1 March 3, 2025 SANTANDER HOLDINGS USA, INC. Fourth Quarter 2024 Fixed Income Investor Presentation

2 This presentation of Santander Holdings USA, Inc. (“SHUSA”) contains “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995 regarding the financial condition, results of operations, business plans and future performance of SHUSA. Words such as “may,” “could,” “should,” “will,” “believe,” “expect,” “anticipate,” “estimate,” “intend,” “plan,” “goal” or similar expressions are intended to indicate forward-looking statements. Although SHUSA believes that the expectations reflected in these forward-looking statements are reasonable as of the date on which the statements are made, factors such as the risks and uncertainties described in SHUSA’s filings with the Securities and Exchange Commission from time to time may cause SHUSA’s performance to differ materially from that suggested by the forward-looking statements. If one or more of the factors affecting SHUSA’s forward-looking statements renders those statements incorrect, SHUSA’s actual results, performance or achievements could differ materially from those expressed in or implied by the forward-looking statements. Readers should not consider these factors to be a complete set of all potential risks or uncertainties as new factors emerge from time to time. In this presentation, we may sometimes refer to certain non-GAAP figures or financial ratios to help illustrate certain concepts. These ratios, each of which is defined in this document, if utilized, may include Pre- Tax Pre- Provision Income, the Tangible Common Equity to Tangible Assets Ratio, and the Texas Ratio. This information supplements our results as reported in accordance with generally accepted accounting principles (“GAAP”) and should not be viewed in isolation from, or as a substitute for, our GAAP results. We believe that this additional information and the reconciliations we provide may be useful to investors, analysts, regulators and others as they evaluate the impact of these items on our results for the periods presented due to the extent to which the items are indicative of our ongoing operations. Where applicable, we provide GAAP reconciliations for such additional information. SHUSA’s subsidiaries include Santander Consumer USA Inc. (“SC”), Santander Bank, N.A. (“SBNA”), Banco Santander International (“BSI”), Santander Securities LLC (“SSLLC”), Santander US Capital Markets LLC (“SanCap”), as well as several other subsidiaries. The information in this presentation is intended only to assist investors and does not constitute legal, tax, accounting, financial or investment advice or an offer to invest. In making this presentation available, SHUSA gives no advice and makes no recommendation to buy, sell, or otherwise deal in shares or other securities of Banco Santander, S.A. (“Santander”), SHUSA, SBNA, SC or any other securities or investments. It is not our intention to state, indicate, or imply in any manner that current or past results are indicative of future results or expectations. As with all investments, there are associated risks, and you could lose money investing. Prior to making any investment, a prospective investor should consult with its own investment, accounting, legal, and financial advisors and independently evaluate the risks, consequences, and suitability of that investment. No offering of securities shall be made in the United States except pursuant to registration under the Securities Act of 1933, as amended, or an exemption therefrom. Important Information

3 1 At a glance 2 Results Appendix 4 Index 3 Core Business Activities

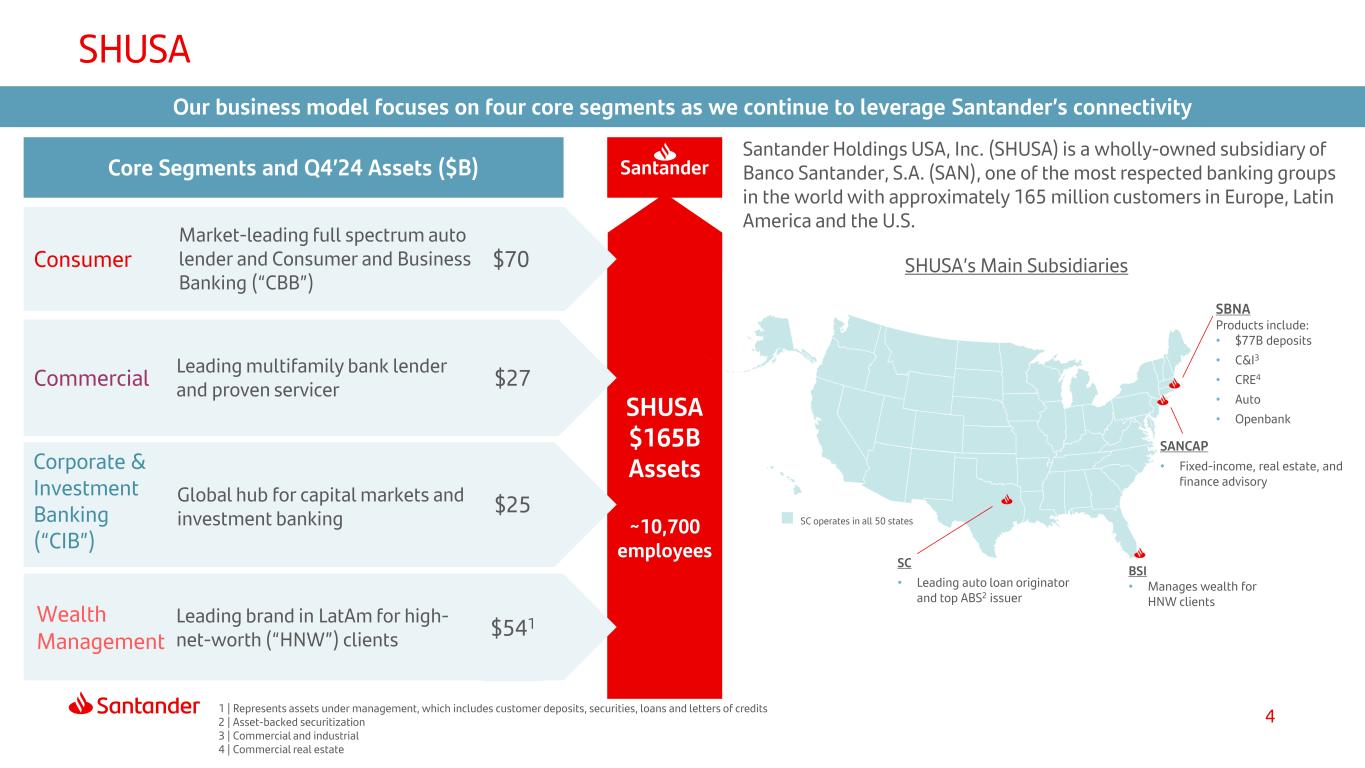

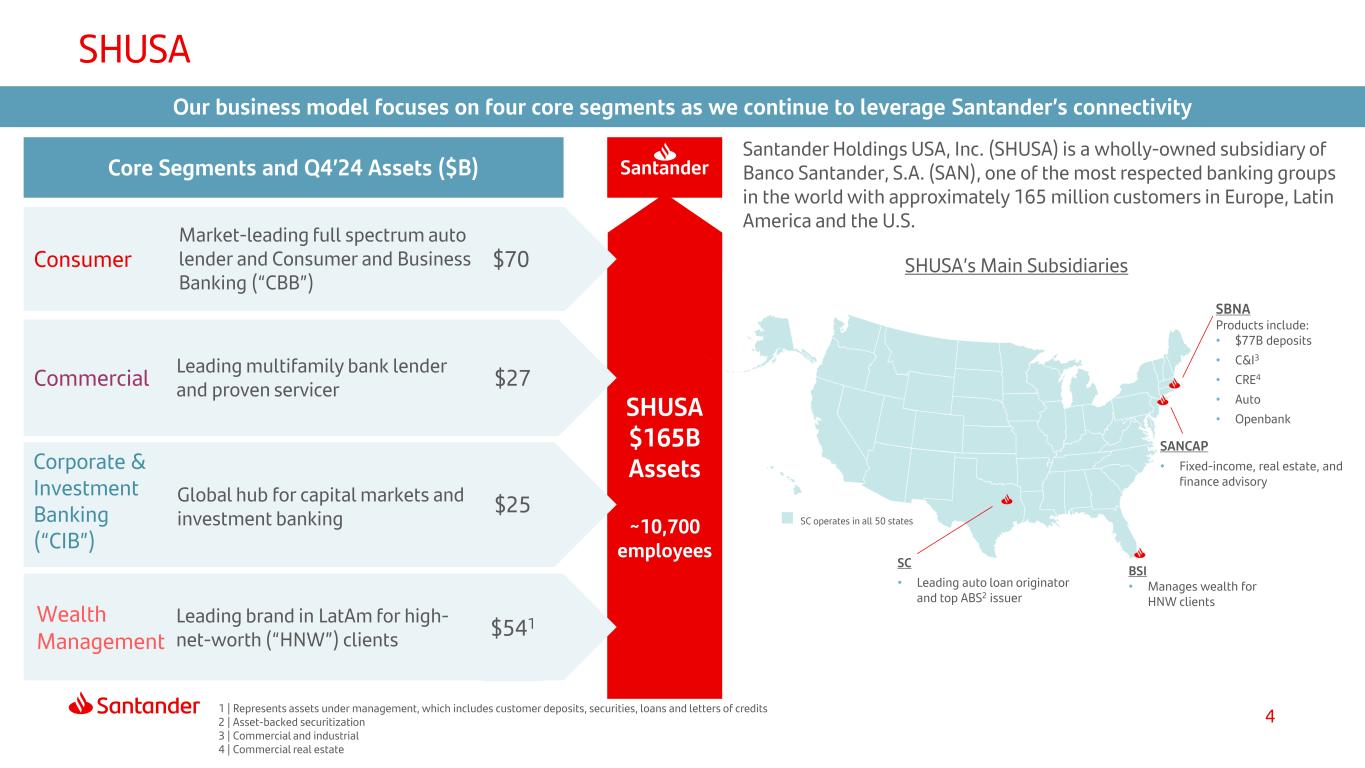

4 Santander SHUSA $165B Assets ~10,700 employees Consumer Commercial Market-leading full spectrum auto lender and Consumer and Business Banking (“CBB”) Leading multifamily bank lender and proven servicer Global hub for capital markets and investment banking Leading brand in LatAm for high- net-worth (“HNW”) clients Our business model focuses on four core segments as we continue to leverage Santander’s connectivity Core Segments and Q4’24 Assets ($B) $70 $27 $25 $541Wealth Management Corporate & Investment Banking (“CIB”) SC operates in all 50 states SBNA Products include: • $77B deposits • C&I3 • CRE4 • Auto • Openbank SANCAP • Fixed-income, real estate, and finance advisory BSI • Manages wealth for HNW clients SC • Leading auto loan originator and top ABS2 issuer SHUSA’s Main Subsidiaries Santander Holdings USA, Inc. (SHUSA) is a wholly-owned subsidiary of Banco Santander, S.A. (SAN), one of the most respected banking groups in the world with approximately 165 million customers in Europe, Latin America and the U.S. SHUSA 1 | Represents assets under management, which includes customer deposits, securities, loans and letters of credits 2 | Asset-backed securitization 3 | Commercial and industrial 4 | Commercial real estate

5 Launched Openbank digital high-yield savings platform in the US, surpassing $2B in deposits within the first three months of operation #7 auto loan originator in the US, diversifying across strategic dealer groups3 36% of auto loans funded with retail deposits4 Top 5 auto ABS issuer in the US Consumer FDIC joint venture in Multifamily achieved strong performance with robust net income and asset quality Improved net income and operational efficiency as a result of the 2023 integration of the C&I and CRE businesses under common leadership Commercial Achieved double digit growth YoY and record- high profitability Best bank for Wealth Management in Latin America for two consecutive years6 Best International Private Bank in Latin America for two consecutive years6 Best Private Bank for UHNW individuals in Latin America6 Wealth Expanded our business, advisory capabilities, and expertise to generate higher fee income Widening corporate and investment banking offerings across increasing number of industries and added over 1,000 new clients5 to coverage Leading position in efficiency and contributed positively to overall profitability YoY CIB Fitch upgraded the rating of SHUSA senior unsecured debt to ‘A-’ with a stable outlook2 Achieved strong supervisory stress test results which demonstrates balance sheet and capital base strength SBNA earned an “Outstanding” Community Reinvestment Act rating for the second consecutive three- year assessment period Distributed $1.1B in common stock dividends Accomplishments SHUSA is wholly-owned by Santander, which has been recognized as the highest ranked European bank among World’s Most Admired Companies according to annual rankings from Fortune magazine1 2024 Business Highlights 1 | Fortune. "Fortune's Most Admired Companies." Jan. 31, 2025 2 | February 14, 2025 3 | J.D. Power Market Share Report (Jan. 2024 – Dec. 2024; includes Santander Consumer USA and Chrysler Capital combined) 4 | Including lease, auto funded with deposits is 44% 5 | US CIB banking/markets definition of client vs. Bank Secrecy Act/Anti-Money Laundering policy definition 6 | Euromoney’s 2024 Awards for Excellence

6 SHUSA 2024 Results at a Glance FINANCIAL METRICS CREDIT CAPITAL/LIQUIDITY $1.1B NET INCOME Up $144M YoY 12.1% 30-89 DAYS AUTO1 DELINQUENCY Down 27bps YoY 12.7% CET1 3.8% NET INTEREST MARGIN (“NIM”) Down 19bps YoY Up 3bps QoQ 2.5% NET CHARGE-OFFS2 (“NCOs”) Up 31bps YoY 23.0% TLAC RATIO 1 | Consumer auto only 2 | Total NCOs (Consumer + Commercial) PERFORMANCE HIGHLIGHTS Revenues Strong revenue growth, supported by higher CIB and Auto margins, and robust fee income growth (+19% YoY) driven by consumer and deposit fees, CIB, and FDIC joint venture in CRE Offset by strategic balance sheet activities ($3.8B), higher deposit cost, lower loan and lease volume in Auto Expenses Expenses improved (-6% YoY) due to cost initiatives across the company offset by strategic investments in digital transformation and CIB buildout offset Credit Despite expected gradual normalization, overall credit performance remains stable, driven by a resilient employment environment and sustained economic growth Capital and Liquidity Solid position evidenced by regulatory metrics (Common equity Tier 1 (“CET1”) and total loss-absorbing capacity (“TLAC”)), stress tests and contingent liquidity

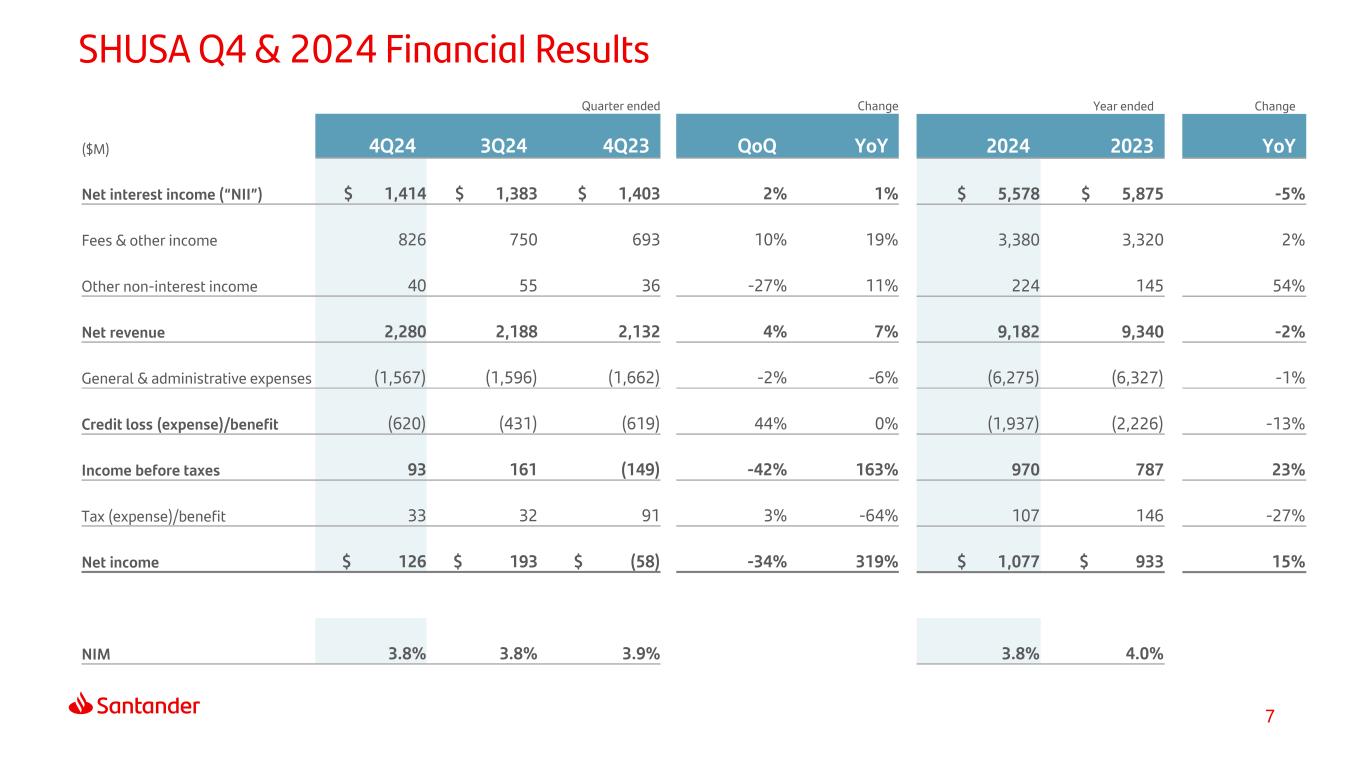

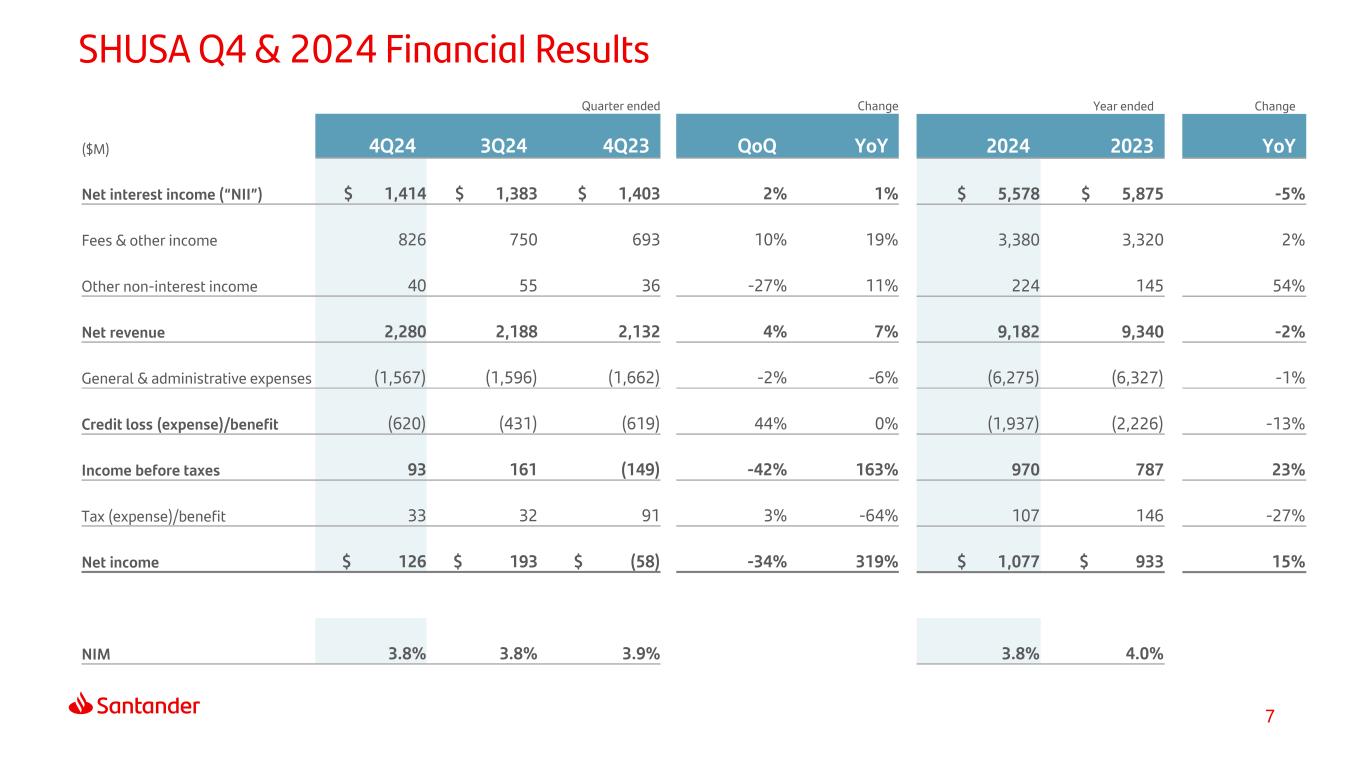

7 SHUSA Q4 & 2024 Financial Results Quarter ended Change ($M) 4Q24 3Q24 4Q23 QoQ YoY Net interest income (“NII”) $ 1,414 $ 1,383 $ 1,403 2% 1% Fees & other income 826 750 693 10% 19% Other non-interest income 40 55 36 -27% 11% Net revenue 2,280 2,188 2,132 4% 7% General & administrative expenses (1,567) (1,596) (1,662) -2% -6% Credit loss (expense)/benefit (620) (431) (619) 44% 0% Income before taxes 93 161 (149) -42% 163% Tax (expense)/benefit 33 32 91 3% -64% Net income $ 126 $ 193 $ (58) -34% 319% NIM 3.8% 3.8% 3.9% Year ended Change 2024 2023 YoY $ 5,578 $ 5,875 -5% 3,380 3,320 2% 224 145 54% 9,182 9,340 -2% (6,275) (6,327) -1% (1,937) (2,226) -13% 970 787 23% 107 146 -27% $ 1,077 $ 933 15% 3.8% 4.0%

