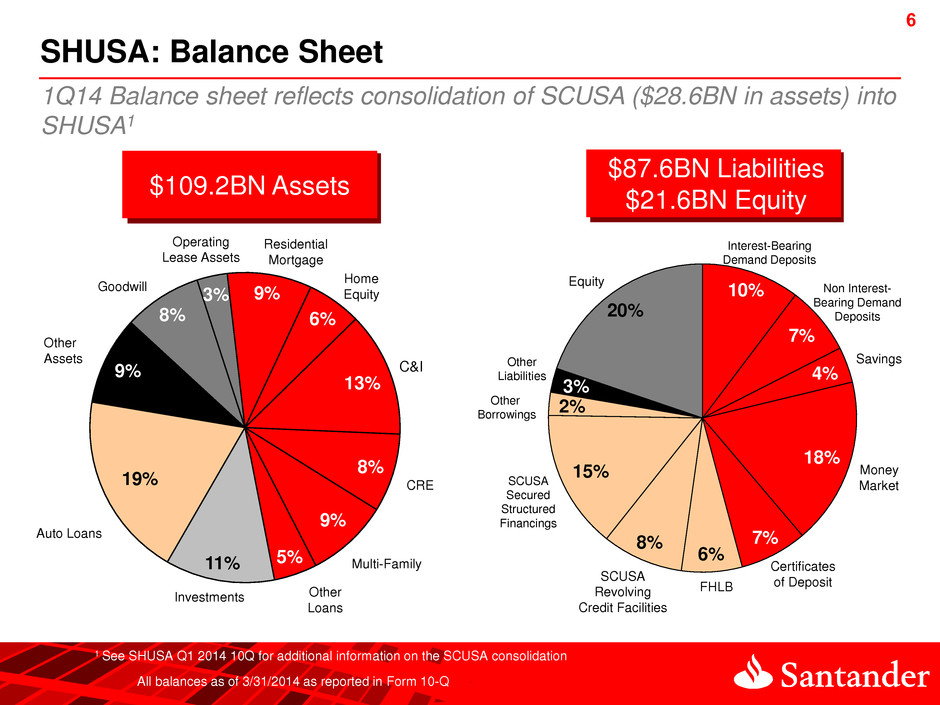

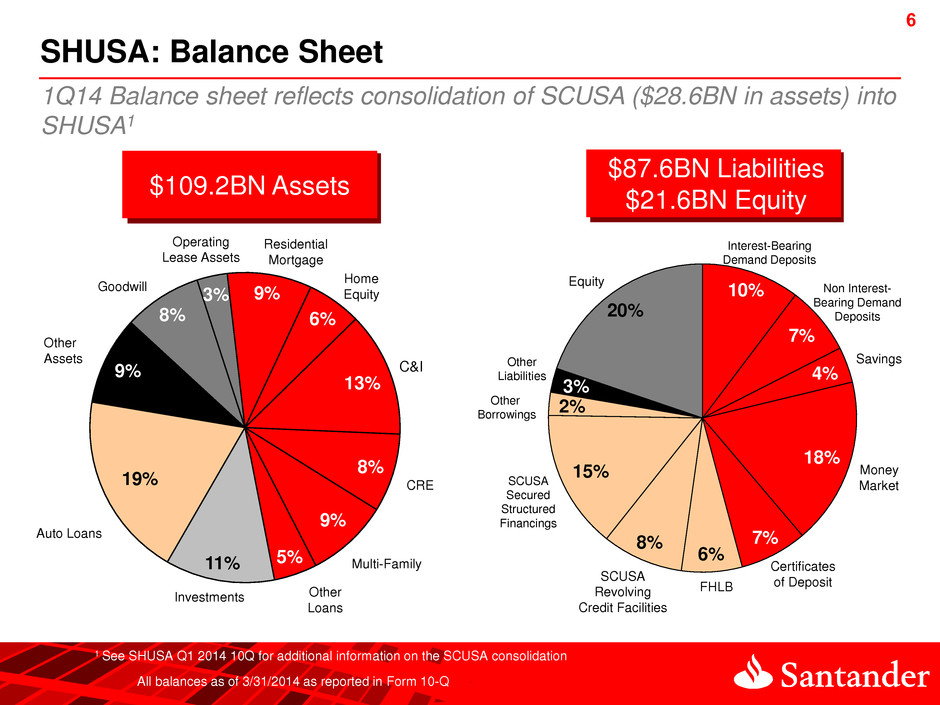

6 6 10% 7% 4% 18% 7% 6% 8% 15% 2% 3% 20% SHUSA: Balance Sheet 19% 9% 8% 3% 9% 6% 13% 8% 9% 5% 11% Investments Non Interest- Bearing Demand Deposits Auto Loans C&I CRE Residential Mortgage Other Loans Operating Lease Assets Goodwill Home Equity Multi-Family $109.2BN Assets $87.6BN Liabilities $21.6BN Equity Interest-Bearing Demand Deposits SCUSA Secured Structured Financings Equity Other Liabilities FHLB Money Market Certificates of Deposit Savings All balances as of 3/31/2014 as reported in Form 10-Q SCUSA Revolving Credit Facilities Other Borrowings Other Assets 1Q14 Balance sheet reflects consolidation of SCUSA ($28.6BN in assets) into SHUSA1 1 See SHUSA Q1 2014 10Q for additional information on the SCUSA consolidation

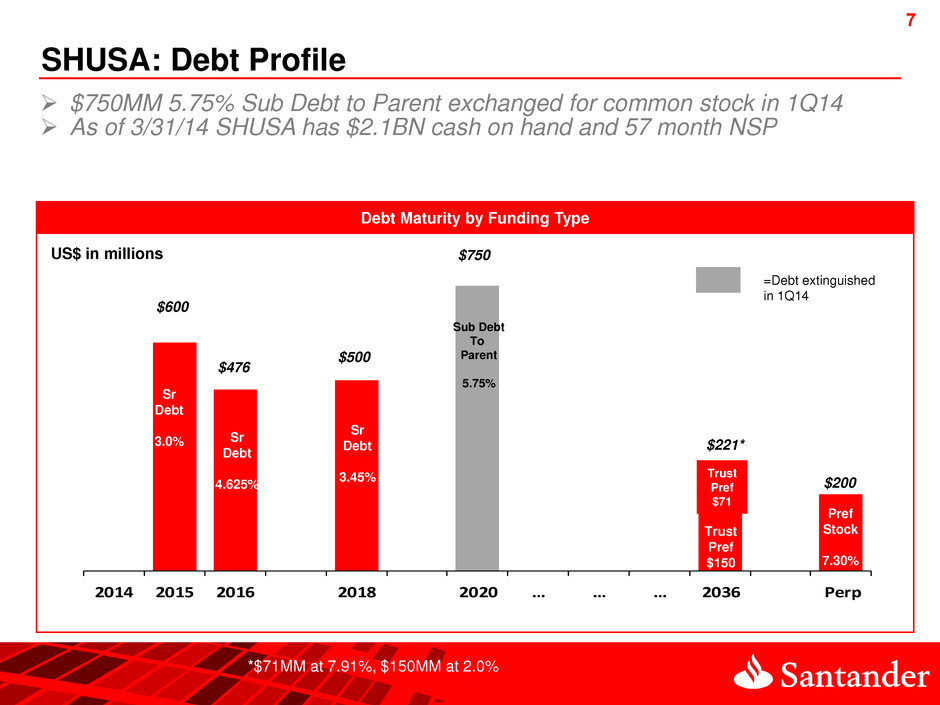

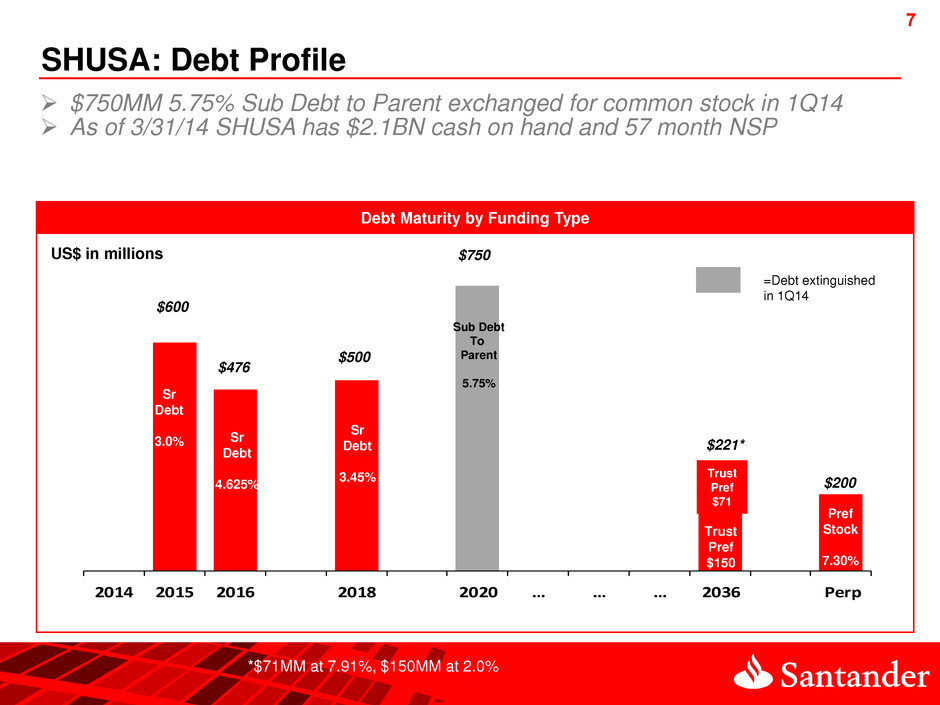

7 7 Debt Maturity by Funding Type 2014 2015 2016 2018 2020 … … … 2036 Perp SHUSA: Debt Profile Sub Debt To Parent 5.75% Trust Pref $150 Pref Stock 7.30% Sr Debt 4.625% Trust Pref $71 $221* $750 $476 $200 US$ in millions $600 Sr Debt 3.0% Sr Debt 3.45% $500 $750MM 5.75% Sub Debt to Parent exchanged for common stock in 1Q14 As of 3/31/14 SHUSA has $2.1BN cash on hand and 57 month NSP *$71MM at 7.91%, $150MM at 2.0% =Debt extinguished in 1Q14