8 1 At a Glance 2 Results Appendix 4 Index 3 Core Business Activities

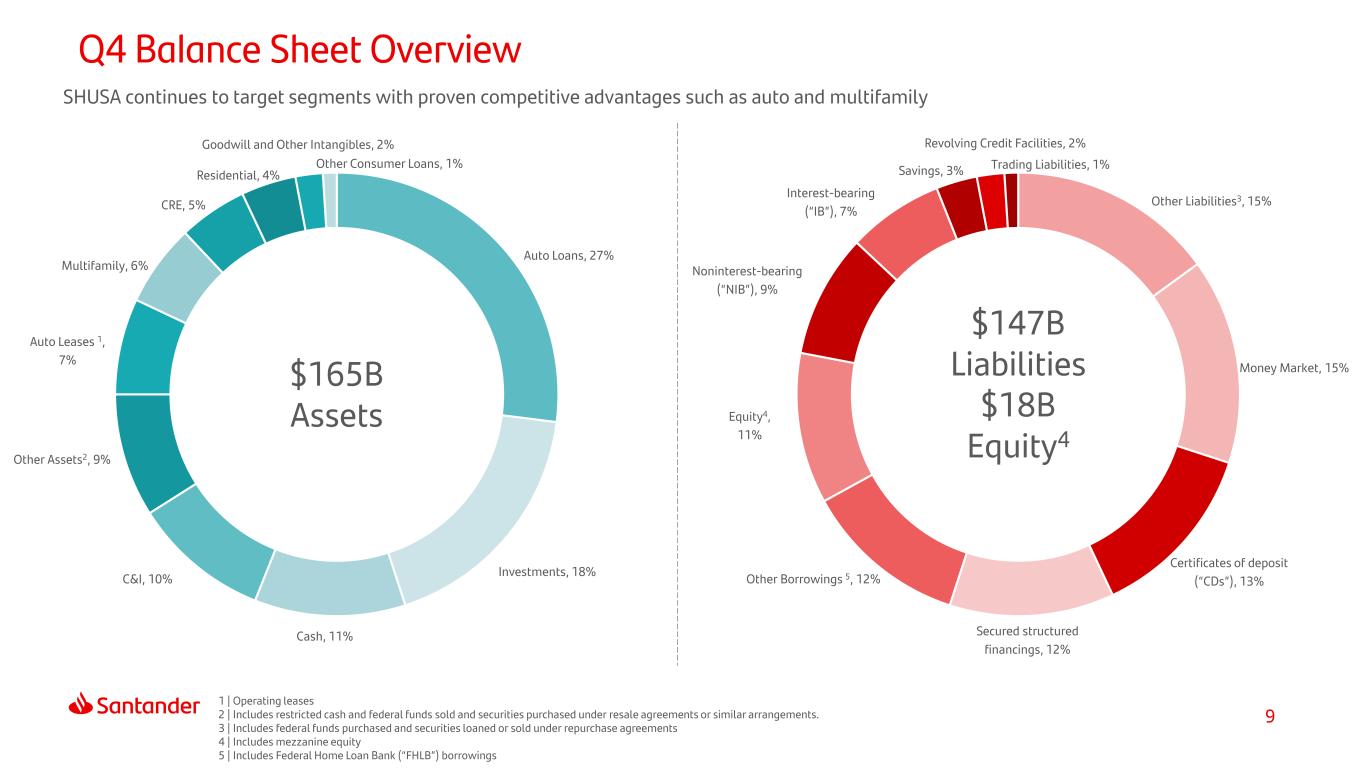

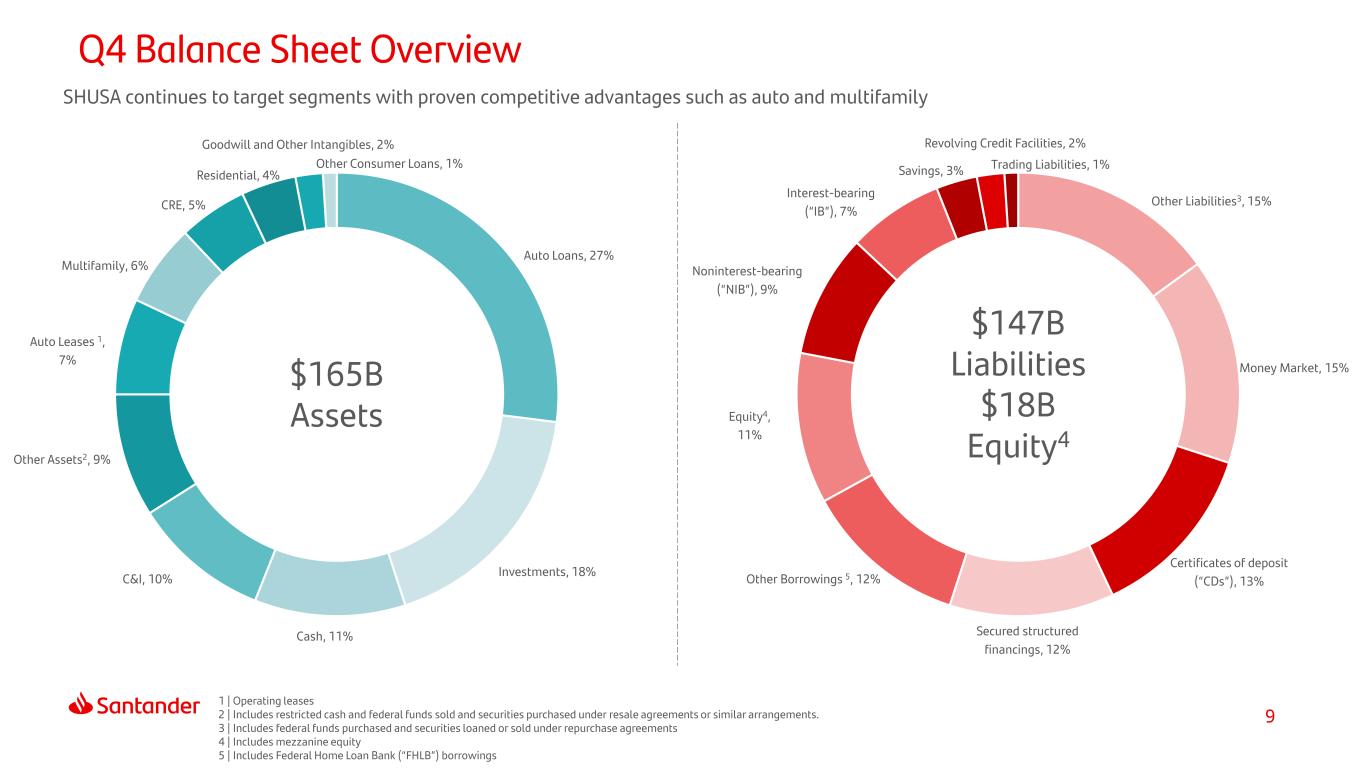

9 Auto Loans, 27% Investments, 18% Cash, 11% C&I, 10% Other Assets2, 9% Auto Leases 1, 7% Multifamily, 6% CRE, 5% Residential, 4% Goodwill and Other Intangibles, 2% Other Consumer Loans, 1% Other Liabilities3, 15% Money Market, 15% Certificates of deposit (“CDs”), 13% Secured structured financings, 12% Other Borrowings 5, 12% Equity4, 11% Noninterest-bearing (“NIB”), 9% Interest-bearing (“IB”), 7% Savings, 3% Revolving Credit Facilities, 2% Trading Liabilities, 1% SHUSA continues to target segments with proven competitive advantages such as auto and multifamily $165B Assets Q4 Balance Sheet Overview 1 | Operating leases 2 | Includes restricted cash and federal funds sold and securities purchased under resale agreements or similar arrangements. 3 | Includes federal funds purchased and securities loaned or sold under repurchase agreements 4 | Includes mezzanine equity 5 | Includes Federal Home Loan Bank (“FHLB”) borrowings $147B Liabilities $18B Equity4

10 Balance Sheet Trends | Assets 1 | Other assets includes securities purchased under repurchase agreements Loans and leases down 6.5% YoY and 3.8% QoQ, driven by declines in C&I, CRE, and lease portfolios resulting from portfolio sales and run-off of existing portfolios, respectively. Loan yields increased in consumer. Auto yields increased 1.28% YoY and 0.17% QoQ. Commercial yields increased 0.49% YoY and decreased 0.16% QoQ. Assets ($B) Yield on Loans ($B) Loans & Leases ($B) Q4 Recap ($B) 5.4% 13.3% 12.3% 9.5% 0% 5% 10% 15% 20% Total commercial Auto Total consumer Total loans 44 43 45 45 44 19 19 19 19 18 19 18 18 17 16 14 14 13 13 12 7 7 7 7 7 4 4 4 3 3 $107 $105 $106 $104 $100 4Q23 1Q24 2Q24 3Q24 4Q24 Other Residential Leases C&I CRE Auto Leases Short-Term Funds Other Assets1 Investments Gross Loans 93 92 93 91 88 25 26 28 29 29 20 20 21 18 17 13 14 13 17 19 14 14 13 13 12 $165 $166 $168 $168 $165 4Q23 1Q24 2Q24 3Q24 4Q24

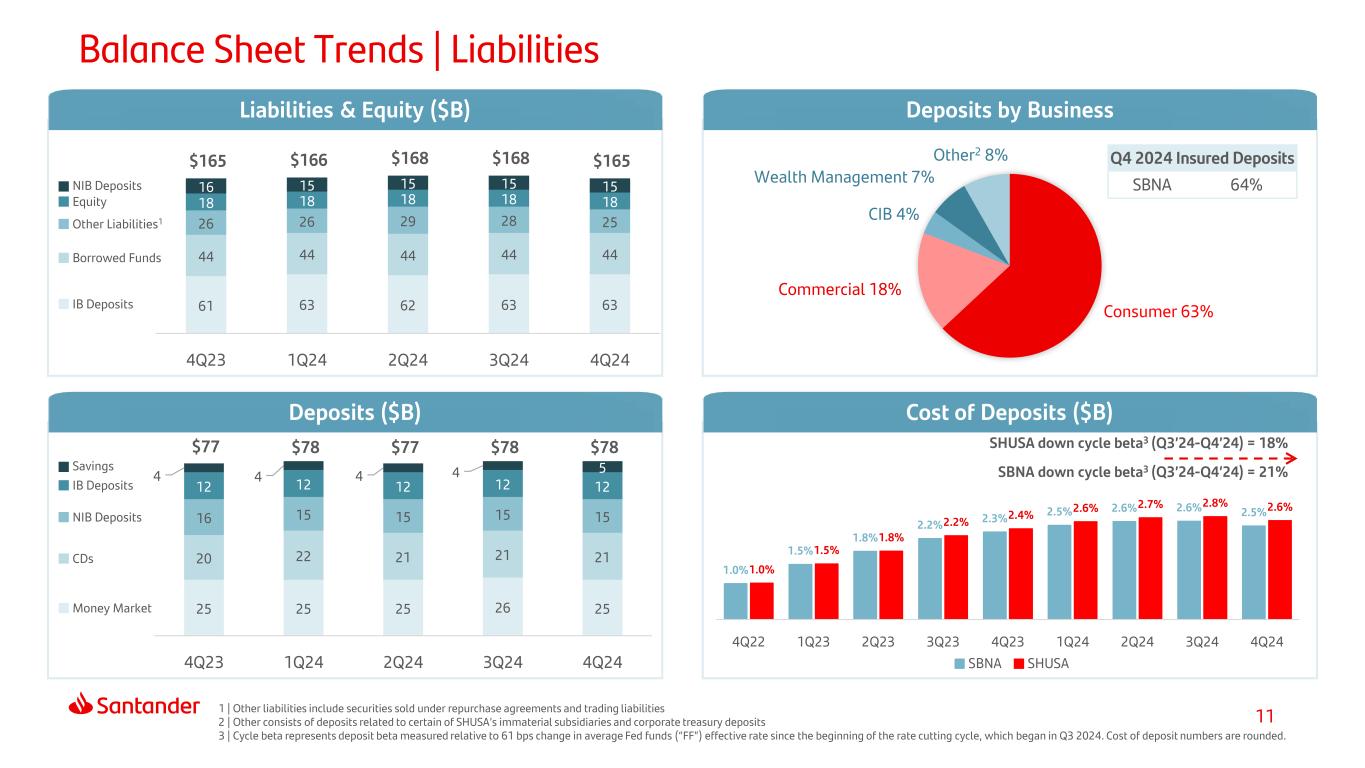

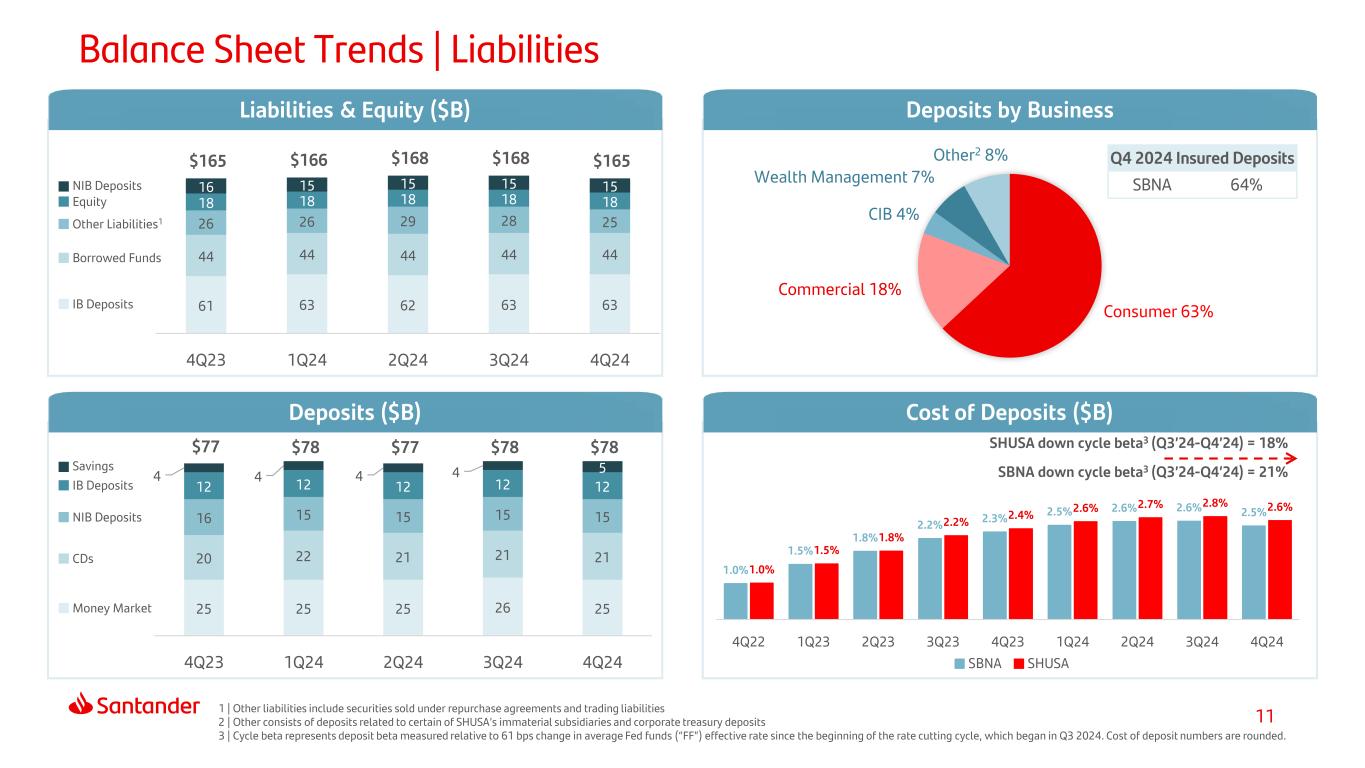

11 Consumer 63% Commercial 18% CIB 4% Wealth Management 7% Other2 8% 61 63 62 63 63 44 44 44 44 44 26 26 29 28 25 18 18 18 18 18 16 15 15 15 15 $165 $166 $168 $168 $165 4Q23 1Q24 2Q24 3Q24 4Q24 Balance Sheet Trends | Liabilities Deposits ($B) Cost of Deposits ($B) Liabilities & Equity ($B) Deposits by Business 1 | Other liabilities include securities sold under repurchase agreements and trading liabilities 2 | Other consists of deposits related to certain of SHUSA’s immaterial subsidiaries and corporate treasury deposits 3 | Cycle beta represents deposit beta measured relative to 61 bps change in average Fed funds (“FF”) effective rate since the beginning of the rate cutting cycle, which began in Q3 2024. Cost of deposit numbers are rounded. Q4 2024 Insured Deposits SBNA 64% 1.0% 1.5% 1.8% 2.2% 2.3% 2.5% 2.6% 2.6% 2.5% 1.0% 1.5% 1.8% 2.2% 2.4% 2.6% 2.7% 2.8% 2.6% 4Q22 1Q23 2Q23 3Q23 4Q23 1Q24 2Q24 3Q24 4Q24 SBNA SHUSA SBNA down cycle beta3 (Q3’24-Q4’24) = 21% SHUSA down cycle beta3 (Q3’24-Q4’24) = 18% NIB Deposits Equity Other Liabilities1 Borrowed Funds IB Deposits Savings IB Deposits NIB Deposits CDs Money Market 25 25 25 26 25 20 22 21 21 21 16 15 15 15 15 12 12 12 12 12 4 4 4 4 5 $77 $78 $77 $78 $78 4Q23 1Q24 2Q24 3Q24 4Q24

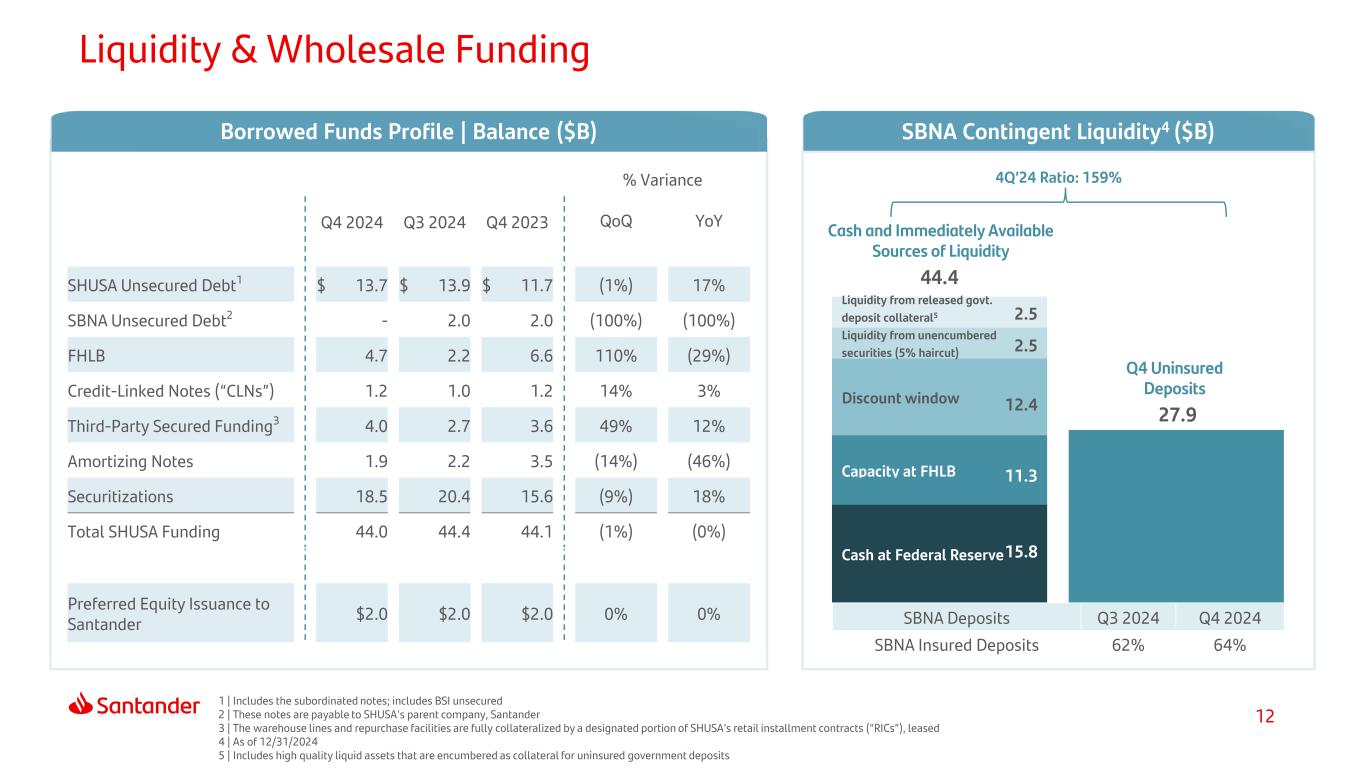

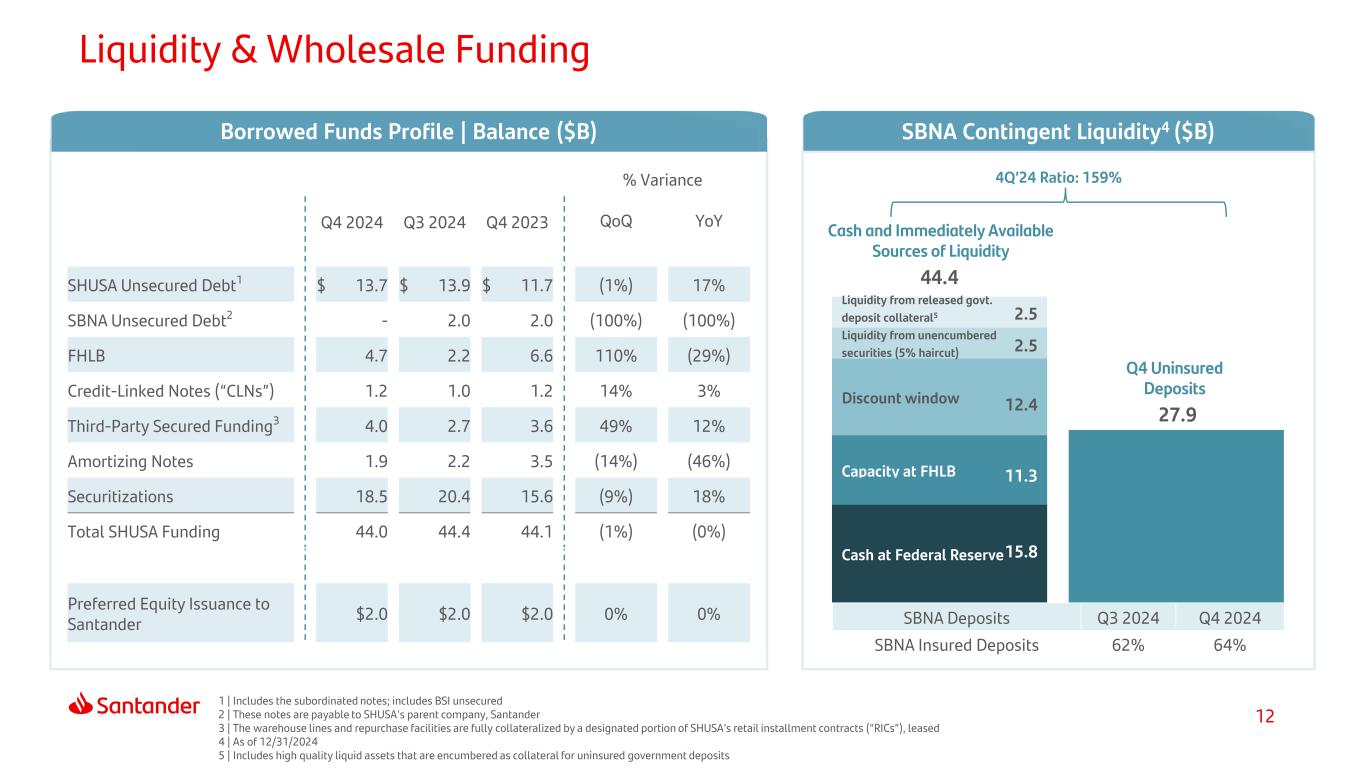

12 Cash at Federal Reserve Capacity at FHLB Discount window Liquidity from unencumbered securities (5% haircut) Liquidity from released govt. deposit collateral5 44.4 27.9 Liquidity & Wholesale Funding Cash and Immediately Available Sources of Liquidity Q4 Uninsured Deposits SBNA Deposits Q3 2024 Q4 2024 SBNA Insured Deposits 62% 64% Borrowed Funds Profile | Balance ($B) SBNA Contingent Liquidity4 ($B) 4Q’24 Ratio: 159% 11.3 15.8 1 | Includes the subordinated notes; includes BSI unsecured 2 | These notes are payable to SHUSA's parent company, Santander 3 | The warehouse lines and repurchase facilities are fully collateralized by a designated portion of SHUSA’s retail installment contracts (“RICs”), leased 4 | As of 12/31/2024 5 | Includes high quality liquid assets that are encumbered as collateral for uninsured government deposits % Variance Q4 2024 Q3 2024 Q4 2023 QoQ YoY SHUSA Unsecured Debt1 $ 13.7 $ 13.9 $ 11.7 (1%) 17% SBNA Unsecured Debt2 - 2.0 2.0 (100%) (100%) FHLB 4.7 2.2 6.6 110% (29%) Credit-Linked Notes (“CLNs”) 1.2 1.0 1.2 14% 3% Third-Party Secured Funding3 4.0 2.7 3.6 49% 12% Amortizing Notes 1.9 2.2 3.5 (14%) (46%) Securitizations 18.5 20.4 15.6 (9%) 18% Total SHUSA Funding 44.0 44.4 44.1 (1%) (0%) Preferred Equity Issuance to Santander $2.0 $2.0 $2.0 0% 0% 2.5 2.5 12.4

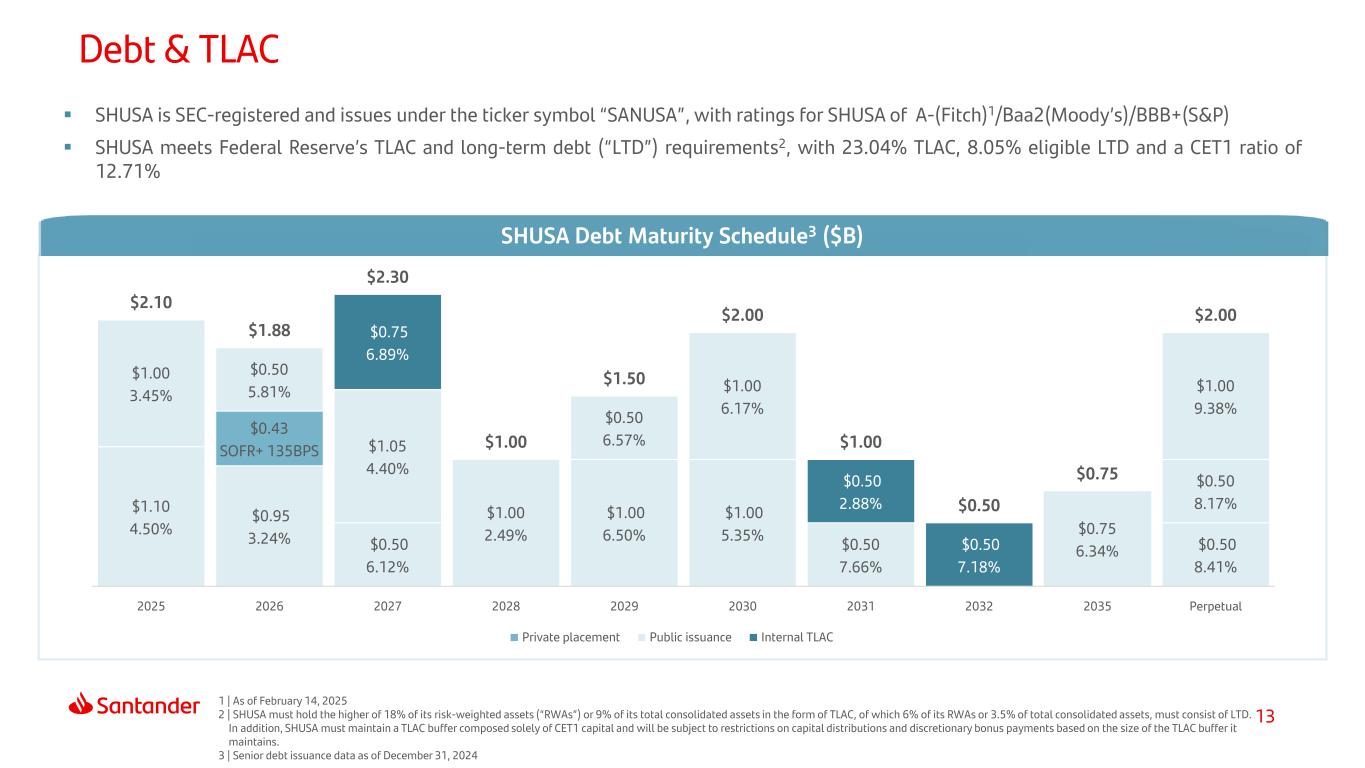

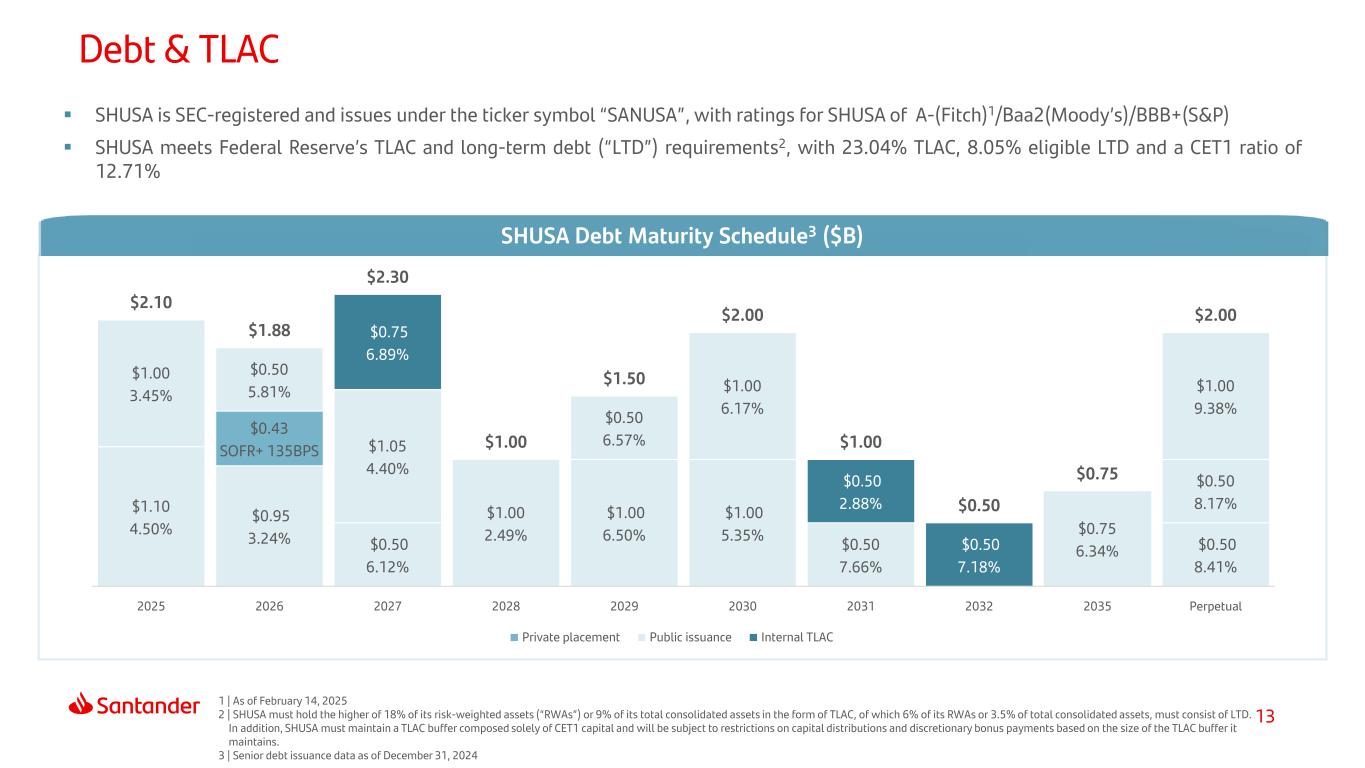

13 Debt & TLAC 1 | As of February 14, 2025 2 | SHUSA must hold the higher of 18% of its risk-weighted assets (“RWAs”) or 9% of its total consolidated assets in the form of TLAC, of which 6% of its RWAs or 3.5% of total consolidated assets, must consist of LTD. In addition, SHUSA must maintain a TLAC buffer composed solely of CET1 capital and will be subject to restrictions on capital distributions and discretionary bonus payments based on the size of the TLAC buffer it maintains. 3 | Senior debt issuance data as of December 31, 2024 SHUSA is SEC-registered and issues under the ticker symbol “SANUSA”, with ratings for SHUSA of A-(Fitch)1/Baa2(Moody’s)/BBB+(S&P) SHUSA meets Federal Reserve’s TLAC and long-term debt (“LTD”) requirements2, with 23.04% TLAC, 8.05% eligible LTD and a CET1 ratio of 12.71% SHUSA Debt Maturity Schedule3 ($B) $0.95 3.24% $0.50 6.12% $1.00 6.50% $1.00 5.35% $0.50 8.41% $1.10 4.50% $0.43 SOFR+ 135BPS $0.50 8.17% $1.00 3.45% $0.50 5.81% $1.05 4.40% $1.00 2.49% $0.50 6.57% $1.00 6.17% $0.50 7.66% $0.75 6.34% $1.00 9.38% $0.75 6.89% $0.50 2.88% $0.50 7.18% $2.10 $1.88 $2.30 $1.00 $1.50 $2.00 $1.00 $0.50 $0.75 $2.00 2025 2026 2027 2028 2029 2030 2031 2032 2035 Perpetual Private placement Public issuance Internal TLAC