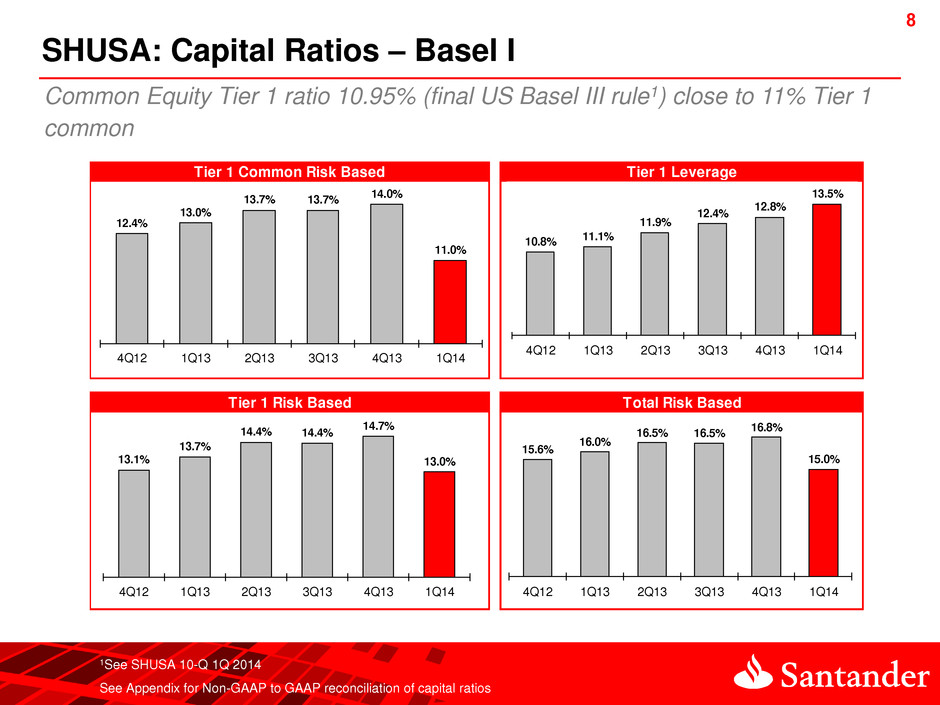

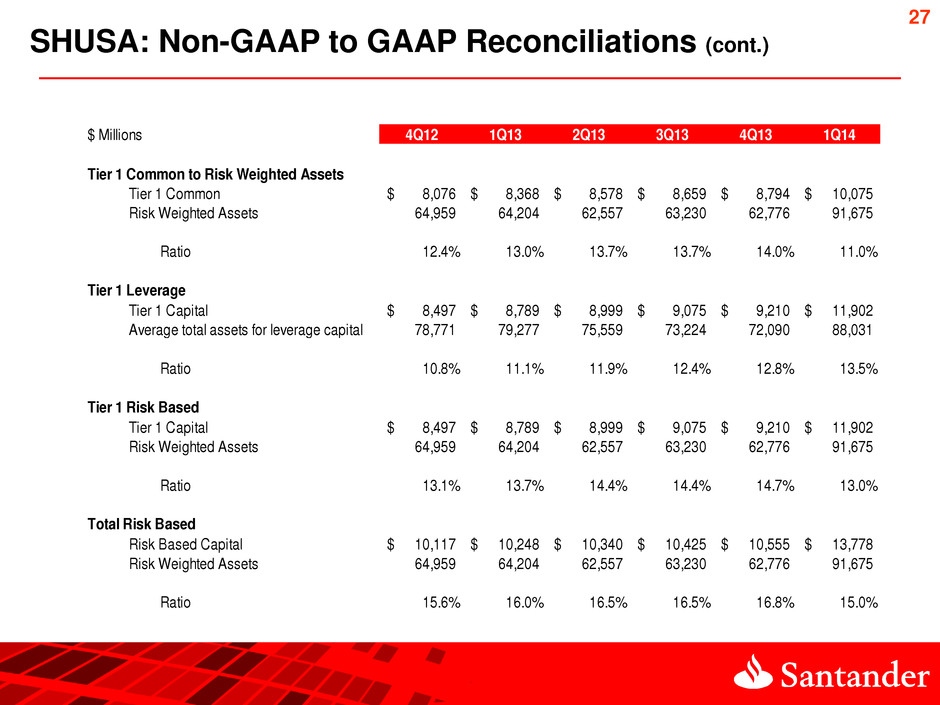

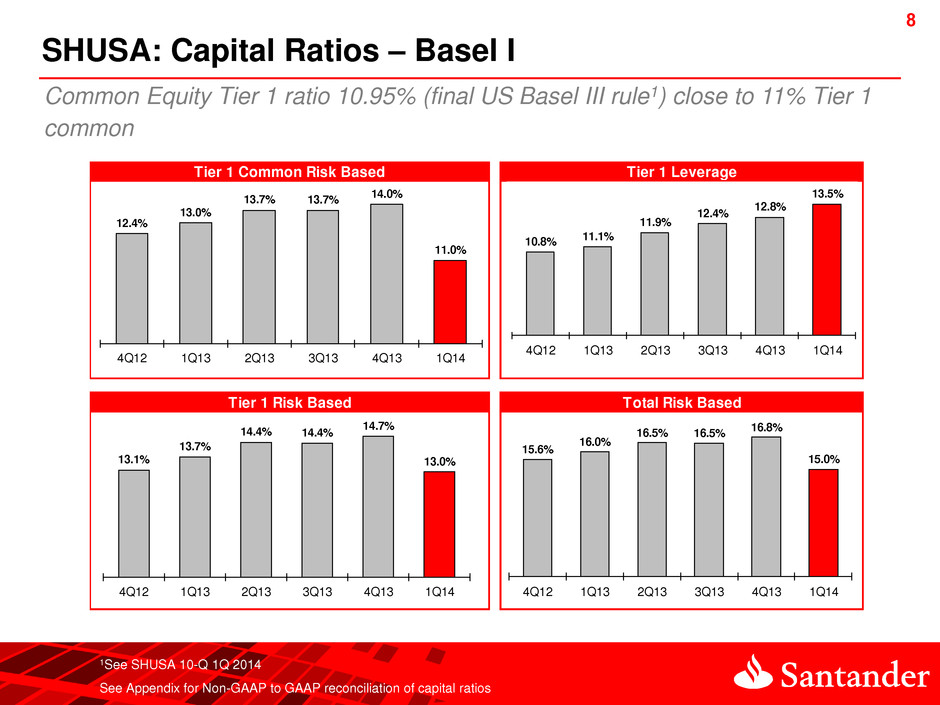

8 8 SHUSA: Capital Ratios – Basel I 1See SHUSA 10-Q 1Q 2014 See Appendix for Non-GAAP to GAAP reconciliation of capital ratios Common Equity Tier 1 ratio 10.95% (final US Basel III rule1) close to 11% Tier 1 common Total Risk Based Tier 1 Common Risk Based Tier 1 Leverage Tier 1 Risk Based 12.4% 13.0% 13.7% 13.7% 14.0% 11.0% 4Q12 1Q13 2Q13 3Q13 4Q13 1Q14 10.8% 11.1% 11.9% 12.4% 12.8% 13.5% 4Q12 1Q13 2Q13 3Q13 4Q13 1Q14 13.1% 13.7% 14.4% 14.4% 14.7% 13.0% 4Q12 1Q13 2Q13 3Q13 4Q13 1Q14 15.6% 16.0% 16.5% 16.5% 16.8% 15.0% 4Q12 1Q13 2Q13 3Q13 4Q13 1Q14

9 9 SHUSA: Capital Ratios – 1Q14 vs 4Q13 1Q14 ratios reflect consolidation of SCUSA and issuance of $2.5BN common stock Tier 1 Common Risk Based Tier 1 Risk Based