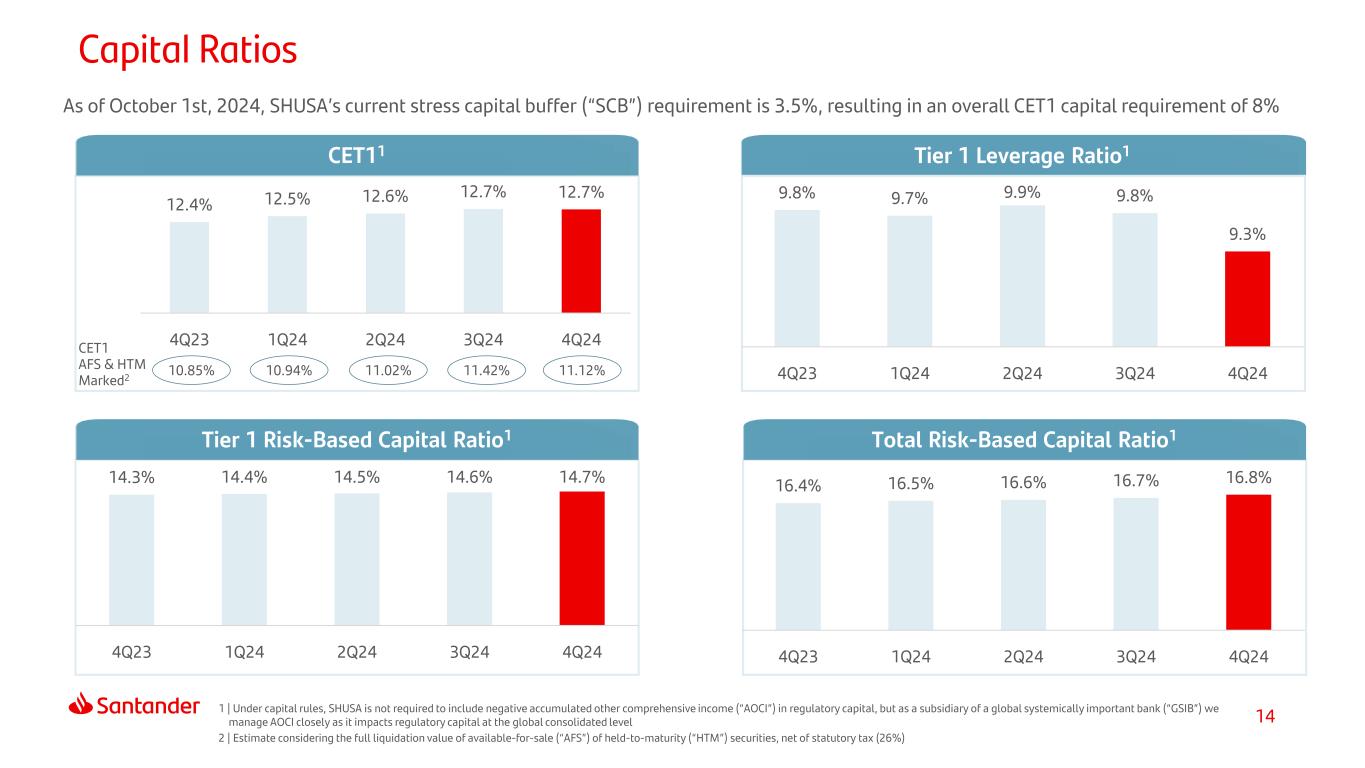

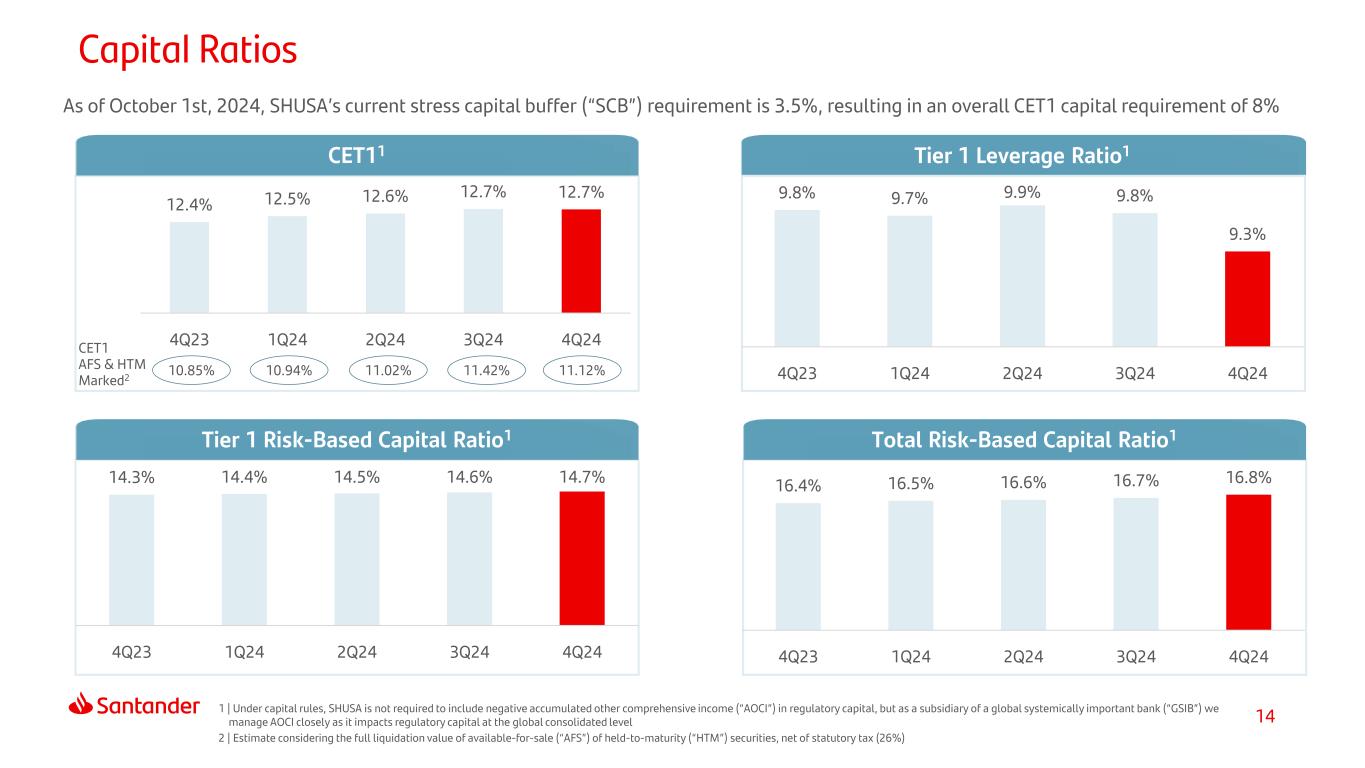

14 As of October 1st, 2024, SHUSA’s current stress capital buffer (“SCB”) requirement is 3.5%, resulting in an overall CET1 capital requirement of 8% Capital Ratios Tier 1 Risk-Based Capital Ratio1 CET11 Tier 1 Leverage Ratio1 Total Risk-Based Capital Ratio1 1 | Under capital rules, SHUSA is not required to include negative accumulated other comprehensive income (“AOCI”) in regulatory capital, but as a subsidiary of a global systemically important bank (“GSIB”) we manage AOCI closely as it impacts regulatory capital at the global consolidated level 2 | Estimate considering the full liquidation value of available-for-sale (“AFS”) of held-to-maturity (“HTM”) securities, net of statutory tax (26%) 14.3% 14.4% 14.5% 14.6% 14.7% 4Q23 1Q24 2Q24 3Q24 4Q24 16.4% 16.5% 16.6% 16.7% 16.8% 4Q23 1Q24 2Q24 3Q24 4Q24 9.8% 9.7% 9.9% 9.8% 9.3% 4Q23 1Q24 2Q24 3Q24 4Q24 12.4% 12.5% 12.6% 12.7% 12.7% 4Q23 1Q24 2Q24 3Q24 4Q24CET1 AFS & HTM Marked2 10.85% 10.94% 11.02% 11.42% 11.12%

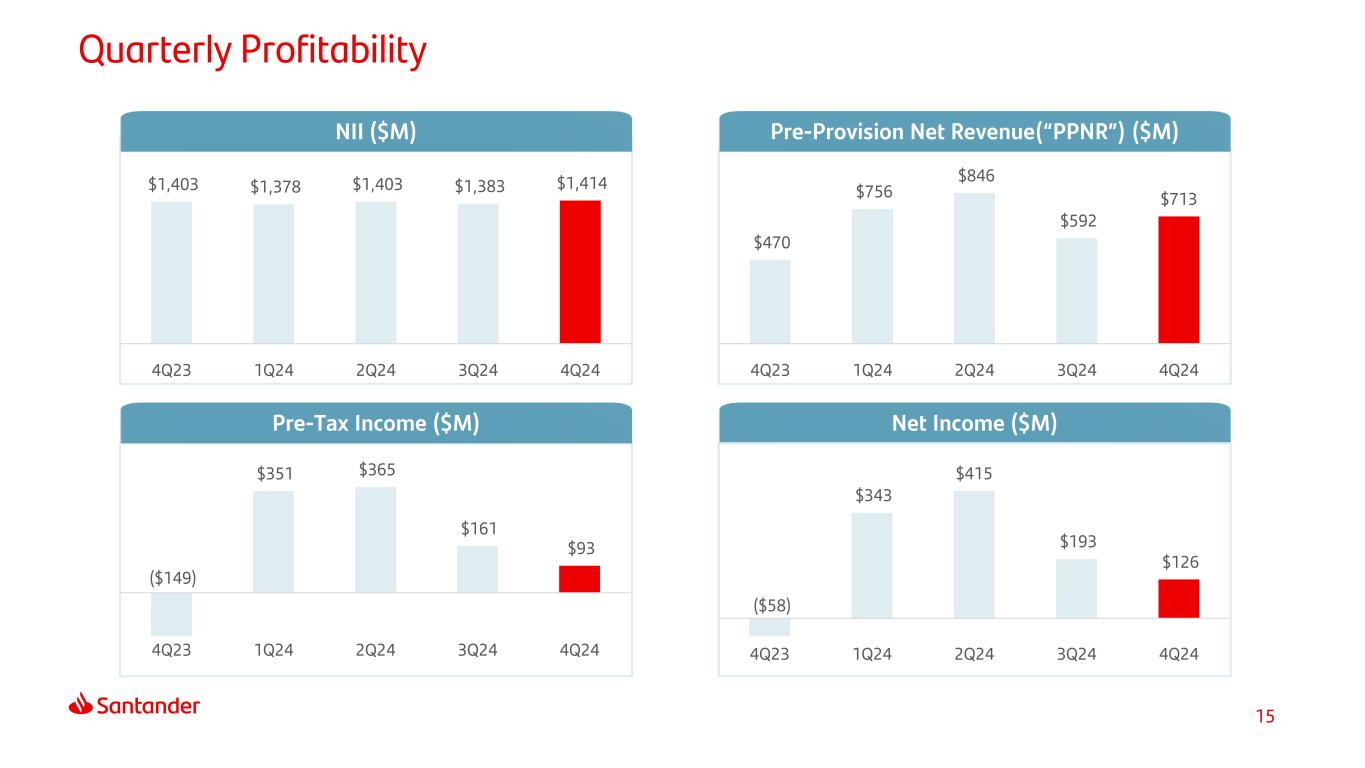

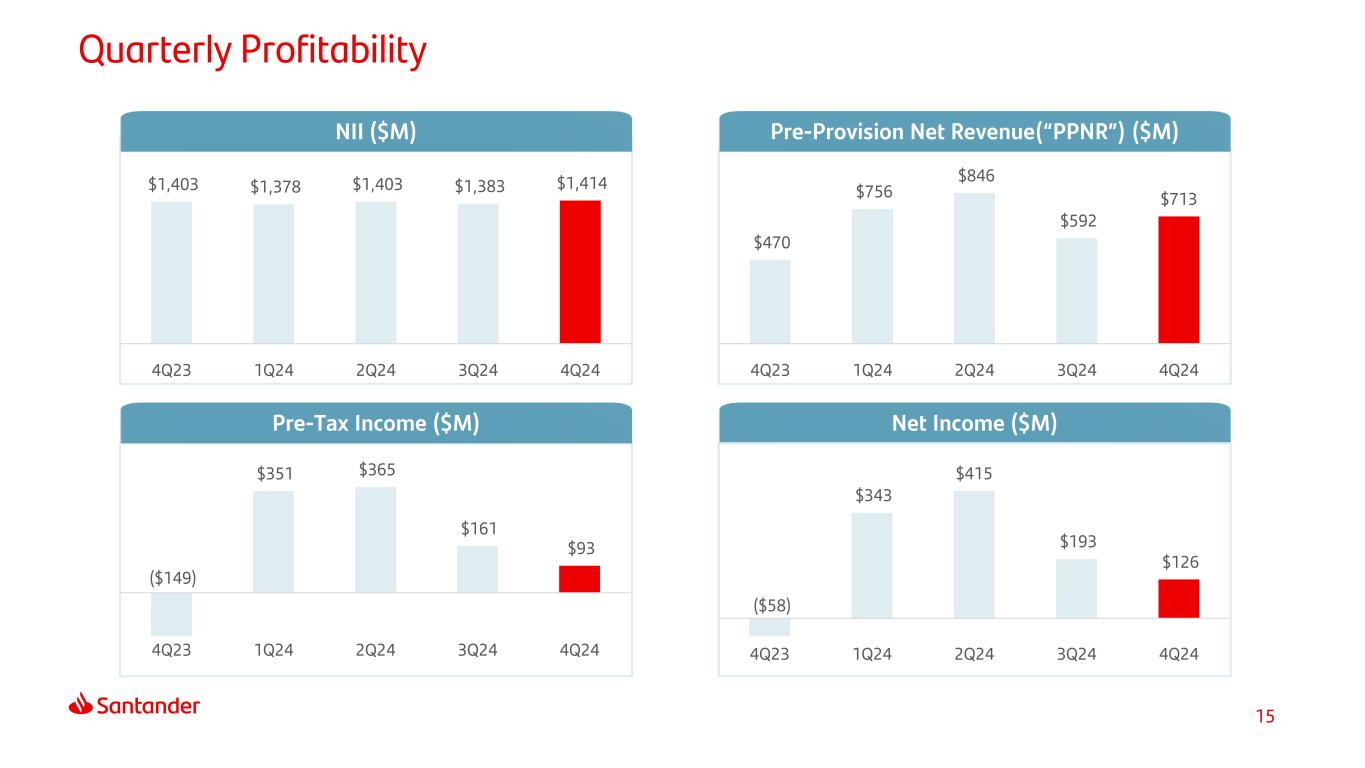

15 Quarterly Profitability NII ($M) Pre-Tax Income ($M) Net Income ($M) Pre-Provision Net Revenue(“PPNR”) ($M) $470 $756 $846 $592 $713 4Q23 1Q24 2Q24 3Q24 4Q24 $1,403 $1,378 $1,403 $1,383 $1,414 4Q23 1Q24 2Q24 3Q24 4Q24 ($58) $343 $415 $193 $126 4Q23 1Q24 2Q24 3Q24 4Q24 ($149) $351 $365 $161 $93 4Q23 1Q24 2Q24 3Q24 4Q24

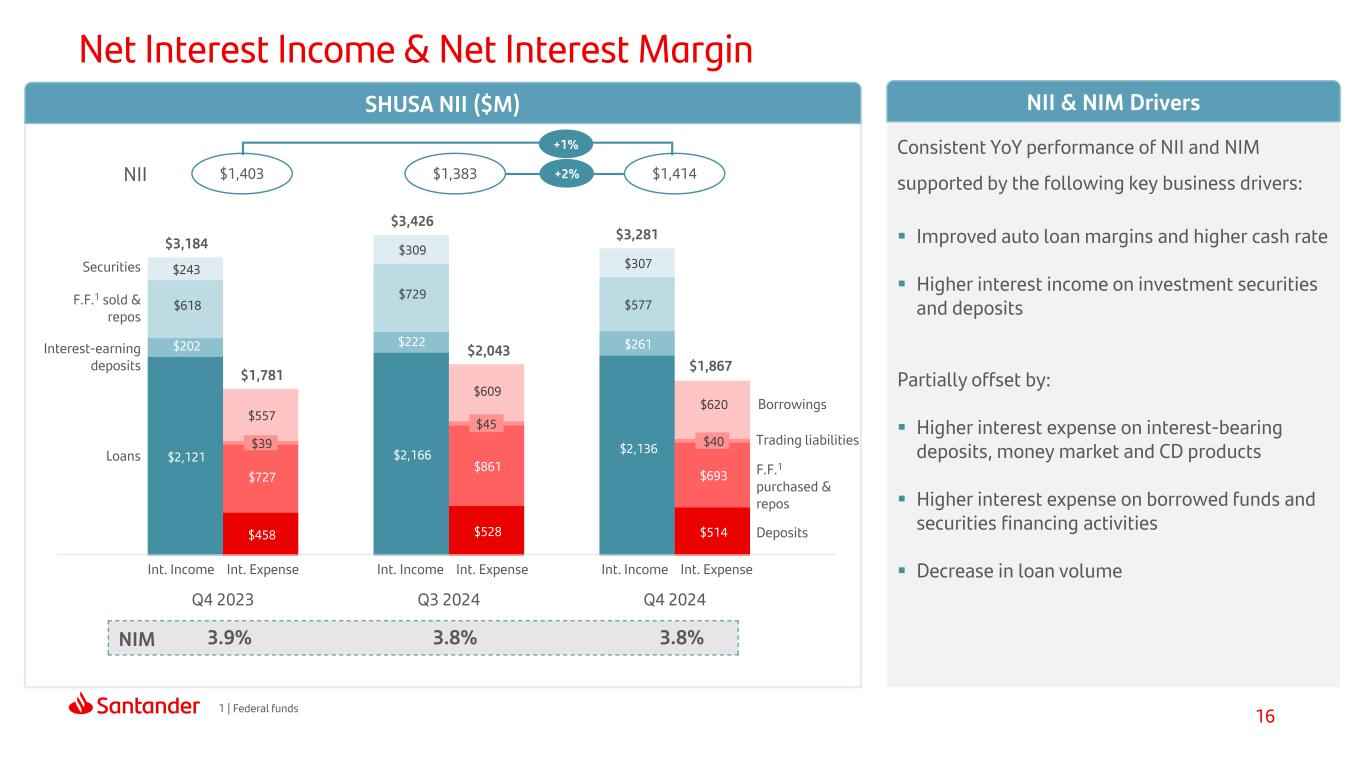

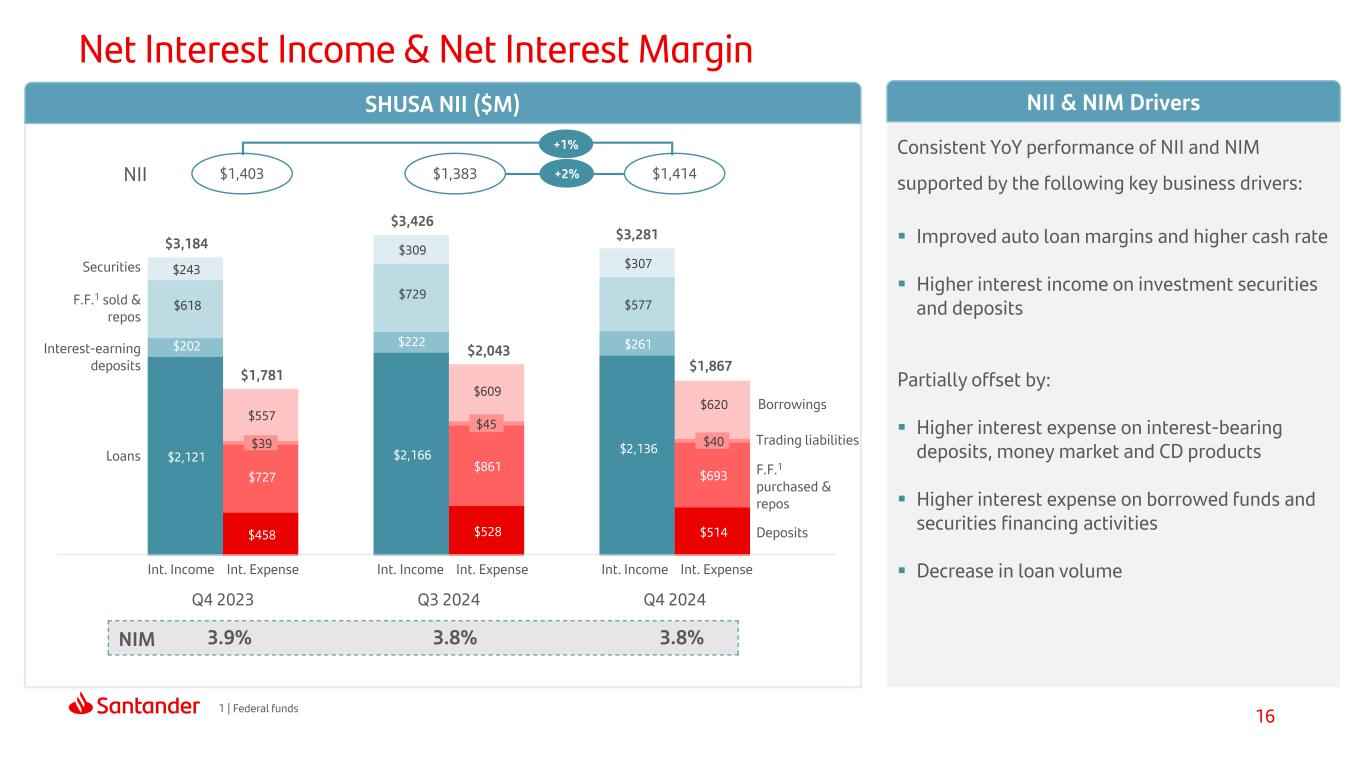

16 $2,121 $2,166 $2,136 $202 $222 $261 $618 $729 $577 $243 $309 $307 $458 $528 $514 $727 $861 $693 $39 $45 $40 $557 $609 $620 Q4 2023 Q3 2024 Q4 2024 Net Interest Income & Net Interest Margin NIM 3.9% 3.8% 3.8% $3,281$3,184 $3,426 $1,781 $2,043 $1,867 NII $1,403 $1,383 $1,414+2% +1% Securities F.F.1 sold & repos Interest-earning deposits Loans Borrowings Trading liabilities F.F.1 purchased & repos Deposits SHUSA NII ($M) NII & NIM Drivers Consistent YoY performance of NII and NIM supported by the following key business drivers: Improved auto loan margins and higher cash rate Higher interest income on investment securities and deposits Partially offset by: Higher interest expense on interest-bearing deposits, money market and CD products Higher interest expense on borrowed funds and securities financing activities Decrease in loan volume 1 | Federal funds Int. Income Int. Expense Int. Income Int. ExpenseInt. Income Int. Expense

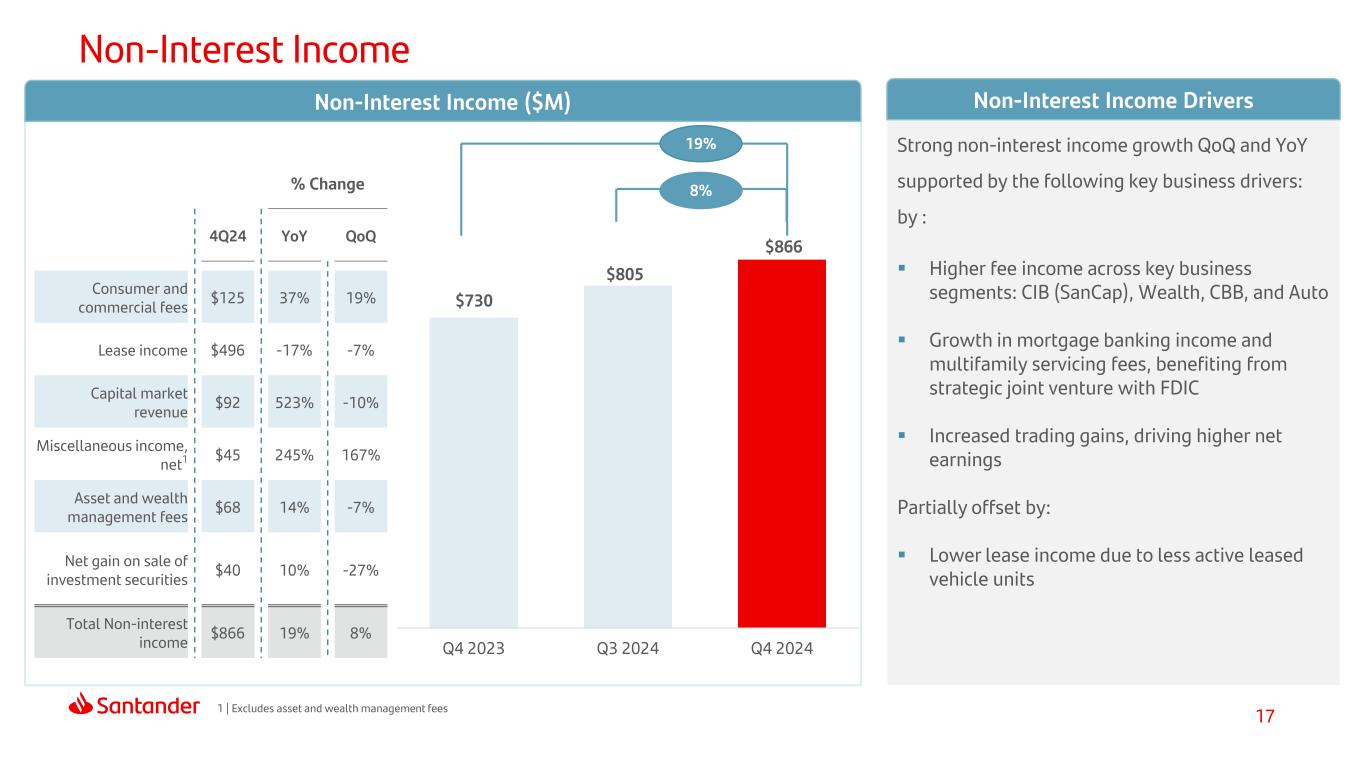

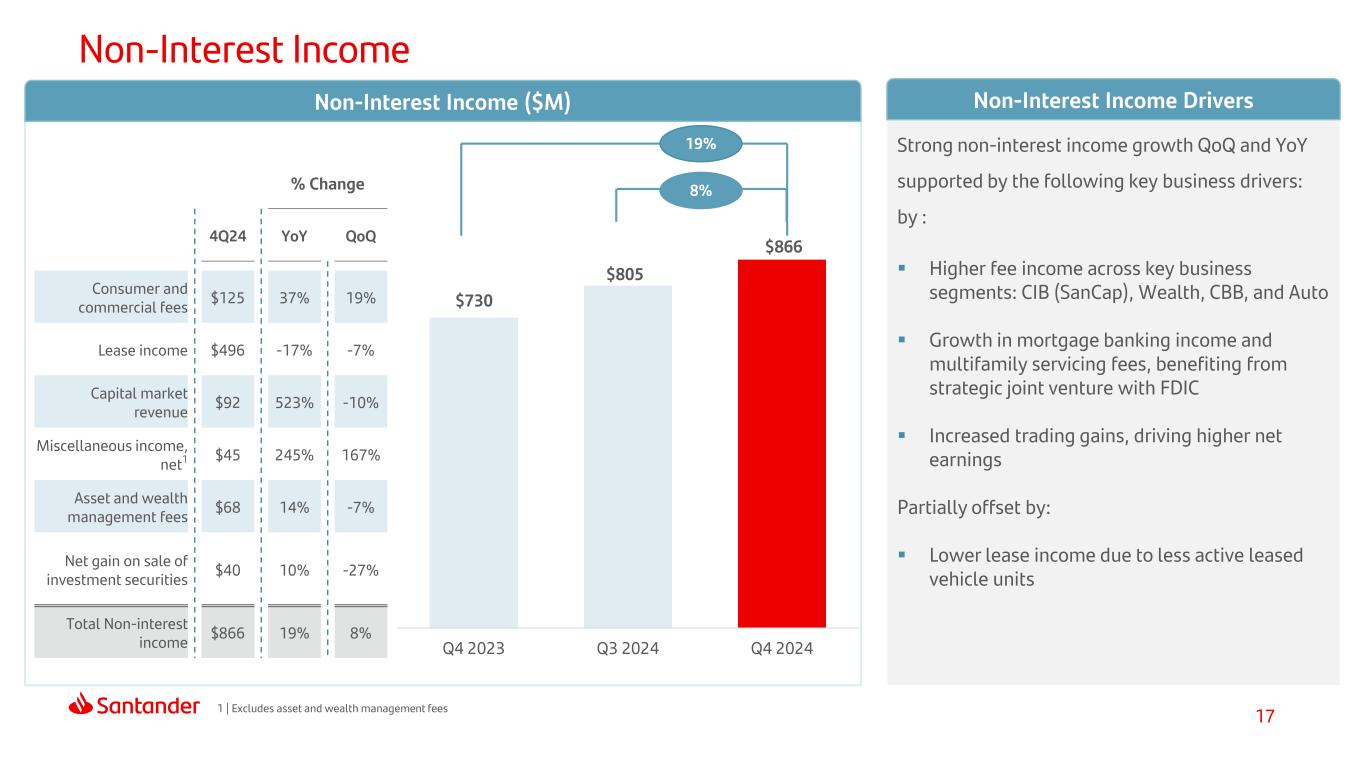

17 Non-Interest Income Non-Interest Income ($M) Non-Interest Income Drivers Strong non-interest income growth QoQ and YoY supported by the following key business drivers: by : Higher fee income across key business segments: CIB (SanCap), Wealth, CBB, and Auto Growth in mortgage banking income and multifamily servicing fees, benefiting from strategic joint venture with FDIC Increased trading gains, driving higher net earnings Partially offset by: Lower lease income due to less active leased vehicle units 8% 19% % Change 4Q24 YoY QoQ Consumer and commercial fees $125 37% 19% Lease income $496 -17% -7% Capital market revenue $92 523% -10% Miscellaneous income, net1 $45 245% 167% Asset and wealth management fees $68 14% -7% Net gain on sale of investment securities $40 10% -27% Total Non-interest income $866 19% 8% $730 $805 $866 Q4 2023 Q3 2024 Q4 2024 1 | Excludes asset and wealth management fees

18 $545 $533 $545 $162 $157 $179 $206 $196 $222 $80 $87 $79 $469 $443 $374 $201 $180 $168 Q4 2023 Q3 2024 Q4 2024 General, Administrative, and Other Expenses Expenses ($M) Expense Drivers Total expenses declined QoQ and YoY driven by: Lower auto lease volumes, leading to reduced depreciation and lease expenses Partially offset by: Strategic investments in banking system build- out and digital capabilities % Change YoY QoQ (16%) (6%) (20%) (16%) (2%) (10%) +8% +13% +11% 14% 0% +2% $1,663 $1,596 $1,567 -2% -6% Other expense Lease Loan Technology Occupancy and equipment Compensation and benefits

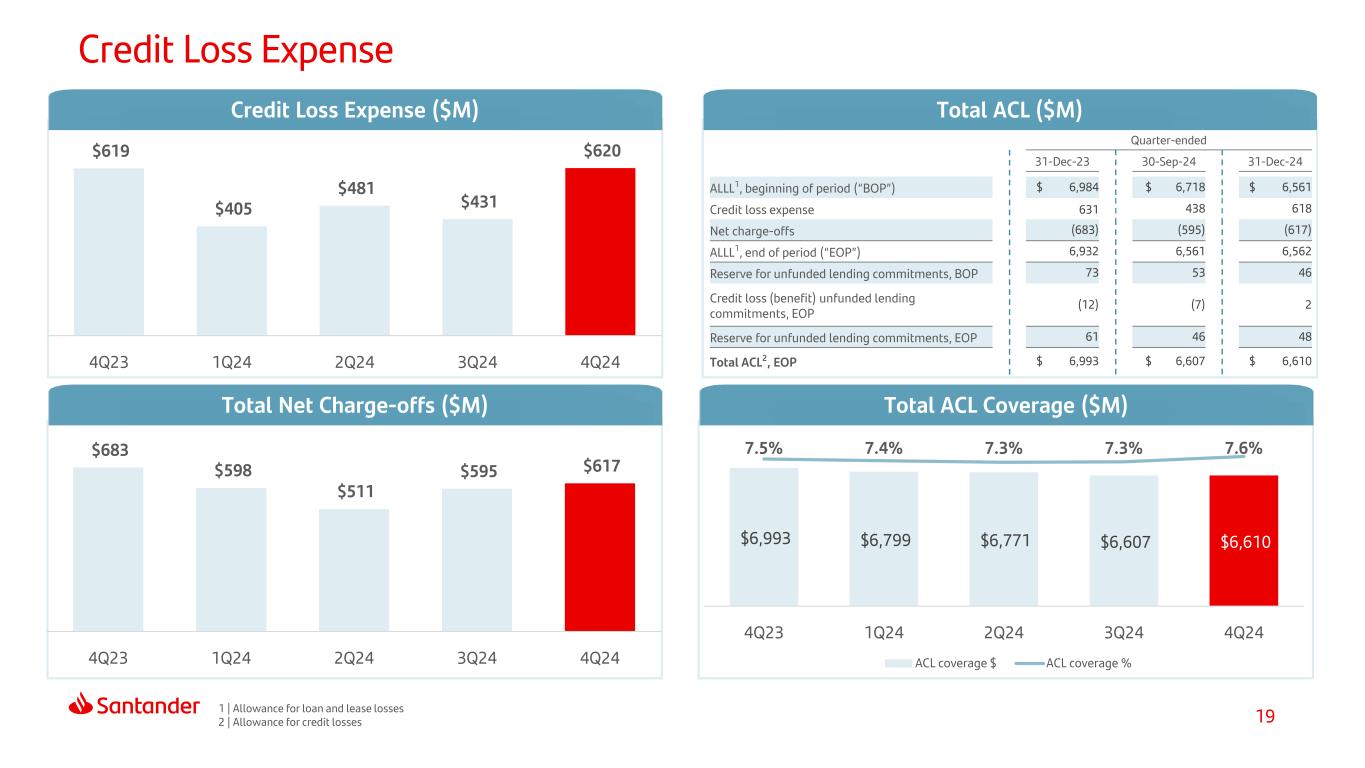

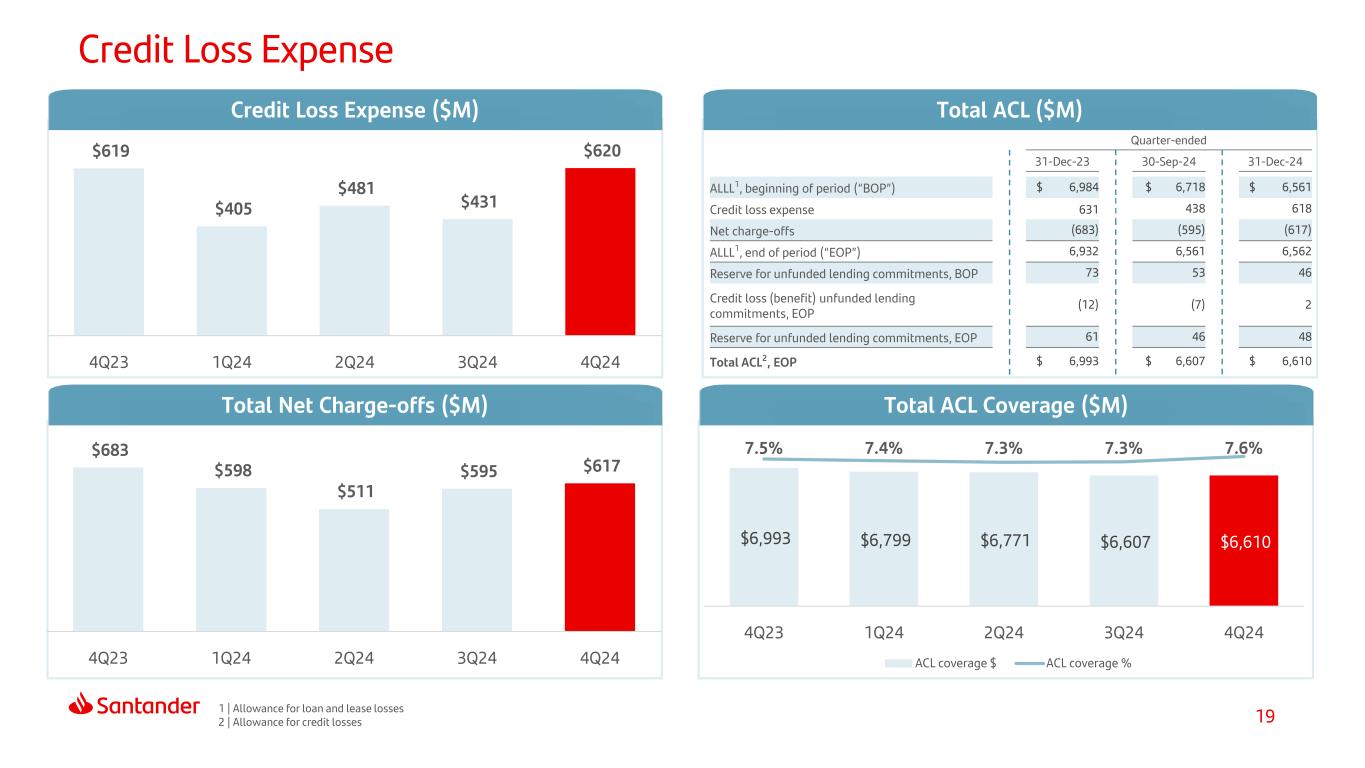

19 Credit Loss Expense Credit Loss Expense ($M) Total ACL ($M) Total Net Charge-offs ($M) Total ACL Coverage ($M) 1 | Allowance for loan and lease losses 2 | Allowance for credit losses Quarter-ended 31-Dec-23 30-Sep-24 31-Dec-24 ALLL1, beginning of period (“BOP”) $ 6,984 $ 6,718 $ 6,561 Credit loss expense 631 438 618 Net charge-offs (683) (595) (617) ALLL1, end of period (“EOP”) 6,932 6,561 6,562 Reserve for unfunded lending commitments, BOP 73 53 46 Credit loss (benefit) unfunded lending commitments, EOP (12) (7) 2 Reserve for unfunded lending commitments, EOP 61 46 48 Total ACL2, EOP $ 6,993 $ 6,607 $ 6,610 $619 $405 $481 $431 $620 4Q23 1Q24 2Q24 3Q24 4Q24 $683 $598 $511 $595 $617 4Q23 1Q24 2Q24 3Q24 4Q24 $6,993 $6,799 $6,771 $6,607 $6,610 7.5% 7.4% 7.3% 7.3% 7.6% $- $1,0 00 $2,0 00 $3,0 00 $4,0 00 $5,0 00 $6,0 00 $7,0 00 $8,0 00 0.0 % 1.0 % 2.0 % 3.0 % 4.0 % 5.0 % 6.0 % 7.0 % 8.0 % 4Q23 1Q24 2Q24 3Q24 4Q24 ACL coverage $ ACL coverage %