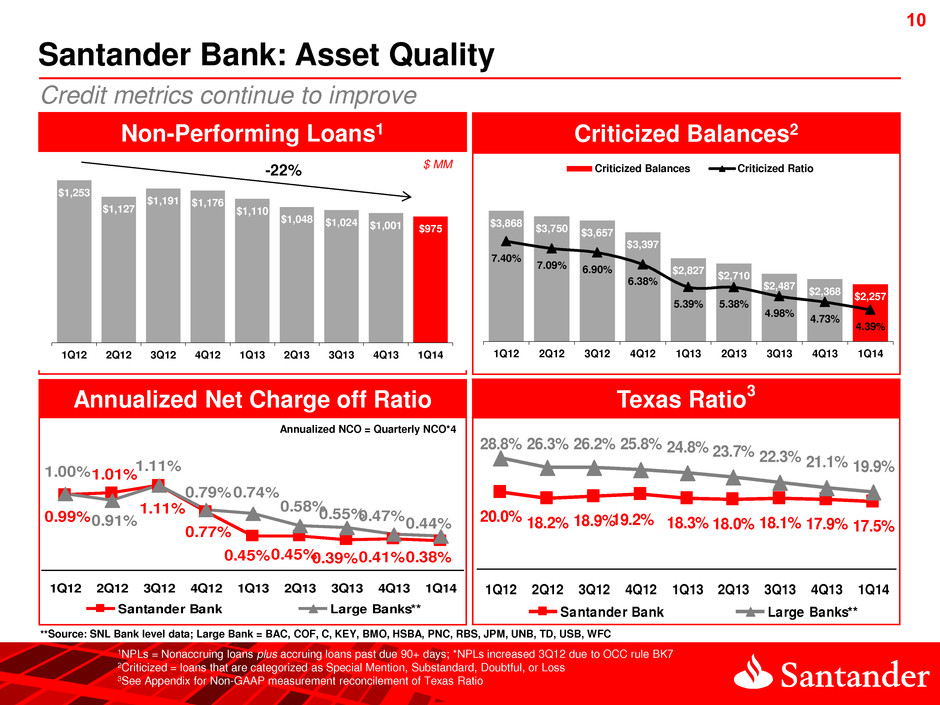

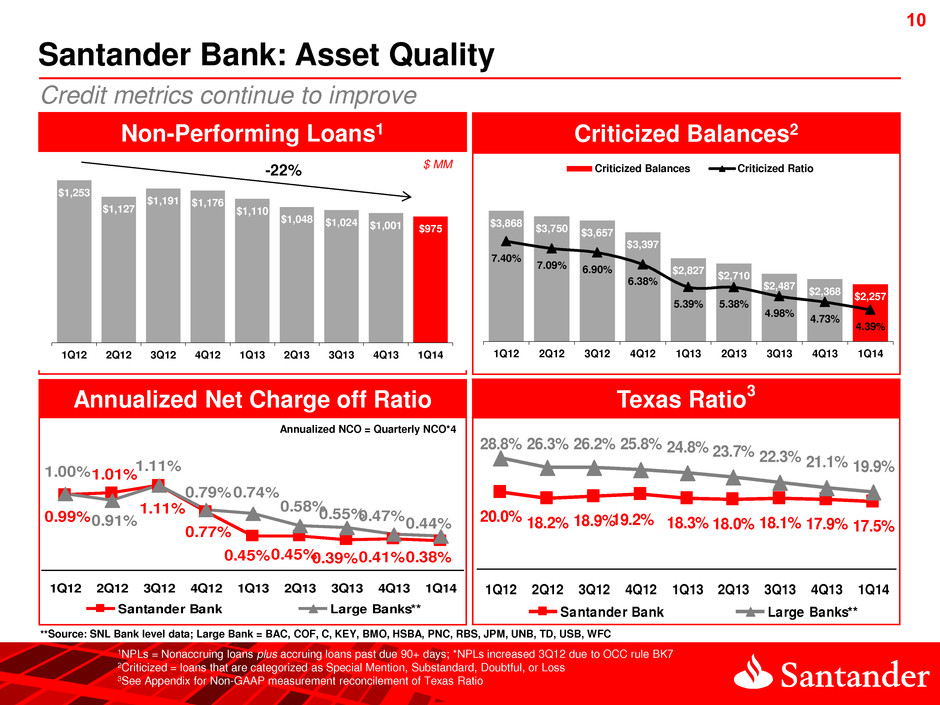

10 10 Non-Performing Loans1 $1,253 $1,127 $1,191 $1,176 $1,110 $1,048 $1,024 $1,001 $975 1Q12 2Q12 3Q12 4Q12 1Q13 2Q13 3Q13 4Q13 1Q14 Texas Ratio3 Annualized Net Charge off Ratio 0.99% 0.39%0.41%0.45%0.45% 0.77% 1.11% 1.01% 0.38% 0.55% 0.58% 0.74%0.79% 1.11% 0.91% 1.00% 0.47% 0.44% 1Q12 2Q12 3Q12 4Q12 1Q13 2Q13 3Q13 4Q13 1Q14 Santander Bank Large Banks** Santander Bank: Asset Quality $ MM -22% Credit metrics continue to improve $ MM Annualized NCO = Quarterly NCO*4 **Source: SNL Bank level data; Large Bank = BAC, COF, C, KEY, BMO, HSBA, PNC, RBS, JPM, UNB, TD, USB, WFC 1NPLs = Nonaccruing loans plus accruing loans past due 90+ days; *NPLs increased 3Q12 due to OCC rule BK7 2Criticized = loans that are categorized as Special Mention, Substandard, Doubtful, or Loss 3See Appendix for Non-GAAP measurement reconcilement of Texas Ratio 22.3% 21.1% 19.9% 17.5%18.2 18.9%19.2% 18.3% 18.0% 17.9%18.1% 20.0% 23.7%28.8 26.3% 26.2% 25.8% 24.8% 1Q12 2Q12 3Q12 4 12 1 13 2 13 3 13 4Q13 1Q14 Santander Bank Large Banks** $3,868 $3,750 $3,657 $3,397 $2,827 $2,710 $2,487 $2,368 $2,257 7.40% 7.09% 6.90% 6.38% 5.39% 5.38% 4.98% 4.73% 4.39% Q12 2Q 2 3Q12 4Q12 1Q13 2Q13 3Q13 4Q13 1Q14 Criticized Balances Criticized Ratio Criticized Balances2

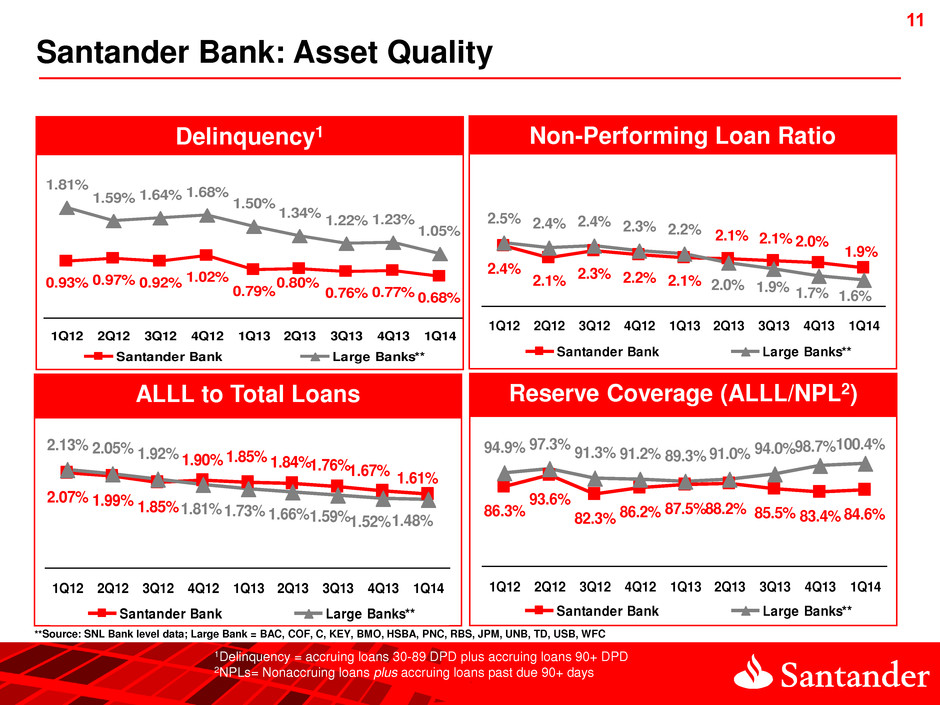

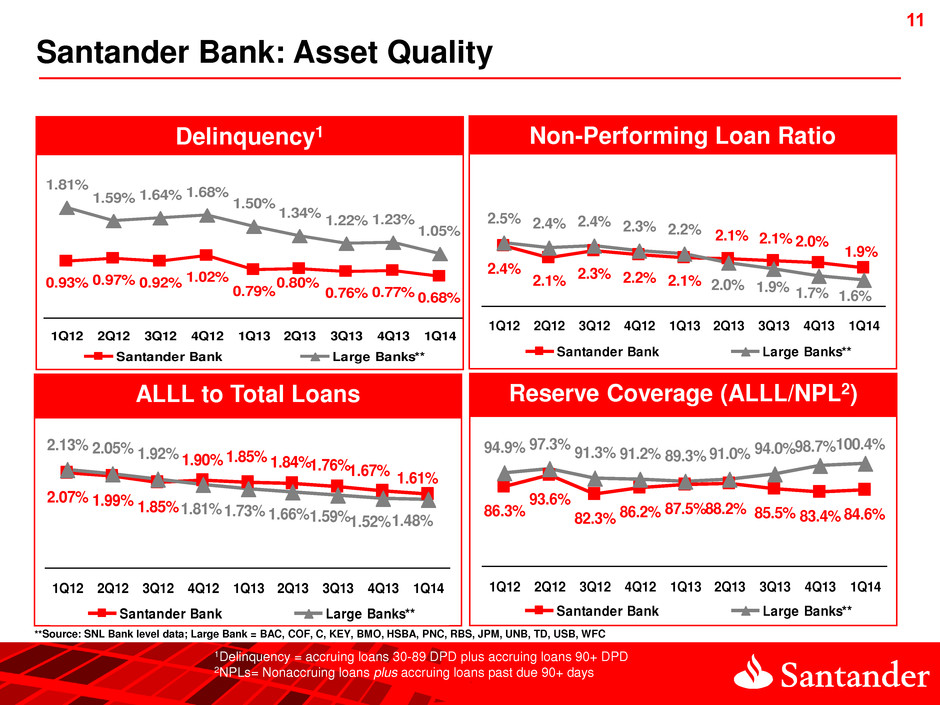

11 11 Delinquency1 Reserve Coverage (ALLL/NPL2) 86.3% 85.5% 83.4%88.2%87.5%86.2%82.3% 93.6% 84.6% 94.0%91.0%89.3%91.2%91.3% 97.3%94.9% 98.7%100.4% 1Q12 2Q12 3Q12 4Q12 1Q13 2Q13 3Q13 4Q13 1Q14 Santander Bank Large Banks** Non-Performing Loan Ratio Santander Bank: Asset Quality 1.9% 2.1% 2.3% 2.2% 2.1% 2.1% 2.0%2.1% 2.4% 1.6%1.7% 2.5% 2.4% 2.4% 2.3% 2.2% 2.0% 1.9% 1Q12 2Q12 3Q12 4Q12 1Q13 2Q13 3Q13 4Q13 1Q14 Santander Bank Large Banks** **Source: SNL Bank level data; Large Bank = BAC, COF, C, KEY, BMO, HSBA, PNC, RBS, JPM, UNB, TD, USB, WFC ALLL to Total Loans 2.07% 1.76%1.67% 1.84%1.85%1.90% 1.85%1.99% 1.61% 1.59%1.66%1.73%1.81% 1. 2%2.05% 2.13% 1.52%1.48% 1Q12 2Q12 3Q12 4Q12 1Q13 2Q13 3Q13 4Q13 1Q14 Santander Bank Large Banks** 1Delinquency = accruing loans 30-89 DPD plus accruing loans 90+ DPD 2NPLs= Nonaccruing loans plus accruing loans past due 90+ days 0.93% 0.76 0.77% 0.80 0.79% 1.02%0.92%0.97% 0.68% 1.22% 1.34% 1.50% 1.68%1.64%1.59% 1.81% 1.23% 1.05% 1Q12 2Q12 3Q12 4Q12 1Q13 2 13 3 13 4 13 1 14 Santander Bank Large Banks**

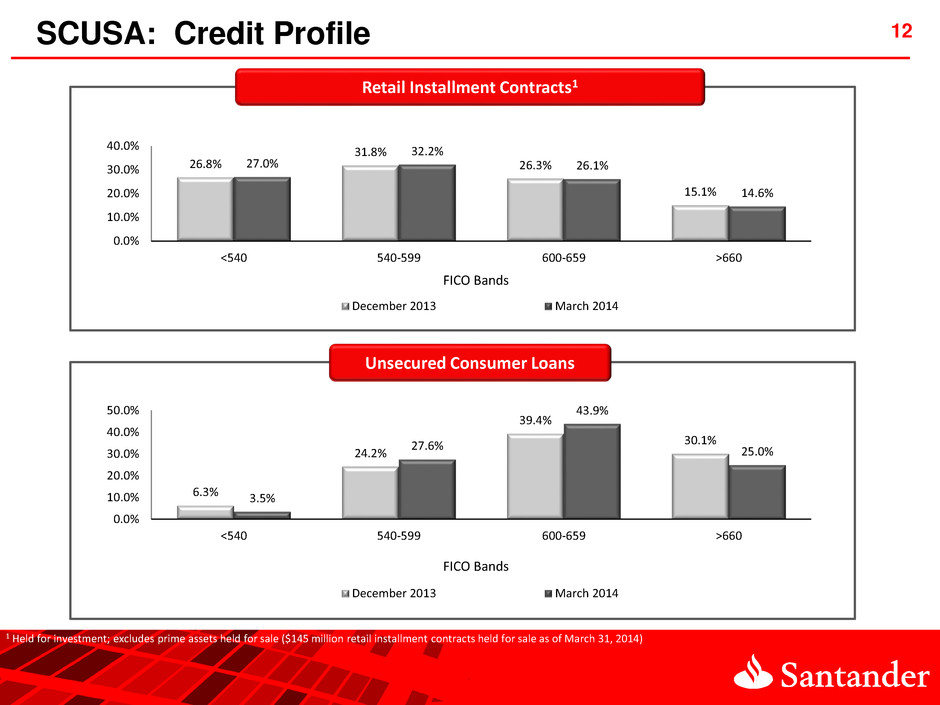

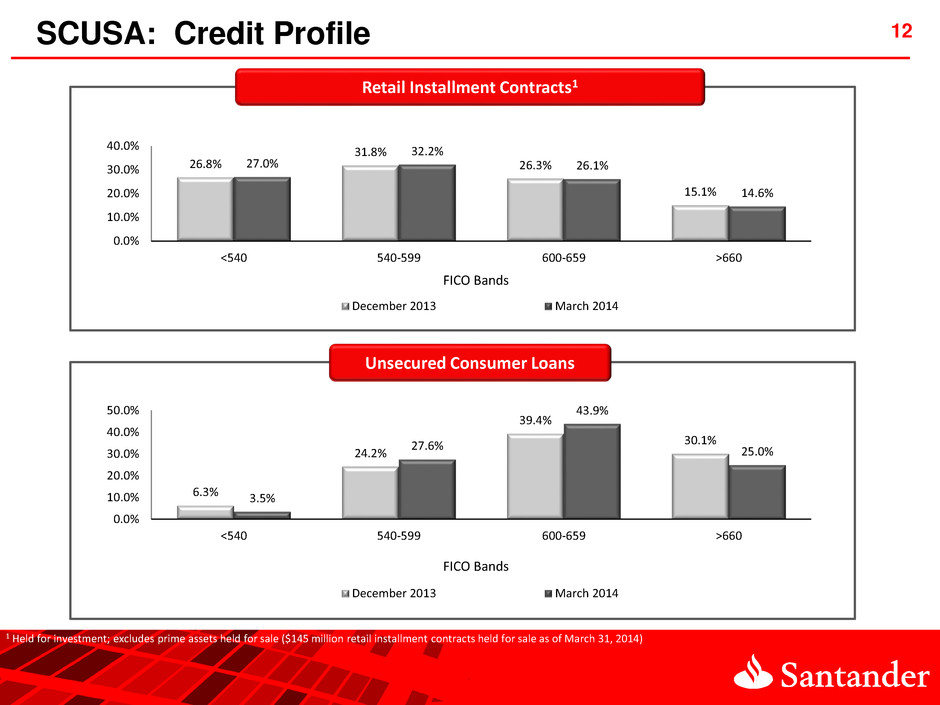

12 26.8% 31.8% 26.3% 15.1% 27.0% 32.2% 26.1% 14.6% 0.0% 10.0% 20.0% 30.0% 40.0% <540 540-599 600-659 >660 December 2013 March 2014 Retail Installment Contracts1 FICO Bands Unsecured Consumer Loans 6.3% 24.2% 39.4% 30.1% 3.5% 27.6% 43.9% 25.0% 0.0% 10.0% 20.0% 30.0% 40.0% 50.0% <540 540-599 600-659 >660 December 2013 March 2014 FICO Bands 1 Held for investment; excludes prime assets held for sale ($145 million retail installment contracts held for sale as of March 31, 2014) SCUSA: Credit Profile

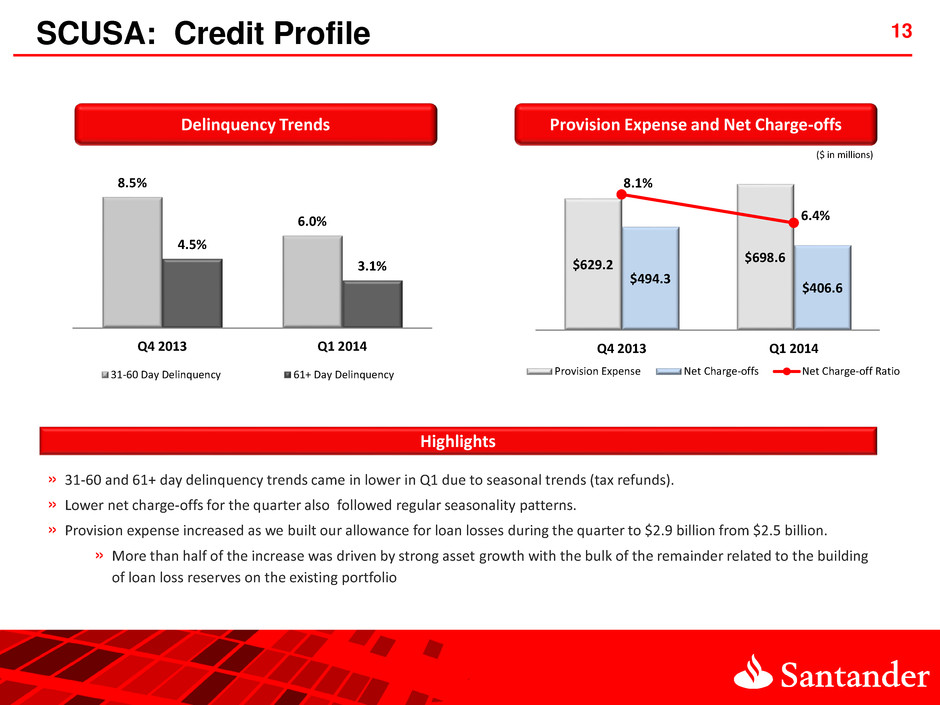

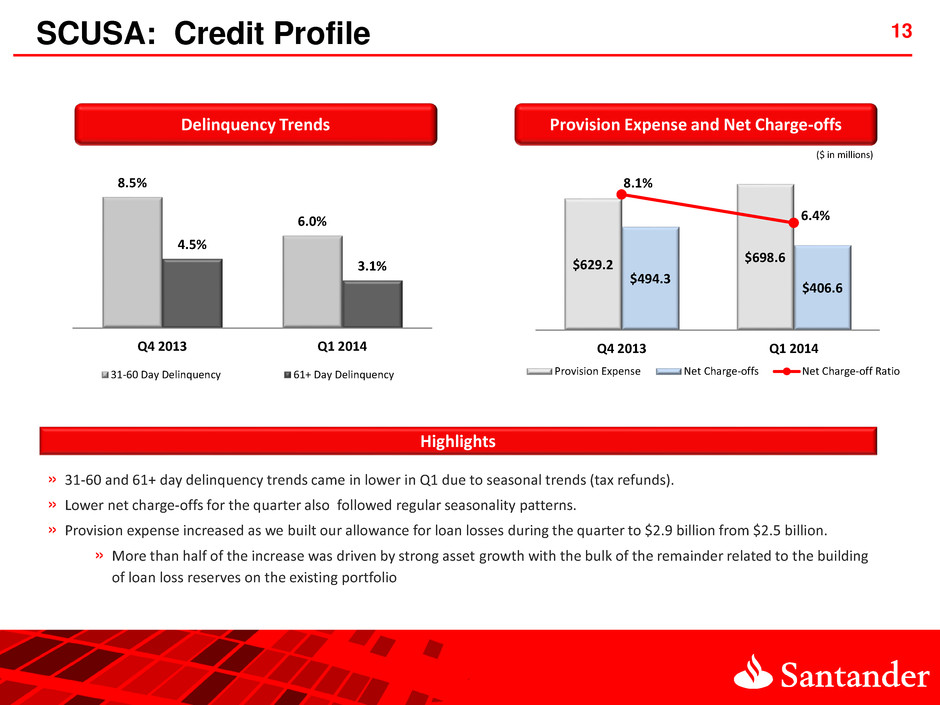

8.5% 6.0% 4.5% 3.1% Q4 2013 Q1 2014 31-60 Day Delinquency 61+ Day Delinquency $629.2 $698.6 $494.3 $406.6 8.1% 6.4% Q4 2013 Q1 2014 Provision Expense Net Charge-offs Net Charge-off Ratio 13 ($ in millions) » 31-60 and 61+ day delinquency trends came in lower in Q1 due to seasonal trends (tax refunds). » Lower net charge-offs for the quarter also followed regular seasonality patterns. » Provision expense increased as we built our allowance for loan losses during the quarter to $2.9 billion from $2.5 billion. » More than half of the increase was driven by strong asset growth with the bulk of the remainder related to the building of loan loss reserves on the existing portfolio Highlights Delinquency Trends Provision Expense and Net Charge-offs SCUSA: Credit Profile

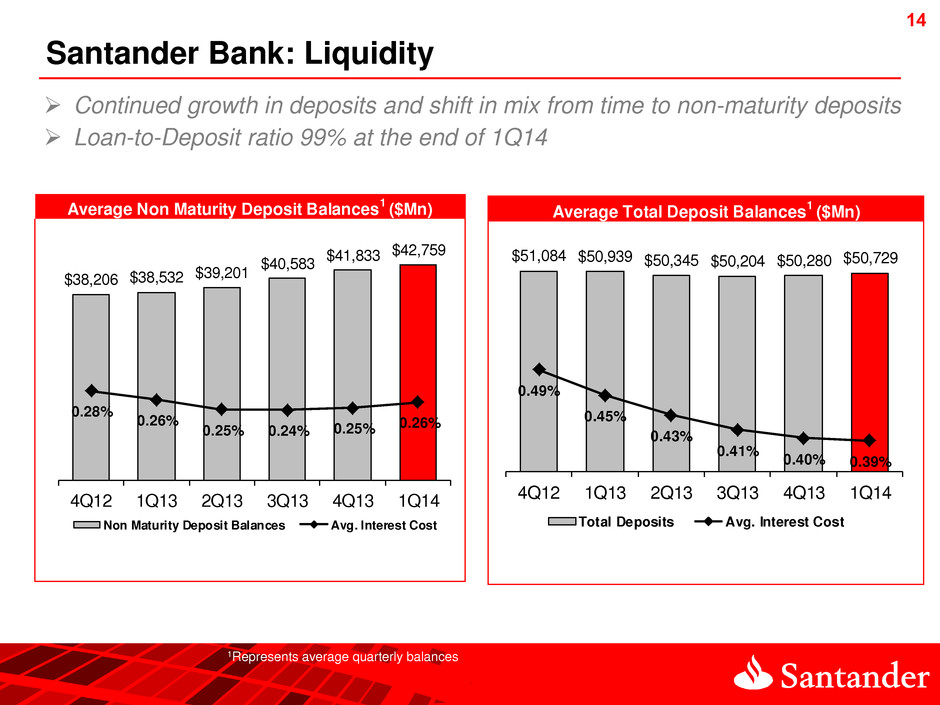

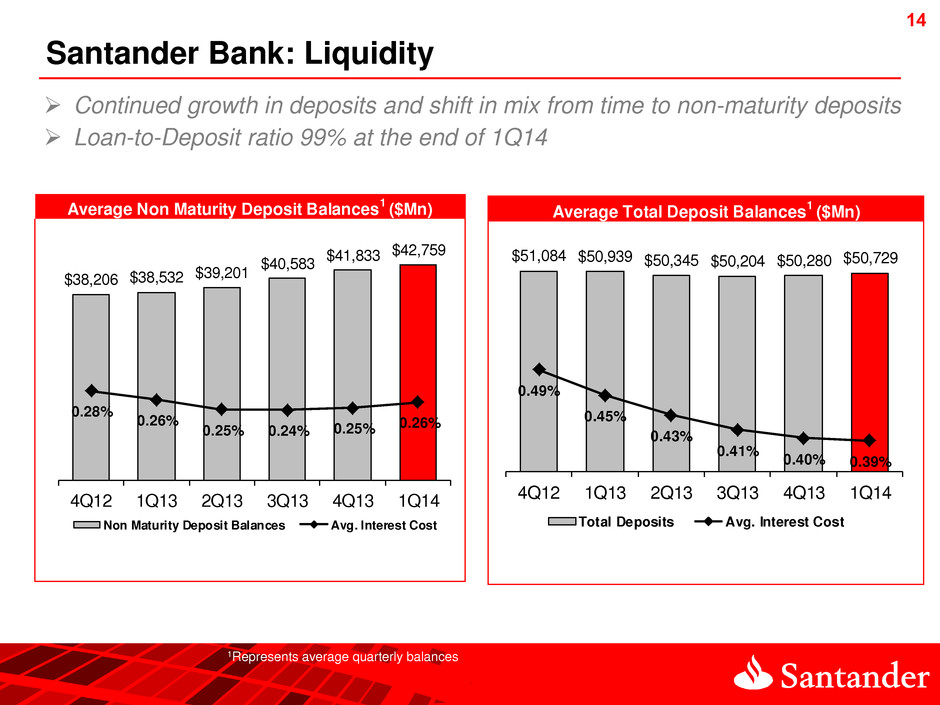

14 14 Santander Bank: Liquidity 1Represents average quarterly balances Continued growth in deposits and shift in mix from time to non-maturity deposits Loan-to-Deposit ratio 99% at the end of 1Q14 Average Non Maturity Deposit Balances 1 ($Mn) $38,206 $38,532 $39,201 $40,583 $41,833 $42,759 0.28% 0.26% 0.25% 0.24% 0.25% 0.26% 4Q12 1Q13 2Q13 3Q13 4Q13 1Q14 Non Maturity Deposit Balances Avg. Interest Cost Average Total Deposit Balances 1 ($Mn) $51,084 $50,939 $50,345 $50,204 $50,280 $50,729 0.49% 0.45% 0.43% 0.41% 0.40% 0.39% 4Q12 1Q13 2Q13 3Q13 4Q13 1Q14 Total Deposits Avg. Interest Cost