20 1 At a Glance 2 Results Appendix 4 Index 3 Core Business Activities

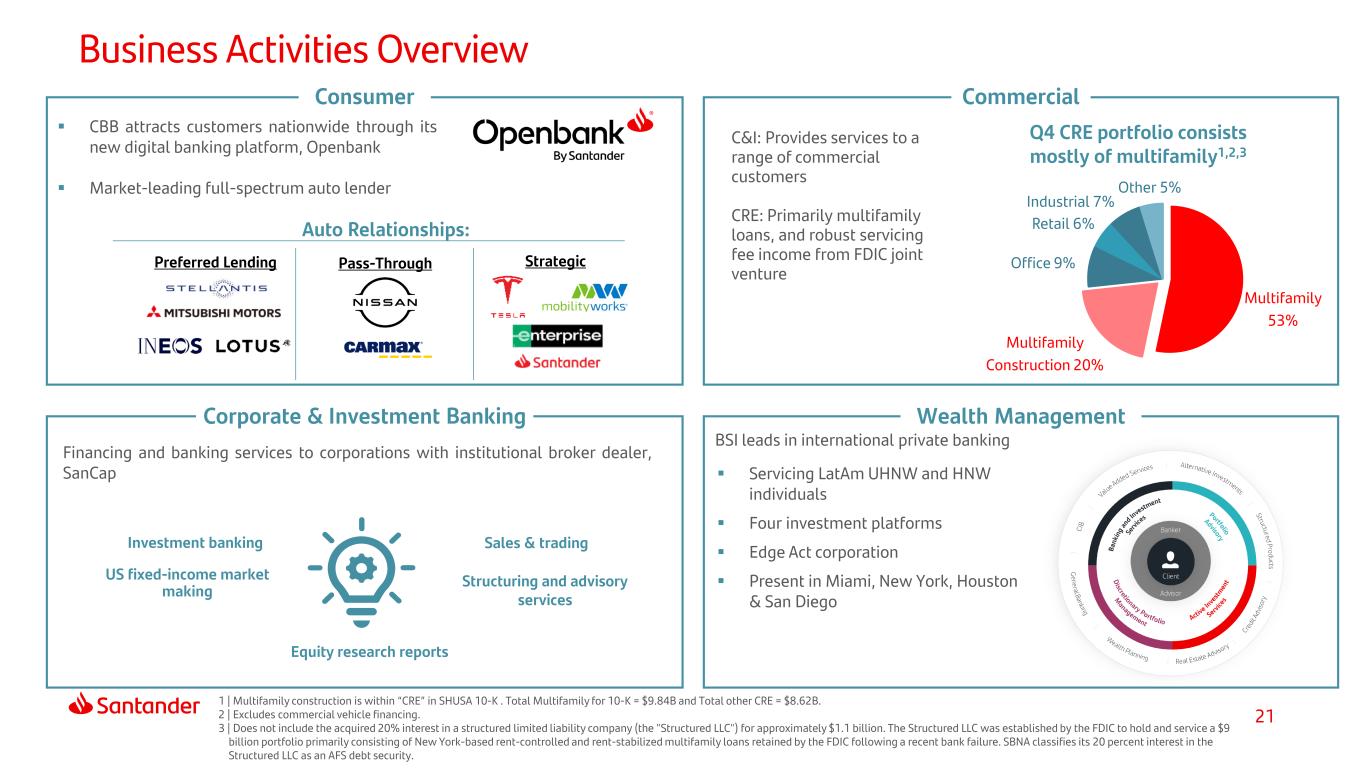

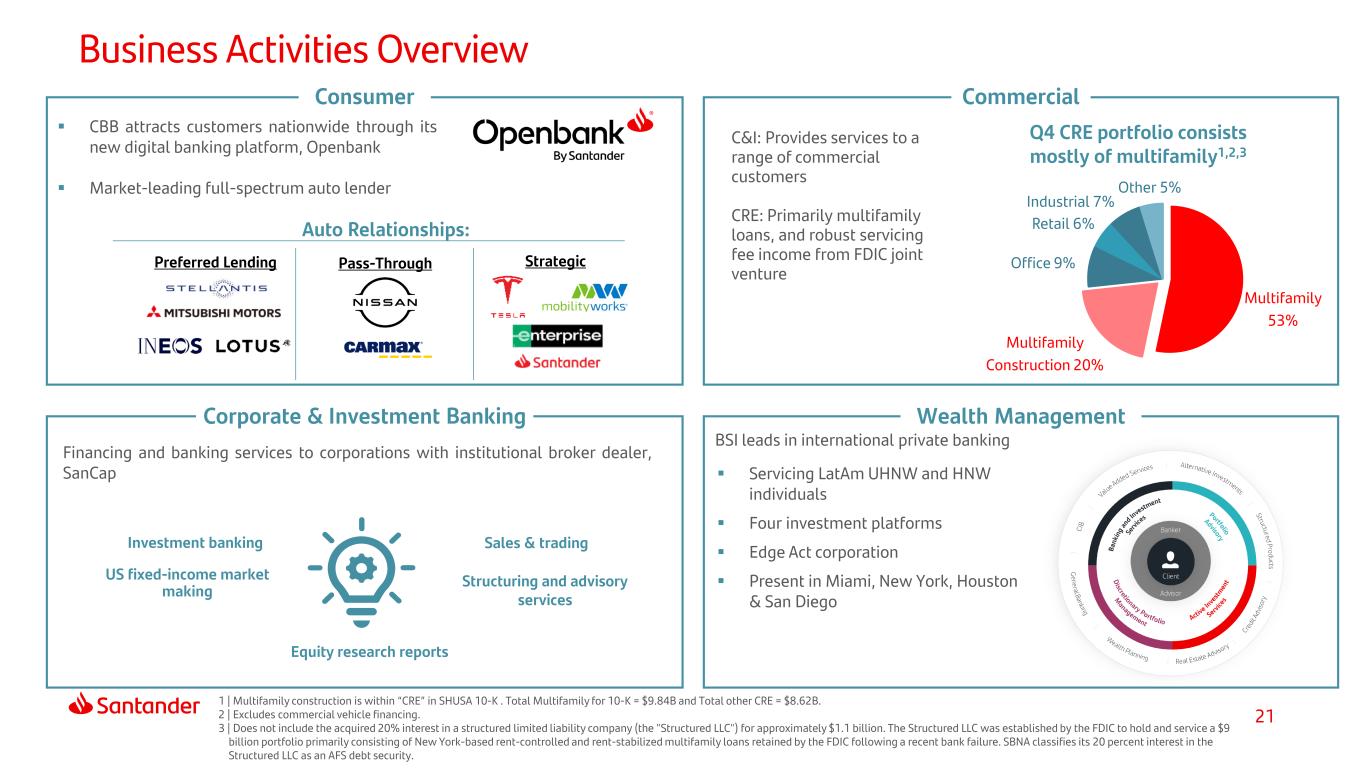

21 Consumer Corporate & Investment Banking Commercial Wealth Management CBB attracts customers nationwide through its new digital banking platform, Openbank Market-leading full-spectrum auto lender C&I: Provides services to a range of commercial customers CRE: Primarily multifamily loans, and robust servicing fee income from FDIC joint venture Q4 CRE portfolio consists mostly of multifamily1,2,3 Financing and banking services to corporations with institutional broker dealer, SanCap Equity research reports Investment banking BSI leads in international private banking Servicing LatAm UHNW and HNW individuals Four investment platforms Edge Act corporation Present in Miami, New York, Houston & San Diego 1 | Multifamily construction is within “CRE” in SHUSA 10-K . Total Multifamily for 10-K = $9.84B and Total other CRE = $8.62B. 2 | Excludes commercial vehicle financing. 3 | Does not include the acquired 20% interest in a structured limited liability company (the "Structured LLC") for approximately $1.1 billion. The Structured LLC was established by the FDIC to hold and service a $9 billion portfolio primarily consisting of New York-based rent-controlled and rent-stabilized multifamily loans retained by the FDIC following a recent bank failure. SBNA classifies its 20 percent interest in the Structured LLC as an AFS debt security. Business Activities Overview Sales & trading US fixed-income market making Structuring and advisory services Preferred Lending StrategicPass-Through Auto Relationships: Multifamily 53% Multifamily Construction 20% Office 9% Retail 6% Industrial 7% Other 5%

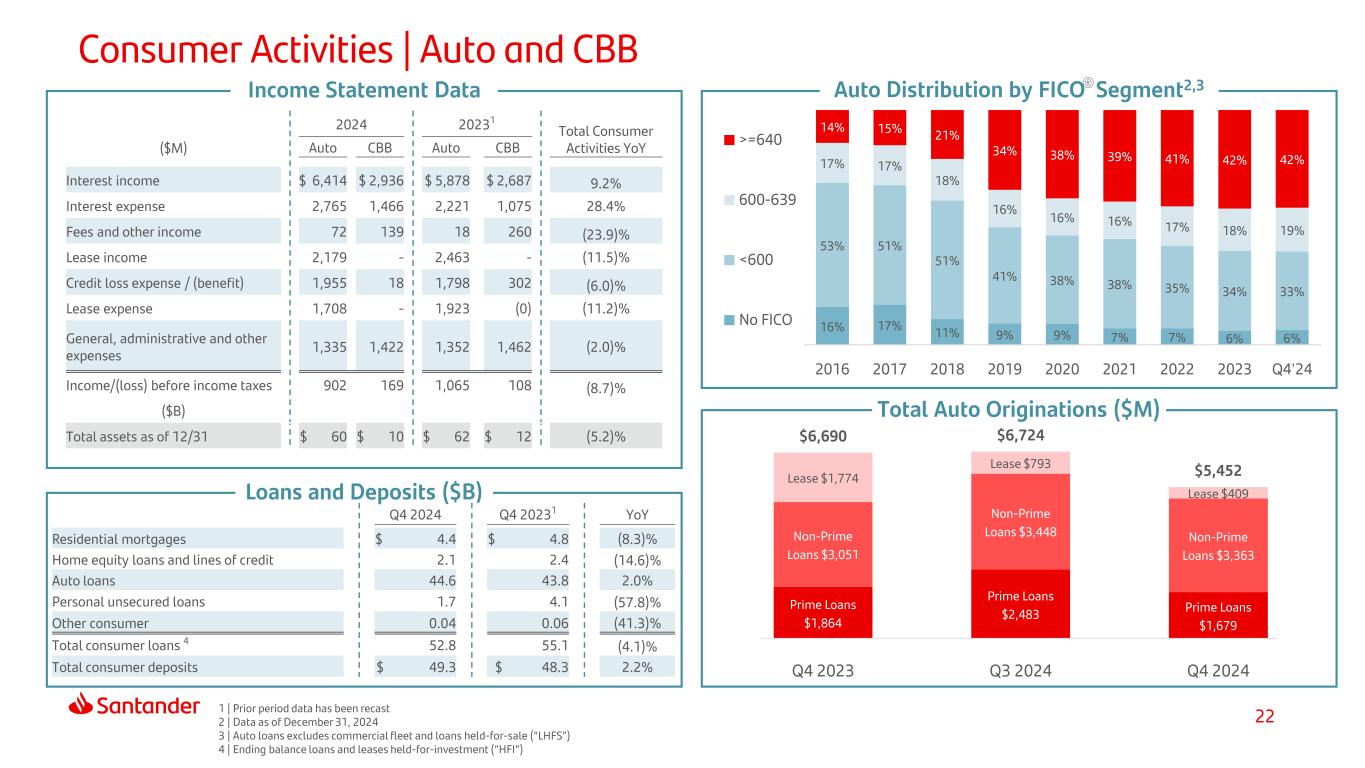

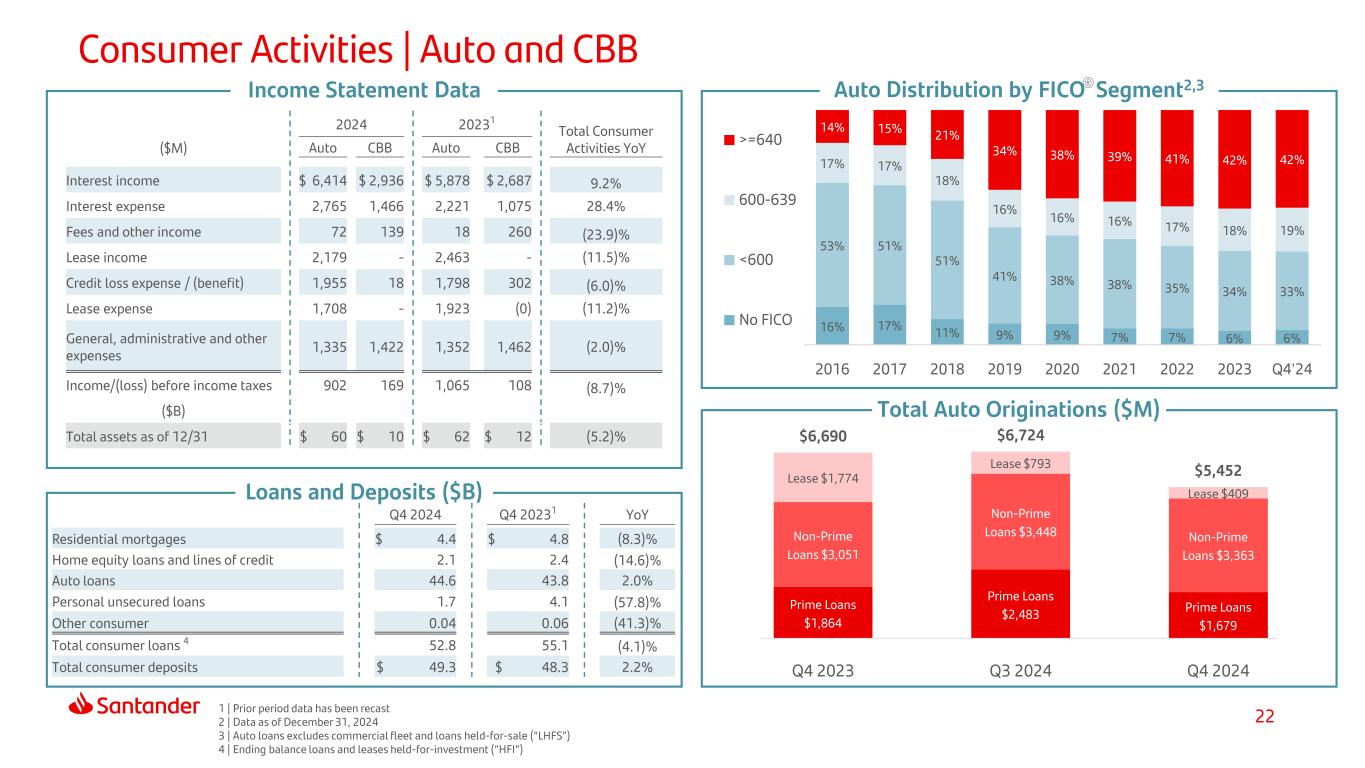

22 Prime Loans $1,679 Prime Loans $2,483 Prime Loans $1,864 Non-Prime Loans $3,363 Non-Prime Loans $3,448Non-Prime Loans $3,051 Lease $409 Lease $793 Lease $1,774 $5,452 $6,724$6,690 Q4 2024Q3 2024Q4 2023 Income Statement Data Loans and Deposits ($B) Consumer Activities | Auto and CBB Auto Distribution by FICO Segment2,3 Total Auto Originations ($M) 1 | Prior period data has been recast 2 | Data as of December 31, 2024 3 | Auto loans excludes commercial fleet and loans held-for-sale (“LHFS”) 4 | Ending balance loans and leases held-for-investment (“HFI”) 16% 17% 11% 9% 9% 7% 7% 6% 6% 53% 51% 51% 41% 38% 38% 35% 34% 33% 17% 17% 18% 16% 16% 16% 17% 18% 19% 14% 15% 21% 34% 38% 39% 41% 42% 42% 2016 2017 2018 2019 2020 2021 2022 2023 Q4'24 >=640 600-639 <600 No FICO Q4 2024 Q4 20231 YoY Residential mortgages $ 4.4 $ 4.8 (8.3)% Home equity loans and lines of credit 2.1 2.4 (14.6)% Auto loans 44.6 43.8 2.0% Personal unsecured loans 1.7 4.1 (57.8)% Other consumer 0.04 0.06 (41.3)% Total consumer loans 4 52.8 55.1 (4.1)% Total consumer deposits $ 49.3 $ 48.3 2.2% 2024 20231 Total Consumer Activities YoY($M) Auto CBB Auto CBB Interest income $ 6,414 $ 2,936 $ 5,878 $ 2,687 9.2% Interest expense 2,765 1,466 2,221 1,075 28.4% Fees and other income 72 139 18 260 (23.9)% Lease income 2,179 - 2,463 - (11.5)% Credit loss expense / (benefit) 1,955 18 1,798 302 (6.0)% Lease expense 1,708 - 1,923 (0) (11.2)% General, administrative and other expenses 1,335 1,422 1,352 1,462 (2.0)% Income/(loss) before income taxes 902 169 1,065 108 (8.7)% ($B) Total assets as of 12/31 $ 60 $ 10 $ 62 $ 12 (5.2)%

23 Income Statement Data Loans and Deposits ($B) Commercial Activities | CRE, Multifamily, and C&I Q4 CRE Portfolio and Geographic Diversification2 Q4 Portfolio by maturity and interest rate2 ($M) 1 | Prior period data has been recast 2 | Data as of December 31, 2024 3 | Ending balance loans and leases HFI CRE TOTAL ~ $18.5BMultifamily 53% Multifamily Construction 20% Office 9% Retail 6% Industrial 7% Other 5% NY 31% NJ 12% MA 9%TX 8% Other 40% $- $1.0 $2.0 $3.0 $4.0 $5.0 In One Year or Less One to Five Years Five+ Years Fixed Rate CRE Fixed Rate Multifamily Variable Rate CRE Variable Rate Multifamily Q4 2024 Q4 20231 YoY C&I loans $ 8.4 $ 11.2 (25.0)% CRE loans 8.6 8.7 (1.4)% Other commercial 7.6 7.5 1.8% Multifamily loans 9.9 10.5 (6.7)% Total commercial loans 3 34.5 38.0 (9.2)% Total commercial deposits $ 13.8 $ 13.2 4.7% 2024 20231 Total Commercial Activities YoY($M) C&I CRE C&I CRE Interest income $ 988 $1,535 $ 943 $1,340 10.6% Interest expense 633 1,035 620 891 10.3% Fees and other income 66 76 56 25 77.1% Lease income - - 0.1 0 (100.0)% Credit loss (benefit) / expense (66) 70 (23) 176 (97.7)% Lease expense - - (0.1) (0.1) (100.0)% General, administrative and other expenses 214 138 261 135 (10.9)% Income/(loss) before income taxes 274 368 141 162 111.7% ($B) Total assets as of 12/31 $ 4 $ 23 $ 5 $ 24 (6.1)%

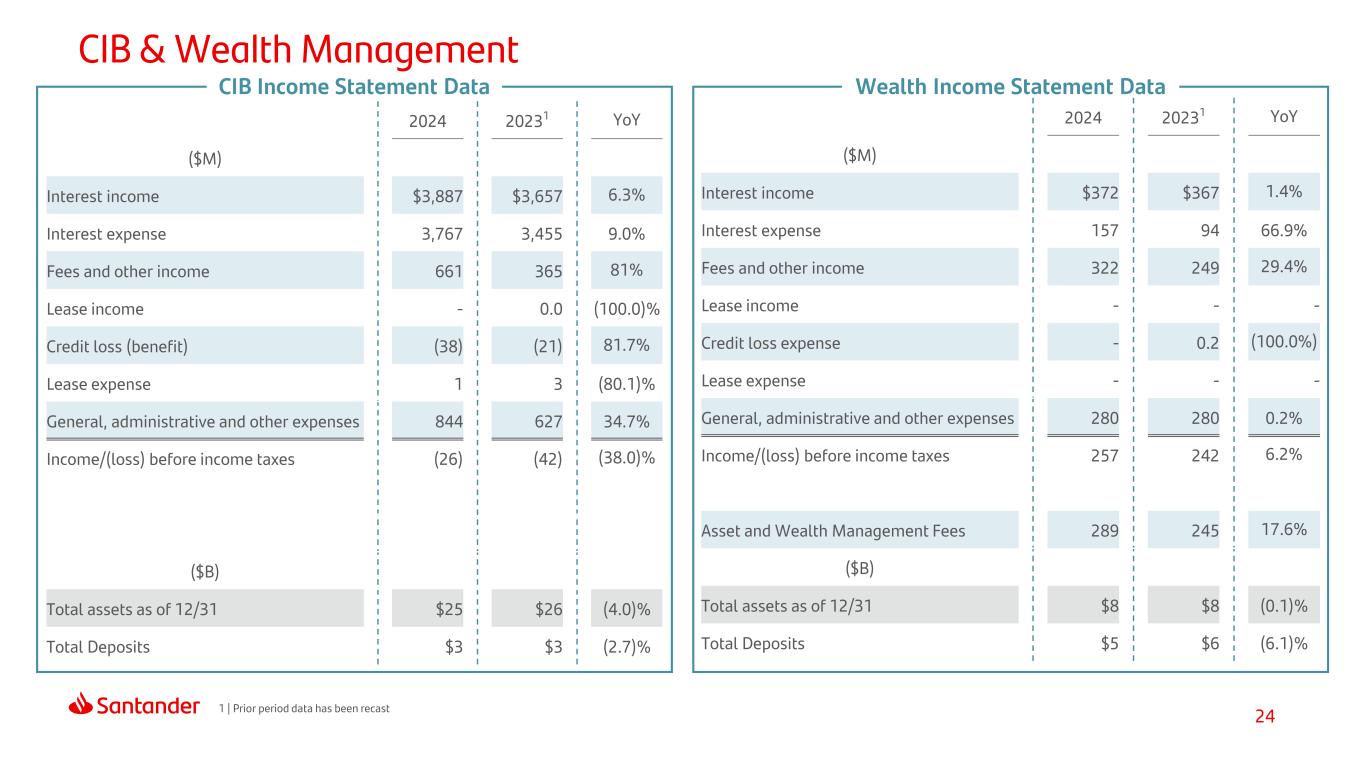

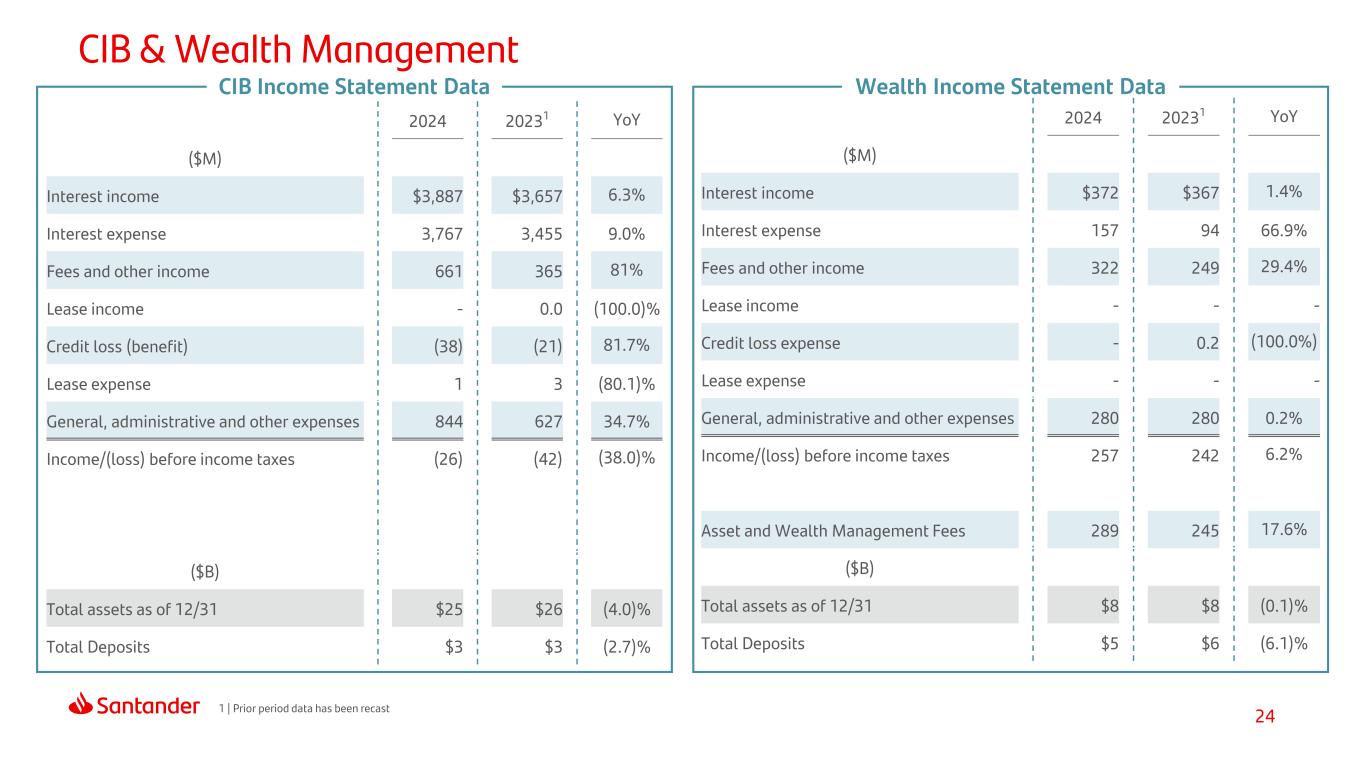

24 CIB Income Statement Data Wealth Income Statement Data 1 | Prior period data has been recast CIB & Wealth Management 2024 20231 YoY ($M) Interest income $372 $367 1.4% Interest expense 157 94 66.9% Fees and other income 322 249 29.4% Lease income - - - Credit loss expense - 0.2 (100.0%) Lease expense - - - General, administrative and other expenses 280 280 0.2% Income/(loss) before income taxes 257 242 6.2% Asset and Wealth Management Fees 289 245 17.6% ($B) Total assets as of 12/31 $8 $8 (0.1)% Total Deposits $5 $6 (6.1)% 2024 20231 YoY ($M) Interest income $3,887 $3,657 6.3% Interest expense 3,767 3,455 9.0% Fees and other income 661 365 81% Lease income - 0.0 (100.0)% Credit loss (benefit) (38) (21) 81.7% Lease expense 1 3 (80.1)% General, administrative and other expenses 844 627 34.7% Income/(loss) before income taxes (26) (42) (38.0)% ($B) Total assets as of 12/31 $25 $26 (4.0)% Total Deposits $3 $3 (2.7)%

25 1 At a Glance 2 Results Appendix 4 Index 3 Core Business Activities

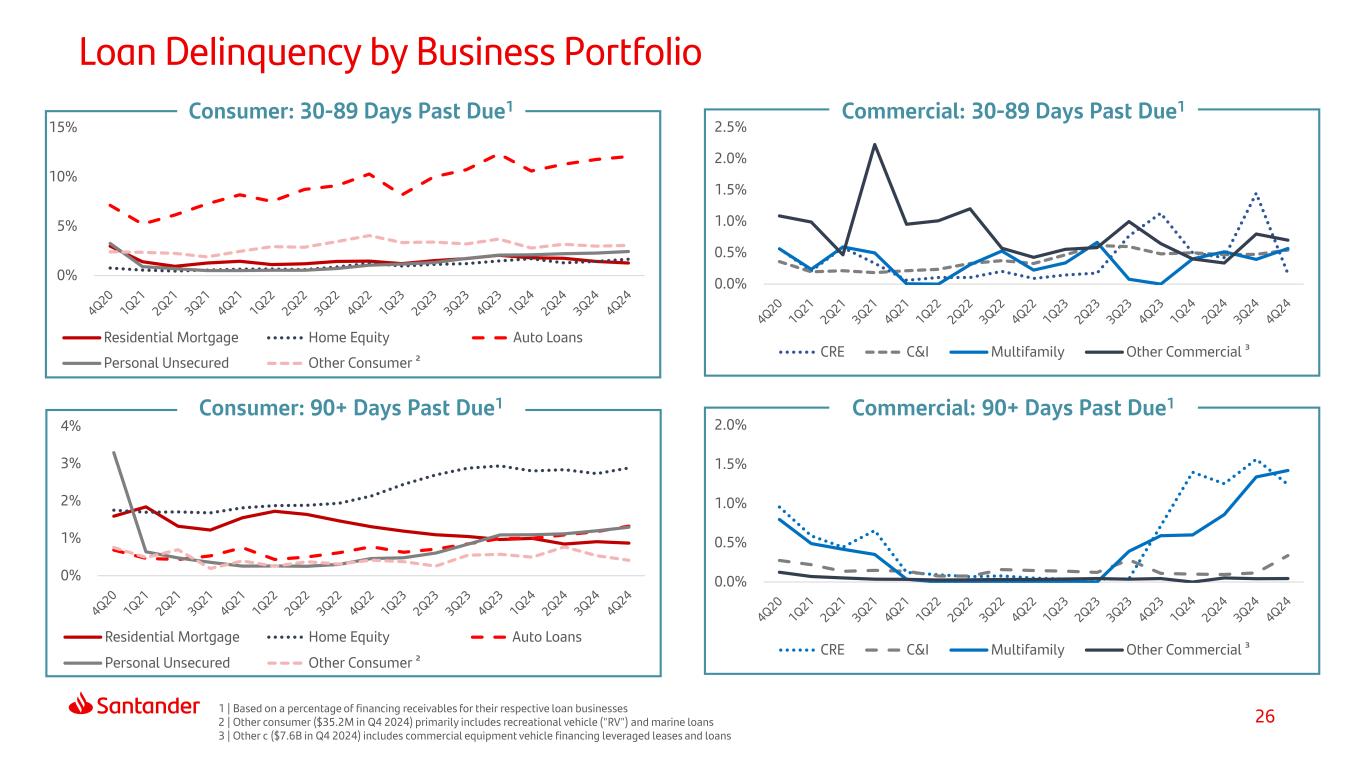

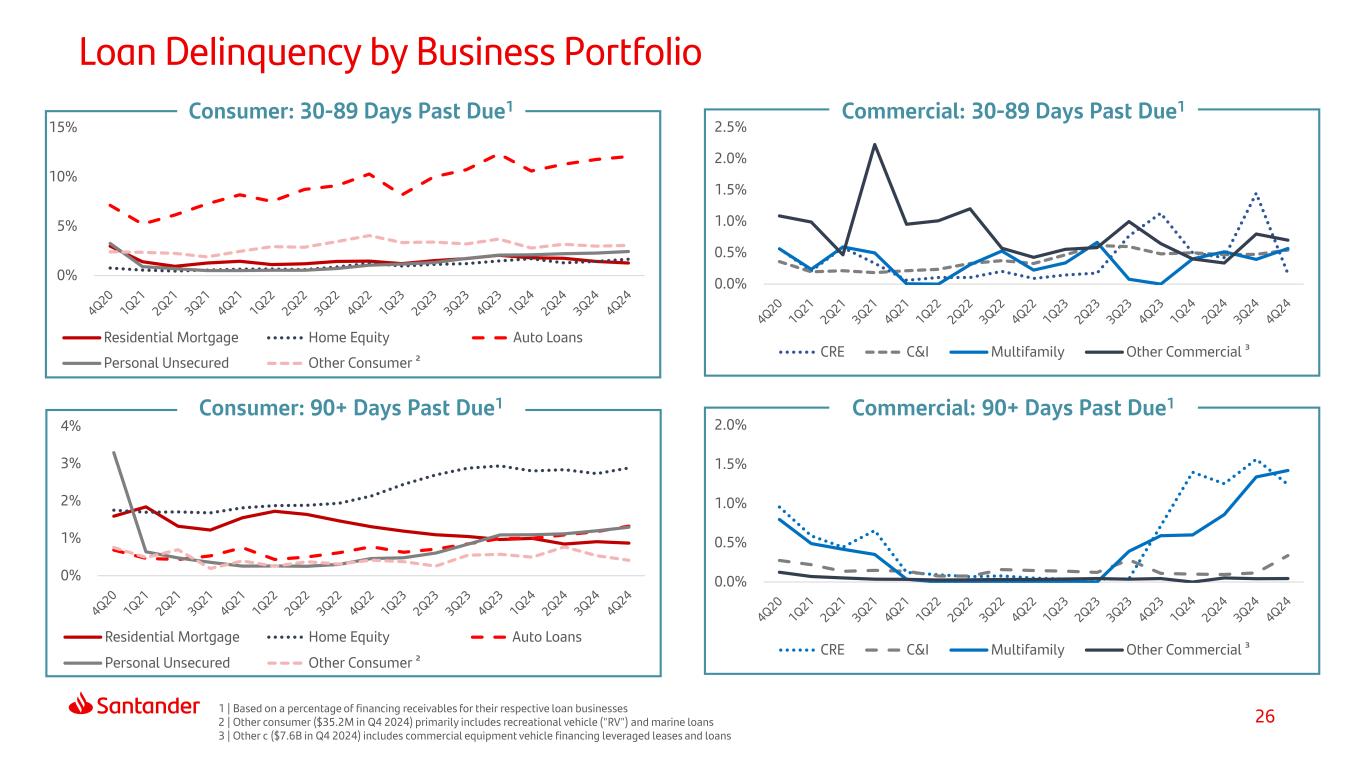

26 Loan Delinquency by Business Portfolio 1 | Based on a percentage of financing receivables for their respective loan businesses 2 | Other consumer ($35.2M in Q4 2024) primarily includes recreational vehicle ("RV") and marine loans 3 | Other c ($7.6B in Q4 2024) includes commercial equipment vehicle financing leveraged leases and loans Consumer: 30-89 Days Past Due1 Consumer: 90+ Days Past Due1 Commercial: 30-89 Days Past Due1 Commercial: 90+ Days Past Due1 0% 5% 10% 15% Residential Mortgage Home Equity Auto Loans Personal Unsecured Other Consumer ² 0% 1% 2% 3% 4% Residential Mortgage Home Equity Auto Loans Personal Unsecured Other Consumer ² 0.0% 0.5% 1.0% 1.5% 2.0% 2.5% CRE C&I Multifamily Other Commercial ³ 0.0% 0.5% 1.0% 1.5% 2.0% CRE C&I Multifamily Other Commercial ³

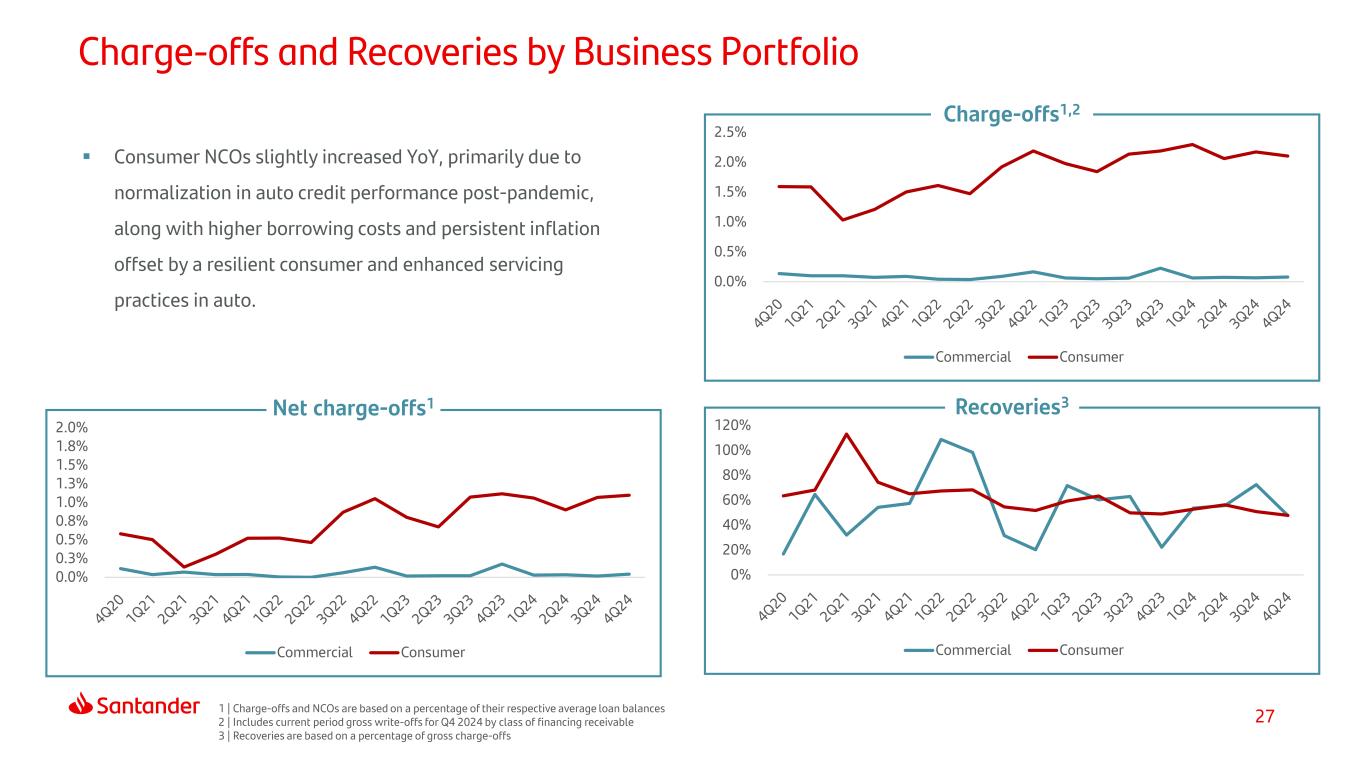

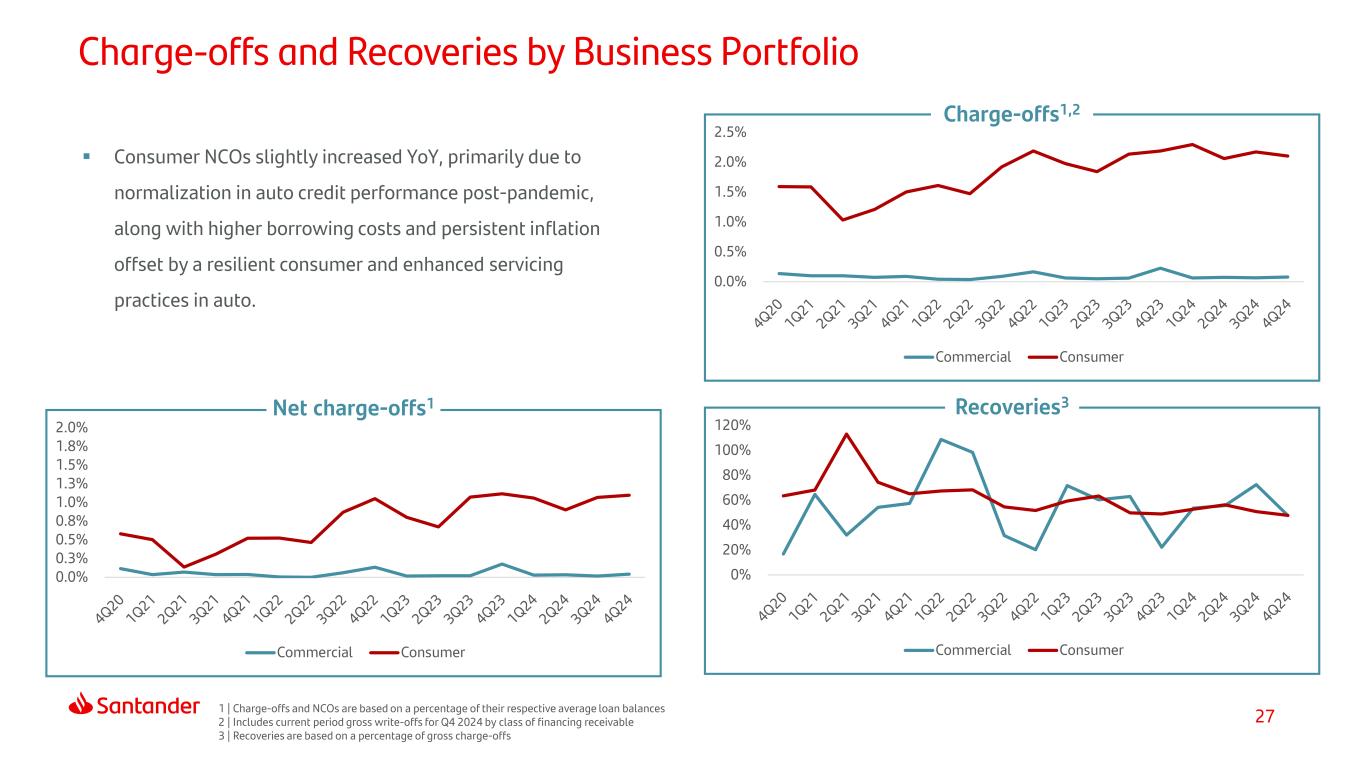

27 Charge-offs and Recoveries by Business Portfolio Charge-offs1,2 Recoveries3 1 | Charge-offs and NCOs are based on a percentage of their respective average loan balances 2 | Includes current period gross write-offs for Q4 2024 by class of financing receivable 3 | Recoveries are based on a percentage of gross charge-offs Consumer NCOs slightly increased YoY, primarily due to normalization in auto credit performance post-pandemic, along with higher borrowing costs and persistent inflation offset by a resilient consumer and enhanced servicing practices in auto. 0.0% 0.5% 1.0% 1.5% 2.0% 2.5% Commercial Consumer 0.0% 0.3% 0.5% 0.8% 1.0% 1.3% 1.5% 1.8% 2.0% Commercial Consumer 0% 20% 40% 60% 80% 100% 120% Commercial Consumer Net charge-offs1