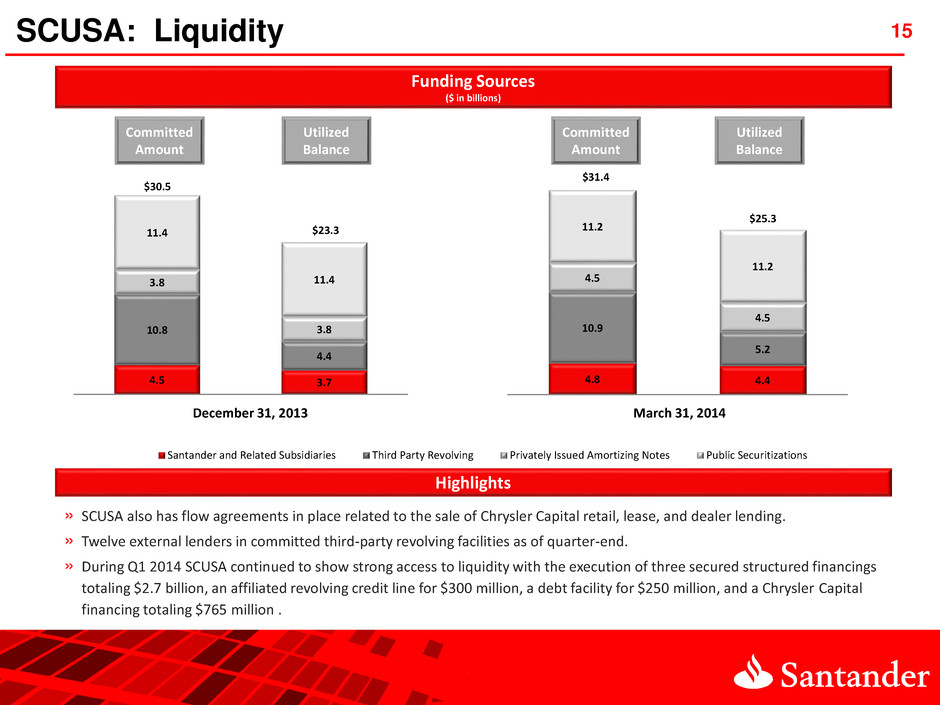

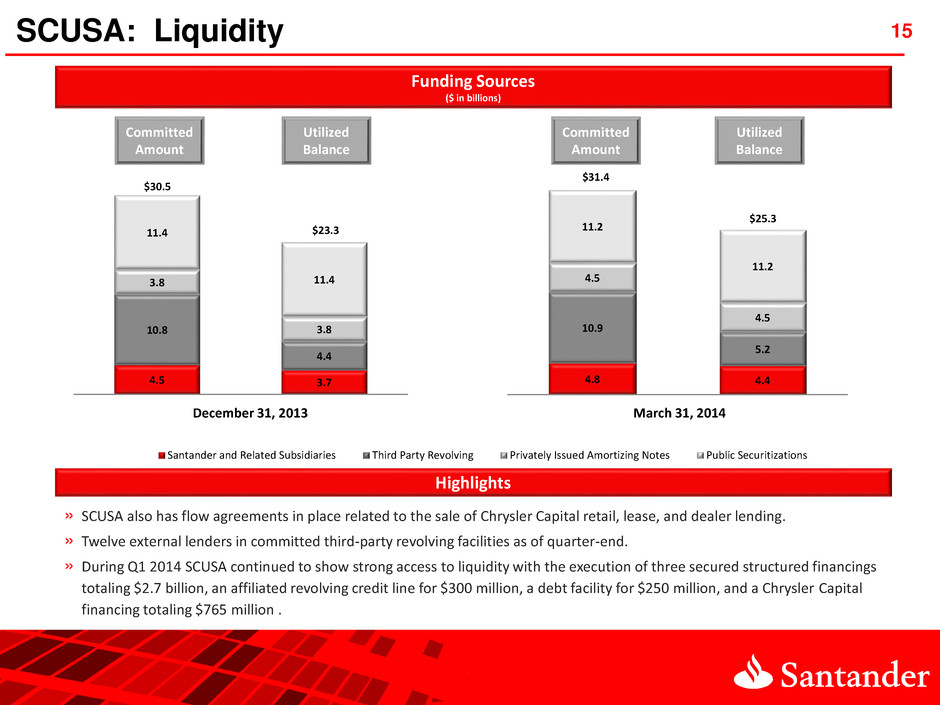

Funding Sources ($ in billions) » SCUSA also has flow agreements in place related to the sale of Chrysler Capital retail, lease, and dealer lending. » Twelve external lenders in committed third-party revolving facilities as of quarter-end. » During Q1 2014 SCUSA continued to show strong access to liquidity with the execution of three secured structured financings totaling $2.7 billion, an affiliated revolving credit line for $300 million, a debt facility for $250 million, and a Chrysler Capital financing totaling $765 million . Highlights 15 4.8 4.4 10.9 5.2 4.5 4.5 11.2 11.2 Santander and Related Subsidiaries Third Party Revolving Privately Issued Amortizing Notes Public Securitizations 4.5 3.7 10.8 4.4 3.8 3.8 11.4 11.4 $23.3 $30.5 Committed Amount Utilized Balance Committed Amount Utilized Balance December 31, 2013 March 31, 2014 $31.4 $25.3 SCUSA: Liquidity

Appendix

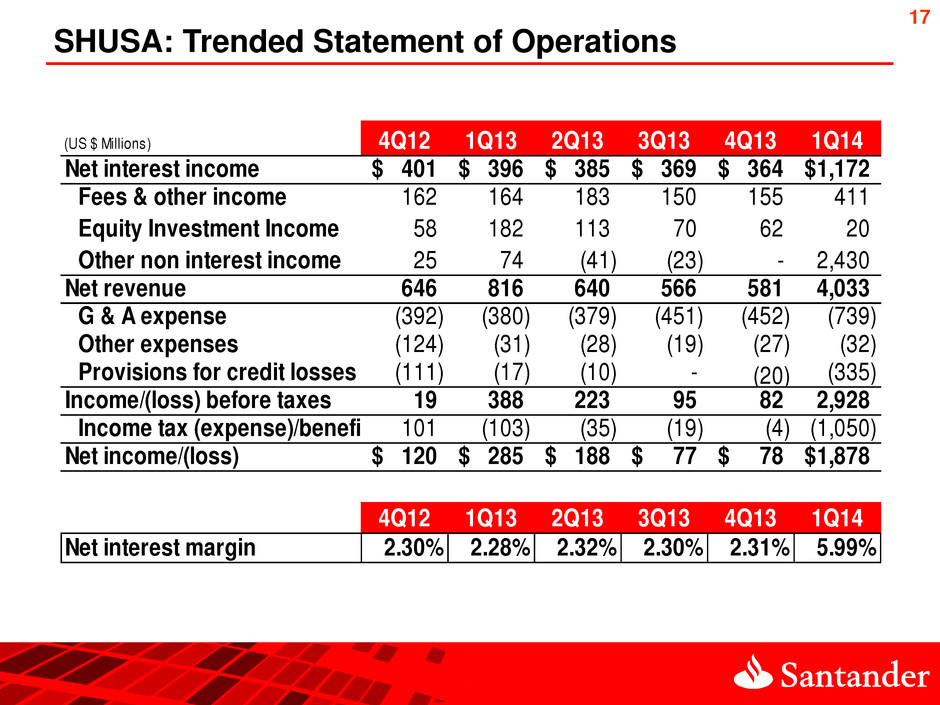

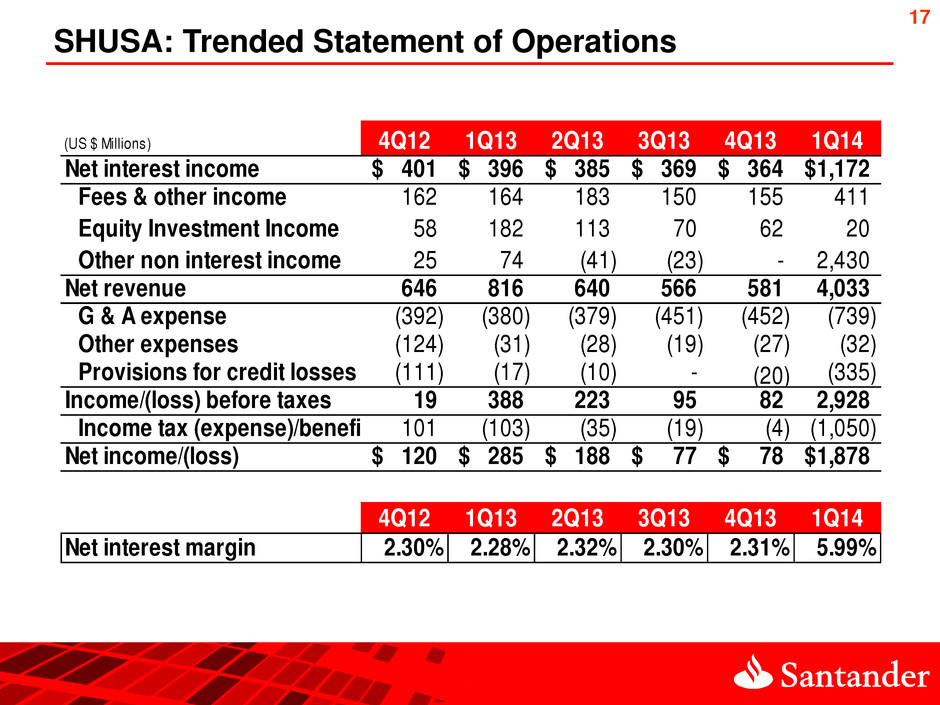

17 SHUSA: Trended Statement of Operations (US $ Millions) 4Q12 1Q13 2Q13 3Q13 4Q13 1Q14 Net interest income 401$ 396$ 385$ 369$ 364$ 1,172$ Fees & other income 162 164 183 150 155 411 Equity Investment Income 58 182 113 70 62 20 Other non interest income 25 74 (41) (23) - 2,430 Net revenue 646 816 640 566 581 4,033 G & A expense (392) (380) (379) (451) (452) (739) Other expenses (124) (31) (28) (19) (27) (32) Provisions for credit losses (111) (17) (10) - (20) (335) Income/(loss) before taxes 19 388 223 95 82 2,928 Income tax (expense)/benefit 101 (103) (35) (19) (4) (1,050) Net income/(loss) 120$ 285$ 188$ 77$ 78$ 1,878$ 4Q12 1Q13 2Q13 3Q13 4Q13 1Q14 Net interest margin 2.30% 2.28% 2.32% 2.30% 2.31% 5.99%

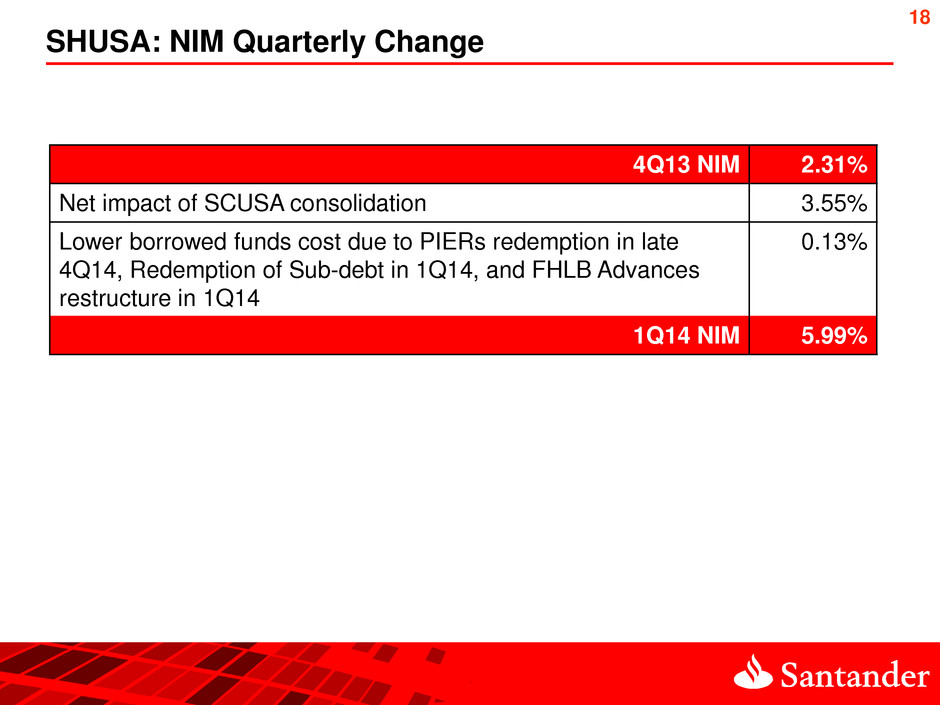

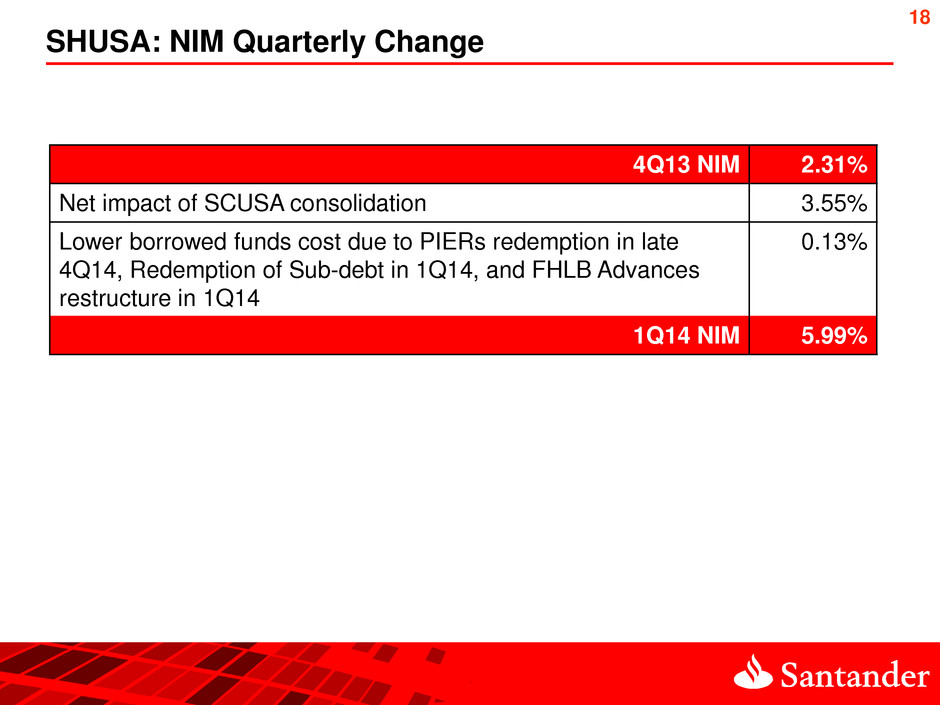

18 SHUSA: NIM Quarterly Change 4Q13 NIM 2.31% Net impact of SCUSA consolidation 3.55% Lower borrowed funds cost due to PIERs redemption in late 4Q14, Redemption of Sub-debt in 1Q14, and FHLB Advances restructure in 1Q14 0.13% 1Q14 NIM 5.99%

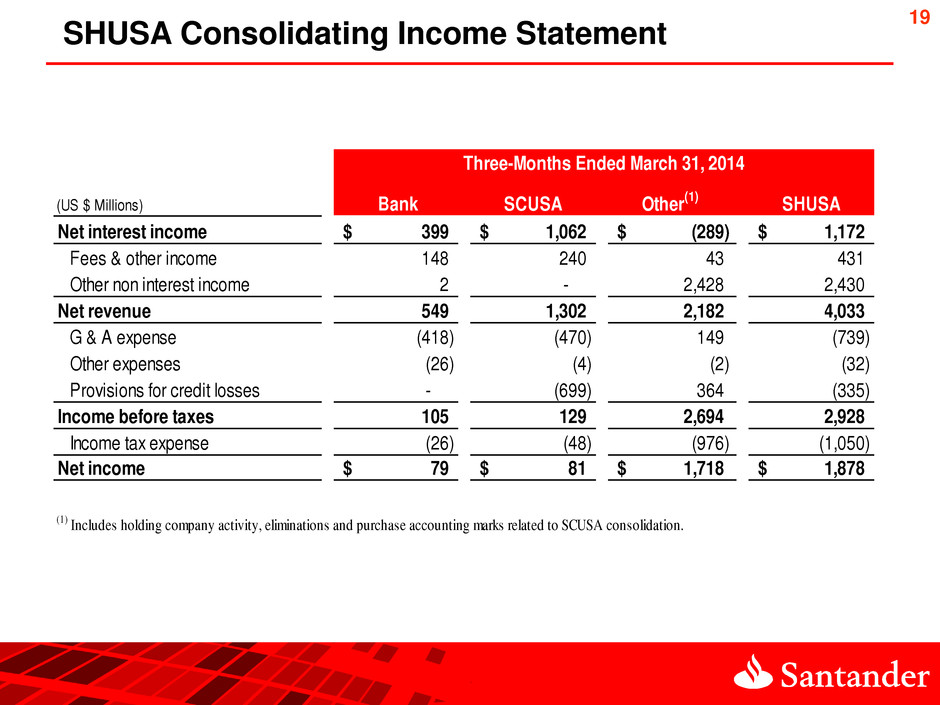

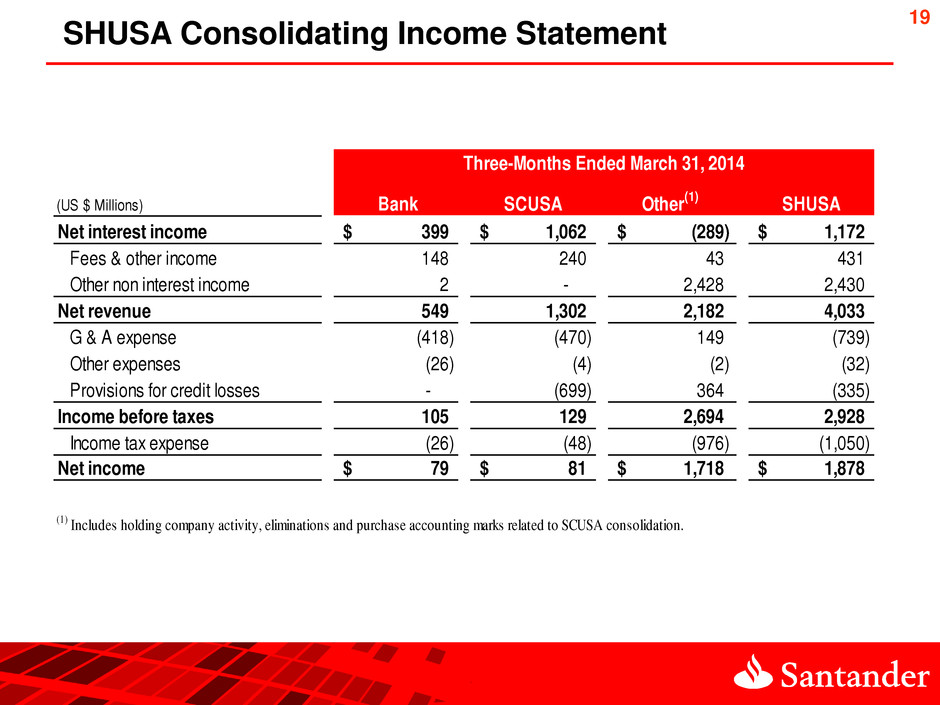

19 SHUSA Consolidating Income Statement (US $ Millions) Bank Other (1) Net interest income 399$ 1,062$ (289)$ 1,172$ Fees & other income 148 240 43 431 Other non interest income 2 - 2,428 2,430 Net revenue 549 1,302 2,182 4,033 G & A expense (418) (470) 149 (739) Other expenses (26) (4) (2) (32) Provisions for credit losses - (699) 364 (335) Income before taxes 105 129 2,694 2,928 Income tax expense (26) (48) (976) (1,050) Net income 79$ 81$ 1,718$ 1,878$ (1) Includes holding company activity, eliminations and purchase accounting marks related to SCUSA consolidation. SCUSA SHUSA Three-Months Ended March 31, 2014

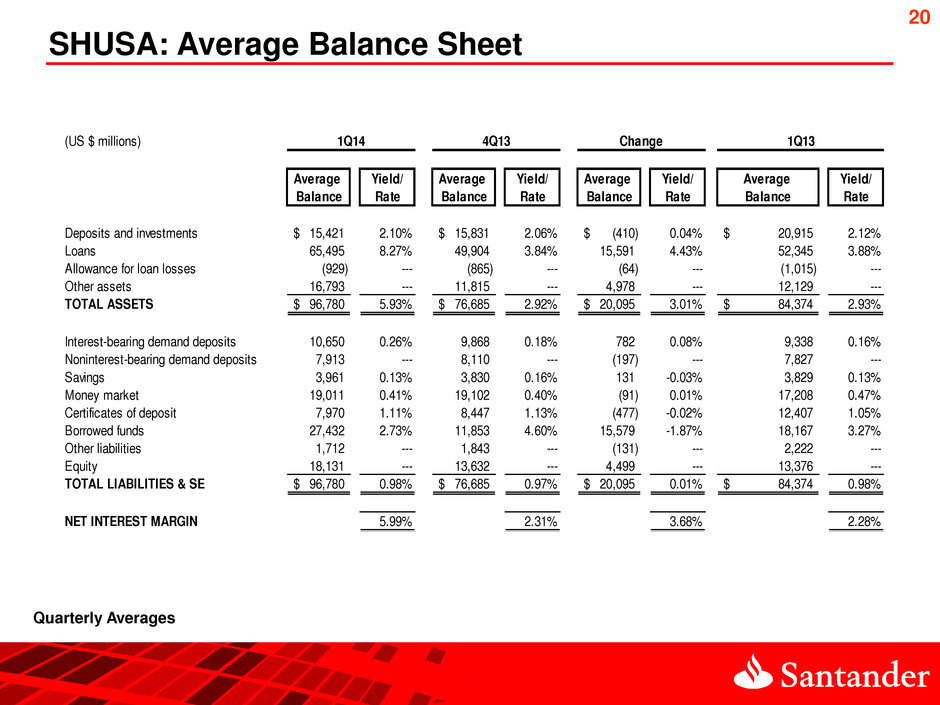

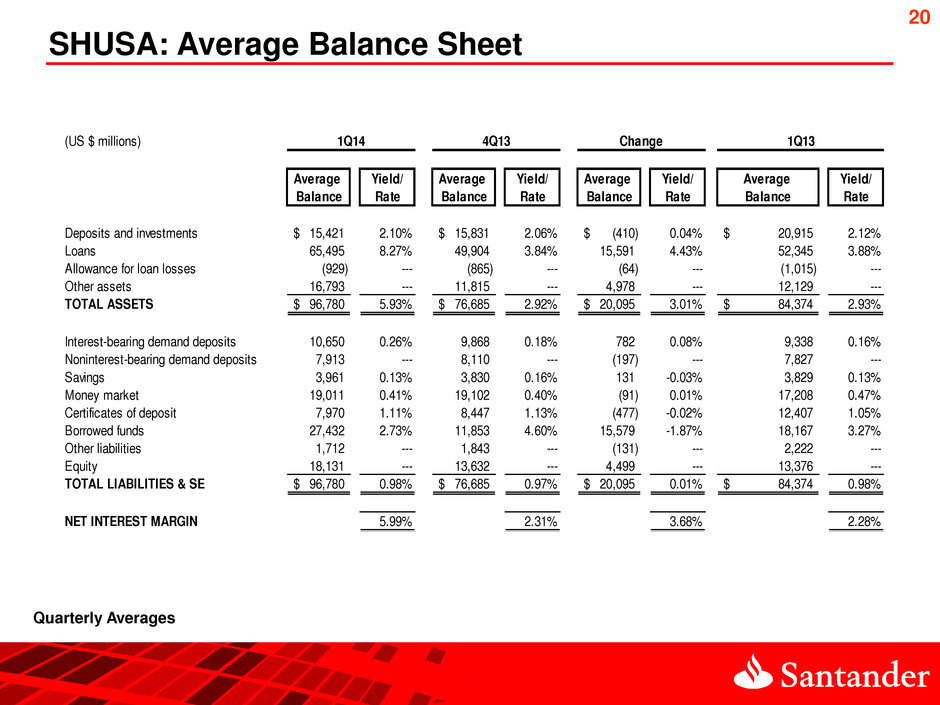

20 SHUSA: Average Balance Sheet Quarterly Averages (US $ millions) Average Yield/ Average Yield/ Average Yield/ Average Yield/ Balance Rate Balance Rate Balance Rate Balance Rate Deposits and investments 15,421$ 2.10% 15,831$ 2.06% (410)$ 0.04% 20,915$ 2.12% Loans 65,495 8.27% 49,904 3.84% 15,591 4.43% 52,345 3.88% Allowance for loan losses (929) --- (865) --- (64) --- (1,015) --- Other assets 16,793 --- 11,815 --- 4,978 --- 12,129 --- TOTAL ASSETS 96,780$ 5.93% 76,685$ 2.92% 20,095$ 3.01% 84,374$ 2.93% Interest-bearing demand deposits 10,650 0.26% 9,868 0.18% 782 0.08% 9,338 0.16% Noninterest-bearing demand deposits 7,913 --- 8,110 --- (197) --- 7,827 --- Savings 3,961 0.13% 3,830 0.16% 131 -0.03% 3,829 0.13% Money market 19,011 0.41% 19,102 0.40% (91) 0.01% 17,208 0.47% Certificates of deposit 7,970 1.11% 8,447 1.13% (477) -0.02% 12,407 1.05% Borrowed funds 27,432 2.73% 11,853 4.60% 15,579 -1.87% 18,167 3.27% Other liabilities 1,712 --- 1,843 --- (131) --- 2,222 --- Equity 18,131 --- 13,632 --- 4,499 --- 13,376 --- TOTAL LIABILITIES & SE 96,780$ 0.98% 76,685$ 0.97% 20,095$ 0.01% 84,374$ 0.98% NET INTEREST MARGIN 5.99% 2.31% 3.68% 2.28% 1Q14 4Q13 Change 1Q13

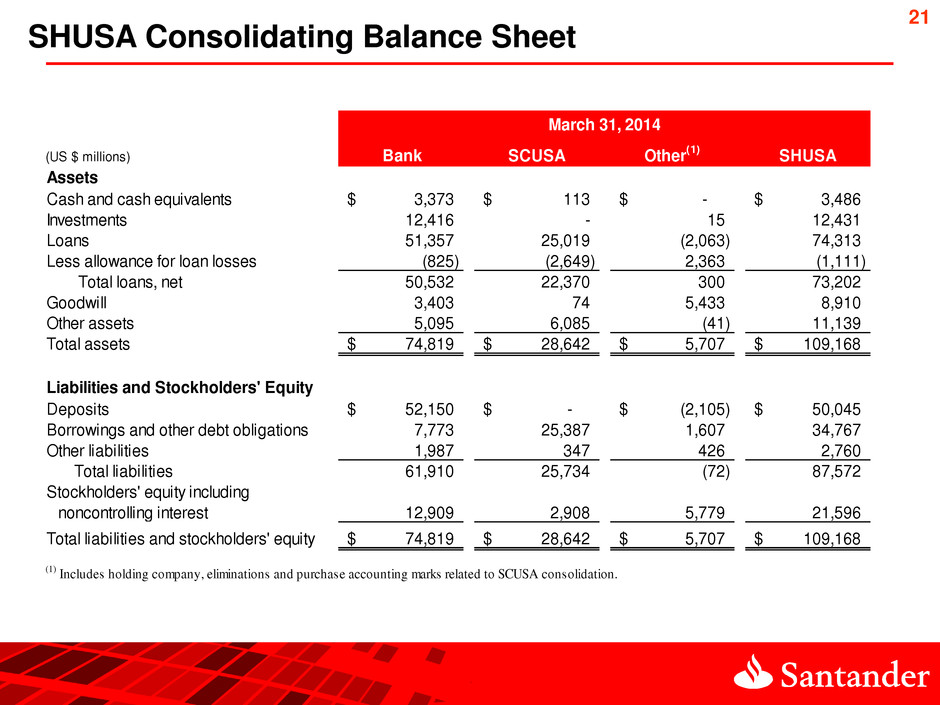

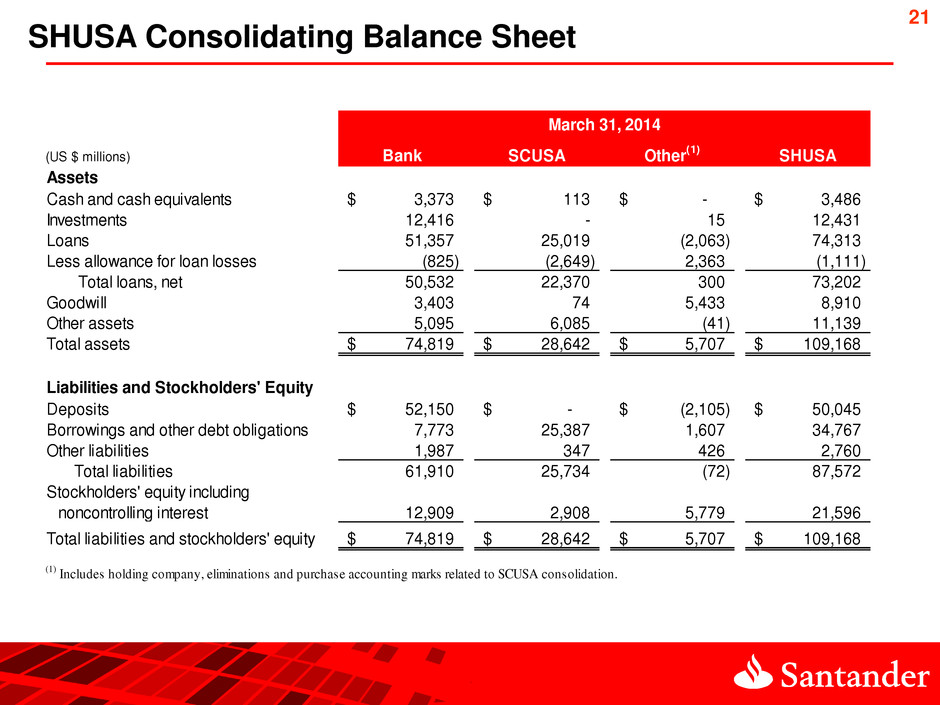

21 SHUSA Consolidating Balance Sheet (US $ millions) Bank SCUSA Other (1) SHUSA Assets Cash and cash equivalents 3,373$ 113$ -$ 3,486$ Investments 12,416 - 15 12,431 Loans 51,357 25,019 (2,063) 74,313 Less allowance for loan losses (825) (2,649) 2,363 (1,111) Total loans, net 50,532 22,370 300 73,202 Goodwill 3,403 74 5,433 8,910 Other assets 5,095 6,085 (41) 11,139 Total assets 74,819$ 28,642$ 5,707$ 109,168$ Liabilities and Stockholders' Equity Deposits 52,150$ -$ (2,105)$ 50,045$ Borrowings and other debt obligations 7,773 25,387 1,607 34,767 Other liabilities 1,987 347 426 2,760 Total liabilities 61,910 25,734 (72) 87,572 Stockholders' equity including noncontrolling interest 12,909 2,908 5,779 21,596 Total liabilities and stockholders' equity 74,819$ 28,642$ 5,707$ 109,168$ (1) Includes holding company, eliminations and purchase accounting marks related to SCUSA consolidation. March 31, 2014

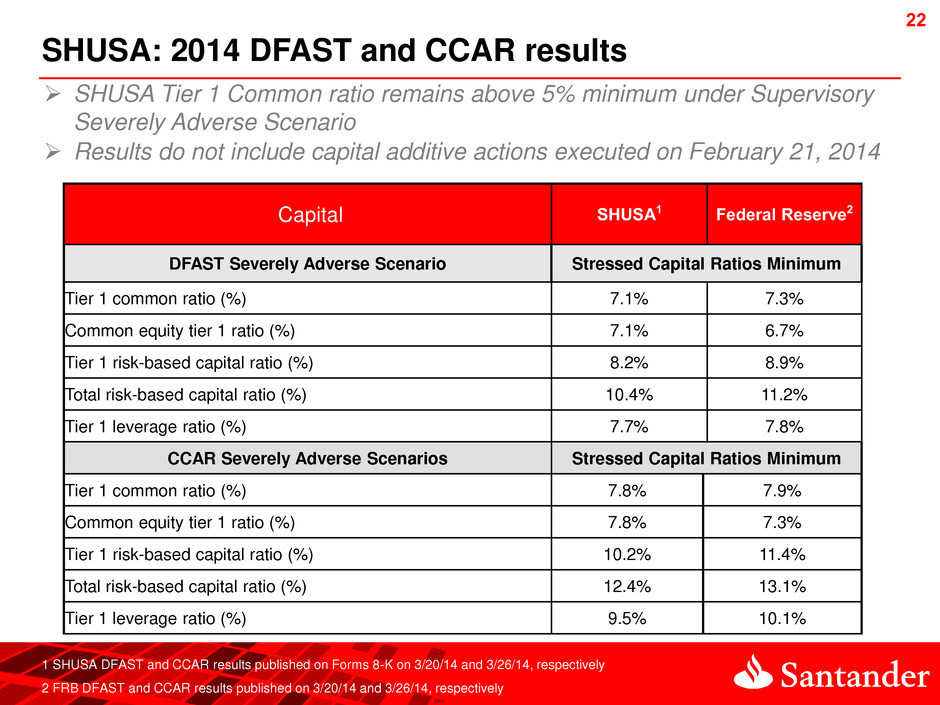

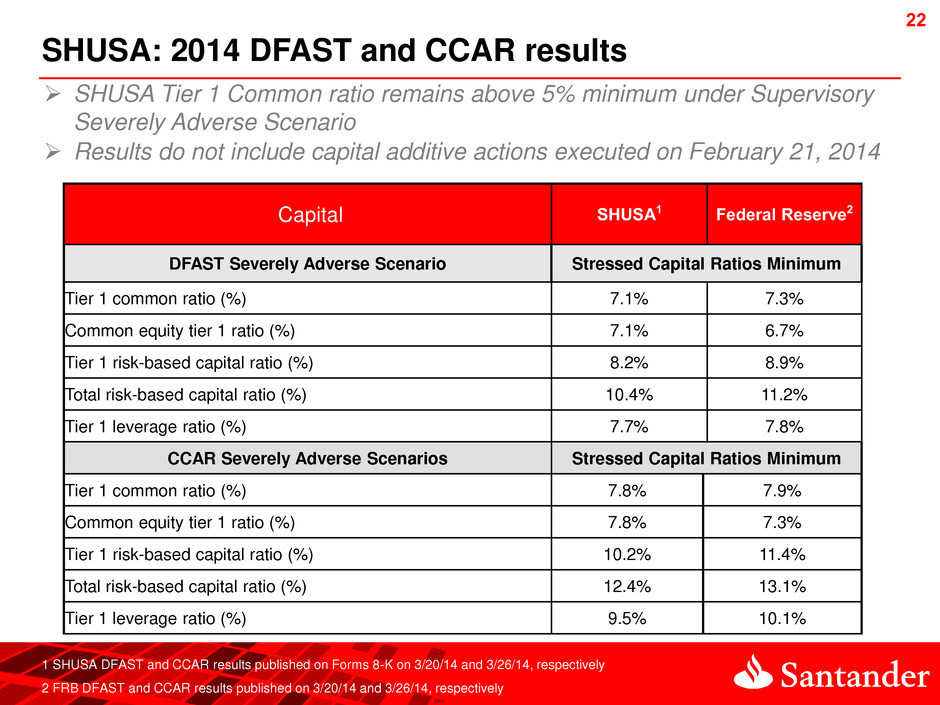

22 22 SHUSA: 2014 DFAST and CCAR results 1 SHUSA DFAST and CCAR results published on Forms 8-K on 3/20/14 and 3/26/14, respectively 2 FRB DFAST and CCAR results published on 3/20/14 and 3/26/14, respectively Capital SHUSA1 Federal Reserve2 DFAST Severely Adverse Scenario Stressed Capital Ratios Minimum Tier 1 common ratio (%) 7.1% 7.3% Common equity tier 1 ratio (%) 7.1% 6.7% Tier 1 risk-based capital ratio (%) 8.2% 8.9% Total risk-based capital ratio (%) 10.4% 11.2% Tier 1 leverage ratio (%) 7.7% 7.8% CCAR Severely Adverse Scenarios Stressed Capital Ratios Minimum Tier 1 common ratio (%) 7.8% 7.9% Common equity tier 1 ratio (%) 7.8% 7.3% Tier 1 risk-based capital ratio (%) 10.2% 11.4% Total risk-based capital ratio (%) 12.4% 13.1% Tier 1 leverage ratio (%) 9.5% 10.1% SHUSA Tier 1 Common ratio remains above 5% minimum under Supervisory Severely Adverse Scenario Results do not include capital additive actions executed on February 21, 2014

23 23 SHUSA: CCAR results – Qualitative1 On March 26, 2014, the Federal Reserve (FRB) announced that, based on qualitative concerns, it objected to the capital plan of SHUSA SHUSA was a first-time filer in the CCAR program in 2014 The FRB does not allow bank holding companies to disclose confidential supervisory information regarding capital plans submitted during the CCAR process The FRB did not object to SHUSA’s payment of dividends on its outstanding class of preferred stock The FRB’s CCAR stress test results did not include the capital actions completed by SHUSA in February 2014 which increased SHUSA’s common equity by $2.5BN Including the $2.5BN addition of common equity, SHUSA’s minimum Tier 1 common ratio under the FRB Severely Adverse scenario would increase from 7.8% to 10.2% under SHUSA’s calculations 1 SHUSA DFAST and CCAR results published on Forms 8-K on 3/20/14 and 3/26/14, respectively

24 24 Rating Agencies Santander Bank Text Moody’s S&P Fitch LT Senior Debt Baa1 BBB BBB+ ST Deposits P-2 A-2 F-2 Outlook Stable Stable Stable SHUSA Moody’s S&P Fitch Baa2 BBB BBB+ P-2 A-2 F-2 Negative Stable Stable On December 20, 2013, S&P revised SHUSA and Santander Bank’s outlook from negative to stable On April 8, 2014 Moody’s affirmed the ratings of SHUSA and Santander Bank On June 5, 2014 Fitch upgraded SHUSA and Santander Bank from BBB/F- 2/Negative to BBB+/F-2/Stable June 5, 2014 SHUSA and Santander Bank upgraded from BBB/F-2/Negative to BBB+/F- 2/Stable by Fitch on June 5, 2014

25 25 SHUSA: Reconciliation of 4Q12 Non-GAAP Pro-forma Profitability (US$ in Millions) Actual 4Q12 Non-GAAP Pro-forma 4Q12 Significant Other Expense Item Adjustments Pre-Provision Net Revenue $130 $130 - +$47 PIERS tender offer costs - +$36 FHLB advance termination expense - +$8 Hurricane Sandy expenses - +$16 Foreclosure review settlement costs Pre-Provision Net Revenue $130 $237 Provisions for credit losses -$111 -$111 - +$25 Hurricane Sandy related Provisions for Credit Losses Pre-Tax Income $19 $151 Income tax benefit $101 $101 - -$53 Reduced tax benefit without extraordinary items Net Income $120 $199

26 SHUSA: Non-GAAP to GAAP Reconciliations $ Millions 4Q12 1Q13 2Q13 3Q13 4Q13 1Q14 SHUSA Pre-Tax Pre-Provision Income Pre-tax income, as reported 19$ 388$ 223$ 95$ 82$ 2,927$ Add back: Provision for credit losses 111 17 10 - 20 (335) Pre-Tax Pre-Provision Income 130$ 405$ 233$ 95$ 102$ 3,262$

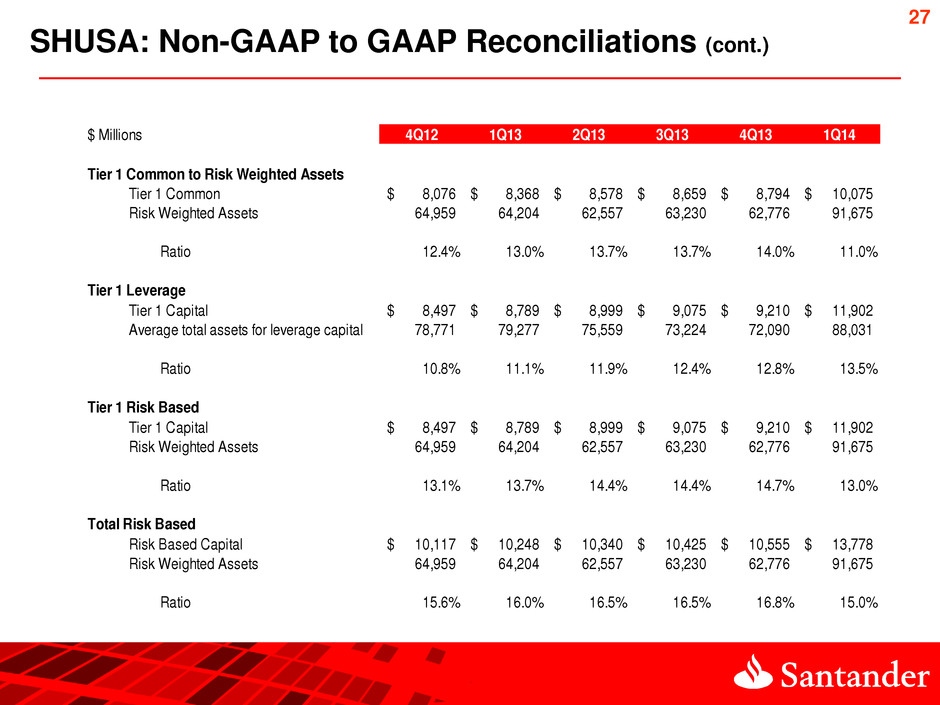

27 SHUSA: Non-GAAP to GAAP Reconciliations (cont.) $ Millions 4Q12 1Q13 2Q13 3Q13 4Q13 1Q14 Tier 1 Common to Risk Weighted Assets Tier 1 Common 8,076$ 8,368$ 8,578$ 8,659$ 8,794$ 10,075$ Risk Weighted Assets 64,959 64,204 62,557 63,230 62,776 91,675 Ratio 12.4% 13.0% 13.7% 13.7% 14.0% 11.0% Tier 1 Leverage Tier 1 Capital 8,497$ 8,789$ 8,999$ 9,075$ 9,210$ 11,902$ 78,771 79,277 75,559 73,224 72,090 88,031 Ratio 10.8% 11.1% 11.9% 12.4% 12.8% 13.5% Tier 1 Risk Based Tier 1 Capital 8,497$ 8,789$ 8,999$ 9,075$ 9,210$ 11,902$ Risk Weighted Assets 64,959 64,204 62,557 63,230 62,776 91,675 Ratio 13.1% 13.7% 14.4% 14.4% 14.7% 13.0% Total Risk Based Risk Based Capital 10,117$ 10,248$ 10,340$ 10,425$ 10,555$ 13,778$ Risk Weighted Assets 64,959 64,204 62,557 63,230 62,776 91,675 Ratio 15.6% 16.0% 16.5% 16.5% 16.8% 15.0% Average total assets for leverage capital