28 Q4 ACL was $6.6 billion, a decrease of $383 million from December 31, 2023. The decrease in the ACL was primarily driven by the sale of certain personal unsecured loans and off-balance sheet securitizations of auto loans and improvement in the macroeconomic outlook for certain macro variables. The ACL for the consumer segment decreased by $322 million and the ACL for the commercial segment decreased $61 million, compared to December 31, 2023. Total Allowance For Credit Losses (“ACL”) 1 | Includes ACL for unfunded commitments Allowance Ratios ($M) December 31, 2024 September 30, 2024 June 30, 2024 December 31, 2023 (Audited) (Unaudited) (Unaudited) (Audited) Total loans HFI $ 87,304 $ 89,686 $ 92,334 $ 93,047 Total ACL1 6,610 6,607 6,771 6,993 Total Allowance Ratio 7.6% 7.3% 7.3% 7.5%

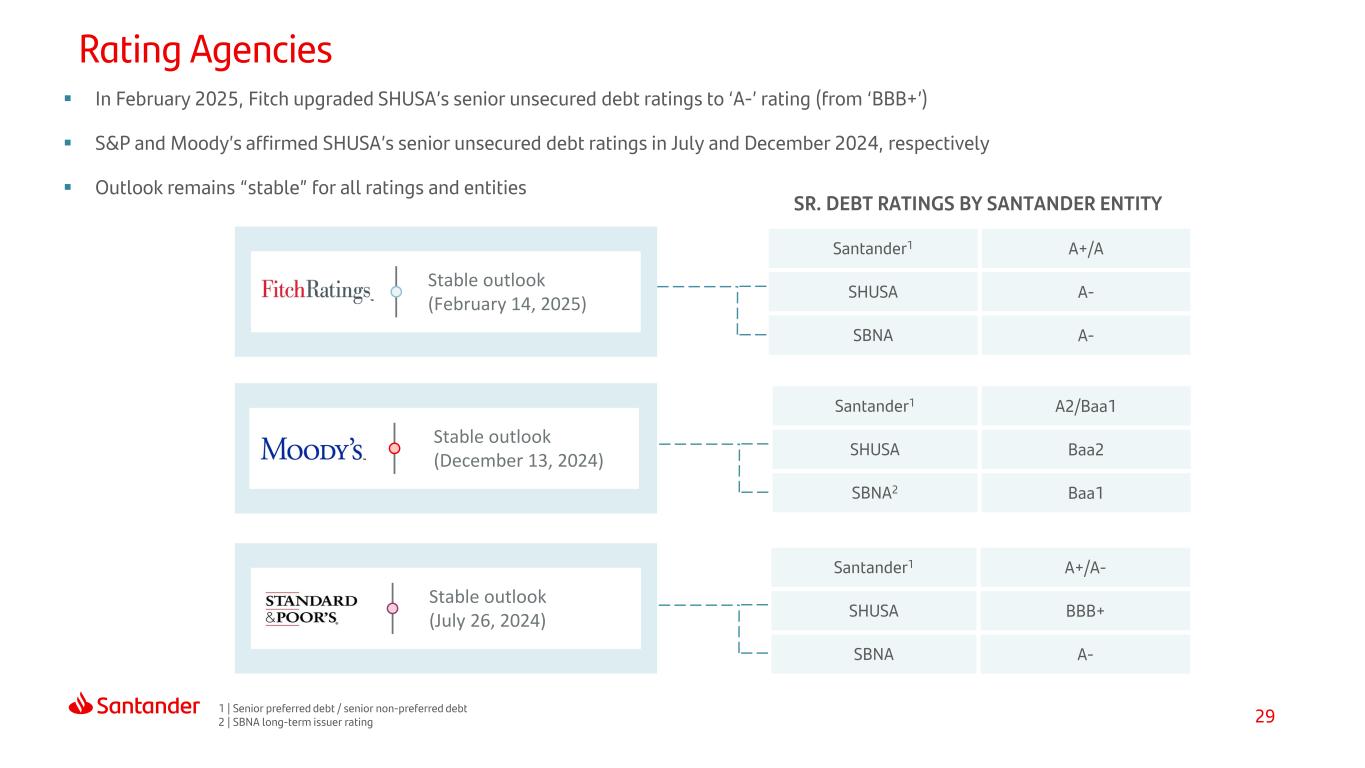

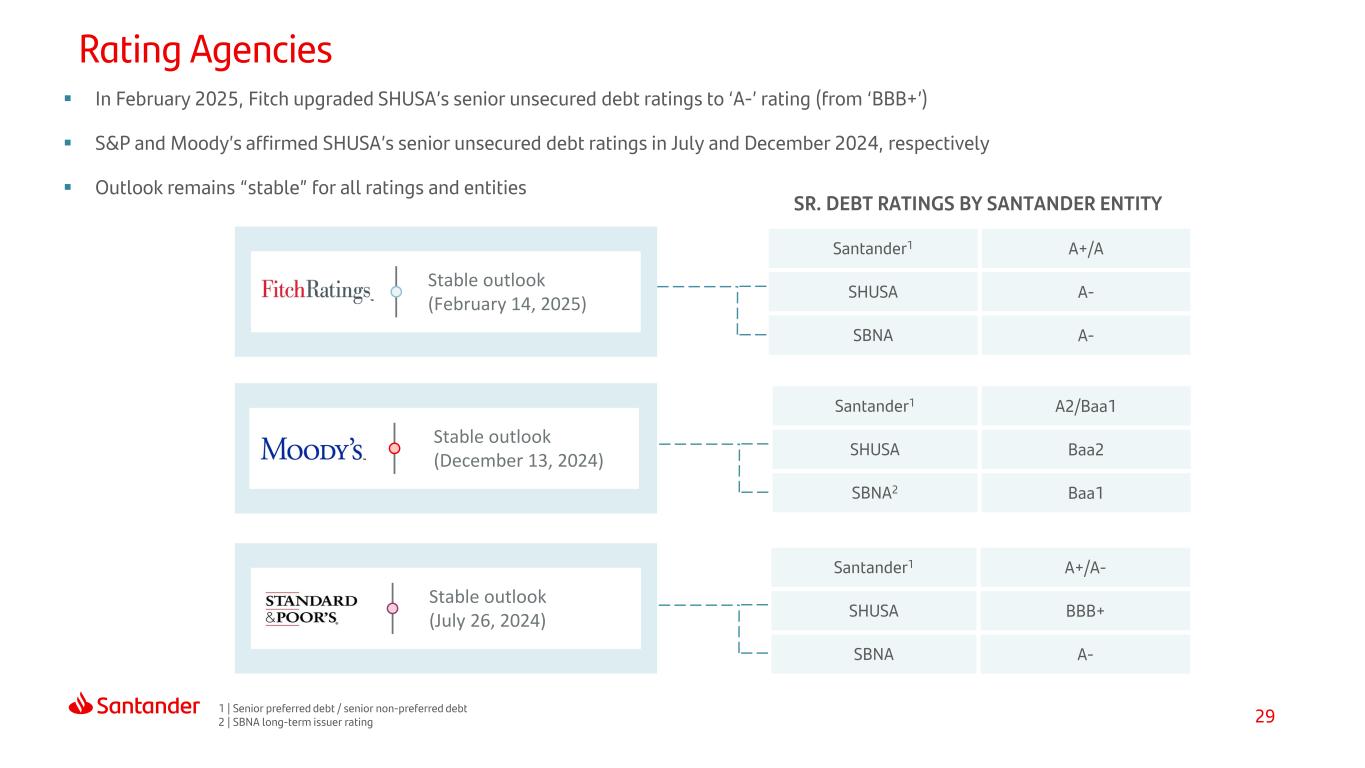

29 Santander1 A2/Baa1 SHUSA Baa2 SBNA2 Baa1 Santander1 A+/A- SHUSA BBB+ SBNA A- Stable outlook (February 14, 2025) In February 2025, Fitch upgraded SHUSA’s senior unsecured debt ratings to ‘A-’ rating (from ‘BBB+’) S&P and Moody’s affirmed SHUSA’s senior unsecured debt ratings in July and December 2024, respectively Outlook remains “stable” for all ratings and entities SR. DEBT RATINGS BY SANTANDER ENTITY Santander1 A+/A SHUSA A- SBNA A- Stable outlook (December 13, 2024) Stable outlook (July 26, 2024) Rating Agencies 1 | Senior preferred debt / senior non-preferred debt 2 | SBNA long-term issuer rating

30 SHUSA | Quarterly Trended Statement Of Operations ($M) Q4 2023 Q1 2024 Q2 2024 Q3 2024 Q4 2024 Interest income $ 3,184 $ 3,254 $ 3,505 $ 3,426 $ 3,281 Interest expense (1,781) (1,876) (2,102) (2,043) (1,867) Net interest income 1,403 1,378 1,403 1,383 1,414 Fees & other income 693 873 932 750 826 Other non-interest income 36 65 64 55 40 Net revenue 2,132 2,316 2,399 2,188 2,280 General, administrative, and other expenses (1,662) (1,560) (1,554) (1,596) (1,567) Credit loss expense (619) (405) (481) (431) (620) Income before taxes (149) 351 364 161 93 Income tax (expense) / benefit 91 (8) 50 32 33 Net income / (loss) (58) 343 414 193 126 NIM 3.9% 3.8% 3.9% 3.8% 3.8%

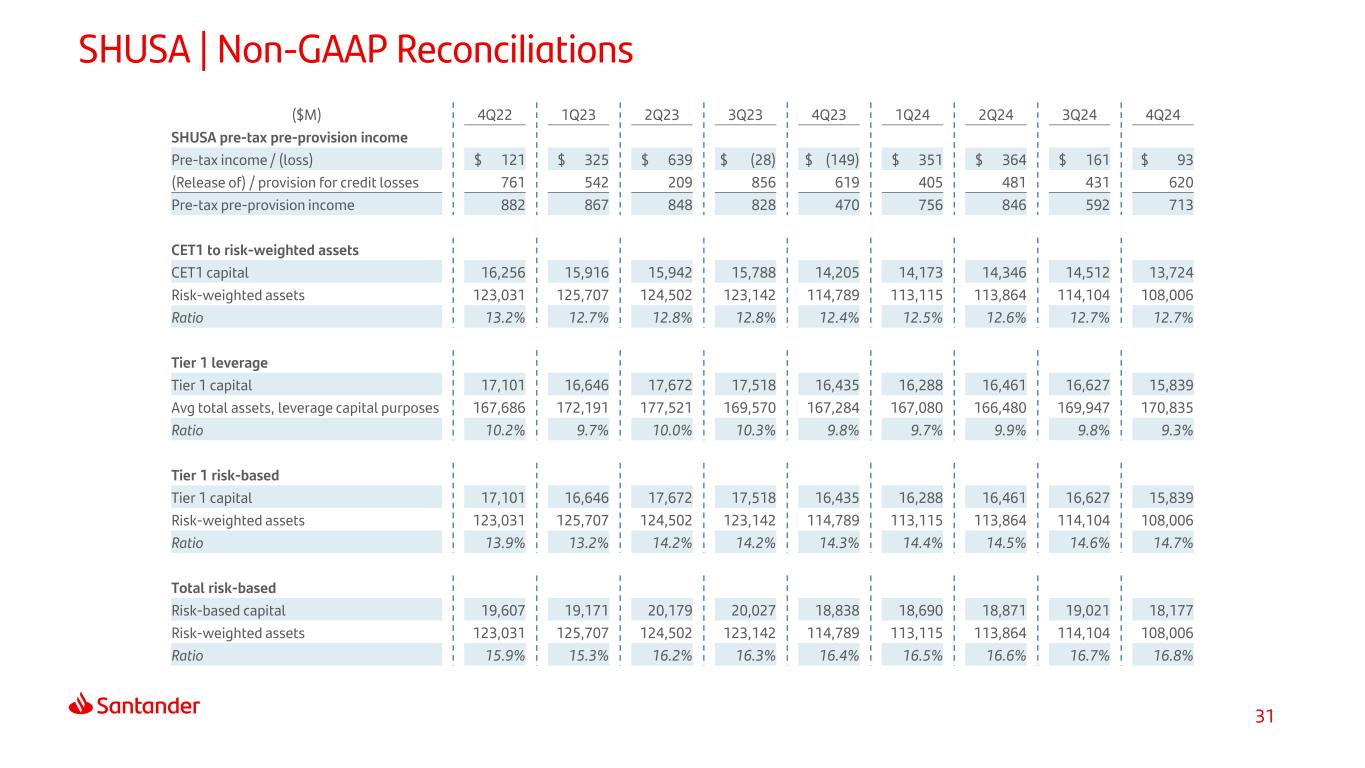

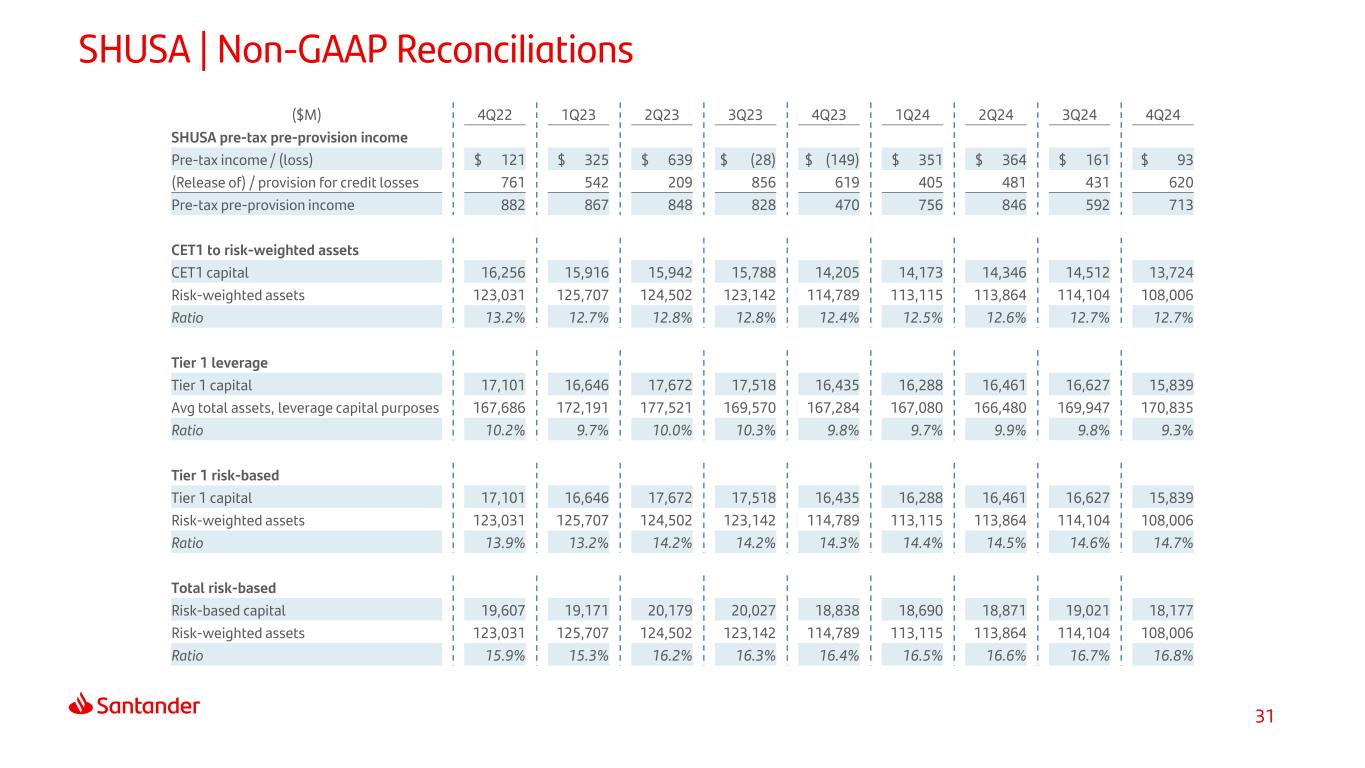

31 SHUSA | Non-GAAP Reconciliations ($M) 4Q22 1Q23 2Q23 3Q23 4Q23 1Q24 2Q24 3Q24 4Q24 SHUSA pre-tax pre-provision income Pre-tax income / (loss) $ 121 $ 325 $ 639 $ (28) $ (149) $ 351 $ 364 $ 161 $ 93 (Release of) / provision for credit losses 761 542 209 856 619 405 481 431 620 Pre-tax pre-provision income 882 867 848 828 470 756 846 592 713 CET1 to risk-weighted assets CET1 capital 16,256 15,916 15,942 15,788 14,205 14,173 14,346 14,512 13,724 Risk-weighted assets 123,031 125,707 124,502 123,142 114,789 113,115 113,864 114,104 108,006 Ratio 13.2% 12.7% 12.8% 12.8% 12.4% 12.5% 12.6% 12.7% 12.7% Tier 1 leverage Tier 1 capital 17,101 16,646 17,672 17,518 16,435 16,288 16,461 16,627 15,839 Avg total assets, leverage capital purposes 167,686 172,191 177,521 169,570 167,284 167,080 166,480 169,947 170,835 Ratio 10.2% 9.7% 10.0% 10.3% 9.8% 9.7% 9.9% 9.8% 9.3% Tier 1 risk-based Tier 1 capital 17,101 16,646 17,672 17,518 16,435 16,288 16,461 16,627 15,839 Risk-weighted assets 123,031 125,707 124,502 123,142 114,789 113,115 113,864 114,104 108,006 Ratio 13.9% 13.2% 14.2% 14.2% 14.3% 14.4% 14.5% 14.6% 14.7% Total risk-based Risk-based capital 19,607 19,171 20,179 20,027 18,838 18,690 18,871 19,021 18,177 Risk-weighted assets 123,031 125,707 124,502 123,142 114,789 113,115 113,864 114,104 108,006 Ratio 15.9% 15.3% 16.2% 16.3% 16.4% 16.5% 16.6% 16.7% 16.8%

Thank You. Our purpose is to help people and businesses prosper. Our culture is based on believing that everything we do should be: